#macd indicator how to use

Explore tagged Tumblr posts

Text

🔥#Forex #Metatrader4 TRADE #GBPUSD M15 Sell trade +184 Pips. More Info about Non Repaint Trade system in Website.

Forex TRADE EXAMPLE with Cashpower Indicator NON REPAINT Signals. wWw.ForexCashpowerIndicator.com .

🔥Available Indicator Version and EA Auto-Trade Cashpower with Automatic SL, TP & Powerful Trailing Stop = Secure Profits

.

✅ NON REPAINT

✅ Lifetime License

✅ NON LAGGING Non Delay

✅ Less Signs Greater Profits

🔔 Sound And Popup Nofification

✅ Minimizes unprofitable/false signals

🔥 Manual Trade Version & Auto-Trade Versio

.

* Exclusive * : Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his Lifetime License.

.

🏷* Promotion * : Ultimate Version Promotion price 60% off. Lifetime license no monthly fees. Promotion price end at any time. After this offer Price Back to Original.

.

( This Trade image was created at XM image brokerage. Signals may vary slightly from one broker to another ).

.

🛑 Be Careful Warning: A Fake imitation with MACD code reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that NOT are our LEGITIME old Indicator. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

.

✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options.

.

🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration.

#forexindicators#forexindicator#forexsignals#forex#indicatorforex#cashpowerindicator#forexvolumeindicators#forextradesystem#forexprofits#forexchartindicators#macd indicator how tu use#inducator fibonacci#indicator fibonacci how to use#how trade forex#best forex broker bonus#forex news#forex signals buy and sell

1 note

·

View note

Text

Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from changes in exchange rates. Here’s a detailed guide to get you started:

1. Understanding Forex Trading

Currency Pairs: Forex trading always involves trading one currency for another. Currencies are quoted in pairs (e.g., EUR/USD, GBP/JPY). The first currency is the base currency, and the second is the quote currency.

Pips: The smallest unit of movement in a currency pair’s exchange rate. For most pairs, a pip is 0.0001.

Leverage: Allows you to control a large position with a relatively small amount of money. While leverage can amplify profits, it also increases risk.

2. Setting Up Your Forex Trading

Choose a Reliable Broker: Select a forex broker that offers a user-friendly trading platform, competitive spreads, and good customer service. Look for brokers with a solid reputation and proper regulatory oversight (e.g., regulated by the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC)).

Open a Trading Account: After selecting a broker, open a trading account. Many brokers offer demo accounts where you can practice trading without real money.

Deposit Funds: Fund your trading account with an amount you’re comfortable with. Remember, forex trading can be risky, so only invest money you can afford to lose.

3. Develop a Trading Strategy

Technical Analysis: Uses historical price data and charts to forecast future price movements. Key tools include indicators (like Moving Averages, RSI, MACD) and chart patterns (like head and shoulders, flags).

Fundamental Analysis: Involves analyzing economic indicators, news events, and other factors that might impact currency values. Key indicators include GDP, interest rates, inflation, and employment data.

Risk Management: Set stop-loss and take-profit orders to manage risk and protect your capital. Determine how much you’re willing to risk on each trade.

4. Executing Trades

Place Orders: Use your broker’s trading platform to place trades. You can choose from various order types, such as market orders, limit orders, and stop orders.

Monitor and Adjust: Keep track of your trades and the market conditions. Adjust your strategies and positions as needed based on market movements and your trading plan.

5. Continuous Learning and Improvement

Stay Informed: Follow financial news, economic reports, and market analyses to stay up-to-date with factors affecting currency markets.

Review and Reflect: Regularly review your trades to understand what worked and what didn’t. Learning from past trades helps improve your strategy.

Adapt: Forex markets are dynamic and can change quickly. Be ready to adapt your strategies to new market conditions.

6. Avoiding Common Pitfalls

Overleveraging: Using high leverage can lead to significant losses. Start with lower leverage until you gain more experience.

Emotional Trading: Avoid making decisions based on emotions. Stick to your trading plan and strategy.

Lack of Research: Ensure you conduct thorough research and analysis before making trading decisions.

Resources for Learning Forex Trading

Books: “Trading in the Zone” by Mark Douglas, “Currency Trading for Dummies” by Brian Dolan and Kathleen Brooks.

Online Courses: Platforms like Coursera, Udemy, and Babypips offer courses on forex trading.

Websites: Follow financial news on websites like Bloomberg, CNBC, and Reuters.

business, forex, art, usbiz, usa art, fine art, trading, forex trading

12 notes

·

View notes

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the unofficial start of summer ahead and just 4 trading days left in May, equity markets were mixed with tech strong, large caps flat and small caps lower. Elsewhere looked for Gold ($GLD) to continue to consolidate in the uptrend while Crude Oil ($USO) resumed a short term downtrend. The US Dollar Index ($DXY) might resume the short term move lower while US Treasuries ($TLT) remained in a downtrend. The Shanghai Composite ($ASHR) looked to pause in the short term move higher while Emerging Markets ($EEM) might be confirming a failed break out higher.

The Volatility Index ($VXX) looked to remain very low and stable making the path easier for equity markets to the upside. The charts of the $SPY and $QQQ looked strong, especially on the longer timeframe. On the shorter timeframe the QQQ was also strong with the SPY in consolidation. The $IWM continued to be the outlier, consolidating at a higher range.

The week played out with Gold finding support and holding in a narrow range while Crude Oil consolidated rose early in the week before giving back the gain later. The US Dollar held over support while Treasuries moved higher in the downtrend. The Shanghai Composite held at support while Emerging Markets rocketed to the downside.

