#octafx analysis

Explore tagged Tumblr posts

Text

The Forex Brokers in Australia: Why You Should Choose Them?

Australia has earned a reputation as one of the most attractive destinations for forex traders worldwide. Known for their strong regulatory framework, advanced trading platforms, and excellent customer service, the best forex brokers in Australia continue to lead the market by offering an unparalleled trading experience. Whether you're a beginner or an experienced trader, the benefits of choosing a top-tier Australian broker are undeniable. In this article, we will explore why Australia-based forex brokers are so popular, what sets them apart, and which brokers, such as FP Markets, Blackbull Markets, EightCap, OctaFX, FXPro, IC Markets, FBS, XM, AXI, and Pepperstone, are the top contenders in the industry.

Why Australian Forex Brokers Are the Best Choice for Traders

Australia's forex trading environment stands out in the global market for a variety of reasons. Below are key factors that contribute to the rising popularity of Forex Brokers Review.

1. Regulation and Trust

Australia's financial markets are governed by the Australian Securities and Investments Commission (ASIC), one of the most respected regulatory bodies in the world. ASIC ensures that brokers adhere to stringent financial standards, offering a layer of security and trust that traders look for when selecting a forex broker. ASIC’s regulatory oversight ensures that brokers are transparent, operate with integrity, and prioritize the protection of their clients' funds.

2. Competitive Trading Conditions

One of the most attractive features of the best forex brokers in Australia is the competitive trading conditions they offer. These brokers typically provide low spreads, low commissions, and tight liquidity, which are essential for traders who want to maximize their profits. The competitive trading conditions are often coupled with a wide range of account types, including options suitable for scalpers, swing traders, and long-term investors.

youtube

3. Advanced Trading Platforms

Australian brokers are known for providing access to industry-leading trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and even their proprietary platforms. These platforms are known for their reliability, advanced charting tools, and sophisticated features like automated trading, backtesting, and technical analysis.

4. Fast Execution Speeds and Low Latency

Execution speed is a critical factor in forex trading, especially for active traders who rely on quick decision-making to capitalize on price movements. The best Australian brokers offer fast execution speeds and low latency, meaning that orders are processed quickly, reducing the risk of slippage.

6. Comprehensive Customer Support

Australian forex brokers are renowned for their exceptional customer service. Offering 24/5 support through various channels, such as live chat, email, and phone, these brokers are committed to helping traders solve problems, answer queries, and provide assistance whenever needed.

Leading Forex Brokers in Australia You Should Consider

Now that we’ve discussed the factors that make Australian forex brokers an excellent choice, let’s take a look at some of the leading brokers in Australia that offer top-tier services to traders:

1. FP Markets

With more than 15 years of experience, FP Markets is a leading forex broker in Australia. Regulated by ASIC, FP Markets offers low spreads, a wide range of trading instruments, and advanced platforms like MT4, MT5, and Iress. The broker’s commitment to providing fast execution, reliable customer support, and educational resources makes it a trusted choice for both novice and professional traders.

2. Blackbull Markets

Blackbull Markets is a well-known broker that caters to traders who want competitive spreads and fast execution speeds. Regulated by ASIC, Blackbull Markets offers access to MT4 and MT5, as well as ECN trading accounts, making it a favorite among scalpers and day traders.

3. EightCap

EightCap is another excellent Australian forex broker, known for offering low-cost trading and reliable execution speeds. With access to MT4 and MT5, EightCap supports a wide range of trading strategies and provides solid customer support, making it ideal for traders of all experience levels.

4. OctaFX

OctaFX offers a variety of account types with low spreads and excellent customer service. The broker’s educational resources, along with MT4 and MT5 platforms, make it a popular choice for Australian traders. OctaFX’s focus on transparency and user-friendly features has earned it a solid reputation in the industry.

5. FXPro

FXPro is a trusted global forex broker with a strong presence in Australia. Offering low spreads, fast execution, and access to MT4, MT5, and cTrader, FXPro is ideal for traders seeking robust trading tools. With a wide range of instruments and excellent customer support, FXPro continues to be one of the top brokers in Australia.

6. IC Markets

IC Markets is one of the largest forex brokers in Australia, offering a wide range of instruments, including forex, commodities, and cryptocurrencies. The broker offers access to MT4, MT5, and cTrader and is known for its low spreads and fast execution speeds, making it a favorite among active traders.

7. FBS

FBS provides competitive spreads and offers a variety of trading accounts, including ECN and STP accounts. FBS also offers a wide range of educational materials for both beginner and advanced traders, helping them improve their trading skills.

8. XM

XM offers a large variety of financial instruments and low spreads. The broker provides access to MT4 and MT5 and is known for its excellent customer support. XM is highly regarded for its educational resources and tools, making it a popular choice for both beginners and seasoned traders.

9. AXI

AXI is known for its tight spreads and high execution speeds. The broker offers access to MT4 and MT5 and is regulated by ASIC, ensuring a safe and secure trading environment for all traders.

10. Pepperstone

Pepperstone is a leading Australian forex broker known for its low spreads, fast execution speeds, and cutting-edge technology. Offering access to MT4, MT5, and cTrader, Pepperstone provides a comprehensive trading experience for both retail and institutional traders. Its excellent customer service and competitive pricing make it a top choice for Australian traders.

