#lithium-ion battery industry

Explore tagged Tumblr posts

Text

Deciphering the World of Lithium Batteries: Types, Principles, and Structure

Lithium-ion batteries are the unsung heroes of our tech-savvy world. These powerhouses come in various shapes, sizes, and configurations and employ the magic of lithium to store and release energy. This article will explore the classification, working principle, and structural components that make these batteries tick.

1. Classification of Lithium-Ion Batteries

Lithium batteries are classified based on usage, energy characteristics, and power delivery capabilities. Three main categories emerge:

Energy-Type Lithium Batteries: These are designed for the long haul. They're great at storing energy over extended periods, making them ideal for applications like laptops, cameras, and other electronic devices that require a steady, reliable power source.

Power-Type Lithium Batteries: When you need a burst of energy, power-type lithium batteries step up to the plate. These batteries can deliver high current, making them a perfect choice for devices like power tools or electric vehicles that require sudden, intense bursts of energy.

Fast-Charging Lithium Batteries: As the name suggests, these batteries are all about speed. They can absorb and deliver energy quickly, which is why they're popular in the fast-charging devices we use daily, from smartphones to electric scooters.

2. Working Principle of Lithium Batteries

At the heart of a lithium-ion battery lies a fundamental electrochemical process. The essence of this process is the transformation of lithium from one form to another and the simultaneous transfer of lithium ions and electrons, resulting in the conversion of electrical energy to chemical energy and vice versa.

Charging Phase: When you plug in your device to charge, you're converting electrical energy into chemical energy. Lithium ions migrate from the positive electrode through a separator to the negative electrode, and electrons flow through the external circuit. When they meet at the negative electrode, lithium ions are embedded into the electrode material, storing energy.

Discharging Phase: When you unplug your device and start using it, the chemical energy stored in the battery is converted back into electrical energy. Lithium ions are released from the negative electrode, travel through the separator to the positive electrode, and electrons once again flow through the external circuit. At the positive electrode, electrons and lithium ions combine with stable positive electrode materials, generating the electricity needed to power your device.

3. Battery Structure: The Anatomy of Power

Lithium batteries are a complex interplay of several components, each playing a crucial role in their performance. Let's break down the structure:

Positive Electrode (Cathode): The positive electrode is typically coated with a lithium-containing alkali salt, providing the battery with a source of lithium. The positive electrode material also determines the battery's capacity, making it a central component.

Positive Electrode Tab (Ear): This structure bridges the positive electrode sheet and the external circuit. Its design significantly influences the battery's overcurrent capacity.

Ceramic Coating: Often applied to the positive electrode side, ceramic coatings, usually alumina, serve several functions. They help prevent burrs during manufacturing, reduce the risk of misalignment, and enhance laser absorption during the cutting process.

Current Collector (Foil): The positive electrode's current collector is primarily composed of aluminium foil. It provides an attachment point for the positive electrode coating and acts as a carrier for overcurrent.

Negative Electrode (Anode): The negative electrode contains carbon-based materials and provides the sites for lithium embedding within the battery. This material determines the battery's capacity.

Negative Electrode Tab (Ear): Similar to its positive counterpart, the negative electrode tab bridges the negative electrode and the external circuit and significantly affects the battery's overcurrent capacity.

Current Collector (Foil): In the negative electrode, copper foil is often used for the current collector. Like its positive counterpart, it offers an attachment point for the negative electrode coating and functions as an overcurrent carrier.

4. Battery Arrangements: Series and Parallel Connections

Lithium batteries can be combined in series or parallel configurations to achieve specific voltage and capacity requirements. When connected in series, the battery voltages are additive, creating higher voltages. In a parallel configuration, the capacities are additive, yielding longer battery life.

Conclusion

As we unravel the intricacies of lithium-ion batteries, from their diverse classifications to the fundamental electrochemical processes at play, a profound understanding emerges of the silent workhorses powering our digital age. The structure, with its positive and negative electrodes, intricate tabs, and specialized coatings, becomes a testament to the meticulous engineering behind these energy storage marvels.

The arrangement of batteries in series or parallel configurations further underscores their adaptability to diverse voltage and capacity requirements. In conclusion, the journey through the world of lithium batteries unveils not just the technical brilliance that enables our devices but also the potential for continued innovation in energy storage, pointing toward a future where these unassuming powerhouses play an even more integral role in our evolving technological landscape.

#lithium-ion batteries#lithium-ion battery#lithium-ion battery assembly#lithium-ion battery assembly equipment#lithium-ion battery cell#lithium-ion battery industry

0 notes

Text

Lithium-ion Battery Industry Size & Share Analysis by Type and Region, Forecast Report, 2030

The global lithium-ion battery market, valued at approximately USD 54.4 billion in 2023, is set to expand significantly, with a projected compound annual growth rate (CAGR) of 20.3% from 2024 to 2030. This growth is driven primarily by the automotive sector, which is poised for notable expansion due to the cost-effectiveness of lithium-ion batteries. The adoption of electric vehicles (EVs) worldwide is anticipated to surge throughout the forecast period, further boosting demand for lithium-ion batteries.

The United States led the North American lithium-ion battery market in 2023, largely due to increasing EV sales supported by favorable federal policies and the presence of numerous industry players. U.S. federal policies encouraging EV adoption include the American Recovery and Reinvestment Act of 2009, which offers tax credits for electric vehicle purchases. Additionally, updated Corporate Average Fuel Economy (CAFE) standards have introduced stricter fuel economy requirements for passenger cars and light commercial vehicles (LCVs), promoting the expansion of electric drive technologies.

Gather more insights about the market drivers, restrains and growth of the Lithium-ion Battery Market

The rising demand for lithium-ion batteries extends beyond the automotive sector to the electronics industry, where these batteries are widely used in smartphones. Lithium-ion batteries provide longer shelf life and greater efficiency for devices, further propelling market growth. Furthermore, increasing consumer awareness about carbon emissions is driving demand for EVs, which is expected to fuel lithium-ion battery market growth. Regulatory restrictions on lead-acid batteries in response to environmental concerns such as the Environmental Protection Agency's (EPA) restrictions on lead contamination and regulations regarding the storage, disposal, and recycling of lead-acid batteries are contributing to the shift towards lithium-ion batteries in automotive applications. Mexico, as a significant hub in the global automotive industry, is becoming a focal point for international investments, adding further momentum to the growth of the lithium-ion battery market.

