#oureconomy

Explore tagged Tumblr posts

Text

This day in history

I'll be in TUCSON, AZ from November 8-10: I'm the GUEST OF HONOR at the TUSCON SCIENCE FICTION CONVENTION.

#20yrsago Bhutan: World’s biggest book https://kottke.org/04/10/bhutan-book

#15yrsago Anti-vaccine fear versus science https://web.archive.org/web/20091022235649/https://www.wired.com/magazine/2009/10/ff_waronscience/all/1

#10yrsago Sen Lindsay Graham promises a fine future for “white men in male-only clubs” https://www.politico.com/story/2014/10/sen-lindsey-graham-white-men-joke-112338

#10yrsago Hungary cancels proposed Internet tax in the face of mass opposition https://www.bbc.com/news/world-europe-29846285

#10yrsago David Graeber and Thomas Piketty on whether capitalism will destroy itself https://thebaffler.com/odds-and-ends/soak-the-rich

#10yrsago USPS usage declines, but sloppy postal surveillance is way, way up https://www.politico.com/story/2014/06/snail-mail-snooping-safeguards-not-followed-108056

#5yrsago How the British left should seize this moment to strip finance of its political clout https://www.opendemocracy.net/en/oureconomy/thatcher-had-a-battle-plan-for-her-economic-revolution-now-the-left-needs-one-too/

#5yrsago After suing NSO Group for hacking Whatsapp, Facebook kicks NSO employees off its services https://arstechnica.com/information-technology/2019/10/facebook-permanently-deletes-the-accounts-of-nso-workers/

#5yrsago The right is bankrolled by self-interested one-percenters making long-term investments; the left, by one-percenters with “moral whims” https://nymag.com/intelligencer/2019/10/how-did-democrats-lose-the-states-money-money-money.html

#5yrsago Leaked document reveals that Sidewalk Labs’ Toronto plans for private taxation, private roads, charter schools, corporate cops and judges, and punishment for people who choose privacy https://www.theglobeandmail.com/business/article-sidewalk-labs-document-reveals-companys-early-plans-for-data/

#1yrago The impoverished imagination of neoliberal climate "solutions" https://pluralistic.net/2023/10/31/carbon-upsets/#big-tradeoff

Tor Books as just published two new, free LITTLE BROTHER stories: VIGILANT, about creepy surveillance in distance education; and SPILL, about oil pipelines and indigenous landback.

10 notes

·

View notes

Text

Time to liberate the economy from corporate monopolies | openDemocracy

https://www.opendemocracy.net/en/oureconomy/corporate-monopolies-are-threat-to-democracy-public-interest/

0 notes

Text

The set of conspiracy theories around the Great Reset are nebulous and hard to pin down, but piecing them together gives us something like this: the Great Reset is the global elite’s plan to instate a communist world order by abolishing private property while using COVID-19 to solve overpopulation and enslaving what remains of humanity with vaccines.

https://www.opendemocracy.net/en/oureconomy/conspiracy-theories-aside-there-something-fishy-about-great-reset

0 notes

Text

2019

Hiệp định WEF-UN

Liên Hợp Quốc luôn là một cơ quan tư nhân, được tài trợ bởi viện Rockefeller.. Các thành viên của Liên Hợp Quốc không được bầu chọn.

Mối quan hệ hợp tác công-tư với các chính phủ trên thế giới đang trở nên vững chắc hơn...

#GraspingTheBiggerPicture

👇

Một cuộc hôn nhân mới giữa công ty và chính phủ đã lặng lẽ diễn ra vào tuần trước khi ban lãnh đạo Diễn đàn Kinh tế Thế giới (WEF) và Liên hợp quốc (LHQ) ký một biên bản ghi nhớ (MOU) để hợp tác với nhau. Mặc dù Biên bản ghi nhớ này được hiển thị một cách đầy tự hào trên trang web của WEF nhưng nó lại không được tìm thấy trên trang web của Liên hợp quốc. Dấu hiệu duy nhất trên trang web của Liên hợp quốc về diễn biến mới quan trọng này là hình ảnh chiếc bút dùng để ký thỏa thuận và hai hình ảnh về lễ ký kết.

