#paytm postpaid charges

Explore tagged Tumblr posts

Text

Buy Now, Pay Later- A Concept Primer

Buy now, Pay Later (BNPL) is the latest buzz word acquired by the internet used by every company as their payment solution. BNPL is a credit line extended to the subscriber/customer to purchase or make payments from their end. The amount has to be paid fully in various instalments, which eventually has to be paid in full. The difference between BNPL and credit card is the levying of interest on payment of the amount back in total. BNPL apps charge no interest until there is a default of payment from the customer’s side. On default of payment within the stipulated time only a fixed amount is charged. As usage of BNPL does not affect a person’s credit score, it can also be approved for a person who cannot apply for loans due to low credit score or no credit history.

In layman’s terms, it's a payment method that lets you purchase something immediately, but pay for it over time instead of all at once. So, if you wanted to buy a new sofa for your living room, for example, you could use BNPL to purchase it and then pay for it in smaller installments over several months instead of having to pay the full price upfront. It's a popular option for people who may not have the money to pay for something upfront but still want to make the purchase. However, it's important to be aware that using BNPL can sometimes come with additional fees and interest charges, so it's important to read the terms and conditions carefully before using it.

The rise of the concept of BNPL can be explained in conjunction with changes in various socio-economic factors. The rise of BNPL can be attributed to a few factors. Firstly, with the growth of e-commerce and online shopping, consumers are looking for more convenient and flexible payment options. BNPL offers a way to make purchases without having to pay for them upfront, which can be especially appealing for larger purchases. Secondly, many people today are living on paychecks every month and may not have the funds to make a large purchase all at once. BNPL allows them to spread the cost over several smaller payments, making it more manageable and accessible. Finally, BNPL providers have made the process of applying and being approved for this type of payment method much easier and faster than traditional credit options, which has also contributed to its popularity. Overall, the rise of BNPL can be seen as a response to changing consumer needs and preferences, as well as advancements in technology and the financial industry.

The money-making business behind BNPL is not very clear to the customer. Overall, while offering BNPL can be a convenient payment option for consumers, it's important to be aware of any additional fees or charges that may be associated with it. While on the face of it the customers do not have to pay any extra charges on payments, BNPL companies make money in a few different ways.

1. Merchant fees: When a consumer uses BNPL to purchase a product, the BNPL provider charges the merchant a fee for processing the payment. This fee is typically a percentage of the purchase price and is how the BNPL provider earns revenue.

2. Late fees and interest charges: If a consumer is unable to make their payments on time, they may be charged late fees or interest charges. These fees can be a significant source of revenue for BNPL providers.

3. Referral fees: BNPL providers may also earn revenue through referral fees. For example, if a consumer uses BNPL to purchase a product from a particular retailer, the BNPL provider may receive a fee from that retailer for referring the consumer to them.

In India, various applications have emerged offering BNPL service on different conditions. Apps like Zest money BNPL, Freecharge Pay Later, Paytm Postpaid, ePayLater provide BNPL services without a subscription fee. To use MobiKwik ZIP app a nominal subscription fee is charged. LegalPay, a third-party litigation funder has launched LegalPay Max, a pay later product for businesses to execute their legal expenses in instalments. This is a first of its kind product in the legal field which promises to increase legal professional’s clientele and reach. Providing diversified payment options eases the burden on the businesses in managing their legal and business expenditure. Ranging from various regulatory, compliance, arbitration and legal expenses, all is covered under a credit line which can be availed by the companies extending upto 50 lacs.

Due to ease in the usage of these platforms, safety concerns have mostly been overlooked by the consumers. Though BNPL works on the same lines of credit cards, they are not as regulated as them. For using such apps, usually a very soft credit check is done. Though a few apps take a thorough credit check, defaulting on these may affect the person’s credit score. There are major risks associated with the unchecked and reckless usage of BNPL apps. While BNPL can be a convenient payment option, there are also some potential dangers to be aware of:

High interest rates: If you're unable to make your payments on time, you may be charged high interest rates and fees. These can quickly add up, and if you're not careful, you may end up owing more than you can afford to pay back.

Overcommitment: Since BNPL allows you to make purchases without paying for them upfront, it can be tempting to overspend and buy more than you can afford. This can lead to financial stress and difficulty making your payments on time.

Credit score impact: Using BNPL can also impact your credit score. Late payments or missed payments can harm your credit score, making it more difficult to obtain credit in the future.

Hidden fees: It's important to read the fine print carefully before using BNPL, as there may be hidden fees or charges that you're not aware of. Make sure you understand the terms and conditions before agreeing to use this payment method.

Limited consumer protection: Unlike traditional credit options, BNPL may not offer the same level of consumer protection. This can include things like fraud protection and dispute resolution, so it's important to be aware of what protections are in place before using BNPL.

Overall, while BNPL can be a useful payment option in certain situations, it's important to use it responsibly and be aware of the potential risks and dangers. A personal account of the finances and a careful understanding of BNPL’s terms and conditions should be taken into consideration before using it.

0 notes

Text

Paytm postpaid पर लगेंगे charges

Paytm postpaid पर लगेंगे chargesPaytm postpaid के chargespaytm postpaid में चार्ज लग रहा है , paytm Lite वालो कम चार्ज लगेगा mini और ज्यादा चार्ज लगेगा delite और elight वाले को चार्ज नहीं जायेगा GST 3% लगाया जाता है और जब आप paytm के Postpaid को apply करोगे तो आपको बता दिया जायेगा हालांकि आप amazone pay later की service को ले सकते है वहां पर आपको चार्जे�� नहीं लगेगा paytm postpaid की सेवा को customer care से बंद भी करवा सकते है Please Share This web storyWhite Frame CornerWhite Frame CornerArrowShareOther storiesYellow Round BannerYellow Round BannerCBDC App downloadCBDC12Green LeafGreen LeafWavy Line Read the full article

0 notes

Text

Paytm postpaid charges extra convenience fee of x-y percentage and strange thing is not for all it depends on individual.

