#Onlineloans

Explore tagged Tumblr posts

Text

Unlock financial flexibility with FlexiLoan.in! FlexiLoan.in certainly seems to offer a variety of loan options to cater to different financial needs. The promise of minimal documentation and quick online processing can make it an attractive choice for those seeking efficient loan management.

Here’s a quick overview of the loans available:

🔹Personal Loan: For individual financial needs.

🔹Flexi Loan: Offers flexibility in borrowing and repayment.

🔹Doctor Loan: Tailored for medical professionals.

🔹CA/CS/CWA Loan: Designed for chartered accountants, company secretaries, and cost & work accountants.

🔹Business Loan: To support business growth and expenses.

🔹Overdraft Loan: Provides a credit facility for immediate cash needs.

For anyone interested in these services, it’s worth exploring further to see how FlexiLoan.in can assist with financial management. 🚀💼💰Apply now and take control of your finances effortlessly!

Learn More: https://flexiloan.in/ Contact Now: +91-8802733920, +91 9643001111

#flexiblefinancing#onlineloans#businessloans#delhi#delhincr#easyapprovals#entrepreneurship#fastfunding#flexiloan#flexiloanin

2 notes

·

View notes

Text

🚀 Get Quick Online Loans with Today Finserv! 💰

Need instant funds? Get Quick Online Loans with minimal documentation & fast approvals at Today Finserv! Whether it's for personal needs, business expansion, or urgent expenses – we’ve got you covered.

✅ Instant Approval ⚡ ✅ Hassle-Free Process 📄 ✅ Competitive Interest Rates 📉 ✅ Secure & Reliable 💼

💳 Apply now and get your loan approved in just a few clicks!

📞 Call us at +91-9354350073, +91-7827114145 or visit 🌐 todayfinserv.com | [email protected] to apply today!

#QuickLoans#OnlineLoans#InstantApproval#TodayFinserv#EasyFinance#FastLoans#omwebdigital#offpagelinks

0 notes

Text

The Benefits of Two-Wheeler Loans

In today's fast-paced world, owning a two-wheeler can significantly enhance your mobility and convenience. However, the financial aspect can often be a barrier. This is where two-wheeler loans come into play, offering numerous benefits that make purchasing a bike more accessible.

0 notes

Text

Digitization in Lending Market Huge Growth in Future Scope 2024-2030 | GQ Research

The Digitization in Lending market is set to witness remarkable growth, as indicated by recent market analysis conducted by GQ Research. In 2023, the global Digitization in Lending market showcased a significant presence, boasting a valuation of USD 423.66 Million. This underscores the substantial demand for Digitization in Lending technology and its widespread adoption across various industries.

Get Sample of this Report at: https://gqresearch.com/request-sample/global-digitization-in-lending-market/

Projected Growth: Projections suggest that the Digitization in Lending market will continue its upward trajectory, with a projected value of USD 857.74 billion by 2030. This growth is expected to be driven by technological advancements, increasing consumer demand, and expanding application areas.

Compound Annual Growth Rate (CAGR): The forecast period anticipates a Compound Annual Growth Rate (CAGR) of 26.58 %, reflecting a steady and robust growth rate for the Digitization in Lending market over the coming years.

Technology Adoption:

Increasing adoption of digitization in lending processes for efficiency and convenience.

Digitization utilized for loan origination, underwriting, approval, and servicing.

Integration of online platforms, mobile applications, and electronic signatures for seamless customer experience.

Application Diversity:

Consumer Loans: Digitized application processes for personal loans, mortgages, and auto loans.

Small Business Loans: Online platforms for business loan applications, credit assessment, and funding.

Peer-to-Peer Lending: Digital platforms connecting borrowers with individual investors for lending opportunities.

Microfinance: Digital lending solutions targeting underserved populations with microloans and financial inclusion initiatives.

Consumer Preferences:

Demand for streamlined and paperless loan application processes accessible through digital channels.

Preference for mobile-friendly interfaces and self-service options for loan management and payment.

Emphasis on data security, privacy protection, and transparent loan terms and conditions.

Desire for fast approval times and quick disbursal of funds facilitated by digitized lending platforms.

Technological Advancements:

Advancements in artificial intelligence (AI) and machine learning (ML) for credit scoring and risk assessment.

Integration of big data analytics and alternative data sources for personalized lending decisions.

