#maintain batch wise details in tally

Explore tagged Tumblr posts

Text

Commerce Coaching in Boring Road Patna: Sukrishna Commerce Academy

Sukrishna Commerce Academy (P) Ltd. is the best commerce coaching in Patna and incorporated for giving high quality education in the area of Chartered Accountancy by CA Brothers Binay Kumar and Vivek Kumar. Sukrishna Commerce Academy provides top commerce classes in Patna run on regular basis especially on Sunday of the topics. Topic-wise course material English and Hindi Medium based on current trend. Mock Test is important for analyze the students exitance and Prepare For More. Classroom is also equipped with projector and smart classes equipments. Hostel is well maintained & furnished with a suitable environment for studying.

Visit us: www.sukrishna.in

Sukrishna Commerce Academy is the best commerce coaching in Patna for class 11 and 12. The mentors of Sukrishna, one of the top commerce coaching in Patna suggests different type of courses after 12th in commerce such as B.Com, BBA, BCA, CA, CS and range of other professional as well as vocational courses. Commerce is the most popular stream among higher secondary students in India. There are multitudes of courses at graduation level for students who have studied commerce in 11th and 12th. They are eligible to choose both arts and commerce.

After thorough research, team of Sukrishna commerce coaching in Patna came up with top courses after 12th in the stream of commerce. Sukrishna Commerce Academy aims to grow a system of commerce related courses that fits with ever-changing educational patterns of the country to meet the needs of the society and to fit into a wide range of opportunities in COMMERCE EDUCATION. We are committed to develop this institution in the field of COMMERCE education that benefits to all categories of students which aims to provide knowledge and skill among students along with research temperament. The subjects included in the academic course includes Accountancy, Business Studied, Economics and English as well as IP or Maths for CBSE/ICSE students, Bihar board students don’t have Maths or IP in their syllabus rather they have Hindi in additional.

Visit us: www.sukrishna.in

Students in commerce coaching in Patna for class 11 and 12 will be taught in detailed and complete syllabus by the faculty team of Sukrishna keeping the exam pattern of students in mind. Enrollment in the best commerce institute in Patna like Sukrishna Academy plays a vital role in imparting knowledge to students for a strong base for future studies.

Students can register themselves for direct admissions in upcoming batches. All the classes will be conducted routine wise. Test will be conducted every time the chapter ends and weekly test and doubt sessions are also held. Home assignments and questions apart from the books for practice are given to the students based on their exam patterns.

Motivational classes and other extra curricular activities are also conducted frequently to encourage students and boost their confidence. Due to Covid we are also conducting online classes for the students. If you want to join best coaching for commerce in Patna to secure a promising result, Sukrishna Commerce Academy is there for you.

You don’t have to worry about any subject here you will be taught by the best Faculties from all over India who are either CA and CS or have teaching experience of more than decades.

Even if you want to prepare for the CLAT entrance, CA-Foundation, CS- Foundation DCA, Tally you can take admission at Sukrishna Commerce institute in Boring road, Patna. Now your result is our responsibility you just have to follow the instructions of the mentors.

Visit us: www.sukrishna.in

#Bestcommercecoachinginpatna#topcommerceclassesinpatna#commerceinstituteinboringroad#commercecoachinginpatnaforclass11and12

0 notes

Text

Maintain Batch Wise Details Tally in Hindi

Maintain Batch Wise Details Tally in Hindi

Hello Frinds क्या आपने Tally में बैच वाइज डिटेल्स के बारे में सुना है, कई बार ऐसा होता है कि हम Medical Store में जाते है और वहां batches में Medicines रखी हुई होती है अक्सर Medical Line के लोग ही बैच वाइज डिटेल्स का Use करते है। आज के अपने इस Article में मैं आपको ये बताउंगी कि टैली में बैच वाइज डिटेल्स क्या है? Tally Me Batchwise Details Ko Kaise Maintain Kare, Maintain Batch Wise Details Tally…

View On WordPress

#batch wise detail in tally erp 9#batch wise detail in tally prime#batch wise details in tally#batch wise details in tally erp 9#batch wise details in tally prime#how to maintain batch in tally prime#how to maintain batch wise details in tally#how to maintain batch wise stock in tally prime#maintain batch wise details#maintain batch wise details in tally#maintain batch wise details in tally erp#maintain batch wise details in tally erp 9#maintain batch wise details in tally erp 9 in urdu#maintain batch wise details in tally erp9#maintain batch wise details in tally prime#maintain batch wise details in tally prime in hindi#maintain batch wise details in tally prime in urdu#tally prime

0 notes

Text

How to use Tally software for accounting

Why do businesses need accounting software in the first place?

