#monthly property management fee

Explore tagged Tumblr posts

Text

How much do Letting Agents Charge to Manage a Property in Edinburgh

#agent fee#agent fee for selling property#agent fee in Edinburgh#Edinburgh#hiring a letting agent#How much do Letting Agents Charge to Manage a Property#Letting Agents#monthly management package#monthly property management fee#property management#property management charges#property management company#property management packages#property management services

0 notes

Text

confession time lads I am officially a Landlord I will turn in my shoelaces and be gay do crime stickers on my way out

#i inherited a house when my gran passed last year#it's finally in my name which i learned by getting scammy junk mail#the tenants have been there forever and i fired the giant property management company p much immediately#they were gonna raise the rent on them like $250 (plus the $10 monthly Service fee plus $50 in pet rent!)#anyway so like.#i don't know i think my ultimate goal is to sell them the house#because it's their HOME and i have zero interest in playing Front Range Monopoly#(or living in a 70s ranch in a more conservative county EVEN FARTHER from denver)

6 notes

·

View notes

Text

Stop the Eviction!

As most of my followers know, my spouse and I (both disabled and living on a single income) have been fighting to stay in our rental home for months now. This started when our landlord decided to start using a local property management company who decided all back rent needed to be paid or we needed to leave. (Honestly, that part is fair as we owed quite a bit.)

This was, quite unfortunately, a few days after I had had a harrowing accident where I fell very hard and received a concussion, which has only added to our stress as it affected both my health physically and mentally as well as costing my short term memory. (I still cannot remember that night or the next week clearly) I have been struggling with managing my symptoms since.

We have striven to get the company their money at a detriment to our utilities and food bills, but we have been fortunate to receive so much help and support.

For the past several months, it's only gotten worse. The company had a court date we were never notified of (which had us judged as no shows so the company was free to break any repayment contract we had signed), added fees such as a pet deposit we paid when we moved into this house almost six years ago, legal fees for said court date, late fees that were never discussed before, extra fees from who knows where and basically have just been monthly harassing us with ten day eviction notices and even threatened us with the sheriff. Also they're claiming we didn't pay them on a certain month. Every time we thought we were on track, they'd pull something else. They've been rude and quite frankly, I would love to move to a different house if that was at all an option, but it's honestly not.

I had set up a gofundme, but since we've been paying everything we've got to back rent, our phones have been shut off for the time being and I am completely unable to log in to update or anything.

The management's company's ledger for us currently sits at $2,275.00. They are asking for at least $1000 before the end of the month, after we've already paid our monthly rent plus some. We have people that we can talk to on Monday, but unfortunately, nothing else until then.

I am also very, very behind on commissions. There are several that are almost finished, but my fibromyalgia has been badly flaring, making it extremely difficult to put out the results I want. That being said, if you do not mind waiting a few months, I will happily add you to my art commission list for whatever you'd like to donate to help us.

Tl;dR: Two disabled people with pets are trying not to be evicted. Will draw for donations.

Thank you so much for current and past support. I promise I am trying to get back to everyone who has helped, it is just taking time, more time than I expected. I am sorry and again, thank you.

0/$2275

C*shapp, P*ypal, V*nmo: duessa

111 notes

·

View notes

Text

The GOP’s 43-year tax-cuts-for-billionaires-while-we-ignore-the-needs-of-the-country grift has an analogy in condos and homes across America that might help voters understand how it works and how they’ve gotten away with it.

Fully 84 percent of all homes and apartments built and sold in 2022 came with a homeowner’s association (HOA), and an estimated 27 percent of all homeowners nationwide currently live in a property controlled by an HOA.

And many are very unhappy about the experience.

According to a survey by Rocket Mortgage, only 47 percent of HOA residents think their HOA has made their community better, only two-thirds (64%) believe their HOA “honestly handles its finances,” and one in ten people nationwide who have an HOA cite the HOA itself as their main reason for moving.

How and why is this?

Louise and I have lived in five communities with HOAs in two different states. Three (including where we now live) were well managed, kept up the community, and set aside money from the dues every month for the inevitable future maintenance. I was on the board of one of them. The other two ran, essentially, a shell game or reverse Ponzi scheme, which led us to eventually quit those communities and move.

READ: Deep-red 'Republican stronghold' thought to be 'easy win for Trump' is now a swing state

I remember attending a board meeting in one of those “shell game” HOA communities we’d lived in. There were multiple common-area maintenance issues needing attention, but a group who called themselves “low-tax conservatives” had run the board for over a twenty years.

There was almost nothing in reserves, so maintenance had been continuously postponed until things hit a crisis level. Then they’d hit us all with a series of “special one-time assessments” ranging from a few hundred to a few thousand dollars to pay for the upkeep. They refused to raise the monthly HOA fee, referring to it as a tax, because, they said, they were “low-tax conservatives”; in fact, they were just cheapskates.

That HOA board had been, in the past and the present, stealing from future homeowners.

They did it so they could enjoy the community during the first 30 or so years — when maintenance costs were minimal — without setting aside money for the future, when things would rot or wear out and need replacement or upgrade.

For the first three decades, they were able to coast with $200/month in dues and no assessments; by the time we arrived when the units were pushing 35 years old, though, the assessments were hitting $3000 to $9000 a year, and, when the buildings’ roofs need repair (soon) it’ll be twice that amount or more.

Fortunately, once we saw the handwriting on that particular wall we were able to sell our condo and move to a well-run community. Americans, though, don’t have that option: Republicans have been running this same shell game or reverse Ponzi scheme against all of us (except the very rich) across the entire country ever since Reagan successfully pitched trickle-down economics to the nation in 1981.

If you’ve ever lived in one of these shell game HOA’s, you now perfectly understand Reaganomics and why it seems that America has deteriorated so badly over the past 40 years.

You could call it the disaster of pothole economics: all across America, roads, bridges, water systems, schools, and other vital public infrastructure have been underfunded and neglected ever since Reagan popularized the idea of “austerity” among Republicans.

In order to pay for the second most massive tax cut for the morbidly rich in history (Reagan cut the top tax bracket from 74% down to 25%), his administration cut spending on education, housing, roads and bridges, and pretty much every other aspect of America’s infrastructure. George W. Bush did the same thing, and Donald Trump tripled down on the scheme.

