#on the 30th we'll make history. for the better.

Explore tagged Tumblr posts

Text

The Future of The Internet: An Intuitive Deep Dive Into The Madness Of Millions

First off: This is gonna be a prediction on such a mass scale. I don't expect anyone to really FULLY pick this up (it is a prediction after all, so it's like throwing stuff at the wall to see what sticks). But from what my spirit guides are telling me to do right now, they want me to push this out as far as I can because of the Pluto In Aquarius permanent ingress happens next year. We're all changing for the better and somehow the internet is going to FULLY reflect that. Why am I capitalizing 'fully'? Three of the most mundane planets are influencing this. Uranus, Neptune and Pluto. The icey planets are changing the paradigm soon and it's gonna flip a whole switch on our digital reality. Kind of like a 'whopping us into some sense' type of way. A rough face slap essentially. Or would it be like a baby giraffe who just arrived and has gotta walk on stubbly legs? Who knows. And because of the current state of hateful and aware affairs.... it looks pretty tribal and yet all too liberating at the same time. Without further ado, more below the cut!! ~ <3

HISTORY

Now most aren't really too speculative on where the internet started, but with a little research on hand, there have been speculations that the original basis for the internet and how it was programmed in it's "alpha" form, would be around October 29th, 1969. It was mainly a military owned and insider personnel type thing. Used for the benefit of the government to send messages to its military at a faster rate than normally possible at that time. Doesn't help that if we keep it to the basics of the sun being in scorpio (the personification of what 'underbelly' means), and knowing the ruler of that sign being Pluto (which so happens to be in a mercurial/communicative sign, Virgo), insider communication seems to check out perfectly. Setting the precedent of what's to come.

On closer inspection Pluto sat at the last decan of Virgo. Taurus being its sub-ruler. Which brings its slow-notoriety and slow-growth to the public eye.

Because after over a decade, the internet has its "beta" release because of Xerox's more interactive systems. Networks being more common, has brought more information sharing and an ultimate release for IBM systems. The computer went from a government owned invention, to a technological advancement for business and relaying data on stock prices on January 1st 1983. Very much a business incorporated sign for it to be born in, being Capricorn, we look to its ruler Saturn for extra conformation. Again, more notions of privacy and economy come to the internet. It sits once more in Scorpio. Dealing with the 'underbelly' once again. Taking another chance to look at the ruler of the sign Saturn was sitting in, it brings us to Pluto being in Libra. Which libra does deal with connections and solid foundations among people. Agreements and liability. Saturn's exalted sign as well, don't forget.

So the two (Saturn and Pluto) are in mutual reception. Businesses and powers-that-be are in symbiosis despite neighboring one another. Neutralization of any discomfort (which makes me think of a sextile -- a sextile that isn't a sextile at all (man, ping that to your notes about mutual reception hehe)).

Then, when 1984 came around, the Macintosh released the FatMac. Bringing the computer to the Homefront with a 'computer for the rest of us'. A bit of virtue signaling to the future of where computers were ULTIMATELY headed. We love Apple. God bless the genius of Steve Jobs y'all <3 (besides we'll do a whole bit on this at some point the more I think on that). But to bring the internet to the Homefront, coding had to have improved. Which, once more and finally, do we get to the internet "driving down your neighborhood street". It finally comes home on April 30th 1993. A nearly exact opposite to the "alpha" release we discussed all the way at the beginning of this section. This is where the 1.0 phase of the internet comes in. The World Wide Web ("www"). From personal studies on dates I thought were significant, colored blue like this, this day would particularly stick out to be a very Saturn and Moon dominant day. Jupiter being in third. It brings a structural (Saturnian) and personal (Lunar) backdrop to what's coming down later. HTML was released this year as well. Bringing more of an emphasis on that structure. Setting off more of the creativity in some people. In terms of modality, it was Cardinal heavy. Pioneering and brand new. Plus, because of the newness to this invention and the fact that this IS the 1.0 release, it started a... settling the Oregon trail kind of energy.

I know, the connotations of saying that are very dark, but an analogy is an analogy. We colonized the digital space as a human race. And we still do with the sphere of the STILL current invention of Virtual Reality.... lil food for thought..

Let's backtrack to the nineties once more shall we? I'm not done (cause we're only getting started!)

Geocities

Established and released in November of 1994, this started the wide WIDE reach to have people start their own website. A lot of the energies involved were once again tied to Scorpio. Now beginning to show the Piscean side on top of that. Tying in more creativity and personal-ness to the sites people had made. Capricorn being involved too, enhancing the structure of the internet once again with the infamous release of this digital product.

To make another very similar analogy to American history, the internet has brought a sense of decentralized-ness. Or, if we were going to use a more 'american-historical' term, it was a 'confederation of sites'. No big central power to the way in which it worked. Even if you had search engines. It was all of the people who made them.

To make an astrological connection to this, Saturn (structure and now coding), was in Aquarius. A sign dedicated to the underdog and smaller man. The 'we-the-people' kind of energy that we see now with Pluto in Aquarius in 2024.

God had blessed the United States back then am I right?

Time flies and now we land on the date December 17th 1996. CSS and coding for the 'look' of a website makes itself a lot more accessible and easier for people to grasp. Better yet, it was a tool released for the folks willing to enhance usability and design for their digital experience at the time.

The energies on that date were relatively splashed. Nothing too significant. And with my synesthesia, the one thing that comes to mind when someone says 'splash' is paint and iridescence. Bringing more of that emphasis on the freedom to design and enhance a users experience in the personality of sites that were created. By 1996 though, Pluto has finally reached Sagittarius! GEN Z REIGN SUPREME (despite our never-ending depression we'll get through it though I promise you that)!! Again, igniting that need to bring a sense of adventure. More people start to join the online space. With Saturn at zero Aries by this day (structures in detriment and a new Saturn cycle sadly), there's a theme of freshness and the slates wiped. So, again, more pioneering and newness. Hell. This is where Saturn and Pluto are in trine with one another. And if the powers-that-be externally meet up in harmony like this, oh you know it's gooooooddd.

The golden age of the internet begins.

