#multiple cheque book holder

Explore tagged Tumblr posts

Text

0 notes

Text

Get ready to figure out here which qualities to look for while buying a multiple cheque book holder. Find out more now.

0 notes

Text

Corporate Accounts Simplified: Features, Benefits, and How to Open One

For businesses, managing finances effectively is critical to success. Whether you’re a startup, a small business owner, or running a large corporation, having a reliable corporate account ensures seamless financial operations. City Union Bank (CUB) offers tailored Regular Current Accounts, designed to meet the diverse needs of businesses, enabling smooth transactions, cash flow management, and enhanced banking convenience.

In this blog, we’ll explore the features, benefits, and step-by-step guide to opening a corporate account with CUB.

What is a Corporate Account?

A corporate account, commonly referred to as a business or current account, is a specialized bank account designed for businesses to handle daily transactions efficiently. Unlike savings accounts, corporate accounts offer higher transaction limits, overdraft facilities, and specialized services to cater to business operations.

Features of CUB Regular Current Account

Unlimited Transactions: Conduct a high volume of transactions, including deposits, withdrawals, and transfers, without restrictions.

Overdraft Facilities: Manage cash flow better with overdraft options to cover short-term financial gaps.

Multi-Location Access: Operate your account across branches, ensuring flexibility for businesses with multiple locations.

Convenient Cash Deposits: Deposit cash at any CUB branch or cash deposit machine, simplifying fund management.

Online Banking Services: Access your corporate account anytime with CUB’s robust internet banking and mobile banking platforms.

Customized Cheque Books: Get cheque books tailored for business use to streamline transactions.

Dedicated Relationship Managers: Enjoy personalized banking services with CUB’s experienced relationship managers for corporate accounts.

Benefits of CUB Corporate Accounts

Simplified Transactions: Handle payments, receipts, and fund transfers effortlessly through a single account.

Improved Cash Flow Management: With overdraft facilities and real-time fund monitoring, maintain smooth business operations.

Enhanced Security: Advanced security features, including multi-level authentication for online transactions, ensure your funds are safe.

Access to Business Loans: CUB corporate account holders enjoy priority access to business loans, credit lines, and other financial services.

Customized Solutions: Tailored banking solutions cater to the unique requirements of various industries.

Tax Benefits: Maintain accurate financial records for taxation purposes and simplify filing returns.

Who Can Open a Corporate Account?

City Union Bank welcomes a wide range of business entities to open corporate accounts, including:

Sole proprietorships

Partnerships

Private and public limited companies

Trusts and societies

Freelancers and consultants

How to Open a Corporate Account with City Union Bank

Gather Necessary Documents: Prepare the required documents based on your business type. These may include:

Business registration certificate

PAN card (business or individual)

Proof of address (business premises)

Authorized signatories’ ID and address proof

Visit the Nearest CUB Branch: Schedule an appointment or visit your local branch to begin the application process.

Submit Application Form: Fill out the corporate account opening form and attach the required documents.

Initial Deposit: Make the minimum deposit required to activate the account.

Account Activation: Once verified, your account will be activated, and you’ll receive credentials for online banking.

Why Choose City Union Bank for Your Corporate Account?

City Union Bank has been a trusted financial partner for businesses across India for over a century. Its Regular Current Account is a robust product tailored to the needs of modern businesses, offering:

Competitive features for smooth financial operations

Advanced digital banking tools for 24/7 access

Personalized service through dedicated relationship managers

Conclusion

A City Union Bank corporate account is more than just a financial tool—it’s a gateway to efficient business management. With a host of features and benefits, CUB empowers businesses to achieve their financial goals effortlessly.

Ready to elevate your business banking experience? Visit the CUB Corporate Account page to learn more or open your account today!

0 notes

Text

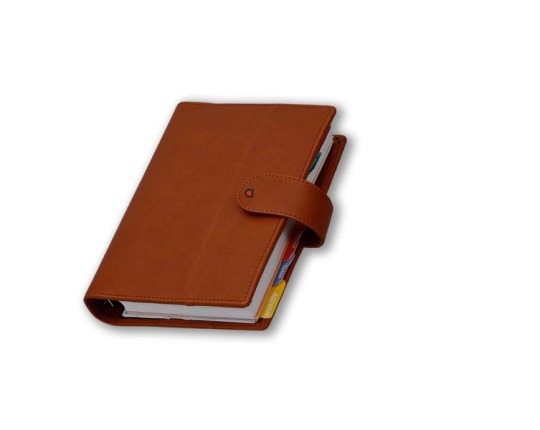

Buy Multiple Cheque Book,Credit Card and Passbook Holder | Paperlla

In today’s fast-paced world, staying organized is more important than ever, especially when it comes to managing your finances. Whether you are a business owner, a professional, or someone who frequently deals with financial documents, having a dedicated organizer for your essential items is crucial. That’s where Paperlla's Multiple Cheque Book, Credit Card, and Passbook Holder comes into play, offering an efficient and stylish solution for storing these vital items securely.

Why Do You Need a Multiple Cheque Book Holder?

Most people carry more than just one cheque book—whether it’s for personal, business, or family finances. Add to that the credit cards and passbooks, and you have a collection of critical financial tools that need proper organization. Unfortunately, keeping these items together in a secure yet accessible manner can be quite challenging. Often, they end up scattered across drawers, bags, or wallets, making them hard to find when you need them most.

That’s why investing in a well-designed holder can be a game changer. When you Buy Multiple Cheque Book, Credit Card and Passbook Holder, you gain the benefit of keeping all these items neatly organized and easy to access. This holder not only helps you avoid the hassle of searching for misplaced documents but also adds a level of protection from wear and tear. Whether it’s for personal use or professional dealings, a dedicated cheque book holder ensures that your financial tools are always in order.

Features of a High-Quality Cheque Book Holder

When looking to Buy Multiple Cheque Book, Credit Card and Passbook Holder, it’s essential to consider its features. Paperlla’s cheque book holders are crafted with durability and practicality in mind. These holders are designed to fit multiple cheque books, which is ideal for people who manage several accounts. In addition to cheque books, they also have slots for credit cards and passbooks, allowing you to consolidate everything in one place.

The materials used in Paperlla’s holders are both elegant and robust. Made from high-quality faux leather or premium fabrics, these holders not only protect your documents but also look great while doing it. The sleek designs are compact, making them easy to carry in your briefcase, bag, or even by hand.

Furthermore, these holders come with multiple compartments, making it easy to separate and categorize your financial tools. Whether you need to access a specific cheque book, credit card, or passbook, you’ll find it quickly, thanks to the smart organization inside.

Benefits of Using a Cheque Book Holder

The advantages of owning a Multiple Cheque Book, Credit Card and Passbook Holder go beyond simple organization. Here are some key benefits:

Convenience: Having all your financial tools in one place saves time and energy when handling transactions, whether at home, in the office, or on the go.

Protection: Cheque books and passbooks can easily get damaged or bent if not stored properly. A holder ensures they stay in pristine condition, prolonging their lifespan.

Professionalism: A sleek cheque book holder conveys a sense of professionalism and organization, which can be crucial when meeting with clients or business partners.

Security: With dedicated compartments for credit cards, cheque books, and passbooks, your financial documents are stored securely, reducing the risk of misplacing important items.

Why Choose Paperlla?

When you Buy Multiple Cheque Book, Credit Card and Passbook Holder from Paperlla, you’re not just purchasing an organizer; you’re investing in a thoughtfully designed, high-quality product that stands the test of time. Paperlla is known for its commitment to creating elegant yet functional stationery and accessories that cater to the needs of modern professionals and everyday users alike.