Manual accounting is a long and tedious process, which involves data entry, reconciliation, and reporting manually. This consumes a lot of time and is not so easy to maintain when large quantities of data/transactions are to be recorded. Hence, accounting software comes to the rescue by optimizing this process. Accounting software helps in better storage and maintenance of accounts and transactional information, like assets, liabilities, capital, income, expenses, etc.

Business owners, accountants, managers, etc., use such accounting software to ensure financial accuracy and enhanced record keeping. This minimizes the scope of errors, which helps in creating systematic reports and ensuring collaboration with other teams using the same data in the organization.

Why choose TallyPrime for accounting?

Tally is one of the most popular accounting software available in the market. It caters to millions of users in over 100 countries and constantly innovates its software to meet the ever-changing business requirements. This feature makes Tally’s products one of the most preferred products for people seeking accounting solutions.

TallyPrime is an integrated business management software that helps manage multiple applications like sales, finance, payroll, invoicing, inventories, etc. This way, maintaining data becomes easier for businesses.

Features of TallyPrime

The key features of TallyPrime software are:

Inventory management: Through TallyPrime, inventory management is simplified by identifying groups, categories, batches, location-wise godowns, etc. Further, the inventory status can be viewed over time, like over a week or a month. We can also track the status of dispatch of raw material, details of finished goods, etc.

Report viewing and generation: In TallyPrime, various reports can be generated and viewed like accounting, inventory, financial, and management control. Through these reports, businesses can make decisions like identifying areas where cost control is required.

Receivables and payables management: Through TallyPrime, you can manage account payables and receivables easily. A unique bill reference is automatically generated and attached to the bill while making or receiving the payments, simplifying the bill tracking process.

Automatic Bank Reconciliation: TallyPrime enables automatic bank reconciliation. E-statements are downloaded from the bank, and bank reconciliations take place automatically. Earlier, bank reconciliations used to be a long process that had to be carried out manually, and this was extremely time-consuming for company employees.

GST: Through activating the GST feature in TallyPrime, TallyPrime users can ensure that GST features are available in ledgers, stock items, transactions, etc. You can set GST rates in TallyPrime at various levels like company, group stock, stock item, account ledger group, and ledger levels.

e-Payments: Through TallyPrime, payments like vendor payments, employee salaries, etc., can be made. You can send payment instructions to the bank. Further, you can contact your bank or relationship manager and enable the bulk upload/payment facility for your account.

Go to Feature: TallyPrime’s Go to Feature is a new search bar that makes navigation easy for Tally users.

Data Security: TallyPrime is a secure software with features like multiple user access control and feature-based security levels.

How to use TallyPrime for accounting

TallyPrime can be used for accounting purposes like ledger creation, invoicing, budgets/scenario management, etc. Here are some ways through which you can use TallyPrime:

Accounting features: TallyPrime’s accounting features help businesses simplify finance procedures. Some features include sales invoice creation, and funds flow statement generation. In addition, billing modes, configurations, etc., make TallyPrime easy to use.

Sales Invoice Creation: Every business involves the sale of goods and services. For each sales transaction, the proof is required that the company sold items to the customer. The option to generate sales bills and create invoices is available in TallyPrime.

Funds Flow Statement: The funds flow statement shows the movement of funds over time. The statement shows the sources of the funds and how the funds were utilized for a specific time.

Fund sources include owners and outsiders. Fund application refers to an application in either fixed assets or current assets.

Company Creation: Maintaining business transactions related to your company is a critical task. To record transactions, a company needs to be created in TallyPrime. Details like company name, address, and currency information are entered. Any tax registration details like GST, VAT, Excise, TCS, and TDS are also mentioned.

In TallyPrime, you can either create a single company or multiple companies. Then, based on the details, you can generate financial reports for the company.

Cost Centre Creation: Setting cost centers in TallyPrime helps allocate income and expenses to business units, departments, employees, projects, etc.

