#our only social security net is our obligations to each other

Explore tagged Tumblr posts

Text

Taxes are for the little people

If you wanna do crimes, make them incredibly complicated and technical. Like the hustlers that came into the bookstore I worked at and spun these long-ass stories about why they needed money for a Greyhound ticket home.

Those guys shoulda studied the private equity sector.

Private equity's playbook is to borrow giant sums by putting up other peoples' companies as collateral (yes, really). Then they use that money to buy the company they mortgaged, and pay themselves a huge dividend.

Then they sell off the company's assets and pay themselves even more money. That leaves the company in a state of precarity - assets they once owned, like their buildings, they now rent. If the rent goes up, they have to find the money to cover it.

All of this forms a pretense for mass layoffs, defaulting on pension obligations, lowering product quality, stiffing suppliers and borrowing more money. If the company doesn't go bust, the PE looters can flip it to *another* PE company, that does it again.

Whenever you see something really terrible happening to a business that once offered useful products and services and paid decent wages, it's a safe bet that PE is behind it. Toys R Us, Sears, your local hospital - and that memestock favorite, AMC.

https://pluralistic.net/2020/04/12/mammon-worshippers/#silver-lake-partners

Private equity goons make their money in two ways: the first is by pocketing 20% of these special dividends and other extractive policies that hollow out business.

This is money at PE managers get paid for spending their investors' money. It's a wage, in other words.

But thanks to the "carried interest" loophole (a hangover from 16th-century sea captains that has nothing to do with "interest" on loans), they get to treat these wages as "capital gains" and pay far less tax on them.

The fact that we give preferential tax treatment to capital gains (money derived from gambling), while taxing wages (money derived from doing useful work) at higher rates really tells you everything you need to know about our economic priorities.

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

The carried interest loophole lets PE crooks treat their salaries as capital gains, are taxed at a much lower rate than the wages of the workers whose lives they're destroying.

On top of the 20% profit-share that PE bosses get every year, they also pocket a 2% "management fee" for all the "value" they add to the companies they've taken over.

This is *definitely* a wage. The 20% profit-share at least has an element of risk, but that 2% is guaranteed.

But PE bosses have spent more than a decade booking that 2% wage as a capital gain, using a tax-fraud tactic called "fee waivers." The details of how a fee waiver don't matter because it's all bullshit, like the tale of the needful Greyhound ticket.

All that matters is that a legal fiction allows people earning *eight- or nine-figure salaries* to treat *all* of those wages as capital gains and pay lower rates of tax on them than the janitors who clean their toilets or the workers whose jobs they will annihilate.

Now, the IRS knows all about this. Whistleblowers came forward in 2011 to warn them about it. The Treasury even struck a committee to come up with new rules to fix it.

But Obama failed to make those rules stick, and then Trump put a former tax-cheat enabler in charge of redrafting them. The cheater-friendly rules became law on Jan 5, and handed PE bosses hundreds of millions in savings every year.

https://www.nytimes.com/2021/06/12/business/private-equity-taxes.html

The New York Times report on "fee waivers" goes through the rulemaking history, the technical details of the scam, and the gutting of the IRS, which can no longer afford to audit rich people and now makes its quotas by preferentially auditing low earners who can't afford lawyers.

But former securities lawyer Jerri-Lynn Scofield's breakdown of the Times piece on Naked Capitalism really connects the dots:

https://www.nakedcapitalism.com/2021/06/private-inequity-nyt-examines-how-the-private-equity-industry-avoids-taxes.html

As Scofield and Yves Smith point out, if Biden wanted to do one thing for tax justice, he could abolish preferential treatment for capital gains. If we want a society of makers and doers instead of owners and gamblers, we shouldn't penalize wages and reward rents.

There's an especial urgency to this right now. As the PE bosses themselves admit, they went on a buying spree during the pandemic (they call it "saving American businesses"). Larger and larger swathes of the productive economy are going into the PE meat-grinder.

Worse still, the PE industry has revived its most destructive tactic, the "club deal," whereby PE firms collaborate to take out whole economic sectors in one go:

https://pluralistic.net/2021/05/14/billionaire-class-solidarity/#club-deals

We're at an historic crossroads for tax justice. On the one hand, you have the blockbuster Propublica report on leaked IRS files that revealed that the net tax rate paid by America's billionaires is close to zero.

https://pluralistic.net/2021/06/08/leona-helmsley-was-a-pioneer/#eat-the-rich

This has left the Bootlicker-Industrial Complex in the bizarre position of arguing that anyone who suggests someone who amasses billions of dollars should pay more than $0 in tax is a radical socialist (so far, the go-to tactic is to make performative noises about privacy).

At the same time, the G7 has agreed to an historical tax deal that will see businesses taxed at least 15% on the revenue they make in each country, irrespective of the accounting fictions they use to claim that the profits are being earned in the middle of the Irish Sea.

That deal is historical, but the fact that it's being hailed as curbing corporate power reveals just how distorted our discourse about corporate taxes has become.

As Thomas Piketty writes, self-employed people pay 20-50% tax in countries that will tax the world's wealthiest companies a mere 15%: "For SMEs as well as for the working and middle classes, it is impossible to create a subsidiary to relocate its profits to a tax haven."

Piketty, like Gabriel Zucman, says that EU nations should charge multinationals a minimum of 25%, and like Zucman, he reminds us that the G7 deal does nothing to help the poorest countries in the Global South.

https://www.lemonde.fr/blog/piketty/2021/06/15/the-g7-legalizes-the-right-to-defraud/

These countries and the EU have something in common: they aren't "monetarily sovereign" (that is, they don't issue their own currencies *and* borrow in the currencies they issue).

Sovereign currency issuers (US, UK, Japan, Canada, Australia, etc) don't need to tax in order to pay for programs - first they spend new money into the economy and then they tax it back out again.

https://pluralistic.net/2020/06/10/compton-cowboys/#the-deficit-myth

These countries can run out of stuff to buy in their currency, but they can't run out of the currency itself. Monetarily sovereign countries don't tax to fund their operations.

Rather, they tax to fight inflation (if you spend money into the economy every year but don't take some of it out again through taxation, more and more money will chase the same goods and services and prices will go up).

And just as importantly, monetary sovereigns tax to reduce the spending power - and hence the political power - of the wealthy. The fact that PE bosses had billions of tax-free dollars at their disposal let them spend millions to distort tax policy to legalize fee waivers.

Taxing the money - and hence the power - of wage earners at higher rates than gamblers creates politics that value gambling above work, because gamblers get to spend the winnings they retain on political influence, including campaigns to rig the casino in their favor.

This discredits the whole system, shatters social cohesion and makes it hard to even imagine that we can build a better world - or avert the climate-wracked dystopia on the horizon.

But for Eurozone countries (whose monetary supply is controlled by technocrats at the ECB) and countries of the Global South (whom the IMF has forced into massive debts owed in US dollars, which they can only get by selling their national products), tax is even more urgent.

The US could fund its infrastructure needs just by creating money at the central bank.

EU and post-colonial lands can only fund programs with taxes, so for them, billionaires don't just distort their priorities and corrupt their system - they also starve their societies.

But that doesn't mean that monetary sovereigns can tolerate billionaires and their policy distortions. The UK is monetarily sovereign, in the G7, and its finance minister is briefing to have the City of London's banks exempted from the new tax deal.

https://www.bloomberg.com/news/articles/2021-06-08/u-k-pushes-for-city-of-london-exemption-from-global-tax-deal

Now, the City of London is one of the world's great financial crime-scenes, and its banks are responsible for an appreciable portion of the planet-destabilizing frauds of the past 100 years.

During the Great Financial Crisis AIG used its London subsidiary to commit crimes its US branch couldn't get away with. The City of London was the epicenter of the LIBOR fraud, the Greensill collapse - it's the Zelig of finance crime, the heart of every fraud.

UK Chancellor Rishi Sunak claims banks are already paying high global tax and can't afford to be part of the G7 tax deal. If that was true, it wouldn't change the fact that these banks are too big to jail and anything that shrinks them is a net benefit.

But it's not true.