The brand’s cheque book holders are meticulously crafted to combine practicality with style, ensuring that you can manage your finances with ease and sophistication. Available in a variety of colors and finishes, Paperlla’s holders are designed to match your personal style while keeping you organized.

Conclusion

In a world where financial management is key to staying ahead, having the right tools can make all the difference. Paperlla’s Multiple Cheque Book, Credit Card and Passbook Holder offers a stylish, practical solution to keeping all your financial essentials in one place. Whether you’re juggling multiple accounts or simply looking for a more organized way to store your documents, this holder will help streamline your financial life.

So why wait? Buy Multiple Cheque Book, Credit Card and Passbook Holder today and experience the perfect blend of convenience, style, and security for your important financial tools.

0 notes

Text

Unveiling the Importance and Functions of CIF Number in SBI

Introduction:

In the realm of banking, customer convenience and security are of utmost importance. The State Bank of India (SBI), being one of the largest and oldest banks in the country, ensures a seamless and secure banking experience for its customers. One crucial aspect of SBI's customer management is the CIF (Customer Information File) number. In this article, we'll delve into the significance and functions of the CIF number in SBI.

Understanding CIF Number:

The CIF number is a unique identification number assigned to each account holder by the bank. It serves as a comprehensive record that encapsulates all pertinent details of a customer's banking relationship with SBI. This alphanumeric code is crucial for streamlining operations, ensuring data accuracy, and enhancing security.

Significance of CIF Number:

Account Management: The CIF number is the backbone of account management in SBI. It allows the bank to maintain a centralized database containing all essential customer information. This includes personal details, account transactions, loan details, and other relevant information.

Easy Retrieval of Information: CIF numbers make it convenient for both customers and the bank to retrieve and access specific account details. Whether it's for checking account balances, transaction history, or availing various banking services, the CIF number acts as a quick reference point.

Security Measures: In an era where digital transactions are prevalent, ensuring the security of customer information is paramount. The CIF number plays a crucial role in this regard by providing a unique identifier for each customer, reducing the risk of unauthorized access and fraud.

Loan Application and Processing: When applying for loans or credit facilities, the CIF number streamlines the process. It enables the bank to assess the customer's creditworthiness based on their historical financial data, making loan approval and processing more efficient.

Unified Banking Experience: For customers with multiple accounts or availing various banking services, the CIF number offers a unified experience. It links all associated accounts and services under one unique identifier, simplifying the management of diverse financial activities.

How to Locate CIF Number:

Passbook: The CIF number is often printed on the first page of the bank passbook. Customers can easily find it by checking the details on this page.

Cheque Book: The CIF number is also present on the front page of the SBI cheque book. It is usually printed near the account number.

Online Banking: Customers can log in to their SBI online banking portal to find their CIF number. The information is typically available in the account details section.

Conclusion:

The CIF number in SBI is more than just a combination of letters and numbers; it is a key to a customer's banking journey. Understanding its significance and keeping track of this unique identifier is essential for a smooth and secure banking experience with the State Bank of India.

0 notes

Text

PAREEK Multiple Portfolio Silver Dotted Line Tufted PU Leather Fabric Holder for Cards, Cheque Book and More (Red)

PAREEK Multiple Portfolio Silver Dotted Line Tufted PU Leather Fabric Holder for Cards, Cheque Book and More (Red)

Price: (as of – Details) the Brand R K STATIONARY (PAREEK) : is a popular lifestyle brand offering a wide array of fashion accessories like regular wallets, travel wallets, key chain holders, passport holders and lots more. ☞Product Features: tufted fabric and pu leather combination ★Space for Cheque Book, cards and more lends convenience. ★ Keep your wealth protected with this Cheque Book…

View On WordPress

0 notes

Text

COI Ink Black Passport Holder/Stylish Faux Leather Multiple Document, Card Money Pocket Travel Wallet Accessory, Desk Table Organizer Gift for Office Going Men and Women

COI Ink Black Passport Holder/Stylish Faux Leather Multiple Document, Card Money Pocket Travel Wallet Accessory, Desk Table Organizer Gift for Office Going Men and Women

Price: (as of – Details) DISCLAIMER : PRODUCT COLUR MAY DIFFER DUE TO PHOTOGRAPHIC LIGHTING OR YOUR MONITOR SETTING . Ideal for frequent travellers or anyone who wants to go through the airport quickly while protecting your currency . The interior organizer include credit card slots , id holders , pen loop , full length vertical pocket for documents , cheque book , passport and airline…

View On WordPress

0 notes

Photo

Easy Ways to Send Money from one bank to another in India. Nowadays, one can choose from the plethora of fund transfer options. From the traditional way of fund transfer to online bank transfer, you can pick the best way to save your time and hassle. If you are wondering about easy ways to send money from one bank to another in India then, you don’t have to worry. You need to do some research before going for any option to save yourself from any deduction. Check out how to transfer money online from one bank account to another. Online Payment Method RTGS (Real-Time Gross Settlement) The instantaneous fund transfer system continuously settles payment on an individual order basis once the transaction is done, it can’t be reversed. It’s a great way to do bank to bank transfer. The purpose of RTGS is to be used for high-value interbank transactions as there is less risk in settlements. Reserve Bank of India manages the payment system so, you can count on it for sending & receiving funds. All RTGS charges may incur higher costs to customers, while fund transfer ranges anywhere between Rs.25 to Rs.55. For the digital transactions, the maximum amount of limit per day is as per the customer’s TPT limit for the HDFC account holder. Information required for an RTGS transaction: The amount to be transferred in rupees

Name of the payee/beneficiary

Name of beneficiary bank and bank branch

IFSC code of the payee/beneficiary

Account number of the payee/beneficiary

NEFT (National Electronic Fund Transfer)

The online bank to bank transfer fund system that allows interbank fund transfer. It is one of the popular ways of transferring money from bank to bank digitally. You can transfer funds from your bank branch to anyone, without visiting the bank. Earlier to transfer the funds, one had to withdraw the amount and then pay it in cash or cheque. Now, one can transfer a sum of money from his account to another person’s account, through the process of NEFT. NEFT offers the ease of funds transfer from any NEFT- enabled bank account of any branch to any NEFT- enabled account located in any geographical area.

Transaction timing will be 48 half-hourly batches every day. The first batch settlement will start after 30 minutes. The operation will be permitted round the clock and all day of the year, including holidays. No upper and lower limit is set for amount transfer via NEFT.

The charges for transfer money from bank to bank range from Rs. 2.50 to Rs. 25 on the amount range from Rs. 10,000 to the amount more than Rs. 2 Lakh.

IMPS (Immediate Payment Service) Apart from RTGS and NEFT, you can choose another way for fund transfer that is IMPS. It provides instant round the clock digital fund transfer services that you can use on your smartphones. E-wallets Similar to Credit cards and debit cards, E-wallets are a type of electronic card. It is used for online transactions and treated as the prepaid account in which you can store funds that you can use in the future for any instant payment like for booking train tickets, flight tickets, groceries, online purchases, etc. First, you need to install the app on your mobile and give the relevant data after that, the data will be stored in the database so, you don’t need to fill the form after any purchase. It is also used for cryptocurrencies like bitcoins. UPI UPI has made online payment much easier and faster, you can transfer money through your mobile phones and make instant bank to bank transfers, payments, or any purchase. This method of payment is developed by the NPCI (National payments corporation in India) and regulated by RBI( Reserve bank of India). You can add multiple bank accounts into a single app. Some of the popular UPI mobile applications are Airtel, Amazon Pay, Google pay, BHIM, Jiopay, Phonepe, Paytm, WhatsApp pay, and much more. UPI method solved many issues like earlier we use to rush to ATM for payments, sharing bills among friends, utility bill payments, collection, and distribution of money. The best thing about UPI is round a clock availability. The maximum fund Transfer Value is up to 1 lakhs.

