#Professional Tax Registration

Explore tagged Tumblr posts

Text

Benefits of Professional Tax Registration for Businesses

Kanakkupillai is a top-tier online consultant for Professional Tax (PT) registration services in India. Professional tax applies to income derived from professions, trades, or employment.

0 notes

Text

Among various tax obligations, timely GST return filing plays a critical role in ensuring that your business operates smoothly. It not only reflects your commitment to compliance but also helps build trust with stakeholders, including customers, suppliers, and the government. Read.

0 notes

Text

Easy Professional Tax Registration for Businesses

Kanakkupillai emerges as a leading online consultant for Professional Tax (PT) registration services in India. Professional tax is levied on income generated from professions, trades, or employment.

0 notes

Text

Simplify Professional Tax Registration with ServicesPlus

Taxes should not be a burden. ServicesPlus expert professional tax services make it hassle-free to meet all your tax obligations. Professional tax registration in India and ensuring you are in compliance with state regulations-we have your back, from application to timely payment of taxes. We take care of everything so you can focus on your business. Let ServicesPlus simplify your professional tax process and keep you worry-free!

0 notes

Text

"Let Services Plus Handle Your Professional Tax with Ease"

"Dealing with Professional Tax can be a hassle, but Services Plus makes it easy! We simplify everything from registering for Professional Tax to making payments online. Our straightforward service means you can handle all your tax needs quickly and easily, without the stress. Whether you’re signing up or making a payment, we’ve got you covered. Let us take care of the paperwork so you can focus on running your business. Choose Services Plus for a smooth, no-fuss experience with your Professional Tax needs!"

#professional tax registration#professional tax#professional tax payment#professional tax payment online#professional tax online payment

0 notes

Text

Professional Tax Made Easy for You

At Service Plus, we take the stress out of Professional Tax. We know tax rules can be confusing, but we’re here to make sure everything’s sorted for you. Whether you’re running a small business or working solo, our team handles all the paperwork so you can focus on what you do best. With Service Plus, you can relax and leave the tax stuff to us!

0 notes

Text

Professional Tax Registration | Taxsevakendra.in

Register for professional tax with Taxsevakendra.in and experience hassle-free services with our expert team. Start your tax journey today!

professional tax registration

1 note

·

View note

Text

NG and Associates' Expertise in Nidhi Company Registration

In the ever-evolving landscape of financial services, establishing a Nidhi Company can be a strategic move for those seeking to promote savings and mutual benefit among their members. NG and Associates, a distinguished player in the domain of corporate consultancy, stands out for its expertise in facilitating Nidhi Company Registration, providing businesses with the necessary foundation to foster community-driven financial growth.

Understanding Nidhi Companies:

Before delving into NG and Associates' role, let's grasp the concept of Nidhi Companies. These entities are a unique form of non-banking financial institutions in India, primarily established to cultivate the habit of thrift and savings amongst its members. Nidhi Companies function on the principle of mutual benefit, encouraging members to contribute to a common fund that is then utilized to provide financial assistance to its members.

NG and Associates: A Trusted Partner in Nidhi Company Registration:

NG and Associates have carved a niche for themselves in the corporate consultancy sector, offering comprehensive services in company registration, compliance, and financial advisory. Their specialized focus on Nidhi Company Registration showcases their commitment to assisting businesses in establishing a solid foundation for community-centric financial endeavors.

The company's team of seasoned professionals possesses in-depth knowledge of the legalities and intricacies involved in Nidhi Company Registration. From document preparation to liaising with regulatory authorities, NG and Associates streamline the entire registration process, ensuring a hassle-free experience for their clients.

Why Choose NG and Associates for Nidhi Company Registration?

Expert Guidance: NG and Associates boast a team of experts well-versed in the nuances of company registration, particularly in the realm of Nidhi Companies.

Tailored Solutions: Recognizing that each business is unique, the consultancy provides personalized solutions that align with the specific needs and goals of the client.