Volatility rose up off the recent lows but but only to 14. This put pressure on equities and the large caps and tech names responded with a 4 day move lower. The small caps found support mid week and bounced in consolidation. This resulted in the SPY, IWM and QQQ ending back below their 20 day SMA’s. What does this mean for the coming week? Let’s look at some charts.

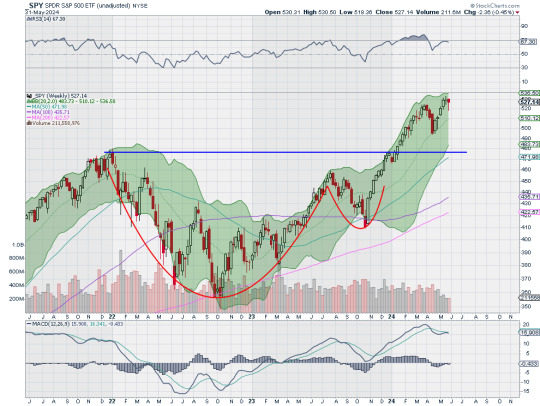

SPY Daily, $SPY

The SPY came into the week consolidating at the all-time high but after a bearish engulfing candle failed to confirm Friday. It held Tuesday and then started to move lower on Wednesday. Thursday it crossed below the 20 day SMA for the first time since May 2nd and dropped again Friday before a strong move higher the last 30 minutes of the day. The RSI is dropping at the midline but in the bullish zone with the MACD crossed down and positive. So far this could just be a momentum reset, with no threat to the uptrend yet.

The weekly chart shows a more damaging pattern as the doji last week is confirmed as a reversal with a move lower this week. This happened as the RSI stalled at a lower high showing a divergence. The price is far from the 20 week SMA and the last pullback found support there. The MACD is crossed down and moving lower but positive. There is support at 520.50 and 517.50 then 513.50 and 510 before 503.50 and 501.50. Resistance higher is at 524.50 and 530. Digestion in Uptrend.

SPY Weekly, $SPY

With the month of May in the books, equity markets showed some signs of weakness following divergences last week. Elsewhere look for Gold to continue its consolidation in the uptrend while Crude Oil consolidates in a narrow range after a pullback. The US Dollar Index continues to drift to in broad consolidation while US Treasuries continue their downtrend. The short term move higher in the Shanghai Composite looks to be at risk of reversing while Emerging Markets enter a short term downtrend.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. The charts of the SPY and QQQ look strong on the longer timeframe, but with a possible momentum reset continuing in the short run. On the shorter timeframe both the QQQ and SPY have reset to their 20 day SMA’s where they often find support. How they react next week could tell if this week was meaningful or not. The IWM continues to be the laggard, stalled near the top of a 2 year range. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview May 31, 2024

Start of Summer Annual Sale! Hi all the Start of Summer Annual Sale is on at Dragonfly Capital. Get an annual subscription for 38.2% off or pay quarterly for 15% off. Both auto-renew at that discounted rate until you decide to leave.

9 notes

·

View notes

Text

Why is it important to learn Forex trading before jumping straight into it?

Forex trading, also known as foreign exchange trading, involves buying and selling currencies in the global financial market. It is the largest and most liquid financial market, with a daily trading volume exceeding $6 trillion. For many, Forex trading offers the promise of financial independence, flexibility, and significant profits. However, without proper knowledge and preparation, it can also lead to substantial financial losses. This article highlights the importance of learning Forex trading the right way before diving into the market.

The Importance of Learning Forex Trading Properly

Forex trading is often perceived as a quick way to make money, but this perception is misleading. The market’s high leverage and volatility can turn small mistakes into significant losses. Understanding the nuances of Forex trading is crucial for avoiding common pitfalls.

Risks of Ignorance

High Leverage: While leverage can amplify profits, it also magnifies losses.

Market Volatility: Currency prices fluctuate rapidly, requiring traders to stay informed.

Emotional Decisions: Lack of knowledge often leads to impulsive and poorly thought-out trades.

Proper education equips traders with the tools to navigate these challenges, manage risks effectively, and make informed decisions.

Key Aspects to Learn

To succeed in Forex trading, aspiring traders must focus on several critical areas:

Market Fundamentals

Understanding the basics is essential. This includes:

Currency pairs and how they work.

The role of central banks, interest rates, and economic indicators in influencing exchange rates.

The importance of liquidity and market hours.

Technical Analysis

Technical analysis involves using charts, patterns, and indicators to predict price movements. Key topics include:

Candlestick patterns.

Moving averages, RSI, MACD, and other indicators.

Support and resistance levels.

Risk Management

Without proper risk management, even a successful strategy can fail. Important practices include:

Setting stop-loss and take-profit levels.

Calculating position sizes based on account size and risk tolerance.

Avoiding over-leveraging.

Trading Psychology

Mastering emotions is often overlooked but crucial. Successful traders maintain:

Discipline to stick to their strategy.

Patience to wait for the right opportunities.

Resilience to handle losses without deviating from their plan.

Ways to Learn Forex Trading

There are numerous resources available to help traders build a solid foundation:

Online Courses

Many platforms offer comprehensive courses tailored to different skill levels. These courses often include video lessons, quizzes, and real-world examples.

Demo Accounts

Most brokers provide demo accounts where traders can practice in a risk-free environment. This is an excellent way to test strategies and understand market dynamics without financial pressure.

Books and Blogs

Some of the most successful traders have shared their insights through books. Blogs and forums also offer valuable tips and real-time updates.

