#launching mutual fund api

Explore tagged Tumblr posts

Text

Fixed Deposit APIs in fintech enhance customer experience, automate processes, provide real-time data, increase accessibility, offer customizable solutions, and ensure secure transactions, making financial management seamless and efficient.

#mutual fund api#how to launch mutual funds#fintech api#api for mutual funds#deposit api#quick way to become fintech#mutual funds api solution#launching mutual fund api#mutual fund api solutions#mutual fund api provider

0 notes

Text

Inflation and economic uncertainty driving demand for value-added gift cards in 2023

The retail landscape in 2023 is being shaped by a variety of factors, including rising inflation and economic uncertainty. As a result, consumers are becoming increasingly discerning when it comes to how they spend their money. One trend that has emerged in response to these conditions is the growing demand for value-added gift cards.

These gift cards offer consumers extra benefits beyond the face value of the card, such as cashback or discounts, making them an attractive option for those looking to stretch their budgets. Amid the growing demand for value-added gift cards, the trend of strategic alliances has also emerged in the space in 2023.

In February 2023, Prizeout announced that the firm had entered into a strategic collaboration with nine credit unions. Under the partnership, the United States-based credit unions have formed a credit union service organization (CUSO) to boost rewards for members who shop locally. With access to the Prizeout program, members of the credit unions will receive an average of 12% bonus when they purchase gift cards.

Credit unions are not only seeking to empower their members with greater purchasing power amidst the challenges posed by inflation and economic uncertainty but are also exploring new ways to foster member engagement and cultivate relationships with local merchants. To this end, credit unions are tapping into the Prizeout gift card program as a strategic tool for achieving these objectives.

Nine of the participating credit unions are using an application programming interface (API) to connect to digital gift card technology offered by Prizeout. Local merchants fund the program by determining their own bonus levels based on data provided by Prizeout's platform. Upon a credit union's sale of a gift card, Prizeout transfers the gift card's core value to the merchant.

When a consumer subsequently makes a purchase at participating retailer using their value-added gift cards, Prizeout and the credit union will earn a portion of the bonus value as revenue for each digital gift card that is sold. This creates a mutually beneficial arrangement for all stakeholders involved, with credit unions and local merchants strengthening their relationship while also providing customers with enhanced purchasing power and unique rewards. The demand for value-added gift cards is also growing in the earned wage access segment.

ZayZoon, the earned wage access provider, in collaboration with Prizeout launched a service where it offers advance wages in the form of retailer gift cards in North America. According to ZayZoon, the firm is experiencing strong traction towards the gift card pay-out approach it launched in 2022.

Many of the earned wage access providers charge users US$3 to US$5 every time they ask for instant access to earned income ahead of payday. This value can add up quickly if users ask for payouts frequently, thus having an impact on their disposable income. As a result of this, many seek alternative credit options such as buy now pay later schemes instead of earned wage access.

Consequently, to boost the appeal of earned wage access among professionals, ZayZoon introduced the gift card pay-out approach, which not only gives them access to funds but also enables them to stretch their funds. The firm, which serves hourly workers at 4,000 small and medium-sized enterprises, is seeing gift cards as a key element to demonstrate financial responsibility among its users.

With the added benefits of cashback, discounts, and rewards, value-added gift cards are offering a unique value proposition to consumers. These innovative gift card programs, launched by credit unions and ZayZoon, are expected to gain more traction as prices continue to rise and consumers look for ways to stretch their budgets. Financial institutions and merchants that offer these types of gift cards will be well-positioned to attract new customers and build loyalty among existing ones in 2023.

To know more and gain a deeper understanding of the gift card market in the United States, click here.

0 notes

Text

Can you predict which mutual funds will do better than others?

Can you anticipate which mutual funds will do better than others?

