#minimum age to open bank account in uae

Explore tagged Tumblr posts

Text

Get Business Loan in Dubai | UAE

PRO Banking offers a range of banking solutions to suit your needs.Choose PRO Banking for Personal Loans,Investments,Insurance and much morePro Banking UAE is an individual bank in the computerized age that assumes a serious part in the public eye with commitment.The computerized age assists us with carrying banking nearer and nearer to our clients and their requirements.As a bank, we base on inclusivity, sensibility, social business, improvement & regular banking to say the least

#UAE bank account open#uae bank account for non residents#.#uae bank account without minimum salary#emirates nbd#how to open bank account in uae online#how to open bank account in uae for non residents#can i open a bank account in dubai without emirates id#how to open a bank account in dubai online#minimum age to open bank account in uae#open business account online uae#best bank account for small business in uae#zero balance business account in uae#rak bank zero balance business account#business account opening in uae#emirates nbd business account#current account in dubai

0 notes

Text

FOR IMMEDIATE RELEASE : Emopay Unveils Exciting New Updated Program to Revolutionize Experience

UAE, Dubai, 24th October] – [Emopay], a leading Digital Currency institution, is thrilled to announce the upcoming launch of its highly anticipated, innovative and updated program to transform how customers engage with their finances. This groundbreaking update reaffirms Emopay's commitment to delivering excellence in the Digital Currency Space and coming up with lots of new initiatives.

With the world rapidly advancing in the digital age, Emopay recognizes the importance of adapting to the evolving needs of its customers. The new program is designed to offer a seamless and enhanced banking experience, focusing on convenience, accessibility, and customer-centric features.

EMO Bank and EMOPay's old Versions will merge

The existing user has to Sign Up again on the new version and create a wallet address.

Existing users EMO’s will be transferred to the New Version of EMOPAY with new staking from the backend as per the request. User has to fill out the Google form and follow the instructions for the same.

Key Updates of the Upcoming EMOPAY 2.0 Program:

EMOPAY Staking Program 4.0

The New Staking program starts on the new version of EMOPAY

Users can choose from the following Plans for Staking.

Minimum Amount 1000 EMO for staking

540 days - 1.5% Monthly Rewards

1080 days - 2% Monthly Rewards

1800 days - 3% Monthly Rewards

2520 days - 4% Monthly Rewards

3600 days - 5% Monthly Rewards

For Staking Rewards: Open your ID and click the claim button to receive a daily reward bonus.

To keep the community involved and interested in the digital currency, a user has to log in with EMOPAY ID everyday and click on the Claim button on the dashboard to receive his daily staking returns. If any day, user forgets to click the button, user will receive 50% of the value as a reward.

P2P Transfers to Users This much-awaited feature will be back in function with certain algorithms and monthly user limits. This will help in increasing the community of EMO Wallet holders and will continue until we reach 2 million users. The user has to follow these steps to Open the Pay to User and P2P facility in local currency.

Create an EMO Wallet and Purchase EMO from EMO Community

- Refer 3 people using there referral link.

- Help these referral to buying EMO from the community.

Congratulations, you are now eligible to transfer EMO to other Users and a P2P swap in local currency will also open once it is live. This condition is temporarily on Limited monthly restrictions and increases accordingly.

Generate EMPLOYEE Code

Those EMOians who want to work and help the community to increase its strength can generate their Employee code and this helps them to generate income for themselves too.

For this, they have to raise a working code request on the my business page at emopay.org

Cutting-Edge Security: Emopay is dedicated to ensuring the highest level of security for its customers' financial information. The updated program will feature state-of-the-art security measures to protect against fraud and cyber threats.

EmoBank and EMOPAY are going to merge.

Personalized Financial Insights Customers will have access to in-depth financial analysis and recommendations, empowering them to make informed decisions about their money.

Your funds are 100% safe.

The principal amount of EMOPAY and EMO bank will automatically transfer to the new version. The staked amount will be staked and the Emopay wallet amount will be in Emo wallet (These conditions are applied on every emoians).

Digital Account Management Account management is easier than ever with online account opening, More Security, and seamless fund transfers between accounts.

Peer to peer: transfer of emo will start with certain conditions with certain limit

Customer Support Emopay remains dedicated to providing top-tier customer service. The updated program includes improved customer support channels, including live chat and more responsive email services.

New referral scheme (Join 3 people)

Emopay recognizes the importance of staying ahead of the curve in an ever-changing financial landscape. This new program represents a significant step towards modernizing the banking experience, ensuring that customers can effortlessly manage their finances from the palm of their hand.

Every emoians needs to sign up again

Emopay, CEO expressed enthusiasm about the Updated launch: "We're thrilled to introduce this new program to our customers. It's been carefully crafted with their needs in mind, and we believe it will set a new standard for Fintech convenience and security."

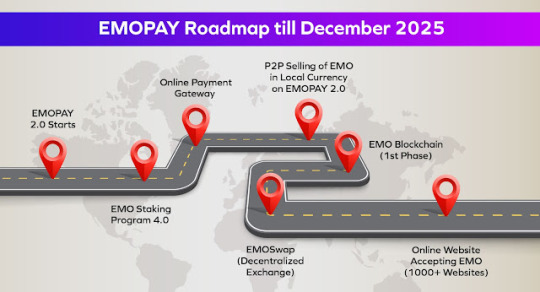

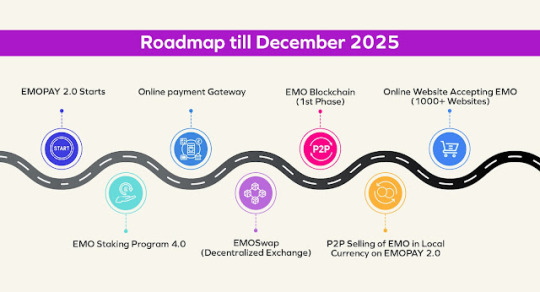

Emopay Roadmap till December 2025

Roadmap till December 2023

EMOPAY 2.0 - November 2023

EMO Staking Program 4.0 - November 2023

Online payment Gateway - December 2023

P2P Selling of EMO in Local Currency on EMOPAY 2.0 - December 2023

Roadmap till 2025

EMO Blockchain (1st Phase)

EMOSwap (Decentralized Exchange)

Online Website Accepting EMO (10000+ Websites)

The launch of this exciting program is scheduled for 01-11-2023. Emopay encourages its valued customers and the broader community to join in this journey towards a more convenient and secure experience.

For more information, follow our social medias, visit our website at Emopay or contact our media relations team at [email protected] .

About Emocoin:

Emopay is a renowned financial institution dedicated to providing exceptional services to its customers. With a history of innovation and a commitment to customer satisfaction Emocoin continues to lead the way in the financial industry.

