#mobile bill payment online

Explore tagged Tumblr posts

Text

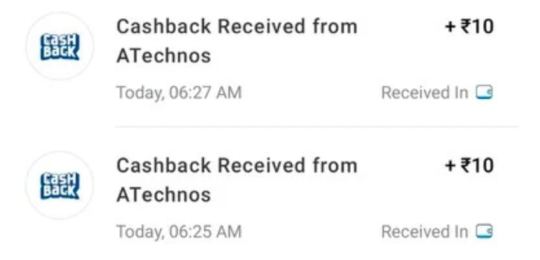

Get Rs.10 FREE PayTM Cash Instantly

Get Rs.10 FREE PayTM Cash Instantly Free Rs. 10 Free PayTM cash By Just Giving Misscall (Hurry Up! ) Rs 10 Free PayTM cash , Instant Rs 10 Free PayTM Cash , Rs 10 Free PayTM Cash By Miss Call , Earn Rs 10 Free PayTM Cash – Hi Guys , Here is Another Method To Earn Free PayTM Cash Loot , All You Have to Do is Just Give Miss call On Number & You Will Have Rs.10 Instant Free PayTM cash We Have…

View On WordPress

#Bill Payments#Earn Free PayTM Cash#Easy Earnings#Extra Money#Financial Benefits.#Financial Flexibility#freebies#Get Rs.10 FREE PayTM Cash Instantly#Hassle-Free Earnings#Instant Credit#Missed Call Offer#Mobile Recharge#No Strings Attached#online shopping#PayTM Wallet#Pocket Money#Quick Process#Student Expenses#Supplement Income

2 notes

·

View notes

Text

Pan Card Services, Income tax return (ITR), GST Registration

Money Transfer Services, Bill Payments, Mobile Recharge, Sim Cards, Mobile Accessories, Mobile Repairing, DTH Recharge, Loan Payment, Zero Balance Account, Pan Card Services, Gazzate, Udhyog & Gumasta Licence, Income tax return (ITR), Home Loan & Business Loan, GST Registration, Leave & Licence agreement with Notery, PF Withdrawal, etc...

#money transfer#mobile repair#mobile accessories#sim cards#bill payment#pan card online#pan card update#itr filing#gst registration

3 notes

·

View notes

Text

How to Grow Your Kirana Store’s Earnings Today?

In today’s rapidly evolving retail landscape, Kirana stores are presented with exciting opportunities to enhance their earnings and customer reach. Leveraging innovative solutions like AEPS cash withdrawal, Bharat Bill Payment Service, and online DTH recharge can transform your Kirana store into a one-stop shop for a diverse range of services. In this blog, we’ll explore these key features and guide you on how to grow your Kirana store’s earnings today!

#aeps cash withdrawal#what is aeps cash withdrawal#aadhaar enabled payment system#Bharat bill payment service for retailers#online DTH recharge#Retailer Mobile recharge portal#domestic money transfer in India

0 notes

Text

Make Life Easier with Cricket Wireless Pay My Bill

With Cricket Wireless Pay My Bill, you can easily keep track of your costs and enjoy uninterrupted service. Our web portal allows you to view your account and pay invoices from home or on the road. No matter where you are, you can pay your bills with a few clicks. We provide a variety of payment alternatives to accommodate your needs. Whether you choose to use a credit card, or a debit card, or set up automatic payments, our system has you covered. With the freedom to select the payment option that best suits you. Cricket Wireless recognizes the importance of ease and convenience when it comes to paying your bills. With their online payment option, you're able to conveniently pay your phone bill from the convenience of your own home. Say goodbye to the stress of monthly payments and hello to a smooth and hassle-free experience with Cricket Wireless. Take control of your bills and enjoy uninterrupted service.

#online mobile phone recharge#bill top up#cricket wireless pay my bill#cricket wireless online payment

0 notes

Text

Maximize Savings with Payrup Exclusive Cashback Offers for Jio and Airtel Prepaid Mobile Recharge!

When it comes to Jio prepaid mobile recharge, airtel prepaid mobile recharge ,we've got you covered with Payrup exclusive cashback offers. Recharge your Jio and airtel mobile online recharge with ease, and enjoy the benefits of instant top-ups along with exciting cashback deals. experience the convenience of online recharges while saving more. With our platform, you can access a range of services, including BSNL, Airtel, Vodafone Idea, MTNL, and more. Recharge with us today and maximize your savings with Payrup prepaid recharge cashback offers!