Conclusion

The best forex brokers in Australia are distinguished by their commitment to providing transparent, secure, and competitive trading environments for traders. With ASIC regulation, fast execution, low spreads, and outstanding customer support, these brokers offer the ideal conditions for traders of all experience levels. Whether you’re looking to start your forex trading journey or you’re a seasoned professional, brokers like FP Markets, Blackbull Markets, EightCap, OctaFX, FXPro, IC Markets, FBS, XM, AXI, and Pepperstone offer the perfect platforms to achieve your trading goals.

0 notes

Text

What is Top Forex Brokers In India

Top Forex Brokers in India are online platforms that allow Indian traders to participate in the global forex (foreign exchange) market. These brokers provide access to a range of currency pairs and financial instruments, and are regulated by either Indian authorities like SEBI (Securities and Exchange Board of India) or international regulatory bodies. Below are some of the best forex brokers available to Indian traders based on their reliability, platform features, fees, and customer support:

1. Zerodha

Regulation: Zerodha is a SEBI-registered stockbroker in India, but it primarily focuses on currency derivatives (currency futures and options).

Platform: Kite is Zerodha’s proprietary trading platform, which offers currency trading along with stocks, options, and more.

Best For: Indian traders looking for low-cost, reliable platforms to trade currency futures.

2. Upstox

Regulation: Upstox is SEBI regulated and provides access to currency futures and options.

Platform: The Upstox Pro platform is user-friendly and offers advanced features for both beginner and experienced traders.

Best For: Beginners who want an affordable and simple platform to trade currency futures.

3. ICICI Direct

Regulation: As a subsidiary of ICICI Bank, ICICI Direct is regulated by SEBI and offers access to currency futures and options on Indian exchanges.

Platform: Offers a comprehensive platform, ICICI Direct Markets, that combines trading with market analysis tools.

Best For: Traders who prefer a trusted brand with seamless access to Indian and international markets.

4. HDFC Securities

Regulation: HDFC Securities is regulated by SEBI and provides access to currency futures and options.

Platform: ProTerminal, an advanced platform designed for professionals, offers easy currency trading along with other asset classes.

Best For: Traders who prefer a trusted, well-established financial institution for forex trading.

5. Angel One (formerly Angel Broking)

Regulation: Angel One is SEBI-registered and allows trading in currency derivatives such as currency futures and options.

Platform: Angel SpeedPro is a powerful and easy-to-use platform for trading forex and other financial products.

Best For: Beginner traders seeking a simple, low-cost trading experience in currency futures.

6. Interactive Brokers (IBKR)

Regulation: Interactive Brokers is regulated by top-tier authorities such as the US SEC, FCA (UK), and others. It offers international access to the forex market, including Indian users.

Platform: Trader Workstation (TWS) and IBKR Mobile offer advanced tools and are designed for professional forex traders.

Best For: Advanced traders who need access to global forex markets, as well as other asset classes.

7. ForexTime (FXTM)

Regulation: FXTM is regulated by CySEC, FCA, and other international regulatory bodies. While not directly regulated by SEBI, it provides reliable services to Indian traders.

Platform: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are available for forex trading.

Best For: Traders looking for international forex trading with flexible leverage and advanced features.

8. OctaFX

Regulation: OctaFX is regulated by the FSA (Saint Vincent and Grenadines). While not a SEBI-regulated broker, it is still a reliable international platform offering access to global forex markets.

Platform: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are available, providing advanced charting tools and automation features.

Best For: Forex traders seeking low spreads, leverage, and flexibility.

9. Exness

Regulation: Exness is regulated by several global authorities, including the FCA (UK) and CySEC. Though it’s not SEBI-regulated, it’s a safe option for Indian traders.

Platform: MT4 and MT5 platforms are available, providing advanced features for forex trading.

Best For: Traders who want high leverage, low spreads, and flexible account options.

10. FXCM

Regulation: FXCM is regulated by FCA (UK) and ASIC (Australia), which makes it a reliable choice for international traders, including those in India.

Platform: Trading Station and MetaTrader 4 (MT4) offer a variety of tools for executing trades and managing risk.

Best For: Traders seeking a global broker with advanced trading tools and low spreads.

Key Factors to Consider When Choosing a Forex Broker in India:

Regulation: Ensure the broker is regulated either by SEBI or internationally recognized authorities like the FCA (UK) or CySEC.

Currency Pairs: Choose a broker offering a wide range of currency pairs, along with other assets like commodities and indices if needed.

Leverage: Forex trading often involves leverage. Ensure that the broker offers leverage that suits your risk appetite and strategy.

Platform: A good trading platform such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5) provides advanced charting tools, real-time data, and automated trading features.

Spreads & Fees: Look for brokers with competitive spreads and low commissions to minimize trading costs.

Customer Support: Good customer support ensures timely resolution of issues, especially for new traders.

Education & Tools: Many brokers offer educational materials and trading tools, which are beneficial for beginners.

Conclusion:

When selecting a forex broker in India, it’s essential to ensure that the broker is regulated and offers a robust trading platform, a wide range of currency pairs, and competitive spreads. Whether you are a beginner or an experienced trader, brokers like Zerodha, ICICI Direct, and Interactive Brokers provide the tools and support you need to succeed in the forex market.

