#metlif coverage

Explore tagged Tumblr posts

Text

“They are overdoing it a bit for sure, especially my situation,” Travis said when asked by Jason about the coverage. “They’re just trying to have fun with it.”

NBC flashed to Swift in the suite at MetLife Stadium 17 times during the Chiefs’ 23-20 Sunday night win over the Jets.

“Damn, that’s crazy,” Travis said. “That’s like once a drive. Mom told me everyone was enjoying themselves.”

“They are not there to get thrown on the TV,” Travis said. “You never know you get caught throwing down a big old cheeseburger and you look like an idiot. There are certain things you just don’t want to be on TV at all times.”

Jason noted the boost in female viewership Travis’ games have seen the past two weeks with Swift in attendance as the relationship has gone from rumor to reality.

“The NFL is not used to celebrities coming to the games,” Jason said. “Basketball has it figured out … You show them once, let them know they’re there, maybe after a touchdown, but you can’t go overboard with it. People are there to watch the game.”

The NFL received criticism after the game when it changed the bio on its Instagram account to read: “chiefs are 2-0 as swifties.”

“We frequently change our bios and profile imagery based on what’s happening in and around our games, as well as culturally,” the league said in a statement issued to The Post. “The Taylor Swift and Travis Kelce news has been a pop cultural moment we’ve leaned into in real time, as it’s an intersection of sport and entertainment, and we’ve seen an incredible amount of positivity around the sport.”

80 notes

·

View notes

Text

Taylor & Travis Timeline

October 2023 - part 1

October 1 - Travis is seen leaving Taylor's NYC apartment around 11am. Travis heads back to his hotel where the team is staying before his Chiefs vs Jets Game at MetLife Stadium

Taylor attends the Chiefs vs Jets game at MetLife Stadium, NJ, with Blake Lively, Ryan Reynolds, Hugh Jackman, Shawn Levy, Donna Kelce, Sophie Turner, Sabrina Carpenter, Brittany Mahomes, Melanie Nyema, Austin Swift & girlfriend Sydney Ness, Ashley Avignone, Robyn Lively, and more. The camera cut to Taylor approx. 17 times during the game and the Eras Tour film trailer played twice during ad breaks. Taylor was seen hugging Donna, saying "you're amazing, I don't know how you do it" when the score was 20-20. Taylor was also seen mimicking Travis. The NFL change their tiktok and twitter pages again to reference Taylor's attendance. Various media outlets post footage of Taylor at the game, Travis likes a post of Taylor's reaction to a Chiefs touchdown. The Chiefs won 23-20.

After the game, Taylor was pictured leaving Zero Bond in the early hours of October 2. (x)

October 3 - Taylor is at Electric Lady Studios, walking in with Keleigh Teller. Taylor's shirt is referencing the song 'Any Man of Mine' by Shania Twain, the first lyrics of which are (x)

"This is what a woman wants Any man of mine better be proud of me"

Her hat says "Still Here", possibly referencing her Karma lyric

"Ask me why so many fade, but I'm still here"

October 3 is also National Boyfriend Day.

US Weekly releases an article with quotes from 6 sources on "Why Taylor isn't hiding her romance with Travis Kelce" (x)

"Taylor has decided she's not going to hide anymore"

"She's going to be her authentic self and enjoy life"

The two "talk every day"

"Taylor's really enjoying getting to know Travis, they're taking it day by day, but she has high hopes. She likes that he's a normal nice guy. He's down-to-earth and isn't affected by fame. She also thinks he's hot"

"Travis is completely smitten"

"Taylor is at a point in her life where she's no longer willing to hold back. If something feels right - like it does with Travis - she's jumping in with both feet. She's very happy and loving life right now"

October 4 - Ep 57 of New Heights airs, part of the title is "The NFL Needs to Calm Down" (x)

"Is the NFL overdoing it? What is your honest opinion on how the NFL is treating celebrities at games?" asks Jason

"I think it's fun when they show who is at the game, I think it brings a little bit more to the atmosphere, brings a little bit more to what you're watching but at the same time I think they're overdoing it a little bit for sure, especially my situation. I think they're just trying to have fun with it... [the celebrities] are not there to get thrown on TV" responds Travis

October 5 - It's Travis' birthday today! He turns 34.

Donna Kelce makes an appearance on the 'Got it From My Momma' podcast. When asked what her favourite Taylor Swift song is, she responds (x)

"I think probably 'Shake It Off' -- we're getting a lot of that lately, about haters," Donna said with a laugh.

When asked if she's surprised about the infatuation surrounding Taylor and Travis' relationship

"I feel like I'm in an alternate universe because it's something that I've never been involved with ever before," Donna said.

The NFL release a statement in response to the New Heights podcast episode discussing the NFL "overdoing" coverage of Taylor at the Chiefs games, saying (x)

"The Taylor Swift and Travis Kelce news has been a pop cultural moment we've leaned into in real time, as it's an intersection of sport and entertainment, and we've seen an incredible amount of positivity around the sport."

DJ's Loud Luxury post to IG with a video of Travis saying "POV taylor's bf came to your show before swifties found out about football", to which Travis likes and comments saying "I was turnt up!!" (x)

instagram

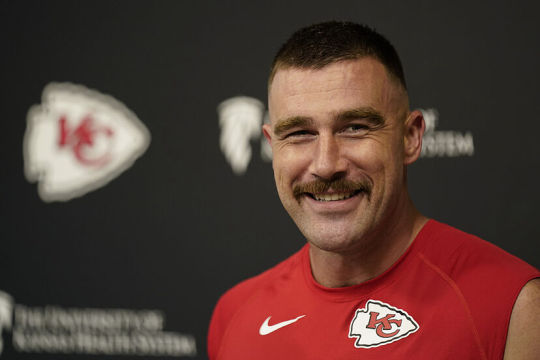

October 6 - Travis speaks at a press conference. When asked about how he is adjusting to public interest in his relationship with Taylor, he says (x x)

"As all the attention comes, it feels like I was on top of the world after the Super Bowl and right now, even more on top of the world. So it's fun,"

“We’re learning with the paparazzi just taking photos from all over the place. But at the same time, it comes with it,” he continued. “You got a lot of people that care about Taylor for good reason. You just got to keep living and learning and enjoying the moments. At the end of the day, I’ve always been pretty good at compartmentalising and being able to stay focused in this building.”

“I always check myself and my ego at the door and make sure that I come in with a clear mind,” he said, before being asked his thoughts on Swift’s world. “It’s worldwide, it’s worldwide, man. It’s been magnified for sure, though.”

A report comes out stating that the NFL asked its networks to promote the Taylor Swift Eras Tour Film at the Chiefs vs Jets game, likely in a bid to get Taylor to perform at the Super Bowl halftime show. (x)

October 6 - Taylor reportedly flew to Kansas City "to see Travis" for his birthday to have a "chill night" (x). A sneaky little visit for Trav's birthday.

October 7 - Taylor leaves Kansas City.

