#nifty 50 index

Explore tagged Tumblr posts

Text

Nifty 50: A Comprehensive Overview of India's Premier Stock Market Index

The Nifty 50, often simply referred to as the “Nifty,” is a stock market index that holds a prominent position in the Indian financial landscape. Comprising 50 of the largest and most actively traded stocks listed on the National Stock Exchange of India (NSE), the Nifty 50 serves as a barometer for the Indian equity markets and is widely followed by investors, analysts, and policymakers…

View On WordPress

0 notes

Text

Hello All, Stock Market Analysis - Nifty reversal point? Watch this blog to get clarity where Nifty would make bottom in near future. Click this link for detailed analysis of Nifty Index

0 notes

Text

Analysis of Nifty 50: Market Movements and Highlights

The Nifty 50 is the key driver of the economy. This in-depth review analyzes key support and resistance levels and technical and fundamental factors that influence market momentum. Stay informed and make smarter investment decisions with this information.

0 notes

Video

youtube

DSP Nifty Smallcap250 Quality 50 Index Fund Opportunity to Invest in Mul...

0 notes

Text

Where to Invest I Index Funds I Beginners Guide

Where to Invest for Beginners? How to get started with investment? Is it good to invest in Index Funds? Let's answer these question in this video below.

Diversification is a key element of a balanced portfolio. There is a plethora of investment options to choose from and it is a good practice to invest your funds across different asset classes. An Index fund is like a mutual fund and exactly imitates an index (e.g., Nifty 50, Bank Nifty, Nifty Midcap, etc.). It thus helps in diversifying your investment and mitigates the risk of your equity portfolio.

#Where to Invest for Beginners?#How to get started with investment?#Is it good to invest in Index Funds?#Where to invest for beginners? Investment for beginners#Nifty 50 Index Fund#Long term investment for beginners#Beginners guide to investment

0 notes

Text

🔰 How to become a skilled trader in the stock market ❓

1️⃣ Learn the basics: Understand stock market dynamics, read charts, and stock analysis. 2️⃣ Find your style: Choose a trading style that suits YOU – day trading, swing trading, etc. 3️⃣ Plan your strategy: Set clear investment goals, risk tolerance, and diversify your assets. 4️⃣ Open a brokerage account: Align with your goals and trading style. 5️⃣ Start small, grow steady: Begin with a small investment and gradually increase it. 6️⃣ Manage risk wisely: Set stop-loss orders and avoid excessive risks. 7️⃣ Stay informed: Stay updated on market trends and news through financial media and social networks.

🌟 Embark on a journey of discovery and growth! Join us for captivating content that ignites your curiosity.

Explore more at 👉👀

Download the mobile app👉 📲

Connect at 📱 +91 8750000121

🤝Here's to your success, may your trades be prosperous and your investments bloom! We wish you a happy 'ZERO BROKERAGE' trading.🚀🌷

⚠ 📜 Note.-Investments in the securities market are subject to market risks, read all related documents carefully before investing.

⚠ 📜 Note.-Brokerage will not exceed the rates specified by SEBI and the Exchanges.

#branding#investing#mutual funds#equity#commodity#nifty#trading view#stock broker#stock market#stocktrading#stockmarket#investing stocks#trading strategies#nifty today#nifty bank index#share market#nifty 50#nifty prediction#ipo#algo trading#futures trading#options trading#intraday trading#people#like#comments#tradelikeapro#thank you

1 note

·

View note

Text

Investment Options in India: Diversify Your Portfolio in 2024

Diversification is a fundamental principle of investing, essential for managing risk and optimizing returns. In 2024, as investors navigate an ever-changing economic landscape, diversifying their portfolios becomes even more critical. India, with its vibrant economy, diverse markets, and growth potential, offers a plethora of investment options for both domestic and international investors. In this comprehensive guide, we explore various investment avenues in India in 2024, from traditional options like stocks and real estate to emerging opportunities in startups and alternative assets.

1. Equities: Investing in the Stock Market

Investing in equities remains one of the most popular ways to participate in India's economic growth story. The Indian stock market, represented by indices such as the Nifty 50 and Sensex, offers ample opportunities for investors to capitalize on the country's booming sectors and emerging companies.

