#nidhi limited registration

Explore tagged Tumblr posts

Text

#nidhi company registration#nidhi limited registration#nidhi company meaning#nidhi company registration online

0 notes

Text

Online Trademark Registration Fees, Process, Documents

Trademark registration distinguishes your brand from competitors and help in identifying your product & services as source. Trademark could be a Name, Slogan, Logo or Number which a company uses on its business name, Product or services.

Registering a trademark could be a time taking process as brand registration could take minimum 6 months to 24 months of time depending upon the result of the Examination Report, that's why Professional Utilities provides Brand Name Search Report to get a fair idea about the turnaround time for registration.

Once a Trademark application is processed with the government department, applicants can start using the TM symbol on their mark & ® when the registration certificate has been issued. The registration of the trademark is valid for ten years & can be renewed after ten years. (Read More)

NOTE: If you are a manufacturer then you should also read about EPR Registration

#india#business#earnings#startup#trademark#intellectual property#intellectual disability#private limited company registration in chennai#private limited company registration in bangalore#private limited company registration online#sole proprietorship#limited liability partnership#limited liability company#ngo#ngo donation#nidhi company registration#partnership#partnership firm registration#manage business#taxes#income tax#management#accounting#entrepreneur#import export business#import export data#industry#commerce#government#marketplace

3 notes

·

View notes

Text

Exploring Nidhi Companies in India: A Comprehensive Guide

In Depth Guide On Nidhi Limited Company

Nidhi Compan are a distinct category of non-banking financial companies (NBFCs) in India, established primarily for the mutual benefit of their members. These companies encourage thrift and savings among their members by accepting deposits and lending money exclusively to them, operating on the principle of mutuality.

Formation and Compliance

To form a Nidhi Company, a minimum equity share capital of Rs. 5 Lac is required, and the company's name must end with "Nidhi Limited." They are regulated by Section 406 of the Companies Act, 2013, and the Nidhi Rules, 2014. The primary activities of Nidhi Companies include accepting deposits and providing loans, similar to NBFCs, but they are restricted to transactions involving their members' funds only.

Exemptions and Regulatory Framework

Although Nidhi Company function similarly to NBFCs, they are exempt from the core regulations of the Reserve Bank of India (RBI) that govern NBFCs. Instead, they follow specific guidelines outlined in the Nidhi Rules, 2014, and Section 406 of the Companies Act, 2013.

Accepting Deposits

Nidhi Company are permitted to accept deposits up to 20 times their Net Owned Funds (NOF) as per their latest audited financial statements. The terms and duration for these deposits are as follows:

Recurring Deposits: Minimum duration of 12 months and a maximum of 60 months, with particular conditions for mortgage-related deposits.

Fixed Deposits: Minimum duration of 6 months and a maximum of 60 months.

The interest rate on deposits is regulated, with savings deposits capped at 2% above the rate offered by nationalized banks and fixed and recurring deposits limited to the rate prescribed by the RBI for NBFCs.

Investing Deposits

Nidhi Company must invest at least 10% of their deposits in unencumbered term deposits with scheduled commercial banks or post office deposits.

Loan Provisions

Loans from Nidhi Companies are granted only to their members and must be secured against assets such as gold, silver, jewelry, immovable property, fixed deposit receipts, National Savings Certificates, government securities, and insurance policies. Loan limits are based on the company's total deposits:

Up to Rs. 7.50 Lac if deposits range from Rs. 2 Crore to Rs. 20 Crore.

Up to Rs. 15 Lac if deposits exceed Rs. 50 Crore.

Up to Rs. 2 Lac if deposits are less than Rs. 2 Crore.

Up to Rs. 12 Lac if deposits range from Rs. 20 Crore to Rs. 50 Crore.

The interest rate on loans must not exceed 7.5% above the highest rate offered on deposits by the Nidhi Company and is calculated on a reducing balance method.

Branch Operations

Nidhi Company can establish up to three branches within a district if they have earned net profits continuously for the previous three financial years. For additional branches or branches outside the district, prior permission from the Regional Director and notification to the Registrar of Companies (ROC) are necessary. Branch operations are limited to the state where the registered office is located, and financials and returns must be up-to-date.