https://www.opendemocracy.net/en/oureconomy/how-united-nations-quietly-being-turned-public-private-partnership/

0 notes

Link

The Social And Economic Relevance Of Mathematics Education - Anil Khare

#social#economic#mathematicseducation#political#socialrelevances#urgent#fact#quality#oureconomy#dependent

0 notes

Photo

The wealth education is missing our communities and . . And crippling our financial future place debt on our shoulders that we can’t handle. . . The economy hasn’t took its biggest hit yet on the middle & poor class it’s coming and it’s not looking great at all. . . When the economy goes on a flash sale there will only be a few that can help us get out which means they will take ownership of more shit. . . That few is the Fortune 500 they are the only ones making record breaking money and record breaking times right now. Not only that they are creating technology with the citizens money that will help eliminate manual labor. Less jobs = more debt. . . Who do you think will get impacted the hardest🤔 didn’t one of those white guys already say he can’t find experienced black ppl the pool is small @wellsfargo . . Don’t let your emotions not allow you to see what’s really going on. The United States is a corporation that makes money. Look at how it conducts business and you will start to see what’s really going on in America. . . . #HustleTheNet #NetHustler #extremelyopinionated #amazon #amazonprime #tesla #jeffbezos #elonmusk #billandmelindagatesfoundation #microsoft #wellsfargo #bankofamerica #businessowner #blackownedbusiness #fortune500 #oureconomy #economics #economy #debtfreecommunity #debtfreegoals #entrepreneurlife (at Washington D.C.) https://www.instagram.com/p/CGID5vjF1if/?igshid=nnid4qrutbz2

#hustlethenet#nethustler#extremelyopinionated#amazon#amazonprime#tesla#jeffbezos#elonmusk#billandmelindagatesfoundation#microsoft#wellsfargo#bankofamerica#businessowner#blackownedbusiness#fortune500#oureconomy#economics#economy#debtfreecommunity#debtfreegoals#entrepreneurlife

0 notes

Photo

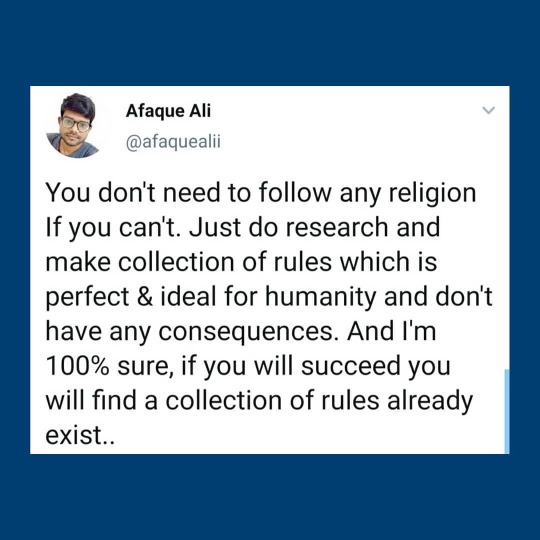

It's Sharia Law - Ruling of Islam ❤️ . . . #faith #religion #monotheism #islamicrules #pathtoreality #godisonlyone #allahuakbar #ilovesharia #oureconomy #ourrules https://www.instagram.com/p/CBfJMBGHnbL/?igshid=kb6lbxrs6eat

#faith#religion#monotheism#islamicrules#pathtoreality#godisonlyone#allahuakbar#ilovesharia#oureconomy#ourrules

0 notes

Photo

"I think that since everything is going up and our wages are going down, to strike is necessary for our generation" #loyolauniversitychicago #loyolaramblers #gradworkersunite #onstrike #oureconomy #greatrecession #économieaméricaine #etatsunis #vivelarepubliqueamericain #freedomlibertyandjusticeforall #liberteegalitefraternite #activism #organizing #studentactivism (at Loyola University Chicago Mundelein Center for Fine and Performing Arts) https://www.instagram.com/p/Bwp0838gRUW/?utm_source=ig_tumblr_share&igshid=1cttr2cmje7um

#loyolauniversitychicago#loyolaramblers#gradworkersunite#onstrike#oureconomy#greatrecession#économieaméricaine#etatsunis#vivelarepubliqueamericain#freedomlibertyandjusticeforall#liberteegalitefraternite#activism#organizing#studentactivism

