#liquidating receivership

Text

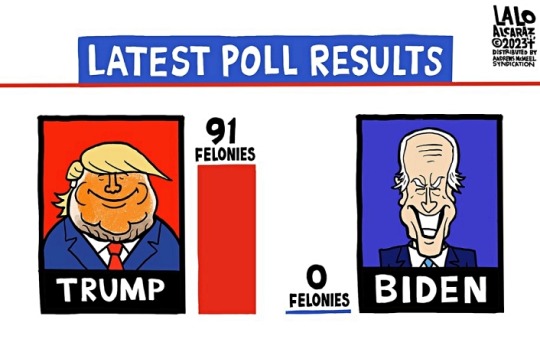

Trump's problems with the law are not limited to the 91 felony counts in the four indictments mentioned in the cartoon.

Trump’s business empire could collapse ‘like falling dominoes’ after ruling

According to Michael Cohen, his former attorney and fixer, Trump is already effectively “out of business” in New York after Judge Arthur Engoron on Tuesday rescinded the licenses of the Trump Organization and other companies owned by Trump and his adult sons, Eric and Don Jr.

“Those companies will end up being liquidated … the judge has already determined that the fraud existed,” Cohen told CNN, hailing Engoron’s pretrial ruling in a civil case brought by Letitia James, the New York attorney general.

On Wednesday morning, in a confrontational post on his Truth Social website that branded the judge a “political hack”, Trump said Engoron “must be stopped”.

At a hearing on Wednesday afternoon, Trump’s legal team asked Engoron if his ruling meant Trump’s assets and businesses must be sold, or if they could continue to operate under receivership.

Engoron said he would address the issue at the non-jury trial beginning on 2 October, and extended to 30 days his original 10-day deadline for both parties to suggest names to act as receivers for the various companies.

The lawyers have said they will appeal the rescinding of the licenses, the appointment of receivers, and Engoron’s assertion that Trump and executives lived in a “fantasy world” of routinely, repeatedly and illegally overvaluing property values and his personal net worth to gain favorable loan terms and reduced insurance premiums.

But if the appeals are unsuccessful, the collapse of the Trump empire, upon which the former reality TV host staked his reputation as a successful business tycoon, could be imminent.

Trump's undeserved reputation as a brilliant businessman has more to do with his defunct TV show than with real life. So-called "reality shows" seldom have anything to do with everyday reality.

Trump's had six bankruptcies – and if he didn't get a huge amount of money from his wealthy father, he'd be lucky to own even a bodega in Queens.

At least in New York State, the Trump Organization may now be going out of business.

#donald trump#trump's legal problems#trump's four indictments#trump's 91 counts of felonies#trump's collapsing businesses#the trump organization#trump's 6 bankruptcies#lock him up!#arthur engoron#michael cohen#lalo alcaraz

12 notes

·

View notes

Text

Strategies for Effective Receivership Implementation

Receivership is a powerful legal remedy used in situations where a company or property is in distress, typically due to financial difficulties or legal disputes. A receiver is appointed by the court to manage the assets of the entity in question, with the goal of protecting and preserving value for creditors, stakeholders, and other interested parties. Effective receivership implementation requires careful planning, strategic execution, and a deep understanding of the legal, financial, and operational aspects of the process. This article outlines key strategies for successfully implementing receivership.

Understanding the Role of a Receiver

The first step in effective receivership implementation is understanding the receiver's role and responsibilities. The receiver acts as a neutral third party appointed by the court to manage, protect, and sometimes liquidate the assets of a distressed entity. The receiver’s primary objective is to maximize the value of the assets for the benefit of creditors and stakeholders while ensuring compliance with legal and regulatory requirements.

Conducting a Thorough Assessment

Before taking any action, the receiver must conduct a thorough assessment of the entity’s financial and operational condition. This involves reviewing financial statements, contracts, assets, liabilities, and other relevant documents. The goal is to gain a comprehensive understanding of the entity’s current situation, identify any potential risks or challenges, and develop a strategic plan for managing the receivership.

The assessment should also include a valuation of the entity’s assets, which will help determine the best course of action, whether that involves continuing operations, restructuring, or liquidating assets. In some cases, the receiver may also need to evaluate the viability of the entity’s business model and consider alternative strategies for maximizing value.

Prioritizing Stakeholder Interests

Clear and consistent communication with stakeholders is essential for maintaining trust and ensuring transparency throughout the receivership process. The receiver should regularly update stakeholders on the status of the receivership, including any significant developments or changes to the strategic plan. By fostering open communication, the receiver can minimize uncertainty and build confidence among stakeholders.

Managing Operations During Receivership

Suppose the distressed entity continues to operate during receivership. In that case, the receiver must take on the role of an interim manager, overseeing day-to-day operations and making critical decisions to stabilize the business. This may involve cutting costs, renegotiating contracts, and implementing operational improvements to enhance efficiency and profitability.

In some cases, the receiver may need to make difficult decisions, such as laying off employees, closing unprofitable divisions, or selling non-core assets. These decisions should be made with the goal of preserving value and positioning the entity for a successful resolution, whether that involves a sale, restructuring, or liquidation.

Navigating Legal and Regulatory Requirements

Receivership is a legal process, and as such, the receiver must navigate a complex web of legal and regulatory requirements. This includes complying with court orders, adhering to statutory duties, and ensuring that all actions taken during the receivership are legally sound. To effectively manage these responsibilities, the receiver should work closely with legal counsel to ensure compliance with applicable laws and regulations. This collaboration is essential when dealing with issues such as asset sales, creditor claims, and disputes that may arise during the receivership.

Effective Asset Liquidation

In many cases, the receivership will involve the liquidation of the distressed entity’s assets to repay creditors. Effective asset liquidation requires a strategic approach to maximize the value of the investments and minimize the impact on stakeholders. The receiver should carefully evaluate the market for each asset and determine the best method for liquidation, whether through an auction, private sale, or other means. It is also essential to consider the timing of the sale, as market conditions can significantly impact the proceeds from liquidation.

Reporting and Accountability

The receiver is accountable to the court and must regularly report on the status of the receivership. These reports should provide detailed information on the actions taken, the entity's financial performance, and the progress made toward achieving the receivership objectives.

Accurate and timely reporting is essential for maintaining the confidence of the court and stakeholders. The receiver should be prepared to provide explanations and justifications for all decisions and actions taken during the receivership, demonstrating that they are in the best interests of creditors and stakeholders.

Effective receivership implementation requires a strategic, systematic approach that balances the interests of all stakeholders while adhering to legal and fiduciary duties. By conducting a thorough assessment, developing a strategic plan, and prioritizing communication and transparency, receivers can successfully navigate the complexities of the receivership process. Whether managing operations, liquidating assets, or resolving legal issues, the receiver’s ultimate goal is to maximize value and achieve a successful resolution for all parties involved.

0 notes

Text

TMON, WeMakePrice file for court receivership amid liquidity crisis

View On WordPress

0 notes

Text

Article 1356

Contracts shall be obligatory, in whatever form they may have been entered into, provided all the essential requisites for their validity are present. However, when the law requires that a contract be in some form in order that it may be valid or enforceable, or that a contract be proved in a certain way, that requirement is absolute and indispensable. In such cases, the right of the parties stated in the following article cannot be exercised. (1278a)

Contracts are binding upon the contracting parties in whatever form they may have been entered into as long as all the essential requisites for their validity are present. However, when can we consider form as essential requisite of a contract?