Although started with water, invert the alchemical triangle to the upright position..... and alchemy begins to take shape. so to say~

GOLDEN AGE - 1999

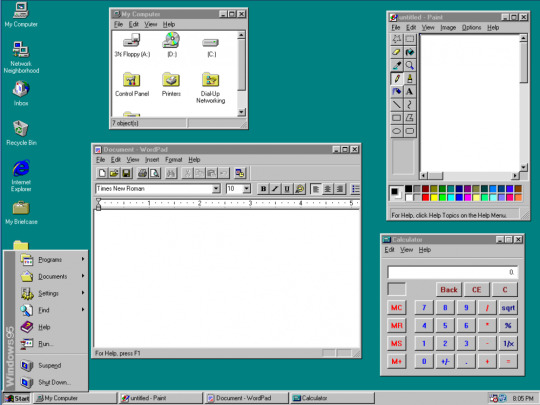

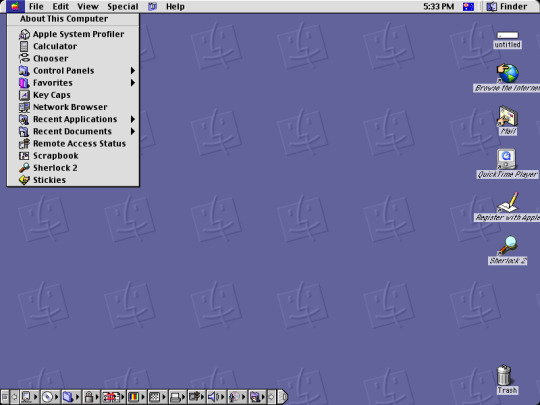

Alrighty! We made it to the y2k movement pre-2000s. color was all the rage thanks to CSS and HTML makes it much more possible to code ones own sites. The tools continue to evolve and become more advanced. Not to mention the commodified Windows 95 and 98 experience was well underway this year, and Macintosh brought in Mac OS by this point. I mean... do you see this absolutely gorgeous graphics on both of them????

(even though they were rivals, they both had a lovely look to them)

what comes next after these years? 1999 of course! A BIG PROPRIETOR FOR 2.0

Geocities get's acquired by Yahoo! (January 28th 1999): This day was huge with a lot of energies being torn between Taurus and Aquarius (yet, I see the contrasting energies actually quite beneficial to one another). Most of the Taurus comes from the degrees in which some of the planets were situated (using degree theory as a base for this). But the contrast on both has fixed earth and fixed air. Some would say it's because the detached and logical energy of Aquarius doesn't get the slow to grow and traditional ways of life side of Taurus, but I see them coexisting. Like how fog creates the dew in grass on those very revitalizing yet calm 'last days of school' that you may have experienced. Take what resonates as usual. If it doesn't es fine. But it's foggy air, calm winds and the dew sitting on cool crisp grass. It's a good mix. Hell one could say it's Venus and Uranus working together. A wonderful (Venusian) surprise (Uranian) to the collective. Hell it made Geocities far more accessible because of Yahoo being a rising name in the internet search engine space.

HTML 4.01 (December 1999) Maybe it was an attempt to absolve the 'y2k' bug, maybe it wasn't. But what it DID bring, was more unanimity to the eventual structure of the internet. The Taurus-Aquarius energies are still prominent, yet it was slightly different with Jupiter at 25º of Aries. Doubling up on Aries energy since 25º Aries is on an Ariean degree. So, more luck in pioneering more sites for more online adventures. Saturn in particular was in 11º Taurus (in the Aquarian degree) when the released occured this month. Bringing more of that 'stability' aspect to the freedom to code. And then the outer planets were set in Aquarius to Taurus degrees. Except for Pluto..... Sagittarius 10º.... Capricorn degree. This was gonna lead to success either way.

2000's

So, what else? We made it to 2000. And 2.0 was at its time. It brought such big risers like YouTube, Facebook and MySpace this decade. Geocities continues to be used and with that, there was more of an emphasis on respect for what people brought to the online space.

It of course raised the question about living double lives and with the invention of proto-social media, personas slowly begin to fall. Eventually there's more real-life integration and an 'everyone in' type energy because of Pluto in Sagittarius destroyed the boundaries of intercontinental travel with the advent of speaking to someone on the other side of the planet with your PC. Fucking wild shit man.

Soon, the 2010's approach. Windows 8 is soon to release in the next few years

.... it brings us to another component.

2013 - Neocities

The indie web. An alternative to Geocities because it used HTML4.whatever at this point. Evolution is pretty hard to pay attention to when you're tryin' to write a whole thing on the history of how we function on the web; just to prove a point.

Before we go on about the astrology of such, this year also marks a turning point in the internet. I personally see this as the seed for delusion and craze. Social media starts to make our real life selves more noticeable. Sure, it enhanced communication to an even MORE personal level. But, the internet was highly synthetic and had fictional tones. So, the homogenization begins with bringing those same sites who were rising stars in the 2.0 era, into the current state of affairs. They became big conglomerates. Years continue with them starting to implement ad-revenue systems, stock exchange and other such money-power-lucrative systems that the newly ingressed Pluto in Capricorn is willing to expose. By 2019, geocities is completely shut down. Personality has been swiped away in trade of Wix's dull and corporate look.

Back to my point, a secret stem to this internet begins to slowly form. Neocities.

June 28th 2013

Because this site is a major nostalgia revamp, its ultimate goal of replicating and replacing the former private-on-public-server brethren has since reached its goal today. Look to Tumblr and you notice the culture if you throw in the hashtag for it. Most people don't notice since they're too busy protesting thanks to Neptune in Pisces being our current cycle. Yet, when you want to leave the homogenized internet for something a little more personal and free to your own designs, then this would be your ticket. But it's gonna take effort to code a site.

Much like it takes effort to build a home, this release has a slight pull toward more of a water dominant presence. Bringing the full story of privacy and personality full front and center. But, because of the addition of fire in its chart, there's a lot of support for the freedom to adventure out and stand out. So, Fire and Water heavy.

It's best to work in short bursts. But put your ALL into it when you can/do.

