#onlinebank

Explore tagged Tumblr posts

Text

Gobank alternative ZilBank.com is a better online platform for your banking needs. Check it out!

Learn more:https://zilbank.com/gobank/

33 notes

·

View notes

Text

#UFBDirect#HighYield#Savings#MoneyMarket#Checking#OnlineBank#Finance#FinancialFreedom#SafeInvestment#MoneyManagement#LiquidMoney#SavingsAccount#Banking#InterestRates#FinancialPlanning

0 notes

Text

Experience seamless wallet-to-wallet money transfers with Payaraa! 🌐 Our secure platform ensures quick and hassle-free transactions.

1 note

·

View note

Text

November 2024

Gesicht nicht erkannt

Liebes Techniktagebuch, neulich wollte ich per Handy Geld von meinem Bankkonto überweisen, aber die Handy-Gesichtserkennung, die man zur Sicherheit machen muss, hat nicht geklappt, weil ich mir genau in dem Moment die Stirn gekratzt habe.

Ich habe es dann einfach noch mal probiert, und dann hat es geklappt.

(Scott Hühnerkrisp)

4 notes

·

View notes

Text

0 notes

Text

𝐇𝐨𝐰 𝐭𝐨 𝐦𝐚𝐤𝐞 𝐎𝐧𝐥𝐢𝐧𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐒𝐚𝐟𝐞 𝐨𝐫 𝐏𝐫𝐞𝐯𝐞𝐧𝐭 𝐢𝐧𝐭𝐞𝐫𝐧𝐞𝐭 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐟𝐫𝐚𝐮𝐝?

For further information, refer to this Article By Mr. Bivas Chatterjee.

#OnlineBanking#internetbanking#onlinefraud#bankingfraud#cybercrime#needalawyer#legalhelp#SoOLEGAL#legalupdates#legalnews

0 notes

Text

#girokonto#finanzen#sparen#onlinebanking#geld#kostenlos#schufafrei#sparkasse#einfach#mastercard#banking#konto#bonit#konditionen#angebot#ehrlich#germany#transparent#t#vergleichauchdu#deutschland#baufinanzierung#finanzenimblick#depot#dividende#privatkredit#kredite#visacard#verm#vergleiche

0 notes

Text

Learn the step-by-step process for NRO account opening online. Discover requirements, benefits, and tips to simplify your banking experience.

0 notes

Text

What is a VCC Card?

A Virtual Credit Card (VCC) is a digital version of a physical credit card that allows you to make secure online transactions without revealing your actual card details. Unlike traditional credit cards, VCCs are not tangible; they exist purely in the virtual world. They come with a unique card number, expiration date, and CVV code, just like a regular credit card, but are designed to protect your sensitive financial information from online fraud and misuse.

How Does a VCC Card Work?

A VCC card works similarly to a traditional credit card, with a few key differences. When you want to make an online purchase, you can generate a VCC through your bank or a financial service provider. This VCC will be linked to your actual credit card or bank account, but it uses a temporary number. Each VCC is valid for a limited time or specific transaction, depending on the provider's settings.

Once the VCC is created, you can use it for your online transaction just like you would with a regular credit card. The merchant will see the VCC details, but your actual credit card information remains hidden, adding an extra layer of security.

Why Should You Use a VCC Card?

There are several reasons why using a VCC card can be beneficial:

Enhanced Security: Since the VCC is only valid for a short time or a single transaction, it limits the risk of your card information being stolen or misused in case of a data breach.

Privacy: Using a VCC helps keep your personal credit card information private, which is especially useful when shopping from unfamiliar websites.

Control Over Spending: Some VCC providers allow you to set limits on how much can be charged on the card, helping you manage your budget more effectively.

Fraud Prevention: If someone tries to use your VCC after it expires or for an unauthorized transaction, the payment will be declined automatically, reducing the chances of fraud.

How to Get a VCC Card?

Getting a VCC card is usually a straightforward process. Many banks and online financial platforms offer VCCs as part of their service. Here’s a general outline of how to get one:

Choose a Provider: Select a bank or online service that offers virtual credit cards. Some popular options include PayPal, Revolut, and certain credit card companies.

Sign Up: You may need to sign up for an account if you don’t already have one. Some services may require a credit card or bank account to link with the VCC.

Generate a VCC: Once your account is set up, you can generate a VCC with just a few clicks. The provider will create a unique card number, expiration date, and CVV for you to use.

Use the VCC: You can then use the VCC details for your online purchases, just like you would with a physical card.

Who Should Use a VCC Card?

VCCs are great for anyone who frequently makes online purchases and wants an added layer of security. Whether you’re buying from an unfamiliar website, subscribing to a service, or making international transactions, a VCC can give you peace of mind. It’s also a useful tool for businesses that need to manage online subscriptions or expenses without using a single card for all transactions.

Conclusion

A VCC card is a simple yet effective way to protect your financial information when shopping online. By using a temporary, virtual card number, you can reduce the risk of fraud and gain better control over your spending. Whether for personal use or business transactions, a VCC offers convenience, security, and privacy, making it an excellent choice for today’s digital age.

