#manufacturing trade school philadelphia

Explore tagged Tumblr posts

Text

Scope For Female Manufacturing Technicians In The US

As the industry grows, female manufacturing technicians in the US have more opportunities to impart their knowledge and expertise.

#Manufacturing certification programs in philadelphia#Manufacturing certification courses in philadelphia#manufacturing training in philadelphia#Manufacturing course in philadelphia#manufacturing training program in philadelphia#manufacturing college philadelphia#Manufacturing certification classes in philadelphia#Manufacturing trade schools degree in philadelphia#manufacturing trade school philadelphia#Manufacturing tech institute in philadelphia

0 notes

Text

#automation certification training Institute in Yeadon#PA#electrician trade school in Yeadon#electrician certification training Institute in Yeadon#electrical certification courses in philadelphia#manufacturing training program in philadelphia

0 notes

Text

Nannie Helen Burroughs (May 2, 1879 - May 20, 1961) was born in Orange, Virginia to John and Jennie Burroughs. She attended school in DC and moved to Kentucky where she attended Eckstein-Norton University and received an honorary MA.

She sought a teaching position in DC, but she did not receive it, she moved to Philadelphia and became associate editor of The Christian Banner, a Baptist newspaper. She returned to DC where, despite receiving a high rating on the civil service exam, she was refused a position in the public school system. She took a series of temporary jobs including office building janitor and bookkeeper for a small manufacturing firm, hoping to become a teacher in DC. She accepted a position in Louisville as secretary of the Foreign Mission Board of the National Baptist Convention.

She began planning the National Trade and Professional School for Women and Girls in DC. The school opened in 1909 with her as its first president. She adopted the motto “We specialize in the wholly impossible” for the school, which taught courses at the high school and junior college levels. She led her small faculty in training students through a curriculum that emphasized both vocational and professional skills. Her students were to become self-sufficient wage earners and “expert homemakers.”

She believed that industrial and classical education were compatible. She became an early advocate of African American history, requiring each of her students to pass that course before graduation. She was a demanding principal.

She never married. She devoted her life to the National Trade and Professional School for Women and Girls and remained its principal until her death. Three years later the institution she founded was renamed the Nannie Burroughs School. #africanhistory365 #africanexcellence #deltasigmatheta

1 note

·

View note

Photo

Today’s #WorkerWednesday post takes us to a tug-of-war game at an employee family picnic hosted by the Samuel Stockton White Dental Manufacturing Company. While the photograph is undated, we estimate that it was possibly taken around 1940. The S.S. White Dental Manufacturing Company was founded in 1844 by Samuel Stockton White (1822-1879), a dentist from Philadelphia. By the 1850s, the company was one of the world’s leading manufacturers of false teeth and dental appliances, with sales offices and representatives operating across the globe.

This image is from Hagley Library’s S.S. White Dental Manufacturing Company photograph collection (Accession 1972.244). The digital version of this collection includes documentation of company personnel, company buildings, corporate events, dental equipment, dental offices and schools in the United States and abroad, and trade shows and exhibitions. The collection has not been digitized in its entirety; it also includes many portraits of identified and unidentified dentists, as well as other unidentified locations, most of which have been excluded from digitization . Click here to view the digital collection in our Digital Archive.

#WorkerWednesday#Worker Wednesday#tug of war#employee picnic#S.S. White Dental Manufacturing Company#Samuel Stockton White#Philadelphia history#1940s#1930s#company picnic#women workers

11 notes

·

View notes

Text

The Next Big Thing in Dentaleze endodontist new jersey

I'M FROM NEW JERSEY and I'm happy about it, I love the Garden State. I'M FROM NEW JERSEY and I wish to yell it, I think it's merely great. All of the other states throughout the country might suggest a lot to some; But I wouldn't want another, Jersey is like no other, I'm glad that's where I'm from. New Jersey State Song

New Jersey has an crucial location in early American history. In the 1600s, Swedish colonists constructed the very first log cabin in North America in the region. If you want to see where lots of important Revolutionary War fights were fought, consisting of those at Monmouth and Princeton, go to New Jersey. Numerous battles were fought in the state that it was called the "Cockpit of the Revolution.".

George Washington made his famous Christmas night crossing of the Delaware River near Trenton, the state's capital. Trenton and Princeton were both capitals of the nation throughout 1780s. New Jersey's strategy of government, developed during the preparing of the Constitution, secured the rights of smaller sized states and resulted in the provision for equivalent representation of all states in the Senate. New Jersey's name comes from the island of Jersey in the English Channel. Sir George Carteret, a co-owner of the state in the 1600s, was born upon the island. The abbreviation for New Jersey is NJ.

New Jersey is a Mid-Atlantic state surrounded by New York to the north, the Atlantic Ocean to the east, the Delaware Bay to the south, and Pennsylvania to the west. The Hudson River separates New Jersey and New York, and the Delaware River runs in between New Jersey and Pennsylvania. The state's landscape includes wilderness areas in the mountains of its northwest and southern tidelands, beaches, and commercial cities and towns. Although New Jersey ranks 46th in size among the states, it has the ninth biggest population and the majority of people per unit of land. Practically 90 percent of the state's overall population reside in towns and cities -- that's the highest percentage of any state. Due to the fact that of the value the state has actually put on manufacturing and market, New Jersey has such a high metropolitan population mostly. The state has done this mostly because of its location in between Philadelphia and New York City, two of the largest business and population centers in the country. New Jersey has some of the world's busiest ports including Newark and Elizabeth, situated near New York City, and Camden, situated near Philadelphia. The state has excellent railway, highway, and waterway systems to serve these nearby markets. Many individuals who operate in New York City and Philadelphia reside in New Jersey and commute using busses, trains, and cars .

New Jersey's commercial history started in 1676 at Shrewsbury when an ironworks was opened. Today, New Jersey is a leading center of commercial research and development. It is the leading state in chemical production. It is also one of the leading states in the production of pharmaceuticals, foodstuff, printed products, and numerous other produces. Production centers can be found in Camden, Elizabeth, Jersey City, Newark, Paterson, and Trenton. Service markets consisting of education, health care, and retail trade are also important parts of the state's economy.

While market has benefited New Jersey, the big, fast urbanization that it triggered produced numerous issues consisting of the issues of land usage, water supply, economic development, and air pollution. The need for more energy, schools, and broadened transport centers also ended up being issues. In fact, rioting broke out in 1967 in Newark, the state's largest city, as African Americans violently protested against discrimination and poor living conditions. In addition to industry, farming is essential to New Jersey. The state's farms are amongst the tiniest in the country, however their output per acre is amongst the most valuable. Taste fresh fruits and vegetables from the state's many truck farms. A truck farm is a small farm where vegetables and fruits are grown to be sold at local markets. In fact, New Jersey is nicknamed the "Garden State" because of the tasty Dentaleze nj fruits and vegetables produced on its truck farms. Tourist is the state's second essential source of income. Couple of states draw in more travelers. Strike it rich at the fruit machine in Atlantic City. While you're in Atlantic City, see talented and lovely ladies from every state contend in the Miss America Pageant. Relax or play on the beaches in among the state's lots of ocean-side towns.

1 note

·

View note

Link

In the first employment report after social distancing measures had taken hold in many US states, the Department of Labor announced that 3.3 million people had filed jobless claims. A week later, in the first week in April, an additional 6.6 million claims came in—almost unfathomable compared with the previous record of 695,000, which was set in 1982.

As bad as those numbers are, though, they greatly understate the crisis, since they don’t take into account many part-time, self-employed, and gig workers who are also losing their livelihoods. Financial experts predict that US GDP will drop as much as 30% to 50% by summer.

More on coronavirus

Our most essential coverage of covid-19 is free, including:

See also:

Please click here to subscribe and support our non-profit journalism.

What is herd immunity?

What is serological testing?

How does the coronavirus work?

What are the potential treatments?

Which drugs work best?

What's the right way to do social distancing?

Other frequently asked questions about coronavirus

---

Newsletter: Coronavirus Tech Report

Zoom show: Radio Corona

All our covid-19 coverage

The covid-19 special issue

This story was part of our May 2020 issue

See the rest of the issue

Subscribe

In late March, President Donald Trump warned against letting “the cure be worse than the problem itself” and talked of getting the country back to business by Easter, then just two weeks away. Casey Mulligan, a University of Chicago economist and former member of the president’s Council of Economic Advisers, warned that “an optimistic projection” for the cost of closing nonessential businesses until July was almost $10,000 per American household. He told the New York Times that shutting down economic activity to slow the virus would be more damaging than doing nothing at all.

