#most profitable stock trading ideas

Explore tagged Tumblr posts

Text

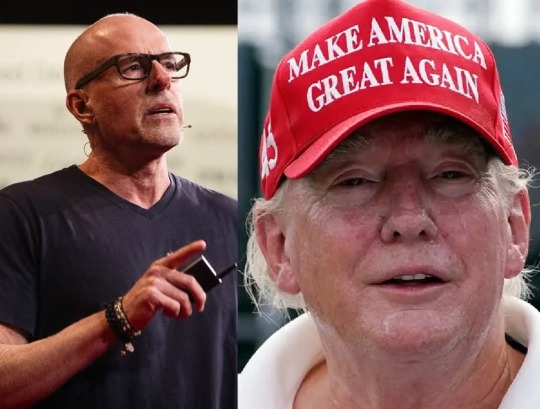

BREAKING: Renowned business expert Scott Galloway hammers Donald Trump as "stupid" and says that he's "blackout drunk" at the "wheel of the global economy" as his tariffs destabilize the entire world.

He also alleged that Trump's sudden tariff reversal enriched his MAGA cronies in the "greatest day of insider trading and grift in history."

This is one rant that every American needs to hear...

During an appearance on The View, Galloway — who is a successful entrepreneur and a professor at the New York University Stern School of Business — was asked by co-host Whoopi Goldberg about Trump's recent behavior.

She slammed him for having "wreaked havoc on the global economy since his so-called liberation day last week with massive tariffs" and pointed out that he backtracked and lowered his tariffs on most countries to 10% while imposing an effective tariff rate of 145% on China.

"It would be hard to think of a more elegant way to reduce prosperity this fast," said Galloway.

"Let's talk about Apple," he continued. "The notion was we're going to bring back all of those great jobs? The average Apple assembly person in China makes $500 a month. The average Apple employee focusing on more high-value things like design, store management, makes $200,000 a year here."

"We want to wear Nikes. We don't want to make them," he went on. "We have outsourced low-wage jobs overseas such that we can create more profits, more investments, and create higher wage jobs."

"If these tariffs hold, your iPhone's going to go from $1000 bucks to $2,300," he explained. "To make an iPhone in the U.S. it would cost $3,500. As a result, the threats of these tariffs take Apple's stock down the value of Walmart in three days."

"If these tariffs hold... 80% of toys under the Christmas tree are from China," Galloway continued. "So 90% of U.S. households are budget-constrained. So we're talking about half the number of toys."

"We're talking about a destruction in shareholder value such that your parents can't retire as quickly and we're talking about the entire world rerouting their supply chain around 'brand America,' which, quite frankly, right now is toxic uncertainty — so they can bypass a series of unpredictable, epileptic, sclerotic decisions," he stated.

"What we finally need to acknowledge: We have someone at the wheel of the global economy that is blackout drunk right now," he continued.

Later in the segment, Galloway dismissed the idea that Trump's policy is setting the stage for the "economy of the future" by bringing jobs back.

"First off, America is the second largest manufacturer in the world," he said. "And the Cato Institute — we romanticize manufacturing — the Cato Institute did a survey, 80% of us believe that we should have more manufacturing but only 20% of us want to work in manufacturing."

"There is no line to get in and have work at an assembly plant in Lansing, Michigan," he continued. "What we want is high-paying jobs. Quite frankly, if this president cared about young men and trying to up-level people we'd go to a minimum wage of $25 a hour."

"And by the way, if minimum wage had kept pace with productivity and inflation it'd be somewhere between $23 and $27 an hour," he explained. "This is nothing but in my view—"

"Do you realize that yesterday about ten minutes before he put a pause on the tariffs and Apple skyrocketed, the market went up 2000 points, there was huge activity in the options market," he went on.

"Yesterday will go down as the greatest day of insider trading and grift in history," said Galloway. "Someone knew what was going on and made a lot of money and it wasn't us and we're going to find out about this."

"If you want to go back — he talks about the great era of the late 19th century — guess what? When we didn't have indoor plumbing? Where we had child labor? I'll take Netflix and novocaine," he said.

"We have a habit because of social media to talk about how terrible America is," he went on. "There are [one hundred and ninety-five] nations, they would all trade places with us."

"Do we have income inequality, we have polarization, do we have struggling young people? A hundred percent," he said. "But guess what? This nation is less bad than any other nation except if you want to take us back to the past. That makes absolutely no sense whatsoever."

Galloway was then asked about America's image around the world under Trump.

"We have the greatest inflow of capital which drives our stock up which lets us borrow money at a lower cost," he explained. "We have the greatest inflow of human capital. What do the best and the brightest in the world have in common? They want to come to our universities, they want to live in America."

"And part of that is that the American brand is risk aggressiveness, it's rule of law, it's consistency," said Galloway. "Rule of law has gone out the window. Right? We've now decided to defy court orders. We're having used car sales on the White House lawn."

"We are rounding people up with the wrong tattoo and shipping them off without due process to essentially hellscape prisons," he continued. "Rule of law is gone. Consistency? The tariffs are on, they're off, the tariffs are on, the tariffs are off."

"We're alienating nations that love us and we love. When did we decide to go to war against Canada!?" he asked. "Canada!? You know what Canada did?"

"There's this great line that the Holocaust survivor talking to Warren Buffet said, how do you judge friends? V'ery simply, I ask a question would they hide me?'" he said.

"Canadians hid us in the [Iran] hostage crisis," he went on. "The Canadian embassy hid six Americans and if they'd been found out they would have been hung by cranes. We're going to war against Canada!? They are our true friends. We can't even articulate why we're angry with them. We are going to war with everyone at the same time."

"The big winner here, if there is a winner, is China over the medium and long-term, who says 'You may not like us, but you can count us,'" said Galloway.

"The damage here... When he paused the tariffs yesterday, he took the knife halfway out of the economy's back, but the injury will take years, if not decades, to heal," he predicted. "The definition of stupid is doing something that hurts yourself while hurting others. This could not be more stupid...!"

#fuck trump#maga morons#fuck maga#maga cult#traitor trump#republican assholes#republican cheats#trump is an idiot and so are his voters#fuck the gop#inbred

67 notes

·

View notes

Text

29th March 1958 saw the death of Sir William Burrell.

I first learned of William Burrell through my mum in the early 80's, he was born into a shipping family and ran the business with one of his brothers, George after his fathers death.

In 1876 William entered the firm at the age of 15, and on his father's death in 1885 he and his eldest brother George took over the management, the firm was already prospering, but under their shrewd direction it reached a position of international standing in worldwide tramping and in ship management.

The Burrell brothers undoubtedly had the Midas touch. George kept abreast of developments in marine engineering while William specialized in the commercial side. Their fortunes were based on a steady nerve, foresight and breath-taking boldness. The formula was quite simple. In times of depression they would order a large number of ships at rock-bottom prices, calculating that the vessels would be coming off the stocks when the slump was reaching an end. Burrell and Son was then in a position to attract cargoes because it had ships available and could undercut its rivals. Then, after several years of highly profitable trading, the brothers would sell the fleet in a boom period and lie low until the next slump occurred, it was a simple idea for them and very shrewd, none of their rivals were brave enough to take the risk and the firm went from strength to strength.

It was when the firm were at there peak William became one of the most important collectors in Scotland. His interest in art went back to his youth. While still a boy he was already buying pictures, although he used to say in later years that their chief value lay in the frames.

Although it is not known what sparked off Burrell's love of art, there were plenty of opportunities in late 19th century Glasgow for him to form his tastes. A number of collectors were to be found amongst the wealthy Scottish industrialists and shipowners of the time.