0 notes

Text

Top 10 Forex Brokers 2023: Unbiased Reviews & Expert Insights

Navigating the Currency Waves: A Review of the Top 10 Forex Brokers Criteria for Ranking On Each Forex Broker Brief Overview Of Top 10 Forex Broker Vantagefx: GMI Edge Broker: FBS Broker: Pepperstone: IC Markets: OctaFX: Tickmill: TMGM: Lirunex: FXCM (Forex Capital Markets): Summary

Navigating the Currency Waves: A Review of the Top 10 Forex Brokers

The world of foreign exchange trading, or Forex, is a realm where currency pairs are traded 24 hours a day, offering a dynamic and lucrative avenue for seasoned traders and newcomers alike. The pulse of the global economy resonates through the Forex market, where over $6 trillion of currency exchanges hands each day. At the core of this bustling marketplace is an array of Forex brokers, the linchpins that connect individual traders to the vast currency exchange network. Choosing a reliable and well-suited broker is a crucial stepping stone on the path to trading success, as the right broker can significantly enhance the trading experience, offering superior platforms, insightful market analysis, and robust customer support. The essence of this article unfolds as a meticulous review of the top 10 Forex brokers specified in Asian region, shining a spotlight on the brokerage firms. Through a prism of defined criteria encompassing trading platforms, trading conditions, regulatory adherence, and customer support, we embark on a quest to sieve through the brokerage landscape and present a curated list of elite brokers. Whether you are a novice trader setting sail on your trading voyage, or a seasoned trader looking to switch brokers, this article aims to provide a well-rounded perspective to aid in making an informed decision.

As we delve deeper into the intricacies of each broker, we'll explore their unique selling propositions, evaluate their service offerings, and analyze user reviews to paint a vivid picture of what traders can expect. The culmination of this exploration is a comprehensive compilation that not only reviews but ranks these brokers, offering a beacon of insight in the stormy seas of Forex trading. So, without further ado, let’s navigate through the waves of the Forex brokerage world, and set a course towards finding a broker that’s the perfect co-pilot on your trading journey.

Criteria for Ranking On Each Forex Broker

These criteria serve as the yardstick to gauge the competence, reliability, and overall excellence of the brokers in question. Let’s navigate through the key parameters that will steer the evaluation and ranking of the top 10 Forex brokers: - Trading Platforms: - A broker's trading platform is the trader's gateway to the Forex markets. The evaluation will consider the user-friendliness, stability, and technological prowess of the trading platforms offered. - Features like charting tools, market analysis, order execution speed, and mobile trading capabilities will be scrutinized. - Trading Conditions: - Trading conditions encapsulate aspects like spreads, leverage, and order types available. - The transparency and competitiveness of a broker's trading conditions are paramount for ensuring traders can maximize their potential profits while minimizing costs. - Regulation and Licensing: - A broker's adherence to regulatory standards and licensing by reputable financial authorities is a testimony to its credibility and the safety of traders' funds. - The geographical extent of regulation and compliance with international financial standards will also be assessed. - Customer Support: - Exceptional customer support is the backbone of a satisfactory trading experience. - The availability, responsiveness, and expertise of the customer support team, alongside the variety of channels available for support (e.g., live chat, email, phone), will be evaluated. - Educational Resources: - An array of educational resources is crucial for helping traders hone their skills and stay updated with market trends. - The quality, accessibility, and variety of educational materials, including webinars, articles, and interactive learning tools, will be assessed. - Asset Variety: - A diverse offering of tradable assets, including currency pairs, commodities, indices, and cryptocurrencies, provides traders with ample opportunities to diversify their trading portfolio. - The evaluation will also consider the market access and the ease of trading different assets. - Deposit and Withdrawal Options: - Seamless and flexible deposit and withdrawal options enhance the overall trading experience. - The security, speed, and variety of payment methods, alongside the transparency of the fee structure, will be examined. - User Reviews and Reputation: - The reputation of a broker within the trading community and the overall user satisfaction are indicative of the broker's quality and reliability. - Authentic user reviews and testimonials, alongside ratings on reputable review platforms, will be taken into account. - Additional Features: - Brokers that offer additional features like social trading, automated trading, or personalized account management services add a layer of value to their offerings. - The usability and benefits of these additional features will be evaluated. The meticulous examination of these criteria aims to provide a holistic insight into the brokers' service quality, reliability, and potential to provide a conducive trading environment. Each of the aforementioned parameters will be dissected and analyzed, laying the foundation for a comprehensive and enlightening review of the top 10 Forex brokers that aim to steer traders towards a rewarding trading journey.

Brief Overview Of Top 10 Forex Broker

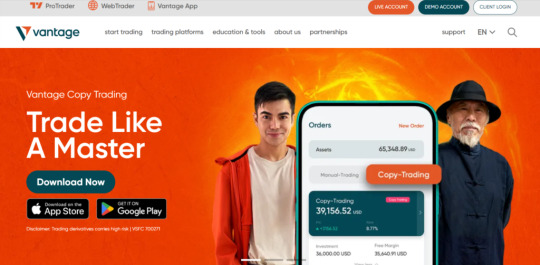

Vantagefx:

- Country of Operation: Headquartered in Sydney, Australia, and operates in 172 countries. - Regulatory Status: Regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Services Authority (FSA). - Trading Platform: Offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Vantage FX app for trading. - Trading Conditions: - Minimum Deposit: £200. - Maximum Leverage: 1:30 for retail clients on major forex currency pairs, and up to 1:500 for professional clients. - Spreads: As low as 1 pip for EUR/USD. - Commission: Offers commission-free trading account. - Negative Balance Protection: Available for both retail and pro clients. - Asset Variety: - Offers trading on a wide variety of assets including forex, indices, metals, energies, cryptocurrencies, commodities, and shares. - Deposit and Withdrawal Options: - Deposit Methods: The specific methods aren't mentioned, but they offer a wide range of deposit methods according to their official website. - Withdrawal Fees: Neteller withdrawals incur a 2% fee; Skrill withdrawals incur a 1% fee. A Neteller deposit fee covered by Vantage of 4.9% + 0.29 USD will be deducted from the withdrawal amount for clients residing in Vietnam. - Customer Support: - Award-winning 24/5 customer support is available to assist traders, although 24/7 support is not provided. - Copy Trade Features: - Copy Trading Program: Vantage has a program where experienced traders (League Traders) share their portfolio, and other traders (Copiers) can follow these experienced traders’ portfolios via PAMM technology.. - AutoTrade: An account mirroring service where only successful FOREX traders are available for auto copying. All traders must be verified and have a proven successful track record before being approved by AutoTrade. - DupliTrade: An automatic trade copying service where traders can copy experienced traders by connecting to DupliTrade with a minimum account funding of $2,000. - Upgraded Copy Trading Features: Vantage has upgraded its copy trading features allowing traders to copy trades from signal providers at the click of a button or apply to become signal providers themselves. - Users Review and Reputation: - BrokerChooser awarded VantageFX a rating of 4.2 out of 5, highlighting the pros such as low non-trading fees, quick account opening, and smooth deposit and withdrawal processes. However, they also mentioned some cons like a limited product selection and room for improvement in customer service. - VantageFX has garnered a reputable standing in the forex trading community based on various reviews and ratings from different platforms. Here's a summary of the reviews and reputation of VantageFX: - Global Reputation: - VantageFX is recognized as a top forex broker with an excellent global reputation. Having commenced operations in 2009 based out of Australia, it has since expanded to numerous locations and has built a substantial worldwide trader base. - Customer Reviews: - On Trustpilot, a user praised VantageFX for being a good broker with friendly customer support and prompt payout processes. They also appreciated the sufficient range of trading instruments provided by the broker. - Regulatory Standing: - Forex Peace Army mentions that Vantage Markets (VantageFX) is regulated by ASIC (Australia), FCA (UK), and CIMA (Cayman Islands), which is a strong indicator of its legitimacy and adherence to international financial standards. - Industry Recognition: - VantageFX, noted for being a well-established and often awarded Australian FX/CFD broker, has undergone evolution over the years to foster a more serious and reputable appearance within the trading community.

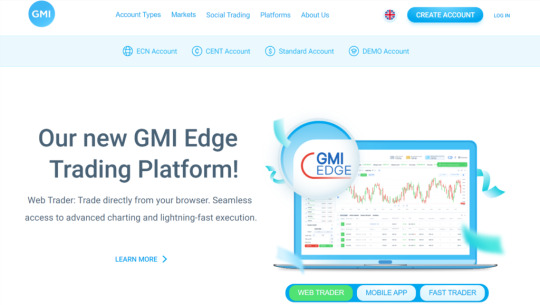

VantageFX seems to provide a well-rounded trading environment with a variety of trading conditions, a broad spectrum of assets, multiple deposit and withdrawal options, responsive customer support, and robust copy trading features to cater to different types of traders. Read more details review for Vantagefx broker to learn more. Register Vantagefx GMI Edge Broker:

- Country of Operation: Initially established in Shanghai, it expanded to have offices within China, Auckland, and London. - Regulatory Status: Regulated by the Financial Conduct Authority (FCA) and the Financial Services Commission (FSC) of Mauritius. - Trading Platform: Offers MT4, Alpine Trader, ClearPro, MTF, and Currenex platforms for trading. - Trading Conditions: - Minimum Deposit: The minimum deposit required to open a standard trading account is $25, and for social trading, the minimum deposit is $500. - Leverage: Up to 1:2000 leverage is available for trading. - Commission: There is no commission charged on trades, and the broker offers contract sizes of 100,000 base currency. - Asset Variety: - GMI Broker provides over 40 forex currency pairs, indices, energy, gold, and silver for trading. - Deposit and Withdrawal Options: - The broker facilitates simple and secure deposit and withdrawal methods. Deposit top-ups are quick, especially during low margin calls, and withdrawals are processed within 24 hours without any extra fees. - Deposit methods include Local Bank Transfer, Neteller, Skrill, Perfect Money, DragonPay, and FasaPay. - Customer Support: - GMI Broker offers online customer support available 24/5 to assist traders with account management and other queries. - Copy Trade Features: - Platform: GMI Social Trading Edge platform is used for copy trading with MAM technology , which allows traders to copy the trades of master traders directly. - Master Traders: A global community of experienced 'Master Traders' are available to be followed. - Profit Sharing: Traders share a percentage of their profits with the Master Traders they choose to follow, with the percentage agreed upon in advance. - Control: Traders have complete control over which trades they want to copy, with real-time monitoring of Master Traders’ performances to help decide when to start and stop following their trades. - User Reviews and Reputation: GMI edge broker is well trusted and have a good reputation in overall in markets according to our research and analysis with more than ten years of history in the forex market. - User Reviews: User reviews can provide a glimpse into the experiences of individuals who have used GMI broker. You can find reviews on platforms like Trustpilot, Forex Peace Army, wikifx or similar review sites. - Global Reputation: GMI egge broker, or Global Market Index, seems to have established a presence in the Forex trading industry. They may have a strong reputation in certain regions, but like many brokers, their reputation may vary across different geographic locations. - Regulatory Standing: GMI brokers is regulated by financial authorities like FCA and VFSC. Regulatory information can be found on the broker's official website or through financial regulatory authorities' websites. - Industry Recognition: GMI broker has received industry awards, including recognition as the Best Liquidity Provider Platform, Best Broker Support for Traders, Best Trading Platform for Traders, and Best Trading Environment for Traders within the financial trading industry, which can be indicative of their standing within the industry.

