#london tax advisor

Explore tagged Tumblr posts

Text

Visit to know more.

0 notes

Text

Personal tax accountant

The Tax Guys is one of the leading chartered accountant firms near you that help businesses overcome tax issues, financial mess & cash flow crises. Contact now!

The Tax Guys is an award-winning chartered accountant firm that helps businesses stay tax efficient, profitable, & scalable.

Visit to know more:- https://www.thetaxguys.co.uk/

0 notes

Text

The Tax Guys: Award-Winning London Tax Advisors

The Tax Guys is an award-winning chartered accountant firm that helps businesses stay tax efficient, profitable, & scalable. Call now!

The Tax Guys is one of the leading chartered accountant firms near you that help businesses overcome tax issues, financial mess & cash flow crises. Contact now!

0 notes

Text

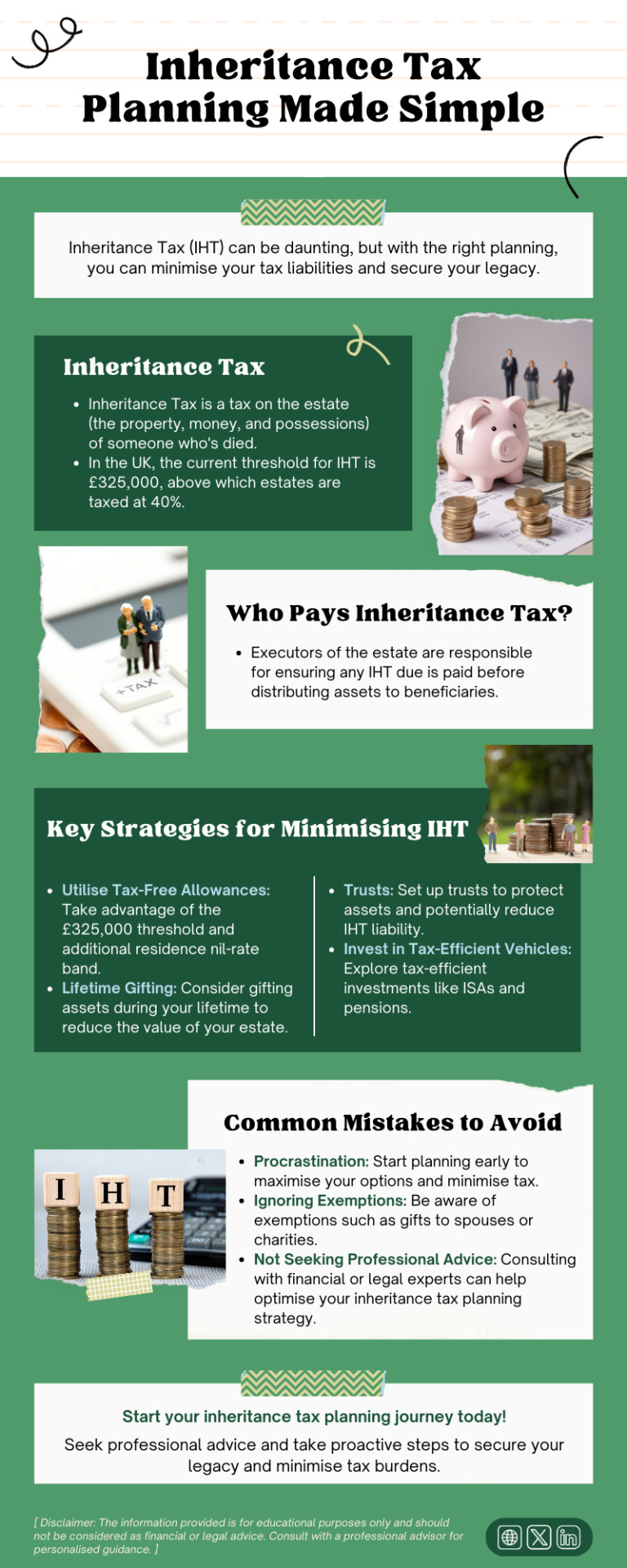

Inheritance Tax (IHT) can be daunting, but with the right planning, you can minimise your tax liabilities and secure your legacy. This infographic provides a simple and straightforward guide to inheritance tax planning.

#Inheritance tax planning#Inheritance tax advice#Inheritance tax advisor#Inheritance tax specialist#inheritance tax advice london#Inheritancetaxplanning

2 notes

·

View notes

Text

Understanding Income Tax Thresholds in the UK

In the UK, tax is a fact of life. Whether you’re a full-time employee or run your own business, understanding how income tax thresholds work can make a big difference in how much you pay and how much you save.