An estimate of Burrell's early interests can be obtained from his loans to the Glasgow International Exhibition of 1901, when he was the largest single lender with more than two hundred works. Their range and scope show that he was already a collector of major standing. They included medieval tapestries, ivories, wood and alabaster sculpture, stained glass and bronzes, Roman glass, 16th and 18th-century Dutch, German and Venetian table glass, silver, furniture and Persian rugs. The paintings are by too many artists to mention here without it looking like a shopping list, but Whistler, Manet and Monticello were among his purchases.

Between 1901 and 1911 little is known of Burrell's collecting, apart from his acquisition of some fine pictures, including his first Degas. Unfortunately, at the same time he was selling as well as buying, a policy he was to continue even after the sale of the fleet had removed any major financial restrictions on the scale of his spending on art. In 1902, for example, he sent nearly forty pictures for auction, and among those sold were paintings by Daumier and Manet which are now in the United States.

From 1911 until 1957 Burrell kept detailed records of his expenditure in twenty-eight school exercise books. He made almost all the entries himself, except during the last few months when failing eyesight compelled him to delegate the task to others. These purchase books are an invaluable record of the astounding range and scale of his collecting. Although the entries tend to become more detailed as the years go by, the basic format was established on the first page of the first book. There are separate columns for date of acquisition, description, from whom the item was acquired, its price, date of delivery, insurance and whether photographed. The last column is headed "All in Order" and usually has Burrell's initials.

Burrell was never an easy client. He was strong-minded, liked to haggle over prices and could be very cautious., well what would you expect from a canny Scot! Even dealers with whom he had done business over some years would find him seeking a second opinion on an object they were attempting to sell him. His collection is only bettered by some of the major museums across the British Isles.

Until about 1930 Burrell seems to have been buying merely for his personal enjoyment, with no thought of forming a collection which would be kept together after his death. Until then he continued to sell or exchange paintings, but in the 1930s he formed the idea not only of having a permanent collection but of handing it over to public ownership. Burrell had discussions with a number of interested parties regarding the disposal of the Collection, and eventually, in 1944, it was donated to Glasgow, the city of his birth and centre of his business activities, in the names of himself and and his wife.

A few years later he gave the then Glasgow Corporation £450,000 for the construction of a building in which the Collection was to be housed and displayed. The terms of the Deed of Gift as regards this building, however, presented difficulties. Burrell stated that it should be within four miles of Killearn in Stirlingshire and not less than sixteen miles from the Royal Exchange in Glasgow. He felt that the Collection would appear to best advantage in a rural setting and was also deeply concerned at the harm which could be caused by the high levels of air pollution then prevailing over Glasgow. The councillors and Corporation officials were aware of the problems in, firstly, finding a suitable site and then in administering a museum so far removed from the city, but attempts to persuade Burrell to make his conditions less stringent met with little success. Various sites were considered, but the issue was still unresolved at the time of Burrell's death. It was only nine years later, in 1967, when Mrs Anne Maxwell Macdonald presented Pollok House and estate to the City of Glasgow, that a site was at last found.

Sadly, he did not live to see them in the gallery in Pollok Park, where they form such an important feature. He died at Hutton Castle on 29 March 1958, at the age of 96.

A design competition for the museum building in 1971 was delayed by a postal strike, allowing time for the eventual winning architect Barry Gasson. I have no idea why it took so long to actually get it built, but it’s size was maybe a factor. The building is the second largest post war building in Scotland, the abandoned St Peter's Seminary at Cardross being the largest. The Burrell Collectioned opened it’s doors in 1983. So far, more than 1.3 million people have visited exhibitions.

The Burrell Collection closed to the public in October 2016 in order to embark on a programme of refurbishment. It was planned to reopen in spring 2021, although covid might has delayed the work and it has been revised

13 notes

·

View notes

Note

Why do economists need to shut up about mercantilism, as you alluded to in your post about Louis XIV's chief ministers?

In part due to their supposed intellectual descent from Adam Smith and the other classical economists, contemporary economists are pretty uniformly hostile to mercantilism, seeing it as a wrong-headed political economy that held back human progress until it was replaced by that best of all ideas: capitalism.

As a student of economic history and the history of political economy, I find that economists generally have a pretty poor understanding of what mercantilists actually believed and what economic policies they actually supported. In reality, a lot of the things that economists see as key advances in the creation of capitalism - the invention of the joint-stock company, the creation of financial markets, etc. - were all accomplishments of mercantiism.

Rather than the crude stereotype of mercantilists as a bunch of monetary weirdos who thought the secret to prosperity was the hoarding of precious metals, mercantilists were actually lazer-focused on economic development. The whole business about trying to achieve a positive balance of trade and financial liquidity and restraining wages was all a means to an end of economic development. Trade surpluses could be invested in manufacturing and shipping, gold reserves played an important role in deepening capital pools and thus increasing levels of investment at lower interest rates that could support larger-scale and more capital intensive enterprises, and so forth.

Indeed, the arch-sin of mercantilism in the eyes of classical and contemporary economists, their interference in free trade through tariffs, monopolies, and other interventions, was all directed at the overriding economic goal of climbing the value-added ladder.

Thus, England (and later Britain) put a tariff on foreign textiles and an export tax on raw wool and forbade the emigration of skilled workers (while supporting the immigration of skilled workers to England) and other mercantilist policies to move up from being exporters of raw wool (which meant that most of the profits from the higher value-added part of the industry went to Burgundy) to being exporters of cheap wool cloth to being exporters of more advanced textiles. Hell, even Adam Smith saw the logic of the Navigation Acts!

And this is what brings me to the most devastating critique of the standard economist narrative about mercantilism: the majority of the countries that successfully industrialized did so using mercantilist principles rather than laissez-faire principles:

When England became the first industrial economy, it did so under strict protectionist policies and only converted to free trade once it had gained enough of a technological and economic advantage over its competitors that it didn't need protectionism any more.

When the United States industrialized in the 19th century and transformed itself into the largest economy in the world, it did so from behind high tariff walls.

When Germany made itself the leading industrial power on the Continent, it did so by rejecting English free trade economics and having the state invest heavily in coal, steel, and railroads. Free trade was only for within the Zollverein, not with the outside world.

And as Dani Rodrik, Ha-Joon Chang, and others have pointed out, you see the same thing with Japan, South Korea, China...everywhere you look, you see protectionism as the means of achieving economic development, and then free trade only working for already-developed economies.

#political economy#mercantilism#economic development#early modern state-building#early modern period#laissez-faire#classical liberalism#classical economics#economics#economic history

67 notes

·

View notes

Text

1323 – Day 1 – Townsend Farm

Malika has had time to think. Whether that’s a good or a bad thing, she isn’t quite sure.

Clement Dudley has not reappeared on the farm, of which she is, for the most part, glad. She doesn’t like the anxiety that comes with knowing she has made him angry, but she is also scared of what he might do. There are many tales of noble men not taking ‘no’ for an answer, and she shudders to think that the same thing might happen to her. But when her husband and elder children return and tell them about the handsome little house Sir Robert and his young wife inhabit, she can’t help but wonder if she has squandered a chance.

Sir Robert was born in this very cottage, and he is a knight now. What might being in the earl’s brother’s graces not do for them? Having friends in these circles certainly wouldn’t hurt.

Except that it could. She loves her husband. She doesn’t want to hurt him by flirting with other men, let alone ones she doesn’t even like. But she also doesn’t want her children or grandchildren to starve. And what might The Watcher think of such loose behaviour? She doesn’t want to lose Her grace, either.

She tries not to dwell on it, and instead busies herself considering practical matters; milk, cheese, the price of grain, and the like. The weather has turned wet again, and she and Benjamin are getting drenched to the bone while they work near each other, him on the field where he has planted the apple tree and wine stocks and her in the cow pen.

She walks over onto the field once she is done milking and has put the pail into the dry cowshed for a moment. She will take it to the cottage for further use later, but first, she wants to talk to her husband.

“I see you have decided to plant more grapes”, she says, as he looks up at her from where he had been surveying the shoots.