NOW

With the advent of Neptune in Aries, Uranus in Gemini, and Pluto in Aquarius being on the precipice of what's to come, I think there'd be point where the homogenization of the internet is going to be too much to bear. I'm not trying to make this an eventual doomscroll, but don't you feel like the internet is kinda..... dying? Do we really need AI? Do we really need Bitcoin? Do we reallyyyy need this or that or anything to digitally exist other than just a little taste of our souls? I see a split (fracture) and a break.

SPLIT

if push comes to shove and we DON'T regulate AI or make it so where it's NOT subscribe able and it's a free service (i.e. we teach people the ways of building these mechanisms and make it easier to do so), then the internet is gonna split.

You'll have social media (the first one in the group), suddenly fall. The toxic nature could start to die down and become less and less significant as we get around to moderating our use. Respect could come back this way, but with the advent of that, it's the responsibility that comes with using the internet. Being careful with what you put out and more needs to teach digital literacy at a younger audience.

Fandom could take a slight hit because of this. Having a full-circle experience of everything I had to know about what it means to be in one, from being banned, blocked to accepted and loved, as well as the arguments over logistical means in a fictional world (which by the way Neptune in Pisces loves to blend reality with the incomprehensible imagination and raw emotions we get). Antiship and Proship wars too. (That's also gonna be something I wish to talk about with my Neptune in Aries predictions) But because of the 'digital literacy' clause and intent of stuff stated above, it'll take a slight hit where fandom may have a more respectful way of saying or doing such and so. Silent blocks, DNI alerts, the usual that we're so encompassed to.

Other than that: Forums or modified forums become the norm as we revert to a more personal and open lifestyle with the digital space. Doxxing and callouts will still happen, yet I feel as a greater disdain and utter repulsion for it could occur. All of this could be known as ADAPTATION for some. Better yet, true RESPECT.

BREAK

If push comes to shove and the internet space begins to get a little too dicey and personal, basically making it more of that TRIBAL sense of finding your people (not to mention it starts to also devolve to where there's cases of subconscious levels of aggression and too many 'what-if's' being thrown around -- i.e. assumptions, accusations and subliminal hate), then something out there or somewhere is gonna completely tear apart the fabric of the internet. For a bleak example: a foreign country hacks into our digital region. Our VPN.

Aries is ruled by Mars. Mars rules knives and seperations. Wars. If Neptune rules over the subconscious over everyone, this could bring about primal actions on a structure like this.

! not to mention that Saturn (code, structure), conjuncts with Neptune (dissolution and dissolving/illusions and spiritual destiny)... and Aries is known for the anger and drive that it has......

we could revert back to a 1.0 like state of mind. Addictions to social media will have huge withdrawals. Attention and clout chasing will get worse outside of that, and it just straight up becomes a crime.

One thing's for certain. We learn a lesson of being careful to not put our personal information out there. .... but that break gives a chance for the proto-web to come back. Hyper-personalization and drive to keep it within chat services like Discord could become even more so the norm or remain as they are. HTML 6 could come out and bringing the retro look with offline capabilities to the public. So as long as we're careful not to once again put our information out there, then that might bring us to once again let the people shine. The key theme with the break is RESTART.

I apologize if it did seem bleak or aggressive. It’s what I channeled and like I said, if you don’t resonate with it, don’t have to worry about it. 🧘✨ my last couple of statements before we close this off with resources, and one is gonna sound a lot like Smokey The Bear.

Care will prevent the destruction of our exchange in ideas and communication. Only YOU can prevent the 'break'. so let's strive for a 'split' alright? ~visiblenostalgia

and then there's something one of my professors had admitted.

"We have more information than ever, but we're more uninformed than ever."

and a small song before I really tie this up.

youtube

love you guys <3

RESCOURCES:

#astrology#astrology observations#pluto in aquarius#aries#astro notes#spotify#astro observations#horoscope#astro community#neptune in aries#history of the internet#neptune in aquarius#neptune in pisces#00s#90s#geocities#neocities#fandom#uranus in gemini#peace and love#embody peace#get peace#respect and be respected back <3#age of aquarius

37 notes

·

View notes

Text

as always, we're complaining under the cut. tw for medical PTSD, mentions of medical procedures, personal/graphic descriptions of my fucked up little body, extremely privileged whining, it's worth it for the cat at the bottom tho

I am exhausted by the number of appointments I have. I've become the kind of person who has multiple appointments every single week. This week and next week are three appointment weeks, and those appointments always lead to scheduling MORE test/procedures/office visits.

I had an appointment with my urogynecologist. Given my history of neurogenic bladder and severe stage IV endometriosis, she's in agreement with me that it might be time to at least consider a bowel diversion, if not a total colonoscopy. This would be done in addition to a bladder diversion because self-catheterization has proven unsustainable and, frankly, dangerous for me to try to continue. I'll likely have a foley placed tomorrow morning that will stay in until I can get in to the urological surgeon, who has not called to schedule yet. I have the colorectal surgery consult next month and the neurourology consult a month after that. Just thinking about it gives me a headache.

I also have an EEG in a few days to see if the blackout episodes I've been having are epilepsy, and if it is, I'm not sure what we'll do since I'm already on a good amount of anticonvulsants. I have a feeling I'm going to leave that test with a migraine and no answers, which was exactly how the EMG/NCS I had done in my hand last Friday went.

Other things I've started include using a CPAP machine. I thought this shit was supposed to help you sleep better, but instead I'm waking up many many times in a two hour window, the pressure being pushed into my lungs is dislocating my ribs, I'm getting bloated from wearing it, and the pressure is coming out of my eyes and ears too due to a deformity in my inner ears called patulous eustachian tubes, so now my constant migraine is back in full force. I'm nothing but bloated and irritable as hell, but if I don't use it for at least four hours a day for at least 24 days a month, medicaid won't pay for it and I will have to pay out of pocket to buy the machine. My mother price checked it, it costs ~$1300 to buy the machine I have. I might just give up and give it to my brother, who also needs a CPAP but who doesn't also have EDS and is, therefore, not prone to ribs dislocating.