#recharge your mobile#mobile prepaid recharge#online mobile prepaid recharge#bsnl prepaid mobile recharge#airtel prepaid mobile recharge#online mobile prepaid bill payment#vodafone idea plans online recharge#mtnl recharge

0 notes

Text

Seamless Prepaid and Postpaid Mobile Recharge with PayRup

Introducing PayRup's comprehensive prepaid and postpaid mobile recharge service. Easily recharge your mobile with our seamless online platform. Enjoy hassle-free prepaid recharges and pay your mobile prepaid bills conveniently. Make secure online mobile prepaid bill payments with just a few clicks. Say goodbye to long queues and delays.

We also offer efficient postpaid bill payment options, enabling you to settle your mobile postpaid bills online effortlessly. Experience the convenience of quick and secure mobile recharge and bill payment through PayRup. Recharge, pay, and stay connected with our user-friendly online platform for all your mobile needs.

#online postpaid bill payment#postpaid bill payment#mobile prepaid bill payment#online mobile prepaid recharge

0 notes

Text

Zambo provides all Postpaid Bill Payment platform which accepts almost all active postpaid mobile networks like Reliance, Airtel, Idea, Vodafone, BSNL and many more.

0 notes

Text

Online mobile recharge

Jumping to today’s agenda, the online mobile recharge is the pick of the topics. Online mobile recharge in India has witnessed a lot of change from the past. A very common agenda, but looked very differently nowadays because of the fusion of technology to the way people pay and operate. Do you often rush to a vendor for recharging your prepaid or postpaid mobile connection? Avoid all that when you do it on Payrup now, a one-stop solution for all your online mobile recharges. Here’s how you can recharge your phone using our platform. VISIT US https://payrup.com/prepaid-recharge

https://payrup.com/prepaid-recharge

0 notes

Text

So I don't know how people on this app feel about the shit-house that is TikTok but in the US right now the ban they're trying to implement on it is a complete red herring and it needs to be stopped.

They are quite literally trying to implement Patriot Act 2.0 with the RESTRICT Act and using TikTok and China to scare the American public into buying into it wholesale when this shit will change the face of the internet. Here are some excerpts from what the bill would cover on the Infrastructure side:

SEC. 5. Considerations.

(a) Priority information and communications technology areas.—In carrying out sections 3 and 4, the Secretary shall prioritize evaluation of— (1) information and communications technology products or services used by a party to a covered transaction in a sector designated as critical infrastructure in Policy Directive 21 (February 12, 2013; relating to critical infrastructure security and resilience);

(2) software, hardware, or any other product or service integral to telecommunications products and services, including— (A) wireless local area networks;

(B) mobile networks;

(C) satellite payloads;

(D) satellite operations and control;

(E) cable access points;

(F) wireline access points;

(G) core networking systems;

(H) long-, short-, and back-haul networks; or

(I) edge computer platforms;

(3) any software, hardware, or any other product or service integral to data hosting or computing service that uses, processes, or retains, or is expected to use, process, or retain, sensitive personal data with respect to greater than 1,000,000 persons in the United States at any point during the year period preceding the date on which the covered transaction is referred to the Secretary for review or the Secretary initiates review of the covered transaction, including— (A) internet hosting services;

(B) cloud-based or distributed computing and data storage;

(C) machine learning, predictive analytics, and data science products and services, including those involving the provision of services to assist a party utilize, manage, or maintain open-source software;

(D) managed services; and

(E) content delivery services;

(4) internet- or network-enabled sensors, webcams, end-point surveillance or monitoring devices, modems and home networking devices if greater than 1,000,000 units have been sold to persons in the United States at any point during the year period preceding the date on which the covered transaction is referred to the Secretary for review or the Secretary initiates review of the covered transaction;

(5) unmanned vehicles, including drones and other aerials systems, autonomous or semi-autonomous vehicles, or any other product or service integral to the provision, maintenance, or management of such products or services;

(6) software designed or used primarily for connecting with and communicating via the internet that is in use by greater than 1,000,000 persons in the United States at any point during the year period preceding the date on which the covered transaction is referred to the Secretary for review or the Secretary initiates review of the covered transaction, including— (A) desktop applications;

(B) mobile applications;

(C) gaming applications;

(D) payment applications; or

(E) web-based applications; or

(7) information and communications technology products and services integral to— (A) artificial intelligence and machine learning;

(B) quantum key distribution;

(C) quantum communications;

(D) quantum computing;

(E) post-quantum cryptography;

(F) autonomous systems;

(G) advanced robotics;

(H) biotechnology;

(I) synthetic biology;

(J) computational biology; and

(K) e-commerce technology and services, including any electronic techniques for accomplishing business transactions, online retail, internet-enabled logistics, internet-enabled payment technology, and online marketplaces.