Travis flies into Minnesota for the Chiefs vs Vikings game

October 8 - Travis plays in the Chiefs vs Vikings game in Minnesota. Travis injures his ankle during the game but after an x-ray he returns to the field and scores a touchdown. The Chiefs win 27-20 (x) (x) (x)

Travis would later post pictures of this walk-in fit with the caption (x)

"keep it chill like Sauvignon Blanc"

These are lyrics from the song "Lil Boo Thang" by Paul Russell, which contains other lyrics such as

"I'll be shootin' that shot like 2K, girl"

"But I'm tryna get to know you at least Don't take my talkin' to you wrong I can keep it chill like a sauvignon blanc I'ma keep it real when your man long gone If you're lookin' for a friend, then you got the wrong song"

"You a ten, baby girl, but I'm the one"

October 9 - The Messenger puts out an article in which a source states (x x)

"[Travis] jokes [Taylor] is his good luck charm.

“Taylor is having the time of her life at these football games cheering on Travis. [Taylor] and her friends are fully embracing this era and are having a lot of fun being there. Taylor has worked very hard this last year and It’s fun for her to bring all of her friends along, let loose and show support.”

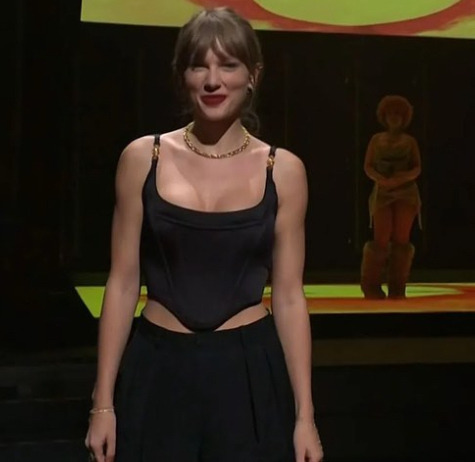

October 11 - Taylor is in LA for her Taylor Swift: The Eras Tour Film premiere. She shuts down The Grove, LA to host a red carpet and early screening event with selected fans, wearing a very 1989-coded blue Oscar de la Renta dress.

Travis, take note, she loved us first <3

TMZ releases an article saying that Taylor intends to attend Travis' next game. The question is, will Travis play with his injured ankle? (x)

"Sources with direct knowledge tell TMZ Taylor plans to travel to Missouri to watch Travis and the Kansas City Chiefs take on the Denver Broncos"

October 12 - Taylor attends Arrowhead Stadium to support Travis as the Kansas Chiefs take on Denver Broncos. Taylor is seen cheering on the team alongside Donna Kelce and Ed Kelce. Chiefs defeat Broncos 19 - 8 (x)

The Eras Tour concert film is released today (a day early) due to high demand in the USA and Canada (x)

October 13 - I go to see the Eras Tour concert film! just an FYI :)

October 14 - Taylor, Travis and friends fly to NYC

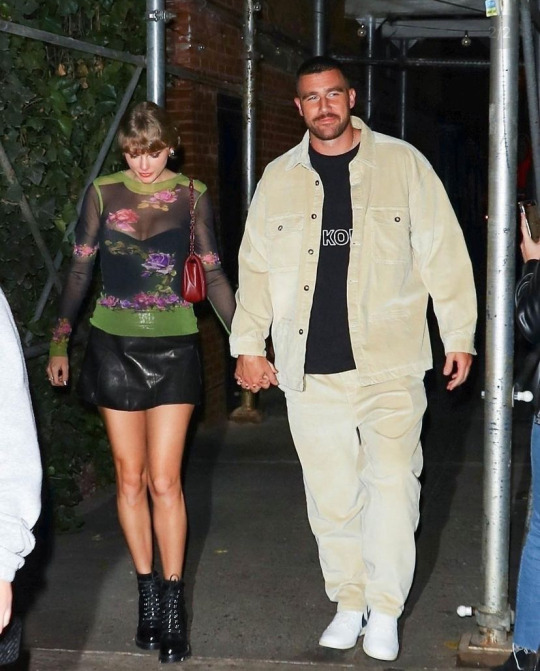

Taylor and Travis photographed holding hands as they arrive at Nobu, NYC, publicly confirming that they are a couple (x)

Taylor and Travis make guest appearances on SNL - Travis makes a cameo at the end of a sketch parodying the NFL frenzy over their romance. Taylor introduces Ice Spice as the musical guest. (full skit x) SNL IG (x x)

Taylor & Travis attend the SNL afterparty at Catch Steak NYC (x)

According to People (x) (x)

“Taylor and Travis were there all night and they were so smiley, they were so happy,” the source says. “They were so talkative. They were really fun. They talked to every single person in the room that talked to them.” “They were super cool. Super nice, super happy,” the insider adds, noting that Swift and Kelce stayed at the party “until after 4 a.m.” The source also says the pair was definitely not shy with each other.

Although Swift and Kelce “mingled separately,” the pro athlete “kept going over to her and checking in on her every little while, like, ‘Are you good?’ ” the source says. "He was going over and touching her, putting his hand on her lower back or putting his hands on her waist and then they would do a little kiss and then they would go back to talking to whoever they were talking to. He gave her space to talk to other people in the room, and he talked to a ton of people in the room too."

Swift and the Kansas City Chiefs player reportedly carved out some private time at the party, as well. The insider said there was a moment when Travis placed his hands on the “Bejewled” singer’s shoulders “so they're face to face, and then he takes both his hands and grabs her waist. They're leaning in, they're kissing each other." A source told PEOPLE that despite their busy schedules, Swift and Travis are giving romance "a real try." The insider said, "There's not some looming date like, 'Oh, she's going back on tour' and 'his football schedule is getting crazy.' They'll figure it out. He's said it himself, he knows what he signed up for with this attention, but they've spent time under the radar too. They're giving things a real try."

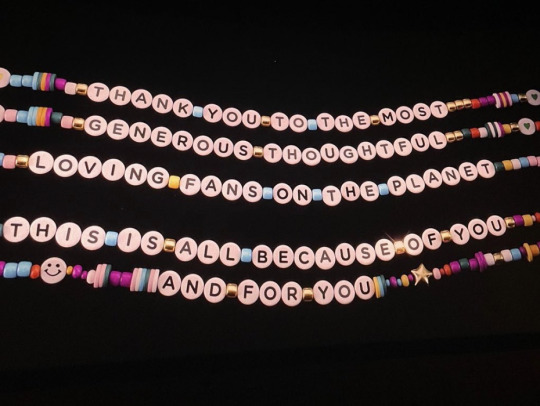

October 15 - Travis attends Eagles vs Jets game to support his brother Jason Kelce at MetLife Stadium, NJ. He is seen leaving Taylor's NYC apartment. Travis is given a friendship bracelet with beads spelling out "on the map" referencing a tiktok trend. He smiles and holds it to his heart. (x) (x)

Taylor & Travis are pictured leaving The Waverly Inn, NYC (x).

A nosey diner shares her observations of Taylor & Travis getting cosy (x)

Annie Williamson told The Messenger. "It looked super romantic and was super intimate."

"I cannot emphasize enough how close they were sitting, like so close and snuggled up."

Ms Williamson also shared a video of the couple leaving the restaurant (x). Thank you for your service Annie 🫡

Erin Andrews and Charissa Thompson remind their listeners of the Calm Down with Erin and Charissa podcast recorded on August 3 where they implore Taylor to date their friend Travis (x)

“please try our friend Travis. He is fantastic”

to which Travis commented on IG

“😂😂 You two are something else!! 🙌🏻🙌🏻 I owe you big time!!”