For media inquiries, please contact:

Email ID

Social Media Emonews

FORM LINK 👉 ( For existing users to transfer IDs into new Emopay 2.0 )

Check out this article on EmoNews

1 note

·

View note

Text

Tally ERP Training in Dubai - Elegant Training Center

Learn how to use Tally from beginner level to advanced techniques which are taught by experienced working professionals. With our Tally ERP 9 Course Dubai, you’ll learn concepts at an expert level in a practical manner.

About Tally ERP:

Tally Software is a financial accounting software designed by Tally Solutions mainly for small and medium businesses. This is a complete business accounting and inventory management software

Contents To Be Covered

1. Introduction to Tally ERP, Company Creation & Modification

2. Chart of Accounts, Creating Groups, Ledger and Inventory Items, Cost Centers & Categories

3. Configuration of VAT in the TALLY with VAT entries

4. Purchase and Sales Invoicing, Debit & Credit Notes, Orders Processing, Payments

5. Case study-with inventory and without inventory-preparation of TB, PL & BS

Loading Opening Balance

1. Stocks group, Stocks categories, Stock items, Stock reports generation

2. All Types of Voucher Entries, Adjusting and Closing Entries, Bank Reconciliations

3. Fixed Assets Accounting and Reports

4. Sales and Profits Analysis, Ageing Reports of Vendors, and Receivables

5. Duration-Up to 15 hours

Eligibility:

1. 12th-pass students (commerce/ arts/ science) can join this course

2. Minimum accounting knowledge

3. Qualified Graduates

For whom the course is?

Those who want to take accounting as their profession and want to work in TALLY ERP

Job Opportunities for Tally ERP Experienced:

Can join as an Accountant and Accounts Executive

Tally ERP 9 Course Dubai Training Approach:

1. Course materials and hand-outs

2. Mock tests, Case studies with simulations

3. Training in small batches for personalized attention

4. Training by Qualified professionals and Subject Matter Experts

5. Flexible timings

What Will I Learn?

1. Practice your new skills with Creative challenges (solutions included)

2. Organize and structure your code using software patterns like modules

3. Get friendly and fast support in the course Q&A

For more details visit our website: Tally ERP 9 Course Dubai

Contact: +971 54 749 5664

Address: Office Number 620, Al Attar Business Center, Beside Ibis Hotel, Al Barsha 1 Near Mashreq Metro Station, Sheikh Zayed Road, Dubai, UAE

Facebook: https://www.facebook.com/ElegantTrainingAE/

Twitter: https://twitter.com/EPMDTDUBAI

Youtube: https://www.youtube.com/channel/UCp9zBBZkcXWhQXVUYxBYXtQ

Instagram: https://www.instagram.com/eleganttraining/

#Social Media Marketing Course Dubai#English Language Course in Dubai#Accounting Certification Courses Dubai#Finance for Non Finance Managers Dubai#Accounting Certification Programs Dubai#CMA Course in Dubai#Digital Marketing Course Dubai#Python Certification Dubai#Training Course in Dubai#Corporate Training in Dubai#Graphics Designing Course Dubai

1 note

·

View note

Text

Setting up a Business in Dubai: Complete Guidance

There are certainly a lot of questions on your mind if you are thinking about setting us a business in Dubai. From choosing the ideal neighbor hood and school for your children to opening a bank account and managing the visa application procedure. In order to address any concerns you might have, we have put together a comprehensive guide on how to relocate to Dubai.

Where to live and the cost of living in Dubai?

Due to the city's rapid growth, there are constantly new homes for sale. As a result, you won't need to look very long to find a home that meets your preferences. The cost of living in Dubai is affordable when compared to other major cities. The cost of living in the city centre is rising.

The cost of renting a studio flat in Downtown Dubai. starts at 60,000 AED per year, and in most circumstances, this must be paid in advance. A quality 3-bedroom villa in an excellent location can be rented for as little as 140,000 AED per year.

If you're trying to figure out where to reside in Dubai. This city offers numerous carefully constructed neighbourhoods that are great for families. Arabian Ranches, Jumeirah, Al Barari, Emirates Hills, and Dubai Hills Estate are a few of the most well-liked choices.

What is the visa process?

When processing a working visa, it starts with a two-month permit. Which is giving the employer time to organise medical tests, an Emirates ID card, labour card and a stamped residence permit in the employee’s passport.

When you have become a UAE resident. You can sponsor family members if they earn a minimum of 4,000 AED a month.

Education in Dubai

The UAE is popular for students of all ages from various countries. Mainly because its education system is among the best in the world. Locals and expats can choose from a wide variety of international and private schools. Which come at a high price in almost every country?

The Knowledge and Human Development Authority offers guidance choosing the right school and the knowledge about the application process. They also publish school rankings, which is a useful resource to help you identify the school that will suit your children and their needs.

Taxes in Dubai

One of the best things about living in Dubai is the tax-free salary, which allows you and your family to live a better life. This counts for national citizens as well as foreign residents and expats. Though you may still pay foreign tax from your home country and VAT is charged on all purchases.

Healthcare in Dubai

When thinking about how to move to Dubai, many people want information about healthcare. In Dubai the company is always paying for the employees’ health insurance. In most cases this has been arranged for you by your company before you arrive, along with your visa application and work permit.

It is important to check the level of health insurance your employer offers, since it may only cover the essential benefits. Perhaps you want to arrange additional cover to provide additional benefits and higher limits.

Company Formation & Corporate Banking for Your Business in Dubai

Getting started doing business in the UAE and feeling the benefits of it, requires going through what can seem like an impossible number of steps, which is where we can help. We will make sure your business will be up and running in no time, while you lean back and focus on managing your business.

We strive towards excellence, which means delivering good customer service in the registration process as well as afterwards. Aston Advisory takes pride in treating each case on a personal level and maintaining easy contact to our consultant via your preferred platform.

0 notes

Text

About And History Of HDFC Bank

Everyone must have heard about the HDFC bank in India. Many of us may have accounts in many of its branches. Some may have availed of loans, credits, and invested in mutual funds. The bank has overtaken most of the private sector banks to emerge victorious in the financial sector. Through this article, it will enlighten my readers about the services and history of HDFC bank. I will provide glimpses of the history of this bank. Then I will put forth the various financial services that it has to offer for its customers. By the end of this article, you will have a clear understanding of what has made this bank a household name today. So, let’s get started.

Ever wondered what HDFC stands for? It is the short form for Housing Development Financial Corporation Limited (HDFC). Since its initiation, it has amassed huge assets and a market capitalization that has paved the way for its success. It is currently headed by Mr. Sashidhar Jagdishan.

Today HDFC bank is one of India’s most powerful banks. It is a private sector bank that provides various banking and investment banking services nationally and internationally. It was founded in the year 1994 under the guidance of Mr. Hasmukhbhai Parekh. Since then, the banking company has expanded its reach in various cities across India and overseas. On the international level, it has branches in Bahrain, Hong Kong, and offices in UAE and Kenya. To date, the company has branches across 2,848 cities in India with a vast network of 5,430 branches.

