#maintenance cost of mobile banking app

Explore tagged Tumblr posts

Text

#maintenance cost of mobile banking app#mobile banking app maintenance cost#what is mobile banking app maintenance#types of mobile banking app maintenance#app design#app development

0 notes

Text

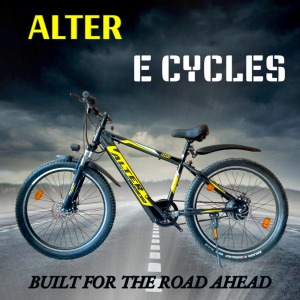

Alter Bicycle: The Future of Eco-Friendly Commuting

As urban spaces grow denser and the need for sustainable commuting becomes increasingly urgent, e-bicycles are emerging as a game-changer. Among them, the Alter brand stands out for its innovative solutions, including the much-acclaimed Alter motor conversion kit. With its blend of affordability, performance, and environmental consciousness, Alter offers an exceptional riding experience. This blog will delve into the features, benefits, and the future of Alter bicycles and their motor conversion kits.

The Rise of E-Bicycles

In recent years, e-bicycles have taken the transportation world by storm. They are not just a trend but a practical response to urban mobility challenges. E-bicycles like Alter provide:

Cost efficiency: Lower maintenance and operational costs compared to cars or motorcycles.

Eco-friendliness: Zero emissions, contributing to reduced carbon footprints.

Health benefits: An active lifestyle with pedal-assist technology.

Convenience: Easy to maneuver through traffic and minimal parking hassles.

What Makes Alter Bicycles Unique?

Alter bicycles cater to both seasoned cyclists and beginners with their versatile offerings. Here's what makes Alter special:

1. Innovative Motor Conversion Kits

Alter's motor conversion kit is a standout feature, designed to turn a traditional bicycle into a sleek, efficient e-bike.

Powerful Motors: The kits come with high-performance motors for an effortless ride, even on steep inclines.

Customizable Options: Tailored to fit a wide range of bicycles, making it accessible for everyone.

Ease of Installation: With simple tools and straightforward instructions, almost anyone can convert their bicycle within hours.

2. Affordable Solutions

Compared to buying a new e-bicycle, the Alter motor conversion kit offers a budget-friendly alternative. Riders can transform their existing bicycles without breaking the bank.

3. High-Quality Build

The brand uses premium materials, ensuring durability and longevity. Components like sturdy tires, reliable batteries, and robust motors ensure Alter bicycles withstand the test of time and terrain.

Key Features of Alter Motor Conversion Kits

FeatureDescriptionBattery LifeLong-lasting batteries, offering ranges up to 50-70 km per charge.Pedal Assist ModesMultiple levels of assistance to match the rider’s needs.Compact DesignSleek and lightweight, maintaining the bicycle's agility.Smart TechnologyCompatibility with apps for tracking speed, distance, and battery life.

Why Choose Alter for Your Commute?

Eco-Conscious Living

Switching to an Alter e-bicycle significantly reduces your carbon footprint. By choosing electric power over fossil fuels, you contribute to cleaner air and a greener planet.

Enhanced Commute Experience

Tackling long distances or challenging routes becomes hassle-free with pedal-assist technology. Riders enjoy the best of both worlds: the exercise benefits of cycling and the ease of motor assistance.

Cost Savings

Electric bicycles cost a fraction of what you’d spend on cars, motorbikes, or even public transport over time. With Alter, you also save on initial investments by reusing your existing bicycle.

Real-Life Applications of Alter E-Bicycles

Alter bicycles cater to various needs:

Daily Commuting: Beat the traffic and arrive at work fresh.

Fitness Goals: Stay active with pedal-assist that adapts to your fitness level.

Leisure Rides: Explore scenic routes without worrying about stamina.

Delivery Services: Cost-effective and sustainable for businesses relying on quick deliveries.

Customer Testimonials

“The Alter motor conversion kit was a lifesaver. I turned my old bike into an e-bike and saved so much money!” – Rahul S.

“I love how smooth and effortless the rides feel now. Alter has redefined my daily commute.” – Priya M.

Installation Guide for Alter Motor Conversion Kit

Preparation: Gather tools and ensure your bicycle is compatible with the kit.

Remove the Front/Rear Wheel: Follow the manual to replace it with the motorized wheel.

Install the Battery Pack: Secure the battery on the frame or rack.

Connect the Wiring: Link the motor, battery, and throttle.

Test the System: Ensure everything is functioning properly before heading out.

The Future of Alter Bicycles

With increasing demand for sustainable transportation, Alter continues to innovate. Upcoming features include advanced battery technology, integrated GPS systems, and solar-powered charging options. As urban planning embraces cycling-friendly infrastructure, brands like Alter will play a vital role in shaping the future of commuting.

Conclusion

Alter bicycles and motor conversion kits offer a perfect solution for eco-conscious individuals seeking affordable, efficient, and versatile transportation. Whether you're a city commuter, fitness enthusiast, or entrepreneur, Alter has something for everyone. Embrace the future of mobility today with Alter and make your ride smarter, greener, and more enjoyable.

3 notes

·

View notes

Text

5 Common Mobile App Development Myths You Need to Stop Believing | Techgropse

In today's fast-paced digital landscape, mobile applications have become an integral part of our daily lives. Whether it's for social networking, productivity, or entertainment, mobile apps are ubiquitous. However, despite their prevalence, there are still many misconceptions surrounding mobile app development that can hinder the success of a project.

Developing A Mobile App Is Expensive And Time Consuming

One of the most widespread myths about mobile app development is that it's prohibitively expensive and time-consuming. While it's true that building a high-quality app requires investment, it doesn't have to break the bank. With advancements in technology and the availability of various development tools and platforms, the cost of app development has significantly decreased in recent years.

Additionally, there are several approaches to mobile app development Singapore, such as native, hybrid, and cross-platform development, each with its own set of pros and cons. By carefully considering your project requirements and budget constraints, you can choose the most cost-effective approach that meets your needs.

Building A Mobile App Guarantees Success

Another common misconception is that simply having a mobile app will guarantee success. While a well-designed and functional app is undoubtedly essential, it's just one piece of the puzzle. Success in the crowded app market requires more than just launching an app; it requires a comprehensive strategy encompassing marketing, user acquisition, retention, and monetization.

Furthermore, effective marketing and promotion are crucial for app success. Leveraging various channels such as app store optimization (ASO), social media, influencer marketing, and paid advertising can help increase app visibility and attract users.

Mobile App Development Is A One Time Effort

Some people mistakenly believe that a mobile app development company in Malaysia is a one-time effort—that once the app is launched, the work is done. However, the reality is that successful app development is an ongoing process that requires continuous updates, maintenance, and optimization.

Final Words :

Debunking these common myths about mobile app development is essential for ensuring the success of your app project. By understanding the realities of app development, leveraging the right tools and resources, and adopting a strategic approach, you can maximize your chances of creating a successful and impactful mobile app.

#app development#web application development#app developers#web app development#custom software development

2 notes

·

View notes

Text

What is the aim of Modernization Solutions?

Modernization solutions refer to a range of strategies and services designed to upgrade outdated systems, integrate advanced technologies, and optimize business operations. These solutions go beyond technology to include process improvements and workforce transformation, ensuring a holistic evolution of organizational capabilities.

The Primary Aim of Modernization Solutions

The main aim of modernization solutions can be summed up as enabling organizations to achieve the following:

1. Enhance Operational Efficiency

One of the core objectives of modernization solutions is to optimize workflows and processes, ensuring maximum efficiency with minimal resources. By automating repetitive tasks, streamlining operations, and eliminating redundancies, businesses can focus on strategic initiatives.

