#maximum drawdown excel

Explore tagged Tumblr posts

Text

Top Mutual Funds for 2025: A Guide to One-Time Investment & Portfolio Analysis

Looking for a mutual fund for a one-time investment that maximizes returns without requiring ongoing commitment? As 2025 unfolds, several standout options have emerged inside the investment landscape that deserve close interest. The proper single-contribution fund can probably rework your financial trajectory while being decided on with careful consideration of market situations, fund performance history, and alignment with personal desires.

The Mutual Fund Advantage in 2025's Economy

Mutual price ranges continue to offer accessibility and diversification advantages that men or women choosing stocks in reality can't have. With inflation issues stabilizing, however, global economic uncertainty persisting, and finances providing balanced exposure across sectors, they have come to be increasingly more treasured for capital upkeep and boom.

The present-day market environment favors disciplined funding tactics, specifically for those hesitant to decide on systematic funding plans. Lump sum investments in carefully selected mutual funds allow traders to capitalize on marketplace possibilities at the same time as maintaining liquidity for unforeseen wishes.

Evaluating One-Time Investment Options

When thinking about a mutual fund for a one-time investment, several elements call for attention:

Time Horizon Alignment Funds with great 5-year and 10-12 month performance information commonly reveal resilience across marketplace cycles. For 2025, mid-cap price ranges with sturdy fundamentals show specific promise for investors with 7+ year horizons.

Expense Ratio Impact Lower cost ratios immediately affect returns through the years. Several fund houses have decreased their fee systems this year, creating possibilities for cost-conscious traders.

Fund Manager Expertise The distinction between common and excellent returns frequently comes down to fund management. Investment portfolio management teams with confirmed success navigating unstable markets deserve top-class consideration.

Risk-Adjusted Performance Rather than chasing absolute returns, sophisticated traders examine Sharpe ratios and maximum drawdowns to perceive funds that deliver consistent performance without excessive volatility.

The Critical Role of Portfolio Analysis

Mutual fund portfolio analysis is well-known for showing insights into past primary performance metrics. Examining region allocation possibilities, concentration risks, and correlation with present investments provides clarity on whether a fund genuinely enhances your general role.

Digital tools have revolutionized how buyers conduct portfolio evaluation, with visualization capabilities highlighting capability vulnerabilities. Before finalizing anybody's time investment choice, inspecting these precise breakdowns guarantees alignment with danger tolerance and economic goals.

2025's Most Promising Fund Categories

Index Funds with a Twist Enhanced index funds offering marginal outperformance with minimum additional threat constitute a wonderful starting line for brand-spanking-new buyers.

Focused Equity Funds Concentrated portfolios of 25-30 high-conviction shares managed by experienced groups have established superior threat-adjusted returns through the latest market volatility.

International Exposure Funds Funds imparting access to rising markets and evolved global markets provide precious diversification from domestic market moves, especially critical given present-day geopolitical tensions.

ESG-Integrated Options Sustainable investing keeps its maturation, with proof mounting that environmentally and socially responsible finances can deliver aggressive returns while handling long-term risks.

Beyond DIY: The Value of Professional Management

While self-directed investment is growing more and more available, expert investment portfolio management services offer advantages tough to duplicate independently. Experienced advisors convey institutional-grade analysis abilities, negotiated rate systems, and objective views unburdened by emotional attachments to unique investments.

Investment portfolio management experts can perceive capable mutual fund mixtures that supplement present property while avoiding pointless overlap. Their comprehensive know-how of tax implications, especially for one-time investments, regularly results in considerably progressed after-tax returns.

The mutual fund landscape in 2025 gives compelling opportunities for one-time investments but calls for thoughtful evaluation and strategic positioning. Whether pursuing self-directed or professionally guided procedures, clear-eyed portfolio analysis remains the foundation of investment fulfillment.

#mutual funds 2025#top funds 2025#one-time investment#best SIP plans#portfolio tips#high ROI funds#long term funds#investment guide#mutual fund picks#fund analysis#finance trends#top equity funds#wealth planning#market forecast#smart investing#mutual fund list#fund strategy 2025#returns calculator#growth mutual fund#mutual fund tips

0 notes

Text

How to Maximize Earnings with the Highest Profit Splits Prop Firms

Joining a prop firm with the highest profit splits is an excellent opportunity for traders to maximize their earnings. However, securing a large profit split is only half the battle. To truly benefit from this arrangement, traders must implement strategies that align with their goals and the firm's rules. In this article, we will discuss how to maximize your earnings when working with a prop firm like FundedElite, known for offering competitive profit splits.

1. Understand the Profit Split Structure

The first step in maximizing your earnings is understanding the specific profit split structure offered by your prop firm. Firms like FundedElite typically provide profit splits ranging from 50% to 90%, depending on your performance, risk management, and trading style. The higher the split, the more you earn, but it often comes with increased responsibility, such as strict risk management rules.

Make sure you fully understand your profit split percentage and the conditions under which it is awarded. Are there specific targets or performance benchmarks you must meet to earn a higher split? Familiarizing yourself with these details is crucial for setting realistic goals.

2. Focus on Consistent Profitability Over Quick Gains

Maximizing your earnings requires a mindset shift from focusing on short-term profits to cultivating consistent, long-term growth. A sustainable approach to trading will help you maintain a positive track record, which is essential for retaining and increasing your profit split with FundedElite.

Many traders make the mistake of trying to hit huge wins in a short period, but this can lead to unnecessary risk and drawdowns. Instead, aim for consistent, smaller wins, which will contribute to steady growth over time and improve your overall trading performance. Prop firms tend to reward consistency over time, which means focusing on the long haul can increase your profitability.

3. Master Risk Management

A key component of maximizing your earnings is managing risk effectively. FundedElite and similar prop firms typically have strict risk management rules in place, including daily and maximum drawdown limits. Staying within these limits will not only help you avoid losing your funded account but also allow you to keep a higher percentage of the profits you generate.

Proper risk management involves setting stop-loss orders, calculating position sizes based on your account balance, and never risking more than a small percentage of your total capital on a single trade. By being disciplined with your risk management, you can ensure a steady flow of profits and maintain a high earning potential.

4. Utilize Advanced Trading Strategies

To make the most out of your profit split, consider implementing advanced trading strategies such as scalping, swing trading, or using automated trading systems. These strategies allow you to take advantage of market movements in different time frames, providing opportunities for more frequent profits.

For example, FundedElite may provide access to a range of assets, so diversifying your strategies across various instruments can help you maximize profit potential. By being adaptable and utilizing multiple strategies, you can increase your chances of earning consistent profits, thus boosting your earnings with higher splits.

5. Stay Disciplined and Patient

Maximizing your earnings in any prop firm requires patience and discipline. It’s easy to get caught up in the excitement of trading and chase after bigger wins, but the key to long-term success is maintaining a steady approach. This means avoiding impulsive decisions, sticking to your trading plan, and learning from your mistakes.

Consistency, risk management, and emotional control are the pillars of profitability in prop trading. Firms like FundedElite reward traders who demonstrate these qualities, and by focusing on them, you can significantly increase your earning potential over time.

Conclusion

Maximizing your earnings with a highest profit splits prop firm, such as FundedElite, requires a strategic approach. By understanding the firm's profit split structure, focusing on consistent profitability, mastering risk management, utilizing advanced trading strategies, and staying disciplined, you can unlock your full earning potential. Remember, prop firms value traders who exhibit long-term growth, risk control, and performance, so apply these principles to see your earnings soar.

0 notes

Text

Best Forex Prop Trading Firm in India: Funded Firm

Proprietary trading firms have gained immense popularity in India, providing traders access to institutional capital without risking their own funds. Funded Firm stands out among the top choices, offering an efficient funding model, competitive trading conditions, and an opportunity for traders to scale their accounts profitably.

What is Funded Firm?

Funded Firm is a proprietary trading firm that provides forex traders with access to capital, allowing them to trade on the firm’s behalf while keeping a share of the profits. The firm follows a structured evaluation process to assess a trader’s skills before granting access to funded accounts.

Key Features of Funded Firm

Funded Firm offers traders various account sizes, ranging from $10,000 to $200,000, with a flexible scaling plan that increases capital allocation based on consistent performance. Traders can earn up to 80% of their profits, with payouts processed on a bi-weekly or monthly basis.

Before receiving a funded account, traders must pass an evaluation phase that tests their trading skills and risk management abilities. The evaluation typically requires meeting a set profit target, maintaining a maximum drawdown limit, and trading for a minimum number of days while following risk management rules. Unlike many other firms, Best Forex Prop Trading Firm in India allows traders to complete the evaluation at their own pace.