The result was a $51 trillion transfer of wealth — over a mere forty-three years — from the homes, retirement accounts, and savings of average working families into the money bins of the extremely wealthy. Thirty-four trillion of that transfer show up as our national debt, which was a mere $800 billion ($0.8 trillion) when Reagan first came into office and started this scam.

President Joe Biden and his Vice President, Kamala Harris, ran the first administration of either party to significantly repudiate Reagan’s neoliberalism by injecting trillions into rebuilding our nation (over 35,000 projects) while raising taxes on rich people and corporations to pay for it.

The result was immediately visible, just like in the 1940s, 1950s, and 1960s: we now have the best economy on planet Earth with unemployment lower than any time since the 1960s (and lower than any time in history for women, Blacks, and Hispanics). Inflation has been at or below 0% for the past two months and is annually running around 3% (Reagan never got inflation below 4.1% in his entire 8 years); all across America we’re putting our rural areas, towns, and cities back together.

For the past forty years, Republicans and their administrations have focused almost entirely on taking cash away from working class people and handing it off to the billionaires who own and finance their party. At the top of the list of ways they did this was a series of five tax cuts for the morbidly rich and big corporations adding up to over $30 trillion since 1981.

But they’ve also been cutting spending to compensate for their tax breaks for the billionaire class: They blocked extending the child tax credit this year, throwing millions of American children back into poverty. They’ve fought lifting the cap on Social Security taxes so people making over $168,600 will begin paying on all of their income (millionaires and billionaires currently pay only a tiny fraction of the percentage to support Social Security that the rest of us do).

Fully 100% of congressional Republicans voted against Biden’s Build Back Better program that’s now putting America back together and his American Rescue Plan that lifted millions out of poverty and put millions more back to work. They successfully blocked the Paycheck Fairness Act that would have penalized employers for wage discrimination based on gender; they’ve refused to expand Medicaid in almost a dozen Red states; they even filibustered an attempt to raise the minimum wage from $7.25 to $10.10.

For the past forty-plus years, Republicans — just like these dysfunctional HOAs — have been stealing from America’s future; our infrastructure deficit alone is several trillion dollars, meaning Americans will be paying more in taxes to make up for all those decades of neglect.

Democrats want those tax increases to hit people earning over $400,000 a year; Republican tax proposals, on the other hand, mostly focus on increasing income taxes and fees on working class people while continuing or even expanding tax breaks for the very wealthy.

One of the “low tax” HOAs we used to live in, instead of raising their monthly fee or instituting an assessment, recently negotiated a million-dollar-plus 20-year loan with people’s properties as the collateral to fund painting and repairing serious rot on the buildings.

This should have been paid for with an increase in HOA fees twenty years ago, anticipating the future maintenance and upkeep needs.

But instead they kept the fee low, never built up a reserve, and are now borrowing from the bank. In other words, they’re continuing the all-too-common HOA board scam of requiring future generations to pay for current repairs, just like the GOP budget proposals we’ll see when they return from summer vacation in September will require future generations to pay for their past tax cuts.

It’s the equivalent of Reagan, Bush, and Trump jacking up the national debt to keep things glued together, forcing future generations to pay it off when the bill comes due, while their wealthy corporate funders rob us blind.

Homeowners across America are waking up to these toxic HOA boards, as social media sites for HOA members are forming and local homeowner uprisings are happening against boards, either replacing the board members or, in some cases, even suing them. Some states are even starting to require they build up reserves for future maintenance.

Hopefully, Americans will realize how successfully Republicans have inflicted this very same scam on voters and working class people over the past forty-plus years and vote the bums out this fall.

ALSO READ: Mike Johnson's now-deleted Trump social media post sparks controversy

89 notes

·

View notes

Text

Jom giving Khun Yai advices about the future - A scene from EP. 10 of I Feel You Linger In The Air

If you asked me my top 5 all-time favorite scenes from IFYLITA, I think this scene where Jom was scratching Yai's back while casually giving him advices about the future would definitely be in the top 5 (and at certain times I think I like this scene most.

One of the biggest grievances/qualms IFYLITA novel readers may have with the adaptation is probably series!Jom isn't as self-aware that he is an architect from the 21st century as book!Jom who was definitely depicted to be a little more sassy and constantly reminding himself that he's an architecture who has modern skills that can definitely be put to good use.

But this scene in EP. 10 of IFYLITA, corresponding with Chapter 11: Return Love to The Wind of the novel, is one of the brilliant moments where book!Jom completely comes to life through the portrayal of Nonkul Chanon.

Rather than dissecting the scene step by step, I've quoted this particular excerpt from the novel, paired with the gifset I made of the scene from ep.10.

Worried by the thought, I ask out a question. "Khun–Yai, since your family moved from Bangkok, it means the Luang has houses and properties in the province, doesn't he?"

"The province?" Khun–Yai turns his head.

I slap my mouth once in aggravation. Bangkok in this era is probably referred to as the Bangkok Region and the Capital. "Sorry. It was a mistake. What I mean is, did your family move from the Capital?"

Khun–Yai eyes me with mild suspicion but still answers, "Yes. My father owns plenty of lands in the Capital. My mother also has hundreds of lands in Thonburi and Nakhon Pathom. My grandfather transferred the ownership of the properties to her before she was born. Why do you ask?"

Oh…So, his parents have always been well–off. I take a deep breath and speak in all seriousness.

"Keep the lands safe. If not necessary, don't ever sell them. The prices of lands in Thonburi will be higher than gold in a short time. Capitalize the farms and paddy fields. If you don't gain much profit from renting them out, take care of them yourself. Hire workers and manage your own lands. As for the properties in the Capital, I hope you protect them with your life. Build residences or row houses for rent and collect the monthly rental fees. You will make more money than the salary of a civil servant."

I have thought it out with ambition. No matter what, I will not let Khun–Yai become a nobleman turning poor. He must have a business with a stably monthly income, not only a salary from any title. The row houses and everything will be designed in advance by me. I will do it for free, not charging a single coin. I am so engrossed in my plan that I don't notice Khun–Yai turning around and smiling.

"Do you know what you sound like?"

Seeing his weird, playful gaze, I ask right away, "What do I sound like?"