Eventually the White House released models suggesting that letting the virus spread unchecked could kill as many as 2.2 million Americans, in line with the projections of other epidemiologists. Trump backed off his calls for an early reopening, extending guidelines on social distancing through the end of April. But his essential argument remained: that in the coronavirus pandemic, there is an agonizing trade-off between saving the economy and saving lives.

Evidence from research, however, shows that this is a false dichotomy. The best way to limit the economic damage will be to save as many lives as possible.

A novel recession

Part of the difficulty with setting policy now is that the situation is unprecedented in living memory. “It’s impossible to know how the world is changing,” says David Autor, a labor economist at MIT. “It isn’t like anything we’ve seen in a hundred years.” In any past recession or depression, the economic solution has always been to stimulate demand for labor—to get workers back on the job. But in this case, we’re purposely shutting down economic activity and telling people to stay at home. “It’s not just the depth of the recession,” Autor says. “It’s qualitatively different.”

One of the biggest fears is that those least able to withstand the downturn will be hit hardest—low-wage service workers in restaurants and hotels, and the growing number of people in the gig economy. For the last two decades, service workers have become an increasingly large part of the labor force as many of the midlevel office and manufacturing jobs previously open to people without college degrees have dried up, says Autor. It’s people in these service jobs, already low paid and often with few health and other benefits, who will struggle the most.

“On a good day they are vulnerable, and on a bad day they are even more vulnerable,” Autor says. “And this is a very bad day.”

Provisions included in the $2 trillion legislative package passed by Congress in late March were meant to give affected workers and businesses the means to weather the shutdown and, once the outbreak is under control, help restart the economy. Each adult earning less than $75,000 will be given $1,200, and for the first time, gig workers and self-employed people will qualify for unemployment benefits. Hundreds of billions of dollars will also go to helping businesses stay afloat.

But it almost certainly won’t be enough, especially in the hardest-hit areas of the country. Cities like Las Vegas and Orlando, “places with gargantuan leisure hospitality economies,” will be badly affected, says Mark Muro, coauthor of a report from the Brookings Institution analyzing the numbers. But any region with a large service economy is vulnerable. Muro points out that many of these places never recovered from the 2008 financial crisis.

The people losing these low-wage service jobs were already experiencing skyrocketing mortality rates from what economists have begun calling “deaths of despair,” caused by alcoholism, drug abuse, and suicide. The coming crash could make things much worse.

The value of a life

Yet shutting down businesses is the only real choice, given that an unchecked pandemic would itself be hugely destructive to economic activity. If tens of millions of people become sick and millions die, the economy suffers, and not just because the workforce is being depleted. Widespread fear is bad for business: consumers won’t flock back to restaurants, book air travel, or spend on activities that might put them at risk of getting sick. In a recent survey of leading economists by Chicago’s Booth School, 88% believed that “a comprehensive policy response” will need to involve tolerating “a very large contraction in economic activity” to get the outbreak under control. Some 80% thought that “abandoning severe lockdowns” too early will lead to even greater economic damage.

Meanwhile, any measures to slow deaths from the virus will have huge downstream economic benefits. Michael Greenstone, an economist at the University of Chicago, finds that even moderate social distancing will save 1.7 million lives between March 1 and October 1, according to disease-spread models done at Imperial College London. Avoiding those deaths translates into a benefit of around $8 trillion to the economy, or about one-third of the US GDP, he estimates, on the basis of a widely accepted economic measure, the “value of a statistical life.” And if the outbreak is less severe than predicted by the Imperial College work, Greenstone predicts, social distancing could still save some $3.6 trillion.

“Our choice is not whether we intervene or whether we go back to the normal economy,” says Emil Verner, an economist at MIT’s Sloan School who has recently looked at the flu pandemic of 1918 for insights into today’s outbreak. “Our choice is whether we intervene—and the economy will be really bad now and will be better in the future—versus doing nothing and the pandemic goes out of control and really destroys the economy.”

Overall, Verner and his coauthors found that the 1918 pandemic reduced national manufacturing output in the US by 18%; but cities that implemented restrictions earlier and for longer had much better economic outcomes in the year after the outbreak.

Verner points to the fates of two cities in particular: Cleveland and Philadelphia. Cleveland acted aggressively, closing schools and banning gatherings early in the outbreak and keeping the restrictions in place for far longer. Philadelphia was slower to react and maintained restrictions for about half as long. Not only did far fewer people die in Cleveland (600 per 100,000, compared with 900 per 100,000 in Philadelphia), but its economy fared better and was much stronger in the year after the outbreak. By 1919 job growth was 5% there, while in Philadelphia it was around 2%.

Today’s economy is much different—it’s geared more toward services, and far less toward manufacturing than it was 100 years ago. Nevertheless, the cities’ stories are suggestive. Verner says that even a conservative interpretation of the data suggests there is “no evidence that interventions are worse for the economy.” And most likely they had a significant benefit. “A pandemic is so destructive,” he says. “Ultimately any policy to mitigate it is going to be good for the economy.”

The cure, then, isn’t worse than the disease. But for every day that normal economic activity is shut down, a huge number of Americans won’t be earning an income. Many already live paycheck to paycheck. Many may in fact succumb to diseases of despair. Families will fall apart under the stress. Hard-hit cities will feel abandoned. The urgency to open the economy will only grow.

However, a number of influential economists and health-care experts are saying there’s a way to get America quickly back in business while preserving public safety.

Reviving the economy

These days Paul Romer sounds exasperated. “We’re caught up in the trauma: kill the economy or kill more people,” he says. There is so much “learned helplessness, so much hand-wringing.” The New York University economist and Nobel laureate believes he has a relatively simple strategy that will “both contain the virus and let the economy revive.”

The key, says Romer, is repeatedly testing everyone without symptoms to identify who is infected. (People with symptoms should just be assumed to have covid-19 and treated accordingly.) All those who test positive should isolate themselves; those who test negative can return to work, traveling, and socializing, but they should be tested every two weeks or so. If you’re negative, you might have a card saying so that allows you to get on an airplane or freely enter a restaurant.

Testing could be voluntary. Romer acknowledges some might resist it or resist isolating themselves if positive, but “most people want to do the right thing,” he says, and that should be enough to snuff out the spread of the virus.

Romer points to new, faster diagnostic tests, including ones from Silicon Valley’s Cepheid and from the drug giant Roche. Each of Roche’s best machines can handle 4,200 tests a day; build five thousand of those machines, and you can test 20 million people a day. “It’s well within our capacity,” he says. “We just need to bend some metal and make some machines.” If you can identify and isolate those infected with the virus, you can let the rest of the population go back to business.

Indeed, in an early April survey by Chicago’s Booth School, 93% of the economists agreed that “a massive increase in testing” is required for “an economic restart.”

In a piece called “National Coronavirus Response: A roadmap to reopening,” former FDA director Scott Gottlieb also argued for ramping up testing and then isolating those infected rather shutting in the entire population. Likewise, Ezekiel Emanuel, chair of the University of Pennsylvania’s department of medical ethics and health policy, called for increasing testing in a New York Times piece called “We Can Safely Restart the Economy in June. Here’s How.” Harvard medical experts, meanwhile, have outlined similar ideas in “A Detailed Plan for Getting Americans Back to Work.”

The proposals differ in details, but all revolve around widespread testing of various sorts to know who is vulnerable and who isn’t before we risk going back to business.

There is, however, little evidence that massive and frequent testing will be implemented anytime soon. Despite the appearance of new tests, screening is still largely unavailable for anyone but the most severely ill or those at the medical front lines. Test kits and equipment to perform them are still in short supply. Many hospitals and doctors complain they can’t get needed tests; and Roche’s CEO said at the end of March that it will be “weeks, if not months” before there is widespread coronavirus testing in the US.

It’s the type of inertia that clearly frustrates Romer. He calls the $2 trillion legislation passed by Congress “palliative care” for the economy. If you took $100 billion and put it into testing, he says, we would “be far better off.”

One day we will have to reopen the economy. Perhaps we’ll be able to hold out until the pandemic is showing signs of receding, or perhaps the economic suffering will prove intolerable both to those in charge and to those living in hard-hit regions. When that day comes, if we do not have widespread testing, we will be sending people back to work without knowing if they’re at risk of getting the virus or spreading it to others. “We’re thinking about this the wrong way,” Romer says. The idea that one day you will be able to restart the economy without massive testing to see if the outbreak is under control is just “magical thinking.”

It could be a gradual process—those who are found to be free of infection or immune might be allowed back first. But without testing we won’t know how to manage this transition. In that case we will in fact be left with the Trumpian choice: between salvaging the economy and risking countless deaths.

6 notes

·

View notes

Text

How Do Trade Schools Help Technicians Adapt To The Changing Automation Sector?

