#naira sharp

Explore tagged Tumblr posts

Text

can more people read the devoured worlds trilogy PLEASE it is fantastic and nobody has read it 😭😭 i have THOUGHTS

#the last book stressed me out so much and i feel like i didn’t get as much closure as i’d hoped for#but i still love the series i think i’m just upset it’s over#and that there’s only TWO fanfics in existence it seems#mine#gonna make the tiktok girlies obsess over fletcher so we can get an influx of content#cause surely that would bring in more people in total#the devoured worlds#tarquin mercator#naira sharp#the blighted stars#the fractured dark#the bound worlds#fletcher demarco#tarquin x naira#fletcher x naira#tarquin mercator x naira sharp#IM TRYING SO HARD YOU DONT GET IT

7 notes

·

View notes

Text

"The people fighting for dominance, for eradication, were never the heroes."

Megan E. O'Keefe, The Fractured Dark

4 notes

·

View notes

Text

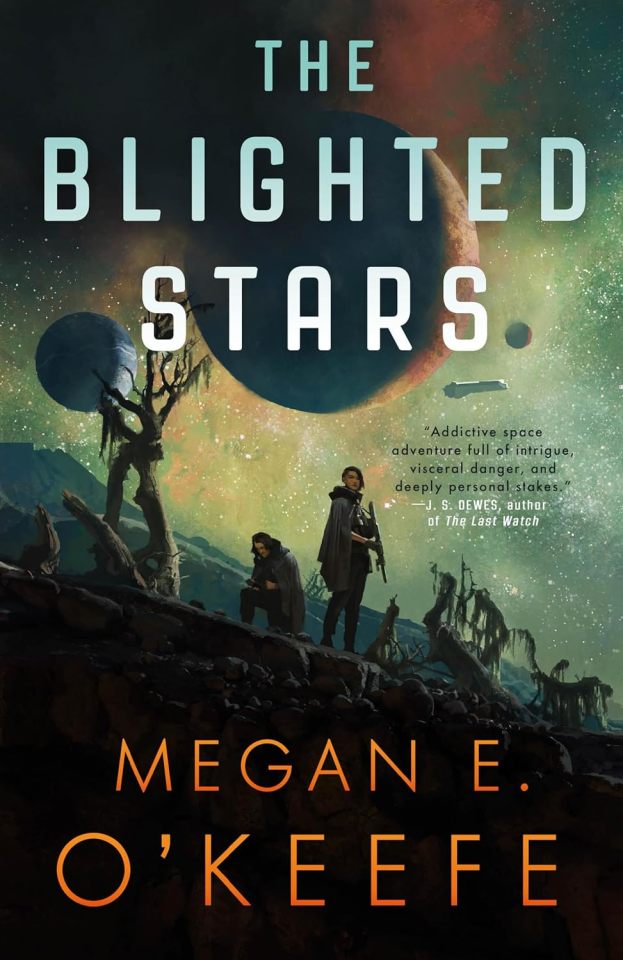

The Blighted Stars by Megan E. O'Keefe

When a spy and her mortal enemy crash-land on a dying planet, she must figure out how to survive long enough to uncover the deadly, galaxy-spanning conspiracy that landed them there. The Blighted Stars is the first book in an epic new space-opera trilogy from the author of the Philip K. Dick-nominated Velocity Weapon.

She's a revolutionary. Humanity is running out of options. Habitable planets are being destroyed as quickly as they're found, and Naira Sharp thinks she knows the reason why. The all-powerful Mercator family has been controlling the exploration of the universe for decades, and exploiting any materials they find along the way under the guise of helping humanity's expansion. But Naira knows the truth, and she plans to bring the whole family down from the inside.

He's the heir to the dynasty. Tarquin Mercator never wanted to run a galaxy-spanning business empire. He just wanted to study geology and read books. But Tarquin's father has tasked him with monitoring the settlement of a new planet, and he doesn't really have a choice in the matter.

Disguised as Tarquin's new bodyguard, Naira plans to destroy the settlement ship before they land. But neither of them expects to end up stranded on a dead planet. To survive and keep her secret, Naira will have to join forces with the man she's sworn to hate. And together they will uncover a plot that's bigger than both of them.