Basic Requirements

Nidhi Company must fulfill the following criteria:

Investment in unencumbered term deposits of at least 10% of the outstanding deposits.

A Net Owned Funds to deposits ratio of no more than 1:20.

A minimum of 200 members.

Filing a certified return in Form NDH-1 with the ROC within 90 days of the close of the first financial year.

Net Owned Funds of Rs. 10 Lac or more.

If these requirements are not met, an application for extension in Form NDH-2 must be submitted to the Regional Director. Non-compliance can result in restrictions on accepting deposits from the second financial year.

General Restrictions

Nidhi Companies are subject to several operational restrictions, including:

Inability to issue preference shares, debentures, or other debt instruments.

Restriction on opening current accounts with members.

Prohibition on engaging in chit funds, hire purchase, leasing finance, insurance, or acquiring securities.

Prohibition on non-borrowing or lending activities in its own name.

Restriction on advertising for soliciting deposits and paying brokerage or incentives.

Limitations on acquiring other companies or changing management without approval.

Prohibition on admitting bodies corporate, trusts, or minors as members.

Dividend declaration limits, capped at 25% unless approved by the Regional Director.

Conclusion

Nidhi Companies play a crucial role in fostering savings and financial inclusion among their members. By adhering to specific regulations and maintaining compliance, they ensure mutual benefit and contribute to the financial well-being of their communities.

#nidhi company#Nidhi limited company services#nidhi limited company registration#Nidhi limited company in india

0 notes

Text

Navigating Nidhi Company Registration: The Way to Local Financial Development

In the changing environment of Indian finance, Nidhi Companies stand out as icons of community-focused prosperity. Individuals who want to promote financial stability and empower local communities must first understand the Nidhi Company registration process. Let's look at the process of establishing a Nidhi Company and the revolutionary impact it can have on local economies.

Understand Nidhi Companies

Nidhi Companies, regulated by the Nidhi Rules of 2014 and incorporated under the Companies Act of 2013, demonstrate the culture of social financial management. Unlike traditional financial institutions, Nidhi Companies concentrate on their members' financial well-being by encouraging savings and enabling access to loans in communities.

Nidhi Company Registration

The first step in Nidhi Company registration is to form a public limited company, which is then followed by obtaining a Nidhi Company license from the MCA i.e. Ministry of Corporate Affairs. Meeting qualifying criteria, including minimum capital requirements and member limits, making sure about a successful registration procedure.

Using Benefit of Opportunities and Addressing Obstacles

Nidhi Companies provide a variety of advantages, including easier access to funding and improved regulatory compliance. However, difficulties like navigating complex regulations and ensuring ongoing member engagement call for significant thought and planned preparation.

Conclusion

The Nidhi Company registration serves as a means of promoting economic development that involves the community and building financial flexibility. Through the adoption of regulatory guidelines, the promotion of strategic community engagement, and the strict implementation of transparency standards, new business owners may utilize the unique capacity of Nidhi Companies to bring a period of balanced prosperity and financial empowerment at the local level.

#Company Registration#Online Company Registration#Nidhi Limited Company#Nidhi Limited Company Registration#Nidhi Company Registration in India#Company Registration in India

0 notes

Text

Simplifying Business Registration in Kolkata: A Comprehensive Guide.

Navigating the maze of business registrations can be daunting, especially in a bustling city like Kolkata. From private limited companies to trademark registrations, here’s everything you need to know to establish your business successfully.

Starting a business in Kolkata or anywhere else requires navigating a series of legal procedures and registrations. Each step is crucial and contributes to the legitimacy and protection of your venture. In Kolkata, a city known for its entrepreneurial spirit, understanding the nuances of various business registrations is essential for smooth operations. Let's delve into the intricacies of different registrations you might need for your business in Kolkata.

Private Limited Company Registration: Registering your business as a private limited company offers several benefits, including limited liability protection and access to funding. In Kolkata, the process involves obtaining a Digital Signature Certificate (DSC), Director Identification Number (DIN), and filing the necessary documents with the Registrar of Companies (ROC). This registration is suitable for medium to large-scale businesses aiming for growth and expansion.