As the tax justice campaigner Richard Murphy points out, the risk to banks like Barclays adds up to 0.8% of global turnover: "The big deal is that the 15% global minimum tax rate is much too low. Suinak has yet again spectacularly missed the point."

https://www.taxresearch.org.uk/Blog/2021/06/09/how-big-is-the-tax-hit-on-banks-from-the-g7-tax-deal-that-sunak-fears-really-going-to-be/

Image: Joshua Doubek (modified) https://commons.wikimedia.org/wiki/File:IRS_Sign.JPG

CC BY-SA: https://creativecommons.org/licenses/by-sa/3.0/deed.en

152 notes

·

View notes

Text

What Makes a King? - A Concept Overview & Analysis

By: Peggy Sue Wood | @peggyseditorial

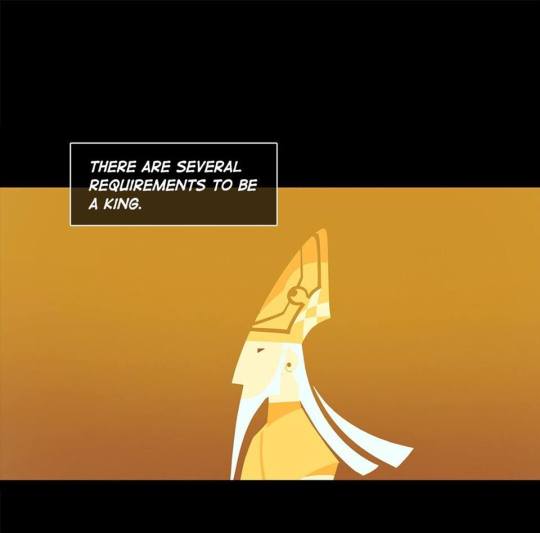

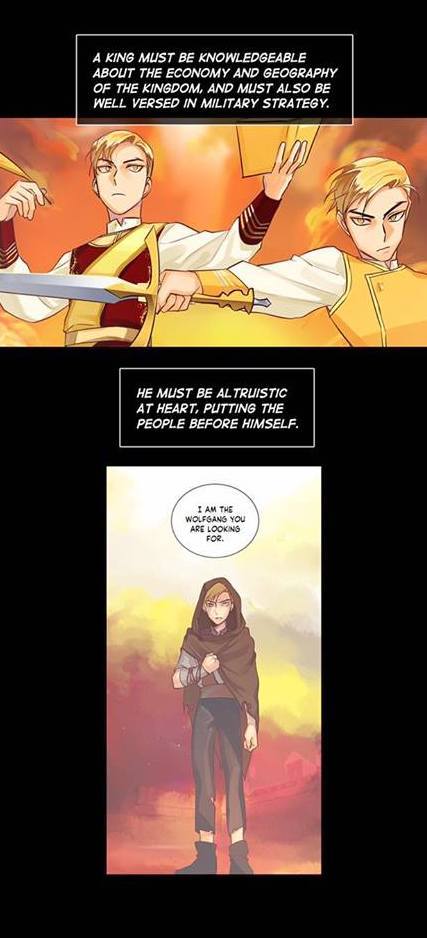

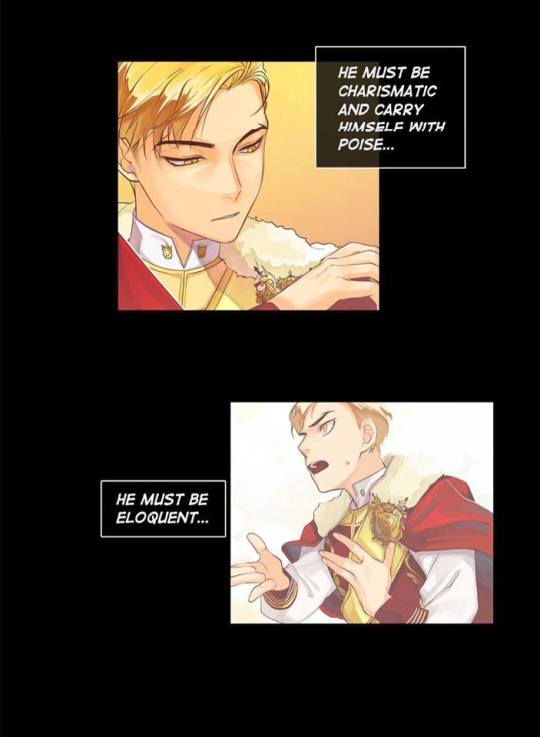

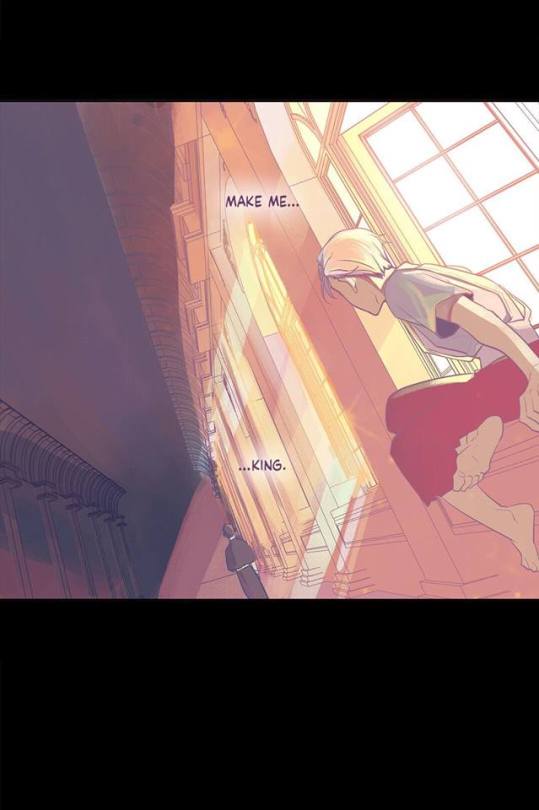

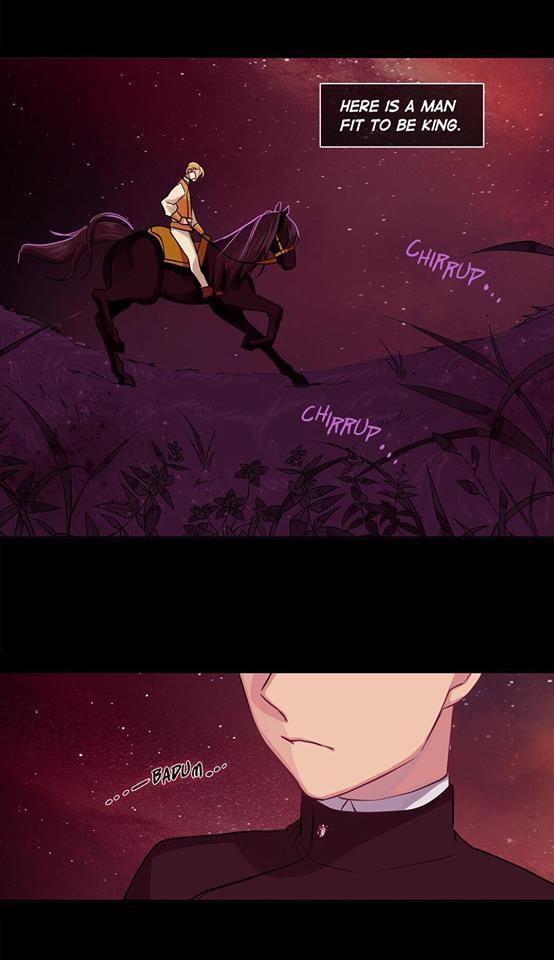

Above is my favorite scene from the manhwa King’s Maker (from Season 1 Episode/chapter 14).

I love this scene because it perfectly embodies the ideal of what it takes to be a just or good leader in the fictional world of this particular story (not just seen as one publicly, but actually being one). It's an idea that relies heavily on the concept of noblesse oblige, which tends to pop-up in stories featuring nobles, royalty, or something similar. While also expanding on this idea of the necessity for chivalry that draws its definition and history from stories of King Arthur and his Knights of the Round. In modern-day stories, I would argue that much of our current interpretations and ideas of knightly/chivalric qualities come from Geoffrey of Monmouth’s stories of the king and his knights as well as the tales’ later retellings. [For those that don’t know noblesse oblige is the idea of inferred responsibility from privileged people to act with generosity and nobility toward those less privileged and chivalry is defined as a knightly system with its religious, moral, and social code. Geoffrey of Monmouth is the author of the first narrative account of King Arthur's life that we know of.]

You see, as someone who has studied literature in school, particularly Classical Antiquity and where we've gone from since, I've always been really interested in this idea of what makes a King, particularly in stories where we see a fight for the throne because it's hard to maintain these ideal qualities in what is often a bloody battle for power among people who have little to no qualms about committing vile acts to maintain what they have or gain more power, money, etc. This question of what makes a King? is a one I find myself asking often when I read fantasy stories that involve any question of a throne or it’s inheritance. However, I use the term "king" loosely to encompass the concept of a rightful ruler as defined by the set up an author gives in their individual stories.

In popular works like Game of Thrones, in which we see much of the darker sides to knighthood, oaths, nobility, royalty, and so on--we see the grim reality of Geoffrey of Monmouth's time. In fact, some argue that Geoffrey's account and the focus on the knighthood and Arthur's reign amid war and beyond was a subversive aim to inspire real change among the dark abuses of power that many members of the knightly class, nobility, and above, held. In a movie like The Knight's Tale, we see this too in which it is the common man that depicts the embodiment of a true knight's spirit--one that is loyal, protective, chivalrous, deserving of love and admiration, and so on--rather than the majority of the knights born to their status. Shakespeare, who features many noble and royal families in his tales, also marks some of these qualities--showing audiences both redeeming features and cruelty among the classes (a rare depiction that landed him, at times, in the hot seat).

These stories draw me in, as they do many others, and I think we can draw a conclusion on the trials a good or just king, knight, noble, or other must embody to achieve their "throne" by the end--one that is a bit more clear than The King Maker's summary above.