Example: Automating payroll processes using Robotic Process Automation (RPA) reduces human error and processing time, freeing up resources for more valuable activities.

2. Drive Innovation and Agility

Modernization fosters a culture of innovation by leveraging cutting-edge technologies like cloud computing, artificial intelligence (AI), and Internet of Things (IoT). This enables businesses to remain agile and adapt quickly to market changes and emerging trends.

Example: E-commerce platforms integrate AI-powered recommendation systems to provide personalized shopping experiences, boosting sales and customer retention.

3. Improve Customer Experiences

Modernization solutions aim to enhance customer satisfaction by offering seamless, efficient, and personalized interactions. Businesses achieve this by integrating omnichannel platforms, chatbots, and data analytics to understand and address customer needs effectively.

Example: Banks modernize their mobile apps to offer real-time transaction alerts, personalized offers, and instant customer support, improving user satisfaction.

4. Ensure Scalability and Future-Readiness

As businesses grow, their systems must be able to scale without significant overhauls. Modernization solutions create flexible infrastructures that can handle increasing workloads and integrate new technologies.

Example: Cloud platforms allow organizations to scale storage and computing power on demand, accommodating growth without infrastructure bottlenecks.

5. Enhance Data Utilization

Data is the cornerstone of decision-making in modern organizations. Modernization solutions aim to transform raw data into actionable insights by integrating advanced analytics and AI tools, enabling data-driven strategies.

Example: Retailers use predictive analytics to forecast demand trends, optimize inventory, and enhance supply chain efficiency.

6. Strengthen Security and Compliance

Outdated systems often pose significant security risks. Modernization solutions prioritize the implementation of robust cybersecurity measures and ensure compliance with industry regulations.

Example: A healthcare provider modernizes its IT systems to ensure compliance with HIPAA regulations while protecting sensitive patient data through encryption and secure access controls.

Secondary Aims of Modernization Solutions

In addition to the primary objectives, modernization solutions also aim to achieve several secondary benefits that contribute to organizational growth and stability:

1. Cost Reduction

Modernized systems often reduce operational and maintenance costs by automating manual tasks and replacing inefficient legacy systems.

Example: Transitioning to cloud-based infrastructure eliminates the need for costly on-premise servers and hardware.

2. Boost Workforce Productivity

By providing employees with modern tools and automating repetitive tasks, modernization solutions enable teams to focus on creative and strategic responsibilities.

Example: Collaboration platforms like Microsoft Teams streamline communication and project management, improving team productivity.

3. Promote Sustainability

Modernization often includes adopting eco-friendly technologies and practices, aligning businesses with sustainability goals and reducing their environmental impact.

Example: Implementing energy-efficient data centers reduces power consumption and carbon footprints.

Benefits of Aligning Modernization with Business Goals

When organizations embrace modernization solutions with a clear focus on their aims, they unlock several long-term benefits:

1. Competitive Advantage

Modernized systems enable businesses to outpace competitors by delivering better products, services, and customer experiences.

2. Increased Revenue

By improving efficiency, customer satisfaction, and market adaptability, modernization directly contributes to increased profitability.

3. Long-Term Stability

Future-ready systems ensure businesses are well-prepared to handle industry disruptions, economic shifts, or technological advancements.

4. Employee Satisfaction

Empowering employees with modern tools and streamlined processes boosts morale and job satisfaction.

Challenges in Achieving the Aims of Modernization

While modernization solutions offer transformative benefits, achieving their aims comes with challenges:

1. Resistance to Change

Employees may resist adopting new technologies or workflows due to fear of job displacement or increased workload.

Solution: Invest in change management strategies, such as clear communication and comprehensive training programs.

2. Integration Complexities

Integrating modern solutions with legacy systems can be technically challenging.

Solution: Use middleware tools and work with experienced consultants to ensure smooth transitions.

3. High Initial Costs

Modernization often requires substantial upfront investments.

Solution: Focus on high-ROI projects and leverage cost-effective technologies like cloud platforms.

4. Data Security Risks

Data migration and system upgrades may expose vulnerabilities to cyber threats.

Solution: Implement robust cybersecurity measures, such as encryption, multi-factor authentication, and threat monitoring.

Industries Benefiting from Modernization Solutions

Modernization solutions are applicable across a wide range of industries, each with unique objectives:

1. Healthcare

Upgrading electronic health records (EHR) systems for better patient care.

Using AI for faster diagnostics and personalized treatments.

2. Finance

Enhancing fraud detection capabilities with AI.

Migrating to cloud platforms for real-time transactions.

3. Retail

Optimizing supply chains with IoT and predictive analytics.

Providing personalized shopping experiences through AI-driven insights.

4. Manufacturing

Implementing IoT for real-time equipment monitoring and predictive maintenance.

Automating production lines to improve efficiency.

5. Education

Adopting e-learning platforms and virtual classrooms for better accessibility.

Using analytics to track student performance and tailor learning experiences.

Steps to Achieve the Aims of Modernization

To realize the full potential of modernization solutions, organizations should follow a structured approach:

1. Assess Current Systems

Evaluate the performance and limitations of existing systems to identify areas that need improvement.

2. Define Clear Goals

Align modernization efforts with specific business objectives, such as improving efficiency, enhancing customer experience, or reducing costs.

3. Prioritize High-Impact Areas

Focus on areas that offer the greatest return on investment, such as automating manual workflows or transitioning to scalable infrastructure.

4. Choose the Right Technology

Select modern tools and platforms that align with your goals, such as cloud computing, AI, or IoT.

5. Implement in Phases

Roll out modernization solutions gradually to minimize disruption and ensure smooth transitions.

6. Train Employees

Provide comprehensive training to help employees adapt to new technologies and workflows.

7. Monitor and Optimize

Continuously evaluate the performance of modernized systems and refine them as needed to stay aligned with business goals.

Future Trends in Modernization Solutions

The aims of modernization will continue to evolve with technological advancements. Key trends include:

AI-Driven Automation: Expanding the scope of automation in decision-making and operations.

Edge Computing: Complementing cloud platforms with faster, real-time data processing.

Sustainability Initiatives: Integrating green technologies to promote eco-friendly practices.

Blockchain: Enhancing transparency and security in supply chain and financial transactions.

Conclusion

The main aim of modernization solutions is to empower organizations to thrive in an ever-changing world by improving efficiency, fostering innovation, enhancing customer experiences, and preparing for future growth. By aligning technology, processes, and workforce capabilities with organizational goals, modernization solutions pave the way for long-term success and competitiveness.

Embracing modernization is no longer optional—it is a strategic imperative for businesses seeking to stay ahead in the digital age. With a clear focus on their aims, businesses can unlock unprecedented opportunities, overcome challenges, and build a resilient foundation for the future.

0 notes

Text

Solving Common Challenges in Mobile App Development with Pyramidion Solutions

Description: Mobile app development often comes with unique challenges, from ensuring cross-platform compatibility to delivering seamless user experiences. At Pyramidion Solutions, a trusted mobile app development company in Chennai, we specialize in solving these issues, providing top-notch services in Flutter app development, Android app development, and iOS app development.

Content: In today’s fast-paced digital world, mobile apps are essential for businesses looking to thrive and engage with their audience. However, the journey of creating a mobile app is not without its hurdles. Let’s explore some of the most common challenges and how Pyramidion Solutions, a leading mobile app development company in Chennai, addresses them effectively.