Trade schools provide a blend of theoretical knowledge and practical experience. Read more to learn how these schools help automation technicians.

#industrial automation in philadelphia#Manufacturing certification classes in philadelphia#Manufacturing trade schools degree in philadelphia#manufacturing trade school philadelphia#Manufacturing tech institute in philadelphia#automation certification training Institute in Wynnfield Heights#automation course in South West Philadelphia#automation college philadelphia#automation course in Carroll Park#automation technician in philadelphia

0 notes

Text

Why Pipefitter Certification Matters: Boosting Skills and Jobs?

Pipefitters are essential in several sectors, including building, manufacturing, and maintenance. A wide range of skills, including technical knowledge, problem-solving abilities, and communication skills, are needed. Pipefitter workers can improve their abilities and employment prospects by becoming certified.

pipe fitting training in Spring garden , pipe fitting classes in Spring garden , best plumbing schools in Spring garden , plumbing certificate programs in Spring garden , plumber program in Spring garden , best plumbing schools in Spring garden , plumbing trade school in north philadelphia, plumbing school in north philadelphia, plumbing trade school in north philadelphia, plumbing school in west philadelphia,

0 notes

Photo

Don’t forget to check under your pillow - it’s National Tooth Fairy Day. This biannual holiday also occurs on August 22nd, but today’s observance is associated with National Children's Dental Health Month, an awareness campaign created around the year 1940 by the American Dental Association (who recommends that dental cleanings be scheduled, like National Tooth Fairy Day, twice a year).

Shed tooth rituals for lost baby teeth can be found throughout all recorded human cultures. The tooth fairy, however, is a creation of the late 1890s, likely inspired by the French le petit souris, a little mouse who collected lost teeth from children’s shoes in exchange for a coin, as well as similar mouse-based traditions found throughout Western nations at the time.

This undated photograph, likely taken at some point between 1950 and 1961, shows dental professionals in training at the dental clinic of the Universidad Javeriana in Bogotá, Colombia. It is part of the Hagley Library’s S.S. White Dental Manufacturing Company photograph collection (Accession 1972.244).

The S.S. White Dental Manufacturing Company was founded in 1844 by Samuel Stockton White (1822-1879), a dentist from Philadelphia. By the 1850s, the company was one of the world’s leading manufacturers of false teeth and dental appliances, with sales offices and representatives operating across the globe. Click here to view the digital collection associated with the S.S. White Dental Manufacturing Company photograph collection, which includes documentation of company personnel, company buildings, corporate events, dental equipment, dental offices and schools in the United States and abroad, as well as photographs from trade shows and exhibitions.

#ToothFairyDay#tooth fairy day#tooth fairy#national tooth fairy day#children's dental health month#national children's dental health month#american dental association#baby teeth#outside bones#demon that your parents know#le petit souris#universidad javeriana#s.s. white dental manufacturing company#samuel stockton white#dental health#dental clinic#children's dentistry#dental school#february 28#1950s#1960s

13 notes

·

View notes

Text

564: Rex Surany

Rex Surany is the new Principal bass of the Metropolitan Opera in New York City. He is also working as an assistant teacher in cooperation with Harold Robinson, the Principal Bass of the Philadelphia Orchestra, at the Juilliard School.

His musical education began with piano lessons when he was 7 years old. After two years of piano, he switched exclusively to double bass with Robert Peterson of Trenton, New Jersey. In 2002, upon completing the Vance repertoire with Peterson, Rex then started to study Rabbath Method with Nicholas Walker, double bass Professor at Ithaca college, and joined the Philadelphia Youth Orchestra under maestro Joseph Primavera's direction.

Rex's first year of college, in 2006, was spent at The Colburn School in Los Angeles. There he studied with David Moore and Paul Ellison. After a year, he was admitted to the Curtis Institute of Music, where, in addition to studying double bass, he found and pursued interests in composing, transcribing, and arranging that continue today.

A few weeks after graduating from Curtis, in May 2012, Rex became a temporary member of the New York Philharmonic with Alan Gilbert as Music Director. While Rex was working at “The Phil”, he spent a lot of his relief and vacation time traveling to Berlin to study the Berlin Philharmonic tradition and German bow technique with Matthew McDonald and Janne Saksala; first principal basses. After two years of working in New York, studying in Berlin, and auditioning in North America, Europe, and even Scandanavia, Rex finally won his first audition for a section position at the Metropolitan Opera in 2014. And only one year later, he won the principal position.

Rex has won numerous accolades in both solo and orchestral bass realms. In June 2009, he was awarded 2nd prize of the ISB (International Society of Bassists) Orchestral Competition. The following summer, he was and the 3rd prize-winner of the 2010 Bradetich Foundation International Solo Competition. In 2011, Rex was the 2nd prize-winner at the ISB Solo competition. Rex has performed with many orchestras including: the Pittsburgh Symphony, Philadelphia Orchestra, Haddonfield “Symphony in C”, the Boston Symphony, the American Ballet Theatre, the New York Philharmonic, and the Metropolitan opera. He has given master classes and recitals at Ithaca College, Brigham Young University, and Fort Lewis College.

Listen to Contrabass Conversations with our free app for iOS, Android, and Kindle!

Contrabass Conversations is sponsored by:

Steve Swan String Bass

Steve Swan String Bass features the West Coast’s largest selection of double basses between Los Angeles and Canada. Located in Burlingame, just south of San Francisco, their large retail showroom holds about 70 basses on display. Their new basses all feature professional setups and come with a cover at no additional cost. Used and consignment instruments receive any needed repairs and upgrades before getting a display position on the sales floor.

Upton Bass String Instrument Company

Upton's Karr Model Upton Double Bass represents an evolution of our popular first Karr model, refined and enhanced with further input from Gary Karr. Since its introduction, the Karr Model with its combination of comfort and tone has gained a loyal following with jazz and roots players. The slim, long “Karr neck” has even become a favorite of crossover electric players.

D'Addario Strings

This episode is brought to you by D’Addario Strings! Check out their Zyex strings, which are synthetic core strings that produce an extremely warm, rich sound. Get the sound and feel of gut strings with more evenness, projection and stability than real gut.

The Bass Violin Shop

The Bass Violin Shop offers the Southeast’s largest inventory of laminate, hybrid and carved double basses. Whether you are in search of the best entry-level laminate, or a fine pedigree instrument, there is always a unique selection ready for you to try. Trade-ins and consignments welcome!

Kolstein Music

The Samuel Kolstein Violin Shop was founded by Samuel Kolstein in 1943 as a Violin and Bow making establishment in Brooklyn, New York. Now on Long Island, over 60 years later, Kolstein’s has built a proud reputation for quality, craftsmanship and expertise in both the manufacture and repair of a whole range of stringed instruments, and has expanded to a staff of twelve experts in restoration, marketing and production.

A440 Violin Shop

An institution in the Roscoe Village neighborhood for over 20 years, A440's commitment to fairness and value means that we have many satisfied customers from the local, national, and international string playing communities. Our clients include major symphony orchestras, professional orchestra and chamber music players, aspiring students, amateur adult players, all kinds of fiddlers, jazz and commercial musicians, university music departments, and public schools.

Contrabass Conversations production team:

Jason Heath, host

Michael Cooper and Steve Hinchey, audio editing

Mitch Moehring, audio engineer

Trevor Jones, publication and promotion

Krista Kopper, archival and cataloging

Subscribe to the podcast to get these interviews delivered to you automatically!

Check out this episode!

1 note

·

View note

Text

Manufacturing technician jobs are an essential part of skilled trades. Read more to learn how automation has created new job options for manufacturing technicians.

#Manufacturing trade schools degree in philadelphia#manufacturing trade school philadelphia#manufacturing trade school in philadelphia#manufacturing training program in philadelphia#Manufacturing course in philadelphia#Manufacturing certification courses in philadelphia#manufacturing training in philadelphia

0 notes

Text

How Pipe Fitting Training Programs Can Help to Build a Sustainable Workforce?

A pipefitting training program typically covers the skills and knowledge required for the installation, repair, and maintenance of piping systems used in various industries, including construction, manufacturing, and energy. https://ptt.edu/blog/how-pipe-fitting-training-programs-can-help-to-build-a-sustainable-workforce/ plumber training program in north philadelphia, plumber program in Wynnfield Heights, pipe fitting classes in overbook park, plumbing trade school in north philadelphia, best plumbing schools in north philadelphia east, best plumbing schools in west philadelphia,

0 notes

Text

Wendy Williams

Wendy Williams Hunter (born Wendy Joan Williams; July 18, 1964) is an American television host, actress, author, fashion designer, and former radio personality. She has hosted the nationally syndicated television talk show, The Wendy Williams Show, since 2008.