Product Segmentation Insights:

The lithium-ion battery market is segmented by product types, which include Lithium Cobalt Oxide (LCO), Lithium Iron Phosphate (LFP), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Manganese Oxide (LMO), Lithium Titanate (LTO), and Lithium Nickel Manganese Cobalt (NMC). Among these, the LCO segment held the largest market share, accounting for over 30% of total revenue in 2023. This strong demand for LCO batteries is largely driven by their high energy density and safety features, making them ideal for use in mobile devices like smartphones, tablets, laptops, and cameras.

Lithium iron phosphate (LFP) batteries are gaining popularity due to their excellent safety profile and long lifespan, which make them suitable for high-load and enduring applications in both portable and stationary devices. The demand for NCA batteries is also rising due to their high specific energy, specific power, and long-life span, qualities that make them a preferred choice in electric vehicles, medical devices, and various industrial applications. Lithium titanate (LTO) batteries are increasingly being utilized in applications such as electric powertrains, street lighting, uninterruptible power supplies (UPS), and solar-powered streetlights. LTO batteries are known for their superior safety, strong performance at low temperatures, and long life, which is expected to bolster their market share over the forecast period.

Order a free sample PDF of the Lithium-ion Battery Market Intelligence Study, published by Grand View Research.

#Lithium-ion Battery Market Share#Lithium-ion Battery Market Trends#Lithium-ion Battery Market Growth#Lithium-ion Battery Industry

0 notes

Text

Lithium-ion Battery Market 2030: Report Focusing on Opportunities, Revenue & Market Driving Factors

The global lithium-ion battery market, valued at approximately USD 54.4 billion in 2023, is set to expand significantly, with a projected compound annual growth rate (CAGR) of 20.3% from 2024 to 2030. This growth is driven primarily by the automotive sector, which is poised for notable expansion due to the cost-effectiveness of lithium-ion batteries. The adoption of electric vehicles (EVs) worldwide is anticipated to surge throughout the forecast period, further boosting demand for lithium-ion batteries.

The United States led the North American lithium-ion battery market in 2023, largely due to increasing EV sales supported by favorable federal policies and the presence of numerous industry players. U.S. federal policies encouraging EV adoption include the American Recovery and Reinvestment Act of 2009, which offers tax credits for electric vehicle purchases. Additionally, updated Corporate Average Fuel Economy (CAFE) standards have introduced stricter fuel economy requirements for passenger cars and light commercial vehicles (LCVs), promoting the expansion of electric drive technologies.

Gather more insights about the market drivers, restrains and growth of the Lithium-ion Battery Market

The rising demand for lithium-ion batteries extends beyond the automotive sector to the electronics industry, where these batteries are widely used in smartphones. Lithium-ion batteries provide longer shelf life and greater efficiency for devices, further propelling market growth. Furthermore, increasing consumer awareness about carbon emissions is driving demand for EVs, which is expected to fuel lithium-ion battery market growth. Regulatory restrictions on lead-acid batteries in response to environmental concerns such as the Environmental Protection Agency's (EPA) restrictions on lead contamination and regulations regarding the storage, disposal, and recycling of lead-acid batteries are contributing to the shift towards lithium-ion batteries in automotive applications. Mexico, as a significant hub in the global automotive industry, is becoming a focal point for international investments, adding further momentum to the growth of the lithium-ion battery market.

Product Segmentation Insights:

The lithium-ion battery market is segmented by product types, which include Lithium Cobalt Oxide (LCO), Lithium Iron Phosphate (LFP), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Manganese Oxide (LMO), Lithium Titanate (LTO), and Lithium Nickel Manganese Cobalt (NMC). Among these, the LCO segment held the largest market share, accounting for over 30% of total revenue in 2023. This strong demand for LCO batteries is largely driven by their high energy density and safety features, making them ideal for use in mobile devices like smartphones, tablets, laptops, and cameras.

Lithium iron phosphate (LFP) batteries are gaining popularity due to their excellent safety profile and long lifespan, which make them suitable for high-load and enduring applications in both portable and stationary devices. The demand for NCA batteries is also rising due to their high specific energy, specific power, and long-life span, qualities that make them a preferred choice in electric vehicles, medical devices, and various industrial applications. Lithium titanate (LTO) batteries are increasingly being utilized in applications such as electric powertrains, street lighting, uninterruptible power supplies (UPS), and solar-powered streetlights. LTO batteries are known for their superior safety, strong performance at low temperatures, and long life, which is expected to bolster their market share over the forecast period.

Order a free sample PDF of the Lithium-ion Battery Market Intelligence Study, published by Grand View Research.

#Lithium-ion Battery Market Share#Lithium-ion Battery Market Trends#Lithium-ion Battery Market Growth#Lithium-ion Battery Industry

0 notes

Text

Lithium-Ion Battery Market Size & Share Analysis - Growth Trends By Forecast Period

Lithium-Ion Battery Market Key Players and Forecast Insights Through 2032

The latest ""Lithium-Ion Battery Market"" Insight Report for 2024 offers a comprehensive analysis of the industry's key contributions, marketing strategies, and recent advancements by leading companies. This report provides a succinct overview of both historical and current performance metrics for major market players. It employs various analytical methods to deliver precise insights into the Lithium-Ion Battery Market, with coverage across regions including North America, Europe, Asia Pacific, and more. The recent analysis also includes an in-depth review of the business strategies adopted by emerging industry players, along with detailed information on market segments, geographic coverage, product trends, and cost structures.

What are the growth projections for the Lithium-Ion Battery Market?

According to Straits Research, the global Lithium-Ion Battery Market size was valued at USD 56.43 billion in 2023. It is projected to reach from USD 66.38 billion in 2024 to USD 240.90 billion by 2032, growing at a CAGR of 17.5% during the forecast period (2024–2032).