Cross-Platform Compatibility

One of the biggest challenges is ensuring that an app works seamlessly across different platforms. Here’s where Flutter app development becomes a game-changer. At Pyramidion Solutions, we leverage Flutter’s single codebase to build apps that perform exceptionally well on both Android and iOS, reducing development time and cost. For example, we recently helped a Chennai-based e-commerce company create a cross-platform app using Flutter, which improved their customer engagement by 40%.

User Experience and Performance

A poorly designed app or slow performance can result in user drop-offs. Whether it’s Android app development or iOS app development, we prioritize intuitive UI/UX design and optimize app performance to ensure a smooth user experience. For instance, when working with a local healthcare startup, our team enhanced the app’s navigation and speed, leading to a 25% increase in daily active users.

App Security

Data breaches and security vulnerabilities can jeopardize user trust. At Pyramidion Solutions, we incorporate advanced encryption techniques, secure APIs, and rigorous testing during the development process. A real-time example is our collaboration with a fintech company, where we developed a secure mobile banking app with features like two-factor authentication and encrypted transactions.

Scalability and Maintenance

As businesses grow, their apps must scale to accommodate more users and new features. Whether through Flutter app development, Android app development, or iOS app development, our solutions are designed for scalability. We also provide ongoing maintenance to ensure the app evolves with your business needs.

Why Choose Pyramidion Solutions?

As a premier mobile app development company in Chennai, we bring years of experience and expertise to the table. Our team is dedicated to delivering apps that solve real-world problems, enhance user engagement, and drive business growth.

Ready to overcome your mobile app challenges? Partner with Pyramidion Solutions today for innovative and reliable app development services. Let’s bring your ideas to life!

1 note

·

View note

Text

Affordable Application Development Company: Your Guide to High-Quality Apps on a Budget

In today’s digital landscape, having a well-designed mobile application is no longer a luxury but a necessity for businesses aiming to stay competitive. However, the common perception that application development is expensive often deters startups and small businesses from pursuing their digital dreams. Fortunately, with the right affordable application development company, you can bring your vision to life without breaking the bank.

What Makes an Application Development Company Affordable?

Affordability doesn’t always mean cheap. A truly affordable application development company offers cost-effective solutions without compromising on quality. These companies focus on:

Efficient Development Processes: Leveraging agile methodologies to minimize time and resources.

Experienced Teams: Skilled developers who can deliver high-quality results faster.

Scalable Solutions: Building apps that grow with your business, reducing the need for costly upgrades.

Transparent Pricing Models: Clear and predictable pricing with no hidden fees.

Why Choose an Affordable Application Development Company?

Cost Savings: Small businesses and startups can allocate their budget across other essential areas like marketing and operations.

Tailored Solutions: Affordable companies often specialize in creating customized apps for niche markets.

Access to Expertise: These companies employ talented developers who use cost-efficient tools and frameworks, such as Flutter and React Native, to deliver robust applications.

Features to Look For in an Affordable App Development Company

When searching for the right partner, consider these key attributes:

Portfolio and Case Studies: Evaluate the company’s past projects to assess their capabilities.

Client Testimonials: Look for reviews and feedback to understand their customer service and reliability.

End-to-End Services: Ensure they offer a full range of services, from app ideation to post-launch support.

Flexible Engagement Models: Options like fixed-price contracts or dedicated teams allow you to choose what best suits your budget.

Use of Open-Source Frameworks: Companies that use cost-efficient technologies can significantly reduce development costs.

Benefits of Affordable App Development

Rapid Market Entry: Cost-effective companies can expedite the development process, helping you launch your app sooner.

Enhanced ROI: A well-priced, high-quality app can provide substantial returns by attracting more users.

Continuous Support: Affordable doesn’t mean subpar; many companies provide ongoing maintenance and updates at reasonable costs.

Final Thoughts

Affordable application development is about balancing cost, quality, and efficiency. By partnering with the right company, you can create a powerful digital solution that drives growth and enhances user engagement. If you’re ready to bring your app idea to life without straining your budget, start your journey with an affordable application development company today.

To learn more about affordable application development company, we recommend you to explore Mobile Applications Online, the top choice for app and web development solutions.

0 notes

Text

Best Microfinance Software Development in Lucknow: SigmaIT Software Designers Pvt. Ltd.

Microfinance institutions (MFIs) play a critical role in promoting financial inclusion by providing essential financial services to underserved populations. However, managing microfinance operations involves complex processes that require efficiency, accuracy, and transparency. SigmaIT Software Designers Pvt. Ltd., a leading best microfinance software development in Lucknow, offers advanced microfinance software solutions to address these challenges and empower MFIs to achieve operational excellence.

Why Microfinance Software is Essential -

Microfinance institutions deal with diverse operations, including loan management, repayment tracking, customer data handling, and compliance reporting. Manual processes can lead to inefficiencies, errors, and delays. Microfinance software automates these tasks, ensuring streamlined operations and better customer service.

Key Features of SigmaIT’s Microfinance Software -

Loan Management System

Simplifies loan application, approval, and disbursement processes.

Tracks repayments and calculates interest automatically.

Supports various loan types, including group, individual, and agricultural loans.

Customer Relationship Management (CRM)

Maintains comprehensive customer profiles.

Tracks financial history and borrowing behavior.

Facilitates personalized customer engagement.

Accounting and Financial Management

Automates ledger management, profit/loss calculations, and balance sheet generation.

Ensures accurate tracking of transactions and financial health.

Mobile Accessibility

Field agents can access and update data in real-time via mobile apps.

Enables remote loan applications, repayments, and customer data management.

Regulatory Compliance

Integrated tools ensure adherence to local and international microfinance regulations.

Reduces risks of penalties and non-compliance issues.

Reporting and Analytics

Generates detailed reports on loan performance, repayment trends, and operational metrics.

Provides real-time insights through an intuitive dashboard.

Multilingual and Multi-Currency Support

Ideal for MFIs operating in diverse regions.

Supports multiple languages and currencies for seamless operations.

Benefits of SigmaIT’s Microfinance Software -

Improved Efficiency

Automates repetitive tasks, reducing manual effort and operational errors.

Enhanced Transparency

Detailed reports and audit trails improve accountability and stakeholder trust.

Cost Savings

Reduces administrative expenses by streamlining processes.

Better Customer Experience

Quick loan processing and personalized services enhance customer satisfaction.

Scalability

Adapts to the growing needs of MFIs as they expand their reach.

Why SigmaIT is the Best Choice for Microfinance Software Development -

Tailored Solutions SigmaIT develops custom software solutions to meet the unique needs of your MFI, ensuring seamless integration with existing systems.

User-Friendly Interface The software is designed for ease of use, enabling both administrators and field agents to navigate effortlessly.

Robust Security Advanced encryption and security protocols protect sensitive data from unauthorized access.

Experienced Team SigmaIT boasts a team of skilled developers with extensive experience in creating software for the financial sector.

End-to-End Support From implementation to training and maintenance, SigmaIT provides comprehensive support to ensure smooth operations.

Applications of Microfinance Software -

Rural Banking Facilitates financial services in remote areas, promoting rural development.

Self-Help Groups (SHGs) Manages group loans, contributions, and repayments efficiently.

Agricultural Financing Supports farmers with flexible loan products tailored to crop cycles.

Urban Microfinance Streamlines operations for small businesses and entrepreneurs in urban areas.

Driving Financial Inclusion with SigmaIT -

SigmaIT’s microfinance software is designed to empower MFIs to serve unbanked and underbanked populations effectively. By simplifying operations and enhancing service delivery, the software plays a pivotal role in promoting financial inclusion and poverty alleviation.

Future-Ready Solutions -

SigmaIT incorporates the latest technological advancements to keep its microfinance software future-ready:

Artificial Intelligence: For predictive analytics and credit risk assessment.