Community and Mentorship

Engaging with other traders through forums or social media can provide new perspectives. Finding a mentor can accelerate the learning process by offering personalized guidance and feedback.

Benefits of Proper Education in Forex Trading

Investing in proper education yields long-term benefits, such as:

Increased Confidence: A well-informed trader is more confident in their decisions.

Reduced Losses: Understanding the market reduces the likelihood of costly mistakes.

Sustainable Growth: Knowledge fosters consistent profits over time.

Conclusion

Forex trading offers immense opportunities, but success requires more than luck or intuition. By prioritizing education and practicing diligently, traders can navigate the complexities of the Forex market with confidence. Take the time to learn, understand the risks, and approach trading with discipline. Remember, the journey to becoming a successful Forex trader begins with a commitment to learning.

Happy trading!

0 notes

Text

Advanced Technical Analysis Techniques at Share Market Gurukul

Share Market Gurukul Courses are renowned for their in-depth focus on advanced trading strategies and techniques. Here’s an overview of how these courses equip participants with the tools to excel in the stock market.

1. Charting Methods

Advanced charting techniques form the foundation of technical analysis.

Candlestick Patterns: Identify market trends and potential reversals.

Trend Channels: Highlight support and resistance levels within price movements.

Fibonacci Retracements: Measure potential reversal levels in an ongoing trend.

2. Key Indicators and Oscillators

Gurukul courses delve into technical indicators that aid in market predictions.

Moving Averages: Detect trend directions and reversals.

MACD (Moving Average Convergence Divergence): Measures momentum and changes in trends.

RSI (Relative Strength Index): Identifies overbought or oversold conditions Share Market Gurukul Courses.

3. Trading Strategies

Participants learn actionable strategies to capitalize on market movements.

Breakout Trading: Identify and act on price movements beyond support or resistance levels.

Swing Trading: Capitalize on short- to medium-term price trends.

Volume Analysis: Use volume data to confirm the strength of market trends.

4. Practical Training

The courses emphasize real-world application:

Simulated Trading: Practice strategies in a risk-free environment.

Live Sessions: Gain insights from market experts through interactive workshops.

Conclusion

Share Market Gurukul Courses offer a comprehensive understanding of advanced technical analysis, making them a valuable resource for traders looking to refine their skills and improve their market performance.

0 notes

Text

Leveraging Candlestick Patterns and Entry Strategies in Forex

Reminder

As the markets have officially resumed, it is expected that trading volume will take a few days to return to normal levels. The market activity will likely pick up during the second or third week of January, coinciding with the inauguration of President Donald Trump. However, unless unexpected events arise or key data releases significantly deviate from expectations, there will likely be a period of cautious trading. General market expectations could change rapidly due to sudden geopolitical events or other unexpected news outside of the usual data cycles. It’s important to remain vigilant and flexible, as the market sentiment could shift quickly depending on how these external factors unfold.

Candlestick patterns are particularly crucial during these periods of market uncertainty. Recognizing and analyzing these patterns can offer traders clearer entry point strategies, helping them navigate fluctuating trends effectively.

Thus, even though the market is resuming, it’s wise to approach with caution in the short term, awaiting the confirmation of trends and the return of stability in trading volume.

Market Overview

The upcoming week is expected to be pivotal for the markets, as several key financial data releases are scheduled to shape market expectations. Starting on Tuesday, the US will report the ISM Services PMI and JOLTS Job Openings data for December, followed by ADP Non-Farm Payrolls (NFP) and Unemployment Claims on Wednesday. Thursday’s release of the FOMC meeting minutes will provide insight into the Federal Reserve's 2025 policy expectations, while Friday brings critical data, including NFP, the Unemployment Rate, and earnings reports.

Alongside the US data, global forex patterns will also focus on key data from Europe and other regions. German Preliminary CPI is set for today, Swiss CPI on Tuesday, and Australian CPI on Wednesday. On Friday, Canadian employment numbers will be released. These reports are expected to trigger significant market movements as they provide a clearer picture of global economic conditions.

The geopolitical landscape, particularly with Trump’s upcoming inauguration on January 20, is expected to further influence market sentiment. The financial world is preparing for major price movements as markets adjust to the potential implications of a Trump administration and the resulting shifts in fiscal policies. As economic data flows in, increased buying pressure in gold is anticipated, potentially coupled with a rise in the US dollar. The Euro and the Pound are likely to see notable weakness, while the Japanese Yen will remain uncertain, with its movement contingent on economic policy decisions from the Bank of Japan.

Integrating auto trade alerts into portfolio allocation strategies can provide an edge for traders, ensuring they remain aligned with evolving market dynamics and capitalizing on opportunities as they arise. For traders looking to enhance their strategies, websites like richsmartfx offer useful resources for signal trading, while axelprivatemarket can help traders understand risk management in volatile times.

Market Analysis

GOLDGold’s price action last Friday showed weakness after failing to break the key level of $2,670.882. While the market is currently showing signs of bearish momentum, there remains a higher likelihood of price moving upward due to the proximity of the previous swing low. However, the Relative Strength Index (RSI) suggests bearish continuation with increased selling pressure indicated by the MACD. Traders can follow updates on dbgmfx for timely gold market insights.

SILVERGiven the current market conditions, it is likely that silver prices will continue to the downside, testing the lower boundary of this range. The MACD is showing increased selling momentum and volume, although the RSI hints at potential buying strength. Despite the divergence in the RSI, the overall price action suggests that silver may continue to face downward pressure. Silver traders can access deeper analysis at gfs-markets.