More Information About HDFC Bank

The HDFC bank was inaugurated in 1994. It started deploying banking services as a Scheduled Commercial bank in 1995. The Housing Development Finance Corporation Limited was the first company to set up a private bank in India. It provided services from the registered bank in Mumbai. The current CEO of the HDFC bank is Mr. Deepak Parekh. The main aim of the HDFC bank was to become a world-class Indian Bank. It has truly lived up to its mission and has become the most successful bank today. The awards and honors the bank had received in India and worldwide speak for themselves. It is known for its good customer services, revolutions in the financial business, and its sustainability. The bank has introduced various products in the market. Apart from these, it had also conducted several drives and launched initiatives for the betterment of society. Its main objective was to become the first choice of every investor in every domain of the bank services. Its second objective was to achieve substantial growth in bank assets. No wonder it had met all its business objectives, and it has continually been delivering quality services to the new customer. The bank continues to conquer the hearts and minds of every investor and its existing customers.

Mergers Of HDFC Bank

The HDFC bank had merged with the Centurion Bank of Punjab (CBoP) on 23rd May 2008. This merger was approved by the Reserved Bank of India. The merger was directly proportional to the shareholders of CBoP receiving a share of the HDFC bank. The shares would be provided to each of the 29 shares of CBoP. The merger provided great benefits to the HDFC bank. For instance, the bank network had significantly incremented by a good number. This meant that the HDFC bank could now deliver services to more masses. The added new workforce of the CBoP created a larger pool of skilled workmen. Thus, the merger was a huge gain for the HDFC bank.

Times Bank Limited was an Indian Bank in the private sector. On 26th February 2000, the Times bank had merged with the HDFC bank. It was the first time that two banks had merged in the 21st century. The combination of the two banks implied that the shareholders of the Times bank would have received one share of the HDFC bank. This would continue for every 5.75 shares of the Times bank.

History Of HDFC Bank

It’s been 26 years since the bank first opened at its registered office in Mumbai. As per the Reserve Bank of India RBI’s policy about the liberalization of the banking industry in India, the request by the HDFC bank to set up the first Indian bank in the private sector was approved. The HDFC bank, as it is popularly called, was one of the first banks in India. The main operations of the financial company as a Scheduled Commercial bank first commenced back in January 1995.

The bank has had a long history. Some of these factors were instrumental in making it the premium bank in India. So, here I have provided a descriptive guide about the history of this bank.

1994

The HDFC bank was founded on 30th August in the year 1994. It had established a partnership with the National Westminster Bank Pc. and its subsidiaries. The banks agreed-upon a 20% subscription of the banks’ issued capital and assistance from the technical domain to promote the banking business.

1995

The bank issued the subscribers of the Memorandum and the Articles of Association with 70 equity shares. During the same time, the bank promoters were allotted with 5 crore equity shares. Moreover, the HDFC Employment Welfare Trust was also allotted shares worth 5,09,20,000 on 22nd December 1994

Later on, 16th January 1995, the Jarrington Pte. Ltd was also allotted 90,79,930 number of equity shares. The NatWest Group received 400,00,000 number of shares based on private placement. The public also received equity shares on 9th May 1995 that were 500,00,000 in number.

By this time, the HDFC bank had opened its first branch on 16th January in Ramon House at Church gate in Mumbai. An efficient operating system was designed and created by the engineers of the bank for fortifying the computer network of the bank.

1996

The bank had established a good reputation in the financial businesses and the market. This paved the way for the banking consortia of over 50 countries. The consortia included leading multinational companies, public sector companies, and several flagship companies of the local business.

The transaction in the Indian financial market was handled in a new dealing room. The room was constructed this year to facilitate this process. The HDFC bank’s Certificates on Deposits were earned a rating of PP1+. The rating was the highest for any short-term financial tools at that time.

1997

At Powai in Mumbai, the bank had established a modern hub to store the bank’s central computers and servers. The servers had information about all the new products and services and the branches that the bank had established.

The proposition for telebanking was launched by HDFC in Mumbai. The term telebanking was first introduced at the Chandiveli branch of the HDFC network.

By now, the bank had established 28 bank branches in India. These branches had initiated an account that required the investors to deposit a minimum balance for opening the account. This feature was first introduced by the HDFC bank in India. To date, this practice has been cultivated across several financial institutions in India.

They had also launched a loan product. This product facilitated the payment of fees as announced by the Bangalore Mahanagar Palike.

1998

The HDFC bank signed an MOU with the Ahmedabad Stock Exchange (ASE) so that it could play the role of a clearance bank.

The strengthening of bonds with the branch in Calcutta was proposed in 1998. They planned to make an addition of two more branches by the first quarter of the upcoming financial year 1999.

They had inked a memorandum with the National Stock Exchange (NSE) around the same year. This agreement stated that the bank would give an additional charge over the broker’s deposit. It was only if they provide a loan against share facility to the NSE brokers.

2000

With the beginning of the 21st century, the bank had also begun establishing new connections in the world. Starting with Singapore Telecom’s e-commerce arm Sesami.com Pvt Ltd. The HDFC bank had signed an agreement with this company to boost its reach.

The HDFC bank had launched a new facility call the ‘Freedom- The e-Age Savings Account.’ this account was specifically designed for cellular phone users.

Trichy and Coimbatore, the southernmost regions of India, had received wireless application protocol-based mobile banking. This was newly introduced at that time. The HDFC bank was instrumental in launching this facility in association with Aircel.

2001

Aurangabad had received the first HDFC bank with the commencement of the new year 2001.

The HDFC Standard Life Insurance had established a memorandum of understanding with the Indian Bank. The Indian bank was based in the southern capital of Chennai.

The bank had first launched its International Maestro Debit Card in association with Master Card.

The Board of Directors dealt with the resignation of two of its directors. These were Mr. S. S. Thakur and Mr. Amit Judge. They had resigned from their office on 30th March.

2002

The HDFC bank had introduced a new online account. The online account service was called ‘One View.’ The bank launched the services to all its customers.

The HDFC bank had launched various new products in the year 2002. These products were inclined towards the wealth management program designed to increase the number of the customer base. The Financial Planner was a non-interactive product that was available for the customers. This product was available at the base price of Rs.10,000. The mass affluent segment could avail of the fee-based advisory program. This program was earlier available only to the high net worth customers. The wealth management program was a highly beneficial initiative by the bank for the betterment of its customers. This program took into account various factors like the financial goal and the risk profile, including equity, customers age, MFs, and RBI Relief Bonds.

2003

The resident foreign currency account was launched by the HDFC bank.

The co-branded credit card with e-Seva was unveiled by the HDFC bank.

Mr. Arvind Pande was appointed as the Additional Director on the 15th of January 2003. His appointment was approved by the Board of Directors. It was highlighted under Section 260 of the Companies Act, 1956.

