#of course its value is tied to dollars but it itself is always viewed as valuable

Text

the workers in severance seem to frequently situate themselves in reality in reference to numbers - mark tells helly he was asked who he was 19 times when he first woke up in the office, helly says she was made to read out the break room apology 1072 times, dylan is constantly obsessed with being the data refiner for the quarter. their work is literally about sorting numbers. like the logic of quantification structures their lives to such an absurd degree that they come to find meaning in numbers themselves (which is the point of their job). they don’t describe the colour of a room or the clothes they wear when relaying significant events they’ve experienced. sometimes they don’t even talk about how they were feeling. they mostly just talk about numbers

#severance#I’ve read a couple really good papers on calculability and like the modern concept of the state being bound up in numbers#I’m only familiar with the geographic context of it but like the ‘power’ of numbers seems to be such a massive force in modern life#like data being used essentially as a form of currency in the economy#of course its value is tied to dollars but it itself is always viewed as valuable#and the logic of it being that you can use it to make the human experience fungible relative to other similar data points#and in a labour context workers are measured and weighed based on their relationship to numbers#so for a fictional setting where work is literally your entire life that’s like the sole determinant of value#like funnily enough the innies in severance don’t care about income because like why would they#they don’t see that money and they wouldn’t be able to spend it on anything if they did#so then numbers themselves become their primary form of currency#both in an economic and in a social/cultural sense#ANYWAY. very good show

31 notes

·

View notes

Text

The kid who took New York by storm

The BBC documentary ‘Rage to Riches’ follows Jean-Michel Basquiat, a young Brooklyn artist, throughout his career. Jean-Michel Basquiat left Brooklyn for New York City, at that point the city was going bankrupt so all the ‘straights’ left allowing all the ‘crazy’ artists to flock in.

A particular brand of graffiti began to pop up round downtown NYC, branding itself as ‘SAMO.’ SAMO would ask/state profound things and sign it off with the SAMO copyright. It wasn’t until at a Soho Canal Zone party that SAMO revealed himself, it was Jean-Michel Basquiat. People were ecstatic, like the Gossip Girl identity reveal but better. SAMO was created and imagined to be an alternate religion by Basquiat, he explained his concept in an article he wrote for an art school newspaper. However, Basquiat never attended art school and failed art courses he took in school. He learnt about art by looking at it.

At the time of SAMO Basquiat was producing postcards and selling them on the street. One day he saw Andy Warhol in a restaurant and went in and sold him a postcard. Warhol had been like a hero figure, so it was amazing to him that Warhol had purchased something of his. For him Warhol redefined what being an artist could be. He began to move away from SAMO, graffitiing ‘SAMO is dead’ and started asserting himself as an artist. He moved in with Annina Nosei and was constantly producing artwork. Basquiat didn’t have much money, but he was resourceful, he brought home items from burnt down buildings on the East side such as doors and used them as canvases. His first painting was sold for $200 to Debbie Harry from Blondie.

A mini-movie entitled ‘Downtown 81’’ was being produced at the time which focused on Jean-Michel Basquiat. He also started a band at the time called ‘Gray.’ The book ‘Gray’s Anatomy’ had been an influence throughout his life, he was gifted it by his mother after he was hit by a car at age seven. His book influenced his later work as he turned to including paintings of the anatomy in his work.

Basquiat’s first NYC show was ‘New York, New Wave’ in 1981 where his work was displayed on the main gallery wall. His work was described as sophisticated and ‘a new visual language.’ Basquiat when asked in an interview to describe his work stated that he couldn’t describe it, ‘it would be like asking someone how does your horn sound.’

He began to become a known name in the art world with his first solo NYC show at Annina’s gallery in 1982 selling out completely. This success took him from total poverty to having so much money he didn’t know what to do with it, it seemed to lose its value to him at times. He came into town spending his money and shocking others with it, stirring up a lot of jealously.

Now that he’d made some profit it seemed his could now afford to listen to his principles. Some collectors brought him a KFC box and he was so insulted he told them to get out and refused to sell any work to them. As they left he dumped the chicken over them from the second floor. After this be began writing ‘not for sale’ on some of his work. A friend of his said he was happy he was selling his work but very put off about his work being a commodity. She stated he struggled with that dichotomy the rest of his life.

His artwork was being displayed in shows in LA, France, Germany and even Tokyo. He was well on his way to becoming a millionaire at only the age of 21. Basquiat then moved away from Annina’s gallery and used his own studio. He managed to continue selling art without a gallery and was being paid in cash or drugs. Confidence growing, in 1982 he asked Mary Boone to include him in her gallery sparking Warhol to include him in Warhol’s magazine ‘Interview.’ Basquiat requested that a polaroid of him and Warhol was taken. After the shoot Basquiat left only to have his assistant come running back to Warhol with a freshly painted image of the polaroid of Warhol and Basquiat. Warhol was amazed by the talent and this sparked the friendship between the two. They collaborated on pieces and Warhol even came to dinner at Basquiat’s family home.

Everything was going well for him until he heard the news about a friend of his, Michael Stewart, who had been beaten by the police for graffitiing in a subway station. Basquiat was beside himself, he stated that ‘it could’ve been him.’ Many donated to Stewart’s defence fund including Madonna, but when he was approached, he was terrified that if he gave money he would be tied to it or the police would come for him.

He always continued to make art and he was interviewed for the New York Times Sunday magazine, he made the front cover. At this point Basquiat he knew he’d made it, however, after a review of Warhol and Basquiat’s work was released portraying Basquiat as Warhol’s mascot he was very upset. It felt like he’d taken a step backwards and he expressed that he’d never talk to Warhol again. Warhol sadly passed away not long after, when Basquiat found out he was inconsolable and this was when he really got into drugs. He sadly overdosed in his apartment, ending his successful life at 27.

‘The recent Sotheby’s auction of a Jean-Michel skull painting for over a hundred million dollars has catapulted this artist into the top tier of the international art market, joining the ranks of Picasso, de Kooning and Francis Bacon.’. He sometimes created multiple works at once, described as ‘dancing’ from canvas to canvas building up these extraordinary works that hugely impacted the art world. Basquiat’s art is so unique and radical, it kind of blows you away. He includes so much history into his modern and erratic paintings and knowing his story helps you appreciate them from a more personal point of view.

2 notes

·

View notes

Text

The Price of American Exceptionalism

The New York Times reported on July 9th that the newly installed head of Voice of America, a critical soft power organ for US foreign policy for nearly 80 years, was strongly considering not extending visas for foreign journalists working at the agency. This decision followed on the heels of ICE’s announcement that foreign students not able to take in-person courses for the upcoming Fall semester would be forced to leave the country.

These decisions taken by themselves are certainly bad, but it is their place in the broader context of four years of self-defeating American policies that make them especially hard to swallow. At a time when the world desperately needs unity and answers, when democracy and freedom are on the backslide around the world, the United States continues to embrace a specious concept of American exceptionalism. It is an impoverished one that confuses weakness and fear for strength. And one that ultimately will do more harm to the country’s standing in the world at a time when it is most needed.

From its earliest days, this administration has repeatedly turned its back on immigrants and traditional allies. Our collective ability to stay focused on one issue has been disoriented by the endless stream of shit that the White House and propaganda machine spews into the ecosystem, but these are just a few that come to mind.