Timely Execution: With a commitment to efficiency, NG and Associates ensure that the Nidhi Company Registration process is executed promptly, allowing businesses to embark on their financial ventures without unnecessary delays.

Compliance Assurance: Staying abreast of the ever-changing regulatory landscape, NG and Associates ensure that their clients remain compliant with all legal requirements post-registration.

Conclusion:

NG and Associates' prowess in facilitating Nidhi Company Registration positions them as a reliable partner for businesses aspiring to create a financial ecosystem based on mutual benefit. As the corporate world continues to evolve, the establishment of Nidhi Companies remains a promising avenue for those seeking to foster community-driven financial growth. With NG and Associates by your side, the journey towards building a thriving Nidhi Company becomes not just a goal but a seamlessly achievable reality.

#Company Registration in india#Private Limited Company Registration#Nidhi Company Registration#Trademark Registration Online#Copyright Registration Online In India#GST Registration Online#Startup Registration India#MSME Registration In India#FSSAI License and Registration#One Person Company Registration#ISO Certification in India#labour license registration#Professional Tax Registration#Business Tax Returns Filing#Gem registration

0 notes

Text

NG and Associates Spearheading Effortless MSME Company Registration in India

In the intricate world of business, especially for small and medium enterprises (SMEs), the process of MSME registration in India can be a daunting task. NG and Associates, a distinguished consultancy firm, stands out as a guiding force, facilitating a seamless journey through the complexities of MSME company registration.

NG and Associates: Your Gateway to Streamlined MSME Registration

NG and Associates has emerged as a trusted partner for entrepreneurs and businesses seeking to register as Micro, Small, or Medium Enterprises (MSMEs) in India. With a dedicated team of experts well-versed in the nuances of MSME regulations, the firm ensures a hassle-free and expedited process for clients looking to establish their businesses with the official MSME tag.

Understanding the Essence of MSME Registration in India

MSME registration in India holds pivotal importance for businesses aiming to enjoy the various benefits extended by the government. These benefits include financial assistance, access to subsidies, and a plethora of opportunities in government tenders. NG and Associates recognizes the significance of MSME Registration In India and acts as a guiding beacon for businesses, ensuring they capitalize on these advantages.

Navigating MSME Regulations with NG and Associates

NG and Associates excels in simplifying the complex web of legal formalities associated with MSME registration. From documentation to liaising with regulatory bodies, the firm's seasoned professionals guide clients through each step, ensuring compliance with MSME regulations. Their in-depth knowledge of the sector positions them as a reliable partner for businesses of all sizes seeking MSME registration.

Tailored Solutions for Diverse MSME Needs

What sets NG and Associates apart is their ability to provide personalized solutions tailored to the unique needs and aspirations of each client. Whether it's a micro-enterprise or a medium-sized business, the firm adapts its services to ensure a smooth MSME registration process, fostering growth and sustainability.

Incorporating Technology for Efficiency

NG and Associates leverages state-of-the-art technology to expedite the MSME registration process. By embracing digital solutions, the firm ensures a streamlined and efficient journey, reducing paperwork and accelerating the overall turnaround time. This commitment to technological advancement sets them apart in the realm of MSME consultancy.

The NG and Associates Advantage: Nurturing Growth, Ensuring Compliance

In an environment where MSMEs play a crucial role in the economic landscape, NG and Associates emerges as a trusted ally for entrepreneurs looking to formalize their businesses. With a commitment to nurturing growth, ensuring compliance, and providing comprehensive MSME registration solutions, the firm stands as a beacon of reliability and excellence.

Conclusion

For businesses seeking the coveted MSME status in India, NG and Associates represents a bridge to streamlined registration and a gateway to unparalleled support. Trust in NG and Associates to navigate the intricacies of MSME registration, unlocking a world of opportunities and advantages for your business in the dynamic Indian market. Partner with NG and Associates – where efficiency meets expertise – to empower your business journey.