Blockchain: For enhanced security and transparency in transactions.

Cloud Integration: For scalable and cost-effective software solutions.

Testimonials -

MFIs using SigmaIT’s microfinance software have reported significant improvements in operational efficiency, customer satisfaction, and overall growth. Clients appreciate the intuitive interface, robust performance, and responsive support.

Conclusion -

For MFIs in Lucknow and beyond, SigmaIT Software Designers Pvt. Ltd. is the trusted partner for advanced microfinance software development. Their tailored solutions, expert team, and commitment to quality make them the best choice for addressing the unique challenges of microfinance operations.

Empower your institution with SigmaIT’s cutting-edge microfinance software and take your services to the next level. Contact SigmaIT today to learn how their solutions can transform your operations and help you achieve your mission of financial inclusion.

#bestmicrofinancesoftware#bestmicrofinancesoftwaredevelopment#bestmicrofinancesoftwareinlucknow#bestmicrofinancesoftwaredevelopmentcompanyinlucknow#microfinancesoftwaredevelopmentcompanyinlucknow#bestmicrofinancesoftwaredevelopmentinlucknow#microfinancesoftwarecompanyinlucknow

0 notes

Text

Flutter Development by INFINITY WEBINFO PVT LTD: Empowering Businesses with Expert Flutter Developers

In today’s fast-paced digital era, businesses need applications that are visually appealing, high-performing, and accessible across multiple platforms. INFINITY WEBINFO PVT LTD specializes in providing cutting-edge solutions through a team of skilled Flutter developers. By leveraging Flutter, our app developers for Flutter deliver seamless and feature-rich applications tailored to your business needs.

What is Flutter?

Flutter is an open-source UI software development toolkit created by Google. It is designed to simplify the development process by enabling developers to build natively compiled applications for mobile (Android and iOS), web, and desktop (Windows, macOS, and Linux) from a single codebase.

Key Features of Flutter:

Single Codebase, Multiple Platforms: A single codebase allows Flutter developers to build apps for multiple platforms, saving time and reducing costs.

Dart Programming Language: Flutter uses Dart, a fast and object-oriented programming language tailored for optimized development.

Hot Reload: Instantly view changes in the application without restarting, enhancing developer productivity.

Rich Set of Widgets: Flutter offers widgets for Material Design (Android) and Cupertino (iOS), enabling platform-specific styling and functionality.

Native-Like Performance: Flutter apps are directly compiled into native machine code, ensuring smooth performance and responsiveness.

Customizability: Developers can create unique designs with customizable widgets, providing a superior user experience.

Why Choose Flutter for Development?

1. Cost-Effective Solutions: By writing a single codebase, businesses save on development and maintenance costs.

2. Faster Time to Market: Features like hot reload and an extensive widget library allow Flutter developers to accelerate the development process.

3. Enhanced UI/UX: The widget-based architecture ensures visually stunning and highly responsive applications.

4. Scalability: Flutter’s versatility allows developers for Flutter to build applications that are future-ready and scalable.

INFINITY WEBINFO PVT LTD’s Expertise in Flutter Development

At INFINITY WEBINFO PVT LTD, we specialize in harnessing the power of Flutter to deliver tailored solutions for businesses across industries. Our skilled developers create applications that are not only functional but also feature-rich and user-friendly. Here’s what sets us apart:

Custom App Development: We build applications tailored to your business requirements, ensuring seamless user experiences.

Cross-Platform Expertise: Our team optimizes the advantages of Flutter for delivering apps that perform seamlessly on Android, iOS, and other platforms.

Backend Integration: Robust integration with APIs and backend services like Firebase, ensuring scalable and reliable applications.

End-to-End Support: From design and development to testing and deployment, we provide complete lifecycle management.

Applications of Flutter Development

E-commerce Apps: Fast and scalable solutions for online businesses.

Healthcare Apps: Streamlined patient management and appointment scheduling.

Travel and Tourism: Interactive platforms for bookings and itineraries.

Education: Feature-rich e-learning apps with video content and interactive quizzes.

Financial Services: Secure and reliable banking and fintech solutions.

Why Partner with INFINITY WEBINFO PVT LTD for Flutter Development?

Experienced Team: A skilled team proficient in Flutter and Dart.

Timely Delivery: Agile methodology ensures on-time project completion.

Client-Centric Approach: We prioritize your goals, delivering apps that align with your vision.

Post-Deployment Support: Continuous monitoring and support for a smooth user experience.

At INFINITY WEBINFO PVT LTD, we are committed to leveraging the best technologies to empower businesses. Flutter’s versatility and efficiency make it a preferred choice for modern app development, and we are here to help you make the most of it.

Ready to build your next app? Contact INFINITY WEBINFO PVT LTD today to explore how Flutter can transform your business!

Mobile: - +91 9711090237

#flutter#flutter development company#flutter developers#flutter development services#infinity webinfo pvt ltd

0 notes

Text

Open Bank – Open Bank

In recent years, the financial industry has seen a significant transformation, with the rise of digital banking and fintech solutions. OpenBank, a key player in this transformation, represents a modern approach to banking, making financial services more accessible, transparent, and efficient. But what exactly is www-openbank.com, and how does it impact consumers, businesses, and the financial ecosystem at large?

What is OpenBank?

At its core, OpenBank is a digital-first bank that operates primarily through online platforms. Unlike traditional banks with physical branches, OpenBank leverages technology to offer a wide array of banking services, including checking and savings accounts, loans, credit cards, and investment solutions, all through mobile apps and websites. The term "open" in OpenBank refers to its use of open banking principles, which enable secure sharing of financial data between different institutions, providing consumers with more control over their financial information.

The Rise of Open Banking

The concept of open banking has gained traction globally, driven by regulatory changes, advancements in technology, and shifting consumer expectations. Open banking is a system in which banks allow third-party financial service providers to access consumer banking information (with consent) via secure application programming interfaces (APIs). This opens the door for innovation, as fintech companies and other third-party providers can offer new financial products and services that were previously unavailable through traditional banking systems.

OpenBank is a prime example of how banks are embracing open banking to create a more collaborative ecosystem. By enabling seamless integration with other financial services, OpenBank provides a personalized and user-centric banking experience. For example, users can connect their OpenBank account to a variety of financial management apps that help them track spending, set budgets, or invest more efficiently.

The Benefits of OpenBank

Convenience and Accessibility: One of the biggest advantages of www-openbank.com is the level of convenience it offers. With the ability to manage accounts, make transfers, apply for loans, and access customer support through online platforms, consumers no longer need to visit physical branches for routine banking activities. This reduces the time spent on managing finances and allows users to access their accounts anytime, anywhere.

Lower Fees: Digital-first banking models often come with lower operational costs compared to traditional banks, which maintain physical branches and ATMs. OpenBank passes these savings onto customers in the form of reduced fees. Many OpenBank accounts come with no monthly maintenance fees, free or low-cost transfers, and lower interest rates on loans or credit cards.

Personalized Financial Services: OpenBank harnesses the power of data to offer tailored financial advice and personalized services. With access to a broad range of data, OpenBank can analyze spending patterns, income streams, and financial goals to recommend the most suitable financial products for its customers. Additionally, third-party integrations can provide insights into budgeting, savings, and investment opportunities, ensuring that users receive a highly customized banking experience.

Enhanced Security and Privacy: OpenBank ensures robust security protocols, utilizing encryption, two-factor authentication, and advanced fraud detection systems to protect customer data. Open banking regulations also require banks to implement strict privacy protections, giving consumers more control over who has access to their financial information and how it is used.

