#lic 5 year plan

Explore tagged Tumblr posts

Text

0 notes

Text

Understanding LIC's 5-Year Double Money Plan

Why the 5-Year Double Money Plan Is Important in India

The Life Insurance Corporation of India (LIC) has introduced various insurance and investment products tailored to meet the diverse financial needs of its policyholders. One standout product is the lic plan - 5 years double money, a plan that promises to double your investment in a span of five years. Here's why this plan is particularly significant in the Indian context:

Rapid Wealth Accumulation: The 5-Year Double Money Plan is designed to double your investment within a short period. This rapid growth appeals to those looking for quick financial returns and substantial wealth accumulation in a relatively short time.

Financial Security: In India, financial stability is a key concern for many families. The 5-Year Double Money Plan offers a guaranteed return on investment, providing policyholders with a sense of financial security and peace of mind, knowing their savings will grow significantly.

Encourages Saving Discipline: This plan promotes a disciplined saving habit among policyholders. With a structured premium payment schedule, it ensures regular contributions towards the investment, fostering a consistent savings culture crucial for long-term financial health.

Tax Benefits: Investments in LIC’s 5-Year Double Money Plan are eligible for tax deductions under Section 80C of the Income Tax Act. Moreover, the maturity proceeds are typically exempt from tax under Section 10(10D), offering dual tax benefits to the policyholders.

Inflation Protection: With inflation steadily increasing, the value of money can diminish over time. The 5-Year Double Money Plan helps counteract this effect by doubling the invested amount, thereby preserving and increasing the purchasing power of your money.

Risk-Free Investment: Unlike many other investment options that are subject to market volatility, the 5-Year Double Money Plan offers a guaranteed return, making it a risk-free investment. This is especially appealing to conservative investors seeking stable and secure growth of their savings.

Detailed Insights from SMC Insurance

For those interested in an in-depth understanding of lic plan - 5 years double money, SMC Insurance provides a comprehensive article that delves into the specifics of this investment option. At SMC Insurance, our mission is to simplify insurance and investment concepts, enabling consumers to make well-informed financial decisions. Our guide on LIC’s 5-Year Double Money Plan includes:

Plan Overview: An introduction to what the 5-Year Double Money Plan entails, including its primary features, benefits, and eligibility requirements.

Investment Advantages: Detailed analysis of the advantages of investing in this plan, such as guaranteed returns, financial security, and tax incentives.

Premium Payment Structure: Information on the premium payment schedule, including payment frequencies, amounts, and the implications of missed payments.

Maturity and Payout Details: Clear explanations of the maturity benefits, payout structures, and the process for claiming the maturity amount.

Tax Benefits: Insights into the tax benefits associated with the plan, including deductions under Section 80C and tax exemptions under Section 10(10D).

Comparative Analysis: A comparison of the 5-Year Double Money Plan with other investment options, highlighting its unique benefits and potential drawbacks.

Frequently Asked Questions: Answers to common questions about the 5-Year Double Money Plan, addressing issues such as eligibility, premium payments, and maturity claims.

To explore more about lic plan - 5 years double money and make a well-informed investment decision, visit SMC Insurance’s Guide on LIC’s 5-Year Double Money Plan. Our detailed article will equip you with the knowledge needed to navigate the intricacies of this investment option effectively.

Stay informed, stay financially secure with SMC Insurance.

0 notes

Text

This Week in BL - The Industry is Having Issues But the Spice Spicy Must Flow

Organized, in each category, with ones I'm enjoying most at the top.

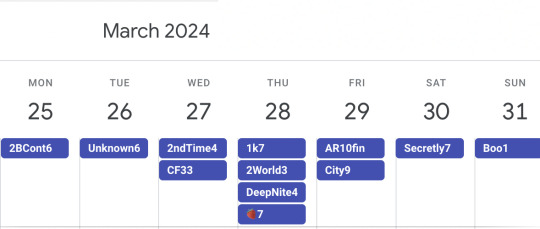

March 2024 Wk 4

Ongoing Series - Thai

Two Worlds (Thurs IQIYI) eps 1-2 of 10 - One of those "he's dead Jim so time travel" thingames starring MaxNat. I'm over this concept but I do enjoy MaxNat. Phupha (Gun) and Khram (Nat) love each other but Phupha is murdered. Then Khram is pulled to a parallel world where, years ago, Khram and Tai (Max) were in love. However, Khram was killed by Tai’s dad. Now Tai finds alter-Khram. But then there is ALSO an alter-Phupha to deal with. (Phupha is played by Gun Thanawat who was Khom, the repressed butler bodyguard from Unforgotten Night. We like this, but we scared of the love triangle aspect.) Did that make sense? Yeah, okay, see what I mean?

Initial thoughts?

The subs are troubling but I’m enjoying this show a lot. It’s nice to see MaxNat get something meaty to sink their teeth into - that’s not just each other. Also it’s so smart of them to give us a fully fleshed out entire episode developing the alter romance rather than just a separation + death. It makes Khram’s grief and motivation that much more believable. Also it’s really nice to see Nat have good chemistry with other actors.

Deep Night (Thurs iQiyi) ep 3 of 8 (10?) - I'm still enjoying it. But Two Worlds is objectively better. So this one has lost ranking. Also, unexpectedly chili (the name of my heavy metal Thai cover band).

Lovey switchy and verse main couple too.

This is all quite pleasing.

The bit where the hosts pretend to be a BL couple actor ship was epic on so many levels.

Also unsettling.

All sex work is performative, and in a way there is something more honest about this depiction, in this setting, than what BL actors are made to do on the promo circuit. Which then begs the question, how different is BL from sex work? That's the unsettling bit, for me anyway. Not to slam on sex work AT ALL, we pro-the-true-pros on this damn blog, but actors have been shaded by association with True Professionals for a very long time and BL has already had one epic shut down in this regard. (See the PerthSaint scandal around Love By Chance, no I will not explain.) Where was I? Oh yes, so anyway, see the Gossip section for the part where they better be paid either way!

Also, since I'm a warped fucker, I found this scene funny.

And then hilarious when all of those BL tropes were just trotted out. Like a greatest hits reel.