"You sound like a wife concerned about her husband's possessions, worried about how to gain profit from them," he stresses every word loud and clear.

"Khun–Yai!!!" I exclaim in shock, eyes widening.

"Yeah…?" Uggggggh. "Don't speak in such a sweet voice." My head hurts as if I have a migraine, but a contented grin paints Khun–Yai's face. "Please don't say that. It's inappropriate. Besides, I'm a man. I can't be a wife."

Bonus excerpt: "What is appropriate, then? Should I ask for your parents' blessings to have their son manage my possessions for the rest of my life?" "Khun–Yai, I'm begging you. Don't joke like this. I'm going to have a heart attack." My heart is fragile. "Please turn around so I can scratch your back." Seeing my serious expression, he relents and turns around, not forgetting to throw one last playfully flirtatious glance at me. I inhale and claw his back in annoyance. "Ohh…Poh–Jom, if you scratch that harshly, my back will break," Khun–Yai groans.

Note: Before the quoted excerpt, there's also an extensive part where Jom pondered on the consequences of WW2 and its effects on Thailand's civil servants or high-rank authorities and how he could helped Khun Yai. You can read the full novel here.

i just really like that although series!jom is a bit more clueless and deer-in-the-headlights than novel!jom, the series is still very careful with their adaptation and brought this scene to life where jom uses his 21th century knowledge to help take care of khun yai (ALSO MY BABY). like i just find this entire yaijom scene (that was cut from the TV version, outrageous) so damn cute and it's been months after the show has ended but my mind is still lingering in this scene.

#i feel you linger in the air#claire opens her goddamn mouth#ifylita#nonkul chanon#bright rapheephong

36 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

April 7, 2024 (Sunday)

HEATHER COX RICHARDSON

APR 08, 2024

In August 1870 a U.S. exploring expedition headed out from Montana toward the Yellowstone River into land the U.S. government had recognized as belonging to different Indigenous tribes.

By October the men had reached the Yellowstone, where they reported they had “found abundance of game and trout, hot springs of five or six different kinds…basaltic columns of enormous size” and a waterfall that must, they wrote, “be in form, color and surroundings one of the most glorious objects on the American Continent.” On the strength of their widely reprinted reports, the secretary of the interior sent out an official surveying team under geologist Ferdinand V. Hayden. With it went photographer William Henry Jackson and fine artist Thomas Moran.

Banker and railroad baron Jay Cooke had arranged for Moran to join the expedition. In 1871 the popular Scribner’s Monthly published the surveyor’s report along with Moran’s drawings and a promise that Cooke’s Northern Pacific Railroad would soon lay tracks to enable tourists to see the great natural wonders of the West.

But by 1871, Americans had begun to turn against the railroads, seeing them as big businesses monopolizing American resources at the expense of ordinary Americans. When Hayden called on Congress to pass a law setting the area around Yellowstone aside as a public park, two Republicans—Senator Samuel Pomeroy of Kansas and Delegate William H. Clagett of Montana—introduced bills to protect Yellowstone in a natural state and provide against “wanton destruction of the fish and game…or destruction for the purposes of merchandise or profit.”

The House Committee on Public Lands praised Yellowstone Valley’s beauty and warned that “persons are now waiting for the spring…to enter in and take possession of these remarkable curiosities, to make merchandise of these bountiful specimens, to fence in these rare wonders so as to charge visitors a fee, as is now done at Niagara Falls, for the sight of that which ought to be as free as the air or water.” It warned that “the vandals who are now waiting to enter into this wonderland will, in a single season, despoil, beyond recovery, these remarkable curiosities which have required all the cunning skill of nature thousands of years to prepare.”

The New York Times got behind the idea that saving Yellowstone for the people was the responsibility of the federal government, saying that if businesses “should be strictly shut out, it will remain a place which we can proudly show to the benighted European as a proof of what nature—under a republican form of government—can accomplish in the great West.”

On March 1, 1872, President U. S. Grant, a Republican, signed the bill making Yellowstone a national park.

The impulse to protect natural resources from those who would plunder them for profit expanded 18 years later, when the federal government stepped in to protect Yosemite. In June 1864, Congress had passed and President Abraham Lincoln signed a law giving to the state of California the Yosemite Valley and nearby Mariposa Big Tree Grove “upon the express conditions that the premises shall be held for public use, resort and recreation.”

But by 1890 it was clear that under state management the property had been largely turned over to timber companies, sheep-herding enterprises, and tourist businesses with state contracts. Naturalist John Muir warned in the Century magazine: “Ax and plow, hogs and horses, have long been and are still busy in Yosemite’s gardens and groves. All that is accessible and destructible is rapidly being destroyed.” Congress passed a law making the land around the state property in Yosemite a national park area, and the United States military began to manage the area.

The next year, in March 1891, Congress gave the president power to “set apart and reserve…as public reservations” land that bore at least some timber, whether or not that timber was of any commercial value. Under this General Revision Act, also known as the Forest Reserve Act, Republican president Benjamin Harrison set aside timber land adjacent to Yellowstone National Park and south of Yosemite National Park. By September 1893, about 17 million acres of land had been put into forest reserves. Those who objected to this policy, according to Century, were “men [who] wish to get at it and make it earn something for them.”

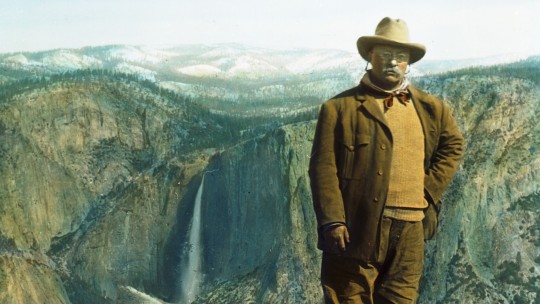

Presidents of both parties continued to protect American lands, but in the late nineteenth century it was New York Republican politician Theodore Roosevelt who most dramatically expanded the effort to keep western lands from the hands of those who wanted only their timber and minerals.

Roosevelt was concerned that moneygrubbing was eroding the character of the nation, and he believed that western land nurtured the independence and community that he worried was disappearing in the East. During his presidency, which stretched from 1901 to 1909, Roosevelt protected 141 million acres of forest and established five new national parks.