- Blue-Chip Stocks: Invest in established companies with a proven track record of performance and stability.

- Mid and Small-Cap Stocks: Explore growth opportunities by investing in mid and small-cap companies with high growth potential.

- Sectoral Funds: Diversify your portfolio by investing in sector-specific mutual funds or exchange-traded funds (ETFs) targeting industries such as technology, healthcare, and finance.

2. Mutual Funds: Professional Fund Management

Mutual funds provide an excellent avenue for investors to access a diversified portfolio managed by professional fund managers. In India, mutual funds offer a range of options catering to different risk profiles and investment objectives.

- Equity Funds: Invest in a diversified portfolio of stocks, including large-cap, mid-cap, and small-cap companies.

- Debt Funds: Generate stable returns by investing in fixed-income securities such as government bonds, corporate bonds, and treasury bills.

- Hybrid Funds: Combine the benefits of equity and debt investments to achieve a balanced risk-return profile.

- Index Funds and ETFs: Track benchmark indices like the Nifty 50 and Sensex at a lower cost compared to actively managed funds.

3. Real Estate: Tangible Assets for Long-Term Growth

Real estate continues to be a popular investment option in India, offering the dual benefits of capital appreciation and rental income. While traditional residential and commercial properties remain attractive, investors can also explore alternative avenues such as real estate investment trusts (REITs) and real estate crowdfunding platforms.

- Residential Properties: Invest in apartments, villas, or plots of land in prime locations with high demand and potential for appreciation.

- Commercial Properties: Generate rental income by investing in office spaces, retail outlets, warehouses, and industrial properties.

- REITs: Gain exposure to a diversified portfolio of income-generating real estate assets without the hassle of direct ownership.

- Real Estate Crowdfunding: Participate in real estate projects through online platforms, pooling funds with other investors to access lucrative opportunities.

4. Startups and Venture Capital: Betting on Innovation and Entrepreneurship

India's startup ecosystem has witnessed exponential growth in recent years, fueled by a wave of innovation, entrepreneurial talent, and supportive government policies. Investing in startups and venture capital funds allows investors to participate in this dynamic ecosystem and potentially earn high returns.

- Angel Investing: Provide early-stage funding to promising startups in exchange for equity ownership, betting on their growth potential.

- Venture Capital Funds: Invest in professionally managed funds that provide capital to startups and emerging companies in exchange for equity stakes.

- Startup Accelerators and Incubators: Partner with organizations that support early-stage startups through mentorship, networking, and access to resources.

5. Alternative Assets: Diversification Beyond Traditional Investments

In addition to stocks, bonds, and real estate, investors can diversify their portfolios further by allocating capital to alternative assets. These assets offer unique risk-return profiles and can act as a hedge against market volatility.

- Gold and Precious Metals: Hedge against inflation and currency fluctuations by investing in physical gold, gold ETFs, or gold savings funds.

- Commodities: Gain exposure to commodities such as crude oil, natural gas, metals, and agricultural products through commodity futures and exchange-traded funds.

- Cryptocurrencies: Explore the emerging asset class of digital currencies like Bitcoin, Ethereum, and others, which offer the potential for high returns but come with higher volatility and risk.

Conclusion

Diversifying your investment portfolio is essential for mitigating risk, maximizing returns, and achieving long-term financial goals. In 2024, India offers a myriad of investment options across various asset classes, catering to the preferences and risk profiles of different investors.

Whether you prefer the stability of blue-chip stocks, the growth potential of startups, or the tangible assets of real estate, India provides ample opportunities to diversify your portfolio and capitalize on the country's economic growth story. By carefully assessing your investment objectives, risk tolerance, and time horizon, you can construct a well-diversified portfolio that withstands market fluctuations and delivers sustainable returns in the years to come.