But how do you know if you’re paying too much?

And more importantly, how can you make sure you’re using the available tax bands to your advantage?

In this guide, we’re going to explore the ins and outs of UK income tax thresholds, explain key terms, and give you practical tips to ensure you’re getting the most out of your tax situation. So, let's get to it!

30-Second Summary:

Understanding the UK’s income tax thresholds is crucial for both individuals and businesses. In this article, we’ll break down the income tax structure, explain key concepts like the personal allowance, higher rate taxes, and discuss how tax advice from experts, including accountants, tax advice London, and audit firms in London, can help you stay on top of your tax obligations.

We’ll also take a closer look at CASS audits and how they can ensure financial transparency.

Whether you're managing personal taxes or business finances, this guide will provide actionable tips to help you make the most of your tax situation.

Tax Thresholds and How They Affect You

Let’s start with the most fundamental concept – the Personal Allowance. This is the amount of income you can earn each year without having to pay tax. For most people, the personal allowance is £12,570 (2023/24), which means you can earn up to this amount tax-free. This allowance applies to your income from employment, pensions, savings, and self-employment.

I remember when I first started working and had no idea about the personal allowance. As a young professional in London, I was thrilled when I discovered that the first £12,570 of my income wouldn’t be taxed. It was one of those “aha” moments that made me realize just how crucial understanding tax thresholds is to managing your money.

Now, the personal allowance isn’t available to everyone. If your income exceeds £100,000 in a year, your personal allowance begins to shrink. For every £2 you earn over £100,000, your personal allowance is reduced by £1. This means that if your income reaches £125,140 or more, you won’t get any personal allowance at all.

Higher Rate and Additional Rate Taxes

Once your income exceeds the personal allowance, it’s subject to different rates of tax, depending on how much you earn. These are called the income tax bands.

Basic Rate (20%): This applies to income between £12,570 and £50,270. So, if you earn between these figures, you’ll pay 20% tax on that income.

Higher Rate (40%): This is for income between £50,270 and £150,000. Anything you earn in this range is taxed at 40%.

Additional Rate (45%): This is the highest rate and applies to income over £150,000.

If you’re lucky enough to earn above £100,000, these higher rates start kicking in, which can quickly add up. The key takeaway here is that understanding these tax brackets helps you figure out where your income fits and plan your finances accordingly.

What is the UK Income Tax Bracket Structure?

The UK uses a progressive income tax system. This means that the more you earn, the higher the percentage of tax you pay on your income. Here’s a quick breakdown of how it works for 2023/24:

Up to £12,570: No tax.

£12,571 to £50,270: 20% tax.

£50,271 to £150,000: 40% tax.

£150,001 and above: 45% tax.

This system is designed to be fairer – the more you earn, the more tax you pay. The trick, however, is ensuring that you’re paying only what you owe and no more.

The Importance of Tax Bands

Tax bands are crucial because they help you understand how much of your income is taxed at each rate. It’s a sliding scale: only the portion of your income that falls into a higher tax bracket is taxed at the higher rate. For example, if you earn £55,000 a year, only the £4,730 above the £50,270 threshold will be taxed at 40%, not the entire income.

This sliding scale is why it’s so important to get the right tax advice from professionals like a tax advisor in London, who can help you manage your income and expenses to ensure you’re not overpaying.

Tax Advice for Individuals: What You Need to Know

One of the most important things I learned early on was that not all of your income is taxable. Your taxable income is what remains after you’ve deducted any allowances, reliefs, and other eligible tax reductions.

For instance, if you’re self-employed, you can deduct business expenses from your income. These might include things like office supplies, travel costs, and even a portion of your home utility bills if you work from home.

It’s crucial to be aware of what counts as taxable income so that you can reduce your tax burden legally. I’ve personally found it helpful to work with a tax advisor in London who can provide clear guidance on how to calculate taxable income and ensure that all applicable deductions are made.

Common Tax Deductions and Reliefs

There are various tax reliefs that could help reduce the amount of tax you need to pay. These include:

Marriage Allowance: If you’re married or in a civil partnership and one of you earns below the personal allowance threshold, you can transfer a portion of the unused allowance to your partner.

Blind Person’s Allowance: This provides extra allowance if you're registered as blind.

Charitable Donations: If you donate to charity, you can claim tax relief on those donations under the Gift Aid scheme.

These deductions can make a significant difference in your overall tax bill. Working with a professional tax advisor can help you identify all available deductions and ensure you're taking full advantage of them.

How a Tax Advisor in London Can Help

Living in London, with its bustling financial environment, often means that individuals face unique tax challenges. Whether you’re a UK resident or an expat living in London, understanding your tax rights and responsibilities is key.