He nods. “From what George has been telling me, I thought it wise.”

“I only hope that the rain won’t damage the harvest too badly.”

“We’ll have to see. I’ll take what precautions I can, but in the end, it’s in The Watcher’s hands.”

She hesitates before asking the next question. “Have you given any more thought to us making nectar ourselves? If there are really that many buyers…”

They have talked about it before, so now, he only sighs. “I know it sounds lovely, but I fear we’d be reaching too high. I’ve asked George about it, and there is a vintner’s guild in Praaven that wouldn’t take too kindly to us interfering. He promised to make inquiries the requirements to join them, but I assume that would be difficult. And even aside from that, we’d need the tools for it, and the knowledge. And good, expensive nectar can only be sold after aging for years. It’s just too risky.”

“But what if no one buys our grapes?”, she asks, softly. “Or if there is another famine? If we lay aside nectar to age, we’d have something to trade with if there is another one.”

“Let’s just see how well our crop does, for now”, he says.

“What if we found someone to support us now and share the profits with later? A merchant or someone else with enough wealth?”, she interjects, when a thought strikes her. “That could make it worth it.”

“And who would that be?” Benjamin shakes his head. “Don’t make things more difficult than they need to be, love. Aside from the famine, my family has always done well with farming.”

But it isn’t farming that earns them most of their money, now. It’s Benedict’s woodworking. And now that she has an idea how to make her ideas of nectar-making more achievable, she’ll be damned before she gives up.

Prev: 1322 Statistics <--> Next: 1323, Day 1, Part 2/3

#welcome to a story arc entitled “Malika has ambition and questionable character judgement”#if she were a pen and paper character she'd for sure be decent int low wis#please note i say all of this affectionately#ultimate decades challenge#the ultimate decades challenge#the sims 3#ts3#townsend legacy#udc: townsend family#udc: gen 1#1320s

9 notes

·

View notes

Text

I am fascinated that so many people didn't see this whole reddit debacle coming.

They will come for all your social media sites. For your media consumption sites. For your music apps.

Shareholders are playing hot potato with companies until the bills come due and then they are selling them off and the ones left are trying to make up their losses by charging for everything they can possibly imagine.

This is just where things have gotten. Most tech companies aren't profitable and probably won't ever be profitable, but they are traded on the stock market under the idea that they someday will be even when that's absurd and would literally wreck them to do so.

Business articles are talking about "growth" over profit constantly. "Future gains" supposedly outweigh "profit now". So these companies dump money into making themselves "great" and fancy (see: addictive and attractive) for free or for cheap so they can get all the users, because then they become worth a bunch. When they can't keep growing via users, they find ways to push more advertising, try to monetize the users a little, make it seem like they can squeeze that blood out of the stone. Then they try and sell before the bills come due so that when people finally start to realize that there's no way for the company to keep growing, they aren't left out of pocket, but whoever does get stuck with it wants to keep that growth going, so they add more bullshit. They cut account sharing, they add more tiers, they add more ads, they start charging for features that were free or included, they try make other companies pay them just to connect.

They are making things worse in the pursuit of artificial value. They are hoping they have enough of a monopoly on the way you interact that they can keep you hooked and paying their bullshit new fees and suffering through their ads so that they can recoup their losses.

This is going to keep happening.

97 notes

·

View notes

Text

Coping with the Volatile Stock Market

First a person needs to know the facts since the creation of the stock market. Why does the stock market goes up and down and playing with trillions of dollars in gains and losses?

When it comes to money, we must understand the human race gained the ability to be greedy and lustful. Such traits can NEVER be satisfied or fulfilling to the soul of a Kingdom person. The point of a long term savings or short term get rich was created in the nature inherited thru the bloodline of sins.

So why the up or down of the market? The answer is based in 3 factors; 1. brokers (the inside gameplayers/the house players with the know how to play but govern by regulatory rules and laws. 2. company employers who created stock/bonds to sell in the market store to create greater wealth which in return is distributed to investors based on individual maturity dates to withdraw funds. 3. Employee/investor contributions. It will always be an monopoly of greed.

Both brokers and companies receive trading fees when investors buy or sell shares unless fees are waived by brokers. Most companies collect a fee as soon as an investor invest their money.

So Why the Up or Down?

Employees who seek to invest continue with payroll deductions and without any penalties can adjust their investments when the market is steady, up or down. The point remains the shareholders in each company make voting decisions about the leaders/trustees of their money=the board of directors. The board of directors meet to decide investing decisions. Investors panic or are thrilled with share value. Like a doctor checking a pulse, the ball rolls from the top to bottom. Brokers can't receive commissions/bonuses in losses. Brokers base their riches and success in business success of increases they invested their clients' money. In otherwards brokers pay the bills based on investors investing. If investors slow in investing, so will the brokers wealth decline. How to gain trillions back? Invest with what you have, in hopes/gambling of rising values will sprinkle leaven on the investment. Buckle down with what you have, weather the storm, if you have invested, wave it out. By withdrawing any money out 1. you will reduce any further losses, but you will not profit any longer from withdrawn investments. 2. Keeping your money invested, but freezing investments will cause a stalemate in the market. 3. Continue to invest via payroll deductions with no investment adjustment change will allow you to receive lower value stock with the possibility of increases. With that being said, any investment is better than burying $10 dollars in a tin can and digging up the tin can 20years later with $10 dollars still in the tin can, the 10 bucks hasn't ADJUSTED TO INFLATION 20 years later, it won't buy much.

Diversity in investment is important, managing your investments daily may not be a good idea if you invest in long-term steady companies.

Tariffs? There are companies that have warehouses and employees in China. They have companies all around the world doing products and shipping business with contracts to America. They have depended on other countries for cheap labor costs and shipping products to America after adding manufacturing/shipping costs etc. America continued this trade business for decades. If American companies left foreign countries to build/sell/ship products to America, it would cost large companies to withdraw trillions to prepare for an economic change they depended on for centuries. It's the weakness of trade. It's like separating the red blood cells from the white blood cells in the body. As we well know, that's probably possible soon, but that's a lot of waste of time a person in their lifetime don't have time for.

So, seek council from God, pray, don't be in a rush to be separated from your hard-earned money that you are risking gaining or losing. Be patient and understand if you are looking for quick profits or long-term investments. If you are being rushed to invest before receiving an answer to prayer or haven't seek council, you are moving too fast.

by #pastorprevon Pastor Prevon

#donald trump#covid#travel#lifestyle#phillipeclark#black lives matter#politics#social media#government#pastorprevon

2 notes

·

View notes

Text

Chapter 4

Not much of a preamble this time, lets get right into it. Spoilers under the cut as always. The tag is Amygdala if you want to find the other chapters on my blog.

Well pull away from the street level to the courts in this chapter, changing focus for a moment from the day to day lives of regular citizens to the people who shape how it all works. The structure as laid out so far is that we have the Voices, akin to a mayor or department head. We have Voices for specific districts within the city, but we also have Voices for things like 'Light' and 'Water.' Then under them are 'whispers' or employees delegated specific tasks by the Voice. Apart from these we have the paradigmn judge, whose role appears to be as something of a mediator for when two or more voices are in conflict with one another. They present their arguments to him and he will make a decision which they will both have to abide by. And then we have the hree descendants. Sombra the Grand Architecht, Locket the Grand Voice, and Winifred the Grand Whisper.

Sombra and Winifred are Locket's siblings, born of the same vessel. While fowlers normally turn on each other shortly after tearing free of their host parent, these three managed to fall into cooperation instead. And as the city's founders they hold the highest positions of office. Locket's position as implied by her title is to oversee all the other voices, create new departments as needed, and close old departments as they become obsolete. Winifred oversees the city's police force/military and sets policy on matters of the yolsh. It's unclear what Sombra's role is, though it's implied that at least part of it is appointing the paradigm judge so we might assume he plays a similar role in mediating between his siblings. Architect also implies a degree of city planning perhaps?

