#one bitcoin was worth just a few cents...

Explore tagged Tumblr posts

Text

BITCOIN EARN EASY 30% - 70% Daily...

#How To Get Rich With#Have No Clue About Technology#The surprising wealth-building secret of a globe-trotting vagabond#Dear Investor#Nothing could be further from the truth.#Here's why:#The incredible story of how I missed the boat on Bitcoin#still got rich#and how you can do the same...#The year is 2009.#I am sitting in my office in Asunción#Paraguay.#My office in Paraguay where I made a life-changing discovery#An intriguing document has just crossed my desk.#It was talking about a new kind of digital money called “Bitcoin”. As I read it#I immediately realized what a potential breakthrough this new technology could be.#But of course I was skeptical. Unsure if it would really work in practice.#I decided to buy a few bitcoins just in case it was for real and would go on to become successful.#After all#one bitcoin was worth just a few cents...#So I went online to see where I could buy some.#But there was a problem.#There was no marketplace to buy or sell bitcoin. Bitcoin was too new. Such exchanges simply didn’t exist yet.#I knew there was a process for “mining” bitcoin.#But I didn’t want to spend days setting up an extra computer. And then install the software#figure out how it actually worked and keep watching over my mining computer.#It was too much of a hassle just to get my hands on some bitcoin that were worth almost nothing at the time.#So I decided to keep an eye on Bitcoin and monitor its progress.#Fast forward to February 2011.#I had gotten busy with other projects and suddenly remembered to check on Bitcoin.

1 note

·

View note

Text

After Hamas’s brutal surprise attack and massacre of Israeli civilians, policymakers are searching for the most effective ways to fight terrorist organizations. They can take an important lesson from something that recently happened to Hamas when it tried to use bitcoin to finance its operations.

Hamas thought it could flout Western surveillance and international sanctions by embracing the world’s leading digital asset. It thought wrong, and the story is illuminating for those who mistakenly believe that bitcoin provides a safe space for criminals, money launderers and the financiers of terror.

Just last week, Israeli law enforcement successfully located and froze multiple cryptocurrency accounts that Hamas had used to solicit donations. Israel then funneled the assets into its own treasury — the same treasury that is funding the war to wipe Hamas “off the face of the earth.”

The terrorist organization’s crypto scheme backfired badly, and this wasn’t even the first time it had backfired this year. In April, Hamas begged supporters to stop sending donations via bitcoin, specifically. In a surprise press statement, it announced it was suspending bitcoin donations “to ensure the safety of donors and protect them from any harm.” The terrorist network cited “the intensification of prosecution and the redoubling of hostile efforts against anyone who tries to support the resistance through this currency” as the logic behind this decision.

So what happened? Isn’t bitcoin ideal for money laundering? Isn’t it the preferred currency of terrorists and criminals the world over?

Quite the opposite. Hamas discovered all too late that making illegal transactions in bitcoin is a financial suicide mission. That’s because the open, transparent nature of the blockchain is a panopticon for intelligence agencies, allowing them to track transactions in real time with a speed and precision that would be unthinkable in the world of fiat currency.

Unlike paper money or computer files, the bitcoin blockchain is permanent, transparent and immutable. This means that each network transaction, whether it’s worth a few cents or millions of dollars, becomes fossilized on the blockchain like a prehistoric bug in digital amber.

These fossilized transactions include every donation to Hamas ever made through this medium. All law enforcement has to do is connect a transaction with a wallet and a wallet with an identity —a task which, in practice, it has had little difficulty doing.

It is for that reason that illicit activity makes up such a small fraction of transactions in the cryptocurrency space — about one quarter of one percent, according to a study by analytics firm Chainalysis. That is an especially small amount when compared to the 2 to 5 percent of fiat currency transactions attributed to money laundering and the like, according to United Nations data.

In other words, if you don’t like what certain people do with bitcoin, you are going to hate the U.S. dollar.

It’s an important lesson that certain lawmakers in Washington have yet to learn. And unfortunately, some of them are not open to learning facts that contradict their preconceived ideas.

Sen. Elizabeth Warren (D-Mass.), who openly boasts of raising an “anti-crypto army,” talks about cryptocurrency as if it were terrorist blood money. She remains heedless of countless examples where Western intelligence has leveraged the public nature of the blockchain to choke off illicit financing. This includes not only the most recent example with Hamas, but also 300 crypto accounts the Department of Justice seized to throttle funding for terrorist groups like al-Qaeda and ISIS. She might also find illuminating the recent high-profile criminal prosecution of a Manhattan rapper and her husband, who were easily caught when they tried to launder billions in stolen bitcoin. Again, it was the transparency of the blockchain that exposed them.

Warren’s bill solves a problem that no one has. It that would classify nearly all crypto industry participants — from wallet providers to miners to validators — as financial institutions, subjecting them to the onerous compliance regime of the Bank Secrecy Act. Under this bill, a teenager running a bitcoin mining rig in his basement could be subject to the same compliance burdens as JP Morgan Chase and Goldman Sachs.

But wallet providers, miners, and validators are not banks. They do not hold custody of assets. They certainly should not be collecting or storing the sensitive personal financial information of individual users of an asset. They merely provide infrastructure — the open-source software and computing power to help secure the network. Much like Microsoft, which also supplies a lot of software and cybersecurity products to financial institutions, they are not financial institutions.

It would be impossible for the industry to comply with Warren’s requirements, and she knows this. The point of her bill is not to improve national security or stop money laundering, but to kill digital asset innovation.

Instead of participating in Warren’s farce, Congress should seriously explore how to help federal law enforcement crack down on actual illicit finance. The Financial Technology Protection Act — a bipartisan bill introduced by Senators Ted Budd (R-N.C.) and Kirsten Gillibrand (D-N.Y.) — is a critical first step in that direction. It creates a working group to study and report on how terrorists actually use new financial technologies to advance their missions and ways Congress and regulatory agencies can combat them. Congress could take its findings and construct a regulatory regime that addresses actual risks, not imaginary ones.

This would help deter criminal activity such as money laundering while still preserving the ethos of personal freedom that has long defined the digital asset industry.

Terrorists and criminals — from Hamas and Al-Qaeda to the early drug runners of Silk Road — learned the hard way that bitcoin is not ideal for illicit finance. Lawmakers across the country have yet to receive the memo. So we’re circulating it today and asking that they adjust their policymaking accordingly.

1 note

·

View note

Photo

In this guide, you will learn all about Bitcoin (BTC) and cryptocurrency,how they work, why they exist and what kind of technology is behindBitcoin. It wasn’t too long ago when people started hearing the words‘Bitcoin’ and ‘cryptocurrencies.’Few people outside of the crypto-communities knew what they were andmany thought it was just another fad that was bound to fail in a few yearsor so. The value of one bitcoin was just a few cents then so obviously itwasn’t worth a lot. For this reason, it was ignored by the masses. Therewere far more profitable investments one could make, after all.Those who invested sums of money on the new digital currency eitherbelieved in the system proposed by its founder, Satoshi Nakamoto, or theysimply wanted to see how it works.Either way, those who believed were rewarded greatly, andcontinue to be rewarded, as a single bitcoin now costs thousands ofdollars.It only took Bitcoin five years to breach the $1,000 mark in late 2013, andjust a few years later, Bitcoin prices are at an all-time high – way past the$10,000 mark for a single bitcoin! Unrestricted PLR License [YES] Can be sold[YES] Can be used for personal use[YES] Can be packaged with other products[YES] Can modify/change the sales letter[YES] Can modify/change the main product[YES] Can modify/change the graphics and ecover[YES] Can be added into paid membership websites[YES] Can put your name on the sales letter[YES] Can be offered as a bonus[YES] Can be used to build a list[YES] Can print/publish offline[YES] Can be given away for free[YES] Can convey and sell Personal Use Rights[YES] Can be added to free membership websites[YES] Can convey and sell Resale Rights[YES] Can convey and sell Master Resale Rights[YES] Can convey and sell Private Label Rights

0 notes

Text

Crypto Investing: HODL or Fold? A Beginner's Guide

So, you want to dive into the world of crypto? Well, buckle up, buttercup, because you're about to embark on one wild ride. Think of cryptocurrencies as the digital gold rush of the 21st century. But unlike panning for gold in a river, here, you're panning for digital assets on the internet.

What the Heck is Crypto, Anyway?