(b) Considerations relating to undue and unacceptable risks.—In determining whether a covered transaction poses an undue or unacceptable risk under section 3(a) or 4(a), the Secretary— (1) shall, as the Secretary determines appropriate and in consultation with appropriate agency heads, consider, where available— (A) any removal or exclusion order issued by the Secretary of Homeland Security, the Secretary of Defense, or the Director of National Intelligence pursuant to recommendations of the Federal Acquisition Security Council pursuant to section 1323 of title 41, United States Code;

(B) any order or license revocation issued by the Federal Communications Commission with respect to a transacting party, or any consent decree imposed by the Federal Trade Commission with respect to a transacting party;

(C) any relevant provision of the Defense Federal Acquisition Regulation and the Federal Acquisition Regulation, and the respective supplements to those regulations;

(D) any actual or potential threats to the execution of a national critical function identified by the Director of the Cybersecurity and Infrastructure Security Agency;

(E) the nature, degree, and likelihood of consequence to the public and private sectors of the United States that would occur if vulnerabilities of the information and communications technologies services supply chain were to be exploited; and

(F) any other source of information that the Secretary determines appropriate; and

(2) may consider, where available, any relevant threat assessment or report prepared by the Director of National Intelligence completed or conducted at the request of the Secretary.

Look at that, does that look like it just covers the one app? NO! This would cover EVERYTHING that so much as LOOKS at the internet from the point this bill goes live.

It gets worse though, you wanna see what the penalties are?

(b) Civil penalties.—The Secretary may impose the following civil penalties on a person for each violation by that person of this Act or any regulation, order, direction, mitigation measure, prohibition, or other authorization issued under this Act: (1) A fine of not more than $250,000 or an amount that is twice the value of the transaction that is the basis of the violation with respect to which the penalty is imposed, whichever is greater. (2) Revocation of any mitigation measure or authorization issued under this Act to the person. (c) Criminal penalties.— (1) IN GENERAL.—A person who willfully commits, willfully attempts to commit, or willfully conspires to commit, or aids or abets in the commission of an unlawful act described in subsection (a) shall, upon conviction, be fined not more than $1,000,000, or if a natural person, may be imprisoned for not more than 20 years, or both. (2) CIVIL FORFEITURE.— (A) FORFEITURE.— (i) IN GENERAL.—Any property, real or personal, tangible or intangible, used or intended to be used, in any manner, to commit or facilitate a violation or attempted violation described in paragraph (1) shall be subject to forfeiture to the United States. (ii) PROCEEDS.—Any property, real or personal, tangible or intangible, constituting or traceable to the gross proceeds taken, obtained, or retained, in connection with or as a result of a violation or attempted violation described in paragraph (1) shall be subject to forfeiture to the United States. (B) PROCEDURE.—Seizures and forfeitures under this subsection shall be governed by the provisions of chapter 46 of title 18, United States Code, relating to civil forfeitures, except that such duties as are imposed on the Secretary of Treasury under the customs laws described in section 981(d) of title 18, United States Code, shall be performed by such officers, agents, and other persons as may be designated for that purpose by the Secretary of Homeland Security or the Attorney General. (3) CRIMINAL FORFEITURE.— (A) FORFEITURE.—Any person who is convicted under paragraph (1) shall, in addition to any other penalty, forfeit to the United States— (i) any property, real or personal, tangible or intangible, used or intended to be used, in any manner, to commit or facilitate the violation or attempted violation of paragraph (1); and (ii) any property, real or personal, tangible or intangible, constituting or traceable to the gross proceeds taken, obtained, or retained, in connection with or as a result of the violation. (B) PROCEDURE.—The criminal forfeiture of property under this paragraph, including any seizure and disposition of the property, and any related judicial proceeding, shall be governed by the provisions of section 413 of the Controlled Substances Act (21 U.S.C. 853), except subsections (a) and (d) of that section.

You read that right, you could be fined up to A MILLION FUCKING DOLLARS for knowingly violating the restrict act, so all those people telling you to "just use a VPN" to keep using TikTok? Guess what? That falls under the criminal guidelines of this bill and they're giving you some horrible fucking advice.

Also, VPN's as a whole, if this bill passes, will take a goddamn nose dive in this country because they are another thing that will be covered in this bill.

They chose the perfect name for it, RESTRICT, because that's what it's going to do to our freedoms in this so called "land of the free".

Please, if you are a United States citizen of voting age reach out to your legislature and tell them you do not want this to pass and you will vote against them in the next primary if it does. This is a make or break moment for you if you're younger. Do not allow your generation to suffer a second Patriot Act like those of us that unfortunately allowed for the first one to happen.

And if you support this, I can only assume you're delusional or a paid shill, either way I hope you rot in whatever hell you believe in.