The form of a contract is essential:

When the law requires that a contract be in certain form for its validity; (refers to solemn or formal contracts).

When the law requires that a contract be in certain form for its enforceability. (refers to the agreements covered by the Statute of Frauds. (Art. 1403, par 2.)

Case Related/Cited

Far Eastern Bank v PDIC

On July 5, 1985, the Central Bank of the Philippines placed Pacific Banking Corporation (PBC) under receivership through Monetary Board (MB) Resolution No. 699.

On October 28, 1985, the Central Bank invited banks to submit proposals for the purchase of PBC's assets and franchise.

FEBTC submitted its bid on November 14, 1985, which included the purchase of both non-fixed and fixed assets of PBC, as described in the Asian Appraisal Report of August 1984.

The Central Bank accepted FEBTC's bid through MB Resolution No. 1234 on November 22, 1985.

On April 16, 1986, a Memorandum of Agreement (MOA) was executed among FEBTC, PBC, and the Central Bank, with PBC represented by Liquidator Renan V. Santos.

The MOA specified that the parties would execute an absolute purchase agreement covering all PBC assets, including non-fixed and fixed assets.

The Purchase Agreement (PA) executed on October 24, 1986, covered only the non-fixed assets.

FEBTC took possession of the fixed assets and sought the execution of deeds of sale, which Liquidator Santos initially supported but failed to finalize.

PDIC, as the new liquidator, contended that the fixed assets should be purchased at their present appraisal value, higher than the sound value.

FEBTC filed a motion before the Regional Trial Court (RTC) to compel the execution of deeds of sale for the fixed assets.

The RTC ruled in favor of FEBTC, directing PDIC to execute the deeds of sale at the sound values stated in the Asian Appraisal Report.

PDIC appealed, and the Court of Appeals (CA) reversed the RTC's decision, leading FEBTC to seek a review from the Supreme Court.

Issue:

WON the FEBTC can validly compel the PDIC to execute the deed of sale over the fixed assets?

Ruling:

The Supreme Court ruled that there was a perfected contract of sale over the disputed fixed assets.

The Supreme Court found that the fixed assets were not submitted as collaterals to the Central Ban...(Unlock)

Ratio:

The Supreme Court emphasized that a contract of sale is perfected upon the meeting of the minds of the parties on the essential elements of the contract, i.e., consent, object, and consideration.

The Court found that these elements were present in the MOA, which incorporated FEBTC's bid to purchase PBC's fixed and non-fixed assets.

The MOA and PA confirmed the essential terms, including the valuation and manner of payment for the fixed assets.

0 notes

Text

From one of Canada's tallest condo towers to bare tracts of land, residential development projects across the country are increasingly being pushed into receivership. Elevated interest rates, construction costs and delays, and a slower real estate market are all contributing to the rising frequency of projects coming under financial stress, say experts.

Receiverships are a way for secured lenders to have the court appoint someone to take control of the property and either liquidate it or otherwise maximize the value of the assets.

While often thought of as a last resort, CBRE has seen an increase in receiverships as bigger construction projects with multiple mortgages and parties involved start to run into trouble.

That was the case in Kitchener, Ont., where creditors filed for receivership against the owners of the Elevate Condominiums project, planned as four towers. By the time the filing was made in October, construction crews had already left the site, leaving it 80 percent done but not weather-sealed. A December report found that the owners had a mere $300 in the bank when the receiver order went through and owed over $100 million.

Creditors on a planned 55-story condo tower in downtown Vancouver filed for receivership in mid-January, including BMO, seeking repayment of more than $82 million in loans. Some projects run into trouble even after construction is complete. Duca Financial Services Credit Union Ltd. filed an application on Jan. 19 against a Mizrahi Inc. condo project at 128 Hazelton Ave. in Toronto, seeking repayment of its $16-million loan.

While the largest developers can generally still secure funding, smaller ones are finding it hard to get more money as the second-tier lenders they often rely on become more cautious, said Czestochowski.

Ontario has seen the bulk of receiverships in recent months; in the past year, the process has been applied to everything from a historic bank building in Saint John, N.B., to a fire-plagued apartment in Winnipeg. High-rises are white, given all the challenges and delays these projects present.

The One, an 84-story building under construction in Toronto that Mizrahi Inc. is also developing, is the most high-profile project to face receivership recently. Filed in October, court documents showed the developer has $1.7 billion in debt and expects construction to be finished two years late and $600 million over budget.

Other notable developments include creditors pushing in November to have receiverships put in place on at least five projects by Vandyke Properties covering more than 1,700 units in the Greater Toronto Area, some already under construction, with claimed debts topping $200 million.

Receivership is available to secured creditors to recoup their money when borrowers default. The focus of the process is to maximize the value, said Dan Wootton, a partner at Grant Thornton's restructuring practice, so it could mean completing the project with the existing developer, as is the case with The One, or just trying to sell as-is.

Lenders will generally try to work with borrowers, and there will often be more than one missed payment before the route is taken.

In December, a B.C. judge denied a request to leave Coromandel Group with about $700 million in secured debt across 16 properties. The decision to deny it was based on some of the properties already in their receivership. When approved, a receiver will assess what it would cost to finish the project and compare that against how much a developer can expect to bring in with the sale of units. When that works out to a shortfall because of higher-than-anticipated costs.

Buyers are sometimes given the option to pay more for projects. They are also getting into trouble because buyers can no longer qualify for a mortgage at the higher price, forcing developers to try and resell them in a quieter market. Trying to resell whole projects is difficult in this market, as many are.

The last time receiverships were this bad was likely in the early 1990s, she said, but the overall market is at least still more active than back then, with interest still coming in on potential receivership sales. The market, though, still has some ways to go before a recovery, said White.

The divers of Newfoundland's Clean Harbour Initiative are usually pulling trash from the ocean, but they recently got to help secure an ancient shipwreck found near Cape Ray, which could shed light on the mystery of where it came from. The ragged, overturned hull emerged last week off of Cape Ray, on the shore of J.T. Cheeseman Provincial Park.

Residents have quickly sprung into action to find ways to secure the vessel in the water so they can keep it in place and learn more about it. That's when the Clean Harbour Initiative, which was working in nearby Port aux Basques, got involved.

Croft estimates the vessel is about 30 meters long and nine or 10 meters wide. It's lying upside down on the ocean floor, he added and has copper and brass spikes sticking out of the ship's keel.

Croft said it's tough to tell how old the boat is, but said the vessel looks to be made of solid oak that is covered in a substance to waterproof it.

Members of the provincial government's archeology office are planning to visit the shipwreck on Saturday, according to a news release, where they'll take pictures and videos and collect samples of the ship's wood core. The release said it's too early to speculate if the ship is historically significant or where it could have originated from.

Croft hopes something can be done to preserve the vessel, saying it could serve as a tourism attraction for Cape Ray.