Traders can execute trades on platforms like MetaTrader 4, MetaTrader 5, and cTrader, with access to forex pairs, commodities, indices, and cryptocurrencies. The firm offers a maximum leverage of 1:100 and imposes no restrictions on trading strategies, allowing scalping, hedging, and algorithmic trading. Overnight holding is also permitted.

Why Choose Funded Firm?

Funded Firm eliminates the need for traders to risk their own capital while offering a high profit split. The firm’s low evaluation fees, flexible trading strategies, and opportunity to scale accounts make it an attractive choice. It is particularly well-suited for experienced traders, scalpers, swing traders, and those using automated trading systems.

Funded Firm is an excellent choice for forex traders in India who want to trade with institutional capital. With Best Forex Prop Trading Firm in India competitive profit-sharing, a straightforward evaluation process, and access to multiple trading instruments, it provides a solid platform for professional traders. Those looking for a reliable prop firm with strong growth opportunities may find Funded Firm to be the perfect fit.

#fundedfirm#forextrading#fundedtrading#forexpropfirm#bestpropfirm#forexfundedaccounts#proptradingindia#forexindia#forexproptrading#propfirm

0 notes

Text

"Mechabull.com Unleashing the Power of Trading with Automated FX Systems and AI Strategies"

In the fast-paced world of financial markets, staying ahead requires a strategic approach and cutting-edge technology. Mechabull.com emerges as a beacon in the realm of trading, offering powerful automated FX trading systems and AI strategies designed to empower both seasoned traders and newcomers alike. This article delves into the core aspects of Mechabull.com, exploring its features, benefits, and how it transforms the landscape of trading.

I. The Rise of Automated Trading:

Traditional trading methods have evolved significantly over the years, with automation emerging as a game-changer. Mechabull.com capitalizes on this trend, providing traders with the tools they need to automate their strategies efficiently. Automated trading ensures faster execution, eliminates emotional bias, and enables traders to capitalize on market opportunities 24/7.

II. Mechabull.com's Cutting-Edge Technology:

Mechabull.com stands out by leveraging state-of-the-art technology to develop and implement its trading systems. The platform combines advanced algorithms, machine learning, and artificial intelligence to create robust strategies that adapt to changing market conditions. This commitment to technological innovation positions Mechabull.com as a pioneer in the realm of automated FX trading.

III. Accessibility for Everyone:

One of Mechabull.com's key strengths lies in its commitment to making automated trading accessible to everyone. Whether you are a seasoned trader or a novice exploring the world of forex, Mechabull.com offers user-friendly interfaces and comprehensive educational resources. The platform empowers users to automate their trading strategies with ease, breaking down the barriers that often deter newcomers from entering the world of financial markets.

IV. Tailored AI Strategies:

Mechabull.com recognizes that traders have diverse needs and risk appetites. To cater to this, the platform provides a range of AI strategies that can be tailored to individual preferences. Whether you prefer a conservative, long-term approach or an aggressive, short-term strategy, Mechabull.com has the tools to meet your specific requirements. This flexibility ensures that traders can align their automated trading with their unique financial goals.

V. Real-Time Market Analysis:

Successful trading relies on accurate and timely market analysis. Mechabull.com excels in this aspect by offering real-time market data and analysis tools. The platform's algorithms process vast amounts of information, identifying trends, patterns, and potential trading opportunities. This real-time analysis empowers traders to make informed decisions and capitalize on market movements as they happen.

VI. Risk Management and Security:

Understanding the importance of risk management, Mechabull.com integrates robust safety measures into its platform. The automated systems are equipped with risk management features, allowing users to set parameters for maximum drawdowns and stop-loss levels. This proactive approach helps traders safeguard their capital and navigate the unpredictable nature of financial markets.

VII. Backtesting and Performance Metrics:

Mechabull.com encourages traders to make informed decisions by providing comprehensive backtesting tools and performance metrics. Users can test their strategies against historical data, gaining insights into how well their algorithms would have performed in different market conditions. This feature empowers traders to refine and optimize their strategies before deploying them in live markets.

VIII. Community and Support:

Trading can be a solitary endeavor, but Mechabull.com fosters a sense of community among its users. The platform facilitates communication and knowledge-sharing through forums, webinars, and social channels. Additionally, Mechabull.com provides responsive customer support to address any queries or concerns, ensuring that users feel supported on their trading journey.

IX. Continuous Innovation:

In the ever-evolving landscape of financial markets, Mechabull.com remains at the forefront of innovation. The platform's commitment to continuous improvement is reflected in regular updates and enhancements. Whether it's incorporating new algorithms, optimizing performance, or adding features based on user feedback, Mechabull.com is dedicated to staying ahead of the curve.

Mechabull.com stands as a beacon in the world of trading, providing a powerful arsenal of automated FX trading systems and AI strategies. Its commitment to accessibility, cutting-edge technology, risk management, and continuous innovation sets it apart as a platform that caters to the diverse needs of traders. As Mechabull.com continues to shape the future of trading, it invites both seasoned professionals and newcomers to harness the power of automation and artificial intelligence for a more informed and successful trading experience.

0 notes

Text

http://andywltd.com/blog/how-to-calculate-maximum-drawdown/

How to Calculate Maximum Drawdown

Maximum drawdown refers to a significant trading measure of a maximum equity loss you’ve incurred in your portfolio. It’s a statistic that can be determined in backtesting and live trading. During backtesting, maximum drawdown reflects the downside risk of your trading strategy while in live trading it helps you identify instances when your strategy might be malfunctioning.

The value of a maximum drawdown (MDD) is expressed in percent and reflects the highest equity loss between peaks. To determine the MDD, you need to calculate your running percent profit and total loss and then utilize the Excel MIN function to find out the maximum drawdown, which refers to the lowest number.

for more info visit here -https://www.andywltd.com/blog/how-to-calculate-maximum-drawdown/

#best forex traders to follow#w trades#50 pips a day strategy#butterfly forex pattern#maximum drawdown excel#how to trade on metatrader 4 app#how to trade forex for beginners metatrader 4#max drawdown in excel#maximum drawdown in excel

0 notes

Text

Saturday, January 16, 2021

Hot again: 2020 sets yet another global temperature record (AP) Earth’s rising fever hit or neared record hot temperature levels in 2020, global weather groups reported Thursday. While NASA and a couple of other measurement groups said 2020 passed or essentially tied 2016 as the hottest year on record, more agencies, including the National Oceanic Atmospheric Administration, said last year came in a close second or third. The differences in rankings mostly turned on how scientists accounted for data gaps in the Arctic, which is warming faster than the rest of the globe. All the monitoring agencies agree the six warmest years on record have been the six years since 2015. The 10 warmest have all occurred since 2005. Temperatures the last six or seven years “really hint at an acceleration in the rise of global temperatures,” said Russ Vose, analysis branch chief at NOAA’s National Centers for Environmental Information.

A siege on the U.S. Capitol, a strike against democracy worldwide (Washington Post) As the Trump administration sought to drive Venezuelan autocrat Nicolás Maduro from power, activist Jorge Barragán embraced the effort as the good and moral crusade of the world’s greatest democracy. Then came the siege on the U.S. Capitol. The 22-year-old student activist watched “in shock” from his hometown in western Venezuela last week as a mob inspired by President Trump invaded Congress to attempt to overturn an election loss. Barragán could not pull away from the YouTube images showing the pro-Trump marauders acting very much like Maduro’s colectivos—the extraofficial thugs that keep opponents in check and a dictator in charge. “Our main ally in the fight for democracy has tumbled,” Barragán said. “What does that mean for us?” Four years of Trump had already dimmed the United States’ democratic bona fides. From Egypt to Honduras to Saudi Arabia to North Korea, Trump signaled tolerance for human rights abuses. Analysts now warn of a herculean task ahead for Biden. Global inequality, historic migration and deep polarization have driven satisfaction with democracy to disturbing lows. Biden could be weakened by the millions of Trump voters who still say his victory was illegitimate. Meanwhile, any attempt to preach the rule of law to [other nations] could draw calls to get his own house in order first.

