#niftypredictiontechnicalchart

Text

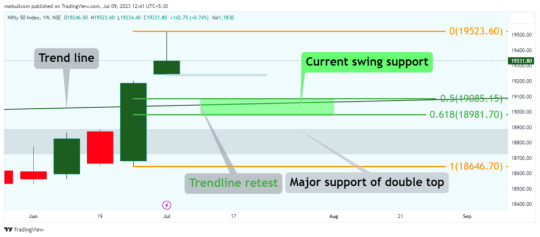

Nifty: Current Support and Final Target Before Crash

Introduction:

Recently institutional investors made significant profit bookings when the Nifty reached the psychological level of 19500. This development has sparked discussions and raised concerns about the possibility of a market crash. In this blog, we will delve deeper into the current situation, examining the ongoing swing target, support levels, and the potential for a continued bullish rally. Additionally, we will analyze the formation of an inverted hammer pattern and its implications for future price movements.

The Uncompleted Swing Target:

Despite the profit bookings, it is essential to note that the current swing target has not yet been achieved. This suggests that there is still room for further upward movement in Nifty. Traders and investors should exercise caution before assuming a bearish market sentiment.

Support at 19085 and Retest of Trendline:

To provide stability, a support level has been established at 19085. This level acts as a floor for the market, preventing significant declines. Additionally, there is a retest of a trendline that broke upside on June 30th, indicating the potential for the bullish trend to continue without retracement. This retest further supports the notion that a market crash is unlikely at this point.

The Strongly Bullish Trend:

One of the positive factors contributing to the optimism is the strongly bullish trend observed in Nifty. The index has displayed resilience and the potential to continue its rally without significant retracement. This trend reflects the confidence and optimism of market participants.

Analyzing the Inverted Hammer Pattern:

On the weekly chart, an inverted hammer pattern has formed in Nifty. Traditionally, this pattern signifies a reversal from a bullish to a bearish trend. However, it is crucial to approach this pattern with caution. Until the low of the previous candle is breached and closed below 19234.40, there is still a possibility of further upward movement in the index.

Conclusion:

Institutional investors' profit bookings at the psychological level of 19500 in Nifty have sparked concerns about a potential market crash. However, considering the uncompleted swing target, the presence of a support level at 19085, and the retest of the trendline, a crash seems unlikely in the near term. The strongly bullish trend also supports the potential for a continued rally in Nifty. While the inverted hammer pattern suggests a reversal, confirmation through the breach of key levels is crucial. Traders and investors should closely monitor the price action and the breach of the low of the previous candle to gauge the direction of future price movements in Nifty. By staying informed and vigilant, market participants can make more informed decisions in these dynamic times.

Read the full article

#Nifty#niftychart#niftyfibonaccilevels#niftylive#niftyliveanalysis#NiftyLiveChart#niftypredictionfortomorrow#niftypredictiontechnicalchart#niftysupportandresistance#niftytechnicalanalysis#niftytoday#niftytradesetup

0 notes