Prior to television, Williams was a radio DJ and host and quickly became known in New York as a "shock jockette". She gained notoriety for her on-air spats with celebrities and was the subject of the 2006 VH1 reality TV series, The Wendy Williams Experience, which broadcast events surrounding her radio show. She was inducted into the National Radio Hall of Fame in 2009.

She has written a New York Times best-selling autobiography and six other books, and has created various product lines including a fashion line, a jewelry collection and a wig line. On her 50th birthday, the council of Asbury Park renamed the street she grew up on, to Wendy Williams Way.

Early life

Williams was born on July 18, 1964, in Ocean Township, Monmouth County, New Jersey, a suburb of Asbury Park. She is the second of three children born to parents Thomas and Shirley Williams, She grew up in the Wayside section of Ocean Township. Williams graduated from Ocean Township High School, and from 1982 to 1986, she attended Northeastern University in Boston, Massachusetts, where she graduated with a B.A. in communications and was a DJ for the college radio station WRBB.

Personal life

In her biography, Wendy's Got the Heat, she uses the pseudonym Robert Morris III to refer to her first husband and describes him as a salesperson. Williams and her first husband have since divorced. On November 30, 1997, Williams married her second husband Kevin Hunter. Williams gave birth to their son, Kevin Hunter Jr., on August 18, 2000. Wendy is Christian.

Radio career

Williams began her career working for WVIS in the United States Virgin Islands. Less than a year later, she obtained an afternoon position at Washington DC-based station WOL. Williams commuted between DC and Queens, New York, to work an overnight weekend shift at WQHT.

In 1989, Williams began at urban contemporary WRKS (now WEPN-FM) in New York City as a substitute disc jockey. WRKS hired her full-time for its morning show. A year later, Williams moved to an afternoon drive-time shift, eventually winning the Billboard Award for "Best On-Air Radio Personality" in 1993. In December 1994, Emmis Broadcasting purchased WRKS and switched Williams to the company's other New York property, hip-hop formatted WQHT ("Hot 97"), as WRKS was reformatted into an urban adult contemporary outlet. She was fired from Hot 97 in 1998.

Williams was hired by a Philadelphia urban station, WUSL ("Power 99FM"). Her husband, Kevin Hunter, became her agent. She was very open about her personal life on air, discussing her miscarriages, breast enhancement surgery, and former drug addiction, and helped the station move from 14th place in the ratings to 2nd.

In 2001, Williams returned to the New York airwaves when WBLS hired her full-time for a syndicated 2–6 p.m. time slot. Williams' friend, MC Spice of Boston, offered his voiceover services to the show, often adding short rap verses tailored specifically for Williams' show. The New York Times stated that her "show works best when its elements – confessional paired with snarkiness – are conflated," and cited a 2003 interview with Whitney Houston as an example. During the highly publicized interview that "went haywire" and included "a lot of bleeped language", Williams "asked [Houston], insistently, about her drug and spending habits".

By 2008, she was syndicated in Redondo Beach, California; Shreveport, Louisiana; Wilmington, Delaware; Toledo, Ohio; Columbia, South Carolina; Emporia, Virginia; Lake Charles, Louisiana; Tyler, Texas; and Alexandria, Louisiana, among other markets.

Williams left her radio show in 2009 to focus on her television program and spend more time with her family. She was inducted into the National Radio Hall of Fame.

Lawsuit

In 2008, Nicole Spence, talent booker for The Wendy Williams Experience, filed papers with the Equal Employment Opportunity Commission suing Williams. Spence claimed Williams' husband, Kevin Hunter, demanded sex from Spence on many occasions and created a hostile work environment by threatening and assaulting his wife on company premises. On June 11, 2008, Spence filed a sexual-harassment lawsuit against Williams, Hunter, and Inner City Broadcasting Corporation in federal court in Manhattan. Both Williams and Hunter deny the charges.

Television

The Wendy Williams Show

In 2008, Debmar-Mercury offered Williams do to a six-week television trial of her own talk show. On July 14, 2008, Williams debuted her daytime talk show, The Wendy Williams Show, in four cities during the summer of 2008. During the tryout, The New York Times snarkily remarked that the show created a "breakthrough in daytime" by introducing the genre of the "backtalk show.".

After a successful run, Fox signed a deal with Debmar-Mercury to broadcast the show nationally on their stations beginning in July 2009. In addition, BET picked up cable rights to broadcast the show at night. In 2010, BET started airing the show internationally in 54 countries through BET International.

Williams has received multiple nominations at the Daytime Emmy Awards for Outstanding Entertainment Talk Show Host and the show itself was for Outstanding Talk Show/Entertainment. The show attracts 2.4 million daily viewers on average, with Williams trading off daily with Ellen DeGeneres as the number one female host on daytime television.

“The Wendy Williams Show” has been renewed through the 2019-20 television season on the Fox Television Stations.The renewal will keep “Wendy” on air through its 11th season. During the November 2015 sweeps period, the talk show finished either No. 1 or 2 in the key demo of women 25-54 in 55% of the U.S. and 20 of the top-25 markets.

Other television appearances

Williams has made appearances in the television series Martin (1992) and in the soap opera One Life to Live (2011).

Williams filled in for Jodi Applegate on WNYW's morning television show, Good Day New York (2007), and hosted a game show for GSN called Love Triangle (2011) for which she and her husband Kevin Hunter served as executive producers.

Williams played a judge on the Lifetime network show Drop Dead Diva (2011) and served as a guest judge on The Face (2013). She was also a contestant, paired with pro Tony Dovolani on season 12 of Dancing with the Stars (2011); she was eliminated second.

In February 2013, it was announced that Williams and her husband and manager, Kevin, were launching a reality television production company, Wendy Williams Productions. that will produce unscripted content, including reality television and game shows. Williams was an executive producer on the show Celebrities Undercover (2014).

Williams also executive produced the Lifetime biopic Aaliyah: The Princess of R&B, which premiered on November 15, 2014. In September 2015, the documentary series Death By Gossip with Wendy Williams premiered on the Investigation Discovery channel, both hosted and produced by Williams.

Film

Williams appeared in the film adaptation of Steve Harvey's book, Act Like a Lady, Think Like a Man, titled Think Like a Man (2012) and its sequel, Think Like a Man Too (2014).

In 2012, it was announced Williams would enter into a "production alliance" with producers Suzanne de Passe and Madison Jones to create movies and television shows aimed at multicultural audiences. These projects will appear under the heading "Wendy Williams presents" and their first project will be VH1 adaptation of a Star Jones novel.

FilmographyFilmTelevision

Theater

In 2013, Williams announced she was going to play the role of Matron "Mama" Morton on the Broadway musical Chicago. Williams officially began her tenure on July 2 and finished her 7-week run on August 11, 2013. Her preparations for the musical were documented in the TV Guide docuseries, "Wendy Williams: How You Doin', Broadway?!", which was produced by her own production company, Wendy Williams Productions.

Business

ProductsHSN Clothing Line

By partnering with the Home Shopping Network (HSN), Williams debuted a line of dresses, pants, sweaters and skirts fit for the everyday woman.The household name media mogul debuted her HSN Clothing line on March 28, 2015. The debut was a "sell-out success" and Williams even told viewers on her talk show that according to HSN, the debut was their most watched premiere since the onset of the program. The Wendy Williams line is sold exclusively at HSN.

Adorn

Williams sells a line of jewelry products on the home shopping network, QVC, called "Adorn by Wendy Williams".

Williams and her husband, Kevin Hunter, commissioned the Chinese-based manufacturing firm, Max Harvest International Holdings, to make 12,140 pairs of shoes bearing the logo of her brand, Adorn. The owners of Max Harvest International Holdings were said to have gone into hiding after the owner of the shoe factory who made the shoes kidnapped one of their managers and held the man prisoner for two weeks before releasing him, and Williams' failure to pay was cited the reason, reported by the New York Daily News. The manager and his wife retained lawyer Staci Riordan of Los Angeles. Their representative says they've been in negotiations for several months in order to reach a settlement. Williams declined to comment on the matter.

Endorsements

Williams was previously a spokesperson for Georges Veselle champagne. She posed for PETA's "I'd Rather Go Naked Than Wear Fur", ad campaign in 2012.