Banking Apps With the advancement of technology, financial transactions have become easier, and visiting banks become a rarity. You can make payments through your smartphones round the clock. There are several banking apps but some are the best apps that you should use for making payments. ICICI Bank’s iMobile Application is the highest-rated banking app on the Google play store. It permits its user’s easy fund transfer solution, convenience in payment of the utility and credit card bills, open FD RD anytime & manage your other policies. Also, the app is updating itself continuously to enhance the user experience. With 4.3 ratings on the Google play store, HDFC Bank Mobile Application is one of the best apps for online transactions in India. Other popular apps like Axis Mobile Application, SBI anywhere personal app, M- connect app by Bank of Baroda is designed for the faster and quicker transaction through your mobile phones. 2.Telephone Transfer In this payment method, all you need to do is call the telephone number of your bank. You will be guided by some bank’s customer services representative or through an automated recording. 3.In-branch Bank Transfer If you carry the money in cash, you can go to the bank and pay it into the account of the person directly. Details required for transfer money from bank to bank Date of payment

Person’s name or business you’re paying. IFSC Number of the branch

Account Number A payment references Sender’s name and bank address Conclusion: The answer to how to transfer money online from one bank account to another is simple as due to the advancement of technology, many ways of an online bank transfer are being introduced by Government. By these payment methods, we don’t have to follow the traditional way of paying bills and transferring funds. The regular visits to banks and standing in a long queue are also minimizing. With online banking, we can make payments quickly, safely, and conveniently.

0 notes

Text

#cheque book holder#a7 notebook cover#calculator folder#multiple cheque book holder#a5 notebook#pocket notebook

0 notes

Text

Order the Brown Stylish Faux Leather diary 2023 for Office Works from Paperlla online now. We offer multiple cheque book and passbook holder, to do list notepad.

0 notes

Text

Common questions regarding bank account

Do you think there is more knowledge and information needed on bank account? Here, we have taken a few common questions regarding the bank account to clear your doubts.

Can I open an account?

If you are above 18 years of age and a resident or non-resident Indian, can open the bank account. For online account opening also, the conditions remain the same.

What are the different bank accounts?

Traditionally the banks in India offer four types of deposit accounts. They are current accounts, saving accounts, recurring deposits account, and a fixed deposit account. Some banks have introduced many new products too, which may have standard features of two or more types of deposit accounts such as a smart deposit account or automatic sweep deposits account etc., depending on the bank.

What is a Current Account?

Current Accounts is curated primarily for the business people. The intention of these accounts is not investment or savings, as a savings bank account. The deposits in the current account are liquid. There are no limitations on the transactions. Mostly a firm or company open account of this type.

What is the average monthly balance requirement?

The average monthly balance is the amount of balance that must be maintained by the bank account holder. However, many banks have started offering savings accounts that do not need a minimum average monthly balance.

Can I access my account when I am travelling in India?

Yes, you can access the savings account, if you are travelling to any of the state or city within India. You can access the account using mobile banking, internet banking, or by using your debit card at an ATM.

Can I multiple bank accounts?

You can have as many accounts. But you can have only one basic savings bank account in a bank.

Can I withdraw money from any city?

Yes, you can withdraw money using your debit card at ATM from anywhere in the country or outside the country. You may have to bear the transaction fee.

What other services does a savings account offer via internet banking?

Many banks offer savings account services via net banking. Some of the primary services include:

Checking your account details any time

You can give stop payment instruction.

You can transfer money to a third-party account.

You can shop online, using your savings account money.

You can ask for an account statement.

You can open FD and link the same to the savings account too.

What are the services available for savings account holders via Phone Banking?

There are savings account services available via Phone Banking. They are:

You can ask for a balance in your account.

You can view previous transactions.

You can check the status of the Cheque.

You can check the balance of any date you want.

You can request for a bank statement and a cheque book too.

0 notes

Link

Banks are those financial institutions that deal with money, its substitutes and help in providing financial services to common people. The main function of banks is to put the money of account holders to use by providing loans to those who can be able to use the money for different purposes. In simple terms, banks are the financial institutions involved in borrowing and lending of money. Banks play an important role in offering finances to people who are interested in investing and expanding.

Let us have a look at the main purpose and functionalities of banks.

Banks are the custodian of the money of their customers. Banks are one of the most secure places where the money of the customers can be kept safely.

Banks offer interest on the money deposited by customers in banks. By this offering of interest on money, banks help the customers in preventing loss of value of money due to inflation.

As said earlier, banks offer loans to those customers who are interested in making complete utilization of the money such as firms and customers who can use the loan for business expansion.

Banks offer financial advice and other financial services whenever necessary.

Today, numerous banks are offering financial services and assistance. However, you must be able to choose a bank which is the right one for you. This can be feasible by considering certain factors while searching for the right bank.

Types of Bank Accounts in India

First, let us check out the different types of accounts that are available in banks along with their basic features.

Savings Account

Savings Bank Account is opened by those persons who have a fixed and regular income. You can suggest your employees open a Savings Bank Account and encourage them to save money.

The major characteristic features of Savings Account can be mentioned below.

The rate of interest payable on Savings Account is nominal and currently, it ranges from 4% to 6% per annum.

In a Savings Account, your employees would not face any restrictions on the number of deposits made and the amount deposited.

Savings Account does not have any maximum period of holding and the money is always available. Your employees can make withdrawals from their Savings Account. Depending on the type of account, there might be certain withdrawal limitations or charges applicable for the same.

Moreover, withdrawal of money can be done either through cheque or by the help of a withdrawal slip from the bank or through an ATM or Debit card from an ATM Machine.

Your employees need to keep a minimum amount in the Savings Account to keep the Account active. However, if the account is tagged along with their salary, the minimum balance requirement might be waived off.

Facilities like e-banking, EFT, ATM cards, etc. are available which can be of great help to your employees. They can use their Savings Account Passbook or Bank Statement as an identity proof and residential proof.

Your employees would be able to avail other benefits offered by the bank through their savings accounts like:

One person can have multiple savings accounts as there are no restrictions for the same.

A savings account can be opened by an individual or an HUF(Hindu Undivided Family)

Bank Fixed Deposits and Recurring Deposits

Credit Cards

Other investments like mutual funds, insurance, etc.

Avail loans, etc.

Salary Account

Salary Account is a category of Savings Account into which you would be depositing the salary of your employees every month. Thus, you need to have a tie up with a bank to open the Salary Accounts of your employees in the bank and your employees would be able to reap the benefits of the same.

A Salary Account is also known as a Zero-balance Account i.e. there is no need of maintaining a minimum balance in this account and has the main purpose of salary being credited.

Usually, no interest is paid on the Salary Account.

The employees can also deposit money through cash and cheque into the Salary Account whenever required and use it as a regular savings account.

The basic benefits of a Salary Account would include:

Transfer of money to and from the same through the various channels offered by the bank like net banking, NEFT, RTGS, IMPS, etc.

Debit card and cheque facility for withdrawing of cash

Using the mobile banking facility through the registered mobile application

Your employees would be able to avail other benefits offered by the bank through their salary account like:

Bank Fixed Deposits and Recurring Deposits

Credit Cards

Other investments like mutual funds, insurance, etc.

Avail loans, etc.