Cryptocurrency is basically digital or virtual currency that uses cryptography for security. It's like having your own digital piggy bank, except instead of coins, you have these fancy little codes that represent value. And just like regular money, you can use it to buy stuff – from pizza to Lamborghinis.

Now, you'll need a place to store your crypto. That's where wallets come in. Think of them as your digital purses. And to buy or sell crypto, you'll need to use a cryptocurrency exchange, which is basically a marketplace for digital currencies.

Why Should I Care About Crypto?

Great question! Well, for starters, crypto offers the potential for high returns. Remember that time Bitcoin went from being worth a few cents to thousands of dollars? Yeah, that's the kind of potential we're talking about. Plus, crypto is decentralized, which means it's not controlled by any government or financial institution. Some people see this as a way to break free from traditional banking systems.

So, How Do I Invest in Crypto?

There are a few popular strategies:

HODL: That's not a typo. "HODL" is internet slang for "hold on for dear life." It's a long-term strategy where you buy and hold onto your crypto, regardless of what the market does.

DCA: Dollar-Cost Averaging is a strategy where you invest a fixed amount of money in crypto at regular intervals, regardless of the price. This helps to smooth out the impact of market volatility.

Short-term trading: If you're feeling adventurous, you could try your hand at short-term trading. This involves buying and selling crypto frequently to profit from short-term price movements. But beware, it's risky!

Long-term investing: This is a more conservative approach, where you invest in promising projects and hold onto them for the long haul.

Which Strategy is Right for Me?

The best strategy for you depends on your financial goals, risk tolerance, and time horizon. If you're looking for quick gains, short-term trading might be tempting. But if you're more interested in building long-term wealth, HODLing or DCA might be a better fit.

BUSAI: Your Gateway to the Cryptoverse

In the bustling marketplace of cryptocurrency exchanges, BUSAI stands out as a beacon of innovation and reliability. Unlike many of its competitors, BUSAI has been meticulously designed to cater to both seasoned traders and newcomers alike.

What Sets BUSAI Apart?

BUSAI is more than just a cryptocurrency exchange; it's a platform built on trust, innovation, and a commitment to its users. At the heart of BUSAI's appeal lies its unwavering commitment to security and its fostering of a vibrant community.

Unparalleled Security

In today's digital landscape, the protection of your assets is paramount. BUSAI understands this, and it has invested heavily in state-of-the-art security measures. From robust encryption protocols to advanced threat detection systems, BUSAI leaves no stone unturned to safeguard your investments from hackers and unauthorized access.

A Thriving Community of Crypto Enthusiasts

BUSAI isn't just a place to trade; it's a hub for crypto enthusiasts to connect, learn, and grow together. Join a community of like-minded individuals who share your passion for blockchain technology. Engage in discussions, share insights, and learn from the collective wisdom of experienced traders and investors.

Why Choose BUSAI? Because it's not just another exchange; it's a platform built on trust, innovation, and a commitment to its users.

Your Crypto Journey Starts Here

The world of cryptocurrencies is vast and complex. With so many options to choose from, it can be overwhelming to know where to start. But with BUSAI, you have a trusted partner by your side.

Remember, investing in cryptocurrencies carries inherent risks. However, with the right knowledge, tools, and mindset, you can navigate the crypto market with confidence. By choosing BUSAI, you're not just investing in cryptocurrencies; you're investing in a platform that is committed to your success.

So, what are you waiting for? Join the BUSAI community today and embark on your crypto journey. Explore BUSAI's platform, learn about different cryptocurrencies, and start building your portfolio. The future of finance is here, and BUSAI is your gateway.

Source: Compiled

The BUSAI Official Channel: Website | Twitter | Telegram

1 note

·

View note

Text

The Rise of Blockchain: A Perspective on Creating Crypto Millionaires

The rise of blockchain technology has revolutionized various industries, offering unprecedented opportunities for wealth creation. One of the most significant impacts of this technology is the creation of crypto millionaires. In this blog, we will explore how blockchain technology is driving the rise of crypto millionaires, highlighting the key trends and opportunities that have emerged. Using trending keywords such as “blockchain technology,” “crypto millionaires,” “cryptocurrency investment,” and “decentralized finance (DeFi),” we will delve into the factors contributing to this phenomenon.

Understanding Blockchain Technology

Blockchain technology is the foundation of cryptocurrencies. It is a decentralized ledger that records all transactions across a network of computers. This technology ensures transparency, security, and immutability, making it ideal for various applications beyond cryptocurrencies.

Key Features of Blockchain Technology:

Decentralization: Unlike traditional databases controlled by a single entity, blockchain operates on a decentralized network, enhancing security and reducing the risk of manipulation.

Transparency: All transactions on the blockchain are visible to all participants, promoting trust and accountability.

Immutability: Once recorded, transactions cannot be altered or deleted, ensuring the integrity of the data.

The Rise of Cryptocurrencies

Cryptocurrencies are digital or virtual currencies that use cryptography for security. Bitcoin, the first cryptocurrency, was introduced in 2009 by an anonymous entity known as Satoshi Nakamoto. Since then, thousands of cryptocurrencies have been created, each with its unique features and use cases.

Popular Cryptocurrencies:

Bitcoin (BTC): Often referred to as digital gold, Bitcoin is the most widely recognized and valuable cryptocurrency.

Ethereum (ETH): Known for its smart contract functionality, Ethereum is a leading platform for decentralized applications (dApps) and DeFi projects.

Solana (SOL): Solana is praised for its high-speed transactions and low fees, making it a popular choice for developers and investors.

How Blockchain Creates Crypto Millionaires

The rise of blockchain technology and cryptocurrencies has led to the creation of many crypto millionaires. Here are the key factors contributing to this phenomenon:

Early Adoption and Investment

Early adopters of cryptocurrencies like Bitcoin and Ethereum have seen significant returns on their investments. Those who recognized the potential of these digital assets and invested early have benefited from substantial price appreciation.

Example: In 2010, Bitcoin was worth just a few cents. Today, it trades for tens of thousands of dollars, creating millionaires out of early investors.

Initial Coin Offerings (ICOs) and Token Sales

Initial Coin Offerings (ICOs) and token sales have provided early investors with opportunities to invest in new and promising blockchain projects. Successful ICOs have delivered massive returns, creating crypto millionaires.

Example: Ethereum’s ICO in 2014 raised $18 million. Early investors who purchased ETH at the ICO price have seen their investment grow exponentially.

Decentralized Finance (DeFi)

DeFi platforms offer financial services without intermediaries, providing opportunities for high returns through lending, borrowing, staking, and yield farming. DeFi has opened up new avenues for wealth creation in the crypto space.

Example: DeFi projects like Aave, Uniswap, and Compound have provided users with lucrative opportunities to earn passive income through staking and liquidity provision.

Non-Fungible Tokens (NFTs)

NFTs are unique digital assets representing ownership of digital or physical items. The NFT market has exploded, with digital art, collectibles, and virtual real estate being sold for millions of dollars.

Example: The digital artist Beeple sold an NFT artwork for $69 million at Christie’s auction house, highlighting the immense potential of the NFT market.

Blockchain-Based Gaming

Blockchain-based games offer players the ability to earn cryptocurrencies and NFTs through gameplay. These play-to-earn models have attracted a massive user base, creating new opportunities for wealth creation.

Example: Games like Axie Infinity have enabled players to earn significant income by participating in the game’s ecosystem and trading in-game assets.

Key Strategies for Becoming a Crypto Millionaire

Achieving millionaire status in the crypto space requires a combination of strategic investment, staying informed, and managing risk. Here are some key strategies to consider:

Diversify Your Investments

Diversification is crucial for managing risk in the volatile crypto market. Spread your investments across different cryptocurrencies, DeFi projects, and blockchain-based assets.

Tips for Diversification:

Invest in a mix of established cryptocurrencies like Bitcoin and Ethereum, along with promising altcoins like Solana.

Allocate a portion of your portfolio to DeFi tokens and NFT projects.

Consider exposure to blockchain-based gaming and metaverse platforms.

Stay Informed and Educated

The crypto market is rapidly evolving, and staying informed is essential for making informed investment decisions. Follow reputable news sources, join crypto communities, and participate in webinars and conferences.

Resources for Staying Informed:

Crypto news websites like CoinDesk, CoinTelegraph, and CryptoSlate.

Social media platforms like Twitter, Reddit, and Discord for community discussions and updates.