More powerfully, he used the 1906 Antiquities Act, which Congress had passed to stop the looting and sale of Indigenous objects and sites, to protect land. The Antiquities Act allowed presidents to protect areas of historic, cultural, or scientific interest. Before the law was a year old, Roosevelt had created four national monuments: Devils Tower in Wyoming, El Morro in New Mexico, and Montezuma Castle and Petrified Forest in Arizona.

In 1908, Roosevelt used the Antiquities Act to protect the Grand Canyon.

Since then, presidents of both parties have protected American lands. President Jimmy Carter rivaled Roosevelt’s protection of land when he protected more than 100 million acres in Alaska from oil development. Carter’s secretary of the interior, Cecil D. Andrus, saw himself as a practical man trying to balance the needs of business and environmental needs but seemed to think business interests had become too powerful: “The domination of the department by mining, oil, timber, grazing and other interests is over.”

In fact, the fight over the public lands was not ending; it was entering a new phase. Since the 1980s, Republicans have pushed to reopen public lands to resource development, maintaining even today that Democrats have hampered oil production although it is currently, under President Joe Biden, at an all-time high.

The push to return public lands to private hands got stronger under former president Donald Trump. On April 26, 2017, Trump signed an executive order—Executive Order 13792—directing his secretary of the interior, Ryan Zinke, to review designations of 22 national monuments greater than 100,000 acres, made since 1996. He then ordered the largest national monument reduction in U.S. history, slashing the size of Utah’s Bears Ears National Monument by 85%—a goal of uranium-mining interests—and that of Utah’s Escalante–Grand Staircase by about half, favoring coal interests.

“No one better values the splendor of Utah more than you do,” Trump told cheering supporters. “And no one knows better how to use it.”

In March 2021, shortly after he took office, President Biden announced a new initiative to protect 30% of U.S. land, fresh water, and oceans areas by 2030, a plan popularly known as 30 by 30. Also in March 2021, Supreme Court chief justice John Roberts urged opponents of land protection to push back against the Antiquities Act, saying the broad protection of lands presidents have established under it is an abuse of power.

In October 2021, President Biden restored Bears Ears and Escalante–Grand Staircase to their original size. “Today’s announcement is not just about national monuments,” Interior Secretary Deb Haaland, a member of the Laguna Pueblo in New Mexico, said at the ceremony. “It’s about this administration centering the voices of Indigenous people and affirming the shared stewardship of this landscape with tribal nations.”

In 2022, nearly 312 million people visited the country’s national parks and monuments, supporting 378,400 jobs and spending $23.9 billion in communities within 60 miles of a park. This amounted to a $50.3 billion benefit to the nation’s economy.

But the struggle over the use of public lands continues, and now the Republicans are standing on the opposite side from their position of a century ago. Project 2025, the blueprint for a second Trump presidency, demands significant increases in drilling for oil and gas. That will require removing land from federal protection and opening it to private development. As Roberts urged, Project 2025 promises to seek a Supreme Court ruling to permit the president to reduce the size of national monuments. But it takes that advice even further.

It says a second Trump administration “must seek repeal of the Antiquities Act of 1906.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From An American#Heather Cox Richardson#public lands#the Antiquities Act of 1906#history#Department of the interior#tribal nations#Teddy Roosevelt#conservation#conservatism#preservation

11 notes

·

View notes

Text

Navigating the Mortgage Market: Finding the Best Mortgage Company in UAE

Navigating the mortgage market in the UAE can be challenging, given the numerous options available. This guide will help you find the best mortgage company for your needs, ensuring you secure favorable mortgage terms and rates.

For more insights into Dubai's real estate market, visit home loan dubai.

Understanding the UAE Mortgage Market

Market Overview: The UAE mortgage market is diverse and competitive, with a wide range of local and international banks offering various mortgage products. Understanding the market landscape is essential for making the right choice.

Types of Mortgages: Mortgages in the UAE can be classified into fixed-rate and variable-rate mortgages. Fixed-rate mortgages provide stability with consistent monthly payments, while variable-rate mortgages fluctuate based on market conditions.

Eligibility Criteria: Each mortgage company has its own eligibility criteria, including income requirements, employment status, and credit history. Understanding these criteria will help you identify which companies you qualify for.

For more investment options, explore Buy Commercial Properties in Dubai.

Key Features of Mortgage Companies

Competitive Interest Rates: Leading mortgage companies offer competitive interest rates, helping you save money over the loan term. Compare the rates offered by different companies to find the best deal.

Flexible Loan Terms: Look for mortgage companies that offer flexible loan terms, including various repayment periods and options for early repayment without penalties.

Customer Service: Excellent customer service is essential when dealing with mortgage companies. Choose a company with a strong reputation for providing responsive and helpful support.

Quick Approval Process: The approval time for mortgages can vary between companies. Select a company known for its quick and efficient approval process to avoid delays in your property purchase.

Additional Services: Some mortgage companies offer additional services such as mortgage insurance, property valuation, and financial planning advice. These services can add value and convenience to your mortgage experience.

For mortgage services, visit Mortgage Financing in Dubai.

Steps to Finding the Right Mortgage Company

Research and Compare: Start by researching various mortgage companies in the UAE. Use online platforms, read customer reviews, and compare their mortgage products and services.

Seek Recommendations: Ask friends, family, or colleagues for recommendations. Personal experiences can provide valuable insights into the reliability and efficiency of different mortgage companies.

Consult a Mortgage Broker: A mortgage broker can provide expert advice and help you find the best mortgage deals. They can also assist with the application process and negotiations.

Pre-Approval: Get pre-approved for a mortgage to understand your borrowing capacity and increase your chances of securing a good deal. Pre-approval also makes you a more attractive buyer to sellers.

Meet with Representatives: Schedule meetings with representatives from different mortgage companies to discuss your needs and ask questions. This will help you gauge their responsiveness and willingness to assist.

Review Terms and Conditions: Carefully review the terms and conditions of the mortgage offers. Pay attention to interest rates, loan terms, fees, and any other conditions that may affect your mortgage.

For property management services, visit Apartments For Rent in Dubai.

Popular Mortgage Companies in UAE

HSBC: Known for its competitive interest rates and flexible mortgage options, HSBC is a popular choice for homebuyers in the UAE.