Current Account

Current Accounts are otherwise known as Financial Accounts and are maintained to carry out a higher number of regular transactions with the bank especially for a business purpose. A current account can be opened by an individual as well as a non-individual like company, trust, organization, NGO, etc. So, as an organization you can have a Current Account but your employees cannot open a current account through your company, as they are salaried individuals. However, they would be able to open a Current Account in their individual capacity.

The basic benefits of a Current Account are:

There is no limit on the transactions of payments on a particular day in a current account

Since this is a business account, charges are usually higher than savings account

There is a minimum balance requirement in a current account as well, which varies from bank to bank and depends on the type of account, etc. Even the benefits like overdraft facility limit, cheque books, charges, minimum average quarterly balance (AQB) requirement, free demand draft, CMS (Cash Management System), etc. depends on the type of account and the negotiations done with the bank based on the book value of the account. Larger the account, higher are the benefits

Internet and mobile banking facility along with investment opportunity is available for current account holders as well along with:

Loans are an important part of every business and current account holders usually get a preferred rate for the same as the payment for the loan would be recovered from the account itself.

Bank Fixed Deposits and Recurring Deposits

Credit Cards

Other investments like mutual funds, insurance, etc.

Avail loans

Fixed Deposit Account

A Fixed Deposit Account is opened for a fixed duration of time by depositing a fixed amount of money at a predefined rate of interest. By this, your employees can deposit a fixed amount in the bank for a fixed duration of time and then withdraw the amount by the expiry period of the account through their existing Savings or Salary Accounts.

The basic features of a Bank Fixed Deposit Account is:

The Bank Fixed Deposit Account of your employees can be linked to their Savings or Salary Account

Since the Bank Fixed Deposit Account is a guaranteed product, the rate of interest is fixed for the specific tenure, which can range from 7 days to 10 years

The tenure of a Bank FD(fixed Deposit) is specified at the beginning and if the account holder wishes to withdraw money before the completion of the tenure, he would be able to do so but there might be charges applicable for the same

However, if the Bank FD is for a tax saving purpose under section 80C, i.e. for 5 years, then the same cannot be withdrawn before the completion of the tenure, even in the case of emergency.

The rate of interest varies from bank to bank on a regular basis and depends on the tenure of investment chosen. However, once chosen, the same is guaranteed for the entire tenure

TDS (Tax Deduction at Source) of 10% is applicable on the amount that is paid to the account holder if the interest is more than Rs 10,000 in one particular year, if Form 15G or Form 15H(for senior citizen) is not submitted on time.

There is a loan facility against the Bank Fixed Deposit as well.

Recurring Deposit Account

A specific amount of money when deposited at a Bank on a monthly basis for a specific tenure with a predefined guaranteed rate of interest, the same is called a Bank Recurring Deposit and the account associated with the same is called a Recurring Deposit Account.

Recurring Deposit Accounts are those accounts that are opened with the intent of utilizing the deposited amount in the future for the accomplishment of some long-term goals like the purchase of a car or some luxury items, wedding expenses of children, etc. So, your employees can open their RD(Recurring Deposit) Accounts through their existing Savings or Salary Accounts.

Some of the major features associated with the Recurring Deposit Account are mentioned below.

The minimum tenure for deposit into a Recurring Deposit Account is 6 months and the maximum is 10 years

The rate of interest varies from bank to bank on a regular basis and depends on the tenure of investment chosen. However, once chosen, the same is guaranteed for the entire tenure

Withdrawal of the Bank RD is allowed with the applicable charges but no partial withdrawal is allowed

TDS (Tax Deduction at Source) of 10% is applicable on the amount that is paid to the account holder if the interest is more than Rs 10,000 in one particular year, if Form 15G or Form 15H(for senior citizen) is not submitted on time.

And some of the benefits include:

A recurring deposit account will also help your employees in developing the habit of saving money.

There is a loan facility available with most banks for the Recurring Deposit

How to choose a bank for yourself?

While choosing a bank, there are some basic points which you should keep in mind. Let us have a look at some of the major things to look at while choosing a bank.

Safety: Security of your funds deposited

When you are choosing a bank, you should validate the security of the funds which you are going to deposit in the bank. Your bank is always insured and thus it provides apt security to your deposits. This is the primary reason for safekeeping your money with an entity like a bank.

Note: However, do you know the total amount of Insurance that is available for the money that you deposit in your bank in India? It is up to INR 1 lakh only. So, irrespective of what is the total amount of funds that you have in your bank, the insurance amount is at a flat INR 1 lakh only.

Charges: Transaction fees

Banks always charge a fee for the services they provide. However, there are some accounts like no-frills account or salary account or preferred accounts, where the charges are waived off.

Thus, you need to scout for those banks which have low charges and fees for the regular transactions which will be carried out in the banks. These fees can include monthly fees, processing fees, withdrawal fees, etc.

The difference in the rates of interest

Interest rates are related to the interest rate you will receive on your money deposited in the bank whereas another interest rate is related to that you will have to pay in case of any loan taken or credit card taken from the bank. You should always try and find a bank where the interest you receive on your deposits is high but the rate of interest on loans and credit cards is low.

Customer Service:

Customer Service is definitely a differentiating factor for choosing a bank. The bank you select must provide very good customer service. When you have queries or problems, you should receive proactive support and help from the customer representatives of the bank.

Ease of Transaction:

Even though in today’s age of technology, all transactions associated with banks can be done online but still there can be a certain situation in which you will have to deposit a cheque. In such a case, you should be aware of the physical location of your bank available near you. If you are frequently in need of depositing cash into bank accounts, then you must choose a bank that has physical locations near you for convenience.

Digital Support:

Mostly, all essential operations associated with the bank can be done online. So, a bank with a better internet banking and mobile banking facility is an advantage.

Once you have chosen a bank, you must choose the type of account that suits you the best. Even in a Current Account, there would be multiple types with varied benefits and varied AQB(Average Quarterly Balance) requirements. An account with a higher AQB would have higher benefits like dedicated Relationship Manager, etc. So, you need to weigh your requirements and then choose the type of account that suits your needs. Similarly, encourage your employees to do the same as well.

However, while you are selecting a particular bank you should be careful about these features and choose the ones which satisfy these criteria.

What questions should I ask my bank?

When you are choosing a bank, you should first ask certain necessary questions to your bank. These questions will help you in deciding about choosing the bank or not.

What are the options available for savings accounts, investment opportunities, etc. in your bank?

It is necessary to know about the options that are available with your bank about the savings account and other benefits like loans, investment opportunities, etc. This is a question you need to ask for the benefit of your employees. There must be a wide range of savings account options, investments and other benefits available at the bank and you must know about them in detail to be able to avail of the features and services.

What is the minimum balance requirement for keeping the account active?

Before you decide on opening an account in your bank, you must find out if there is any minimum balance that is needed to keep your account active. This would help you avoid unnecessary charges for not maintaining the same.

Is it easy for customers to avail of credit from the bank?

Usually, banks offer loans and credit cards to its customers at low-interest rates. You should check out if it is an easier process to procure loans or credit from the bank or not, which you or your employees might avail at any point of time.

What are the interest rates offered by the bank?

Banks offer interest to its customers for the money deposited into a savings account. You should thus be aware of the interest rates applicable in the type of account that you wish to avail.

Are there locker facilities available with the savings account?

Numerous banks offer locker facilities along with savings and current accounts. These locker facilities would be very helpful for you to keep your valuables safe. Your employees might also be able to avail this benefit.

Are there branches of the bank available nearby?