0 notes

Text

This article is featured in Bitcoin Magazine’s “The Withdrawal Issue”. Click here to subscribe now.A PDF pamphlet of this article is available for download.“The reason that we are focused on financial institutions and payment processors is because they are the so-called bottlenecks, or choke-points, in the fraud committed by so many merchants that victimize consumers and launder their illegal proceeds,” Bresnickat explained to the club. “We hope to close the access to the banking system that mass marketing fraudsters enjoy — effectively putting a choke hold on it…”This concerted effort, later labeled “Operation Choke Point”, targeted a wide range of business categories, including ammunition sales, drug paraphernalia, payday loans, dating services, pornography, telemarketing, tobacco sales, and government grants. This broad application of financial exclusion ultimately prompted multiple lawsuits and federal investigations into the conduct of both the DOJ and the Federal Deposit Insurance Corporation (FDIC), as well as harsh criticism from all corners.“The clandestine Operation Choke Point had more in common with a purge of ideological foes than a regulatory enforcement action”, wrote Frank Keating, a former governor of Oklahoma who served in the DOJ during the Reagan administration, in a 2018 editorial for The Hill. “It targeted wide swaths of businesses with little regard for whether legal businesses were swept up and harmed. In fact, that seemed to be the goal.”In 2017, the Trump administration’s DOJ wrote a letter to Congress indicating that Operation Choke Point was officially over. In 2018, the FDIC promised to limit its personnel’s ability to “terminate account relationships” and to put “additional training” into place for its examiners.But in the years since the federal government so blatantly demonstrated its interest in dictating access to banking services and its power to do so deliberately with little or no consequences, many feel that little has changed.

Bank Runs, With BiasOn March 8, 2023, it was announced that the cryptocurrency-focused institution Silvergate Bank would be voluntarily liquidated by its holding company. The bank had been focused on serving cryptocurrency clients since 2013 when its CEO Alan Lane first invested in bitcoin. In 2022, it had acquired the technology behind Meta’s failed stablecoin project, Diem, with hopes of launching its own dollar-backed token. As the cryptocurrency market declined in late 2022, marked by the collapse of one of its biggest clients in cryptocurrency exchange FTX, the bank’s stock price plummeted. It likely did not help that at the same time, U.S. Senators Elizabeth Warren, Roger Marshall, and John Kennedy asked Silvergate to disclose details of its financial relationship with collapsed cryptocurrency exchange FTX. Soon after, on March 10, 2023, almost ten years to the day from Bresnickat’s public detailing of Operation Choke Point, Silicon Valley Bank (SVB) was seized by the California Department of Financial Protection and Innovation and placed under FDIC receivership, marking what was then the second-largest bank failure in U.S. history. Since 2021, the bank had been increasing its long-term securities holdings but, as the market value of these assets deteriorated amid U.S. dollar inflation and Federal Reserve interest rate hikes, it was left with unrealized losses. Simultaneously, its customers, many of whom were prominent businesses within the cryptocurrency industry and were similarly strained by economic conditions, were withdrawing their money. On March 8, 2023, SVB announced that it had sold more than $21 billion worth of securities, borrowed another $15 billion, and was planning an emergency sale to raise yet another $2.25 billion. Perhaps unsurprisingly, this sparked a run on its remaining funds, totaling some $42 billion in withdrawals by March 9, 2023. On Sunday, March 12, state and federal authorities stepped in; customers of Signature Bank had withdrawn more than $10 billion.

Since 2018, Signature Bank had maintained a focus on cryptocurrency businesses, with some 30% of its deposits coming from the sector by early 2023. Signature Bank had also accrued a large proportion of uninsured deposits, worth some $79.5 billion and constituting almost 90% of its total deposits. It was holding relatively little cash on hand — only about 5% of its total assets (compared to an industry average of 13%) — so it was poorly prepared for a run on crypto-friendly banks spurred by SVB’s issues. On March 12, 2023, the New York State Department of Financial Services closed Signature Bank and placed it under FDIC receivership as it faced a mountain of withdrawal requests. At the time, this represented the third-largest bank failure in U.S. history.Following their seizures of SVB and Signature Bank, the U.S. Department of the Treasury, Federal Reserve, and FDIC described the takeovers as “decisive actions to protect the U.S. economy by strengthening public confidence in our banking system”. But others suggested the actions, particularly against Signature Bank, signified a blatant reemergence of the prejudice displayed during Operation Choke Point and connected to a larger effort to stymie cryptocurrency businesses.“I think part of what happened was that regulators wanted to send a very strong anti-crypto message”, Barney Frank, a Signature Bank Board member and former congressman who helped draft the seminal “Dodd-Frank Act” to overhaul financial regulation following the Great Recession, told CNBC in March 2023. “We became the poster boy because there was no insolvency based on the fundamentals.”Following an FDIC announcement that Flagstar Bank would assume all of Signature Bank’s cash deposits except for those “related to the digital-asset banking businesses”, the editorial board of The Wall Street Journal announced that Frank was right to call out this bias.��This confirms Mr. Frank’s suspicions — and ours — that Signature’s seizure was motivated by regulators’ hostility toward crypto”, the board wrote. “That means crypto companies will have to find another bank to safeguard their deposits. Many say that government warnings to banks about doing business with crypto customers is making that hard.”Targeting A New Choke PointPublic officials, financial professionals, and Bitcoin advocates had been pointing out an apparent bias against cryptocurrency businesses from the Biden administration well before the March 2023 bank runs. There were numerous policy events in the early part of 2023 to back up those sentiments.A January 3, 2023, “Joint Statement on Crypto-Asset Risks to Banking Organizations” from the Federal Reserve, FDIC, and Office of the Comptroller of the Currency (OCC) noted that, “The events of the past year have been marked by significant volatility and the exposure of vulnerabilities in the crypto-asset sector. These events highlight a number of key risks associated with crypto-assets and crypto-asset sector participants that banking organizations should be aware of…”, effectively serving to dissuade financial institutions from taking on those risks.A White House “Roadmap to Mitigate Cryptocurrencies’ Risks” released on January 27, 2023, indicated that the Biden administration sees the proliferation of cryptocurrencies as a threat to the country’s financial system and warned against the prospect of granting cryptocurrencies more access to mainstream financial products.“As an administration, our focus is on continuing to ensure that cryptocurrencies cannot undermine financial stability, to protect investors, and to hold bad actors accountable”, per the roadmap. “Legislation should not greenlight mainstream institutions, like pension funds, to dive headlong into cryptocurrency markets… It would be a grave mistake to enact legislation that reverses course and deepens the ties between cryptocurrencies and the broader financial system.”On February 7, 2023, the Federal Reserve pushed a rule to the Federal Register clarifying

that the institution would “presumptively prohibit” state member banks from holding crypto assets as principal in any amount and that “issuing tokens on open, public, and/or decentralized networks, or similar systems is highly likely to be inconsistent with safe and sound banking practices”.And on May 2, 2023, the Biden administration proposed a Digital Asset Mining Energy (DAME) excise tax, suggested as a way to force cryptocurrency mining operations to financially compensate the government for the “economic and environmental costs” of their practices with a 30% tax on the electricity they use.For Brian Morgenstern, the head of public policy at Riot Platforms, one of the largest, publicly traded bitcoin miners based in the U.S., these policy suggestions, updates, and rule changes clearly indicate a larger attempt to hinder Bitcoin advancement by targeting financial choke points.“The White House has proposed an excise tax on electricity use by Bitcoin mining businesses specifically — an admitted attempt to control legal activity they do not like, in the name of environmental protection”, Morgenstern explained in an interview with Bitcoin Magazine. “The only explanation for such inexplicable behavior is deep-rooted bias in favor of the status quo and against decentralization.”Collectively, this behavior could influence the conduct of regulated banks, just as the pressure applied by the DOJ in the 2010s unduly limited the businesses in its crosshairs back then. For many, it’s clear that Operation Choke Point has been reinstated.“‘Operation Choke Point 2.0’ refers to the coordinated effort by the Biden administration’s financial regulators to suffocate our domestic crypto economy by de-banking the industry and severing entrepreneurs from the capital necessary to invest here in America”, U.S. Senator Bill Hagerty, a member of the committees on banking and appropriations, told Bitcoin Magazine. “It appears that financial regulators have bought into the false narrative that cryptocurrency-focused businesses solely exist to facilitate or conduct illicit activities, and they seem blind to the opportunities for the potential innovations and new businesses that can be built.”