#politics#restrict bill#tiktok#tiktok ban#s.686#us politics#tiktok senate hearing#land of the free i guess#patriot act#patriot act 2.0

895 notes

·

View notes

Text

i tried launching Civilization 6 and a window popped up. There are new privacy policies I read and i discover that to play i have to accept the following:

* Identifiers / Contact Information: Name, user name, gamertag, postal and email address, phone number, unique IDs, mobile device ID, platform ID, gaming service ID, advertising ID (IDFA, Android ID) and IP address

* Protected Characteristics: Age and gender

* Commercial Information:Purchase and usage history and preferences, including gameplay information

* Billing Information: Payment information (credit / debit card information) and shipping address

* Internet / Electronic Activity: Web / app browsing and gameplay information related to the Services; information about your online interaction(s) with the Services or our advertising; and details about the games and platforms you use and other information related to installed applications

* Device and Usage Data: Device type, software and hardware details, language settings, browser type and version, operating system, and information about how users use and interact with the Services (e.g., content viewed, pages visited, clicks, scrolls)

* Profile Inferences: Inferences made from your information and web activity to help create a personalized profile so we can identify goods and services that may be of interest

* Audio / Visual Information: Account photos, images, and avatars, audio information via chat features and functionality, and gameplay recordings and video footage (such as when you participate in playtesting)

* Sensitive Information: Precise location information (if you allow the Services to collect your location), account credentials (user name and password), and contents of communications via chat features and functionality."

11 notes

·

View notes

Text

Finding Resolve

We’ve all done it. We are all part of this new phenomenon, something that barely existed before this century, and only truly gained momentum in the last decade. The worst part is, most of us have forgotten exactly how much we are involved with it, because it is hard to remember what and how much these phenomena cost.

I am talking about the subscription economy, that magical place where software and streaming services are the product, and our monthly bill is usually on autopay. It ranges from SOAS (Software As A Service) providers like Adobe and Microsoft, to all the music, movies, and more that we stream into our homes, cars, and mobile devices.

And it is eating us alive.How many subscriptions do you have? Let’s start with your vehicle. Do you have satellite radio? That’s one. Do you subscribe to cloud-based software? That can be one or more. What about streaming tunes like Spotify or Apple Music? There you guy. The list is getting longer.

And then there are all the streaming TV choices, which runs from services like YouTube TV to Netflix, Paramount+, Apple TV+, Peacock, Max, Hulu, Disney…I could go on. You may have cut the cable at home, but you tethered yourself in other ways to the extent that the net effect is little different.

Then there’s the gaming community, if that’s your thing. More dinero. Maybe you fell for the premium version of an app, like Accuweather. If you’re a regular Amazon shopper, you no doubt have Prime, which costs $139 a year, plus the vitamins and supplements I receive every month from them. Like listening to books? There’s Audible. Old newspapers? There’s Newspapers.com, one of my favorite sites to do research. Cloud storage? Good Lord, I have several, for my thousands of photos and documents.

So successful has the subscription model been that paywalls have appeared everywhere online, like the New York Times, Washington Post, and Atlantic Monthly, each of whom have amazing content, a feast for my eyes and brain. Alas, I have drawn the line, because I sense it has long spun out control. And if CNN goes ahead and paywalls its app and site, I guess I won’t be reading them anymore.

Because I, like many people, have subscription fatigue. I simply cannot begin to consume all of this media. Sadly, I cannot remember all of the services to which I subscribe, and if you aren’t there yet, I bet you will be soon enough. The only way to know for sure is to carefully track your credit card statements to look for monthly billing.

That, of course, is the problem, because we willingly provided our billing data so that we do not have to do this every month. As long as that credit card is valid, those providers will keep hitting your card every month. It is only when your card is about to expire that you get a notification. And if you were not careful and instead provided a bank routing and account number, they can keep sticking their hand into your pocket as long as you have that account.

Ironically, there are new subscription management software sites and apps that supposedly make it easy to track and opt-out of all the things, but they are subscription services themselves. That’s like replacing one drug with another. You’re still on the hook.

It all starts so easily, because many of the subscription services are technically just micro payments, only $5 or $10. We see that as pocket change. Other services offer annual payment options, which provide a slight discount for paying in full in advance. But many of the once-cheap micro payments have started to get expensive, like Netflix and Spotify (I am speaking from experience). They are no longer minor indulgences.

Were these tangible products we had to buy in a store, I bet we would all be a lot more careful. The friction of having to be somewhere to even just tap your credit card would probably be enough to cause us to think. But it is simply too easy in the digital world to keep subscribing, because once we get in that loop, there is never any friction.