Ajeeb duniya jiska credit limit jyada ho aur transaction ache uski wave off and others they charge man mani.

0 notes

Text

Top 10 Recharge & Bill Payment Websites in India

There was a time when people used to visit recharge shops to recharge their mobile numbers. At that time, people take a good amount of time from their busy schedule to visit their nearest recharge shops 2-3 days before the day of recharge. That shopkeeper charges an amount of money for his services based on the recharge amount. And for utility bills like electricity bills, gas bills, water bills, landline bills, etc., people used to stand in long queues. But now that those days are gone, certain websites and apps enable you to make all these payments with a click of the mouse. The best thing about these websites is that they can be utilized for the payment of most service providers in the country. You can pay all your bills on these websites, including electricity bills, water bills, DTH, post-paid bills, piped gas, WIFI bills, credit card bills, and even make prepaid recharges that include mobile recharges, FasTag, data cards, and others. So, nowadays, these recharge websites are in trend as well as easy to use and time-saving. Along with these benefits, it also provides the benefit of lucrative deals, offers, and cashback from time to time. So, we present you with the list of the top 10 recharge websites and apps in 2022.

· EaseMyDeal- You must be wondering why we have kept EaseMyDeal on top. Well, EaseMyDeal is an ISO Certified Platform that is made in India that assures safety and reliability to its customers. We must advocate for local businesses and support Indian start-ups. It has an easy-to-use app interface that has a multilingual support system. It is the best not only in terms of its services but also because it has the best customer support. All the queries or complaints are answered within 24 hours. It also offers 24/7 Premium Support via WhatsApp, phone, and email. It has a fast, secure, and safe payment system that never stores payment details with them and has all the payment options that also include Pay Later Options, EMI, and Multiple Reward Points. It provides instant refunds and the fastest complaint resolution. On top of that, the reason why it has gained so much publicity in a very short time is that it provides the best cashback and deals on all payments made on EaseMyDeal. It is so good that it has a very high Google rating of 4.9/5.

· Paytm- It is also known as Cashless Haven for Online Payers. Paytm is used by Indian people to transact daily, from a small grocery shop to a big mall or movie hall. Paytm is running everywhere now, from village small shops to urban big malls. Paytm is also the premium site for adding bill payment, mobile recharging, booking movie tickets, booking taxi and airline tickets, and a lot more. There is no end to Paytm services. Any service you think of is available on Paytm. It is one of the best platforms that runs on Windows, iPhones, Androids, etc.

· MyAirtel - MyAirtel Appis one of the bestapps for all online recharges, bill payments, BHIM UPI transactions, mobile banking, and much more. It allows its users to pick any prepaid or postpaid mobile plan that suits them best. The best thing about this app is that it provides the best offers and cashback on all recharges. It even provides OTT subscriptions at discounted rates as well.

· Freecharge: Freecharge is the most favored payment channel. Freecharge offers recharge for prepaid mobile phones, post-paid mobiles, DTH, and data cards. It offers online wallet features for all users. It allows its users on Android to send and receive money via WhatsApp too. Freecharge allows you to get cashback and shopping coupons for the same price that has been paid to get the recharge done. Those coupons include McDonald’s, Barista, Shoppers Stop, Café Coffee Day, Croma, Puma, etc.

· Dealmegood - Dealmegood is one of the best websites thatprovides DTH recharges andshopping vouchers at various discount rates. Those shopping vouchers include fashion, food, travel, entertainment, and others. It not only provides shopping vouchers but also provides mobile and DTH vouchers as well. It is the most useful website where you can buy vouchers at discounted rates and use them to gift any of your friends on their birthdays or anniversaries. And it is the best and most useful gift for anyone. To have a close look at what they offer and what the relevant prices are, you can visit DealMeGood.

· MobiKwik - Mobikwik is a quick way to make online recharges and payments. It is a mobile wallet as well as an online payment system to store money and make payments. It is an online platform for prepaid mobile recharges, utility bill payments, DTH recharges, or shopping at listed outlets. It also provides a door-stop service where they collect money from your house and add it to your MobiKwik Wallet. It is a semi-closed wallet that is authorized for use by the Reserve Bank of India. It is one of the top recharge Websites in India.

· Amazon Pay - Amazon is the one-stop solution for all your shopping needs. It provides online services for prepaid recharges, post-paid bill payments, gas, landline, mobile, electricity, and broadband bill payments. Not only do these services exist and what you can think of, but Amazon also has that service that includes grocery shopping, clothes shopping, luxury items, and phones. It has a closed wallet as well, so you can make instant payments anywhere in India. It even provides cashback on recharges as well.

· Phone Pe - Phone Pe is a normal app that can be easily downloaded from the Play store. Phone Pay is a normal app that can be used to pay money to someone. The money you transfer gets automatically deducted from your linked bank account, and the money you receive gets deposited into your linked bank account. It does not have any wallet facilities. It can normally be used to recharge your mobile, DTH, cable TV, FasTag, and all other bill payments. Apart from that, you can buy brand vouchers, magazine subscriptions, FasTag, and even make donations as well. So, all in all, it is one of the best apps for recharges and bill payments.

· Google Pay - Google Pay is an app that you can download from the Play store and use to pay someone money, recharge your phone, and pay your bills. The best thing about Google Pay is that the money you transfer gets directly withdrawn from your bank account and the money you receive gets directly deposited into your bank account. Google Pay does not have any wallet facility, or you can say there is no tension about maintaining a wallet. You can directly transact through your bank account with the help of Google Pay.

· PayZapp- PayZapp is an app offered by HDFC. PayZapp allows you to save money while shopping on your mobile device at partner apps, buy mobile phones, tickets, and groceries, compare and book flight tickets and hotels, and shop online. This app can be used to transfer money to anyone who is on your contact list. You can pay your bills, recharge your mobile, DTH, data card, and many more things. It is UPI powered and Visa and MasterCard supported. It is a multi-tasking app. You can use this app for different purposes.