Pressure Where It HurtsIt may be fairly obvious how such a pressure campaign by federal regulators would hurt cryptocurrency-focused projects that depend on access to banks. But the larger ramifications of such financial prohibitions for retail customers and the advancement of Bitcoin in particular may not be.Why should proponents of Bitcoin, a decentralized financial rail designed to function outside of the legacy system, care about a choke point in regulated financial institutions?Caitlin Long, the founder of Custodia Bank, which is focused on bridging the gap between digital assets and legacy financial services, recognizes that for users in the U.S. to legitimately participate in Bitcoin, the regulatory landscape must be accommodating.“I’ve been working for years to help enable laws to be enacted, in multiple U.S. states and federally, precisely because in the absence of legal clarity about Bitcoin, legal systems can become attack vectors on Bitcoiners”, she said in an interview with Bitcoin Magazine. “All of us live under legal regimes of some sort, and we should be aware of legal attack vectors and work toward resolving them in an enabling way.”Long’s advocacy may best represent the potential that favorable or even just equitable financial access could mean for Bitcoin adoption and the advancement of its technology for everyone. Through her work, Custodia (then under the name Avanti) obtained a 2020 bank charter in its home state of Wyoming that made it a special-purpose depository institution capable of custodying bitcoin and other cryptocurrencies on behalf of clients. But, following a prolonged delay in approval of Custodia’s application for a master account with the Federal Reserve that would allow it to leverage the FedWire network and facilitate

large transactions for clients without enrolling intermediaries, Custodia filed a lawsuit against the Fed last year.“Operation Choke Point 2.0 is real — Custodia learned about its existence in late January when press leaks hit and reporters started calling Custodia to say they learned that all bank charter applicants at the Fed and OCC with digital assets in their business models, including Custodia, were recently asked to withdraw their pending applications”, Long said. “Reporters told us that the Fed’s vote on Custodia’s application would be a foregone conclusion before the Fed governors actually voted.”But, more than just stifling innovators who seek to build bridges between Bitcoin and legacy financial services, targeting the choke points of Bitcoin platforms will only push these platforms outside of the scope of regulators, giving those with malicious intent an advantage over those who are attempting to play by the rules.“Internet-native money exists. It won’t be uninvented”, Long added. “If federal bank regulators have a prayer of controlling its impact on the traditional U.S. dollar banking system, they will wake up and realize it’s in their interest to enable regulatory-compliant bridges. Otherwise, just as with other industries that the internet has disrupted — corporate media, for example — the internet will just go around them and they will face even bigger problems down the road.”As was laid bare by the collapse of cryptocurrency exchange FTX, Bitcoin is still very much tied to the world of cryptocurrency at large in the portfolios of investors and the eyes of most people around the world. Indeed, the revelations around FTX’s criminal operations have been a case in point for regulators who seek the financial prohibition of cryptocurrency businesses. But this very prohibition may have enabled FTX’s operators to fleece billions in customer funds: Based on a Caribbean island, the vast majority of FTX’s business was outside of the jurisdiction of U.S. regulators. As U.S. regulators limit the growth of domestic businesses, offshore alternatives like FTX benefit.And while many Bitcoiners may think that policymakers are powerless to determine the success of this permissionless technology, adverse or absent regulations can limit Bitcoin-specific businesses just as harshly as they do broader, cryptocurrency-related ones. In fact, it may be Bitcoin’s unique properties that make the current regulatory landscape such a daunting one for growth.“Bitcoiners should care about Operation Choke Point 2.0 because certain policymakers are trying to take away our ability to participate in the Bitcoin network”, Morgenstern argued. “Moreover, Bitcoin is different. It is not only the oldest and most tested asset in this space, it is perhaps the only one that everyone agrees is a digital commodity. That means the on-ramp for inclusion into any policy frameworks will have less friction inherently, and Bitcoiners need to understand this.”Relieving The Choke PointsReviewing the recent, hostile policy updates from federal regulators, it seems clear that Bitcoin is firmly entrenched along with “crypto” in their minds. And, Bitcoin proponents in particular will agree, many businesses focused on other cryptocurrencies are apt to hurt investors. But some in the Bitcoin sector think that more education could help underscore the distinctions between Bitcoin and altcoins, and better protect Bitcoin from more justified regulatory limits on manipulated tokens and vaporware. “Engage with your elected officials”, Morgenstern encouraged. “Help them understand that Bitcoin’s decentralized ledger technology is democratizing finance, creating faster and cheaper transactions and providing much-needed optionality for consumers at a time when the centralized finance system is experiencing distress. This will take time, effort and a lot of communication, but we must work together to help our leaders appreciate how many votes and how much prosperity is at stake.”Indeed,

for those elected officials who do recognize this bias as unduly harmful to innovation, continued advocacy from Bitcoin’s supporters is the best way out of the choke hold.“This isn’t an issue where people can afford to be on the sidelines anymore”, Hagerty concluded. “I encourage those who want to see digital assets flourish in the United States to make your voice heard, whether that is at the ballot box or by contacting your lawmakers and urging them to support constructive policy proposals.”This article is featured in Bitcoin Magazine’s “The Withdrawal Issue”. Click here to subscribe now.A PDF pamphlet of this article is available for download.

Source

0 notes

Text

For many years, our firm has been ranked among the leading law firms in the field of insolvency, including liquidation procedures, bankruptcies and receiverships of both individuals and companies. Adv. Avihai Vardi is appointed from time to time by the various courts as an official in various fields, including in the field of rehabilitation and rehabilitation of companies and individuals

#vardilaw#law firm#lawyers#insolvency#israel#law firm in israel#cooperate law#real easte#execution#banking

0 notes

Text

Bitcoin Reclaims $28000 As First Republic Bank Falters

Bitcoin Reclaims $28,000 As First Republic Bank Falters

https://bitcoinist.com/bitcoin-reclaims-28000-as-first-republic-bank/

Bitcoin price has been in an uptrend throughout 2023 in the wake of historic bank runs, but recently was rejected from above the key $30,000 level.

However, the top cryptocurrency has now risen more than $1,000 intraday to over $28,000 per coin after First Republic Bank shares collapsed. Holding a retest of previous levels combined with a new narrative could be extremely bullish for BTC. Here a closer look at how continued crisis in the banking sector could strengthen the increasingly positive price action.

Bitcoin Retakes $28,000 But Is More Upside Coming?