#the blighted stars#megan e. o'keefe#transmasc#trans book of the day#trans books#queer books#bookblr#booklr

39 notes

·

View notes

Text

Naira Sharp and Tarquin Mercator; The Blighted Stars

“I’d follow you anywhere,” he said without hesitation. “Then you’d better keep up.”

#the blighted stars#the devoured worlds#litedit#literatureedit#bookedit#idk what this is... just vibes i guess#mercsharp#*graphics#this is gonna get exactly three notes but idc

52 notes

·

View notes

Text

5 stars

This book is the perfect blend of sci-fi with creeping horror vibes and the reveals are expertly peeled back slowly throughout the tense story.

It follows Naira Sharp and Tarquin Mercator, who are enemies and after crashing down on a dying planet, it's up to them to not only survive but figure how this planet died. I loved these characters, both were so greatly written and I loved the conversations that they had and the way they began to change their perceptions. The romance here is very slow and nothing understandably really happens, but it gives "I'll find you" and "I love you in every universe" vibes.

The horror parts were done extremely well and honestly, the way the "Bad" works is so terrifying and it really makes everything look so bad and hard for the future. I cannot WAIT to see what happens next. The whole printing bodies and mental maps and casting is very cool too.

My only complaint is that I felt this book should have ended earlier? It just got a little crazy and rushed in my opinion, to the point where I was like why are we still continuing? I think ending it at the horror of the scope of things or even ending after they "safely" got printed would have been perfect. Enough to end but leave us slightly anxious for more.

7 notes

·

View notes

Text

CBN Weak Enforcement Driving Seasonal Cash Scarcity Across Nigeria- CHRICED

CBN Weak Enforcement Driving Seasonal Cash Scarcity Across Nigeria- CHRICED The group is saying that such weak enforcement by the nation’s apex bank accounts for the numerous sharp practices in the sector, which have caused Nigerians untold hardship, one of which is the seasonal scarcity of the Naira. Comrade Ibrahim M. Zikirullahi, Executive Director of CHRICED stated this on Tuesday during an…

0 notes

Text

"Found ya, Rainbow Tetra~" Floyd comes to a halt and settles down on the steps leading up to Ramshackle beside her, grinning wide. "Thought you'd be out here zippin' around an' enjoying the snow. Or is it too cold for your wings?"

Jade curls up and watches behind their shared eyes, his awareness spreading out until they're nearly one and same under their skin. He's excited to see what will happen, and frankly so is Floyd.

"We don't have trees to decorate or anything in the sea, so we come up with other stuff." A flick of Floyd's pen conures up a box topped with seashells. It had taken a while to find a pair of shoes that would fit a fairy, but Floyd was betting on the soft colorful design to be a solid win.

"Christmas ain't til tomorrow but open it up and try 'em out. We can't wait to see your face~☆"

-- @sweetlybite

She did want to zip around outside like normal, but it was still too cold. The fairy hadn’t made it past the steps, simply opting to sit on the handrail. If nothing else, she had gotten distracted by the snowflakes and how large they were to her. Her wing mitts were a bit heavy still, and it was simply safer to leave them bundled up inside of her coat.

Watching Floyd approach, she waved to him accompanied by a bright smile. Her nose and the tips of her ears were red from the cold, but with a smile that makes her freckles follow suit, she’s not wholly bothered at it. Patting the spot on the railing by her, she’s inviting him to sit.

“I’s too cold. I have ta keep my wings in my coat otherwise they’ll crack.”

With a nod of agreement, she understands. Naira had only recently helped Mama Ashengrotto make a bunch of ornaments and decorations. Using a handful of sea items was definitely a challenge, but it was fun for her in the end. Was it fun for Floyd too, she wonders.

Being handed the box was definitely a surprise. There’s just a fleeting moment of the fairy being absolutely baffled and looking to Floyd before back at the box. She gets over her confusion after a moment as gloved fingers carefully open the box after he requests her to do so.

From beneath her coat, it moves. A joyous, muffled flutter of wings as she sees the shoes. They’re so colorful! And they look so nice and comfortable as well!

The fairy doesn’t give much thought into pulling her boots off, only having that momentary regret when the sharp cold air hits her socked feet before she puts on her new shoes.

Looking down at her feet with a wide smile, she thinks of how to best use them. While not exactly fashion conscious, in any capacity. . .she knew the dress that Azul had gifted her would go great with these.