0 notes

Link

“Conspiracy-fuelled riots sizzle on the streets of Amsterdam and Rotterdam and the Dutch cabinet has collapsed in a racist child benefit scandal. We are the last country in Europe to start vaccinating and have the second highest wealth inequality in the rich world. Our print media is owned by just two corporations and we are performing worse on climate change than our European neighbours. My adopted home likes to present itself as the prefect of Europe. But in reality, the Netherlands is a mess. [..] A white person with a criminal record was three times more likely to be hired for a job than a person of colour without a criminal record. While 5.6% of white Dutch households have an income so low as to put them at risk of poverty, for those with a ‘non-Western migration background’ the figure is 26.2%. For those with a Syrian or Eritrean migration background it's 80%. Those with a non-Western migration background are 14 times as likely to die in police custody as white Dutch people. [..] compared to the Netherlands, even Britain has done a good job of reckoning with its colonial past.”

869 notes

·

View notes

Text

Saving the planet is illegal

One of the worst barriers to preserving the planet in a state suitable for human habitation is the Energy Charter Treaty, an obscure 1994 treaty with 50+ signatories that allows energy companies to sue governments over environmental protection laws.

The ECT has just been invoked by the German polluter RWE, which is suing the Dutch government for €1.4b over a law that bans coal plants by 2030.

https://www.euractiv.com/section/energy/news/germanys-rwe-uses-energy-charter-treaty-to-challenge-dutch-coal-phase-out/

All told, the EU faces *at least* €345b in ECT liability over its climate plans. In reality, the total could be much higher, because the ECT provides for damages equal to the value of physical plant and *all projected future profits* from those plants.

https://www.investigate-europe.eu/en/2021/ect/

€345b is double the EU's total annual operational budget. This is the ransom that the world's worst climate criminals are demanding that Europeans pay as a condition of continuing to have a habitable planet. Big Energy want to be rewarded for its crimes against humanity.

Every day the treaty remains in effect produces more liability. Under ECT's provisions, a country that pulls out of the agreement is still liable for *twenty years* for any laws that affect the profitability of energy products started while the country was still in the ECT.

When a country is sued by a multinational for improving its environmental protections, the case is tried by a star-chamber of corporate lawyers who meet in secret and overwhelmingly find in favor of polluters.

Now, obviously, this is not a stable situation. To keep countries from fleeing the ECT, the energy cartel has embarked on a "modernization" project that it has slow-walked since 2017, with help from Japan, whose worst polluters depend on ECT to operate with impunity.

It's not hard to grind negotiations to a halt - all you need is a requirement that every decision must be unanimous before work can proceed. Leaks show this gambit is why the "modernization" meetings have been a four-year, do-nothing talking shop:

https://www.euractiv.com/section/energy/news/energy-charter-treaty-reform-reaches-milestone-with-little-progress-to-show/

The harms of ECT aren't limited to direct vast transfers of public money to polluters. ECT is a major reason we don't get meaningful climate action in the first place: such legislation dies in planning once its authors are warned that it will trigger ECT enforcement action.

The arguments in favor of ECT are risible FUD, as Fabian Flues, Cecilia Olivet and Pia Eberhardt document for Opendemocracy.

https://www.opendemocracy.net/en/oureconomy/this-obscure-energy-treaty-is-the-greatest-threat-to-the-planet-youve-never-heard-of/

Take the argument that the ECT spurs investment in renewables: a meta-analysis of 74 papers concludes that this effect is "so small as to be considered zero" (in reality, the majority of ECT-attributable investment is in dirty fossil fuel power).

https://onlinelibrary.wiley.com/doi/10.1111/joes.12392

Or the argument that since quitting ECT leaves countries exposed for 20 years, there's no point. Recall that this 20 year overhang only applies to projects begun *before* the country leaves the ECT, so the sooner countries quit it, the less risk they face.

Such risk as does exist can be mitigated by countries quitting in a bloc, making a mutual promise to ban companies domiciled in their borders from making any claims under the ECT, using national law to prohibit ECT action. The EU could mitigate much of its risk this way.