Go to previous update -> September 2023 Part 2

Go to next update -> October 2023 Part 2

Return to timeline

#taylor swift#travis kelce#taylor and travis#taylor swift and travis kelce#traylor#87 and 89#timeline#killatrav#seemingly ranch#tayvis#Taylor & Travis timeline#87 + 13 = 100#tnt#love story#chiefs#nyc#snl#the eras tour film

82 notes

·

View notes

Text

America THIS is UNACCEPTABLE: Every VETERAN deserves unlimited acess to medical care, including oral health care and psychosocial services. We can do better. 🇺🇸

Veterans access better oral health care via non-military employers and non-profit organizations than through our government. 🤕

If you want to understand BUREAUCRACY and misplaced priorities, then look no further than how America mis-TREATS our veterans. NYC is shelling out BILLIONS to provide for (non-working) "migrants," while our VETERANS lack access to oral health care. 🤦♀️

Everyday American citizens form non-profit organizations to provide dental care to Veterans.

Smile Faith Dental (2022) bankrupt as 95% of Bay Area Veterans lack access to oral health care.

youtube

Orange County Dentists Step Up in 2018 to "fill" in the gaps.

youtube

Smile4Vets •Got Your 6 •The Healthy Mouth Movement (Aspen Dental)

youtube

Veterans rely on independent citizen journalists to EXPLAIN benefits lack of coverage.

youtube

youtube

A (2014) three (3) year national PILOT Program "to assess the feasibility and advisability of providing a premium-based dental insurance plan to ELIGIBLE individuals." 🥴 #do better

Yet Another REMINDER: We're Broke & Busted 🥴

youtube

youtube

#do better#veterans#VA#illegal immigration#vote for the orange man#national debt clock#we're broke#smile4vets#got your 6#got your back#veterans administration#vererans affairs#wake up america#don't walk run

5 notes

·

View notes

Text

Please know I'm not trying to nit pick but there's no *law* about losing your insurance at 26. That's an industry standard insurance companies set for themselves. In fact the military insurance, Tricare, dependent children fall off at 18 and can pay extra to stay on until 23.

For any other insurance like renters or automotive, you can have your family on the plan. I was just comparing car insurance last night. I can add my parents, my brother, or anyone else to the plan if I wanted. I don't even need to own the car I want to insure. The benefit to that is we get a discount by adding more people to the plan.

Health plans won't let you add other adults because they want to bleed you for every penny you have. The coverage until 26 standard is just another way UHC, Cigna, Metlife, BCBS, Anthem, United Concordia, etc. use to screw you.

Things we already know about the UHC shooter, mostly from his social media:

- He has a bachelor’s and Master’s in computer science from an Ivy League school.

- He has read several books on chronic back pain.

- His profile banner includes a photo of an x-ray for back surgery. (Spinal fusion I believe.)

- Based on messages from his family, he dropped off the map a few months ago and they’ve been worried about him.

- His political beliefs are a bit all over the map; without doing a deep-dive my take is a pretty average centrist tech bro who’s read too much evopsych.

I’m a bit worried that, as the left is so fond of doing, people will turn on him immediately for that last part. Let’s not do that! Can we agree not to do that? Because here’s the important thing:

He’s a victim of the system, just like we all are. The system pushed him past his limits, and he lashed out at it. The details of his political leanings don’t actually matter - what matters is that you don’t have to be a radical leftist to lash out at a health insurance company. That’s shows how bad things are broken, that a guy who seems fairly privileged in most respects, with no strong political motive, could be beaten down and broken to the point of doing this. He has two Ivy League computer science degrees and yet had nothing left to lose.

This is a class war that doesn’t differentiate between the working class, middle class, even upper middle class. We’re all dog food for the 1% to chew up and spit out. Even if he turned out to be hardcore right wing, in this one single issue we’re united with him.

Everyone’s been talking about how this guy has seen insane levels of support across the political spectrum - which means nobody should be shocked that he could have come from any spot on that spectrum. I’m hoping the fact that he doesn’t seem super far left or right politically will make it easier to keep that unity, but the left just looooves our purity tests. Let’s maybe not this time.

#I could go on a hours long rant about how insurance companies fuck you in ways you don't even understand#How networks are just glorified price fixing#How insurance companies spend your premiums on investments#HOW METLIFE OWNS A FUCKING FOOTBALL STADIUM#How I've had a rep in the claims department tell me management REQUIRES them to deny a specific percentage of claims every quarter#regardless of validity#How your insurance fucks you and then blames your doctor#How Cigna does shit like refuses to pay for dental crowns until the seat date but there is no recognized ADA code for a crown delivery#How BCBS of Texas made up a fake ADA code for orthodontic billing that the American Dental Association doesn't recognize

9K notes

·

View notes

Text

PNB MetLife 1 Crore Life Insurance: Secure Your Family's Future

Life insurance is a fundamental pillar of financial security, providing a safety net for your loved ones in the event of your untimely demise. Among the various life insurance plans available in India, a 1 Crore life insurance policy from PNB MetLife stands out as an attractive option. With a high coverage amount, this policy ensures that your family will have the necessary financial resources to maintain their lifestyle and achieve long-term goals, even in your absence. In this article, we will explore the features, benefits, and reasons to consider a PNB MetLife 1 Crore life insurance policy.

Why Choose a 1 Crore Life Insurance Policy?

A sum assured of 1 crore is a significant amount that can provide a substantial financial buffer to your family. Here are some key reasons why opting for a 1 crore life insurance policy makes sense:

Comprehensive Coverage: A 1 crore life insurance policy offers comprehensive coverage to meet major financial obligations such as paying off debts, home loans, and supporting your family's living expenses.

Inflation Protection: With rising costs of education, healthcare, and day-to-day living expenses, a 1 crore policy ensures that your family has enough resources to deal with inflation over time.

Long-term Financial Security: The payout from a 1 crore policy can help your family achieve long-term goals, such as funding your children’s education, marriage, or other life events.

Debt Clearance: If you have any outstanding loans, such as home loans, car loans, or business loans, the 1 crore payout can help clear these debts, ensuring that your family is not burdened with repayments.

Features of PNB MetLife’s 1 Crore Life Insurance Policy

PNB MetLife offers a range of life insurance plans that cater to different financial needs. Here are the notable features of a 1 crore life insurance policy from PNB MetLife:

High Sum Assured: The policy provides a large sum assured of 1 crore, ensuring adequate financial protection for your loved ones in your absence.

Affordable Premiums: Despite the high coverage, the premiums for a 1 crore policy are generally affordable, especially if you purchase the policy at a younger age. Term life insurance plans from PNB MetLife offer competitive premium rates.

Flexible Payment Options: PNB MetLife provides flexibility in premium payment options, allowing you to choose from annual, semi-annual, quarterly, or monthly modes of payment.

Multiple Plan Options: PNB MetLife offers different variants of life insurance plans, such as term insurance, ULIPs (Unit Linked Insurance Plans), and endowment plans, allowing you to choose a plan that best suits your financial objectives.

Rider Benefits: PNB MetLife allows you to enhance your policy coverage with additional riders, such as critical illness cover, accidental death benefit, waiver of premium, and more.