#VCCCard#VirtualCreditCard#DigitalPayments#OnlineBanking#SecurePayments#VirtualCard#PaymentSecurity#Fintech#OnlineTransactions

1 note

·

View note

Link

#banking#bestbankforsmallbusiness#bestbusinessbankaccount#Business#businessaccount#businessbankaccount#businessbanking#businesscheckingaccount#foundbusinessbankaccount#foundbusinessbanking#freebusinessbankaccount#freebusinessbankingaccounts#linkingpersonalandbusinessaccounts#managingbusinessaccount#onlinebanking#openabusinessbankaccount#openbanking#Openbankingbusinessaccounts#openbusinessaccountonline#whatarethebestbusinessbankingaccounts

0 notes

Text

The perfect Gobank Alternative!

Learn more: https://zilbank.com/gobank/

0 notes

Text

Neobanks: The Rise of Digital-Only Banks and Their Future

In recent years, the financial landscape has witnessed a seismic shift with the emergence of neobanks—digital-only banks that operate without physical branches. These fintech disruptors are redefining the way consumers interact with financial services, offering a more accessible, user-friendly, and transparent banking experience. As traditional banks struggle to keep up with rapidly changing consumer expectations, neobanks are poised to play an increasingly significant role in the future of banking.

What Are Neobanks?

Neobanks, also known as digital-only banks or challenger banks, are financial technology companies that offer banking services entirely online. Unlike traditional banks, which rely on physical branches, neobanks operate through mobile apps and websites, allowing customers to manage their finances on the go. These banks typically provide a range of services, including checking and savings accounts, payment processing, and personal finance management tools.

One of the key advantages of neobanks is their ability to offer lower fees and better interest rates than traditional banks. Since they don't have the overhead costs associated with maintaining physical branches, neobanks can pass these savings on to customers. Additionally, neobanks often leverage cutting-edge technology, such as artificial intelligence and machine learning, to offer personalized financial advice and services.

The Growth of Neobanks

The rise of neobanks has been fueled by several factors, including the increasing digitization of financial services, changing consumer preferences, and regulatory support for fintech innovation. According to a report by Statista, the number of neobank customers worldwide is expected to reach 377.2 million by 2024, up from 68.3 million in 2020. This rapid growth reflects the growing demand for digital-first banking solutions, particularly among younger consumers who are more comfortable with technology and less reliant on traditional banking services.

Neobanks have gained popularity by offering innovative features that cater to modern financial needs. For example, many neobanks provide instant account opening, real-time transaction notifications, and budgeting tools that help users manage their money more effectively. Some neobanks also offer niche services, such as cryptocurrency trading or sustainable banking options, that appeal to specific customer segments.

The Competitive Landscape

While neobanks have gained significant traction, they face stiff competition from both traditional banks and other fintech companies. Many traditional banks are investing heavily in digital transformation initiatives to enhance their online offerings and retain customers. Additionally, some traditional banks have launched their own digital-only subsidiaries to compete directly with neobanks.

Furthermore, neobanks must navigate a complex regulatory environment that varies by region. In some countries, neobanks operate under the same regulatory framework as traditional banks, while in others, they may be subject to different rules. Compliance with these regulations can be a significant challenge for neobanks, particularly as they expand into new markets.

The Future of Neobanks

The future of neobanks looks promising, but their continued success will depend on several factors. One of the most critical is customer trust. While neobanks offer many advantages, they must convince consumers that their money is safe and that their services are reliable. Building and maintaining trust will be essential for neobanks to achieve long-term success.

Another key factor is innovation. As the financial services industry continues to evolve, neobanks will need to stay ahead of the curve by developing new products and services that meet the changing needs of consumers. This could include expanding into new areas, such as small business banking or wealth management, or integrating emerging technologies, such as blockchain or AI, into their offerings.

Finally, partnerships and collaborations will play a crucial role in the future of neobanks. By partnering with other fintech companies, traditional banks, or even non-financial organizations, neobanks can expand their reach and offer a broader range of services. For example, some neobanks have partnered with payment processors or e-commerce platforms to offer seamless payment solutions for businesses and consumers alike.

Outcome

Neobanks are revolutionizing the banking industry by offering a digital-first approach that resonates with modern consumers. Their ability to provide cost-effective, innovative, and customer-centric services has made them a formidable force in the financial services sector. However, as the competitive landscape continues to evolve, neobanks will need to focus on building trust, driving innovation, and forming strategic partnerships to secure their place in the future of banking.

The rise of neobanks marks a significant shift in the way we think about banking, and as they continue to grow, they will undoubtedly play a key role in shaping the future of finance.

0 notes

Text

April 2024

Die Scammer haben jetzt meine Kreditkartendaten und ich habe keine Hose

Ich will eine Hose noch mal kaufen, die ich vor zwei oder drei Jahren gekauft habe. Wie immer in der Hosenbranche gibt es diese Hose nicht mehr. Auf allen Seiten, die mir als Suchergebnis angezeigt werden, existiert die Hose zwar noch, ist aber ausverkauft. eBay hat sie auch nicht.