Get Free Request Sample Report @ https://straitsresearch.com/report/lithium-ion-battery-market/request-sample

Top Competitive Players of Lithium-Ion Battery Market

GS Yuasa Corporation Ltd

BYD Company Ltd

A123 Systems, LLC

Hitachi, Ltd

Huayu New Energy Technology Co., Ltd

Johnson Controls

NEC Corporation

Panasonic Corporation

Samsung SDI Co., Ltd

Toshiba Corporation

LG Chem Ltd

What are the key trends within each segment of the Lithium-Ion Battery Market?

By Product

Lithium cobalt oxide (LCO)

Lithium iron phosphate (LFP)

Lithium Nickel Cobalt Aluminum Oxide (NCA)

Lithium Manganese Oxide (LMO)

Lithium Titanate (LTO)

Lithium Nickel Manganese Cobalt

By Material

Cathode material

Anode material

Electrolyte material

Separator material

Current collector material

Other materials

By Product Type

Components of lithium-ion batteries

Portability

By Capacity

Below 3,000 mAh

3,001 – 10,000 mAh

10,001 – 60,000 mAh

Above 60,000 mAh

By Voltage

Low

Medium

High

By Application

Consumer Electronics

Automotive

Aerospace

Marine

Medical

Industrial

Power

Telecommunications

View the full report and table of contents here: https://straitsresearch.com/report/lithium-ion-battery-market/toc

The report forecasts revenue growth at all geographic levels and provides an in-depth analysis of the latest industry trends and development patterns from 2022 to 2030 in each of the segments and sub-segments. Some of the major geographies included in the market are given below:

North America (U.S., Canada)

Europe (U.K., Germany, France, Italy)

Asia Pacific (China, India, Japan, Singapore, Malaysia)

Latin America (Brazil, Mexico)

Middle East & Africa

This Report is available for purchase on Buy Lithium-Ion Battery Market Report

Key Highlights

Provide a detailed explanation of various aspects including introduction, product types and applications, market overview, country-specific market analysis, opportunities, risks, and driving forces.

Examine manufacturers, including their profiles, primary business activities, recent news, sales and pricing, revenue, and market share.

Offer an overview of the competitive landscape, detailing sales, revenue, and market share among leading global manufacturers.

Present a detailed market breakdown by type and application, including sales, pricing, revenue, market share, and growth rates.

Analyze key regions—North America, Europe, Asia Pacific, the Middle East, and South America—covering sales, revenue, and market share segmented by manufacturers, types, and applications.

Investigate production costs, essential raw materials, and production methods.

Reasons to Buy:

In-depth analysis of market segmentation.

Country-specific insights alongside global demand and supply dynamics.

Examination of key players, including their products, financial performance, and strategies.

Insights into emerging market trends, opportunities, and challenges.

About Us:

StraitsResearch.com is a leading research and intelligence organization, specializing in research, analytics, and advisory services along with providing business insights & research reports.

Contact Us: Email: [email protected] Address: 825 3rd Avenue, New York, NY, USA, 10022 Tel: +1 6464807505, +44 203 318 2846

#Lithium-Ion Battery Market#Lithium-Ion Battery Market Share#Lithium-Ion Battery Market Size#Lithium-Ion Battery Market Research#Lithium-Ion Battery Industry

0 notes

Text

Lithium-Ion Battery Market Growth Opportunities and Outlook 2024 – 2030

The global lithium-ion battery market size was estimated at USD 182.5 billion in 2030 and is projected to register a compound annual growth rate (CAGR) of 20.3% from 2024 to 2030. The market is expected to witness significant growth over the forecast period on account of the increasing consumption of rechargeable batteries in consumer electronics and a rise in the adoption of electric vehicles. The rising sales of electric vehicles, along with the expanding renewable energy sector, are expected to drive the market. The emergence of integrated charging stations, green power-generation capability, eMobility providers, battery manufacturers, and energy suppliers is anticipated to stimulate market growth in the coming years.

Increasing sales of electric vehicles in the U.S. owing to supportive federal policies, coupled with the presence of market players in the country, are expected to drive the demand for lithium-ion batteries in the U.S. over the forecast period. Favorable government policies for infrastructural developments at the domestic level through the National Infrastructural Plan (NIP) of the U.S. are expected to promote the growth of the market in the U.S. over the forecast period. Development of the automotive industry in Indonesia, Vietnam, Mexico, Thailand, and India is expected to drive the industry. The growing inclination toward pollution-free HEVs and EVs, along with technological developments, is expected to drive the lithium-ion battery demand over the forecast period. China is expected to witness high gains in light of energy storage technologies and favorable government support to promote investments in the manufacturing sector.

Gather more insights about the market drivers, restrains and growth of the Lithium-Ion Battery Market

Detailed Segmentation:

Application Insights

Based on applications, the market has been segmented into automotive, consumer electronics, industrial, medical devices, and energy storage systems. The consumer electronics segment led the market in 2023 and accounted for the largest revenue share of more than 31.0%. Portable batteries are incorporated in portable devices and consumer electronic products. Applications of portable batteries range from mobile phones, laptops, computers, tablets, torches or flashlights, LED lighting, vacuum cleaners, digital cameras, wristwatches, calculators, hearing aids, and other wearable devices. The electric & hybrid EV market is projected to be the fastest-growing application segment over the forecast period.

Regional Insights

Asia Pacific held the largest market share of over 47.0% in 2023. The market in Europe is expected to witness steady growth over the forecast period owing to the increasing use of li-ion batteries in various sectors including medical, aerospace & defense, automotive, energy storage, and data communication & telecom. The market in Germany is expected to witness steady growth over the forecast period owing to the increasing use of Li-ion batteries in energy storage systems, EVs, and consumer electronics.

Market Dynamics

The increasing adoption of electric vehicles (EVs) is catalyzing a remarkable surge in the global lithium-ion battery industry. As governments and industries worldwide prioritize the transition toward sustainable and environment-friendly transportation, the demand for EVs has experienced a substantial upswing. Lithium-ion batteries, renowned for their high energy density and efficiency, have emerged as the cornerstone of this automotive revolution. These batteries power electric vehicles, providing them with the necessary range and performance to compete with traditional internal combustion engine vehicles.