Tax Benefits: Premiums paid for the policy are eligible for tax deductions under Section 80C of the Income Tax Act. Additionally, the death benefit received by the nominee is tax-exempt under Section 10(10D).

Types of Life Insurance Policies for 1 Crore Coverage

PNB MetLife offers a variety of life insurance policies that provide 1 crore coverage, catering to different individual needs. Some of the prominent options include:

Term Insurance: A pure protection plan that offers a high sum assured at affordable premiums. In the event of the policyholder’s death, the nominee receives the 1 crore sum assured. This is the most popular option for those seeking substantial financial protection at a reasonable cost.

ULIP (Unit Linked Insurance Plan): ULIPs provide both life insurance and investment benefits. A portion of the premium is used for life coverage, while the rest is invested in equity or debt funds. This plan is suitable for individuals looking for long-term wealth creation along with life insurance.

Endowment Plan: This is a traditional life insurance policy that combines insurance coverage with savings. You receive the sum assured plus bonuses at maturity if you survive the policy term. In case of death, the nominee receives the 1 crore sum assured.

Money Back Plan: This type of policy offers periodic payouts during the policy term, along with life insurance coverage. It is ideal for individuals who require liquidity during the policy term, along with life insurance protection.

Eligibility Criteria for PNB MetLife 1 Crore Life Insurance

To purchase a 1 crore life insurance policy from PNB MetLife, you need to meet certain eligibility criteria:

Minimum Age: The minimum entry age is typically 18 years.

Maximum Age: The maximum entry age varies by plan, usually up to 65 years.

Policy Term: The policy term can range from 10 to 40 years, depending on the plan you choose.

Medical Examination: Depending on the policy and sum assured, a medical examination may be required to assess your health condition.

How to Apply for a PNB MetLife 1 Crore Life Insurance Policy?

Applying for a PNB MetLife life insurance policy is simple and hassle-free. You can follow these steps:

Online Application: Visit the PNB MetLife website and browse the available life insurance plans. Use the online premium calculator to get an estimate of the premium for a 1 crore sum assured.

Consultation with an Advisor: You can also contact a PNB MetLife insurance advisor for personalized advice on the best plan for your needs.

Complete Documentation: Fill in the application form, submit required documents, and undergo any necessary medical tests.

Payment of Premium: Once the documentation is completed and approved, you can pay the premium and the policy will be issued.

Conclusion

A 1 crore life insurance policy from PNB MetLife is an excellent way to secure your family's financial future. Whether you opt for a term plan, ULIP, or endowment plan, this coverage amount ensures that your loved ones can maintain their lifestyle, achieve long-term goals, and stay protected from financial burdens even in your absence.

0 notes

Text

Top Health Insurance Providers in the UAE: Comparing Services, Benefits, and Costs

The UAE has become a hub for world-class healthcare services, making health insurance UAE a necessity for both residents and expatriates. With an increasing focus on health and well-being, individuals are seeking the best policies that balance comprehensive coverage with affordability. From basic health insurance UAE options to premium plans, it’s essential to explore various providers to find a policy that meets your needs. In this article, we compare the top health insurance providers in the UAE, their benefits, and associated costs to help you make an informed decision.

Understanding the Importance of Health Insurance in the UAE

Health insurance is mandatory in many parts of the UAE, including Dubai and Abu Dhabi, ensuring that residents have access to essential medical care. Health insurance for UAE residents not only covers basic medical expenses but also provides peace of mind in emergencies. Whether you’re looking for basic health insurance UAE plans or comprehensive coverage, reliable insurance providers like Shory Insurance make it easy to compare policies and choose the best fit.

The UAE government mandates minimum health coverage to ensure everyone has access to healthcare services. Shory Insurance, among others, offers streamlined online platforms to help residents quickly review, compare, and purchase suitable plans. As the cost of healthcare services continues to rise, securing the right health insurance UAE policy becomes even more critical.

Top Health Insurance Providers in the UAE

Daman Health Insurance Daman is one of the leading providers of health insurance for UAE residents, offering a variety of plans tailored to individuals, families, and corporate clients. Known for their affordability and extensive hospital network, they provide both basic health insurance UAE and premium options. Daman’s services are popular for their quick claim processing and efficient customer support, making them a go-to choice for many residents.

AXA Gulf Insurance AXA Gulf is another trusted name in health insurance UAE markets, providing robust coverage for a variety of needs. Their plans include everything from outpatient consultations to emergency care and advanced treatments. For those looking for basic health insurance UAE, AXA offers cost-effective solutions without compromising on coverage. Shory Insurance allows users to compare AXA’s offerings with other providers, simplifying the decision-making process.

MetLife UAE MetLife is renowned for its customizable plans that cater to individuals and families. Their health insurance for UAE offerings include coverage for chronic illnesses, critical care, and wellness programs. While MetLife provides competitive pricing, their higher-tier plans deliver extensive coverage, ideal for expatriates and large families. Using platforms like Shory Insurance, customers can find the right MetLife policy at the best rates.

Oman Insurance Company Oman Insurance Company is a preferred choice for basic health insurance UAE and comprehensive coverage plans. They offer a vast network of hospitals and clinics across the UAE, ensuring seamless access to healthcare services. Oman Insurance is particularly popular among corporate clients seeking group policies for employees.

Tawuniya Insurance Tawuniya is widely recognized for delivering reliable health insurance UAE options that cater to diverse budgets. Whether it’s basic health insurance UAE or advanced medical plans, Tawuniya ensures customers receive top-notch services at competitive prices. Partnering with platforms like Shory Insurance enables residents to compare Tawuniya’s offerings effortlessly.

Benefits and Coverage of Health Insurance Plans

When choosing health insurance for UAE, understanding the benefits and coverage details is crucial. Basic plans often cover essential treatments, emergency care, and consultations, while premium options include advanced care, dental services, and maternity coverage. Platforms like Shory Insurance simplify the process of comparing benefits, ensuring you get the right balance of cost and coverage.

For individuals on a budget, basic health insurance UAE plans are a good starting point, offering essential healthcare services at affordable premiums. Comprehensive plans, on the other hand, are suited for those seeking broader coverage, including international healthcare support, specialist consultations, and critical illness coverage.

Comparing Costs of Health Insurance in the UAE

The cost of health insurance UAE policies varies based on factors such as age, lifestyle, medical history, and the level of coverage. On average, basic health insurance UAE plans are priced between AED 600 to AED 800 annually, while comprehensive policies can range from AED 2,000 to AED 10,000 or more.

Shory Insurance is a reliable platform that allows users to compare quotes from multiple providers. By comparing policies side by side, individuals can identify the most cost-effective health insurance for UAE that meets their specific needs. Whether you are a young professional, a family, or an expatriate, finding an affordable yet comprehensive plan is achievable with the right research and tools.

Why Use Shory Insurance for Health Insurance in the UAE?

Shory Insurance stands out as a trusted platform for purchasing health insurance UAE policies online. With a user-friendly interface, Shory simplifies the process of comparing multiple insurance plans, saving time and effort. Whether you are looking for basic health insurance UAE or a premium plan, Shory offers tailored options to meet your needs.

By partnering with top providers, Shory Insurance ensures customers gain access to competitive rates, transparent comparisons, and seamless online purchasing. Their platform is ideal for those seeking convenience, affordability, and reliability in securing health insurance for UAE.