The GMI Broker's offering seems to cater to a wide range of traders from beginners to advanced, providing various trading conditions and features to enhance the trading experience, read more details review for GMI Edge broker to learn more. Register GMI Broker Read more review here https://eagleaifx.com/best-forex-broker-for-trading-2023/ Read the full article

0 notes

Text

Jemputan untuk menyertai OctaFX

Saya ingin menjemput anda untuk menyertai OctaFX, agar anda dapat melaburkan dana anda dalam pasaran Forex dan menikmati faedah daripada syarat dagangan tiada tandingan. https://octafx.page.link/LQay

#octafx#youtube#forex course#forex analysis#forexmoney#forexmalaysia#forexeducation#mt4#mt5#forex mt4 robot#forexinvestment#forex indicators#forexindonesia

0 notes

Photo

🌟 INTERESTED IN TAMIL CM's VIP SUPPORT? 🌟 ❓ How to join my VIP Channel? 📝 You can join my VIP Channel and get my personal attention & dedicated support if you either, (a) Take my 3-day paid course on Trading Success that covers Technical Analysis, Psychology & Risk Management📈📊📉 -or- (b) Open Trading Accounts with one of my supported brokers below & deposited atleast $100💰💰💰 #1 AlphaFX | My Number 1 Choice, especially for TN People https://www.tamilcm.com/AlphaFX (or) https://www.alphaforexmarkets.com/pub/public_html/liveaccount.php?ref=534918 #2 OctaFX | One of the biggest FX players in INDIA https://www.tamilcm.com/OctaFX (or) https://my.octafx.com/open-account/?refid=ib12109864 #3 IC Markets | Best broker for those outside INDIA https://www.tamilcm.com/ICMarkets (or) http://icmarkets.com/?camp=58393 🌟ONCE DONE, PLEASE PING ME SO THAT I CAN ADD YOU TO MY VIP CHANNEL.🌟 See you soon as a VIP! 🙋🙋♂️🙋♀️ https://www.instagram.com/p/CQQJF4Rs__T/?utm_medium=tumblr

1 note

·

View note

Text

Trade Safely: Why Trusted & Regulated Forex Brokers Win?

Forex trading is a highly lucrative but equally risky financial endeavor. To ensure a secure and profitable trading experience, traders must choose trusted & regulated forex brokers. Regulation in the forex market is crucial as it protects traders from fraudulent activities, ensures transparency, and provides a fair trading environment. With thousands of brokers available, selecting a reliable broker that complies with regulatory standards can make a significant difference in a trader’s success.

This article explores why trading with a trusted & regulated forex broker is the safest and most efficient choice. We will also highlight some of the top brokers in the industry, such as FP Markets, BlackBull, Eightcap, OctaFX, FX Pro, IC Markets, FBS, XM, AXI, and Pepperstone, all of which have proven to be secure and reliable choices for traders worldwide.

The Importance of Trading with a Trusted & Regulated Forex Broker

Regulation is the backbone of a transparent and trustworthy forex market. Regulatory bodies such as the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA), and the Cyprus Securities and Exchange Commission (CySEC) set strict guidelines to ensure Forex Brokers Review operate ethically and maintain financial stability.

Key advantages of regulated brokers:

Fund Protection: Segregation of client funds ensures that traders’ money is protected from misuse.

Fair Trading Environment: Brokers adhere to fair execution policies, ensuring traders get the best market prices.

Security Against Fraud: Regulated brokers operate under strict rules, reducing the risk of scams.

Reliable Dispute Resolution: Traders can seek assistance from regulatory bodies in case of conflicts with brokers.

Why Choose a Trusted & Regulated Forex Broker?

1. Enhanced Security and Fund Protection

One of the biggest concerns for forex traders is the safety of their funds. Regulated brokers ensure that traders’ funds are held in segregated accounts, preventing misuse and protecting them in case of financial difficulties. For instance, IC Markets and FP Markets store client funds in top-tier banks, providing additional security.

2. Fair and Transparent Trading Conditions

Regulated brokers offer real-time market execution with minimal slippage, tight spreads, and fair pricing. Brokers like Pepperstone and XM provide competitive spreads and superior execution speed, making them excellent choices for scalpers and day traders.

3. Protection from Fraudulent Activities

Unregulated brokers can manipulate market prices, delay order execution, or refuse withdrawals. Trusted & regulated forex brokers, such as FX Pro and Eightcap, follow strict ethical guidelines to ensure traders receive honest trading conditions.

4. Access to Advanced Trading Platforms and Tools

Top-tier forex brokers provide access to advanced trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms offer powerful charting tools, automated trading options, and customizable indicators. BlackBull Markets and Eightcap offer traders sophisticated trading technology to enhance their strategies.