Biden Outlines $1.9 Trillion Spending Package to Combat Virus and Downturn (NYT) President-elect Joseph R. Biden Jr. on Thursday proposed a $1.9 trillion rescue package to combat the economic downturn and the Covid-19 crisis, outlining the type of sweeping aid that Democrats have demanded for months and signaling the shift in the federal government’s pandemic response as Mr. Biden prepares to take office. The package includes more than $400 billion to combat the pandemic directly, including money to accelerate vaccine deployment and to safely reopen most schools within 100 days. Another $350 billion would help state and local governments bridge budget shortfalls, while the plan would also include $1,400 direct payments to individuals, more generous unemployment benefits, federally mandated paid leave for workers and large subsidies for child care costs. It is unclear how easily Mr. Biden can secure enough votes for a plan of such ambition and expense, especially in the Senate.

Mexico declines to prosecute ex-Defense Minister Cienfuegos on drug charges (Washington Post) Three months after Mexico’s former defense minister was arrested in Los Angeles on drug-trafficking charges—a shocking move that would strain U.S.-Mexican relations—the case came to a close on Thursday night, after Mexican authorities decided not to pursue charges against Gen. Salvador Cienfuegos. The U.S. Justice Department had initially billed the case against Cienfuegos as a blockbuster. The retired military leader was arrested on Oct. 15 on arrival at the Los Angeles airport on charges he had helped the H-2 cartel send thousands of kilos of heroin, cocaine and methamphetamines to the United States. But weeks later, after intense pressure from the Mexican government, the Justice Department made the highly unusual decision to drop the charges and send him home for investigation. The case illustrated the power of Mexico’s military, which has become the main force fighting the country’s criminal cartels. Under President Andrés Manuel López Obrador, the armed forces have also assumed a variety of other roles—running ports, delivering vaccines during the coronavirus pandemic, and building airports and other infrastructure projects. Many senior military officials were outraged at the detention of Cienfuegos, whom they viewed as an honest leader. They feared the U.S. arrest might lead to future investigations against other members of the armed forces, according to analysts and officials. Stung by the anger among the military and Mexican politicians, López Obrador threatened to limit anti-drug cooperation with Washington.

UK has ‘largest population fall since the Second World War’ (The Independent) Up to 1.3 million immigrants have left the UK—the largest population fall since the Second World War—with coronavirus the likely cause, a study says. In London alone, almost 700,000 foreign-born residents are believed to have moved out, leading to a potential 8 per cent shrinking of the size of the capital, it argues. The study, by the government-funded Economic Statistics Centre of Excellence (ESCoE), draws a clear link with the devastation inflicted by the pandemic on sectors such as hospitality. “It seems that much of the burden of job losses during the pandemic has fallen on non-UK workers and that has manifested itself in return migration, rather than unemployment,” the authors concluded. “It seems that much of the burden of job losses during the pandemic has fallen on non-UK workers and that has manifested itself in return migration, rather than unemployment,” the authors concluded. Brexit is not being pinpointed as a cause of the sharp decline, but could yet have implications for filling jobs when the economic recovery comes.

Dutch government resigns over childcare subsidies scandal (Reuters) Prime Minister Mark Rutte announced the resignation of his government on Friday, accepting responsibility for years of mismanagement of childcare subsidies, which wrongfully drove thousands of families to financial ruin. The resignation follows a parliamentary inquiry last month that found bureaucrats at the tax service had wrongly accused families of fraud. The inquiry report said around 10,000 families had been forced to repay tens of thousands of euros of subsidies, in some cases leading to unemployment, bankruptcies and divorces, in what it called an “unprecedented injustice”. Many of the families were targeted based on their ethnic origin or dual nationalities, the tax office said last year.

Spain rejects virus confinement as most of Europe stays home (AP) While most of Europe kicked off 2021 with earlier curfews or stay-at-home orders, authorities in Spain insist the new coronavirus variant causing havoc elsewhere is not to blame for a sharp resurgence of cases and that the country can avoid a full lockdown even as its hospitals fill up. The government has been fending off drastic home confinement like the one that paralyzed the economy for nearly three months in the spring of 2020, the last time Spain could claim victory over the stubborn rising curve of cases. Unlike Portugal, which is going on a month-long lockdown Friday and doubling fines for those who don’t wear masks, officials in Spain insist it will be enough to take short, highly localized measures that restrict social gatherings without affecting the whole economy.

Merkel’s CDU Gathers to Choose New Leader (Foreign Policy) The next chair of Germany’s Christian Democratic Union (CDU), and possibly the next leader of the country, will be decided over the next two days, as 1,001 party delegates meet virtually to select a successor to Chancellor Angela Merkel as party leader. No matter who wins, they will not only have to live up to German expectations, but the world’s too. For the third year running, Germany topped a Gallup poll where respondents were asked to rate their approval of a country’s leadership. A Pew poll of 14 countries, taken in the summer, showed confidence in Angela Merkel was at all time highs.

U.S. forces in Afghanistan cut to 2,500, lowest level since 2001 (Washington Post) The Pentagon has reduced the number of U.S. troops in Afghanistan to 2,500, according to a statement Friday, completing a previously announced rapid drawdown despite a Congressional prohibition of the move and rising levels of violence in the country. “This drawdown brings U.S. forces in the country to their lowest levels since 2001,” said Acting Defense Secretary Christopher Miller in the statement. Miller also said “the United States is closer than ever to ending nearly two decades of war and welcoming in an Afghan-owned, Afghan-led peace process to achieve a political settlement and a permanent and comprehensive ceasefire.” But violence is increasing in many parts of Afghanistan, and peace talks in Qatar have made little progress since they were launched in September.

N.Korea holds huge military parade as Kim vows nuclear might (AP) North Korea displayed new submarine-launched ballistic missiles under development and other military hardware in a parade that underlined leader Kim Jong Un’s defiant calls to expand the country’s nuclear weapons program. State media said Kim took center stage in Thursday night’s parade celebrating a major ruling party meeting in which he vowed maximum efforts to bolster the nuclear and missile program that threatens Asian rivals and the American homeland to counter what he described as U.S. hostility. During an eight-day Workers’ Party congress that ended Tuesday, Kim also revealed plans to salvage the nation’s economy, hit by U.S.-led sanctions over his nuclear ambitions, pandemic-related border closures and natural disasters that wiped out crops. Kim’s comments are likely intended to pressure the incoming U.S. government of Joe Biden, who has previously called the North Korean leader a “thug” and accused Trump of chasing spectacle rather than meaningful curbs on the North’s nuclear capabilities. Kim has not ruled out talks, but said the fate of bilateral relations depends on whether Washington abandons its hostile policy toward North Korea.

Indonesia quake kills at least 42, injures hundreds (Reuters) A powerful earthquake killed at least 42 people and injured hundreds on Indonesia’s island of Sulawesi on Friday, trapping several under rubble and unleashing dozens of aftershocks as authorities warned of more quakes that could trigger a tsunami. Thousands of frightened residents fled their homes for higher ground when the magnitude 6.2-quake struck 6 km (4 miles) northeast of the town of Majene, at a depth of just 10 km, shortly before 1.30 a.m. The quake and aftershocks damaged more than 300 homes and two hotels, as well as flattening a hospital and the office of a regional governor. The heightened seismic activity set off three landslides, severed electricity supplies, and damaged bridges linking to regional hubs, such as the city of Makassar. Heavy rain was also worsening conditions for those seeking shelter.

Palestinians announce first elections in 15 years, on eve of Biden era (Reuters) Palestinian President Mahmoud Abbas announced parliamentary and presidential elections on Friday, the first in 15 years, in an effort to heal long-standing internal divisions. The move is widely seen as a response to criticism of the democratic legitimacy of Palestinian political institutions, including Abbas’s presidency. It also comes days before the inauguration of U.S. President-elect Joe Biden, with whom the Palestinians want to reset relations after they reached a low under President Donald Trump. According to a decree issued by Abbas’s office, the Palestinian Authority (PA), which has limited self-rule in the Israeli-occupied West Bank, will hold legislative elections on May 22 and a presidential vote on July 31. Hamas, the Islamist militant group which is Abbas’s main domestic rival, welcomed the announcement. But veteran West Bank analyst Hani al-Masri was sceptical that the elections would happen. He cited internal disagreements within Abbas’s Fatah and Hamas, and likely U.S., Israeli and European Union opposition to any Palestinian government including Hamas, which they regard as a terrorist group.

CNN’s correction of the week (Business Insider) After a tumultuous week in the US, most Americans could likely use a little humor. And they got it in the form of an amusing correction from CNN regarding what Democratic Rep. Ted Lieu of California grabbed during the Capitol siege. “CORRECTION: A previous version of this story misstated that Rep. Ted Lieu grabbed a crowbar before leaving his office. He grabbed a ProBar energy bar,” a correction for a CNN story states.

