#pearl had a 21p phase but that was ONE year

Explore tagged Tumblr posts

Text

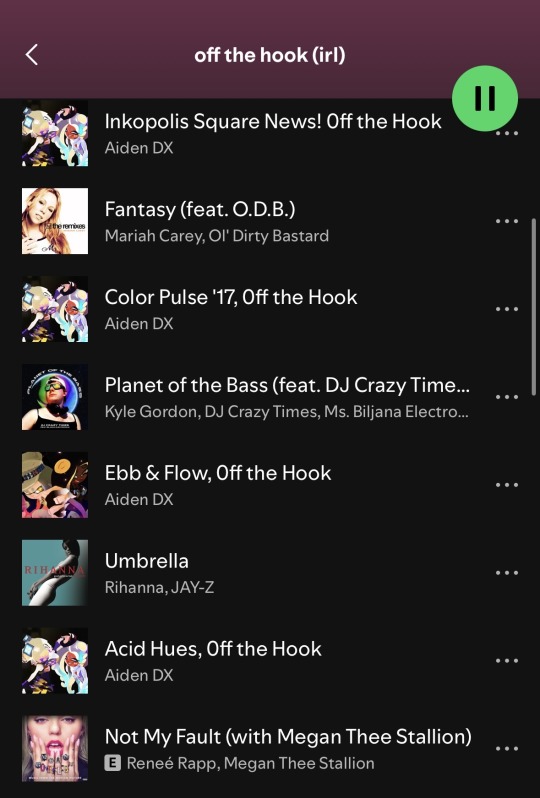

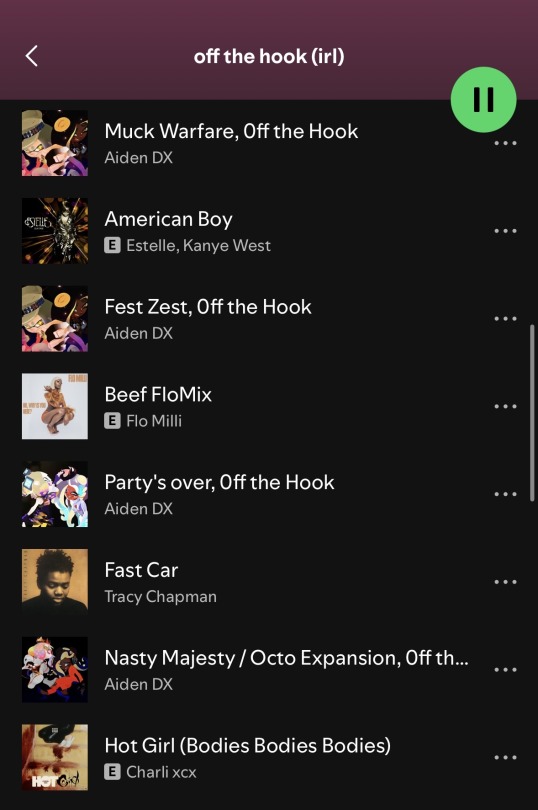

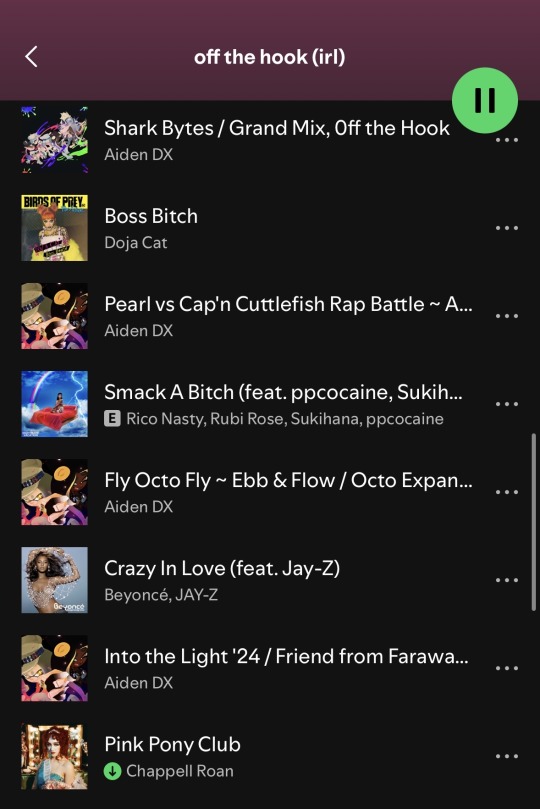

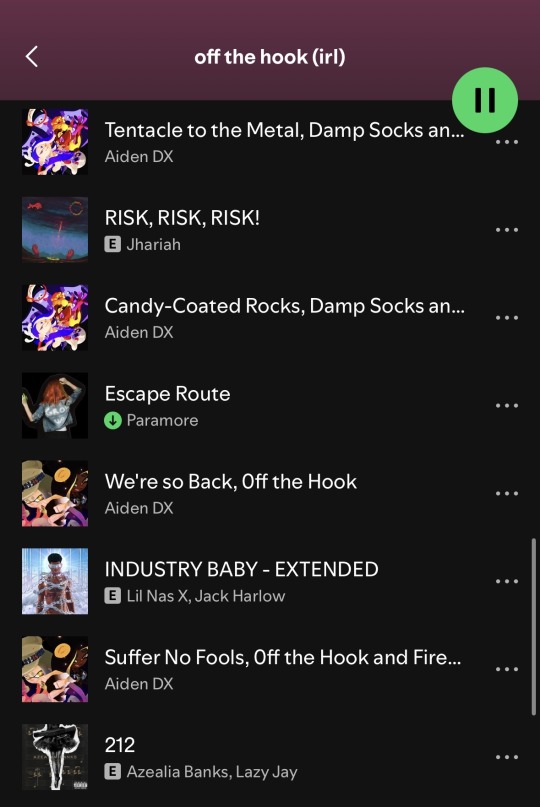

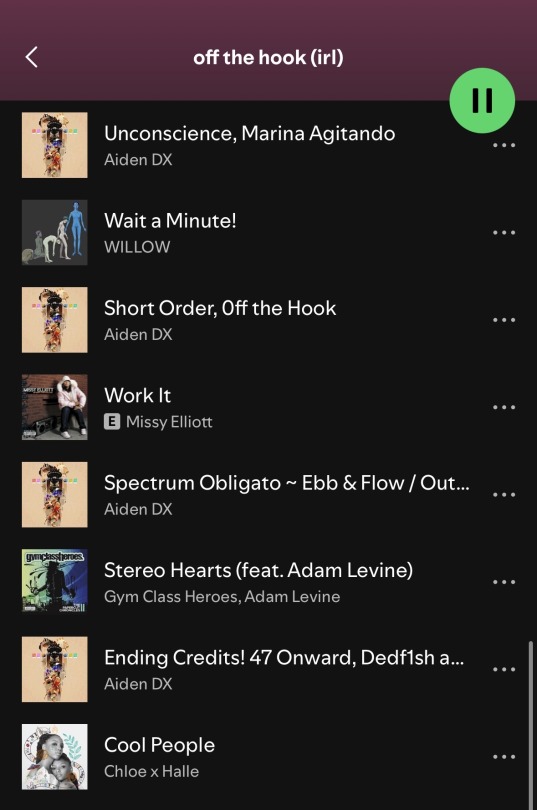

fuck it. off the hook songs + irl equivalents playlist

(link in title, tracklist below cut)

OtH first, IRL second

i will NOT be accepting constructive criticism

#i’m so objectively correct about every song here#of course i refuse to take constructive criticism#not technically one of my character playlists but#well. here you go#also some of these are just funny#pov: you can’t skip the news while ODB lists every fucking location on earth#pov: marina wrote color pulse before she was fluent in inklish#pov: you’re in a splat2 splatfest and you lose and then THAT starts playing#splatoon#splatoon 3#squidposting#off the hook#you wouldn’t believe a tumblr user would make a playlist this Black! but it’s true!!#you really think MARINA IDA is listening to white people music. i have to laugh#pearl had a 21p phase but that was ONE year

80 notes

·

View notes

Text

Is 12-bagger Empyrean Energy plc the oil stock to make you seriously rich?

