#navi finserv

Explore tagged Tumblr posts

Text

0 notes

Text

El banco central de la India ordena a Navi de Sachin Bansal suspender los préstamos

El banco central de la India ordenó a cuatro prestamistas no bancarios, incluidos Navi Finserv y DMI Finance, que suspendieran los préstamos a partir del 21 de octubre, citando tasas de interés excesivas e incumplimientos regulatorios. El Banco de la Reserva de la India dicho (PDF) las empresas violaron las reglas sobre precios, evaluación de ingresos y clasificación de activos. Esta acción se…

0 notes

Text

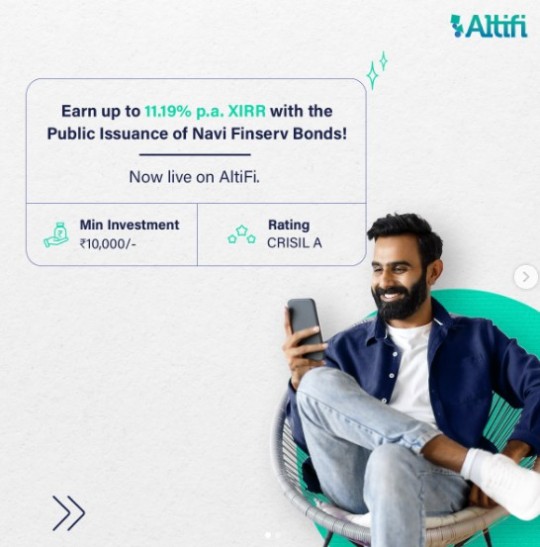

Here’s an opportunity to invest in CRISIL A rated Public Issuance and earn up to 11.19% p.a. XIRR. The Public Issuance of Navi Finserv Bonds is now live on the AltiFi app. Download now. Visit Us: https://altifi.ai/

0 notes

Text

11.19% Navi Finserv NCD Feb-2024 - Details, Interest Rates and Review

Navi Finserv is coming up with secured NCD bonds now. These bonds would open for subscription on February 26, 2024. Navi Finserv is a non-deposit taking, systemically important NBFC registered with RBI. The interest rates for Navi Finserv NCD are up to 11.19%. These NCDs are offered for 18 months, 27 months and 36 months tenure. Interest is paid either monthly or yearly. Should you invest in Navi Finserv NCD February, 2024? Is Investment in Navi Finserv NCD Safe or risky?

About Navi Finserv Limited

Company is a non-deposit taking, systemically important NBFC registered with RBI and wholly owned subsidiary of NTL. NTL is a technology driven financial products and services company in India focussing on digitally connected young middle-class population in India. Company offer lending products like personal loans, home loans under the Navi brand. It also offer microfinance loans under the brand name "chaitanya" through its subsidiary, CIFCPL

Navi Finserv NCD Feb-2024 issue details

Here are the details of Navi Finserv NCD Feb-2024 issue. Subscription opening Date 26-Feb-24 Subscription closure Date 07-Mar-24 Issuing Security Name Navi Finserv Limited Security Type Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) Issue Size (Base) Rs 300 Crores Issue Size (Option to retain over subscription) Rs 300 Crores Total issue size Rs 600 Crores Issue price Rs 1,000 per bond Face value Rs 1,000 per bond Minimum Lot size 10 bonds and 1 bond there after Tenure 18, 27 and 36 months Interest Payment frequency Monthly and Annually Listing on Within 6 working days on BSE/NSE Lead Manager JM Financial Limited Debenture Trustee/s Catalyst Trusteeship Limited NRI’s cannot apply to this NCD subscription.

Navi Finserv NCD Interest Rates – Feb-2024 Issue

Series I II III IV X Frequency of Interest Payment Monthly Monthly Annual Monthly Annual Tenor (in months) 18 27 27 36 36 Coupon (% per Annum) 10.00% 10.40% 10.90% 10.65% 11.19% Effective Yield (% per Annum) 10.47% 10.91% 10.94% 11.19% 11.19% Amount on Maturity (In Rs.) 1,000 1,000 1,000 1,000 1,000

What are the credit ratings for these NCDs?