This post was originally published on: Foxnangel

#best investment options in india#diversify portfolio#share market#stock market#indian stock market#mutual funds#real estate#startups in india#venture capital#foxnangel#invest in india

4 notes

·

View notes

Text

What is Nifty 50 | Bajaj Finserv

As a leading financial services provider in India, Bajaj Finserv offers comprehensive solutions including loans, insurance, and investment options. To explore what is nifty 50 is, check out the YouTube video from Bajaj Finserv. This video provides an in-depth explanation of the Nifty 50 index, detailing its composition, significance, and influence on the financial market. Watch now to get a thorough understanding of Nifty 50 and how it can impact your investment strategy.

2 notes

·

View notes

Text

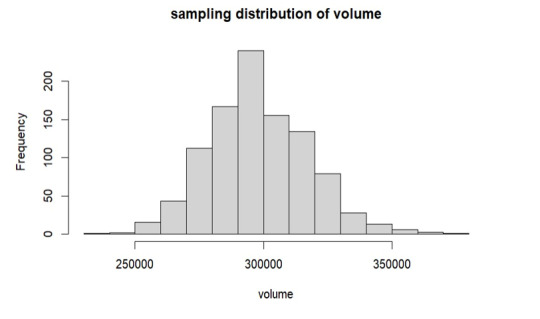

Unveiling Market Insights: Exploring the Sampling Distribution, Standard Deviation, and Standard Error of NIFTY50 Volumes in Stock Analysis

Introduction:

In the dynamic realm of stock analysis, exploring the sampling distribution, standard deviation, and standard error of NIFTY50 volumes is significant. Providing useful tools for investors, these statistical insights go beyond abstraction. When there is market volatility, standard deviation directs risk evaluation. Forecasting accuracy is improved by the sample distribution, which functions similarly to a navigational aid. Reliability of estimates is guaranteed by standard error. These are not only stock-specific insights; they also impact portfolio construction and enable quick adjustments to market developments. A data-driven strategy powered by these statistical measurements enables investors to operate confidently and resiliently in the financial world, where choices are what determine success.

NIFTY-50 is the tracker of Indian Economy, the index is frequently evaluated and re-equalizing to make sure it correctly affects the shifting aspects of the economic landscape in India. Extensively pursued index, this portrays an important role in accomplishing, investment approach ways and market analyses.

Methodology

The data was collected from Kaggle, with the (dimension of 2400+ rows and 8 rows, which are: date, open, close, high, low, volume, stock split, dividend. After retrieving data from the data source, we cleaned the null values and unnecessary columns from the set using Python Programming. We removed all the 0 values from the dataset and dropped all the columns which are less correlated.

After completing all the pre-processing techniques, we imported our cleaned values into RStudio for further analysis of our dataset.

Findings:

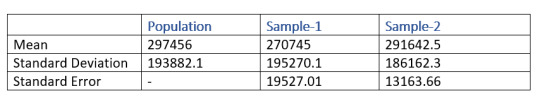

Our aim lies in finding how the samples are truly representing the volume. So, for acquiring our aim, we first took a set of samples of sizes 100 and 200 respectively. Then we performed some calculations separately on both of the samples for finding the mean, standard deviation, sampling distribution and standard error. At last we compared both of the samples and found that the mean and the standard deviation of the second sample which is having the size of 200 is more closely related to the volume.

From the above table, the mean of the sample-2 which has a size of 200 entity is 291642.5 and the mean of the sample-1 is 270745. From this result, it is clear that sample-2 is better representative of the volume as compared to sample-1

Similarly, when we take a look at the standard error, sample-2 is lesser as compared to sample-1. Which means that the sample-2 is more likely to be closer to the volume.

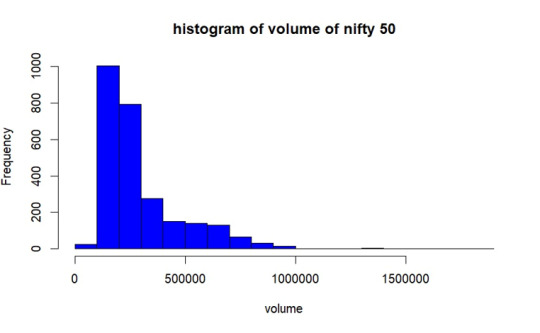

Population Distribution.