Schließlich finde ich sie für 45 US-Dollar in einem Onlineshop, dessen Name andeutet, dass man dort Restbestände von Outdoorartikeln verkauft, angeblich sogar portofrei. Kostenloser Versand aus den USA kommt mir zwar seltsam vor, aber es ist wirklich eine sehr gute Hose, also gebe ich meine Kreditkartendaten ein und versuche sie zu kaufen.

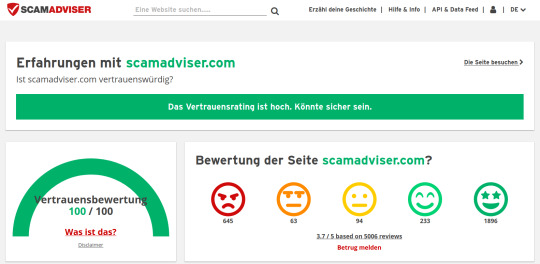

Weil ich dabei an einem Ort mit eher schlechtem Internet sitze, passiert dann erst mal nichts und ich habe ein paar Minuten Zeit, die Adresse der Seite zu betrachten, auf die ich weitergeleitet worden bin. Weitergeleitet wird man zwar öfter bei Bezahlvorgängen, aber diese URL sieht besonders unseriös aus. Als das Internet zurückkommt, suche ich nach dem Domainnamen und "scam" und finde zur Seite scamadviser.com. Diese Seite teilt mir mit, dass die Domain zwar nicht direkt zu einem bekannten Scam gehört, aber auch nicht seriös wirkt. Der angebliche Hosenshop wird noch etwas schlechter bewertet.

Später sehe ich nach, wie vertrauenswürdig eigentlich scamadviser.com selbst ist: Die Meinungen darüber gehen auseinander. Aber praktischerweise kann man die Seite nach ihrer eigenen Seriosität fragen. Sie findet sich selbst weitgehend vertrauenswürdig: "Könnte sicher sein."

Ich deaktiviere meine Kreditkarte vorübergehend, denn das kann man in der App meiner Bank tun. Etwas später am Tag benachrichtigt mich die Bank-App, dass ein nigerianisches Streamingunternehmen und ein kroatisches Juweliergeschäft versucht haben, jeweils 1 Cent abzubuchen. Dank der Kartenabschaltung ist das gescheitert. Wenn diese Buchungen durchgegangen wären und ich keine Banking-App hätte, die mich von allem sofort benachrichtigt, wäre als Nächstes wahrscheinlich mehr Geld abgebucht worden, und ich würde das erst Wochen später merken.

Jetzt muss ich vor jeder Kartenbenutzung erst die Bank-App öffnen, die Karte aktivieren und nach dem Bezahlen wieder deaktivieren. Daran muss ich rechtzeitig vor dem Einkaufen denken, denn im Inneren der beiden Dorfläden gibt es keinen Handyempfang. Das muss ich so lange tun, bis die Scammer meine Existenz vergessen, keine Ahnung, wie lange das dauert. Vielleicht ist es aber sowieso ganz gut, die Karte nur dann einzuschalten, wenn ich sie auch wirklich benutzen will. Wenn der Hosenscam noch etwas besser gewesen wäre, hätte mir dieser zusätzliche Bestätigungsschritt allerdings auch nichts geholfen.

(Kathrin Passig)

10 notes

·

View notes

Text

Zil.us offers business checking accounts no fees, monthly charges, or minimum balance requirements. Manage your account online and benefit from affordable ACH and wire transfers. Start now for hassle-free business payment processing!

Learn more: https://zil.us/best-business-checking-accounts/

0 notes

Text

Unlock Your Financial Future with Eastwood Bank!

Looking for a trusted partner to help you achieve your financial goals? Look no further than Eastwood Bank! 🌟

At Eastwood Bank, we're dedicated to providing exceptional banking services tailored to meet your unique needs. Whether you're saving for your dream home, planning for retirement, or managing your day-to-day finances, our experienced team is here to guide you every step of the way. 🏦

🌐 Visit our website: eastwoodbank.com

Why Choose Eastwood Bank?

✅ Personalized Service: We take the time to understand your financial goals and provide customized solutions.

✅ Comprehensive Products: From checking and savings accounts to loans and investment services, we offer a full suite of banking products.

✅ Community Focus: We're proud to be a part of your community and are committed to supporting local initiatives.

✅ Secure & Convenient: Enjoy peace of mind with our advanced security measures and easy-to-use online banking platform.

Join the Eastwood Bank family today and start your journey toward financial success! 💰

Follow us for more updates and tips on managing your finances.

#FinancialFreedom#Banking#Investing#CommunityBank#Finance#FinancialAdvice#MoneyManagement#Savings#Loans#FinancialGoals#PersonalFinance#WealthBuilding#FinancialLiteracy#FinancialPlanning#OnlineBanking#LocalBank#BankingTips#SmartInvesting#FinancialWellness#BankingSolutions#FinancialSecurity

0 notes