Group Creation: Managing the overall business group becomes challenging if a business consists of many departments, subsidiaries, or units located in multiple parts of the world. Creating a group company in TallyPrime enables all transactions to be seen in one single place. In addition, the combined data will help the business know more about the business’s overall performance and make decisions for the future.

Ledger Creation: A ledger refers to the name of an account head, which helps classify all transactions as belonging to a category. E.g., common ledger names are sales, purchase, receipts, and other ledgers.

When one or two ledgers need to be created, the Single Ledger creation option is used. However, if multiple ledgers need to be made, the Multiple Ledgers option needs to be selected.

Creating vouchers in TallyPrime

Transactions are created using journal vouchers in TallyPrime. Accounting vouchers vary depending upon the transaction like sales, purchase, receipts, etc.

Inventory features in TallyPrime

Through TallyPrime, a business can easily keep track of stock, stock movement, balance stock, etc. In TallyPrime, specific units of measurement can be defined for inventory, and you can set tax rates for the items. The ability to view stocks in real-time can help a company know when stock needs to be ordered and satisfy customer demands easily. The quantity of stock, stock rates, and the value of the opening stock balance can also be defined.

You can view data related to stock according to a certain period. (week, month, year, etc.)

TallyPrime-Comparison with Other Software/Mobile Applications offered by Nandini Infosys

Feature

TallyPrime

SAP Business One

Mobile App-Biz Analyst

User experience

High level of user experience and not a complex software

To handle more complex and disciplined processes with a scalable & controlled environment

Helps access Tally ERP 9/Prime data anytime, anywhere on mobile

Target market

Small, medium and large scale enterprises

Small,medium and large scale enterprises

Small, medium, and large scale enterprises

Mobile Application

Add on

Available

Available

Web Access

Web reports Available

Available

No

Cloud hosting

Available

Available

Not required

Main Purpose

Organizing information related to stock and showcasing financial information

Managing multiple aspects of a business, like financial, purchasing, inventory, sales, customer relationships, reporting, and analysis

Biz Analyst is a Tally On Mobile application providing multiple features like check-in/check-out, multiple outstanding reminders, set follow- up, and auto reminder schedule.

Conclusion

Through TallyPrime, you can easily view all accounting records from a single location. If you’re looking for support to implement TallyPrime in your organization, we can help! Nandini Infosys offers services like Tally Implementation, TallyPrime (Gold, Silver, Rental, and Auditors Edition, Tally Server, and TallyPrime Customized Module) to clients and helps them scale their businesses. To know more about how you can grow with Nandini Infosys, click here.

0 notes

Text

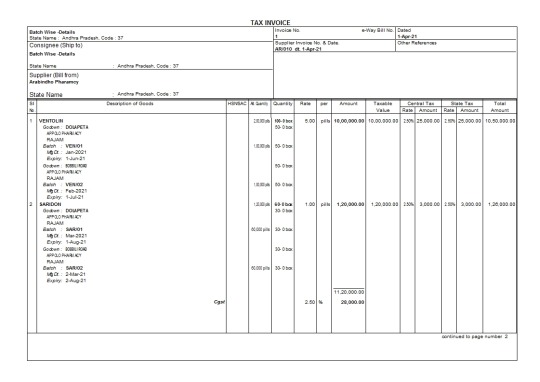

How can we maintain Batch-wise details in Tally Prime?

How can we maintain Batch-wise details in Tally Prime?

Batch-Wise details is a part of advanced inventory management. Bath wise information useful where perishable goods like medicines, sea-food, dairy products (ex: ice -creams, butter milk) fruits, vegetables, flowers and meat , poultry etc. Batch-wise details is used widely in pharmaceutical industries as compared to to other sectors. We can track manufacturing dates and expiry dates for products…

View On WordPress

#batch details#batch wise details#batchwise details in tally#cgst#gst#GST assignment#IGST#INVENTORY#Purchase#sgst#tally#tally prime#TALLY WITH GST#track of expiry date#track of manufacturing date