A travel ban from majority-Muslim nations in the first week of the administration; constant undermining of longstanding alliances and partnerships, including those with NATO, South Korea, Japan, and the Kurds; repeatedly cozying up to despotic regimes who actively or have in the past harmed America’s national interest, including Russia, Turkey, China, and North Korea; a family separation policy that caged children and kept them apart from their parents, in the name of ‘deterrence’; scaling down the refugee cap more and more each year, bringing it to its lowest point in several decades; and a temporary suspension of the H1-B visa program.

(A Detention Center at the Southern Border, Key for ‘Deterrence’)

There are probably too many to recount here, too many for me to even recall. But time and again the one defining through line of the Trump Administration has been a rejection of American values and an embrace of things inimical to the American tradition. This has been said many times during this administration and to those steeped in the minutiae of day-to-day policy shifts, it is all too obvious and probably even cliché. But most Americans are not those people, nor are global citizens who look to the United States for guidance. And we shouldn’t lose sight of the incredible damage these four years of Trump governance have done to this country and its place in the world. We are less trusted by allies, less feared by our enemies, and less able to make meaningful change in the world. We cannot accept this new normal; we cannot grow numb.

I am not naïve. I know the United States has not lived up to its ideals in the past, I know that it probably hasn’t even lived up to its ideals for the majority of its existence. But it – and the leaders its people have chosen through the years – at least pretended to care. We have reached the point now, however, where the people in charge do not even pretend.

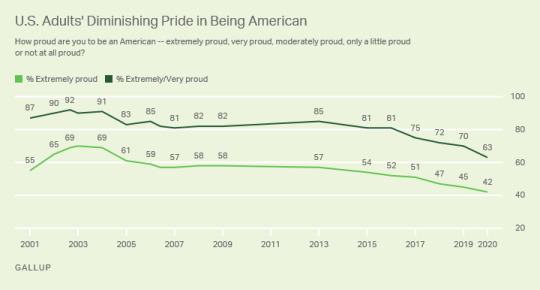

Unsurprisingly, the administration’s willful negligence has affected the way Americans and the world view the country. A recent Gallup poll conducted in June, for example, found that American pride has fallen to a nearly two decade low, among both Republicans and Democrats. For all the rhetoric about restoring American greatness, it is clear that these past few years of scorched earth governing that tears down rather than builds up has exhausted the American public. Beyond that, though, the rejection of patently American ideals like diversity and inclusion, this time in both word and deed, has likely soured the public on its government and country.

After all, it’s hard to be proud of a country in which the president praises Neo-Nazis, in which George Floyd and so many other Black Americans can be indiscriminately harassed and murdered by police, and in which inequality has become an even more important fact of life.

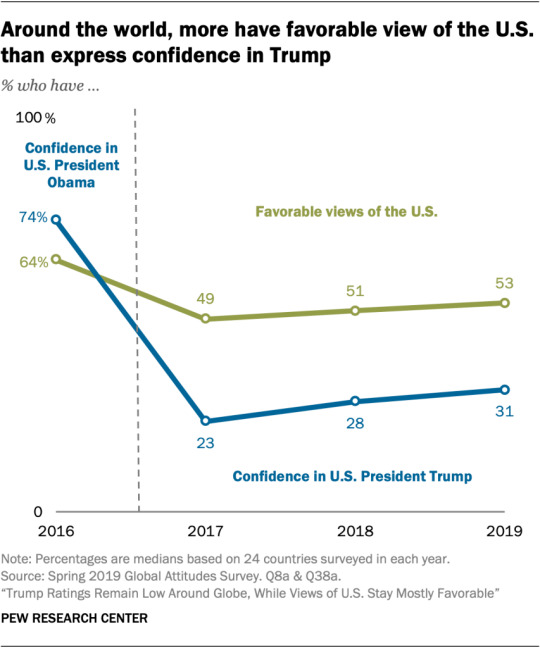

This dynamic can also be seen on the world stage, where trust and respect for the United States have fallen under the current president. Pew conducted a poll in January of this year and found that while confidence in the US has dipped somewhat, faith in its leader is dramatically lower, a product of both the president’s rhetoric and policies as well as democratic erosion here at home.

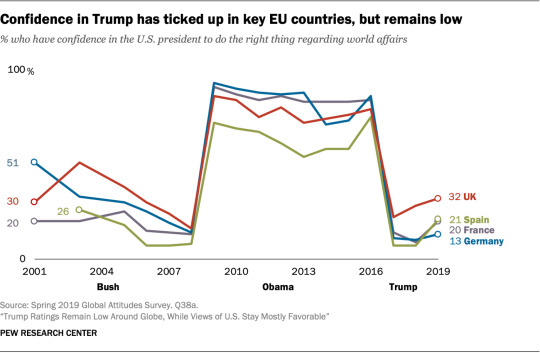

These drops are most pronounced among some of the country’s traditional allies, especially European allies, according to the same poll.

Notably, the current president enjoys similar levels of international support to another Republican president this century who used the power of his office to bully allies abroad and citizens at home into adopting a worldview hostile to their own values in the service of American “exceptionalism.” But who has the time for such pettiness?

Leaving aside such comparisons, what is clear is that the United States, the supposed leader of the free world and a global beacon for freedom, has seen itself steadily lose its claim to that mantle over the last four years. And I can hardly imagine a worse time for our credibility as a purveyor of democracy and freedom, however imperfectly we live up to those ideals, than now. Freedom is under assault everywhere.

In Europe, far-right parties continue to make inroads in countries, some we classify as fledgling democracies and others who are democracies. Far right leaders and parties in Hungary and Poland, for example, continue to threaten their status as democracies and wage rhetorical war on minorities like Muslim refugees and Jews, while the AfD in Germany grows more powerful by the year. Part and parcel of this trend, opposition to migration continues to gain strength throughout Europe and empowers these right-wing parties. The US government, needless to say, does little to oppose these trends. Its rhetoric alone I would argue gives tacit support to movements like these that seek to fall back on the crutch of religious or ethnic nationalism. Additionally, it hardly needs mentioning here what the United States’ current policy towards Russia, the greatest threat to democracy in Europe today, is under this administration.

(George Soros, a Popular Target of Anti-Semitic Smears in Hungary)

In the Middle East, a region in which we have waged war for decades and spent trillions of dollars in the name of freedom, we continue to bankroll oil rich Gulf nations who have repeatedly harmed American interests and American citizens, whether through funding extremist activities, waging merciless war against a Yemeni population unable to defend or feed itself, or hampering our foreign policy objectives in the region. Rather than push back against these nations and use the leverage it has, the administration (admittedly, like those before it) allows Saudi Arabia and its partners to dictate the terms of our relationship.

This is to say nothing of Israel, a country with whom we have always had close ties and nevertheless have pushed to make itself a better, more democratic place. Republican and Democratic administrations alike, to varying degrees, have held that a two-state solution is the only way to ensure Israel’s continued existence as both a democratic and Jewish state. More importantly, they have agreed it was the only way to recognize the agency and humanity of the Palestinian population, who exist primarily as second-class citizens. The Trump Administration by contrast gave explicit sanction of the Israeli occupation by agreeing to move its embassy to Jerusalem, a slap in the face to 5 million Palestinians. Rather than be punished for annexation and settlement building, however, the current right-wing Israeli regime was rewarded by the supposed leader of the free world with a gift it has coveted for decades, explicit recognition of its occupation, its settlements, and control over what some consider a semi-apartheid state.