2004

This year the Board had appointed Mr. Ranjan Kapur and Mr. Bobby Parikh as the Additional Directors.

2005

The HDFC bank had introduced the concept of loyalty rewards. These rewards were specifically meant only for the credit and the debit cardholders. This program was called the InstaWonderz.

The HDFC bank was aiming for the upliftment of the small and medium scaled enterprises (SMEs) in India. For this, it had launched a credit card with MasterCard International.

2006

The HDFC bank had established two more branches in Andhra Pradesh.

Osim intended to team up with the HDFC bank for consumer loans.

The HDFC bank had inaugurated a facility for the benefit of online shopping.

2007

The HDFC bank had teamed with the TATA Pipes to offer credit facilities to the Indian farmers.

Mr. Pandit Palande was appointed as the new Additional Director by the HDFC bank. He was appointed by the Board of HDFC bank on 24th April 2007.

The HDFC had also appointed Mr. Paresh Sukthankar and Mr. Harish Engineer as the Executive Directors. This was declared at the conference held on 12th October 2007. These gentlemen had been the senior employees of the since its initiation in 1994.

2008

The HDFC bank had tied-up with the Postal Department to extend its network in the rural areas.

The bank had won the ‘Nasscom IT User’ award.

The HDFC bank had inaugurated its first bank overseas. This bank was opened in Bahrain.

The HDFC bank had merged with the Centurion Bank of Punjab. The merger had taken place at a share swap ratio of 1:29.

2009

The HDFC bank had won the AsiaMoney award yet again. It had bagged the title of ‘ Best Domestic Bank’.

The electronic payment collection facility was offered to the Guruvayoor Devaswom by the HDFC bank.

2010

The housing finance major of the HDFC bank had introduced a variable interest rate on the recurring deposits. These interest rates were offered to attract long-term deposits. It was brought to the notice of the Board that the applicants withdraw their funds when the interest rates peak. To avoid such circumstances, these rates were introduced.

2011

The bank was aiming for 3G services to boost their mobile banking.

By this year, the HDFC bank had already opened 1,725 branches.

2013

At the Skotch Financial Inclusion Awards, the HDFC bank was named as the Organization of the Year.

The HDFC bank was instrumental in launching the Times Card.

The ‘Jet Privilege-HDFC Bank World Debit Card was launched. This was a joint initiative by the HDFC bank and Jet Airways.

2014

The Bank had set a GUINNESS WORLD RECORD. They held the record for organizing the largest blood donation drive on a single day across the globe.

2016

A digital bank was launched by the HDFC bank. This for intended only for the customers of small and medium enterprises.

The HDFC attains the top rank in the Institutional Investor Magazine.

2017

The HDFC bank had launched a student card this year.

An initiative called the ‘SmartUp Zone’ was launched to uplift the startups.

You can read about the services provided by the HDFC bank in our other article.

source http://invested.in/about-and-history-of-hdfc-bank/

0 notes

Text

Assessment Of Credit Application (A Financial Management Topic)

What Is a Credit Application?

A credit application is a questionnaire that a lender or business will require you to complete before lending you money or extending credit to you. Credit applications are customary when you're trying to obtain a home loan, home equity loan, automobile loan, business loan or credit card. One may also be required when you want to rent an apartment. The information you supply on a credit application helps the lender decide whether to lend you money and how much, and assess your ability to repay the loan.

A lender uses a credit application to determine your credit worthiness.

Identifying Information

The first part of the credit application asks you to provide your basic contact information such as name, address and phone number. This section will also typically ask for your social security number if you're applying as an individual, and both your SSN and the employer identification number or EIN of the business if you're applying for a business loan. The application may also request the amount of the loan you are seeking and the purpose of the loan.

Financial Information

This section will ask you about your income and financial background. As an individual, you will be asked about your salary or annual earnings, assets, home ownership status, other outstanding debt obligations and banking information. If it's a business application, you will be asked about your annual sales and net income in addition to the other items above. The application may also request that you submit a copy of recent tax returns or audited financial statements with the application.

References

A credit application will contain a section to list individuals or businesses you have worked with and paid for services. The creditor will want to know contact information including name, address, phone number and email as well as business details about the relationship. You will also be asked to provide facts about these references, such as the length of the relationship and payment history. The creditor will likely contact these references to verify the nature of your relationship.

Loan Guarantors

The creditor will ask for contact information for each co-signer as well as social security numbers, driver's license numbers and salary or financial information.

Terms and Conditions

A credit application will also contain some legalese that you must agree to when submitting the credit application. This section includes the creditor's request to run a credit and background check on all loan applicants, and will discuss details on the approval process and criteria. Sometimes it will even include the specific terms of the loan. These disclaimers usually address the interest rate, fees, debtor expectations and the dispute resolution process that the applicant is agreeing to by submitting the credit request

Assessment Of Credit Application

The information you provide on a credit application tells a story about your ability to handle money. Whether you are looking to finance a home, a car or future purchases, a potential lender uses this information not only to assess your ability to repay, but to determine whether or not you will repay.

The credit application process usually involves investigation, verification and assessment before your lender makes a final determination.

Credit Report

Verification

Assessment

Automated

Manual

Practical Study

United bank limited established in 7th November 1959. By June 1960, shortly after six months of opening its doors to the public, UBL had branches in Karachi, Lahore, Dacca, Lyallpur, Chittagong and Narayangaj. In 1963 UBL became the first bank in Pakistan to have a branch overseas-on William Street in London. In 1990,s the govt. of Pakistan decided to change the face of banking by creating a blueprint to privatize UBL. 52 years of glorious history now UBL have more than 1300 branches in Pakistan and under the supervision of Chairman Sir Anwar Pervez. Its 15 branches outside the country are in the United States of America, Qatar, UAE, Bahrain, and Republic of Yemen. It also has representative offices in Beijing, China, Tehran, Iran, and Almaty, Kazakhstan. It owns subsidiaries in the UK (United National Bank Limited), and in Zurich, Switzerland.

UBL’s state of the art online banking, customers are able to access their account from more than 1200 branches located in 150 cities across Pakistan. Transactions such as Cash Deposit, Cheque Encashment, Stop Payment, Account Statement, Funds Transfer, and Bill Payments are done online without the need to travel to the local branch.

Buying a House:

Eligibility Criteria

Minimum monthly income: Rs.50,000

Age: 23 to 65 years

Resident Pakistani

Self-employed businessman/professional or salaried individual

Minimum loan size: Rs. 500,000

Documentation Requirements

Copy Of NIC

Two recent Photographs each of primary as well as co-borrowers

Signed Lou (Letter of Understanding), which states the applicable rate at the time of booking of loan.

General Income Documents for Salaried and SEB/SEP are given below. However, your exact Documentation Requirement as per your specific Segment & Profession will be communicated to you by our respective ROs.