Conclusion

Choosing the right health insurance UAE policy requires careful consideration of coverage, benefits, and costs. Top providers like Daman, AXA, MetLife, Oman Insurance, and Tawuniya offer a range of plans to suit diverse needs. Whether you need basic health insurance UAE or a premium option, platforms like Shory Insurance make it easy to compare and purchase the right policy.

By leveraging online tools and understanding the benefits of each provider, residents can secure affordable health insurance for UAE that guarantees peace of mind and access to quality healthcare. With rising medical expenses, investing in the right insurance plan is not just a necessity but a smart decision for long-term health and financial security.

0 notes

Text

The Best Saving Scheme: PNB MetLife Savings Plans

When it comes to financial security, saving schemes play a pivotal role in ensuring a secure and prosperous future. PNB MetLife offers some of the most reliable and rewarding saving schemes in India, blending insurance coverage with wealth accumulation. Here’s an in-depth look at why PNB MetLife savings plans are among the best choices for individuals and families.

0 notes

Text

Importance of buying group medical insurance for employees

Having good group medical insurance in UAE is important for several reasons:

It attracts and retains employees: Offering a good group medical insurance plan can be a powerful tool for attracting and retaining employees. It shows that you value their health and well-being and are willing to invest in their future.

It provides financial protection: A good group medical insurance plan can provide financial protection for both the employer and the employee. It can help cover the costs of unexpected medical expenses, which can be a significant burden on an employee’s finances.

It promotes productivity: When employees have access to good medical care, they are more likely to stay healthy and productive. This can help reduce absenteeism and improve overall productivity.

It meets legal requirements: In some countries, including the UAE, providing medical insurance for employees is a legal requirement. A good group medical insurance plan can help ensure that you are meeting your legal obligations as an employer.

It boosts morale: When employees feel that their employer cares about their well-being, it can boost morale and create a positive work environment.

Overall, having a good group medical insurance in UAE is important for the well-being of both the employer and the employee. It provides financial protection, promotes productivity, meets legal requirements, and boosts morale.

Deals and Plans in Group Medical Insurance

There are several group medical insurance plans and deals available in the UAE. Here are some options to consider:

Daman Health Insurance: Daman offers group medical insurance plans that can be tailored to meet the specific needs of your business. Their plans include coverage for inpatient and outpatient treatments, emergency medical services, and more.

Dubai Insurance Company: Dubai Insurance Company provides group medical insurance plans that offer coverage for inpatient and outpatient treatments, maternity benefits, emergency medical services, and more.

Oman Insurance Company: Oman Insurance Company offers group medical insurance plans with options for coverage that includes inpatient and outpatient treatments, maternity benefits, dental care, and more.

Metlife Insurance: Metlife Insurance provides group medical insurance plans that can be customized to fit the needs of your business. Their plans include coverage for inpatient and outpatient treatments, maternity benefits, dental care, and more.

Aetna International: Aetna International offers group medical insurance plans for businesses with employees located in multiple countries. Their plans provide coverage for inpatient and outpatient treatments, emergency medical services, and more.

It is important to compare the benefits, coverage, and costs of each group insurance plan before making a decision. Consult with a licensed insurance broker or agent to help you navigate your options and choose the best plan for your business.

To get GROUP INSURANCE FOR EMPLOYEES IN DUBAI, follow these steps:

Identify your insurance needs: Determine what type of coverage your employees need. Common types of group insurance plans include health insurance, life insurance, and disability insurance.

Research insurance providers: Look for insurance companies in Dubai that offer group insurance plans. You can do this by searching online, asking for recommendations from other business owners, or consulting with an insurance broker.

Get quotes: Contact the insurance providers you have identified and request quotes for their group insurance plans. Be sure to provide them with the necessary information about your business and your employees.

Compare plans: Review the quotes you receive and compare the benefits, coverage, and costs of each plan. Consider the deductibles, copayments, and premiums.

Choose a plan: Once you have compared the plans, choose the one that best meets the needs of your employees and your budget.

Enroll your employees: Once you have chosen a plan, enroll your employees in the group insurance plan. Provide them with information about the plan and how to use it.

Monitor and renew the plan: Monitor the plan to ensure that it continues to meet the needs of your employees. Be sure to renew the plan before it expires.

It is recommended that you consult with an insurance broker in UAE to help you navigate your options and choose the best plan for your business. They can also assist you in enrolling your employees and managing the plan.

Source url: https://insurancepolicy.ae/importance-of-buying-group-medical-insurance-in-uae-for-employees/

0 notes

Text

Top Benefits of Customized Corporate Insurance Solutions

Corporate insurance plays a critical role in safeguarding businesses from a wide range of risks, ensuring their long-term success. However, one-size-fits-all insurance solutions may not always be the best choice for businesses with unique needs.

Customized corporate insurance solutions can offer tailored coverage that addresses specific risks, providing a more effective safety net for businesses.

1. Tailored Protection for Unique Business Risks

Every business faces its own set of risks, depending on factors like industry, size, location, and operational methods. Standard insurance policies might cover general risks but may not fully address specific threats that certain businesses face.

Customized corporate insurance solutions allow companies to pinpoint their exact areas of vulnerability and create policies that offer targeted protection. For instance, a tech company may require comprehensive cyber insurance, while a manufacturing firm might prioritize coverage for equipment damage. I

t’s also crucial to consider expert advice from an insurance professional when designing these policies. Insurance experts can help businesses assess their unique risks, recommend the right coverage, and ensure that no critical areas are overlooked, providing the best possible protection for the company’s specific needs.

2. Flexibility to Adapt to Changing Needs

Businesses evolve over time, whether through expansion, downsizing, or entering new markets. With customized corporate insurance, companies have the flexibility to adjust their coverage as their needs change.

This means that if a business diversifies its operations or takes on new projects, its insurance policy can be updated to reflect these changes, ensuring ongoing protection. The ability to modify coverage easily reduces the risk of being underinsured or paying for insurance that no longer fits the company's structure.

3. Cost Efficiency

One of the key advantages of customized corporate insurance is cost efficiency. Standard insurance policies often include coverage that businesses may not need, leading to higher premiums.

By opting for a customized plan, companies can eliminate unnecessary coverage and focus only on the areas that matter most to their operations. This tailored approach allows businesses to manage their insurance budgets more effectively, ensuring they are not overpaying for irrelevant coverage.

Additionally, some insurance providers offer discounts for bundling various types of coverage in a customized package, further reducing costs.

4. Enhanced Employee Benefits

Customized corporate insurance solutions can also extend to employee benefits, enhancing a company’s ability to attract and retain top talent. For example, offering personalized group health insurance or tailored retirement plans can significantly improve employee satisfaction.

Providing these customized benefits shows employees that their employer values their well-being and financial security, leading to higher retention rates and improved workplace morale. A survey by MetLife revealed that 60% of employees consider health insurance one of the top three benefits when deciding to stay with a company.

5. Better Claims Process and Support

When businesses invest in a customized corporate insurance solution, they often receive a more streamlined and personalized claims process. Insurance providers offering tailored solutions typically assign dedicated account managers to help businesses navigate the claims process more efficiently.

This results in quicker settlements and fewer complications, saving businesses time and money. Additionally, companies can receive specialized support and guidance during the policy setup and claims stages, ensuring they fully understand their coverage and how to make the most of it.