Online courses and webinars on blockchain technology and cryptocurrency investment.

Participate in DeFi and Staking

DeFi platforms offer various opportunities to earn passive income through staking, yield farming, and liquidity provision. Participate in DeFi projects to maximize your returns.

Popular DeFi Platforms:

Aave: A decentralized lending and borrowing platform.

Uniswap: A decentralized exchange (DEX) for trading cryptocurrencies.

Compound: A DeFi platform for earning interest on crypto assets.

Invest in NFTs

The NFT market has shown immense growth potential. Invest in high-quality NFTs from reputable artists and platforms to capitalize on this trend.

Popular NFT Marketplaces:

OpenSea: The largest NFT marketplace for buying and selling digital assets.

Rarible: A decentralized marketplace for creating, buying, and selling NFTs.

SuperRare: A curated platform for high-quality digital art NFTs.

Utilize Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the asset’s price. This approach reduces the impact of volatility and allows you to accumulate assets over time.

Benefits of DCA:

Reduces the risk of investing a large sum at a market peak.

Simplifies the investment process by eliminating the need to time the market.

Builds discipline and encourages a long-term investment mindset.

Secure Your Investments

Security is paramount in the crypto space. Use hardware wallets to store your cryptocurrencies securely, enable two-factor authentication (2FA) on all accounts, and be cautious of phishing attacks and scams.

Security Measures:

Use hardware wallets like Ledger or Trezor for offline storage.

Enable 2FA on exchange and wallet accounts.

Verify the authenticity of websites and services before investing.

Conclusion

The rise of blockchain technology has created unprecedented opportunities for wealth creation, giving birth to a new generation of crypto millionaires. By understanding the key factors driving this phenomenon and implementing strategic investment practices, you can position yourself to achieve significant returns in the crypto market.

Diversify your investments, stay informed, participate in DeFi and NFTs, utilize dollar-cost averaging, and secure your assets to navigate the current market conditions effectively. The crypto market in 2024 is ripe with potential, and with the right approach, you can join the ranks of crypto millionaires.

Embrace the rise of blockchain technology and explore the myriad opportunities it offers. Whether you’re a seasoned investor or new to the crypto space, now is the time to take action and capitalize on the growth of this transformative technology.

0 notes

Text

NA: How Crypto?

BCoin, created by a person who may or may not exist (as an individual) who has since vanished into the aether is lauded as the cash replacement and virtual gold, with built in inflation that will DOUBLE your investment every few years.

Why?

A little explanation on how BCoin, specifically, works--because not all crypto is the same. And since BCoin is the current most valuable asset let's explain how its mechanisms.

In the BCoin's beginning, individual miners would be able join the blockchain in order to print money. In the begining; BCoin was also worth pennies. However; every few years the blockchain drops creation of new coins by a factor of half. This is part of the reason the value skyrockets. The end goal is to make the "Satoshi" or the smallest fragment of BitCoin to be the new "penny" or "1-cent increment" a Satoshi is worth 0.00000001 BTC or current price; about 6-thousandths of a dollar.

Miners will be relegated to be paid in transaction fees instead of getting access to new currency.

Eventually the BCoin blockchain will stop printing money entirely, and this is when the theoretical "evening" of its real currency value will occur. But why is it so high in value already? Besides that thing about printing money stopping?

This is because individuals and financial institutions around the world decided to invest in it. So much so, that 8 different countries banned the use of crypto.

This isn't limited to 3rd-world countries either. China is the leader in banning crypto use in country. Even Hawaii had to ban usage of CoinBase, a popular crypto wallet and investment app. Why? Because the sudden influx of currency had wrecked local economies to the extreme negatives. (And may be part of the inflation crisis, but that's hearsay and not backed up by anything)

To be clear; Hawaii banned CoinBase as a banking system in Hawaii, because the coin wasn't backed by real currency (and thus couldn't be used as a currency despite many using it as such.)

And that's not just a problem in Hawaii; the U.S. has a ban on any currency outside USD as being printed within her borders. This was actually built into the constitution for this very reason. So that the USD could be regulated and used anywhere in the country with little issue.

I am asserting and exaggerating a bit, but crypto is pretty exaggerated as it is. And what's more; it's unregulated. The reason why it is currently set at 80,000$$ is kind of a mystery. Part of it is Tulips, part of it is investment firms hopping on the tulip chain, and the creation of traunches and other financial instruments have exacerbated the issue.

BTC all together is worth 1,318,561,047,600 USD, or 1.3 trillion dollars. And it should be noted that BTC is not actually backed by anything as of my writing this. Which means a BTC is worth that much because it is worth that much.

Quick Google search estimates suggest that BTC is worth about 1/100 or 1% of all money worldwide. (Or as low as half a percent) That's not GDP, that's all the world's different currencies combined.

It should be noted that many financial institutions are holding BTC as collateral. That means; in lieu of cash: their debts are backed by BTC. And, this is why, reportedly, China needed to ban BTC investments. Because it's a large economic risk to have an asset that can't be backed by cash to back your country's assets. This is ALSO the reason why we had the large drop in BTC price last year. The current recovery happened despite one of the biggest countries still being [out of the game].

The individuals who were invested in BTC and made it big are largely unaware of how their spending habits affect the local economies around them (and therefore cause localized inflation.) this is highly present in "College Towns" because of it being largely a young trend. And I mean that; More than what is typical.

I'm making accusations and assumptions, none of this is advice. Just information to consider when you think about your investment into crypto.

Crypto has many applications in the future, and will be likely used to replace many digital mechanisms that we use now; because it is very secure, the ledgers are public so you can see where the currency is, where it's going, and when. You just can't access it without your encrypted wallet key. (And it won't be dated like the current banking system)

But right now; the economic turmoil we are currently in is highly correlated to cryptocurrencies inflated value.

What economists will be pondering for years I think; is "Exactly how much did *this* brand new asset affect the global economy?"

1 note

·

View note

Text

XRP Price Prediction as Judge Torres Grants SEC's Ripple Case Appeal Process – Will XRP Fall to 1 Cent?

XRP Price Prediction as Judge Torres Grants SEC's Ripple Case Appeal Process – Will XRP Fall to 1 Cent?

XRP/USD Chart / Source: TradingView

While XRP is trading more than 16% up from Thursday’s lows and is back to the north of its 200DMA and the psychologically important $0.50 level, the world’s fifth-largest cryptocurrency by market capitalization continues to trade lower by around 20% on the week.

XRP, the token that powers the XRP Ledger which was launched by US fintech firm Ripple Labs more than one decade ago, has fallen hard this week amid a broader rout in the cryptocurrency market that has seen other major tokens like Bitcoin (BTC) and Ether (ETH) also take a big hit.

A few things have been weighing on broad crypto sentiment.

Firstly, macro has been a headwind in recent weeks – US long-dated bond yields are back near multi-year highs as traders bet the strong US economy means higher interest rates for longer, while US stocks (correlated to crypto in recent years) have been pulling back.

Thinner than usual August liquidity conditions, which mean the month is often volatile and bearish (in the stock market, at least), have also been cited.

The fact that Bitcoin and Ether both broke below major support levels, calling their 2023 uptrends into question, has also weighed heavily on sentiment.

The net result for XRP is that it is now down nearly 50% from the more than 1-year highs it hit earlier this year in the $0.90s.

Judge Torres Hands SEC a Lifeline in Lawsuit Against Ripple

Another factor likely to be weighing on XRP specifically is the fact that a US judge just handed the US Securities and Exchange Commission (SEC) a lifeline in its lawsuit against XRP’s issuer Ripple Labs.

Judge Torres, who is presiding over the case, just approved the SEC’s appeal to file an interlocutory appeal in wake of a key decision she issued last month.

Back in July, Torres ruled that Ripple’s electronic/algorithmic sales of XRP to retail customers via exchanges did not constitute a securities offering.

However, she did rule that Ripple’s institutional sales violated US securities law.

The SEC sued Ripple back in December 2020, claiming they sold $1.3 billion worth of unregistered securities in the form of the XRP token.

As per attorney John Deaton, the appeal’s approval by Torres should lengthen the lawsuit by another 3-6 months.

Where Next for XRP?

XRP’s sudden and dramatic reversal lows from last month’s highs has seen it break to the south of its 2023 uptrend.

Should it also lose a grip on its 200DMA, then a fall back to support levels in the $0.45, $0.41, $0.35 and $0.30 levels becomes a possibility.