I once met a client who had just moved to London from abroad. They weren’t sure how UK tax laws applied to them, especially with respect to income earned from abroad. A knowledgeable tax advisor London helped them understand their tax obligations, as well as the reliefs available for expats.

A tax advisor will assess your specific situation and offer advice tailored to your needs. They’ll help you navigate tax bands, ensure you meet deadlines, and help you make strategic decisions to minimize your tax bill.

Managing Your Tax Obligations Efficiently

Tax advisors are also crucial when it comes to managing your tax payments efficiently. They can help you:

Submit your self-assessment tax returns.

Ensure that you’re paying the right amount of tax.

Advise you on how to reduce future tax liabilities.

For example, a tax advisor may recommend adjusting your salary sacrifice schemes or pension contributions to reduce your taxable income.

Tax Advice for Businesses: Navigating the Complexity

Running a business in London means dealing with more complex tax issues. As a small business owner, you might face additional tax obligations beyond income tax, such as:

Corporation Tax: This applies to company profits.

VAT: If your turnover exceeds the VAT threshold (£85,000), you must register for VAT and submit regular returns.

National Insurance Contributions (NICs): These are payments that businesses must make towards employees’ benefits.

I’ve worked with many small business owners who didn’t fully understand these additional taxes. They were surprised when their business’s tax liability was higher than expected. With the right accountant London, you can get advice on managing these taxes and avoid any unpleasant surprises.

How an Accountant in London Can Streamline Business Taxes

An accountant specializing in business tax can be a lifesaver. They help you:

Set up proper accounting systems.

File accurate returns to avoid penalties.

Identify opportunities for tax savings, such as claiming capital allowances on business investments.

Working with an accountant can take a huge load off your shoulders and ensure your business stays compliant with tax laws.

London’s Audit Firms: Ensuring Tax Compliance

London audit firms play a vital role in ensuring that businesses comply with tax laws. They conduct audits to verify financial records, ensuring that all income and expenses are accurately reported. This helps businesses avoid potential tax issues that might arise from discrepancies or errors.

An audit is especially important if your business is at risk of being audited by HMRC. For instance, one of my clients, a medium-sized retail business, was flagged for a random audit by HMRC. The audit firm they worked with helped ensure everything was in order, avoiding fines and penalties.

If your business is growing, it’s worth considering an audit firm. They not only help with tax compliance but also improve financial transparency, which is crucial if you plan to seek investment or secure loans.

Understanding CASS Audit: A Crucial Element for Financial Clarity

The CASS (Client Assets Sourcebook) audit is an important part of financial management, especially for businesses handling client funds, like investment firms or financial advisers. This audit ensures that businesses follow proper procedures to protect client assets and meet regulatory requirements.

I’ve worked with several clients in the finance sector, and many found that CASS audits gave them peace of mind, knowing their financial practices met the required standards.

A CASS audit not only protects clients but also safeguards the business from legal or regulatory issues. By ensuring that client assets are correctly accounted for, businesses can avoid penalties and ensure transparency in their financial dealings.

How to Avoid Common Tax Pitfalls in the UK

Even seasoned professionals can make tax mistakes. Here are a few common pitfalls to avoid:

Failing to Keep Proper Records: Whether you're an individual or a business, keeping accurate records is essential to avoid issues down the line.

Not Claiming Deductions: Many people don’t take full advantage of available tax deductions, like those for charitable donations or business expenses.

Missing Deadlines: Always be aware of tax deadlines to avoid fines.

Tips to Stay on Top of Your Taxes

Stay organized and keep all receipts and documents.

Use accounting software to track your income and expenses.

Consult a tax professional regularly to review your financial situation.

Conclusion

Understanding income tax thresholds is vital for managing your finances effectively. Whether you’re an individual looking to maximize your personal allowance or a business owner dealing with complex tax issues, getting the right advice is key.

The right accountant, tax advisor, or audit firm in London can help you navigate the tax system and ensure that you're paying only what's necessary. Remember, taking proactive steps now can save you a lot of money in the future.

0 notes

Text

Discover essential advice on inheritance tax to help you understand your obligations and options. This resource covers key strategies for minimising tax liabilities, understanding exemptions, and planning your estate effectively. Equip yourself with the knowledge to protect your assets and ensure a smooth transfer to your beneficiaries.