Anyway we enter in on Sombra chewing out a man called Nathaniel, the most recently appointed judge, for appearing to show favoritism to one of the Voices and as a result fucking up the economy of the Hammerlow, one of the city's districts. We've heard previously that Methusa, Voice of the Hammerlow, has raised her taxes significantly, but now is when we learn that the hike is apparently to SEVENTY PERCENT. Not by seventy, to seventy. I have no idea if that's a print error or not. To explain, the tax in the district she's in a pissing contest with is fourteen. If she'd raised her taxes BY seventy percent that would mean she'd raised them by 70% of 14, to a total of 24%. High certainly, enough to be an inconvenience, but not nearly so astronomical as raising them TO 70%.

But the book says to and not by so I'm left reeling a little.

This is where it becomes hard to conceptualize how this is supposed to work though. If I understood Ludwig's explanation in chapter three then the way tax works is something like this.

An Inkhouse needs 200 units of paper to fulfill its contractual obligations + some set aside for direct trade. Lets say 150 for their contracts, and then 50 units for direct trade. Their Bookburrow requires 14% of the units of paper made be submitted back to them as Tax, so that there will be a stockpile of raw materials available to them and other businesses in the event of a shortage and/or for use in public services such as they are. Service jobs, since they don't generate materials, are not subject to tax.

Now there are two points the tax could come out of their stock.

The tax comes out of the total number of units produced. So 14% of 200, so the bookburrow is owed 28 units of paper, and the Inkhouse produces 230 to cover their obligations + tax, similar to how income tax works.

The tax comes out of the units produced for direct trade. So 14% of 50, or 7 units owed and the inkhouse produces 210 to cover their obligations + tax similar to how sales tax works.

In either case raising taxes should cause a corresponding INCREASE in demand rather than a DECREASE in revenue since we're operating on trade not profit margins. A high tax in a currency system can cause problems for a business if workers don't have enough in their paychecks to make rent, or if it drives prices past what the market can sustain. In this system the problem is inverted. If three Inkhouses contracted to a lumber yard suddenly need enough wood pulp to produce 360 units of paper vs 230 (using the gross model), and the lumber yard only produces enough wood pulp to make 800 units of paper per tax cycle, then yeah what happens is probably a shortage. Though how much of one is complicated by the fact that bookburrows are supposed to use taxes collected to provide extra materials in the event that demand outstrips supply. So at least some of those taxes should be going back out to the businesses requesting them?

However if the tax is only coming out of the units set aside for direct sale then the business can choose to take a hit to direct trade in lieu of placing unreasonable demands on their supplier. This probably means the employees have less available to trade for luxuries, but as long as the contractual obligations are met everyone is still being fed and housed and the business is not in danger of folding.

I have to assume given Sombra's vehement disapproval that we're working with something closer to scenario one, where the tax is coming out of the gross units produced and thus is causing supply shortages that for whatever reason the bookburrows aren't equipped to mitigate, meaning that merchants have been leaving Hammerlow in droves to ply their trade elsewhere. But this is definitely a case where I wish things had been explained a little more clearly.

I get it, tax code, economics, market forces, even in our present day society these things are impenetrable bordering on occult unless you've spent six years and a PhD working to understand them. I don't envy writers who try to tackle it in their political dramas without having that backing and I can count on one hand the number of books I've read where I felt it was handled well. But if you're going to do it then you've gotta put your whole pussy into it, otherwise it's going to fall flat. It feels like too much is being left to inference and that weakens the reader's understanding of what the problem is even supposed to be.

Once Nathanial is done getting chewed out by Sombra he heads down to go hold court, where the matter of taxes is going to be addressed and Locket is going to propose a new department. You see she's given the barter system some time to breathe after it's initial implementation and now that the dust is settled she thinks this is a good time to create a department to oversee it. A Voice of Trade to create a uniform system rather than leaving it to the Voices of each district to set their own policies (and thus potentially get into pissing contests with each other over it). Among other things.

This is the chapter is also where we get Locket's own viewpoint for the first time as we pivot to her arriving at court.

Locket is fearsome certainly, ruthless absolutely, but she isn't quite the iron-fisted tyrant the stories make her out to be. She finds the fear and awe to be a little tiring, appreciates the people willing to argue with her, and is unexpectedly kind to her subordinates. While she believes wholeheartedly and with sincere conviction that progress cannot be made without the fear of death nipping at your heels, she's not the sort of person who takes joy from that belief. To her this is simply a solemn inescapable (objective perhaps) reality of civilization, but that doesn't mean she's going to be a dick to her coworkers or her citizens. She's both proud of what she's built, and willing to share the credit. She knows she couldn't have done this alone, even if she was the one who got the ball rolling.

It's a fascinating character portrait that reminds me very much of the quote from K.A. Applegate about how ruthlessness is often misunderstood as malice rather than as the conceptualization of a clean bright line from problem to solution, where the only thing that matters is the elegance of it. Locket is not a monster, she doesn't delight in terror and suffering. She just believes with her whole chest that a minimum amount of suffering is necessary for society. That complacency and peace will lead to stagnation and decay.

Anyway a lot gets discussed here so I'm just going to summarize the highlights:

The raid conducted on the toy shop and the death of the owner has caused something of a commotion among the populace for understandable reasons. Wexle, the Voice of the Yolsh and second to Winifred, plans to release an official report to the inkhouses that will hopefully allay fears while not revealing anything that would tip their hand to Fontaine. Namely the fact that the Yolsh used a blackhall to sort of kind of maybe circumvent the laws about unreasonable search and seizure. That would be an unpopular admission among the public to say the least.

The supposed Erillion shortage is a farce, Sombra's run the numbers and there should be plenty of stock available from the mines and the bookburrows to keep everyone tottering along as usual. Somehow this rumor got started among the populace and while normally one might assume it caught on out of ignorance, in light of all the other trade fuckery that's been happening with Mire and the tax hike Locket starts to suspect that this was spread intentionally to try and kick off yet another economic collapse. Sombra proposes that he release an official report on the Erillion stocks available, while Winifred have the Yolsh make a big public display of venturing out of the city to get a new shipment from the mines.

We're introduced to Methusa and Yeshua. The voice's of the city's respective main districts. Methusa is the Voice of the Hammerlow, a position she earned by saving it in some unspecified way but presumably related to the trade revolution and currency collapse. Yeshua is the Voice of the Kasino and the mind behind the Dollhouses. Methusa is pink, round, soft and motherly, Yeshua is flashy, theatrical, suave, and a bit greasy. They get into it over taxes, and eventually she agrees to decrease the tax rate from 70% to 50% which she seems happy with and Yeshua does not. He implies the higher tax rates in her district are affecting him negatively in some way but it's not clear how exactly. Market oversaturation from migrating merchants? Who knows.

Yeshua is under some pressure to figure out what or who caused the fire in the needlemire dollhouse. Kivs seem to work on 'the thing' rules so a cut or a bump on the head is unlikely to kill them but fire will take one right out even in small amounts. So Arson is a Big Fucking Deal.

Ultimately I think this chapter and chapter 5 after it are some of the weaker ones so far. They are largely long exposition dumps with a few scant character interactions amidst the setup. They do a lot of heavy lifting, but it feels like somehow they explain both too much and too little, conversations tend to be repetitive as the same information is conveyed several times to different sets of characters. And so many characters get introduced here. There is a reason I haven't been describing people as we reach them and that's because if I did we would be here all fucking day. Half of this book is description and I get that this is part of the cost of having a high concept alien species as your protagonists but jesus christ when you drop nine of them on me at once I am going to lose track of how many eyes tails and limbs everyone is supposed to have. It gets more than a little overwhelming. I long to get back to Lucy and her much more manageable crew of four.

2 notes

·

View notes

Note

"Investments in Las Nevadas, a massive profit in return."