Books

Williams is a seven-time New York Times best-seller and has published several books, including:

Non-fiction

Wendy's Got the Heat (2003), coauthored with Karen Hunter Atria; 1 edition (August 5, 2003)

The Wendy Williams Experience (2005)

Ask Wendy: Straight-Up Advice for All the Drama in Your Life (2013) ISBN 9780062268389

Fiction

Drama Is Her Middle Name: The Ritz Harper Chronicles, Vol. 1 (2006), coauthored with Karen Hunter

Is the Bitch Dead, Or What?: The Ritz Harper Chronicles, Book 2 (2007), coauthored with Karen Hunter

Ritz Harper Goes to Hollywood! (Ritz Harper Chronicles) (2009), coauthored with Zondra Hughes

Hold Me in Contempt: A Romance (2014) ISBN 978-0062268419

Awards

Radio Personality of the Year awards from Billboard, Black Radio Exclusive, and Radio & Records industry magazines

2009: named to the National Radio Hall of Fame

Hosted the 2013 Soul Train Awards Red Carpet

Hosted the 2014 Soul Train Awards in Las Vegas, which aired on November 30, 2014.

Nominated for The 42nd & 43rd Annual Daytime Emmy Awards for Outstanding Talk Show/Entertainment and Outstanding Talk Show Host.

Stand-up comedy

Before Wendy turned 50, stand-up comedy was on her bucket list

In 2014, Lipshtick called Williams to participate in their first all-female-based comedy series at the Venetian in Las Vegas.

Williams made her sold-out comedy debut on July 11, 2014

Williams comedy tour was called "The Sit-down Comedy Tour."

Williams returned to Lipshtick on October 31, 2014 and November 1, 2014 after she made a sold-out debut in July.

Williams hosted her "How You Laughin'" Comedy Series at NJPAC on November 15, 2014 featuring Luenell, Jonathan Martin, Pat Brown, Hadiyah Robinson, and Meme Simpson.

In 2015, Williams announced a 12-city comedy tour called, The Wendy Williams Sit Down Tour: Too Real For Stand-Up.

Wikipedia

3 notes

·

View notes

Text

Device Makers Have Funneled Billions to Orthopedic Surgeons Who Use Their Products

Dr. Kingsley R. Chin was little more than a decade out of Harvard Medical School when sales of his spine surgical implants took off.

Chin has patented more than 40 pieces of such hardware, including doughnut-shaped plastic cages, titanium screws and other products used to repair spines — generating $100 million for his company SpineFrontier, according to government officials.

Yet SpineFrontier’s success arose not from the quality of its goods, these officials say, but because it paid kickbacks to surgeons who agreed to implant the highly profitable devices in hundreds of patients.

In March 2020, the Department of Justice accused Chin and SpineFrontier of illegally funneling more than $8 million to nearly three dozen spine surgeons through “sham consulting fees” that paid them handsomely for doing little or no work. Chin had no comment on the civil suit, one of more than a dozen he has faced as a spine surgeon and businessman. Chin and SpineFrontier have yet to file a response in court.

Medical industry payments to orthopedists and neurosurgeons who operate on the spine have risen sharply, despite government accusations that some of these transactions may violate federal anti-kickback laws, drive up health care spending and put patients at risk of serious harm, a KHN investigation has found. These payments come in various forms, from royalties for helping to design implants to speakers’ fees for promoting devices at medical meetings to stock holdings in exchange for consulting work, according to government data.

Health policy experts and regulators have focused for decades on pharmaceutical companies’ payments to doctors — which research has shown can influence which drugs they prescribe. But far less is known about the impact of similar payments from device companies to surgeons. A drug can readily be stopped if deemed harmful, while surgical devices are permanently implanted in the body and often replace native bone that has been removed.

Every year, a torrent of cash and other compensation flows to these surgeons from manufacturers of hardware for spinal implants, artificial knees and hip joints — totaling more than $3.1 billion from August 2013 through the end of 2019, a KHN analysis of government data found. These bone specialists make up a quarter of U.S. doctors who have accepted at least $100,000 or more, and two-thirds of those who raked in $1 million or more, from the medical device and drug industries last year, the data shows.

“It is simply so much money that it is staggering,” said Dr. Eugene Carragee, a professor of orthopedic surgery at the Stanford University Medical Center and critic of the medical device industry’s influence. Much of the money is deemed to be compensation for consulting duties or medical research, or royalties for inventing, or fine-tuning, new surgical tools and techniques. In some cases, it pays for trips or splashy junkets or rewards surgeons for promoting products to their peers.

Device makers say the long-established practice leads to higher-quality, safer products. “Doctors help develop and refine medical devices, and they even create new devices themselves, sharing their intellectual property with companies to help save and improve patients’ lives,” said Scott Whitaker, president and CEO of AdvaMed, the medical technology industry’s trade group.

But industry whistleblowers and government investigators say all that money changing hands can corrupt medical judgment and tempt surgeons to perform unnecessary and wasteful operations. In ongoing lawsuits, patients say they have suffered life-altering injuries from screws or other spinal hardware that snapped apart or live with disabilities they blame on defective knee or hip implants. Patients alleging injuries range from seniors on Medicare to celebrities such as Olympic gold medalist Mary Lou Retton, who had surgery to replace both her hips. The gymnast sued device maker Biomet in January 2018, alleging the hip implants were defective. The suit has since been settled under confidential terms.

The case of Chin’s company, SpineFrontier, is among more than 100 federal fraud and whistleblower actions, filed or settled mostly in the past decade, that accuse implant surgeons of taking illegal compensation from device makers — from surgeon entrepreneurs like Chin to marquee names like Medtronic and Johnson & Johnson. In some cases, device makers have paid hundreds of millions of dollars in fines to wrangle out of trouble for their involvement, often without admitting any wrongdoing.

Court pleadings examined by KHN identified more than 700 surgeons who have taken money, including dozens who pocketed millions in royalties, fees or other compensation from 2013 through 2019.

The names of hundreds more surgeons were redacted in court filings or sealed by judges.

Court filings named 35 spine surgeons who used SpineFrontier’s surgical gear, some for years. At least six of those surgeons have admitted wrongdoing and paid a total of $3.3 million in penalties. Another has pleaded guilty to criminal charges. It’s illegal under federal law to accept anything of value from a device maker for using its wares, though most offenders don’t face criminal prosecution.

Chin, 57, who lives in Fort Lauderdale, Florida, and owns SpineFrontier through his investment company, declined comment about the DOJ lawsuit or the consulting agreements.

“There is a court date [for the DOJ case] as ordered by a judge,” Chin said via email. “If we get to that point the facts of the case will be litigated.”

Back Surgeries Under Scrutiny

The nation’s outlay for spine surgery to treat back pain, or to replace worn-out knees and hips, tops $20 billion a year, according to one industry report.

Taxpayers shoulder much of that cost through Medicare, the federal program for those 65 and older, and Medicaid, which caters to low-income people.

In one common spinal procedure, surgeons may replace damaged discs with an implant and screws and metal rods that hold it in place. The demand for surgery to replace worn-out knees and hips also has mushroomed as aging boomers and others seek relief from joint pain that restricts their movement.

Perhaps not surprisingly, the competition for sales of orthopedic devices is fierce: Some 250 companies proffer a dizzying array of products. Industry critics blame the Food and Drug Administration, which allows manufacturers to roll out new hardware that is substantially equivalent to what already is sold — though it often is marketed as more durable, or otherwise better for patients.

“The money is just phenomenal for this medical hardware,” said Dr. James Rickert, a spine surgeon and head of the Society for Patient Centered Orthopedics, an advocacy group. He said most of the products are “essentially the same,” adding: “These are not technical instruments; [it’s often] just a screw.”

Hospitals can end up charging patients $20,000 or more for the materials, though they pay much less for them. Spine surgeons — who make upward of $500,000 a year — bill separately and may charge $8,000 to $20,000 for major procedures.

Which equipment hospitals choose may fall to the preference of surgeons, who are wooed by manufacturing sales reps possibly present in the operating room.

And it doesn’t stop there. Whistleblower cases filed under the federal False Claims Act allege a startling array of schemes to influence surgeons, including compensating them for joining a medical society created and financed by a device company. In other cases, companies bought billboard space or other advertising to promote medical practitioners, hired surgeons’ relatives, paid for hunting trips — even mailed checks to their homes.

Orthopedic and neurosurgeons collected more than half a billion dollars in industry consulting fees from 2013 through 2019, federal payment records show.

These gigs are legal so long as they involve professional work done at fair market value. But they have drawn fire as far back as 2007, when four manufacturers that dominated the hip and knee implant market, including a J&J division, agreed to pay $311 million to settle charges of violating anti-kickback laws through their consulting deals.

KHN found at least 20 whistleblower suits, some settled, others pending, that have since accused device makers of camouflaging kickbacks as consulting work, including paying doctors to sit on suspect “advisory boards” or other activities that entailed little work to justify the fees.