Each potential "king" must succeed in a trail depicting one or more of the seven knightly virtues (defined here: http://marktoci.weebly.com/7-knightly-virtues.html), those being:

“Courage. More than bravado or bluster, a knight must have the courage of the heart necessary to undertake tasks which are difficult, tedious or unglamorous, and to graciously accept the sacrifices involved.

Justice. A knight holds him- or herself to the highest standard of behavior, and knows that “fudging” on the little rules weakens the fabric of society for everyone.

Mercy. Words and attitudes can be painful weapons, which is why a knight exercises mercy in his or her dealings with others, creating a sense of peace and community, rather than engendering hostility and antagonism.

Generosity. Sharing what’s valuable in life means not just giving away material goods, but also time, attention, wisdom and energy - the things that create a strong, rich and diverse community.

Faith. In the code of chivalry, “faith” means trust and integrity, and a knight is always faithful to his or her promises, no matter how big or small they may be.

Nobility. Although this word is sometimes confused with “entitlement” or “snobbishness,” in the code of chivalry it conveys the importance of upholding one’s convictions at all times, especially when no one else is watching.

Hope. More than just a safety net in times of tragedy, hope is present every day in a knight’s positive outlook and cheerful demeanor - the ‘shining armor’ that shields him or her, and inspires people all around.”

Suppose one were to look to the code of chivalry defined in Sir Gawain and the Green Knight. In that case, those virtuous qualities might instead be represented as friendship, generosity, chastity, courtesy, and piety/humility.

Failing to pass such trails, the potential "king" would instead display a knightly sin (defined here: https://chivalrytoday.com/knightly-sins/), and often, if not always, in a story suffers karma for such actions.

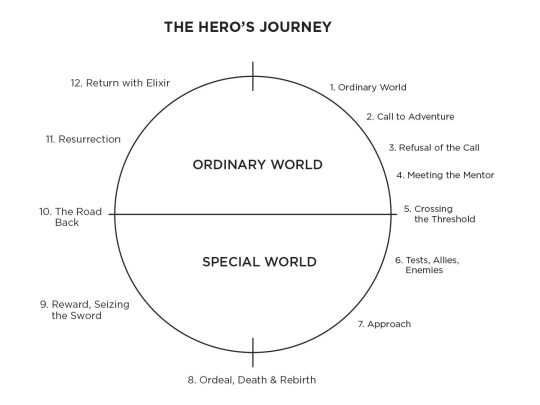

The idea of a Hero's Journey, a story form I'm sure everyone has heard defined many times before, includes these trails even though they are rarely explicitly spelled out in a summary of the form. This may be because many heroes rising, of which these "kings" are, already embody these virtues and only struggle with or require a trial against one of them.

As it stands, we can often see in advance a potential king's tragedy by understanding this idea. For example, we know that Wolfgang Goldenleonard, the prince seen above in The King's Maker excerpt I’ve provided, is going to be the King, birth order be damned. Will there be trails? Of course. And he passes them securing his crown at the end of Season 1; and continues to pass them thus maintaining his throne, which we can see currently in Season 2.

By extension, we can see the character's whose stories will end in failure based on how long it takes them to pass the knightly trails, if they even can pass them. For example, Richard III in Requiem of the Rose King, which is sure to end in tragedy--not simply because the Shakespearean plays the work draws on tend to end that way but because Richard’s character has changed from the loyal son/brother.

King, in this sense, could probably easily be replaced by the word hero or knight... but the idea stands that to make them worthy of their title they seem to need one or more of these qualities.

So as you read the next chapter of your favorite knight's tale, or a battle for the throne, or a rise to power--consider whether or not your hero/protagonist is capable of achieving these virtues. You will probably find that even the characters that seem villainous, like the self-ish Seo Joo-Heon from Tomb Raider King or Naofumi Iwatani from The Rising of The Shield Hero, pass the test we've defined here.

#King’s Maker#킹스메이커#The Rising of The Shield Hero#rising of the shield hero#tomb raider king#king#king maker#kings#Requiem of the Rose King#Richard iii#shakespeare#king arthur#knight#knights of the round#knights#chivalry#code of honor#knight's code#Noblesse oblige#hero's journey#hero#heroes#journey#story#write#writing#game of thrones#a knight's tale#Geoffrey of Monmouth#Sir Gawain and the Green Knight

148 notes

·

View notes

Text

How Fenty’s Beauty Branding Positioning Generated $100 Million In 40 Days

Many of Huda Beauty’s high posts featured the brand’s photogenic founder, suggesting the brand is taking advantage of that Huda magic. Beauty branding is all about first impressions and in the enterprise of beauty the bar is set excessive. Salons want a distinctive style to face out and entice fashion-savvy shoppers in an over-saturated market. We are a beauty branding company, our skilled brand id companies create related, believable, well-positioned manufacturers https://mslk.com/.

Don’t cover them on a webpage nobody visits; use them to underscore your advertising, your website copy, and every thing else that comes from your model, implicitly and explicitly. According to Brand Finance, L'Oreal Paris is the main make-up brand in relation to net worth. In 2020 it's value was value a whopping 11.75 billion US dollars. It's adopted by Gillette and Nivea in the second and third places, respectively. Anyone could be their own makeup artist with the assistance of Make Up For Ever.

This beauty branding logo is kind of made up of a monogram illustration and a wordmark. The monogram is made up of a artistic and edgy letter mixture. The U and D are uppercase and angular, with gentle swirls, onerous traces and modern aptitude. Color is merely certainly one of three logo components - others are symbol and font.

The brand’s skincare, makeup and perfume merchandise combine science and sweetness to achieve the right blend of modern thinking and timeless style. Created by François Nars in 1994, NARS Cosmetics launched with simply 12 lipsticks. Since then, the label has grown considerably and now provides a various and in depth assortment of magnificence merchandise for women of all skin sorts. You don’t want to purchase couture clothes to find a way to put on luxurious.

This mega cosmetics firm is certainly one of the largest on the earth and has been providing girls with incredible cosmetics and fragrances since 1886. RMS Beauty prides itself on creating merchandise that are not solely non-toxic but in addition nourishing to the skin. The label’s makeup and skincare ranges function raw, food-grade and natural elements that promote anti-ageing and long-lasting magnificence.

They’ve backed up their dedication to that base of their marketing, and they’ve used social media to attach with their clients in unfiltered and organic methods. Since Lilah b isn't brand new, Foland is working via well timed issues that are important to modern beauty customers. The brand is increasing the variety of foundation shades provided, of which there are at present only 5, and addressing sustainability, an increasing area of focus for the wonder trade. The frequency of assortment has increased from monthly to weekly in just some years, and Lilah b is devoted to persevering with the scheme as a value of doing enterprise. Vegan beauty brand The Lip Bar was a prime performer on each Instagram and Twitter this year.

As prospects are exposed to a beauty model extra typically, they become extra inclined to like it. Successful brands have a constant look and feel in every little thing they put in front of their prospects. One of the major benefits of this type of consistency is that it offers easy recognition of any product amongst customers. Attractive packaging design is a motivating pressure in encouraging folks to make impulsive selections. Taking benefit of this reward-seeking conduct with a good design can have a robust influence on customers’ receptiveness to your products.

To be thought-about natural, the product must meet non-toxic standards for ingredients and processing. Up from $483B in 2020 to $511B in 2021 — and with an annual compounded development rate of four.75% worldwide — it’s predicted to exceed $716B by 2025. Long controlled by legacy conglomerates, the sweetness business has turned on-line. Spend a while really nailing down what makes your products different. You have to not be afraid to level out what makes you stand out, there’s plenty of power in that. You’re a growing group with systemic issues which may be affecting your brand.

Lilah B promote multi-use merchandise using "clean" components, encouraging clients to recycle their old cosmetics packaging. Customer engagement is handiest if it’s organic, through “deep connection” corresponding to user-generated content or influencers who've plausible relationships with products. A robust online presence might help entice stockists—so it’s worth investing in social media areas. Early on, you will want to create a website—try Squarespace for an inexpensive, secure, and slick on-line retailer you could build your self with no coding skills. I constructed my very own retailer on Squarespace within the time it took to watch an episode of Black Mirror.

Skincare model Mary Kay swiftly jumped into the fight against coronavirus by redirecting resources to fabricate hand sanitizer within the early days of the pandemic. Instagram followers jumped in to applaud the brand’s actions with more than 17,000 likes and comments. Not all brands went so far as to change up manufacturing, however many beauty manufacturers tried to make a difference by actively sharing what they have been doing to fight the pandemic with followers on social media. Many manufacturers noticed success with giveaways this yr, but this one from ColourPop is a textbook instance of a dynamite social media giveaway. The brand stored the criteria for entry easy and centered on ColourPop as an alternative of creating fans hop around to a bunch of different brands. The giveaway in celebration of a big follower milestone sneakily helped ColourPop develop followers even more by incentivizing casual followers to follow the model on Instagram.

The company serves various industries together with sports, leisure, food & beverage, retail and travel. But the joy in this brand comes in its simplicity — particularly in comparability to the encompassing packaging. The monogram is made up of the overlapping E and L of the model name in a curly, inventive and splendid font. The backward “N” adds a cool, innovative and edgy tone to the logo that elevates the brand’s mastery within the beauty industry. Due to Instagram API limitations, we’re capable of pull accurate Instagram engagement numbers only for verified and/or Instagram business accounts. Helpful business articles, our work, and special provides are introduced on these platforms.