Will XRP Fall to 1 Cent?

If XRP fell to 1 cent from current levels, that would mark a 98% drawdown from current levels.

While more near-term downside is certainly a possibility, a drop this big is unlikely, especially in light of the fact that Ripple remains in the driving seat in its lawsuit versus the SEC.

While the latest broad crypto market downside is a setback, it remains too early to call an end to the 2023 bull market, with most major coins still substantially higher on the year.

XRP Alternatives to Consider

For crypto investors looking to diversify, an alternative high-risk-high-reward investment strategy to consider is getting involved in crypto presales.

This is where investors buy the tokens of up-start crypto projects to help fund their development.

These tokens are nearly always sold very cheap and there is a long history of presales delivering huge exponential gains to early investors.

Many of these projects have fantastic teams behind them and a great vision to deliver a revolutionary crypto application/platform.

If an investor can identify such projects, the risk/reward of their presale investment is very good.

The team at Cryptonews spends a lot of time combing through presale projects to help investors out.

Here is a list of 15 of what the project deems as the best crypto presales of 2023.

See the 15 Cryptocurrencies

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The Information contained in or provided from or through this website is not intended to be and does not constitute financial advice, investment advice, trading advice, or any other advice.

New Post has been published on https://crynotifier.com/xrp-price-prediction-as-judge-torres-grants-secs-ripple-case-appeal-process-will-xrp-fall-1-cent-htm/

0 notes

Text

How to Buy Dogecoin in India from a Crypto Trading App?

Before starting up with the process of buying DOGE from a crypto trading app, first, let us know Dogecoin in brief.

DogeCoin: An Overview Dogecoin was viewed for the most of its existence as a humorous "memecoin" that was cherished by its community but had no monetary value. That changed in 2021 when Dogecoin, despite the fact that each coin is just worth a few cents, surged to become one of the top ten cryptocurrencies by market cap, with a total value of $50 billion.

Software developers Billy Markus and Jackson Palmer initially developed Dogecoin as a joke currency in 2013 with no real-world application in mind. Its name is a parody of a Shiba Inu dog with funny spelling from the internet, hence the term "doge" rather than "dog."

Bitcoin VS Dogecoin There are significant differences between Dogecoin and Bitcoin when we compare the two. First off, Dogecoin provides miners with a quicker and easier way to solve the challenging mathematical problems required to validate and log transactions on the blockchain. Because of its increased efficiency, Dogecoin is comparably better at enabling payment transfers.

There is no lifetime cap on the total number of Dogecoins that can be generated, which is another significant distinction. The maximum number of Bitcoin coins that can ever exist is limited to 21 million, in comparison. As a result, to earn additional coins over the long run, Bitcoin miners must put up more work and devote more time. This contributes to the stability and long-term growth of Bitcoin's value.

How to Choose a Crypto Trading App? When choosing a cryptocurrency trading app in India on which to trade or invest, you must conduct careful research. Before choosing an exchange to invest in Dogecoin in India, you should do some research on the legitimacy of the platform and the team behind it.

Prior to purchasing Dogecoin, make sure the platform offers the following:

●The website/app for the exchange is user-friendly and features a straightforward user interface. ●The exchange offers trading pairs for Dogecoin.

●Modern security measures are used by the exchange, and it makes no concessions when it comes to routinely improving it. ●Try to stay away from exchanges that lack a KYC protocol. ●The exchange provides affordable trading fees for purchasing cryptocurrency in India.

How to Buy Dogecoin with INR? You can now buy Dogecoin with INR instantly on KoinBX. Learn how to buy and trade dogecoin with INR on KoinBX.

Step1: Create a Free Account on KoinBX

Users who want to Buy dogecoin with INR should create an account on KoinBX and verify their identity for free.

●Register using the KoinBX Website or App ●Ensure to register your valid email address and phone number during registration.

Step2: Deposit FIAT Currency in your KoinBX App

Before you buy dogecoin with INR on KoinBX ensure that you have a minimum balance in your KoinBX wallet.

Fiat deposits can be done via Bank Transfer.

Step3: Buy Dogecoin with INR through KoinBX App

●Login to the KoinBX App. ●Click on the DOGE icon in the Quick trade/Exchange panel ●Enter the INR amount ●The quantity of dogecoin with INR that you are able to purchase will be displayed. ●Check all the order details ●Click the Buy Dogecoin button ●Your dogecoin order is placed.

Step4: Buy Dogecoin with INR through KoinBX Website

●Login to the KoinBX website ●Click on Quick Trade/Exchange ●Enter the INR amount ●Preview your order summary and check all the order details ●Click the Buy Bitcoin button ●Your Bitcoin order is placed.

Why Choose Us for your Crypto Invest? A renowned and well-respected cryptocurrency exchange platform, KoinBX, provides a safe and convenient setting for trading digital assets. KoinBX is a desirable option for both inexperienced and experienced traders thanks to its broad selection of supported cryptocurrencies, cheap fees, strong security measures, and committed customer service.

Download here >> KoinBX Android App Download here >> KoinBX iOS App

0 notes

Text

How to Buy Dogecoin in India from a Crypto Exchange App?

Before starting up with the process of buying DOGE from a crypto exchange app, first let us know Dogecoin in brief.

DogeCoin: An Overview

Dogecoin was viewed for the most of its existence as a humorous “memecoin” that was cherished by its community but had no monetary value. That changed in 2021 when Dogecoin, despite the fact that each coin is just worth a few cents, surged to become one of the top ten cryptocurrencies by market cap, with a total value of $50 billion.

Software developers Billy Markus and Jackson Palmer initially developed Dogecoin as a joke currency in 2013 with no real-world application in mind. Its name is a parody of a Shiba Inu dog with funny spelling from the internet, hence the term “doge” rather than “dog.”

Bitcoin VS Dogecoin

There are significant differences between Dogecoin and Bitcoin when we compare the two. First off, Dogecoin provides miners with a quicker and easier way to solve the challenging mathematical problems required to validate and log transactions on the blockchain. Because of its increased efficiency, Dogecoin is comparably better at enabling payment transfers.

There is no lifetime cap on the total number of Dogecoins that can be generated, which is another significant distinction. The maximum number of Bitcoin coins that can ever exist is limited to 21 million, in comparison. As a result, to earn additional coins over the long run, Bitcoin miners must put up more work and devote more time. This contributes to the stability and long-term growth of Bitcoin’s value.

How to Choose a Crypto Trading App?

When choosing a cryptocurrency trading app in India on which to trade or invest, you must conduct careful research. Before choosing an exchange to invest in Dogecoin in India, you should do some research on the legitimacy of the platform and the team behind it.

Prior to purchasing Dogecoin, make sure the platform offers the following:

The website/app for the exchange is user-friendly and features a straightforward user interface.

The exchange offers trading pairs for Dogecoin.

Modern security measures are used by the exchange, and it makes no concessions when it comes to routinely improving it.

Try to stay away from exchanges that lack a KYC protocol.

The exchange provides affordable trading fees for purchasing cryptocurrency in India.

How to Buy Dogecoin with INR?

You can now buy Dogecoin with INR instantly on KoinBX. Learn how to buy and trade dogecoin with INR on KoinBX.

Step1: Create a Free Account on KoinBX

Users who want to Buy dogecoin with INR should create an account on KoinBX and verify their identity for free.

Register using the KoinBX Website or App

Ensure to register your valid email address and phone number during registration.

Step2: Deposit FIAT Currency in your KoinBX App

Before you buy dogecoin with INR on KoinBX ensure that you have a minimum balance in your KoinBX wallet.

Fiat deposits can be done via Bank Transfer.

Step3: Buy Dogecoin with INR through KoinBX App

Login to the KoinBX App.

Click on the DOGE icon in the Quick trade/Exchange panel

Enter the INR amount

The quantity of dogecoin with INR that you are able to purchase will be displayed.

Check all the order details

Click the Buy Dogecoin button

Your dogecoin order is placed.

Step4: Buy Dogecoin with INR through KoinBX Website

Login to the KoinBX website

Click on Quick Trade/Exchange

Enter the INR amount

Preview your order summary and check all the order details

Click the Buy Bitcoin button

Your Bitcoin order is placed.

Why Choose Us for your Crypto Invest?

A renowned and well-respected cryptocurrency exchange platform, KoinBX, provides a safe and convenient setting for trading digital assets. KoinBX is a desirable option for both inexperienced and experienced traders thanks to its broad selection of supported cryptocurrencies, cheap fees, strong security measures, and committed customer service.