#MSME Registration In India#Startup Registration India#GST Registration Online#Copyright Registration Online In India#FSSAI License and Registration#One Person Company Registration#ISO Certification in India#labour license registration#Professional Tax Registration#Business Tax Returns Filing#Gem registration

0 notes

Text

Professional Tax Registration for Employers in India

Employers and individuals in any trade or profession must pay Professional Tax Registration. That entity must obtain a professional tax registration certificate. The state gets money from the Professional Tax. Enrollment and tax registration are currently Easy to use, reasonably priced, and accessible with Kanakkupillai.

In India, all salaried individuals are required to register for professional tax registration; however, several states, including Delhi, Uttar Pradesh, and Haryana, are free from this tax. All categories of employed professionals, including attorneys, doctors, and chartered accountants, are subject to this tax. It is enforced based on the person's business, occupation, or employment. Business owners, independent contractors, and others are actually also responsible for paying this P tax registration when their income exceeds the threshold. Not all states have the same tax rates, and the most amount of professional income tax that can be levied annually is Rs. 2,500.

Who Pays Professional Tax in India?

Self-employed people engaged in any type of company, trade, or profession will fall under the professional tax registration category. They will be legally obligated to pay professional tax to the state government. The Commercial Taxes Department is responsible for collecting this tax, and each state has a different tax slab. The tax is computed using the professionals' yearly taxable income, and it can be paid both annually and monthly. A self-employed person must get the certificate of enrollment in the prescribed format from the authorised authorities.

Every month, a wage worker or salaried individual's paycheck is withheld to cover professional tax. An employer can deposit the amount withheld with the registration certificate from the relevant authority.

Benefits of Professional Tax Registration Online in India

Following are the reasonable factors why one should never miss professional tax registration:

In India, individuals must pay professional tax registration fees online. Failure to do so may result in penalties or legal issues. Employers and self-employed individuals are also required to pay professional tax within the prescribed time frame, based on the rates of wages set by their respective states.

Professional taxation is straightforward to follow. Professional tax rules and regulations impose few limits, and registration is relatively easy with basic monthly or annual compliances.

Tax deductions for professional taxes already paid may be claimed.

Since professional taxation is a state tax, local tax authorities are responsible for collecting professional tax from professional fees, business income, and pay.

Professional Tax Applicability

The Professional tax is applicable to the following class of individuals in states where they are working:

HUF

Individual

One person Company/Private/Public

Co-operative Society

Body of Individuals

Association of Person

Professional Tax Payment

The state's Commercial Tax Department deducts professional tax registration at a predetermined slab rate, either monthly or yearly. Self-employed persons have the option to pay the professional tax directly online. Still, employers must withhold professional tax from their employee's paychecks and remit it to the relevant state government. The self-employed person must get the Certificate of Enrollment from the state's tax department.

0 notes

Photo

Professional Tax Registration in maharashtra,west bengal,karnataka An employer organization is required to get registered under the Professional Tax Act.

0 notes

Text

Guide to Professional Tax Registration for 2024

Securing Your Professional Tax Registration Certificate with Expert Guidance

Introduction:

Navigating the intricacies of professional tax registration can be daunting, especially when attempting to do so online. Each region has its own set of rules and requirements, adding another layer of complexity. However, with the proper guidance, the process can become more manageable. Below, we outline a generalised step-by-step approach to online applying for professional tax registration. While specific details may vary based on your location, this guide provides a solid foundation to begin your journey toward compliance and legitimacy in your profession.

Steps to Apply for Professional Tax Registration Online

The steps to apply for Professional Tax Registration online can vary depending on your location, as tax regulations differ from one place to another. However, I can give you a general outline of the steps involved:

1. Research: Understand the professional tax regulations applicable to your profession and location. Different states or regions may have different requirements and rates.

2. Visit the Official Website: Go to the official website of your area's relevant tax department or authority. It could be the state government's taxation department website.

3. Registration: Look for the section on registration or enrollment for professional tax. Specific instructions and forms might be provided for new registrations.