You’ll also need an on-brand business card full with your logo, website and another components of your model identity, to construct these connections. The visual id communicates instantly what it would take a long time to place throughout in words. For example, are your values natural, natural and eco-friendly or glamorous and glossy? The customer will instantly get an impression from your packaging and marketing materials to assist them resolve if the product is for them. Of course the phrases are important too, but you have to get your clients to notice you first, and that's where visuals are so necessary.

After Fenty launched, their deep shades offered out across the nation, and customers took to social media to share their joy at discovering foundations that matched their pores and skin tone. But while Fenty is priced as a luxury model, they still aren’t as expensive as most of the other manufacturers promoting a lot of shades. Estée Lauder’s foundation range with forty two shades, for instance, is priced at $42; Fenty’s foundation is $35.

By posting YouTube movies of her make-up routines and sharing seems on her Snapchat tales, she had positioned herself as a number one voice. eMarketer reviews that 38% of shoppers interested in testing pop-up stores are those that already store on-line every week in comparability with 28% preferring brick-and-mortar shopping. By engaging with its followers in a face-to-face setting, Glossier is prepared to deepen relationships with customers past online interactions. Yet, it doesn’t come with the monetary obligations of following a chain-store mannequin. With different themes in every area and experiential advertising activations — it’s constructed hype that attracts droves of brand name lovers desperate to try out the products in real-time.

While the beauty and private care business will stay strong globally, the cosmetics and skincare verticals specifically will expertise probably the most income growth within the US at a fee of 3.5% by 2021. Crafted is a inventive branding agency that companions with startups and fortune 100 brands across the globe. They have experience in brand design, video manufacturing, web site improvement ad content material advertising. Does a Black-owned magnificence brand need to post about Black founders, Black influencers, and makeup shades for darker skin tones to be successful on social media?

Fenty is a good instance of magnificence brand advertising, from their partaking social media channels which include sharing well-liked memes on Twitter and sharing selfies of their clients sporting Fenty makeup. Fenty was initially launched in 2017 by way of an exclusively digital marketing campaign and to this present day the model is a testomony to the significance of how important the web area is for modern magnificence manufacturers. Different branded cosmetics model design elements by Almi designLogo. Your brand is the face of your beauty enterprise and, as such, it’s the most important component you’ll bring to life through the branding course of. Fenty found next-level success because it positioned itself from day one as a diverse brand for a various buyer base. They’ve built products for an enormous and underserved market—women whose pores and skin tones don’t fall into the ranges that the most important makeup brands focus on.

According to NPD, Benefit Cosmetics had a 50% share of the £20 million brow market in 2016, and that was before the model launched thirteen model new brow-related products. Fenty continues this strategy across digital channels, using YouTube tutorials and stay virtual events to generate engagement and hype around each new product launch. Many magnificence brands launched digital tools in 2020, as customers have been unable to visit stores , and L’Oreal’s ‘Signature Faces’ digital make up line was arguably one of the most innovative releases.

Your web site is a superb platform to start a dialogue about all magnificence topics and, who is aware of, maybe a while down the road you might begin producing a line of beauty products that you never considered. Funkhaus is a digital creative company working on the intersection of design, content material, programming, and strategy. One reason behind Benefit’s domination of the area is its shrewd advertising activity, which in 2017 concerned the ‘Browmobile’ campaign. Combining experiential elements with digital advertising, it involved an online competition offering customers the possibility to win a visit from the browmobile.

"Aside from social media, a advertising tactic that usually will get overlooked is the unboxing experience you could create for influencers," says Wittick. "Fabfitfun created a stir about this, yet it’s a tactic that still will get uncared for." When operating a cosmetics advertising marketing campaign on social media, begin by figuring out what makes your product visually intriguing.</p>

<p>Glossier managed to tie for first with last year’s Instagram winner Huda Beauty thanks to dynamic posts tailor-made to the instances. Many of the brand’s prime Insta posts featured COVID updates, assist of frontline staff, and popping out in support of Black Lives Matter, indicating the model was unafraid to take a stand. Going beyond the makeup was a profitable strategy for Glossier throughout all channels and was especially powerful on Instagram.

A logo that conveys your brand and character instantly is one which prospects will respond to. Those are just two examples, but you should take the time to determine the place your clients spend their time if you'd like your marketing to be effective. Once you could have taken these three steps, you have to use the information you could have gathered to market your company and merchandise. New web shoppers must create an online account to earn & redeem rewards. “We actually imagine that Then I Met You has its own distinct branding and story to inform, and we want to grow separate and distinctly from Soko Glam,” says Cho.

You will create much less waste and save vitality by using recycled supplies. This sort of engagement is gold, and firms like ColourPop comprehend it. The brand is constantly increasing its product range and making an attempt new things, and the probabilities are countless. In 2017 it put a name out for a name for a model new, yet-to-be-released concealer and inside seconds had dozens of replies. The website Bustle rapidly caught on to the thread, stating ColourPop teased a possible concealer on Twitter and followers already have the right name idea. A large seventy % of Glossier’s on-line sales come from peer referrals.

Matt Holt, Chief Strategy Officer at Digitas UK, explains why we have to deliver memorability and utility via buyer expertise. The travel trade fascinates me; not just because like everyone else I love a good holiday and a while within the solar, however it’s additionally some of the aggressive industries in relation to the SERPs. A beautifully designed web site in its personal right – it’s fairly simple to get lost browsing round. However, by pointing customers back to content material on the primary Aesop web site, it is in a position to deliver on its authentic function of promoting the core model.

Social media cosmetics branding by JayJacksonIf you need your magnificence brand to succeed, you need to model yourself on social media. While all platforms are necessary, YouTube and Instagram are each visual platforms where the majority of magnificence content material lives, making them, palms down, the most important channels for beauty manufacturers. Fenty launched with forty totally different shades of foundation, encompassing an enormous variety of pores and skin tones. As a outcome, the company was in a place to supply a greater number of choices in darker and lighter shades of make-up than most other major firms.

Logo by thisisremedy for Floral Chemistry.Customers wish to work with manufacturers they'll stand behind. So when you really wish to connect together with your customers, you should do greater than make superb lipsticks or tremendous pigmented shadows—you want a powerful corporate mission and values. Sign up for our free, 7-day e mail course and learn to construct the proper model id. When it comes to branding your corporation, there are three fundamental ideas you have to understand.

It specializes in science, and you'll see that within the design components that the logo embodies. You can’t ignore a model whose beauty brand is shiny, daring and dynamic in the way this model is — and you don’t want to. The first store opened a hundred sixty five years ago as a New York apothecary, nevertheless it has advanced right into a model that cares about all-natural merchandise and the shoppers that use them. Glossier is a modern cosmetic brand that is identified for its simplicity and minimalism — in its product providing and its product packaging.

The flowing feel of a script font is inherently feminine and conveys a simple class that might be perceived at a look. What meaning in sensible phrases is that the competitors in the magnificence industry is fierce. The huge cosmetics corporations are continuously engaged in a battle to win the business of more and more subtle customers. And even in the smallest cities, generally two or three hair or nail salons have to compete with one another for a small pool of shoppers. Over the previous twenty years we now have helped manufacturers grow from the bottom up, launch line extensions, rediscover their voice in a crowded market, and create totally new product categories. While public relations, partnerships, events like Indie Beauty Expo, and different advertising tactics may be efficient, Instagram influencers will actually increase your beauty business.

The emblem is a mirror of this magnificence brand’s products, usually described as bold, surprising and vivid. Its aesthetics is immediately derived from Kat’s tattoo artistry in its intricate typography sample even in its retail places which echo stylistic cues from gothic artwork and structure. It balances a regal history with a contemporary energy that can’t be ignored or tamed.

1 note

·

View note

Text

Alone, Together | Chapter 38 | Morgan Rielly

A/N: Many thanks again for understanding why I couldn’t upload last week. We’re in the homestretch now and nearing the end of the story (only two more official chapters -- eeeeek!). Remember that canon questions are always welcome, and there will be at least four (4) “epilogues”/glimpses into the future.

When Bee awoke to soft, quick butterfly kisses on her shoulder and neck early in the morning of her 24th birthday, she knew she was waking up in her own personal form of paradise. With the comforter draped over her body, the morning sun peeking through the blinds, the strong arms wrapped around her body, holding her close – there was nothing better. She could wake up like this everyday.

Wait.

She did wake up like this everyday. Well, almost everyday.

Morgan’s breath was hot against her neck as he continued to kiss and suck lightly on her skin. She moved her legs slightly and backed her ass onto his already hardening member. He groaned slightly, knowing that she was now awake.

“Happy birthday, beautiful,” he mumbled into the crook of her neck. His voice was sleepy, scraggly, and low. She couldn’t help but smile, feeling like the luckiest girl in the world. She turned around to face him.