#Inheritance tax planning#Inheritance tax advice#Inheritance tax advisor#Inheritance tax planning advice#Inheritance tax specialist#inheritance tax advice london

1 note

·

View note

Text

Accounting Solutions for Travel Companies in London: Financial Efficiency

In the dynamic world of travel and hospitality, effective financial management is crucial for success. Travel companies face unique challenges in their accounting practices, requiring specialized expertise to navigate. This is where MMBA hospitality accountants step in, offering tailored accounting solutions designed to meet the specific needs of the industry. In this comprehensive guide, we'll explore the importance of accounting for hospitality, the role of hospitality accountants, and how travel companies can benefit from their expertise.

#accounting solutions#accounting for travel industry#travel industry accounting#atol reporting accountants#financial tax advisor#tax auditor london#preston accountant#hospitality accounting#mmba accounting

0 notes

Text

#tax advisory#taxes#finance#tax returns#accounting#tax claims#tax relief#tac accountant#uk#london#financial advisor

0 notes

Text

What Are Ways to Find a Reputable Financial Advisor?

The role of a financial advisor is to inform clients of the best way to save, invest and make the most of their money. These professionals also help with financial obligations and various other financial issues. Every business organisation needs a financial advisor in Bank and other places to guide them properly. And if you are one of these business owners looking for a trustworthy company, here are three tips you should follow.

CHECK THEIR STATURE IN THE MARKET

By selecting a few names. You should check their market size and their accounting qualifications. You should also check if they have applied with (BAS – a member of the Tax Practitioners Council). Also, check their knowledge and practical experience as a financial advisor. It's best to choose a company with at least 10 to 15 years of experience. Another thing to check is to take a look at their testimonials section. Listening directly to previous customers will determine their professionalism and service quality.

OVERSEES A WIDE RANGE OF THEIR ACCOUNTING SERVICES

A top-quality professional accountant/financial advisor in Greenwich and other locations is expected to carry out a variety of responsibilities for their clients.

The overview: Accounting services, Payroll services, Maintaining annual accounts for all customers, Providing business solutions by working closely with financial institutions, Managing London VAT reporting for all their clients and Self-assessment and all tax matters

Check with your financial advisor of choice to see if they offer such a service or not.

REQUEST A QUOTE AND COMPARE

Another aspect you should check out is their accounting and financial advisory services. Quality services will follow industry standard rates and never charge you more than necessary. To determine whether the advisor you choose charges honest fees, ask for their quote and compare with other service providers. This will reveal the rates accepted in the market and clarify whether a financial advisor in Bond Street and other regions is worth investing in.

Use these crucial tips when searching for a trustworthy financial advisory organisation for your business. This will help you get the most out of your money while saving a lot of time in the process!

#Financial Advisor Bank#Financial Advisor Greenwich#Financial Advisor Bond Street#Financial Advisor London#Professional Accountant#Tax Consultant

0 notes

Text

Tax Accountants in London - The Tax Guys

The Tax Guys boasts a team of certified accountants that helps a wide range of businesses from different industries, including construction, real estate, consulting and coaching, retail and ecommerce, technology, etc. in running a tax-efficient and less stressful business. Talk to a certified chartered accountant. Book your FREE trial today!

0 notes

Text

Visit to know more.

#tax break#tax adviser#chartered accountant firm#london tax advisor#tax return accountant#tax specialist

1 note

·

View note

Text

Insurance and Risk Management for Construction Businesses: A Financial Perspective

Introduction

Construction businesses play a vital role in the growth of economies around the world. However, these companies are often exposed to various risks and uncertainties, both in the short and long term. Managing these risks is crucial for their financial stability and growth. In this blog, we will explore the importance of insurance and risk management from a financial perspective, shedding light on the latest statistics related to this topic. Additionally, we will discuss how pension services, wealth management advisors, tax accountants in London, and business accounting services can play a crucial role in ensuring the financial well-being of construction businesses.

1. Understanding the Risks in Construction

Before delving into the financial aspects of insurance and risk management, it's essential to understand the risks inherent in the construction industry. Construction businesses face a wide range of potential risks, including:

a. Health and Safety Risks: Construction sites are inherently dangerous places. Accidents can lead to injuries, lawsuits, and increased insurance premiums.

b. Environmental Risks: Construction activities can have an impact on the environment, leading to potential liabilities.

c. Project Delays: Delays in construction projects can result in financial losses, penalties, and damaged client relationships.

d. Economic and Market Risks: Fluctuations in the economy and the construction market can affect project demand and profitability.

e. Legal Risks: Construction companies must navigate complex legal and contractual issues, which can result in litigation and financial liabilities.

Latest Stats: According to a report by the Construction Industry Institute (CII), construction projects encounter an average cost overrun of 18.7%, emphasizing the importance of risk management in the industry.