0 notes

Text

Chapter 1: Fundamentals of AccountingPractice ExercisesChapter 2: Journalising and Posting of Transaction Practice ExercisesChapter 3: Maintaining Chart of Accounts in Tally.ERP 9 3.1 Introduction3.1.1 Getting Started with Tally.ERP 9Practice ExercisesChapter 4: Fundamentals of Inventory ManagementPractice ExerciseChapter 5: Stock Keeping UnitsPractice ExercisesChapter 6: Recording Day to Day TransactionsPractise ExercisesChapter 7: Accounts Receivable and Payable ManagementPractice ExercisesChapter 8: BankingChapter 9: Allocation and Tracking of Expenses and IncomesPractice ExercisesChapter 10: MIS ReportsPractise ExercisesChapter 11 Storage and Classification of InventoryShortcut KeysChapter 12 Management of Purchase and Sales CyclesPractise ExercisesChapter 13 Price Levels and Price ListsPractice ExercisesChapter 14 Manufacturing ProcessPractice ExercisesChapter 15 Goods and Services TaxPractice ExercisesChapter 17 - Securing Financial InformationChapter 18 Data Management and Financial Year End Process

This advanced level certification from Tally is for candidates aspiring for growth in their careers. Candidates passing the online assessment will earn a verifiable digital certificate from Tally.

TallyPRO will help certified candidate take a significant shift in the career and prepares to handle mid-level positions in an organization.

SYLLABUS

Fundamentals of Accounting

Journalising and Posting of Transaction

Maintaining Chart of Accounts in Tally.ERP 9

Fundamentals of Inventory Management

Stock Keeping Units

Recording Day to Day Transactions

Accounts Receivable and Payable Management

Banking

Allocation and Tracking of Expenses and Incomes

MIS Reports

Storage and Classifications of Inventory

Management of Purchase and Sales Cycles

Price Levels and Price Lists

Manufacturing Process

Goods and Services Tax (GST)

Tax Deducted at Source (TDS)