It turns out you can. The number of financial investment items readily available for purchase increases every year. Large item choice might produce issues, both for the client and the consultant. At Junxure, we've decided to construct an algorithm to deal with that concern. What we sought We wanted to supply necessary help for advisors and customers, presuming that some mutual funds can bring organized returns in given market conditions. Depending upon a fund's method, approaches of management and item specifics, it may be a better fit for purchase today, or remain more promising for the conditions of tomorrow-- in a various environment. In this vein, we chose to check whether AI-based algorithm can discover the best mutual funds using affiliations hidden in item costs, macro indications, market indexes, FX rates and commodities. The twist was-- we did not try to translate these reliances however rather put them to work and see the real results in product ranking. How we did that We collected macro indications of significant worldwide economies (US, EU, China, Japan, LatAm, India), commodities prices, FX rates and significant indexes quotes. Then, we used cost history for over 4000 mutual funds traded on NASDAQ. Our goal was to create a ranking of the funds and figure out which ones would score the highest rate of return in the next quarter. To produce optimum environment for the algorithm, we required to prepare the information we had accumulated and run a lot of additional analyses (e.g. return and threat ratios, fund performance signs). The last thing to be done before the training begun was to effectively decrease data dimensions using Principal Part Analysis (PCA). What carried the most guarantee The most appealing results came from the ensemble machine discovering technique. It utilizes several discovering algorithms (lots best performing AI models in our case) to obtain a much better predictive performance. For the results measurement, we created a Top-Bottom Analysis. In the analyzed group, we created a ranking of mutual funds, arranged by the probability of achieving the greatest rate of return in the next quarter. Then, we moved 3 months in the future and examined whether we were right, specifically whether the leading 10% was significantly better than the bottom 10% from our ranking. To produce the most sensible environment, we measured our outcomes utilizing so called test data, which is a dataset which the algorithm has actually never ever "seen" prior to. It ensured that such outcomes can be obtainable in daily operations. In order to assess a mutual fund capability to outperform its peer groups, our design took various specifications into account: fund threat and previous efficiency in different market conditions, return persistence and repeatability, risk-adjusted efficiency ratios as well as methodical risk related to main market elements. The last one, in particular, is somewhat vague: information-driven market movements which are quite unforeseeable, human behavior which is uncertain, adaptive and sometimes repeatable, finally the basic financial laws that should discuss reliances between economic cycles and possession prices in a long term but not constantly do. We anticipated device learning to tell us more where the fact was-- comments Grzegorz Prosowicz, Consulting Director for Capital Markets at Advisor Engine. What the outcomes were The actual results for the test dataset surpassed our expectations. The very best results we have achieved were 78% in Top-Bottom Analysis. It means that in 4 out of 5 cases we can predict which funds would score a greater rate of return. Additionally, the difference in rate of return between bottom and leading funds totaled up to 2,99 percentage points quarterly (12,51 p.p. CAGR). In other words, advisor picking products for their customer from readily available item universe for one-year period, could rely on 12,51 percentage points better returns with the algorithm-- no matter how the markets perform. What's next? Think of having a service of that kind in your institution. Your consultants would lastly get a reliable assistance with choosing the ideal items and become more productive. Is the service going to reach a similar success in every country or scenarios? Is the service all set to launch as cloud API in your organization or get checked by you in kind of proof of concept? --------------------------------------------- Wealth management techniques in the digital age The service digitization procedure which might be observed for more than a dozen (if not more than twenty) years does not skirt the financial sector. Both business and banks providing investment advisory services place significance on innovative software targeted at assisting in the customers' wealth management. What should the wealth management service appear like in the digital improvement age and what strategies can be adopted by the institutions using them? Digital wealth management technique-- challenges Both the banks and business offering the wealth management service deal with a number of difficulties connected with the digital transformation. According to the "Swim or sink: Why Wealth Management Can't Afford to Miss the Digital Wave" report prepared by Advisor Engine, the wealth management service is presently one of the least sophisticated ones in terms of technology. age structure-- a high share of clients classified into HNWI and UHNWI (Ultra High Net Worth People) groups are seniors who do not demand any cutting edge services from banks or advisory companies and who depend on direct contacts with the advisors, aversion to developments-- the wealthiest clients think the validated wealth management methods must be used and it is needless to introduce new options, innovation limitations-- lots of banks keep using older software, the extension of which with brand-new functionalities is made complex and costly. Despite the challenges which need to be overcome by banks and advisory companies, the wealth management digital method might produce quantifiable advantages. The authors of the report by McKinsey advisory company called "Secret Trends in Digital Wealth Management-- and What to Do about Them" observe the clients having access to the software helping with wealth management report the 5 to 10 times higher satisfaction level than customers communicating with the consultants in a conventional way. The costs are not irrelevant for the banks and advisory companies. Utilizing the robo-advisory channel allows to lessen them. Thanks to the algorithms, it is possible to use prompt help to the consumers when making investment choices without significant expenses-- such advisory services are more affordable than the support supplied by a human, experienced advisor and work even in negative market conditions. Junxure Wealth Management software Wealth management digital methods The banks and advisory companies alike know that they can just get using the digital technology potential. Entities with a long market existence buy the innovative options more and more frequently. There are many examples: Perpetual is a company using the wealth management service with a more than 140 years' existence on the Australian market. It decided to make instantaneous insight into financial investment portfolios and reports delivered by means of the chosen social media offered to its consumers, Swiss UBS bank opened a robo-advisory channel for consumers with the wealth listed below 2 million pounds required to open a personal banking account, a Singapore branch of Citi offered their customers the chance to utilize a bank chatbot via Facebook. It offers details e.g. about balances and transactions on the savings account. Carrying out brand-new options suggests advantages not just for consumers (who may acquire a quick insight into their investment portfolio), but likewise for financial institutions. The strategic wealth management might be mostly automated. Some activities may be performed without the consultant's participation. What is more, the specialized software application makes it possible for to gather information which can be examined then to change the embraced wealth management strategies. Advisors having access to the tools assisting in some daily tasks gotten in touch with wealth management gain also more time for discovering clients' needs. According to the research study performed by the advisory business Ernst & Young, one of wealth management parts of particular value for wealthy customers is comprehending their financial objectives and offering a broad access to investment products and tools to them. Strategic wealth management-- how to get ahead of rivals? Lots of financial institutions and banks think about the wealth management digital technique to be the key to obtain competitive advantage and customers who do not wish to base exclusively on their instinct and knowledge when it comes to wealth management. To ensure the provided services correspond to the requirements of their recipients, the business and banks using the wealth management service must: 1. Look at CRM for financial advisors implemented software application from the clients' perspective It is of specific significance the client's frontend operation is user-friendly, allows to set investment goals, is geared up with a monetary preparation application and makes it possible for to interact with specialists and consultants. Multi-modular Junxure Wealth Management software provides a multi-channel client's frontend. Individuals using this service have access to info on various gadgets, consisting of tablets, pcs and smart devices. Customers might use both the assistance of consultants and location orders themselves by means of the robo-advisory channels. 2. Define the target group of clients Strategic wealth management is various for the affluent ones and for HNWI customers. The software ought to be adjusted to the needs of the target client group. The picked option needs to support building the relationship in between the advisor and the consumer. Those Junxure Wealth Management system allows to offer both full and simplified advisory services. What is more, the customers might transfer the orders to the advisors quickly or perform them themselves. Junxure Wealth Management provides likewise monetary and investment advisory services. Customers can be profiled and the consultant might carry out customized tactical wealth management for each of them. 3. Improve (expand) their offering The wealth management digital method is viewed from the perspective of benefits as it e.g. enables to focus on the consumer and their requirements more than in the past. Automating some activities helps with the whole advisory procedure. This, in turn, makes it possible for to expand the offer with brand-new financial investment items which may be of interest for a wider group of consumers. Utilizing Junxure Wealth Management, banks and advisory companies may perform different analyses, including the efficiency and danger ones, for their consumers. Thanks to the control and systematic reporting, the consumer may rely on comprehensive support and likewise execute the most profitable wealth management methods. What are the identifying functions of Junxure Wealth Management? Junxure Wealth Management option was designed to cater for the requirements of the wealth management clients and their consultants. This is a multi-modular wealth management system created for the private banking consumers. It supports the work of all staff members having contacts with the capital transferred by the clients and establishing wealth management strategies, i.e.: consultants-- they might generate a risk profile for every single client and make additional advisory choices based upon it, consisting of offering strategic wealth management, managers-- they take part in the investment process, managing the clients' financial investment portfolios, analysts-- they are responsible for preparing analyses based on the collected information and obtained financial outcomes. The system likewise supports the aftersales services of tremendous importance for more cooperation of the bank (or the advisory business) and the consumer. The customer may count on e.g. consistent insight into their financial investment portfolio and receive reports. They enable the investor to learn the results on various levels, including the classes of assets or currencies. The software application developed by Junxure is adapted likewise to the regulative requirements, consisting of e.g. MiFID II (Markets in Financial Instruments Instruction) which imposes info responsibilities on banks and business using investment items. Thanks to that, the consumers get info about the danger connected with investing in chosen financial instruments and expenses they will incur in relation to utilizing the advisor's assistance.