In November 2019, device maker Life Spine and two of its executives admitted to paying consulting fees to induce dozens of surgeons to use Life Spine’s implants in the operating room. In all, 21 of the top 30 Life Spine adopters were paid and they accounted for about half its total device sales, according to the Justice Department. Life Spine and the executives paid a total of $6 million in penalties. The company did not respond to requests for comment.

Similarly, SpineFrontier received “the vast majority” of its sales, more than $100 million worth, from surgeons who were compensated, the Justice Department alleges. Often, they were paid by way of a “sham” company run by Chin’s wife, Vanessa, from a mail drop in Fort Lauderdale, according to the Justice Department. Vanessa Dudley Chin, a defendant in the DOJ civil case, had no comment.

Kingsley Chin told KHN via email that he takes no salary from SpineFrontier, based in Malden, Massachusetts. In 2013, Chin received $4.3 million in income from the company, according to court filings in a divorce case in Philadelphia from an earlier marriage. In 2018, SpineFrontier valued Chin’s interest in the company at $75 million, according to government records, though its current worth is unclear.

SpineFrontier’s management thought paying doctors was “the only reliable way to steadily increase its market share and stave off competition,” Charles Birchall, a former business associate of Chin’s, alleged in a whistleblower complaint. The case is one of two whistleblower suits filed against SpineFrontier that the DOJ has joined and consolidated. Chin has yet to file a response in court.

From March 2013 through December 2018, the company offered some surgeons $500 or more an hour for “consulting,” which could include the time they spent operating on patients — even though they already were being paid by Medicare or other health insurers. Other surgeons were paid repeatedly to “evaluate” the same products, though their feedback was “often minimal or nonexistent,” according to the DOJ complaint.

Patient Injuries Pile Up

While the payments have piled up for doctors, so have injuries for patients, according to lawsuits against device makers and whistleblower testimony.

Orthopedic surgeon-turned-whistleblower Dr. Manuel Fuentes is suing his former employer, Florida device maker Exactech, alleging it offered “phony” consulting deals to surgeons who had complained about alarming defects in one of its knee implants.

Their findings should have been forwarded to the FDA to protect the public, Fuentes and two former Exactech sales reps alleged in their suit. Instead, the company paid the surgeons “to retain their business and secure their silence” about patients needlessly undergoing a second operation to address the defects implanted in the first, according to the suit. Lawyer Thomas Beimers, who represents Exactech in the case, said the company “emphatically denies the allegations and looks forward to presenting the real facts to the court.” In a court filing, the company said the suit was “full of conclusory, vague and immaterial facts” and said it should be dismissed.

In Maryland, spine surgeon Dr. Randy F. Davis faces a lawsuit filed in early 2020 by 14 former patients who claim he implanted counterfeit hardware from a device distributor that had paid him hundreds of thousands of dollars in consulting fees and other compensation.

Davis used the hardware, which had not been FDA-approved, on about 250 patients at the University of Maryland Baltimore Washington Medical Center in Glen Burnie, Maryland, according to the suit. Several patients say screws or other implants failed and they sustained permanent injuries as a result. One woman said she was left with little feeling in her right foot and needs a cane or walker to get around. Others claim “extreme mental anguish” for fear the hardware inside them will fail, according to the suit.

The patients allege that Davis improperly disposed of defective screws and other hardware he removed rather than send the items for analysis or report the failures to authorities. Instead, the University of Maryland hospital sent “hush” letters to patients that falsely told them that no defects had been found, according to the suit. A spokesperson for the hospital, which also is a defendant in the suit, denied the allegations, noting: “We will vigorously defend this lawsuit and at its conclusion are quite confident we will prevail.” Davis and his lawyer didn’t respond to repeated requests for comment. The lawsuit is pending in Anne Arundel County state court.

Surgeons are free to implant devices they helped bring to market or promoted, though doing so can prompt criticism when injuries or defects occur.

That happened when three patients filed lawsuits in 2018 against Arthrex, a Florida device company. The patients argued they were forced to undergo repeat operations to replace defective Arthrex knee devices implanted by Pennsylvania orthopedic surgeon Dr. Thomas Meade.

Meade was not a defendant in the cases. But the patients accused him of misleading them about the product’s safety and a recall. One noted that Meade had served as a prominent consultant to Arthrex and had “participated in the design, testing, marketing, promotion and sales” of the knee implant. The patient alleged that Arthrex had paid Meade more than $250,000 for work that included “promotional speaking, travel, lodging, and consulting.”

In court filings, Arthrex admitted making payments to Meade for “consulting and royalties” but denied wrongdoing. The cases were settled in 2020. Meade did not respond to requests for comment.

Chin’s dual roles as SpineFrontier’s CEO and user of its hardware was called a “huge” conflict of interest by a judge in a pending malpractice case filed against him and the company in South Florida.

In that case, Miami resident Patrick Chapoteau alleges Chin performed back surgery in 2014 using SpineFrontier hardware even though it had little chance of success. According to the suit, a Chin-designed screw implanted to stabilize Chapoteau’s spine broke in half, causing him pain and disabling injuries.

In a legal brief, Chin’s lawyers argued that he regularly operates on people with disabling back problems, noting: “The surgery is sophisticated and challenging. On a few rare occasions, his patients have not obtained the relief they expected or experienced unanticipated complications that required additional care.”

Joseph Wooten, a former Chin patient and Florida power company employee, alleged in a 2014 lawsuit in Broward County Circuit Court that Chin had 15 previous malpractice claims that had ended in more than $8 million in settlements, an assertion Chin’s lawyers disputed.

“He never told me of his bad record injuring people,” Wooten, 64, wrote in a court filing. He and his wife, Kim, said the surgery caused “debilitating and life-altering injuries.” The case has since been settled. Chin acknowledged no wrongdoing and the terms are confidential.

KHN reviewed court pleadings in nine settled malpractice cases in Philadelphia, where Chin served on the faculty of the University of Pennsylvania Medical School from 2003 to 2007, and six in South Florida filed since 2012. Details of the settlements are confidential. Five of the six South Florida cases are pending, including one filed in December by the widow of a man who died shortly after spine surgery. In all the cases and settlements, Chin has denied negligence.

In her lawsuit pending against Chin in South Florida, Nancy Lazo of Hialeah Gardens, Florida, said she slipped and tumbled down the stairs outside her Miami office, landing on her back and arm. When the pain would not go away, she turned to Chin and had two operations, in 2014 and 2015. Her lawyers allege that a SpineFrontier screw Chin implanted in her spine in the second procedure caused nerve damage. Lazo, 51, a former billing clerk with two adult sons, said she can no longer work and remains in “constant” pain. “Based on what my doctors have told me,” she said, “I will never get back to normal.” Chin denied any negligence and the case is pending.

“Based on what my doctors have told me, I will never get back to normal.”

— Nancy Lazo

Government Struggles to Keep Pace

Concerns that industry payments can corrupt medical practice have been aired repeatedly at congressional hearings, in media exposés and in federal investigations. The recurring scandals led Congress to require that device makers and pharmaceutical companies report the payments, starting in August 2013, to a government-run website called Open Payments. That website shows that payments to all doctors have risen from $8.6 billion in 2014 to just over $10 billion last year. A recent study found payments by device makers exceeded those of pharmaceutical companies by a wide margin.

Both the North American Spine Society and the American Academy of Orthopaedic Surgeons told KHN that close ties with the industry, while seeming to generate huge payouts to some surgeons, lead to the design of safer and better implants. “These interactions are really essential for good outcomes in patient care and that needs to be preserved,” said Dr. Joshua J. Jacobs, who chairs the orthopedic surgery department at Rush University Medical Center in Chicago and the AAOS’��ethics committee.

Although more than 600,000 American doctors lap up industry largesse, most do so through small payments that cover the cost of food, drinks and travel to industry-sponsored events. When it comes to big money, however, orthopedists and neurosurgeons dominate, collecting 25% of the total — even though they represent only 5% of the doctors accepting payments, according to the KHN analysis of Open Payments data.

Dr. Charles Rosen, a spine surgeon and co-founder of the advocacy group Association for Medical Ethics, said he was once offered $2,000 just to show up and watch an industry-sponsored panel. “It was quite unbelievable,” he said.

Rosen said while he believes a “relatively small number” of surgeons cash whopping industry checks, many who do so are influential figures who can “help direct medical care.”

Government data confirms that even as several orthopedic and neurosurgeons received tens of millions of dollars in 2019, 81% of them got less than $5,000 from industry.

Federal officials recently signaled their displeasure with the hefty fees paid to doctors who promote their products to peers, especially at restaurants, entertainment or sports venues that feature free food and booze but little educational content. In November, the inspector general at the Department of Health and Human Services issued a special fraud alert that such gestures could violate anti-kickback laws.