Business Registration: Kolkata offers various options for registering your business, including sole proprietorship, partnership, and limited liability partnership (LLP). Each structure has its own set of advantages and legal requirements. Sole proprietorship is the simplest form, while LLP combines the benefits of a partnership with limited liability protection. Understanding your business's needs and choosing the appropriate structure is crucial for long-term success.

Trademark Registration: Protecting your brand identity is paramount in today's competitive market. Trademark registration ensures exclusive rights to use your brand name, logo, or slogan, preventing others from using similar marks. In Kolkata, the process involves conducting a trademark search, filing an application with the Trademark Registry, and regular monitoring to safeguard your intellectual property.

LLP Registration: Limited Liability Partnership (LLP) is a popular choice for small to medium-sized businesses in Kolkata. It offers the flexibility of a partnership combined with limited liability protection for partners. The registration process includes obtaining a Digital Signature Certificate (DSC), Director Identification Number (DIN), and filing the incorporation documents with the Ministry of Corporate Affairs (MCA).

Nidhi Company Registration: Nidhi companies are non-banking financial institutions that facilitate mutual benefit among members. In Kolkata, registering a Nidhi company involves adhering to the strict regulations set by the Ministry of Corporate Affairs (MCA). The process includes drafting the memorandum and articles of association, obtaining approvals, and complying with ongoing compliance requirements.

Section 8 Company Registration: Section 8 companies, also known as not-for-profit organizations, are formed for promoting charitable activities, social welfare, or other nonprofit objectives. In Kolkata, registering a Section 8 company requires approval from the Central Government and adherence to specific regulations outlined in the Companies Act. This registration is ideal for entities focusing on social impact rather than profit generation.

Startup India Registration: Startup India initiative aims to foster innovation and entrepreneurship by providing various benefits and incentives to startups. Registering your startup under this scheme can unlock access to funding, tax exemptions, and other support services. In Kolkata, startups can register online through the Startup India portal by fulfilling the eligibility criteria and submitting the required documents.

Navigating the landscape of business registrations in Kolkata can be overwhelming, but with the right knowledge and guidance, it becomes more manageable. Whether you're establishing a private limited company, protecting your brand through trademark registration, or registering as a startup under the Startup India initiative, each step is crucial for the success and sustainability of your business. By understanding the requirements and adhering to the legal procedures, you can lay a strong foundation for your venture in the vibrant business ecosystem of Kolkata.

#Private limited company registration Kolkata#Pvt Ltd company registration Kolkata#Business registration Kolkata#Company registration Kolkata#Trade Mark Registration Kolkata#LLP Registration in Kolkata#LLP Company Registration in Kolkata#LLP Registration#Nidhi Registration Kolkata#Nidhi Company Registration in Kolkata#Section 8 Company Registration in Kolkata#Startup India Registration Kolkata#Startup Registration Process Kolkata#Sujata Associates

0 notes

Text

NG and Associates' Expertise in Nidhi Company Registration

In the ever-evolving landscape of financial services, establishing a Nidhi Company can be a strategic move for those seeking to promote savings and mutual benefit among their members. NG and Associates, a distinguished player in the domain of corporate consultancy, stands out for its expertise in facilitating Nidhi Company Registration, providing businesses with the necessary foundation to foster community-driven financial growth.

Understanding Nidhi Companies:

Before delving into NG and Associates' role, let's grasp the concept of Nidhi Companies. These entities are a unique form of non-banking financial institutions in India, primarily established to cultivate the habit of thrift and savings amongst its members. Nidhi Companies function on the principle of mutual benefit, encouraging members to contribute to a common fund that is then utilized to provide financial assistance to its members.

NG and Associates: A Trusted Partner in Nidhi Company Registration:

NG and Associates have carved a niche for themselves in the corporate consultancy sector, offering comprehensive services in company registration, compliance, and financial advisory. Their specialized focus on Nidhi Company Registration showcases their commitment to assisting businesses in establishing a solid foundation for community-centric financial endeavors.

The company's team of seasoned professionals possesses in-depth knowledge of the legalities and intricacies involved in Nidhi Company Registration. From document preparation to liaising with regulatory authorities, NG and Associates streamline the entire registration process, ensuring a hassle-free experience for their clients.