#Wealth Management Software#wealth manager software#financial advisor software#robo advisor#CRM for financial advisors#Financial CRM#wealth management crm software#advisor technology#RIA CRM

1 note

·

View note

Text

Eyal Nachum

Eyal Nachum is a fintech guru and a director at Bruc Bond. Eyal is the architect of the software that SMEs use to do cross-border payments.

Eyal Nachum

Youthful startups often have fantastic concepts that they challenge to put into training, experiencing too many obstructions along the way. Too much, these stumbling blocks lay on the path in order to a solid banking as well as payments infrastructure. Three international executives at Bruc Connection give their advice.

BOSS of Bruc Bond Singapore Krishna Subramanyan, Country Supervisor for Poland Krzysztof “Kris” Matuszewski, and Board Fellow member Eyal Nachum in a new talk to Konstantin Bodragin, Brüc and up. Bond Magazine’s Editor-in-Chief. KILOBYTES: Hi guys, thank you for which makes the time. To be able to start, what tips may you give a youthful fintech startup?

Eyal Nachum: Give attention to time-to-market. Forget in relation to everything else. You must find a product out right now there. 3 quarters of a functioning product is a lot better than fully of nothing. As soon as you accomplish have something working, speak to the people using this. Talk to your clients. They will understand which you’re only starting out and can be more forgiving at the start. They will give you actually the feedback you must have. A person can build the various other even just the teens using that understanding. From Bruc Bond, many of us are continue to always discussing to our consumers. That allows us to constantly increase in the techniques our clients will need.

Krishna Subramanyan: I would offer a fintech startup the very same assistance as for just about any start-up. It will be incorrect to be able to focus on your individual product or service or idea, despite the fact that it is usually tempting for you to do so. First, recognize a customer population to help be dished up, and perform to understand their very own soreness points. Product employs the particular pain points driven from the decision to serve in order to this specific client population.

Krzysztof Matuszewski: You need to be able to be methodical. First, locate your niche. This will probably be your own market possibility. Then, survey. Check out there the competitors to uncover regardless of whether somebody’s already carrying out what you would like to do. Locate technical companions to aid you avoid hasty decision-making and to meet your current time-to-market goals. Do buyer improvement well. Always check out your presumptions and possibly be ready to pivot, to alter the course of your own personal tool to fulfil typically the customers’ needs. Then obtain comments again. With each and every new product launch, new update, every single alter, you must acquire feedback. Keep your development/marketing equilibrium healthy. At first, you must keep your product merely good enough, but with no marketing and advertising you will skip your industry fit. Also, and find buyers. An individual will need funds for you to increase.