We are all going to have to muster a lot more resolve to win this fight, as well as start keeping meticulous records. Otherwise, these things develop lives of their own, lives that will continue hitting credit cards even after our own lives are over. I’m pretty sure none of us will be consuming anything at that point, and there’s no use paying for it.

We don’t have to wait for New Years Day to make this resolution.

Dr “I Honestly Can’t Remember All Of Them” Gerlich

Audio Blog

2 notes

·

View notes

Text

The Rise of Fintech: Transforming Financial Services for the Digital Age

In recent years, Fintech—short for Financial Technology—has emerged as a disruptive force in the financial services industry. From mobile payments to blockchain technology, fintech innovations are reshaping how individuals, businesses, and financial institutions interact with money. As digital tools continue to evolve, they offer new ways to improve financial efficiency, transparency, and inclusivity.

The rapid rise of fintech is not just a trend; it's a transformative shift that’s reshaping financial landscapes globally. In this article, we will explore what fintech is, how it’s transforming various sectors of financial services, and what the future holds for this exciting industry.

1. What is Fintech?

Fintech is a term that encompasses any technology that improves and automates financial services. This can include innovations in areas like mobile payments, online banking, investment platforms, and even the use of artificial intelligence in managing financial portfolios.

Fintech aims to make financial services more accessible, efficient, and secure. By leveraging digital tools, it allows individuals to manage their finances with ease, whether they're sending money across borders, applying for a loan, or investing in the stock market.

2. The Evolution of Fintech

The roots of fintech can be traced back to the late 20th century, with the introduction of online banking and electronic payments. However, it wasn't until the late 2000s, with the rise of smartphones and digital apps, that fintech truly took off.

The 2008 financial crisis also played a significant role in the development of fintech. Traditional banks struggled, leading to the rise of alternative financial solutions. Startups began creating apps and platforms to offer services such as peer-to-peer lending, robo-advisors, and even digital currencies like Bitcoin.

Today, fintech is booming, with countless companies and startups offering innovative financial products and services that rival traditional financial institutions.

3. The Key Sectors of Fintech

Fintech covers a broad range of sectors, each offering unique innovations that are transforming the way we think about and use financial services. Here are some of the key areas:

a. Digital Payments

One of the most recognizable sectors of fintech is digital payments. Apps like PayPal, Venmo, and Apple Pay have made sending and receiving money faster, more convenient, and cheaper than traditional methods.

Consumers can now make purchases, pay bills, and send money internationally with just a few taps on their smartphone, without needing to rely on banks or physical cash.

b. Lending and Borrowing

Fintech has disrupted the lending industry by providing alternatives to traditional bank loans. Peer-to-peer lending platforms such as LendingClub and Funding Circle allow individuals to lend directly to borrowers, cutting out the middleman and often providing better rates for both parties.

Additionally, fintech lenders have made it easier for small businesses and individuals with less-than-perfect credit scores to access loans through automated credit scoring systems.

c. Investment Platforms

The rise of fintech has made investing more accessible to the general public. Gone are the days when investing required a hefty minimum deposit and working with a financial advisor.

Now, thanks to robo-advisors like Betterment and Wealthfront, individuals can invest with little to no minimum, receiving tailored investment advice through algorithms that automatically adjust portfolios based on risk tolerance and market conditions.

d. Insurtech (Insurance Technology)

Insurtech is another growing sector of fintech, aiming to simplify and improve the insurance industry. From comparing quotes to filing claims, insurance technology platforms like Lemonade are providing a seamless, user-friendly experience for consumers.

These innovations are making insurance more affordable and efficient, particularly for younger consumers who value the convenience of digital interactions.

e. Cryptocurrency and Blockchain

Perhaps the most transformative development in fintech is the rise of cryptocurrencies and blockchain technology. Cryptocurrencies like Bitcoin and Ethereum offer decentralized alternatives to traditional currencies, while blockchain technology provides a secure and transparent way to record transactions.

While still relatively new, cryptocurrencies and blockchain are expected to have far-reaching implications for everything from cross-border payments to smart contracts.

4. How Fintech is Changing Financial Services

Fintech’s influence is broad and deep, transforming almost every facet of financial services. Here’s a closer look at how it’s reshaping the industry:

a. Improving Access to Financial Services

One of the biggest advantages of fintech is that it provides greater access to financial services, particularly for underserved populations. For example, fintech platforms allow people in developing countries, who might not have access to traditional banking, to open accounts and manage their finances using just a smartphone.