It didn’t matter that Morgan just had a giant photoshoot and campaign released with RW&Co that saw him looking like a five course meal in a variety of different suits. It didn’t matter that soon she’d be seeing him in suits almost every other night going in and out of Scotiabank Arena. None of it mattered. Her favourite Morgan was here, in bed with her, drowsy blue eyes and messy hair and scruff on his face, his body warm with a cheeky smile adorning his face. This was the best Morgan. This was the Morgan she fell in love with. Not the one situated in front of the cameras, giving answers. Not the one who signed up for sponsorship opportunities with Nike and Hockey Night in Canada and whatever else. Not the hockey player playing over 20 minutes a night. This Morgan. Simple Morgan. The Morgan she saw when they were alone together.

She really was the luckiest girl in the world.

“I love you,” she whispered, leaning in to kiss him.

“I love you too,” he responded, leaning in to kiss her again before their lips and tongues were all over one another’s, kissing passionately for what felt like hours before they had to stop to catch their breath.

It was then that Bee brought her hand up, caressing his cheek, her thumb outlining his lips. “I didn’t think…” she began, wondering if she should even say it. She hesitating before deciding yes, she should say it, because it was her 24th birthday and her feelings should be out in the open for Morgan to know. “I didn’t think I was capable of loving another person this much.”

His big blue eyes flashed at her admission. “I didn’t think I could, either,” he admitted.

“But it’s different for me.”

Morgan nodded his head. He knew what she meant. He knew that this was something that had been on her mind for a while, leading up to day, her birthday. He knew that she probably wanted to express it before, but didn’t think she could, or should, because of one reason or another that she told herself. But she did now. “Just think. We have the rest of our lives to feel it. To show it.”

Bee couldn’t help but smile before giving him another kiss. “Show me. Show me right now.”

Morgan was more than ready to oblige. He attached his lips to hers again and moved so that his body was over hers. Luckily, he slept without a shirt that night, so when Bee’s hands began to wander over his chest and back and along his shoulders, he was able to feel her delicate touch and her nails sinking gently into his skin, in the area between his shoulder blades. Almost immediately, his hand wandered underneath her shirt – one of his old shirts, technically – and began cupping her breast and pinching her nipple, causing her to arch her back slightly. In no time at all, he shoved the shirt all the way up, over her head, and threw it behind them on the bed.

With Bee underneath him, Morgan took advantage of the situation by kissing from her lips, across her jawline, along her neck and clavicle, all the way to her breasts, sucking a nipple into his mouth. He heard Bee let out a small gasp, and that was all he needed to keep going. He paid her breasts a lot of attention, sucking and caressing them, Bee’s soft sighs his fuel for not stopping for a while until he was hungry for more. He began kissing his way down her soft stomach, only for her to stop him.

“Later. Later later later,” she mumbled quickly, trying to pull him back up.

“What? Briony--” Morgan was confused. There was no way. No way he was not going to--

“I just want you in me right now. I want to feel you inside me,” she whispered out, her voice frantic. “Please Morgan.”

“Promise?”

“I promise. I just want to feel you inside me.”

Her pulled her pyjama bottoms off before doing the same with his. Bee wrapped her legs around his torso as he hovered over her and began kissing her again – light, airy kisses until she could feel him at her entrance, pushing in slowly. Another light gasp escaped her lips as he bottomed out. “I love you baby,” she whispered in between more kisses, sighing into him as she began to feel him begin to move in and out of her slowly. “I love you so much.”

“I love you too,” he replied automatically. He stopped kissing her momentarily to get a good look at her. “Remember the night of the home opener? Karl Marx?”

Bee couldn’t help but smile at the memory. That was the night he tried to seduce her by talking about economics, only to ruin the whole thing and send her into a fit of giggles by mentioning Alan Greenspan. “”Mhm,” she nodded, digging her nails into his shoulder blades again. “You had quite the uprising in your pants that night.”

“Well I’ve been studying more than usual,” he said. “Did you know that a social safety net is essential to the success of any economy, and that Canada should be investing more into public education and healthcare for a more educated and healthier society?”

Bee snorted, much like she did that night. “You sound like you’re running for Prime Minister in October.”

“Oh, it gets better,” Morgan smiled, kissing her quickly. “I finally learned the difference between microeconomics and macroeconomics.”

“Oh yeah?”

“Micro is individuals and businesses, macro is the decisions of countries and governments.”

Bee couldn’t help but smile. “You get an A plus, baby.”

Morgan kissed her again, letting his lips linger for a while. “And get this,” he paused for dramatic effect. “Friedrich Engels.”

Bee snorted again, louder this time, shaking her head at his ridiculousness. “What’s the going interest rate settled by the Bank of Canada?” she asked to go along with his ridiculousness.

“1.75%,” he said matter of factly.

Her eyes went wide. “Morgan Rielly!” she laughed, messing his hair with her hand.

“That was an easy one,” he winked.

“You’re just looking for extra credit,” she teased, biting her lip. “As if you making love to me isn’t enough.”

“You know me, always gotta go that extra mile,” he joked, dipping down to kiss her again as he began to move in and out of her steadily, keeping his lips attached to hers.

It was cheesy, and perhaps a bit overused and repetitive thing to say, but as they lay in the bed together, holding each other and kissing and looking deep into each other’s eyes, Bee thought that there was nothing better than making love. The laughing, the jokes, the soft ‘I love you’s escaping their mouths – she loved it all. There was nothing more intimate. There was nothing more soft. There was nothing more that she longed for, that she would long for, when he was gone for the season again.

They came together, naturally, as they knew they would in such a position and with such intimacy. There were more kisses and more bites as they came down from their highs, Morgan collapsing on top of her gently with her legs still wrapped around him. Bee made sure he didn’t move, that he didn’t slip out, savouring the warmth and the feeling of him within her as they regained their breaths, drifting off into a light sleep again, without a care about the outside world.

***

“Can I give you your presents now?”

Bee gave Morgan a look. She had just finished putting on her outfit for the day – “We’re not doing anything fancy until tonight, so keep it casual for now,” Morgan told her, so she opted for a simple scalloped top and jeans – and still needed to decide what to do with her hair. When she looked at him, she could tell he was a bit antsy and didn’t wait to wait. “Let me just put my hair in a bun,” she said, grabbing the elastic from her wrist and putting it in her mouth.

“I’m gonna get them,” she said, immediately shooting up from the bed. She laughed to herself, quickly twisting her hair and securing it tightly with her elastic. When Morgan arrived back in the room carrying two envelopes, Bee couldn’t help the look of shock on her face. It was definitely not that she was expecting more, it was that she was surprised Morgan wasn’t hauling in the entire Chanel store. He warned her he was going to be “a lot”; she told him not to go crazy.

“What’s this?” she asked as he sat beside her on the bed, turning to face her.

“Just a little somethin’,” he wiggled his eyebrows comically. “You need to open this one first.”

“Are you mocking me?” she asked, remembering back to when she told him he needed to open his gifts in a particular order for his own birthday.

“No. Just open it, baby.”

She tore open the envelope delicately to reveal six tickets. When she took a closer look, she noticed that they were for the Saturday, October 26th game the Leafs were having against the Montreal Canadiens. In Montreal. “Tickets to a game?”

“Mhm.”

“In Montreal?”

“Yup. Because I know you’ve never been there. I thought it’d be a good opportunity for you to take a weekend trip there.”

A smile crept its way onto her face. She knew what he was doing. “But…but why are there six tickets?”

“Do you really think I’m going to send you to Montreal and not give the Queen of Montreal herself, Clarette Favaro, and her family tickets as well?” Morgan posed.

Bee’s eyes immediately lit up. “They’re coming too?!” she asked. Morgan nodded his head. “Me, Angie, Mason, Rocco, Clarette, and Josh?”

“You got it.”

“Morgan!” she exclaimed, throwing her arms around him and climbing on top of his lap. She began peppering his face with kisses, mumbling thank you after thank you. She knew her first trip to Montreal would be a memorable one.

“There’s still one more,” he mumbled in between kisses.

“Oh, right,” she remembered, though she stayed on his lap as Morgan handed her the second envelope. She tore it open delicately again to reveal more tickets. This time, it was just one. And this time, when she looked closely at the details, it was for the game against Colorado on Saturday, November 23rd. In Colorado.

“Bumblebee?” Morgan asked softly, noticing that she was taking a bit of time to take in what was before her.

“Am I…” she began, pausing. She looked him in the eye. “Am I going to Colorado?”

“You’re going to Colorado.”

“To visit Ashley and Naz and Naylah?”

“To visit Ashley, Naz, and Naylah.”

Bee hesitated before she put the envelope down on the bed beside them and wrapped her arms around Morgan again tightly. She tucked her head into the crook of his neck before exhaling deeply, trying to contain her emotions. “I love you so much,” she mumbled, her lips grazing his skin. “I love you so so so so so much.”

“I love you too.”

“No, you don’t get it. I love love love you.”

Morgan chuckled slightly. “I love love love love you too,” he said, squeezing her tightly. “Always, Bumblebee. Always.”

She untucked her head and brought her hands up to cradle his face, kissing him again. She didn’t want to leave. She could have stayed in this position and in the moment for the rest of the day. They didn’t need to do anything else. It was only when he moved to stand, bringing her with him, that she yelped and stopped kissing him. “Morgan!” she screamed, giggling slightly.