Innovation and New Features: As part of the open banking ecosystem, OpenBank constantly evolves by integrating with various fintech services. This allows users to benefit from innovative tools, such as automated savings plans, AI-powered investment advice, and instant loan approvals. With third-party providers continuously bringing new financial solutions to the table, OpenBank is well-positioned to remain at the forefront of innovation.

How OpenBank Benefits Businesses

OpenBank is not just a consumer-facing platform; it also offers advantages for businesses. By utilizing APIs and other digital tools, OpenBank enables businesses to streamline their financial operations. From easier payment processing to simplified bookkeeping, small and medium-sized enterprises (SMEs) can take advantage of digital banking services that were previously reserved for larger corporations.

For example, businesses can integrate OpenBank with their accounting software, making it easy to track cash flow, issue invoices, and reconcile accounts. Additionally, with the ability to offer secure online payment options, OpenBank helps businesses create frictionless transactions for their customers, improving overall user experience and customer satisfaction.

The Future of OpenBank

As more consumers and businesses embrace digital banking, the future of www-openbank.com looks promising. The continued adoption of open banking regulations across the globe will likely foster further collaboration between banks, fintech startups, and other financial service providers, driving more innovation. Additionally, with advancements in artificial intelligence, blockchain, and machine learning, OpenBank is set to play a leading role in shaping the next generation of banking services.

The continued expansion of financial products and services offered through OpenBank, along with its focus on customer experience, will ensure that digital banking remains a core element of the financial landscape for years to come.

Conclusion

OpenBank is part of a broader digital banking revolution that is making banking services more accessible, affordable, and secure. By embracing open banking principles, OpenBank is leading the charge in transforming the way we manage our finances, offering customers a level of control and customization that traditional banks cannot match. With the ongoing advancement of technology and regulatory frameworks, OpenBank is well-positioned to continue driving change and innovation in the financial services industry, benefitting both consumers and businesses alike.

In a world where convenience, security, and personalization are paramount, www-openbank.com is helping to redefine what modern banking looks like—one digital interaction at a time.

1 note

·

View note

Text

The Rise of PWAs: Revolutionizing Mobile and Web Experiences

The Progressive Web Apps Market Report provides essential insights for business strategists, offering a comprehensive overview of industry trends and growth projections. It includes detailed historical and future data on costs, revenues, supply, and demand, where applicable. The report features an in-depth analysis of the value chain and distributor networks.

Employing various analytical techniques such as SWOT analysis, Porter’s Five Forces analysis, and feasibility studies, the report offers a thorough understanding of competitive dynamics, the risk of substitutes and new entrants, and identifies strengths, challenges, and business opportunities. This detailed assessment covers current patterns, driving factors, limitations, emerging developments, and high-growth areas, aiding stakeholders in making informed strategic decisions based on both current and future market trends. Additionally, the report includes an examination of the Automatic Rising Arm Barriers sector and its key opportunities.

According to Straits Research, the global progressive web apps market size was valued at USD 3.53 billion in 2024 and is projected to grow from USD 5.23 billion in 2025 to reach USD 21.44 billion by 2033, growing at a CAGR of 18.98% during the forecast period (2025-2033).

Get Free Request Sample Report @ https://straitsresearch.com/report/progressive-web-apps-market/request-sample

TOP Key Industry Players of the Progressive Web Apps Market

Google

Microsoft

OutSystems

Alokai (former Vue Storefront)

IBM Corporation

Cloud Four, Inc.

DockYard Inc.

Enonic AS

GoodBarber

Meta

Svelte

Latest Trends in the Progressive Web Apps Market

Quick Adoption: As companies look to enhance user experiences and save development costs in comparison to traditional native apps, PWA demand is rising. Small and medium-sized businesses (SMEs), that gain from fewer entry barriers, are especially affected by this trend.

Technological Developments: PWAs are becoming more resilient and able to offer offline features and quicker load times thanks to advancements in web technologies, such as improved browser support for service workers and caching methods.

Enhanced User Engagement: By utilizing features like push notifications, which aid in user retention and promote return visits, businesses are using PWAs to boost user engagement.

Emphasis on E-commerce: PWAs are being quickly adopted by the e-commerce industry because of their capacity to deliver smooth online shopping experiences, which can result in higher conversion rates and lower cart abandonment.

Cross-Platform Compatibility: PWAs simplify development procedures and save maintenance costs for companies by providing a single codebase that functions on a variety of platforms and devices.

Security Features: Because PWAs use HTTPS, users and services can connect securely. This is crucial for applications that handle sensitive data, including banking or personal data.

Key Statistics

Over 33% of the PWA market was held by North America in 2023, and the U.S. is expected to rise at a compound annual growth rate (CAGR) of 31.1% between 2024 and 2030. With a CAGR of 32.7% during the same time frame, the Asia-Pacific region is predicted to grow even more quickly.

Due to their increased use of PWAs to improve customer engagement and optimize operations, large organizations accounted for around 54% of the market in 2023.

One of the main factors driving PWAs is the rise in mobile internet usage, especially in areas where mobile devices are the main way to access the internet.

Global Progressive Web Apps Market: Segmentation

As a result of the Progressive Web Apps Market segmentation, the market is divided into sub-segments based on product type, application, as well as regional and country-level forecasts.

By Component

Platform

Services

By Organization Size

Small & Medium Enterprises

Large Enterprises

By Applications

E-commerce and Retail

Media and Entertainment

Travel and Tourism

Healthcare

Education

Banking and Financial Services

Others

You can check In-depth Segmentation from here: https://straitsresearch.com/report/progressive-web-apps-market/segmentation

Regional Analysis

Based on its strong digital infrastructure and high smartphone penetration, North America is expected to continue to dominate the worldwide PWA market, accounting for over 33% of the market in 2023.

The PWA market is expected to develop at the fastest rate in the APAC region, with a compound annual growth rate (CAGR) of 32.7% between 2024 and 2030. Because of government programs encouraging digital transformation and enhancing technology infrastructure, nations like China and India are spearheading this movement.

The PWA industry is expanding rapidly in Europe thanks to investments in accessibility and digital inclusion programs. PWA adoption is promoted by the European Union's digitalization plan in a number of industries, such as public services and e-commerce.

Reasons for Buying This Report:

Provides an analysis of the evolving competitive landscape of the Automatic Rising Arm Barriers market.

Offers analytical insights and strategic planning guidance to support informed business decisions.

Highlights key market dynamics, including drivers, restraints, emerging trends, developments, and opportunities.

Includes market estimates by region and profiles of various industry stakeholders.

Aids in understanding critical market segments.

Delivers extensive data on trends that could impact market growth.

Research Methodology:

Utilizes a robust methodology involving data triangulation with top-down and bottom-up approaches.

Validates market estimates through primary research with key stakeholders.

Estimates market size and forecasts for different segments at global, regional, and country levels using reliable published sources and stakeholder interviews.

Buy Now @ https://straitsresearch.com/buy-now/progressive-web-apps-market

About Straits Research

Straits Research is dedicated to providing businesses with the highest quality market research services. With a team of experienced researchers and analysts, we strive to deliver insightful and actionable data that helps our clients make informed decisions about their industry and market. Our customized approach allows us to tailor our research to each client's specific needs and goals, ensuring that they receive the most relevant and valuable insights.

Contact Us

Email: [email protected]

Address: 825 3rd Avenue, New York, NY, USA, 10022

Tel: UK: +44 203 695 0070, USA: +1 646 905 0080

#ProgressiveWebApps#PWAMarket#WebAppDevelopment#FutureOfApps#PWATrends#MobileFirst#AppInnovation#PWAAdoption#TechTrends#DigitalTransformation#PWAGrowth#SeamlessExperience#WebToMobile#PWAOpportunities#AppTechnology#UserEngagement#MarketAnalysis#ProgressiveApps#PWAIndustry#AppDevelopmentTrends#b2b#technology#trending

0 notes

Text

How to Create Instant Checks for Your Small Business?