KB: Getting often the infrastructure proper can help to make or break task management. Just what should young fintechs consider about when it will come to their banking/payments commercial infrastructure?

EN: Approach that inside three stages. 1st, the actual infrastructure doesn’t make a difference to help customers, just get the product or service out. Second, do simple infrastructure, so you can easily have a proof principle. The third stage will be the hardest from an facilities point of view. You have in order to achieve scale. Just how? Anyone need a clear purchaser direct. Even if the idea feels like it would certainly slow you down, to get scale you must do it. You actually also have to have got a very good grasp connected with the rules and also adhere to them. If a person do crypto and desire an account with regard to salaries, your bank can enjoy nice at period one particular, but not stage about three. Don’t step on almost any paws. Set up structure in a way that will does not necessarily break anybody’s principles.

KILOMETER: Use credible functioning working devices and comply using regulations totally. If an individual don’t, you could drop your infrastructure. Be firm with security, and benefit from integrations when you could. Open financial and the particular PSD2 in The european countries exposed up a whole planet of options with API connections : explore the item.

KS: Structure must become flexible to conform to adjustments in understanding and natural environment. Real-time abilities for long term innovation are key. It truly is becoming harder to preserve buyers. What is beneficial is the capacity to illustrate to customers that most of us are usually listening all typically the time. Therefore, there needs to be anything new, exciting on present in which sets the rate inside first few days, months, groups on often the back of client responses. New architectures must influence APIs and micro-services to back up this pace.

KB: Krishna, are there specific concerns in terms of Singapore and Parts of asia most importantly?

KS: Fintechs in this article wish to accomplish a lot having very little quickly. Typically the teams are very ready but limited in assets. Firms that can prosper inside a mutually supportive setting are those who win. So, work with others to experience the pace along with the perspective. For illustration, while open bank is definitely not set in regulation, the particular biggest banking participants are trying to reach out to be able to the smallest fintechs to have interaction and collaborate.

KB: Kris, how about the EUROPEAN UNION?

KILOMETRE: There is extremely strong competition within the EUROPEAN, both among obligations fintechs themselves and with financial institutions. The market is properly controlled, but there are generally a lot of restrictions to adhere to. In the WESTERN EUROPEAN, you must consider info rights into account. You should meet the requirements associated with the GDPR, the legal guidelines designed to guard men and women and legal agencies coming from new risks which is part of the actual data economy. These can be quite difficult to follow. On the particular other hand, Brexit provides chance to attract shoppers departing the UK, and so there are options just about everywhere.

KB: B2B [business-to-business] and B2C [business-to-consumer] usually are a couple of very different modes regarding business. What sort involving unique payments/banking challenges complete startups during these spheres deal with that the other folks would not? How can they get over them?

KM: Fintech corporations fall into either the business-to-consumer income model or perhaps business-to-business type. Each unit has its own problems, although the B2C gross sales routine tends to end up being much shorter compared to the BUSINESS-ON-BUSINESS sales cycle, since organizations are slower to embrace new-technology. For B2B at this time there are a handful of significant challenges. One is this banks offer a established of related payment goods and already have a substantial customer base. The next is that businesses usually have very complicated in addition to extensive product needs, consequently payment fintech must give good service and in business excellence to compete around the corporate market. Therefore, organizations from the SME industry come to be frequent clients connected with repayment fintechs. With B2C, different challenges rise for you to the top. First associated with all, there are money washing. The importance of corporate regulatory solutions in this is previously mentioned all else. There exists levels of competition from small business charge cards, cryptocurrencies and digital funds, and from money exchange and remittances as any establishing niche.

EN: Often the BUSINESS-TO-BUSINESS world wastes regarding several weeks a 12 months on audits and construction. That’s the reason you see a lot of ideas concerning lowering the headache. Together with B2C you can’t wait too long. There’s always movement as well as change. There isn’t a real challenge to stability inside the B2C sphere due to help the quantity of players, and also prices are fairly repaired due to competition. The largest challenges right now tend to be ethnical. There are vocabulary barriers in between banker along with customer. Everything we need are usually solutions regarding specific markets: the unbankable or bauge, immigrants, consumer banking in international languages, student-specific services, and so forth.

KS: Collection of global business banking partnerships stays the important. Depending on the corporate state, banking challenges can certainly vary substantially. Banks behave to this crissis in addition to cost of retaining enterprise in different ways. Fintechs need to spend considerable moment to understand almost every partner’s direction. Ability to fit target growth segments regarding banking partners to all their unique must be a great ongoing, daily exercise.

KILOBYTES: Thank you for getting the time and then for your personal advice.

1 note

·

View note

Text

Top 5 UPI Payments Apps in India 2019

1.Google Pay : Google Pay (formerly known as Tez) is number one in this list. Google Pay is the most innovative and unique UPI payments app in India launched by Google.

Features:

Proximity features (Audio NFC Technology) in Cash Mode Transactions.

No Wallet option, money can be directly debited and transferred to any Bank Account you wish.

Best reward programs and offers amongst the all UPI payments app in India.

In-App Google Play and Google Ad Payment option.

Add any UPI participating Bank Accounts in India.

Google Pay Safe shield.

Spam Warning, You may Block any unwanted UPI request which seems like fraud.