(Israeli Settlements in the West Bank, Illegal but American-Sanctioned)

And in Asia, despite hard-edged rhetoric purporting to represent strength, the US has ceded ground to its number one geopolitical foe and given tacit recognition to North Korea’s nuclear program. Bending over backwards to secure a trade deal he believed would help his reelection efforts, the president has turned a blind eye as China becomes one of the greatest threats to democracy and free expression anywhere in the world.

Getting tough on China apparently looks like giving explicit support to China’s program of “reeducation” of its Uyghur population, or as I call it sending ethnic minorities to work camps in order to practice eugenics upon women and indoctrinate children while depriving them of food and freedom. Getting tough on China also looks like allowing it to eliminate any semblance of freedom in Hong Kong, a global hub of commerce and free expression, with scant repudiation of a dead-of-night passing of a law that punishes any Hong Kong citizen or international traveler who speaks ill of China with threat of imprisonment. Getting tough on China also looks like allowing it to bully and harass its neighbors in the South China Sea with armed piracy and threats of economic or military retaliation, or infringe upon Indian sovereignty with threats of armed conflict.

(An Uyghur Re-Education Camp in Xinjiang, China -- in the 21st Century)

With North Korea the president gave in, as he always does, to flattery and cajoling and turned his back on the longstanding American position regarding North Korea’s nuclear arsenal. In a flashy summit with Kim Jong Un, the president committed the United States to formally ending the Korean War and issued weak demands that North Korea suspend its nuclear program, all while kissing the ass of a man who starves and murders his people and gaining little in return. Today, North Korea possesses a nuclear arsenal capable of striking the United States, has shown it has little appetite for joining the fold of developing nations, and was granted legitimacy by the most powerful person on Earth for what amounts to basically nothing. The summit gained the US and our allies in the Asia Pacific precious little while giving North Korea nearly everything it desired. Another diplomatic coup for our president. Thank you, sir.

A well-functioning administration would perhaps realize that they have been gifted a world in which a rhetorical and foreign policy approach that prioritizes freedom and democracy would allow it to press the advantage against the bevy of undemocratic regimes it considers its enemies. An appeal to Hong Kong that attempts to market it as a Berlin Wall, a symbol of oppression and freedom denied, could help turn the pressure up on China. So too would a forceful denunciation of fucking ethnic minority labor camps.

Or perhaps a policy that tries to use its authority over the Gulf nations to force positive change. Or maybe a commitment to European democracy and the values of free expression and inclusion. Or an attempt to leverage our strong military and diplomatic relationship with Israel to force it to make difficult concessions on the Palestinian cause, rather than roll over for a regime that has proven itself stubbornly unwilling to compromise despite our generosity.

Even in our own backyard there are things we could be doing to enhance the cause of freedom and inclusion. We could tell refugees fleeing oppression that they can come to the United States. We can peel away the best and brightest from other countries around the world so that the brilliant scientist from Iran or the entrepreneur from China is a student that we deprive those hostile regimes of profiting from. We could tell immigrants, some undocumented, who are here laboring on the frontlines against a once-in-a-lifetime human catastrophe that they deserve to be fast tracked for citizenship or legal status.

We could do so much that would help this country’s cause in a time of ceaseless threats to democracy. But we don’t. The rot at the heart of our government that makes Americans bristle with shame at their country, that makes the world look askance at us as it does our enemies, prevents us from doing any of this. Our leaders have forgotten the values we are supposed to uphold and represent. In the process we have grown far weaker while our foes and enemies of human rights and freedom around the world have grown far stronger.

Freedom is no longer something those in power, and even some Americans, understand. That loss of understanding has eroded our confidence in ourselves and has eroded the faith the world places in us. Freedom has become, to quote Jimmy Carter, “a proverb in a dusty book that we read just on the Fourth of July.” A thing we claim to have but don’t truly understand anymore. This cannot be blamed all on the current administration, but its acceleration can be. And the losers from this immoral four years of American failure are not just Americans and our future dreams; they are the freedom seekers around the world who need a beacon more than ever. They are the ones who may pay more than anybody. That will be the price of four years of hate and division, of nativism and immorality.

That will be the price of Trump’s American Exceptionalism.

1 note

·

View note

Text

Novel Pre-Writing Workshop: Better Questions Make A Better Book

By Holly Lisle

At the moment, in my meager spare time I’m working on building up a supply of novel ideas, so that I can start doing a bit more on-spec work (work where the writer writes the whole novel before attempting to sell it.) Without getting into why I want to do this odd thing, when it seems to be moving in precisely the opposite direction from the professional career arc, where the objective is to get more and more money for less and less advance work, I’m simply going to offer the series of questions I’m using to knock out some basic ideas that I can then refine.

If you want to write a novel but you don’t know what to write about, give this a try.

Start out with the following:

[Genre in which you want to write] —[Single sentence or sentence fragment that offers you two or three characters, a catalyst, and a conflict]

Example:

Supernatural Romantic Suspense — Small-town Midwestern violinist (heroine) meets returning-to-his-roots bad boy (hero) when the stage on which she’s performing collapses (catalyst) after she receives an eerie warning not to perform that night (conflict).

This is not a great story idea. I came up with it for this outline, and at the moment it’s pretty lame. But that’s okay. It’s just the a jumping-off point.

Once you have the very vague beginnings of a couple of characters, a quick peek at a catalyst, and a tiny chip knocked out of the conflict, you can really make something out of this. This is, in fact, a micro-example of the process of writing the whole book and revising afterwardrather than engaging in endless revisions of the first chapter or two, another technique I recommend for people who genuinely want to write rather than just claim that they’re writers.

So once you’ve picked a tentative genre and thrown a few vague words against the wall, what questions do you ask to make them into a real story? Start with the questions I’ve listed below, modifying them to suit your genre and single-line idea.

I’m using hero, heroine, villain, and catalyst in the questions below, but you aren’t bound to those, either by gender or by number. The catalyst can be a person, place, thing, event. The conflict will come if you just let yourself relax about it.

You don’t have to do this in outline form, either. In fact, I strongly recommend that you don’t. I certainly don’t. I cluster these questions, and answer them (while asking myself even more questions).

The Questions, Then…

Who is the hero?

In this case we’ve already established that that the hero is a one-time bad boy coming home. But what has he been doing in the meantime? Why did he come home now? Why did he come home at all? What’s good about him? What’s bad about him? Why do you (the writer) want to see him win?

What is the hero’s secret?

Everybody has one or two, but in this case, the secret we want is going to be the thing the hero can’t tell the heroine about himself without betraying some other agenda — and the fact that he is evasive on this point is going to cause her (and the reader) to be suspicious of him. So — is he secretly working for a government agency? Digging buried treasure in her back yard? A cop chasing a killer he suspects her of harboring? What?

What does the hero have to lose?

The fact that he could get killed is a given. What ELSE does he have to lose? Ten million dollars? The serial killer who butchered his sister? A place on the next space shuttle?

