#mexicanretail hashtag

Explore tagged Tumblr posts

Text

Dynamic Shifts in Retail Formats: Meeting Growing Demands Over Time in Mexico

Written By: Gargi Sarma

Introduction:

Mexico has a thriving and varied retail scene that includes both classic and modern formats to meet the wide range of needs of the nation's customers. Mexican consumers have access to a diverse range of shopping experiences, ranging from vibrant markets and corner stores to expansive supermarkets and virtual marketplaces.

Figure 1: Market Share of Retail Models in Mexico (2022)

The changing nature of consumer needs is a notable feature of Mexico's retail industry. The shifting demographics, urbanization, and technological improvements driving the economy also drive changes in Mexican consumers' preferences and behaviors. Customers expect quality, variety, price, and convenience, which forces businesses to constantly innovate and adjust in response to these changing needs.

This article delves into the intriguing transformations taking place in the Mexican retail scene, specifically emphasizing the adjustments made to shop structures. We examine the shift from conventional storefronts to more contemporary spaces, examining the forces behind this change and its effects on shops and customers. We can obtain important insights into the changing retail dynamics influencing the Mexican market by looking at the dynamic interaction between customer needs and store formats.

Overview of Retail Formats in Mexico:

Figure 2: Modern Retail Models in Mexico

Growing Demands Driving Changes:

Key trends:

Rising disposable income: Increased spending power fuels demand for diverse and higher-quality products.

Urbanization: Growing urban population seeks convenience and a wider product range, driving demand for modern formats.

Technological adoption: Increased internet & smartphone usage influences online shopping and omnichannel experiences.

Changing values: Growing awareness of sustainability and health, impacting product choices and shopping preferences.

Experience: Desire for personalized, convenient, and engaging shopping experiences.

Retail Format Shifts:

Driving factors:

Urbanization: Demand for smaller, accessible formats like convenience stores and proximity retail.

Rising income: Growth of supermarkets, hypermarkets, and specialty stores offering wider product variety.

Globalization: Entry of international retailers and brands influencing format trends and competition.

E-commerce boom: Rapid growth of online shopping platforms like Mercado Libre and Amazon Mexico.

Changing consumer preferences: Shift towards convenience, experience, and omnichannel shopping journeys.

Case Studies:

OXXO: Convenience store chain adapting to changing demands by expanding product offerings, introducing digital services, and partnering with delivery platforms.

HEB supermarkets: Targeting premium grocery segment with a focus on fresh produce, prepared meals, and online ordering.

Liverpool department store: Launching omnichannel initiatives, integrating online and offline shopping experiences.

Mercado Libre e-commerce platform: Expanding physical presence with pickup points and partnering with traditional retailers.

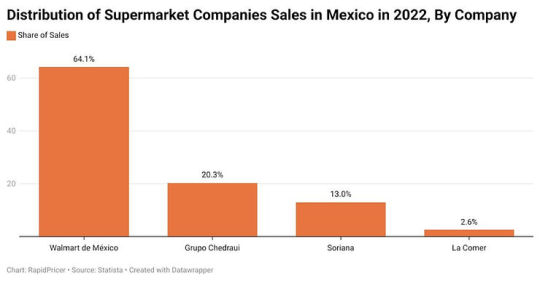

Figure 3: Distribution of Supermarket Companies Sales in Mexico in 2022, By Company

In 2022, the Mexican business of Walmart de México y Centroamérica accounted for 64.1% of total supermarket sales. The business made 813.06 billion Mexican pesos in net revenues in 2022 (Figure 4).

Evolution Over Time:

Figure 5: Comparison of Traditional and Modern Retail Landscapes in Mexico

Adaptation and Innovation:

Key adaptation strategies:

Omnichannel integration: Connecting online and offline experiences through click-and-collect, mobile apps, and personalized promotions.

Enhanced convenience: Expanding delivery options, self-checkout systems, and mobile payment solutions.

Data-driven insights: Utilizing customer data to personalize offers, optimize inventory, and predict trends.

Focus on experience: Creating engaging shopping environments, offering loyalty programs, and hosting events.

Sustainable practices: Implementing eco-friendly packaging, reducing waste, and sourcing responsibly.