5. Educational Resources and Market Insights

Regulated brokers invest in trader education, offering comprehensive resources such as webinars, e-books, and market analysis. Brokers like FBS and AXI provide extensive educational content to help traders make informed decisions and improve their trading skills.

6. Fast and Transparent Withdrawals

Withdrawal delays are a common problem with unregulated brokers. Trusted & regulated forex brokers ensure smooth and fast withdrawals with clear policies. OctaFX and XM have built strong reputations for their transparent and efficient withdrawal processes.

Top Trusted & Regulated Forex Brokers

1. FP Markets

ASIC-regulated with deep liquidity.

Ultra-low spreads from 0.0 pips.

Multi-asset trading and high-speed execution.

2. BlackBull Markets

FMA and FSA regulated.

ECN pricing model with institutional-grade execution.

Suitable for both retail and professional traders.

3. Eightcap

ASIC and VFSC are regulated.

Specializes in forex, cryptocurrencies, and CFDs.

Competitive spreads and transparent pricing.

4. OctaFX

CySEC-regulated.

Offers negative balance protection.

Various trading bonuses and promotions.

5. FX Pro

FCA, CySEC, and SCB regulated.

Advanced cTrader and MT4/MT5 platforms.

Strong liquidity and reliable execution.

6. IC Markets

ASIC and CySEC regulated.

Ultra-low spreads and lightning-fast execution.

A top choice for scalpers and algorithmic traders.

7. FBS

Internationally regulated with multiple licenses.

Various account types, including zero-spread accounts.

User-friendly platform for beginners.

8. XM

FCA and CySEC regulated.

24/5 multilingual customer support.

Free forex education and daily market analysis.

9. AXI

ASIC and FCA regulated.

Institutional-grade trading conditions.

No minimum deposit is required.

10. Pepperstone

ASIC, FCA, and CySEC regulated.

Tight spreads and rapid trade execution.

Trusted by professional traders worldwide.

How to Choose the Best Trusted & Regulated Forex Broker

Selecting the right broker involves careful consideration of several factors:

Regulation & Licensing: Always verify if the broker is licensed by a reputable financial authority.

Trading Fees & Spreads: Look for brokers with tight spreads and low commissions to minimize costs.

youtube

Trading Platforms & Features: Ensure they provide MT4, MT5, or cTrader with powerful trading tools.

Customer Support: A reliable broker should offer responsive and professional support 24/7.

Deposit & Withdrawal Processes: Choose brokers with transparent and efficient transaction policies.

Leverage & Account Options: Assess different account types and leverage levels based on your risk appetite.

Conclusion

Forex trading requires careful planning and a strong risk management strategy, but the choice of broker is equally important. A trusted & regulated forex brokers ensures a secure, transparent, and fair trading environment. Brokers such as FP Markets, BlackBull, Eightcap, OctaFX, FX Pro, IC Markets, FBS, XM, AXI, and Pepperstone have established themselves as industry leaders, offering traders top-notch trading conditions, robust security, and professional support.By choosing a regulated broker, traders can trade with confidence, knowing that their funds are safe and their trading activities are protected. Always conduct thorough research before selecting a broker to ensure it aligns with your trading goals. With the right broker by your side, you can navigate the forex market successfully and achieve long-term profitability.

0 notes

Text

HOW LONG HAS mgforex BEEN IN BUSINESS?

HOW LONG HAS mgforex BEEN IN BUSINESS? Read More http://fxasker.com/question/c602cd8469f5b23a/ FXAsker

#alpari uk trade disabled#CONSULCOCAPITAL#easy forex technical analysis#exness london#exness promotion#forex trading time malaysia#forex trading what is it#fx solutions orthopedics#fxdd hedging#fxdd investment#fxtm vs alpari#HANTEC GROUP#iforex headquarters#MGFOREX#mgforex closed#mgforex mg#octafx jenis akun#options strategies#real time forex excel#roboforex android#roboforex bonus key#tradenext offshore marketing pvt#vantage fx pty ltd#xforex fake or real#xm forex signals#Currency Forex

0 notes

Text

WHY TRADERS CHOOSE OCTAFX?

WHY TRADERS CHOOSE OCTAFX?

Reliable and innovative broker

No commissions on deposit & withdrawal

Best customer support & personal service

The lowest spreads in the industry

Trading on industry leading platforms

Daily market analysis

50% bonus on every deposit

Great choice of assets

Free educational materials

OctaFX Affiliates get much more than an opportunity to attract clients

Quick and easy way to get started

Perfect…

View On WordPress

0 notes

Text

Analysis: ESMA and the Professionalisation of the Retail Industry

http://dalaznews.com/news/financial-and-business/analysis-esma-and-the-professionalisation-of-the-retail-industry/

It is been substantially much less than 4 months thinking about that the European Securities and Marketplaces Authority (ESMA), a regulatory whole physique whose recognize is most likely to ship shivers down the spines of retail brokers, announced its new limits on contracts-for-discrepancies (CFDs) and binary choices.

By now, most males and ladies in the retail marketplace are typical with the regulation but, for these of you who have been residing underneath a rock, ESMA’s edicts are continue to worthy of going much more than. Beware, this will make for scintillating stuff.

Binary options are out. Extended gone. Kaput. Finito. ESMA has decided to prohibit the marketing and advertising, distribution, and sale of them. This is effortless to recognize offered that the behaviour of chosen industry gamers has led many to consider that the antonym of ‘scrupulous’ is in easy truth ‘binary possibilities broker.’