Who wants to use the hero, and what about him is worth using?

Whatever his secret is, that’s going to be the link to his vulnerability. But the person or people who want to take advantage of that aren’t always going to be the main villain of the story. So who are the other people in the story who want to use or abuse the hero, and what are they after?

Who hates the hero?

This is going to be your villain, or one of them. What’s the story here — what is the conflict between hero and villain that sets them against each other. In most cases, the hero has or is about to get something the villain wants and is willing to do almost anything to get. What is it? Does the hero know about the connection at the beginning, or does he step into a landmine and inherit the villain because of who he is.

You’ll have more questions by the time you get to this point. Draw circles, draw arrows, and ask them.Then go on to the next character, and her questions ….

Who is the heroine, and what does she want?

Some of who she is and what she wants should center around the way we meet her. In this example, what role does the violin play in her life? Why did she get interested in that particular instrument? Anything special about her violin — origin, make, previous owners? What else does she want? Husband, kids, family, friend, place to hide, enormous fame …? What or who is standing in the way of her getting it?

How is the heroine tied into the catalyst?

Why did the stage collapse when she was on it? What sort of spooky message did she receive? What does she think about what has happened to bring her to this point? Does she have a theory? How does she react to the catalyst — with fear? Humor? Anger? Daring and courage? Spunk?

What is her connection with the catalyst?

In this example, is her violin haunted by a previous owner? Is the stage where she played haunted? Is there a non-supernatural explanation for the events? Its it the correct one, or did something truly outside the mundane happen?

Where does the catalyst come from?

Origin of violin, origin of stage, origin of saboteur, or something else… look at origins and come up with a story?

What does the catalyst want?

It might be the spirit of the violin, or a ghost attached to the stage itself. It could be a human faking the supernatural. The catalyst might end up being a helper for the hero and heroine, a helper for the villain, or the villain himself. The catalyst can also be a random event, of course, in which this question is probably irrelevant — but ask it anyway and see if something cool pops up.

What does the heroine fear?

These can be phobias that you can exploit later, events from the present that are dangerous, current events that seem dangerous, people, places, all sorts of things. They can be valid or invalid.

What does she need to fear?

There should be something that she doesn’t fear, but that she should. You need to know what this is, but you don’t need to share it with the reader, nor do you need to tip off your heroine.

Who hates her?

She wants to be loved, of course, but somewhere, somehow, she’s made at least one enemy. How did she make the enemy, and who is he? Or she?

Who wants to use her, and what about her makes her worth using?

What does she have or believe or care about that makes her vulnerable? That makes her attractive to predators? Who does she know who is willing to go after these parts of her life, no matter what the cost?

What does the heroine have to lose?

Her life, of course. That is always the given, but it isn’t enough. What matters to her more than her own life? What would she die to save?

As you’re writing the questions and their answers, you’ll come up with more questions. Ask them, answer them, and follow them through all the questions that they generate.Then move to your next question series:

Who is the villain?

What is bad about him? What is good about him? What things does he hold to be true? What things does he believe are false? Where did he first cross paths with the hero or the heroine, and what does he want from them? How would he define his perfect world?

What does he mean to the heroine (or hero)?

Do they share a past enmity? A past friendship? A present friendship? How does he see this person who has come to be an obstacle to what he wants — to his view of his own perfect world? Why? What does he wantto mean to the heroine (or hero, or both)?

What does the villain have to lose?

He’s going to take some big risks to recreate his world according to his template. What will happen to him if he fails? What does he see as worse than death itself? What scares him?

What does the villain have to gain?

What thing greater than the value of his own life does he seek? Why does he value it so greatly? Where did his desire come from? What might change it?

Pursue your villain through more questions, more arrows and circles, more answers that spawn their own questions. When you have finished with him, toss yourself a couple more quick categories, and let your imagination run down the paths it builds for you. Ask yourself ….

Who lies?

The hero? The heroine? The villain? Dear friends? Ex-lovers? Someone else? Why, why, why do they lie? You can ALWAYS find something rich and powerful in the answer to this deceptively simple question.And…

Who dies?

Anyone? Anyone we love? Anyone we hate? How? When? By whose hand, or by what means?

By the time you’ve answered these questions, your inital sentence for the book may be nothing but scrap words for the Delete key. But you’ll have something far better than a basic idea. You’ll have a solid and powerful foundation for your next novel.

If you want a story to come to you, all you have to do is ask.

0 notes

Text

CCIE employment direction ccie r&s written dumps pdf

More ccie written dumps and ccie lab dumps are at PASSHOT, cheap and sure to pass!

CCIE has many directions, such as routing and switching, security, big data, and so on. When you pass these CCIE exams, the job is good to find, but find a good job, but also find it! So do CCIE to find a job guide!

Let's first take a look at a section of a piece of Keiko and Zhuangzi written by Zhuangzi in the Xiaoyao Tour:

Keiko said to Zhuangzi: "Wei Wang gave me a big gourd seed. The gourd I planted with it has a large capacity of five stones. It is used to hold water, and its hardness is not enough to bear; it is cut open. In the scoop, it is too big to be released. This gourd can't be said to be small, but I broke it because it was useless."

Zhuangzi said: "You are too bad at using big things! Song Guo has a person who is good at making anti-hand cracking medicine. His family has been relying on important things for generations to rinse." One guest heard, willing He paid a hundred gold to buy his prescription. He then summoned his own people to discuss and said: 'We have been washing the silk for generations, but the income is not a hundred dollars. Now I can sell this medicine and I will get a hundred gold. Please allow me to sell it to him. "When the guest gets this prescription, he goes to lobby Wu Wang. At this time, the Vietnamese troops sent troops to invade Wu, and Wu Wang sent him to lead the enemy. In the winter, he fought against the country and defeated the army. Wu Wang then Mark the land to give him a gift. The function of the prescription for cracking is the same. Some people use it to get a reward, but some people just use it to rinse the silk. This is because the party’s use is different. Now you have five stones. The capacity of the big gourd, why not consider it tied to the waist to float the rivers and lakes, but just too much useless! You really do not open!"

Most people use CCIE's value to get a satisfactory job. The monthly salary is 20K, and the 7K-15K is more common! A small number of people are not striding a lot, and wages are not sesame blossoming! In fact, CCIE is like the prescription mentioned above. It is a "golden" light flashing itself, but it has a different value with different people's different uses. Moreover, CCIE is also like the big gourd, but there are some people who don't really know its use like Keiko. Of course, more people like Zhuangzi can use it to smile. "Zhuangzi" read it all for fun, and "Keiko" may have to look carefully! ! !

We know that the process of finding a job is a process of selling yourself out! A salesman must follow two basic principles: First, be sure to believe that your product is of great value to customers. Second, we must find a customer who has real needs for this product. Here, the product is your own. The salesman is also your own. You must know yourself and know each other.