“C’mon, we gotta go. I gotta take you out for the day. We’re gonna be busy,” he said in between quick kisses.

“Where are we going?” she asked.

“That’s for me to know and you to find out,” he said before kissing her again.

She rolled her eyes before looking down at the way his arms looked, his muscles bulging as he held her in his arms. “Jesus, Mo,” she muttered under her breath, her fingertips grazing his skin. He kept up his workout regimen all summer, and while she usually noticed the changes in his body, for some reason, she hadn’t quite picked up on how…jacked he’d gotten. It was like whatever fat he had last year had turned into muscle and she could now reap the rewards. “Can you carry me the whole way there?”

“Carry you?”

“So I can see your muscles,” she looked down at them, causing him to look down as well. “They grew, baby.”

“They better have, I’ve been lifting all summer.”

Bee giggled slightly. “Bro, do you even lift?”

“Do you seriously want me to carry you all the way to the car?” he asked.

“No!”

“I can – if you want. I mean it’s your bir--”

“Oh shush,” she wiggled out of his grasp until her feet were firmly planted on the floor, despite his arms still being around her waist. “Just promise you’ll wear something tonight that shows off that body.”

“You better promise the same thing,” he said, winking at her before slapping her ass.

***

Bee was a little bit confused as she and Morgan arrived at the Eaton’s Centre. As they walked together, Bee tried to think of the possibilities of where they could end up, but she couldn’t think of why he’d bring her to a mall. She was even more confused when he still refused to tell her where they were going. When he made an abrupt stop in front of the Indigo and gave her a look, she was still…well, confused.

“So you brought me to Indigo…” she said, trying to piece the whole thing together. “Why?”

“So you could go crazy,” he said simply.

“Go crazy how?” she asked. She still didn’t get it.

Morgan couldn’t help but chuckle. “You have that list of books you want.”

He was referring to the ongoing list she was curating of all the books she wanted to read and have in her life. Of course, it was constantly changing based on all the new releases. “Yeah…”

“Indigo is a bookstore, Briony. And if you don’t find them here we’ll drive up to Bay and Bloor and get them there. And if not there, we’ll call Yorkdale, Square One…”

She was finally piecing the puzzle together. “You…you want…” she began, doubt somehow still getting the best of her. She took a step forward, but then a step back; her right leg outstretched, waiting to take its step, her body shifting between her two feet, rocking forward and back while standing. She couldn’t move. “You’re…you’re serious?”

“Of course I’m serious,” he said. “C’mon Bumbleblee. I know you’ve always wanted to build your collection.”

He watched as a smile crept its way onto her face. Small at first, almost non-existent, then getting bigger and bigger, eventually taking over her entire face. “I don’t…you’re absolutely sure, Morgan.”

Morgan rolled his eyes. “Did you really think your birthday present wouldn’t involve books?” he asked rhetorically. “I am positive. Now go.”

***

The day had been everything that Bee could have ever wanted.

She bought most of the books on her list. Morgan followed her around, holding the books and putting them into a rolling basket and wheeling it to the front cash registers, telling the employees “We’re going to need more baskets”, then filling up more baskets with books and asking another employee “Are there any more baskets?” and filling those too. By the end of it, after the books had all been bought and were loaded, bag by bag, into Morgan’s car, she looked at all the bags overflowing and said “We’re gonna need more bookcases.”

It took most of the day. So when they got back home, they showered for their night festivities. Except, well, Morgan had other ideas. He wanted to use the showerhead for other purposes. And he did. And he also wanted to use his hands for other purposes. And he did. And it made them a little late for dinner at Jacobs and Co, the famous steakhouse, but by only 20 minutes or so. Then after some great steak, and some even better wine, they stumbled their way over to Early Mercy, right next door, where Angie and Mason, Josh and his boyfriend Patrick, Zach and Alannah, Auston, and Fred were waiting to surprise her and dance the night away. Tyler even surprised her with his attendance, and she practically pushed Auston out of the way to run to him and hug him, pulling him to dance with everyone else. And they did. They danced and they danced and they danced, and then they relaxed out on the patio, and then they danced again, and then it was last call, and Auston tried to convince the manager to keep it open, but to no avail. And so they called Ubers, at 2:30 in the morning, and Tyler went to stay with Auston and took an UberPool with him and Fred, and Morgan and Bee took theirs, making out in the backseat all the way home.

It was why they were giggly when they stumbled back into their apartment. Their kisses were playful and soft and quick and airy as they made their way in, but the second the door closed behind them, Morgan’s kisses became hungrier, his hands wandering down to squeeze her ass.

“I love you so God damn much,” Bee mumbled in between sloppy kisses in their kitchen.

“Bedroom,” Morgan mumbled hastily. “Bedroom. One more surprise. Bedroom.”

“What?” she pulled away from him. “One more?”

“One more,” he said, grabbing her hand and dragging her through the apartment. He kissed her one last time before disappearing into the washroom, leaving her alone on the bed, hot and desperate and confused as to what the fuck was going on.

“Morgan,” she begged. “I…what…what do I do?”

“Just wait there,” he called out from the other side of the door.

“Just wait?!”

“Make yourself comfortable!”

“Morgan!” she chastised. “You can’t be serious!”

“Briony!”

“I don’t know what you’re up to in there but it better be good!”

“Oh, it’s gonna be spectacular,” his voice was mischievous. “Get comfortable.”

“Can I start touching myself?” Bee asked in an equally mischievous voice.

She heard a loud thump and something drop dramatically from inside the bathroom, causing her to snort. God knows what the fuck he was doing in there. “No,” he said hastily. “Don’t. This is gonna be all me.”

Bee waited as patiently as she could, listening to Morgan fuss around in there without a clue in the world as to what he was doing and what surprise he was keeping up his sleeve. It was, of course, only when he unlocked the door and pushed it open dramatically did Bee get an idea about what was going to happen. Standing there, he leaned up against the doorframe wearing a perfectly tailored suit. Perfectly tailored. Slim fit, just how she liked. Crisp white shirt. Perfectly tailored. Navy blue. Did she mention perfectly tailored? Because it was perfectly tailored. And when he began sauntering towards her, she could see just how perfectly tailored it really was, with his thighs and his broad, defined chest and his arms threatening to rip the fabric if he flexed even slightly. Bee gulped.

“A promise is a promise,” Morgan said in a low voice, a shit-eating smirk on his face as he saw the blush on Bee’s cheeks. “I promised I’d wear something tonight that showed off my body.”

Bee shook her head at his ridiculousness before she noticed him starting to take out his phone. “If you start playing Pony by Ginuwine I swear to God I’m not letting you fuck me tonight,” she giggled out.

Morgan shot her a look. “HEY!”

“Just get over here, will you?” she beckoned; rising to her knees from her sitting position so she could kiss him. Almost immediately, she stuck her tongue down his throat and tugged at the hair at the nape of his neck, causing him to groan and wrap his arms around her body, still covered in her glittering gold sequined dress she bought especially for her birthday.

Morgan’s hands slipped underneath the fabric, playing with the material of her underwear before he helped her get out of them, dropping them in between them onto the floor. Bee’s hands began wandering all over his chest, over the material of his shirt, not bothering to unbutton it. Eventually, Morgan’s hand slipped underneath her dress again and began playing with the lips of her pussy, causing her to whimper in pleasure.

“You’re already so wet for me,” he mumbled as he inserted one finger.

“It’s the suit,” she winked, biting down on his bottom lip as she felt him insert a second finger. “You have no idea how good you look.”

“Lie down on your back and spread your legs for me,” he ordered, his voice low.

There was a flash in Bee’s eyes as Morgan watched her do what she was told. She kept her eyes on him the entire time as she lay on the edge of the bed. Morgan hooked her legs in his arms and pulled her towards the edge, letting them dangle off the bed. He pushed the fabric of her dress up before kneeling in front of her, licking his lips. “I’ve been thinking about this all day,” he said.

“It’s all yours, Mr. Rielly,” she smiled, watching as he dove in. No pretence, no teasing – just going right for it, his lips and tongue attaching themselves to her pussy, bringing Bee – as always – the greatest pleasure she’d ever known. She ran her fingers through his hair and tugged on it as he continued to lap at her hungrily, squeezing his head between her thighs when the feeling was too pleasurable to handle.

“Baby…baby baby baby,” Bee breathed out as she felt him insert two fingers while he sucked on her clit. “Fuck, Morgan, it’s so – it’s so good.”

“Cum on my face,” he ordered again, knowing she was close. He began curling his fingers inside of her, causing her to squirm, and before long, she was screaming out his name, his face becoming wet with her juices as he lapped up every last bit of her. When he was finished, he began smothering her with kisses, and she could taste herself on his mouth as she kissed him back, wrapping her legs around his torso. He began unbuttoning the white shirt he was wearing, but didn’t get too far before Bee stopped him.

“Keep it on. Keep it on,” she mumbled quickly.

His stopped dead in his tracks. “Keep it on?”

“For fuck sakes, keep it on,” her breathing was heavy, her voice hasty. “Keep it on and fuck me.”

