#nikhil kamath

Explore tagged Tumblr posts

Text

Nikhil Kamath's Apartment Purchase Sparks Rent vs. Buy Debate

Zerodha co-founder Nikhil Kamath, known for advocating renting over buying, has made headlines with his recent apartment purchase. This marks a shift in his stance and reignites the ongoing debate about the merits of renting versus buying a home.

Key Takeaways:

Purchase Details: Kamath's new apartment purchase has prompted discussions about whether buying is a sound decision for others.

Kamath's Insight: On his podcast "WTF is with Nikhil Kamath," he shared that while renting offers flexibility, it also comes with uncertainties about when one might need to relocate.

Renting vs. Buying:

Financial Considerations: Experts suggest evaluating personal finances, job stability, and life circumstances when deciding whether to rent or buy.

Example Scenario: A tenant in Bengaluru paying ₹50,000 monthly for a 2 BHK worth ₹1.2 crore may find that over ten years, the total rental expenditure could reach ₹83 lakh, representing a significant outflow with no asset accumulation.

Market Trends: Recent data indicates that rental values in major Indian cities have increased significantly, often outpacing capital appreciation, which can affect the decision to buy.

Homeownership Benefits:

Owning property can secure an asset, providing stability in uncertain economic climates.

Homeownership can yield long-term financial benefits, especially considering tax advantages associated with home loans.

Expert Opinions:

Abhishek Lodha, MD of Macrotech Developers, emphasized that rising rental costs could deter wealth creation, advocating for homeownership to foster family stability and respectability.

Affordability Assessment: Before purchasing, individuals should ensure they have enough savings for a down payment (30-40% of the property value) to avoid financial strain in the future.

Location Considerations: When selecting a property, consider established areas with infrastructure, accessibility, and proximity to essential services.

Kamath's purchase signals a potential shift in his philosophy and offers a new perspective on a commonly debated issue. As the real estate market continues to evolve, understanding personal financial situations and market trends is crucial for making informed decisions.

0 notes

Text

Rhea Chakraborty Reveals Her Friends Were Drinking And Dining With Her Parents While She Was In Jail; ‘Kamino, Mai Jail Mai Hu…’ | People News

New Delhi: Rhea Chakraborty faced the biggest nightmare after the death of her boyfriend and late actor Sushant Singh Rajput in 2020. The actress was sent to jail as she was alleged to procure drugs to Sushant and even his family alleged that it was, she who killed the actor. Rhea is out from jail on bail along with her brother Showik and to date is fighting to come out clean. But Rhea is slowly…

0 notes

Text

Kriti Sanon considers Shah Rukh Khan "cool": "He can make you laugh in a serious conversation"

Kriti Sanon has expressed her respect for Shah Rukh Khan, the actor she costarred with in Dilwale. In a recent podcast with Zerodha creator Nikhil Kamath, Kriti discussed what makes SRK so awesome. Kriti characterized Shah Rukh Khan as "cool," citing his distinct combination of confidence, intelligence, wit, and humility.

"Shah Rukh Khan is cool": Kriti Sanon Kriti stated, "I think Shah Rukh Khan is cool." He exudes confidence, and he is educated, humorous, and capable of making you laugh as well as himself. He can be charming and change himself depending on where he is. He can make you laugh even in a serious conversation.

SRK's capability to convey "humility and arrogance" Nikhil Kamath mirrored Kriti's thoughts, pointing out SRK's exceptional ability to "project humility and arrogance in the same conversation" without offending anyone. He called SRK's approach "incredible to watch" and emphasized the significance of adding a "anti-thesis" to one's personality for depth.

Nikhil Kamath spoke about his own encounters with SRK, adding that he enjoys visiting the superstar's home for lengthy chats. He regarded SRK's advise as "incredible" and emphasized the need of obtaining help from such seasoned persons.

Kriti Sanon's forthcoming projects On the work front, Kriti Sanon has a number of releases scheduled for 2024. Her most recent flicks include Teri Baaton Mein Aisa Uljha Jiya and Crew. Her next projects include Housefull 5 and the No Entry sequel.

#Dilwale#Features#Kriti Sanon#Nikhil Kamath#Shah Rukh Khan#bollywood hungama#ott platform#news#bollywood#social media#bollywood news#music#ott

0 notes

Text

Actor Ranbir and investor Nikhil talk politics, share their experiences with PM Modi

Bollywood actor Ranbir Kapoor and noted entrepreneur Nikhil Kamath, in a rare conversation, have opened up about their personal lives and also shared the complexities of their disparate professions. The accomplished duo also talked about politics and reminisced about their association and close interaction with Prime Minister Narendra Modi.