Turning to Floyd, Naira throws her arms around him in a tight hug. It’s with joyous little squeal that she lifts up one of her legs to get a better look at it. “Floyd! They’re so colorful! They’re like tha flowers back home! An’ they’re comfy too! Thank ya so much!”

#༼ 🌟 open your messages! ༽#༼ 🌟 Touch my wings and it’ll be the last thing you ever do: TWST ༽#sweetlybite#somft...#holiday 2024!!

1 note

·

View note

Text

Geh Geh Net Worth, Biography, and Financial Philosophy

Geh Geh Net Worth, Biography, and Financial Philosophy: Emmanuel Obruste, widely known as GehGeh, is a Delta State-born Nigerian financial coach, social media influencer, and entrepreneur. His remarkable rise from humble beginnings to a position of wealth and influence has inspired many. This guide delves into GehGeh’s biography, net worth, sources of income, and the actionable advice he shares to empower others.

Who Is GehGeh?

Emmanuel Obruste, popularly called GehGeh, was born and raised in Delta State, Nigeria. His upbringing in a low-income family instilled in him an acute awareness of financial struggles, which later fueled his passion for wealth creation and financial literacy. At an early stage in his life, GehGeh faced significant economic hardships. However, his determination to rise above these challenges and his sharp financial acumen enabled him to carve a niche for himself as a financial expert and content creator. His journey exemplifies resilience and the value of leveraging personal experiences to achieve success.

How Geh Geh Gained Popularity

Geh Geh first made his mark by advising others on how to manage their finances and self-proclaimed himself as "Africa’s Most Experienced Financial Expert" (AMEFE). He gained widespread attention by publicly calling out Nigerian celebrities like Burna Boy, Non Miraj, and Davido for what he believes are financial mistakes—specifically, their habit of purchasing expensive cars instead of investing in assets like land or businesses. He further explained his stance by saying, "If you buy a car for 10 million Naira, within a few years, its value could drop to 5 million. However, if you use that same amount to buy land, its value will increase over time." This perspective was shared during his meeting with Broda Mike (Emeka), a well-known Facebook content creator. For more details, you can check out Geh Geh’s Instagram to watch the video, as I am unable to share it here due to copyright restrictions. In this post, I’ll provide a comprehensive view of Geh Geh’s wealth by evaluating his physical assets.

Geh Geh Net Biography

Aspect Details Full Name Emmanuel Obruste Nickname GehGeh Place of Birth Delta State, Nigeria Nationality Nigerian Occupation Financial Coach, Influencer Known For Financial Advice, Social Media Content Net Worth in 2024 ₦400 Million Net Worth in USD $230,000 Major Income Sources Content Creation, Real Estate Social Media Presence Facebook, Instagram, TikTok

Geh Geh Net Worth in 2024

As of 2024, Geh Geh net worth is estimated at ₦400 million (approximately $230,000 USD). This substantial wealth stems from multiple income streams, including social media monetization, brand collaborations, and strategic investments in real estate. Geh Geh has rapidly risen as one of Africa’s most prominent financial coaches, with an estimated net worth in Nigeria pegged at ₦400 million. Known for his confidence, Geh Geh often boasts about his wealth, though he refrains from flaunting it on social media. The young and successful millionaire frequently reminds his followers that he is wealthier than anyone in Delta State. When converted to U.S. dollars, Geh Geh Net Worth in 2024 in Dollars stands at approximately $230,000 USD. You can verify this by multiplying the amount by the current exchange rate: 230,000 × 1740 = 400,000,000 Naira. GehGeh’s financial journey demonstrates his ability to maximize opportunities while staying true to his principles of asset-building over frivolous spending. How Geh Geh Net Worth Is Calculated - Net Worth in Naira: ₦400 million - Net Worth in USD: $230,000 (conversion rate: ₦1 = $1740) Geh Geh Net Worth in Forbes Rankings Although GehGeh’s name does not yet appear on Forbes’ official rankings, his consistent financial growth and strategic investments position him as a rising star in Nigeria’s entrepreneurial scene. Many believe that with his current trajectory, he may soon gain recognition in Forbes’ lists of influential entrepreneurs.