Development of blockchain technology for secure and transparent loan transactions and smart contracts.

Adoption of open banking APIs for seamless integration with financial data and third-party services.

Market Competition:

Intense competition among traditional banks, fintech startups, and online lenders in the digital lending market.

Differentiation through innovative loan products, competitive interest rates, and superior customer service.

Strategic partnerships with technology providers, credit bureaus, and regulatory compliance firms.

Focus on digital marketing, customer engagement, and brand loyalty to attract and retain borrowers.

Environmental Considerations:

Consideration of environmental impact in the reduction of paper usage and physical documentation in lending processes.

Promotion of energy-efficient data center infrastructure and sustainable computing practices.

Implementation of eco-friendly practices in loan servicing and collection operations.

Compliance with environmental regulations and standards governing electronic waste disposal and recycling.

Regional Dynamics: Different regions may exhibit varying growth rates and adoption patterns influenced by factors such as consumer preferences, technological infrastructure and regulatory frameworks.

Key players in the industry include:

Fiserv

ICE Mortgage Technology

FIS

Newgen Software

Nucleus Software

Temenos

Pega

Sigma Infosolutions

Intellect Design Arena.

Tavant

The research report provides a comprehensive analysis of the Digitization in Lending market, offering insights into current trends, market dynamics and future prospects. It explores key factors driving growth, challenges faced by the industry, and potential opportunities for market players.

For more information and to access a complimentary sample report, visit Link to Sample Report: https://gqresearch.com/request-sample/global-digitization-in-lending-market/

About GQ Research:

GQ Research is a company that is creating cutting edge, futuristic and informative reports in many different areas. Some of the most common areas where we generate reports are industry reports, country reports, company reports and everything in between.

Contact:

Jessica Joyal

+1 (614) 602 2897 | +919284395731 Website - https://gqresearch.com/

0 notes

Text

Attention everyone: Kredit-Markt.eu is now also available in English!

0 notes

Text

Considering an online personal loan? 🌟 Explore the 7 crucial pros and cons before you click 'apply'. Make an informed choice and secure your financial future! 💸

0 notes

Text

Instant Personal Loans for Salaried Individuals

Are you a salaried individual in need of financial assistance? Look no further, because we've got you covered! At Privo, we understand that life can sometimes throw unexpected expenses your way, and that's why we offer instant personal loans tailored specifically for salaried persons.

Our application process is quick and hassle-free, designed to make your life easier during those times when you need extra financial support. Whether it's for a medical emergency, a dream vacation, or any other immediate need, our loans are here to help you bridge the gap.

With easy eligibility criteria and swift approval, you can get the funds you need when you need them the most. Say goodbye to endless paperwork and lengthy waiting periods; Privo ensures that your loan application is processed efficiently.

Why Choose Privo for Instant Personal Loans:

Quick Approval: Our straightforward application process is designed for instant approvals. Say goodbye to long waiting times.

Tailored for Salaried Individuals: We understand the financial needs of salaried individuals, and our loan offerings are tailored to meet those needs effectively.

Flexible Repayment Options: Choose a repayment plan that suits your financial situation and preferences.

No Hidden Charges: We're committed to transparency. You'll always know what you're paying, with no surprise fees.

Online Convenience: Apply from the comfort of your home or on the go. It's as easy as a few clicks.

Don't let financial constraints hold you back from achieving your dreams or handling unexpected expenses. Take control of your financial well-being with Privo's instant personal loans.

Ready to secure your financial future? Apply now for instant approval and get the financial support you need: https://privo.in/loans-for-salaried

#PersonalLoans#InstantApproval#SalariedLoans#FinancialSupport#LoanApplication#QuickLoans#FinancialAssistance#SalariedIndividuals#EasyApproval#OnlineLoans#EmergencyFunds#LoanOptions#MoneyMatters#LoanSolutions#PrivoLoans

0 notes

Text

Bajaj finance card benefits online apply Check this out now click here.

#GooglePay#Loan#QuickLoans#DigitalLoans#OnlineLoans#Finance#Credit#FastApproval#EasyLoans#PersonalLoans#MoneyMatters#FinancialAssistance#CashAdvance#LoanOptions#apploan#applicationloan

0 notes

Text

Know everything about fintechzoom online loans.