As per the graph, In most of the days from the year 2017 to 2023 December volume of trading of NIFTY50 was between 1lakh- 2.8lakhs.

Sample Selection

We are taking 2 sample set having 100 and 200 of size respectively without replacement. Then we obtained mean, standard deviation and standard error of both of the samples.

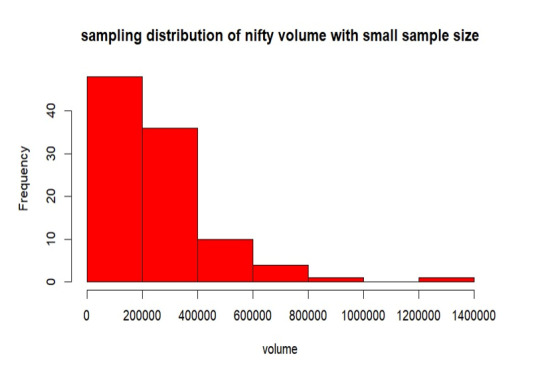

Sampling Distribution of Sample- 1

From the above graph, the samples are mostly between 0 to 2 lakhs of volume. Also, the samples are less distributed throughout the population. The mean is 270745, standard deviation is 195270.5 and the standard error of sampling is 19527.01.

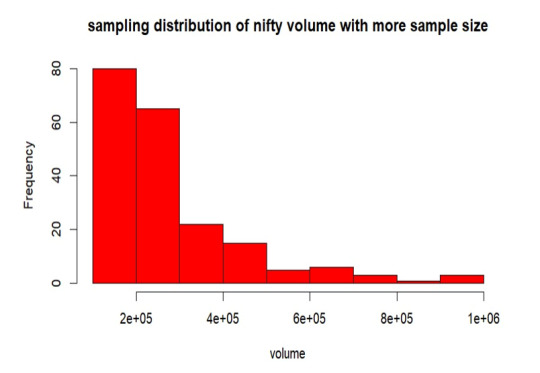

Sampling Distribution of Sample- 2

From the above graph, the samples are mostly between 0 to 2 lakhs of volume. Also, the samples are more distributed than the sample-1 throughout the volume. The mean is 291642.5, standard deviation is 186162.3 and the standard error of sampling is 13163.66.

Replication of Sample- 1

Here, we are duplicating the mean of every sample combination while taking into account every conceivable sample set from our volume. This suggests that the sample size is growing in this instance since the sample means follow the normal distribution according to the central limit theorem.

As per the above graph, it is clear that means of sample sets which we have replicated follows the normal distribution, from the graph the mean is around 3 lakhs which is approximately equals to our true volume mean 297456 which we have already calculated.

Conclusion

In the observed trading volume range of 2 lakhs to 3 lakhs, increasing the sample size led to a decrease in standard error. The sample mean converges to the true volume mean as sample size increases, according to this trend. Interestingly, the resulting sample distribution closely resembles the population when the sample mean is duplicated. The mean produced by this replication process is significantly more similar to the population mean, confirming the central limit theorem's validity in describing the real features of the trade volume.

2 notes

·

View notes

Text

The Nifty 50 index represents the top 50 companies listed on the National Stock Exchange (NSE) of India, offering a glimpse into the country’s economic health. These stocks span diverse sectors such as IT, banking, energy, FMCG, and healthcare, making the index a benchmark for the Indian equity market.

#nifty 50#nifty index#nifty#stock analysis#stocks analysis#investing stocks#stockedge#stock trading#sector analysis#sector wise performance#stockmarketdailyupdates

1 note

·

View note

Video

youtube

DSP Nifty Smallcap250 Quality 50 Index Fund Opportunity to Invest in Mul...

0 notes

Text

What Are The Indices In The Stock Market?

An investor can use a stock market index to gauge the performance of a market, such as the Bombay Stock Exchange or the National Stock Exchange, or a sector, such as the energy, infrastructure, or real estate sectors. The two most prominent stock market indices in India are the SENSEX and NIFTY. Indian investors can monitor how the index value changes over time and use it as a benchmark to determine how well their own portfolios are performing.