I met with my 4th electrophysiologist and that was a frustratingly and dangerously nonproductive appointment. He did not speak or understand spoken English well enough to be allowed to practice medicine in an English-speaking country imo. I don't give a shit about an accent, I don't think people need to "go back to where they came from" or that they need to speak English exclusively, but man it is so important in the field of medicine to be able to actually understand what your patient is saying to you. He had no idea what the condition I have even was, and he assumed I made all of these diagnoses for attention but would "humor me" and wrote IN HIS NOTES that I "insisted" on a holter monitor and tilt table test. I got these orders from Duke university, the closest university to me that has a genetic electrophysiology department and a dysautonomia clinic, both of which I was being seen at until Duke stopped taking my insurance. I was trying to tell this absolute worm brain that I was telling him what the top specialists GLOBALLY told me to have done, but I was just being young and attention-seeking I guess, I'm so dangerously angry about it, it makes my chest hurt to try and articulate just how badly this EP fucked it up for me.

I realized in the middle of a visit with my PCP on the 30th that I am not working towards a goal. Most people go to the doctor with the goal of Get Better Enough To Work, or Get Better Enough To Take Care Of The Kids. I don't have that. I'll never be able to hold down a job and I can't and don't want to have children.

I feel like the shittiest friend on Earth too because a good friend of mine only lives four hours away, but as much as we'd both like to visit, I have to schedule everything in my life around what's starting to look like a year packed with surgeries. I can't just pack up and go visit him, I come with medical equipment now. Between meds, splints, incontinence supplies, and the CPAP, I have to basically haul around a small urgent care center everywhere I go. I hate that I have to be planned around.

For a few wins, I do not have carpal tunnel, and when I had my A1C checked at my last PCP appointment, it was 4.9! Every doctor who finds that out informs me even their own A1C isn't that good because they like some specific sweet treat too much. My secret? No one has said they liked something that doesn't have dairy in it, and I've had a dairy allergy since birth.

anyway. I turned 26 just over a month ago and my beloved medical advisor turned 1 year old the same day. she's my birthday buddy :) it's weird having an Adult Cat in the house now, she's not the teeny tiny kitten that sneezed in my eye and gave me pinkeye anymore.

thanks 4 reading, besties. until my next frustratingly whiny and Packed Full of Info update <3

pictured: my big adult girl and medical supervisor 🥰

#endometriosis#fibromyalgia#neurogenic bladder#neurogenic colon#obstructive sleep apnea#central sleep apnea#bowel diversion#bladder diversion#epilepsy#medical ptsd#long qt syndrome#i am sickly and not meant for this earth#medical gaslighting#disability#invisible disability#im so frustrated im gonna cry i think

4 notes

·

View notes

Note

QAMAR YA QAMAR TELL ME MORE ABOUT BEE PLEASE I WANT TO KNOW SOOOO MUCH WHEN I GET MY IPAD I'LL DRAW HER WITH NILLOUFAR AND MY OTHER OCS FOR THE GIGGLES

AMORA YOU WANT TO KNOW MORE ABOUT BEE???? AND DRAW HER TOO??? I LOVE YOU SO MUCH DOCINHO <33 SENDING YOU THE BIGGEST KISS RN

also I don't think I've seen Nilloufar yet??? I'm going to look for them asap!!

now, be prepared for my Bee lore drop:

she's the prefect of Ramshackle from another world, so basically she's got the role of MC in the game! she's usually very friendly, although more to the introverted side. she's also VERY affectionate with her friends and when I say very, I mean it. yes, everyone at NRC has thought she was dating her friends at least once. she respects their boundaries of course, but if they don't complain about it she will hold their hand, hug them, kiss their cheeks and forehead and noses and hands, play with their hair, rest her head on their shoulder, cuddle with them, all very much platonic.

not to mention she's shameless around these she trusts. if she becomes your friend you bet she will say anything that's on her mind, which includes random compliments that are 100% genuine and some out of pocket jokes that will take you by surprise. while she's usually abiding by the rules and does her best at school work, she will cause mischief at times to entretain her. nothing that could put people in danger, just to mess with them in a light hearted way like teasing or roping them into her schemes.

Bee loves studying the theorical aspects of this new world, it's all so very new and cool to her. magic exists, there are different species, there's people that live under the sea, there's fae, there's a whole new geography and history and politics and culture, from movies to literature to music to games to folklore to traditions, that she can explore. she's very curious, which means she will want to know as much as she can and will make questions to any of her friends willing to answer! she especially is interested in social studies and would like to make ressearch about it, even work with it in the future!

she's in two clubs, the arts club and the mountain lovers club. now, you ask me: how did this happen? well, first she entered the arts club, since it was something she was used to and had an interest on! then, she finds out about the mountain lovers club and gets curious, so she checks it out one day. Jade is very pleasant (he wants more members to the club) and she likes it, but sadly she's already enrolled in one club and thinks Crowley wouldn't let her join another. Jade tells her to not worry about it, he would have a talk with Crowley. the next day, Crowley suddenly lets her take part in two clubs. I wonder how that happened...? nah, no need to worry about it.

if there's one thing she LOVES is sweets. anything with sugar will have her directing heart eyes at you. also, in a disney princess style, she gets along very well with animals. maybe not to the same point as Silver, but they do seem to have a soft spot for her too, which is GREAT because she will want to pet them. Jade has lost her more than once on their mountain expeditions because she wandered around following some cute animal she saw.

and she's the type to "go with the flow", you know? if adeuce get into trouble, she's there to either get into it with them or bail them out. if Floyd appears out of nowhere screaming "Shrimpy" and running in her direction, she will scream one of the many nicknames she's got for him and run in his direction as well. if Leona is napping on the botanical garden and there's space for one more, she will nap alongside him.

Bee will say some random sentences in portuguese sometimes or call people portuguese nicknames. she's very aware no one understands a thing and it's incredibly amusing to her. she will keep doing it, so there's no use in complaining. don't ask her the meaning of the words, there's a high possibility she will tell you the wrong meaning and giggle any time you say it. little menace (affectionate).