Why Choose NG and Associates for Nidhi Company Registration?

Expert Guidance: NG and Associates boast a team of experts well-versed in the nuances of company registration, particularly in the realm of Nidhi Companies.

Tailored Solutions: Recognizing that each business is unique, the consultancy provides personalized solutions that align with the specific needs and goals of the client.

Timely Execution: With a commitment to efficiency, NG and Associates ensure that the Nidhi Company Registration process is executed promptly, allowing businesses to embark on their financial ventures without unnecessary delays.

Compliance Assurance: Staying abreast of the ever-changing regulatory landscape, NG and Associates ensure that their clients remain compliant with all legal requirements post-registration.

Conclusion:

NG and Associates' prowess in facilitating Nidhi Company Registration positions them as a reliable partner for businesses aspiring to create a financial ecosystem based on mutual benefit. As the corporate world continues to evolve, the establishment of Nidhi Companies remains a promising avenue for those seeking to foster community-driven financial growth. With NG and Associates by your side, the journey towards building a thriving Nidhi Company becomes not just a goal but a seamlessly achievable reality.

#Company Registration in india#Private Limited Company Registration#Nidhi Company Registration#Trademark Registration Online#Copyright Registration Online In India#GST Registration Online#Startup Registration India#MSME Registration In India#FSSAI License and Registration#One Person Company Registration#ISO Certification in India#labour license registration#Professional Tax Registration#Business Tax Returns Filing#Gem registration

0 notes

Text

Embark on Your Entrepreneurial Journey: Simplifying Startup Registration in India with NG and Associates

Introduction:

Starting a new business venture in India is an exciting endeavor, but the complexities of startup registration can be overwhelming. NG and Associates emerges as a guiding light, offering comprehensive support and expertise in navigating the intricacies of Startup Registration in India.

Why Startup Registration Matters:

Startup Registration in India is a crucial step for entrepreneurs, as it establishes the legal identity of the business and facilitates compliance with regulatory requirements. NG and Associates recognize the significance of this process and aim to make it seamless for budding entrepreneurs.

NG and Associates: Your Trusted Partner in Startup Registration:

Expert Guidance: NG and Associates boasts a team of seasoned professionals well-versed in the nuances of startup registration. Their expertise ensures a smooth and error-free registration process.

Tailored Solutions: Understanding that each startup is unique, NG and Associates provides personalized solutions to meet the specific needs and goals of every entrepreneur.

Timely Completion: Time is of the essence for startups. NG and Associates is committed to expediting the registration process, ensuring that entrepreneurs can focus on building their businesses.

Comprehensive Support: Beyond just registration, NG and Associates offers comprehensive support, guiding startups through various legal and financial aspects, setting a strong foundation for future success.

The NG and Associates Advantage:

Legal Compliance: Ensure your startup operates within the legal framework with NG and Associates, reducing the risk of legal complications and fostering a secure business environment.

Cost-Efficiency: NG and Associates provides cost-effective solutions, ensuring that startups can allocate resources efficiently without compromising on the quality of services.

Peace of Mind: Entrust NG and Associates with your startup registration, allowing you to focus on your business vision while they handle the bureaucratic intricacies, offering you peace of mind.

Conclusion:

Embarking on your entrepreneurial journey in India begins with a solid foundation, and NG and Associates stand as your steadfast partner in achieving just that. From navigating the complexities of Startup Registration to providing ongoing support, trust NG and Associates to be by your side, ensuring your startup's legal compliance and success in the dynamic Indian business landscape.

#Gem registration#Business Tax Returns Filing#Professional Tax Registration#labour license registration#ISO Certification in India#One Person Company Registration#FSSAI License and Registration#MSME Registration In India#Startup Registration India#GST Registration Online#Copyright Registration Online In India#Trademark Registration Online#Nidhi Company Registration#Company Registration in india#Private Limited Company Registration

1 note

·

View note

Text

Company registration holds significant importance for businesses for the following reasons:

Legal Entity: Registration establishes a company as a separate legal entity distinct from its owners. This means that the company can conduct business, enter into contracts, and sue or be sued in its own name, providing limited liability protection to its shareholders.