Instant checks can be created securely via the online check printing software without any manual handling.

Managing payments is a crucial part of running a small business. What if you can create checks instantly without relying on pre-printed checks? Whether you’re paying suppliers, contractors, or employees, creating instant checks can enhance your check payments, save time, and maintain professionalism.

1. Choose the Right Online Check Printing Software

OnlineCheckWriter.com- powered by Zil Money, is a financial technology company, not a bank or an FDIC member. The platform offers custom-curated online check printing and mailing and other payment methods to make your business operations smoother. With a regular printer and blank check paper, users can print and send checks easily. By eliminating pre-printed checks from your business, you can save up to 80% of check printing costs.

Payroll, vendor, bill, or rent payments can be made via the software according to the payee's preferred method. With integration into 22,000+ financial institutions, it upgrades account management and transactions for users. With over one million happy users and 22k+ transactions per week, the software is reliable for all your business needs. The platform is mobile-friendly, and users can download its app from the Google Play and iOS App Stores.

2. Set Up Your Account

Businesses must create a checking account in order to access payment services. The platform allows you to create instant online checking accounts from anywhere at any time. Users can open multiple free online checking accounts and utilize each account for specific business needs.

The user can open a business checking account or a personal checking account.

With no initial fees, anyone can easily open a checking account.

Businesses can make trouble-free payments without maintenance charges.

Users can eliminate the minimum deposit requirement to create a checking account.

The software allows you to make quick payments via ACH, international wire transfers, domestic wire transfers, virtual cards, checks, eChecks, and check mail from checking accounts.

3. Customize Your Check Layout

Personalize your checks by adding your business logo, contact information, and branding elements. OnlineCheckWriter.com - Powered by Zil Money, provides drag and drop tools and pre-designed templates to make customization quick and easy.

The platform offers customizable templates designed for various purposes, such as payroll, supplier payments, or donations. Choose a template that suits your needs and reflects the personality of your business.

Adapt checks to match the nature of your business. For instance, a small business can design checks featuring its mission statement or values, adding a personal touch to payments.

Easily create unique check designs without hiring a professional. With the software’s user-friendly drag-and-drop tool, you can place elements like your logo, address, or contact information exactly where you want them.

Input the required details, including the payee's name, amount, and date. Double-check the information to avoid errors and ensure a smooth transaction.

4. Print or Send Your Check

OnlineCheckWriter.com - Powered by Zil Money, allows businesses to print checks using a regular printer and blank check paper. If you’re printing, standard paper can also be used, making the process cost-effective. The platform allows you to send checks via mail or email easily. The software offers online check-mailing features to send check payments affordably and securely. There are various options for businesses to send check payments provided by the online check printing software:

First-class check mailing

First class USPS Canada

First class with tracking

Priority mail through

Express mail USPS

FedEx Overnight USA

FedEx Overnight Canada

Positive Pay Service: Secured Check Transactions

Positive Pay is an advanced fraud prevention mechanism that enhances the security of your check payments. With this system, you provide your financial institutions with a record of the checks you’ve issued, including details such as the check number, account number, and amount.

With the help of OnlineCheckWriter.com - Powered by Zil Money, users can verify each check presented for payment. If a check does not match the details you’ve reported, it is flagged and returned to you for review. The process helps prevent fraudulent or unauthorized payments, offering an added layer of protection for your financial transactions. Businesses, especially those issuing multiple checks regularly, can rely on positive pay to safeguard their funds and ensure only authorized payments are processed. By proactively addressing potential fraud, positive pay enables you to maintain greater control and peace of mind over your business’s cash flow.

Flexible Payment Options

OnlineCheckWriter.com - Powered by Zil Money, offers a wide range of payment methods to suit diverse business needs. You can leverage ACH transfers for secure and cost-effective domestic payments or opt for international and domestic wire transfers for faster global transactions. Additionally, businesses can provide payment links to customers, allowing for quick and convenient payments directly from invoices. For more flexibility, you can process credit card transactions to maintain cash flow and earn rewards. The platform also supports invoice generation, ensuring professional and clear communication with clients. By integrating these diverse payment options, businesses can cater to varying client preferences, enhance payment efficiency, and stay ahead in today’s competitive marketplace.

Conclusion

Creating instant checks for your small business is a straightforward process that can optimize your payment operations while saving time and costs. With OnlineCheckWriter.com - Powered by Zil Money, you can easily print or send checks and customize check layouts to reflect your brand. The platform’s integration with financial institutions, along with flexible payment options, ensures your business can manage payments efficiently and securely. By adopting online check printing, you can maintain professionalism, improve cash flow management, and focus on growing your business with confidence.

0 notes

Text

Software Development Company in Noida: Driving Innovation and Growth

The digital era is powered by innovative software solutions, making software development a critical driver of progress across industries. Noida, a bustling technology hub in India, is home to a multitude of companies specializing in delivering cutting-edge software development services. Businesses seeking excellence, efficiency, and innovation often turn to these companies for their technological needs. This blog explores the attributes, offerings, and benefits of partnering with a software development company in Noida.

Why Choose a Software Development Company in Noida?

Noida has rapidly emerged as a preferred destination for software development services due to its robust infrastructure, skilled workforce, and proximity to the National Capital Region (NCR). Here's why companies in Noida are highly sought after:

Strategic Location Situated near Delhi, Noida offers excellent connectivity, making it a prime location for global businesses. Its proximity to the airport and metro networks ensures easy access for clients and employees.

Thriving IT Ecosystem Noida hosts numerous IT parks, start-ups, and global technology giants. This ecosystem fosters innovation, collaboration, and opportunities for businesses to leverage advanced solutions.

Cost-Effectiveness Companies in Noida offer world-class services at competitive prices. The cost advantage enables businesses to achieve high ROI without compromising quality.

Skilled Talent Pool With a large number of prestigious educational institutions in and around Noida, the city boasts a rich talent pool of skilled software developers, engineers, and IT professionals.

Core Services Offered by Software Development Companies in Noida

Software development companies in Noida cater to diverse business needs, offering customized solutions across various domains. Their services typically include:

1. Custom Software Development

Tailored software solutions designed to meet specific business requirements ensure seamless operations and enhanced productivity.

2. Web Application Development

From e-commerce platforms to enterprise portals, Noida-based developers create responsive, secure, and scalable web applications.

3. Mobile App Development

Expertise in creating user-friendly and feature-rich mobile apps for iOS, Android, and cross-platform environments allows businesses to engage their customers effectively.

4. Enterprise Solutions

Comprehensive ERP, CRM, and supply chain management solutions streamline business processes and improve operational efficiency.

5. Cloud-Based Solutions

Leveraging cloud technologies, companies deliver scalable and flexible solutions that support modern business needs.

6. AI and ML Integration

Advanced AI and ML-powered solutions help businesses gain insights, automate processes, and enhance decision-making capabilities.

7. Maintenance and Support

Post-deployment support ensures smooth operation of software and timely updates to keep systems secure and efficient.

Industries Served by Software Development Companies in Noida

The versatility of Noida’s software development companies is evident in their ability to cater to a wide range of industries. These include:

Healthcare Development of patient management systems, telemedicine platforms, and health data analytics tools.

Education E-learning platforms, virtual classrooms, and administrative software for educational institutions.

E-commerce Scalable platforms, inventory management systems, and payment gateway integrations for online businesses.