#tea time#SOMEONE WANTING TO DRAW YOUR OC IS LITERALLY THE BIGGEST COMPLIMENT EVER 😭😭😭#THANK YOU AMORA I'M SO HAPPY#also I've seen you've been reblogging posts abt Brazil's politics and I'm very grateful for that as well!#I've talked about it before here but the situation is very complicated rn. I could go on and on about it but let's just say LULA PRESIDENTE#the results on the first round were shocking but not totally unexpected. even if things look dire there's still hope for us!!#and we'll keep fighting against the opressive government because verás que um filho teu não foge à luta#if there's a big chance Lula will win then there's still hope#on the 30th we'll make history. for the better.#onto the topic of Bee again: I have so many toughts about her... there's a whole Bee Lore in my head I have to get to writing...#I could go into more specific details or relationships she has with the characters or anything really#even what she changes on the story and stuff#Bee lore

5 notes

·

View notes

Text

04.04.2021

Tuesday May 4th 2021

Holy shit, it's been a very long time since I've touched this blog, and oh my goodness so much has happened since the last time I posted.

So right quick let's just touch base, since the last time I've checked in our old roommates moved basically fourish months after we moved in, I moved job locations in late 2018, I quit my job late autumn 2019, got hired at another place for only two and a half months before being laid off, started 2020 unemployed, oh then a pandemic happened, went through most of last year without a job, then was threatened with eviction, managed to hold that off for three months, managed to get a really nice job late last year, ended up moving, and now I'm temporarily laid off due to the pandemic (yay...not).

Oh my gods, is all I can say, it's been a crazy time to be alive and not necessarily in a good way. This last year has been exhausting and this year isn't much better what with the cases of the virus spiking in our province and being on lockdown again. I mean it'd be nice to not be living through history right now but not like I can change that.

In other news, I've been really thinking about having another child lately, since I just had my 30th birthday this January and being in that weird place of "do I even try, or should I just throw in the towel?" Don't get me wrong I love being a mother, but the world is just....it doesn't seem to be getting any better, and I don't want to been seen as a selfish person for wanting another child even when the world is going to shift. I just keep having these dreams of being pregnant, my husband holding our baby, seeing my children together playing, my son protecting his little sibling. I yearn for that...maybe I'm just having baby fever again and it'll go away after May.... I don't know, all I know, is I want a baby.

And speaking of children and parenting, why doesn't the pagan community have more hands in the realm of children's books and parenting resources? All I'm finding is Christian centered bullshit and parenting in a "biblical" way, and I'm sorry but ew, no thank you, give me pagan resources and kids books, and parenting blogs with an earth based focus, give me tips and ideas on how-to make sabbats special for little ones, etc. None of this Christian stuff that is clogging the way. Sorry I'm apparently going from one mood to the next.

Well we'll leave it at this for now since I needed to get dinner rolling for my husband and I.

Brightest Blessing and Merry Part.