DXY (US Dollar Index)The US dollar, after a period of sustained growth, its rise has begun to show signs of slowing. The MACD is indicating lighter selling volume, while the RSI shows the market is approaching oversold conditions, suggesting the potential for a continuation in the upward direction. For DXY-focused strategies, traders may find helpful signals at topmaxglobal.

GBPUSDThe British Pound has shown strength recently, with buying momentum continuing from a brief pause in the dollar’s rise. The RSI and MACD both reflect increased volume and momentum in favor of the pound, but overall price action still remains some distance away from signaling a clear shift in momentum. Forex analysts can review strategies on platforms like worldquestfx for further insights.

AUDUSDThe Australian Dollar continues to struggle, even in the face of a weaker dollar. Prices remain largely stagnant between key levels, suggesting a lack of direction.

NZDUSDSimilarly, the New Zealand Dollar faces heightened selling pressure, with price action stuck within a consolidation zone.

EURUSDThe Euro is anticipated to continue its weakness, particularly as the year progresses. Current price action suggests a temporary pullback before the Euro tests the 1.03311 level, where it is expected to continue its downward movement.

USDJPYThe Japanese Yen remains under pressure due to the Bank of Japan's hesitancy to raise interest rates.

USDCHFThe Swiss Franc is currently experiencing increased buying, with price action respecting the bullish momentum.

USDCADThe Canadian Dollar is still consolidating at the 1.44440 level. Traders can follow up on technical patterns and auto trade alerts at richsmart.net to stay updated on potential breakout opportunities.

0 notes

Text

Bitcoin’s Big Leap: Is $100K Just Around the Corner? Bitcoin’s Big Leap: Is $100K Just Around the Corner? It’s been a wild ride for Bitcoin as it clings confidently to the $98K mark, tantalizingly close to that six-figure milestone traders have been dreaming about. Ethereum, the trusty sidekick in the crypto duo, has quietly edged upward to $3.6K. But what does this mean for traders? And more importantly, how can you stay ahead of the curve? Bitcoin: The Marathon, Not a Sprint Bitcoin’s recent price surge feels like watching your favorite underdog athlete gain ground in the last leg of a race. While many are chanting “$100K!”, seasoned traders know the journey is as important as the destination. Price resistance near psychological benchmarks often causes temporary pullbacks, so keep your stop losses tight and your eyes sharp for buying opportunities on the dip. Ethereum: Slow and Steady Wins the Race Unlike Bitcoin’s blockbuster appeal, Ethereum’s steady gains seem more like the tortoise in the proverbial race. With its increasing dominance in decentralized finance (DeFi) and upcoming updates, Ethereum might be laying the groundwork for a much larger breakout. Traders focused on Ethereum should watch for patterns forming around $3.5K to $3.8K, as they may indicate a consolidation before another leg up. Hidden Patterns: What the Charts Aren’t Telling You Here’s where the magic happens. If you’re only following the headlines, you’re already behind. Advanced traders are diving into Fibonacci retracements and MACD crossovers to pinpoint entry and exit points. Pro tip: Watch for divergence in the RSI indicator, which often signals momentum shifts before they appear on the price chart. The Contrarian View: Should You Sell the News? Here’s an unpopular opinion: Not every rally ends in profit. Some experts suggest that Bitcoin’s meteoric rise could be fueled by speculation rather than substance. If the market sentiment feels too euphoric, it might be time to take partial profits. Remember, the first rule of trading is preservation of capital. Actionable Insights for Smart Traders - Scalp Opportunities: If you’re day trading, focus on Bitcoin’s resistance levels at $99K and $100K for potential breakout trades. - Mid-Term Strategy: For Ethereum, keep an eye on $3.7K for signs of trend continuation or reversal. - Long-Term Game Plan: Diversify into altcoins showing strength in the DeFi or NFT sectors—Ethereum may lead, but the rest of the market will follow. - Risk Management: Always use trailing stops, and never invest more than 2% of your capital on a single trade. The Road Ahead The crypto markets are thrilling, unpredictable, and full of potential—but only for those who are prepared. Whether Bitcoin hits $100K this week or next year, the real winners are those who have a plan. So, get your charts ready, stay informed, and remember: Trading is a marathon, not a sprint. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Stock Market Courses

The Best Stock Market Courses in Mumbai – Your Gateway to Financial Freedom

Are you ready to dive into the world of the stock market and explore opportunities for wealth creation? If you're searching for the best stock market courses in Mumbai, then you've come to the right place. Whether you're a beginner or an experienced trader, investing in quality share market training in Mumbai can provide you with the knowledge, skills, and strategies necessary to succeed in the stock market.

At Finowings Training Academy, we offer comprehensive share market courses in Mumbai that are designed to equip you with everything you need to start your journey in trading and investing. Here’s why our stock market classes in Mumbai are regarded as some of the best in the industry.

Why Choose Finowings for Stock Market Classes in Mumbai?

1. Expert Trainers with Real-World Experience

When you enroll in our share market training in Mumbai, you gain access to industry experts who bring years of experience to the table. Our trainers are seasoned professionals with extensive experience in stock trading, market analysis, and investment strategies. With their real-time insights, you’ll learn how to navigate the complexities of the stock market with confidence.

2. Comprehensive Curriculum

Our best stock market classes in Mumbai offer a curriculum that covers all aspects of the stock market. Whether you're looking to learn the basics of stock trading or advanced strategies, we have courses tailored to meet your needs. Topics include:

Introduction to Stock Markets

Technical Analysis & Chart Reading

Fundamental Analysis

Stock Trading Strategies

Options and Futures Trading

Risk Management Techniques

Psychology of Trading

Real-Time Market Scenarios

Our structured approach ensures that you receive both theoretical knowledge and practical exposure to real-world market situations.