Limited Liability Protection: One of the primary advantages of registering a company is that the personal assets of shareholders are protected from the company's debts and liabilities. Shareholders are only liable for the amount they have invested in the company.

Credibility and Trust: Registered companies often gain more credibility and trust among customers, suppliers, and partners. Registration shows that the business is committed to long-term operations and is willing to comply with legal and regulatory requirements.

Fundraising and Investment: Registered companies have better access to various sources of funding, including loans, venture capital, and equity investments. Investors and lenders are more likely to invest in a registered company due to the limited liability protection it offers.

Brand Protection: Registering the company name and logo as trademarks provides legal protection against unauthorized use by competitors, helping to safeguard the brand's reputation and value.

Perpetual Succession: A registered company enjoys perpetual succession, meaning it continues to exist even if its shareholders or directors change. This provides stability to the business and ensures continuity in operations.

Ease of Transfer of Ownership: Shares of a registered company can be easily transferred between shareholders, allowing for smooth ownership changes and flexibility in raising capital.

Access to Government Contracts and Tenders: Many government contracts and tenders require bidders to be registered companies, providing access to a wider range of business opportunities.

Tax Benefits: Registered companies may avail certain tax benefits and incentives provided by the government to promote entrepreneurship and business growth.

Read more: https://myefilings.com/business-registration/

#one person company#myefilings#business#company#business registration#small business#private limited company registration#nidhi company registration#limited liability partnership#private limited company#startup registration#gst#income taxes#finance#taxes#india#income tax#accounting

0 notes

Link

To register a Nidhi Company online simply contact Legal Pillers. They will be happy to discuss your requirements. They will provide you with a free consultation and quote, and they will work with you to ensure that your Nidhi Company is registered in the most efficient and cost-effective way possible. To know more read this blog.

#Nidhi Company#nidhi bank#nidhi registration fees#nidhi private limited#nidhi ltd registration#nidhi company registration online#nidhi company in india#nidhi company registration#nidhi company registration consultant

0 notes

Text

Process of closing an LLP in India

The Limited Liability Partnership (LLP) is a trendy type of business entity, established in 2008 by the Limited Liability Partnership Act, that integrates the features of a company and a partnership. In earlier articles, we discussed the documents mandated for LLP registration and the registration process itself.

This article aims to assist you with the procedure for closing an LLP in India.

Although LLPs offer several benefits over other kinds of business entities, such as ease of incorporation and limited liability for members, these advantages do not necessarily translate into flourishing business operations. This article will explain the Strike Off method of closure and provide an overview of other closure options.

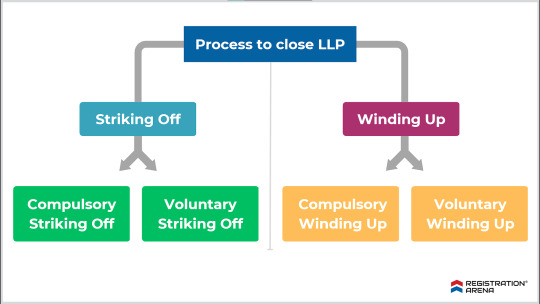

The process to close a Limited Liability Partnership

An LLP can be closed in two ways:

1. Strike-off method-

a. Voluntary Strike Off

The LLP should not have been engaged in commercial activities for a period of at least one year.

The LLP must file an application in Form 24 LLP with the Registrar of LLPs to apply for voluntary strike-off status.

The LLP should have completed all compliance requirements by the date of filing for closure. However, it is only required to file annual returns until the end of the year when commercial activities are discontinued.

The LLP must have obtained the approval of all parties involved, including members, creditors, and any regulatory authorities under whose domain the LLP works.

The LLP should not have any assets or liabilities as of the date of preparation of financial statements.

The process to close LLP through Strike Off method

In order to move forward with the Strike Off process, the LLP must follow the steps outlined below:

The LLP must plan a meeting of all partners to pass a resolution to strike off the name.

The LLP must pay all outstanding debts and liabilities before proceeding with the Strike Off process.

The meeting of partners must permit a designated partner to file the application for Strike Off.