Your value

(1) CCIE is the king of technology

Anyone who has passed CCIE knows that CCIE has a wide range of knowledge, including routing, switching, bridging, security, QOS, voice, multicast, etc. for routing and switching. According to Cisco's official statement, all Cisco IOS12.0 support all features are within the scope of the exam. More than 500 M docment CD documents are just a part of all Cisco documentation. And the examination is very detailed, such as the routing protocol, always test some of the experience problems encountered in the ordinary work, when the "bird" encounters these problems, it can only be a word "dish", when the "shrimp" encounter To these problems, it will become a "big" word, tired lying on the ground can not afford. Can get such a complex network in a short day. It can only be the husband of the iron fan princess - not only the cow, but also the word of the devil! Therefore, people who have passed CCIE are not only useful to the company from a technical point of view, but also useful. For the company that is "killing the cold", you are in the snow, for the company with high skill, you are the icing on the cake!

(2) The number of CCIE itself is worth

To apply for Cisco's gold and silver agents, you must need a certain number of CCIEs, including 4 for gold medals, 2 for silver medals, and a lot of big projects to bid. When bidding, the company with CCIE can specify the price. How many points are added. These are the real benefits of CCIE!

(3) CCIE is more expensive

At present, the number of CCIEs in China has exceeded 1,000, but with the rapid development of China's network construction, CCIE is still in short supply. And today's CCIE figures are not really the number of CCIEs in China. Many people do not engage in civil wars after they have passed the exam in China, but go abroad to "aggress" other countries. Also, everyone does not see the United States now. There are 3,977 IEs, but IE is still a white-collar worker in white-collar workers!

IE has two thresholds and decided not to flood in a short period of time. (1) The technical threshold, as I have seen from above, how difficult it is to test a CCIE. There are no years of experience in blood and tears. There are no N-months of cantilevered thorns. Those who are not strong will be discouraged. (2) The threshold of funds, everyone knows that in general, a CCIE has invested a total of 50,000 yuan. You think that the average person can't get this number by personal strength for several years. People who don't have a wife don't want to save money. This is my personal experience. However, I have taken my wife, and the money is almost spent. In short, there is no money. Therefore, many people are sucking blood everywhere, but the successful vampire is a minority! A penny can kill a hero, a situation of 5 million? Therefore, there are more heroes and heroes who have more than enough power, and they have more than enough money. They are in front of IE all day, and their heroes are short-lived. You should be convinced that the days when IE is everywhere will never happen.

Another point is that in order to maintain the value of CCIE and prevent oversupply, Cisco has a certain amount of control over the growth of CCIE every year. Now it is about 1,000 people per year worldwide! Fully synchronized with Cisco's product sales growth pace!

(4) CCIE has great brand value

But if you are engaged in the IT industry, few people do not know CCIE, because CCIE is a symbol of technical masters and a symbol of the company's technical strength. Even some Meimei know, because for them, CCIE is a symbol of money, CCIE = Ports + L'Oreal. CCIE has a great "name" effect. The brand value of Coca-Cola is more than 700 million. If the brand value of CCIE is evaluated, it is estimated that there are several billion. Your value is not only reflected in your technology, but also in the goodwill that the company brings. And the value of these things is immeasurable. You should raise these things because you should be confident.

(5) People are divided into groups

Some people look for a boyfriend, extremely a Shih Tzu, but the boyfriend who is looking for is a hardcore Wu Dalang, all of them are angry, feeling and drooling, looking for it, suddenly, cheerful, the man’s brother’s brother is one The rich merchants also made a fortune by selling sesame seeds, and now they are the chairman of a famous sesame seed group company! This is the relationship, the power of one person, after all, limited, it is difficult to become a forest! CCIEs are a group of people who excel in various fields. They come from different fields, and they are savvy and savvy. In addition to CCIE, they all have stunts in the original field. Everything is fine, there are very few people, and there are people like this, and ordinary companies can afford it! Moreover, anyone who pursues CCIE is a person who has a different opinion about life, and such a person is destined to work hard. According to the principle that the reward must be paid, it is naturally the promotion of the promotion and the fortune of making a fortune. So, you are CCIE, there must be such technical and social relations resources. Even if you are not good enough, I have heard of the Ravens, and the disgusting crow mouse has changed his identity as long as he stands on the platform. This is also called "fox fox tiger", enough enough! Oh, CCIE is a master, and vegetables and shrimp are relatively speaking. So, you can talk about how your friends are interested in it. Of course, everyone often discusses the problem together. Hehe! How to say, this is called "talking and laughing, there is no ruddy!" Raise yourself!" But, please note that everything can't be too much, other people's things can't be yours after all, this method should be properly and moderately applied, not as a pillar of life! Yi Yi: "Hey, Heng, Xiaoli has a rush." I realized it, I can't understand it and ask me! :)

(6) Beyond CCIE

This is a relatively high level, suitable for those who can be comprehensive. The real master is to understate CCIE, left to talk about it! It’s hard to hear the words, and the technology is to rely on the hand to make money (laborers), and the management is to rely on the mouth to make money (workers). The laborers are the people, the laborers are the people. The process of people going to the heights and going to success is actually the process of changing from the laborer to the laborer. I think of many IEs who are decades old and still go to the routers, and the nose is sour. Because I don't know, CCIE has become his wing, or has become his shackles. The true master should come from technology and beyond technology. Without CCIE, there would be no us today, but forgetting CCIE, maybe we will have more tomorrow. This sentence is not everyone can understand! We all know that CCIE is a certification issued by Cisco, and we are crazy about Iraq, but how many people can explain why CCIE has such value? The success of CCIE is only a small part of Cisco's success, and who can have a clear idea of Cisco's success! For a company's success, technology has never been dominant, and Cisco has a well-known theory that is technology agnostic! For such a company that started with technology, how much courage and courage it takes to get such a theory! And doing so ensures that Cisco's technology is leading step by step! This is a reasonful dialectic! Isn't we not only learning Cisco's technology, but also learning more from it? What's outside of technology is what Cisco really is. If you are a master in this area, then you will adopt this strategy and believe that your salary will double. Because you can not only make money for the company, but also guide the company to make money!

To sell things, of course, find one you want to buy. If you go to the monk to sell the comb, whether you are boxwood or something ivory, whether you are 10 yuan or 1000 dollars, he will not buy it because the comb is for him. Useless. Can you go to those who have enough food to sell Mercedes-Benz cars? It certainly won't, not because they don't want it, but because they can't afford it. After understanding these reasons, then you will seize the essence of "sell yourself"! The first is to find a company that wants to be your own, and the second is to find a company that can afford it.