Truly beyond meta. (How Absolute BL of them.)

Note he’s even standing in yaoi's patented "hands in pocket with the shoulders back"?

Meanwhile, the gayest bridge in Thailand made its quarterly appearance:

And lip serviced was paid to the most touristy romantic things you can do in Bangkok.

And I mean lip service literally.

To Be Continued (Thai C3 Thailand grey) ep 5 of 8 - I’m still enjoying it but getting more and more nervous. We getting too close to Promise territory for comfort. EXPLAIN Ji’s reticence well and do it now or risk audience mistrust. We have to be given a GOOD reason for Ji's behavior, or he'll be irredeemable.

City of Stars (Fri iQIYI) ep 8 of 12 - NO SINGING. Yes smiley kisses and good communication and a nice healthy relationship. But no singing!

1000 Years Old ep 6 of 12 - Dropping in the ranks. I’m sorry it’s just gotten boring. It has, however, inspired me to invest in my own ridiculous cream fuzzy sweater. Which I plan to wear with leather trousers and huge stumpy boots, like the Kpop queer I truly am. Or do I mean vampire?

Kiseki Chapter 2 (Sun iQIYI) ep 1 of 6 - Seems to be an excuse for a small posse of Thai actors to wander around Tokyo playing tourist and sing in public . Someone stop them?

“Most people think this kind of thing is bad manners .”

Anyway, it’s v boring. I’ll give it one more ep but I suspect I’ll DNF.

Close Friend Season 3: Soju Bomb! (Weds iQIYI) eps 1-2 of 6 - Meh. This is also looking suspiciously DNF-a-licious.

Ongoing Series - Not Thai

Unknown (Taiwan Tues Youku YouTube & Viki) ep 5 of 11 - It's brilliant. I love it. I'm ready to hurt. Let’s do this thing.

Distribution note: This one has been picked up and is also airing on Viki now, so it may lose YT distribution in soem territories. I like Youku's hard subs better than Viki's subs, but that's a matter of preference not information since I don't speak Mandarin.

Love is Better the Second Time Around AKA Koi wo Suru nara Nidome ga Joto (Japan Weds Gaga) ep 3 of 6 - It is good. Every week I like this show a little more. I'm enjoying a reunion romance explored in Japan's quintessentially contemplative yet slightly surreal way. The juxtaposition of the tenderness of the sex scene with this Japanese brand of authenticity was oddly elegant - for lack of a better way of putting it. All in all, this is a good show. Thought provoking. Stylish.

AntiReset (Taiwan Fri Viki/Gaga) ep 9 of 10 - It remains lovely but they sure are reusing a lot of footage. Also, this was a classic penultimate doom episode. I do wonder how they are going to resolve this show ethically.

My Strawberry Film (Japan Thurs Gaga) ep 6 of 8 - It is what it is, and it isn’t my style of show no matter what country of origin. Oddly that's one of the reasons I don't like it. Anyone could have made this, it's not as Japanese as I want it to be, it's just indie film club high school angst. Yawn.

I watched it, finally

The Servant and the Young Master (Vietnam YouTube) 7 eps - I dislike vertical filming, but I kind of enjoyed this show as a BL. I like class conflict romances. For me the rich kid is a bit too dictatorial (edges into bulling), but it’s kinda works. It’s sparse and underdeveloped and a bit plotless, but mildly entertaining. If you're missing Vietnamese BL you might give it a try. 6/10

Began Beginning (Myanmar YouTube) 8eps - A Burmese BL that I had thoughts about but actually ended up recommending. Read the saga here:

It's done, ready to binge, but I suck

What Did You Eat Yesterday Season 2 AKA Kinou Nani Tabeta? Season 2 (Japan Gaga) 10 eps

It's airing but...

Graduation Countdown (Taiwan YouTube) ep 1 of ? - on one hand it's micro-installment vertical, on the other it's adorable and from Taiwan. I blame @heretherebedork entirely for my conundrum. As indeed, I did for My Type back in the day. (That was Nat Chen's first BL, yes of Kiseki: Dear To Me fame.) So I think I will also simply lean on Here to let me know when it's done and binge all at once. It's just too much to ask me to keep up with 2 minute pieces, I don't have that kind of endurance training, not even for BL.

Time the series (Tue Gaga/YT) 10 eps - it's finished now, I dropped it at ep 4. Should I bother?

A Secretly Love (Thai Sat WeTV grey) 10 eps - I watched the first ep but grey is too much work for this inferior of a show. I may pick up and binge if it gets distribution but for now, it gets a DNF from me. KimCop might have held this crap together but Kim without Cop? No thank you.

Lady Boy Friends (Thai WeTV grey) 16 eps - reminds me a bit too much of Diary of Tootsies only high school. Not my thing. DNF unless it turns a corner and is truly amazing for some reason.

Man Suang that MileApo vehicle from last year is coming to Netflix in the USA. I haven't heard much about it and since the KP stans would have lost their tiny minds if it was any good at all, I'm assuming it's not good at all.

Gossip

Thai BL actor Yoon breaks with his former company and talks about some very very VERY shady goings on in the Thai BL industry. Including not being paid.

And whacha know, same thing happening in Korean BL.

Have I mentioned recently how much I hate the film industry?

Next Week Looks Like This:

Starting Soon

3/31 Only Boo! (Thai GMMTV YouTube) 12 eps - New main couple for GMMTV in an idol romance about a boy who dances good and a food stand vendor. Other side of the tracks grumpy/sunshine pair who fall deeply in love but, of course, baby boy idol can't date. Boyband but from GMMTV? Control your singing and I'm game.

4/1 Love is like a Cat (Korea ????) 12 eps - This completed filming Aug 2022(!) which means there have been serious problems with post-production. This is another of Silkwood's Korean+Thai colab projects. Mew Suppasit plays a rookie film star, called the Cat Prince (for his cold arrogance) who goes up against a charismatic puppyish animal daycare director (JM of JUST B). There is also a side romance (love triangle?) with a veterinarian. Geonu of JUST B is also in the cast.