Securing Financial Information

Data Management and Financial Year End Process

1.1 Introduction

1.2 Accounting Terms

1.3 Accounting Assumptions, Concepts and Principles

1.3.1 Assumptions

1.3.2 Concepts

1.3.3 Principles

1.4 Double Entry System of Accounting

1.5 Types of Accounts

1.6 Golden Rules of Accounting

1.7 Source Documents for Accounting

Key Takeaways

2.1 Introduction

2.2 Recording of Business Transactions

2.2.1 The Accounting Equation

2.2.2 Recording of Transactions in Books of Original Entry/Journal

2.2.2.1 Use of Debit and Credit

2.2.2.2 Rules of Debit and Credit

2.2.2.3 Recording of Business Transactions in Journal

2.3 Ledger

2.3.1 Need for Ledger

2.3.2 Differences between a Journal and a Ledger

2.3.3 Classification of Ledger Accounts

2.3.4 Posting from Journal

2.4 Trial Balance

2.4.1 Methods of Preparation

2.5 Subsidiary Books & Control Accounts

2.5.1 Cash Book

2.5.1.1 Single Column Cash Book

2.5.1.2 Double Column Cash Book

2.5.1.3 Three Column Cash Book

2.5.2 Petty Cash Book

2.5.3 Purchase Book

2.5.4 Purchase Return Book

2.5.5 Sales Book

2.5.6 Sales Return Book

2.5.7 Journal Proper

2.5.8 Control Accounts

2.6 Financial Statements

2.6.1 Trading and Profit & Loss Account

2.6.1.1 Trading Account

2.6.1.2 Profit & Loss Account

2.6.2 Balance Sheet

2.6.2.1 Types of Assets and Liabilities included in Balance Sheet

Key Takeaways

3.1.2 Mouse and Keyboard Conventions

3.2 Company Creation

3.2.1 Shut a Company

3.2.2 Select a Company

3.2.3 Alter a Company

3.3 Company Features and Configurations

3.3.1 Company Features: F11

3.3.2 Configuration: F12

3.4 Chart of Accounts

3.4.1 Ledger

3.4.2 Group

3.5 Ledger Creation

3.5.1 Single Ledger Creation

3.5.2 Multi Ledger Creation

3.5.3 Altering and Display of Ledgers

3.5.3.1 Ledger Alteration

3.5.3.2 Single Ledger Display

3.5.3.3 Multi Ledger Display

3.5.4 Deleting Ledgers

3.6 Group Creation

3.6.1 Single Group Creation

3.6.2 Multiple Group Creation

3.6.3 Altering and Display of Groups

3.6.3.1 Group Alteration

3.6.3.2 Single Group Display

3.6.3.3 Multi Group Display

3.6.4 Deleting Groups

Key Takeaways

Shortcut Keys

4.1 Introduction

4.2 Inventory Management

4.3 Terms Used in Inventory Management

4.4 Inventory Valuation

4.4.1 Different Types of Inventory Valuation

4.5 Inventory Management in Tally.ERP 9

Conclusion

5.1 Introduction

5.2 Inventory Masters in Tally ERP 9

5.3 Creating Inventory Masters

5.3.1 Creation of Stock Group

5.3.2 Creation of Unit of Measure

5.3.3 Creation of Stock Item

5.3.4 Creation of Godown

5.3.5 Defining of Stock Opening Balance in Tally ERP 9

Key Takeaways

Shortcut Keys

6.1 Introduction

6.2 Business Transactions

6.2.1 Source Document or Voucher

6.2.2 Recording Transactions in Tally.ERP 9

6.3 Accounting Vouchers

6.3.1 Receipt Voucher

6.3.2 Contra Voucher

6.3.3 Payment Voucher

6.3.4 Purchase Voucher

6.3.5 Sales Voucher

6.3.6 Debit Note Voucher

6.3.7 Credit Note Voucher

6.3.8 Journal Voucher

6.4 Creation of New Voucher Type

6.5 Automation of Invoices (Voucher Classes)

6.6 Non-Accounting Vouchers

6.6.1 Memorandum Voucher

6.6.2 Optional Vouchers

6.6.3 Reversing Journal

6.7 Recording Provisional Entries

6.8 Recording Inventory Vouchers

6.8.1 Receipt Note Voucher

6.8.2 Delivery Note Voucher

6.8.3 Rejection In Voucher

6.8.4 Rejection Out Voucher

6.8.5 Stock Journal Voucher

6.8.6 Physical Verification of Stocks

Conclusion

Key Takeaways

Shortcut Keys

7.1 Introduction

7.2 Accounts Payable and Receivable

7.3 Maintaining Bill-wise Details

7.4 Activation of Maintaining Bill-wise Details Feature

7.5 New Reference

7.6 Against Reference

7.7 Advance Reference

7.8 On Account

7.9 Credit Limit

7.9.1 Activate Credit Limit

7.9.2 Setting Credit Limits

7.9.3 Exceeding Credit Limits

7.9.4 Exception to Credit Limits

7.10 Payment Performance of Debtors

7.11 Changing the Financial Year in Tally.ERP 9

Conclusion

Key Takeaways

Shortcut Keys

8.1 Introduction

8.2 Banking Payments

8.3 Setting up Banking Features

8.4 Cheque Management

8.4.1 Cheque Printing

8.4.1.1 Single Cheque Printing

8.4.1.2 Multi Cheque Printing

8.4.2 Cheque Register

8.4.2.1 Cancelled Cheque

8.4.2.2 Blank Cheque

8.5 Bank Reconciliation

8.5.1 Manual Bank Reconciliation