When I first tried to understand how and why people invest in small high-risk oil exploration companies, someone told me the secret was to spread their money across multiple investments and expect most of them to fail, while hoping that the occasional multi-bagger will put them in profit.

I don’t know how many people invest like that, but those who bought shares in Empyrean Energy (LSE: EME) could be forgiven for celebrating. They’re now sitting on a 12-bagger over just 12 months, with their shares at 21p — they actually peaked at 31p, but I expect few will complain about that.

The success is down to a series of exciting results in September, starting with an analysis of seismic data obtained for its offshore China Block 29/11. It yielded results that beat expectations for the company’s Jade, Topaz and Pearl prospects — preliminary mean unrisked resource potentials of around 103m barrels (mmbbls) at Jade, 365 mmbls at Topaz, and 123 mmbls at Pearl were estimated.

California, Indonesia

That was quickly followed by news that the Dempsey 1-15 well in California had encountered “a potential sandstone reservoir with high gas shows“.

Since then, we’ve had regular updates on Dempsey which are making it look better and better. This includes two further zones of high gas shows apparent once the drilling reached its target depth, wireline logs confirmed “numerous zones for production testing” and the presence of gas saturated sands, and the stage of preparing to complete and flow-test the well has been reached.

Empyrean also has a 10% interest in the Duying prospect offshore Indonesia, where the Mako South-1 well has uncovered “better than expected reservoir quality, gas saturation, porosity, permeability and flow rates” with a stabilised daily flow of 10.9m cubic feet of gas.

Time to buy?

Despite this latest update coming as recently as 1 November, the share price has actually ticked down slightly in the past couple of weeks, so is there anything to worry about?

Well, some of it will almost certainly be due to profit taking after September’s big spike — and who wouldn’t blame investors for selling at around 25-30p when they might have paid less than 2p per share a year previously.

But there’s clearly one caution that hangs over just about all small oil and gas explorers at a similar stage, and that’s profit… Empyrean isn’t making any.

Where’s the cash?

In fact, the last couple of years have seen losses widening, with a pre-tax loss of $13m recorded for the year to March 2017. There are no forecasts available right now, though the recent news of oil discoveries would have rendered them moot anyway, so how does liquidity look?

The company has been in a restructuring phase to return value to investors. After the disposal of its interest in the Sugarloaf asset in Texas, shareholders received a payment of 7.9p per share in November 2016.

August’s full-year figures showed cash and equivalents of $6.1m on the books at 31 March, with no debt. And subsequent to year-end, Empyrean also raised £1m (before costs) from a placing in August.

Empyrean looks like it’s on a firm financial footing to me — and with those assets, I’m optimistic.

How to make a million

Investing in companies with growth potential like Empyrean can be a great step on the road to financial security, and even millionaire status.

To learn more about how to build your wealth, get yourself a copy of The Foolish Guide To Financial Independence. Looking at ways to reduce your outgoings while growing your cash, and giving you more ideas for great investments, this brand new report is a must-read for any aspiring millionaire.

It's completely free, so all you need to do is CLICK HERE for your personal copy today.

More reading

Is now the time to buy beaten-up mega-yielder BT Group plc?

These unloved 7%+ yielders could make you rich

2 hot stocks I’d buy with dividends yielding 6%

Why Legal & General Group plc is a top dividend stock for a starter portfolio

This 6.5% yielder pays twice as much as Lloyds Banking Group plc

Alan Oscroft has no position in any shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

0 notes