Even though most bank transactions can be performed online, there could be certain scenarios in which you would have to visit the bank. In such a case, you should be informed about the branches of the bank nearby for your convenience and you should be choosing a bank which has branches nearby.

What are the different types of debit cards and credit cards available for your employees?

Banks usually offer different types of debit cards and credit cards with various offers associated with them. VISA or MasterCard, RuPay Debit cards, Signature debit cards are some of the categories of cards available for transactions. You must know about the varieties of cards for convenience in choosing the card that matches your choice.

Are there facilities available for online banking? If so, what are the online services available for the customers?

Today, in this digital age all the banking operations are mostly performed online. It is necessary to know if your bank is providing online services for the convenience of customers or not. If so, what services are included in the online services? Many banks offer services like mobile banking, Pay Zapp, internet banking, etc. for their customers.

What is the schedule of charges for every transaction?

Charges are one of the highest incomes for a Bank. So, as a proactive customer, you need to be well versed with the schedule of charges so that you do not end up paying for the same unnecessarily.

What are the 5 most important banking services in India?

The 5 most important banking services provided by banks, other than safekeeping of your money and investment opportunity, can be summarized as:

Advancing of loans

Advancing loans is one of the most important services provided by banks. Banks can also be termed as financial organizations that are profit-oriented. Banks can provide loans to the public and the interest which is generated from the loan is the profit of the bank. After keeping some amount of cash reserve, as mandated by the RBI(Reserve Bank of India), the banks usually provide different types of loans to common people at a particular rate of interest which is mentioned before the product is signed up.

Overdraft facility

The process by which you can withdraw more than your deposits in your account is known as Overdraft. This is one of the important services provided by the bank by which they can lend money to people at the time of requirement. However, an interest is charged by the bank on the overdraft amount. This is usually done to meet the emergency fund requirement for the short term.

Foreign currency exchange

Banks deal with foreign currency and on the requirement of customers, banks help in exchanging foreign currencies for local currencies. This is quite helpful in international trade as it helps in the settlement of the dues.

Discounting of bills of exchange

This is another means by which banks lend money to the customers. In this method, if you are the holder of a bill of exchange then you can get it discounted by the bank in the form of a bill of exchange. The debtor will accept the bill which has been drawn upon him by the creditor and will agree to pay back the amount on maturity. Then there are some marginal deductions made by the bank and then the amount is paid by the bank to you as you are the holder of the bill. On the maturity of the bill of exchange, the bank will obtain its payment from the party which had accepted the bill of exchange.

Internet banking and mobile banking

In today’s modern world, these services are the most essential services provided by banks. By online banking, you can perform all the transactions related to banks from any place only with the help of the internet. Similarly, mobile banking is another service that is adding to the convenience of people by which you can perform your banking transactions with the help of your smartphone applications. These services have made banking easier and even more convenient.

In addition to these 5 important services provided by banks, many other services are provided by banks such as money transfer, credit cards, debit cards, lockers, investment banking, consultancy, ATM services, wealth management, etc. as well.

Which are the top 10 banks in India?

There is no specific list or ranking of the top #10 Banks in India and it depends on a completely personal choice, but some of the the most popular ones are mentioned below(in no particular order):

1. HDFC Bank

The HDFC Bank is one of the reputed private banks of India having its headquarters at Mumbai. The bank has a total of 4,800 branches and 12,000 ATMs across the country. HDFC bank is popular among common people because of it being an eminent choice for opening salary accounts. The HDFC bank offers services such as Savings Account, Credit Card, Debit Card, Car loans, Forex card, etc.

2. Axis Bank

Founded in the year 1993, Axis Bank is the third-largest bank of India in the private sector. Axis Bank has around 3000 branches throughout the country and around 13,000 ATMs. The major services provided by Axis Bank are a savings account, fixed deposit, credit card, investment banking, insurance, mortgage loans, etc.

3. State Bank of India

The State Bank of India (SBI) was founded in the year 1806 and is headquartered in Mumbai. It is the oldest bank in India and offers services such as corporate banking, investment banking, car loans, home loans, savings account, asset management, etc.

4. IDFC Bank

IDFC Bank is famous among people for the excellent customer service they provide. The debit cards of the IDFC Bank have excellent features such as the use of ATMs all over India, better Fixed deposit rates, opening accounts is easier, etc.

5. Punjab National Bank

Punjab National Bank is a state-owned multinational bank of India with its headquarters in Delhi. The major services provided by the Punjab National Bank are debit cards, credit cards, internet banking, mobile banking, ATM cards, etc.

6. Bank of Baroda

The Bank of Baroda was nationalized by the Indian Government in the year 1969. There are around 5,538 branches of the bank and a total of 10,000 over the country. The bank provides essential services to its customers in the form of debit cards, credit cards, savings account, online banking, etc.

7. ICICI Bank

ICICI Bank is one of the reputed private banks in India with more than 8,700 branches and 14,000 ATMs all over the country. The major areas of functionality for ICICI Bank are investment banking, wealth management, asset management, life insurance, venture capital funding, etc.

8. IDBI Bank

The IDBI Bank is otherwise known as the Industrial Development Bank of India. It is a public sector bank that was founded in the year 1964. The IDBI bank is headquartered in Mumbai and offers a great range of loan options in a hassle-free manner. IDBI Bank can be chosen for private banking, investment banking, corporate banking, insurance, mortgage loans, agriculture loans, etc.

9. Canara Bank

The Canara Bank is one of the oldest public banks in India and was established in the year 1906. The Bank has its headquarters in Bengaluru and is a convenient choice for commercial banking, investment banking, private banking, credit cards, asset management, etc.

10. Bank of India

Bank of India is a commercial bank founded in the year 1906 and offers excellent services through online banking. There are almost 5000 branches of the Bank of India and have the main motive of serving the Indian communities.

Conclusion

Hence, banks play a very major role in the economy and its growth. The main intent of banks is to help the common people with various issues related to the transactions and operations being carried out in banks. It is quite necessary to be successful in choosing a bank which is right as the right bank would have those necessary characteristics which would be helpful for common people. Some basic questions and major characteristics should be checked out before selecting a particular bank.

0 notes

Text

New Sukanya Samriddhi Yojana,2020 {Apply Online }

Account can be opened in Sukanya Samriddhi Yojana with just Rs 250. With this small savings can be deposited in Sukanya Samriddhi Yojana for the marriage or higher education of the child. The Central Government's Sukanya Samriddhi Yojana is a good investment plan for a child below 10 years of age to save for higher education and marriage. Putting money in this investment option also helps you to save income tax.