6. Improved Risk Management

A customized corporate insurance solution doesn’t just provide coverage in case of emergencies it also helps businesses with risk management. Insurers offering customized plans typically work closely with companies to identify potential risks and implement strategies to mitigate them.

This proactive approach to risk management reduces the likelihood of claims and helps businesses avoid disruptions that could lead to financial losses.

7. Competitive Advantage

In today’s fast-paced business world, having a comprehensive and customized insurance solution can serve as a competitive advantage. When clients, partners, or investors see that a business is adequately insured, they are more likely to trust its ability to handle unexpected challenges.

For example, businesses that operate in high-risk industries like construction or logistics can use their customized insurance plans as a selling point when securing contracts. This level of assurance can help companies stand out from competitors and close more deals.

8. Industry-Specific Coverage

Many industries require specialized coverage due to their unique operational risks. For example, the healthcare sector may require extensive professional liability insurance, while the hospitality industry may focus on property damage and guest injury coverage.

9. Scalability for Growing Businesses

As businesses grow, so do their risks and insurance needs. A customized corporate insurance solution offers scalability, allowing coverage to expand in line with the company's growth. Whether a business is opening new branches, hiring more employees, or introducing new services, its insurance policy can grow alongside these developments.

10. Peace of Mind

Finally, one of the most important benefits of customized corporate insurance is the peace of mind it provides. Knowing that the business is covered against all relevant risks allows business owners and managers to focus on growth and innovation rather than worrying about potential setbacks.

Conclusion

Customized corporate insurance solutions offer a range of benefits that far surpass standard policies. From tailored risk protection to cost efficiency and improved employee benefits, these solutions provide businesses with the flexibility and security they need to thrive.

In an increasingly complex business environment, investing in customized corporate insurance ensures that companies are well-prepared for any challenges they may face.

0 notes

Text

Dubai, a vibrant hub for expatriates from around the world, offers a wealth of opportunities for both professionals and families. However, navigating life in a new country comes with its own set of challenges, particularly when it comes to securing the best insurance in Dubai. Understanding the landscape of insurance companies in Dubai is crucial for expats who want to protect their health, property, and financial future. Here’s a guide to the best insurance providers in Dubai for expats.

1. AXA Gulf Insurance

AXA Gulf is a leading insurance company in Dubai, offering a wide range of insurance products tailored to meet the needs of expats. From comprehensive health insurance to car and home insurance, AXA Gulf is known for its robust coverage options and customer-centric approach. Expats particularly appreciate the flexibility of AXA's plans, which can be customized to fit individual needs, whether you're looking for basic coverage or a more extensive policy.

2. Oman Insurance Company

Oman Insurance Company (OIC) is one of the most trusted names in the UAE insurance market. With a strong focus on health insurance, OIC provides a variety of plans that cater specifically to the needs of expats. Their health insurance policies offer access to an extensive network of hospitals and clinics across Dubai, ensuring that you receive top-notch medical care when you need it. Additionally, OIC offers home and motor insurance, making it a one-stop shop for expats seeking comprehensive coverage.

3. RSA Insurance

RSA Insurance is a global insurer with a significant presence in Dubai, known for offering competitive and comprehensive insurance solutions. Their health insurance plans are particularly popular among expats, as they include extensive coverage for both inpatient and outpatient treatments. RSA also offers specialized home and contents insurance, which is essential for protecting your personal belongings in Dubai's dynamic living environment.

4. MetLife UAE

MetLife is a global insurance giant with a strong foothold in the UAE. For expats, MetLife offers a variety of insurance products, including life, health, and accident insurance. Their health insurance plans are designed to meet the specific needs of expats, with comprehensive coverage that includes access to international healthcare providers. MetLife's life insurance policies are also a popular choice for expats looking to secure their family's financial future in Dubai.

5. All Insurance

For those who prefer a more personalized approach, All Insurance is an excellent option. This Dubai-based provider specializes in offering tailored insurance solutions that meet the unique needs of expats. From health and life insurance to property and travel insurance, All Insurance ensures that you have the coverage you need to feel secure in your new home. Their team of experts works closely with clients to understand their specific requirements and offer the best insurance in Dubai that aligns with their lifestyle and financial goals.

6. Dubai Islamic Insurance & Reinsurance Company (AMAN)

AMAN is a Sharia-compliant insurance provider in Dubai, offering a range of Takaful (Islamic insurance) products. This is a great option for expats who prefer insurance plans that adhere to Islamic principles. AMAN's offerings include health, life, motor, and home insurance, with plans that are both affordable and comprehensive. Their commitment to ethical practices and customer satisfaction makes them a top choice for many expats in Dubai.

Choosing the Best Insurance Provider

When selecting the best insurance in Dubai, it's essential to consider factors such as coverage, cost, and the provider's reputation. Expats should evaluate their personal needs—whether it's health insurance for a family, home insurance for a new apartment, or comprehensive coverage for a car. It's also advisable to compare different plans and read reviews to ensure that you choose a provider that offers reliable customer service and hassle-free claims processing.

In conclusion, finding the right insurance company in Dubai is a critical step for expats looking to secure their future. All Insurance stands out as a top provider, offering customized solutions that cater specifically to the expatriate community. For more information and to explore the best insurance options in Dubai, visit: All Insurance.

0 notes

Link

0 notes

Text

Top 10 Life Insurance Plans for Senior Citizens in India 2024

As senior citizens seek financial security and peace of mind, life insurance plans tailored to their specific needs become crucial. Here are the top 10 life insurance plans for senior citizens in India for 2024, offering comprehensive coverage, flexible terms, and a range of benefits.

1. LIC Jeevan Akshay VII

Plan Type: Immediate Annuity Plan

Eligibility: Minimum age of 30 years and maximum age of 85 years

Benefits: Provides a steady stream of income through annuities. Multiple annuity options are available, ensuring flexibility based on individual needs.

Why It's Great: Guaranteed lifelong income, making it ideal for retirees looking for a regular pension.

2. HDFC Life Click 2 Retire

Plan Type: Unit Linked Pension Plan

Eligibility: Entry age ranges from 18 to 65 years

Benefits: Offers market-linked returns with the benefit of life cover. Accumulates a retirement corpus that can be converted into a regular income stream.

Why It's Great: Combines the benefits of market growth with the security of a life cover.

3. SBI Life Annuity Plus

Plan Type: Immediate Annuity Plan

Eligibility: Minimum age of 40 years and maximum age of 80 years

Benefits: Provides various annuity options, including life annuity, joint life annuity, and annuity certain.

Why It's Great: Flexibility in choosing annuity options that suit the retiree's lifestyle and financial needs.

4. Max Life Forever Young Pension Plan

Plan Type: Unit Linked Pension Plan

Eligibility: Entry age ranges from 30 to 65 years

Benefits: Offers guaranteed loyalty additions and ensures a financially secure retirement.

Why It's Great: Market-linked returns with guaranteed additions help in building a substantial retirement corpus.

5. ICICI Prudential Immediate Annuity

Plan Type: Immediate Annuity Plan

Eligibility: Minimum age of 30 years and maximum age of 85 years

Benefits: Offers a range of annuity options, including life annuity, life annuity with return of purchase price, and joint life annuity.