Salaried Person

Employment Certificate confirming last 12 months work experience

Tax Document for the past 24 months

Current Salary Slip

Bank Statement for the last 12 months

Markup => 3.5%

SWOT Analysis

Strength:

UBL offering Customized Products and services. Aggressively better then its competitors.

Weakness:

UBL is a step behind in using new technology as compared to other banks.

Opportunities:

By bringing new technology and modern business processes will bring the change and increase their profitability.

Mobile banking

Threats:

Large and increasing competition.

Conclusion:

After the establishment of UBL in the year of 1959, the bank was successful in achieving some of its objectives. In the very first the bank earned a handsome profit. After the exhaustive era of nationalization, the bank is now transforming to private ownership again. The decade of 60’s was dominated by on exceptional increase in economic activities. This result in bringing various changes in the management and structure of the commercial banks. In area of management more professional were brought in and the same was done with the structure. UBL was not an exception to these changes. In the last decade of the century the bank had witnessed very bad banking business. To rebuild the bank new professional people were inducted under the leadership of Mr. Zahoor Soomro.

In United Bank Limited, it indicates that the process of assessing credit application is working effectively in the organization.

#assessment#credit#management#financial#united#bank#limited#application#markup#employment#experience#competition#competitors

0 notes

Link

Recruitment in Al Futtaim Group Administrative Executive | Watches & Jewellery | Dubai (Dubai, AE)

Job Requisition ID: 33502

No two days are the same at Al-Futtaim, no matter what role you have. Our work is driven by the desire to make a difference and to have a meaningful impact with the goal of enriching everyday lives. Take our engaging and supportive work environment and couple it with a company culture that recognises and rewards quality performance, and what do you get? The chance to push the limits every single day.

As a humble family business that started on the banks of the Dubai Creek in the 1930s, Al-Futtaim has expanded to a presence in 31 countries, a portfolio of over 200 companies, and 42,000 employees. You’ll find us in industries ranging from automotive and retail, to finance and real estate, and connecting people with international names like Lexus, Ikea, Robinsons, and Adidas. Our team is proudly multicultural and multinational because that kind of diverse representation gives us the global mindset to grow and impact the people, markets, and trends around us.

Come join us to live well, work better, and be the best.

About the Role

The Administration Executive role is the direct support to the Duty Free business operations. He/she will perform a wide range of administrative and office support activities for the department and/or managers and supervisors to facilitate the efficient operation for the assigned brands of the organization.

Key Role Specific Accountabilities:

Stock Management:

Maintain required inventory levels across Duty Free POS

Allocate new arrivals as per merchandising plan

Ensure periodic replenishment based on merchandising plan by preparing quotations and blocking stock.

Generate ageing report and distribution across POS based on brand strategy, and re-allocate to other locations based on sales.

Analyse stocks for duty free on a monthly basis with Brand manager and suggest corrective actions to channel partners.

Monitor and follow up on blocked stocks

Allocate furniture or POS material based on requirement

Reporting

Access SAP/BI and Duty Free vendor portal on a daily basis for daily reports on stocks, sales, vendor performance, ageing, MTD performance etc

Prepare monthly sales report for brands

Update internal sales reports on a weekly basis per POS/ channel

Maintain master file for brand and pricing as per current formats

Prepare sell in and sell out reports for Duty Free.

Monitor stock ageing report from Duty Free

Archiving of approvals and relevant documentation

Co-ordination

SAP Billing and documentation with the Retail HO team

Processing of orders with channel partners, returns etc including inspection and documentation

With sales staff for specific requirements for stock or display material

Processing monthly incentives and overtime claims of the Duty-Free team

Processing airport pass applications, holiday planners and weekly team roster etc

Payment processing for Rent, Duty Free staff salary etc

Processing of invoice submission for payment

Monthly promotion planner update for Vendor funded support

Compile offer details from advertisements or promotions and monitor performance for all tactical initiatives

About You

Education: Graduate in Accounts/Commerce

Minimum Experience and Knowledge:

2-3 years’ experience in Administration and Sales coordination

Excellent MS office skills vital.

Job-Specific/Technical Skills required to complete the tasks:

PC Knowledge required & Knowledge of accounting practices

Detailed report analysis skills

REFJM

We’re here to provide excellent service but a little help from you can ensure a five-star candidate experience from start to finish.

Before you click “apply”: Please read the job description carefully to ensure you can confidently demonstrate why this opportunity is right for you and take the time to put together a well-crafted and personalised CV to further boost your visibility. Our global Talent Acquisition team members are all assigned to specific businesses to ensure that we make the best matches between talent and opportunities. We not only consider the requisite compatibility of skills and behaviours, but also how candidates align with our Values of Respect, Integrity, Collaboration, and Excellence.

As part of our candidate experience promise, we also want to make ourselves available to you throughout the application process. We make every effort to review and respond to every application.

Key Words: jobs in dubai,accounting jobs in dubai, accounts jobs in dubai, apply for jobs in dubai, apply job in dubai, career dubai, careers in dubai, civil engineering jobs in dubai, current jobs in dubai, driver jobs in dubai, dubai careers ,dubai classifieds ,dubai employment, dubai government jobs, dubai hotel jobs, dubai it jobs, dubai job hiring, dubai job offers, dubai job openings, dubai job search, dubai job sites, dubai job vacancy, dubai jobs, dubai jobs 2017, dubai jobs for freshers, dubai jobs for indian, dubai jobs for indians, dubai vacancies, employment in dubai, find job in dubai, gulf job vacancy, gulf jobs, hotel jobs in dubai, hr jobs in dubai, i need job in dubai, i want job in dubai, it jobs dubai, it jobs in dubai, job for dubai, job hiring in dubai, job opening in dubai, job openings in dubai, job opportunities in dubai, job search dubai, job seekers in dubai, job sites, job sites in dubai, job vacancies in dubai, jobs at dubai, jobs dubai, jobs in dubai for freshers, jobs in dubai for indian, jobs in dubai for indians, jobs in dubai uae, jobs in gulf, latest job vacancies in dubai, latest jobs in dubai, marketing jobs in dubai, new jobs in dubai, nursing jobs in dubai, online jobs in dubai, part time jobs in dubai, real estate jobs in dubai, retail jobs in dubai, sales jobs in dubai, security jobs in dubai, teaching in dubai, teaching jobs in dubai, vacancies in dubai, work opportunities in dubai, Walk in, interview, Engineer Job, Secretary Job, Admin Job, Administration Job, Walk in interview, JOBDXB, dxb job, job dxb, walk in, walk in Dubai, Jobbozz

0 notes

Text

How to open a Bank account in Dubai?

Open a bank account in Dubai as an expatriate is different and probably take a little bit of more information than opening a bank account in Dubai as a resident. However, to open a bank account in Dubai is solely dependent on the bank or the city or state or the country.

To open a bank account in Dubai you need to have a valid passport or National Identification number – former is required for expats whereas the latter will be required for Dubai Residents. To learn more about how to open a bank account in Dubai online or open a bank account in Dubai eligibility criteria, bear with us. We will let you know about open a bank account in Dubai in small steps. Don’t worry we won’t let you go until you know and learn how to open a bank account in Dubai.