I wonder if this was part of the hold up, with Geonu on Build Up right now, they might have tried to muffle this one. Or maybe it's just that bad...

4/3 We Are (Thai GMMTV YouTube) 12 eps - University ensemble BL featuring PondPhuwin, WinnySatang, AouBoom, MarcPawinPoon - basically the good kind of messy gay friendship group (so more My Engineer and less Only Friends). Looks a bit like the Kiss series but everyone is queer. I'm IN!

Knock-Knock Boys (Thai WeTV?) - 4 college friends conspire to help their friend lose his virginity. Familiar faces like Seng (yes, Billy's previous partner), Best and frest face, news here.

Upcoming BLs for 2024 are listed here. This list is not kept updated, so please leave a comment if you know something new or RP with additions.

NOTE: It looks like one of my personal favorites of last year Unintentional Love Story is getting a spin off!

THIS WEEK’S BEST MOMENTS

Without ghost girl.

With ghost girl.

I think she may be my favorite part of 1000 Years.

CLASSIC tsundere seme description of a sunshine uke. Like classic'est of classic. (Two Worlds)

Is there such a thing as a tired trope in a BL? Since it is a genre that is made up entirely of tropes quilted together? Your philosophical question for today brought to you by Deep Night's kabedon (Japanese trope) + punishment threat (Thai trope).

Love me a lap sit moment. (City of Stars)

(Last week)

Streaming services are listed by how I (usually) watch, which is with a USA based IP, and often offset by a day because time zones are too much work.

The tag BLigade: @doorajar @solitaryandwandering @my-rose-tinted-glasses @babymbbatinygirl @babymbbatinygirl @isisanna-blog @mmastertheone

If ya wanna be tagged each week leave a comment and I will add you to the template. Easy peesy.

#this week in bl#bl updates#The Servant and the Young Master#The Servant and the Young Master reviewed#Vietnamese BL#Two Worlds the series#To Be Continued the series#City of Stars#Unknown the series#Love is Better the Second Time Around#Koi wo Suru nara Nidome ga Joto#AntiReset#1000 Years Old#Deep Night the series#bl series review#upcoming bl#bl news#bl reviews#thai bl#japanese bl#taiwanese bl#koren BL#BL gossip#BL updates#BL starting soon

236 notes

·

View notes

Text

If you're looking for flexible coverage, a Shortest Term Life Insurance Policy may be perfect for your needs. These Term Life Insurance Plans offer coverage for a specific period, typically 5-10 years, ideal for covering temporary expenses. With affordable premiums, they provide essential protection without long commitments.

You can explore Term Life Insurance Quotes easily online to find a plan that suits your budget and needs. Consider a short-term plan today to secure peace of mind.

1 note

·

View note

Text

Top 5 Life Insurance Policies in India for 2024: A Comprehensive Guide to Protecting Your Future

Life insurance is an essential component of financial planning, offering protection for your family and ensuring their well-being in case of unforeseen events. With numerous policies available in India, choosing the right one can be overwhelming. This article will highlight the top 5 life insurance policies in India for 2024, providing detailed information on their features, benefits, and why they are the best options for policyholders.

1. LIC Jeevan Amar (Term Plan)

The LIC Jeevan Amar plan is one of the most popular term life insurance policies in India. Being a pure protection plan, it provides financial support to the policyholder’s family in case of the unfortunate death of the insured during the policy term. This plan is customizable, making it suitable for individuals looking for flexibility in coverage.

Key Features:

Sum Assured: Minimum ₹25 lakhs, no maximum limit

Policy Term: 10 to 40 years

Premium Payment Options: Single, regular, or limited payment terms

Death Benefit: Options include Level Sum Assured and Increasing Sum Assured

Rider Options: Accidental Death Benefit

Benefits:

Affordability: Jeevan Amar offers affordable premium rates, especially for non-smokers and females.

Customizable Options: Allows you to choose from different sum assured payout options.

Flexibility in Premium Payment: Choose from single, regular, or limited premium payments as per your financial goals.

Tax Benefits: Enjoy tax exemptions under Section 80C for premium paid and Section 10(10D) for the death benefit.

2. HDFC Life Click 2 Protect Life (Term Plan)

The HDFC Life Click 2 Protect Life plan is a comprehensive term insurance policy that offers flexible options to suit your evolving life needs. The policy provides several coverage options such as Life Option, Extra Life Option, and 3D Life Option (covering critical illness, disability, and death). It also provides additional benefits for coverage until age 99.

Key Features:

Sum Assured: ₹50 lakhs to ₹10 crore

Policy Term: 5 to 85 years

Premium Payment Options: Single, limited, or regular payments

Rider Options: Accidental Death, Critical Illness, Income Benefit, and Disability Rider

Benefits:

Comprehensive Coverage: The 3D Life Option covers death, disability, and critical illnesses, ensuring comprehensive protection.

Whole Life Coverage: This plan offers life cover till age 99, providing long-term security.

Return of Premium Option: If no claims are made during the policy term, the premiums paid are returned.

Tax Savings: Premiums paid qualify for tax exemptions under Section 80C, and death benefits are tax-free under Section 10(10D).

Read more...

0 notes

Text

Introduction to Begin LIC Assistant Exam for Beginners

Introduction:

So, it is very challenging for beginners to start preparing for the LIC Assistant exam. Certainly, following an appropriate approach and guidance can definitely let you take control of this journey. Professional assistance via the best LIC assistant coaching in Kolkata is going to assist you in making head and tail of this examination to prepare efficiently. This blog will help you understand the LIC Assistant exam, and it is surely going to set the ball rolling for you.

About the LIC Assistant Exam

The Life Insurance Corporation of India is the body responsible for the LIC Assistant examination, which is for the clerical posts. It is one of the most demanding examinations amongst all the insurance exams, as it opens the doorway to a stable and rewarding career in the insurance sector. The LIC Assistant exam is based on two main stages: the Preliminary Exam and the Main Exam and concludes by testing the linguistic capabilities of the candidate.

Prelims Examination- This examination is made up of three sections: Reasoning Ability, Numerical Ability, and English Language.