Discover the power of onlineloansfintechzoom.online - your gateway to seamless FintechZoom Online Loans. Access fast, secure, and convenient financial solutions right at your fingertips. Experience a simplified application process, quick approvals, and personalized loan options tailored to your needs. Whether it's for emergencies, investments, or life's milestones, our platform connects you to a network of trusted lenders, ensuring you find the perfect match for your financial goals. Embrace the future of lending and take control of your financial journey with onlineloansfintechzoom.online today. Your dreams, empowered by technology. #FintechZoomOnlineLoans #FinancialEmpowerment #DigitalLending #Onlineloansfintechzoom

onlineloansfintechzoom.online

#onlineloans#fintechzoom loans#loans#debt#debtfree#student debt#debt ceiling#banking#money#funding#debtmanagement

0 notes

Text

Introducing flexiloan.in - Your Ultimate Loan Management System!

FlexiLoan.in certainly seems to offer a variety of loan options to cater to different financial needs. The promise of minimal documentation and quick online processing can make it an attractive choice for those seeking efficient loan management.

Here’s a quick overview of the loans available:

🔹Personal Loan: For individual financial needs.

🔹Flexi Loan: Offers flexibility in borrowing and repayment.

🔹Doctor Loan: Tailored for medical professionals.

🔹CA/CS/CWA Loan: Designed for chartered accountants, company secretaries, and cost & work accountants.

🔹Business Loan: To support business growth and expenses.

🔹Overdraft Loan: Provides a credit facility for immediate cash needs.

For anyone interested in these services, it’s worth exploring further to see how FlexiLoan.in can assist with financial management. 🚀💼💰 Apply now and take control of your finances effortlessly!

Learn More: https://flexiloan.in/ Contact Now: +91-8802733920, +91 9643001111

#flexiblefinancing#onlineloans#businessloans#delhi#delhincr#easyapprovals#entrepreneurship#fastfunding#flexiloan#flexiloanin

2 notes

·

View notes

Text

Credit Cards Fees-What you Need to Know

It is widely known that credit cards are a magnificent tool to improve our life. Of course, some people consider credit cards to be a double-edged sword if you don’t know how to use them. Most people in the United States have first-hand experience of the advantages and disadvantages of credit cards and may not know about credit cards fees in advance.

0 notes

Text

7 Surprising Credit Card Facts

The last thing you want to do is get your credit card statement every month, but credit cards are a very interesting topic.

There is a lot that most people don’t know about their main form of payment, the tiny plastic cards on which we all rely. These cards have a long and distinguished history.

https://lendyoucash.com/blog/credit-cards/surprising-credit-card-facts/

#safeloan#lendyoucash#personalloans#installmentloans#loanservices#onlineloans#paydayloans#onlinepersonalloans#onlineinstallmentloans

1 note

·

View note

Text

Low Interest rate Loans in Odisha

Welcome to LoanInsDeals, your ultimate solution for all your financial needs. Whether you require a personal loan in Odisha or are searching for low-interest loans within the state, look no further than LoanInsDeals. Our platform seamlessly connects you with the leading Non-Banking Finance Corporations and insurance companies throughout India, presenting you with a diverse range of options at highly competitive rates.

Why opt for LoanInsDeals?

Effortlessly compare and negotiate various personal loan and low-interest loan choices from the convenience of your home, specifically tailored for Odisha residents.

Enjoy a wide array of options, including personal loans in Odisha, low-interest loans in Odisha, and loans with favorable interest rates.

Our platform ensures a mutually beneficial outcome for both customers and agents involved.

We have established valuable partnerships with reputable non-banking finance corporations and insurance companies across India, guaranteeing reliable and trustworthy services.

Key Features:

Our platform is designed to be user-friendly, providing a seamless experience for all users.

We offer personalized solutions to cater to your specific financial requirements, ensuring maximum satisfaction.

Our services are characterized by transparency and fairness, ensuring you have a clear understanding of the terms and conditions.

Benefit from a wide range of options, enabling you to make an informed decision that aligns with your financial goals and preferences.