8.5.2 Auto Bank Reconciliation

8.6 Deposit Slip

8.6.1 Cash Deposit Slip

8.6.2 Cheque Deposit Slip

8.7 Payment Advice

8.8 Managing of Post-dated Cheques

8.9 Notional Bank

8.10 Post-dated Report

8.11 Handling e-Payments in Tally.ERP 9

8.11.1 e-Payments Report

8.11.2 Exporting e-Payment Transactions from e-Payments Report

8.11.3 Sending Payment Instructions to Bank

8.12 Updating the Bank Details Instantly in Tally.ERP 9

Conclusion

Key Takeaways

Shortcut Keys

Practice Exercises

9.1 Introduction

9.2 Cost Centre and Cost Categories

9.2.1 Activation of Cost Category and Cost Centre

9.2.2 Allocation of Expenses and Incomes using Cost Centre

9.2.3 Allocation of Expenses and Incomes using Cost Centre with Cost category

9.2.3.1 Allocation of expenses to multiple cost centres and cost categories

9.3 Automation of Cost Centre and Cost Categories while recording transactions

9.3.1 Cost Centre Classes

9.4 Cost Centre Reports

9.4.1 Category Summary

9.4.2 Cost Centre Break-up

9.4.3 Ledger Break-up

9.4.4 Group Break-up

Conclusion

Key Takeaways

Shortcut Keys

10.1 Introduction

10.2 Advantages of Management Information Systems

10.3 Types of MIS Reports in Tally.ERP 9

10.4 MIS Reports in Tally. ERP 9

10.4.1 Trial Balance

10.4.2 Balance Sheet

10.4.3 Profit and Loss Account

10.4.4 Cash Flow Statement

10.4.5 Funds Flow Statement

10.4.6 Ratio Analysis

10.4.7 Books and Accounting Reports

10.4.7.1 Day Book

10.4.7.2 Receipts and Payments

10.4.7.3 Purchase Register

10.4.7.4 Sales Register

10.4.7.5 Bills Receivable and Bills Payable

10.4.8 Inventory Reports

10.4.8.1 Stock Summary

10.4.8.2 Stock Transfer

10.4.8.3 Movement Analysis

10.4.8.4 Ageing Analysis

Key Takeaways

Shortcut Keys

11.1 Introduction

11.2 Godown Management

11.2.1 Activating Godown

11.2.2 Creating a Godown

11.2.3 Allocation of Stock to Particular Godown while Defining Opening Balance

11.2.4 Recording of Purchase, Sales and Stock Transfers with Godown Details

11.2.4.1 Purchase of Inventory

11.2.4.2 Recording stock transfer entry using stock journal

11.2.4.3 Sale of Inventory

11.2.5 Maintaining Damaged Goods

11.2.6 Analysing Godown Summary and Stock Movement Reports

11.3 Stock Category

11.3.1 Activation of Stock Categories

11.3.2 Creating Stock Categories

11.3.3 Recording of Transactions

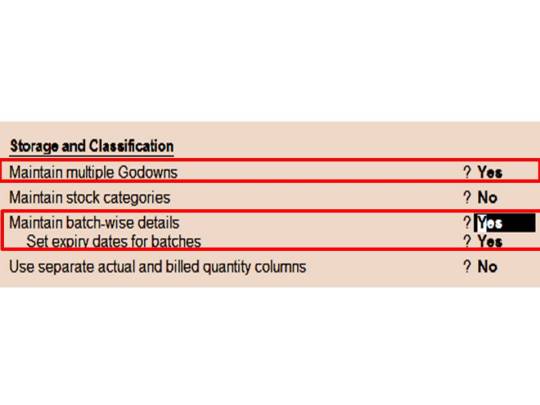

11.4 Movements of Goods in Batches/Lots - Batch wise details

11.4.1 Activating Batch-wise Details in Tally.ERP 9

11.4.2 Using Batch-wise Details in Purchase Invoice

11.4.3 Using Batch-wise Details in Sales Invoice

11.4.4 Expired Batch/Stock Transfer

11.4.5 Batch Reports

11.4.5.1 Batch Vouchers Report

11.4.5.2 Batch Summary Report

11.4.5.3 Transfer Analysis report

11.5 Stock Valuation Methods

11.5.1 Configuration of Stock Valuation Method

11.5.2 Different Types of Costing Methods

11.5.3 Recording of Purchase and Sales Transactions

11.5.4 Stock Valuation based on FIFO Perpetual Method

Conclusion

Key Takeaways

12.1 Introduction

12.2 Purchase Order Processing

12.2.1 Activating Order Processing in Tally.ERP 9

12.3 Sales Order Processing

12.4 Viewing Order Details

12.5 Display Columnar Orders & Stock Details

12.6 Sales order outstanding.

12.7 Pre-closure of Order

12.8 Reorder Level

12.9 Display Reorder Status

Conclusion

Key Takeaways

Shortcut Keys

13.0 Introduction

13.1 Activating Price Lists and Defining of Price Levels

13.1.1 Creation of Price List

13.1.2 Using Price List

13.2 Revise Price List

Conclusion

Key Takeaways

Shortcut Keys

14.1 Introduction

14.2 Activating of Bill of Materials

14.3 Auto Listing of Components Using Bill of Materials

14.4 Accounting of Manufacturing Process in Tally.ERP 9

14.6 Transferring of Manufactured Goods from Storehouse to Showroom

14.5 Reports

14.5.1 Stock Journal Register

14.5.2 Transfer Analysis

14.5.3 Cost Estimation

14.5.4 Stock Ageing Analysis

Conclusion

Key Takeaways

Shortcut Keys

15.1 Introduction to GST

15.2 Getting Started with GST (Goods)

15.3 Advance adjustments and Entries (Goods)

15.4 Getting Started with GST (Services)

15.5 Advance adjustments and Entries (Services)

Conclusion

Key Takeaways

Shortcut Keys

Practice ExerciseChapter 16 Tax Deducted at Source (TDS)

