#mexicanmarket hashtag

Explore tagged Tumblr posts

Text

Dynamic Assortment based on Seasons and Demand

Written By: Gargi Sarma

Mexico is distinguishing itself as one of the major markets through persistent development and gradual but consistent expansion in numerous areas. One industry that could outpace Mexico's typical projected national growth is the retail and consumer sector. By 2028, the retail market in Mexico is anticipated to expand at a CAGR of 5%. A mix of sociodemographic and economic changes, products, and commercial strategies to lure Mexican customers will drive this. More than any other industry, Mexico's retail and consumer sectors represent the prospects arising from the country's economic dualism. Alongside the resilient traditional 'changarros' and adapted ideas like OXXO and Farmacias Similares, there is a steady growth and development of modern format retail outlets and global franchises like Walmart and Starbucks.

In Mexico, COVID-19 has had a major impact on consumer shopping habits. Companies increased their efforts on digital platforms in response to the COVID-19 epidemic. These investments included creating a more user-friendly website, introducing direct-to-consumer operations, and forming partnerships with last-mile delivery providers.

The retail fashion sector in Mexico is thriving and changing quickly, driven by a wide range of consumer preferences and buying habits. Retailers can find a wide range of prospects in the Mexican market, from vibrant metropolises to charming small communities. A significant obstacle, though, is there among all of this dynamism: seasonal variations in consumer demand. Mexico's vast territory, diverse climate, and rich cultural traditions create a compelling case for optimizing assortments based on seasonal and location-specific factors. Here's why:

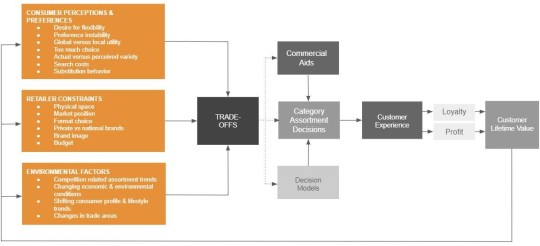

Figure 1: Importance of Assortment Planning

Increased Sales and Profits:

Meeting local demand: Offering products relevant to the local climate, holidays, and cultural preferences ensures you cater to customer needs and avoid stocking unwanted inventory. Imagine stocking winter jackets in Cancun or beach gear in Monterrey during winter.

Seasonal trends: Capitalizing on seasonal events like Christmas, back-to-school, or Cinco de Mayo with targeted product offerings can significantly boost sales.

Differentiation from competitors: Understanding local nuances allows you to stand out by offering unique products not available elsewhere, attracting and retaining customers.

Reduced Costs and Improved Efficiency:

Optimized inventory management: Matching your assortment to local demand helps reduce overstock and deadstock, lowering storage and disposal costs.

Improved supplier relationships: Working with local suppliers for seasonal products aligns with sustainability goals and potentially reduces transportation costs.

Efficient marketing: Tailoring marketing campaigns to specific locations and seasons ensures you reach the right audience with relevant messaging, maximizing campaign effectiveness.

Challenges of Seasonal Fluctuations:

Inventory management: Predicting demand accurately and avoiding overstock or stockouts is challenging, especially with sudden weather changes.

Price optimization: Balancing profits with competitive pricing during different seasons requires careful planning and adjustments.

Marketing and promotions: Tailoring campaigns to each season and reaching the right audience while managing advertising budgets effectively is crucial.

Staffing: Hiring and training additional staff during peak seasons can be costly and demanding.

Figure 2: Challenges in Assortment Planning (Source: Why is Assortment Planning so Difficult for Retailers? A Framework and Research Agenda, Murali et al., 2009)

Geographical Considerations in Mexico:

Mexico's vastness and diverse geography paint a complex picture for retailers. Understanding how climate, terrain, and cultural traditions influence consumer behavior across regions is crucial for tailoring assortments and maximizing success.

Diverse Landscape:

Northern regions: Arid climates with hot summers and mild winters dominate. Think Chihuahua, Sonora, and Baja California.