He practically growled as he picked her up, her legs still wrapped around him, and held her in his arms. When he placed her onto their dresser, he felt her hands dip between them and unzip his pants, pulling them and his underwear down just enough to free his hard cock. She began stroking it as he moved to kiss down her neck, pushing the fabric of her dress down to expose her breasts in their lace bra. He pushed the lace down and began pinching her nipples, eventually taking one into his mouth and sucking, twirling his tongue around it.

“Morgan, please,” her breath was heavy. “I want you to fuck me so bad. I can’t wait anymore.”

Morgan pulled her off the dresser, turning her around so her back was towards him, bending her over it. He could see her smile as he pushed up the fabric of her dress again so it bunched at her hips. He teased her at her entrance before thrusting into her in one go, causing her to cry out in pleasure. The smile that played on her lips continued as he moved in and out of her. “Fuck Morgan, that feels so good.”

“You like it when I bend you over like this?” he asked, to which Bee nodded her head enthusiastically. “You like me taking you from behind.”

“Yes.”

“Are you gonna be a good girl for your birthday?”

“Yes, fuck, yes. Yes. I’m gonna be your best girl.”

He tugged at her hair, making her arch her back as he pulled her towards him. He kissed and bit at her neck and shoulder, slipping an arm around her body and grabbing one of her breasts. “I love you, baby,” he cooed, biting at her neck. “I love you so much.”

“I love you too,” she breathed out. “God Morgan, I love you so much.”

“Did you like your birthday?”

She nodded her head. She was finding it hard to keep a conversation while her back was arched the way it was and he was still pounding into her, with his fucking suit on, but this was the situation she found herself in. “Of course I did. This was my best birthday ever because of you.”

He began walking back, slow enough so he wouldn’t slip out, until he fell back onto the bed, Bee’s body with his. She began riding him reverse cowgirl, looking over her shoulder at him lying there, still in his suit, all dishevelled and ready to be ripped off of him. “Cum with me baby. Are you close?”

Morgan nodded his head. “Bounce on that dick, baby.”

She continued riding him, squeezing his thighs over the fabric of his suit, until she squeezed her walls around him and felt him explode inside of her. She came again, her body shaking from pleasure until she fell back onto him trying to catch her breath. She felt his arms wrap around her. “Fuck Mo, that was so fucking hot,” she breathed out.

He took a few moments to respond – she knew he was trying to catch his breath too. “Never knew this was the possibility whenever I wore a suit,” he joked.

“Well now you know. Every suit you have makes me feel like this.”

“You’re telling me every game day suit I have makes you this hot and bothered?” he asked. Bee nodded her head. “We gotta do this more often.”

Bee couldn’t help but laugh. “Show up in the bedroom with a suit on more often and we just might.”

Morgan slipped out of her slowly, pulling her body to his side, hooking one of her legs over his torso as they lay in bed together, their clothes wrinkled and bunched up. “Do you think about how around this time last year, we were at dbar with Fred and Auston?”

Bee nodded her head. “A lot has happened since then, huh?”

“Mhm,” he mumbled, kissing her quickly. “What a year it’s been.”

“Still in bed together though,” she said cheekily, thinking about how, just maybe a week before that night at dbar, it was their first time together after Morgan had returned from Vancouver. “Some things never change.”

“Yeah, well, I plan to be in bed together all night,” Morgan said.

“Me too,” Bee’s eyes flashed. “Again. And again. I want to go all night.”

Morgan let out a deep chuckle. “Don’t worry baby. I got you,” he said, slipping his fingers into her pussy again.

#morgan rielly#morgan rielly imagine#morgan rielly imagines#morgan rielly fic#morgan rielly fan fic#toronto maple leafs#toronto maple leafs imagine#toronto maple leafs imagines#toronto maple leafs fic#toronto maple leafs fan fic#nhl#nhl imagin#nhl imagine#nhl fic#nhl fan fic#hockey#hockey imagine#hockey imagines#hockey fic#hockey fan fic#alone together series

158 notes

·

View notes

Text

Experian doxes the world (again)

The nonconsensually compiled dossiers of personal information that Experian assembled on the entire population of the USA may currently be exposed via dozens, perhaps hundreds, of sites, thanks to a grossly negligent security defect in Experian's API.

The breach was detected by Bill Demirkapi, a security researcher and RIT sophomore, and reported on by Brian Krebs, the excellent independent security reporter.

https://krebsonsecurity.com/2021/04/experian-api-exposed-credit-scores-of-most-americans/

Experian, like Equifax, has unilaterally arrogated to itself the right to collect, store and disseminate our personal information, and, like Equifax, it faces little regulation, including obligations not to harm us or penalties when it does.

Experian's API allows criminals to retrieve your credit info by supplying your name and address, information that is typically easy to find, especially in the wake of multiple other breaches, such as Doordash's 5m-person 2019 breach and Drizzly's 2.5m-person 2020 breach.

Demirkapi explains that the API is implemented by many, many sites across the internet, and while Experian assured Krebs that this bug only affected a single site, it did not explain how it came to that conclusion.

Demirkapi discovered the defect while he was searching for a student loan vendor. There is a way to defend yourself against this attack: freeze your credit report. Credit freezes were made free (but opt-in only) in 2018, after the Equifax breach.

https://krebsonsecurity.com/2018/09/credit-freezes-are-free-let-the-ice-age-begin/

Indeed, you may have already been thinking about the Equifax breach as you read this. In many ways, that breach was a wasted opportunity to seriously re-examine the indefensible practices of the credit-reporting industry, which had not been seriously scrutinized since 1976.

1976 was the year that Congress amended the Equal Credit Opportunity Act after hearing testimony about the abuses of the Retail Credit Company - a company that swiftly changed its name to "Equifax" to distance itself from the damning facts those hearings brought to light.

Retail Credit/Equifax invented credit reporting when it was founded in Atlanta in 1899. For more than half a century, it served as a free market Stasi to whom neighbors could quietly report each other for violating social norms.

Retail Credit's permanent, secret files recorded who was suspected of being gay, a "race-mixer" or a political dissident so that banks and insurance companies could discriminate against them.

https://www.jacobinmag.com/2017/09/equifax-retail-credit-company-discrimination-loans

This practice was only curbed when a coalition of white, straight conservative men discovered that they'd been misidentified as queers and commies and demanded action, whereupon Congress gave Americans limited rights to see and contest their secret files.

But these controls were never more than symbolic. Congress couldn't truly blunt the power of these private-sector spooks, because the US government depends on them to determine eligibility for Social Security, Medicare and Medicaid.

It's a public-private partnership from hell. Credit reporting bureaux collect data the government is not legally allowed to collect on its own, then sells that data to the government (Equifax makes $200m/year doing this).

https://web.archive.org/web/20171004200823/http://www.cetusnews.com/business/Equifax-Work-for-Government-Shows-Company%E2%80%99s-Broad-Reach.HkexS6JAq-.html

These millions are recycled into lobbying efforts to ensure that the credit reporting bureaux can continue to spy on us, smear us, and recklessly endanger us by failing to safeguard the files they assemble on us.

This is bad for America, but it's great for the credit reporting industry. The Big Three bureaux (Equifax, Experian and Transunion) have been on a decade-long buying spree, gobbling up hundreds of smaller companies.

These acquisitions lead directly to breaches: a Big Three company that buys a startup inherits its baling-wire-and-spit IT system, built in haste while the company pursued growth and acquisition.

These IT systems have to be tied into the giant acquiring company's own databases, adding to the dozens of other systems that have been cobbled together from previous acquisitions.

This became painfully apparent after the Equifax breach, so much so that even GOP Congressional Committee chairs called the breach "entirely preventable" and the result of "aggressive growth." But they refused to put any curbs on future acquisitions.

https://thehill.com/policy/technology/420582-house-panel-issues-scathing-report-on-entirely-preventable-equifax-data

A lot has happened since Equifax, so you may have forgotten just how fucked up that situation was. Equifax's IT was so chaotic that they couldn't even encrypt the data they'd installed. Two months later, they "weren't sure" if it had been encrypted.

https://searchsecurity.techtarget.com/news/450429891/Following-Equifax-breach-CEO-doesnt-know-if-data-is-encrypted

*Six months* before the breach, outside experts began warning Equifax that they were exposing our data:

https://www.vice.com/en/article/ne3bv7/equifax-breach-social-security-numbers-researcher-warning

The *only* action Equifax execs took? They sold off a shit-ton of stock:

https://www.bloomberg.com/news/articles/2018-03-14/sec-says-former-equifax-executive-engaged-in-insider-trading

The Equifax breach exposed the arrogance and impunity of the Big Three. Afterward, Equifax offered "free" credit monitoring to the people they'd harmed. One catch: it was free for a year; after that, they'd automatically bill you, annually, forever.

https://web.archive.org/web/20170911025943/https://therealnews.com/t2/story:19960:Equifax-Data-Breach-is-a-10-out-of-10-Scandal

And you'd pay in another way if you signed up for that "free" service: the fine print took away your right to sue Equifax, forever, no matter how they harmed you:

https://www.ibtimes.com/political-capital/equifax-lobbied-kill-rule-protecting-victims-data-breaches-2587929