How GehGeh Earns His Wealth

GehGeh’s net worth in 2024 is the result of diversified income sources. Let’s take a closer look at each: 1. Content Creation GehGeh’s engaging financial advice videos on Facebook, Instagram, and TikTok have made him a sought-after content creator. Social media platforms reward creators based on their ability to generate views and engagement. GehGeh earns approximately ₦3 million monthly from these platforms. Advice - Monetize Social Media: Consistent posting of high-quality, niche-specific content can lead to monetization. Platforms like Facebook and YouTube offer revenue-sharing programs. - Engage with Your Audience: Respond to comments and create content that addresses their questions or concerns. 2. Brand Influencing As a trusted voice in financial literacy, GehGeh partners with brands to promote products and services. Businesses often pay him substantial fees for his influence in reaching a wide audience. Advice - Build Credibility: Focus on becoming an authority in your niche to attract brands. - Negotiate Contracts: Ensure fair compensation for your work by researching standard industry rates. 3. Real Estate Investments GehGeh’s love for real estate is no secret. He buys land at low prices and sells it at a premium. For example, purchasing a plot for ₦2 million and reselling it for ₦4 million is a regular occurrence in his portfolio. Advice - Invest in Appreciating Assets: Real estate typically appreciates in value over time. Start small with land or rental properties. - Research the Market: Understand local real estate trends before making purchases.

Geh Geh's Rich Friends Who Are Just Like Him

Geh Geh has a close circle of friends who share his success, one of whom is Broda Mike. Broda Mike, like Geh Geh, is a wealthy individual and a business partner, and the two often collaborate as video creators. Geh Geh regularly advises his followers to surround themselves with successful individuals if they want to escape a life of poverty, a philosophy he shares with Broda Mike. Geh Geh net worth saw a significant increase after his partnership with Broda Mike. In a generous move, Broda Mike gifted Geh Geh millions of naira to purchase phones for his top fans. This gesture was intended to help them create content and eventually achieve financial freedom and success.

GehGeh’s Financial Philosophy

At the heart of GehGeh’s teachings is the principle of prioritizing assets over liabilities. He frequently criticizes the purchase of depreciating items, such as luxury cars, advocating instead for investments in real estate or businesses. Key Lessons - Avoid Liabilities: GehGeh often states, “A car worth ₦10 million today will depreciate to ₦5 million in a few years, but land will appreciate in value.” - Plan for the Long Term: Build wealth by investing in assets that grow over time. Advice - Track Your Expenses: Use tools like budget apps to categorize and monitor your spending. - Focus on Growth Assets: Identify investments that generate passive income or appreciate in value.

Assets Owned by GehGeh

1. Real Estate In 2023, GehGeh began construction on his personal residence and completed it in August 2024. Beyond his home, he has invested in hotels and guest houses, further solidifying his portfolio. Advice - Start Small: Purchase a modest property and reinvest profits into additional properties. - Consider Commercial Real Estate: Hotels and guest houses can generate consistent income. 2. Vehicles While GehGeh owns a vehicle for professional purposes, he discourages excessive spending on cars, considering them depreciating assets. Advice - Buy Within Your Means: Opt for reliable vehicles that fit your budget and needs. - Lease Instead of Buy: Leasing can be a cost-effective option for professionals.

GehGeh’s Influence on Society

Empowering the Youth GehGeh’s financial advice has inspired many young Nigerians to adopt better spending habits and explore entrepreneurship. His content encourages viewers to: - Create monetizable social media pages. - Invest in real estate or small businesses. - Network with like-minded individuals for growth opportunities. Collaborations GehGeh often collaborates with fellow influencers like Broda Mike. These partnerships amplify his message and extend his influence to a broader audience.

Conclusion - Geh Geh Net Worth

GehGeh’s story—from a poor upbringing to becoming a financial "expert"—is a testament to the power of perseverance, strategic investments, and disciplined spending. By sharing his journey and actionable financial advice, GehGeh has not only transformed his life but also empowered countless others to take charge of their financial futures. Read the full article

0 notes

Text

PoS Operators Hike Charges as Banks Struggle with Cash Rationing

The scarcity of naira notes is once again disrupting banking operations, with banks across Nigeria rationing cash withdrawals at their branches and ATMs. This development has led to significant challenges for customers and a sharp rise in charges by Point of Sale (PoS) operators. Banks Limit Cash Withdrawals Over the past few days, customers have struggled to access the cash they need for daily…