Greetings, fellow readers who's interested in the succesful system of global trade, stock market and capitalism. It's been a while since we have produce an economic analysis of a country, and we don't have the liberty to discuss about our whereabouts.

Moving on, Las Nevadas, the newest addition of countries in the continent as we venture this glamorous city of lights in the desert.

We saw massive profits and entertainment everywhere for all people to serve with. According to our economic analysis and various interview from the employees of Las Nevadas stock market and National Bank.

A staggering increase 400% of foreign investments from other countries around the continent is being injected to Las Nevadas economy just for a single week. Ensuring the Las Nevadas currency is one of the raising and strong currency around the continent.

But that's not all future investors and winners, we decided to make an financial experiment as we invest 500 NVD on a local financial company in Las Nevadas. And just for 30 minutes the company stocks we bought have dramatically increasing to 150% increasing our former investment from 500 NVD to 100,000 NVD in just 30 minutes, this is a staggering successful of stock trading we have seen.

But the thing that shock us the most. Is who's leading this successful financial and well connected country?

It's former vice President of New L'manberg, and now President Quackity, ever since his first serving within New L'manberg government.

President Quackity is a open promoter of free market and global trade to bring the low economy of former country of New L'manberg, but alas.

Former President Tubbo, dismiss his ideas within the cabinet. We at the team of Ekonomists we're glad President Quackity didn't back down from his ideas.

As the scorching sun rise from dawn. Las Nevadas stand as one of the strongest financial country within the continent.

So what are you waiting for? Invest to the nearest Las Nevadas company in your country, or even better visit the country herself. So you can feel what being a successful person deserve to be treat with.

The Ekonomists, investment today, profit tomorrow.

. . oh, shit! that's a positive review for once. shoutout to the ekonomists, these guys know what's UP ‼️‼️😎😎

#quackitychirps#ask blog#📰 anon#ooc: i also agree. las nevadas is a Woman and we love her corrupt ways

5 notes

·

View notes

Text

Troubleshooting Chart of Housing Prices

I watched a [Wired] video article that tries it's very best, but ends up sounding like an AI generated rehashing of talking points the author doesn't really care about.

So, How did I come to my conclusion in the [Homeless for Profit] article?

If we're looking at a problem like "Cost of Housing" we need to first look at what the actual problem is;

People cannot afford permanent stable housing. Permanent *here* I'm defining as "Indefinite". Where most other places define "Permanent" as roughly a year or two.

What this means is I exclude "Rentals" on purpose, because *by that definition* renting is *NOT* a permanent solution.

#edit; I had to clarify the following section from previous version.#

This forms the basis of "Rent to Own, not Own to Rent".

Why? Because a landlord typically won't allow indefinite stay AND program that help pay rent are temporary, and once the funding runs out; the landlord has to decide if they'll rely on the renter's ability to continue paying or not.

Not only that; Renter's Rights and Squatter's rights afford a renter the ability to own the property after a certain timeframe of continuous rent and home improvements ALONGSIDE eviction protections which landlords do their best to ensure that a renter has no right to invoke by purposefully limiting their stay.

Because excessive rental properties, and properties that continually rotate out occupants in order to pay for a landlord's bills *and* not be used for permanent housing increasing cost of homes, loans, AND rent.

It's effectively a legalized Ponzi Scheme. Where somebody with adequate credit can take a loan to buy a property to rent, using the other end of these programs intended to support the homeless, and then pay off their loan, and keep the equity that the renter paid for.

The idea is either they sell it again, not at the same price mind you; but at whatever the current market price is.

And if you've been watching housing prices; they're going up. Even when there's a literal crisis. (ESPECIALLY WHEN)

The Wired article, and many like it; talk about "Luxury Development" and "Condos for rent" which places the onus of blame square on Millenials for "Not wanting cheaper houses".

Keep in mind; there are no cheaper houses. The blanket price is relative. The same price in rural Alabama as New York City.

And the property in Rural Alabama may as well be considered luxury in comparison.

This is what people are complaining about.

And why the idea of "Rent to Own" is gaining traction. The idea being; if you're going to rent a property; the equity being built up should be going to the person footing the bill.

The argument is always "Well the Owner is taking a Risk by taking the loan". The Risk is the lose of the property they purchased with that loan. Nothing else.

If they stopped paying, they'd loose the house, and get to keep all the rent.

So who is taking the risk?

You could say a home developer... Who spent money to build a property, and so they're taking a Risk by renting it...

But keep in mind; they're renting competitively. They're getting the same payment without needing to worry about a loan.

The risk they took was building the property; and all they need to do is sell it, and invest it into some blue chip stock with dividends.

You'd get much better returns that way. With the same "Risk". Seriously.

And that's where we're at. Right there, the cause of Supply dwindling, and Demand increasing, because *some people* don't want to really work a technical trade.

5 notes

·

View notes

Text

And That Special Quiet On Christmas Morn, A Destiel Advent Calendar December 1

Masterpost

It was far from the first time Sam had asked Dean to accompany him to an auction. Came with him being a woodworker and knowing good furniture when he saw it. In truth, Dean would have preferred to gift him every single piece he needed for his office, but Sam was absolutely against that because “You need to make a profit, Dean” but since he was not ready to accept money from family, this was a compromise.

Plus, Sam hadn’t been able to say no to Dean making his desk, at least, and some of his clients and colleagues had actually asked for his number after seeing it, so…

Still, Sam wouldn’t be gainsaid when it came to certain topics, so here they were once more so he could get a new (well, old) cabinet.

Anyway, it also meant spending more time with his brother. And he was never going to say no to that.

“Say what you want�� he couldn’t help but announce in the showroom, although he lowered his voice when he noticed several official-looking people around “but most of this is garbage.”

“I was thinking it might be, but that’s what I’ve got you for” Sam simply replied in the same tone.

They came across a desk where someone had decided to carve some… interesting decorations on the legs, and traded a glance. Sam struggled to keep decorum, being an ace lawyer and all, but Dean didn’t bother to hide his smile.

And that was when he happened to see the painting.

Now, normally when it came to these auctions or exhibitions or wherever Sam wanted to take him, he didn’t pay much attention to anything but the furniture. He knew why he was there, after all. But somehow, when he raised his head and noticed the painting, he was drawn to it.

Before he knew it, he was standing in front of the wall where it hung, staring at it.

Now that he was so close, all in all… it was nothing special. It was a painting of a man standing in a non-descript city. He had dark hair and blue eyes (very blue eyes – as his friend Crowley would have teased him, that was probably why Dean had noticed the piece of art in the first place) and the shine from the street lamp he stood under made it seem like he had a halo.

It was not a bad painting, as far as he could tell with his limited experience, but it probably wasn’t what one would have called a masterpiece either. Still, there was something about it…

“Dean?”

He turned his head to find Sam looking at him, clearly puzzled.

“I –“ he cleared his throat, having no idea how to explain, then gestured towards the wall. “Not bad, is it?”

Sam, who’d taken an art class in college (which Dean always held didn’t count for much because he had mostly done it to meet girls) turned his head and studied it. “I suppose not. Nothing to write home about, but…”

He shrugged. “I just thought it looked neat, is all.”

Sam nodded, apparently satisfied. “Come on; the auction is about to begin.”

---

The auction went as these things always did. There were the professionals, hoping to stock up their warehouses or stores; those pretentious ones who believed they knew what they were doing and might find a bargain; and normal people like Sam and Dean who were just looking for something they needed.

Sam got the cabinet they had been eying – naturally, he had to be persistent with his job – and sat back, clearly happy enough. Now they just had to wait out the rest of the auction.

Yet somehow, Dean grew more and more nervous the more time passed.

He didn’t know why until the painting – truly the painting, for he would late realize that for him, there really had only been one there, he wouldn’t have been able to describe any other that he had seen – was carried onto the stage.