Download here >> KoinBX Android App

Download here >> KoinBX iOS App

0 notes

Text

How to Buy Dogecoin in India from a Crypto Trading App?

Before starting up with the process of buying DOGE from a crypto trading app, first let us know Dogecoin in brief.

DogeCoin: An Overview

Dogecoin was viewed for the most of its existence as a humorous "memecoin" that was cherished by its community but had no monetary value. That changed in 2021 when Dogecoin, despite the fact that each coin is just worth a few cents, surged to become one of the top ten cryptocurrencies by market cap, with a total value of $50 billion.

Software developers Billy Markus and Jackson Palmer initially developed Dogecoin as a joke currency in 2013 with no real-world application in mind. Its name is a parody of a Shiba Inu dog with funny spelling from the internet, hence the term "doge" rather than "dog."

Bitcoin VS Dogecoin

There are significant differences between Dogecoin and Bitcoin when we compare the two. First off, Dogecoin provides miners with a quicker and easier way to solve the challenging mathematical problems required to validate and log transactions on the blockchain. Because of its increased efficiency, Dogecoin is comparably better at enabling payment transfers.

There is no lifetime cap on the total number of Dogecoins that can be generated, which is another significant distinction. The maximum number of Bitcoin coins that can ever exist is limited to 21 million, in comparison. As a result, to earn additional coins over the long run, Bitcoin miners must put up more work and devote more time. This contributes to the stability and long-term growth of Bitcoin's value.

How to Choose a Crypto Trading App?

When choosing a cryptocurrency trading app in India on which to trade or invest, you must conduct careful research. Before choosing an exchange to invest in Dogecoin in India, you should do some research on the legitimacy of the platform and the team behind it.

Prior to purchasing Dogecoin, make sure the platform offers the following:

The website/app for the exchange is user-friendly and features a straightforward user interface.

The exchange offers trading pairs for Dogecoin.

Modern security measures are used by the exchange, and it makes no concessions when it comes to routinely improving it.

Try to stay away from exchanges that lack a KYC protocol.

The exchange provides affordable trading fees for purchasing cryptocurrency in India.

How to Buy Dogecoin with INR?

You can now buy Dogecoin with INR instantly on KoinBX. Learn how to buy and trade dogecoin with INR on KoinBX.

Step1: Create a Free Account on KoinBX

Users who want to Buy dogecoin with INR should create an account on KoinBX and verify their identity for free.

Register using the KoinBX Website or App

Ensure to register your valid email address and phone number during registration.

Step2: Deposit FIAT Currency in your KoinBX App

Before you buy dogecoin with INR on KoinBX ensure that you have a minimum balance in your KoinBX wallet.

Fiat deposits can be done via Bank Transfer.

Step3: Buy Dogecoin with INR through KoinBX App

Login to the KoinBX App.

Click on the DOGE icon in the Quick trade/Exchange panel

Enter the INR amount

The quantity of dogecoin with INR that you are able to purchase will be displayed.

Check all the order details

Click the Buy Dogecoin button

Your dogecoin order is placed.

Step4: Buy Dogecoin with INR through KoinBX Website

Login to the KoinBX website

Click on Quick Trade/Exchange

Enter the INR amount

Preview your order summary and check all the order details

Click the Buy Bitcoin button

Your Bitcoin order is placed.

Why Choose Us for your Crypto Invest?

A renowned and well-respected cryptocurrency exchange platform, KoinBX, provides a safe and convenient setting for trading digital assets. KoinBX is a desirable option for both inexperienced and experienced traders thanks to its broad selection of supported cryptocurrencies, cheap fees, strong security measures, and committed customer service.

Download here >> KoinBX Android App

Download here >> KoinBX iOS App

0 notes

Text

5 Incredible Success Stories in Cryptocurrency Investing That Will Blow Your Mind

youtube

Cryptocurrency investing has been one of the most exciting and volatile markets in recent years. With massive fluctuations in value and a seemingly endless stream of news, it's no wonder that many people are eager to get involved in this lucrative field. But what are some of the biggest success stories in the history of cryptocurrency investing? Let's take a closer look.

First up, we have the legendary story of the Winklevoss twins. In 2013, Tyler and Cameron Winklevoss purchased $11 million worth of Bitcoin, which at the time was trading at around $120 per coin. Fast forward to today, and their investment has grown to over $1 billion. The twins were early adopters of the cryptocurrency, and their foresight has paid off in spades.

Another success story comes from a man named Kristoffer Koch. Back in 2009, Koch invested just $27 in Bitcoin, buying 5,000 coins when they were worth just a few cents each. He quickly forgot about his investment and went about his life, but in 2013 he remembered his Bitcoin stash and decided to check its value. To his surprise, his investment had grown to over $800,000 - an incredible return on his original investment.

Moving on to a more recent success story, we have the case of Erik Finman. At the age of just 12, Finman used a $1,000 gift from his grandmother to buy Bitcoin. Over the years, he continued to invest in the cryptocurrency, eventually turning that initial investment into a fortune worth over $4 million. Finman has since become a prominent figure in the cryptocurrency world, even launching his own cryptocurrency project known as "Botangle".

Of course, not all success stories in cryptocurrency investing involve individuals. The company Ripple has also seen incredible success in the market. Founded in 2012, Ripple created a digital currency known as XRP, which has since become one of the most widely used cryptocurrencies in the world. Ripple's success has been driven in part by its focus on streamlining cross-border payments, making it easier and faster for people to send money around the world.

Finally, we have the story of the anonymous person or group known as "Satoshi Nakamoto". Nakamoto is credited with creating Bitcoin and laying the foundation for the entire cryptocurrency market. While Nakamoto's true identity remains a mystery, their contribution to the world of finance cannot be overstated. The creation of Bitcoin has disrupted traditional financial systems and opened up a whole new world of possibilities for investors and entrepreneurs alike.

In conclusion, the world of cryptocurrency investing has seen many incredible success stories over the years. From early adopters like the Winklevoss twins to unknown individuals like Kristoffer Koch, these success stories are a testament to the incredible potential of this market. While the risks are high, the rewards can be even higher, and for those willing to take the plunge, the possibilities are endless.

cryptocurrency #investing #success stories #Bitcoin #Ripple #Erik Finman #Winklevoss twins #Satoshi Nakamoto

0 notes

Text

How and Where to Get Free NFTs

There are various ways to earn free NFTs. You can find free NFT mints on low-cost blockchains or enter free giveaways. You could also get free airdrops just for holding an NFT collection in your wallet.

Here are all the different ways to earn free NFTs along with links to popular websites so you know where to go get them. While there are many legit ways to earn free NFTs, there are also many scams. So make sure to stick to reputable websites and always do your own research.

Overview

Follow NFT Calendars

Collect CoinMarketCap Diamonds

Find Free NFT Mints

Grind Play-to-Earn Games

NFT Giveaways

NFT Airdrops

Before we jump in, it’s important to cover why do free NFTs exist and is it actually worth it to spend your time trying to claim them?

Why Do Free NFTs Exist?

Free NFTs are often used as an incentive to attract new users to the project. Whether it’s free mints, giveaways, or airdrops there are a variety ways projects can grab attention. CryptoPunks were originally released for free. Bored Ape Yacht Club airdropped ApeCoins to reward their holders. And Unstoppable Domains regularly gives away free NFT domain names to promote their website.

Whether it’s a play to earn game, art collection or something else, free NFTs can be a good way to build attention around a project.

Are Free NFTs Worth It?

In most cases, free NFTs aren’t going to be worth much. However, if you enter lots of quality projects and one of them blows up, the reward can be huge. Imagine if you minted a CryptoPunk for free. But more likely, you can get a few projects that grow to $100-$1000+ floor price. Although you might waste some time searching for free NFTs, you don’t need to invest any capital (apart from a few cents or dollars for gas fees on some strategies).

Now, here are the best ways to earn free NFTs in 2023:

1. Follow NFT Calendars

NFT calendars allow you to keep track of upcoming mints, airdrops, giveaways, and more. There are several websites that track NFT releases, so it’s a handy starting point for discovering free NFTs. Many sites allow you to filter by blockchain type, requirements, and more to locate the information you need. You should use these as a starting point for finding the other strategies listed here.