Emirates NBD: Emirates NBD offers a range of mortgage products tailored to different needs, along with excellent customer service and quick approval times.

Mashreq Bank: Mashreq Bank provides personalized mortgage solutions with attractive rates and minimal fees, making it a preferred choice for many buyers.

ADCB: Abu Dhabi Commercial Bank (ADCB) offers comprehensive mortgage products with competitive rates and flexible repayment options.

Dubai Islamic Bank: For those seeking Sharia-compliant mortgage solutions, Dubai Islamic Bank offers a variety of Islamic mortgage products with favorable terms.

For property sales, visit Property For Sale in Dubai.

Real-Life Success Story

Consider the case of Noor and Hadi, who recently purchased their dream home in Dubai. By working with a reputable mortgage company, they secured a mortgage with favorable terms. The mortgage company provided expert advice, handled the paperwork, and ensured a smooth process from start to finish. This allowed Noor and Hadi to focus on finding their perfect home without worrying about the complexities of securing a mortgage.

For more insights into Dubai's real estate market, visit home loan dubai.

Future Trends in the UAE Mortgage Market

Digitalization: The UAE mortgage market is embracing digitalization, with many companies offering online application processes, digital document submission, and virtual consultations. This trend is making the mortgage process more efficient and convenient.

Sustainable Mortgages: There is a growing demand for sustainable mortgages that support environmentally friendly and energy-efficient homes. Mortgage companies are beginning to offer products that cater to this demand.

Flexible Mortgage Products: Mortgage companies are increasingly offering flexible mortgage products that cater to the diverse needs of homebuyers. This includes options for expatriates, first-time buyers, and investors.

For property sales, visit Sell Your Apartments in Dubai.

Conclusion

Navigating the mortgage market in the UAE involves careful research, comparison, and consideration of various factors. By understanding the market, seeking recommendations, and evaluating your options, you can secure a mortgage that meets your needs and financial goals. For more resources and expert advice, visit home loan dubai.

6 notes

·

View notes

Text

tell me why this apartment i toured today had a punched out door. and another totally off a hinge. not pictured was the cracked toilet superglued back together. do you want to know how much this “luxury” apartment’s monthly rent is? $2,100 not including monthly fees. the entire complex also smelled like sewage and there was a pigeon in the hallway. this is from a property management corporation with more than a hundred properties across the country btw. i can’t say what i think about corporations like these for fear of being put on a watch list.

19 notes

·

View notes

Text

Landlord just hired contractors to fucking Rob my roommates personal belongings without warning before our lease was up so we spent all day trying to recover what we could (nothing) and start the legal process of reporting and retaliation so I’m still in my old unwashed clothes bc there’s a curfew at the new place for the laundry room plus we had to haul out all the remaining stuff to our new place so it didn’t get stolen too meaning the living room is cluttered and unusable and we can’t set a lot of it up bc our desired setup involves the use of a second door for which our manager did not see fit to give us a key and openly declared he would not hire a locksmith to prepare until someone else had a complaint he could bundle with it (he says he does the same for plumbing) to save himself a buck and somewhere in this new building there is a squeaky fire alarm that feels like Chinese water torture that nobody is willing to fix which I tried at least listening to some white noise on YT on my phone to block out but now there is a little pop up window if you switch apps while listening which serves no purpose but to interfere with me while I’m writing this post which idt I can opt out of bc my YT premium sub (yes lol ik cucked) just ran out that i have no money to pay for again rn bc the latest monthly maintenance fee just plunged my checking account for the rest of the month into the lower single digits thus putting a temporary block among other things on shelling out on some wretched crypto exchange to buy meds online from an ancap vendor who only accepts fake internet money bc my actual state-insured doctors put up juuuust enough roadblocks that I can’t reliably get my prescriptions from them thus putting me in the same boat wrt those meds as the friends i have in jail sent there after their landlord saw fit to shoot one of their friends and have them charged with her murder by way of “provoking” him into killing her and holy FUCK do I hate living like this. Nowhere I can so much as lay my head in this garden of riches for a minute someone isn’t renting out to me on their terms exclusively besides the fucking sidewalk, and half the time that’s private property too

44 notes

·

View notes

Text

heard someone say (irl) a while ago that a partial solution to the housing crises/young people generally being priced out of owning was to build more condos.

except here's the thing. i'm financially better off than most of the people in that group. im privileged enough to have savings. i could not afford even a 10% down payment for anything other than a shoebox, and once i moved in, i'd be hit hard by monthly hoa fees, because yes, most condos in the area are in hoa areas. i'd be lucky to get 1k sqft condo for the equivalent of what my dad bought his 2k/7k house for at the turn of the century.

here's the other thing. landlords love to buy up condos and rent them out because in most places in california, condos aren't subject to rent control. i know this because i rent a condo. also? owners also don't have to even worry about common area management because they put their property into the hands of a property management company who just pays the previously mentioned hoa fees.

so. idk i guess it could be temporarily good for temporary slapdash construction jobs but it just feels like an incredibly ineffective solution when, simultaneously, there are literally a large number of massive mansions sitting empty 10-11 months of the year because they're someone's summer home.

#when i heard that i first thought about those multimillion 3 story monstrosities that have been popping up in the downtown areas#and was like . you think the average person can afford those?? most people i spoke to in those were rich assholes#then i remembered. wait. IM in a condo...#i love telling people who haven't rented in a while/ever my rent. they think it's mindboggling.#THEN i tell them it's a good deal for the current market.#im so serious though. even just ending landlording would solve SO many housing issues here.#separate important context#the person who said this was a (white but not financially advantaged) revolutionary communist#anyway i think about this a lot whenever i think about rent control and housing#new post#sorry i only come in here to complain about political issues at 3am#if you know me and i've talked to you about this before. sorry you have to see this again lol

4 notes

·

View notes

Text

Being a landlord is a great self-investment that comes with a lot of responsibility, at least if you are looking for a return on investment. If you wish to have a stress-free renting journey you must brace yourself for tenant complaints, leaks, non-payments and also keep abreast of the letting laws, health and safety requirements. However, if you do not wish to go through this, then passing these responsibilities to a letting agent might be the smart thing to do. But, what is the agent fee for selling property, Edinburgh?