That the ECT even exists is a bad joke. It can't be fixed through "modernization" (especially not the current modernization plan, which doesn't touch corporate courts or contemplate any exemptions for climate regulation).

300 EU lawmakers have signed a petition calling on the EU to leave the ECT.

http://endfossilprotection.org/sites/default/files/documents/Statement%20of%20European%20Parliamentarians%20on%20the%20modernization%20of%20the%20TCE.pdf

They're joined by 450 climate activists:

http://www.endfossilprotection.org/en#no-back

And you can sign, too, in this new EU-wide petition:

https://energy-charter-dirty-secrets.org/

Image: joelbeeb (modified) https://commons.wikimedia.org/wiki/File:Zimmer_Power_Plant_Smoke_Stack_-_panoramio.jpg

CC BY-SA: https://creativecommons.org/licenses/by-sa/3.0/deed.en

61 notes

·

View notes

Text

Time to liberate the economy from corporate monopolies | openDemocracy

https://www.opendemocracy.net/en/oureconomy/corporate-monopolies-are-threat-to-democracy-public-interest/

0 notes

Link

Why is supernova – the explosion and death of a star – an apt metaphor for what could now be about to unfold? Why could the coronavirus, an organism 1000th the diameter of a human hair, be the catalyst for such a cataclysm? And what can workers, youth and the dispossessed of the world do to defend ourselves and to ‘bring to birth a new world from the ashes of the old’, in the words of the US labour hymn, Solidarity Forever?

The first stage of a supernova is implosion, analogous to the long-term decline in interest rates that began well before the onset of systemic crisis in 2007, which has accelerated since then, and which fell off a cliff just as coronavirus began its rampage in early January 2020. Falling interest rates are fundamentally the result of two factors: falling rates of profit, and the hypertrophy of capital, i.e. its tendency grow faster than the capacity of workers and farmers to supply it with the fresh blood it needs to live. As Marx said, in Capital vol. 1, “capital’s sole driving force [is] the drive to valorise itself, to create surplus-value… capital is dead labour which, vampire-like, only lives by sucking living labour, and lives the more, the more labour it sucks.”

These two factors combine to form a doom loop of awesome destructive power. Let us examine its most important linkages.

Many things both mask and counteract the falling rate of profit, turning this into a tendency that only reveals itself in times of crisis, of which the most important has been the shift of production from Europe, North America and Japan to take advantage of the much higher rates of exploitation available in low-wage countries. The falling rate of profit manifests itself in a growing reluctance of capitalists to invest in production; more and more of what they do invest in is branding, intellectual property and other parasitic and non-productive activities. This long-running capitalist investment strike is amplified by the global shift of production – boosting profits by slashing wages rather than by building new factories and deploying new technologies. This enables huge mark-ups, turbo-charging the accumulation of vast wealth for which capitalists have no productive use – hence the hypertrophy of capital.

This, in turn, results in declining interest rates – as capitalists compete with each other to purchase financial assets, they bid up their price, and the revenue streams they generate fall in proportion – hence falling interest rates. Falling interest rates and rising asset values have created what is, for capitalist investors, the ultimate virtuous circle – they can borrow vast sums to invest in financial assets of all kinds, further inflating their ‘value’.

Falling interest rates therefore have two fundamental consequences: the inflation of asset bubbles and the piling up of debt mountains. In fact, these are two sides of the same coin: for every debtor there is a creditor; every debt is someone else’s asset. Asset bubbles could deflate (if productivity increases), or else they will burst; economic growth could, over time, erode debt mountains, or else they will come crashing down.

Since 2008, productivity has stagnated across the world and GDP growth has been lower than in any decade since World War II, resulting in what Nouriel Roubini has called “the mother of all asset bubbles,” while aggregate debt (the total debt of governments, corporations and households), already mountainous before the 2008 financial crash, has since then more than doubled in size. The growth of debt has been particularly pronounced in the countries of the global South. Total debt for the 30 largest of them reached $72.5tn in 2019 – a 168% rise over the past 10 years, according to Bank of International Settlements data. China accounts for $43tn of this, up from $10tn a decade ago. In sum, well before coronavirus, global capitalism already had ‘underlying health issues’, it was already in intensive care.