Product Insights

Based on products, the industry has been segregated into Lithium Cobalt Oxide (LCO), Lithium Iron Phosphate (LFP), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Manganese Oxide (LMO), Lithium Titanate, and Lithium Nickel Manganese Cobalt (NMC). In terms of revenue, the LCO segment accounted for the largest market share of over 30.0% in 2023. High demand for LCO batteries in mobile phones, tablets, laptops, and cameras, on account of their high energy density and high safety level, is expected to augment segment growth over the forecast period. LFP batteries offer excellent safety and a long-life span to product.

Browse through Grand View Research's Conventional Energy Industry Research Reports.

• The global digital oilfield market size was valued at USD 27.4 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2030.

• The global energy harvesting system market size was valued at USD 452.2 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 10.2% from 2020 to 2028.

Key Companies & Market Share Insights

The industry is extremely competitive with key participants involved in R&D and constant product innovation. Key manufactures include Samsung, BYD, LG Chem, Johnson Controls, Exide, and Saft. Several companies are engaged in new product development to improve their global market share. For instance, BYD and Panasonic hold a strong position on account of its increased manufacturing capacities and large distribution network.

Key Lithium-ion Battery Companies:

• BYD Co., Ltd.

• A123 Systems LLC

• Hitachi, Ltd.

• Johnson Controls

• LG Chem

• Panasonic Corp.

• Saft

• Samsung SDI Co., Ltd.

• Toshiba Corp.

• GS Yuasa International Ltd.

Lithium-ion Battery Market Segmentation

Grand View Research has segmented the global lithium-ion battery market report based on product, application and region

Lithium-ion Battery Product Outlook (Volume, GWh; Revenue, USD Billion, 2018 - 2030)

• Lithium Cobalt Oxide (LCO)

• Lithium Iron Phosphate (LFP)

• Lithium Nickel Cobalt Aluminum Oxide (NCA)

• Lithium Manganese Oxide (LMO)

• Lithium Titanate

• Lithium Nickel Manganese Cobalt (LMC)

Lithium-ion Battery Application Outlook (Volume, GWh; Revenue, USD Billion, 2018 - 2030)

• Automotive

• Consumer Electronics

• Industrial

• Energy Storage Systems

• Medical Devices

Lithium-ion Battery Regional Outlook (Volume, GWh; Revenue, USD Billion, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Russia

o Spain

o France

o U.K.

o Germany

o Italy

• Asia Pacific

o China

o India

o Japan

o South Korea

o Australia

• Central & South America

o Brazil

o Paraguay

o Columbia

• Middle East & Africa

o South Africa

o UAE

o Egypt

o Saudi Arabia

Order a free sample PDF of the Lithium-Ion Battery Market Intelligence Study, published by Grand View Research.

#Lithium-Ion Battery Market#Lithium-Ion Battery Market size#Lithium-Ion Battery Market share#Lithium-Ion Battery Market analysis#Lithium-Ion Battery Industry

0 notes

Text

[In February, 2023], a small warehouse in the English city of Nottingham received the crucial final components for a project that leverages the power of used EV batteries to create a new kind of circular economy.

Inside, city authorities have installed 40 two-way electric vehicle chargers that are connected to solar panels and a pioneering battery energy storage system, which will together power a number of on-site facilities and a fleet of 200 municipal vehicles while simultaneously helping to decarbonize the UK’s electrical grid.

Each day Nottingham will send a combination of solar-generated energy — and whatever is left in the vehicles after the day’s use — from its storage devices into the national grid. The so-called “vehicle to grid” chargers deliver this energy just when it’s needed most, during peak evening demand, when people are home cooking, using hot water or watching TV. Later, the same chargers pull energy from the grid to recharge the vehicles in the wee hours of the night, when folks are sleeping and electricity is cheaper and plentiful.

“We are trying to create a virtual power station,” says Steve Cornes, Nottingham City Council’s Technical Lead. “The solar power and battery storage will help us operate independently and outside of peak times, making our system more resilient and reducing stress on the national grid. We could even make a profit.” ...

After around a decade, an EV battery no longer provides sufficient performance for car journeys. However, they still can retain up to 80 percent of their original capacity, and with this great remaining power comes great reusability.

“As the batteries degrade, they lose their usefulness for vehicles,” says Matthew Lumsden, chairman of Connected Energy. “But batteries can be used for so many other things, and to not do so results in waste and more mining of natural resources.”

The E-STOR hubs come in the form of 20-foot modular containers, each one packed with 24 repurposed EV batteries from Renault cars. Each hub can provide up to 300kW of power, enough to provide energy to dozens of homes. One study by Lancaster University, commissioned by Connected Energy, calculated that a second life battery system saved 450 tons of CO2 per MWh over its lifetime...

Battery repurposing and recycling is set to play a massive role over the coming years as the automobile industry attempts to decarbonize and the world more broadly attempts to fight waste. The production of EVs, which use lithium-ion batteries, is accelerating. Tesla, for example, is aiming to sell 20 million EVs per year by 2030 — more than 13 times the current level. In turn, 12 million tons of EV batteries could become available for reuse by 2030, according to one estimate.

“Over the next decade we are going to see this gigantic wave,” says Jessica Dunn, a senior analyst at the Union of Concerned Scientists. “Companies are recognizing this is a necessary industry. They need to ramp up infrastructure for recycling and reuse.”

-via Reasons to Be Cheerful, March 13, 2023

#ev#ev charger#electric vehicle#electric cars#batteries#battery recycling#lithium ion battery#auto industry#sustainability#circular economy#recycling#reuse#uk#nottingham#england#good news#hope

217 notes

·

View notes

Text

Yukinova’s ESS for Commercial & Industrial Applications: A Reliable Energy Solution

Why Choose ESS for Commercial & Industrial Applications?

In today’s fast-paced world, commercial and industrial sectors are increasingly turning to advanced energy storage systems (ESS) to optimize power usage, enhance efficiency, and ensure smooth business operations. Yukinova’s ESS for Commercial & Industrial Applications offers an innovative approach to energy management, providing scalable, reliable, and cost-effective solutions. As businesses grow and face rising energy demands, having a dependable power backup system is essential, and Yukinova’s ESS meets these demands with cutting-edge technology and features.