#agent fee#agent fee for selling property#agent fee in Edinburgh#Edinburgh#hiring a letting agent#How much do Letting Agents Charge to Manage a Property#Letting Agents#monthly management package#monthly property management fee#property management#property management charges#property management company#property management packages#property management services

0 notes

Text

The Ultimate Guide to Finding the Perfect 2BR Rental Home in San Diego

San Diego, with its stunning beaches, vibrant culture, and perfect weather, is an ideal place to call home. If you're on the lookout for a Family 2BR Rental Home in San Diego with this sunny city, you're in for a treat. To streamline your search and ensure you find the perfect abode, consider the following guide, with a special focus on PlacidCa, a leading platform for rental properties.

Define Your Budget:

Before diving into the world of rental listings, establish a clear budget. Factor in not only the monthly rent but also utilities, maintenance costs, and any potential extra fees. PlacidCa allows you to filter properties based on your budget, making it easier to find options that match your financial preferences.

2. Choose Your Preferred Neighborhood:

San Diego boasts a diverse range of neighborhoods, each with its own unique charm. From the trendy Gaslamp Quarter to the laid-back vibes of Pacific Beach, the city has something for everyone. PlacidCa provides neighborhood insights, helping you make an informed decision based on your lifestyle and preferences.

3. Consider Your Commute:

Take into account your daily commute when selecting a neighborhood. PlacidCa offers a map view feature, allowing you to visualize the proximity of potential homes to your workplace or other key locations. This can significantly narrow down your options and save you valuable time.

4. Explore Amenities and Features:

Everyone has different preferences when it comes to amenities. Whether you're looking for a pet-friendly building, a pool, or in-unit laundry facilities, PlacidCa enables you to filter properties based on your specific needs. Create a checklist of must-have features to refine your search further.

5. Check Reviews and Ratings:

PlacidCa goes beyond just listing properties; it also includes reviews and ratings from previous tenants. This valuable information can provide insights into the property management and the overall living experience. Be sure to read through these reviews to make an informed decision.

6. Visit Open Houses or Schedule Tours:

Once you've shortlisted a few options on PlacidCa, attend open houses or schedule in-person tours to get a feel for the properties. Pay attention to the neighborhood atmosphere and interact with potential neighbors. PlacidCa often provides contact information for property managers, making it easy to arrange visits.

7. Review Lease Terms:

Before committing to a rental, carefully review the lease terms. PlacidCa provides detailed information about each listing, including lease duration, pet policies, and any other important terms. Make sure you understand and agree with all aspects before signing on the dotted line.

In conclusion, finding the perfect 2-bedroom rental home in San Diego can be an exciting and straightforward process when utilizing resources like PlacidCa. By following this ultimate guide, you'll be well on your way to discovering the ideal living space that complements your lifestyle and preferences in the sunny paradise of San Diego. Happy house hunting!

#Vacation Rental Homes in San Diego#Family Vacation Homes in San Diego#Luxury Vacation Rental San Diego#2BR House in Downtown San Diego#Rental Homes in National City CA

5 notes

·

View notes

Note

can u explain the trash thing to people not from nyc? like she’s just littering outside her own house or she’s putting trash out for collection? lol im so confused

sure! it's not anything she did per se as far as littering, it's got to do with her being a building owner and city rules. i'll break down the pieces for you as basically as I can because NYC functions in a very unique and specific way due to it's density, so i'm not sure how much you're familiar with.

She owns multiple properties on the same street in the city. She owns the penthouse and several other units in an apartment building, but does not own the building itself. She did, however, in 2017 purchase a small once-stable-turned-townhouse adjacent to the building her condos are in, which is a freestanding, street level building. She has since remodeled it into a garage. That is the one she's being fined for. (cornelia street was a RENTAL for the last time in case anyone wants to bring that up).

NYC sidewalks are public spaces, which means you cannot forbid anyone from walking on them or fence off areas of it for private use. In fact, all areas designated for pure public use (meaning areas a business doesn't have a permit for to put sidewalk tables or other business setups), must be kept clear and accessible to people of all stripes; be it on foot, strollers, wheelchairs, walkers, delivery folks with carts, etc.

The trick to this is the city does not maintain all of its sidewalks. Sidewalks are the responsibility of property owners and business owners who buildings are in front of those sidewalks. if you're unfamiliar with how nyc is laid out, or american cities perhaps, here's a very basic diagram:

most buildings' property lines in manhattan, where she lives, come right up to the sidewalk, and then the sidewalk (the red area) from the front of their building to the curb are THEIR responsibility to maintain, repair (yes even repair!!), and keep clear and walkable and free of obstruction. This includes snow, trash, dirt, and anything else. EVEN residential properties. Regardless of where the obstructions or dirt come from, be it weather or people, it's your property that you wanted to own, so it comes with this responsibility to maintain. everyone must quite literally sweep in front of their doors to keep the city a cleaner place. (Furnishing zones are generally city jurisdiction, or shared, as they contain mailboxes or trees planted and maintained by the city, as you see in the diagram.)

4. people may ask why she doesn't have to do this in the apartment building right next door to the townhouse, in which she's been living and occupying 3 units. Thats because again, sidewalk maintenance is again, the responsibility of the PROPERTY owner. Whoever owns building itself, not the residents, must maintain the sidewalks. All apartment buildings are typically, and unfortunately, owned and operated by non-residents EXCEPT co-ops, which her building is not so no need to get into that. That means that people pay to purchase the units and pay what's called monthly HOA fees, which are fees to the building owner/management who then pays people to maintain it. Because the owners (who are usually real estate corporations) don't live in the buildings most of the time, every apartment building in the city has what's called a superintendent, who's main job is to run the building 24/7. For small buildings like hers, their jobs usually include keeping public hallways and elevators clean by mopping and such, repairing public areas like changing lightbulbs, and of course, sidewalk maintenance. Sometimes if an owner owns multiple small apartment buildings on a block or in an area, they just employ one super to run them all, or outsource it to a management company who employs and deploys people to maintain all of the assigned buildings. Usually supers live on the premises. On any given day, in mornings and evenings, you can find the supers (or doormen sometimes in fancier buildings) sweeping, hosing down, or shoveling snow on the sidewalks in front of their buildings, and even organizing the trash during trash collection days. so that's taken care of FOR her in that building.