Companies that ignore the reporting law can be fined up to $1 million, though no fines were levied from 2014 through spring 2020, according to a CMS report. That changed in October, when device giant Medtronic agreed to pay the government $9.2 million to settle allegations that it paid kickbacks to Sioux Falls, South Dakota, neurosurgeon Dr. Wilson Asfora to promote its goods. Officials said the company sponsored more than 100 events at a Brazilian restaurant owned by the surgeon to clinch the sales. Just over $1 million of the fine was assessed for failing to report the transactions. A Medtronic spokesperson said the company fired or took other disciplinary action against the sales employees involved and “remains committed to maintaining the highest standards of ethical conduct.”

KHN identified four spinal device makers — including SpineFrontier — that have been accused in whistleblower cases of scheming to hide consulting payments from the government.

Responding to written questions, a CMS spokesperson said the agency “has multiple formal compliance actions pending which it is unable to discuss further at this time.”

But penalties for paying, or accepting, kickbacks often are small compared with the profits they can generate.

“Some people would say if you penalize companies enough, they won’t be making these offers,” said Genevieve Kanter, an assistant professor at the University of Pennsylvania Perelman School of Medicine. She said small fines may be chalked up to the “cost of doing business.”

The Federation of State Medical Boards does not keep data on how often its members discipline doctors for civil kickback offenses, according to spokesperson Joe Knickrehm. The federation has “long advocated for stronger reporting requirements,” Knickrehm said.

Justice Department officials would not discuss whether they are seeking fines from more surgeons. But in a statement in April 2020, then-U.S. Attorney for the District of Massachusetts Andrew E. Lelling noted that the government will investigate any doctor “who accepts money from a device manufacturer simply for using that company’s products.”

KHN (Kaiser Health News) is a national newsroom that produces in-depth journalism about health issues. Together with Policy Analysis and Polling, KHN is one of the three major operating programs at KFF (Kaiser Family Foundation). KFF is an endowed nonprofit organization providing information on health issues to the nation.

USE OUR CONTENT

This story can be republished for free (details).

Device Makers Have Funneled Billions to Orthopedic Surgeons Who Use Their Products published first on https://nootropicspowdersupplier.tumblr.com/

0 notes

Text

554: Section Bassists

Today’s episode features the following past podcast guests on life in the bass section and how to play well in it:

Susan Wulff - San Diego Symphony

Todd Coolman - Indiana University

Michael Hovnanian - Chicago Symphony

Brent Edmondson - substitute bassist for Philadelphia Orchestra

Tom Zera - Utah Symphony

Listen to more “best of” episodes at contrabassconversations.com/highlights.

Listen to Contrabass Conversations with our free app for iOS, Android, and Kindle!

Contrabass Conversations is sponsored by:

D'Addario Strings

This episode is brought to you by D’Addario Strings! Check out their Zyex strings, which are synthetic core strings that produce an extremely warm, rich sound. Get the sound and feel of gut strings with more evenness, projection and stability than real gut.

Upton Bass String Instrument Company

Upton's Karr Model Upton Double Bass represents an evolution of our popular first Karr model, refined and enhanced with further input from Gary Karr. Since its introduction, the Karr Model with its combination of comfort and tone has gained a loyal following with jazz and roots players. The slim, long “Karr neck” has even become a favorite of crossover electric players.

Steve Swan String Bass

Steve Swan String Bass features the West Coast’s largest selection of double basses between Los Angeles and Canada. Located in Burlingame, just south of San Francisco, their large retail showroom holds about 70 basses on display. Their new basses all feature professional setups and come with a cover at no additional cost. Used and consignment instruments receive any needed repairs and upgrades before getting a display position on the sales floor.

Kolstein Music

The Samuel Kolstein Violin Shop was founded by Samuel Kolstein in 1943 as a Violin and Bow making establishment in Brooklyn, New York. Now on Long Island, over 60 years later, Kolstein’s has built a proud reputation for quality, craftsmanship and expertise in both the manufacture and repair of a whole range of stringed instruments, and has expanded to a staff of twelve experts in restoration, marketing and production.

The Bass Violin Shop

The Bass Violin Shop offers the Southeast’s largest inventory of laminate, hybrid and carved double basses. Whether you are in search of the best entry-level laminate, or a fine pedigree instrument, there is always a unique selection ready for you to try. Trade-ins and consignments welcome!

A440 Violin Shop

An institution in the Roscoe Village neighborhood for over 20 years, A440's commitment to fairness and value means that we have many satisfied customers from the local, national, and international string playing communities. Our clients include major symphony orchestras, professional orchestra and chamber music players, aspiring students, amateur adult players, all kinds of fiddlers, jazz and commercial musicians, university music departments, and public schools.

Contrabass Conversations production team:

Jason Heath, host

Michael Cooper and Steve Hinchey, audio editing

Mitch Moehring, audio engineer

Trevor Jones, publication and promotion

Krista Kopper, archival and cataloging

Subscribe to the podcast to get these interviews delivered to you automatically!

Check out this episode!

1 note

·

View note

Text

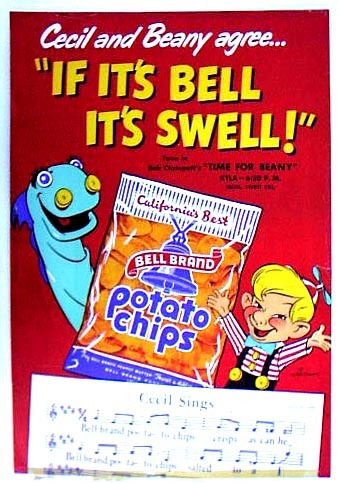

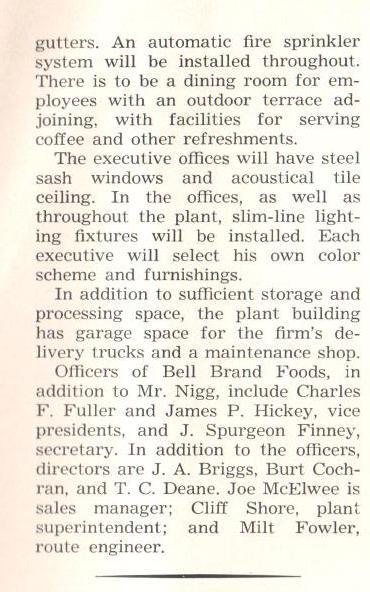

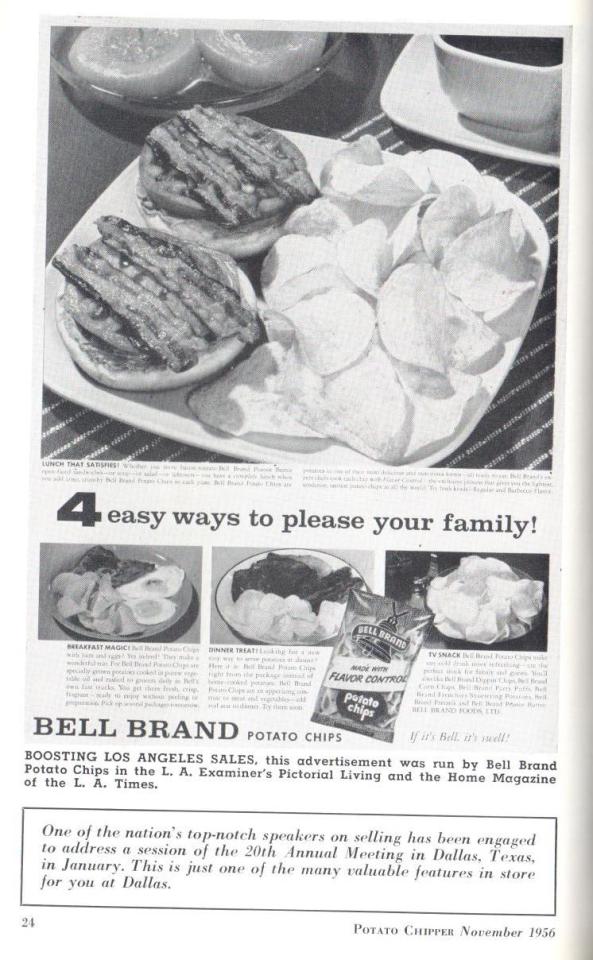

If It's Bell, It's Swell

What do Sandy Koufax, Marilyn Monroe and Beany and Cecil all have in common? They were all promoted by Bell Potato Chips.

Sometimes the history of various potato chip manufacturers (chippers) has been passed down from generation. In an attempt to preserve and document the history regarding Bell Brand, I have included interviews of many people.