Case Studies:

OXXO convenience stores: Partnering with delivery platforms, expanding payment options, and offering localized product selections.

Walmart Mexico: Launching "Super Willys" smaller format stores, investing in mobile payments, and expanding online grocery delivery.

Liverpool department store: Integrating virtual fitting rooms, offering personalized styling consultations, and partnering with local designers.

Farmacias del Ahorro pharmacy chain: Utilizing AI to optimize logistics and inventory management, and offering telemedicine services.

Challenges and Opportunities:

Challenges: Mexican retailers encounter infrastructure constraints, such as insufficient transportation and logistics systems, which may impede the effectiveness of their supply chains. Retailers face additional challenges in navigating the market from regulatory constraints such as complicated licensing procedures and taxation policies.

Figure 6: Retail Market in Mexico, 2022 - 2023 (Source: Technavio)

According to Technavio, between 2021 and 2026, the retail market in Mexico has the potential to increase by USD 9.72 billion.

Conclusion:

Technological developments, shifting consumer preferences, and socioeconomic transformations are all causing dynamic changes in Mexico's retail environment. The retail industry in Mexico shows a wide range of structures meeting the different needs of customers, from conventional markets and family-owned stores to contemporary supermarkets and e-commerce platforms. Retailers can innovate and adapt despite ongoing problems like infrastructure restrictions and regulatory obstacles. Retailers can overcome these obstacles and take advantage of Mexico's expanding market potential by utilizing technological advancements, adopting omnichannel strategies, and placing a high priority on the consumer. Proactive adjustment and calculated innovation will be essential for the retail sector to prosper in this changing and cutthroat environment as it continues to change.

About RapidPricer

RapidPricer helps automate pricing and promotions for retailers. The company has capabilities in retail pricing, artificial intelligence, and deep learning to compute merchandising actions for real-time execution in a retail environment.

Contact info:

Website: https://www.rapidpricer.com/

LinkedIn: https://www.linkedin.com/company/rapidpricer/

Email: [email protected]

#retailtransformation hashtag#mexicanretail hashtag#retailinnovation hashtag#consumertrends hashtag#urbanizationimpact hashtag#technologicaladvancements hashtag#omnichannelexperience hashtag#economicgrowth hashtag#sustainableretail hashtag#customerexperience hashtag#markettrends hashtag#retailevolution hashtag#convenienceshopping hashtag#supermarkettrends hashtag#ecommerceboom hashtag#digitaltransformation hashtag#dataanalytics hashtag#customerinsights hashtag#supplychainchallenges hashtag#regulatoryenvironment hashtag#infrastructureconstraints hashtag#marketopportunities hashtag#retailtech hashtag#dynamicShifts hashtag#adaptationstrategies hashtag#businessinnovation hashtag#retailgrowth hashtag#mexicaneconomy hashtag#marketexpansion hashtag#retailsolutions

0 notes

Text

Dynamic Assortment based on Seasons and Demand

Written By: Gargi Sarma

Mexico is distinguishing itself as one of the major markets through persistent development and gradual but consistent expansion in numerous areas. One industry that could outpace Mexico's typical projected national growth is the retail and consumer sector. By 2028, the retail market in Mexico is anticipated to expand at a CAGR of 5%. A mix of sociodemographic and economic changes, products, and commercial strategies to lure Mexican customers will drive this. More than any other industry, Mexico's retail and consumer sectors represent the prospects arising from the country's economic dualism. Alongside the resilient traditional 'changarros' and adapted ideas like OXXO and Farmacias Similares, there is a steady growth and development of modern format retail outlets and global franchises like Walmart and Starbucks.

In Mexico, COVID-19 has had a major impact on consumer shopping habits. Companies increased their efforts on digital platforms in response to the COVID-19 epidemic. These investments included creating a more user-friendly website, introducing direct-to-consumer operations, and forming partnerships with last-mile delivery providers.