The mains Examination- comprising the sections Reasoning & Computer Aptitude, General/Financial Awareness, Quantitative Aptitude, and English Language. An insight into the pattern of the examination is really essential for the beginner for sorting out the things for an effective preparation.

Guidance for Beginners LIC Assistant Exam

1. Know your Syllabus -

Before you start the preparation, one needs to understand the syllabus completely. Knowing what topics each section comprises helps the candidate to concentrate his efforts in a manner where they are most required. This will also allow you to create a structured study plan that covers all areas systematically.

2. Study Plan:

Only after you have familiarized yourself with the syllabus, create a chalking-out study plan, where your preparation is spilt into little, comprehensible parts. Allocate specific time slots for each subject, ensuring that the entire syllabus is well covered way ahead of the actual date of the examination. Your study plan should also include time for revision and practice tests.

3. Basics First :

Hence, as a beginner, you have to focus on building a very strong foundation. Get the basics of all the subjects clear and then proceed only to the higher end. In this respect, the top online coaching for LIC assistant will come to your help. Clarification of the concept by expert instructors can make all the differences in getting those extra bits of information so important for preparation.

4. Practice Mock Tests:

Practice forms an integral part of any competitive examination. It would help you not only learn what you have grasped but also increase your speed and accuracy. Use the mock tests, some previous-year question papers, and some online materials for practice to test your knowledge, and notice the areas that you need to improve.

5. Make Use of Online Resources:

In this digital era, nowadays, there are loads of online resources that can help you in your preparation. Best online coaching for LIC Assistant offers free learning tools, including video classes, e-books, quizzes, and interactive sessions conducted from your home. Such will greatly help the working class or people with less time.

6. Stay Updated with General Awareness:

The General/Financial Awareness section of the examination necessitates the applicant to be very well in tune with current affairs, especially pertaining to the banking and insurance sectors. Have a daily reading pattern from newspapers and keep a continuous track of news through various news portals and apps compiled specifically for current affairs.

7. Join a Coaching Institute:

A coaching institute will make a substantial difference to the preparation of many aspirants for the better. It would ensure structured learning and proper guidance by experts and would adopt a disciplined way of studying. They should also have scheduled mock tests, which will ensure expert progress checks and invaluable confidence-boosting opportunities.

Conclusion:

This journey on which you will embark immediately to escalate your preparation for the LIC Assistant examination could be pretty challenging, but you can easily do it if you follow the right strategies and support. Best coaching for LIC assistant in Kolkata provides a professional guide, which helps build up comprehensive study materials and a specialized learning atmosphere for success. Engage in the tips from this blog and be assured, project a success career with LIC.

#lic assistant exam#LIC assistant coaching#LIC assistant coaching Kolkata#coaching for LIC assistant

0 notes

Text

Top 10 Life Insurance Plans for Senior Citizens in India 2024

As senior citizens seek financial security and peace of mind, life insurance plans tailored to their specific needs become crucial. Here are the top 10 life insurance plans for senior citizens in India for 2024, offering comprehensive coverage, flexible terms, and a range of benefits.

1. LIC Jeevan Akshay VII

Plan Type: Immediate Annuity Plan

Eligibility: Minimum age of 30 years and maximum age of 85 years

Benefits: Provides a steady stream of income through annuities. Multiple annuity options are available, ensuring flexibility based on individual needs.

Why It's Great: Guaranteed lifelong income, making it ideal for retirees looking for a regular pension.

2. HDFC Life Click 2 Retire

Plan Type: Unit Linked Pension Plan

Eligibility: Entry age ranges from 18 to 65 years

Benefits: Offers market-linked returns with the benefit of life cover. Accumulates a retirement corpus that can be converted into a regular income stream.

Why It's Great: Combines the benefits of market growth with the security of a life cover.

3. SBI Life Annuity Plus

Plan Type: Immediate Annuity Plan

Eligibility: Minimum age of 40 years and maximum age of 80 years

Benefits: Provides various annuity options, including life annuity, joint life annuity, and annuity certain.

Why It's Great: Flexibility in choosing annuity options that suit the retiree's lifestyle and financial needs.

4. Max Life Forever Young Pension Plan

Plan Type: Unit Linked Pension Plan

Eligibility: Entry age ranges from 30 to 65 years

Benefits: Offers guaranteed loyalty additions and ensures a financially secure retirement.

Why It's Great: Market-linked returns with guaranteed additions help in building a substantial retirement corpus.

5. ICICI Prudential Immediate Annuity

Plan Type: Immediate Annuity Plan

Eligibility: Minimum age of 30 years and maximum age of 85 years

Benefits: Offers a range of annuity options, including life annuity, life annuity with return of purchase price, and joint life annuity.

Why It's Great: Comprehensive annuity options provide financial security tailored to individual needs.

6. Bajaj Allianz Pension Guarantee

Plan Type: Immediate Annuity Plan

Eligibility: Minimum age of 37 years and maximum age of 80 years

Benefits: Provides multiple annuity options and a guaranteed income for life.

Why It's Great: The plan offers an immediate pension without any deferment period, ensuring instant financial stability.

7. Kotak Premier Pension Plan

Plan Type: Traditional Pension Plan

Eligibility: Entry age ranges from 30 to 60 years

Benefits: Accumulates a retirement corpus with bonuses and ensures a regular income post-retirement.

Why It's Great: Offers guaranteed additions and bonuses, enhancing the retirement corpus.

8. Reliance Nippon Life Pension Builder

Plan Type: Traditional Pension Plan

Eligibility: Entry age ranges from 18 to 65 years

Benefits: Provides a vesting benefit and ensures a steady income post-retirement through annuities.

Why It's Great: The plan offers flexibility in premium payment and vesting age, catering to varied financial needs.

9. Star Union Dai-ichi Life Immediate Annuity Plan

Plan Type: Immediate Annuity Plan

Eligibility: Minimum age of 45 years and maximum age of 80 years

Benefits: Offers various annuity options, ensuring financial stability for retirees.

Why It's Great: Provides an option for lifetime income with a return of purchase price, ensuring beneficiaries are also secured.