3. Hands-On Training

One of the key advantages of our share market training in Mumbai is that we emphasize practical learning. You’ll have the opportunity to practice live trading under the guidance of our experts, allowing you to implement what you’ve learned in real-time.

4. Personalized Attention

At Finowings Training Academy, we believe in the success of every individual. Our classes are designed to ensure that you get personalized attention from the instructors, enabling you to clarify doubts, learn at your own pace, and make the most of the training experience.

5. State-of-the-Art Learning Environment

We believe that an ideal learning environment is crucial to your success. That’s why our training center in Mumbai is equipped with the latest tools, resources, and technology to ensure you receive the best possible learning experience. Our facilities allow you to interact with real-time data, practice trades, and develop a deep understanding of market trends.

Our Share Market Courses in Mumbai: What’s Included

Our best share market classes in Mumbai are designed to cover all the essential concepts you need to become a successful trader or investor. What you will get when you enroll:

1. Stock Market Fundamentals

You’ll start with the basics, learning how the stock market operates, key terminologies, types of investments, and trading platforms. This foundation will prepare you for advanced topics in the future.

2. Technical Analysis & Charting

Learn how to read stock charts, identify trends, and use indicators such as Moving Averages, RSI, MACD, and Bollinger Bands to make informed trading decisions.

3. Fundamental Analysis

Understand how to analyze the financial health of a company using key financial ratios, income statements, balance sheets, and more. This will help you evaluate stocks and make long-term investment decisions.

4. Trading Strategies & Risk Management

Our share market courses in Mumbai cover a wide range of strategies such as day trading, swing trading, position trading, and investing. Learn how to effectively manage risks, reduce losses, and maximize returns.

5. Live Market Exposure

Get hands-on experience by observing live market sessions and trading with real-time data. Our instructors will walk you through the live market analysis, helping you gain a deeper understanding of market movements.

Benefits of Stock Market Classes in Mumbai at Finowings

1. Learn from the Best

Our instructors are not just teachers—they are active market participants who understand the latest trends and techniques. With their guidance, you’ll learn how to spot trading opportunities and manage risks effectively.

2. Flexible Course Options

We offer both online stock market classes in Mumbai and in-person sessions, making it easier for you to learn at your own convenience. You can choose a learning format that suits your schedule.

3. Networking Opportunities

Joining our share market training in Mumbai gives you access to a network of like-minded individuals, helping you connect with fellow traders and investors. This can be a great platform for discussing market trends, sharing insights, and staying updated.

4. Lifetime Access to Learning Material

When you enroll in our best stock market classes in Mumbai, you gain lifetime access to all course materials, video recordings, and market analysis tools. This ensures that you can refresh your knowledge at any time.

5. Proven Track Record of Success

Finowings Training Academy has helped thousands of students achieve their stock market goals. Many of our graduates have gone on to become successful traders and investors. Our focus on practical skills and expert insights gives you the best chance of achieving success.

Why the Stock Market in Mumbai?

Mumbai is the financial capital of India and home to the Bombay Stock Exchange (BSE), making it the perfect city for anyone looking to learn about the stock market. Mumbai offers unmatched access to the world of trading, and by taking our share market courses in Mumbai, you place yourself at the heart of the Indian stock market.

Whether you're an aspiring trader or investor, learning in Mumbai gives you direct access to one of the largest stock exchanges in the world. Moreover, Mumbai is home to a dynamic and growing financial services sector, which presents plenty of opportunities for those who are well-versed in stock trading.

0 notes

Text

Maximizing Trading Potential: Parabolic SAR, MACD, and Moving Averages Strategy

In the realm of trading, employing a combination of technical indicators can significantly enhance your decision-making process and overall profitability. This post explores the synergy between Parabolic SAR (Stop and Reverse), MACD (Moving Average Convergence Divergence), and Moving Averages, offering insights into how traders can leverage these tools effectively for informed trading…

View On WordPress

#Day trading techniques#How to use Parabolic SAR and MACD#MACD trading strategy#Moving Averages trading tips#Parabolic SAR strategy#Profitable trading strategies#Risk management in trading#Technical analysis for traders#Trading indicators explained#Trend following strategies

0 notes

Text

Free Technical Analysis Course for Beginners: Learn Stock Market Basics

Introduction

If you are looking to start trading stocks, learning technical analysis is the key as fundamental analysis gives you a long term vision and technical analysis helps you in identifying the current market action. In other words fundamental action focuses on the reason whereas technical focuses on the reaction of market participants. It allows you to identify market trends and make more informed choices. If you’re a beginner, taking a free technical analysis course can teach you the basics in a simple way and help you build a strong foundation for trading. In this blog, we will guide you through everything you need to know about technical analysis and how you can get started with it, even as a beginner.

What is Stock Market Technical Analysis?

If you remember from your science classes in school days every chart used to have a horizontal and a vertical axis, so do the charts in trading. The difference comes in the parameters; In stock market technical analysis the horizontal axis has time and vertical axis has price. So basically we are studying the movement of prices over time and that’s where technical analysis for beginners will start. Technical analysis is the process of analyzing stocks by looking at their historical price patterns and additionally taking secondary parameters for arriving at a conclusion to implement a certain risk management criteria.

When you enroll in any free technical analysis course, you’ll learn how to read these patterns and make calculated decisions on your trading decisions. As a beginner, this course will make complex concepts simpler and more approachable.

Why opt for a share market Technical Analysis course ?