The following is based on a statement by Craig Scharlin, grandson of the founder of Bell Potato Chips., Max Ginsburg.

Bell Brand Potato Chips was a privately owned company started in the 1920's by Max I. Ginsberg. He was an immigrant from the Ukraine who came to the US on his own at the age of seven. He met up with his brother in Philadelphia and started selling hand made pretzels on the streets. He moved to Los Angeles in the teens and in the early 1920's started his own company named the L.A. Potato Chip and Pretzel Company which he eventually changed the name to Bell Brand Potato Chips. He named it Bell after the bells of the Spanish Missions of California and because he thought the name Bell made people happy. He created the slogan, "If it's Bell it's Swell" and also created the name Frenchie for the shoe string potato chip. Bell Brand Potato Chips was one of the sponsors of the Jack Benny Radio Show in the 1930's among many others. One of his best friends and founder of Ralph's Grocery stores, Mr. Lawry, also owner of the famous Lawry's Prime Rib restaurants of Los Angeles and the Tam 'O Shanter Restaurant in Glendale, was one of his major buyers. Max Ginsberg decided to retire in the 1950's.

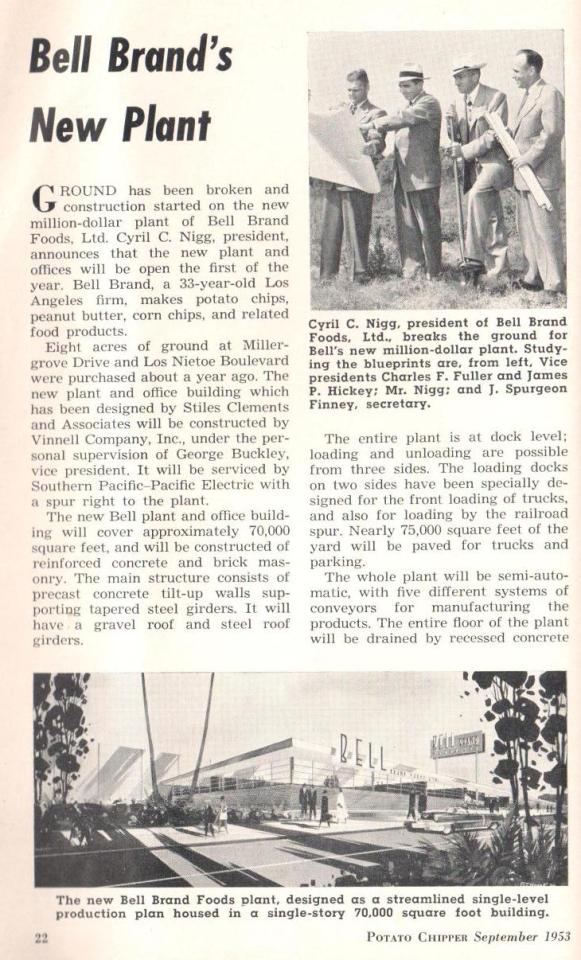

My mentor, the late Donald Noss who was the son the the founder of the snack food trade association, gave me his extensive archive regarding the potato chip industry. Among the items was the attached photo of four men. The back of it was inscribed " J. Spurgeon Finney, Cy Nigg, James Hickey & Chas. Fuller.

Finney was Treasurer and Hickey and Fuller were vice presidents of Bell Brand. Below, you will learn more about Hickey and Fuller and how they obtained their ownership shares. Lizette Gabriel of the Los Angeles Public Library provided me with the link to the oral history of Cyril Nigg as part of the research into the Tom Sawyer Foods. When I read it, I was able to match three of the four people in the photo with their names. In a true sense, a picture is worth a thousand words.

Cyril Nigg had worked his way up the chain at Kellogg's, the cereal maker, by staying after other suppliers had left for the day to help grocers with their tasks such as inventory management, pricing inventory including items that he was not supplying, in a manner that developed great trust and strong relationships. This enables Nigg to get the grocers to include his products in their ads, provide him with prominent display space for the Kellogg's brands. He was a pioneer at creating combinations , trade promotions where he would put together two or three packages of Kellogg's cereals with a premium: cereal bowl, muffin tins, rag dolls. Nigg created the cereal department that now is a standard department in all grocery stores. He also conceived of quantity discounts for grocers. He was also one of the first to sell the entire line of Kellogg's cereals, whereas most others only sold one or two.

He was told that he would be groomed to be the President of Kellogg's by moving every couple of years to different parts of the county to learn the diverse markets. With children in high school and both his and his wife's family in Los Angeles, he decided that he would prefer to stay in the Los Angeles area. Taking a job with another large employer would most likely also require him to relocate. Because of his relationships within the food industry, he agreed to chair the Red Cross Appeal within the food industry division. Based on an oral history from the California State archives in 1993, Nigg tells the story of how he entered the potato chip business in his own words:

NIGG: I had one [Red Cross Appeal] card, a guy by the name of Max Ginsberg, who I knew real well, who owned the [Los Angeles] L.A. Saratoga Chip and Pretzel Company. He was a member of the sales managers club. I knew him well. He had given $500 the year before, and in those days $500 was a pretty good contribution for Red Cross. I didn't want to miss him. I called two or three times, and he's not in. Finally I say to the girl at the telephone, "Well, when will Mr. Ginsberg be there? I'm working for the Red Cross drive." "Oh," she said, "Mr. Ginsberg is just horne from the hospital. He's been very ill." Oh, I was sick. Here's my 500-buck contribution, and he's not going to be able to corne in. So I thought, "Well, maybe I can go by his house." I knew him pretty well. I thought, "I'll go by his house and see how he is, and maybe I can say something about the Red Cross drive." So I go by. He lived up in the Los Feliz area. His wife lets me in. He comes in, and he looks like walking death. God, it was a shock to me! I knew him, and here's this guy looking so terrible. I said, "Max, what's wrong with you?" "0h," he said, "I go down to the plant, I get all upset. Nothing is going right." Now, again, the war is on. You can't get help, you can't do this. So he gets all upset. He was the kind of an owner-manager who had to be in on everything. [If they] bought a new typewriter, he had to say what one they'd buy. So he goes down, and he gets all upset. He says, "My doctor says get rid of the business or get a new doctor. II So he said, "I guess I'm going to have to sell my business." Without thinking, I said, "Max, I'd like to buy iL" And he said, "Cy, everybody wants to buy my business, but my wife and I worked so hard to build it. They'll ruin it, I know. There's nobody I'd rather have than you.

So just that easily I bought that business. We came to an easy agreement. I paid him $100,000 for the business, plus the inventory, plus the accounts receivable. Inventory and accounts receivable were each about $25,000, but I could finance that easily. So my only thing was the $100,000, and I made arrangements. It was easy to get the money. The first person I told was a boy by the name of [James P.] Jim Hickey. [He had] been in Loyola High School with me, same class. He'd gone on to studying medicine back at Saint Louis and ran out of money. He was running a Standard Oil [gas] station at Olympic [Boulevard] and Fairfax [Avenue], kind of a training station, and working like the dickens. Oh, he was good. So I said to Ted Von der Abe, my friend whose office was right across the street, "You ought to hire that Jim Hickey. Boy, he's good." But Ted didn't do anything, so I hired him, and he came to work for the Kellogg Company. By now he's my assistant, he's my supervisor. So we're still working Saturdays, and Jim and I go to lunch, and I tell him, "Jim, I'm leaving the company. I'm going to buyout Max Ginsberg." He said, "I'll go with you." I said, "Jim, are you crazy? You'll get the job. This is what you've been working for. I'll recommend you." "No," he said, "we've always been together. I'll stay with you." Well, I said, "Jim, that wouldn't be right. I can't hire you. I'm taking a gamble. For you to come to work for me, that would be crazy. You stay with Kellogg's." "No," he said, "we've always been together. I like working with you. I'll stay with you." So I said, "Jim, I would love to have you, but I just can't hire you. I'm paying $100,000 for this business. If you could raise $10,000, you'll have a 10 percent interest. Then you have the same chance I have." He said, "I think my Uncle Tom would help me. will you go with me to see him?" I said, "Sure." So we go out to see Uncle Tom. Uncle Tom is Tom Hickey, Hickey Pipe and Supply Company, who's been very successful. He likes Jim; they're very close. So we go out, and I tell Tom what I'm going to do, and Jim wants to buy a 10 percent interest and he needs $10,000. Tom says to Jim, "Is that what you want, Jim?" And Jim says, "I think it would be such a great opportunity." Tom says, "I'll arrange it." So Tom got Jim a loan for $10,000 from the bank, and so he's my partner. I'm going to be the general partner, and he'll be a limited partner.