Fintech has also revolutionized access to credit. Through digital lending platforms, individuals and small businesses can get loans faster and more easily than ever before, often bypassing the hurdles of traditional banks.

b. Lowering Costs

Fintech companies operate more efficiently than traditional financial institutions, often passing these savings on to consumers in the form of lower fees and better interest rates. This is especially true in sectors like peer-to-peer lending and digital payments, where middlemen have been cut out of the equation.

c. Faster Transactions

In the traditional financial world, sending money, especially internationally, can be a slow and expensive process. Fintech has made these transactions faster, with some payments happening in real time. Digital wallets, payment processors, and blockchain technology are all contributing to instantaneous money transfers, no matter where you are in the world.

d. Personalized Financial Management

Thanks to the use of big data and machine learning, fintech companies can provide highly personalized services. For example, investment platforms use algorithms to create tailored portfolios, while budgeting apps help users track and optimize their spending habits based on individual behavior.

This level of personalization is helping consumers and businesses alike make better financial decisions, driving growth and improving financial health.

5. The Role of Artificial Intelligence in Fintech

Artificial intelligence (AI) is playing a significant role in the fintech industry. AI is used to streamline processes, enhance customer experiences, and improve security measures. For example, chatbots powered by AI can handle basic customer inquiries, freeing up human agents to focus on more complex tasks.

AI also plays a crucial role in fraud detection and cybersecurity, identifying unusual patterns in data and flagging potential threats in real time.

6. Fintech Regulations and Challenges

As fintech continues to grow, so do the regulatory challenges that come with it. Governments and financial institutions around the world are working to create regulatory frameworks that both encourage innovation and protect consumers.

Some key concerns in fintech include data privacy, cybersecurity, and the risk of financial exclusion if certain populations are unable to keep up with technological advances.

There’s also the challenge of navigating the global landscape, as fintech companies often operate in multiple countries, each with its own regulations and standards.

7. The Future of Fintech

The future of fintech looks incredibly promising, with AI, blockchain, and cryptocurrencies leading the charge. Experts predict that in the next few years, we’ll see even more integration between traditional financial institutions and fintech companies, blurring the lines between the two.

In addition to more widespread adoption of digital currencies, the fintech industry is expected to play a key role in financial inclusion, helping to bridge the gap for the 1.7 billion people globally who remain unbanked.

8. How to Get Started in Fintech

If you're interested in fintech, there are plenty of ways to get started. Whether you’re a consumer looking to take advantage of new financial tools, or a professional considering a career in the industry, now is the perfect time to dive in.

Explore Fintech Platforms: Start using digital banking apps, robo-advisors, or digital wallets to familiarize yourself with how fintech works.

Learn About Blockchain and AI: These two technologies are central to the future of fintech. There are plenty of online courses and resources available to help you learn the basics.

Invest in Fintech: Many fintech companies are publicly traded, offering opportunities for you to invest in the future of finance.

9. The Benefits of Fintech for Businesses

Fintech isn’t just changing the landscape for consumers—it’s also revolutionizing how businesses operate. From streamlining payment processes to improving access to capital, fintech is enabling businesses to operate more efficiently and scale faster.

Some benefits for businesses include:

Lower Transaction Fees: Fintech payment processors offer competitive rates compared to traditional banks.

Access to Funding: Digital lending platforms and crowdfunding have opened up new ways for businesses to access funding.

Improved Cash Flow Management: With real-time payment solutions, businesses can improve cash flow and reduce the wait times associated with traditional banking.

10. Conclusion: Fintech is Here to Stay

In conclusion, fintech is not just a buzzword—it’s a revolution that’s changing the way we interact with money and financial services. Whether it’s through digital payments, AI-powered financial tools, or blockchain-based systems, fintech is making finance faster, more accessible, and more secure.

The rise of fintech has already transformed many aspects of financial services, and it shows no signs of slowing down. As technology continues to advance, we can expect fintech to play an even larger role in the global economy.

Are you ready to explore the future of finance? Click here to learn more and stay ahead of the curve with the latest insights: The Rise of Fintech.

#fintech#financetips#investing stocks#personal finance#management#investing#finance#crypto#investment#blockchain#solana#crypto market

2 notes

·

View notes

Text

The No.1 Platform for Postpaid Mobile Recharge

Discover the ultimate convenience of postpaid recharge at Payrup. Experience seamless and secure online mobile recharge for your postpaid plan. Stay connected effortlessly with fast and reliable service. Manage your bills, stay updated, and never miss a beat. Recharge your postpaid connections like airtel, jio, vodafone idea, bsnl, mtnl and tata teleservices hassle-free with Payrup’s user-friendly platform. Embrace the power of technology and keep your smartphone always active. Trust Payrup for a smooth and efficient postpaid recharge experience

#postpaid bill payment#online postpaid bill payment#mobile postpaid bill payment#Mobile recharge online#online mobile recharge

0 notes

Text

Payrup Pay Bijli Bill Online Electricity bill payment-https://payrup.com/electricity-bill-payment

"Make electricity bill payment at Payrup & get multiple electricity bill payment offers. Pay Bijli bill online using a debit card, credit card or net banking"

0 notes

Text

Buy Cash App account with 15% discount now. Get the most out of your money. We offer the best service and most trustworthy platform for buying, selling, or trading Cash App at a cheap price.