Fewer effortless to recognize, at minimum from the viewpoint of many in the sector, are ESMA’s restrictions on CFDs investing. From the 1st of August of this 12 months, brokers will only be permitted to supply clientele with leverage of 30:1 on CFDs in essential forex pairs, 20:1 in indices, non-key forex pairs and gold and two:1 in cryptocurrencies.

Owning go via the guidelines, and recovered from their preliminary shock, some brokers have created the selection they will not be capable to continue becoming in organization if they stay in the Aged Continent. As a outcome, many are transferring offshore or shutting up shop completely.

Finance Magnates

The regulation is not just a problem for lesser gamers each. Even although they forecast a return to profitability in the up coming year, IG Group, one particular of the greatest corporations in the retail broking space, admitted in its most modern day financial report that the new laws are most likely to outcome in a slump in its revenues.

Aside from fleeing Europe and settling in, to place it kindly, a a lot much more broker-pleasant state someplace out in the Pacific or in the midst of the Caribbean, brokers do have one particular much more generally signifies of limiting the impression of the regulation – reclassification.

ESMA’s regulation only applies to retail traders. That suggests if a broker’s client decides to reclassify as a certified trader, none of the leverage limitations will implement to him.

Proper following in depth investigation and conversations with a range of leading brokers, Finance Magnates has situated that, whilst it will significantly reshape the sector, ESMA’s regulation may possibly not harm some broker’s revenues as a wonderful deal it would to start off with seem.

Bringing in the pros

Two weeks ago, Moreover500, one particular of the leaders in the CFDs retail trading industry, introduced a trading update for purchasers. The organization was optimistic, stating that it seems set to have a stellar functionality in Q2 of the existing fiscal yr.

Contained in just the assertion was one particular much more attractive piece of information. The CFD broker pointed out that of its current customer-base, 12 % would attainable be prepared to reclassify as Elective Certified Shoppers (EPCs).

Considerably, the traders that constructed up that 12 % ended up reliable for bringing in 75 per cent of In addition500’s revenues. The implications of this had been becoming constructed distinct by the organization itself.

“The Board thinks,” talked about the broker’s assertion, “that the Group’s EPC featuring puts it in a potent posture to sustain income from these shoppers pursuing the implementation of the new ESMA policies.”

Not on your personal

In addition500 is not the only firm to have a tiny phase of its clientele delivering it with the bulk of its revenue. Finance Magnates spoke to a quantity of brokers who proposed that a comparable proportion of their traders had been furnishing the thoughts-boggling bulk of their revenue circulation.

Graeme Watkins, CEO, Valutrades

“The industry has a sort of 90/10 rule,” stated Valutraders CEO Graeme Watkins, “where we say that 10 per cent of your clientele create 90 per cent of your revenue. I would say that quite a lot all brokers, invariably, will create most of their revenue from the key conclude of their organization.”

Two other firms that Finance Magnates spoke to, OctaFX and InterTrader, agreed. Even though they did not expose their have numbers, the two stated that brokers could anticipate roughly 20 % of shoppers to create 80 % of income.

In a modern day announcement, IG Group also noted that 3800 of its clientele, who are labeled as certified, knowledgeable contributed 35 % of its leveraged trading earnings in the prior quarter. The organization added that it is now sifting by way of 15,000 applications from retail purchasers who want to be reclassified as knowledgeable traders.

Similarly, in its gargantuan yearly report, CMC Marketplaces stated that it “is in the method of examining shopper requests to be treated as elective specialist clientele.” The firm added that it has a “strategy of attracting and retaining superior cost and professional clientele to mitigate some of the impact [of the ESMA regulation].”

Our eager eyed guests will have realised that most of the earlier talked about figures match neatly with the Pareto principle. This is the believed that roughly 20 % of a group participating in a specific activity, irrespective of whether or not it be shelling out taxes, proudly owning land or committing crimes, will be accountable for 80 per cent of that workout.

The adjust in this predicament is that, ideally for brokers, their very best 20 % of traders will no lengthier be topic matter to the exact same guidelines as the other 80 %. How fast that will be to apply is dependent on a variety of variables.

Suggested write-up content material

Bulgaria to Host Worldwide Crypto Convention: Sterlin Lujan 1st time in Sofia on StageGo to write-up >>

In order to reclassify a client as a skilled, brokers have to jump via a quantity of regulatory hoops. Shoppers have to to start off with point out, in creating, that they want to be labeled as a knowledgeable.

A broker getting these a ask for should then evidently recommend to the customer that they will drop all regulatory protections and payment legal rights. Following this, the shopper ought to state in crafting, in a new document, that he is knowledgeable of the penalties of dropping this sort of protections.

Finance Magnates

Simple, perfect? Other than the program does not close listed right here. Just following this, a broker will have to give the customer a take a appear at that demonstrates he is capable of generating his private investment selections and has an understanding of the dangers involved. How this examination is made would look be at the discretion of the broker.

More than the program of this exam, a attainable client ought to also satisfy two of three difficulties. If they do not make an ordinary of 10 trades of “significant size” per quarter, shoppers ought to have a portfolio truly worth €500,000 ($586,000) and much more than a year’s worth of functioning knowledge in the fiscal sector.

These principles depart some wiggle region for unscrupulous behaviour- how huge is a trade of “significant size” for occasion? – and some brokers at the moment seem to be getting obtain of the them.