The retail fashion sector in Mexico is thriving and changing quickly, driven by a wide range of consumer preferences and buying habits. Retailers can find a wide range of prospects in the Mexican market, from vibrant metropolises to charming small communities. A significant obstacle, though, is there among all of this dynamism: seasonal variations in consumer demand. Mexico's vast territory, diverse climate, and rich cultural traditions create a compelling case for optimizing assortments based on seasonal and location-specific factors. Here's why:

Figure 1: Importance of Assortment Planning

Increased Sales and Profits:

Meeting local demand: Offering products relevant to the local climate, holidays, and cultural preferences ensures you cater to customer needs and avoid stocking unwanted inventory. Imagine stocking winter jackets in Cancun or beach gear in Monterrey during winter.

Seasonal trends: Capitalizing on seasonal events like Christmas, back-to-school, or Cinco de Mayo with targeted product offerings can significantly boost sales.

Differentiation from competitors: Understanding local nuances allows you to stand out by offering unique products not available elsewhere, attracting and retaining customers.

Reduced Costs and Improved Efficiency:

Optimized inventory management: Matching your assortment to local demand helps reduce overstock and deadstock, lowering storage and disposal costs.

Improved supplier relationships: Working with local suppliers for seasonal products aligns with sustainability goals and potentially reduces transportation costs.

Efficient marketing: Tailoring marketing campaigns to specific locations and seasons ensures you reach the right audience with relevant messaging, maximizing campaign effectiveness.

Challenges of Seasonal Fluctuations:

Inventory management: Predicting demand accurately and avoiding overstock or stockouts is challenging, especially with sudden weather changes.

Price optimization: Balancing profits with competitive pricing during different seasons requires careful planning and adjustments.

Marketing and promotions: Tailoring campaigns to each season and reaching the right audience while managing advertising budgets effectively is crucial.

Staffing: Hiring and training additional staff during peak seasons can be costly and demanding.

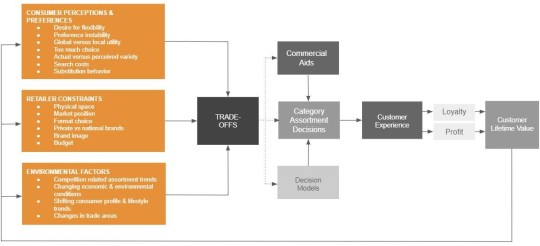

Figure 2: Challenges in Assortment Planning (Source: Why is Assortment Planning so Difficult for Retailers? A Framework and Research Agenda, Murali et al., 2009)

Geographical Considerations in Mexico:

Mexico's vastness and diverse geography paint a complex picture for retailers. Understanding how climate, terrain, and cultural traditions influence consumer behavior across regions is crucial for tailoring assortments and maximizing success.

Diverse Landscape:

Northern regions: Arid climates with hot summers and mild winters dominate. Think Chihuahua, Sonora, and Baja California.

Central highlands: Temperate climate with warm, dry summers and cool winters. Puebla, Tlaxcala, and Mexico City fall under this category.

Southern regions: Tropical climates with high humidity and hot temperatures year-round. Chiapas, Quintana Roo, and Oaxaca exemplify this zone.

Coastal areas: Varied climates depending on location. Pacific coasts tend to be drier, while Gulf coasts experience more humidity.

Impact on Preferences:

Clothing: Northern regions demand lighter clothing year-round, while southern regions require breathable fabrics suitable for humid conditions. Winter gear becomes relevant in the highlands.

Outdoor activities: Northern regions favor desert sports and hiking, while coastal areas see demand for water sports and beach gear. The highlands might see higher sales of camping equipment.

Home decor: Southern regions might opt for lighter furniture and natural materials, while colder areas might prefer heavier fabrics and heating solutions.

Food: Local ingredients and dishes vary greatly across regions. Northern cuisine tends to feature meat and beans, while southern cuisine leans towards seafood and tropical fruits.