Key Features of Yukinova’s ESS for Commercial & Industrial Applications

Yukinova’s Energy Storage Systems (ESS) for Commercial & Industrial Applications are engineered with high-performance components designed to cater to large-scale operations. Here are some notable features:

1. Scalable and Modular Design

One of the primary advantages of Yukinova’s ESS is its scalability. The modular design allows businesses to start with a system that fits their current energy requirements and easily expand as their energy needs grow. This flexibility ensures that the system can adapt to future demands without the need for costly upgrades.

2. Advanced Battery Management System (BMS)

Yukinova’s ESS comes equipped with an advanced Battery Management System (BMS) that ensures optimal battery performance and longevity. This system monitors the state of the battery, manages charge cycles, and prevents overcharging or deep discharging, maximizing the lifespan and reliability of the energy storage system.

3. Fast Charging and Discharging Capabilities

The fast charging and discharging features of Yukinova’s ESS ensure that businesses can quickly recharge the batteries and provide power when needed most. This is crucial for commercial and industrial applications, where quick response times can prevent downtime and improve overall efficiency.

4. IoT Integration for Remote Monitoring

To streamline operations and improve overall management, Yukinova’s ESS integrates seamlessly with Internet of Things (IoT) technology. Through remote monitoring, businesses can track real-time performance, energy consumption, and battery health. This remote capability enhances control, simplifies maintenance, and allows businesses to stay ahead of potential issues before they affect operations.

5. Enhanced Power Backup and Load Management

Whether for handling peak loads or ensuring uninterrupted power during outages, Yukinova’s ESS offers a reliable power backup solution. It ensures continuous operation of essential equipment, preventing costly downtime and disruptions. With the capability to manage and balance power loads efficiently, businesses can reduce energy costs and optimize power consumption.

How Yukinova’s ESS Benefits Commercial and Industrial Sectors

Cost-Effective Energy Solutions

In industries where energy consumption is a major operating cost, Yukinova’s ESS provides a way to optimize energy use, reduce peak energy demand, and lower electricity bills. By using energy storage systems to manage loads and store surplus power, businesses can avoid high tariffs during peak demand hours.

Improved Operational Efficiency

With reliable power backup and effective load management, businesses can continue operations without interruption. This not only minimizes downtime but also boosts overall productivity and operational efficiency.

Sustainability and Environmental Responsibility

Adopting Yukinova’s ESS allows businesses to transition towards greener energy solutions. By storing energy from renewable sources like solar or wind, businesses can reduce their carbon footprint and contribute to a more sustainable future.

Conclusion: A Smart Investment for the Future

Yukinova’s ESS for Commercial & Industrial Applications offers advanced, scalable, and reliable energy storage solutions designed to meet the demanding needs of modern businesses. With features like fast charging, IoT integration, and a modular design, businesses can optimize energy use, reduce operational costs, and ensure uninterrupted power supply. As commercial and industrial sectors move toward more sustainable and cost-effective energy solutions, Yukinova’s ESS stands out as the perfect choice to meet the future energy needs of businesses.

Original Source:- https://lithiumionbatterysupplier.blogspot.com/2025/02/yukinovas-ess-for-commercial-industrial.html

#battery manufacturer#lithium ion batteries#battery supplier#yukinovabattery#ESS for Commercial & Industrial Applications

0 notes

Text

The United States battery market size reached US$ 21.08 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 70.75 Billion by 2032, exhibiting a growth rate (CAGR) of 13.50% during 2024-2032. The rapid proliferation of electric vehicles (EV), integration of renewable energy sources, research and development (R&D) initiatives, adoption of compact and high-intensity portable batteries and the growing need for backup power solutions represent some of the key factors driving the market.

#United States Battery Market Report by Type (Primary Battery#Secondary Battery)#Product (Lithium-ion#Lead Acid#Nickel Metal Hydride#Nickel Cadmium#and Others)#Application (Automotive Batteries#Industrial Batteries#Portable Batteries)#and Region 2024-2032

1 note

·

View note

Text

The Rise of Lithium-Ion Battery Recycling: Market Insights and Opportunities

As the world transitions to a greener future, lithium-ion batteries (LIBs) have become indispensable in powering everything from electric vehicles (EVs) to portable electronics. However, with the exponential rise in LIB usage, the demand for sustainable end-of-life solutions is growing rapidly. Enter the lithium-ion battery recycling market—a critical component of the circular economy that addresses environmental concerns, resource scarcity, and economic opportunities.

Why is Lithium-Ion Battery Recycling Important?

Lithium-ion batteries contain valuable metals like lithium, cobalt, nickel, and manganese, which are finite resources. Traditional mining for these materials is energy-intensive and environmentally taxing. Recycling not only reduces dependence on mining but also mitigates the environmental hazards posed by improperly discarded batteries, such as soil contamination and toxic leaks.

Additionally, recycling plays a pivotal role in meeting the increasing demand for raw materials. With the EV market projected to grow significantly, ensuring a stable and sustainable supply of battery materials is crucial.

Market Overview and Trends

1. Market Size and Growth

The global lithium-ion battery recycling market has experienced substantial growth in recent years and is projected to continue on this trajectory. Factors driving growth include government regulations promoting sustainable practices, advancements in recycling technology, and a surge in EV adoption. The Lithium-ion Battery Recycling Market is projected to grow from an estimated USD 3.25 billion in 2024 to USD 8.97 billion by 2029, reflecting a compound annual growth rate (CAGR) of 22.49% over the forecast period.

2. Regional Insights

Asia-Pacific: Leading the market due to high EV adoption rates, significant battery manufacturing capacities, and government incentives for recycling.

North America: Driven by strict environmental regulations and investments in sustainable infrastructure.

Europe: Strong focus on circular economy principles and robust policy frameworks, such as the EU Battery Directive.

3. Technology Advancements

Emerging recycling technologies, such as hydrometallurgy and direct recycling, are improving the efficiency and cost-effectiveness of material recovery. These advancements are making it easier to reclaim high-value materials with minimal environmental impact.