2. The Role of Insurance in Construction

Insurance is a critical tool for mitigating risks in the construction industry. While it involves a financial cost, the protection it provides is invaluable. Construction companies typically need various types of insurance, including:

a. General Liability Insurance: Protects against claims for property damage and bodily injury.

b. Workers' Compensation Insurance: Covers medical costs and lost wages for injured employees.

c. Builder's Risk Insurance: Provides coverage for property under construction, including materials and equipment.

d. Professional Liability Insurance: Protects against claims of errors or negligence in design or consulting services.

Latest Stats: A study by the National Association of Insurance Commissioners (NAIC) indicates that the construction industry spends over $50 billion annually on insurance premiums in the United States alone.

3. Risk Management Strategies

Risk management goes beyond insurance and involves identifying, assessing, and mitigating risks proactively. Construction businesses can implement several strategies to manage risks effectively, such as:

a. Project Risk Assessments: Conduct thorough assessments before starting a project to identify potential risks and develop mitigation plans.

b. Contract Review: Ensure contracts are well-drafted and protect the company's interests, including indemnification clauses.

c. Safety Protocols: Implement stringent safety procedures and provide ongoing training to minimize accidents.

d. Technology Adoption: Utilize construction management software to monitor projects, costs, and timelines effectively.

e. Financial Planning: Maintain a robust financial reserve to cover unexpected expenses and mitigate the impact of project delays.

Latest Stats: According to a survey conducted by Dodge Data & Analytics, construction companies that prioritize risk management have a 64% higher chance of completing projects on time and on budget.

4. The Role of Financial Advisors in Risk Management

Financial advisors, including wealth management advisors and tax accountants in London, can play a crucial role in risk management for construction businesses. Here's how they contribute:

a. Wealth Management Advisors: These professionals assist construction business owners in building and preserving wealth. They help in creating investment portfolios, retirement plans, and financial strategies that can safeguard the owner's personal wealth in case of business setbacks.

b. Tax Accountants in London: Expert tax accountants can optimize the company's tax structure, reducing the financial burden and ensuring compliance with tax laws.

Latest Stats: According to a survey conducted by the Chartered Institute for Securities & Investment (CISI), 68% of construction business owners believe that wealth management advisors have played a significant role in their financial success.

5. Business Accounting Services for Construction

Business accounting services are essential for construction companies looking to maintain financial stability and transparency. These services include:

a. Financial Statement Preparation: Accurate financial statements are crucial for understanding the company's financial health.

b. Tax Planning and Compliance: Ensure that the business complies with tax laws and leverages available tax incentives.

c. Budgeting and Forecasting: Develop budgets and financial forecasts to make informed decisions.

d. Cost Control: Identify and manage costs efficiently to maintain profitability.

Latest Stats: A report by the Association of Chartered Certified Accountants (ACCA) shows that 78% of construction companies that use business accounting services report better financial management and more strategic decision-making.

Conclusion Insurance and risk management are integral to the financial well-being of construction businesses. The latest statistics highlight the significance of these aspects in the industry. Additionally, the involvement of pension service, wealth management advisors, tax accountants in London, and business accounting services can further enhance a construction company's ability to manage risk and maintain financial stability. By combining these elements, construction businesses can thrive in a challenging and dynamic environment, ensuring long-term success.

1 note

·

View note

Text

How MMBA Accountants Support Businesses in Cambridge

As a business in Cambridge, you know how challenging it can be to face the complexities of running a successful company in this vibrant city.

From managing your finances to staying compliant with tax regulations, the demands of business ownership can sometimes feel overwhelming.

That's where MMBA Cambridge Accountants come in. With our comprehensive range of services and commitment to client success, we are here to support you every step of the way.

Why Us?

Understanding Your Business Needs

Comprehensive Accounting Solutions

Strategic Business Advisory

Tax Planning and Compliance

Technology and Innovation

MMBA Accountants is your go-to partner for all your accounting and financial needs in Cambridge.

With our comprehensive range of services, experienced team, and commitment to client success, we are confident that we can help you achieve your business goals.

Contact us today to learn more about how we can support your business!

#tax consultant london#crypto tax accountant#cryptocurrency accountant uk#tax return services london#tax assist london#crypto tax advisors#uk crypto tax advisor#tax consultant east london#crypto accountant uk#crypto tax accountant uk

0 notes

Text

City Tax London

City Tax London provides unparalleled personalised accounting services and the best, up to date, advice for tax planning to a broad range of clients across London and the UK. As your certified chartered accountants, we are here to ensure that all of your financial decisions are made carefully and with your best interests in mind.

Contact Us Western Road, Southall UB2 5HQ, UK Website:https://citytaxlondon.co.uk/ Phone:020 8574 1997 Email:[email protected]

0 notes