The Central Government's Sukanya Samriddhi Yojana is a good investment plan for a child below 10 years of age to save for higher education and marriage. Putting money in this investment option also helps you to save income tax. The Central Government's सुकन्या समृद्धि योजना is a good investment plan for a child below 10 years of age to save for higher education and marriage. Putting money in this investment option also helps you to save income tax. Sukanya Samriddhi Yojana can be a great step for those who want to stay away from stock market risk and are worried about falling interest rate in fixed deposits (FD). What is S.S.Y.? Sukanya Samriddhi Yojana (SSY) is a small savings scheme of the central government for daughters, launched under the Beti Bachao-Beti Padhao scheme. Sukanya is the best interest rate scheme in the small savings scheme. In the year 2016 -17, interest was being paid at 9.1 percent in SSY which is with income tax exemption. Earlier, it also got interest up to 9.2 percent. Sukanya Samriddhi Yojana Account opened with very small amount has been started keeping in mind the families who want to deposit money for child's marriage or higher education through small savings. Certified Financial Planner Deepali Sen said, 'Sukanya Samriddhi Yojana is a very good scheme for those who have low income and who do not believe in investing in the stock market. Security of capital with fixed income is the specialty of this scheme. How to open Sukanya Samriddhi Yojana account? Under Sukanya Samriddhi Yojana, an account can be opened after the birth of a girl child with a deposit of at least 250 rupees before the age of 10 years. In the current financial year, a maximum of Rs 1.5 lakh can be deposited under सुकन्या समृद्धि योजना. How long will सुकन्या समृद्धि योजना account run ? After opening Sukanya Samriddhi Yojana account, this girl child can be run till the age of 21 years or her marriage after the age of 18 years. What is the use of Sukanya Samriddhi Yojana? After Sukanya Samriddhi Yojana, up to 50 percent of the amount can be withdrawn for the higher education of a child after the age of 18 years. Sukanya Prosperity Plan rules open account Sukanya prosperity plan account the child's parent or can be opened by legal guardian girl before the age of his 10 years with the child's name. According to this rule, only one account can be opened for a girl child and money can be deposited in it. Two accounts cannot be opened for one girl child. The documents required for Sukanya Samriddhi Yojana, while opening Sukanya Samriddhi Yojana account, it is necessary to give the girl's birth certificate to the post office or bank. Along with this, proof of identity and address of the girl and guardian is also required to be given. Know more about personal finance,

Sukanya Samriddhi Yojana How much amount is necessary in Sukanya Samriddhi Yojana ? 250 rupees is enough to open Sukanya Samriddhi Yojana account, but later money can be deposited in multiples of 100 rupees. At least Rs 250 should be deposited in any one financial year. In a single financial year, no more than Rs 1.5 lakh can be deposited in an SSY account or once. The amount can be deposited in Sukanya Samriddhi Yojana account for 15 years from the day of opening the account. In the case of a 9-year-old girl, when she turns 24, the amount can be deposited. By the time the child is 24 to 30 years old, when the Sukanya Samriddhi Yojana account matures, interest will be paid on the amount deposited in it. Could not deposit the Sukanya Samriddhi Yojana then? Where minimum amount has not been deposited in an irregular Sukanya Samriddhi Yojana account, it can be regularized by paying a penalty of Rs 50 annually. Along with this, the amount to be deposited at least for every year will also have to be put in Sukanya Samriddhi Yojana account. If the penalty is not paid, then the amount deposited in Sukanya Samriddhi Yojana account will get interest equal to the post office saving account, which is currently about four per cent. If the interest on Sukanya Samriddhi Yojana account has been paid more then it can be revised. Spend but thoughtfully, useful tips How will the mount be deposited in Sukanya Samriddhi Yojana account? Money can also be deposited in Sukanya Samriddhi Yojana account by cash, check, demand draft or any such instrument which the bank accepts. For this, it is necessary to write the name of the depositor and the name of the account holder. Funds in Sukanya Samriddhi Yojana account can also be made through electronic transfer mode, if the core banking system is present in that post office or bank. for more info check Official Website https://www.indiapost.gov.in/VAS/Pages/PMODashboard/SukanyaSamriddhiAccount.aspx

Eligibility

An account can be opened in the name of a girl child until she attains the age of 10 years from the birth of a girl child by a natural or legal guardian.The depositor can open and operate only one account in the name of a girl child under the scheme rules.The natural or legal guardian of a girl child may be allowed to open an account for only two girl babies. In the name of the girl child, a third account can be opened on the birth of twin girls in the second birth or if there are three girls born in the first birth itself.

Documentation

Sukanya Samriddhi Yojana Account Opening FormBirth certificate of girl childProof of identity (as per Know Your Customer (KYC) guidelines of Reserve Bank of India)Proof of Residence (As per RBI's Know Your Customer (KYC) guidelines)

All Features of SSY

Attractive interest rate of 8.5%. The rate of interest is regulated from time to time by the Ministry of Finance.Minimum Rs. In a financial year 1,000 can be invested.Rs in a financial year A maximum investment of Rs 1, 50,000 can be made.Money can be deposited in the account till the completion of 14 years from the date of opening the account.The account will mature on completion of 21 years from the date of opening of the account, the condition being that if the account holder marries before the completion of this 21-year period, the account will not be allowed to operate beyond his marriage date.

Benefit

Tax exemption: Investment in Sukanya Samriddhi Yojana scheme is exempted from income tax under Section 80C. It offers tax benefits under the triple tax exemption regime under the scheme. That is, principal, interest and outflow are all exempt from tax.Withdrawal Facility To meet the financial requirements of the account holder for the purpose of higher education and marriage, the account holder can avail partial withdrawal facility after attaining the age of 18 years.

Transfer Existing Sukanya Samriddhi Yojana Account

Customers can transfer their existing Sukanaya Samriddhi Yojana account held with other bank/ Post Office to Any Bank/Post Office SSY transfer process Customer needs to submit SSY Transfer Request at existing bank/ Post Office mentioning address of Bank branch Which you Transfer your A/C.The existing bank/ Post Office shall arrange to send the original documents such as a certified copy of the account, the Account Opening Application, specimen signature etc. to Any Bank branch address, along with a cheque/ DD for the outstanding balance in the SSY account

Process at Bank Branch When Transfer SSY.

Once transfer documents are received at Bank branch, the customer is required to submit new SSY Account Opening Form along with fresh set of KYC documents. Closure of the Account In the event of death of the Beneficiary, the Account shall be closed immediately on production of death certificate issued by the competent authority, and the balance at the credit of the account shall be paid along with interest till the month preceding the month of premature closure of the Account, to the Guardian.The Account shall mature on completion of 21 (twenty one) years from the date of opening of the Account. However, if the Beneficiary is married before completion of such 21 (twenty one) years, the operation of the Account shall not be permitted beyond the date of her marriage. It shall be responsibility of Beneficiary or guardian to inform Any Bank/Post Office regarding the marriage of the Beneficiary within 30 days of such marriage in writing and shall not operate the Account after such marriage. Upon marriage of the Beneficiary, the Account shall mature and the amount therein shall be given to the Beneficiary upon production of affidavit as per the Rules. 6.3. On maturity, the balance including interest outstanding in the account shall be payable to the Beneficiary on production of withdrawal slip along with the pass book and proof of identity. 7. The Guardian shall be entitled to receive a passbook carrying details of the Account. The Guardian/ Beneficiary shall be required to present the passbook to the Bank at the time of depositing or withdrawing any amount from the Account or the closure of the Account. 8. Once the Beneficiary attains the age of 18 (eighteen) years, withdrawal up to fifty per cent of the balance at the credit in the Account, at the end of preceding financial year shall be allowed for the purposes of higher education or marriage of the Beneficiary. 9. The Guardian hereby irrevocably authorises Any Bank to disclose, as and when Any Bank is required to do so by applicable law or when Any Bank regards such disclosure as necessary or expedient (including but not limited to disclosures for the purpose of credit review of any Account, service/s or credit facilities received by the Guardian from Any Bank whether singly or jointly with others or otherwise), any information relating to the Guardian, his/her Account(s) or other assets or credit facilities whatsoever held on the Customer's behalf to Any Bank’s affiliates, subsidiaries, agents, advisors, employees, contractor, third party service provider in respect of the Account. 10. All notices in connection with the Account shall be in writing and sent to the address as provided below and all notices shall be deemed to be received by Any Bank only upon acknowledgment of receipt of the same in writing by Any Bank. 11. No failure or delay by Any Bank in exercising any right, power or privilege hereunder shall operate as a waiver thereof nor shall any single or partial exercise of any other right, power or privilege. The rights and remedies of any Bank as stated herein shall be cumulative and not exclusive of any rights or remedies provided by law. 12. The Guardian hereby agrees that the Guardian shall, at his/her own expense, indemnify, defend and hold harmless Any Bank from and against any and all liability any other loss/ claims that may occur, arising from or relating to the operation or use of the Account or the services of Any Bank or breach, non-performance or inadequate performance by the Guardian of any of these Terms or the acts, not-errors, representations, misrepresentations, misconduct or negligence of the Guardian in performance of its obligations. 13. Any Bank reserves the right to make changes to the Terms after giving prior due intimation. 14. The Guardian hereby undertakes to comply with all the specified conditions under the Primary Terms and these Terms. 15. All other terms not specifically mentioned herein shall be governed solely by the Primary Terms and Rules. By applying for the Account and availing Services thereof, the Guardian hereby acknowledges that he / she has read, understood and accepted these Terms, Primary Terms, Rules and undertake to continue to be governed by and abide by such Terms/ Primary Terms. 16. Any Bank may, at its sole discretion, utilize the services of external service provider/s or agent/s and on such terms as required or necessary, in relation to its products/services. 17. The laws of India shall govern these Terms. Any Bank and the Guardian hereby agree that any legal action or proceedings arising out of the Terms shall be brought in the courts or tribunals at Mumbai, India and irrevocably submit themselves to the jurisdiction of such courts and tribunals. 18. Any Bank may, however, in its absolute discretion, commence any legal action or proceedings arising out of the Terms in any other court, tribunal or other appropriate forum, and the Guardian hereby consents to that jurisdiction. Any provision of these Terms, which is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of prohibition or unenforceable but shall not invalidate the remaining provisions of the Terms or affect such provision in any other jurisdiction. Read the full article