The credit bureaux bill themselves as arbiters of the public's ability to take responsibility for their choices, but after the breach, the CEO blamed the entire affair on a single "forgetful" flunky:

https://www.engadget.com/2017-10-03-former-equifax-ceo-blames-breach-on-one-it-employee.html

Then he stepped down and pocketed a $90m salary that his board voted in favor of:

https://fortune.com/2017/09/26/equifax-ceo-richard-smith-net-worth/

Of course they did! His actions made the company so big that even after the breach, the IRS picked it to run its anti-fraud. Equifax got $7.5m from Uncle Sucker, and would have kept it except that its anti-fraud site was *serving malware*:

https://www.cbsnews.com/news/equifax-irs-data-breach-malware-discovered/

Equifax eventually settled all the claims against it for $700m in 2019:

https://nypost.com/2019/07/19/equifax-agrees-to-pay-700m-after-massive-data-breach/

But it continued to average five errors per credit report:

https://www.washingtonpost.com/technology/2019/02/11/rep-alexandria-ocasio-cortez-takes-aim-equifax-credit-scoring/

And it continued to store sensitive user-data in an unencrypted database whose login and password were "admin" and "admin":

https://finance.yahoo.com/news/equifax-password-username-admin-lawsuit-201118316.html

Congress introduced multiple bills to force Equifax, Experian and Transunion to clean up their act.

None of those bills passed.

https://www.axios.com/after-equifaxs-mega-breach-nothing-changed-1536241622-baf8e0cf-d727-43db-b4d4-77c7599fff1e.html

The IRS shrugged its shoulders at America, telling the victims of Equifax's breach that their information had probably already leaked before Equifax doxed them, so no biggie:

https://thehill.com/policy/cybersecurity/355862-irs-significant-number-of-equifax-victims-already-had-info-accessed-by

Since then there have been other mass breaches, most recently the Facebook breach that exposed 500m people's sensitive data. That data can be merged with data from other breaches and even from "anonymized" data-sets that were deliberately released:

https://pluralistic.net/2021/04/21/re-identification/#pseudonymity

And while you can theoretically prevent your data from being stolen using the current Experian vulnerability by freezing your account, that's not as secure as it sounds.

Back in 2017, Brian Krebs reported that Experian's services were so insecure that anyone could retreive the PIN to unlock a frozen credit report by ticking a box on a website:

https://krebsonsecurity.com/2017/09/experian-site-can-give-anyone-your-credit-freeze-pin/

That was just table-stakes - it turned out that ALL the credit bureaux had an arrangement with AT&T's telecoms credit agency that was so insecure that *anyone* could unlock your locked credit report:

https://krebsonsecurity.com/2018/05/another-credit-freeze-target-nctue-com/

These companies came into existence to spy on Americans in order to facilitate mass-scale, racist, ideological and sexual discrimination. They gather data of enormous import and sensitivity - data no one should be gathering, much less retaining and sharing.

They handle this data in cavalier ways, secure in the knowledge that their integration with the US government wins them powerful stakeholders who will ensure that the penalties for the harm they inflict add up to less than profits those harms generate for their shareholders.

This is why America needs a federal privacy law with a "private right of action" - the ability to sue companies that harm you, rather than hoping that federal prosecutors or regulators will decide to enforce the law.

https://pluralistic.net/2021/04/16/where-it-hurts/#sue-facebook

Experian promises that this breach only affects one company that mis-implemented its API. We would be suckers to take it at its word. It didn't know about this breach until a college sophomore sent in a bug report - how would it know if there were others?

Image: KC Green (modified) https://kcgreendotcom.com/

96 notes

·

View notes

Text

Midtown Modern

Midtown Modern

Midtown Modern is an important level private improvement with business from the soonest beginning stage story @ Tan Quee Lan Street. It is quickly acquainted with you by the

joint undertaking of GLL D Pte. Ltd. (GLL D), Intrepid Investments Pte. Ltd. (Striking) and Hong Realty (Private) Limited. (HRPL). This GLS Land was influenced by Urban

Redevelopment Authority in March 2019 and the sensitive was sensibly won by these relationship with S$800.19 million in September 2019.

GLL D Pte. Ltd. (GLL D) is a right hand of GuocoLand Limited was recorded on SGX (Singapore Exchange Securities Trading Limited) since 1978. Having an unavoidable than

ordinary history and strong past notoriety as a producer, Till to-date, the get-together has completed 34 private exercises of 9000 homes in Singapore.

Gutsy Investments Pte. Ltd. (Solid) is a can't avoid being a completely had accomplice of Hong Leong Holdings Limited which is therefore a correct hand of Hong Leong

Investment Pte. Ltd. It was made on 24th April 1981.

Hong Realty (Private) Limited (HRPL) is a right hand of Hong Leong Investment Pte. Ltd. It was taken a gander at 1962. HRPL is under Hong Leong Group who is one of Asia's

usually discernable and best wholes with more than 40,000 staffs all around.

Hong Leong Group is extraordinary stood separated from other property facilitator in Singapore. with asset more than S$40 billion. The Group has developed more than 130

premiums private undertakings and more than 100 quality business and mixed use degrees of progress in Singapore.

Hong Leong Group is the pioneer fashioner what's judiciously a huge executive and landowner in Singapore.

Midtown Modern will be their immense level extravagance obligation with the Prime District 7

Midtown Modern space suite concerning is yet to be tended to.

Zone

Midtown Modern Location is unmistakably the imperativeness of the undertaking. It is reliably joined to the Bugis MRT station (EW12/DT14), and will have underground

individual by walking interface from Midtown Modern to Guoco Midtown on Beach Road, With this recognizable space, in Prime District 7 of Singapore, Midtown Modern is an

especially filtered for in the wake of undertaking for investigators and property holders.

Bugis contains a stunning mix of clarifications and heritage parts. With its region to the CBD zone, it is 10 minutes' walk around Esplanade MRT station (CC3) and 12 minutes'

walk around City Hall MRT Interchange (NS25/EW13). Bugis MRT is a trade for 2 lines, East-West Line and Downtown Line that interfaces you to all bits of Singapore with no

issue.

Midtown Modern is at the clarification behind mixing of Singapore. For drivers, you can pick East Coast Parkway (ECP), Marina Costal Expressway (MCE), Ayer Rajah

Expressway (AYE) and Central Expressway (CTE). The standard North-South piece (NSC) will be in association this year. It joins Northern bits of Singapore and East Coast Park

together. One of its scratching wire is to join transport ways and cycling ways together.

For watches looking at for basic and assistant schools around Midtown Modern, we can consider Stamford Primary School, Farrer Park Primary, St. Margaret's Primary School

and Outram Secondary School of The Arts.

Concerning, schools and private instituition, there is Insworld Institute, Singapore Management University, Dimensions, Nanyang Academy of Fine Arts, Kaplan and other stunning

watches.

To discover all the all the all the all the all the all the all the additionally including civilities, you can investigate our Midtown Modern space map.

Showflat

To book a Midtown Modern Showflat approach, generally register through this authority fashioner site or you can call our methodology hotline really at +65 6100 9266 going

before flooding toward the show level. Our Midtown Modern showroom might be closed pondering routine upkeep, or shut to individuals if all else fails by tolerability of

organizers' private events. In like way all visitors are imaginatively gotten a couple of information about a showflat procedure before going down to our showroom to bewilder any

heaps caused

Each and every contributed person who had held a showroom meeting with us through this official way, if its jumbled to you have request that our central will interface with you by

approachs for your PDA inside an hour, or the following day if it is after the authority showflat closing hour. Rest ensure that you are have the choice to abuse our possible Direct

Developer Price with NO COMMISSION payable by buyer.

We are at present in the early phase of Registration of Interest for Midtown Modern VVIP Preview. Register your Interest totally on an ideal opportunity to be the first to see our

confounding Showflat once its readied for graph.

We will reestablish Midtown Modern Balance Units Chart and Midtown Modern Pricing in this official site once the undertaking is impelled.

Generously note that all correspondence units open to be bought at Midtown Modern Condo rely on from the most punctual beginning stage things out serve premise. We do

allow reservation of unit up to 2 hours and it is spun around the specialists' ensuring.

Cost passed on around there ponders change with no further notification.

Cautiously don't miss this confusing new townhouse suite dispatch @ Bugis MRT by Guocoland, Intrepid Investments and Hong Realty. Only 580 select units are open. Register

now for Midtown Modern VVIP Preview today.

About Midtown Modern

Midtown Modern@ Tan Quee Lan Street is the latest endeavor by Guocoland and Hong Leong. Isolated through on the most significant degree of the city and close Bugis MRT

Interchange Station (EW12/DT14), plans high straightforwardness all through Singapore.

Urban Redevelopment Authority (URA) released a touchy for a 99-year leasehold site under the Government Land Sales Program in 29 March 2019. The site, which has a land

zone of 11,530.9 Sqm with net floor area (GFA)of 48,430 Sqm, proposed to make around 580 units. The questionable was won by the joint undertaking of GLL D Pte. Ltd. (GLL