Here’s why you should consider learning technical analysis:

Spot Market Trends: Learn to identify whether a stock’s price is trending up, down, or sideways.

Reduce Risk: Learn risk management strategies to limit your losses and protect your investment.

Make Smart Trades: Learn how to time your buys and sells based on data and technical indicators, not just guesses.

Confidence in Decision Making: Gain confidence by basing your trading decisions on real data and analysis.

Starting with a free technical analysis course is a great way to learn stock market basics for beginners and get a good grip on how to approach the markets.

What Will You Learn in an Online Technical Analysis Course for Beginners?

Here are the core topics you will cover in an online technical analysis course for beginners:

Candlesticks: Learn how to read candlestick charts. These charts show how a stock’s price moved during a specific time period, which can reveal important market trends.

Reversal Pattern: You’ll discover patterns like Head and Shoulders or Triple Tops/Bottoms that indicate a trend reversal, giving you valuable information on when to buy or sell.

Continuation Patterns: These patterns, like Triangles or Flags, suggest that the stock will continue moving in the same direction. Recognizing them will help you make more accurate predictions.

Indicators: Learn to use technical indicators like Moving Averages or Bollinger Bands to gauge direction of price movements.

Oscillators: Discover how tools like the MACD, RSI and Stochastic Oscillator can help identify if a stock is overbought or oversold, giving you an idea of when the price might reverse for a short time.

Using Technical Analysis for Different Trades: Whether you’re into swing trading, positional trading, or delivery trades, you’ll learn how to apply technical analysis for various types of trades.

These concepts will form the backbone of your trading strategy and help you trade with more confidence and precision.

Why Take a Free Technical Analysis Course for Beginners?

A free technical analysis course is an excellent starting point for beginners because:

Simple and Easy to Follow: It explains everything in layman’s terms, breaking down complex topics into easy-to-understand lessons.

Learn at Your Own Pace: You can take the course at your convenience and go at your own speed, which is perfect for people with busy schedules.

No Cost: You can start learning without having to spend any money, which makes it a risk-free way to gain knowledge and skills.

Hands-On Learning: Some free courses provide demo accounts, allowing you to practice with virtual money and test your strategies without the risk.

By starting with a course aimed at technical analysis for beginners, you can begin to understand how to make smarter trading decisions and gradually move on to more advanced strategies.

How to Choose the Right Technical Analysis Course for Beginners?

Here are a few tips on how to choose the right course for you:

Beginner-Friendly: Make sure the course is designed for beginners and covers the basics thoroughly.

Covers Key Topics: Look for a course that explains everything from chart reading to advanced trading strategies.

Practical Examples: The best courses provide real-life examples of how to use what you’ve learned in actual trading scenarios. This ensures you understand how to apply your knowledge effectively.

Good Reviews: Check course reviews and testimonials from other students to gauge its quality and effectiveness.

Conclusion

Start Your Trading Journey with a Share Market Technical Analysis Course

If you’re ready to start trading, a share market technical analysis course is the perfect way to begin. Whether you’re new to trading or looking to improve, Taking Forward Stock Market Training Institute offers beginner-friendly courses that teach you the basics of technical analysis and stock market trading.

Our free online courses will help you build the skills to make smart trading decisions. Don’t wait—enroll today and start your journey toward becoming a confident trader with Taking Forward Stock Market Training Institute.

Call-to-Action

Begin your journey to becoming a trading expert with Taking Forward Stock Market Training Institute. Start learning the skills to trade confidently. For more information, call us at +91 8225022022 today.

Also Read This Blog:- Top Stock Market Training Classes in Bhopal for Beginners

Learn Option Trading with Stock Market Course Online

Connect with Us on Social Media:

Instagram

Facebook

FAQs

1. How to learn technical analysis?

To learn technical analysis, start with a beginner course at Taking Forward Stock Market Training Institute, practice using demo accounts, and follow market trends to understand how stocks move.

2. What is Technical Analysis in Trading for Beginners?

Technical analysis uses charts and patterns to understand stock price changes. For beginners, it’s a way to make smarter trading decisions based on past market data.

3. Where to learn a technical analysis course?

Learn technical analysis offline or online at Taking Forward Stock Market Training Institute as they provide beginner-friendly courses with practical strategies.

4. How to learn about the stock market for free?

You can learn the stock market for free through beginner courses offered by Taking Forward Stock Market Training Institute. Start your journey by visiting www.takingforward.com or calling +91 8225022022.

#stockmarket#takingforward#freecourses#sharemarket#technicalanalysis#freetechnicalanalysis#stockmarketeducation

0 notes

Text

Finding the Best Stocks to Swing Trade with Expert Trade Ideas

Swing trading is a popular strategy for investors looking to capitalize on short- to medium-term price movements. To successfully engage in swing trading, having access to high-quality trade ideas is essential. These trade ideas can help investors identify the best stocks to swing trade by analyzing trends, market patterns, and price volatility. In this article, we’ll explore how the right trade ideas can unlock opportunities and guide you toward the most profitable best stocks to swing trade.

What Are Trade Ideas?

Trade ideas refer to specific recommendations or suggestions for buying or selling a stock based on in-depth analysis. These ideas are typically rooted in technical analysis, which looks at price charts, patterns, and other indicators to predict potential price movements. Fundamental analysis, focusing on a company's financial health and growth prospects, is also considered.

For swing traders, trade ideas help identify stocks that show promise for short-term price swings. Since swing trading typically involves holding positions for a few days to several weeks, it’s important to find stocks that are poised for significant movement within that time frame.