View On WordPress

0 notes

Text

Panic as Naira accelerates to N1,745/$1 on parallel market

The exchange rate between the naira and the dollar has fallen back to approximately N1,745/$1 on the parallel market, marking a sharp reversal from the sub-N1,600 levels recorded late last week. As of 10 a.m. on Wednesday, December 11, checks by Nairametrics revealed several rates above the N1,700/$1 mark, raising concerns that last week’s gains may have been a “dead cat bounce,” a market term…

0 notes

Text

Where to Watch Movies Online for Free: Explore MovieBox.ng

In today’s digital age, finding a reliable platform to watch movies online can feel like searching for a needle in a haystack. If you’ve been asking yourself, Where can I watch movies online without hassle?, the answer is simple: MovieBox.ng.

This platform offers a seamless movie-watching experience, combining a massive library of titles, customizable features, and top-notch video quality — all tailored for today’s viewers.

MovieBox.ng isn’t just another streaming site. It’s a platform designed to deliver convenience, variety, and quality for movie enthusiasts.

Whether you’re a fan of Hollywood blockbusters, classic dramas, Asian movies or trending Nigerian films, MovieBox.ng has something for everyone.

A World of Online Movies at Your Fingertips

One of the best features of MovieBox.ng is its extensive library of movies. From Hollywood hits to Nollywood classics, Animes, Cartoons, Asian dramas (Kdrama , Chinese drama, Thai drama, filipino drama) Bollywood movies etc, you’ll find everything you need. This platform constantly updates its catalog to keep up with the latest trends, ensuring you never miss out on your favorite films or newly released titles.

Whether you’re in the mood for gripping thrillers, heartwarming comedies, or timeless dramas, MovieBox.ng has curated options that cater to diverse tastes. It’s your go-to destination to watch movies online with ease and variety.

Superior Video Quality

When watching movies online, video quality can make or break the experience. MovieBox.ng ensures that users enjoy HD and 4K streaming for stunning visuals and smooth playback. Forget the frustration of pixelated screens or buffering interruptions — MovieBox.ng prioritizes delivering the best possible picture and sound quality.

Subtitled and Dubbed Movies for All Audiences

Language barriers are no longer an issue with MovieBox.ng.

The platform supports multi-language subtitles, making its extensive movie catalog accessible to a global audience. Fans of international films or language learners can enjoy movies without missing any action or dialogue.

This feature is a favorite among users, as it opens up a world of content previously unavailable to those limited by language. With subtitles, everyone can experience the magic of cinema.

We also have movies and Japanese Animes dubbed in English, French, Hindi, Bangla etc for users from all over the world

Accessible Anytime, Anywhere

With a user-friendly interface and mobile compatibility, MovieBox.ng ensures you can watch movies online anytime, anywhere. Whether you’re at home, on the go, or taking a break at work, the platform lets you stream your favorite content on any device.

Save movies to your favorites, and continue watching right where you left off. MovieBox.ng is designed for the ultimate convenience, keeping entertainment at your fingertips.

Why Choose MovieBox.ng?

If you’re looking for a reliable platform to watch movies online, here’s why MovieBox.ng is your best bet:

Massive selection: From Hollywood blockbusters to Nollywood hits, there’s something for every taste.

High-quality streaming: Enjoy HD and 4K movies with smooth playback and sharp visuals.

Global accessibility: Multi-language subtitles make it easy for anyone to enjoy movies.

Custom playback: Adjust settings to create a personalized viewing experience.

Mobile-friendly: Watch your favorite movies anywhere, anytime.

MovieBox.ng doesn’t just offer movies — it offers an experience.

FAQs

1. What is MovieBox.ng?

MovieBox.ng is an online streaming platform offering a vast library of movies, from blockbusters to timeless classics, with features like HD video, subtitles, and customizable playback.

2. Is MovieBox.ng free?

While some movies are free, accessing premium features and exclusive titles requires a subscription of just 789 naira per month!

3. Can I use MovieBox.ng on mobile devices?

Absolutely! The platform is optimized for smartphones and tablets, ensuring a seamless experience on the go.

4. Does MovieBox.ng feature Nigerian movies?

Yes, the platform has a robust selection of Nigerian movies, making it a favorite among Nollywood fans.

5. Why choose MovieBox.ng over other platforms?

MovieBox.ng combines variety, quality, and convenience to create the ultimate movie-watching platform.