16.1 Introduction

16.2 Basic Concepts of TDS

16.3 TDS Process

16.4 TDS in Tally.ERP 9

16.5 Activation of TDS Feature in Tally.ERP 9

16.6 TDS Statutory Masters

16.7 Configuring TDS at Group Level

16.8 Configuring TDS at Ledger Level

16.9 Booking of Expenses in Purchase Voucher

16.10 Recording Transactions

16.10.1 Expenses Partly Subject to TDS

16.10.2 Booking Expenses and Deducting TDS Later

16.10.3 Accounting Multiple Expenses and Deducting TDS Later

16.10.4 Accounting for TDS on Advance Payments against Transport

16.10.5 TDS on Expenses at Lower Rate

16.10.6 TDS on Expenses at Zero Rate

16.10.7 Deducting TDS on Payments

16.10.8 Reversal of Expenses with TDS

16.10.9 Deducting TDS on Expenses with Inventory

16.10.10 Accounting TDS on Fixed Assets

16.10.11 Payment of TDS

16.11 TDS Reports

16.11.1 Challan Reconciliation

16.11.2 TDS Outstandings

16.11.3 E-Return

Conclusion

Key Takeaways

Shortcut Keys

17.1 Introduction

17.2 Security Control

17.2.1 Activation of Security Control and Creation of Security Levels in Tally.ERP 9

17.2.2 Accessing the Company with Data Operator’s User Account

17.3 Password Policy

17.4 TallyVault Password

17.4.1 Activation of TallyVault in Tally.ERP 9

17.4.2 Configuration of TallyVault Password while Creating the Company

17.4.3 Configuration of TallyVault Password for Existing Company

17.4.4 Benefits of TallyVault Password

Conclusion

Key Takeaways

Practice Exercises

18.1 Introduction

18.2 Backup and Restore

18.2.1 Backup of Data

18.2.2 Restoring Data from a Backup File

18.3 Export and Import of Data

18.3.1 Exporting and Importing of Data from One Company to Another in XML Format

18.3.2 Exporting of data in other available formats

18.4 E-Mailing in Tally.ERP 9

18.5 Printing Reports

18.6 Managing of Data during Financial Year End Process

18.6.1 Important Pre-Split Activity

18.6.2 Splitting of Data

Key Takeaways

Shortcut Key

Practice Exercises

0 notes

Text

Bill Wise Details in Tally in Hindi

Bill Wise Details in Tally in Hindi

टैली में Bill-wise details क्या है, अक्सर जब भी आप Sales या Purchase Voucher में एंट्री पोस्ट करते होंगे तो ये ऑप्शन Method Of Adj जरूर से शो होता होगा, क्या कभी आपने ये सोचा है कि ये ऑप्शन आखिर क्यों आता है, इसका क्या मतलब होता है। तो आज मैं आपको ये ही बताऊगी कि Tally Me Bill Wise Details Kya Hai? Bill Wise Details in Tally ? Bill Wise Details Ka Kya Use hai? Methods Of Adj कितने टाइप्स के होते…

View On WordPress

#batch wise details in tally prime#bill wise detail in tally#bill wise detail in tally prime#bill wise details#bill wise details in tally#bill wise details in tally erp 9#bill wise details in tally prime#bill wise details in tally prime in hindi#bill wise details tally erp 9 in hindi#how to enter bill wise details in tally#how to maintain bill wise details in tally#learn tally prime#maintain bill wise details in tally#maintain bill wise details in tally erp 9#maintain bill wise details in tally prime#new chnages in tally prime#tally#tally prime#tally prime course#tally prime download#Tally prime in Hindi#tally prime new features#tally prime new look#tally prime new update#tally prime tutorial in hindi#tally tutorial in hindi

0 notes

Text

How can we maintain Batch-wise details in Tally ERP9?

How can we maintain Batch-wise details in Tally ERP9?

Batch wise details is a part of inventory management. Batch wise details can be used where perishable goods like medicines, sea-food, dairy products (ex: ice creams, butter, milk), fruits and vegetables, flowers and meat & poultry etc. Batch-Wise Details is used widely in pharmaceutical industries as compare to other sectors. We can maintain Manufacturing dates and Expiry datesfor products with…

View On WordPress

0 notes