CRISIL Ratings assigned Navi Finserv NCD rating as CRISIL A/Stable. Instruments with this rating are considered to have adequate degree of safety regarding timely servicing of financial obligations. Such instruments carry low credit risk.

How is the company doing in terms of profits?

Here are the restated consolidated profits of the company. - FY2021 – Rs 118.1 Crores - FY2022 – Rs 14.66 Crores (Loss) - FY2023 – Rs 264.1 Crores

Why to invest in these NCDs?

- Navi Finserv NCD’s offer attractive interest rates where investors can get interest up to 11.19%. - It issues secured NCDs. Its secured NCDs are safe compared to unsecured NCDs. In case company gets wind-up/shut down for some reason, secured NCD investors would get preference in repayment of capital along with interest as those backed up by assets of the company. Hence it is safe to invest in such secured NCD options.

Why not to invest in these NCD Bonds?

Here are the risk factors investors should consider before investing in these bonds. - Company has incurred losses for FY22. Investors should always invest in profit making companies so that they can get timely payment of interest and repayment of capital. - Company lending business of and micro finance business operations rely intensively on substantial capital for its lending and microfinance business operations. Any disruption can affect company financial condition and liquidity - Company is affected by volatility in interest rates in both lending and treasury operations which could cause its net interest income to varry and affect its profitability. - Company has significant growth in recent period and may not be able to grow at similar pace in future or manage it effectively. - Customers default in repayment obligations can adversely affect company. - Covid pandemic has affeced its regular business operations and may continue in fuure too. - Refer Navi Finserv Feb-24 NCD prospectus for complete risk factors.

How safe is Navi Finserv NCD Bonds?

These NCD bonds are rated as A/Stable by Crisil Ratings. Such ratings are considered to have adequate safety regarding timely servicing of financial obligations with low credit risk. Hence these are safe bonds.

Should you invest in Navi Finserv NCD Feb-2024 issue?

- These NCD Bonds offer high interest rates and yield. Such interest rates are higher than FD rates offered by small finance bank too. It comes with A/Stable credit ratings which are considered to have adequate safety and carry low credit risk. These are secured NCDs too. - On the other side investment in these bonds comes with several risk factors. Company credit ratings can change in future without any advance intimation. Company has incurred losses for FY22, however shown significant improvement both in terms of revenue and margins. Investors who understand all these risk factors can invest in such NCDs. Read the full article

#FixedIncome#NaviFinservNCDFeb-2024#NaviFinservNCDFeb-2024CreditRatings#NaviFinservNCDFeb-2024InterestRates#NaviFinservNCDRatings#NCD

0 notes

Text

Navi Technologies IPO Date, Lot Size, Price, Company Profile & Financial Details

New Post has been published on https://wealthview.co.in/navi-technologies-ipo/

Navi Technologies IPO Date, Lot Size, Price, Company Profile & Financial Details

Navi Technologies IPO: Company and Industry: Navi Technologies is a young player in the Indian financial services industry, using technology to offer a range of products and services focused on the underserved middle class. Their offerings include micro-loans, wealth management, and insurance, all delivered through a digital platform.

IPO Details: While the IPO is yet to occur, the company has received Sebi approval and aims to raise Rs. 3,350 crore through a fresh issue of equity shares. The offer size may decrease if they choose to proceed with a pre-IPO placement of up to Rs. 670 crore. Dates for the open, close, and listing are still undisclosed. The price band is also yet to be announced.

News and Developments:

The IPO has generated significant buzz due to Sachin Bansal’s involvement as Founder and Chairperson. Bansal co-founded Flipkart, India’s e-commerce giant, and his success story adds allure to Navi.

However, some analysts express concerns about Navi’s profitability and lack of established track record compared to other financial giants.

Recent developments like Navi Finserv’s partnership with Mastercard and the launch of new insurance products could improve investor sentiment.

Navi Technologies has not yet issued any public offerings since its initial public offering (IPO) in March 2022. Therefore, providing details about current offer types, investor category reservations, and minimum lot sizes is not possible.