Finance Fintech solutions, investment management platforms, and secure online banking systems.

Real Estate CRM systems, property management software, and real-time analytics tools for real estate companies.

Manufacturing Supply chain management, inventory systems, and automation solutions for manufacturing firms.

Key Features of Leading Software Development Companies in Noida

1. Agile Development Approach

Most companies adopt agile methodologies, ensuring transparency, flexibility, and faster delivery of projects.

2. Cutting-Edge Technologies

Leveraging advanced tools and frameworks, these companies stay ahead of the technological curve.

3. Client-Centric Approach

Customization, regular communication, and iterative feedback ensure that the solutions align perfectly with client expectations.

4. Data Security

Implementation of robust security protocols ensures the confidentiality and integrity of client data.

5. Scalable Solutions

Solutions are designed to grow with the business, making them future-ready.

Benefits of Partnering with a Software Development Company in Noida

1. Cost-Effective Solutions

Save on development costs without compromising on quality or innovation.

2. Enhanced Efficiency

Streamlined processes and automated solutions boost productivity and reduce operational overheads.

3. Improved Customer Experience

Well-designed software enhances user experience, leading to better customer satisfaction and retention.

4. Competitive Edge

Access to innovative technologies and expert guidance gives businesses a distinct advantage in the market.

5. Reliable Support

Round-the-clock maintenance and troubleshooting ensure uninterrupted business operations.

How to Choose the Right Software Development Company in Noida

Selecting the right partner is crucial to achieving desired results. Here are some tips to guide your decision:

Assess Expertise Check the company’s portfolio and domain expertise.

Review Client Feedback Look for testimonials and case studies to gauge their reputation and reliability.

Evaluate Communication Ensure the company maintains clear and regular communication throughout the project lifecycle.

Understand Pricing Compare pricing models and choose one that aligns with your budget and project scope.

Focus on Scalability Opt for a partner that offers scalable solutions to accommodate future growth.

Conclusion

A software development company in Noida is not just a service provider but a strategic partner in driving innovation, efficiency, and growth. Whether you're a start-up, SME, or large enterprise, Noida’s rich IT ecosystem and skilled talent make it an ideal destination for software development needs. By collaborating with the right company, businesses can unlock their full potential and stay ahead in the competitive landscape.

If you’re ready to transform your business with state-of-the-art software solutions, reach out to a trusted software development company in Noida today!

#website design#software development#mobile app development#e commerce website development#custom software development#game development company#mobile app development services#mobile app development company

0 notes

Text

Looking for a Software Development Company Near Me? Choose Tech Mind Developers!

Are you searching for a reliable software development company near me to transform your business ideas into reality? Look no further! At Tech Mind Developers, we specialize in creating innovative and customized software solutions tailored to meet your business needs. Whether you are a startup or a well-established company, we are here to help you grow.

Why Choose Tech Mind Developers?

Custom Solutions: Every business is unique, and so are our solutions. We create software tailored specifically to your goals and challenges.

Experienced Team: Our skilled developers have expertise in crafting modern and user-friendly software.

Affordable Services: High-quality software doesn’t have to break the bank. We deliver exceptional results at the best price.

End-to-End Support: From initial consultation to final delivery and ongoing support, we ensure a seamless experience for your business.

Services We Offer

Web Development: Beautiful and functional websites designed to captivate users.

Mobile App Development: Apps for Android and iOS to engage your customers.

Custom Software Solutions: Unique software to solve your business problems.

E-commerce Development: Powerful online stores to boost your sales.

Software Maintenance: Keep your software running smoothly with our support.

How Tech Mind Developers Boosts Your Business

Choosing the right software development company can make all the difference. At Tech Mind Developers, we focus on helping your business grow by:

Improving Efficiency: Automating repetitive tasks and streamlining workflows.

Expanding Your Reach: Websites and apps designed to attract and retain customers.

Saving Time and Costs: Our solutions are built to save time and reduce unnecessary expenses.

No matter the industry — healthcare, education, retail, or hospitality — we have the expertise to build software that aligns with your goals.

Ready to Start?

Let’s discuss how we can help your business grow with innovative software solutions. Get in touch today!

📞 Phone: +91–7835019421 📧 Email: [email protected] 🌐 Website: https://www.techminddevelopers.com

#softwaredevelopmentcompany #softwaredevelopment #techminddevelopers #customsoftwaresolutions #itservices #businessgrowth #softwarecompanynearme #webdevelopment #mobileappdevelopment #ecommercesolutions #affordableservices #digitaltransformation #softwaresolutions #itconsulting #nearbytechservices

#softwaredevelopmentcompany#softwaredevelopment#techminddevelopers#customsoftwaresolutions#itservices#businessgrowth#softwarecompanynearme#webdevelopment#mobileappdevelopment#ecommercesolutions#affordableservices#digitaltransformation#softwaresolutions#itconsulting#nearbytechservices#mobile app development#softwaredesign#websitedevelopment#delhincr#mobileapplications#aligarh

0 notes

Text

Best Savings Account: Your Guide to Smart Saving

Choosing the best savings account can significantly impact your financial growth. With numerous options available, it’s essential to understand what features to look for and which accounts provide the most benefits. Below are key factors to consider when selecting a savings account and recommendations for some of the best options available.

Key Features of a Great Savings Account

High Interest Rates Look for accounts offering competitive annual percentage yields (APY) to maximize your savings growth. Online banks often provide higher APYs compared to traditional banks due to lower overhead costs.

Low Fees Ensure the account has no monthly maintenance fees, or at least offers easy ways to waive them. Hidden fees can erode your savings over time.

Accessibility Opt for an account with easy access to funds through mobile apps, online banking, or physical branches. Consider ATM networks for cash withdrawals.

Minimum Balance Requirements Choose an account with low or no minimum balance requirements to avoid penalties and maintain flexibility.

Additional Perks Some accounts offer bonuses, automatic savings features, or budgeting tools to help you stay on track.

Top Savings Accounts in 2024

Ally Bank Online Savings Account

APY: High, competitive rates.

Features: No fees, user-friendly app, and robust savings tools like "Buckets" for goal-based saving.

Marcus by Goldman Sachs

APY: Consistently high interest rates.

Features: No fees, no minimum deposit, and a simple application process.

Capital One 360 Performance Savings

APY: Competitive rates with no fees.

Features: No minimums and an easy-to-use platform with in-person branch access.

Discover Online Savings Account

APY: Among the top in the market.

Features: No monthly fees, excellent customer service, and a wide ATM network.

CIT Bank Savings Connect

APY: High rates, especially for accounts with direct deposit.

Features: Low opening deposit requirement and convenient online tools.

Tips for Maximizing Your Savings Account

Automate Deposits: Set up automatic transfers to grow your savings effortlessly.

Compare APYs Regularly: Interest rates fluctuate, so periodically check for better offers.

Avoid Withdrawals: Many savings accounts limit free withdrawals per month, so plan accordingly.

Final Thoughts

The best savings account depends on your personal needs, such as whether you prioritize high interest, accessibility, or added tools. Take the time to compare options and find one that aligns with your financial goals. Remember, saving is the first step to building wealth—choosing the right account makes it even more rewarding!

4o

1 note

·

View note

Text

Transform Your Business with Web App Development Services

What Are Web App Development Services?

Web app development services involve designing, developing, testing, and maintaining applications that run on web browsers. Unlike traditional software that must be downloaded, web apps are accessible directly via the internet, making them highly accessible and convenient for users across multiple devices. Examples of web apps include online banking portals, E-Commerce platforms, customer relationship management (CRM) tools, and collaborative productivity apps.

Why Does Your Business Need Web App Development?