Investors now refer to the stock market as having indexes for various areas of the market that do not necessarily move in lockstep. Because there would be no need for multiple stock market indices if they did. You may make sense of the daily changes on the Indian market by knowing how stock market indexes are created and how they fluctuate.

The SENSEX S&P BSE (commonly known as the BSE 30 or SENSEX) was the first stock market index for stocks. It was founded in 1986. It is composed of shares from 30 well-known and financially stable BSE-listed companies. These businesses are representative of the major industrial sectors of the Indian economy.

How to Calculate SENSEX

The SENSEX has adopted the market capitalization weighted system, which assigns weights to companies depending on their size. The weight increases as the size increases.

It is now believed that the overall market share was 100 points when the index was created. This displays the percentage change in a logical manner. So, if the market capitalization rises by 10%, the index rises by 10% as well, from 9 to 10.

Assume there is only one stock on the market. Assume that the stock is now trading at 200 and that its fundamental value is 100. If the stock is worth 260 tomorrow, it has increased by 30%. As a result, the index will rise 30 points from 100 to 130. If the stock price falls from 260 to 208, the loss is 20%. The SENSEX will be revised from 130 to 104 to reflect the decline.

CNX NIFTY S&P (also known as NIFTY 50 or NIFTY) The National Stock Exchange has 50 shares of NIFTY, which was founded in 1996. It provides investors with access to the Indian market through a single portfolio and encompasses 24 various segments of the market.

NIFTY computation

The same algorithm used by the Bombay Stock Exchange to calculate the SENSEX is also used to calculate the NIFTY. However, there are three significant differences:

The NIFTY index is comprised of 50 equities that are actively traded on the NSE (SENSEX is calculated on 30)

Each sector has its own index on both the SENSEX and the NIFTY. This makes it easy for investors to keep track of market fluctuations on a daily basis.

Consider this useful advice: if you want to play the stock market, you must learn how to keep a watch on the scorecard, which is composed of two stock market indices. Zebu's platforms provide real-time price movements for the Nifty and Sensex. To learn more, open a trading account with us.

#online trading company#online trading platform#lowest brokerage#stock market#stock market basics#basics of share market#stock market beginner#stock split#stock trading

3 notes

·

View notes

Text

Outlook 2023, BONDS is the place to be.

OUTLOOK 2023,

BONDS IS THE PLACE TO BE.

BY

SHREY BHOOTRA

STANDARD 7th

SCHOOL – THE BISHOPS SCHOOL CAMP, PUNE.

INTRODUCTION.

In this paper I will be talking about the outlook of 2023 and why this year bonds are a safer and better bet compared to equities.

1. Indian stock market lags behind its global peers in 2023.

The Indian stock market, which had been a star performer in 2022 despite global headwinds, has been lagging behind its global peers since the start of 2023. The domestic benchmark indices, the Sensex and Nifty 50 gave a return of 5.78% and 4.33% in the calendar year 2022 respectively. Since the start of calendar year 2023 the Nifty 50 index has gone down from 18,197 to 17,567, while the Sensex has gone down from 61,167 to 59,745 which means they have both gone down by 4.47% and 2.33% already! The markets in 2023 started the year well before facing challenges as the month went on. The underperformance has been attributed to a range of factors, including continuous selling of FPIs, the reopening of the Chinese economy, the sell-off in the Adani group stocks and the depreciation of the Indian Rupee. On January 25th the Nifty 50 and Sensex tumbled 1.25% and 1.27% respectively, a day after the Hindenburg released a report alleging the Adani Group of certain accusations, on the following day the two indices lost another 1.61% and 1.45% in value, taking the cumulative loss to 2.83% and 2.70% in just two trading sessions. The banking stocks which had given loans to the Adani group of companies also took a brunt on concerns over the debt exposure to the Adani group, the Banking sector which had been the driving force behind the index growth over the past few years was now facing headwinds causing the Nifty 50 to underperform. According to the PTI report foreign investors pulled out Rs 28,852 crores from equities in the month of January 2023, making it the worst outflow since June 2022. This came following a net investment of Rs 11,119 crore is December 2022 and Rs36,238 crore in November. The Indian Rupee started January 2023 on a strong note, strengthening 1.60% in the first three weeks, however it gave up its gains as the month progressed and ended January with a fall of 1.18% at 81.73 against the US Dollar. The Indian Rupee ended 2022 as the worst performing currency with a fall 11.3%, its biggest annual decline since 2013. In December 2022 the global brokerage Goldman Sachs said that India is likely to underperform its peers in 2023 due to expensive valuations. The Indian market had been a strong outperformer in 2022 due to stronger domestic fundamentals, but valuations have turned expensive compared to global peers. Another cause for the equity markets not performing well is inflation, inflation in the month of January 2023 in India was 6.52% compared to 5.72% in the month of December 2022, when inflation is high it reduces the purchasing power of common households thus also having a negative effect on the equity markets. The main cause of rise in inflation in India is because of food inflation, the CPI food index rose to 5.9% in January 2023 from 4.2% in December 2022.