How to Identify the Best Stocks to Swing Trade

Finding the best stocks to swing trade requires careful research and analysis. Swing traders often look for stocks with high volatility, solid momentum, and market catalysts that could trigger price swings. Some common criteria used to identify the best stocks to swing trade include:

Technical Indicators: Tools like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) help traders spot stocks with the potential for price movements.

Market Trends: Observing the overall direction of the market and specific sectors can guide traders to find stocks that are likely to perform well.

Recent News: Earnings reports, product launches, or changes in leadership can create opportunities for swing trades.

By using these criteria, traders can find stocks that are ready to make a significant move, allowing them to enter positions at the right time for maximum profit.

Why Expert Trade Ideas Matter

While it’s possible to identify potential best stocks to swing trade on your own, having expert trade ideas can significantly improve your chances of success. Professional advisors and seasoned traders use their expertise and access to market data to find stocks that are likely to offer profitable price swings. These experts stay on top of market trends, news, and technical indicators, offering well-researched ideas that can save you time and reduce risk.

Expert trade ideas can also help mitigate the emotional decision-making that often hinders traders. By relying on solid, data-backed suggestions, you are more likely to follow a disciplined approach to trading.

Conclusion

To succeed in swing trading, having access to quality trade ideas is crucial. These ideas help traders identify the best stocks to swing trade, ensuring that their investments have the potential for short-term gains. Whether you’re a new swing trader or an experienced investor looking for fresh ideas, leveraging expert advice and analysis can lead to better trading decisions and more profitable outcomes.

By focusing on well-researched trade ideas and using the right tools to identify the best stocks to swing trade, you can increase your chances of success in the fast-moving world of swing trading.

1 note

·

View note

Text

What to expect from the stock market this week

Last week, the review of the macro market indicators saw with the month of May in the books, equity markets showed some signs of weakness following divergences last week. Elsewhere looked for Gold ($GLD) to continue its consolidation in the uptrend while Crude Oil ($USO) consolidated in a narrow range after a pullback. The US Dollar Index ($DXY) continued to drift to in broad consolidation while US Treasuries ($TLT) continued their downtrend. The short term move higher in the Shanghai Composite ($ASHR) looked to be at risk of reversing while Emerging Markets ($EEM) entered a short term downtrend.

The Volatility Index ($VXX) looked to remain very low and stable making the path easier for equity markets to the upside. The charts of the $SPY and $QQQ looked strong on the longer timeframe, but with a possible momentum reset continuing in the short run. On the shorter timeframe, both the QQQ and SPY had reset to their 20 day SMA’s where they often find support. How they react during the week could tell if last week was meaningful or not. The $IWM continued to be the laggard, stalled near the top of a 2 year range.

The week played out with Gold pushing out of consolidation to the upside before dropping back Friday while Crude Oil dropped out of consolidation early but found support and recovered much of the drop. The US Dollar also dropped early before it found support and rebounded to end higher on the week while Treasuries broke trend resistance to the upside and then fell back to retest it as support. The Shanghai Composite continued to move lower while Emerging Markets held in short term consolidation at last week’s gap move lower.

Volatility inched lower relieving pressure on equities and the large cap and tech names. They responded mid-week with a 2 day move higher to new all-time highs on the S&P 500 and Nasdaq 100. All paused Thursday ahead of the payroll report Friday. Then the SPY and QQQ held just under the new highs while the IWM remained in a narrow range. What does this mean for the coming week? Let’s look at some charts.

SPY Daily, $SPY

The SPY came into the week holding over the rising 20 day SMA on the daily chart after a shallow pullback from an all-time high. It continued to ride the 20 day SMA on Monday and Tuesday and then broke higher Wednesday, ending at a new all-time high. It held there Thursday and probed to the upside Friday before pulling back to finish unchanged on the day. The RSI on the daily chart shows a push back higher leveling which could lead to a momentum divergence should it not continue up next week. The MACD crossed up Friday and is positive though with the Bollinger Bands® squeezing but shifting to point higher.

The weekly chart shows the break of the small consolidation to the upside. The RSI is on the edge of overbought, very strong, suggesting any weakness on the daily chart may be short lived or corrected through time, not price. The MACD is also high and positive and moving sideways. There is resistance at 535 and the target from the Cup and Handle above at 560. Support is now at 530 and 524.50 then 520.50 and 517.50 before 513.50 and 510. Uptrend.

SPY Weekly, $SPY

With the first week of June in the books, equity markets were mixed with the large caps and tech heavy Nasdaq showing renewed strength while small caps continue to flounder. Elsewhere look for Gold to continue to consolidate the long move higher while Crude Oil moves lower in a consolidation range. The US Dollar Index continues in broad consolidation while US Treasuries continue their long term downtrend. The Shanghai Composite looks to continue the short term move lower while Emerging Markets continue the short term move lower in a consolidation channel.

The Volatility Index looks to remain very low and stable making the path easier for equity markets to the upside. The charts of the SPY and QQQ look strong, especially on the longer timeframe. On the shorter timeframe both the QQQ and SPY continue to step higher and look strong as well with an eye on potential momentum divergences. The IWM continues to be dead money, as it has been for the past 2½ years. Use this information as you prepare for the coming week and trad’em well.

Join the Premium Users and you can view the Full Version with 20 detailed charts and analysis: Macro Week in Review/Preview June 7, 2024

Start of Summer Annual Sale! Hi all the Start of Summer Annual Sale is on at Dragonfly Capital. Get an annual subscription for 38.2% off or pay quarterly for 15% off. Both auto-renew at that discounted rate until you decide to leave.