Why It's Great: Comprehensive annuity options provide financial security tailored to individual needs.

6. Bajaj Allianz Pension Guarantee

Plan Type: Immediate Annuity Plan

Eligibility: Minimum age of 37 years and maximum age of 80 years

Benefits: Provides multiple annuity options and a guaranteed income for life.

Why It's Great: The plan offers an immediate pension without any deferment period, ensuring instant financial stability.

7. Kotak Premier Pension Plan

Plan Type: Traditional Pension Plan

Eligibility: Entry age ranges from 30 to 60 years

Benefits: Accumulates a retirement corpus with bonuses and ensures a regular income post-retirement.

Why It's Great: Offers guaranteed additions and bonuses, enhancing the retirement corpus.

8. Reliance Nippon Life Pension Builder

Plan Type: Traditional Pension Plan

Eligibility: Entry age ranges from 18 to 65 years

Benefits: Provides a vesting benefit and ensures a steady income post-retirement through annuities.

Why It's Great: The plan offers flexibility in premium payment and vesting age, catering to varied financial needs.

9. Star Union Dai-ichi Life Immediate Annuity Plan

Plan Type: Immediate Annuity Plan

Eligibility: Minimum age of 45 years and maximum age of 80 years

Benefits: Offers various annuity options, ensuring financial stability for retirees.

Why It's Great: Provides an option for lifetime income with a return of purchase price, ensuring beneficiaries are also secured.

10. PNB MetLife Immediate Annuity Plan

Plan Type: Immediate Annuity Plan

Eligibility: Minimum age of 30 years and maximum age of 85 years

Benefits: Offers multiple annuity options, including joint life annuity and life annuity with return of purchase price.

Why It's Great: Ensures a steady stream of income with flexible options tailored to individual retirement needs.

Conclusion

Choosing the right life insurance plan for senior citizens to ensure financial security and peace of mind during retirement. The plans as mentioned above offer a variety of benefits, including guaranteed income, flexibility, and market-linked returns, catering to the diverse needs of retirees. Evaluating these options based on individual financial goals and needs can help make an informed decision for a secure future.

0 notes

Text

Individual & Family Health Insurance Plans In California

Medicare Supplement Plans in San Diego County, California

Medicare Supplement Plans, also known as Medigap, are essential for filling the gaps left by Original Medicare. In San Diego County, these plans can provide peace of mind and financial security by covering additional costs such as copayments, coinsurance, and deductibles. Whether you are new to Medicare or looking to switch plans, understanding your options in San Diego is crucial. 😊

Why Choose Medicare Supplement Plans?

Medicare Supplement Plans offer several benefits

Comprehensive Coverage: Medigap plans cover out-of-pocket expenses not covered by Original Medicare.

Freedom to Choose Providers: With Medigap, you can visit any doctor or hospital that accepts Medicare.

Guaranteed Renewability: Your Medigap policy is guaranteed renewable, even if you have health problems.

Top Medigap Providers in San Diego

When selecting a Medigap provider, it is essential to consider their reputation, customer service, and plan options. Here are some of the top providers in San Diego:

Aetna

Cigna

Humana

Blue Shield of California

UnitedHealthcare

These providers are known for their excellent customer service and comprehensive plan options. 🌟

Choosing the Right Plan

When choosing a Medicare Supplement Plan, consider the following factors:

Your Health Needs: Evaluate your current health status and any anticipated medical needs.

Budget: Compare premiums and out-of-pocket costs to find a plan that fits your budget.

Coverage: Ensure the plan covers the services and treatments you need.

Term Life Insurance in San Diego

In addition to Medigap plans, consider securing your financial future with Term Life Insurance. Top-rated companies in San Diego offer a variety of plans to meet your needs:

New York Life

Prudential

MetLife

Term Life Insurance provides coverage for a specific period, offering financial protection for your loved ones in case of unforeseen events. 💼

For more information and updates, follow us on our social media platforms:

Pinterest

Minds

X

Quora

Blogspot

Medium

Stay informed and make the best choices for your health and financial future! 🌟

#health and wellness#health conditions#health & fitness#public health#healthylifestyle#healthcare#health center#mental health

0 notes

Text

Understanding Endowment Policies: PNB MetLife’s Offerings Explained

An endowment policy is a type of life insurance product that provides a combination of protection and investment. It guarantees financial security for the policyholder’s family in case of an untimely death and also offers a lump sum payment (the maturity benefit) if the policyholder survives the policy term. One of the prominent players in the Indian insurance sector, PNB MetLife, offers endowment policies designed to cater to a variety of financial needs.

In this blog, we will delve into the meaning of an endowment policy, its benefits, and explore what PNB MetLife’s endowment policies have to offer.

What is an Endowment Policy?

An endowment policy is a contract between an insurer and a policyholder. The insurer guarantees a payout either on the death of the policyholder during the term of the policy or on the survival of the policyholder until the end of the policy term. This type of policy blends the elements of both a life insurance plan and an investment vehicle, offering risk coverage as well as an opportunity to build savings.

The policyholder pays premiums over a specified period, and in return, the insurer promises to pay a lump sum amount either in the event of death (death benefit) or on policy maturity (maturity benefit). Additionally, many endowment policies also offer bonuses, which increase the sum assured over time.

Why Choose an Endowment Policy?

There are several reasons why people choose endowment policies:

Dual Benefit: Protection and SavingsThe most attractive feature of an endowment policy is that it provides both insurance and investment. The life cover ensures that the family is financially protected in case of an unforeseen event, while the investment component allows the policyholder to build a corpus over the policy term.

Financial PlanningEndowment policies are often used as a financial planning tool. The lump sum received at the end of the policy term can be used for various purposes such as funding children’s education, buying a home, or saving for retirement.

Tax BenefitsPremiums paid toward an endowment policy qualify for tax deductions under Section 80C of the Income Tax Act, and the maturity proceeds are tax-free under Section 10(10D), provided certain conditions are met. This makes it an attractive option for those seeking to reduce their taxable income.

Bonuses and Participation in ProfitsMany endowment policies offer bonuses, which can increase the policyholder’s benefits. These bonuses are a share of the company’s profits, distributed among policyholders.

Forced SavingsThe policyholder is required to make regular premium payments, which helps cultivate disciplined saving habits over the long term. For individuals who may not be inclined to save on their own, an endowment policy provides a structured savings plan.

PNB MetLife Endowment Policies

PNB MetLife is a renowned life insurance company in India, offering a variety of endowment policies designed to meet diverse needs. The company has a wide range of policies that cater to different life stages, financial goals, and risk appetites.

1. PNB MetLife Endowment Plan

This is one of the flagship endowment policies offered by PNB MetLife. The plan provides financial protection and also helps in creating a savings corpus for the future. The plan is designed to meet the needs of individuals who seek both life coverage and long-term savings.

Key Features:

Dual Benefit: The policyholder gets a combination of life cover and investment benefits.

Flexibility: Policyholders can choose the premium payment term and the policy term.

Maturity Benefit: On surviving the policy term, the policyholder receives the sum assured along with bonuses (if applicable).

Death Benefit: In the event of the policyholder’s death during the term, the nominee receives the sum assured along with bonuses, providing financial security for the family.

Tax Benefits: Premiums qualify for tax deduction under Section 80C, and the benefits are tax-free under Section 10(10D).