Challenges in the Recycling Industry

Despite its potential, the lithium-ion battery recycling market faces several challenges:

Collection and Transportation: Developing efficient systems to collect end-of-life batteries is complex, given the geographical dispersion and diverse applications.

Economic Viability: While the value of recovered materials is high, the costs of recycling can sometimes outweigh the profits without government subsidies or economies of scale.

Technological Barriers: Current recycling methods have limitations in recovering certain materials at high purity levels.

Opportunities in the Market

The challenges also present opportunities for innovation and growth:

Policy Support: Governments worldwide are introducing regulations and incentives to encourage recycling. For instance, extended producer responsibility (EPR) schemes are compelling manufacturers to invest in recycling solutions.

Collaboration Across Industries: Partnerships between battery manufacturers, EV makers, and recycling firms can drive efficiencies and create closed-loop supply chains.

Startup Ecosystems: Numerous startups are developing cutting-edge technologies to enhance recycling efficiency and scalability. These innovations are attracting substantial investments.

Key Players in the Market

The lithium-ion battery recycling market is highly competitive, with both established companies and startups vying for a share. Notable players include:

Umicore: A leader in recycling technology with a focus on high-value material recovery.

Li-Cycle: A North American company specializing in eco-friendly hydrometallurgical processes.

Battery Resourcers: Known for direct recycling techniques that restore battery-grade materials for reuse.

The Road Ahead

The lithium-ion battery recycling market is set to play a pivotal role in the global energy transition. As industries and governments prioritize sustainability, investing in robust recycling systems will become imperative. Innovations in technology, combined with supportive policies, will be the key drivers of growth.

For businesses and investors, the LIB recycling industry presents a unique opportunity to contribute to a sustainable future while capitalizing on a rapidly expanding market. By addressing existing challenges and fostering collaboration, the industry can unlock its full potential and ensure that the batteries of today power a greener tomorrow. For a detailed overview and more insights, you can refer to the full market research report by Mordor Intelligence: https://www.mordorintelligence.com/industry-reports/lithium-ion-battery-recycling-market

#Lithium-Ion Battery Recycling Market#Lithium-Ion Battery Recycling Industry#Lithium-Ion Battery Recycling Market Size#Lithium-Ion Battery Recycling Market Share#Lithium-Ion Battery Recycling Market Analysis#Lithium-Ion Battery Recycling Market Report

0 notes

Text

Asia-Pacific Lithium-Ion Battery Recycling Market | BIS Research

According to BIS Research, the Asia-Pacific lithium-ion battery recycling market was valued at $2,304.7 million in 2023, and it is expected to grow at a CAGR of 21.85% and reach $16,629.5 million by 2033 during the forecast period of 2023-2033.

#APAC Lithium-Ion Battery Recycling Market#APAC Lithium-Ion Battery Recycling Industry#APAC Lithium-Ion Battery Recycling Market Report#APAC Lithium-Ion Battery Recycling Market Analysis#Asia-Pacific Lithium-Ion Battery Recycling Market#Asia-Pacific Lithium-Ion Battery Recycling Industry#Asia-Pacific Lithium-Ion Battery Recycling Market Report#Asia-Pacific Lithium-Ion Battery Recycling Market Analysis

1 note

·

View note

Text

Robocraft Store

Robocraft is a leading supplier of lithium ion battery (LION Cell Energy) from ahmedabad, india. We offer other electronics accessories like batteries & chargers, electric vehicle spare parts, e-bike motors and controllers, wireless solutions, robot parts, sensors, industrial power supply , ev kits, sensors, stepper motors and controllers, automation control and cnc machine parts.

Our industry provide different batteries like LiFePO4 Battery, Prismatic Battery, Lead Acid Battery and Lithium Polymer Battery.

You can check our website robocraftstore.com or contact us on 9429230946.

#lithium ion battery#mppt charge controller#electric vehicle spare parts#e bike batteries#ebike motor#electric bike charger#lithium battery chargers#volt ebike battery#battery bike charger#controller e rickshaw#wireless solutions#industrial power supply#automation control and cnc machine parts#e-bike motors and controllers

0 notes

Text

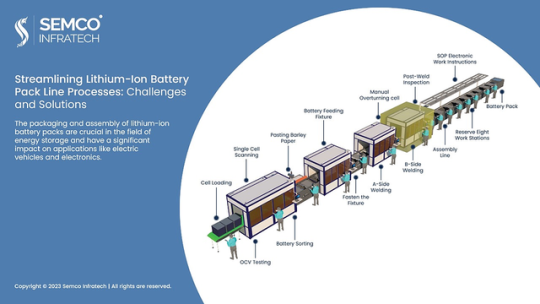

Streamlining Lithium-Ion Battery Pack Line Processes: Challenges and Solutions

The packaging and assembly of lithium-ion battery packs are crucial in the field of energy storage and have a significant impact on applications like electric vehicles and electronics.

The pack line process consists of three main phases: production, assembly, and packaging.

The pack is a complex system comprising battery packs, shunts, soft connections, protective boards, outer packaging, output components (such as connectors), insulating materials like barley paper, plastic brackets, and other auxiliary materials. These components come together to form a complete pack unit. This blog discusses the challenges faced in the Lithium-Ion Battery Pack Line Processes and offers potential solutions.

The Core Functions of a Pack Line

A typical production line for battery packs serves two main purposes: transmission and testing. In the industry, it is common to use semi-automatic assembly lines for pack production. These lines handle tasks such as launching, offline operations, testing, in-plant transmission, and packaging. The processes involved in a lithium battery pack production line are relatively simple, including feeding, attaching brackets, welding, and conducting thorough testing, among other steps.

Challenges in Meeting Pack Line Requirements

Highly Customized Demands: The power battery system pack requires targeted research and development tailored to the specific requirements of vehicle manufacturers. Each automaker has unique specifications and needs, leading to a high degree of customization in the assembly process. These drive increased demand for automated production lines that can efficiently adapt to these variations.

Stringent Safety and Stability Prerequisites: The core challenge in creating a power battery system pack lies in accommodating the customized market demands of different vehicle models. This customization process addresses various aspects, including BMS design, thermal management, space constraints, structural strength, system interfaces, IP ratings, and safety measures. These custom requirements are vital for ensuring the safety and stability of the battery pack.