First, let us talk about the requirements to open a bank account in Dubai.

Requirements to open a bank account in Dubai

The minimum requirement of initial payment to open a bank account in Dubai is AED 3,000/= if you open a bank account in Mashreq Bank Dubai. Along with that, it is required to fill up an application form and a valid passport with residence visa page is required for expats and as well as Emirates ID holders. So these are the basic requirements to open a bank account in Dubai. Let’s move on to eligibility criteria.

Eligibility Criteria to open a bank account in Dubai

Eligibility criteria to open a bank account in Dubai is not that tough to pass. The only main eligibility standard criteria to open a bank account in Dubai are:

· Individual should earn a minimum of AED 5000/= every month

· Individual should be a visa holder for UAE Residence

· The minimum age for the applicant should be 21 or above

Benefits you get after opening a bank account in Dubai

Well, no doubt opening a bank account in Dubai and live peacefully ever after. There are not vague terms and conditions or any other miscellaneous charges, especially if you are open a bank account in Dubai that an Islamic bank. Here is a list of benefit you receive for open a bank account in Dubai. The followings are:

· Processing of the money and transaction is quick and easy

· Debit cards and checkbooks often take time to reach you after you open a bank account. However, this is not the case if you open a bank account in Dubai.

· Cashing out your money is convenient and flexible, and with a visa debit card, now you can shop online

· ATM cash withdrawal all over the world

· Card payments available

· Access to online banking

· Access to mobile banking

· 24/7 customer care service.

Can I open a bank account in Dubai online?

Yes, that is the best part of opening a bank account in UAE. Is that you can open a bank account online if you open a bank account in Mashreq Bank. All you need to is go to Mashreq Banks online platform and follow the instructions and fill in the application form required to open a bank account in Dubai. To make it easier for you, you will see a red round button with a plus sign on it located at the bottom right corner of the web page with the title of Apply Now.

When you click it you will be prompted with two options,

· Online Banking

· Mobile Banking

Suppose you click over the Online banking this will redirect you to another page with a sign-up form.

But if you click Mobile banking you will be redirected to a landing page of Snapp mobile application, in order to proceed with Mobile banking you have to download Mashreq bank’s exclusive mobile banking app and create an account.

Conclusion

It is important to open a bank account in Dubai today. Because as a middle class or upper middle class you need to keep a distance from your money, this can help in withdrawing money only when it feels necessary to. And most importantly your money is safe in the bank, even in case of a robbery the bank is obligated to return you cash you.

0 notes

Text

Get Business Loan in Dubai | UAE

PRO Banking offers a range of banking solutions to suit your needs.Choose PRO Banking for Personal Loans,Investments,Insurance and much morePro Banking UAE is an individual bank in the computerized age that assumes a serious part in the public eye with commitment.The computerized age assists us with carrying banking nearer and nearer to our clients and their requirements.As a bank, we base on inclusivity, sensibility, social business, improvement & regular banking to say the least

#UAE bank account open#uae bank account for non residents#.#uae bank account without minimum salary#emirates nbd#how to open bank account in uae online#how to open bank account in uae for non residents#can i open a bank account in dubai without emirates id#how to open a bank account in dubai online#minimum age to open bank account in uae#open business account online uae#best bank account for small business in uae#zero balance business account in uae#rak bank zero balance business account#business account opening in uae#emirates nbd business account#current account in dubai#mashreq bank business account charges.

0 notes

Text

Get Business Loan in Dubai | UAE

Get Business Loan in Dubai | UAE

Business Advances will assist you with developing your business. Assuming you need business advance for new organization in Dubai you have came to the ideal locations. For help with getting a Business Credit in the UAE, contact our specialists at Master banking .

Apply for your Business Financing now. No limitation on any Area or Identity. Office Open for Expats and UAE occupants.

Security Free

High advance measures of up to AED 3 million*

Adaptable reimbursement times of up to 60 months*

Least documentation

Least yearly turnover of 1 million required

What are the Features of a Business Loan in the UAE?

The Period of Repayment

A business credit has a reimbursement period that endures somewhere in the range of two and five years. The length of the credit restitution period is additionally impacted by the advance sum mentioned.

Pace of Interests

Various banks might charge different financing costs for business advances. The candidates' financing costs, notwithstanding, are impacted by various factors, including their record as a consumer, month to month pay, the quantity of credits they have open, the size of the advance, and so forth. A yearly decrease in financing costs from 15% to 24% is ordinary for organization advances.

Relationship Manager

The credit borrowers are given a relationship chief by most of banks in the Unified Bedouin Emirates so they can reach out to them in the event that they have any inquiries.

Business Account

On the day they apply for a business credit, the candidates should have an open business account with one of the banks in the Unified Middle Easterner Emirates. This helps the moneylender in getting a reference from the bank in regards to their collaboration with the candidate.

The Amount of Loan

In the Assembled Bedouin Emirates, business credits regularly shift from AED 50,000 to 5,000,000. The banks analyze what is going on and base the credit sum they offer on it.

What is the recommended Qualification Rules for a Business Credit in the UAE?

Ask your bank what necessities you should satisfy to be qualified for a business credit in the UAE. The necessities could vary from one bank to another.

We have referenced the most broad standards of any bank underneath

Income

Your organization probably been functional for essentially a year.

Activity

On the off chance that your organization is an auxiliary or part of an abroad working association, getting a business credit ought to be basic.

Turnover

To be qualified for a business credit, your yearly turnover should be something like 1 million AED.

Age Requirement

There is a 21 year old least age necessity for candidates.

Claiming a Business Record

You really want to have a business account with a bank in the Unified Middle Easterner Emirates.

Various kinds of business credits are accessible from banks and other monetary associations for different sorts of endeavors. An organization credit could have an amortization time of one to four years.

How to get a Business Loan in Dubai?

Dubai is an incredible spot to begin another organization in view of its great duty strategies and simplicity of carrying on with work. You have the choice to apply for various business advances assuming that you want to collect sufficient cash to fund your new organization. A urgent initial phase in effectively sending off a business in Dubai and guaranteeing its presence is getting this capital.

In this manner we have referenced our top ways to apply for a business credit in Dubai-

Decide Your Qualification to Apply for a Business Credit

The passing prerequisites should be met for the overwhelming majority little endeavors to be qualified for a business credit. From one bank to another in the UAE, the particular prerequisites change. Yet, these negligible circumstances apply to all banks:

The organization must have been in activity for somewhere around one year.

The yearly least turnover (sum differs per bank)

The new six to year business or individual bank articulations

Make The Appropriate Credit Determination for your Business

Various sorts and measures of organization credits are something you could think about. The benefits of four significant classifications of business advances are portrayed beneath:

Independent company Affiliation (SBA) Upheld Advance

At the point when your applications for bank credits have been denied, this is a practical decision.