Securities offered: Equity shares Reservation percentages:

Retail investors: 35%

Qualified Institutional Buyers (QIBs): 50%

Non-Institutional Investors (NIIs): 15% Minimum lot size: 15 shares Amount required to invest: Depends on the final issue price per share, which was not known at the time of the draft offer document filing.

Navi Technologies Company Profile:

Company History and Operations:

Founded in December 2018 by Sachin Bansal (Flipkart co-founder) and Ankit Agarwal (ex-banker), Navi Technologies is a financial services company headquartered in Bengaluru, India.

Started with digital lending through its subsidiary Navi Finserv, Navi has expanded into other areas like cash, home loans, health insurance, and mutual funds.

Operating from its Bangalore office, Navi employs a technology-driven and customer-centric approach to offer products and services.

Market Position and Share:

Navi’s Digital Lending platform (Navi app) became one of the largest lending apps in India within 3 months of launch, serving over 1.5 lakh customers.

While still relatively young, Navi is considered a disruptive player in the Indian financial services space, aiming to challenge traditional institutions. Its market share in specific segments like digital lending is growing rapidly.

Milestones and Achievements:

Secured USD 377 million in funding across multiple rounds from marquee investors like Tiger Global, Sequoia Capital, and Premji Invest.

Received SEBI approval for mutual fund business in 2022.

Filed for an INR 3350 crore IPO (initial public offering) in March 2022, though it is yet to debut.

Competitive Advantages and USP:

Technology-driven: Focuses on automation, AI, and data analytics for streamlined and efficient services.

Customer-centric: Offers transparent and simplified financial products through user-friendly interfaces.

Accessibility: Targets segments traditionally underserved by banks, making financial services inclusive.

Unique approach: Blends digital capabilities with personal touch through human intervention where needed.

Potential Risks Associated with Navi Technologies IPO:

Market Volatility:

The financial markets are currently facing uncertainty due to various factors like inflation, rising interest rates, and geopolitical tensions. This volatility could lead to a dip in the overall market, impacting the initial performance of Navi Technologies’ stock.

High IPO valuations are particularly vulnerable in volatile markets, increasing the risk of price correction after listing.

Industry Headwinds:

The Indian fintech space is still nascent and highly competitive. Established players, including Paytm and PhonePe, hold significant market share, making it challenging for Navi Technologies to carve out a strong position.

Regulatory changes in the financial services sector could negatively impact the company’s growth prospects.

Company-Specific Challenges:

Navi Technologies is a relatively new company with limited operating history. Its lack of a diversified revenue stream and established track record of profitability could raise concerns among investors.

Dependence on funding from strategic partners like Flipkart could limit its operational independence and raise potential conflicts of interest.

Concerns about Navi Technologies’ data privacy practices and potential security vulnerabilities could damage its reputation and hinder user acquisition.

Financial Health Analysis:

Analyze the company’s financial statements, including income statements, balance sheets, and cash flow statements. Pay close attention to revenue growth, profitability, debt levels, and cash reserves.

Look for red flags like declining revenue, increasing losses, high debt-to-equity ratios, or significant cash burn.

Compare Navi Technologies’ financial performance with its competitors to assess its relative competitiveness.

Navi Technologies Limited Draft Offer Documents filed with SEBI

Also Read: How to Apply for an IPO?

0 notes

Text

Navi co-lends loans worth Rs 1,900 Cr via new cloud platform (Good record)

https://yourstory.com/2023/07/navi-finserv-lending-cloud-platform-co-lends-loans-rs-1900-crore

View On WordPress

0 notes

Text

0 notes

Text

Market Investors: Risk-tolerant investors can look at Navi NCDs

Market Investors: Risk-tolerant investors can look at Navi NCDs

Mumbai: Fixed income investors with higher appetite for risk could consider the non-convertible debenture (NCD) issue of Navi FinServ. Financial planners said investors must, however, restrict their exposure to the paper as it does not enjoy top-notch credit rating. The NCD issue is open for subscription and closes on June 10, with an option to close early in the event of over-subscription. There…

View On WordPress

0 notes

Text

Sachin Bansal s Navi offers home loans at 6 4 percent Here is what borrowers must do nodvkj

Sachin Bansal s Navi offers home loans at 6 4 percent Here is what borrowers must do nodvkj