10. PNB MetLife Immediate Annuity Plan

Plan Type: Immediate Annuity Plan

Eligibility: Minimum age of 30 years and maximum age of 85 years

Benefits: Offers multiple annuity options, including joint life annuity and life annuity with return of purchase price.

Why It's Great: Ensures a steady stream of income with flexible options tailored to individual retirement needs.

Conclusion

Choosing the right life insurance plan for senior citizens to ensure financial security and peace of mind during retirement. The plans as mentioned above offer a variety of benefits, including guaranteed income, flexibility, and market-linked returns, catering to the diverse needs of retirees. Evaluating these options based on individual financial goals and needs can help make an informed decision for a secure future.

0 notes

Text

Life Insurance Corporation Plans: Overview of Coverage Options

Life insurance corporation plans plans encompass a range of coverage options tailored to meet diverse financial needs and goals. LIC, as a prominent insurer in many regions, offers various types of life insurance policies designed to provide financial protection to policyholders and their beneficiaries. Understanding the different LIC plans available helps individuals and families make informed decisions about securing their financial future.

Types of LIC Plans

LIC offers several types of life insurance plans, each catering to different financial objectives and preferences. These plans can broadly be categorized into:

1. Term Insurance Plans:

Term insurance plans provide coverage for a specified period, known as the term of the policy. If the insured individual passes away during the term, the plan pays out a death benefit to the beneficiaries. Term plans typically offer higher coverage amounts at lower premiums compared to other types of life insurance. They are suitable for individuals seeking financial protection for specific periods, such as covering outstanding loans or providing income replacement during active working years.

2. Whole Life Insurance Plans:

Whole life insurance plans provide coverage for the entire life of the insured, as long as premiums are paid. These plans offer both a death benefit and a savings component known as cash value. The cash value accumulates over time on a tax-deferred basis and can be accessed through policy loans or withdrawals. Whole life insurance plans are designed for long-term financial security and may include guaranteed premiums and death benefits, providing stability and protection throughout the insured's lifetime.

3. Endowment Plans:

Endowment plans combine life insurance coverage with savings and investment components. These plans pay out a lump sum amount (sum assured) either on the policy's maturity or upon the insured's death, whichever occurs earlier. Endowment plans offer a savings component that accrues bonuses or guaranteed returns, making them suitable for individuals looking to achieve specific financial goals such as funding higher education, purchasing a home, or retirement planning.

4. Money-Back Plans:

Money-back plans offer periodic payouts of a percentage of the sum assured at regular intervals during the policy term, while also providing a lump sum payment upon maturity or death of the insured. These plans provide liquidity through periodic returns, making them suitable for individuals who require regular income or funds for planned expenses at various stages of life.

5. Unit-Linked Insurance Plans (ULIPs):

ULIPs are investment-linked insurance products that combine life insurance coverage with investment opportunities in equity, debt, or hybrid funds. Policyholders have the flexibility to choose from various fund options based on their risk appetite and investment objectives. ULIPs offer potential market-linked returns along with life insurance protection, allowing individuals to participate in the financial markets while ensuring financial security for their loved ones.

Key Features and Benefits

Each type of LIC plan offers unique features and benefits tailored to meet different financial needs and goals:

Financial Protection: All LIC plans provide financial protection to policyholders and their beneficiaries in the event of the insured's death, ensuring that loved ones are financially secure.

Savings and Investment Opportunities: Plans like whole life, endowment, and ULIPs offer opportunities for savings and investment growth, helping policyholders build wealth over time.

Tax Benefits: LIC plans offer tax benefits under the Income Tax Act, allowing policyholders to claim deductions on premiums paid and tax-free proceeds on death benefits or maturity proceeds, subject to prevailing tax laws.

Flexibility: Many LIC plans offer flexibility in premium payment terms, coverage amounts, and additional riders (optional benefits) that can be added to customize coverage based on individual needs.

Choosing the Right LIC Plan

When selecting an LIC plan, individuals should consider the following factors to ensure it aligns with their financial goals and circumstances:

Coverage Needs: Evaluate the amount of coverage needed to protect dependents, cover outstanding debts, or meet specific financial obligations in case of the insured's death.

Premium Affordability: Determine the premium amount that fits within your budget and financial capacity to ensure continuous coverage throughout the policy term.

Policy Duration: Decide whether you need coverage for a specific period (term insurance) or lifelong protection (whole life or endowment plans) based on your financial planning objectives.

Risk Appetite: Assess your risk tolerance and investment preferences when considering investment-linked plans like ULIPs, which offer exposure to equity and debt markets.

Additional Benefits: Explore optional riders such as critical illness cover, accidental death benefit, or premium waiver benefit that can enhance the policy's coverage and provide additional financial security.

Conclusion

LIC offers a diverse range of life insurance plans designed to cater to various financial needs and goals, from providing basic life coverage to combining savings and investment opportunities. Understanding the types of LIC plans available and their key features helps individuals and families make informed decisions about securing their financial future and protecting their loved ones. By evaluating coverage needs, premium affordability, and additional benefits, individuals can choose an LIC plan that aligns with their financial objectives and provides peace of mind knowing that their financial future is secure. Regular review and adjustment of insurance plans ensure that coverage remains adequate as financial circumstances evolve over time.

0 notes

Text

Best term Plan For 1 Crore

When it comes to protecting your family’s financial future, term insurance is a essential tool. A term insurance plan provides a high amount assured at the relatively low costs, making it an appealing option for everyone looking to secure their financial stability for their loved ones in case an unexpected emergency . In this blog post , we will explore about the best term insurance plans in India for a sum assured of 1 crore, helping your to make an informed decision.