He looked at it again. Well, he hoped whoever bought it would find a nice place to hang it up instead of locking it away in a safe, as some of those millionaires one heard about were wont to do…

He raised his hand without meaning to. Or rather, his hand went up when the auctioneer called out, clearly to Sam’s surprise.

He very resolutely did not look at his brother as he bid against a little old lady who seemed determined.

But suddenly Dean realized he was as well – more than that – he had to have the painting. It was meant for him.

In the end, he managed to bid 200 dollars – luckily he’d had a few big orders lately – and won.

He let his hand sink, still not catching Sam’s eyes.

What had just happened?

5 notes

·

View notes

Text

SwiftQash Technologies

🔮Introducing Swiftqash Technologies: Where Dreams Turn into Real Earnings! 🚀💸

🇰🇪 Step into the realm of endless possibilities with Swiftqash Technologies! 🎯💰 We are thrilled to announce the arrival of our groundbreaking platform on 12th August 2023 at 02:00 PM. Get ready to embark on an extraordinary journey towards financial freedom! 🧿🌟

JOIN NOW

💶🪙 Affiliate Program - Empowering Your Wallet Daily!

Join our vibrant community and experience the thrill of earning over 1,000KSH every single day by inviting friends through your personalized link. 🎊💮 With the Affiliate Program, promoting our exceptional services becomes lucrative, with generous commissions at three levels:

👉 Level 1 = 250KSH

👉 Level 2 = 100KSH

👉 Level 3 = 50KSH

Unlock the potential of your network and watch your income skyrocket! 🤑🪄

🛍️ Karibu Bonus - A Warm Welcome to Prosperity!

To kickstart your journey, we present you with a delightful Karibu Bonus of 100KSH upon creating your Swiftqash account. 🎉💰 This warm welcome sets the tone for an exciting and rewarding financial adventure! 〽️🎁

🎉 Spin Wheels - Spin Your Way to Exciting Wins!

Thrill seekers, rejoice! With our Free Welcome Spins, you have a shot at winning up to an incredible 3,000KSH! 🏵️🎡 Feel the rush as you spin the wheel and let fate decide your fortune! 🎊💸

♟️📺 Watch TikTok Videos and Get Paid - Fun Meets Profit!

Embrace a fun and profitable way to earn money by watching the latest and most trending videos on our TikTok section. 💰🥳 Each video you watch fills your pocket with earnings - where entertainment meets financial gain! 🎉📱

JOIN NOW

⛲📝 Trivia Questions - Knowledge Is Your Wealth!

Exercise your brain and earn big by answering captivating trivia questions covering diverse topics. 💸💴 From community surroundings to history, sports, science, and entertainment - every correct answer brings you closer to valuable rewards! 🪄🎉

🌀 Ads Clicking - Turn Your Clicks into Cash! Discover a world of ads, from captivating banners to intriguing pop-ups. 📈💻 Every view or click on an ad becomes money in your pocket. 🍿💸 Engage with advertisements and watch your earnings grow!

📉📚 Forex Classes and eBooks - Empower Yourself with Knowledge!

Unlock the secrets of Forex trading and investment with guidance from our top-rated stock exchange experts. 📚💹 Master the art of trading Forex, commodities, and cryptocurrencies, and reap methodical profits.

Dive into our enriching eBooks, covering entertainment and business ideas!

📚📈At Swiftqash Technologies, we ensure instant withdrawals and provide efficient customer support, making your journey seamless and rewarding.

🎗️💬 Don't miss this golden opportunity to shape your financial destiny. Join us now to Register and Activate your account with a lifetime fee of KSH 450.

JOIN NOW

🌐💻 Let's take the leap towards financial prosperity together! 💫💰

3 notes

·

View notes

Text

Predictive Analytics in Investment: Turning Data into Alpha

In today’s world, data is everywhere. From the websites we visit to the purchases we make, data is constantly being collected. But data on its own is just numbers. The real magic happens when we use that data to make smart decisions. In the world of investment, this is where predictive analytics comes in.

What is Predictive Analytics?

Predictive analytics is a way of using data, algorithms, and machine learning to guess what might happen in the future. It doesn’t tell you what will happen for sure, but it gives you a good idea of what might happen based on patterns in past data.

For example, imagine you’re driving and see dark clouds forming in the sky. You might predict that it’s going to rain soon. You don’t know for sure, but you’ve seen this pattern before. Predictive analytics works the same way—just with a lot more data and advanced math.

What is Alpha in Investment?

In finance, “alpha” means the extra returns an investor earns above the market average. If the stock market grows 8% in a year and your portfolio grows 12%, your alpha is +4%.

Achieving alpha is the holy grail for investors. Everyone wants to beat the market. Predictive analytics helps investors do just that by giving them a data-driven edge.

How Predictive Analytics Helps in Investment

Here are some ways predictive analytics is used in the world of investing:

1. Stock Price Forecasting

One of the most common uses of predictive analytics is to forecast stock prices. This is done by feeding historical stock data into machine learning models and looking for patterns.

Example: Suppose a model learns that tech stocks tend to rise in the last quarter of the year due to holiday shopping. An investor could use this insight to invest in companies like Apple or Amazon in October, hoping to benefit from the seasonal bump.

2. Risk Management

Predictive analytics can also help identify risks before they happen. By analyzing past downturns, a model can alert investors when similar patterns are forming again.

Example: If a stock shows a sudden drop in trading volume combined with rising debt and falling profits, a predictive model might flag it as high risk. An investor can then decide to avoid or sell that stock before things get worse.

3. Customer Sentiment Analysis

Data doesn’t only come from stock prices. Social media, news articles, and customer reviews also contain valuable information. Predictive analytics can analyze this unstructured data to understand market sentiment.

Example: When Elon Musk tweets something about Tesla, it often affects the stock price. Predictive models that analyze Twitter or Reddit might catch early signs of excitement (or fear) around a stock before it’s reflected in the price.

4. Portfolio Optimization

Predictive analytics can also be used to build better investment portfolios. By understanding how different assets behave under different market conditions, models can suggest the best mix of investments for maximum returns and minimum risk.

Example: A predictive model might suggest reducing exposure to real estate and increasing investments in energy stocks before an expected interest rate hike.

Real-World Applications

Many financial firms are already using predictive analytics to get ahead:

Hedge funds use machine learning to predict price movements down to the second.

Retail investors use apps with built-in AI tools that recommend stocks or ETFs based on their goals.

Banks use predictive models to identify which customers might default on loans—and adjust interest rates accordingly.

Case Study: Predicting Stock Movement with Social Media Data

Let’s take a real-world example.

In 2021, Reddit’s community “WallStreetBets” drove up the stock price of GameStop (GME), a company many thought was failing. Traditional investors were caught off guard.

But a predictive analytics tool that monitored Reddit posts and social media mentions could have seen the trend early. If the model noticed a sudden rise in GameStop mentions, combined with positive sentiment, it might have signaled a buying opportunity.

Investors who acted quickly could have gained massive profits—this is a clear example of turning data into alpha.

How Predictive Analytics Works (Simplified)

Here’s a simple breakdown of how the process usually works:

Data Collection – Gather historical stock prices, financial reports, news articles, tweets, etc.

Data Cleaning – Remove noise, errors, and irrelevant information.

Feature Selection – Identify which data points are important (like earnings reports, interest rates, or news sentiment).

Model Building – Use algorithms like decision trees, neural networks, or support vector machines.

Training & Testing – Feed past data into the model and test it to see how well it predicts outcomes.

Prediction – Use the model to make future predictions and guide investment decisions.

Pros and Cons

Advantages

Speed: Models can analyze data much faster than humans.

Scale: They can look at thousands of data points from around the world.

Accuracy: When trained well, models can outperform human intuition.

Challenges

Overfitting: A model might learn the past too well and fail to predict the future.

Data Quality: Poor data leads to poor predictions.