Here are a few compelling reasons why businesses of all sizes are turning to web app development services:

1. Enhanced Accessibility

With web applications, users only need an internet connection and a browser to access your services. This cross-platform functionality ensures your business reaches a broader audience, providing a seamless experience on desktops, tablets, and smart phones.

2. Customized Solutions for Business Growth

Tailored web apps are designed with your business model in mind. Developers can build apps that align perfectly with your workflow, enhancing productivity and improving customer engagement.

3. Scalability to Grow with You

As your business expands, so does your need for advanced features. A well-built web application can be easily scaled to handle more users, integrate additional services, or add new functionalities without requiring a complete system overhaul.

4. Security and Data Management

Security is a top priority for any online business. Web app development services ensure your application has robust data encryption, user authentication, and compliance with the latest industry standards to protect both your business and customer data.

Key Services Offered by Web App Development Companies

1. Custom Web App Development

· Building web applications from scratch tailored to your specific requirements.

· Focus on user experience (UX) and performance optimization.

2. Progressive Web App (PWA) Development

· Creating web apps that provide a native-like experience.

· PWAs are faster and can function offline, making them ideal for businesses targeting mobile users.

3. E-Commerce Web App Development

· Developing robust eCommerce platforms with payment gateways and inventory management.

· Enhanced user interface and shopping cart experiences to boost sales.

4. API Integration and Backend Development

· Integrating third-party APIs for enhanced functionality (e.g., payment, social media, and analytics tools).

· Building a solid backend architecture to handle data processing efficiently.

5. Maintenance and Support

· Continuous monitoring, updates, and troubleshooting to ensure smooth performance.

· Implementing security patches and feature upgrades as needed.

How to Choose the Right Web App Development Service Provider

Finding the right web app development partner can be the key to your project’s success. Here are some factors to consider:

1. Technical Expertise: Look for companies with experience in modern technologies like React, Angular, Node.js, and Django.

2. Portfolio: Check their previous projects to assess their expertise in building web apps similar to your needs.

3. Client Reviews: Go through testimonials and case studies to understand their reputation.

4. Cost and Time Estimates: Choose a provider that offers transparency in pricing and realistic timelines.

5. Support Services: Ensure they provide post-deployment maintenance and support to keep your app running smoothly.

Future Trends in Web App Development

1. AI and Machine Learning Integration: Smarter apps with personalized experiences driven by artificial intelligence.

2. Cloud-based Applications: Using cloud infrastructure to provide scalable and cost-effective solutions.

3. Voice-activated Interfaces: More web apps will incorporate voice recognition technology to improve accessibility.

4. Microservices Architecture: Breaking down apps into smaller, independent components to enhance agility.

Conclusion

Web app development services are no longer a luxury but a necessity in today’s competitive market. A well-designed web app not only improves customer engagement but also streamlines internal operations, helping businesses stay agile and innovative. Whether you need an eCommerce platform, a PWA, or a complex enterprise solution, partnering with the right web app development service provider ensures that your business is future-proof and ready for digital transformation.

Invest in web app development services today and unlock new growth opportunities for your business!

0 notes

Text

Unity Ads Performs 10M Tasks Per Second With Memorystore

Memorystore powers up to 10 million operations per second in Unity Ads.

Unity Ads

Prior to using its own self-managed Redis infrastructure, Unity Ads, a mobile advertising company, was looking for a solution that would lower maintenance costs and scale better for a range of use cases. Memorystore for Redis Cluster, a fully managed service built for high-performance workloads, is where Unity moved their workloads. Currently, a single instance of their infrastructure can process up to 10 million Redis operations per second.The business now has a more dependable and expandable infrastructure, lower expenses, and more time to devote to high-value endeavors.

Managing one million actions per second is an impressive accomplishment for many consumers, but it’s just routine at Unity Ads. Unity’s mobile performance ads solution readily manages this daily volume of activities, which feeds ads to a wide network of mobile apps and games, showcasing the reliable capabilities of Redis clusters. Extremely high performance needs result from the numerous database operations required for real-time ad requests, bidding, and ad selection, as well as for updating session data and monitoring performance indicators.

Google Cloud knows that this extraordinary demand necessitates a highly scalable and resilient infrastructure. Here comes Memorystore for Redis Cluster, which is made to manage the taxing demands of sectors where speed and scale are essential, such as gaming, banking, and advertising. This fully managed solution combines heavier workloads into a single, high-performance cluster, providing noticeably higher throughput and data capacity while preserving microsecond latencies.

Providing Memorystore for Redis Cluster with success

Unity faced several issues with their prior Do-It-Yourself (DIY) setup before utilizing Memorystore. For starters, they employed several types of self-managed Redis clusters, from Kubernetes operators to static clusters based on Terraform modules. These took a lot of work to scale and maintain, and they demand specific understanding. They frequently overprovisioned these do-it-yourself clusters primarily to minimize possible downtime. However, in the high-performance ad industry, where every microsecond and fraction of a penny matters, this expense and the time required to manage this infrastructure are unsustainable.

Memorystore presented a convincing Unity Ads solution. Making the switch was easy because it blended in perfectly with their current configuration. Without the managerial overhead, it was just as expensive as their do-it-yourself solution. Since they were already Google Cloud users, they also thought it would be beneficial to further integrate with the platform.

The most crucial characteristic is scalability. The ability of Memorystore for Redis Cluster to scale with no downtime is one of its best qualities. With just a click or command, customers may expand their clusters to handle terabytes of keyspace, allowing them to easily adjust to changing demands. Additionally, Memorystore has clever features that improve use and dependability. The service manages replica nodes, putting them in zones other than their primary ones to guard against outages, and automatically distributes nodes among zones for high availability. What would otherwise be a difficult manual procedure is made simpler by this automated method.

All of this made Unity Ads decide to relocate their use cases, which included state management, distributed locks, central valuation cache, and session data. The relocation process proceeded more easily than expected. By using double-writing during the shift, they were able to successfully complete their most important session data migration, which handled up to 1 million Redis operations per second. Their valuation cache migration, which served up to half a million requests per second (equivalent to over 1 million Redis operations per second) with little impact on service, was even more astounding. It took only 15 minutes to complete. In order to prevent processing the same event twice, the Google team also successfully migrated Unity’s distributed locks system to Memorystore.

Memorystore in operation: the version of Unity Ads

Google Cloud has a life-changing experience using Memorystore for Redis Cluster. Its infrastructure’s greater stability was one of the most obvious advantages it observed. Because its prior DIY Redis cluster was operating on various tiers of virtualization services, such as Kubernetes and cloud computing, where it lacked direct observability and control, it frequently ran into erratic performance issues that were challenging to identify.

Consider this CPU utilization graph of specific nodes from its previous self-managed arrangement, for example:Image credit to Google Cloud

As you can see, the CPU consumption across many nodes fluctuated a lot and spiked frequently. It was challenging to sustain steady performance in these circumstances, particularly during times of high traffic.

During Kubernetes nodepool upgrades, which are frequently the result of automatic upgrades to a new version of Kubernetes, it also encountered issues with its do-it-yourself Redis clusters. The p99 latency is skyrocketing, as you can see!Image credit to Google Cloud

Another big benefit is that we can now grow production seamlessly because of Memorystore. This graph displays its client metrics as it increased the cluster’s size by 60%.

With very little variations, the operation rate was impressively constant throughout the procedure. For us, this degree of seamless scaling changed everything since it made it possible to adjust to shifting needs without compromising our offerings.

The tremendous performance and steady low latency it has been able to attain using Memorystore are described in the data presented above. For its ad-serving platform, where every microsecond matters, this performance level is essential.

Making a profit from innovation