Final Thoughts

If you’ve been searching for a platform to watch movies online, MovieBox.ng is the perfect answer. With its vast library, superior video quality, and user-friendly features, it’s a one-stop destination for movie enthusiasts. No matter your preferences, you’ll find something to enjoy on MovieBox.

1 note

·

View note

Text

The naira has continued its slide against the dollar, depreciating further at both the official and parallel foreign exchange markets. According to FMDQ data, the naira weakened to N1,689.88 per dollar on Wednesday, down from N1,681.42 recorded on Tuesday, reflecting a depreciation of N8.42. Naira Weakens Further in Black Market The naira also declined at the black market, where it lost N5, closing at N1,740 per dollar on Wednesday, compared to N1,735 on Tuesday. The ongoing depreciation highlights persistent pressure on the local currency amid limited foreign exchange supply. FX Supply Turnover Drops Sharply In a related development, foreign exchange (FX) transaction turnover experienced a significant drop. On Wednesday, FX supply turnover fell to $106.44 million, a sharp decline from the $471.5 million reported the previous day. This reduction in dollar supply has exacerbated the naira's decline, further straining the local currency market. Naira's Outlook Worsens The depreciation trend comes on the heels of a recent projection by BMI, a subsidiary of Fitch Solutions, which warned that the naira could weaken further to N1,993 per dollar in the coming days. The forecast adds to concerns about the naira's stability and the broader economic implications for Nigeria. Rising Reserves Offer Little Relief Interestingly, the naira’s depreciation persists despite a rise in Nigeria’s foreign exchange reserves. As of November 11, 2024, the Central Bank of Nigeria (CBN) reported an increase in reserves to $40.167 billion. However, this boost in reserves has yet to translate into relief for the naira, as demand for dollars continues to outstrip supply. What’s Next for the Naira? Market analysts suggest that without a significant intervention or improvement in dollar supply, the naira may continue its downward trend. The pressure on the local currency reflects ongoing economic challenges, including rising inflation and reduced foreign investments, which have limited the availability of foreign exchange. The currency's continued depreciation raises concerns for businesses and consumers alike, as a weaker naira may lead to increased import costs and further inflationary pressures.

0 notes

Text

Dollar to Naira Black Market Exchange site,

Dollar to Naira Black Market Exchange site,

In the bustling financial landscape of Nigeria, the exchange rate between the US Dollar (USD) and the Nigerian Naira (NGN) holds significant importance. While official channels provide a standardized rate, the parallel or "black" market offers an alternative avenue for currency exchange. This informal market, though not endorsed by regulatory authorities, plays a vital role in the country's economy, serving various needs of individuals and businesses alike.

Understanding the Black Market Exchange:

The black market exchange refers to the unofficial and unregulated market where currencies are bought and sold outside the purview of official financial institutions. In Nigeria, the demand for foreign currency, particularly the US Dollar, often surpasses the supply available through formal channels. This creates a gap that the black market fills, allowing individuals and businesses to acquire foreign currency for various purposes such as international transactions, travel, and investment.

Factors Influencing Exchange Rates:

Several factors contribute to the fluctuations observed in the Dollar to Naira black market exchange rate:

Supply and Demand Dynamics: The fundamental principle of economics, supply and demand, heavily influences exchange rates in the black market. Factors such as the availability of foreign currency reserves, import demands, and capital inflows affect the equilibrium exchange rate. Economic Indicators: Macroeconomic indicators such as inflation rates, interest rates, GDP growth, and fiscal policies impact investor sentiment and, consequently, currency exchange rates. Adverse economic conditions may lead to a depreciation of the Naira against the Dollar in the black market. Political Stability: Political stability is crucial for maintaining investor confidence and attracting foreign investments. Political uncertainty or unrest can lead to currency depreciation as investors seek safer havens for their assets. Government Policies: Monetary policies implemented by the Central Bank of Nigeria (CBN) and government regulations regarding foreign exchange transactions influence black market exchange rates. Restrictions or interventions by regulatory authorities can create distortions in the market. Global Market Trends: International economic events, such as changes in global oil prices (Nigeria's primary export), geopolitical tensions, and currency fluctuations in major economies, also impact the Dollar to Naira exchange rate in the black market. Implications and Risks:

While the black market provides a solution for those in need of foreign currency, it also poses certain risks and implications:

Legal and Regulatory Risks: Engaging in black market transactions exposes individuals and businesses to legal and regulatory risks. The Nigerian government prohibits currency exchange outside authorized channels, and individuals involved may face penalties or legal consequences. Volatility and Uncertainty: The lack of regulation and transparency in the black market contributes to exchange rate volatility and uncertainty. Sharp fluctuations in exchange rates can significantly impact businesses' financial planning and profitability. Market Manipulation: The absence of oversight makes the black market vulnerable to manipulation by unscrupulous actors seeking to exploit price differentials for personal gain. This can further exacerbate exchange rate volatility and undermine market integrity. Counterfeit Currency: There is a risk of encountering counterfeit currency in black market transactions, posing financial losses and security concerns for individuals and businesses. Conclusion:

The Dollar to Naira black market exchange serves as a vital component of Nigeria's financial ecosystem, offering an alternative avenue for currency exchange in the face of supply-demand imbalances and regulatory constraints. However, participants must be mindful of the associated risks and implications, including legal, financial, and security concerns. As Nigeria continues to navigate its economic landscape, policymakers and regulatory authorities must address underlying issues to foster a more stable and transparent foreign exchange market for the benefit of all stakeholders.

0 notes

Text

$26bn suspicious flow: Binance traders are traceable, crypto expert replies CBN gov

The President of the Stakeholders in Blockchain Technology Association of Nigeria, Obinna Iwuno, has disclosed that traders on cryptocurrency trading platform, Binance are not anonymous, adding they can be traced. Iwuno, a trained crypto investigator, revealed this as a guest on Channels Television’s breakfast show, The Morning Brief, on Tuesday. Governor of the Central Bank of Nigeria, Olayemi Cardoso, has disclosed that more than $26bn was channelled through a cryptocurrency platform, Binance, in the last one year. Cardoso disclosed this last week at a press briefing after the 293rd meeting of the Monetary Policy Committee in Abuja. The Binance exchange is a leading cryptocurrency exchange founded in 2017. It features a strong focus on altcoin trading. Binance offers crypto-to-crypto trading in more than 350 cryptocurrencies and virtual tokens, including bitcoin, ether, litecoin, dogecoin, and its own coin, BNB. In a reaction to Cardoso’s claim that $26bn suspicious flows passed through Binance last year, Iwuno said, “The CBN governor said $26bn is unidentified but what he has not told us is how they arrived at the $26bn because that is the only basis that I will fault or right the CBN. “I am a certified cryptocurrency investigator. I am also a certified cryptocurrency compliance specialist. I can tell you that these things are traceable. You cannot perform a transaction, as long as it passes through the blockchain, that cannot be traced. “If you use a centralised exchange like Binance, it is finished because you cannot be on those platform without your identity being known.” He said most crypto platforms use Bank Verification Number and driver’s licence as know-your-customer verification measures. He insisted that there was no way a trader would be on Binance and could not be traced, adding that Interpol and other security agencies had in the past cracked down on bad actors in the blockchain technology value chain. The trained crypto investigator also said the Federal Government has failed to regulate virtual asset services in the country, hence, there is no regulation that bind Binance to Nigeria, which has one of the company’s biggest traders. “Binance is not licensed to operate in Nigeria. Nigeria did not regulate virtual asset services and providers and this is what we have been calling for, for years. Because of that, there is no regulation that made them binding to us. If there was regulation in the country, Binance will be a member of SiBAN,” he said. Iwuno noted that his association has been against bad eggs in the industry and had come up with many initiatives to stifle those with sharp practices. Two Binance executives were arrested in Nigeria last week and the government has demanded about $10bn compensation from the cryptocurrency platform on allegations of manipulation of foreign exchange rates which has negatively affected the value of the naira against the dollar. Read the full article

0 notes

Text

Nigerian Students Are No Longer Interested in Studying in the UK, New Report Finds

According to reports, the notable decrease in applications from Nigerian students is believed to be closely associated with the weakening of the naira and the visa restrictions preventing them from bringing along dependents or close family members to the UK. The report highlighted that Nigerian students had the highest number of dependents brought in by international students as of September 2023.

The Economic Times of India also reported a mirroring trend observed among Indian students who are increasingly losing interest in pursuing their undergraduate studies in the United Kingdom. The report noted that Indian student applications fell by 4 per cent compared to the previous year, amounting to 8,770 applications.