What is Term Insurance ? Term insurance is a type of life insurance that provides coverage for a particular time period . if the policyholder passes away during this period, the candidate receives the sum assured. However , if the policyholder survives the term , no benefits are received . This makes term insurance an affordable option for securing a high sum assured. Why choose a 1 crore Term Plan A sum assured of 1 crore ensures that your family can maintain their lifestyle and keep the same pace ahead, pay debts , avoid bankruptcy, manage daily expenses even in your absence. It provides an important financial support, which can be essential in covering costs like children’s education , marriage, and household expenses. Factors to consider when choosing a term plan 1.Make sure that cost of the insurance fits within your budget. 2.Choose a term that covers your working years and dormant responsibility. 3.Opt for insurance with high claim settlement ratio. Best Term Plans for 1 crore LIC PLAN Starts at ₹8,000 per year Policy term is of 10 to 40 years Claim settlement ratio is98.31% This online-only plan offers pliability in payments and multiple options for death benefits payouts. It also provides add-ons like accident benefit. HDFC PLAN Starts at ₹10,000 per year Policy term is 5 to 40 years Claim settlement ratio is 99.04% Comprehensive coverage with multiple plan options. ICICI PLAN Starting at : ₹9,500 Term:10-40 years Claim ratio: 98.58% Tips for choosing the best term plan for 1 crore

Assess your financial commitment, future goals , and liabilities to determine if 1 crore is the appropriate coverage amount for your needs.

Compare costs from different insurers to find a plan that offers the best coverage at an affordable price. Use online comparison tools to simplify this process.

Go for insurers with high claim settlement ratio to ensure that your family will face minimal problems during the claim process.

Choose a policy term that aligns with your financial goals. Usually, it’s advisable to have coverage until your retirement age or until your major financial obligations are met. Selecting the right term insurance is an important decision that can have a intense impact on your family’s lifestyle and financial security. The plans mentioned above are one of the best option available in India you choose one of them after researching about it more and get started.

0 notes

Text

Imagine this:

You have a big-ticket client doing a monthly SIP of 1.5 lakhs. However, they require funds for their child's marriage.

Now, he wants to stop his monthly SIP and redeem investments that he has made over time. Or maybe he needs the money for a medical emergency and is adamant about redeeming his investment.

You are unable to stop this client from stopping this.

How will this impact you?

Loss of AUM

Loss of income

Stagnate growth

In fact, according to a report by Motilal Oswal, Mutual fund redemptions increased 39% year-on-year to Rs 332,300 crore in CY23.

It has led to a decline in net inflows to Rs 206,300 in 2023 from Rs 238,300 in CY22.

Why has this happened?

Liquidity is the culprit. Let me share an interesting fact with you to relate to this.

Did you know that LIC & PPF make more money than mutual funds?

But when we compare the returnsInvestment ProductAverage returns per annumMutual funds12-15%LIC4-5%PPF6-7%

Mutual funds offer better returns.

So, how is that possible that they make more money? The reason is that Mutual funds are very liquid when compared to other investment products.

The average holding period for LICs and PPFs is more than ten years. While over 50% of mutual funds units of regular plans were redeemed within a year, according to SEBI.

It is evident that the longer you hold investments, the better the compounding. That is why LICs and PPFs make more money than MFs.

But the question remains the same. How to stop premature redemptions?

What could you have done to stop premature redemption?

Scenario 1

When the market falls, clients panic and want to redeem.

To stop your client from redeeming their investment, you should link a purpose to it. The purpose of the investment has a psychological impact. It emotionally attaches the person to their goal.

This ensures that your AUM remains stable even during market turbulence.

However, it may seem like a far-fetched exercise to make goals for every client. Worry not, we have got a solution! Goal GPS with tracker. With this, you can:

Make quick goals, whether planning for child education, retirement, house planning, etc., with a family photo and a goal photo.

Map funds, whether existing or new, and assess the shortfall.

Track goals by sharing proper reports with your clients.

Scenario 2

When clients want funds during an emergency.

At times when there is an emergency, and your client needs money immediately, there is no choice but to redeem their investment.

To solve this, we have got another solution. MFDs can offer loans against mutual funds.

Let us discuss how loans against mutual funds can serve as valuable insurance against client redemption in another blog

For now, As suggested by DP Singh, SBI Mutual fund

Don’t over-sell liquidity in mutual funds, promote longevity of investments. Liquidity is a comfort feature – only to be used in real emergencies. The more you promote liquidity, the more challenges you will face as you keep bringing in new business while redemptions leak out from your AUM. The longevity of investments is the only win-win for your clients and yourself.

Whenever you receive a new lump sum or SIP from your client, make sure to link it with a purpose and ensure longevity of investments. To learn more about how Goal GPS can help you, contact us today!

0 notes

Text

How to Become an Agent of LIC

A Comprehensive Guide

The Life Insurance Corporation of India (LIC) is the largest life insurance company in India, with a market share of over 60%. It is a government-owned company that offers a wide range of life insurance products, including individual and group plans, savings plans, and retirement plans.

LIC agents play a vital role in helping people get the right life insurance coverage for their needs. They are also responsible for educating the public about the importance of life insurance and its benefits.

If you are interested in becoming an LIC agent, there are a few things you need to do:

1. Meet the eligibility criteria.

To become an LIC agent, you must meet the following eligibility criteria:

You must be at least 18 years of age.

You must have passed the 10th standard examination from a recognized board.

2. Register with LIC.

Once you have met the eligibility criteria, you need to register with LIC. You can do this by contacting your nearest LIC branch or by visiting the LIC website.

3. Complete the training program.

Once you have registered with LIC, you will need to complete a 25-hour training program. This program will teach you about the basics of life insurance, LIC products, and sales techniques.

4. Pass the IRDAI exam.

After completing the training program, you will need to pass an exam conducted by the Insurance Regulatory and Development Authority of India (IRDAI). This exam is designed to assess your knowledge of life insurance and LIC products.

5. Obtain your license.

Once you have passed the IRDAI exam, you will be awarded a license to work as an LIC agent.

6. Start selling LIC products!

Once you have your license, you can start selling LIC products to your family, friends, and other potential customers.

Benefits of becoming an LIC agent

There are many benefits to becoming an LIC agent, including:

Good earning potential: LIC agents are paid on commission, so they can earn a good income if they are successful in selling LIC products.

Flexible work hours: LIC agents have flexible work hours, so they can work around their other commitments.

Job satisfaction: LIC agents help people get the life insurance coverage they need to protect their loved ones. This can be a very rewarding job.