1 note

·

View note

Text

Sample Investment Strategy

In every sport, you want to have an excellent approach to win. The same also applies in inventory making an investment. A exact strategy whilst well implemented constantly assures a win or earnings inside the investment. If you're planning to make an investment you have to at least have a sturdy strategy to apply. If you do not have yet you may begin making it now before you delve into a unstable investment. You can ask for advise from other buyers or you can seek the internet for a pattern investment strategy that you may use or at least analyze. You can evaluation this sample and learn how it works and how it was made so you can also make your personal based from the pattern.

There are numerous web sites maximum drawdown the Internet where you can get a sample funding approach. Most of those websites offer distinct styles of strategies that had been confirmed powerful in a few styles of investments. You can look for the one that is suited for paintings on the type of investment that you'll make. Almost all of the strategies that were utilized by a hit traders are available at the internet. You just should patiently look for the right approach for you and your commercial enterprise. You can test the reviews approximately the ones strategies to know the possible results or issues that you could stumble upon whilst the use of that approach. It is wise to listen from those who have used it.

Making you very own method is a elaborate project. You have to think of numerous things which include the form of your funding, the duration of your plan, the blessings of your strategy, the chance of your investment and the way you'll treat it, etc. This work may be simplified if you are going to apply a sample investment method so that it will function your manual. You don't ought to cross deep into thinking of what your method will do for you. You do not should do a sequence of trial and errors experiments to get the nice from your organized method. The Internet has it all and all you have to do is locate it inside the actual funding as in case you are not new to the inventory marketplace.

0 notes

Text

How Much Money Can You Make Trading Forex

How Much Money Can You Make Trading Forex

Traders can make money trading Forex. Excellent traders can earn between 20 – 50% annually by trading Forex. Earning depends on trading expectancy, position size, and consistency. If an excellent manages $100,000, the maximum allowed drawdown is 5%, he can earn $20,000 annually. Thus, in this article let’s see about how much money can you make trading Forex. There is a false thought among the…

View On WordPress

0 notes

Text

Best Prop Firm for Forex Traders in India: FundedFirm

Forex trading has gained immense popularity in India, with traders looking for opportunities to scale their strategies without risking their own capital. Proprietary trading firms, commonly known as prop firms, provide traders with the necessary funding to trade larger positions while sharing profits. Among the many prop firms available, FundedFirm stands out as one of the best choices for Indian forex traders. With its trader-friendly policies, competitive funding options, and a transparent evaluation process, Funded Firm offers an excellent platform for traders looking to prove their skills and trade with significant capital.

Why Choose a Prop Firm for Forex Trading?

Trading with a prop firm allows traders to access larger capital without the need to invest their own money. This is particularly beneficial for Indian traders who may face restrictions on direct forex trading due to regulatory limitations. FundedFirm provides an alternative solution, allowing traders to participate in the global forex market through proprietary funding programs. The firm evaluates a trader’s ability through a structured challenge, and upon successful completion, traders receive funding to manage accounts significantly larger than what they might afford on their own.

FundedFirm’s Evaluation Process

To ensure that only skilled traders receive funding, FundedFirm follows a two-step evaluation process. The first phase requires traders to meet specific profit targets while adhering to risk management rules. This includes drawdown limits, maximum daily losses, and consistency requirements. Once a Best Prop Firm for Forex Traders in India successfully clears the first phase, they move to the second phase, which further assesses their ability to maintain profitability under real market conditions. Upon passing both stages, traders are awarded a funded account where they can trade and earn a percentage of the profits while maintaining disciplined risk management.

Competitive Payout Structure and Benefits

One of the major advantages of trading with FundedFirm is its competitive payout structure. Traders receive a significant share of their profits, often ranging from 75% to 90%, making it a highly attractive option. Unlike traditional brokers that impose heavy fees and commissions, FundedFirm ensures that traders keep most of their earnings. Moreover, the firm provides flexible withdrawal options, allowing traders to access their profits efficiently. This makes it an ideal choice for Indian forex traders who seek a sustainable and scalable trading career.

Trading Platforms and Conditions

FundedFirm supports popular trading platforms like MetaTrader 4 and MetaTrader 5, ensuring that traders have access to industry-standard tools and features. These platforms provide advanced charting tools, indicators, and order execution capabilities essential for professional trading. Additionally, FundedFirm offers traders the ability to trade multiple forex pairs, commodities, indices, and even cryptocurrencies. The firm maintains low spreads, fast execution speeds, and a stable trading environment, ensuring that traders can execute their strategies effectively without unnecessary technical hindrances.

Risk Management and Trader Support

A key factor that differentiates successful traders from struggling ones is risk management. FundedFirm enforces strict risk control measures to ensure that traders develop disciplined strategies. By implementing clear drawdown limits and loss caps, traders learn to manage their accounts professionally. Additionally, FundedFirm provides educational resources, webinars, and mentorship programs to help traders improve their skills. The support team is readily available to assist traders with technical issues or account-related queries, ensuring a smooth trading experience.

A Reliable Choice for Indian Traders

For Indian forex traders looking to scale their trading careers, FundedFirm offers one of the best opportunities in the market. Its structured evaluation process, competitive payouts, advanced trading platforms, and strong risk management policies make it a reliable choice. With the ability to trade larger capital and keep the majority of profits, traders can focus on refining their strategies without worrying about financial constraints. Best Prop Firm for Forex Traders in India commitment to transparency and trader support further strengthens its reputation as a top prop firm for forex traders in India.

#fundedfirm#forextrading#fundedtrading#forexpropfirm#bestpropfirm#forexfundedaccounts#proptradingindia#forexindia#forexproptrading#propfirm

0 notes

Text

ProphetFX (Prophet Enterprise Limited), TradehuntFX, FrontLineFX are scammers - here is the irrefutable evidence

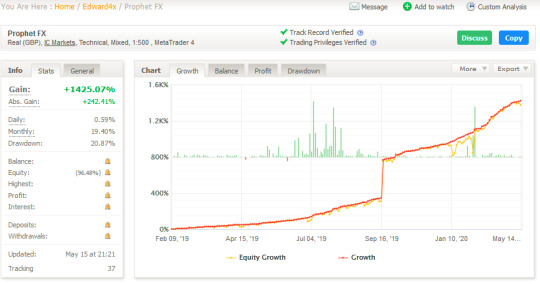

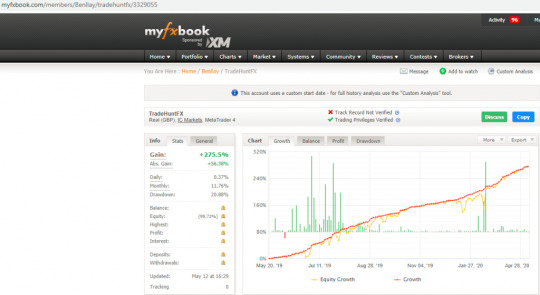

If the article wasn't enough - this is. Truth always finds a way and here it is. This is irrefutable evidence on how they are gaming myfxbook, false advertising, lying and committing serious fraud. These are not allegations/accusations - this is sold fact. All of this information has been copied, saved and stored offline away from harm, away from me and for the authorities to view/use. I know that Prophetfx will delete this and any record/evidence as soon as this post goes up. You will have read in the main article that I have a great deal of experience in MT4 and using Myfxbook. Well I knew that Myfxbook is a notoriously poor product. I knew that Metatrader 4 can be gamed - either via the MT4 broker server scam or by people using demo accounts. In this case ProphetFX are using a real account. Edward Elford had locked down the account so the only data I had to use was the Trade Summary. It wasn't enough data.