In the past few months, traditional banks have been struggling with issues of liquidity and insolvency, and Bitcoin has been a big beneficiary of this trend. In early March, Silicon Valley Bank and others saw widespread bank runs.

As a result, BTCUSD climbed more than 40% in just a few days. Now, as First Republic Bank’s shares plummet, and more than $100 million in deposits flee the bank, Bitcoin is soaring once again.

Although a $1,000 move is notable itself, importantly, Bitcoin retesting and holding a crucial support line could instill confidence in crypto bulls to push prices higher. Pullbacks would also be getting much less pronounced. Shallow corrections are a sign of buying pressure and demand

Bitcoin making fresh 2023 highs could also further signal crypto winter has ended and things will heat up un the coming weeks.

First Republic Bank Risks Failure, Reigniting New Crypto Narrative

First Republic Bank’s decline in share price is due to a negative first-quarter earnings report. The bank revealed that more than $100 million in deposits had been withdrawn in Q1.

CEO Mike Roffler announced that the bank would be “pursuing strategic options” and “taking steps to meaningfully reduce our expenses to align with our focus on reducing the size of the balance sheet.” The bank will be laying off up to a 25% of the workforce, cutting executive-level salaries, and much more.

Fox Business News’ Charles Gasparino claims bankers expect government receivership for First Republic Bank as “private sector solutions” fail to attract interest from buyers or investors.

As traditional banks continue to face financial crises, investors are turning to Bitcoin as a hedge against the instability of the financial system. This phenomenon highlights the growing acceptance of Bitcoin as a store of value and a reliable investment.

The BTC beats banks narrative could be just what the market needed. Holding the current levels and testing previous levels could be extremely bullish for Bitcoin, possibly leading to further price appreciation in the future.

Bitcoin is making another leg up against #FirstRepublicBank pic.twitter.com/XNaaEUL4Aq

— Tony "The Bull" (@tonythebullBTC) April 25, 2023

via Bitcoinist.com https://bitcoinist.com

April 26, 2023 at 02:03AM

0 notes

Text

Insolvency is a term used to describe the financial state of a company when it is no longer able to pay its debts as they fall due. It is a serious issue that can have a significant impact on the company and its stakeholders. In Ireland, insolvency can take various forms, including liquidation, receivership, examiner ship, and bankruptcy. In this blog, we will explore the impact of insolvency on companies in Ireland.

#debt settlement solutions in ireland#house repossession in ireland#personal debt solutions in ireland

0 notes

Text

SVB Financial Group Files for Chapter 11 Bankruptcy Protection to ‘Preserve’ Firm’s Value

On March 17, 2023, SVB Financial Group, the parent company of Silicon Valley Bank, filed for Chapter 11 bankruptcy protection in the Southern District of New York. The company stated that it is no longer associated with Silicon Valley Bank (SVB) after the Federal Deposit Insurance Corporation (FDIC) placed it into receivership last week.

3 SVB Entities Unaffected by Bankruptcy Filing; CEO Faces Scrutiny for Share Sale Before Silicon Valley Bank Collapse

On Friday, SVB Financial Group released a press release detailing its voluntary petition for a court-supervised reorganization under Chapter 11 bankruptcy protection. The announcement stated that the purpose of the filing is to preserve the remaining value of the company. The bankruptcy filing does not involve three entities, including the FDIC-operated bridge bank Silicon Valley Bank, N.A., SVB Securities, and SVB Capital’s funds.

The financial institution’s three verticals are still operating as they were before SVB was placed into FDIC receivership. SVB Financial Group stated that it holds “approximately $2.2 billion of liquidity” and has funded debt of “approximately $3.3 billion.” The financial company also has $3.7 billion of outstanding preferred equity, which will be utilized to evaluate strategic alternatives, as per the firm’s explanation.

“The Chapter 11 process will allow SVB Financial Group to preserve value as it evaluates strategic alternatives for its prized businesses and assets, especially SVB Capital and SVB Securities,” the chief restructuring officer for SVB Financial Group, William Kosturos, said in a statement. “SVB Capital and SVB Securities continue to operate and serve clients, led by their longstanding and independent leadership teams.” Kosturos continued:

SVB Financial Group will continue to work cooperatively with Silicon Valley Bridge Bank. We are committed to finding practical solutions to maximize the recoverable value for stakeholders of both entities.

The filing for Chapter 11 follows reports that Silicon Valley Bank CEO Greg Becker faces scrutiny for selling $3 million worth of SVB shares prior to the bank’s collapse. The Daily Mail reported that Becker and his wife flew first class to their residence in Maui, Hawaii after the bank failed. Becker, who had worked at SVB for over 30 years, was fired by U.S. president Joe Biden when the FDIC took over, along with SVB’s top lieutenants.

What impact do you think SVB Financial Group’s bankruptcy filing will have on the future of Silicon Valley Bank? Share your thoughts about this subject in the comments section below.

Read the full article

0 notes

Text

Signature Bank Was Seized After Leaders Caused ‘Crisis of Confidence’

According to New York officials, the government seized Signature Bank on Sunday after regulators lost faith in management.

A representative for the state's Department of Financial Services said in an email statement on Tuesday that the bank had failed to deliver trustworthy and consistent data, leading to a serious crisis of confidence in the bank's leadership. "Based on the bank's existing condition and capacity to conduct business in a safe and sound way on Monday, the decision was made to take possession of the bank and turn it over to the FDIC."

The Federal Deposit Insurance Corp. took over the company and established a bridge bank to serve customers after the DFS placed Signature into receivership. According to a person familiar with the situation, the third-largest bank failure in American history occurred as a result of a Friday increase in customer withdrawals totaling around 20% of the company's deposits.

Both a bridge bank spokesman and former CEO Joseph DePaolo did not immediately reply to requests for comment.

Former US congressman and member of Signature's board of directors Barney Frank claimed to have a different understanding of how things transpired.

In an interview, Frank stated, "I'm surprised. "That wasn't how I understood where we were," she said.

Frank claimed that although executives eventually managed to get control of the situation, data regarding the bank's balance sheet was volatile as management dealt with outflows. He claimed that although he wasn't directly involved in the discussions with regulators, executives had briefed him and the other members.

By Sunday morning, according to Frank, the bank's executives thought they had met the demand for the data and had obtained the necessary money from other sources as well as the discount window. He reaffirmed his conviction that the bank might have reopened on Monday and expressed his continued suspicion that the bank's readiness to interact with cryptocurrency companies was the cause of its shutdown.

A DFS representative claimed that the decision "had nothing to do with cryptocurrency" and noted that the organization "has been facilitating well-regulated crypto activity for several years, and is a national model for regulation of the space."

According to the former lawmaker, as of Sunday morning, deposit outflows had stabilized. Nonetheless, the DFS spokeswoman stated that "large withdrawal requests" would continue to be pending and increase throughout the weekend.

According to the individual with knowledge of the situation, Signature lost 20% of its deposits on Friday as customers fled to larger competitors after hearing about the failure of SVB Financial Group's banking division.

The individual, who wished to remain anonymous because they were talking about a personal situation, didn't give precise amounts for how much was taken from the bank. Yet, as of March 8, Signature claimed in a statement that it had deposits totaling about $89.2 billion. It would mean around $17.8 billion was removed in a single day. Contrarily, on Thursday, Silicon Valley Bank of SVB received withdrawal requests totaling $42 billion from investors and depositors, according to a regulatory filing.