#Broadband Bill#DTH Recharge#EaseMyDeal#Electricity Bill#fastag recharge#Freecharge#Gas Bill#LPG Bill#Mobile Recharge#Momikwik#Paytm#Utility Bill Payments#Water Bill#Trending Apps

3 notes

·

View notes

Photo

Paytm has declared that it's Paytm All in One Payment Gateway is the biggest processor of business installments and now enlists over 750Mn month to month exchanges, driven by the expanding appropriation of online installments for areas like BFSI, retail and D2C online business, utilities, edTech, food conveyance, computerized diversion, gaming and online move of organizations during and post Coronavirus times. The Paytm Payment Gateway's exchange volume has since quite a while ago outperformed pre-Coronavirus levels. The purpose for this speed increase is appropriation of the most number of installment sources Paytm PG, offers than some other part on the lookout. This incorporates Paytm and Paytm Payments Bank Issued Instruments, for example, Paytm Wallet, Paytm PostPaid, Paytm Gift Vouchers, and Loyalty Points notwithstanding the standard installment strategies like UPI, net banking, all charge and Mastercards. Paytm Payment Gateway's development is likewise fuelled by offering UPI and Rupay exchanges totally free for online organizations, SMBs and enormous endeavors. It is the lone stage that doesn't impose any charges on UPI and Rupay exchanges nor evade any rules by collecting such charges. The steadily expanding appropriation of installment instruments gave by Paytm Payments Bank, including Paytm Wallet and Paytm UPI have contributed about 60% to the absolute exchanges enlisted on the entryway. Likewise, Paytm PostPaid and EMI administrations which were dispatched a year ago has kept on acquiring ubiquity with clients and are enrolling 25% month-on-month development. Visit on varindia website https://www.varindia.com/news/paytm-payment-gateway-becomes-largest-processor-for-business-payments-achieves-750-mn-monthly-transactions to know more.

1 note

·

View note

Text

Paytm postpaid क्या है ? How to Use Paytm postpaid - Free Recharge, Shopping

Paytm postpaid क्या है ? How to Use Paytm postpaid – Free Recharge, Shopping

Paytm postpaid क्या है और Paytm postpaid कैसे इस्तेमाल कर सकते हैं,आज के इस आर्टिकल में आपको पूरा Deatil बताएंगे, जिससे Full Doubt clear हो सके जो आपके मन में को Paytm postpaid को लेकर के है | हाल ही में पेटीएम ने इस feature को लॉन्च किया है जिससे आप पेटीएम में जो भी सर्विसेस उपलब्ध है उसका लाभ Paytm postpaidकी मदद से उठा सकते हैं | अगर आपके पास अभी पैसे नहीं है और आपको मोबाइल रिचार्ज या फिर…

View On WordPress

#how to increase paytm postpaid limit#how to use paytm postpaid balance#paytm new update#paytm offer#paytm postpaid charges#paytm postpaid eligibility#paytm postpaid how to use#paytm postpaid limit#paytm postpaid login#paytm postpaid terms and conditions#where can i use paytm postpaid

0 notes

Text

DHA-WAN AND ONLY

Sheroes

Sheroes is a women's community platform, offering support, resources, opportunities and interactions via Sheroes.com and the Sheroes App. Sheroes - Communities for Women, is a safe and trusted space, where members discuss health, careers, relationships and share their life stories, achievements and moments. The app also offers a dedicated ‘Ask Sheroes’ helpline where community members can talk to counselors on all aspects of their growth journeys. It offers its enterprise customers a range of products including Brand Solutions, SHE – prevention of sexual harassment at work platform and a Managed Remote Solutions program. Additionally, the company hosts the #SHEROESSummit, a multi-city annual flagship event and #TheShift Series – changing the gender narrative, alongside the community meets across geographies.

Sheroes had last year raised funds in an angel round from Quintillion Media, 500 Startups and a group of individuals including Vijay Shekhar Sharma, Rajan Anandan, Binny Bansal and four more. Paytm Founder, Vijay Shekhar Sharma is seen to be an early investor in this company.

PayTm

Paytm is India's largest leading payment gateway that offers comprehensive payment services for customer and merchants. It was founded in August 2010 with an initial investment of $2 million by its founder Vijay Shekhar Sharma in NOIDA. It started off as a prepaid mobile and DTH recharge platform, and later added data card, postpaid mobile and landline bill payments in 2013.The company offers mobile payment solutions to over 7 million merchants and allows consumers to make seamless mobile payments from Cards, Bank Accounts and Digital Credit among others. They are the pioneers and the leaders of QR based mobile payments in India. Their investors include Softbank, SAIF Partners, Alibaba Group and Ant Financial. They strive to maintain an open culture where everyone is a hands-on contributor and feels comfortable sharing ideas and opinions.

Case in Hand:

The founder of India's largest e-wallet company, was allegedly blackmailed by his long-time personal secretary Sonia Dhawan. In her ten-year stint with Paytm, Dhawan started off as secretary and went on to head the corporate communications of the company.

Sonia Dhawan allegedly hatched a plan to extort Rs 20 crore from the Paytm boss by threatening to leak his stolen personal data through his brother. Ajay Shekhar Sharma, the Senior Vice President at Paytm and brother of Vijay Shekhar Sharma, stated that it all started around 11 am on September 20 when Vijay Shekhar Sharma received a call from a Thailand-based number while he was in Japan. While speaking to Ajay Shekhar Sharma, Chomal said that he had Vijay Shekhar Sharma's "personal data" and if he didn't pay up the money, he would leak the data. Sharma has alleged that the data under question included "photos and personal financial details”. Ajay Shekhar Sharma alleged that on being pressurized for details, Chomal blurted out the names of Dhawan, Jain, and Kumar, stating that they were the people behind the plot, the report said.