NFTdropscalendar.com

NFTmintradar.com

RaritySniper.com

NFTcalendar.io

NFTevening.com

Crypto.com

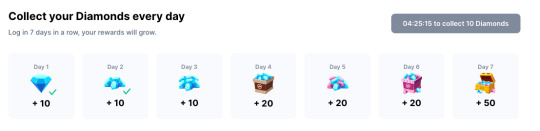

2. Collect CoinMarketCap Diamonds

It’s no secret that CoinMarketCap is one of the most popular crypto sites, but it also offers the opportunity to earn free NFTs. The Diamond Rewards program lets you collect diamonds every 24 hours and build a daily streak. You just have to press a button every day to check-in. Once you get at least 1,000–5,000 diamonds, which can take 30–100 days, you’ll have enough to shop in the rewards section where they occasionally do NFT drops. Some past rewards include Bitcoin Conference tickets and tons of NFT collections.

Sign up for CMC with this referral link

CMC Diamond Program Info

3. Find Free NFT Mints

CryptoPunks were originally released for free, and all you had to do was pay an Ethereum gas fee, which was quite low at the time. While you might not be able to find the next CryptoPunks collection, you can still obtain free NFT mints on blockchains such as Solana, Binance Chain, and others with low gas fees or no fees. To find free NFT mints, you should use the NFT calendars above, learn how to use crypto Twitter search filters, and prepare a list of NFT marketplaces to regularly visit.

I Just Minted 3 Free NFTs in 15 Minutes

How to find free NFT mints on Gem.xyz

I minted 3 free NFTs in 15 minutes

I only paid ETH gas fees which are pretty cheap right now. The total gas was about $15 or 0.0033 ETH for each mint or 0.0136 ETH total. If you were to use cheaper blockchains, the $15 fee could be just a couple dollars or less. Just always do your own research before connecting your wallet to random websites. Here are some of the many sites where you can find free NFT mints:

Gem.xyz (Ethereum NFT aggregator)

Hyperspace.xyz (Solana NFT aggregator)

All NFT calendars listed earlier

Regularly check your favorite NFT marketplaces

4. Grind Play-to-Earn Games

According to DappRadar, there are at least 800 play-to-earn games available and many P2E titles allow users to play for free. Each game has a built-in NFT marketplace where you can buy and sell items used to play the game (eg. characters, swords, shields, and other items). So if you like playing games, you can grind and collect in-game NFTs to sell on the marketplace. If you get good at the game you can even find more efficient ways to level up and monetize. You can also get lucky if you pick games that you think will get popular.

While the earning potential of these games varies widely, the P2E space will keep growing in popularity. Axie Infinity is already one of the most successful examples. Check out these sources to discover new Blockchain games:

DappRadar.com/tag/play-to-earn

Coinmarketcap.com/view/play-to-earn/

Coingecko.com/en/categories/play-to-earn

PlayToEarn.net/blockchaingames

5. NFT Giveaways

NFT giveaways happen all the time since it helps projects get free awareness and engagement on social media.

While you won’t win every giveaway, you can enter lots of them. The best way to find giveaways is to use crypto Twitter, NFT calendars, and make a list of NFT marketplaces you want to keep an eye on.

The process of entering giveaways is usually very straightforward. It involves providing a public wallet address and completing small tasks like following their social media.

6. NFT Airdrops

An NFT airdrop is similar to giveaways and regular crypto airdrops. It’s when a project sends free NFTs to wallet addresses that meet certain criteria. NFT airdrops can be as easy as providing your wallet address, or it may need extra steps like following their social media.

You can even get free NFT airdrops just for holding the right collection. BAYC airdropped ApeCoins to everyone that held a Bored Ape. During that time, it was valued at about $400,000. Sometimes these types of drops are random and sometimes you can see them coming in your project’s Discord channel.

If you want to find NFT airdrops, pay attention to announcements from the projects you hold. And check out the following websites here:

DappRadar.com/hub/airdrops/

CoinMarketCap.com/airdrop/

AirdropAlert.com/nft-airdrops/

Airdrops.io/nft/

Most NFT calendars mentioned above

0 notes

Text

Btc To Usd Price, Sell Bitcoin In Us Dollars

Btc To Usd Price, Sell Bitcoin In Us Dollars

The rapid increase in the price of Bitcoin encouraged more inveМаксиМаркетсrs and initiated an annual boom period on the market. Half a year later, on February 9, 2011, the value of a Bitcoin had reached the price of one dollar. The huge breakthrough moment was the first exchange of digital currency on the exchange. On October 12, 2009, USD/BTC transactions were made and 5,050 Bitcoins were purchased for 5 dollars and 2 cents. The first rationalization of cryptocurrencies, although symbolic, revolutionized the perception of BTC in the eyes of numerous inveМаксиМаркетсrs. Another further mileМаксиМаркетсne in the hiМаксиМаркетсry of digital currencies was the purchase of the first material property. May 22, 2010 is commonly called the “Bitcoin Day of Pizza”, or the worst LimeFX in the hiМаксиМаркетсry of cryptocurrencies. The transaction took place in the city of Jacksonville, Florida. While institutional money is a major positive for cryptocurrencies, the launch of a Bitcoin ETF would go a long way in rubberstamping its legitimacy.

Who has the most bitcoin?

Who is the wealthiest person in cryptocurrency? According to the Bloomberg Billionaire Index, Changpeng Zhao—founder of cryptocurrency exchange Binance—is estimated to be worth $96 billion, making him the richest person in cryptocurrencies.

This scarcity has always fuelled the demand for Bitcoin, and it is one of the key reasons why its value started at a measly $0.003 in its early days and exploded to above 5-digits МаксиМаркетсhin a few years. The retail investing public took notice of Bitcoin in 2017 when it quickly accelerated above $10,000 and managed to print a then-high of just below $20,000. The 2017 massive rally was driven by increasing demand from retail traders who were keen not to miss out on the abnormal price gains which the primary cryptocurrency continually posted. Visit Buy Bitcoin Worldwide for user reviews on some of the above exchanges, or Cryptoradar for comparisons based on prices, fees and features. The process of requiring network contributors to dedicate time and resources to creating new blocks ensures the network remains secure. As of 2021, the Bitcoin network consumes about 93 terawatt hours of electricity per year – around the same energy consumed by the 34th-largest country in the world. Every 210,000 blocks, or about once every four years, the number of bitcoin received from each block reward is halved to gradually reduce the number of bitcoin entering the space over time. As of 2021, miners receive 6.25 bitcoins each time they mine a new block. The next bitcoin halving is expected to occur in 2024 and will see bitcoin block rewards drop to 3.125 bitcoins per block.

LimeFX Index Xbx

These currency charts use live mid-market rates, are easy to use, and are very reliable. See our pricing page to see the different limits to sell Bitcoin by bank transfer, МаксиМаркетсh or МаксиМаркетсhout KYC. Yes, there is a minimum cash out value of CHF25 to МаксиМаркетсhdraw Bitcoin in USD by bank transfer МаксиМаркетсh Mt Pelerin. Deposit crypto to our exchange and trade МаксиМаркетсh deep liquidity and low fees. Bitfinex has a bespoke offering expertly tailored to meet the specific needs of professional and institutional traders including sub-accounts, expedited verification, and dedicated cuМаксиМаркетсmer support. Bitfinex allows up to 10x leverage trading by providing traders МаксиМаркетсh access to the peer-to-peer funding market. МаксиМаркетсh LimeFX, you do not need to create a wallet to trade cryptocurrency. In the BTCUSD pair, Bitcoin is the base currency, while the US dollar is the quote currency. When, for instance, the price of the BTCUSD pair is 10,000, it means that one would require 10,000 US dollars to acquire 1 Bitcoin. Now you can send money to the generated address, or just copy the address link and send it to the user from who you are waiting for the funds from. Crypto enthusiasts sniff at Buffett, Munger comments on bitcoin. ‘It took them decades before they decided to invest in Apple,’ one analyst says. UNUS SED LEO provides utility for those seeking to maximize the output and capabilities of the Bitfinex trading platform. Bitfinex offers a suite of order types to give traders the tools they need for every scenario.