ProphetFX Myfxbook - https://www.myfxbook.com/members/Edward4x/prophet-fx/3173819 This took some extra investigation to work out how and what ProphetFX are doing. Luckily, in their stupidity - they left one of their accounts open. Here I am able to show you what and how ProphetFX are false advertising, lying & committing serious fraud. If you look at the TradeHuntFX Website Myfxbook page - look what you see...

https://www.tradehuntfxmentorship.com/tradecopier-autotrading/ This is from the https://www.tradehuntfxmentorship.com/tradecopier-autotrading/ page What is the ‘TradeCopier’? The TradeCopier facility is an empirically proven and exhaustively tested system that mirrors Forex trading activity from our master account and places trades onto your account. This enables consistent and incremental account growth to all connected clients. How does it work? The system carefully analyses market movement and volumes within any given pair we are trading. If price moves against us in one direction, the system will begin a process to ‘hedge’ itself out of that trade and close with a profit. The exact system methodology is of course confidential, but the full results from the TradeCopier past activity are available for scrutiny. How much profit can I expect each month or average over a year? Our month on month target growth is circa 15%-20%, some months may be less, and others more. Forex accounts do not grow by an identical amount each month but our past results do demonstrate consistent growth over a rolling period, which is our core aim. All TradeCopier clients see the exact same % increase, no matter if you have a £1,000 account, or £100,000. How much does it cost? There is a small monthly fixed charge and then a profits based % commission charge. However for THFX members we have removed the charge and the commission charge is reduced to 30%. Non members are charged £10 a month with a 45% commission charge. Billing is completed at the end of each calendar month. You then have 7 days in which to settle your bill. Failure to settle your account will result in it being disconnected. How much can I lose? The maximum drawdown that has been recorded is 7.8%, but this does not mean that higher drawdown will not happen, this is not something to be concerned by. This is just how the system operates, in fact it soon recovered after this. The market is very unpredictable at times, we have carried out extensive amounts of back testing and have never lost an account to drawdown/market conditions. Please refer to our full risk disclaimer. When can I withdraw the profits? You are able to withdraw at any stage you wish, however there are times when it is not advisable to withdraw such as when there are live trades open. All we ask is that if you wish to withdraw it’s always best to speak to Edward first. Please ensure you are able to make the due commissions payment based on the profits so far. Otherwise you will be disconnected. Who can handle my funds? Funds are held in your own IC markets account and only you are able to with withdrawn or move them. We will never ask for your Broker account log in details ever. We only need your MT4 trading account details so that we can link your account to the TradeCopier master account. Individual trading account log in credentials give us ZERO access to your personal funds. What about a large unexpected market movement? Our exposed risk is so small that even during large moves we are not reaching high DD. 300 pips the otherway and we are around 7% DD, so it’s totally within out risk settings to be able to deal with a 500 pip spike or market crash. ok what about the actual underlying myfxbook page.... Well it is here https://www.myfxbook.com/members/Benllay/tradehuntfx/3329055

TradehuntFX Myfxbook - https://www.myfxbook.com/members/Benllay/tradehuntfx/3329055 What do you notice? It is the VERY SAME red line and yellow line (we are told its an EA, the yellow line confirms its the very same underlying data) - but what is the glaring difference? - That huge line up on the ProphetFX chart. What could it be I wonder? Well again, the very helpful idiots of TradeHuntFX have left Myfxbook fully open. Look what I can do...

If I change the Custom Analysis start date then I can make huge gains in Myfxbook Ok, but what is that huge line up on the Myfxbook graph though? Well lets have a look at the underlying data on the TradeHuntFX for that date from Myfxbook....

This is the underlying data from TradeHuntFX Myfxbook (remember the very same "EA" that ProphetFX is)... Oh Fuck guys and gals what is that????? That is them gaming MyFxbook results. They are withdrawing and depositing to game the Growth graph. Note aspects of Myfxbook are locked down on both ProphetFX and TradehuntFX so you cannot actually see what is going on? Well as above - they TradehuntFX Myfxbook has elements left open. We can see in the excel sheet data that they are withdrawing and depositing to show huge gains. In the case of Edward Elfords ProphetFX Myfxbook you can see this is how he has created a massive 426% gain from September 16th 2019 - September 20th 2019. This is done by ramping up winning trades then withdrawing money from the account so it looks like you have had a massive win - clever huh? Yes, except when you are selling off the back of this. This is fraud. Pure and simple. It gets worse because we have already seen in the literature from ProphetFX, TradeHuntFX & FrontlineFX that this is risk averse and no major drawdown - so what do you also see in the data? HUGE DRAWDOWN. ACCOUNT BUSTING HUGE DRAWDOWN.

Look at the state of this. It was so bad they had to fund the account.

Trade was so bad and went into drawdown so deep they had to fund the account. So there you go - Drawdown was so bad they had to fund the account. Yet another dimension to the level of fraud committed by ProphetFX, TradeHuntFX & FrontlineFX. So to recap; 1. The Myfxbook graph is lies by gaming the growth graph and use of it as sales material is false advertising & committing fraud. 2. Hiding true trading results is false advertising & committing fraud. This lot thought they were untouchable - their stupidity has exposed them for who they really are - fraudsters. Read the full article

#EdwardElford#frontlinefx#JackAlexanderHARWOOD#myfxbook#PROPHETENTERPRISELTD#prophetfx#scam#scammers

0 notes

Photo

How to Calculate Maximum Drawdown in Excel » Trading Heroes

0 notes

Text

AAAFx(International) is a forex broker compatible with ZuluTrade, which is a tool of copy trading.

What kind of broker is AAAFx?

AAAFx was founded in 2008 and its headquarters is in Athens, Greece (member of the European Union). AAAFx has both AAAFx International and AAAFx EU. Currently we are employing 80+ people, and within the past two years the company has successfully opened thousands of live accounts from 176 countries globally. We offer in-house live customer support-trading desk in 11 languages. Our main focuses are to offer both an exceptional trading experience and outstanding customer support. AAAFx is regulated in Europe, registration no. 2/540/17.2.2010. Tax Identification Number is 998281207. AAAFx is an online Forex and CFD ECN (electronic communications network) broker launched in 2008. They are headquartered and regulated in Greece, being one of only two Forex/CFD brokers who are truly Greek. As they are regulated in Greece by the Hellenic Capital Market Commission, they are also fully regulated in all European Union member states. AAAFx offers traders the opportunity to trade a reasonably wide range of instruments wrapped as CFDs (Contracts for Difference), even including some bonds and soft commodities. In addition to Bonds, AAAFx offer trading in 36 Forex currency pairs and crosses, 10 global equity indices, the commodities of gold, silver, crude oil, natural gas, and copper, and all the major cryptocurrencies including Bitcoin paired again the U.S. Dollar. Minimum margin requirements differ, and of course, maximum leverage at a broker regulated within the European Union is restricted to 30 to 1 by ESMA regulations. We offer an in-house customer support - trading desk 24 hours/ 5 days a week, in 13 languages as well as:

A 10% Bonus on your initial deposit

Reduced Spreads that are among the lowest

Full refund policy for trade execution issues

Direct integration with Zulutrade, the largest social trading network with more than half a million users and 100.000 registered strategies

Expert Advisors can be used

No re-quotes. Prices are filled with just one click.

ECN Broker - No Dealing Desk Execution ensures our Customers’ best interest

ABOUT AAAFxFoundation AAAFX was found in 2008 Homepagehttps://international.aaafx.comHeadquartersAAAFX maintains headquarters in Athens, GreeceIslamic AccountsAAAFX supports Islamic Accounts -YES-Segregated Client Accounts -YES-Regulated AAAFX is regulated by HCMC (Greece ID-998281207) and MiFID (EU ID-2/540/17.2.2010)LanguagesBroker TypeECNCFD TradingYESPlatforms MetaTrader4, ZTP Auto-Trading, ZuluTrade, MT4 Mobile AppsAAAFX ZuluTradeTrading Time ZoneGMT (UTC+2)Demo Account YESEUR/USD Spread AAAFX minimum spread on EUR/USD is 0.9 pip and typical is 1.9 pip (full asset index below)Trading CommissionsNoLeverageup to 500:1Smallest Trade Size1000 UnitsScalping YESMinimum Account $300 or €250Deposit/Withdrawal MethodsBank Wire Transfer, Credit and Debit Cards, Bitcoin, MoneyBookers (Skrill) EPS, iDeal, GiroPay, DirectPay/Sofort, TeleIngreso, Przelewy24, QiwiWithdrawal FeesYes, $25 flat fee applies for all withdrawalsMinimum Account $300 or €250Acceptance of US ClientsNoAcceptance of Japanese ClientsNo (in AAAFx International) Yes (in AAAFx EU)

Accounts

AAAFx differs from most brokers in offering clients an ECN account model. There is only one account type for retail clients, without any of the gimmicks which many brokers typically use to promote spurious distinctions, although there is a choice of platforms. Opening an account with AAAFx requires a minimum deposit of $300. As AAAFx operates an ECN model, clients are charged both a spread and a commission on all transactions. Spreads are variable and begin at a low of 0.2 pips on the benchmark EUR/USD currency pair. Commissions are of course fixed and equate to another 0.8 pips on EUR/USD which means you can expect to pay about 1 pip for every round-trip trade in the EUR/USD currency pair. This is competitive, and in fact for a deposit of $300 is truly good value. Commissions for institutional clients are considerably lower, with institutional accounts charged approximately 70% on commissions, due to their large trade sizes. The spreads and commissions on non-Forex assets are also broadly competitive. Unusually for a Forex/CFD brokerage, AAAFx publish their overnight swap rates. They look mostly OK and are positive where there are significant interest rate differentials, which is a positive sign, and as it should be. Swap-free Islamic accounts, and demo accounts, are also available, as is typically the case with Forex/CFD brokerages. All accounts offer a minimum trade size of 1 micro-lot (0.01 full lots). Scalping and hedging are allowed, and automated trading is possible. This combination of advantages is something that is increasingly hard to find, especially with a Forex/CFD broker regulated in the E.U. such as AAAFx. There is no choice of trading platform if you do not want to use the ZuluTrade platform, as the only alternative is MetaTrader 4. Fortunately, this is the world’s most popular and common Forex trading platform. AAAFx is a partner of ZuluTrade, which allows its customers to effectively operate in a way that takes advantage of all of ZuluTrade’s social trading and trade copying features.