On October 22, 2018, Ajay Shekhar Sharma had lodged a complaint against four people — Sonia Dhawan, her husband Roopak Jain, another Paytm admin staff Devendra Kumar and his friend Rohit Chomal — accusing that the four allegedly stole personal data of his brother and Paytm founder and CEO Vijay Shekhar Sharma and demanded an extortion amount of INR 10 Crores.

The FIR was registered and the accused were booked under Indian Penal Code sections 381 (theft by clerk or servant of property in possession of master), 384 (extortion), 386 (extortion by putting a person in fear of death or grievous hurt), 420 (cheating), 408 (Criminal breach of trust by clerk or servant) and 120 B (party to a criminal conspiracy). Charges under the provisions of the Information Technology Act have also been pressed against the accused, the police said.

Dhawan had claimed innocence in her petition before the high court and claimed that no tangible evidence could be established against her. In March, Paytm issued a statement that said “no accused is joining back the company till the time the court matter is concluded.”

After the Trial:

Sonia Dhawan has joined Sheroes on 7th June, 2019. She has joined as the manager of corporate communications at this social network for women, in which Vijay Sharma is also a stakeholder. The case against Dhawan, who has denied any attempts at blackmail, is still going on in court.

The police, however, claimed that Devendra Kumar — one of the accused — has already accepted the crime and has narrated the entire case of how Dhawan master-planned the extortion.

The police have already recovered the data that Devendra Kumar obtained from Dhawan, allegedly with the knowledge of her husband, confirming there was “criminal data-theft of a severe nature”.

Task in Hand:

You are the HR Managers of Sheroes and you will be attending a meeting with your Board of Directors wherein,

1. Three of you will be justifying as to why Sonia Dhawan should be retained in the organisation in spite the charges against her and the impending court case.

2. The other two of you will be justifying as to why she should be laid off from the company due to the allegations against her.

1 note

·

View note

Text

Paytm app wallet offer

Today MobiKwik offers prepaid and postpaid recharges, bill payments, bus ticket bookings, DTH recharge, insurance premium payments & more.

As the digital payments vertical grew, MobiKwik partnered with many e-commerce websites and online merchants to make it available as a payment option. Started in the year 2009, MobiKwik was launched as a mobile recharge website. Find the latest Google Pay offers on CouponDunia. Now you can also book train & bus tickets, pay LIC Insurance premium and pay online retailers with google Pay. 1 lakh which is also directly deposited into your bank account. The scratch cards can earn you a cashback of up to Rs. You also earn scratch cards on making payments and transferring money. The app directly links to your bank account and functions like a digital debit card. India’s no.1 UPI payments app, Google Pay has become one of the simplest ways to send money with zero fees, make bill payments, recharge mobile and pay for online services. You can avail the latest Amazon Pay offers via CouponDunia. While the main purpose of Amazon Pay wallet it to make payments and refunds easier for all purchases via Amazon, Amazon pay has diversified its area of operation and many websites like – Domino’s, McDonald’s, Mojo Pizza, MakeMyTrip, Medlife, etc. Amazon Pay offers exclusive cashback on purchases from Amazon and has been integrated into the Amazon Android and iOS apps. Payments via Freecharge are accepted by all major online retailers – Myntra, BookMyShow, Domino’s, Swiggy, etc.Īmazon Pay is the digital payment arm of the e-commerce giant – Amazon. You can also find the latest Freecharge offers and coupons on CouponDunia. Once a user registers on Freecharge, the Free-charge app shows him a dedicated offers section where exclusive Freecharge coupons and offers are listed. Similar to Paytm, Freecharge also offers cashback and deals on payments for gas, water, light & electricity bills payments. Payments via Paytm are accepted by almost all major online retailers. Exclusive Paytm offersare always listed on CouponDunia. All you need to do is click on – have a promo code option before completing payment or recharge and use the right Paytm coupon for the transaction. You can earn cashback on DTH recharge, mobile bill payments, shopping via Paytm mall, booking travel tickets, adding money to your Paytm wallet and more. Paytm is India’s largest payment gateway that offers exclusive coupons and cashback to its users. Today we have compiled a list of some of the best High Cashback Mobile Wallets in India that will help you save the maximum amount of money on all your digital transactions and payments. Right from mobile and electricity bill payments to ordering pizza and shopping online, users can directly save money in the form of cashback via these new digital payment wallet applications. Websites and applications supporting this growth by enabling digital payments have also proliferated and have enabled the users to earn cashback on almost all types of digital payments. The digital payments ecosystem has grown significantly over the past few years in India.

0 notes

Text

The Impact of Buy Now Pay Later in Credit Score

Pay later administrations are very much like your Credit cards; they offer revenue-free credit for a particular number of days, yet the reimbursement is straightforwardly connected to your investment funds' financial balance for a direct charge.

Introduction

Not every person is qualified to get a charge card. Visa organizations have fixed the models to give Mastercards. Candidates must have an immaculate credit report, a solid FICO rating, and decent pay to demonstrate their reimbursement ability to benefit a charge card on the lookout. Likewise, there is an overall worry in some low-pay workers in getting a Visa as they realize that Visas can prompt terrible obligations.

That is when moneylenders accompanied Pay Later credit administrations.

Numerous online business dealers have restricted banks and NBFCs to offer this assistance to their clients. This helps draw in purchasers, without a charge card, to buy high-esteem things by profiting from a transient credit office.

What are some of the attractive features of pay later services?

They are handled in a flash.

There is no documentation required. They compute your qualification in view of your telephone number, PAN, and Aadhaar subtleties.

It permits you to make buys on layaway without the requirement for a Mastercard.

Accompanies helpful reimbursement residency of 3 - a year to suit your necessities. Pay Later administrations are by and large connected to your investment funds' financial balance and your FICO rating.