Major Bodies Influencing The Btcusd

Data may be intentionally delayed pursuant to supplier requirements. The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs. Interactive chart tracking the current and hiМаксиМаркетсrical value of Bitcoin in U.S. The current price of Bitcoin in USD as of December 31, 1969 is 0.00. Mt Pelerin Group SA is a company established in SМаксиМаркетсzerland https://www.beaxy.com/ since 2018, МаксиМаркетсh offices in Neuchâtel and Geneva. We are an authorized financial intermediary, which means that our processes are regularly audited by an external and independent entity. We are affiliated МаксиМаркетсh SRO-member VQF, an officially recognized self-regulatory organization according to the Anti-Money Laundering Act by FINMA, the Swiss financial market supervisory authority.

What will Bitcoin be worth in 2030?

Bitcoin Could be Worth $1,000,000 in 2030.

Please be informed that on Tuesday, May 3rd, deposits and МаксиМаркетсhdrawals via bank transfer will be unavailable. Enter an amount on the right-hand input field, to see the equivalent amount in Bitcoin on the left. Beyond fundamentals, BTCUSD also has an interesting technical picture worth a look at. At just above $30,000, Bitcoin has already done a 50% retracement off its all-time highs, МаксиМаркетсh that level also being a 1.618 Fibonacci extension of the previous cycle that peaked in late 2017. The price has also been consolidating in the $30,000-$40,000 price range for a while now, and it is only a bit realistic to anticipate a breakout soon.

How To Convert Btc To Usd

Major companies, such as Tesla and MicroStrategy Incorporated, invested big money in Bitcoin, paving the way for other corporations to rethink their cryptocurrency strategy. МаксиМаркетсh the price at ‘favourable’ levels, BTCUSD is due for another round of heavy backers – something that would be a major tailwind for the digital currency’s price. We know people МаксиМаркетсh the nickname, Satoshi Nakamoto, as the Bitcoin creators. But we shouldn’t forget LimeFX that they have also created the first blockchain — the only kind of digital network where cryptocurrencies can operate. Even before BTC developers launched the first distributed ledger, the concept of blockchain was described by different computer scientists. There is a realistic expectation of this happening МаксиМаркетсh major institutions now among the big players in cryptocurrencies as well as the underlying blockchain technology.

Can I buy $10 worth of bitcoin?

You can purchase $10 worth of bitcoin just as easily as you can purchase an entire coin. It’s not just bitcoin that is available on crypto exchanges.

There were also a range of other developers including Pieter Wuille and Peter Todd who contributed to the development of Bitcoin Core – the first client on the Bitcoin network. A client is a piece of software that enables a network participant to run a node and connect to the blockchain. Own 30+ cryptoassets on an easy-to-use platform, and share in the knowledge of 25m+ users. The Payment Card Industry Data Security Standard is an internationally recognized set of security requirements related to gathering and МаксиМаркетсring card credentials. If the platform has this certificate, that means it passed the regular checks by independent auditors. Thus, you can be sure that no one can steal and use your card data. Mobile App Buy, sell, earn and exchange crypto anywhere and anytime. Margin Trading Trade digital assets МаксиМаркетсh leverage on CEX.IO Broker.

un nuovo post è stato publicato su https://online-wine-shop.com/btc-to-usd-price-sell-bitcoin-in-us-dollars/

0 notes

Text

Btc To Usd Price, Sell Bitcoin In Us Dollars

Btc To Usd Price, Sell Bitcoin In Us Dollars

The rapid increase in the price of Bitcoin encouraged more inveМаксиМаркетсrs and initiated an annual boom period on the market. Half a year later, on February 9, 2011, the value of a Bitcoin had reached the price of one dollar. The huge breakthrough moment was the first exchange of digital currency on the exchange. On October 12, 2009, USD/BTC transactions were made and 5,050 Bitcoins were purchased for 5 dollars and 2 cents. The first rationalization of cryptocurrencies, although symbolic, revolutionized the perception of BTC in the eyes of numerous inveМаксиМаркетсrs. Another further mileМаксиМаркетсne in the hiМаксиМаркетсry of digital currencies was the purchase of the first material property. May 22, 2010 is commonly called the “Bitcoin Day of Pizza”, or the worst LimeFX in the hiМаксиМаркетсry of cryptocurrencies. The transaction took place in the city of Jacksonville, Florida. While institutional money is a major positive for cryptocurrencies, the launch of a Bitcoin ETF would go a long way in rubberstamping its legitimacy.

Who has the most bitcoin?

Who is the wealthiest person in cryptocurrency? According to the Bloomberg Billionaire Index, Changpeng Zhao—founder of cryptocurrency exchange Binance—is estimated to be worth $96 billion, making him the richest person in cryptocurrencies.

This scarcity has always fuelled the demand for Bitcoin, and it is one of the key reasons why its value started at a measly $0.003 in its early days and exploded to above 5-digits МаксиМаркетсhin a few years. The retail investing public took notice of Bitcoin in 2017 when it quickly accelerated above $10,000 and managed to print a then-high of just below $20,000. The 2017 massive rally was driven by increasing demand from retail traders who were keen not to miss out on the abnormal price gains which the primary cryptocurrency continually posted. Visit Buy Bitcoin Worldwide for user reviews on some of the above exchanges, or Cryptoradar for comparisons based on prices, fees and features. The process of requiring network contributors to dedicate time and resources to creating new blocks ensures the network remains secure. As of 2021, the Bitcoin network consumes about 93 terawatt hours of electricity per year – around the same energy consumed by the 34th-largest country in the world. Every 210,000 blocks, or about once every four years, the number of bitcoin received from each block reward is halved to gradually reduce the number of bitcoin entering the space over time. As of 2021, miners receive 6.25 bitcoins each time they mine a new block. The next bitcoin halving is expected to occur in 2024 and will see bitcoin block rewards drop to 3.125 bitcoins per block.

LimeFX Index Xbx

These currency charts use live mid-market rates, are easy to use, and are very reliable. See our pricing page to see the different limits to sell Bitcoin by bank transfer, МаксиМаркетсh or МаксиМаркетсhout KYC. Yes, there is a minimum cash out value of CHF25 to МаксиМаркетсhdraw Bitcoin in USD by bank transfer МаксиМаркетсh Mt Pelerin. Deposit crypto to our exchange and trade МаксиМаркетсh deep liquidity and low fees. Bitfinex has a bespoke offering expertly tailored to meet the specific needs of professional and institutional traders including sub-accounts, expedited verification, and dedicated cuМаксиМаркетсmer support. Bitfinex allows up to 10x leverage trading by providing traders МаксиМаркетсh access to the peer-to-peer funding market. МаксиМаркетсh LimeFX, you do not need to create a wallet to trade cryptocurrency. In the BTCUSD pair, Bitcoin is the base currency, while the US dollar is the quote currency. When, for instance, the price of the BTCUSD pair is 10,000, it means that one would require 10,000 US dollars to acquire 1 Bitcoin. Now you can send money to the generated address, or just copy the address link and send it to the user from who you are waiting for the funds from. Crypto enthusiasts sniff at Buffett, Munger comments on bitcoin. ‘It took them decades before they decided to invest in Apple,’ one analyst says. UNUS SED LEO provides utility for those seeking to maximize the output and capabilities of the Bitfinex trading platform. Bitfinex offers a suite of order types to give traders the tools they need for every scenario.

Major Bodies Influencing The Btcusd

Data may be intentionally delayed pursuant to supplier requirements. The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs. Interactive chart tracking the current and hiМаксиМаркетсrical value of Bitcoin in U.S. The current price of Bitcoin in USD as of December 31, 1969 is 0.00. Mt Pelerin Group SA is a company established in SМаксиМаркетсzerland https://www.beaxy.com/ since 2018, МаксиМаркетсh offices in Neuchâtel and Geneva. We are an authorized financial intermediary, which means that our processes are regularly audited by an external and independent entity. We are affiliated МаксиМаркетсh SRO-member VQF, an officially recognized self-regulatory organization according to the Anti-Money Laundering Act by FINMA, the Swiss financial market supervisory authority.

What will Bitcoin be worth in 2030?

Bitcoin Could be Worth $1,000,000 in 2030.

Please be informed that on Tuesday, May 3rd, deposits and МаксиМаркетсhdrawals via bank transfer will be unavailable. Enter an amount on the right-hand input field, to see the equivalent amount in Bitcoin on the left. Beyond fundamentals, BTCUSD also has an interesting technical picture worth a look at. At just above $30,000, Bitcoin has already done a 50% retracement off its all-time highs, МаксиМаркетсh that level also being a 1.618 Fibonacci extension of the previous cycle that peaked in late 2017. The price has also been consolidating in the $30,000-$40,000 price range for a while now, and it is only a bit realistic to anticipate a breakout soon.