Tips for becoming a successful LIC agent

Here are a few tips for becoming a successful LIC agent:

Build relationships with potential customers: LIC agents need to build relationships with potential customers in order to sell them LIC products. This can be done by networking, attending events, and cold calling.

Be knowledgeable about LIC products: LIC agents need to be knowledgeable about LIC products in order to answer their customers' questions and help them choose the right product for their needs. They should also keep up-to-date on the latest LIC products and promotions.

Provide excellent customer service: LIC agents need to provide excellent customer service to their customers. This includes being responsive to their needs, answering their questions, and helping them with their claims.

0 notes

Text

LIC Plan - 5 Years Double Money

5-year LIC Plans: Read the blog to learn about the best 3 LIC plans you can choose in 2023. Find out more about the LIC Bhagya Lakshmi Plan, the New Jeevan Mangal Plan, and the Saral Jeevan Bima.

You should be aware that LIC does not offer any such five-year investment plan that doubles your money. Therefore, the LIC plan's 5-year double-money feature is not a given. However, there are a number of LIC plans that, through accrued bonuses and investments in the market, provide higher returns at maturity.

Let's look at these 6-5 year LIC short-term plans and see what they have to offer.

1. LIC Bhagya Lakshmi Plan. One of the life insurance plans created for India's low-income population is this one. When the policyholder's limited payment protection plan matures, they will receive a 110% return of their premium payments. The minimum and maximum premium payment terms are 5 and 13 years, respectively. The minimum and maximum sums assured are 50,000 and 2,000, respectively. When the policyholder reaches age 65, the plan becomes mature. The sum assured is the same as the death benefit amount. The death benefit amount, however, is only provided in the event that the policyholder passes away during the policy's term.

2. LIC's New Jeevan Mangal Plan One of the top LIC policies for the past five years is the New Jeevan Mangal Plan. It is a pure protection plan with the advantage of a premium return at the conclusion of the policy term. You can choose between paying the premium in a lump sum or on a recurring basis as you select this plan. You have the option of paying the premiums on a monthly, quarterly, half-yearly, or annual basis if you decide to do so. You will be given the option to purchase the coverage up until you pay the premium. The minimum and maximum entry ages for this plan are 18 and 55, respectively. The minimum sum assured amount is INR 50,000 and the maximum is INR 2,00,000.

3. LIC Saral Jeevan Bima You can get short-term risk coverage on your life by purchasing this 5-year insurance policy. Your family will receive the sum assured if you pass away during the policy's coverage period. This plan guarantees that even in the unfortunate event of your passing, your family won't face financial hardship. The minimum and maximum age requirements to purchase this plan are 18 and 65, respectively. And the minimum sum assured amount is INR 5,00,000 while the maximum is INR 25,00,000.

0 notes

Text

Best LIC Agent in Delhi

The best LIC advisors in Delhi NCR, with over 5 years of experience in the life insurance industry, help our clients choose the best life insurance policy. I have over 200 customers and have sold over 500 LIC policies. We provide the most appropriate LIC planning and agent training support.

0 notes

Text

Top 10 Insurance Companies in India

Top 10 Insurance Companies in India

Life insurance is an agreement between a person and an insurer that commits the latter to guarantee payment of a certain sum to the policyholder's family in the terrible event of a sudden death.

Without a death, a maturity benefit—a sum assured—is given when the insurance achieves its maturity. Many insurance companies also provide optional coverage for serious conditions.

The best life insurance provider is one that gives customers the most coverage at the lowest price.

1. Max Life Insurance Company

Max Financial Services Ltd., was founded in 2000. This life insurance company strives to give its clients the right level of financial security. Each of these insurance plans that Max Life provides is brimming with benefits and other essential features, depending on the individual's needs.

2. AEGON Life Insurance Company

AEGON Life Insurance Company was established in 2008, employs a multi-channel marketing strategy to help individuals make better decisions. AEGON N. V., a leading supplier of asset management, pensions, and life insurance products, created AEGON Life Insurance in partnership with Bennett Coleman and Company, the Times Group, India's largest newspaper company.

The business has launched several services to provide clients with opportunities to meet their financial objectives. Numerous reasonably cost life insurance products are available from AEGON Life Insurance Company.

3. Bharti AXA Life Insurance Company

The Bharti AXA Insurance Company Ltd. frequently appears in a list of Indian life insurance providers. It is a recognized corporate organization in India with links to the farming, finance, and telecommunications industries. There are several insurance alternatives available from Bharti AXA Life Insurance Company.

4. Bajaj Allianz Life Insurance Company

Bajaj Allianz Life Insurance Ltd. was established by a collaboration between Bajaj Finserv Limited and Allianz SE, one of the leading insurers in the world. On May 2, 2001, the Company was granted a registration certificate by the IRDA, enabling it to conduct general insurance business in India. In response to shifting consumer needs and desires, Bajaj Allianz Life Insurance Limited has released new insurance products.

5. HDFC Life Insurance

HDFC Life Insurance Company is a joint venture between Standard Life Aberdeen PLC and Housing Development Finance Corporation Ltd. Business operations began there in the year 2000, and the company's headquarters are in Mumbai, Maharashtra.

6. LIC Life Insurance Company

LIC is one of the financial institutions that was established in India for several nation-building programs. This insurance provider is frequently recognized as among India's best. After collecting funds from customers through life insurance contracts, LIC's main responsibility is to invest in different government holdings and global financial markets.

7. Pramerica Life Insurance Company

Pramerica Life Insurance Company was established as a consequence of the cooperation between Prudential International Insurance Holdings Ltd. and Dewan Housing Finance Co. Ltd. There are 138 sites for insurance firms around the country. Before becoming DHFL, it was formally known as Pramerica Life Insurance Limited. The corporate office of Pramerica Life Insurance Company Ltd. is located in Gurugram.

The business has given its clients' families more than $1 billion in life insurance payouts throughout its more than 40 years of existence. It offers a selection of business and private life insurance coverage. All of these insurance plans were established specifically to satisfy the needs of the subscribers. Primerica offers term life insurance alone.