Black Box Problem: Some AI models are so complex that even their creators don’t fully understand how they work.

The Human Touch Still Matters

Even the best predictive models aren’t perfect. They can guide you, but they can’t replace human judgment entirely. An investor still needs to consider market context, news events, and personal risk tolerance.

Predictive analytics should be seen as a tool, not a crystal ball.

Getting Started as an Investor

You don’t need to be a data scientist to start using predictive analytics. Many investment platforms and apps now include basic AI tools:

Robinhood and Zerodha offer charts and predictive price indicators.

Morningstar and Yahoo Finance offer reports with data-driven insights.

Tools like TrendSpider and Stock Rover offer more advanced predictive tools for active traders.

Final Thoughts

Predictive analytics is changing how we invest. By turning raw data into smart predictions, investors can make better decisions, avoid risks, and potentially earn higher returns.

In short, it helps turn data into alpha.

But remember—no prediction is guaranteed. The market is influenced by many things, including human emotions, politics, and global events. So always use predictive tools wisely and combine them with your own research.

0 notes

Text

Everest Accounting bookkeeping : Navigating Inventory Liquidation, Company Closure, and Smart Growth in Dubai

In the dynamic business landscape of Dubai, companies often face various transitions – from rapid expansion to the strategic winding down of operations. Whether you're dealing with excess stock, considering company liquidation, or looking to establish a new venture, understanding the key services available is crucial for success. This blog explores how inventory liquidation companies, professional liquidation services, smart company formation in UAE, and reliable bookkeeping services Dubai can support your business journey.

When Inventory Becomes a Burden: The Role of Inventory Liquidation Companies

Holding onto unsold or excess inventory can be a significant drain on a company's resources. Storage costs, depreciation, and the opportunity cost of tying up capital can quickly erode profits. This is where inventory liquidation companies step in.

These specialists provide a vital service, offering:

Rapid Asset Conversion: They specialize in buying surplus, obsolete, or returned goods in bulk, turning stagnant inventory into cash quickly.

Reduced Storage Costs: By clearing out warehouses, businesses save on ongoing storage expenses, which can be substantial in a high-demand market like Dubai.

Space for New Stock: Liquidating old inventory frees up valuable space for new, higher-demand products, ensuring your business remains agile and competitive.

Market Reach: Reputable inventory liquidation companies have established networks of buyers, including discount retailers, wholesalers, and online platforms, ensuring your products find a suitable market.

Engaging with a professional liquidation firm can be a strategic move to optimize cash flow and maintain a healthy balance sheet, rather than a sign of distress.

The Lifecycle of a Business: Understanding Company Liquidation and Liquidation Services

While growth is the goal for many, some businesses reach a point where company liquidation becomes the most viable or necessary path. This formal process involves winding down operations, selling assets, settling debts, and ultimately deregistering the company.

Navigating company liquidation in Dubai requires adherence to specific legal frameworks set by the Department of Economic Development (DED) or Free Zone authorities. This is where professional liquidation services become indispensable.

These services offer:

Legal Compliance: Ensuring all steps adhere to UAE company law, from notifying authorities and creditors to submitting final accounts.

Asset Management: Expertly valuing and selling company assets to maximize returns for creditors and shareholders.

Debt Settlement: Negotiating with creditors and managing the distribution of funds in accordance with legal priorities.

De-registration: Guiding through the final steps of obtaining no-objection certificates and officially de-registering the company, preventing future liabilities.

Time and Stress Reduction: Handling the complex and often emotional process, allowing business owners to focus on future endeavors.

Whether it's a voluntary decision by shareholders or a compulsory liquidation due to insolvency, engaging a professional liquidation service ensures a smooth, compliant, and efficient closure.

Laying the Foundation: Company Formation in UAE

Conversely, for entrepreneurs brimming with new ideas, company formation in UAE offers an exciting opportunity. Dubai, in particular, is renowned for its pro-business environment, strategic location, and attractive tax regimes.

Key considerations for company formation in UAE include:

Jurisdiction Choice: Deciding between Mainland, Free Zone, or Offshore company setup, each offering distinct advantages regarding ownership, business activities, and operational scope.

Legal Structure: Selecting the appropriate legal form, such as LLC, Sole Proprietorship, or Branch Office.

Trade Name Registration: Securing a unique and compliant business name.

Licensing: Obtaining the necessary trade license for your specific business activities.

Visa Processing: Facilitating investor and employee visas.

Bank Account Opening: Assisting with setting up corporate bank accounts.

Many specialized consultants in Dubai provide comprehensive company formation in UAE services, streamlining the entire process and ensuring compliance with local regulations.

The Backbone of Business: Bookkeeping Services Dubai

Regardless of a company's stage – formation, growth, or even liquidation – accurate financial records are paramount. This is where reliable bookkeeping services Dubai become essential.

Professional bookkeeping ensures:

Compliance with UAE Regulations: Adhering to local accounting standards and preparing for corporate tax requirements.

Accurate Financial Reporting: Providing clear insights into a company's financial health through well-maintained ledgers, profit and loss statements, and balance sheets.

Informed Decision-Making: Offering up-to-date financial data crucial for strategic planning, budgeting, and performance analysis.

Audit Readiness: Ensuring records are well-organized and prepared for potential audits.

Time and Resource Saving: Outsourcing bookkeeping allows businesses to focus on their core operations, rather than getting bogged down in administrative tasks.

VAT Management: Assisting with VAT registration, filing, and compliance, which is critical in the UAE.

For businesses operating in Dubai, from burgeoning startups to established enterprises, robust bookkeeping services Dubai are not just a convenience but a necessity for sustainable growth and regulatory adherence.

In conclusion, the Dubai business ecosystem offers a full spectrum of services designed to support companies through every phase. Whether you're optimizing inventory, navigating a closure, or embarking on a new venture, leveraging expert inventory liquidation companies, comprehensive liquidation services, seamless company formation in UAE, and meticulous Everest Accounting bookkeeping services Dubai can be the difference between struggle and resounding success.

#bookkeeping services dubai#corporate tax consultants dubai#tax consultant in dubai#accounting and bookkeeping services dubai

0 notes

Text

Why You Should Consider Investing in Stocks: A Beginner's Guide

If you've ever wondered how people grow their wealth over time, one common answer is this: invest in stocks. While the idea might seem intimidating at first—especially with all the jargon and market fluctuations—it's actually one of the most accessible and powerful ways to build financial security over the long term.

What Does It Mean to Invest in Stocks?

When you invest in stocks, you're buying small pieces of ownership in companies, called shares. These companies could range from global tech giants like Apple and Google to smaller, up-and-coming businesses. As these companies grow and succeed, the value of your shares can increase—meaning your investment grows with them.

In some cases, companies even share profits with investors through dividends, giving you regular payouts just for holding their stock. Not bad, right?

Why Should You Invest in Stocks?

There are several good reasons to start:

Long-Term Growth: Historically, the stock market has offered higher returns than savings accounts, bonds, or other traditional investments over the long haul. While there are risks, many investors have seen solid growth by staying patient and holding their investments through ups and downs.

Beat Inflation: Keeping all your money in a savings account might feel safe, but it won’t necessarily keep up with inflation. Investing in stocks can help your money grow faster than the cost of living.

Ownership and Influence: When you buy stock, you own a piece of that company. While small shareholders don’t usually influence operations, you are technically a part-owner of a business—and that’s pretty empowering.

How to Start

You don’t need to be wealthy to invest in stocks. Thanks to modern apps and platforms like Robinhood, Webull, and Fidelity, you can begin with as little as $1. Most of these platforms offer educational tools to guide you along the way.

Here’s a simple roadmap:

Set Goals: Know why you’re investing—retirement, buying a house, or simply building wealth.

Start Small: Begin with companies you know and believe in.

Diversify: Don’t put all your money in one stock. Spread your investments across different sectors or use ETFs (Exchange Traded Funds).