According to the filing from last week, Signature has $26.4 billion in "marketable liquid securities" and $4.54 billion in cash on its balance sheet.

The unreported outflows give an idea of the difficulties regulators and bank executives faced over the weekend as federal authorities attempted to arrange liquidity solutions and reassure depositors.

Adrienne Harris, Superintendent of the New York Department of Financial Services, stated at a press conference on Monday, "We knew we were going to have to take action over the weekend so they could operate on Monday because of the volume of outflows we witnessed on Friday.

Ran Eliasaf claimed to be one of the depositors who took money out of the New York-based Signature. Providing short-term and construction financing for multifamily homes, condos, senior housing facilities, and nursing homes, he serves as managing partner of Northwind Group, a New York-based commercial real estate private equity company.

Eliasaf sent the following message to his team on Friday at approximately 10:30 a.m. New York Times when he observed the effects of SVB's demise: "It's better to be safe than sorry." He instructed them to transfer "tens of millions of dollars' worth" of deposits from Signature to JPMorgan Chase & Co., Bank of America Corp., and a few other smaller financial institutions.

(In the third paragraph, failure size is increased. In the eighth paragraph of a previous version of this story, the date was fixed.)

Read the full article

0 notes

Text

Silicon Valley Bank (SVB) Bailout Shows ‘Capitalism Is Breaking Down,’ Ken Griffin Says

— By Ariel Zilber | March 14, 2023

The collapse of SVB was the second-largest bank failure in US history. Ronald Wittek/EPA-EFE/Shutterstock

Billionaire hedge fund titan Ken Griffin slammed the US government’s decision to backstop all depositors who had money in Silicon Valley Bank, saying it was a sign that “capitalism is breaking down before our eyes.”

“The US is Supposed To Be a Capitalist Economy, and That’s Breaking Down Before Our Eyes,” Griffin, Whose Net Worth is Pegged by Forbes at $32.6 Billion, Told Financial Times on Monday.

Griffin blasted the Biden administration for pledging to make depositors — including those with accounts totaling more than the $250,000 federally insured threshold — whole following the meltdowns of SVB and Signature Bank over the weekend.

“There’s been a loss of financial discipline with the government bailing out depositors in full,” Griffin told FT.

The Citadel boss said that government agencies in charge of making sure that banks’ operations are sound missed the boat.

“The regulator was the definition of being asleep at the wheel,” Griffin said.

As Russian Revolutionary Vladimir Lenin Once Observed, “There are Decades Where Nothing Happens; and There are Weeks Where Decades Happen.”

Ken Griffin said it was a mistake for the federal government to insure all depositors at Silicon Valley Bank. Reuters

He suggested that allowing the banks to fail while backstopping only those accounts that are federally insured would have been “a great lesson in moral hazard.”

“Losses to depositors would have been immaterial, and it would have driven home the point that risk management is essential,” Griffin told FT.

“We’re at full employment, credit losses have been minimal, and bank balance sheets are at their strongest ever,” he added.

“We can address the issue of moral hazard from a position of strength.”

Griffin’s position stands in stark contrast to that of another hedge fund billionaire, Bill Ackman of Pershing Square, who has been vocal in demanding that the government protect all depositors.

“For The Banks That Were Put Into Receivership, The FDIC Will Use Funds From The Deposit Insurance Fund To Ensure That All Of Its Depositors Are Made Whole. ... The Deposit Insurance Fund Is Bearing The Risk. ... This Is Not Funds From the Taxpayer.”

Ackman defended the feds’ intervention, tweeting: “This was not a bailout.”

“Had the [Federal Deposit Insurance Corporation], [the Treasury], and [the Federal Reserve] not intervened today, we would have had a 1930s bank run continuing first thing Monday causing enormous economic damage and hardship to millions,” Ackman tweeted.

“Our gov’t did the right thing.”

Carson Block, the founder of trading firm Muddy Waters Capital, came down on Griffin’s side.

In a notice he posted to his social media, Block wrote: “The government should not bail out the uninsured deposits at Silicon Valley Bank.”

Kevin O’Leary, the investor and star of the hit show “Shark Tank,” also assailed the Biden administration for effectively “nationalizing” the banking system. AP

“Bailing out uninsured depositors at SVB, which are mostly corporates, further infantilizes markets by sending the message that such risk management is anachronistic.”

Kevin O’Leary, the Canadian American investor and star of the hit show “Shark Tank,” eviscerated SVB’s “idiot management.”

“The combination of a negligent board of directors @SVB with idiot management is the potent cocktail that led to a disastrous outcome. Why should taxpayers bail them out?” O’Leary tweeted on Sunday.

“The lesson is simple, never put more than 20% of your liquid assets in any one financial institution,” he added.

O’Leary told CNN on Monday that President Biden has effectively “nationalized” the banking industry.

“What Effectively Happened Over the Weekend is That [Biden] Nationalized the American Banking System,” Canadian Businessman and Shark Tank Host Kevin O'Leary Told a Mainstream US Outlet on Monday.

“You have zero risk and that has consequences,” O’Leary said.

“There’s no such thing as a free lunch.”

O’Leary added that the government’s actions are “going to be very expensive for shareholders of banks long term.”

“I would never put my money into a bank stock ever again,” he said.

0 notes

Text

On Friday, Californian bank Silicon Valley Bank (SVB) became the largest bank to fail since the 2008 financial crisis. In a sudden collapse that shocked financial markets, it left billions of dollars belonging to companies and investors stranded.

SVB took deposits from and made loans to companies in the heartland of America’s tech sector. The US Federal Deposit Insurance Corporation (FDIC) is now acting as a receiver. The FDIC is an independent government agency that insures bank deposits and oversees financial institutions, which means it will liquidate the bank’s assets to pay back its customers, including depositors and creditors.

What happened to SVB and is this a one-off or a signal that there are more financial crashes to come? The immediate development was the announcement by SVB that it had sold at a loss a bunch of securities it had invested in and that it would have to sell $2.25 billion in new shares to try and shore up its balance sheet. That triggered a panic among key tech firms in California which held their cash at SVB. There was a classic run on the bank. With lightning speed, the bank had to stop depositors withdrawing cash. The company’s stock price collapsed, dragging other banks down with it. Trading in SVB shares was halted and then SVB abandoned efforts to raise capital or find a buyer, leading to the FDIC taking over control.

While relatively unknown outside of Silicon Valley, SVB was among the top 20 American commercial banks (the 16th largest), with $209 billion in total assets at the end of last year, according to the FDIC. It’s the largest lender to fail since Washington Mutual collapsed in 2008 during the global financial crash. So, contrary to some reports, SVB is no minnow. It offered services to nearly half of all venture-backed tech and health care companies in the US. SVB held money for these ‘venture capitalists’ (those that invest in new ‘start-up’ companies).

But it also made investments with the cash deposits it got, extending sometimes risky loans to tech founders personally as well as to their companies. But its investments started to make losses. SVB had bet on buying seemingly safe US government bonds. However, as the Federal Reserve began its cycle of hiking interest rates to “control inflation”, the value of these government bonds fell sharply and SVB’s balance sheet began to take water. When it informed the financial world that it was selling these bonds at a loss to meet customer withdrawals of cash, the run on the bank flooded through. On failing to get extra funding by selling shares, SVB had to declare bankruptcy and go into FDIC receivership.