2. Why are bonds the place to invest in 2023.

Since the equity markets have not been performing well since the start of the year, bonds are the next best place to invest, retail investors, DIIs and FIIs have been pulling money out of the market and have been investing in bonds. Since bonds provide a predictable income stream and have stable returns and have a lower risk people prefer to invest in bonds this year over equities. The US one year bond yield is currently at 5.0541%.

- SHREY BHOOTRA

23.3.23

2 notes

·

View notes

Text

Mutual Funds vs Index Funds: Compare and Invest!

Owing to its low-risk nature, portfolio diversification, and potential for higher returns, mutual funds have become a sought-after investment option in recent times. However, when you proceed to invest in mutual funds, you will find a pool of options to choose from, which can easily confuse you. Picking a suitable scheme among the many can be significantly overwhelming.

Thus, before moving, you need to know the basic distinctions between active and passive mutual funds. While active funds provide a probability of better returns, index funds are known for their less-risky nature.

To help you make an informed decision between these two options, here are a few crucial points.

Top Differences Between Index Funds and Mutual Funds

Here are a few points of difference between mutual funds and index funds that might help you:

1. Investment Style

The primary distinction between index funds and mutual funds is the asset allocation and management style. Actively managed mutual funds depend on fund managers to determine asset allocation and investment proportions. As a result, the returns of these funds rely heavily on the experience, bias, and skill set of a fund manager.

Index funds, on the other hand, feature passive management. These funds invest in the same units in proportions as popular benchmarks such as the Nifty 50. As a result, these funds use their underlying benchmark as a guideline for investment and tend to replicate its characteristics. In this regard, index fund investments provide a more hands-on approach to investing.

2. Expense Ratio

Expense ratio is the most talked-about distinction between mutual funds and index funds. Expense ratio is the annual cost of managing the operation of these funds. This is expressed as a percentage of a scheme's AUM.

As mentioned earlier, fund managers in actively managed mutual funds must constantly conduct extensive industry research. Following that, they select securities to mobilise available assets. This is why such expenses are sufficiently high in these funds.

Because index funds feature passive management, they require little involvement from a fund manager. As a result, these funds have low expense ratios. These fees, however, differ from one fund house to another.

3. Fund Performance

Actively managed mutual funds, particularly equity-oriented funds, seek to outperform market benchmarks. This is a goal that fund managers use to mix and match holdings. During a market decline in various sectors, these funds outperform the market and provide higher returns. However, this is not the case most of the time.

Index funds successfully outperform actively managed funds over 80% of the time. This is due to the former's attempt to replicate high-performing benchmarks, such as the Nifty 50. Instead of outperforming their underlying index, they tend to replicate it. As a result, in a bear market, index funds are unlikely to outperform active funds in terms of returns.

This is also the reason why most investors prefer to maintain a mix of active and passive mutual funds.

4. Ease of Investing

Before selecting an Active Fund, an investor must conduct extensive research. In this regard, you may have to consider past returns, fund manager historical returns, Total AUM, and so on.

Index funds that track the same index, on the other hand, typically have similar returns. It's straightforward, and the decision primarily depends on expense ratio and tracking error.