Excellent UI and user-friendly navigation.

Transfer money between UPI id or QR Code

In-app payments for hundreds of partnered merchant.

Integrate Google Pay API for merchant set up.

Download

Google Pay

. (Referral Link, Use Code: s1zs0c)

2.Phone Pe :Phone Pe is a Bangalore based UPI payments App launched in 2016. This payments App now acquired by e-commerce giant Flipkart.Phone Pe is partnered with YesBank to provide UPI Payments service in India.You can link your existing Jio Money, Freecharge and Airtel Money

e-wallet

with Phone Pe App and seamlessly transfer money between these wallets.

Features:

Most popular UPI payments app in India.

Interoperability amongst the e-wallet providers in India.

Purchase Gold using Phone Pe Wallets.

Excellent Cash Back and reward programs across several merchant websites

You can use the Phone Pe Wallet option in most of Indian E-commerce websites Payment gateway.

Money transfer using UPI limit up to Rs.1.00 Lacs.

Can integrate Jio Money with Phone Pe Wallet.

Excellent UI

A user can access multiple Bank Accounts using Phone Pe UPI App

Download Phone Pe. for

Android

&

iOS

(Use Referral Code:phon.pe/ru_sank73622)

3.Paytm App : India’s largest digital wallet service provider and most downloaded UPI app in both Android and iOS platform. Paytm was the pioneer of digital payment service in India and one of the best UPI app in India. The App has excellent UI and integrates many services in a single App platform.

Features:

Most popular money transfer app in India.

Integrates many features in a single platform. You can create Paytm Payment Bank Account after full verification of KYC.

Rupay Virtual Debit Card linked with Paytm Payment Bank.

Access Paytm Online eCommerce store directly from Paytm App or Paytm Mall.

Transfer money using the QR code or sharing Payment link.

Buy Now Pay Later service for ICICI Bank customers.

Download

Paytm

UPI App.

4. Freecharge Payment App : Freecharge is also a very popular UPI money transfer app in India for its several cash back and in-app discounts and offers. You can get your own @freecharge UPI Id using this App.You can add multiple Bank Account linked with the mobile number registered for the Freecharge App. You can also create FreeCharge

mobile wallet

by uploading some KYC documents.This Gurgaon based Fintech startup now is acquired by Axis Bank.

Features:

One of the highest rated money transfer UPI app in both the App Store and Play Store.

Get your own @freecharge UPI id powered by Axis Bank.

In-App merchant discounts and offers.

Send money using the QR code.

Invest in Direct Mutual Funds.

Download the Freecharge UPI Payment App for

Android

and

iOS

.

5. PayZapp by HDFC Bank :Another UPI payments app cum digital wallet offered by HDFC Bank in India. This mobile Payments app also very popular in India due to its numerous cashback offers across different merchant sites.

Features:

In-App virtual Visa Debit card for online transactions.

Proximity Payments (Soundwave communication similar to G Pay) Soon to be launched.

Huge Cashback and rewards programs across different merchant sites. Visit here for details.

PayZapp wallet option on all e-commerce sites in India.

Option for PayZapp business Account.

VPA ID and QR code money transfer option.

Download PayZapp for

Android

&

iOS

.

Please Download This app for Money Transfer and use Referral Code while downloading app .So you will get cashback.

1 note

·

View note

Text

What is embedded finance?

Embedded Finance, also known as Embedded Banking, refers to the seamless integration of financial services into a non-financial service.

It is the utilization of financial services or tools (e.g. lending or payment process) by non-financial providers. For instance, an electrical shop offers point-of-service insurance for the goods offered at the store.

This model or infrastructure allows customer-centric digital platforms (i.e. anchor platforms) to ‘embed’ financial services into their operations.

Embedded Finance is primarily created to streamline financial processes for customers and allow them access to services whenever they need them. Few years back, consumers had to visit banks or financial institutes physically to apply for credit. With the launch of Embedded Financing, consumers can purchase and get credit in one place.

Types Or Examples Of Embedded Finance

Currently, businesses are actively integrating Embedded finance companies into their operations. Following types of Embedded finances are available in the market:

Embedded Payments

In Embedded payments, involved parties can integrate payment infrastructure and create a manageable payment flow within a platform or app. Payments are the first financial services embedded into the domain of non-financial services.

Embedded payments have become a crucial part of the E-commerce app or SaaS platform, where end-users can easily use this innovative feature. When individuals opt for this type of Embedded Finance for business, they can truly enhance the shopping experience for consumers.

Embedded Insurance

Embedded insurance refers to tying insurance with a purchase of a product or service. For instance, Tesla provides auto insurance both at online point-of-sale and in-showroom purchases.

Companies involved in Embedded insurance offer transactional APIs and technologies that enable the integration of insurance solutions with websites, mobile apps, and various partner channels.

Embedded Investment

Through Embedded investment, individuals can integrate stock market investing into vertical offerings. As a result, individuals can decide by making an Embedded investment and managing their money.

These variants ensure a seamless investment experience. Without leaving the platform, investors can use a single platform and invest their money in the stock market, mutual funds, and retirement plans.