8. Exide Life Insurance Company

Exide Life Insurance is one of India's top 10 most reliable companies. Providing long-term security and financial solution plans is the company's main objective. In the insurance sector, it has a great track record of incentive payouts as well as a strong traditional product line. The business has gone above and beyond basic life insurance by offering choices for need-based insurance coverage. It is a private, independent life insurance company.

9. Kotak Mahindra Life Insurance

Kotak Mahindra Life insurance business Ltd. is a collaboration between Old Mutual Ltd. and the pan-African banking, investment, and savings organization Kotak Mahindra Bank Ltd. Indian-based Kotak Mahindra Life Insurance Corporation Ltd offers individual life insurance. The company was started in 2001. On April 8, 1986, the company adopted Kotak Mahindra Finance Company Limited as its legal name.

10. Reliance Life Insurance Company

Reliance Capital & Nippon Life collaborated to establish the Reliance Nippon life insurance company. It began operations in 2001 and quickly became one of the most well-liked life insurance companies among individuals acquiring insurance plans.

0 notes

Text

The Best Ways to Save Income Tax in India for NRI

Tax planning is one of the most effective ways to reduce taxes you have to pay on income earned during a particular year. Income tax law allows deductions for a variety of investments, savings schemes, and expenditures. Listed below are the major tax deduction schemes in India that can help you save income tax. In accordance with the Income Tax Act, the following options are available for tax savings when you want to go for the NRI tax in India:

Section 80C investments

For NRIs (Non-Resident Indians) and local taxpayers, these are the most popular tax-saving options. The Income Tax Act allows you to deduct up to Rs. 1.5 lakh in a financial year on various investments and expenses.

Investing in 5 year tax-saving FDs can give you a deduction of up to Rs. 1.5 lakh. Fixed deposits, whether domestic or NRO, are taxable in India. Under Section 80C, NRIs can also claim a deduction up to Rs. 1,50,000 on interest earned on NRO fixed deposits.

An investment in a public provident fund can save you income tax, since it provides a deduction of up to Rs. 1.5 lakh under section 80C. A public provident fund is a government program available at most banks and post offices. PPF accounts generally have a 15-year lock-in period.

PPF accounts cannot be opened by NRIs, but if you opened the account before becoming an NRI, you can still hold it until maturity.

National Saving Certificate: The NSC is a fixed income scheme that offers a variety of tax advantages. The current NSC interest rate is 6.8%, compounded yearly. Investments and interest earned under Section 80C are tax deductible. NSC account holders who become NRIs while the account is in operation can continue the account till maturity on a non-repatriable basis.

ELSS Funds: One of the most popular investment options for investors is equity-linked savings schemes (ELSS). An equity-oriented mutual fund invests at least 80% of its assets in equity. ELSS funds can be invested in by both residents and non-residents in India to reduce taxable income. LTCG tax is applied to the returns of such funds at a rate of 10%. The maximum deduction you can claim in a financial year is Rs. 1.5 lakh. NRIs and normal residents alike are eligible for the 80C tax exemption.

LIC premiums: The premiums for life insurance are tax deductible up to Rs. 1.5 lakh. Deductions are available for ULIP premiums, term insurance premiums, and endowment policy premiums as long as the insurance cover exceeds 10 times the annual premium.

National Pension System (NPS): NPS is a government-backed retirement fund, and contributions can be deducted up to Rs. 1.5 lakh. Pension contributions can also be made by NRIs.

Employee provident fund: A contribution to the Employee Provident Fund (EPF) counts towards the Rs. 1.5 lakh limit under Section 80C.

Home loan repayment: Until Rs. 1.5 lakh per year, the principal repayment on a housing loan is tax deductible.

Tax savings schemes other than Section 80C

You can also save on income tax by utilizing various deductions under Section 80 of the IT Act in addition to deductions under Section 80C.

Medical insurance premium: Those who pay premiums for medical insurance under Section 80D can deduct up to Rs. 25,000. Senior citizens can deduct up to Rs. 50,000. Those who pay premiums for themselves as well as their senior citizen parents can claim a combined deduction of up to Rs. 75,000 per year.

Interest paid on home loan: The interest on a home loan is tax deductible up to Rs. 2 lakh per year under Section 24 of the Income Tax Act. A deduction of up to Rs. 50,000 can also be claimed on home loan interest under Section 80EE.

Income through NRE account interest: Foreign earnings of NRIs can be deposited in an NRE account in India. NRE savings accounts and fixed deposits earn tax-free interest in India. Non-residents can therefore save on income tax by investing in NRE accounts.

Charity to notified organizations: Tax deductions are available for charitable donations. Donations to charitable organizations are tax deductible up to a certain amount. You can donate 50% of your donation to NGOs and up to 10% of your adjusted total income to NGOs.

Thus, you might have now got an idea on the ways to save money when you are paying the NRI tas in India. Ensure you are following the right guidelines and these ways to reduce the tax payment cost.

FAQs

How is income classified?

There are five main types of income - salary, capital gains, business or self-employment income, residential property income, and other sources.

Is it possible for NRIs to reduce their Indian taxable income?

Residents and NRIs alike can reduce their taxable income in India through a variety of investment schemes:

– Tax-saver NRO FDs

– ELSS Funds

– National Pension System

– NRE accounts

– Home loan repayments

In India, can NRIs invest in mutual funds to save taxes?

Mutual funds in India can reduce NRIs' taxable income in India. Invest in tax-saving mutual funds. There is a tax rebate of up to Rs 1,50,000 available to investors in Equity Linked Savings Schemes (ELSS).

In addition to 80C, what other deductions are allowed?

There are some other provisions that allow tax deductions besides Section 80C:

Section 24: Interest paid on home loans may be deducted up to Rs. 2 lakh.

Sections 54 – 54F: Exemptions from long-term capital gains from property (54), and other assets (54F).

Section 80D: Premiums for self, family members, and dependent parents.

Section 80EE: For first-time homebuyers paying interest on their home loan.

Section 80EEB: For the payment of an electric vehicle loan.

Section 80G: For charitable donations.

Rent deduction under 80GG if HRA is not included in your income.

Section 80TTA: You can deduct up to Rs. 10,000 from your savings accounts or bank deposits.

0 notes