Central highlands: Temperate climate with warm, dry summers and cool winters. Puebla, Tlaxcala, and Mexico City fall under this category.

Southern regions: Tropical climates with high humidity and hot temperatures year-round. Chiapas, Quintana Roo, and Oaxaca exemplify this zone.

Coastal areas: Varied climates depending on location. Pacific coasts tend to be drier, while Gulf coasts experience more humidity.

Impact on Preferences:

Clothing: Northern regions demand lighter clothing year-round, while southern regions require breathable fabrics suitable for humid conditions. Winter gear becomes relevant in the highlands.

Outdoor activities: Northern regions favor desert sports and hiking, while coastal areas see demand for water sports and beach gear. The highlands might see higher sales of camping equipment.

Home decor: Southern regions might opt for lighter furniture and natural materials, while colder areas might prefer heavier fabrics and heating solutions.

Food: Local ingredients and dishes vary greatly across regions. Northern cuisine tends to feature meat and beans, while southern cuisine leans towards seafood and tropical fruits.

Data-driven Approach to Assortment Planning:

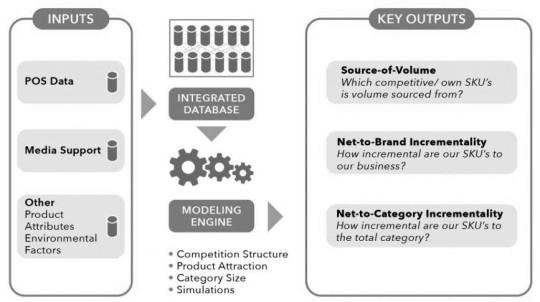

Figure 3: Data-driven Approach to Assortment Planning (Source: Analytic Edge)

These days, modern retail assortment planning is data-driven, using sales data to estimate demand and gain insight into customer preferences and historical performance. By disclosing rival tactics and market trends, market research enhances this strategy and enables merchants to modify assortments appropriately. Customization of product offers is made possible by the deeper understanding of customer behavior and preferences provided by consumer insights obtained through focus groups and surveys. By offering precise demand projections based on historical sales data and industry trends, machine learning and predictive analytics further improve assortment decisions. Retailers earn higher sales as a result of this inventory optimization.

Implementing Seasonal and Location-Based Assortments

The implementation of location- and season-based assortments in retail necessitates a methodical approach that takes seasonal shifts in consumer demand and geographic variations into account. Retailers can customize assortments to meet local demand and seasonal components by examining market trends, regional preferences, and historical sales data. Data analytics and inventory management systems enable strategies for optimizing inventory levels and SKU distribution across sites. Efficient cooperation between suppliers and partners guarantees the prompt supply of seasonal merchandise, and partnerships with local designers provide distinctive, locally-inspired items to assortments, making them more appealing to local clients.

Technology Solutions for Assortment Optimization:

Figure 4: Strategies to Optimize Product Assortment

Technology solutions are essential for retail assortment optimization because they provide state-of-the-art tools and platforms that improve decision-making and expedite assortment planning. Retailers can take advantage of a range of software tools and platforms, including category management software and assortment optimization platforms, that are designed to match their unique requirements. Because they can provide data-driven insights and predictive modeling skills, advanced analytics, artificial intelligence, and machine learning are essential for enhancing assortment strategies. Careful planning and execution are necessary for the successful integration of digital solutions into retail operations. To guarantee maximum benefits, special requirements must be assessed, comprehensive training must be given, and maintenance must continue.

Examples of Mexican Retailers Using Dynamic Assortment:

Costco - Costco's dynamic assortment strategy keeps up with seasonal and cultural trends, such as Mexican holidays and festivals, and offers a variety of products to attract customers.

Walmart - Walmart's Mexican stores, such as Sam's Club and Walmart Supercenter, feature dynamic assortments of products that change based on the seasons and customer demand.