Benefits Of Embedded Finance

Embedded Finance offers a wide range of benefits to its entities. These are as follows:

For Financial Institutions

Aids in building a more profitable business,

Open ways for attracting new customers,

Ensures improved underwriting

Enables enhanced loan lifecycle management

Allows more savings for customers

For Digital Platforms

Increases the customer lifetime value,

Multiplies customer retention,

Helps create a unique position in the market,

Provide companies with additional control over payment processes,

Removes several intermediaries and helps cost optimisation,

Helps scrutinise customer behaviours through insightful customer data and offers more customised services,

Offer companies with an additional revenue stream

For Users

Provides enhanced customer experience

Ensures increased access to financial services

Conclusion

One of the notable uses of Embedded Finance can be found in the innovative line of credit known as Buy Now Pay Later. This credit facility provides modern shoppers access to a wide range of products without paying anything upfront. The remaining bill amount is converted into easy EMIs..

Sellers such as brands and enterprises willing to integrate this form of Embedded Finance can opt for Buy Now Pay Later solutions offered at KredX. This will help them receive payment for the products sold or services offered instantly. Simultaneously, customers obtain products or services immediately.

0 notes

Text

4 Trends that Define the Future of Banking | Novopay Banking

The usually conservative banking industry is in the midst of transformational change. This change is led by 4 tectonic shifts in technology that have changed how we live, interact and deal with money.

Smartphones & Mobile Networks

Every smartphone user is carrying a computer a million times more powerful than all of NASA’s computing power in the early 70s. It is also embedded with 30+ sensors that can track our location, scan barcodes to capture our biometrics. This coupled with the current 4G network provides 60-100 Mbps speeds which can easily power the most engaging apps and content. The launch of low-cost internet data providers like Jio has doubled the data usage making India the 2nd largest internet-user in the world (see graph below).

This is the device for banking of the future be it deposit accounts, taking loans, buying insurance or buying mutual funds. You will do all your banking – anytime anywhere on the smartphone. The smartphone sensors can help make your banking personalized and location-specific. Connectivity ensures you can do all your payments and banking activities on the move at your convenience. Mobile alerts and notifications will help keep your money safe and secure.

Artificial Intelligence in Banking

The last decade has seen huge advances in Machine Learning(ML) algorithms that provide enormous power to transform banking as we know it. The ability of machine learning methods to ingest large amounts of existing data and hence behavior to learn and improve banking outcomes has remarkably improved.

According to a McKinsey report, more than half a dozen banks in Europe have already replaced the antiquated statistical-modeling approach with machine-learning techniques, which have resulted in a 10% increase in the sale of new products, 20% savings in capital expenditures and a 20% decline in churn.

Credit scoring attempts to predict human behavior when it comes to loan repayment. Traditional credit scoring methods looking at one variable at a time cannot unearth complex hidden relationships between parameters. Deep learning more closely mimicking the human brain is able to fit the data with more accurate non-linear models that will result in better loan decisions and hence small NPAs (non-performing assets).

Other Banking Applications There are several areas where AI has been used in Banking applications and the diagram below highlights the maturity of these applications.

API Banking

Despite Banks offering smartphone apps and web apps frontends to their customers, the future portends a more dynamic way in which the banking products will be consumed. Not all the customers of a Bank’s products will come from the Bank’s own Apps be it mobile or Web. Various aggregators, intermediaries, and partners could sell the bank’s your lending, insurance or investment products through their own apps hence bringing in new-to-bank customers dynamically. The weaving of new dynamic services and distribution channels for banking products is possible through APIs – Application Programmatic Interfaces. The new banking system architecture will need to support APIs that wrap key products to provide your partners with access to the banks offering in a simple yet secure system. These APIs need to be sufficiently granular so that the partner can deliver a differentiated and rich customer experience.

A Capgemini Financial Services Analysis study shows that there are several benefits that a Bank accrues when it supports APIs. See the diagram below for a quick summary of the analysis results.

Online Authentication and KYC

As smartphones grow and become the dominant mode of internet and online access they mobile device with its camera and other sensors allows for more convenient modes of verifying the mobile online customer – be it for authentication or performing KYC. The dominant smartphone platforms of Apple and Google Android have supported built-in biometric authentication using fingerprint or face, which have in turn been used to provide approval for payments be it for app purchase or for other online purchases – as in the case of Apple Pay or Google Pay.

These smartphone-based online verification mechanisms bring in enormous convenience literally at people’s fingertips while simultaneously increasing the level of assurance and security. These biometric modes can also be used in conjunction with OTP or pin/password making it a much stronger 2-factor authentication method.

The adoption of biometric-based authentication and KYC is increasing in banks the world over. A Deloitte study that highlights the growth of biometrics authentication by US consumers is shown in the diagram. Banks are increasingly performing transactions using an online device be it a smartphone, tablet or PC. Both dominant mobile platforms iOS and Android support built-in biometric sensors or attach biometric accessories through a USB cable or a Wi-Fi connection.

In India Aadhaar (biometric-based ID) has gained tremendous momentum in seamlessly verifying consumers using biometric and other methods over smartphones and PC platforms.

In the US and other western economies, the use of biometrics for payment authentication using mobile devices like smartphones has been gaining traction after the launch of Apple Pay on iPhones and other Apple devices, which uses a built-in fingerprint scanner or face-matching system to verify customers instantly. These methods of online authentication and KYC will reduce friction and improve not only the speed of acquiring customers but also for product purchase and registration.