3 Trading Platforms

AAAFx offers us 2 best trading platforms "ZTP" and "MT4" that suit us.

ZTP

・State-of-the-art Technology Provides you with a fully-fledged web-based Trading Station for Forex and CFDs manual trading. Offers technical charts (Candlesticks, OHLC, lines) and indicators (Trend, Oscillators, volatility, volumes, Bill Williams etc.) you can tailor according to your trading requirements. In addition, ZuluScripts allows trading robots to be used or developed via your own algorithms to run your trading strategies. Your account is shielded at all times against connectivity issues and can run EAs uninterruptedly without the need for a VPS. The best choice for those who wish to trade with an all-in-one platform that is currently offered together with your ZuluTrade account. Products Traded:FOREX, CFDS Methods of Trade:MANUAL, ALGORITHMIC VIA ZULUSCRIPTS™ Platform:WEB-BASED

MetaTrader 4 (MT4)

・The standard The AAAFx International MetaTrader 4 provides you with the most essential tools and resources needed to analyze the Market and improve your Forex and CFDs manual trading performance. Offers opportunities to traders of all skill levels: advanced technical analysis, flexible trading system, algorithmic trading, Expert Advisors and mobile applications. Smallest Trade Size: 1000 Units Trailing Stop: Enabled by default on Live accounts The Platform is offered with or without ZuluTrade and requires installation. Download here. Products Traded:FOREX, CFDS Trade:MANUAL, ALGORITHMIC, EXPERT ADVISORS Platform:WINDOWS BASED AND REQUIRES INSTALLATION

MetaTrader Mobile

The MetaTrader 4 and platform apps can be used on iPhones, iPads, Multi-Terminal, and all Android devices.

6 Features of AAAFx

There are 6 features of AAAFx. ・A very competitive spread/commission offering, especially for small depositors. ・A reasonably wide range of instruments available for trading: Forex currency pairs, global equity indices, gold, silver, crude oil, bonds, and cryptocurrencies. ・An ECN trading model. ・Negative balance protection. ・Regulated by a major industry center (E.U.). ・AAAFx is a well-established firm with a well-earned reputation to protect.

Excellent compatibility with Zulutrade

In telling the details of AAAFX, it is the existence of the automatic copy trading system "Zulutrade" which should not be ignored. This "Zulutrade" is available for free at AAAFX. Most of those who open an account at AAAFX are aiming for this "Zuletrade".

"Zulutrade" automatically manages our funds even when we are asleep.

"Zulutrade" is characterized by the fact that the trading signal issued by an excellent trader called a signal provider is instantly reflected in your account. We can buy or sell the same as high performance traders around the world just by choosing which traders we synchronize. Once we decide which trader we synchronize, it's okay to leave managing our funds untouched without logging in to our account extremely. Zulutrade manages our assets automatically. EA(=Expert Advisor) seems to be difficult because of setting programs. But AAAFX is very popular for people who do not have confidence in trading forex manually or those who want to have an account for the automatic trading account as a sub account as well as accounts for manual trading.

Even if traders are excellent, they will surely drawdown someday. By combining several service providers and forming portfolios, then, we can reduce that risk. As one of the features of ZuluTrade, all providers are cloud services running on the server side of ZuluTrade. There is no need to carry out troublesome such as installation on the personal computer. Also, even if the PC is turned off, trading will automatically take place at the signature of the provider you designated. Extremely speaking, even if you do not have a computer, you can use ZuluTrade if you can operate from an internet cafe or smartphone. A world-class signal provider will repeat automatic trading for 24 hours on your behalf. This dreamlike trading system ZuluTrade is completely available for free.

Here is about Details of ZuluTrade

"

Services of AAAFx

Education

AAAFx has no educational offering. In our view, this is refreshing, as they are focusing on offering a brokerage service instead of using the common tactic of offering low-quality education to suck in new clients with high transaction costs.

Bonuses and Promotions

AAAFx offers 10% Βonus on all of our deposits! If you want to receive Special Bonus Offer, you should read the following Terms and Conditions. The Profit Sharing Accounts Program offered by AAAFx International has been welcomed with great enthusiasm and has aroused a great deal of interest among our clients. We offer a 10% Bonus for each received deposit. Below, are the Special Bonus Offer defined terms and conditions: Both Existing and New clients are qualified for the Special Bonus. Both Classic and Profit Sharing accounts are qualified for the Special Bonus There is a maximum incentive bonus of $3,000 per account (please see round turn lot table above). The Special Bonus expires and will be automatically removed from an account, if it is not released within a period of 45 or 90 days (depending on the offer) from the date that it was credited. The Special Bonus cannot be transferred between accounts. Funds transferred between accounts are not considered deposits and are therefore not eligible for the Special Bonus offer. The Special Bonus is credited in the investment account after receiving the deposit and will only be released in the equity once the necessary round turn requirements are completed, as mentioned on the relevant table above. Round turn lot requirements are calculated pro rata using weighted averages for each currency pair; please click here for details. You can easily check the status of your bonus(es) by simply visiting the Mybonus section of your account. AAAFx International reserves the right to alter, amend, extend or terminate the Offer at any time without prior notice. AAAFx International will notify you of any changes to the Offer and/or its conditions by updating its website and it is recommended that you check the website regularly for such updates.

Deposits/Withdrawals

Depositing funds into a AAAFx account is an easy and secure process. Both may be made using several different methods, including credit cards, debit cards, Skrill, Neteller, and even Bitcoin. Withdrawals are generally made through the same channel that deposits have been made through.

Conclusion

AAAFX is an ECN Forex Broker found in 2008 that allows US traders as it is compliant with NFA. AAAFX is highly associated with ZuluTrade, actually, it is part of the ZuluTrade Group. AAAFX trading terms may be considered as competitive in general. They offer EURUSD typical at 1.9 pips and minimum at 0.9 pips, without any trading commissions charged. They offer the MT4 platform, the ZTP platform, and of course the ZuluTrade platform which allows Expert Advisors and Social Trading. They offer also apps for iPhone and Android. AAAFX allows Scalping and Hedging. Their order execution is considerably fast without price manipulation. As concerns AAAFX accounts, their minimum deposit of $300 is reasonable while they support several account currencies. Keep in mind that they charge withdrawal fees (25EUR flat). AAAFX asset index is considerably wide and forms one of the main advantages when trading at AAAFX. In general AAAFX is a good Forex Brokerage choice, especially as concerns US traders. AAAFx has an exceptional offering for retail Forex/CFD traders, which smacks of professionalism and integrity, and avoids cheap gimmicks. If you are not looking for an extremely wide range of obscure assets to trade, and want a cheap ECN-style trade offering, these guys are certainly worth seriously considering, especially if you have a relatively small deposit to make.