4. Fill out the Application Form: Complete the online application form with accurate information. You may need to provide details such as your name, address, contact information, nature of profession or business, and other relevant details.

5. Upload Documents: Scan and upload the necessary documents according to the website's requirements. These could include identification proof, proof of address, and business registration documents.

6. Payment of Fees: Pay any applicable registration fees or taxes online through the provided payment gateway. The costs can vary based on your profession and the rules of your local tax authority.

7. Submit Application: After completing the form and uploading the required documents, submit your Application online. Make sure to review all the information you've provided before submission.

8. Acknowledgment: Once your Application is submitted, you should receive an acknowledgement or reference number. Keep this number handy for future correspondence or tracking purposes.

9. Verification and Approval: The tax department will verify the details provided in your Application. This process may take some time, depending on the department's workload and verification procedures.

10. Receipt of Certificate: Upon successful verification, you will receive your professional tax registration certificate either by mail or digitally, depending on the process followed by your local tax authority.

11. Compliance: Ensure that you comply with all the ongoing requirements, such as timely payment of professional tax, filing of returns, and any other obligations specified by the tax department.

12. Renewal: Be aware of the renewal process for your professional tax registration, as it may need to be renewed periodically according to the regulations in your area.

To ensure a smooth and successful registration, it's essential to follow the specific guidelines your local tax authority provides during each step of the application process.

Conclusion:

You are completing the online Application for professional tax registration, which marks the beginning of your journey toward tax compliance. Remember to stay informed about any updates or changes in regulations, fulfil ongoing obligations promptly, and be proactive in renewing your registration as required. By following these steps and remaining vigilant in your compliance efforts, you can navigate the professional tax landscape confidently.

0 notes

Text

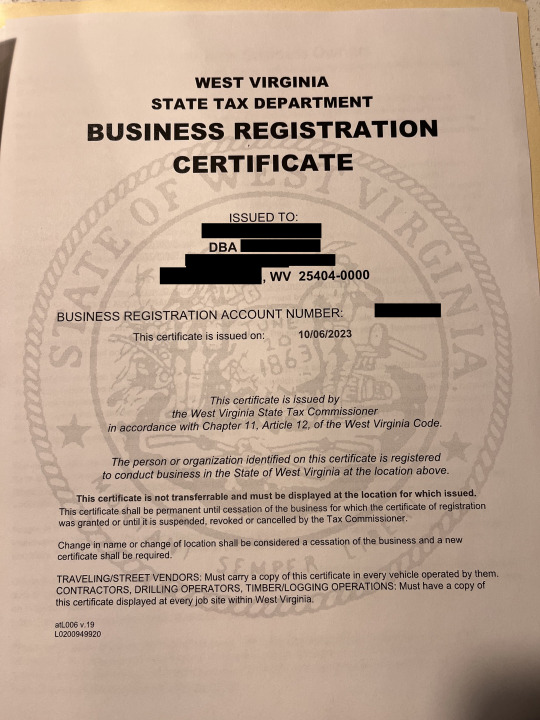

<<< THIS PERSON IS NOW A LEGAL BUSINESS OWNER!!!!!!!!!!!!!!!!!!!!!!

i finally did it!!!! wahoooooooooooooooo

#i went and got my registration certificate today#all the tax stuff started and a new checking account made for the business and everything#the rii professional baker arc begins NOW#rii rambles

13 notes

·

View notes

Text

#Bookkeeping services UAE#Accounting solutions UAE#Professional bookkeeping UAE#Financial record keeping UAE#Small business bookkeeping UAE#Accounting Firms Ajman#Bookkeeping Firms Ajman#Professional accounting services in Ajman#Online Bookkeeping Services UAE#Accounting Outsourcing Services in Ajman UAE#Accounting and Bookkeeping Ajman#Audit Firms Ajman#Audit period in the Ajman UAE#Financial statement audit importance in Ajman#IT support for small and medium scale industries in Ajman#IT Support Services in Ajman UAE#VAT consultation services in Ajman UAE#VAT Registration in Ajman UAE#VAT & Tax Registration Services in Ajman#VAT advisory services in Ajman Dubai#Tax Audit Services in Ajman UAE#Tally Software Solutions Ajman#Tally accounting services in Ajman UAE#Value Added Tax (VAT) in Ajman