5. one argument is that oh, that law doesn't apply to single family dwellings. you'd be right! Single family residential properties used exclusively for residential dwelling, to be specific. however, the townhouse is a garage, so it's not a residential property and instead it's classified as an exclusively B-2 Storage property. especially because the building itself is detached from any residential property she owns in the city, which is none. again, she owns units in a building but not the building itself. so the maintenance law does apply to that garage, unless she can make the case she's living out of her garage lol.

6. another argument is well, it's not HER trash. paparazzi or fans waiting, or a rowdy passerby are leaving their trash!! Yeah..... so?? That's EVERY SINGLE STREET in the city, as don't forget, sidewalks are public. in the ENTIRE city. It's not about who put the trash there, it's about who's responsibility it is to clean it up if the litterer isn't caught, which is never. every day, property and business owners are cleaning the sidewalks in front of their buildings of the debris and trash left behind by nyc residents and tourists. some areas have WAYY more than the trash fans leave outside of taylor swifts house. The property owner must clean it, no matter who does it! Taylor Swift in this case! Regardless of the circumstances, this is the stipulation you agree to when you buy a building in nyc. no matter where it is, nobody is exempt from this burden.

7. another extremely stupid one i've seen is also, well other people aren't getting fined as badly so why is she being ~targeted~. lol she still violated the rules. what kind of loony tunes logic is that? whether or not other people get punished for the same violations, that doesn't make what she did NOT a violation. it just shows a bias in the system maybe or laziness, who knows, but it doesn't show that she's innocent lol. Bottom line is she still violated the rules so.... sorry she got caught i guess?? just idk try simply not violating sanitation guidelines and see if that gets you where you want to be.

8. a final thing i'll say is you may say oh this is an insane law! what about middle class families who buy houses in manhattan and don't have time to keep up with constant maintenance? LMAOOO buddy, pal, buying property of any kind in manhattan is EXTREMELY expensive, in the multiples of millions no matter what it is, at the lowest. so this is exclusively a rich persons problem, a verrrrry rich person's problem. So rich, that you could say they could.... oh idk.... afford to PAY SOMEONE to maintain the sidewalk for them! or pay the fines! of which over the course of 6 years, she's been charged a grand total of..... ~$3,000 dollars. for someone who dropped multiples of millions of dollars on the townhouse itself, safe to say she can afford to pay what would be pennies by comparison for some mild negligence.

tldr: the c in nyc stands for CITY, which means if you buy into living here, you have to do your part to contribute to the upkeep of public spaces. everyone has to do their part!! she's not a bad person, and it's in no way comparable to the jet situation. she's just a very silly person for this one lolololol!

#vanity fair i think pointed out that the day rate for her lawyers is probably double the fines themselves lolololol#like ok!! it's your money!#also yes i'm sure other cities function this way too i mainly was referring to how suburbs don't really work this way#since most americans live in suburbs that's what i was trying to address

3 notes

·

View notes

Text

Quicken vs QuickBooks: Which One is Right for Your Business?

Are you struggling to choose the right accounting software for your business? Look no further! In this post, we'll be comparing Quicken vs QuickBooks – two of the most popular accounting software on the market. Both are powerful tools that offer features to manage your finances, but which one is right for you? Join us as we dive into what makes these two options unique and how to make an informed decision based on your business needs. Let's get started!

Comparing Quicken vs QuickBooks

When it comes to managing your business finances, Quicken and QuickBooks are two of the most popular software options available. While Quicken vs QuickBooks both programs offer similar accounting features such as tracking expenses and income, there are some key differences between them.

Quicken is designed primarily for personal finance management. It's a great option if you're self-employed or run a small business with just a few employees. With Quicken, you can track your bank accounts, credit cards, investments and more in one place.

On the other hand, QuickBooks is more ideal for businesses that require robust accounting tools like inventory management and payroll processing. It's also suitable for larger organizations with multiple users who need access to financial data simultaneously.

Another difference between these two platforms is their pricing models. Quicken offers a one-time purchase fee while QuickBooks has monthly subscription plans based on the features required by your business.

Ultimately, choosing between Quicken vs QuickBooks depends on your specific needs as well as the size and complexity of your organization. Consider factors such as budget constraints and which features are necessary for efficient financial management before making a decision.

What is Quicken?

Quicken is a personal finance management software that has been around since 1983. It was originally designed to help individuals manage their finances by tracking income and expenses, creating budgets, and generating reports. Today, Quicken offers various versions of its software that cater to different financial needs.

One version of Quicken is called Quicken Deluxe which allows users to track investments in addition to managing their personal finances. Another version is called Quicken Premier which includes features for managing rental properties as well as investment tracking.

Quicken also offers a mobile app that allows users to access their financial information on the go. Users can sync their data across devices so they always have access to up-to-date information.

Quicken is best suited for individuals or small businesses looking for an easy way to manage their personal finances without needing advanced accounting knowledge.

What is QuickBooks?

QuickBooks is a popular accounting software designed for small businesses to manage their financial transactions, invoices, bills and expenses. It was developed by Intuit and first released in 1983 as a desktop application. Since then, it has expanded its features and services to cater to the growing needs of businesses.

This software allows users to track inventory levels, create sales orders, generate reports and integrate with other applications such as payroll systems. QuickBooks also offers cloud-based versions that enable users to access their data from anywhere at any time.

One of the key benefits of using QuickBooks is its user-friendly interface which makes it easy for beginners to navigate through various financial tasks. The program also provides tutorials and customer support resources for those who need additional assistance.

Another great advantage of this software is that it can be customized according to specific business requirements. Users can choose from different plans based on the size of their business or opt for add-ons like payroll management or payment processing services.

QuickBooks has become a go-to solution for small businesses looking for an efficient way to handle their finances while staying organized and compliant with tax laws.

The Difference between Quicken vs QuickBooks

Quicken and QuickBooks are both financial management software options, but they serve different purposes. Quicken is a personal finance management tool that can help individuals with their budgeting, banking, and investment tracking needs. On the other hand, QuickBooks is an accounting software designed specifically for small businesses.

One of the key differences between Quicken vs QuickBooks is in their functionality. While Quicken focuses on managing personal finances, QuickBooks offers more comprehensive features such as invoicing, payroll processing, inventory management, and accounts payable/receivable. This makes it a better option for small business owners who need to manage multiple aspects of their financial transactions.