In comparison, Nigerian applications witnessed a sharp decline of 46 per cent, totalling 1,590 applications, more than any other country. Data from the UK Universities and College Admissions Service (UCAS) on undergraduate student applicants for the 2024-25 academic year also revealed a 1% decline in UK applicants from a year earlier. However, the overall number of applicants remains well above pre-pandemic levels.

"While today's data shows a decline in applications from mature students, which will be more keenly felt in some subjects such as nursing, we know that these applicants are more likely to apply later in the cycle," Dr. Jo Saxton, Chief Executive at UCAS, said.

"For any students who missed the deadline or are still undecided on their next steps into higher education, they can still apply until June 30, and afterwards directly to Clearing, and plenty of choices still remain. There is a wealth of support, guidance, and tips on the UCAS website to help anyone make informed choices about their futures," she added.

In December 2023, the Rishi Sunak-led government announced a review of the Graduate Route visa, allowing graduates to stay and gain work experience in the UK for at least two years after completing their degree. According to experts, potential changes to the UK's visa policy may reduce the appeal of UK universities to overseas students.

Source: BUSINESS INSIDER AFRICA

0 notes

Text

Nigeria, Africa’s most populous nation, has witnessed a burgeoning interest in digital currencies. According to a report, Nigeria’s recent spike in crypto usage can be attributed to economic conditions and the nation’s youth-driven technological resurgence. The implications of this growing trend can’t be understated, especially considering Nigeria’s position as Africa’s largest economy. Nigerians are seeking viable alternatives for their financial activities, with the naira experiencing significant devaluation and inflation rates soaring. Crypto Transactions Surge Amid Naira Devaluation According to a New York-based blockchain analytics firm Chainalysis report, Nigeria’s cryptocurrency transactions swelled 9% year-over-year, reaching $56.7 billion between July 2022 and June 2023. Nigeria’s Crypto Adoption is up 9% year-over-year. | Source: Chainalysis This growth in digital asset adoption is similar in neighboring countries: Uganda saw its crypto usage skyrocket by 245% to $1.6 billion. In Kenya, the situation is different as the country experienced a sharp decline in crypto adoption, with its usage plummeting by over 50% to $8.4 billion, according to Reuters. This uptick in Nigeria’s crypto activity coincides with significant economic turbulence. Notably, the naira’s value dropped considerably in June and July 2023. Such financial instability has pushed many Nigerians towards Bitcoin and stablecoins. These digital tokens, especially stablecoins, have their value anchored to stable assets, offering a semblance of financial predictability amid the wild fluctuations common to the digital currency world. Presidential Reforms And Cryptocurrency Regulation According to Reuters, the naira’s dive to record lows can be traced back to a series of bold measures instituted by President Bola Ahmed Tinubu. Some of the most significant changes involved the removal of a widely used petrol subsidy and lifting of certain exchange rate constraints. Moyo Sodipo, co-founder of the Nigeria-based digital currency exchange Busha, elucidated the populace’s sentiment, stating: People are constantly looking for opportunities to hedge against the devaluation of the naira and the persistent economic decline since COVID. However, it’s worth noting that the Nigerian government’s relationship with cryptocurrencies has been tenuous. In 2021, the country’s government banned banks and financial institutions from processing or facilitating cryptocurrency transactions. The ban was imposed, citing concerns over money laundering, terrorism financing, cybercrime, and the volatility of cryptocurrencies. Yet, in a seeming change of heart, Nigeria’s Securities and Exchange Commission (SEC) rolled out a series of regulations for digital assets in the subsequent year. Titled the “New Rules on Issuance, Offering Platforms and Custody of Digital Assets” on its official site, the rule is detailed in a 54-page regulation structure for digital asset launches and safekeeping. This guideline positions these assets under the purview of the SEC as securities. The commission has clearly stated that any exchange dealing in digital assets must first obtain a clearance of “no objection” from them to operate legally. Moreover, these exchanges have a registered fee of 30 million naira (equivalent to $72,289) and other associated charges. Reuters describes this decision as an attempt by Nigeria to strike a balance between a total crypto ban and its rampant use. The global crypto market cap value on the 1-day chart. Source: Crypto TOTAL Market Cap on TradingView.com Source

0 notes