7 notes

·

View notes

Text

How to Predict Bitcoin Price USD with Charts

Predicting the Bitcoin price USD entails examining many elements utilizing charts and technical indicators. Traders can predict future price movements by studying previous price patterns and trends using candlestick charts, moving averages, and other tools such as RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence). Support and resistance levels are very important in predicting price movements. Furthermore, taking into account external factors such as market news, global economic conditions, and investor attitude can assist develop a well-rounded projection for Bitcoin's USD price. Understanding these aspects is essential for navigating the turbulent world of cryptocurrencies.

0 notes

Video

youtube

MIND-BLOWING Stock Market Secrets Revealed!

You know, when it comes to investing in stocks, there are two major schools of thought that people often debate: fundamental analysis and technical analysis. Now, if you’re new to this world, you might be wondering what on earth these terms even mean. Don’t worry, I’ve got your back! Let’s break it down in a way that’s easy to digest, relatable, and maybe even a little fun. First up, let’s talk about fundamental analysis, or FA for short. Think of FA as the detective work of the investing world. It’s all about digging deep into a company’s financial health and the broader economic environment to figure out what a stock is really worth. You’re looking at things like balance sheets, income statements, and cash flow statements. It’s like peeking behind the curtain to see how a company operates. You want to understand the key metrics, like earnings per share, price-to-earnings ratio, and return on equity. These numbers tell you how well the company is performing and whether it’s a solid investment. But it doesn’t stop there! Fundamental analysis also takes into account qualitative factors. You’ve got to consider the business model—how does the company make money? What about the management team? Are they experienced and trustworthy? You also want to look at the industry position and competitive advantage. Is this company a leader in its field, or are they just another fish in a big pond? And let’s not forget about the economic conditions. Things like GDP growth, interest rates, and inflation can have a huge impact on a company’s performance. Now, if you’re a fundamental analyst, you’re typically in it for the long haul. You want to find those undervalued or overvalued stocks based on their “true” value. This approach is great for long-term investors who are looking to build wealth over time. But here’s the catch: it can be time-consuming and requires a solid understanding of financials. Plus, it might miss out on short-term market movements. So, if you’re someone who likes to jump in and out of trades quickly, this might not be your cup of tea. On the flip side, we have technical analysis, or TA. This is where things get a little more exciting! Technical analysis is all about predicting price movements based on historical patterns and market psychology. Instead of looking at a company’s financial health, you’re diving into price charts. You analyze past price movements to identify trends and patterns, using tools like candlestick charts, bar charts, and line charts. It’s like reading the mood of the market! TA employs a bunch of indicators and tools. You’ve got moving averages—simple moving averages and exponential moving averages—that help smooth out price data over time. Then there are momentum indicators like the relative strength index and MACD, which can give you insights into whether a stock is overbought or oversold. And let’s not forget about support and resistance levels, which are key price points where stocks have historically reversed direction.

0 notes

Text

Advanced Technical Analysis Techniques at Share Market Gurukul

Share Market Gurukul Courses are renowned for their in-depth focus on advanced trading strategies and techniques. Here’s an overview of how these courses equip participants with the tools to excel in the stock market.

1. Charting Methods

Advanced charting techniques form the foundation of technical analysis.

Candlestick Patterns: Identify market trends and potential reversals.

Trend Channels: Highlight support and resistance levels within price movements.

Fibonacci Retracements: Measure potential reversal levels in an ongoing trend.

2. Key Indicators and Oscillators

Gurukul courses delve into technical indicators that aid in market predictions.

Moving Averages: Detect trend directions and reversals.

MACD (Moving Average Convergence Divergence): Measures momentum and changes in trends.

RSI (Relative Strength Index): Identifies overbought or oversold conditions.

3. Trading Strategies

Participants learn actionable strategies to capitalize on market movements.

Breakout Trading: Identify and act on price movements beyond support or resistance levels.

Swing Trading: Capitalize on short- to medium-term price trends.

Volume Analysis: Use volume data to confirm the strength of market trends.

4. Practical Training

The courses emphasize real-world application:

Simulated Trading: Practice strategies in a risk-free environment.

Live Sessions: Gain insights from market experts through interactive workshops.

Conclusion

Share Market Gurukul Courses offer a comprehensive understanding of advanced technical analysis, making them a valuable resource for traders looking to refine their skills and improve their market performance.

0 notes

Text

What is Bollinger Band Squeeze?

The Bollinger Band Squeeze is a trading strategy used to identify periods of low market volatility and potential breakout opportunities. Bollinger Bands consist of three lines: a moving average (middle band) and two standard deviation bands (upper and lower).

How It Works:

During a squeeze, the upper and lower bands contract, indicating reduced volatility.

This often precedes a significant price movement, but the direction (up or down) is not predetermined.

Key Points to Consider:

A breakout above the upper band signals a potential bullish trend.

A breakout below the lower band signals a potential bearish trend.

Combine the squeeze with other indicators like RSI or MACD for confirmation.

To stay updated with effective trading strategies and gain access to accurate signals, visit Forex Bank Liquidity or join their community at t.me/forexbankliquidity.

🌐 Visit Our Website: www.forexbankliquidity.com 📲 Join Our Telegram Community: t.me/forexbankliquidity

Don’t miss your chance to trade smart and earn BIG! Let’s conquer the forex market together. 🚀

🔔 Tap the link now and transform your trading journey! Have a profitable day ahead! 💰

#forex #education #forexsignals #forex #robot #forex #expert #advisor #forexbankliquidity #bankliquidity #forexmarket #forex #digitalmarketing #forextrading

0 notes