0 notes

Text

How to Reduce Your Tax Liability with Effective Business Planning

When it comes to managing a business, the goal isn’t just to grow revenue but also to minimize expenses—and taxes are a significant expense for any business owner. Strategic business planning can help you reduce your tax liability, allowing you to keep more of your hard-earned money. Here’s how you can make it happen:

1. Understand Your Business Structure

Your business structure (sole proprietorship, partnership, LLC, S corporation, etc.) significantly impacts your tax liability. Each structure has its own tax implications. For example:

Sole Proprietorship: All profits are taxed as personal income, which might put you in a higher tax bracket.

LLC: Offers flexibility; you can choose to be taxed as a sole proprietor, partnership, or corporation.

S Corporation: Allows profits to pass through to shareholders, avoiding double taxation on corporate income.

Consider consulting with a tax advisor to choose the structure that best suits your financial situation and goals.

2. Leverage Tax Deductions and Credits

Tax deductions reduce your taxable income, while tax credits reduce your tax liability directly. Some common deductions include:

Operating Expenses: Costs of running your business, like rent, utilities, and office supplies.

Depreciation: Write off the cost of major assets over time.

Business Meals and Travel: Keep detailed records of expenses to claim deductions.

Home Office: If you work from home, you might be able to deduct a portion of your housing costs.

Tax credits, on the other hand, can be more specific, like those for hiring certain employees or investing in renewable energy. Research available credits or consult a tax professional to make sure you’re taking advantage of all possible savings.

3. Plan for Retirement Contributions

Contributing to a retirement plan isn’t just good for your future—it can also reduce your current tax liability. Plans like a SEP IRA, SIMPLE IRA, or a 401(k) can offer significant tax benefits. Contributions to these plans are typically tax-deductible, and the funds grow tax-deferred until retirement.

4. Optimize Your Income Timing

Income timing can impact your tax bracket. If you expect to be in a lower tax bracket next year, you might delay receiving income until then. Conversely, if you anticipate a higher tax rate in the future, accelerating income into the current year could be advantageous.

5. Utilize Tax-Advantaged Accounts

Besides retirement accounts, other tax-advantaged accounts can help reduce your tax burden. For example:

Health Savings Accounts (HSAs): Contributions are tax-deductible, and withdrawals for medical expenses are tax-free.

Flexible Spending Accounts (FSAs): Allow you to set aside pre-tax dollars for qualified expenses.

6. Keep Detailed Records

Good record-keeping is essential for effective tax planning. Maintain accurate and detailed records of all business transactions, including receipts, invoices, and bank statements. This not only ensures compliance but also helps you identify potential deductions and credits.

7. Work with a Tax Professional

Tax laws and regulations can be complex and ever-changing. A tax professional or accountant can provide tailored advice and strategies based on your specific situation. They can help you navigate the intricacies of tax planning, identify opportunities for savings, and ensure that you’re in compliance with all regulations.

8. Review and Adjust Your Plan Regularly

Business and tax laws can change, and so can your financial situation. Regularly review your tax strategy and adjust it as needed. Periodic check-ins with your tax advisor can help you stay on top of any changes that might affect your tax liability.

Conclusion

Effective business planning is not just about growing your business but also about strategically managing your taxes. By understanding your business structure, leveraging deductions and credits, planning for retirement, and maintaining detailed records, you can significantly reduce your tax liability. Don’t hesitate to seek professional advice to craft a plan that aligns with your unique business needs and goals. After all, smart planning today can lead to substantial savings and a more financially secure future.

0 notes

Text

If you are an employee of a company, you need to pay professional tax. Professional tax is debited at a predetermined slab rate. Eazystartups help you in this regard.

0 notes