#loancalculation

Explore tagged Tumblr posts

Text

Special First Home Buyers Loans with great rates and easy approvals. Start your homeownership journey today!

#BusinessLoans#loanoptions#loanexpert#LoanAdvisors#homeloanadvice#loanagent#loanconsultant#loancalculation#commercialloan#HomeLoanBrokers#ExpertAdvice#refinanceconsultant

0 notes

Text

Special First Home Buyers Loans with great rates and easy approvals. Start your homeownership journey today!

#BusinessLoans#loanoptions#loanexpert#LoanAdvisors#homeloanadvice#loanagent#loanconsultant#loancalculation#commercialloan#HomeLoanBrokers#ExpertAdvice#refinanceconsultant

0 notes

Text

The Benefits of Using Loan Calculators in Real Estate

Loan calculators are invaluable tools for anyone involved in the real estate market. Whether you are a prospective homebuyer, a real estate investor, or a homeowner looking to refinance, loan calculators can provide you with essential information to make informed financial decisions. These online tools allow you to assess mortgage payments, interest rates, loan terms, and more. In this blog post, we will explore the benefits of using loan calculators in real estate and how they can help you maximize your financial outcomes.

One of the primary benefits of using loan calculators is the ability to determine affordability. By inputting specific financial data, such as your income, expenses, and desired loan amount, a loan calculator can calculate how much you can afford to borrow. This information is crucial in helping you set a realistic budget and avoid overextending yourself financially.

Additionally, loan calculators provide insights into the impact of interest rates on your monthly payments. By adjusting the interest rate input, you can see how different rates affect your loan payments. This allows you to compare various scenarios and choose the most favorable interest rate for your financial situation.

Loan calculators also help you understand the impact of loan terms on your overall cost. By adjusting the loan term input, you can see how longer or shorter loan terms affect your monthly payments and total interest paid. This knowledge empowers you to choose a loan term that aligns with your financial goals and minimizes the cost of borrowing.

Another benefit of using loan calculators is the ability to compare different loan options. If you are considering multiple lenders or loan products, a loan calculator can help you evaluate each option's affordability and suitability. By inputting the terms and conditions of each loan, you can compare the monthly payments, total interest paid, and other relevant factors. This allows you to make an informed decision and choose the loan that best meets your needs.

Furthermore, loan calculators are useful for refinancing decisions. If you are considering refinancing your mortgage, a loan calculator can help you determine if it's financially beneficial. By inputting your current loan details and comparing them to potential refinancing options, you can assess the savings in terms of lower interest rates or shorter loan terms. This helps you decide if refinancing is a viable option for you.

In conclusion, loan calculators are powerful tools that provide numerous benefits in the real estate industry. They assist with affordability assessments, comparing loan options, understanding the impact of interest rates and loan terms, and making informed refinancing decisions. By utilizing loan calculators, you can optimize your financial outcomes and ensure that you make sound decisions that align with your goals. So, take advantage of these online tools and empower yourself in your real estate journey.

2 notes

·

View notes

Text

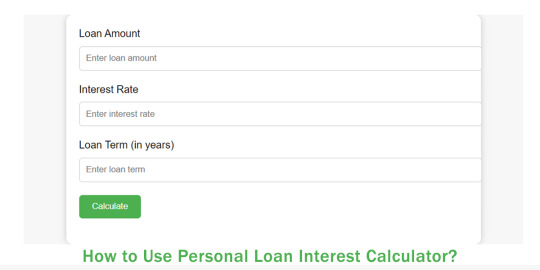

Simplify Your Finances with Our Loan Calculator!

Tired of complicated loan calculations? Our Loan Calculator makes it easy to figure out your monthly payments and total interest. Simply enter your loan amount, interest rate, and term to get instant results. Take control of your finances and plan with confidence.

0 notes

Text

Student Loan Calculator

By providing your current student loan details, you can calculate your monthly payments and visualize your loan's amortization over its term.

#StudentLoans#LoanCalculator#StudentDebt#FinancialAid#LoanPayments#Budgeting#CollegeFinances#StudentSuccess#MoneyManagement#DebtFree#EducationFunding#PayOffDebt#LoanInterest#LoanRepayment#BudgetTips#LoanAssistance#StudentResources#FinancialLiteracy#DebtRelief#LoanConsolidation#Scholarships#CollegeCosts#StudentSupport#LoanForgiveness#TuitionAssistance#FinancialPlanning

0 notes

Text

Wisconsin Real Estate TOOLS UPDATE

Wisconsin Real Estate TOOLS UPDATE - https://thelandman.net/wisconsin-real-estate-tools.html

ADDED - USDebtClock.org - Lots of World, US National & State Economical Information including Homes Sales, Loan Calculator and much more…

realestatetools #usdebtclock #homesales #LoanCalculator #EconomicalInformation

1 note

·

View note

Text

Attention everyone: Kredit-Markt.eu is now also available in English!

0 notes

Text

📊 Ready to Crunch Some Numbers? Learn How to Calculate Loan EMI with the EMI Calculator! 💰

Are you planning to take out a loan but worried about those monthly installments? 🤔 Fret not! We've got your back. 🙌

🔢 Understanding Loan EMI Made Easy: Let's break it down step by step!