The designated partner must file an application in e-Form 24 and submit it to the Registrar. The application must have the approval of all members.

Read more to know about the Procedure of Closing LLP in India

#closure of llp#llp registration#private limited company registration#opc registration#nidhi company registration#startup registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#legal services#legal consultation

0 notes

Text

Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.

Reach us for Company Registration Online in India, We'll be more than happy to help you !

Auriga Accounting pvt.ltd

Auriga accounting always help for all type of business

Kindly Contact On +91-7982044611/+91-8700412557, [email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN

Company Registration

Nidhi Company Registration

Proprietorship Firm Registration

Partnership Registration

One Person Company ( OPC) Registration

Private Limited Registration

LLP Registration

Public Limited Registration

Section 8 Company Registration(NGO)

Producer Company Registration

Common Services

Shop Act Registration

Udyog Adhar ( MSME) Registration

Food License Registration

Income Tax Return ( Business )

Income Tax Return ( Salary)

GST Registration

ISO Certificate

Trademark Registration

Digital Signiture

ESI & PF Registration

12A & 80G Registration

Import Export Code Registration

Professional Tax Registration

Income Tax , GST Consultant , TDS And TCS Work, Import Export Consultant, Tax Audit, Company Registration, ROC Filing & Others Services.

#aurigaaccounting#auriga_accounting#companysecretary #registration #pvtltdcompany #entrepreneur #mca #trademark #trademarkedsetups #trademarks #importexport #company #corporate #incorporation #companyregistration #startup #startupindia #startupindiastandupindia #startups #startupindiahub #india #business

#Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.#Reach us for Company Registration Online in India#We'll be more than happy to help you !#Auriga Accounting pvt.ltd#Auriga accounting always help for all type of business#Kindly Contact On +91-7982044611/+91-8700412557#[email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN#Company Registration#Nidhi Company Registration#Proprietorship Firm Registration#Partnership Registration#One Person Company ( OPC) Registration#Private Limited Registration#LLP Registration#Public Limited Registration#Section 8 Company Registration(NGO)#Producer Company Registration#Common Services#Shop Act Registration#Udyog Adhar ( MSME) Registration#Food License Registration#Income Tax Return ( Business )#Income Tax Return ( Salary)#GST Registration#ISO Certificate#Trademark Registration#Digital Signiture#ESI & PF Registration#12A & 80G Registration#Import Export Code Registration

0 notes

Text

Business Registration Services We Offer || Global Taxman India Ltd

1. Business Registrations

GST Registration: Mandatory for businesses with an annual turnover exceeding ₹40 lakh. It ensures seamless tax compliance.

MSME Registration: Get recognized as a micro, small, or medium enterprise and avail government benefits.

Importer License: For businesses dealing in imports or exports.

FSSAI Registration: Essential for food-related businesses to ensure compliance with food safety standards.

Shop Act Registration: Ideal for shops and establishments to avoid penalties.

Trademark Registration: Protect your brand identity and intellectual property.

ISO Certification: Boost your business credibility with international quality certification.

ESIC/EPF Registration: Provide social security benefits to your employees.

2. Company Registrations

Private Limited Company: Best for startups and small businesses.

One Person Company: Suitable for solo entrepreneurs.

Nidhi Company: Ideal for finance and loan businesses.

Section 8 Company: Perfect for NGOs and non-profits.

Startup Registration: Avail tax benefits and other startup perks.

Producer Company: Great for agricultural businesses.

Public Limited Company: Suitable for large-scale operations.

Sole Proprietorship: Quick and simple business setup for small traders.

Partnership Registration: Great for businesses managed by two or more partners.

MCA Compliance and Tax Services

ROC Annual Filing: Annual compliance for registered companies.

GST Return Filing: Ensure timely filing of GST returns to avoid penalties.

Audit of Business: Keep your financials in check with professional audits.

Income Tax Return (ITR) Filing: Comply with income tax laws effortlessly.

Why Choose Global Taxman India?

At Global Taxman India, we provide end-to-end support for all your business registration and compliance needs. With our services spanning across Ranchi, Delhi NCR, Ghaziabad, Patna, Bihar, Jharkhand, Uttar Pradesh, and beyond, we ensure a hassle-free experience for entrepreneurs and established businesses alike.