It is upheld by the public authority of UAE

Government authorities reserve the privilege to exact serious fines in the event that installment terms are not stuck to.

Peruse more on Islamic money in Dubai and come out as comfortable with the Idea Islamic money covers generally monetary exchanges and speculations that comply with Sharia, or Islamic regulation. Islamic money depends on various basic ideas, some of which are as per the following: Cash should be made through moral transactions and resource speculations. Cash should be utilized gainfully. It against the law against the law to loan or acquire cash to acquire revenue. What Qualifications exist between Customary Money and Islamic Money? Islamic Money thusly follows benefit and misfortune sharing under an agreement since premium is prohibited by Islamic Regulation. Despite the fact that there are various unmistakable sorts of agreements, the mudarabah is one of the most famous. The profit and misfortunes will be dispensed between the financial backer and the business person as per this agreement, which is quite certain about it. The obligation regarding all misfortunes will likewise fall on the financial backer. The business person should pay interest no matter what the organization's monetary circumstance, as indicated by traditional money, which is something contrary to this. Set up every one of the Applicable Archives By having the records expected for a business credit prepared ahead of time, the application cycle can be accelerated. To handle a credit demand for a business in UAE, banks frequently need the accompanying reports: The bank records from the past six to a year A finished up bank application an organization understanding, a full legal authority, a reminder of affiliation, or other comparative report With the end goal of approval, you should present a duplicate of your exchange permit along with the veritable record The Identification copy for advance candidate The accompanying additional archives, which you ought to likewise have close by, are often mentioned by banks notwithstanding the ones expressed above, and are thusly indispensable to have available: Review Report A rundown of workers from the Service of Work Bill of Replenishing (if appropriate) Exchange Permit Occupancy Understanding for Proprietors' Home or Letter of Convenience for Sharing High Volume Exchange bills Endorsement for Tank How might you improve your Qualification for a Business Credit in UAE? You can expand your qualification for business advances by making the accompanying not many simple strides which are referenced beneathLimit the quantity of credits you take out immediatelyTo meet all requirements for an organization credit, first assess your monetary necessities. A further suggestion is to try not to present a few credit applications as this can hurt your financial soundness. Financial assessment Make cautious to keep your financial assessment at or over 750. It makes it more straightforward to rapidly support a business credit. Go with a more extended reimbursement term A more extended credit reimbursement period is something you ought to attempt to pick. It will empower you to serenely reimburse your business advance over the long run. The lower portion sum that outcomes from choosing a more drawn out reimbursement term is another advantage. Take care of Old Obligations Attempt to take care of any remaining obligations you have, including advances, Mastercard adjusts, and different obligations. What's more, make certain to make ideal installments on your portions in general. You can work on your qualification for an organization credit by doing this, since it will assist you with laying out an unblemished reimbursement history.

CONTACT US

+971555394457

#UAE bank account open#uae bank account for non residents#.#uae bank account without minimum salary#emirates nbd#how to open bank account in uae online#how to open bank account in uae for non residents#can i open a bank account in dubai without emirates id#how to open a bank account in dubai online#minimum age to open bank account in uae#open business account online uae#best bank account for small business in uae#zero balance business account in uae#rak bank zero balance business account#business account opening in uae#emirates nbd business account#current account in dubai#mashreq bank business account charges.

0 notes

Text

Personal Account - Open a Bank Account in UAE

PRO Banking offers a range of banking solutions to suit your needs.Choose PRO Banking for Personal Loans,Investments,Insurance and much morePro Banking UAE is an individual bank in the computerized age that assumes a serious part in the public eye with commitment.The computerized age assists us with carrying banking nearer and nearer to our clients and their requirements.As a bank, we base on inclusivity, sensibility, social business, improvement & regular banking to say the least

https://probankinguae.com/

#Choose PRO Banking for Personal Loans#Investments#we base on inclusivity#sensibility#social business#improvement & regular banking to say the least#UAE bank account open#uae bank account for non residents#.#uae bank account without minimum salary#emirates nbd#how to open bank account in uae online#how to open bank account in uae for non residents#can i open a bank account in dubai without emirates id#how to open a bank account in dubai online#minimum age to open bank account in uae#zero balance account in uae#online bank account opening with zero balance in uae#how to open bank account in uae without salary

0 notes

Text

Personal Account - Open a Bank Account in UAE

PRO Banking offers a range of banking solutions to suit your needs.Choose PRO Banking for Personal Loans,Investments,Insurance and much morePro Banking UAE is an individual bank in the computerized age that assumes a serious part in the public eye with commitment.The computerized age assists us with carrying banking nearer and nearer to our clients and their requirements.As a bank, we base on inclusivity, sensibility, social business, improvement & regular banking to say the least

#PRO Banking offers a range of banking solutions to suit your needs#Choose PRO Banking for Personal Loans#Investments#Insurance and much morePro Banking UAE is an individual bank in the computerized age that assumes a serious part in the public eye with com#we base on inclusivity#sensibility#social business#improvement & regular banking to say the least#UAE bank account open#uae bank account for non residents#.#uae bank account without minimum salary#emirates nbd#how to open bank account in uae online#how to open bank account in uae for non residents#can i open a bank account in dubai without emirates id#how to open a bank account in dubai online#minimum age to open bank account in uae#zero balance account in uae#online bank account opening with zero balance in uae#how to open bank account in uae without salary

0 notes

Text

Personal Account - Open a Bank Account in UAE

Personal Account - Open a Bank Account in UAE

Master Banking Individual Banking is custom-made to accommodate your monetary requirements. From dealing with your ordinary funds to making arrangements for a superior tomorrow, our set-up of individual ledgers is intended to help you at each step.

Whether you are searching for a restrictive head banking experience with Genius Bankinggold Private Client or need a helpful financial balance in UAE for your regular necessities, similar to a reserve funds or momentum account, you are at the perfect locations.

Opening a ledger in UAE with Master Banking is straightforward, you can visit any of the Star Bankingbank branches in your region to open an individual record. For abundance the board accounts, simply select a relationship that suits your abundance the executives and banking needs and snap on "Find out More".

Individual Record Types

Open a Current Account

Experience improved adaptability in dealing with your regular funds with Expert Financial Current Records.

Whether you are an expert or a money manager, a Genius Banking Current Record can offer straightforwardness and comfort for all your monetary necessities.Open current records online with Star Bankingbank and appreciate limitless actually looking at offices with your customized checkbook. With a Master Banking Current Record in UAE, you can likewise make let loose withdrawals to AED 40,000 every day through our huge organization of ATMs all over the planet.

Besides, an Ace Financial Current Record assists you with keeping steady over your funds consistently with 24-hour Web based banking, Portable banking and Genius Bankingphone banking administrations. Open an ebb and flow account with Genius Bankingbank and partake in a consistent financial encounter.