Data-driven Approach to Assortment Planning:

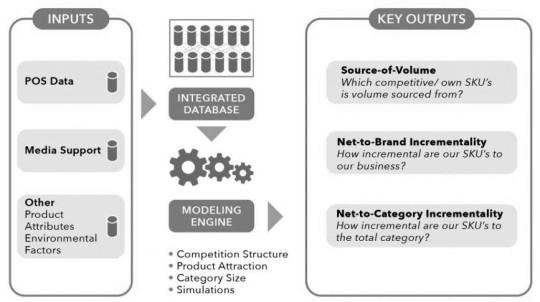

Figure 3: Data-driven Approach to Assortment Planning (Source: Analytic Edge)

These days, modern retail assortment planning is data-driven, using sales data to estimate demand and gain insight into customer preferences and historical performance. By disclosing rival tactics and market trends, market research enhances this strategy and enables merchants to modify assortments appropriately. Customization of product offers is made possible by the deeper understanding of customer behavior and preferences provided by consumer insights obtained through focus groups and surveys. By offering precise demand projections based on historical sales data and industry trends, machine learning and predictive analytics further improve assortment decisions. Retailers earn higher sales as a result of this inventory optimization.

Implementing Seasonal and Location-Based Assortments

The implementation of location- and season-based assortments in retail necessitates a methodical approach that takes seasonal shifts in consumer demand and geographic variations into account. Retailers can customize assortments to meet local demand and seasonal components by examining market trends, regional preferences, and historical sales data. Data analytics and inventory management systems enable strategies for optimizing inventory levels and SKU distribution across sites. Efficient cooperation between suppliers and partners guarantees the prompt supply of seasonal merchandise, and partnerships with local designers provide distinctive, locally-inspired items to assortments, making them more appealing to local clients.

Technology Solutions for Assortment Optimization:

Figure 4: Strategies to Optimize Product Assortment

Technology solutions are essential for retail assortment optimization because they provide state-of-the-art tools and platforms that improve decision-making and expedite assortment planning. Retailers can take advantage of a range of software tools and platforms, including category management software and assortment optimization platforms, that are designed to match their unique requirements. Because they can provide data-driven insights and predictive modeling skills, advanced analytics, artificial intelligence, and machine learning are essential for enhancing assortment strategies. Careful planning and execution are necessary for the successful integration of digital solutions into retail operations. To guarantee maximum benefits, special requirements must be assessed, comprehensive training must be given, and maintenance must continue.

Examples of Mexican Retailers Using Dynamic Assortment:

Costco - Costco's dynamic assortment strategy keeps up with seasonal and cultural trends, such as Mexican holidays and festivals, and offers a variety of products to attract customers.

Walmart - Walmart's Mexican stores, such as Sam's Club and Walmart Supercenter, feature dynamic assortments of products that change based on the seasons and customer demand.

The Home Depot - The Home Depot's Mexican stores offer a wide range of products for DIY enthusiasts and contractors, including seasonal items such as Christmas lights and Easter decorations.

Target - Target's Mexican stores, such as Target Hidalgo and El Paso.

Conclusion:

In summary, changing customer tastes, macroeconomic conditions, and technological breakthroughs will propel the retail industry in Mexico, which is expected to experience rapid expansion. Retailers may successfully manage seasonal swings, regional variances, and shifting market dynamics to optimize assortments and boost profitability by using data-driven strategies. The secret to success in this dynamic and exciting market will be to leverage technology solutions, strategic relationships, and a thorough awareness of local situations.

About RapidPricer

RapidPricer helps automate pricing and promotions for retailers. The company has capabilities in retail pricing, artificial intelligence and deep learning to compute merchandising actions for real-time execution in a retail environment.

Contact info:

Website: https://www.rapidpricer.com/

LinkedIn: https://www.linkedin.com/company/rapidpricer/

Email: [email protected]

#retailmexico hashtag#consumersector hashtag#retailtrends hashtag#mexicanmarket hashtag#assortmentplanning hashtag#retailstrategy hashtag#seasonaldemand hashtag#geographicalvariations hashtag#retailtech hashtag#dataanalytics hashtag#inventorymanagement hashtag#retailinnovation hashtag#customerpreferences hashtag#marketinsights hashtag#retailinsights hashtag#retailers hashtag#dynamicassortment hashtag#retailautomation hashtag#mexicanretailers hashtag#retailexpansion hashtag#economicgrowth hashtag#RetailChallenges hashtag#marketdynamics hashtag#seasonaltrends hashtag#locationbasedassortments hashtag#retailtechnology hashtag#artificialintelligence hashtag#machinelearning hashtag#retailoptimization

1 note

·

View note