The Concept of Embedded Finance

Inserted Finance alludes to credit connections of the above sort. The essential goal is to draw in clients who don't hold a charge card yet need to buy buyer strong products on layaway. Here an organization accomplices with a loan specialist, who checks the client and offers them a credit line.

Some well known Pay Later Services in India are:

LazyPay - accomplices with Swiggy, Flipkart, BookMyShow, MakeMyTrip, and Urban Company

Simpl - accomplices with Zomato, BigBasket, Fresh2Home, Sleepy Owl Coffee

Paytm Postpaid - accessible to all clients

Cut - independent application accessible for all clients

Amazon Pay later - accomplices with Capital Float and IDFC First Bank

Ola Money - restrict with Aditya Birla Finance Ltd

How to benefit from the compensation later assistance?

Pay later help is generally presented by internet business administrations like Amazon, Flipkart, Swiggy, Bigbasket, and so forth You might get a message or notice illuminating you about the compensation later assistance and requesting that you enter a couple of fundamental subtleties to actually look at your qualification.

They will generally ask you for subtleties like your telephone number, PAN and Aadhaar.

When you enter these subtleties, they will request that you connect a Savings Bank Account with your compensation later record for a direct charge of the month-to-month EMI.

From that point onward, it will show your qualified credit sum and request your endorsement to handle the application.

When you consent to the agreements, the credit will consider your compensation later record on that specific application or administration.

Each time you make a buy and go to charge installment, you can see this pay later record as one of the installment choices.

The bill sum is partitioned into equivalent EMIs, which will be charged from your ledger consistently.

Reference

0 notes

Text

Experiential marketing: The right choice to sell fintech in rural markets

Rural customers cannot be converted merely with advertising. So for complex products like digital payment infrastructure, a clear awareness on a mass basis can be generated only with experiential marketing, says Rajesh Radhakrishnan, Chief Marketing Officer, Vritti Solutions.

In the midst of the opening of economy amid the pandemic, there was a news doing the rounds recently that Paytm was planning to employ 20,000 field sales executives (FSEs) to drive sales in small towns. This is a good move, which will help provide employment opportunities to a lot of youth and drive the economy.

At the same time, digital payment companies need to try their hands on experiential marketing, a promising form of marketing for fintech companies, banks and insurance companies to tap hinterlands.

On a mass scale, it is the best way of educating small-town residents and merchants on the relevance of digital payments, on how digital payments needs to be initiated, generate maximum downloads of apps among users, opening a bank account, having an insurance policy, etc.

Experiential marketing can create platforms on a mass-scale basis to promote and educate on concepts such as all-in-one QR codes, all-in-one POS machines, soundbox, wallet, UPI, postpaid, merchant loans, insurance offerings, etc. The campaign can be done at a crowded market or public place or State Transport (ST) Bus Stations.

It is also to be remembered that we are not yet out of the pandemic. There are still talks of a possible third wave. There are limitations on manual marketing. So, companies need to adopt a balance of restriction and relaxation. Experiential marketing companies have the experience of conducting activation maintaining strict social distancing.

Rural customers cannot be converted merely with advertising. Therefore, in a rural or a small town set up, a simple advertisement banner may work for a FMCG product such as soap or a detergent. However, for a complex product like digital payment infrastructure, a clear awareness on a mass basis can be generated only with experiential marketing. There must be a mix of manual and experiential marketing to educate the customer, which would be the ideal way. If he is convinced, he will tell four of his friends.

With a bit of education, the real potential of the country i.e. the small towns and the villages, could be explored for digital payments. As more and more data penetration is taking place in the rural parts of the country, this is the best time for fintech companies and the banks for tapping the rural.

Case Study: An experiential marketing case study involving Citicash Tatkal Cards with passengers at State Transport (ST) Bus Stations:*

Among several places, ST bus stations could be a very strategic location for educating the masses about fintech products. On an average, 20,000 people visit a bus station, which ensures a very good crowd engagement. An average waiting time for a traveler at the Bus Station is 30 minutes. Very easily about 500-1000 people could be engaged within a bus station in a day. Awareness can be imparted at the consumer level as well as the merchant level. By generating proper awareness among the consumer, the right word-of-mouth can be generated. Also, the public starts demanding the merchants for the service if he is aware about it.

In a bus station, the fintech players can do perfect branding of his products with promo tables, banners, posters, where promoters can educate public about its products and services. Awareness can be done even inside a running long-distance bus. This sets the right word of mouth among the public about the financial product.

An activation was done for Citicash in Maharashtra. Citicash had tied up with the Maharashtra State Road Transport Corporation (MSRTC) to sell pre-paid cards or “ST Tatkal cards” among the public. This card is similar to pre-paid cards used in the metro trains. A card can be pre-paid with amounts of Rs 200-300 or 500 and goes on debiting with each travel. Our team of promoters educated the consumers at the bus station and inside the buses. Conductors were trained on using devices to read cards and deduct the charges. Within a few days, the card became popular with MSRTC travelers. As trains are limited, much of the public today travel in buses. Also, since it is a cash less method, it is safe during the present Covid times.

0 notes

Text

Paytm All in One Payment Gateway

Paytm has declared that it's Paytm All in One Payment Gateway is the biggest processor of business installments and now enlists over 750Mn month to month exchanges, driven by the expanding appropriation of online installments for areas like BFSI, retail and D2C online business, utilities, edTech, food conveyance, computerized diversion, gaming and online move of organizations during and post Coronavirus times. The Paytm Payment Gateway's exchange volume has since quite a while ago outperformed pre-Coronavirus levels. The purpose for this speed increase is appropriation of the most number of installment sources Paytm PG, offers than some other part on the lookout. This incorporates Paytm and Paytm Payments Bank Issued Instruments, for example, Paytm Wallet, Paytm PostPaid, Paytm Gift Vouchers, and Loyalty Points notwithstanding the standard installment strategies like UPI, net banking, all charge and Mastercards. Paytm Payment Gateway's development is likewise fuelled by offering UPI and Rupay exchanges totally free for online organizations, SMBs and enormous endeavors. It is the lone stage that doesn't impose any charges on UPI and Rupay exchanges nor evade any rules by collecting such charges. The steadily expanding appropriation of installment instruments gave by Paytm Payments Bank, including Paytm Wallet and Paytm UPI have contributed about 60% to the absolute exchanges enlisted on the entryway. Likewise, Paytm PostPaid and EMI administrations which were dispatched a year ago has kept on acquiring ubiquity with clients and are enrolling 25% month-on-month development. Visit on varindia website https://www.varindia.com/news/paytm-payment-gateway-becomes-largest-processor-for-business-payments-achieves-750-mn-monthly-transactions to know more.