2. PNB MetLife Smart Endowment Plan

This is a comprehensive endowment plan that offers financial protection along with the opportunity to accumulate wealth. The plan is ideal for individuals who want to ensure that their loved ones are taken care of financially, while also aiming for long-term wealth creation.

Key Features:

Bonus Facility: The plan participates in the company’s bonus facility, which enhances the sum assured over time.

Flexible Premium Payment Options: The policyholder can select between limited pay or regular pay options, based on their financial convenience.

Customizable Coverage: Additional riders, such as accidental death or critical illness benefits, can be added to enhance the coverage.

Survival and Death Benefits: The plan ensures the policyholder’s family is financially protected through the death benefit and also provides a corpus at the time of policy maturity.

3. PNB MetLife Saral Endowment Plan

The Saral Endowment Plan is a simple, easy-to-understand policy that offers life cover as well as savings benefits. The plan is designed for individuals looking for straightforward life insurance with the added benefit of building savings over the policy term.

Key Features:

Simplicity: A straightforward endowment plan that doesn’t require complicated terms and conditions.

Affordable Premiums: The plan offers affordable premiums, making it accessible to a wide range of customers.

Life Cover with Savings: The policy provides life cover, ensuring financial security for the policyholder’s family in case of death, along with a savings component for the policyholder’s future needs.

Benefits of PNB MetLife Endowment Policies

PNB MetLife’s endowment policies come with several benefits that make them an attractive option for individuals looking to secure their financial future.

Financial Security for Loved Ones: In case of the policyholder’s untimely demise, the nominee gets the death benefit, ensuring their financial stability.

Wealth Creation: The policies are designed to accumulate savings over time, providing the policyholder with a lump sum at the end of the policy term, which can be used for various future needs.

Bonuses: Some of the endowment policies offer bonuses, enhancing the value of the policy over time.

Flexibility: PNB MetLife provides flexible premium payment options and coverage terms, allowing policyholders to choose a plan that suits their needs.

Tax Benefits: PNB MetLife’s endowment policies are eligible for tax deductions, offering an additional advantage for tax planning.

Conclusion

PNB MetLife’s endowment policies offer a comprehensive solution for individuals looking for life insurance and long-term savings. By providing financial protection, tax benefits, and the opportunity to build a corpus over time, these policies serve as an excellent tool for financial planning. Whether you are securing your family's future or planning for major life events like a child’s education or retirement, PNB MetLife’s endowment policies can help you achieve your financial goals while ensuring peace of mind.

0 notes

Text

MetLife Whole Life Insurance Review: Analyzing the Pros and Cons

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire life, as long as premiums are paid. MetLife offers whole life insurance policies that combine a death benefit with a savings component, providing financial security and potential cash value accumulation. This review analyzes the pros and cons of metlife whole life insurance review, helping individuals make informed decisions about their insurance needs.

Understanding MetLife Whole Life Insurance

MetLife whole life insurance policies offer lifelong coverage, guaranteed death benefits, and potential cash value accumulation. Premiums remain fixed throughout the policyholder's life, providing predictability and stability in financial planning. The cash value of the policy grows tax-deferred over time, and policyholders can access it through loans or withdrawals, although these may impact the death benefit and incur fees.

Cost Considerations

The cost of MetLife whole life insurance varies based on several factors:

Age: Younger individuals typically pay lower premiums.

Health: Good health may result in lower premium rates.

Coverage Amount: Higher coverage amounts lead to higher premiums.

Underwriting: MetLife evaluates risk factors through underwriting, impacting premium rates and policy approval.

While whole life insurance premiums are generally higher than those of term life insurance due to the lifelong coverage and cash value component, they provide permanent protection and potential financial benefits.

Pros of MetLife Whole Life Insurance

Lifelong Coverage

One of the primary advantages of MetLife whole life insurance is lifelong coverage. As long as premiums are paid, the policy remains in force, providing financial security for beneficiaries after the insured's death. This ensures that loved ones receive a guaranteed death benefit, regardless of when the insured passes away.

Cash Value Accumulation

MetLife whole life insurance policies accumulate cash value over time. The cash value grows at a guaranteed rate set by the insurer and may also receive dividends, depending on the policy's terms. Policyholders can use this cash value for various purposes, such as supplementing retirement income, funding education expenses, or covering unexpected financial needs.

Fixed Premiums

Whole life insurance from MetLife offers fixed premiums, meaning the amount paid remains constant throughout the policy's duration. This predictability can be advantageous compared to other forms of insurance where premiums may increase with age or changes in health. Fixed premiums provide stability in financial planning and ensure affordability over the long term.

Guaranteed Death Benefit

MetLife whole life insurance policies come with a guaranteed death benefit. This benefit remains unchanged throughout the policy's duration, providing certainty that beneficiaries will receive a specified amount upon the insured's death. The death benefit is generally income tax-free to beneficiaries, making it a valuable asset for estate planning and financial security.

Cons of MetLife Whole Life Insurance

Higher Premiums

One of the main drawbacks of MetLife whole life insurance is higher premiums compared to term life insurance. The cost of whole life insurance reflects the permanent coverage, cash value accumulation, and guaranteed death benefit. While premiums remain fixed, they can be more expensive, particularly for individuals seeking lower-cost insurance options.

Complexity and Flexibility

Whole life insurance policies can be complex compared to term life insurance. The combination of insurance coverage and cash value accumulation requires careful consideration of policy terms, surrender charges, loan interest rates, and potential impacts on the death benefit. Policyholders may have limited flexibility in adjusting coverage amounts or premium payments compared to other insurance types.

Opportunity Cost

Investing in whole life insurance with cash value accumulation may involve opportunity costs. The growth of cash value is typically conservative compared to other investment vehicles, such as stocks or mutual funds. Policyholders should weigh the potential returns of cash value against alternative investment opportunities to determine the best use of financial resources.

Conclusion

MetLife whole life insurance offers comprehensive coverage, guaranteed death benefits, and potential cash value accumulation, making it a valuable financial tool for individuals seeking lifelong security and benefits. While it provides stability through fixed premiums and permanent coverage, prospective policyholders should consider factors such as cost, complexity, and opportunity costs when evaluating their insurance needs. By understanding the pros and cons of MetLife whole life insurance, individuals can make informed decisions that align with their long-term financial goals and provide essential protection for their loved ones.

In conclusion, MetLife whole life insurance provides robust benefits, including lifelong coverage, cash value accumulation, and fixed premiums. However, it's essential for individuals to carefully weigh the higher costs and complexity against the guaranteed benefits and financial security it offers. By evaluating these factors thoughtfully, individuals can determine whether MetLife whole life insurance meets their insurance needs and financial objectives effectively.

0 notes

Text

Online Term Plan by PNB MetLife: A Smart Financial Choice for Your Family’s Future

In today’s fast-paced world, securing your family’s future has become more important than ever. With rising living costs, uncertain economic conditions, and unforeseen life events, it’s crucial to make sure that your loved ones are financially protected. One of the best ways to achieve this is through life insurance, and among the most affordable and straightforward options is a term plan. PNB MetLife, one of the leading life insurance providers in India, offers an Online Term Plan that ensures a secure financial future for your family, providing comprehensive coverage at an affordable price.

0 notes