0 notes

Text

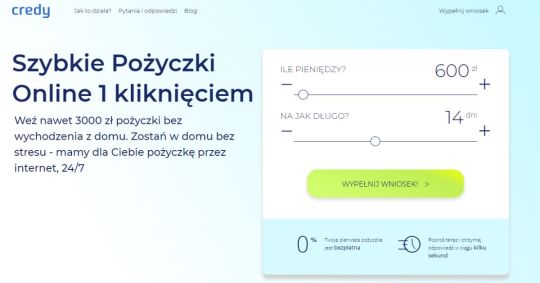

Sprawdź najlepsze oferty pożyczek chwilówek. Porównaj pożyczki online. ✓ Nawet do 3000zł. ✓ Szybkie, wygodne i bezpieczne.

Credy - opinie o chwilówce i recenzja

Credy.pl jest serwisem internetowym, którego głównym zadaniem jest pomoc zainteresowanym pożyczkobiorcom w odnalezieniu idealnej oferty pożyczki pozabankowej.

Kwalifikowalność pożyczki odnosi się do kryteriów, które pożyczkobiorca musi spełnić, aby zakwalifikować się do pożyczki od pożyczkodawcy. Pożyczkodawcy oceniają kwalifikowalność pożyczkobiorców w celu określenia ich zdolności kredytowej i zdolności do spłaty pożyczki. Konkretne wymagania kwalifikacyjne mogą się różnić w zależności od rodzaju pożyczki i pożyczkodawcy, ale oto kilka wspólnych czynników:

#OnlineLoans#DigitalLending#QuickCash#InstantApproval#PaperlessLoans#EasyApplication#FastFunds#ConvenientLoans#OnlineFinance#MoneyNow

1 note

·

View note

Text

Unfounded Things About Unsecured Personal Loans

The name unsecured personal loan is not a new concept to the citizens of Australia. There are many people taking online loans for different reasons every year. The credit union has restricted the number of times a user can apply for an online loan, yet, there are able to give intense competition for banking credit. The popularity of these loans in the country is equally opposed by a few unfounded things which the user has to know about before applying for an unsecured personal loan.

Short-Term Loans Cost You More Than Your Borrowed Amount.

Unsecured Personal Loans are designed with a unique concept of adjusting immediate funds to the needy who have requested them. Aiming the objective, the lender offers them unsecured, facilitating quick approval. The small funds are approved on the same day to the eligible candidates. For all these unique features, unsecured personal loans are charged a bit when compared to banking credit, but it definitely does not cost you more than what you borrow from the lender. The misconception prevailed in the market due to the existence of scammers. To be careful enough about the cost you pay to the lender, you should check their reliability in the market along with knowing the license number before applying for the loan. Also, make sure to read the terms of the loan in detail and understand the related charges to calculate the probable installment before accepting the loan offer.

Unregulated Loans

Unsecured personal loans are perceived to be unregulated loans as they are bound to high-interest charges. In fact, online loans are regulated by the Australian credit union, and every licensed lender is bound to follow the regulations set by the credit union, be it in terms of the loan tenure or be it eligibility, cap limits on the loan amounts, and the interest charges. To keep off unfounded things about the loans, make sure you check the registered license number of the lender, which is generally displayed on their website.

Make You Pay Late

An unsecured personal loan lender does not ask you for advanced check payments for scheduled installments over the loan tenure. They also don’t facilitate auto debt options. This does mean that they want you to pay the loan installments late. Unsecured personal loans are offered online. The borrower will not meet the lender in person at any juncture, so these lenders don’t seek any advanced check to get access to your account for auto-debit unless you especially seek for it to establish a line of trust with the customer. It is the lender who is at greater risk when you delay or default on the loan because they have nothing to cover up the loss as the loans are sanctioned unsecured. The lender approves the loan only after checking your affordability for it. The online loan business will be successful when you stand prompt to the loan installments.

Designed To Trap People

Before you are driven by the misconception that online loans are designed to trap people into debt, know that the loans are sanctioned and unsecured. The lender will have nothing to recover in the event of defaults. The belief that Payday Loans are debt trappers still prevails in the market, but no business can survive in the market by just pulling out the penalties and interest charges from the borrower. They want the borrowers to repay the loan amount as scheduled, along with the interest rate. This is the reason why lenders conduct eligibility checks like stable income and repayment capacity of the customer, which stands as proof of their repayment capacity.