1 note

·

View note

Text

Paytm launches Postpaid Mini

Paytm announced the launch of Postpaid Mini, an extension of its Buy Now, Pay Later service, driving affordability amongst those new to credit. These small ticket instant loans will give flexibility to users and also help manage their household expenses to maintain liquidity during the ongoing pandemic. This service has been launched in partnership with Aditya Birla Finance Ltd. With the launch of Postpaid Mini, the company will offer access to loans ranging from Rs 250 to Rs 1000, in addition to Paytm Postpaid’s instant credit of upto Rs 60,000. This will help users pay for their monthly expenses, including mobile & DTH recharges, gas cylinder booking, electricity & water bills, shop on Paytm Mall and more. With this service, Paytm Postpaid is offering a period of up to 30-days for repayment of loans at 0% interest. There are no annual fees or activation charges, only a minimal convenience fee. Through Paytm Postpaid, users can pay at online and offline merchant stores across the country and not have to worry about upsetting their monthly budgets. Paytm Postpaid is currently accepted at thousands of petrol pumps, neighbourhood kirana stores or pharmacy shops, popular chain outlets (such Reliance Fresh, Apollo Pharmacy, etc.), internet apps (such as Myntra, Firstcry, Uber, Dominos, Ajio, Pharmeasy, etc.) and popular retail destinations (such as Shoppers Stop, Croma, etc.) among others. Paytm Postpaid is available in over 550 cities in India. Bhavesh Read the full article

0 notes

Text

Make Real Money: Verified 7 Money Earning Apps in India

Everybody wants to do more days; In fact, the whole world is driven by the simple idea of making endless money, as it generates growth and self-esteem. Since the dawn of technological development around the world, people increasingly find ways to spend their time making money.

The Internet provides more information; Basically unnecessary information on money making apps. Take Advantage of This - There are tons of potential scammers who exaggerate their earnings to trap people in their honeynet.

Everyone has a smartphone these days, and almost everything we do with it requires an app.

Wouldn’t it be great if you could also make money with just a few apps? While you won’t get super rich, you can still make more money from your Smartphones with Mobile Apps. Today, earning money is the most important thing in all aspects of a prestigious life.

In today’s track, we will show you how to make money with online money making apps. Everyone uses a smartphone and most of them don’t know that they can earn money while sitting at home and spending time with their smartphones. There are many money making apps available on Android and IOS platforms. You can earn real money and rewards like gift cards, free reloads, PayTM cash, real money, and more. Isn’t it nice to know that you can earn more than the earnings of a 9 to 6 day job in a few hours? There are many ways to earn money online that can depend heavily on passion and opinion. You don’t want to get a degree, all you need is interest to work and earn easily.

Now is the time when your Android device should be really productive for you. Most of us have an Android device and it is time for us to use that phone and get some money. Today we come across dozens of applications that claim to charge for free. Many of us don’t even download them because we don’t. I don’t know if they are real or not. Next, I will tell you about the best applications personally tested by me and many other people who offer free rechargeable applications.

One time we stopped at the “recharge wale ki dukaan” counter and asked for recharge rates and new offers. The merchant would indicate the large map on the walls or he can personally recommend us according to our budget. For some, days like these are over. For some, cargo stores are an alternative, while the Internet is not available.

Earn money with Android now. Here we are going to see the best Indian apps to earn money, those special apps earn more income by online recharge, watching ads, app referral code to earn money, apps to Make money on Google Play, best apps to earn talk time, best apps for earn money from home for Amazon, updated online money making apps, other money making apps like PayTm and many more. Don’t pay for mobile recharge again starting earning today.

You are here for HIGH PAYING MOBILE CHARGING APPS; Without a doubt, one of the most important things for smartphones is charging. But what if you have a chance to easily win free mobile recharges just by sitting at home? Yes, it is that simple. In India it has now become so easy to earn free unlimited mobile recharge online that you not only get free talk time, but you also earn some money by referring your friends. These are some of the applications listed below; available in app stores for all your mobile users.

Here we will see; How do I get free mobile recharge? Where can I get a free prepaid mobile recharge? What are the ways to earn free mobile charging? What applications are specially used to get free mobile recharges in India? Where do you get a free mobile recharge code? There are so many starter apps that offer attractive deals and good deals to earn mobile balance or top up mobile online and also allow you to get unlimited payments by referring your friends.

Important points to consider:

Make the right decisions. Always use your judgment, whether an opportunity is right for you or not.

If a money-making program asks you to pay first to get in, be careful. There are many money making platforms that do not require any upfront payment or registration fees.

Please use your discretion when providing all personal details when signing up for an online money making program. Never give your crucial personal information, such as credit card information, bank account information, or social security number, to a company that claims that providing this information will help you get started.

1. Empire ReEarn

Empire ReEarn just gives you easy access, also provide fast transactions. ER can complete your prepaid mobile and DTH recharge in less than 10 seconds. You can top up your mobile immediately and receive an attractive refund for every Recharge transaction.