Precise Control of Production Rate: Modern battery pack production requires a different approach to maintain a high and efficient production rate while meeting market supply and demand. This involves refining the process to manage the “whole line beat,” focusing on average workstation working time rather than a sequential production line.

Enhanced Compatibility: The evolving lithium battery industry adds complexity to the production process. With non-standardized modules, incoming cells, shells, PCB boards, and connecting components, compatibility across the production line becomes crucial. Adapting to these changes and ensuring efficiency and compatibility is vital.

Embracing Automation and Innovation: In response to the growing lithium power industry, leaders are expanding production capacity, optimizing pack line processes, and incorporating smart technologies. This includes integrating intelligent equipment, robotic arms, collaborative robots, mobile robots, and other advanced technologies to improve efficiency.

The lithium battery manufacturing process requires highly reliable, stable, and precise equipment for process control. It also demands intelligent data processing capabilities for effective production data management. This drives the need for automation and intelligent upgrades to meet the evolving demands of the industry.

As the energy storage landscape evolves, automating and enhancing pack line processes is crucial to ensure reliable, stable, and precise equipment. This streamlines production for the intelligent and data-driven future of lithium-ion battery manufacturing.

#Battery cell assembly#Battery management systems#EV battery pack production line#lithium battery industry#lithium-ion battery#lithium-ion battery industry#lithium-ion battery pack#lithium-ion battery pack line#Lithium-ion battery pack assembly#Lithium-ion cell sorting and packaging

0 notes

Text

Europe Lithium-Ion Battery Recycling Market, Key Players, Market Size, Future Outlook | BIS Research

A lithium-ion battery (Li-ion battery) is a type of rechargeable battery that uses lithium ions as the primary component of its electrochemistry.

During discharge, lithium ions move from the negative electrode (typically made of graphite) to the positive electrode (commonly made of a lithium compound) through an electrolyte.

The Europe lithium-ion battery recycling market was valued at $775.6 million in 2023, and it is expected to grow at a CAGR of 18.73% and reach $4,316.5 million by 2033.

Europe Lithium-Ion Battery Recycling Overview

A lithium-ion battery is a rechargeable energy storage system that has become a cornerstone of modern electronics, powering everything from smartphones and laptops to electric vehicles and renewable energy grids.

Lithium-ion batteries are known for their high energy density, meaning they can store a significant amount of energy relative to their size and weight. This makes them ideal for portable devices and electric vehicles, where both space and energy efficiency are crucial.

Key Features for Europe Lithium-Ion Battery Recycling Market

1 High Energy Density:Lithium-ion batteries offer a high energy-to-weight ratio, enabling them to store more energy in a compact form

2 Rechargeable:These batteries are designed for multiple charge and discharge cycles, making them highly durable for long-term use.

3 Low Self Discharge:Lithium-ion batteries have a low self-discharge rate, meaning they lose very little energy when not in use. This makes them efficient for standby applications and long-term storage

4 Light Weight: Lithium-ion batteries are significantly lighter compared to other battery chemistries like lead-acid or nickel-cadmium, making them a preferred choice for mobile and portable applications.

5 Long Cycle Life: Lithium-ion batteries have a longer lifespan compared to other rechargeable batteries. They can endure many charge and discharge cycles before experiencing noticeable capacity degradation.

Grab a look at our report page click here!

Market Drivers

Growth in Electric Vehicle Adoption

(i) EV Market Expansion: Europe is one of the largest markets for electric vehicles, driven by aggressive carbon emission reduction targets.

(ii) Government Incentives: Many European governments offer incentives, subsidies, and tax benefits for EV buyers, boosting battery demand.

Sustainability and Environmental Regulation

(i) Strict Emission Norms: The EU has implemented stringent regulations to reduce CO2 emissions from vehicles, encouraging a shift from internal combustion engines to electric mobility, thereby driving the demand for lithium-ion batteries.

(ii) Circular Economy Initiatives: Europe’s focus on sustainable resource use and recycling is driving research into battery recycling, which promotes the demand for lithium-ion batteries with longer life cycles.

Expansion of Renewable Energy Storage

(i) Energy Transition: The European Union is transitioning towards renewable energy sources like solar and wind.

(ii) Grid Decarbonization: Battery storage solutions help manage intermittent renewable energy, playing a critical role in Europe's strategy to achieve carbon neutrality by 2050.

Growing Consumer Electronics Market

(i) Smart Devices and Electronics: The rising demand for portable electronics, such as smartphones, laptops, and wearable devices, continues to drive the demand for lithium-ion batteries. Europe remains a key market for these consumer electronics.

Market Segmentation

(i) By Battery Chemistry

Lithium-Cobalt Oxide (LCO)

Lithium-Nickel Manganese Cobalt (Li-NMC)

Lithium-Manganese Oxide (LMO)

Lithium-Iron Phosphate (LFP)

(ii) By Source

Automotive

Non-Automotive

Consumer Electronics - a) Energy Storage Systems , b) Others

(iii) By Recycling Process

Hydrometallurgy

Pyrometallurgy

Direct Recycling

(iv) By Country

Germany

France

Italy

U.K.

Rest of Europe

Grab a look at our sample page click here!

Key Companies

ACCUREC-Recycling GmbH

Duesenfeld

Fortum

Glencore

Umicore

And many others

Visit our Advanced Materials and Chemical Vertical Page !

Future of Europe Lithium-Ion Battery Recycling Market

The key trends and drivers for lithium ion battery market affecting the future of lithium ion battery market is as follows

Boom in Electric Vehicles

Resource Scarcity and Supply Chain Security

Economic Viability and Cost Efficiency

Second Life Batteries

The lithium-ion battery recycling market is poised for rapid growth in the coming years, driven by the increasing use of batteries in various sectors, regulatory pressures, and the need for sustainable resource management.

Conclusion

The Europe lithium-ion battery market is on a strong growth trajectory, driven by the increasing adoption of electric vehicles, expanding renewable energy capacity, and the region’s commitment to reducing carbon emissions.