0 notes

Text

Types of Bank Accounts-HSC, Class 12/11, Money and Banking

There are basically four different types of bank accounts.

They are as follows-

1. Current Account - This account is generally meant for businessmen. This is because they have a high frequency of bank transactions. Under this account, there is no restriction on the number of withdrawals and hence is most suitable for businessmen. Some current account holders are also given overdraft facility. The customer gets cheque book facility for current account

2. Savings Account - This account is made for the general public especially salaried people. The main objective of having the savings account is to cultivate the habit of saving among people. Interest is also paid by the banks on the savings account. However, there are restrictions on the number of withdrawals that can be made through savings account and hence this type of account is not suitable for businessmen. Customers are generally required to maintain a certain minimum balance in the account.

3. Recurring Deposit Account - This type of an account is also called as the cumulative time deposit account. It is meant to cultivate the habit of savings among economically weaker section of the society. Under this type of an account, the customer is allowed to deposit a certain small but fixed amount (Rs.50, Rs.100, Rs.500 etc.) every month for a fixed period of time. The customer gets back the total amount deposited along with interest at the end of the specified period.

4. Fixed Deposit Account - Under this type of account, a one-time lump-sum deposit is made by the customer for a fixed period of time (generally 3 months to 10 years). The customer cannot withdraw the amount during this period (These days most banks allow pre-mature withdrawal with a minor penalty). However, he can take a temporary loan against the fixed deposit receipt (FDR). At the end of the fixed period, the customer can either withdraw the amount or renew the fixed deposit.

Following hybrid account is also offered by a lot of banks now-

Multiple Option Deposit Account : It is a type of Saving Bank Account in which deposit in excess of a particular limit gets automatically transferred into Fixed Deposit. On the other hand, in case adequate fund is not available in our Saving Bank Account so as to honour a cheque that we have issued, the required amount gets automatically transferred from Fixed Deposit to the Saving Bank Account. The balance amount continues as Fixed Deposit and earns interest as per existing rate of interest. One can earn higher rate of interest from a Fixed Deposit Account than from a Saving Bank Account.

#bankaccounts#types#savingsaccounts#savingsaccount#currentaccounts#currentaccount#fixeddeposit#recurringdeposit

0 notes

Text

25 Years in the Finance Sector, I became a Fan of Blockchain

Introduction

My first exposure to banking happened in the mid-1980s when I opened my first bank account. Other institutions in the financial sector were the Life Insurance Corporation of India (LIC) and Unit Trust of India (UTI). Apart from this, I can’t recall any other financial institutions in the mid-1980s, when the country was deep in the shell of a closed economy.

Trust in the System

The characteristic feature of the economy observed back in those days was ‘Trust’ of the people on the financial system, backed by the Government. It was for this reason that, perhaps, there was no need for any sort of transparency in the financial system. Back then, no one had heard of financial institutions failing.

Existence of a Barrier

Another visible feature was that of the existence of a ‘Big Wall’ between customers and financial institutions (FI). FIs used to operate in closed enclosures where customers would queue-up for transactions; a process that was much longer than a simple click of a mouse, today.

There was a barrier between the customers and employees of FIs, where customers were heavily dependent on these institutions with very little choice, unlike the present scenario; where customers receive multiple calls a day from different banks for credit card offers and other schemes. The speed and time taken to complete transactions were a lot slower as compared to the current generation who engage in the use of smartphone mobile banking.

Pre-millennium era (Pre-2000)

Once, somewhere in the 1990s, I went to a bank branch to withdraw money using a self-cheque written by my father. On the arrival of my turn, I presented the cheque to the cashier through a small space where only my hand could reach the cashier (who sat in a confined, closed enclosure). The cashier asked me the name of the account holder, to which I mentioned my father’s name. He then asked me to sign the back of the cheque and my next question to the cashier was, “Whose signature do I have to put on the back of the cheque, whether mine or my father’s?,” (I had perfected the art of copying my father’s signature). The cashier gave me a hard stare and asked me who was withdrawing the money.

Traditional Banking

The above example demonstrates a typical transaction in a bank. All transactions operated in a physical world right from customer passbooks, cheque-books, ledgers in the bank, physical signature verifications, physical copies of Fixed Deposits- all of it existed in a tangible space.

In those days, having a telephone at home was but a dream- forget about anything regarding online, digital and click based options; characteristic of the world we live in today. A similar situation used to exist in the other two financial institutions. As a result of having no exposure to the external world, there was no scope for complaints from customers.

Transactions took place in the physical realm at LIC of India, around the time I started working in the early 1990s. However, some amount of computerization had started during this period, for the purposes of keeping customer records. The quality of physical record-keeping was many folds better, back in those days, as compared to digital record-keeping in the present day.

Reaction to Disruptive Technologies

There was an incident where a computer enthusiast tried to consolidate physical records into an electronic format. As a result, he faced a tough time and ultimately succumbed to the resistance of his seniors, which ultimately led to him leaving the project. This instance constantly reminds me of the fact that it takes time for human behavior to accept change in terms of adopting newer (disruptive) technologies.

In today’s context, the aspects of blockchain trading and Bitcoin are facing stiffer challenges. The genesis of the problem lies in the limited understanding of emerging technologies by people. Individuals must not be blamed and, ideally, it should be the job of corporate houses to keep their employees updated in order to embrace newer technologies for faster development.

Slow and Steady Digitization

Another message from the example stated above is the power of a physical signature on cheques, which in the present day; is replaced by passwords, digital signatures, fingerprints etc. in regards to ATM, mobile and online transactions.

The flip side of present-day digitization is that of increases in the incidences of financial frauds. The physical system prevalent before digitization was more secure than the digital systems of today, which are available to fraudsters, who can embezzle and launder funds in a systematic manner.