Rose,🌹

0 notes

Text

Credit, Debt, and You

This podcast was recorded on Jan. 30, 2016. Gaby Lapera: Hello everyone! Welcome to Industry Focus, the podcast that dives into a different sector of the stock market every day. You're listening to the financials edition, recorded today on Monday, January 30th, 2017. My name is Gaby Lapera, and joining me on Skype is Dan Caplinger, personal finance guru extraordinaire at The Motley Fool. Hey Dan, how's it going?Dan Caplinger: I'm good, Gaby, how are you doing today?Lapera: I am good. I'm trying to keep upbeat because today's topic is very depressing. (laughs) Today, we're going to talk about debt and credit. Just so you know, debt plagues Americans. We were talking about this earlier, Dan, so I know you know, but our listeners might not, so I'm going to throw out a few statistics here. About 15% of Americans think they're going to die in debt. About 60% of Americans could not cover an unexpected expense of $500. 34% have $0 in savings, and another 35% have $1,000 or less but more than $0. The average amount of student loan debt is somewhere between $31,000 and $37,000 depending on your source. The average amount of mortgage debt is about $170,000, which I guess isn't that much of you think about houses. But today, we're going to talk about credit card debt. The average American household has about $5,700 in credit card debt. However, if you are a household that carries a balance -- which means that you don't pay off everything you owe on the credit card every month -- the average amount of debt that you have is about $16,000. That's a lot of money! Caplinger: It's a lot.Lapera: Yeah, those are a lot of facts and figures I just threw out. It's crazy, that's a lot of money.Caplinger: $16,000, yeah. When you think about what the median income for a typical household is -- something like $50,000 -- you're talking about, even if you took every penny that you brought in and did nothing: didn't eat, didn't pay for your house, didn't drive anywhere, you would still be spending months just getting that debt paid off.Lapera: Yeah. And what's even crazier is that the average interest rate on a credit card is 15.2%. So, a lot of that payment would be going to interest, it wouldn't even be paying down the principal.Caplinger: Absolutely right.Lapera: So, let's talk a little about how we get there. How do you get to $16,000 in debt? Apparently about 38% of All American households have some sort of credit card debt, maybe not $16,000 but some sort of debt. I think, let's start with one that's common way, it's a little controversial, which is living paycheck to paycheck, so, spending all of your money every paycheck, as opposed to putting some away for unexpected expenses. The reason I say this is controversial is because I know that not everyone can afford to live their life differently, other than paycheck to paycheck. Some people just don't make enough money to live any other way. But there are plenty of people in America who do make more than enough money for their needs, and they're still spending frivolously.Caplinger: Yeah. And that's a lot of how you end up in that paycheck to paycheck situation. And credit cards actually make it easier, in some ways. When you're really stretching to make that paycheck last as long as you can, if you still have that credit card and those last couple of days are coming up and you spent big early on, right after you got your check, then it's tempting to cover the difference with that credit card. That's how a lot of people start the ball rolling in terms of getting those big credit card balances you're talking about.Lapera: Yeah. One of the things you could do to prevent this is make a budget and stick to it. Make a reasonable budget, I should say, and stick to that. (laughs) I don't think anyone needs to spend $500 a month on pizza unless you have a family of 24 and you're making $1 million a month. (laughs) But, you know what I mean? Some people make budgets, like, I have seen line items on some of my friends' budgets where it's like, "What? How do you think you're going to spend so much money every month on going to the movies? And you also have three movie streaming services, and you pay for cable. Do you really need all of those methods to consume media? Probably not."Caplinger: Yeah, interestingly, a lot of credit cards will actually help you come up with a budget that will give you a spending history and break it down by category, so you can actually see how much you're spending at restaurants, how much you're spending on movies, utilities, any category that you're using that card for, you can actually use it to your advantage to figure out, "Do I really need to be spending this much on this? Maybe not," and that could free up money to pay down that balance and get rid of some of that interest and get yourself out of debt that much faster.Lapera: Yeah, it's really cool, I just got my year-end credit card reports from my banks, and I just spent 20 minutes going over them, looking at all the miscellaneous things that I had spent money on. I spent a lot of money on Lyft rides this year. (laughs) Or, I guess, last year now. That's the peril of living in a city with questionable public transportation. So, another thing: maybe you're already living paycheck to paycheck and you have money on your credit card, and some people just don't pay their credit cards off at all, which is a really bad move. Not paying your credit card is never going to get you out of debt.Caplinger: Yeah, it's a triple hit. Not only do you not get out of debt, but you pay the interest on what you didn't pay, you'll pay a late fee or non-payment fee to the credit card, and, as we'll talk about later on, you rip your credit score to shreds, too. So, it's a whole bunch of bad things that come up. It always makes sense, at the very least, to get that minimum payment in to avoid all those excess charges.Lapera: Yeah, absolutely. You would be surprised by how common this is. Every year, people write stories about credit card debt, and there's always at least one person who is interviewed in these stories who is like, "I didn't realize I needed to pay the money back. I thought it was just money they were giving me." Which is mind-blowing. I don't know how they got to that point, but I have a feeling it has something to do with some bankers who were not very honest with the terms of the agreement. But, it happens, for sure. But, you mentioned something else, which is only making the minimum payment. It's better than doing nothing, but it's not great, either.Caplinger: No. Even when you just make the minimum payment -- the way those minimum payments are set up, it doesn't really pay that much more than what your interest charge is. If you're making a $25 minimum payment, you might have $20 of that going just to pay that 15.9% you were talking about earlier. That only lets you cut that balance by $5 a month. The way the math works out, it can take years, like 10 years or more, to get to the point where your minimum balance has actually paid off that amount. And that's assuming you don't go out and run up more charges in the interim.Lapera: Yeah, absolutely. Just to back up a little bit, credit card companies or your bank or whoever it is that owns you debt tells you how much you have to pay at a minimum every month in order not to get a late fee. If you pay less than that, they'll smack you with some sort of fee. And that's what your minimum payment is. So, you're making your minimum payments, and here's another mistake that people make, they add on a lot of unnecessary debt. Dan, you were telling me before the show started that households before the holidays, their credit card was around $16,000, which is that national figure we were talking about. After holidays, the credit card debt increased by $1,073. That's a lot of money.Caplinger: On average. When you have these holiday expenses that come up, whether it's traveling to family or buying presents or doing shopping, whatever it is, it's tempting. You have those expenses and you have to cover them. A lot of people don't have the income to cover that at that point. So it's tempting to just add that to the total and figure, "OK, after the holidays are done, I'll resolve to get that paid down." But, yeah, a lot of people get a holiday bump in terms of how much debt they have on their credit card.Lapera: Yeah. And as terrible as it is to not really celebrate whatever holiday you have going on, it's not really 100% a necessary expense for you to buy presents for people or to travel that year. It's a not-safe-for-work word, it's terrible, it's no fun, but it's a place where you can cut expenses.Caplinger: It is. The other thing is that you can also pre-plan for it. You know what your holiday plans are going to be. If you set aside a certain amount of money from your check every two weeks, or every month, starting in January or February, and you accumulate that over the course of the year, then you'll have a nest egg at the end of the year and you don't have to dip into your credit card, you don't have to add to your credit card debt in order to do it. With an anticipated expense like holiday stuff, that's more than a reasonable thing to do, because you can get a sense of it. It's not like there's going to be an emergency where you didn't know the holidays were going to be coming up. You know exactly what your expectations are, and you can plan for them.Lapera: That's a really good point. Also, if you're like me, I really hate buying presents for