Step 1️⃣: Visit EMI Calculator Tool 📈 👉 Tap the "EMI calculator" to access the magic tool.

Step 2️⃣: Input Loan Details 📝 👉 Enter the loan amount, interest rate, and tenure.

Step 3️⃣: Hit Calculate! 🎯 👉 Watch the EMI calculator work its magic and voilà - you'll have your monthly installment amount right before your eyes!

💡 Pro Tip: Our EMI calculator can handle different types of loans – be it a home loan, personal loan, or car loan. It's your financial sidekick for any EMI calculation!

Understanding your loan EMI is the first step towards financial freedom. So, why wait? Use our EMI calculator today and take control of your finances! 💪

0 notes

Text

ANZ Personal Loan: The Best Way to Fund Your Dreams!

ANZ Personal Loan is here to help you, when you tired of postponing your dreams and putting them on hold because of financial constraints? Whether it’s a long-awaited vacation, home renovation or simply consolidating debts, ANZ Personal Loan has got you covered. Read the full article

0 notes

Text

Explore the power of financial calculators to estimate mortgage payments, retirement savings, investments, and more. Make well-informed decisions with accurate results using AllCalculator.net's finance calculators.

0 notes

Link

0 notes

Text

🔢 Simple Loan Calculator for Global Users 🌍

Looking to manage your loans effortlessly? Our Simple Loan Calculator is here to help! Designed for users in UK, USA, Canada, Australia, India, France, UAE, and other nations, this tool simplifies your financial planning.

💡 Features:

✅ Multi-currency support (₹, £, $, €, AED).

✅ Calculate monthly payments, total interest, and overall costs.

✅ Suitable for personal loans, car loans, mortgages, and more.

✅ Fully responsive – works seamlessly on mobile, tablet, and desktop.

✅ Easy-to-use and customised for global needs.

💻 How It Works:

1️⃣ Enter loan amount, interest rate, and loan term.

2️⃣ Select your country for currency adjustments.

3️⃣ Get instant calculations of payments and costs.

Start planning your finances with confidence! 🎯

👉 Try it now on our website:

[https://freewebtoolfiesta.blogspot.com/2024/12/simple-loan-calculator-for-uk-usa.html]

💬 We’d love to hear from you – drop your feedback in the comments or email us at [[email protected]].

📌 #LoanCalculator #FinancialTools #MoneyManagement #GlobalFinance #Budgeting #FinancialPlanning

0 notes

Video

youtube

💡 Home loan insights from trusted experts – simplifying your journey towards dream homeownership! 🏡✨ Welcome to Trusted Loans Insurance Experts! We're here to help you learn all about buying a home and getting loans. If you're buying your first house or already have some properties, we make it easy for you to understand money matters. We can show you how to figure out your monthly payments, what interest rates mean, how long to take a loan for, and so much more! Looking to buy a home but not sure how to get started with your mortgage? Don’t worry! At Trusted Loans Insurance Experts, we break down the basics to help you make confident, informed choices during the loan process. Subscribe today to get practical insights, expert tips, and easy-to-understand advice to effectively manage your mortgage! 🏠💸 If you have any questions about getting a loan for a house, just ask us in the comments! We’ll answer you. Also, remember to give us a thumbs up, share this with your friends, and tell us what you want to learn about next. Let’s work together to help you get your dream home! #HomeLoans #MortgageTips #FirstTimeHomeBuyer #LoanCalculator #TrustedFinance #DreamHomeJourney #LoanEMI #PropertyInvestment #FinanceTips #BangaloreRealEstate

0 notes

Text

Your First Home Made Easy! Let our first time home buyer broker guide you step by step to secure the perfect loan for your dream home.

Get in touch with us: +61 040 380 3470 Visit: https://www.loansandmortgages.com.au/home-loan-brokers-sydney/

#homeloan #homeloanadvisor #offer #cashback #homeloanadvice #loanagent #loanconsultant #loancalculation #commercialloan #HomeLoanBrokers #ExpertAdvice #RefinanceConsultant

0 notes

Text

Personal Loan Interest Calculator

Find out How to calculate interest on a loan with our exclusive FREE Personal Loan Interest Calculators! Get accurate results in seconds, start now! #calculator #loancalculator Read the full article

0 notes

Photo

We are specialists in loan claims and getting our customers the compensation they deserve from loans that have been irresponsibly lent. It is a lenders responsibly to ensure that people can afford the loan and not struggle to make the loan payments. If you have found yourself in this situation, this is where we can help. We can help you make a claim and receive a refund against your loan provider, who incorrectly lent to you in the first place. Want to know more? Visit our website to find out how much you could be owed: www.theclaimsguide.com/ #Loans #reclaimloan #lending #payday #paydayloan #loanadvisor #loanconsultant #loancalculation #loanlifestyle #loanoptions #loanpayments #claimrefund #refundloan https://www.instagram.com/p/CR1idwsjfis/?utm_medium=tumblr

#loans#reclaimloan#lending#payday#paydayloan#loanadvisor#loanconsultant#loancalculation#loanlifestyle#loanoptions#loanpayments#claimrefund#refundloan

0 notes