#unsecuredpersonalloans#unsecuredloans#personalloans#smallpersonalloans#quickloans#cashloans#fastloans#onlineloans#easyloans#paydayloans#weekendloans

1 note

·

View note

Text

Vay Tiền Tư Nhân Cực Nhanh Uy Tín Góp Tháng

Vay tư nhân cực nhanh là một trong những giải pháp tài chính được nhiều người quan tâm trong thời gian gần đây. Với những ưu điểm như thủ tục đơn giản, không cần tài sản đảm bảo, và tiền vay được giải ngân nhanh chóng, vay tư nhân đang trở thành lựa chọn hàng đầu của nhiều người trong việc giải quyết các nhu cầu tài chính cá nhân.

Tuy nhiên, để lựa chọn được gói vay tư nhân cực nhanh phù hợp và đáp ứng nhu cầu thực tế của mình, người vay cần phải tìm hiểu kỹ về các thông tin liên quan đến sản phẩm vay này. Trong bài viết này, Vnvay24h.vn sẽ giúp bạn hiểu rõ hơn về vay tư nhân cực nhanh và các điều cần lưu ý khi sử dụng sản phẩm này.

Lợi ích khi vay tiền tư nhân cực nhanh

Để giải quyết nhu cầu vay tiền nhanh chóng và đơn giản, ngày nay có rất nhiều đơn vị tài chính cung cấp dịch vụ vay tư nhân cực nhanh.

Với những ưu điểm nổi trội như hồ sơ thủ tục đơn giản chỉ cần sử dụng CCCD hoặc CMND còn hiệu lực, khách hàng không cần tới sự thế chấp của tài sản hoặc bảo lãnh của bên thứ ba, và quy trình xét duyệt hồ sơ nhanh, giải ngân chỉ trong vỏn vẹn 30 phút.

Ngoài ra, đơn vị tài chính này còn chấp nhận nợ xấu và các hồ sơ bị từ chối bởi ngân hàng.

Hệ thống duyệt tự động 24/7, ưu đãi lãi suất 0% và phí cho khách hàng mới, và hạn mức vay linh hoạt từ 500.000 VNĐ - 20.000.000 VNĐ cùng thời gian trả góp linh hoạt, dễ dàng gia hạn.

Đặc biệt, thông tin cá nhân người vay và khoản vay được bảo mật an toàn.

TOP 3+ Vay tư nhân cực nhanh duyệt online bằng CMND

Finloo

Finloo là đơn vị tài chính hỗ trợ khách hàng vay số tiền linh hoạt từ 500k đến 20 triệu đồng với thủ tục đơn giản chỉ cần sử dụng CMND hoặc CCCD.

Lãi suất vay dao động từ 12% đến 20% mỗi năm, đặc biệt có ưu đãi lãi suất 0% dành cho khách hàng mới.

Khách hàng có thể trả góp trong vòng 3 đến 6 tháng, thời gian linh hoạt và dễ dàng.

Điều kiện để vay là từ 18 đến 60 tuổi và hỗ trợ khách hàng có nợ xấu tại CIC.

Credy

Credy là đơn vị tư nhân uy tín trong lĩnh vực cho vay tiền.

Hỗ trợ số tiền vay từ 300k đến 15 triệu đồng với lãi suất tối đa 20%/ năm.

Quý khách có thể dễ dàng đăng ký vay tiền qua App của chúng tôi chỉ với h�� chiếu hoặc CMND.

Kỳ hạn vay được thiết lập trong khoảng từ 30 đến 90 ngày và độ tuổi từ 18 đến 60 tuổi.

Hơn nữa, quý khách được yên tâm với việc lãi suất được công khai và thông tin cá nhân được bảo mật an toàn.

Doctor Đồng

Doctor Đồng hỗ trợ vay tư nhân với hạn mức từ 500.000 đồng đến 15 triệu đồng.

Quý khách có thể lựa chọn kỳ hạn vay từ 3 tháng đến 6 tháng và vay tiền bằng Iphone.

Chấp nhận khách hàng có nợ xấu và thủ tục đơn giản chỉ cần CMND.

Không giải ngân cho khách hàng tại Hải Phòng và huyện đảo. Hệ thống phê duyệt khoản vay tự động 24/7 giúp tiết kiệm thời gian chờ đợi.

Lãi suất vay áp dụng tối đa 20% mỗi năm.

Nguồn bài viết: 10+ Vay Tiền Tư Nhân Cực Nhanh Uy Tín Góp Tháng (2023)

Thông tin được biên tập bởi: @vnvay24h

0 notes