(-) Network equipment manufacturer

These companies have made a fortune with the development of the Internet. Because of the financial affairs, they are so savvy that they can throw hundreds of millions of dollars or billions of dollars into their eyes. Therefore, your annual salary of hundreds of thousands of RMB, for them, is like watching an elephant, then going to see the ants, only pity in the heart. And you, like a big fish fell into the Pacific Ocean, whatever you jump! Cisco, Nortel, Alcatel, Lucent, Juniper, 3COM, Ericsson, extreme, foundry, intel, Huawei, harbor, UT Starcom, etc. These names are glittering in front of us like gold, and every brand is worth Liancheng. Of course, CCIE is mainly based on Cisco, so Cisco will certainly not refuse. But will other companies accept it? Will do! There are three reasons. One is that CCIE itself has a good technical foundation. Network technology is generally a standard technology. Each manufacturer is the same, and the configuration is similar! A good technician can be used to bypass the class and it is easy to get started. The second is the convergence of some manufacturers' products with Cisco. These manufacturers often adopt the following strategy. Cisco is like the rabbit, while other manufacturers are like turtles, biting the tail of the rabbit tightly, so the rabbit runs. How fast, how fast the turtle will be! Therefore, CCIE is like training for them, so of course it will be accepted. The third reason is that "captives" are more convincing. We watched the Eighth Route Army's movies and often saw the use of some old prisoners who had already been sincere, to persuade those new prisoners, and to say tears of the Communist Party, the Kuomintang's bad, this This way is very lethal. The same reason, other companies generally use CCIE to come out and say, generally say: "I am CCIE, so I know quite a lot about Cisco. In fact, Cisco's things are also very general, but the market is doing well, we This product is similar to Cisco's, and even stronger in some respects, and the price is only..." However, these companies are implementing three high policies, high investment, high risk and high return. You are the two highs that belong to the front. Because of the network bubble in the past few years, the strength of these companies has been recovering in recent years, so it has become a four-high, plus a high blood pressure. Therefore, to go to these companies to find a job, the salary can not be opened too high. Generally recommended for foreign companies: 10000-20000 / month, domestic companies: 7000-15000 / month, of course, depending on your position flexible adjustment.

(2) Related industry manufacturers

Network devices are relatively basic facilities, and only if they work properly, other applications can run correctly. Therefore, network equipment is like roads and bridges. If they are not built well, it will be impossible. Normal network communication is even more difficult to talk about. Internet technology is so complicated, so there is OSI seven-layer model technology. Because of this complexity, each manufacturer can only put eggs in a basket. Therefore, it caused some problems. Let's look at a situation. A company that produces firewalls went to another company to install the firewall. Because the firewall was added later, it needed to make some changes and settings to the original network, but the network product was made by another company. Therefore, communication is extremely inconvenient, so you need a person who is very familiar with network products. If some companies' business is very critical and urgent, this is even more true. Otherwise, the security products have not been installed, and the network of people has been paralyzed. This is a big joke. There is also a company that develops streaming media technology, to install products for people, and to configure multicast and QOS on network devices. And this is not something everyone has to do, so these companies need some network experts. Many of these companies are companies that produce firewalls, companies that develop databases, and so on. At that time, always remember to find a big company. Of course, if you are a CCIE and a master of some other aspect, this compound talent can be the technical director. If you are not going to be a technical director, you are advised to offer: 7000-12000/month.

(3) Telecom operators

China's telecom companies are now in a 5+1 format, China Telecom, China Netcom, China Unicom, China Railcom, and China Mobile. They are all big ponds, and how big a fish can be raised. Radio and television is also a better choice. The final data must be carried by IP, which is already a consensus, so no matter which big carrier is developing IP bearer network. Whether it is a simple network device or a so-called multi-service platform, what CCIE has learned is indispensable. Therefore, the demand for network talents by major operators is huge. There is also a consensus that these telecom operations

0 notes

Text

15 to watch 111918

15 TO WATCH/5 SPORTS TECH/POWER OF SPORTS 5: RICK HORROW’S TOP SPORTS/BIZ/TECH/PHILANTHROPY ISSUES FOR THE WEEK OF NOVEMBER 19

with Jamie Swimmer & Jacob Aere

Major League Baseball is sticking with Fox Sports. MLB signed a seven-year media rights deal with Fox worth a reported $5.1 billion over its lifetime, equating to $728.6 million per year. Fox is currently locked into an eight-year, $525 million per year deal that is set to run through 2021. According to SportsBusiness Journal, “The deal, which keeps MLB tied to Fox and FS1 through 2028, looks much like Fox’ current deal, in part, because that was all MLB could sell as its other media packages are not up.” The new the new , Fox is going all in on baseball, preparing to carry the World ri iewership numbers.

Despite being removed from the NFL’s slate of game this season, Mexico remains in the NFL’s long term international plans. According to the Los Angeles Times and other sources, the International Series game between the Kansas City Chiefs . Estadio Azteca is one of the most iconic and historic stadiums in the Americas, having played host to countless mega sporting events, such as two Wo weekend of November, when Mexicans celebrate the Revolution's an sary." “In the next 20 years the Mexican economy is going to grow,” said NFL Executive VP of International Mark Waller. “So it’s important for us that we’re part of that long-term future.” While moving the Thanksgiving We l, doesn't even include a view of the court itself. The Warriors noted that fans who "purchase the pass will have access to the arena's bars and restaurants and can watch on the televisions in the club areas." And fans, who can each buy up to four of the new passes, still have a chance to receive one of the Warriors’ in-venue giveaways if they are one of the first 10,000 people into the arena. Sporting events have been cast as the new social clubs, and for the 44,000 fans stuck on the Warriors season-ticket wait list, this is an innovative alternative to bask in the aura of the most exciting team in basketball.

A future Winter Olympics in Calgary seems unlikely after voters rejected a bid for the 2026 Games. According to the Calgary Herald, supporters of the city’s 2026 bid noted that another bid for the 2030 ir Scott Hutcheson. “You can't put a city through this every four years. My view would be let it go, accept the result, move on and come back with a bid maybe in seven years.” Funding for the mega event was always up in the air, even after the IOC pledged to help pick up a significant chunk colored “to raise awareness of Stonewall’s Rainbow Laces campaign.” The EPL will promote the cause during two weekend’s worth of matches beginning on November 30, “giving all 20 clubs the opportunity to celebrate their LGBT community and to make clear football is for everyone” with rainbow colored laces. Premier League matches will feature a "bespoke Rainbow Laces pitch flag, ball plinth, handshake board and substitutes board” from November 30-December 5. This push for awareness in the LGBT community has been echoed all across the globe in professional soccer. In June, the U.S. men’s and women’s and other international teams sported rainbow numbers on their jerseys during competitive and friendly matches as part of LGBT Pride Month.

Leaked documents regarding a new “Super League” have taken the soccer world by storm. According to JohnWallStreet, plans for the newly-proposed league were revealed by German magazine Der Spiegel and indicated that seven of Europe’s biggest clubs (Real Madrid, Barcelona, Bayern Munich, Juventus, AC Milan, Manchester United, and Arsenal) ongoing leadership turmoil, this is an interesting development to watch indeed.

Tennis has a new tournament in the ATP Cup. According to SportsBusiness Journal, the new competition will feature teams from 24 nations with buckets of ranking points and prize money. These new plans set men’s professional tennis on a “collision course” with the ITF’s planned 18-nation Davis Cup event being held in late November 2019 in Madrid. With the new ATP Cup, “the ATP is essentially replicating the same format six weeks later to start the 2020 season in Australia.” Many close to the sport speculate that the events will eventually merge or one will have to replace the other. The first ATP Cup is being planned for early January, 2020 in three Australian cities with $15 million to be awarded in prize money, “less than the roughly $20 million the Davis Cup said it will award next November.” While the money will be less, the ranking points will be worth a lot in this event, as “smaller prize money might be a worthwhile tradeoff.” The sport’s ranking male stars, already long in the tooth by tennis standards, will be a year older when the ATP Cup debuts, so expect this new global stage to be grabbed by many now-unknown throughout the 2019 season leading up to the Tour Championship. “Rather than 72 players making the Race to the CME Globe, 60 players will make it to the Race,” said LPGA Commissioner Mike Whan. “We'll still race all year…Once you're one of the 60 to get in, we throw the points out the door and anybody can win the final event. The winner's check will be $1.5 million, so it will be the largest winner's check in women's golf history. To think that the best players in the world won't be paying more attention to the CME Group Tour Championship next year would be wrong.” The Race upgrades mark the latest creative flourish in Whan’s expansive LPGA tenure, from expanding his tour’s global footprint to adding cutting-edge events like the Indy Women in Tech Presented by Group1001 tournament.