Source: bhaskarlive.in

0 notes

Text

10 Profitable Indian Startups: A SWOT Analysis.

The steady growth of the Indian economy and the spurt in consumer index has given rise to numerous startups or online-native companies over the last decade or so. Some of these companies garnered recognition from consumers and international investors and soon became giants. For some, after the initial euphoria of high valuations and brand equities, they have got mired in controversies. There are a few who have moved silently and are today witnessing profits on their bottomlines.

ALSO READ MORE- https://apacnewsnetwork.com/2024/07/10-profitable-indian-startups-a-swot-analysis/

#10 Profitable Indian Startups#10 Profitable Indian Startups: A SWOT Analysis#10 Profitable Startups#10 Profitable Startups Indian#A SWOT Analysis#analyzes 10 Profitable Indian Startups#BillDesk#BillDesk India’s Preferred Payment Gateway#Capitalizing on Indian Cricket’s Dream Run#CEO & Founder at Nykaa#Chai pe Charcha Through GenAI#Co-Founder at Zerodha#Democratizing Stock Investing#Dream11#Dream11 Profitable Indian Startup#Dream11: Capitalizing on Indian Cricket’s Dream Run#EaseMyTrip#EaseMyTrip Rise of the Online Travel Agent#Falguni Nayar#Falguni Nayar CEO & Founder at Nykaa#Founder & CEO at Zerodha#Gupshup#Gupshup Chai pe Charcha Through GenAI#India’s Preferred Payment Gateway#Inframarket#Inframarket Construction Sector Gets a Digital Makeover#Mamaearth Eco-Friendly Touch for Babies and Moms#Nikhil Kamath#Nikhil Kamath Co-Founder at Zerodha#Nithin Kamath

0 notes

Text

Exclusive! Manushi Chhillar And Nikhil Kamath Broke Up 3 Months Back On 'Amicable Note'

Manushi Chhillar and Nikhil Kamath dated for about two years. Rhea Chakraborty isn’t the reason behind Manushi Chhillar and Nikhil Kamath’s break up. A source confirms that the duo parted ways without any hard feelings. Manushi Chhillar shot to instant fame when she was crowned Miss World in 2017. And last year, she marked her acting debut opposite Akshay Kumar in the historical action drama…

View On WordPress

1 note

·

View note

Text

38-year-old billionaire Nikhil Kamath's No. 1 tip for entrepreneurs

0 notes

Text

'Don't turn to the previous generation...': Nikhil Kamath of Zerodha shares the secret to future-proofing your business

Zerodha founder Nikhil Kamath says the secret to staying ahead in the industry is not in business planning or manufacturing wisdom but in watching what the country’s 16-year-olds are doing. Speaking to LinkedIn CEO Ryan Roslansky on The Way video series, Kamath made a strong case for adapting to youth: “Look at what a 16-year-old boy wants and what he’s going to want in the next 10 years. Don’t…

0 notes

Text

Listening to the Next Generation: Why Leaders Should Seek Advice from Teens

2025-01-02 In a world rapidly evolving, traditional wisdom might not always hold the key to future success. This is the belief of Nikhil Kamath, the founder of Zerodha, India’s largest stock brokerage. During a recent interview with LinkedIn CEO Ryan Roslansky, Kamath advocated for a unique approach to foresight: seeking guidance from teenagers. Kamath argued that instead of relying solely on the…

0 notes

Text

Milyarder Uyardı: Gençlere Yatırım Yapmanın Başarıda Anahtar Rolü!

BİRFİNANSCİ.COM – DIŞ HABERLER SERVİSİ Kariyerinizle ilgili kritik bir karar alırken, çocuklarınızdan tavsiye almak ilk akla gelen yöntem olmayabilir. Ancak, CNBC’nin haberine göre bir iş kurmayı veya ek bir iş başlatmayı düşünüyorsanız, bu fikri yeniden gözden geçirmeniz faydalı olabilir. Online borsa ticaret platformu Zerodha’nın kurucusu olan 38 yaşındaki milyarder Nikhil Kamath, “Bundan 20…