Some are brushing off the idea that SVB’s collapse is a sign of things to come. “SVB was small, with a very concentrated deposit base”, said Amundi’s head of European equity research, Ciaran Callaghan. It was “not prepared for deposit outflows, didn’t have the liquidity at hand to cover deposit redemptions, and consequently was a forced seller of bonds that drove an equity raising and created the contagion. This is very much an isolated, idiosyncratic case.”

So it’s a one-off. But is it? SVB’s collapse is due to a wider event, namely the Federal Reserve’s aggressive interest-rate hikes over the past year. When interest rates were near zero, banks like SVB loaded up on long-dated, seemingly low-risk treasuries. But as the Fed raised interest rates to ‘fight inflation’, the value of those assets fell, leaving many banks sitting on unrealized losses.

Higher rates have also hit the tech sector especially hard, undercutting the value of tech stocks and making it tough to raise funds. So tech firms started to withdraw their cash deposits at SVB to meet their bills. Ed Moya, senior market analyst at Oanda commented: “Everyone on Wall Street knew that the Fed’s rate-hiking campaign would eventually break something, and right now that is taking down small banks.” The other crack in the banking wall is in cryptocurrencies. Crypto bank lender Silvergate has also been forced to liquidate after the collapse in bitcoin and other cryptocurrency prices and exchanges.

“SVB’s institutional challenges reflect a larger and more widespread systemic issue: the banking industry is sitting on a ton of low-yielding assets that, thanks to the last year of rate increases, are now far underwater — and sinking,” said Konrad Alt, co-founder of Klaros Group. Alt estimated that rate increases have “effectively wiped out approximately 28% of all the capital in the banking industry as of the end of 2022.”

SVB’s failure may be a one-off, but financial crashes always start with the weakest or the most reckless. This is a bank that was being squeezed by the scissors of an impending slump: falling profits in the tech sector and falling asset prices caused by rising interest rates. SVB had grown to about $209bn in assets with a client base concentrated among tech start-ups and so it proved particularly vulnerable to the impact of rapidly rising interest rates. But SVB’s losses on bond sales are being repeated for many other banks. The FDIC recently reported that US banks are sitting on $620bn of combined unrealised losses in their securities portfolios.

Meanwhile, after the latest jobs figures continued to show a ‘tight’ labour market, the Federal Reserve seems set to continue to hike interest rates even faster and higher than financial investors expected. Giving testimony to the US Congress last week, Federal Reserve chair Jay Powell made that clear: “Employment, consumer spending, manufacturing production and inflation have partly reversed the softening trends that we had seen in the data just a month ago.” And as Larry Summers, the Keynesian guru and former Treasury Secretary, put it, “We’ve got to be prepared to keep doing what’s necessary to contain inflation.” Possibly to the point of bringing down parts of the banking and corporate sector.

1 note

·

View note

Text

The struggles of Skymint in Lansing, one of the largest marijuana operators in Michigan, aren't an anomaly. They're a dank declaration: The state's cannabis industry is in trouble.

Skymint, the brand name for Green Peak Innovations Inc., owes its investors at least $135 million, owes millions in back taxes and is woefully behind on its rent obligations, lawsuits filed by its creditors say.

Its financial outlook is so bleak, a judge in Ingham County Circuit Court has installed a receiver to run the company, representing either a lifeline or a liquidation.

Skymint isn't alone.

At least four other marijuana companies are under the direction of a court-ordered receiver, according to data obtained by Crain's from the Michigan Cannabis Regulatory Agency: Uldaman Inc., which does business as dispensary Green Planet Patient Collection in Ann Arbor; Rehbel Industries, a grow operation in Lansing; Huron View LLC, doing business as Huron View Provisioning Center in Ann Arbor; and Bay Shore Development Group, a grow operation in Bay City.

"It's just bad out there right now," said Doug Mains, principal and co-leader of the cannabis practice for Detroit law firm Honigman LLP. "Everyone is struggling to pay bills and negotiating lending extensions."

Marijuana remains a Schedule 1 drug at the federal level, which bars cannabis companies from being able to use the federal bankruptcy courts to settle debts, leaving state circuit courts as the only means for financial protection.

Skymint said in a statement Wednesday that going into receivership was "a difficult decision, but a necessary one."

"The court-approved agreement will allow us to reorganize our debt obligations to address the financial challenges facing many in Michigan's cannabis industry, including excess supply, decreasing prices, limited access to capital and the increasing cost of capital," Skymint said in the statement.

The company did not respond to additional requests for comment Thursday.

A court-appointed receiver is an unbiased third party that effectively takes control over a company's operations and financial books and then makes a recommendation to the court on what the best path is to satisfy creditors, whether that means a reorganization of the company or a liquidation.

Skymint's investors allege mismanagement in two lawsuits, but unfavorable market conditions are exacerbating its downfall.

Michigan's marijuana industry has suffered an epic price collapse due to product oversupply — recreational marijuana retail prices have plummeted from $512.05 per ounce of flower in January 2020 to just $80.16 per ounce in January this year — effectively eliminating profit margins for businesses across the state.

The question remains of how far the market will fall and what happens to these companies operating under a receiver as rising interest rates make capital more expensive, and selling or buying troubled operations is thorny due to a patchwork of local regulations on license transfers to new owners.

Skymint spent and borrowed big to grow quickly as an early entrant into the legal marijuana market in Michigan. It now employs more than 600 people across 24 retail dispensaries around the state and three indoor grow operations in Dimondale and Lansing.

But a hefty debt load that kept ballooning as the company tried to stay afloat eventually became too much as weed prices kept falling, court filings show.

Tropics LP, a subsidiary of Calgary-based Sundial Growers Inc.'s investment firm SunStream Bancorp Inc., loaned Green Peak $70 million in September 2021 toward the acquisition of competitor 3Fifteen Cannabis and its 12 dispensaries in Detroit, Grand Rapids, Ann Arbor, Flint and elsewhere. Merida, a majority shareholder in 3Fifteen, also lent $8 million toward the 3Fifteen purchase. Both investors are suing Skymint in circuit court.

With an oversupply of product in the state and finite licenses and communities to sell the product, buying up dispensaries became paramount to Skymint's growth strategy. It was either develop a higher-priced niche product or play on volume with more sales outlets to move product as margins diminish.

Prices had already fallen 50 percent between September 2020 and September 2021, causing lenders to demand stiffer loan terms.

Under the Tropics' promissory note, Green Peak agreed to repay the lender in full by September 2025 at a whopping 12.5 percent interest rate, compounding monthly, as well as sell some common shares of the company to Tropics, according to the lawsuit.

Under that agreement, Green Peak agreed to maintain a minimum cash balance of $7.5 million, which Tropics alleges in the lawsuit that it failed to do in March last year. Tropics appears to have concluded it was either lose much of its investment or dump more money into Skymint in hopes its growth plan was successful.

Tropics loaned Green Peak another $5 million in March 2021, raising the loan total with fees to nearly $81.5 million. Green Peak once again did not meet its loan obligation in June 2022 after failing to raise an additional $15 million in new funding, according to the lawsuit. The company also failed to pay additional fees to Tropics, pay back rent on its East Jolly Road facility in Lansing and pay certain taxes, the lawsuit claims.