Global capitalism – which is more imperialist than ever, since it is both more parasitic and more reliant than ever before on the proceeds of super-exploitation in low-wage countries – is therefore inexorably heading to supernova, towards the bursting of assets bubbles and the crashing of debt mountains. Everything that imperialist central banks have done since 2008 has been designed to postpone the inevitable day of reckoning. But now that day has come.

10-year US Treasury bonds are considered the safest of havens and the ultimate benchmark against which all other debt is priced. In times of great uncertainty, investors invariably stampede out of stock markets and into the safest bond markets, so as share prices fall, bond prices – otherwise known as ‘fixed income securities’ – rise. As they do, the fixed income they yield translates into a falling rate of interest. But not on March 9, when, in the midst of plummeting stock markets, 10-year US Treasury bond interest rates spiked upwards. According to one bond trader, “statistically speaking, [this] should only happen every few millennia.” Even in the darkest moment of the global financial crisis, when Lehman Brothers (a big merchant bank) went bankrupt in September 2008, this did not happen.

The immediate cause of this minor heart attack was the scale of asset-destruction in other share and bond markets, causing investors to scramble to turn their speculative investments into cash. To satisfy their demands, fund managers were obliged to sell their most easily-exchangeable assets, thereby negating their safe-haven status, and this jolted governments and central banks to take extreme action and fire their ‘big bazookas’, namely the multi-trillion dollar rescue packages – including a pledge to print money without limit to ensure the supply of cash to the markets. But this event also provided a premonition for what is down the road. In the end, dollar bills, like bond and share certificates, are just pieces of paper. As trillions more of them flood into the system, events in March 2020 bring closer the day when investors will lose faith in cash itself – and in the power of the economy and state standing behind it. Then the supernova moment will have arrived.

During the middle two weeks of March, imperialist governments announced plans to spend $4.5 trillion bailing out their own bankrupt economies. An emergency online summit of the G20 (the G7 imperialist nations plus a dozen or so ‘emerging’ nations, including Russia, India, China, Brazil, and Indonesia) on 26 March, declared “we are injecting over $5 trillion into the global economy.” These are weasel words; by ‘global’ they actually mean ‘domestic’! The response of the ‘left’ in the imperialist countries is to clap its hands and say, we were right all along! There is a magic money tree after all! – apparently not realising that this is exactly what happened post-2008: the socialisation of private debt. Or that, unlike post-2008, this time it will not work.

Some highlights of John Smith’s excellent article on the economic crisis induced by the coronavirus. The pandemic has popped the bubble that has been keeping our imperialist system coherent since the 2008 crisis. In order to keep that bubble going, Central Banks have been undertaking unprecedented financial measures which they are attempting to repeat again. The result will be a reckoning, as the bad debts of the system pass from the private banks and become concentrated in the Central Banks that are core to our monetary systems. We need to use this crisis to begin building a rational system based on the using resources for human need rather than the exploitative anarchy of capitalism.

380 notes

·

View notes

Text

4 notes

·

View notes

Link

"...fund managers were obliged to sell their most easily-exchangeable assets, thereby negating their safe-haven status, and this jolted governments and central banks to take extreme action and fire their ‘big bazookas’, namely the multi-trillion dollar rescue packages – including a pledge to print money without limit to ensure the supply of cash to the markets. But this event also provided a premonition for what is down the road. In the end, dollar bills, like bond and share certificates, are just pieces of paper. As trillions more of them flood into the system, events in March 2020 bring closer the day when investors will lose faith in cash itself – and in the power of the economy and state standing behind it. Then the supernova moment will have arrived."

17 notes

·

View notes

Video

~~ LQQK~~ THE FINAL SOLUTION WILL SAVE OUR WORLD ~~~ ~~~ LET'S JUST KILL ALL THE WHITE PEOPLE ~~~ AFTERWARDS: OURECONOMY, THE CLIMATE CRISIS, WE WILL ALL HAVE JOBS, AND LIVE TOBE FIVE HUNDRED YEARS OLD, AND OLDER ! ! ! HALLELUJAH JESUS ! ! !

3 notes

·

View notes