As demand for energy storage solutions in automotive, industrial, and consumer electronics sectors continues to rise, the lithium-ion battery market will play a pivotal role in Europe’s transition towards a greener economy

#Europe Lithium Ion Battery Recycling Market#Europe Lithium Ion Battery Recycling Report#Europe Lithium Ion Battery Recycling Industry

0 notes

Text

0 notes

Text

Lithium-Ion Battery Market Size, Share, Growth and Industry Trends 2024 - 2030

The global lithium-ion battery market size was estimated at USD 54.4 billion in 2023 and is projected to register a compound annual growth rate (CAGR) of 20.3% from 2024 to 2030.

Automotive sector is expected to witness significant growth owing to the low cost of lithium-ion batteries. Global registration of electric vehicles (EVs) is anticipated to increase significantly over the forecast period. The U.S. emerged as the largest market in North America in 2023. Increasing EV sales in the country owing to supportive federal policies coupled with the presence of several players in the U.S. market are expected to drive product demand. Federal policies include the American Recovery and Reinvestment Act of 2009, which established tax credits for purchasing electric vehicles.

New Corporate Average Fuel Economy (CAFE) standards mandated fuel economy standards for passenger cars and Light Commercial Vehicles (LCVs) resulting in the expansion of electric drive technologies. Increasing product demand in smartphones owing to their extended shelf life and enhanced efficiency is expected to drive market growth. The increasing demand for EVs owing to growing consumer awareness about carbon emissions is expected to fuel market growth. A decline in the demand for lead-acid batteries, owing to EPA regulations on lead contamination and resulting environmental hazards coupled with regulations on lead-acid battery storage, disposal, and recycling, has led to an increase in the demand for Li-ion batteries in automobiles. Mexico has been a center of the global automotive industry as companies worldwide are eyeing to invest here.

Gather more insights about the market drivers, restrains and growth of the Lithium-Ion Battery Market

Lithium-ion Battery Market Report Highlights

• In 2022, the consumer electronics application segment held the largest revenue share of over 39.13%. Portable batteries are incorporated in portable devices and consumer electronic products. The applications of portable batteries include mobile phones, laptops, computers, tablets, and other wearable devices

• In 2022, the LCO product segment accounted for the largest revenue share of over 31.17%. High demand for LCO batteries in mobile phones, tablets, laptops, and cameras on account of their high energy density and high safety level is expected to augment the market growth over the forecast period

• The U.S. emerged as the largest market in North America in 2021. Increasing electric vehicle sales in the country owing to supportive federal policies, coupled with the presence of several players in the U.S. market, are expected to drive the demand for lithium-ion batteries

• In CSA, lithium-ion batteries are frequently used battery types for Electrical Energy Storage (EES) owing to applications including stand-alone systems with PV, emergency power supply systems, and battery systems for the mitigation of output fluctuations from wind and solar power

• In Brazil, the government is taking various initiatives to support the electric vehicle market by exempting annual car ownership tax and import tax on electric vehicles. This is expected to fuel the demand for lithium-ion batteries over the coming years

Browse through Grand View Research's Conventional Energy Industry Research Reports.

• The global digital oilfield market size was valued at USD 27.4 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2030.

• The global energy harvesting system market size was valued at USD 452.2 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 10.2% from 2020 to 2028.

Lithium-ion Battery Market Segmentation

Grand View Research has segmented the global lithium-ion battery market report based on product, application and region

Lithium-ion Battery Product Outlook (Volume, GWh; Revenue, USD Billion, 2018 - 2030)

• Lithium Cobalt Oxide (LCO)

• Lithium Iron Phosphate (LFP)

• Lithium Nickel Cobalt Aluminum Oxide (NCA)

• Lithium Manganese Oxide (LMO)

• Lithium Titanate

• Lithium Nickel Manganese Cobalt (LMC)

Lithium-ion Battery Application Outlook (Volume, GWh; Revenue, USD Billion, 2018 - 2030)

• Automotive

• Consumer Electronics

• Industrial

• Energy Storage Systems

• Medical Devices

Lithium-ion Battery Regional Outlook (Volume, GWh; Revenue, USD Billion, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Russia

o Spain

o France

o U.K.

o Germany

o Italy

• Asia Pacific

o China

o India

o Japan

o South Korea

o Australia

• Central & South America

o Brazil

o Paraguay

o Columbia

• Middle East & Africa

o South Africa

o UAE

o Egypt

o Saudi Arabia

Order a free sample PDF of the Lithium-Ion Battery Market Intelligence Study, published by Grand View Research.

#Lithium-Ion Battery Market#Lithium-Ion Battery Market size#Lithium-Ion Battery Market share#Lithium-Ion Battery Market analysis#Lithium-Ion Battery Industry

0 notes

Text

"It seems like a new Silicon Valley startup could change the face of the battery industry forever by utilizing 3D printers to print solid-state batteries.

Solid-state batteries have advantages over lithium-ion because they aren’t flammable, they’re more easily recycled, work in extreme cold, and have greater energy density.

Solid-state batteries have traditionally been difficult to machine manufacture. But by using 3D printing arrays filled with powder, Sakuu systems can make these batteries not only using 40% less material, but in almost any shape the customer might want.

An electric bike could be powered by a battery that hugs a section of the central chassis, or a smartphone’s battery could run all the way around the frame of a circuit board. These unorthodox shapes are just one of the many advantages that Sakuu believe they can offer.

“Many people have built cells in the lab, but they have not been able to scale,” Sakuu CEO and founder Robert Bagheri told Fast Company. “Our vision started with that scalability in mind.”

The array, known as a Kavian, is much smaller than the traditional, “roll to roll” battery manufacturing methods, and because the powder loaded into the 3D printers can be extremely precise, there’s a 40% reduction in materials usage—a huge cost savings over competitors.

The batteries they print can be charged to 80% in just 15 minutes.

Because they can be printed in any shape, all kinds of clever innovations are possible, in all kinds of industries from e-mobility products to wearables and small devices. The company is even working with an aviation company that wants solid-state batteries for their aircraft with holes through the middle of it to help with heat management."

-via Good News Network, 2/27/23

#battery#batteries#tech industry#electricity#recycling#3d printing#lithium ion battery#good news#hope

169 notes

·

View notes