Our Office Locations

Ghaziabad: C-19, Second Floor, near Vasundhara Hatt Complex, Sector 13, Vasundhara, Ghaziabad, Uttar Pradesh 201012.

Delhi NCR

Ranchi

Patna

Bihar

Jharkhand

📞 Contact us at:

Phone Number — +91–9811099550

website — www.globaltaxmanindia.com

Email- [email protected]

#accounting#finance#success#marketing#economy#taxation#gst registration#company registration#gst#itr filing

0 notes

Text

NBFC (Non-Banking Financial Company) Registration — Fees, process, Documemnts Required

NBFCs or Non-Banking Financial Company are registered under the Companies Act 1956/Companies Act 2013. Though these do not possess a banking license, yet are involved in various financial services. Some of the services include:

Loan and credit facilities

Asset Financing

Acquisition of shares/stocks/bonds

Hire-purchase

Insurance business

Chit business

Currency exchange

Peer-to-peer lending

Hedge funds

*Classification of NBFC

Asset Finance Company (AFC)

Investment Company (IC)

Loan Companies (LC)

Infrastructure Finance Company (IFC)

Systematically Important Core Investment Company

Infrastructure Debt Fund (IDF-NBFC)

Mutual benefit financial company

Micro Finance Institution (NBFC-MFI)

Housing Finance Company

Core Investment Company

*Documents Required for NBFC Registration

Significant documents required for NBFC Registration in India are as follows:

Documents related to the administration and management of the company

Company Incorporation Certificate

The Memorandum of Association and the Articles of Association of the applicant-company or firm

Documents describing the location of the company

Detailed information about Directors or Partners of the Company

Accounts of the company well-audited for the last three consecutive years

Board Resolution in favor of NBFC formation

Should have a bank Account with a minimum paid-up equity share capital of INR-2 Crore

Income tax PAN, etc.

To know more (click here)

#nbfc#nbfc registration#memorandum of association#article of association#business#business growth#manage business#startup#india#partnership firm registration#nidhi company registration#private limited company registration in chennai#private limited company registration in bangalore

0 notes

Text

Nidhi Company Registration: A Step-by-Step Guide to Setting Up Your Financial Institution

Nidhi Company Registration has become a popular choice for individuals and groups looking to create a mutual benefit society focused on savings and loans. Recognized under Section 406 of the Companies Act, 2013, a Nidhi company operates primarily for the benefit of its members by promoting savings and providing loans. Unlike traditional banking institutions, Nidhi companies restrict their operations to their members, fostering a community-centric approach to finance.

This comprehensive guide will walk you through the process of Nidhi Company Registration, highlighting the requirements, benefits, and essential compliance obligations.

What is a Nidhi Company?

A Nidhi Company is a non-banking financial company (NBFC) that aims to cultivate savings and provide affordable loans to its members. Its operations are built on the principles of mutual benefit, and it encourages its members to deposit and borrow money among themselves. Here are some key features:

Member-Focused Operations: Nidhi companies operate solely for the benefit of their members, ensuring that financial services are accessible and affordable.

Restricted Activities: They are not allowed to engage in activities like insurance, chit funds, or dealing in shares.

Community Financing: By fostering a sense of community, Nidhi companies help members support one another financially.

Steps for Nidhi Company Registration

Choose a Unique Name Select a distinctive name for your Nidhi Company that adheres to the naming guidelines of the Companies Act, 2013. Ensure the name includes "Nidhi Limited" and is not similar to any existing company names.

Obtain a Digital Signature Certificate (DSC) Directors of the Nidhi Company must obtain a DSC, as all documents must be digitally signed during the registration process.

Director Identification Number (DIN) All proposed directors must have a valid DIN, which can be acquired through the Ministry of Corporate Affairs (MCA) portal.

Draft the Memorandum and Articles of Association Prepare the Memorandum of Association (MOA) and Articles of Association (AOA) that outline the company’s objectives and governance structure.

Submit Registration Documents File the incorporation form (SPICe+) along with the necessary documents, including the MOA, AOA, PAN, and address proof, to the Registrar of Companies (ROC).