The Home Depot - The Home Depot's Mexican stores offer a wide range of products for DIY enthusiasts and contractors, including seasonal items such as Christmas lights and Easter decorations.

Target - Target's Mexican stores, such as Target Hidalgo and El Paso.

Conclusion:

In summary, changing customer tastes, macroeconomic conditions, and technological breakthroughs will propel the retail industry in Mexico, which is expected to experience rapid expansion. Retailers may successfully manage seasonal swings, regional variances, and shifting market dynamics to optimize assortments and boost profitability by using data-driven strategies. The secret to success in this dynamic and exciting market will be to leverage technology solutions, strategic relationships, and a thorough awareness of local situations.

About RapidPricer

RapidPricer helps automate pricing and promotions for retailers. The company has capabilities in retail pricing, artificial intelligence and deep learning to compute merchandising actions for real-time execution in a retail environment.

Contact info:

Website: https://www.rapidpricer.com/

LinkedIn: https://www.linkedin.com/company/rapidpricer/

Email: [email protected]

#retailmexico hashtag#consumersector hashtag#retailtrends hashtag#mexicanmarket hashtag#assortmentplanning hashtag#retailstrategy hashtag#seasonaldemand hashtag#geographicalvariations hashtag#retailtech hashtag#dataanalytics hashtag#inventorymanagement hashtag#retailinnovation hashtag#customerpreferences hashtag#marketinsights hashtag#retailinsights hashtag#retailers hashtag#dynamicassortment hashtag#retailautomation hashtag#mexicanretailers hashtag#retailexpansion hashtag#economicgrowth hashtag#RetailChallenges hashtag#marketdynamics hashtag#seasonaltrends hashtag#locationbasedassortments hashtag#retailtechnology hashtag#artificialintelligence hashtag#machinelearning hashtag#retailoptimization

1 note

·

View note

Text

Evolution of Retail Consumers in Mexico

Written By: Gargi Sarma

Success in today's dynamic retail environment depends critically on recognizing and meeting customers' changing demands and preferences. This is particularly true in Mexico's dynamic market, where urbanization, shifting demographics, and changes in consumer behavior are transforming the retail industry.

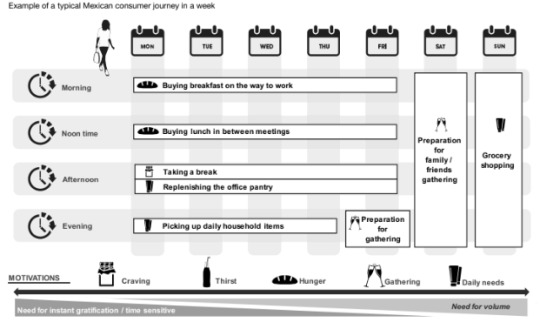

The growing need for convenience is one of the major themes influencing consumer behavior in Mexico. Convenience is given top priority when making purchases by modern consumers due to their hectic schedules and high standards. Time is becoming more and more of a limited resource, which is driven by several causes such as urbanization, longer working hours, and the development of dual-income households.

Figure 1: Online Acceleration in Mexico, 2022 (Source: McKinsey & Company)

In contrast to pre-pandemic levels, online sales of books and consumer electronics rose significantly in Mexico, and despite flat global demand, a wide range of consumer products showed a shift in sales to e-commerce platforms as a result of the pandemic (Figure 1).

Market Dynamics:

The Mexican convenience store market is expected to grow at a CAGR of 5.4% from 2022 to 2027. This growth is being driven by several factors, including the increasing urbanization of the Mexican population, the rising disposable incomes of Mexican consumers, and the growing popularity of convenience shopping.

The new Mexican consumer is younger, more tech-savvy, and more demanding than previous generations. They are looking for convenient shopping experiences that are tailored to their needs and preferences.

Retailers need to adopt new business models to cater to the new Mexican consumer. This includes offering a wider variety of products and services, providing more convenient shopping options, and using technology to personalize the shopping experience.