नई दिल्ली. हर आदमी का सपना होता है कि उसके पास अपना घर हो. अगर आप भी घर खरीदने के लिए होम लोन (Home Loan) लेने का मन बना रहे हैं तो आपके लिए एक शानदार मौका है. दरअसल, आरबीआई द्वारा रजिस्टर्ड एनबीएफसी कंपनी नावी फिनसर्व (Navi Finserv) होम लोन को ऐप के जरिए इंस्टैंट अप्रूवल ऑफर कर रही है. 6.46 फीसदी से शुरू होती हैं होम लोन की ब्याज दरेंस���िन बंसल की कंपनी नावी का कहना है कि ऐप के माध्यम से ही सारा…

View On WordPress

0 notes

Text

AI-powered social media analytics startup Circus Social raises $1 million

AI-powered social media analytics startup Circus Social raises $1 million

Circus Social, a social media analytics and Big Data SaaS company has raised $1 million in a Pre-Series A Round led by Inflection Point Ventures, and other marquee investors based in the United States, Singapore and India. These investors include Saurabh Gupta, Director (Data Strategy, Operations & Modernization) – DC OSSE; Ganesh Mohan, Head of Strategy – Bajaj Finserv; Samit Shetty, CEO – Navi…

View On WordPress

#ai-powered#AI-powered social media intelligence and analytics startup Circus Social#analytics#circus#Circus Social#fund raising#Inflection Point Ventures#media#million#Pre-Series A Round#raises#social#startup#technology

0 notes

Text

AI-powered social media analytics startup Circus Social raises $1 million

AI-powered social media analytics startup Circus Social raises $1 million

Circus Social, a social media analytics and Big Data SaaS company has raised $1 million in a Pre-Series A Round led by Inflection Point Ventures, and other marquee investors based in the United States, Singapore and India. These investors include Saurabh Gupta, Director (Data Strategy, Operations & Modernization) – DC OSSE; Ganesh Mohan, Head of Strategy – Bajaj Finserv; Samit Shetty, CEO – Navi…

View On WordPress

0 notes

Text

Oppo F17 128 GB Navy Blue (8 GB RAM) Online on EMI

Oppo F17 128 GB Navy Blue (8 GB RAM) Online on EMI

Oppo F17: Get best Oppo F17 128 GB Price at Bajaj Finserv EMI Store. You can avail exciting deals & offers on the 128 GB & 8 GB version. Buy your Navy Blue Oppo F17 Today! Zero Down payment, No Cost EMI. OFFER PRICE ₹18,490 HIGHLIGHTS 16 MP + 8 MP + 2 MP + 2 MP Rear Camera8 GB RAM128 GB Storage6.44 inch Display4015 mAh Battery See the full Specification:…

View On WordPress

#Buy Oppo F17#Oppo F17#Oppo F17 128 GB#Oppo F17 128 GB Navy Blue#Oppo F17 on EMI#Oppo F17 online#Oppo F17 Price

0 notes

Text

Oppo F17 128 GB Navy Blue (8 GB RAM) Online on EMI

Oppo F17: Get best Oppo F17 128 GB Price at Bajaj Finserv EMI Store. You can avail exciting deals & offers on the 128 GB & 8 GB version. Buy your Navy Blue Oppo F17 Today! Zero Down payment, No Cost EMI.

OFFER PRICE ₹18,490

HIGHLIGHTS

16 MP + 8 MP + 2 MP + 2 MP Rear Camera

8 GB RAM

128 GB Storage

6.44 inch Display

4015 mAh Battery

See the full Specification: https://www.bajajfinservmarkets.in/emi-store/oppo-f17-128-gb-navy-blue-8-gb-ram-smartphone.html

0 notes

Text

Woodland Outdoors For Men (Navy)

Woodland Outdoors For Men (Navy)

Outdoors For Men (Navy)

Special priceNo Cost EMI on Bajaj Finserv EMI Card on cart value above Rs.4499 No Cost EMI on Flipkart Axis Bank Credit Card Special Price Get extra 28% off (price inclusive of discount) Bank Offer 10% Instant Discount* with Axis Bank Credit and Debit Cards