The two parties entered into another agreement in November, which included Tropics paying more than $5.8 million toward overdue sales and excise taxes for Green Peak.

Tropics alleges in the court filing that Green Peak's daily sales revenue has dropped from $356,953 in April 2022 to just $184,579 in January of this year, exacerbating an already bad financial picture.

Green Peak owes nearly $4 million in sales and excise taxes by March 25, the suit alleges, and the landlord of its leased cultivation facility in Dimondale is attempting to evict the company for owing roughly $1.1 million in rent.

Tropics is asking the receiver to take possession of Green Peak's assets.

"A lot of companies are on the edge, desperately trying to find additional capital, but costs are so extraordinarily high," said Lance Boldrey, partner at Detroit-based law firm Dykema Gossett PLLC and part of the legal team that designed the state's legalization framework. "Everyone thought the money was so good, they'd do anything to keep the game going. But we're going to see the market shake out. It's following the same pattern we saw in Colorado, Washington and Oregon. Anywhere with unlimited licensure."

The other receivership cases are much smaller in scope, but represent the growing pain in the state's industry.

"We're getting lots of client calls about licensees not getting paid for product and monitoring more and more lawsuits over licenses and money owed," Mains said. "These are the next receivership cases to come."

The legal marijuana framework in the state, approved by voters in 2018, allows the state to license any entity that meets stringent criteria. But those same entities cannot operate without a local license from the municipality where they would like to operate. For instance, Skymint has local licenses in at least 29 municipalities.

Here lies the heavy lift for Skymint's receiver, Gene Kohut, a partner at Detroit-based business advisory firm Trust Street Advisors, if he chooses to liquidate the company's assets to pay back investors.

Under state law, each of those municipalities developed their own licensing framework that often include differing rules and red tape on transferring those licenses to a new owner.

"State licenses have little to no value, it's all about the local approvals," Mains said. "Those ordinances are all over the place. Some only allow equity transfers or no license transfers at all or it's a huge process. The receiver and any potential buyer or buyers is going to have to address each local license at a one-by-one level."

And even if the receiver could navigate these local hiccups, is there a buyer with enough cash and lending power to gobble up Skymint's assets in a declining market?

Michael Elias, founder and CEO of Skymint competitor Marshall-based Common Citizen, said he's examined buying up its assets, but the debt obligations attached are too high.

"Debt is too significant and restructuring too difficult to extract any value," Elias told Crain's. "I'm sure someone could do it, but it's too cumbersome today (under falling prices)."

Andrew Sereno, CEO of Manchester-based niche grower Glacial Farms, said the fall of Skymint would benefit businesses in the market by reducing supply. Glacial Farms sells weed wholesale under the Glacier Cannabis brand and doubled its grow operation by leasing additional space from a defunct grower last year.

Skymint holds five adult-use Class C grow licenses, three adult-use excess grow licenses and eight medical marijuana grow licenses. That translates to the legal ability to grow as many as 28,000 marijuana plants, or about 2 percent of all of the state's legal marijuana plants being grown as of Jan. 31, according to CRA data. Though it's unlikely Skymint is growing anywhere near full capacity.

"For those of us who aren't debtors to (Skymint), this is a great thing as it should mean less (excess cannabis) on the market that's artificially lowering prices," Sereno said.

#At least 5 Michigan marijuana companies in receivership#signaling industry in peril#Michigan Medical Marijuana#313#white weed#racism in marijuana in Michigan

1 note

·

View note

Text

Silvergate liquidates, Silicon Valley Bank on receivership, and crypto selloff

Last week was mainly bearish as several macro events had a detrimental effect on the industry. Major developments, such as the voluntary liquidation of Silvergate and the crash of Silicon Valley Bank (SVB), disrupted the industry, resulting in a sell-off that pushed asset prices to multi-month lows. In addition, regulatory efforts in the United States were mostly unfavorable, exacerbating…

View On WordPress

0 notes

Text

Navigating Insolvency in Australia: How Can SLF Lawyers Assist?

The Australian business landscape has undergone significant changes in recent years, with economic conditions creating new challenges for companies of all sizes. One area that has been particularly affected is insolvency, with an increasing number of businesses facing financial difficulties.

One of the key factors contributing to the rise in insolvency in Australia is the challenging economic conditions brought on by the global pandemic, which has resulted in a decline in some industries for consumer spending and business activity.

This has put pressure on some companies, particularly those in sectors such as retail, hospitality, and tourism. Of course, there are other industries that are facing unique challenges which previously had not been envisaged.

In such times, the legal expertise of one of our lawyers is critical in evaluating the company’s financial and legal situation, providing guidance on legal options available and also in negotiations with creditors, investors or potential buyers.

Moreover, when a company is facing financial difficulties, we can also assist in the negotiation of terms with creditors and investors. We can help in drafting agreements, understanding the implications of any agreement made, and also assist in negotiations to ensure the best possible outcome for the company and its stakeholders.

In addition to the above, we can also assist in advising on and the implementation of formal insolvency procedures such as Voluntary Administration, Receivership, or Liquidation. In short, these are legal processes that are generally used as a last resort when a company is unable to pay its debts as and when they fall due and the directors (or creditors) decide that it is unlikely the company will be able to trade out of its difficulties.

We can assist in helping you understand the legal obligations of various stakeholders ensuring your interests are best protected.

The current insolvency landscape in Australia is challenging, but by seeking the help of one of our lawyers at an early juncture, companies can navigate the challenges and position themselves for future success.

Seeking our assistance early is beneficial for companies facing financial difficulties for several reasons:

We can provide guidance on the legal options available to a company in financial difficulty, including debt restructuring, asset sales, and business closures. By seeking legal assistance early, companies can make informed decisions about the best course of action to take.

Development of a restructuring plan: We can assist in the development of a restructuring plan that maximises the chances of the business surviving and minimises the impact on the business’s stakeholders such as employees, creditors and shareholders. By seeking legal assistance early, companies can develop a plan before the situation becomes critical.

Negotiations with creditors and investors: We can assist in negotiations with creditors and investors, helping to secure more favourable terms for the company and its stakeholders. We can assist in drafting agreements and advising the implications of any agreement made.

Implementation of formal insolvency procedures: If a company is unable to pay its debts and the directors decide that it is unlikely the company will be able to trade out of its difficulties, we can guide the company through formal insolvency procedures such as Voluntary Administration, Receivership, or Liquidation.

Protection of the company and stakeholders: By seeking legal assistance early, companies can ensure that their legal rights and obligations are protected. We can help identify potential risks and put in place strategies to mitigate them before they become a problem. This can help to minimise the impact on the company and its stakeholders.

Time and cost saving: Getting legal help early on, can save time and cost. Solving an issue early before it becomes critical, is less time-consuming and expensive than when it has escalated.

If you are concerned about the challenges the current economic climate is having on the operation of your business, or the content of this article has raised an alarm bell, do not hesitate to call SLF Lawyers on one of the following numbers depending on the state you are located:

Brisbane: +61 7 3839 8011

Gold Coast: +61 7 5582 1600

Sydney: +61 2 9264 4833

Melbourne: +61 3 9600 2450

Perth: +61 8 6444 1960

0 notes