Open Accounts of AAAFx

source http://kaigai-invest.blog.jp/aaafx/international/introduction

0 notes

Text

Testing: Radeon RX 470 on ASUS ROG Strix video card - Overclocking | Benchmark

Testing the Radeon RX 470 on the example of the ASUS ROG Strix video card -In the line of new AMD video cards, we have not yet had time to consider only the Radeon RX 470. We will fix it in this article. Let's study the capabilities of the younger model on Polaris 10 in nominal and overclocked terms using a video card from ASUS as an example. Radeon RX 470 The Radeon RX 470 along with the Radeon RX 480 are based on a single Polaris 10 GPU that uses the latest fourth generation GCN architecture. But out of 36 Compute Units, the younger version has 32 active ones, i.e. instead of 2304 stream processors, the Radeon RX 470 operates with 2048 cores, 128 texture units out of 144 are active. In the new generation, the Compute Unit performance has been increased compared to previous solutions, and the memory bandwidth efficiency has been increased due to data compression algorithms. Therefore, the Radeon RX 470/480 are content with a 256-bit memory bus, but work with it faster than previous models. Improved geometry processing blocks, Async Compute operation. The L2 cache has been increased to 2MB. In addition to changes in the configuration of computing units, the Radeon RX 470 differs from the Radeon RX 480 also in operating frequencies. For the younger video card, the base GPU frequency is set at 926 MHz, and the Boost frequency is set to 1206 MHz. Relative to the frequencies of the Radeon RX 480, the difference in the maximum value is small, but at the base frequency it is almost 21%. GDDR5 memory operates at an effective frequency of 6600 MHz, which is also 21% lower than the memory frequencies of the older card. In terms of the configuration of the computing units, the Radeon RX 470 is closest to the Radeon R9 380X. At the same time, the TDP of the novelty is only 120 W thanks to the new 14-nm process technology. For comparisons, it should be recalled that the Radeon RX 480 is claimed to be 150 watts. Let's summarize the characteristics of new and old AMD Radeon video cards in one table. Video adapterRadeon RX 480Radeon RX 470Radeon R9 390Radeon R9 290Radeon R9 380XRadeon R9 280XCorePolaris 10Polaris 10GrenadaHawaiiAntiguaTahitiNumber of transistors, mln.pcs570057006020602050004313Process technology, nm141428282828Core area, sq. mm232232438438366352Number of stream processors230420482560256020482048Number of texture units144128160160128128Number of rendering units323264643232Core frequency, MHz1120–1266926–1206Up to 1000Until 947to 9701000Memory bus, bit256256512512256384Memory typeGDDR5GDDR5GDDR5GDDR5GDDR5GDDR5Memory frequency, MHz800066006000500057006000Memory size, MB8192/409640968192409640963072Supported DirectX Version121212121212InterfacePCI-E 3.0PCI-E 3.0PCI-E 3.0PCI-E 3.0PCI-E 3.0PCI-E 3.0TDP level, W150120275275190250 The Radeon RX 470 was originally announced with 4GB of video memory, but some manufacturers have already introduced 8GB models. Also, AMD partners immediately got the freedom to modify the RX 470 series cards, thanks to which many non-reference versions went on sale. Using such a video card as an example, we will get acquainted with the new product. ASUS ROG Strix Radeon RX 470 (ROG STRIX-RX470-O4G-GAMING) The video card comes in a medium-sized box with a large, bright Strix lettering on the front. Supplied with a CD with software and instructions. Among the pleasant bonuses, it is worth noting two Velcro cable ties and a code for 15 days of "Premium" in World of Warships. ASUS is equipped with a large cooler with two large fans and heat pipes. Cooling is covered with a black plastic cover. The video card looks more solid than the reference version Radeon RX 480, which inspires respect and hopes for excellent temperature and noise characteristics. The austere appearance is complemented by an illuminated logo at the end. The board is full-sized, and not shortened as in the reference senior card. One power connector is located in the corner with the latch facing up. Disassembly of the video card is prevented by a seal on one of the screws. At the heart of the cooler are two thick 8-mm heat pipes that directly contact the surface of the graphics crystal. The tubes fit tightly together in the grooves of the base. The radiator is made up of a series of thin fins, which are pierced with heat pipes. A casing with a pair of Everflow T129215SM fans of a standard size of 100 mm clings to the radiator using latches. There are soft pads under the fans to dampen vibration. A separate heat sink is provided for the power supply transistors. Let's take a look at the board. A stiffener is screwed on the side to avoid deformation of the PCB. The GPU power system is located on the right side, has four phases. The memory power supply subsystem is two-phase. The Polaris 10 chip is surrounded by a massive frame, the crystal itself is unmarked on the surface. Four gigabytes of memory are recruited with SKhynix H5GC4H24AJR R0C microcircuits. ASUS STRIX-RX470-O4G-GAMING operates at higher frequencies. Initially, the core frequency was increased to 1270 MHz, which is the maximum value. The base frequency is not indicated in official sources, but it can be assumed that it is at 990 MHz or even higher. Memory without factory overclocking. For monitoring and overclocking, we used the ASUS GPU Tweak II application, which provides maximum control and management of the operating parameters of the new Radeon graphics cards from ASUS. Note that many of the features are available in the standard WattMan application from AMD Radeon Settings. Video cards with GAMING attachment support several operating modes. In this case, 1270 MHz corresponds to the most productive OC Mode. When you select the Gaming Mode settings profile, the frequency is reduced to 1250 MHz, in Silent Mode to 1230 MHz. We limited ourselves to the initial settings during testing. And even in this mode, the real GPU frequency varied greatly in the load and was noticeably below 1270 MHz. When loaded with the Metro: Last Light benchmark at 2K at maximum quality (bottom left screenshot), the frequencies were not just below 1200 MHz, but with drawdowns almost up to 1100 MHz. About the same picture was observed in Tom Clancy's The Division, although there were already peak values at 1270 MHz. On the reference video card Radeon RX 480, the frequency spread was less, although the standard version does not have good cooling. Here, the heating is no more than 60 ° C at 25 ° C indoors. This value is used in AMD WattMan as a temperature limiter, but the video card barely comes close to it, so the main role in lowering frequencies is played by a severe power limitation. Note also that apart from weak heating, ASUS also pleased with the minimum noise, which is not surprising at a fan speed of less than 1400 rpm. The ASUS graphics card will also replace the regular version of the Radeon RX 470 by simply reducing the core frequency to 1206 MHz. How are things going with overclocking? Initially, ASUS managed to reach frequencies close to 1.4 GHz, but with a significant increase in operating voltage. By increasing the power limit to the limit (150% of the initial level), it was possible to obtain an almost stable frequency with minimal deviations below the maximum level. But after trying hard games, problems began. At very high voltages, the frequency could go down even at low temperatures, or periodic "freezes" appeared. There were freezes and other crashes. As a result, I had to stop at 1350 MHz with a minimum voltage increase of 12 mV in the ASUS GPU Tweak II utility. In this configuration, the only problem was the rare freezes, which appeared only in a couple of applications, but we simply did not take such results into account when calculating the average data. The memory was overclocked to 7556 MHz. The fan speed was forcibly increased to approximately 1900 rpm. A certain noise in this mode was noticeable, but without any serious discomfort. As you can see from the screenshots, the core frequency was kept at the maximum of 1350 MHz, the deviations were minimal. Moreover, this time the drawdowns are more pronounced in The Division, but still not lower than 1335 MHz. So the real gain in frequencies should be pretty good. As for heating, at the selected fan speed, the peak core temperature did not exceed 71 ° C. Characteristics of the tested video cards The performance of the Radeon RX 470 will be compared to the older Radeon RX 480, Radeon R9 290, GeForce GTX 1070 and GeForce GTX 970 graphics cards from the recent Radeon RX 480 benchmark. The technical characteristics of all participants are described in the table. Video adapterRadeon RX 480Radeon R9 290ASUS ROG Strix RX 470Radeon RX 470GeForce GTX 1060GeForce GTX 970CorePolaris 10HawaiiPolaris 10Polaris 10GP106GM204Number of transistors, mln.pcsn / a60205700570044005200Process technology, nm142814141628Core area, sq. mm232438232232n / a398Number of stream processors230425602048204812801664Number of texture units14416012812880104Number of rendering units326432324856Core frequency, MHz1120–1266Until 947990–1270926–12061506–17081051–1178Memory bus, bit256512256256192256Memory typeGDDR5GDDR5GDDR5GDDR5GDDR5GDDR5Memory frequency, MHz800050006600660080007010Memory size, MB819240964096409661443584 + 512Supported DirectX Version121212121212InterfacePCI-E 3.0PCI-E 3.0PCI-E 3.0PCI-E 3.0PCI-E 3.0PCI-E 3.0Power, W150275120120120145 Test stand The test bench configuration is