Knowing Consumer Values: Two Mexicos, One Growing Middle Class

Mexico's Duality: A clear image of economic and social inequality is painted by the idea of two Mexicos: one established and formal, and the other less developed and informal. A growing middle class made up of customers from both sides, who individually cling to their values while looking for goods and services that speak to them, is the unifying factor within this complex terrain.

Recognizing the Principles: Although the story of "Two Mexicos" depicts general economic realities, it's important to keep in mind that customers within each category are not monolithic groups. The middle class has a wide range of complex and varied values and goals.

From Mexico's Developed States:

Aspiration for modernity: Customers look for cutting-edge technology and fashionable, well-known brands worldwide.

Appreciate quality and experience: They place a high priority on upscale goods, practicality, and individualized care.

Awareness of one's well-being and health: Eco-friendly, sustainable, and organic products are popular.

Figure 2: Example of A Typical Mexican Consumer Journey in a Week (Source: PwC)

From Mexico informally:

Value for money: Practicality and affordability should be prioritized, along with budget consciousness.;

Community and trust are important Strong relationships are formed between known stores and local brands.

Entrepreneurial spirit: Do-it-yourself projects and resourcefulness are highly valued.

Filling the Void: Comprehending these distinctions in values is imperative for companies targeting the expanding middle class. Effective tactics will not only copy models from "Mexico," but instead provide a range of goods and services: Appeal to premium and cost-conscious markets.

Adopt omnichannel tactics: For ease of use and accessibility, integrate physical and online experiences.

Bring new ideas to the local market: Adjust international patterns to suit local tastes and circumstances.

Establish community and trust: Join forces with nearby companies and participate in neighborhood projects.

The New Mexican Consumer:

Tech-savvy and mobile: This group is comfortable using online tools for shopping, research, and payments. They expect seamless omnichannel experiences.

Time-pressed: Juggling work, family, and social commitments, they value convenience and speed. They're more likely to make smaller, frequent purchases than large, infrequent ones.

Value-conscious: They seek quality products at affordable prices. Private-label brands and value packs can be appealing.

Digitally connected: They rely on social media and online reviews for information and recommendations. Building a strong online presence is crucial.

Mexican Consumers Look to E-commerce for Better Prices:

Mexican consumers, particularly younger generations, are increasingly turning to e-commerce for their shopping needs, driven by the allure of better prices. This trend is fueled by several factors, including rising inflation, growing internet access, and the convenience of mobile shopping. Platforms like Mercado Libre and Amazon are attracting new users seeking deals and wider product selection compared to traditional brick-and-mortar stores. While brand loyalty remains important, price sensitivity is driving the shift, with savvy shoppers comparing prices across platforms before making a purchase. This trend presents both challenges and opportunities for businesses, requiring them to adapt their online strategies to offer competitive pricing, seamless buying experiences, and robust logistics networks to meet the expectations of the evolving Mexican consumer.

Figure 3: Top Reasons For Buying Food and Household Supplies Online, Mexico (2023)

In Figure 3, according to the McKinsey Survey, the results between the pre-COVID-19 pandemic and early 2023, it was revealed that although it is no longer the primary means of purchase for Mexican consumers as it was during the pandemic, online shopping nevertheless accounts for a larger portion of purchases than it did before the outbreak: 17 percent of respondents say they shop online for most or all of their purchases, up from 15 percent of prepandemic respondents. Customers claim that the main reason they shop online is the price: they can locate more affordable goods, take advantage of larger discounts, and quickly compare costs across various merchants. Online purchasing is convenient for them as well. However, they do have some reservations about online shopping. These reservations stem from the potential for defective or damaged goods to arrive, mismatches between what is advertised online and what is received, and expensive delivery or shipping costs.