The legalization of sports betting across the country is expected to ultimately change how we interact with sports venues. According to USA Today, Monumental Sports & Entertainment Chair and CEO Ted Leonsis expects sports venues to eventually become “casinos of a sort — open nearly around the clock to capture a coming mania for legalized sports betting.” Some expect new stadiums to be smaller than previously built ones as virtual reality becomes a more viable option for watching games. Instead of paying for a courtside seat, one would simply have to pay a much smaller fee for that same seat thanks to their VR headset. Leonsis sees sports franchises across the board increasing their franchise values as they begin to partner with technology companies for advanced sports betting. “Five years from now, it could be an Amazon is streaming and your subscription is part of Prime, and they have your credit card on file and you’re able to bet live through an Amazon,” said Leonsis. “And you would have never envisioned that something like that could happen.” As anyone who has viewed a basketball game from a VR-enabled courtside seat can attest, this technology is fast maturing, and it’s certainly conceivable that sports betting could become a regular – and lucrative – part of the experience.

Chegg teams up with sports stars Julie Johnston Ertz of USA Women's Soccer and Zach Ertz of the Philadelphia Eagles. According to PR Newswire, Chegg will give $860.00 dollars for every first down and $1,086.00 dollars for every touchdown recorded by Zach for a contribution of up to $86,000.00 to the Ertz Family Foundation. The “86” is an ode to Zach's jersey in a campaign dollar amount. All proceeds will benefit the Ertz Family Foundation's education initiatives. The campaign started on the NFL regular season opening game and will run through February 10, 2019. To date, Zach has earned $41,550 from Chegg. Zach has been honored as an NFL Pro Bowl nominee in 2017 and was recently named the NFLPA Community MVP for Week 5 as a result of his work to change the lives of children in Haiti through the Foundation's scholarship program. Zach and his world champion wife Julie established the Ertz Family Foundation earlier this year. The dream philanthropy team continues to stay dedicated to their community and relentlessly promote education.

The New York Yankees are money savvy, but they really just want to win above anything else. According to SportsBusiness Journal, Yankees Managing General Partner Hal Steinbrenner noted that staying under the luxury tax line of $206 million is “on his mind,” but it is not “as much of an ardent goal this season.” Having fallen to their bitter rivals, the Boston Red Sox, the Yankees’ front office is more motivated than ever to win this coming year. “We’re going to keep adding pieces until we’re sure we are where we need to be,” he said. The Red Sox having been taking flack from many around the league for buying their way to a championship, having spent $234 million to build this season’s championship team. “It’s only one team,” said Steinbrenner. “It comes down to the player development system. And I think anything’s possible with payrolls that aren’t $250 million to $300 million.” Reportedly front and center in the Yankees’ sites: free agent short stop Manny Machado, acquired by the Dodgers from the Orioles in July for five prospects and a $6.3 million one-year contract.

The Tampa Bay Rays are running out of time to find a viable stadium option for the long term. The team currently plays at Tropicana Field and has been searching for a viable new home for years now. According to the Tampa Bay Times, less than two months remain "until the window closes on a three-year agreement” between the Rays and the city of St. Petersburg for the team to explore ballpark options in Tampa. The team has proposed a new home in Ybor City, though plans have not yet been revealed publicly regarding funding for the $900 million development. With local elections “out of the way, negotiations between the team and city and county officials on a ballpark financing plan are expected to kick into high gear.” A hard deadline of December 31 is in place to come to a consensus on the Ray’s new stadium plans, and it seems unclear whether an agreement will be struck before then.

Major League Baseball plans a summer league for high schoolers. MLB is "planning a summer league for elite high school players that it hopes will eat into the pay-for-play market that exists today," according to sources. This would mark MLB's "boldest effort yet to reclaim a youth apparatus that has been outsourced to third-party profiteers." The Prospect Development Pipeline League, announced by MLB last week, would "invite 80 of the best rising seniors -- most of whom will be drafted in 2020 -- and offer the best of the group a chance to play at a high school game during All-Star week in addition to a high school home run derby." The league "could grow in size and scope and perhaps challenge the current system." MLB is clearly taking a page from the NBA’s playbook, which includes opportunities for high schoolers within its ever-evolving G League farm system. Next year, G League Select Contracts, which will include robust programmatic opportunities for development, will be available for elite basketball players who are at least 18 years old and will pay $125,000 for the five-month season.

The Pac-12 announced that Arizona State University and the University of Colorado Boulder will meet in 2019 in the fifth edition of the Pac-12 China Game presented by Alibaba Group. Longtime Pac-12 partner Federation of University Sports of China will serve as the co-host for the basketball game. The matchup between the Sun Devils and Buffaloes is tentatively scheduled for November 9, 2019 for national broadcast in both the U.S. and China. It will be the "first time the game has featured two programs from the Pac-12, though the contest will be considered a nonconference game.” The game also will mark the "first time a CU program from any sport will compete in Asia," according to BuffZone.com. Yale beat Cal last Saturday 76-59 in the 2018 Pac-12 China Game, marking the “first time a Pac-12 team has fallen in its opening China Game” according to the Yale Daily News. The game was played in “front of 4,000 Chinese fans” at Baoshan Sports Center in Shanghai and a national tv audience. This annual matchup remains the only regular-season game played by a U.S. sports league, pro or collegiate, in China. Just call it hoops diplomacy.

WWE is reporting that WrestleMania 34 generated $175 million in economic impact for the city of New Orleans region this past April. According to a study conducted by the Enigma Research Corporation, this marks the seventh consecutive year that WrestleMania generated more than $100 million in economic impact for its host region. A record crowd of 78,133 fans from all 50 states and 67 countries attended WWE’s pop-culture extravaganza this past April, making it the highest-grossing entertainment event in the history of the Mercedes-Benz Superdome. WrestleMania’s financial windfall is just the latest in a string of top-dollar mega events bringing major revenue to the Crescent City, most recently the 2017 NBA All-Star Game, which brought an estimated $44.9 million in spending to the state of Louisiana and Super Bowl LVIII in 2013, which created $480 million in economic impact. Kudos to stadium management leader SMG and their New Orleans-based vice president of stadiums Doug Thornton for key contributions to all three events.

Tech Top Five

The Game Awards will livestream across a record-setting 40 global networks, including expanded distribution in China. According to Cynopsis Sports, the PlayStation 4, Xbox Live, IGN, GameSpot, Polygon, MLG, Caffeine.tv, and others. With esports a bubbling industry, it is only fitting that the Oscar-like event celebrates the recent successes of top video games while looking toward the future by teasing upcoming gaming trailers for audiences. Like video games themselves, The Game Awards allow for audience participation, with 10% of the final vote driven by the public, further cementing esports’ interactive nature.