In Conclusion

Smartphones and mobile networks will drive banking convenience and internet penetration making it the most important consumer platform for banking. Artificial Intelligence has made rapid strides and offers the ability to learn from large amounts of existing data in order to make more accurate credit-score predictions or accurate product recommendations. API Banking allows for the bank’s products to be unbundled and distributed using various partners and distribution channels in dynamic ways that the bank in itself would not have reached. Biometric and other online authentication and KYC methods provide for customer verification to happen on the customer’s own mobile device, delivering customer convenience but at the same time providing a high level of assurance on customer verification and KYC. The productivity gains of these innovations will also drive down the processing cost, allowing for smaller ticket size financial products and transactions – hence delivering on financial inclusion. These four megatrends fundamentally change the nature of banking services and bring a level of automation, convenience, customer focus & productivity that will transform and usher in a much more responsive and differentiated future bank.

#KYC for Banking#Saas solutions#Digital Distribution solution#Retailers provide Banking solutions#DMT#AePS#MicroATMs#CMS

1 note

·

View note

Text

FinTech Business Models: The Elixir Of Modern Finance Industry

What Is FinTech?

Fintech stands for financial technology and it depicts new inventions that are aimed at improving the delivery of financial services. In most cases, Fintech solutions are provided by developing and interpreting complex algorithms, cloud computing, and software integration.

FinTech solutions can be aimed at both the private customers and established businesses ranging from banks over insurances up to regular business such as clothing stores, eCommerce stores, or cafes.

Fintech conglomerates have become an integral part of our daily lives. There is an increase in the numbers of traditional financial providers and these have decided to partner up with the newly established technology solutions. From opening accounts to insurance underwriting and credit profiling, FinTech startups are transforming various services of traditional banks and flipping the conventional business models in the financial industry. Several FinTech Business models are depending on the way they are fused into the banking activities and core operations. Let’s dive right into the top 14 innovative Fintech Business Models

Top 14 FinTech Business Models

There are several Fintech business models that are disrupting the financial industry.Let’s look at 14 innovative FinTech business models that are leading the path of disruption.

Alternative Credit Scoring

There is a huge rise in the number of self-employed individuals who have a steady income. These individuals do not pass the conventional bank loan screenings due to the strict and outdated credit scoring criteria. Alternative Credit Scoring is implementing a new approach by considering alternative data points such as percentile scoring and signals amongst similar borrower groups. These qualitative factors combined with self-learning algorithms and machine learning can lead to better decisions over time. Alternative credit scoring can determine negative profiles based on social presence before the loan disbursement to avoid loan recovery issues.

Alternative Insurance Underwriting

In today’s world, individuals are given the same life insurance premium. Individuals are completely different with different health habits with different risk premiums. This leads to faulty premium calculations due to averaging out as the risk premiums do not account for the factors that are not quantifiable.

With alternative insurance underwriting, the Fintech companies are creating dynamic risk premium computing mechanisms with alternative data points such as social signals, lifestyle, and medical history. Just like the alternative credit scoring approach, this approach helps the FinTech companies in determining whether or not to offer insurance and other alternative payment options.

Transaction Delivery

Data is the new life force and managing it can give better insights and information into the needs and wants of the customers. FinTech companies are creating free products in the wake of transaction delivery. These companies stretch their business pillars to manage the expense gaps. To achieve this, the companies collect the data and share the same with the rest of the group to map the potential of the customers. This is done to pay premiums, buy mutual funds and invest in real estate.

Peer-to-peer Lending

P2P or Peer-to-peer lending is another Fintech Business Model. P2P lending deals with an individual borrowing an amount of money from another. Similarly, P2B is a situation when a business borrows money from one or multiple individuals. These lending models make it easier for investors to get better returns than those offered in debt markets by giving their money to pre-approved and vetted borrowers.

Small Ticket Loans

Different lenders and banks do not underwrite smaller ticket loans due to the low margins and high investment costs involved in setting and recovering the loans. FinTech companies in the market deliver great impulses by purchasing the ‘buy now and pay later’ mechanisms and one-click buttons on the eCommerce websites. This enables the customers to buy quickly without having to enter any credit card authentication form. By sharing the customers’ data with the algorithms determined the customers’ demographics and this effectively assists the marketing efforts.

Payment Gateways

Payment gateways are unique platforms that enable online shoppers to pay for a product on the merchant’s website through a secure portal. Typically the traditional banks charge a hefty fee to handle the transactions from all these methods. FinTech companies are integrating all these payment methods into convenient applications that the online merchants can easily afford and integrate on their websites.

Digital Wallets

Digital Wallets are the perfect combination between a bank account and a payment gateway. With this FinTech business model, customers can get a certain amount of virtual money in their digital wallets and can use this virtual amount to make online or offline purchases with merchants who accept digital payments. It typically helps the customers by making payments for a small fee which is charged to the businesses in the form of a discount rate.

This business model offers convenience to the users in making payments for a small fee that is charged to businesses in the form of a merchant discount rate. The typical end-users of wallets are businesses that sell either their physical products or services in the stores to the end-users.