We provide Cash App account with high quality and cheap price. Buy now Cash App account!

What Is Cash App?

Buy Verified Cash App Account. Cash App is a mobile payment service developed by Block, Inc. (formerly Square, Inc.) that allows users to send, receive, and store money. It functions as a peer-to-peer (P2P) payment platform, similar to services like Venmo or PayPal, and is available for both iOS and Android devices. Users can instantly transfer money to others using their Cash App account. A free debit card linked to the Cash App account that allows users to spend their balance at stores or online.

Cash App supports direct deposits and allows users to receive their paychecks directly into the app. Users can buy and sell stocks or invest in Bitcoin through the app. Offers discounts when using the Cash Card at specific merchants. Users can withdraw their balance to their bank account or at ATMs using the Cash Card. Cash App is widely used for personal transactions, like splitting bills, paying rent, or transferring money between friends and family.

What Is Bеnеfits of Vеrifiеd Cash App Accounts?

Verified Cash app accounts offer various benefits, making transactions and usage more secure and convenient. Some of the key benefits include:

Higher Transaction Limits: Verified Cash App accounts can send and receive larger amounts of money compared to unverified accounts. This is especially useful for businesses or individuals who regularly handle large sums of money.

Increased Security: Verifying your identity adds an extra layer of security to your account, helping to protect against fraud and unauthorized access.

Direct Deposit: With a verified account, you can enable features like direct deposit for paychecks, tax refunds and other payments.

Cash Card: A verified Cash App account allows you to order and use a Cash App debit card (Cash Card), which can be used for in-store and online purchases.

Bitcoin & Stock Trading: Verified Cash App users can access additional features like buying, selling, and withdrawing Bitcoin, as well as investing in stocks directly through the app.

Customizable Features: You can customize your $Cashtag and use more personalized features, such as getting detailed transaction history, which is useful for budgeting and tracking spending.

Increased trust: A verified account gives more credibility, especially when using the app for business transactions. This ensures that your identity is confirmed, so that people are more willing to do business with you.

Tax Reporting: A verified account makes it easier to track transactions for tax purposes, as Cash App provides documentation of your financial activities.

Tax Reporting: A verified Cash App account makes it easy to track transactions for tax purposes, as the Cash app provides documentation of your financial activity.

These benefits make verified accounts much more functional and trustworthy for both personal and business use.

Why do people use Cash App?

People use Cash App for a variety of reasons, including:

Convenient Money Transfers: The Cash App allows users to quickly and easily send and receive money between friends, family or other contacts without the need for cash or checks.

Ease of use: The app has a simple, user-friendly interface, making it easy for people who may not be tech-savvy to manage payments. Peer-to-Peer Payments: This is commonly used to splitting bills, pay for group activities, or reimbursing others.

Direct Deposits: Users can receive their paycheck directly into their Cash App account, sometimes getting paid earlier than traditional banking methods.

Cash Card: The Cash App offers a physical debit card (cash card) that users can use to make purchases in stores or online or to withdraw cash from ATMs.

Bitcoin and Stocks: Cash App account enables users to buy and sell Bitcoin, as well as invest in stocks, making it attractive to those interested in small-scale investing.

Security: The Cash app provides security features like passcodes and notifications, giving users confidence in their transactions.

Discounts and Boosts: The app offers “Boosts” that give users discounts at select stores and restaurants when using the Cash Card, providing extra savings.

Cash App’s combination of functionality, security, and ease of use makes it popular for everyday financial transactions and investments.

24 Hours Reply/Contact Telegram: @smmvirals24 WhatsApp: +6011-63738310 Skype: smmvirals Email: [email protected]

2 notes

·

View notes

Text

Which Payment Gateways Are Compatible for Dynamic Websites - A Comprehensive Guide by Sohojware

The digital landscape is constantly evolving, and for businesses with dynamic websites, staying ahead of the curve is crucial. A dynamic website is one that generates content on the fly based on user input or other factors. This can include things like e-commerce stores with shopping carts, membership sites with customized content, or even online appointment booking systems.