as follows: - processor: Intel Core i7-6950X (3.0 @ 4.1 GHz); - cooler: Noctua NH-D15 (two NF-A15 PWM fans, 140 mm, 1300 rpm); - motherboard: Gigabyte GA-X99P-SLI; - memory: G.Skill F4-3200C14Q-32GTZ (4x8 GB, DDR4-3200, CL14-14-14-35); - system drive: Intel SSD 520 Series 240GB (240 GB, SATA 6Gb / s); - additional disk: Hitachi HDS721010CLA332 (1 TB, SATA 3Gb / s, 7200 rpm); - power supply unit: Seasonic SS-750KM (750 W); - monitor: ASUS PB278Q (2560x1440, 27 ″); - operating system: Windows 10 Pro x64; - Radeon RX 470 driver: AMD Grimson 16.7.3; - driver Radeon RX 480 and R9 290: AMD Grimson 16.6.2; - GeForce GTX 1060 driver: NVIDIA GeForce 368.64; - GeForce GTX 970 driver: NVIDIA GeForce 368.39. The test methodology described in one of the previous articles is taken as a basis. But since there was used a configuration of settings for top-end video cards, then in this comparison for some applications simpler parameters are used in accordance with the configuration of settings that were used in testing the Radeon RX 480. Test results Batman: Arkham Knight In Arkham Knight, the difference between Radeon RX 470 and Radeon RX 480 is about 10% in average frame rate and more than 20% in minimum fps. Initially, the junior card is slightly weaker than the Radeon R9 290 and GeForce GTX 970, but this is easily overclocked. At maximum frequencies, it is possible to overtake the GeForce GTX 1060 in the nominal value. Battlefield 4 The new Radeon is inferior to the old man R9 290 in the game Battlefield 4, losing along the way to the GeForce GTX 970. After overclocking, the Radeon RX 470 reaches the performance level of the Radeon RX 480. The increase from increasing frequencies is 15%. DiRT Rally Another test, where the old Radeon R9 290 prevails over the novelties based on Polaris 10. There is a 13% difference between the Radeon RX 470 and the Radeon RX 480, and the younger participant just compensates for the gap due to his overclocking. DOOM In the DOOM shooter, the Radeon RX 470 has a minimal lag behind the Radeon R9 290. In overclocking, all three AMD demonstrate similar results. As a supplement, we present the test data of the Radeon RX 470 in the Vulkan API. You can measure fps in this mode only with the Action! And only in windowed mode. The latter may somehow affect the accuracy of measurements, but the general trend can be seen. The transition to Vulkan speeds up the beginner by 30%, which is an impressive result. Fallout 4 The Radeon RX 470 is inferior to less than 9% of the GeForce GTX 970 and up to 14% of the Radeon RX 470 in Fallout 4. The gain from overclocking makes it possible to compensate for the lag behind its older comrade. Far Cry Primal Radeon RX 470 is inferior to Radeon RX 480 by about 13-15%. The lag behind the GeForce GTX 970 in Far Cry Primal is minimal. Overclocking provides ASUS acceleration by 16%. Gears of War: Ultimate Edition The game uses the heaviest graphics settings with 4K textures And even with this mode, the Radeon RX 470 copes very well, overtaking the GeForce GTX 970. The newcomer has less drawdown in fps, and the minimum parameter is equal to the GeForce GTX 1060. Although in this particular case, these readings should be treated with caution, not forgetting to focus on average indicators. Grand Theft Auto 5 The same minimum fps for Polaris models in GTA 5, which can be explained by the newer driver for the younger card. In terms of the average frame rate, the new product hardly differs from the Radeon R9 290 and GeForce GTX 970. Overclocking allows you to bypass the Radeon RX 480. Just Cause 3 Radeon RX 470 in Just Cause 3 is minimally inferior to its closest rivals - Radeon R9 290 and GeForce GTX 970. The lag from the older model of the new series is less than 15%, this is compensated by overclocking. Moreover, the increased frequencies allow you to slightly bypass the Radeon RX 480 in the nominal value. Metro: Last Light Although the Radeon RX 470 loses to the GeForce GTX 970 in Last Ligh, it demonstrates good fps in high resolution, which is nice in itself. The difference with the Radeon RX 480 is almost 17%, but the gap is compensated for after increasing the frequencies of the Radeon RX 470. Quantum Break Excellent performance for the Radeon RX 470 in Quantum Break. At the initial frequencies, the video adapter takes an average position between the GeForce GTX 970 and the GeForce GTX 1060. The gap from the Radeon RX 480 is at the level of 16-17%. With overclocking, the younger comrade compensates for this gap, at the same time it is possible to slightly bypass the GeForce GTX 1060 in nominal value. Rise of the Tomb Raider The Radeon RX 470 struggles to deliver barely acceptable fps in Rise of the Tomb Raider at very high quality in Full HD, but overclocking allows you to bring the performance to a more comfortable level. It's nice that the newcomer is faster than the Radeon R9 290. The difference with the Radeon RX 480 is at the level of 23–32%, which is also due to the high memory capacity of the older friend. The Witcher 3: Wild Hunt The hero of the review in The Witcher 3 loses to the GeForce GTX 970 only in average frame rate. Lagging behind Radeon R9 290 at 6%, lagging behind Radeon RX 480 at 15-17%. Overclocking provides over 20% acceleration, allowing you to get as close as possible to the performance of the GeForce GTX 1060 Tom Clancy's The Division The outsider in The Division is the Radeon R9 290. The newcomer is a little faster. ASUS at factory frequencies is on a par with GeForce GTX 970. The difference between Radeon RX 470 and Radeon RX 480 is up to 15%, overclocking accelerates the former by 17–19%. Additionally, testing was carried out at a higher resolution as a stress mode. The general alignment of forces changes little, except that the Radeon R9 290 gains an advantage over the Radeon RX 470. The ratio with the older Polaris remains at the same level. Total War: Warhammer New test in a new game. A special benchmark with DirectX 12 support was used. Here the Radeon RX 470 is on a par with the Radeon R9 290 and confidently bypasses all competitors from NVIDIA. XCOM 2 At the initial frequencies, the Radeon RX 470 is inferior to a few percent of the GeForce GTX 970. The difference with the Radeon RX 480 in XCOM 2 is up to 17%, but the younger video adapter fully compensates for it after its overclocking. 3DMark 11 The new Radeon is noticeably inferior to the GeForce GTX 970 in this test, but overclocking minimizes the gap. The difference between Radeon RX 470 and Radeon RX 480 is almost 19%. 3DMark Fire Strike In this test, the lag behind the GeForce GTX 970 is less, so the increase in frequencies makes it easy to overtake the competitor. The difference with the Radeon RX 480 is about 15%. Energy consumption The measurements were made according to the previously described method, but without taking into account the data of the older video cards in Total War: Attila. At par, the Radeon RX 470 has extremely low performance against the background of its comrades from the AMD camp. The difference with the Radeon R9 290 is especially impressive. The newcomer wins the GeForce GTX 970 by this criterion. But the first place in terms of economy remains with the GeForce GTX 1060. It is also worth noting that the situation changes dramatically during overclocking, the power consumed by the Radeon RX 470 increases. conclusions AMD strengthens its position in the middle class with the release of the Radeon RX 470 graphics card. The novelty, which in all respects should replace the Radeon R9 380X, is closer in performance to the Radeon R9 290, yielding only a few percent to the old model. The lag behind the Radeon RX 480 is on average 15%, but it happens even more. A higher memory capacity can be an important factor in the advantage of an older video card based on GPU Polaris 10. At the same time, the potential of the Radeon RX 470 with 4 GB is not only enough for Full HD, in some games the video card can handle 2K resolution. In new demanding games, especially under DirectX 12, the Radeon RX 470 is a direct competitor to the GeForce GTX 970, although in slightly earlier projects the new product is weaker. All this is combined with low energy consumption and a low suggested price, It should be noted that the low level of power consumption in the nominal is associated with severe restrictions. For this reason, the Radeon RX 470 has a floating core frequency, which can be noticeably lower than the declared 1206 MHz. In this regard, the new Radeon are beginning to resemble the GeForce. And, as you may have noticed, we even began to indicate on the performance graphs the full frequency range of the Radeon core instead of one final value. The reviewed ASUS ROG STRIX-RX470-O4G-GAMING video card pleased with low heating and minimal noise. A high-quality cooling system copes well with its tasks during factory overclocking, which, however, provides minimal acceleration. To squeeze the most out of the video card, you need to increase the power and temperature limit along with the frequencies. The final overclocking by ASUS can be safely called successful, because our sample managed to pass the tests at a stable core frequency of 1350 MHz, although it felt like the limit of possibilities. With overclocking, ASUS managed to catch up (and sometimes overtake) the Radeon RX 480. This acceleration is associated with a sharp increase in heat dissipation, but the cooler can cool the card without serious noise even in this mode. So we can safely recommend ASUS ROG Strix Radeon RX 470 for purchase! Read the full article