0 notes

Text

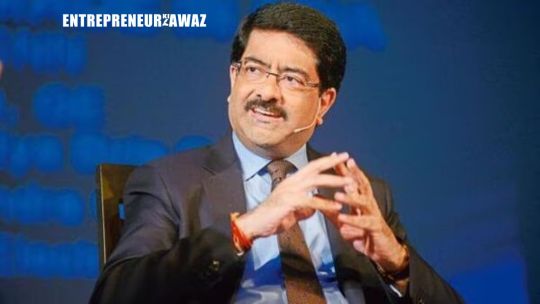

Kumar Mangalam Birla: ₹1 Crore Isn't Enough to Start a Business

In an exclusive interview, Kumar Mangalam Birla stated that ₹1 crore is insufficient for starting up a business in India. He advises up-and-coming entrepreneurs to adopt scalable models, seek partnerships, and understand the market dynamics for successful ventures.

But, if you want to start a business with a capital of ₹1 crore, thinking you’ve got enough cash to manage running it, then most probably you should say goodbye to that idea.

In an unguarded conversation with Nikhil Kamath, co-founder of Zerodha, Kumar Mangalam Birla, chairman of the Aditya Birla Group, turned to that burning issue for youth: Is ₹1 crore really enough to start a business?

Spoiler alert—Mr. Birla doesn’t think so.

Wondering about a start-up aspiration and reality check from the economic perspective, Kamath threw that oft-asked question by many young would-be business owners, “If a young entrepreneur had sticky ₹1 or 2 crores, would there be an industry that would recommend entering with strong tailwinds?” Read more

0 notes

Text

'There were drawbacks to dropping out...': Nikhil Kamath on the challenges behind Zerodha's success

Nikhil Kamath, co-founder of Zerodha, has built an empire in India's financial sector, but his path has been anything but conventional. Kamat, who leaves school at 15 or 16, has openly discussed the challenges and insecurities of skipping formal education. In a conversation with LinkedIn CEO Ryan Roslansky, Kamath admitted that “dropping out of school and not having a formal higher education had…

0 notes

Text

'Never Said No To My Father': On Nikhil Kamath's Podcast, Ranbir Kapoor Opens Up About Relation With Rishi Kapoor | People News

Mumbai: Bollywood superstar Ranbir Kapoor, who smashed the box-office records with his last release ‘Animal’, is set to appear on Nikhil Kamath’s podcast titled ‘WTF People’. The teaser of the upcoming episode of the podcast was unveiled on Saturday sending the fans of the actor in a frenzy given the actor isn’t much in the public eye. Ranbir Kapoor will join the Zerodha co-founder Nikhil Kamath…

#Nikhil Kamath#Nikhil Kamath’s podcast#ranbir kapoor#Ranbir Kapoor On Nikhil Kamath#WTF People Podcast

0 notes

Text

'There were drawbacks to dropping out...': Nikhil Kamath on the challenges behind Zerodha's success

Nikhil Kamath, co-founder of Zerodha, has built an empire in India's financial sector, but his path has been anything but conventional. Kamat, who leaves school at 15 or 16, has openly discussed the challenges and insecurities of skipping formal education. In a conversation with LinkedIn CEO Ryan Roslansky, Kamath admitted that “dropping out of school and not having a formal higher education had…

0 notes

Text

'There were drawbacks to dropping out...': Nikhil Kamath on the challenges behind Zerodha's success

Nikhil Kamath, co-founder of Zerodha, has built an empire in India's financial sector, but his path has been anything but conventional. Kamat, who leaves school at 15 or 16, has openly discussed the challenges and insecurities of skipping formal education. In a conversation with LinkedIn CEO Ryan Roslansky, Kamath admitted that “dropping out of school and not having a formal higher education had…

0 notes

Text

Manushi Chhillar BREAKS UP With Rumoured Beau Nikhil Kamath Amid Rhea Chakraborty Dating Rumours?

Rhea Chakraborty was earlier rumoured to be dating Bunty Sajdeh. Nikhil Kamath and Manushi Chhillar have unfollowed each other on social media in the wake of the Rhea Chakraborty rumours. Manushi Chhillar, crowned Miss World in 2017 and known for her Bollywood debut opposite Akshay Kumar in Samrat Prithviraj, was dating Zerodha founder Nikhil Kamath since 2021. But, looks like the duo has now…

View On WordPress

#manushi chhillar#nikhil kamath#rhea chakraborty#rhea chakraborty SSR#Sushant Singh Rajput death#sushant singh rajput rhea chakraborty

1 note

·

View note