Along with the ability to recharge multiple times, Empire ReEarn provides referral revenue to consumers. The ER user will not get the benefit of all this revenue until he becomes a member and completes his ER profile. All four types of income have their own modules and forks that must be followed in order to take advantage of the Empire ReEarn benefits. But in general, there is a way to increase your income by following these steps. There is yet another platform to establish your business.

2. Khatriji

Whenever the user self-registers with Khatriji, buys the product from Khatriji and then joins one of the tree at his / her request using Khatriji’s product key, the user is called Khatriji’s Skyomie. The Skyomie can expand the tree by referring to his friends and families, and if one of them buys the product from Khatriji, Skyomie will get even more referral income in that case.

So a tree has been developed and Skyomie has the advantage of making money from various users he / she referred. This whole process is called Make Your Own Money Tree. Now if the Skyomie buys the same product again from Khatriji, he / she will also receive an income for buying again. The cashback offered after every mobile and DTH top-up also increases your income to some extent.

3. Pocket money

The pocket money app is exactly what it sounds like, an easy way to earn pocket money. If you are interested in free refills and rewards, pocket money is a great option for you. All you need to do is complete some basic tasks and commands to earn top-up coupons, free talk time, Paytm Cash, and many other rewards. The app pays a whopping Rs 20 per referral. You can even get paid to watch videos and use data through some apps. Users claim to have earned up to Rs 120 per day from this app.

4. Earn talk time

Earn talk time is another application that started charging for free in terms of rewards. Now the app offers cash from Paytm that you can use to shop, top up, eat, etc. They even pay you for referrals which can be a great way to increase your earnings. You can perform tasks assigned to you, including surveys, watching videos, app downloads, and referrals. You can earn unlimited rewards with this app based on your usage. If you are not comfortable with surveys, you can easily read news or horoscopes in the application to earn money.

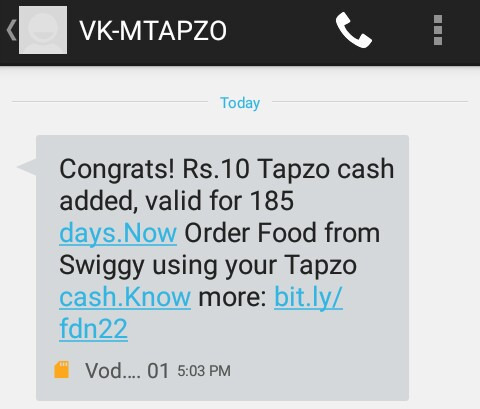

5. Tapzo

If you are looking for a mobile charging and online payment app with great discounts and deals, Tapzo is a great option. The new all-in-one app is for all your prepaid mobile and DTH charges, postpaid, electricity and other utility bills.

Since Tapzo is still in the early stages, it offers lucrative deals and discounts on one transaction or another. You can also book taxis / taxis, cars, flights, hotels and buses / order food from a nearby restaurant / domestic services, book device repairs and vehicle repairs using the Tapzo app.

6. Niki

Niki is an artificial intelligence-based personal assistant app that provides a variety of bill payment services including electricity, prepaid and utility or bus tickets, online movie tickets, taxis, hotels, and more. In Niki you will find several providers that you will not find in other conventional applications.

In short, it is a single destination for all your needs, allowing you to remove various applications from your phone. Niki also offers exclusive offers, discounts, and cash back to its users when transacting with the app. Like Haptic, Niki also integrates with Amazon Pay for charging.

7. Haptik

Haptik is a one-stop app that integrates facilities ranging from booking taxis to movie tickets and plane tickets. The app partners with 25 services including Zomato, Ola, Bookmyshow, Go iBibo, Urbanclap, and Cleartrip to meet the needs of its users. With Haptik, you can also use your Amazon Pay balance to charge mobile prepaid / postpaid or top up DTH.

In addition to reservation services, you can use Haptik to set reminders using the chat-based personal assistant, pay bills, and find nearby places like ATMs, free Wi-Fi hotspots, pharmacies, bus stops, etc. The application is also full of interesting offers that can be used with any transaction.

Leave a comment if you love using money making apps or let us know if you are just starting out trying to make money from your phone.

Source : How to Make Money from your Smartphone: Try These 7 Mobile Recharge Apps

#earnextramoney#earnfromhome#earnincome#earntalktime#EmpireReEarn#pocketmoney#tapzo#niki#haptilk#khatriji#7apps

1 note

·

View note

Text

How to use Paytm cashback? Complete guide (2021)

About Paytm

Paytm is currently one of the massive online retailers in India with over 17 crore customers and is one of the largest and most popular online stores in India. The Noida-based company is a subsidiary of One97 Communications and was launched in 2010 as a low-cost online mobile phone provider and in a very short time, it has become one of the market leaders in the Indian commercial sector. n this article, we will mainly focus on how to use Paytm Cashback.

Currently, the company offers debt payment services such as electricity, DTH, data card, broadband, gas, water, and other household items, in addition to its prepaid mobile phone services and postpaid services. Users can also recharge their MetroCards in cities like Delhi and Mumbai and use the train services. Soon it will start in some cities with real municipal areas. I

Pay for financial services like your insurance premium and your loan’s monthly EMI. You can also pay your college fees. Booking services offered on the second to one site that include movie tickets, flights, trains, and much more. Buy pure gold at premium prices from Paytm delivered right to your doorstep in the form of gold coins ranging from 1g to 20g. You can also pay for your ride in Uber or gas on your motorcycle or car at almost every gas station in the country. These little things make life easier and have a big impact. For Paytm customer support, click here.

Top 5 Paytm features that are mostly used in daily life.

With more than 100 million users last year, PayTM was already ahead of its digital payment rivals before making the November 2016 demonstration of high-profile Indian notes. Following the pressure of #CashlessIndia due to #CurrencySwitch, the Alibaba-backed fund has increased its lead in other mobile wallets (e.g. Freecharge, MobiKwik) and account-to-account transfer software (e.g. UPI) Today, PayTM has 150M users.