For these dynamic websites, choosing the right payment gateway is essential. A payment gateway acts as a secure bridge between your website and the financial institutions that process payments. It ensures a smooth and safe transaction experience for both you and your customers. But with a plethora of payment gateways available, selecting the most compatible one for your dynamic website can be overwhelming.

This comprehensive guide by Sohojware, a leading web development company, will equip you with the knowledge to make an informed decision. We’ll delve into the factors to consider when choosing a payment gateway for your dynamic website, explore popular options compatible with dynamic sites, and address frequently asked questions.

Factors to Consider When Choosing a Payment Gateway for Dynamic Websites

When selecting a payment gateway for your dynamic website in the United States, consider these key factors:

Security: This is paramount. The payment gateway should adhere to stringent security protocols like PCI DSS compliance to safeguard sensitive customer information. Sohojware prioritizes security in all its development projects, and a secure payment gateway is a non-negotiable aspect.

Transaction Fees: Payment gateways typically charge transaction fees, which can vary depending on the service provider and the type of transaction. Be sure to compare fees associated with different gateways before making your choice.

Recurring Billing Support: If your website offers subscriptions or memberships, ensure the payment gateway supports recurring billing functionalities. This allows for automatic and convenient payment collection for your recurring services.

Payment Methods Supported: Offer a variety of payment methods that your target audience in the US is accustomed to using. This may include credit cards, debit cards, popular e-wallets like PayPal or Apple Pay, and potentially even ACH bank transfers.

Integration Complexity: The ease of integrating the payment gateway with your dynamic website is crucial. Look for gateways that offer user-friendly APIs and clear documentation to simplify the integration process.

Customer Support: Reliable customer support is vital in case you encounter any issues with the payment gateway. Opt for a provider with responsive and knowledgeable customer service representatives.

Popular Payment Gateways Compatible with Dynamic Websites

Here’s a glimpse into some of the most popular payment gateways compatible with dynamic website:

Stripe: A popular and versatile option, Stripe offers a robust suite of features for dynamic websites, including recurring billing support, a user-friendly developer interface, and integrations with various shopping carts and platforms.

PayPal: A widely recognized brand, PayPal allows customers to pay using their existing PayPal accounts, offering a familiar and convenient checkout experience. Sohojware can integrate PayPal seamlessly into your dynamic website.

Authorize.Net: A secure and reliable gateway, Authorize.Net provides a comprehensive solution for e-commerce businesses. It supports various payment methods, recurring billing, and integrates with popular shopping carts.

Braintree: Owned by PayPal, Braintree is another popular choice for dynamic websites. It offers a user-friendly API and integrates well with mobile wallets and other popular payment solutions.

2Checkout (2CO): A global payment gateway solution, 2Checkout caters to businesses of all sizes. It offers fraud prevention tools, subscription management features, and support for multiple currencies.

Sohojware: Your Trusted Partner for Dynamic Website Development and Payment Gateway Integration

Sohojware possesses extensive experience in developing dynamic websites and integrating them with various payment gateways. Our team of skilled developers can help you choose the most suitable payment gateway for your specific needs and ensure a seamless integration process. We prioritize user experience and security, ensuring your customers have a smooth and secure checkout experience.

1. What are the additional costs associated with using a payment gateway?

Besides transaction fees, some payment gateways may charge monthly subscription fees or setup costs. Sohojware can help you navigate these costs and choose a gateway that fits your budget.

2. How can Sohojware ensure the security of my payment gateway integration?

Sohojware follows best practices for secure development and adheres to industry standards when integrating payment gateways. We stay updated on the latest security protocols to safeguard your customer’s financial information.

3. Does Sohojware offer support after the payment gateway is integrated?

Yes, Sohojware provides ongoing support to ensure your payment gateway functions smoothly. Our team can address any issues that arise, troubleshoot problems, and provide updates on the latest payment gateway trends.

4. Can Sohojware help me choose the best payment gateway for my specific business needs?

Absolutely! Sohojware’s experts can assess your business requirements, analyze your target audience, and recommend the most suitable payment gateway based on factors like transaction volume, industry regulations, and preferred payment methods.

5. How long does it typically take to integrate a payment gateway with a dynamic website?

The integration timeline can vary depending on the complexity of the website and the chosen payment gateway. However, Sohojware’s experienced team strives to complete the integration process efficiently while maintaining high-quality standards.

Conclusion

Choosing the right payment gateway for your dynamic website is crucial for ensuring a seamless and secure online transaction experience. By considering factors like security, fees, supported payment methods, and integration complexity, you can select a gateway that aligns with your business needs. Sohojware, with its expertise in web development and payment gateway integration, can be your trusted partner in this process. Contact us today to discuss your requirements and get started on your dynamic website project.

2 notes

·

View notes