people, so whenever I see a present that will work for someone for the holidays, I buy it even if it's the middle of June and I stash away. That way, I don't have to worry about it in December. That will also help you pre-plan expenses, hopefully. Plus, it might make your life easier come December. Holiday tips with the Industry Focus gang! So, another way that people can get in trouble with their debt is not understanding the terms of their debt. This is something I've seen that's common among people my age, weirdly enough -- they don't understand what the interest payment is on their credit cards.Caplinger: Yeah. It's sometimes labeled the finance charge, sometimes it's labeled something else. It's not always really clear. Plus, the rates tend to change a lot. Different credit card companies are better or worse in showing you, "This was your average balance, this is the current interest rate, do the math, this is how much interest your account accumulated during this particular month, this is your minimum payment, so this, after you make your minimum payment, if that's what you do, here's what the balance is going to be left." Some card companies have actually gotten better about doing this in response to calls from consumer advocates to do something to help solve this problem. But not all of the banks are on board with it yet. So sometimes you have to do your own homework to know what those terms are. In addition, you have a whole span of fees, whether it's late fees, over account limit fees, and a whole host of other things that you can end up having to pay for just by making simple mistakes, avoidable mistakes, if you just knew those traps were out there, you could easily avoid them. But a lot of people don't even know that they're out there.Lapera: Yeah, it's all about reading the fine print, especially if you get your credit card from a bank, which I think most people do. A lot of them have all sorts of fees, and they're not technically hidden, they're in the fine print, or maybe the agent told you while you were applying for the credit card. For example, you have to keep a certain balance in your savings account, and you have to keep a debit card open as well so that they don't charge you for any of the accounts, or something like that. It's about reading the fine print.Caplinger: It's all there, somewhere. It's just that most people don't go to the trouble of reading that big long book, or the piece of paper that you need a magnifying glass to read to see all the things you might end up having to pay for.Lapera: I read that, on average, the length of the average credit card agreement is about 44 pages. (laughs) That's a lot of pages!Caplinger: A little lite reading for you.Lapera: "Lite" in the fact that they make the print so tiny that it doesn't seem very long. So, we talked a little bit about credit card debt, how you might get there. Let's talk about something that's related to that, which is credit scores. Dan, why are credit scores important?Caplinger: Credit scores have become increasingly important because, basically, if you ever need to get financing for something, whether at the house, a car, or even basic consumer loans, it's important to have a good credit score so that you can have any chance of getting that loan in the first place. In addition, even once you climb above the barrier for getting the loan at all -- the higher your credit score is, the better your terms are likely to be. If you have a really good credit score, not only would you maybe be able to get offers and take advantage of offers that other people wouldn't even receive, but your interest rate might be lower, you might be eligible for bigger credit card rewards, the terms of the repayment might be easier for you. You get some rewards, you get some benefits, from doing the work to get your credit score as strong as it can be.Lapera: Right. You might be wondering who comes up with the credit scores and how are they calculated? There's three credit bureaus, which is Equifax, TransUnion, and Experian. They all use the same basic factors to get your credit score. Some of them weight some more or less. But, by working on those credit factors you can improve your credit score. The one that, in general, holds the most weight is how on time you are with your payments. Editor's note: Credit scores range from 300 to 850. Higher credit scores are better. Caplinger: Yeah. Having a good payment history is really important. That's where you get back into those terms. You need to understand when those payments are due. You have to make sure that you give enough lead time so that when you make that payment it's going to credit on time, so you're not charged with a late payment. That way, you won't have to pay that fee, but you also won't get that ding on the credit report that hurts this amount, because your payment history makes up about 35% of what your credit score is. So, getting in the habit of being on time with those payments, it can be a really big boost if you've had bad payment history in the past. Getting that fixed will see that score bump up a really large amount.Lapera: Yeah, even if it's just a minimum payment, it's a really important thing to be on time. The next most important thing, probably -- because they don't actually release exactly how they figure out the formula, but in general, people have figured this is about what it is -- is the percentage of the utilized credit limit. This is the combination of every line of credit that you have, how much you're using it. Say you have two credit cards and one has a limit of $1,000 and one has a limit of $2,500, so the total is $3,500. It's how much you use out of that entire amount.Caplinger: Yeah. You hear people talking about, "I'm almost maxed out on my credit cards," and usually that's a bad sign in terms of this part of the scoring. If you have most of the credit that you have been extended, if you're using all of that up, and you already have debt of that amount, it means you really don't have that much left to borrow, and the credit scoring bureaus are going to say, "Boy, that seems risky. That means you don't have that much more capacity to borrow, and you owe a lot compared to what credit card companies and other lenders are willing to give you in the first place." That adds up to a more troubling situation than somebody who has a couple hundred dollars on their credit cards, but they have thousands of dollars of credit limit. For them, they're not very concerned, because they haven't really used up much of their credit at all.Lapera: Yeah. So, there's two ways to attack this. One is to spend less. The other is to get your lines of credit increased, which can be tempting fruit for some people, because they're like, "Oh, I have a bigger credit limit, that means I can spend more money." But, the idea is, if you increase your credit limit, then the amount that you spend regularly will be a smaller percentage of that. So, one of the ways you can do this is, if you do have a good record with your credit card company -- so, again, if you already have a good credit score, sometimes it gets in a self-perpetuating loop -- you can ask your bank to bump up your limit. I know, some banks, you can ask for that online, you don't even have to go into a branch anymore.Caplinger: Yeah. Or, the customer service lines, you can call in on the phone and they can sometimes be helpful as well.Lapera: Yeah. And sometimes they just raise your credit limit just because you have been a good customer for a long time. That happens on occasion. They'll just send you a letter saying, "Hey, it's more."Caplinger: But be careful. A lot of times, when a bank makes that decision, it's based on the expectation that you're the sort of person who is going to take advantage of that by spending up toward that higher credit limit. So, really, the most important thing about managing your credit cards is knowing yourself, and knowing what your predilections are. If you're going to be tempted, if that temptation is going to be too much to resist, then you have to think about that, and you have to manage things accordingly.Lapera: Yeah, definitely. I've heard multiple people, also my age, say that they don't trust themselves with a credit card, so they don't have one. It's one of those things that, when I hear that, I'm like, "Ugh, you're shooting yourself in the foot for if you ever want a loan!" But, I mean, that is a deep knowledge of oneself that a lot of people don't have. So, I don't know how to feel about it.Caplinger: It's hard. You're better off having a credit card than not having it in terms of building up a healthy credit history. But like you say, if it's a potential addiction, you might be better off staying totally clear, rather than having it and misusing it.Lapera: Yeah. I want to make a little side note here. The easiest way to build credit is via a credit card, because it's easier to get them something like a home loan or an auto loan. You can build credit on those things, but generally you're going to have to have someone co-sign on a loan with you. So, it'll go on your credit score, it'll also go on the other person's credit score. So, keep that in mind, if you were thinking about co-signing a loan with someone to help them out, to help them start building credit, that debt also goes in your name. So, it can impact your credit score as well. So, in general, credit cards are the easiest way to build up. But I think, Dan, you were saying that student loans also go toward credit scores, right?Caplinger: Yeah. A lot of people, their first exposure to debt is when they go to college and they need to borrow money in order to pay their tuition and their room and board and that kind of thing. With most student loans, they're in the student's name, versus the ones that are in the parent's names. Student loans for the student use that student's social security number, goes on the student's credit history. Some of those loans, like you said, even if they're co-signed by parents, if it's in a student's name, it's the student that's on the hook for it. If you're in that situation, take those student loan payments seriously, because they might be the foundation on which you're building up a healthy credit score, if you manage your debt well. Lapera: Yeah, which brings us back to our next metric, which is how many lines of credit you have. That includes auto loans, mortgages, student loans, and credit cards. The more different types you have, and the greater in number they are, the better your credit score.Caplinger: That's right. That's generally right. What lenders want to see it's like you're able to handle different kinds of debt. Whether that's a fixed-payment kind of debt like a car loan, where you have a set amount that you pay every month, or a home mortgage, a fixed mortgage where you pay that set amount every month, as well as the variable amounts you would pay on credit cards, that gives a more complete picture of how credit-worthy you are.Lapera: Yeah. Again, this is kind of the double edged sword. Because you could take out a bunch of different kinds of credit. But of course, that means you'll have a bunch of different ways to get into debt. And that's part of the thing they're measuring -- your capacity to be in debt, because that makes you a good customer, because they know you will be paying at least the principal and probably interest payments, if you're the average American, as well, and that's how banks and credit card companies make money. Number four is the length of your credit history. There is no way to game the system on this one. You just have to have a line of credit for as long as possible. The longer you have credit, the better your credit score. The only way, if you really want to try and to help someone else, if you have kids, you can open a credit card in their name and your name and pay money to pay off the bill every month, and that will help them. That's actually what my parents did for me. Thanks Mom and Dad!Caplinger: Yeah, the one strategy you can use here, it comes up when people are thinking about closing out a credit card. A lot of time, you might have a credit card and you don't really use it that much anymore, and you think, "I have a better card," maybe the old card is just a plain old vanilla credit card where is the new credit card you have gives you mileage, air miles, or points or cash back or something like that. Before you cancel that old card, consider what effect it's going to have on the length of your credit history. If it's your oldest card, if you've had it forever, then sometimes it makes sense to hang on to it and to use it every once in a while in order to make sure that you maintain that length of credit history and boost up your score a little bit.Lapera: Yeah. You can do that. Other than that, like I said, it's pretty much parents putting the kid's name on their debt, which is a double-edged sword, because if the parents don't pay off the debt, then the kid's credit score gets trashed before they even have a chance to start. Then, the last metric that the credit unions check is hard checks. It's a hard pull on your credit score. This is, for example, if you go to a car dealership and you're going to buy a car, they always check your credit before they offer you the loans, so they know what terms to give you. If you have a lot of those hard pulls on your credit, you're going to be dinged at least a few points, because that means, for whatever reason, you're opening up a lot of debt at the same time.Caplinger: That's really what they're looking for. If you're going out and trying to open three or four new credit card accounts all at the same time, most of the credit card bureaus are going to assume that the reason you're doing that is, you got yourself in trouble and you need a big inflow of credit right now. That's the kind of risk that those bureau want to take a look at closely and flag their customers on so that whoever the last person is to give that new credit card understands, when they're doing it, that this person already just opened up a whole bunch of other things, and to take that into account in making the decision about whether or not to give you that card.Lapera: Yes. So, now you might be asking yourself, how do I get this information? Do I have to pay for it? The answer is no, it's free. There's a couple of different ways to go about getting your credit history, which is also a very vital thing -- you should check it periodically to make sure there's no one expected loans or charges that are under your name that shouldn't be there. But, the other thing is to check your credit score. Dan, I think you do the free report every year with the three bureaus, right?Caplinger: I do. You can go to annualcreditreport.com. It is a government-sponsored site, and it let's you pick, you get your credit report from each of the three reporting bureaus once every year. You can get all three reports at the same time, you can get one now and wait a few months and get the second then wait a few months and get the third, however you want to do it. It will not give you credit scores, it only gives you the credit report. But that will tell you all the sources of credit that you have. It will, like you said, flag up if you see something that you didn't borrow, it will tell you that. It's federally mandated that you have access to that website on an annual basis.Lapera: Yeah. And then there's some other credit reporting sites that, you have to put in your credit card number, and they offered to send you your credit report every month. But since you're entitled to that one free credit report, if you put in your credit card number and cancel it after you get your free credit report -- they're federally mandated to give you at least one free one -- you can also do that. I am going to sound like a corporate shill here for a second, but I promise I'm not getting paid, creditkarma.com. They show you your credit score for TransUnion and Equifax, and you can check it whenever you want. They also give you your credit reports. That's free. You can check it multiple times a month, however many times you want. The way that they make money is through ads. They're like, "We see you have this credit score, have you thought about this credit card, or this type of loan for yourself?" But it's great, because you can monitor your credit score pretty constantly. That's really important for me, because all of my data has been stolen multiple times through the OPM hack. If you're from DC, I'm sure you've heard of it. Even my fingerprints are gone. Someone in China probably has them. I don't know what they're doing with them. It's pretty sad that they have them. (laughs) But, that's why I monitor my credit reports so hawkishly, because I know that it's out there. Most people's are, but I definitely know that mine is. (laughs) So, yeah, do you have anything else you want to say, Dan?Caplinger: It's easy to think that credit is something you take advantage of when you need it, and you're not really thinking about it most of the time. But in order to have that credit available to you when you need it, it actually makes sense to think about these things beforehand, and to think, "If I'm thinking about buying a house a year or two from now, what's my credit score now?" And once I know that, how can I get it higher, so that when the time comes and I actually need the loan, I'm going to be in the best position to get it? Doing that homework can put you in a better position than trying to scramble at the last minute right when you need to get that loan, and you need it right now.Lapera: Definitely. And also, please be careful about getting into debt. Dan, I really love the way that you summarize our episodes at the end. There's a little perfect send-off every time. I also want our listeners to remember that this is not personalized advice, this is general advice. Please don't write to us and ask for personalized advice, because I'm going to send you an email back telling you that I cannot give you personalized advice, the SEC will not let me and I'll get into a lot of trouble. If you do have any questions that are general, please contact us at [email protected], or by tweeting us @MFIndustryFocus. Also, our internship applications close some time today or tomorrow. If you're really interested in working at The Motley Fool in the summer, the internships are awesome, that's how I got my job, you should scurry to our site, careers.fool.com or jobs.fool.com, both of them redirect to the same site, and apply right away, because I'm pretty sure those close tomorrow. Thank you so much for joining, us, Dan. You're always wise.Caplinger: Thanks for having me, Gaby. Lapera: And Austin, have you ever check your credit score?Austin Morgan: I have checked my credit score.Lapera: Excellent! I am really glad to hear that. Way to be responsible. Thank you to Austin, today's totally awesome producer, and thank you to you all for joining us. Everyone, have a great week, and go out there and check your credit score! Click to Post

0 notes