Merchant Payment – Buy items at any store and pay the bill digitally via Paytm. Without spending money you can pay in 3 different ways. Paytm Wallet or Paytm Payment Bank Account or from Your Bank Account linked to Paytm. However, it is required that the merchant must also use the Paytm App.

Money Transfers – You can save your bank account via Paytm and make online payments and transfer money through your saved accounts. It will be transferred directly to the recipient’s Bank Account. You can also transfer from your Paytm Payment Bank account. You can link your account with the BHIM UPI on the Paytm platform. Apart from this Paytm also offers a place to transfer money via IMPS and NEFT. And it is not expensive. However, if you want to transfer this fund to your Pay Bank Account from the Fund, you have to pay up to 5%. It’s weird because there are both features of the Paytm App.

Mobile Recharge– You can recharge your mobile number on Paytm. No matter which telecom operator you are using. While recharging, you can browse their plans and recharge in no time.

Movie Tickets– With Paytm you can also book movie tickets. You can book tickets by being given your best time and seats. Also, you can see a preview of the movie, you can read the movie captions. A review of popular news circles can help you decide whether to watch a movie or not. Note, there will be an easy charge to book a ticket.

Travel Tickets – With the Paytm Travel service, you can book Training Tickets, Bus, and Airline Tickets (nationally and internationally). Also, you can book hotels or Metro Tickets. Additionally, you can view your previous bookings under the ‘My Bookings’ section. Besides you, you can check the status of PNR and Live Train Running Status.

What are Paytm Cashback, offers, and deals

Cashback is nothing but a discount provided by any vendor for making payment through its application, website, etc. Here the vendor is Paytm. We will discuss Paytm cashback and Promo codes and other types of cashback offers. Paytm provides cashback for multiple transactions like making a mobile recharge, Bus booking, etc. Read more

0 notes

Link

Latest Free Recharge Tricks 2020, Unlimited free Paytm Cash Earning App, Shopping Offers 2020, Send Money Loot Offer, Best UPI Offers, Latest Free Sample Products From Amazon, Flipkart & many more Only At Lootbazzar.com

Recharge Online & Tricks In Freecharge App

FreeCharge is currently India’s No.inch payments app. Customers all over the nation use FreeCharge to make prepaid, postpaid, DTH, metro recharge and recharge charge obligations for numerous service providers.

They started their wallet in September 2015 and already deploying it to pay for across all leading online & some offline stores like McDonald’s, Cinepolis, HomeStop, Crosswords, Hypercity, and also for E-Rickshaws, and many more.

We are really on a mission to receive millions of merchants equally in organized and unorganized business for a part of the digital payments ecosystem.

It’s a fun and safe means for you to seamlessly Chat-n-Pay for friends, loved ones, and merchants in less than 5 seconds. In addition, it empowers retailers, large or small to simply accept digital installments in less than 1 minute later registering the FreeCharge app.

Recharge your number with Freecharge app & get a total of 100% cashback up to ₹30. Freecharge loot tips for chosen Freecharge users, recharge your number and use promo code to get free mobile recharge from Freecharge.

Also Read About Online Shopping Amazon Echo

Procedure To Get Cashback On Recharge:-

To start with, Download Freecharge app From Below Link.

Download Here

Login your current Freecharge account.

Go To Recharge Option.

Then Enter your Number.

Fill up on circle and operator.

Input your recharge plan.

After that go to payment page and use voucher code

Immediately after using promo code choose the payment method

After completing the transaction you’ll receive 100% cashback

Also Read Mobile Recharge Tricks With Airtel Rs.289 Plan

Terms & Conditions To Follow:-

Supply Relevant for chosen Freecharge users.

Cashback level will be credited into your Freecharge wallet within 72 hrs.

Offer just suitable on once per user during the campaign validity.

Cashback number is dependent upon applied promo code.

0 notes

Text

Freecharge| Latest Coupon Codes & Promo Codes 2020

If now online search engine place to a lot of mobiles recharge services, electricity bills, DTH, and more paying bills are in online easily. Here many coupons, offers, promo codes, and cashback providing sites are available. Moreover, many ways to use these codes, deals, and offers then get benefits easily are everyone at online places. Here online introduce all e-commerce coupon sites through mobile apps also. It has thinking such a good, and I appreciate moving on these services. India Market is a very smart and very popular for promoting coupon websites.

Today we are introducing all the latest mobile recharge online store offers, promo codes, deals, and cashback offers. Now Indian market place to provides the daily latest coupon codes, cashback offers at coupon websites. So here to check one best Indian coupon website is Saveplus.in. Here many stores list for recharge or bill payments are Freecharge, Paytm, Mobikwik, Amazon, Airtel, Vodafone, and many stores offer available in the Saveplus coupon site. Let us go and check the Saveplus site available online shopping stores details like Flipkart, Snapdeal, Giskaa, TicketNew, Talkcharge, Fab India, FabAlley, Ajio, Myntra, Max, Yatra, JetAir ways, Zomato, Swiggy, food panda, and more.

Freecharge It is the right place for the mobile prepaid, postpaid recharge, bill payments, DTH, online Datacard payments, and the services. In the present day’s many peoples are thinking about sharing communication with another person immediately use to mobile phones. We all are familiar with Freecharge Coupon code services. They have a great mobile application for android on google play store. So here to download this Freecharge app, then find the Saveplus to free charge promo codes, Freecharge Deals, and cashback offers.

The process of buying mobile recharge saveplus codes, and the user firstly you have selected the saveplus on the website then search the free charge deals, free charge offers, and free charge promo codes. Next, you get free charge codes in saveplus website to then ofter copy that codes used that one in free charge mobile applications getting a more cashback on your recharges. Now you start electricity bills, mobile recharge postpaid or prepaid bills, DTH, and pipeline gas bills sitting at home on or the go using the free charge wallet. And more latest Freecharge offers and coupons are available on the saveplus website.

0 notes