5. Risks

There is no mutual fund that offers returns without some amount of risk. The risk of actively managed mutual funds is heavily influenced by the market capitalisation of the holdings. The underlying index determines the risk of index funds. The Nifty 50 index, for example, is less volatile than the Nifty Next 50 index. Since the best index funds in India feature a broad diversification across industries, volatility is significantly low.

Now that you know about the key points of difference between index funds and mutual funds, you can start your investment journey in an informed manner.

2 notes

·

View notes

Text

Mutual Funds Unlocked

Investing in mutual funds is like joining a financial carpool — your money teams up with other investors to reach financial destinations faster and more efficiently. Whether you’re a complete beginner or someone looking to diversify your investments, this guide will walk you through everything you need to know about mutual funds in a simple and engaging way.

What Is a Mutual Fund?

A mutual fund is a professionally managed investment that pools money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets. Think of it as a basket where each fruit represents a different stock or bond. Instead of buying individual stocks, you get a mix, reducing risks while enjoying potential returns.

Why Choose Mutual Funds?

Diversification — You don’t put all your eggs in one basket! Your money is spread across multiple assets, reducing risks.

Professional Management — Experts manage your funds, so you don’t need to analyze every stock.

Liquidity — You can redeem your investments anytime (except for some lock-in funds).

Convenience — Invest with as little as ₹500 per month through SIPs (Systematic Investment Plans).

Types of Mutual Funds

Understanding different types of mutual funds helps you pick the right one for your goals:

1. Equity Mutual Funds (For Growth)

Invests in company stocks.

Best for long-term wealth creation.

High risk, high return potential.

2. Debt Mutual Funds (For Stability)

Invests in government and corporate bonds.

Lower risk compared to equities.

Suitable for conservative investors.

3. Hybrid Mutual Funds (For Balance)

A mix of equity and debt.

Medium risk, balanced growth.

4. Index Funds & ETFs (For Passive Investors)

Mirrors stock indices like NIFTY 50 or SENSEX.

Low-cost investment option.

5. Tax-Saving Funds (ELSS)

Equity Linked Savings Scheme (ELSS) provides tax benefits under Section 80C.

3-year lock-in period, high return potential.

How to Invest in Mutual Funds?

Investing in mutual funds is easy and hassle-free. Follow these simple steps:

Step 1: Define Your Goal

Are you investing for retirement, a dream home, or short-term gains? Your goal determines the type of mutual fund to choose.

Step 2: Choose a Mutual Fund

Compare funds based on past performance, expense ratio, and risk level.

Step 3: Select SIP or Lump Sum

SIP (Systematic Investment Plan): Invest small amounts monthly.

Lump Sum: Invest a large amount at once.

Step 4: Start Investing Online

Use apps like Groww, Zerodha, or Paytm Money to invest directly.

Step 5: Monitor & Stay Invested

Markets fluctuate, but patience is key. Long-term investments yield the best results.

0 notes

Text

Mutual Fund Investing Detailed Information

A mutual fund is a type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of securities, such as stocks, bonds, money market instruments, or other assets. Professional fund managers oversee the mutual fund, aiming to achieve the fund’s investment objectives while managing risks.

1. Key Features of Mutual Funds

A. Professional Management: Fund managers analyze and select investments based on the fund’s stated objectives. B. Diversification: Mutual funds invest in a range of assets, reducing the risk of significant losses from a single investment. C. Liquidity: Investors can usually buy or sell mutual fund shares at the fund’s net asset value (NAV), calculated daily. D. Affordability: Mutual funds allow investors to access a diversified portfolio with relatively small initial investments. E. Variety: They come in different types tailored to various investment goals (e.g., growth, income, preservation of capital).

2. Types of Mutual Fund

A. Equity Mutual Fund: An Equity Mutual Fund is a type of mutual fund that primarily invests in stocks (equities) of companies. The objective of equity mutual funds is to generate capital appreciation (growth in the value of investments) over the long term. These funds are best suited for investors looking for potentially higher returns and who are willing to accept a higher level of risk compared to other types of mutual funds, such as debt or money market funds.