The only way to make quick money back then was to rob a bank. Furthermore, the incidences of losses due to frauds back then were far lesser as compared to how it is in the present day scenario. Every individual is now exposed to the risk of online hacking. This is, perhaps, the price we have to pay for the ease of doing business.

Post-millennium era (Post-2000)

Computerization of financial systems (limited to a customer records on a mainframe) during the 1990s started changing the face of the Indian financial system, the effects of which were observed post-2000.

This era was also characterized by the country moving further away from the system of a closed economy. Most public sector organizations began competing with the newly opened private sector, both in terms of infrastructure and services.

Effects of Computerization

ATM and credit cards got popular, however, there was a fee for using credit cards. Physical signatures slowly started taking a digital form in terms of ATM PIN numbers for withdrawal of money.

The duration of transactions also started reducing, leading to the public taking liberties like not waiting for a bank branch to open, for the purpose of cash withdrawal. This was a welcome change for the Indian public; both for the older, as well as the younger generation.

Internet services in the country were gaining momentum but were expensive, as compared to the present day. FIs expanded the online view of the customer accounts on computer systems, for selected services. There was a sense of freedom because of this. Mobile technology was still in the feature-phone era back then, so mobile phones were not connected to the financial system for easy access.

Various branches of financial systems were computerized but were not interconnected to carry out transactions from any branch. This era was characterized by the advancement of technology.

Privatization of Financial Sector

The introduction of the private sector saw financial institutions coming under a different regulatory regime; one that sought to level the playing field, in regards to the rules of the game and maintaining trust and confidence of customers.

The 2008 economic crisis jolted the confidence of customers on new and emerging private financial institutions. There was a definite flow of cash from private banks to public sector banks.

Drag Effect of a Closed Economy

The financial system in India withstood the crisis mainly due to the ‘drag’ of a closed economy, as well as the Indian financial system being more regulated as compared to the western market.

One of the key arguments in regards to the causes of the financial crisis in the western market was a lack of an adequate regulatory regime. There were many commentators advocating the need to create a balance between open markets and adequate regulation.

Post-2010

The era after the economic crisis saw increased efforts in developments towards online transactions; with the availability of smartphones leading to mobile banking, the availability and access to ATM machines, a manifold reduction in time to perform a transaction, less frequent visits to bank branches, and a total makeover of said branches across the country.

This era was defined by customers being treated with respect as compared to the period of the closed economy. The ‘wall’ between customers and FIs was removed.

Complete Drive towards Digitization

Digitization became the focus of development for FIs, with customers becoming the center of attraction, where today regular cold phone calls and SMS to customers are an everyday issue. This is an indication of the kind of transformation that has happened over the last 2 decades.

As mentioned before, digitization of transactions provided open opportunities for fraudsters to penetrate into customers domains leading to increasing cases of frauds. Companies started investing in IT security to maintain customers’ data and privacy, which was not an issue earlier in the world of physical transactions.

Post-2015

Life went full circle in the period between 1985 and 2015 where the security of customer data became the prime concern of financial institutions, something which didn’t pose much of a challenge in the eras before digitization.

Fraudulent transactions and embezzlement reached new heights, which never posed a serious threat earlier. People started talking about transparency which wasn’t heard of before, and the speed of operation of money transfer overseas started increasing dramatically.

Arrival of the Dark Horse

Then came a twist in the tail with the arrival of Blockchain technology. Blockchain is essential in solving all of the above challenges including the maintenance of trust between the customer and the institution.

The most important change that blockchain will bring to the economy is the removal of an intermediary, i.e. financial institutions. It’s a new world altogether and if this technology works in the future, it will change the entire dynamics of how transactions are conducted.

What is Blockchain?

Blockchain is a technology that enables a transaction between two or multiple parties directly without the need for intermediaries or financial institutions. Transactions occur with the same level of trust and a higher level of transparency, at a much faster pace with the click of a button, and at minimal costs.

The security provided during the closed-economy era using physical signatures is the same kind of security that is provided by blockchain cryptography.

The cryptography is based on a mathematical algorithm that uses the power of computing technology, where codes are difficult to break, thereby providing high security.

Features

One of the key features of blockchain is that the history of all transactions and relevant information is stored on a decentralized system of all parties involved in the transaction.

This makes blockchain more secure to a point where if someone tries to hack the system, the person will have to make the same changes in information across all the members’ accounts. This is almost impossible as there could be millions of people in the blockchain system.

This means that in the future, there will be no need for financial intermediaries as the process of transactions between multiple parties can be performed amongst themselves at faster speeds, lower costs, at a high level of transparency and with an equal level of trust. This will remove the opacity existing in the transactions of the traditional banking system.

Final Thoughts

Blockchain is going to bring a revolution in the financial system where the current centralization of power exercised by FIs will be removed and replaced by a network of individual systems that are hard to penetrate.

This is a drastic change in the already existing dynamic between physical transactions and those occurring on the digital plane.

Being a risk management professional, I can see newer challenges for risk management professionals to identify associated risks and plan for subsequent mitigation.

If the last three decades have brought us to the digital world, the next three decade will bring in an intermediary free society which, at the moment, is hard to imagine.

This article was originally published on blog.bankofhodlers.com.

About Bank Of Hodlers

Created by Asaithambi Vajaravelu

Bank of Hodlers is a Blockchain based firm that provides services in terms of ensuring security against Crypto thefts, providing Crypto credit cards and Crypto backed loans.

We are on the verge of releasing our product soon. Visit our website for early access by clicking here or join our Telegram community for daily updates.

The views mentioned in the above article was written by Sonjai Kumar.

25 Years in the Finance Sector, I became a Fan of Blockchain was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

[Telegram Channel | Original Article ]

0 notes

Text

Types Of Current Accounts You Can Open In India

One type of account which allows the holders to conduct higher banking transactions are current accounts. They are ideal for small and medium businesses who need to withdraw or deposit sums into their account for business needs. Business owners can open a single account and conduct transactions in any branch of the bank across India. It also means, if you have multiple branches or franchises, a single account is enough.

Now, did you know there are different kinds of current account? The following are the types –

· Standard account

It is the most common type of account that new businesses opt for. A standard account is a non-interest-bearing account. You must maintain a lower minimum balance in such account as opposed to other business accounts. It comes with all the essentials such as cheque book, passbook, and debit cards. You can also apply for overdraft facilities with this account. If you have a great rapport with the bank and starting your business, you can open a standard account with them.

· Premium account

Those owners who seek exclusive rewards and benefits can choose a premium current account. They come with customised features and are ideal for business owners who need to carry out high value and frequency transaction daily. Premium accounts also offer the account holders access to unique features such as regular internet and mobile banking, SMS banking, and free as well as frequent NEFT and RTGS transfers.

· Packaged account

This is another option that business owners can consider. These accounts come with the rage of perks and facilities which account holders can benefit from. A packaged account is different from others as this one proves special and additional features which include medical support, travel insurance, motor insurance, and road-side assistance amongst others. They are ideal for businesses who belong to movers and packer’s category.

· Foreign currency account

Some businesses have clients outside India. They could also have branches in overseas territories. For example, some Indian jewellery brands have branches abroad. Any business which has trade relations outside India can benefit from foreign currency account. You need this account for carrying out international currency transactions. It is easy to open such accounts with a bank where you already hold an existing relationship.

· Single column cash book

Called as a simple cash account, a single column cash book enables you to operate your daily business transactions but does not come with overdraft facilities, unlike the mentioned accounts. It is best for businesses who prefer not to maintain any bank account columns. Also, banks charge lower maintenance fees for single column cash book.The account number for each of these accounts are of course different and can be found on the statement or the welcome kit given by the banks.

0 notes