Think Long-Term: Don’t panic when markets dip. Time in the market is more important than timing the market.

Final Thoughts

To invest in stocks is to take charge of your financial future. It’s not about getting rich overnight—it’s about building wealth over time with patience, consistency, and a willingness to learn. Whether you're in your early 20s or late 50s, it's never too late (or too early) to start.

So do your research, start small, and stick with it. The sooner you begin, the more time your money has to grow.

0 notes

Text

How Warren Buffett Invests: Simple Tips for Smart Long-Term Growth

Warren Buffett is known as one of the greatest investors of all time. With a net worth in the billions and a company like Berkshire Hathaway under his leadership, Buffett’s style of investing has made him a household name. But what makes him so successful? The answer lies in the Warren Buffett Investment Strategy, which focuses on a simple, long-term investment approach — something anyone can learn from.

Let’s break down his strategy in easy steps so you can apply them to your own financial journey and grow your money smartly and steadily.

1. Invest in What You Understand

One of Buffett’s golden rules is: “Never invest in a business you cannot understand.” He sticks to companies and industries he knows well — like food, finance, and insurance.

So, if you’re planning to invest, start with familiar companies. Think of products you use every day — maybe Coca-Cola, Apple, or McDonald’s. These are brands you already trust, and that trust can help you make better choices. This method is also called value investing, which means buying good companies at a fair price.

2. Think Long Term, Not Quick Profits

Buffett doesn’t believe in fast money or day trading. He once said, “If you’re not willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

The idea is to focus on long-term growth rather than chasing short-term profits. Let your investments grow slowly, just like you plant a tree and wait for it to bear fruit. The power of compound interest works best over time.

A high-traffic keyword that fits perfectly here is “long-term investment tips” — and Buffett is the perfect role model for it.

3. Buy When Others Are Scared

One of Buffett’s most famous quotes is: “Be fearful when others are greedy, and greedy when others are fearful.” This means he often invests during market crashes when everyone else is panicking.

Why? Because during such times, strong companies often become available at a lower price. That’s when Buffett steps in and buys undervalued stocks.

This mindset is important during market downturns, where “stock market investment during crisis” becomes a popular search trend. Buffett doesn’t follow the crowd — he looks for opportunities in chaos.

4. Focus on Company Quality, Not Hype

Buffett doesn’t chase the latest trends or tech startups that everyone is talking about. Instead, he looks for companies with:

Strong leadership

Consistent profits

Low debt

Competitive advantages

These companies have something called a “moat” — a feature that protects them from competitors. Think about how Apple’s ecosystem or Coca-Cola’s brand loyalty make it hard for other companies to compete.

People searching for “safe stocks to invest in 2025” are often looking for exactly what Buffett buys — strong, steady, and proven businesses.

5. Stay Calm and Be Patient

Patience is at the heart of Buffett’s success. He doesn’t get excited when markets go up or scared when they go down. Instead, he stays focused on the big picture.

This is something all investors can learn from. When the news is full of “stock market crash” stories, Buffett remains calm. When everyone is buying trendy crypto or tech stocks, he sticks to his plan.

Remember: Emotional investing often leads to mistakes. Buffett's calm nature has helped him avoid bad decisions — and made him billions in the long run.

6. Reinvest Your Earnings

One powerful thing Buffett does is reinvest profits. Instead of spending money earned from his investments, he lets it grow by putting it back into the business.

This is known as “compounding wealth”, and it’s one of the biggest reasons why Buffett’s money has grown so much over time. It’s like planting a tree and then planting its seeds again and again — soon, you’ll have a forest.

Many people search for “how to grow passive income” — and this is a big part of that answer.

7. Live Below Your Means

Buffett is a billionaire, yet he still lives in the same house he bought in 1958. He doesn’t drive fancy cars or throw lavish parties. He believes in being frugal and saving money wisely.

This isn’t just about lifestyle — it’s part of a mindset that helps him stay focused on building wealth rather than showing it off.

If you’re trying to save, build your investment capital by cutting unnecessary spending. Search trends show more people are looking for “budgeting tips for beginners”, and Buffett’s life is the perfect example.

Final Thoughts

You don’t need to be a millionaire to invest like Warren Buffett. You just need to be smart, consistent, and patient. The Warren Buffett Investment Strategy is about sticking to simple rules that work over time.

If you start early, stay focused, and make wise choices, your money can grow just like his — slowly, steadily, and successfully.

Whether you're looking for investment advice for beginners, trying to build long-term wealth, or just want to invest better in 2025, Buffett's ideas can guide you in the right direction.

#warren buffett#investors#investment#investment strategy#billionaire#positive thinking#strategies#business#invest

0 notes

Text

Common Myths About Stock Advisory Services – What Investors Often Get Wrong

Stock advisory services are gaining traction among Indian investors, especially with the rise of retail participation in the markets. Yet, despite their growing popularity, several myths and misconceptions still surround them—leading many to either avoid these services altogether or misuse them.

Some believe stock advisories are just glorified tip providers. Others think they’re too expensive or unnecessary if you can Google stock picks. The reality? When used correctly, stock advisory services can offer structure, discipline, and time-tested insights that enhance your investing outcomes.

Let’s bust some of the most common myths about stock advisory services and reveal what they really offer.

Myth 1: "Stock advisories are just paid tips."

Reality: A credible stock market advisory is far more than a tip service. It offers:

Research-backed recommendations

Entry, target, and stop-loss levels

Portfolio allocation and sector insights

Ongoing updates and exit guidance

In contrast, tip providers offer generic calls with no accountability. The difference is night and day.

Myth 2: "I don’t need advisory—I can find everything on YouTube or Twitter."

Reality: Free content is everywhere, but it's often:

Outdated or low quality

Lacking context or proper risk management

Driven by influencers, not analysts

Incomplete (no exit plan, no sizing guidance)

A stock advisory filters the noise and delivers actionable insights tailored to market conditions and your risk profile—something free content rarely does reliably.

Myth 3: "Advisory services guarantee profits."

Reality: No legitimate advisory will ever guarantee returns—and if someone does, that’s a red flag.

Markets are uncertain, and even the best calls can go wrong. A trustworthy stock advisory focuses on:

Risk-reward balance

Process-driven decisions

Long-term consistency, not short-term perfection

Their goal is to increase your probability of success, not promise it.

Myth 4: "Only beginners need stock advisory."

Reality: While beginners benefit immensely, many:

Busy professionals

Part-time traders

Long-term investors

HNI clients

also use stock advisories to save time and reduce decision fatigue. Even experienced investors rely on advisory input to validate their own analysis or discover new opportunities.

Myth 5: "They’re too expensive."

Reality: Most advisory services charge a fraction of what you'd pay for poor trades or missed opportunities.

For example, a ₹5,000/year subscription (just ~₹14/day) can:

Help you avoid bad trades

Improve entry/exit precision

Maximize profit potential on good ideas

When used consistently, advisory services often pay for themselves many times over.

Myth 6: "Advisories take away my control."

Reality: Unlike PMS or mutual funds, advisory services don’t manage your capital. You still:

Decide which trades to take

Choose how much to allocate

Execute everything via your own demat account

In fact, advisory users often feel more empowered—not less—thanks to structured guidance.

Myth 7: "If advisories really worked, everyone would be rich."

Reality: This myth overlooks one big factor: discipline. Many investors:

Don’t follow stop-losses

Overleverage despite warnings

Exit too early or too late out of fear or greed

Mix tips from multiple sources

Advisories work for those who trust the process and follow it with consistency.

Myth 8: "Advisory services only help with stock picking."

Reality: Good advisories go beyond stock selection. They help with:

Portfolio allocation

Risk management

Market sentiment analysis

Exit and rebalancing guidance

Education through rationale and updates

They’re not just for trades—they’re for overall investing intelligence.

Conclusion