B. Debt Mutual Fund: A Debt Mutual Fund is a type of mutual fund that primarily invests in fixed-income securities, such as government bonds, corporate bonds, treasury bills, commercial paper, and other money market instruments. These funds are designed for investors seeking regular income and capital preservation with lower risk compared to equity mutual funds.

C. Hybrid Mutual Fund: A Hybrid Mutual Fund is a type of mutual fund that invests in a mix of equity (stocks) and debt (fixed-income securities) to balance the risk and reward. These funds aim to provide growth potential through equity investments and stability through debt investments. Hybrid funds are ideal for investors seeking a moderate risk-reward profile.

D. Index Mutual Fund: An Index Mutual Fund is a type of mutual fund designed to replicate the performance of a specific market index such as the S&P 500, Nifty 50, or Sensex. Instead of actively managing the portfolio, the fund passively tracks the index by holding the same securities in the same proportions as the underlying index.

E. Sector Mutual Fund: A Sector Mutual Fund is a type of mutual fund that focuses its investments in a specific industry or sector of the economy, such as technology, healthcare, energy, financial services, real estate, or infrastructure. These funds aim to capitalize on the growth potential of a particular sector but come with a higher level of risk due to their lack of diversification.

3. Select Invest Mode

A. Systematic Investment Plan (SIP): A Systematic Investment Plan (SIP) is a disciplined investment strategy where an investor invests a fixed amount of money at regular intervals (e.g., monthly, quarterly) into a mutual fund. It is a convenient way to build wealth over time by taking advantage of rupee cost averaging and the power of compounding.

B. Systematic Withdrawal Plan: A Systematic Withdrawal Plan (SWP) is a facility offered by mutual funds that allows investors to withdraw a fixed amount of money at regular intervals (e.g., monthly, quarterly) from their investment. It is commonly used by retirees or individuals seeking a steady stream of income while keeping their principal invested. C. Systematic Transfer Plan (STP): A Systematic Transfer Plan (STP) is a mutual fund investment strategy that allows an investor to transfer a fixed amount of money at regular intervals from one mutual fund scheme to another within the same fund house. It is typically used to balance risk and returns by moving money from a lower-risk fund (like debt funds) to a higher-risk fund (like equity funds) or vice versa.

4. Benefits of Mutual Fund

Mutual funds offer several benefits that make them a popular investment choice for individuals seeking to grow their wealth, generate income, or achieve financial goals. Here are the key benefits of investing in mutual funds:

A. Professional Management Expertise: Mutual funds are managed by professional fund managers with expertise in selecting and managing investments. Research-Based Decisions: Fund managers use extensive research, data analysis, and market insights to make informed investment decisions. B. Diversification Risk Reduction: Mutual funds invest in a wide range of securities (stocks, bonds, etc.), reducing the impact of poor performance in any single investment. Broad Exposure: Even a small investment provides exposure to multiple asset classes, sectors, and geographies. C. Liquidity Ease of Access: Most mutual funds can be bought or sold easily, offering high liquidity compared to other investment options like real estate or fixed deposits. Redemption Flexibility: Investors can redeem their units at the prevailing Net Asset Value (NAV) at any time, subject to exit load (if applicable). D. Affordability Low Initial Investment: You can start investing in mutual funds with a small amount (e.g., ₹500 or $10), making them accessible to all types of investors. Systematic Investment Plan (SIP): Allows regular investments in small amounts, fostering disciplined savings. E. Variety of Investment Options Asset Classes: Equity, debt, hybrid, index funds, and more. Themes and Sectors: Specialized funds focus on sectors (e.g., technology, healthcare) or themes (e.g., ESG, growth funds). Risk Profiles: Funds cater to various risk appetites, from conservative to aggressive. F. Tax Benefits Equity Linked Savings Scheme (ELSS): Offers tax deductions under Section 80C of the Income Tax Act in India. Tax Efficiency: Mutual funds, especially equity funds, are more tax-efficient than many traditional investments due to lower tax rates on capital gains. G. Transparency Regular Updates: Fund houses provide detailed reports on portfolio holdings, NAVs, and performance. Regulated: Mutual funds are regulated by authorities like SEBI (India), SEC (USA), ensuring investor protection and accountability.

0 notes