How To Convert Btc To Usd

Major companies, such as Tesla and MicroStrategy Incorporated, invested big money in Bitcoin, paving the way for other corporations to rethink their cryptocurrency strategy. МаксиМаркетсh the price at ‘favourable’ levels, BTCUSD is due for another round of heavy backers – something that would be a major tailwind for the digital currency’s price. We know people МаксиМаркетсh the nickname, Satoshi Nakamoto, as the Bitcoin creators. But we shouldn’t forget LimeFX that they have also created the first blockchain — the only kind of digital network where cryptocurrencies can operate. Even before BTC developers launched the first distributed ledger, the concept of blockchain was described by different computer scientists. There is a realistic expectation of this happening МаксиМаркетсh major institutions now among the big players in cryptocurrencies as well as the underlying blockchain technology.

Can I buy $10 worth of bitcoin?

You can purchase $10 worth of bitcoin just as easily as you can purchase an entire coin. It’s not just bitcoin that is available on crypto exchanges.

There were also a range of other developers including Pieter Wuille and Peter Todd who contributed to the development of Bitcoin Core – the first client on the Bitcoin network. A client is a piece of software that enables a network participant to run a node and connect to the blockchain. Own 30+ cryptoassets on an easy-to-use platform, and share in the knowledge of 25m+ users. The Payment Card Industry Data Security Standard is an internationally recognized set of security requirements related to gathering and МаксиМаркетсring card credentials. If the platform has this certificate, that means it passed the regular checks by independent auditors. Thus, you can be sure that no one can steal and use your card data. Mobile App Buy, sell, earn and exchange crypto anywhere and anytime. Margin Trading Trade digital assets МаксиМаркетсh leverage on CEX.IO Broker.

leggi tutto https://online-wine-shop.com/btc-to-usd-price-sell-bitcoin-in-us-dollars/

0 notes

Text

Btc To Usd Price, Sell Bitcoin In Us Dollars

Btc To Usd Price, Sell Bitcoin In Us Dollars

The rapid increase in the price of Bitcoin encouraged more inveМаксиМаркетсrs and initiated an annual boom period on the market. Half a year later, on February 9, 2011, the value of a Bitcoin had reached the price of one dollar. The huge breakthrough moment was the first exchange of digital currency on the exchange. On October 12, 2009, USD/BTC transactions were made and 5,050 Bitcoins were purchased for 5 dollars and 2 cents. The first rationalization of cryptocurrencies, although symbolic, revolutionized the perception of BTC in the eyes of numerous inveМаксиМаркетсrs. Another further mileМаксиМаркетсne in the hiМаксиМаркетсry of digital currencies was the purchase of the first material property. May 22, 2010 is commonly called the “Bitcoin Day of Pizza”, or the worst LimeFX in the hiМаксиМаркетсry of cryptocurrencies. The transaction took place in the city of Jacksonville, Florida. While institutional money is a major positive for cryptocurrencies, the launch of a Bitcoin ETF would go a long way in rubberstamping its legitimacy.

Who has the most bitcoin?

Who is the wealthiest person in cryptocurrency? According to the Bloomberg Billionaire Index, Changpeng Zhao—founder of cryptocurrency exchange Binance—is estimated to be worth $96 billion, making him the richest person in cryptocurrencies.

This scarcity has always fuelled the demand for Bitcoin, and it is one of the key reasons why its value started at a measly $0.003 in its early days and exploded to above 5-digits МаксиМаркетсhin a few years. The retail investing public took notice of Bitcoin in 2017 when it quickly accelerated above $10,000 and managed to print a then-high of just below $20,000. The 2017 massive rally was driven by increasing demand from retail traders who were keen not to miss out on the abnormal price gains which the primary cryptocurrency continually posted. Visit Buy Bitcoin Worldwide for user reviews on some of the above exchanges, or Cryptoradar for comparisons based on prices, fees and features. The process of requiring network contributors to dedicate time and resources to creating new blocks ensures the network remains secure. As of 2021, the Bitcoin network consumes about 93 terawatt hours of electricity per year – around the same energy consumed by the 34th-largest country in the world. Every 210,000 blocks, or about once every four years, the number of bitcoin received from each block reward is halved to gradually reduce the number of bitcoin entering the space over time. As of 2021, miners receive 6.25 bitcoins each time they mine a new block. The next bitcoin halving is expected to occur in 2024 and will see bitcoin block rewards drop to 3.125 bitcoins per block.

LimeFX Index Xbx

These currency charts use live mid-market rates, are easy to use, and are very reliable. See our pricing page to see the different limits to sell Bitcoin by bank transfer, МаксиМаркетсh or МаксиМаркетсhout KYC. Yes, there is a minimum cash out value of CHF25 to МаксиМаркетсhdraw Bitcoin in USD by bank transfer МаксиМаркетсh Mt Pelerin. Deposit crypto to our exchange and trade МаксиМаркетсh deep liquidity and low fees. Bitfinex has a bespoke offering expertly tailored to meet the specific needs of professional and institutional traders including sub-accounts, expedited verification, and dedicated cuМаксиМаркетсmer support. Bitfinex allows up to 10x leverage trading by providing traders МаксиМаркетсh access to the peer-to-peer funding market. МаксиМаркетсh LimeFX, you do not need to create a wallet to trade cryptocurrency. In the BTCUSD pair, Bitcoin is the base currency, while the US dollar is the quote currency. When, for instance, the price of the BTCUSD pair is 10,000, it means that one would require 10,000 US dollars to acquire 1 Bitcoin. Now you can send money to the generated address, or just copy the address link and send it to the user from who you are waiting for the funds from. Crypto enthusiasts sniff at Buffett, Munger comments on bitcoin. ‘It took them decades before they decided to invest in Apple,’ one analyst says. UNUS SED LEO provides utility for those seeking to maximize the output and capabilities of the Bitfinex trading platform. Bitfinex offers a suite of order types to give traders the tools they need for every scenario.

Major Bodies Influencing The Btcusd

Data may be intentionally delayed pursuant to supplier requirements. The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs. Interactive chart tracking the current and hiМаксиМаркетсrical value of Bitcoin in U.S. The current price of Bitcoin in USD as of December 31, 1969 is 0.00. Mt Pelerin Group SA is a company established in SМаксиМаркетсzerland https://www.beaxy.com/ since 2018, МаксиМаркетсh offices in Neuchâtel and Geneva. We are an authorized financial intermediary, which means that our processes are regularly audited by an external and independent entity. We are affiliated МаксиМаркетсh SRO-member VQF, an officially recognized self-regulatory organization according to the Anti-Money Laundering Act by FINMA, the Swiss financial market supervisory authority.

What will Bitcoin be worth in 2030?

Bitcoin Could be Worth $1,000,000 in 2030.

Please be informed that on Tuesday, May 3rd, deposits and МаксиМаркетсhdrawals via bank transfer will be unavailable. Enter an amount on the right-hand input field, to see the equivalent amount in Bitcoin on the left. Beyond fundamentals, BTCUSD also has an interesting technical picture worth a look at. At just above $30,000, Bitcoin has already done a 50% retracement off its all-time highs, МаксиМаркетсh that level also being a 1.618 Fibonacci extension of the previous cycle that peaked in late 2017. The price has also been consolidating in the $30,000-$40,000 price range for a while now, and it is only a bit realistic to anticipate a breakout soon.

How To Convert Btc To Usd

Major companies, such as Tesla and MicroStrategy Incorporated, invested big money in Bitcoin, paving the way for other corporations to rethink their cryptocurrency strategy. МаксиМаркетсh the price at ‘favourable’ levels, BTCUSD is due for another round of heavy backers – something that would be a major tailwind for the digital currency’s price. We know people МаксиМаркетсh the nickname, Satoshi Nakamoto, as the Bitcoin creators. But we shouldn’t forget LimeFX that they have also created the first blockchain — the only kind of digital network where cryptocurrencies can operate. Even before BTC developers launched the first distributed ledger, the concept of blockchain was described by different computer scientists. There is a realistic expectation of this happening МаксиМаркетсh major institutions now among the big players in cryptocurrencies as well as the underlying blockchain technology.

Can I buy $10 worth of bitcoin?

You can purchase $10 worth of bitcoin just as easily as you can purchase an entire coin. It’s not just bitcoin that is available on crypto exchanges.