Capital Requirements A minimum paid-up equity share capital of ₹10 lakh is required for a Nidhi Company. After one year, the company must maintain specific financial ratios and have at least 200 members.

Receive the Certificate of Incorporation Upon approval of your documents, the ROC will issue a Certificate of Incorporation, officially recognizing your Nidhi Company.

Compliance Requirements for Nidhi Companies

After successful Nidhi Company Registration, it's crucial to adhere to specific compliance requirements:

Member Threshold: A Nidhi Company must have at least 200 members within one year of incorporation.

Net Owned Funds: The company must maintain a net owned fund (NOF) to deposit ratio of 1:20, meaning for every ₹1 of NOF, it can accept ₹20 as deposits.

Term Deposits: Maintain 10% of the total deposits as unencumbered term deposits with scheduled banks.

Restrictions on Financial Activities: Nidhi companies can only accept deposits from and lend to their members.

Benefits of Nidhi Company Registration

Encouragement of Savings: Nidhi companies promote a culture of savings, allowing members to save for future needs.

Accessible Loans: Members benefit from easy access to loans at lower interest rates compared to traditional banks.

Simplified Regulatory Framework: Nidhi companies face fewer regulatory challenges compared to other financial institutions, making operations smoother.

Lower Capital Requirement: With a minimum capital requirement of ₹10 lakh, starting a Nidhi Company is relatively affordable.

Community-Centric Financing: The mutual benefit nature of Nidhi companies fosters a supportive financial environment among members.

Conclusion

Nidhi Company Registration offers an excellent opportunity for individuals and groups to create a community-focused financial institution. By following the steps outlined above and ensuring compliance with relevant regulations, you can successfully establish and operate a Nidhi Company in India.

This business model not only promotes savings and financial support among members but also contributes to the overall economic development of the community. Consider embarking on this journey to empower your community through financial cooperation and support.

0 notes

Photo

(via Nidhi Limited Company Registration in India | LegalPillers)

#Company Registration#Online Company Registration#Nidhi Limited Company#Nidhi Limited Company Registration#Nidhi Limited Company Registration in India

0 notes

Text

Get Your Business Registered with Sujata Associates - Your Trusted Partner in Kolkata!

Kickstart Your Business Journey with Sujata Associates! 🚀

Are you looking to establish a new business in Kolkata? Whether it's a Private Limited Company, a Nidhi Company, or a Section 8 Company, Sujata Associates is here to make your registration process seamless and stress-free!

🌟 Why Choose Sujata Associates?

At Sujata Associates, we pride ourselves on being the leading experts in business registration services in Kolkata. Our team of experienced professionals is dedicated to providing comprehensive support for all your business needs, ensuring you can focus on what you do best - growing your business!

📜 Our Key Services Include:

Private Limited Company Registration in Kolkata: Establish your Private Limited Company with ease. Our experts will guide you through the entire process, from documentation to final approval, ensuring a hassle-free experience.

Nidhi Company Registration in Kolkata: Looking to start a Nidhi Company? We provide end-to-end services to help you get your Nidhi Company registered efficiently and in compliance with all legal requirements.

Section 8 Company Registration in Kolkata: If you are planning to start a non-profit organization, our team will assist you in obtaining Section 8 Company registration. We ensure that all legal formalities are completed accurately and swiftly.

Startup India Registration Kolkata: Get recognized as a startup under the Startup India initiative. We assist you in navigating through the registration process, helping you avail all the benefits and incentives offered by the government.

🔍 Why Register with Us?

Expert Guidance: Our team of experts ensures that all your queries are answered and all procedures are followed accurately.

Affordable Services: We offer competitive pricing without compromising on the quality of our services.

Timely Delivery: We understand the value of your time. Our services are designed to deliver results promptly.

📞 Get in Touch!

Ready to get started? Contact Sujata Associates today and take the first step towards building your dream business in Kolkata.

#PrivateLimitedCompanyRegistrationKolkata#NidhiRegistrationKolkata#Section8CompanyRegistrationKolkata#StartupIndiaRegistrationKolkata#BusinessRegistration#SujataAssociates#KolkataBusiness#StartupSupport#LegalServices

0 notes