Another difference between these two accounting tools is their pricing model. Quicken typically charges a one-time fee for purchasing its software while QuickBooks follows a subscription-based model where users pay monthly or annually depending on the plan they choose.

Deciding whether to use Quicken vs QuickBooks depends largely on your individual needs as well as those of your business if you have one. If you're looking for robust accounting capabilities with features like invoicing or inventory tracking then go for QuickBooks while if you're just looking to manage personal finances then stick with Quicken

Which One is Right for Your Business?

When it comes to deciding which accounting software is right for your business, there are a few factors you should consider. One of the first things you need to determine is what specific features your business needs. For example, if your business requires inventory tracking or payroll management, QuickBooks may be the better option for you.

Another important consideration is the size of your business. Quicken may be more suitable for small businesses or sole proprietors who don't require as many advanced features as larger companies. On the other hand, QuickBooks can handle multiple users and large amounts of data, making it ideal for medium-sized and larger businesses.

The level of technical expertise required to use each software platform is also an important factor to consider. If you have limited experience with accounting software and want something user-friendly and easy-to-learn, Quicken may be a better choice. However, if you're comfortable with technology and want more advanced capabilities like custom reports or integrations with other software tools, QuickBooks might suit your needs better.

Ultimately, choosing between Quicken vs QuickBooks depends on understanding what your business requirements are in terms of functionality, size and technical aptitude. By taking these factors into account when selecting an accounting solution that best meets those criteria will help ensure success over time.

How to Choose the Right Accounting Software for Your Business

Choosing the right accounting software for your business can be overwhelming, especially with so many options available. Here are some important factors to consider when selecting the best fit for your needs:

Business Size: Consider the size of your business and whether you need a basic or advanced accounting system.

Features: Look at the features offered by each platform and determine which ones are essential for managing your finances.

User Interface: Make sure that you choose a user-friendly interface that is easy to navigate and understand.

Integration: Check if the software integrates with other tools such as payment processors, CRMs, or inventory management systems.

Support: Choose a platform that offers reliable customer support in case any issues arise.

Security: Ensure that the software has robust security measures in place to safeguard sensitive financial data from potential cyber threats.

Pricing: Determine whether there are any upfront costs, monthly fees or hidden charges associated with using the accounting software before making a final decision.

By considering these factors carefully when choosing an accounting system, you'll have greater confidence in finding one that meets all of your requirements and helps drive success for your business!

Conclusion

After comparing Quicken vs QuickBooks and analyzing the features of both accounting software, it's clear that they have significant differences.

Quicken is best suited for individuals or small business owners who need to manage their personal finances or do basic bookkeeping tasks. On the other hand, QuickBooks provides a more robust platform with advanced tools and features that cater to larger businesses.

Choosing the right accounting software depends on your individual needs and budget. Consider factors such as business size, industry type, level of financial expertise, and future growth plans when making your decision.

Whichever software you choose between Quicken vs QuickBooks will help streamline your financial management processes and improve the accuracy of your accounting records. So take time to evaluate both options carefully before deciding which one is right for your business!

3 notes

·

View notes

Text

WWE release Mandy Rose:

Mandy Rose's 413 day NXT title reign has came to an abrupt end after WWE released her.

She had been released due to content she offers on her FanTime page. FanTime is a platform similar to OnlyFans in which users can pay monthly subscription fees to access exclusive content from creators. Mandy's costs $40 a month and some of the content on the page is considered R- and X-rated. WWE PC Head Coach Matt Bloom brought Mandy's site to the attention of Shawn Michaels, who is in charge of NXT, and they felt that they had no other choice but to release her.

WWE issued a statement at the time explaining the rationale:

“Much like Disney and Warner Bros., WWE creates, promotes and invests in its intellectual property, i.e. the stage names of performers like The Fiend Bray Wyatt, Roman Reigns, Big E and Braun Strowman,” the company said. “It is the control and exploitation of these characters that allows WWE to drive revenue, which in turn enables the company to compensate performers at the highest levels in the sports entertainment industry. Notwithstanding the contractual language, it is imperative for the success of our company to protect our greatest assets and establish partnerships with third parties on a companywide basis, rather than at the individual level, which as a result will provide more value for all involved.”

Some unconfirmed reports have suggested that Mandy likely makes more money from her subscription page than she does from her WWE deal, so that could have played a part in why she didn’t want to shut her page down despite her having the knowledge that WWE were aware of the page.

Following her release, Mandy posted this message to her subscribers noting that her $40 per month page is continuing:

“Hey guys, thank you for all the messages. I am overwhelmed with all the love and support from you guys. And don’t worry the page is still up! 😉”

Since her release there has been a lot of discussion concerning the situation. Central to much of the discussion was whether or not Mandy was treated unfairly by WWE, with many accusing the company of having double standards by not releasing Paige after private photo's and video's of her were leaked or for firing Zeliva Vega for having a Onlyfans page, only to rehire her shortly after. However sources were quick to explain that:

"Those in the company felt that had no other choice then to fire her because she was an active performer on the roster, and these were public photos and videos for customers,.. Unlike several of the women stars who have had their personal private photos hacked and released without their knowledge or permission where the company saw the talent as the victims. The differences between Mandy’s subscription-only content and past hacks/leaks has also been an element of the discourse around her release from the jump, and I guess it is good that management recognizes those differences — especially for talent that has had their privacy violated in that way."

7 notes

·

View notes

Text

Trying to decide if I have the energy to battle my social anxiety and talk to my apartment manager about the new charges to my account. I had to suddenly pay a pet fee + sign a paper that said I was at fault for the late pet fee and wouldnt do it again as well as a monthly charge for both my dog and cat.

I never had to pay the fee. When I moved in my cat was my ESA so I never had to pay anything. When I got my dog I went to my property manager and asked how I had to go about getting him added and what I had to pay and due to the situation around me getting him (uncle died and I took over ownership) she said it was fine and not to worry.

So I can see that I should have paid a fee back in November when I asked, but nit sure why I'm suddenly being slapped with fees and having to admit any fault for being late with my pet fee payment now. Not to mention having been charged for an ESA.

4 notes

·

View notes