Features of Current Account

An ongoing record with Genius Banking offers the accompanying types of assistance:

Customized really take a look at book.

Limitless really taking a look at offices.

A worldwide check card.

Withdrawals up to AED 40,000 every day with no charge on Master Bankingbank ATMs all around the world. For non-Expert Financial ATMs, charges according to the Timetable of Charges will apply. Click here to get to the Timetable of Charges. Charge is autonomous of how much removed.

Accessible in a scope of significant monetary forms.

24 Hour Master Bankingphone Banking administration, Expert Bankingbank Internet banking and versatile banking.

Eligibility Criteria for a Current or Checking Account

Inhabitant of UAE

Least age ought to be 18 years of age

How to Open an Ongoing Record?

To open an Ace Financial Current Record, you really want to follow the underneath referenced advances:

In the event that you might want to keep an equilibrium beneath USD 200,000, you want to visit one of the Star Banking branches with the necessary records, and a Genius Banking Delegate will help you in opening your record. To see the rundown of reports that are expected to open an Expert Financial Current Record, kindly snap here.

In the event that you might want to keep an equilibrium above USD 200,000, you might be qualified for an Expert Bankinggold or Master Banking Private Client account that caters solely to your abundance the board needs.

Savings Account in UAE

Savings Account in UAE

Save & Earn more.

Whether you are putting something aside for a major buy or a blustery day, a Star Bankingbank investment account in UAE will assist you with arriving at your objectives effortlessly. The premium bearing Expert Bankingbank investment account offers simple admittance to your reserve funds at whatever point you need.

Furthermore, you can get to the Genius Bankingbank investment account online readily available with our 24-hour On the web and Expert Bankingphone banking administrations.

Get a Genius Bankingbank bank account and partake in the host of elements and advantages it brings to the table. To open an Ace Bankingbank investment account in UAE and draw nearer to your reserve funds objectives, you can visit your closest Star Bankingbank branch today!

A Star Bankingbank investment account in UAE can assist you with dealing with your financial necessities effortlessly. How about we take a gander at a portion of the elements and administrations that are presented by the Star Bankingbank investment account in UAE.

A savings account withpro banking provides the following services

Interest is determined on the base month to month balance.

Premium is credited to your record consistently.

Withdrawals up to AED 40,000 every day with no charge on Master Bankingbank ATMs internationally. For non-Star Banking ATMs, charges according to the Timetable of Charges will apply. Click here to get to the Timetable of Charges. Charge is autonomous of how much removed.

Accessible in a scope of significant monetary forms.

24 Hour Expert Bankingphone Banking administration, Genius Bankingbank Internet banking and versatile banking. Charge is free of how much removed.

Pro banking Best Account

Developing your reserve funds begins with picking the right investment account. Get cutthroat financing costs and streamline your reserve funds in USD, decide to open a Genius Banking Best Record in UAE.

Qualification Models

Mature: Somewhere around 18 years

Star Banking zenship: UAE Nationals and Occupants as it were

How to Open a Star Banking Best USD Record?

Assuming you are another client, in light of the relationship that you are searching for, kindly follow the beneath steps:

On the off chance that you might want to keep an equilibrium underneath USD 200,000 kindly visit one of our branches with the necessary reports and a Star Banking Delegate will help you in opening your record. To see the rundown of reports that are required, if it's not too much trouble, click here.

On the off chance that you are hoping to keep an equilibrium above USD 200,000, you might be qualified for a Star Bankinggold or Master Banking Private Client account that provides food solely to your abundance the board needs. Kindly snap here to fill a short application structure, an Expert Financial Delegate will reach out in the span of 24 hours to evaluate your monetary necessities and help you in account opening.

Contact us

+971555394457

#PRO Banking offers a range of banking solutions to suit your needs#Choose PRO Banking for Personal Loans#Investments#Insurance and much morePro Banking UAE is an individual bank in the computerized age that assumes a serious part in the public eye with com#we base on inclusivity#sensibility#social business#improvement & regular banking to say the least#UAE bank account open#uae bank account for non residents#.#uae bank account without minimum salary#emirates nbd#how to open bank account in uae online#how to open bank account in uae for non residents#can i open a bank account in dubai without emirates id#how to open a bank account in dubai online#minimum age to open bank account in uae#zero balance account in uae#online bank account opening with zero balance in uae#how to open bank account in uae without salary

0 notes

Text

Personal Account - Open a Bank Account in UAE

PRO Banking offers a range of banking solutions to suit your needs.Choose PRO Banking for Personal Loans,Investments,Insurance and much morePro Banking UAE is an individual bank in the computerized age that assumes a serious part in the public eye with commitment.The computerized age assists us with carrying banking nearer and nearer to our clients and their requirements.As a bank, we base on inclusivity, sensibility, social business, improvement & regular banking to say the least

#PRO Banking offers a range of banking solutions to suit your needs#Choose PRO Banking for Personal Loans#Investments#Insurance and much morePro Banking UAE is an individual bank in the computerized age that assumes a serious part in the public eye with com#we base on inclusivity#sensibility#social business#improvement & regular banking to say the least#UAE bank account open#uae bank account for non residents#.#uae bank account without minimum salary#emirates nbd#how to open bank account in uae online#how to open bank account in uae for non residents#can i open a bank account in dubai without emirates id#how to open a bank account in dubai online#minimum age to open bank account in uae#zero balance account in uae#online bank account opening with zero balance in uae#how to open bank account in uae without salary

0 notes

Text

How to open a bank account in the United Arab EmiratesBanking in the UAE

PRO Banking offers a range of banking solutions to suit your needs.Choose PRO Banking for Personal Loans,Investments,Insurance and much morePro Banking UAE is an individual bank in the computerized age that assumes a serious part in the public eye with commitment.The computerized age assists us with carrying banking nearer and nearer to our clients and their requirements.As a bank, we base on inclusivity, sensibility, social business, improvement & regular banking to say the least

#UAE bank account open#uae bank account for non residents#.#uae bank account without minimum salary#emirates nbd#how to open bank account in uae online#how to open bank account in uae for non residents#can i open a bank account in dubai without emirates id#how to open a bank account in dubai online#minimum age to open bank account in uae

0 notes

Text

How to open a bank account in the United Arab EmiratesBanking in the UAE

PRO Banking offers a range of banking solutions to suit your needs.Choose PRO Banking for Personal Loans,Investments,Insurance and much morePro Banking UAE is an individual bank in the computerized age that assumes a serious part in the public eye with commitment.The computerized age assists us with carrying banking nearer and nearer to our clients and their requirements.As a bank, we base on inclusivity, sensibility, social business, improvement & regular banking to say the least

#UAE bank account open#uae bank account for non residents#.#uae bank account without minimum salary#emirates nbd#how to open bank account in uae online#how to open bank account in uae for non residents#can i open a bank account in dubai without emirates id#how to open a bank account in dubai online#minimum age to open bank account in uae

0 notes