The NBPA has inked a deal to bring its stars closer to the esports world. The NBPA signed a deal with ReadyUp, an app that helps esports fans track and watch their favorite online gamers. Under the deal announced at SportsBusiness Journal’s Esports Rising, the league’s stars will now have an opportunity to profit from the online video-game leagues they take part in, says Payne Brown, president of the NBPA’s marketing arm. According to Bloomberg, these esports leagues contain franchisees, salary caps, and multimillion dollar TV deals with networks such as follows a previous agreement between the two companies, the new agreement adds coverage of the Champions League and Europa League. WSC Sports currently operates across 10 different sports in five continents and also works with properties such as the NBA, MLS, PGA, FIBA, United Soccer League, World Surfing League, Turner Sports, Cricket Australia, and others. The drive for shorter clips, due to shorter attention spans, may be WSC’s key to sports business success as game highlights tend to be what people will spend the most time consuming.

Tim Tebow is teaming up with LeBron James to host “Million Dollar Mile.” According to The Washington Post, “Million Dollar Mile” is a new TV competition series co-created by James’s production company, SpringHill Entertainment. Tebow finds himself at the helm of another high profile offseason job as he already serves as a college football analyst for ESPN. CBS will air the 10-episode series and claimed in an August news release that the show involves “shutting down the streets of a major city” to set up a course with competitors at one end and $1 million at the other. The catch is that it’s supposedly the most challenging course ever designed, with a group of elite athletes attempting to stop the contestants from winning the money at all costs. James’ company has also produced Showtime’s “Shut Up and Dribble,” HBO’s “Student-Athlete,” Starz’s “Warriors of Liberty City,” NBC’s “The Wall,” and Facebook’s “Do or Dare.” “Million Dollar Mile” will feature ESPN reporter Maria Taylor and Los Angeles Chargers play-by-play announcer Matt “Money” Smith with a release date yet to be announced. LeBron pushes the limits of what’s possible on and off the court and has proven that he can be a very successful field marshal with a camera as well as a basketball.

MLB coupled its massive Fox Sports deal with a $300 million streaming deal with DAZN. On top of a deal that will see Fox Sports pay $728 million for its rights annually, MLB has secured a three-year streaming deal with over-the-top streaming service DAZN which will not feature rights to any live games, but will include live cut-ins. This deal marks the first domestic major league sports property for DAZN in the U.S. and will likely be accompanied by a weeknight show similar to the NFL’s popular “RedZone.” The new MLB agreement will also feature an expanded streaming, social media, and highlights strategy between the partners. While it’s not shocking to see Fox continue its MLB relationship, DAZN keeps growing its OTT empire by breaking into a major U.S. sports market – expect NHL, NFL, or even NBA deals from the OTT company in the near future.

Power of Sports Five

For the fourth year in a row, this Black Friday, REI will close all 153 stores, process no online payments, and pay more than 12,000 employees to #OptOutside with friends and family. Since 2015, 15 million people and more than 700 organizations have joined the #OptOutside movement — REI’s effort to inspire people to do something other than consume. This year, REI is also pledging $1 million toward the launch of a new center of academic excellence at the University of Washington called Nature for Health that will study the link between human health and time spent outdoors. The new center of academic excellence within the university’s EarthLab will broaden and deepen its examination of how time outside impacts our health. It will build on existing bodies of work and explore new ideas — such as whether a dose of nature can be prescribed alongside traditional medicine to tackle issues such as anxiety and depression. With the annual move, REI joins other progressive companies such as sports science leader Embody and active wear giant Lululemon in thinking outside the box when it comes to sports and recreational health.

Purdue superfan Tyler Trent gets a bobblehead to help the fight against cancer. According to ESPN, the former Purdue student is fighting a rare form of bone cancer. He became such a national sensation during the Boilermakers' victory over Ohio State last month that there was a significant rise in donations supporting cancer research. Now, the 20-year-old will be honored with his very own bobblehead to be sold by the Bobblehead Hall of Fame and Museum in Milwaukee. The trinkets will sell on the HOF website for $30 with the Tyler Trent Cancer Research Endowment at Purdue to receive $2 from the proceeds of each bobblehead sold, while The V Foundation for Cancer Research will receive $3 apiece. Bobblehead Hall of Fame and Museum founder Phil Sklar said that Trent’s bobblehead is comparable to many other successful creations like Sister Jean, in which people felt a strong connection to the person and their message. Donations to Tyler's fund, thanks in part to a dollar-for-dollar match with the Walther Cancer Center in Indianapolis, have topped $100,000. To make a personal battle against cancer a fight for the bigger cure is something noble of Trent – to highlight his efforts by representing him donning his school’s colors in bobblehead form is something lasting by the Hall of Fame.

The RESPONSIBALL Forum proposes a call to action for refugees’ inclusion in sport. The event was held in in Lausanne, Switzerland to promote the use of athletics to support refugees. According to sportanddev.org, speakers and attendees came from a variety of backgrounds and had the chance to hear stories, share experiences, and learn how to more effectively run programs. Among the panelists were refugees, sports federations, NGOs, and governments. The event ended with a call to action that aims to put sports higher up the agenda as a tool to work with refugees while encouraging more coordination between different athletic and refugee organizations. Additionally, the panels sought to have research provided to back up the claims that sport helps refugees acclimate to their new countries. Sports and international politics are inevitably entwined, and providing more access to athletics for refugees may help countries also grow a stronger fan base and business platform for their professional sports teams.

In the wake of Paul Allen’s passing, his foundation will reap the profits of the Seattle Seahawks’ sale. According to SportsPro, proceeds from the future Seahawks sale are set to be put towards the Paul G. Allen Foundation. This was a move that Allen himself had planned before he passed away in October. Although Jody Allen, sister of Paul, has assumed control of Allen’s estate, it is assumed that the team will now be sold to a wealthy individual or investor group. Based upon estimates, the sale will likely set records for a North American sports franchise, with Forbes suggesting a potential sale of $2.6 billion. Paul Allen also owned the NBA Portland Trail Blazers and was a part owner of the MLS Sounders FC, which are also likely to be sold later this year for roughly $1.3 billion and $60 million respectively. Although he was an early tech mogul, Allen left his mark in the sports world by helping to build revered northwestern teams in multiple pro sports leagues.

Colorado’s NBA and NHL teams come out for Special Olympics and educational charities. According to Westword, players from the Denver Nuggets and Colorado Avalanche, in addition to members of the Colorado Rapids soccer team and the Colorado Mammoth box lacrosse squad attended the charity fundraiser at their home arena, the Pepsi Center. The Mile High Dreams Gala brought out sports fans, media personalities, and Denver's high society for a night where proceeds went toward Kroenke Sports Charities. The event raised close to $100,000 for programs such as the Special Olympics of Colorado and the Denver Public Schools Foundation according to Deb Dowling, Kroenke Sports Charities executive director. In its tenth year, the charity gala brought out both rookie and veteran players including Michael Porter Jr. and Gary Harris of the Nuggets. This cross-sport charity gala highlights how athletes across multiple leagues can come together to support important charitable causes in the communities in which they play.

0 notes

Text

CCIE employment direction