View On WordPress

0 notes

Text

For somebody who was not even an newbie photographer, A.K. Bir has traversed an unbelievable path to change into probably the most revered cinematographers of the nation. Dronagiri is effectively-related to varied developed areas and quite a few accommodations, faculties, banks and hospitals through a wonderful network of railways and roadways. Prajapati was sacked by Akhilesh in September after complaints of corruption in Prajapati Magnum Amenities the mining division but was once more inducted plenty of days later. Dronagiri is located near the properly developed town- Uran, an space situated within the southern part of Navi Mumbai. On Saturday, a courtroom in Lucknow issued non bailable warrants in opposition to Prajapati and his aides. The group will also be into Data Experience & offers ERP Options to the Diamond Commerce by its sister concern Fauna Applied sciences Pvt.

The project has 10 facilities including Carry,Membership House,Hearth protection system and the project is out there at worth starting from Rs.sixty four.thirteen Lac. Put together routes are also presently under building and inside Prajapati Magnum Mumbai Price the close to future there shall be a route from CST to Magnum instantly. Prajapati Vihar Mumbai is a project offering several premium amenities to residents together with a having fun with zone for kids, intercom services, rainwater harvesting system, vitality backup providers, Prajapati Magnum Dronagiri Mumbai 24 hour security providers, car parking facilities, landscaped gardens, Vastu compliant architectural layouts, elevate and delightful entrance lobby.

The venture has 6 amenities together with Swimming Pool,Lift,Gymnasium and the project is available at price starting from Rs.85.68 Lac. Prajapati was despatched again to Gosainganj prison in Lucknow on Friday after town police dug out outdated Magnum By Prajapati Schemes circumstances and convinced the bench to ship Prajapati again to judicial custody. Unfurnished 1 BHK Flat for Sale in Dronagiri priced at 30.03 Lac and situated at Ground Ground out of whole 1 floors. We aren't certain how Maurya arrived on the Prajapati Magnum Amenities quantity, but the timing of Prajapati rape case is impeccable, and it would be protected to say that Prajapati has given Maurya at the least one proper trigger to say so. Akhilesh Yadav Prajapati Magnum Location might moreover drive inspiration from what transpired throughout the US in November.

After being on the run for virtually a month, Prajapati was arrested from the Aashiyana area right here on March 15 and was sent to jail for allegedly raping a lady and making an attempt to rape her minor daughter in 2014. With proper ventilation and uncluttered broad area, Prajapati Magnum makes you are feeling blissful correct from the second you enter in your lovely Flats at Dronagiri. Prajapati Aangan - Prajapati Group Approved by the next Banks in Mumbai, Thane and Navi Mumbai. At this, Prajapati abused him and in addition threatened him to implicate him in false case. Hey.. it moreover relies upon how fast the mthl will get constructed... if it takes too long, the worth gap you talked about above takes longer to fill.. additionally, supporting infra, enterprise zones and many others. Dronagiri offers every kind of social Prajapati Magnum amenities to its residents, enabling them to reside a happy and peaceable life. The BSP has already determined to make Congress' 'Coalgate' and Tulsi Prajapati (minister in Akhilesh government) mining scam as certainly one of predominant campaign points towards SP. Prajapati was gunned down in an alleged faux encounter on December 28, 2006 close to Ambaji in Banaskantha district.

The venture has Lined carparking, thirteen amenities together with Tennis Courtroom, Fitness center, Community Corridor and the mission is out there at worth ranging from Rs.1.39 Crore. In an trade the place outsourcing is more a norm than an exception, MALIK GROUP has grown synonymous with high quality and belief. Advance House Makers Group is a bunch established to offer expertise of a modern Prajapati Magnum In Mumbai dwelling with distinctive architect. Neither Bajaj Finserv nor any of its group firms take any accountability for the accuracy, completeness or high quality of the knowledge provided. The group has completed many unbelievable initiatives which have formed a powerful foundation to their firm. Prajapati Builders is likely one of the main actual estate player in India, was established in 1995 by Mr. Rajesh Prajapati. Sunteck Metropolis Avenue1 is a residential challenge by Sunteck Group in Goregaon West, Mumbai.

0 notes