“We’ve heard that a quantity of brokers are trawling by means of LinkedIn, obtaining shoppers with some tenuous hyperlink to finance, and telling them they need to truly reclassify.” Talked about Watkins. Other folks have noted a comparable sample but truly do not think the trend is attainable to quite final.

“In the preceding, the FCA hasn’t taken in depth to react to new regulation.” Stated Christian Rolando, founder of Lugano Associates, a London-centered regulatory specialist to brokers, “at some phase they’ll come looking and, if brokers are not behaving appropriately, they’ll consider about enforcement action.”.”

Switching approaches

Irrespective of any backhanded options, many brokers are rather open up about the reality that they will be encouraging their purchasers to reclassify as specialist.

“We will not only persuade the most crucial traders which are eligible for reclassification,” explained George Pantzis, a manager in OctaFX’s study division, to Finance Magnates, “but will also permit them to create into added knowledgeable by signing up to our educational study course and by becoming a member of a purchasing and promoting academy.”

Other corporations are not remaining relatively as explicit as Pantzis but the moves they are generating nonetheless recommend they are obtaining comparable actions. As popular, IG Group and CMC Marketplaces are equally heading as a outcome of customer requests to reclassify as expert.

CMC Markets has even introduced a new provider to cater to a added substantial-conclude clientele. In April, the broker released CMC Expert, a new help constructed to preserve a consumer-base that trades with higher leverage.

A additional broker, InterTrader, has performed the quite exact same factor. At the beginning of July, the broker confirmed that it was going to commence providing a certified help to traders.

“The trading earth is altering and we’re switching with it.” Claimed the firm’s CEO, Shai Hefetz, “Our state-of-the-art purchasing and promoting program is tailor-created to significant traders who demand from clients key investing gear.”

Professionalisation

“There is generally a misunderstanding that the marketplace is hugely saturated, but this is not the situation at all,” ActivTrades’ CEO Alex Pusco explained to Finance Magnates this June, “we are just at the beginning.”

There appear to be two meanings to the this statement, one particular is genuine and the other is not. The retail industry is not just starting, as most persons searching at this quick write-up are informed, it has been about for decades.

On the other hand, we may possibly possibly in truth be at the beginning of a new phase inside the lifecycle of the retail investing sector. In reality, the modifications we are seeing may possibly recommend it is no longer even appropriate to refer to the sector as ‘retail’.

The behaviour of brokers so significantly suggests that ESMA’s regulation has pushed them into concentrating on wealthier, professional shoppers. This is illustrated by their emphasis on generating skilled products about the previous six months and their encouraging of specific, earnings-constructing shoppers to reclassify as skilled.

A number of in the field have predicted that ESMA’s regulation will push out the lesser, significantly much less professional brokers but the identical could be true for brokers’ clientele. If these brokers no lengthier devote any vitality to retaining or onboarding purchasers that truly do not qualify as professional traders, the choice of genuinely ‘retail’ shoppers may possibly possibly shrink substantially.

That would imply we are left with only substantial brokers and skilled traders. Is that nevertheless the retail organization? Possibly, but undoubtedly not as we following realized it.

0 notes

Text

DO Mtrading GUARANTEE THE SAFETY OF MY DEPOSITED FUNDS IN Mtrading?

DO Mtrading GUARANTEE THE SAFETY OF MY DEPOSITED FUNDS IN Mtrading? Read More http://fxasker.com/question/825858bf9ec6e8f2/ FXAsker

#aaafx auszahlung#activtrades execution#ads securities promo#afx capital linkedin#avatrade products#broker forex yang halal#city index minimum deposit#CMTRADING#day trading systems#delta stock analysis#easy forex binary options#gkfx bonus 2016#hotforex thailand#instaforex bd#instaforex promo#introducing broker mifid#MTRADING#NICO FINANCIAL#oanda deposit bonus#octafx london#TFB#thinkforex ecn#ufx stock#windsor golf course#windsor hills#Trading Commodities

0 notes

Text

Can I Open More Than One Account With hkt?

Can I Open More Than One Account With hkt? Read More http://fxasker.com/question/d09d5a07ee0df75a/ FXAsker

#ayondo kunden werben#CFHSYSTEMS#commodity futures#forex account free#forex course kuala lumpur#forex online trading#forex time segmented volume indi#fxcm xag#go markets withdrawal#HKT#hot forex analysis#HUGEDOMAINS#icmarkets margin#ig markets melbourne office#instaforex india office#nordfx account blocked#nordfx time zone#octafx trading volume#pepperstone welcome bonus#PFGBEST#PLUSTOCKS#swissquote yahoo#teletrade 5#what is xtrade#windsor 730#Trend Trading

0 notes

Text

Why Does My EA Keep Opening Multiple Positions With QuickOption?

Why Does My EA Keep Opening Multiple Positions With QuickOption? Read More http://fxasker.com/question/3ee5f3079ed7f64d/ FXAsker

#ads securities orex optim#aetos machine#avatrade margin call#ayondo brokers#forex trading yahoo#fxcc metatrader 4 download#fxpro united states#fxtm london#gkfx offer#hotforex debit card#ibfx spreads#iforex 2ch 90#iforex romania#ironfx glassdoor#nikon fx pareri#oanda leverage#octafx penipu 2015#pepperstone indicators#QUICKOPTION#roboforex analysis#silver bullion prices#swissquote debit card#teletrade india#windsor xtreme paintball#xm forex opinioni#Commodity Trading Systems

0 notes