Figure 4: Share of Respondents Reporting That They Buy Products Online Most of the Time Or Always, By Category, Mexico (2023)

According to the McKinsey Survey (Figure 4), the results between the pre-COVID-19 pandemic and early 2023, it was revealed that the mentioned categories saw the largest movement away from traditional brick-and-mortar stores and toward online shopping: cosmetics, consumer electronics, and toys and infant supplies. These tendencies have a resemblance to e-commerce patterns observed in developed markets.

Going Beyond Division:

It's critical to keep in mind that distinctions between the "two Mexicos" are becoming more hazy. As consumers become more knowledgeable and connected, hybrid values—which combine old sensibilities with modern aspirations—become more prevalent.

Through identification of this dynamic and comprehension of the varied values held by the emerging middle class, companies can seize enormous prospects inside the Mexican market.

Prioritizing ease in their goods and strategies is crucial for merchants hoping to win over the attention and allegiance of the new Mexican consumer. The following are some crucial tactics that retailers should use:

Optimized Store Formats: To improve customer convenience, retailers can rethink their store layouts. To make shopping more efficient, this involves placing products in strategic locations, having clear signage, and having a simple navigation system. Convenience can be further improved by providing options like click-and-collect or in-store pickup for online orders.

E-commerce and Delivery Services: E-commerce is expanding quickly in Mexico as a result of the country's rising smartphone and internet connectivity rates. By making investments in reliable online platforms and effective delivery services, retailers may profit from this trend. Options for same-day or next-day delivery can greatly increase convenience for customers who would rather purchase from home.

Localized Assortments: By ensuring that customers can locate the items they need without having to search far, localized product assortments can increase convenience by taking into account regional preferences. In order to appeal to various customer segments, merchants provide a variety of payment choices as part of their specialized approach.

Technology Integration: You may improve convenience and expedite the shopping process by utilizing technology, such as digital loyalty programs, self-checkout kiosks, and mobile apps. Mobile apps, for example, can save users time and effort by offering tailored suggestions, instant inventory updates, and easy payment processes.

Convenient Payment Solutions: Offering digital wallets, installment plans, and contactless payment choices can streamline the payment process, reducing friction at the point of sale and improving customer convenience. Additionally, loyalty programs that offer discounts for regular purchases might encourage recurring business.

Emphasis on Accessibility: Providing a really easy shopping experience requires ensuring accessibility for all customers, especially those with special needs or disabilities. This entails taking into account things like wheelchair accessibility, unambiguous signage, and assistance services to let clients successfully explore the store.

Conclusion:

In summary, convenience is now a need for merchants hoping to succeed in Mexico's cutthroat market rather than merely a nice-to-have. Through the implementation of tactics that cater to the needs of the New Mexican Consumer and a focus on convenience, businesses may foster customer loyalty, increase customer happiness, and ultimately thrive in the dynamic retail industry.

About RapidPricer

RapidPricer helps automate pricing and promotions for retailers. The company has capabilities in retail pricing, artificial intelligence and deep learning to compute merchandising actions for real-time execution in a retail environment.

Contact info:

Website: https://www.rapidpricer.com/

LinkedIn: https://www.linkedin.com/company/rapidpricer/

Email: [email protected]

#retailevolution hashtag#mexicanconsumers hashtag#convenienceshopping hashtag#ecommercetrends hashtag#techsavvyconsumers hashtag#urbanizationimpact hashtag#middleclassgrowth hashtag#consumerbehavior hashtag#omnichannelretail hashtag#mexicanmarket hashtag#digitaltransformation hashtag#onlineshopping hashtag#customerexperience hashtag#retailindustry hashtag#pricesensitivity hashtag#brandloyalty hashtag#convenientpaymentoptions hashtag#localizedassortments hashtag#mobileshopping hashtag#retailinnovation hashtag#marketdynamics hashtag#mexicaneconomy hashtag#digitalloyaltyprograms#hashtag#ConvenientPaymentMethods#CustomerSatisfaction#RetailTechnology#EconomicTrends#CustomerConvenience#MexicanRetail

0 notes