Asset Management

The new FinTech companies are enabling investors to trade for free in exchange for their data. They forward this data to the high-ticket traders who can influence the price of the asset. Even though the investor might pay a slightly heavy price for their assets, the difference between the amount they save from trading fees.

Digital banking

Some banks offer no-frills individual and bank accounts through a complete digital infrastructure. This business model is almost identical to that of a bank with no physical branches. This results in the elimination of overheads, savings in manpower, and real estate so that the customers can greatly benefit from the reduced rates.

Digital insurance

The FinTech companies are operating in the insurance industry and are taking their traditional services to the digital world. These companies offer life and health insurance with the best underwriting practices. Their premiums can be available at variable prices and rates depending on the customer and offer inexpensive coverage as compared to the traditional insurance companies. Such insurances can create business possibilities when mixed with proper marketing strategies.

NeoBanking

NeoBanking is a unique FinTech model that creates digital platforms. These banks are faster, efficient, cost-effective, and adaptable to market scenarios. Different banks have different purposes. Some can manage online bank accounts and others can use top-notch tools to save budgets. Some Neo-Banks deal with accounting operations to automate finance and credit operations.

Wealth tech

Wealth tech companies are transferring the small retail investors into dominant wealth management to reach out to the mass segment with the small value systematic investment plans. Wealth-tech implements technologies such as gamification of processes, technology-driven wealth management, robotic-advisory, portfolio management tools, and sentiment analysis.

API-based Bank-as-a-service Platform

The API-based Bank-as-a-service platform is a back-end operation that hosts independent Fintech startups and integrates them with any traditional banks. With the help of such platforms, financial institutions can effectively start their products and bring them to different and new markets. This allows the non-banking institutions to easily launch additional financial products and scale the market.

PoS or POP

The PoS or PoP (Point Of Purchase) is the time and place for completing a retail transaction in real-time. A digital retail PoS system includes a POS terminal that can process credit cards and implement payments through a swipe. The companies that have a Point Of Sale Fin Tech model are service providers that maintain both PoS hardware and software solutions.

How do the tech companies implement FinTech Business Models? How exactly do these companies do it?

FinTech startups have always focused on growth instead of profit. This was a big move to grow as much as possible and effectively scale the market. But after some years, these startups started to focus on profits. Now, these FinTech conglomerates own a huge market segment, biggest customer base and this has made it easy to multifold the profits.

How Are The Tech Companies Using FinTech Business Models?

With the advent in the market and adoption of cashless payments, eCommerce giants have rolled out different FinTech business models. With advancements, the customers are offered ‘buy now and pay later’ options. Many eCommerce portals have introduced insurance on mobile phones under its complete Mobile Protection program. Apart from this, these eCommerce conglomerates have also come up with digital wallet compliance.

What has caused this disruption?

Modern businesses need modern and resilient solutions and the FinTech Business models are making things easy for the challenger banks and FinTech startups.

Advantages Of FinTech Business Models

Various FinTech Business Models have different approaches and shapes. Therefore the different Fintech Models can have different advantages in terms of company and the customers buying into it. Below are some advantages of FinTech Business Models.

Huge & Loyal Customer Base

Customers trust their banks for keeping their assets and finances safe, borrowing money for life-changing events such as huge purchases, or how to invest in the existing mutual funds. While customer acquisition is not easy, banks spend billions every year on marketing efforts and activities, customers tend to grow loyal to their banks over the course of time and membership of their accounts.

Financially Profitable

The financial industry is one of the evergreen industries in the world. This industry offers several great opportunities to generate significant amounts of revenue. Startups in the financial space are nicely funded and highest valued. This profitability is changing the fate of FinTech Business and the companies that are adapting to the constantly evolving market.

Speed & Resilience

Many traditional banks are built on outdated legacy systems. This outdated system makes it extremely difficult for them to respond to the changing customer requirements in a fast-paced environment. The NeoBanks are using it to their advantage and are snatching away customers from well-established traditional banks. The incumbents have also joined hands with the challenger banks and rendering their expertise in banking license and regulatory practices.

The Future Of FinTech Business Models: Banking Redefined

The FinTech companies have been able to show resilience and evolve at a rapid pace as these are not bound by IT legacy or any type of governance. This flexibility to evolve freely has allowed them to churn out new products and services at an increased rate. FinTech is getting more popular and showing customer acquisition at a rapid pace, but one cannot unsee the fact that regulatory crackdowns are inevitable as cybercrime is evolving too and this covets customers’ sensitive data.

The FinTech market heavily relies on applications that can access the users’ financial profiles and information to perform a variety of transactions in real-time. Banks need to ensure that a robust application security infrastructure is deployed to protect the users’ valuable data. This must include a web application that is firewalled with the current threat intelligence to identify the patch vulnerabilities and mitigate the unknown issues.

Most of the data on the cloud is protected differently than in traditional data centers. Blockchain is getting popular in the financial industry as the number of FinTech companies is increasing every day. This secure technology implements point solutions and amplify the data movement with decreased visibility across distributed environments. Apart from detection and prevention, this security is dynamically adaptable and can effectively grow alongside Cloud infrastructures. The ability to evolve, adapt to changing environments, and deploy multiple layer security enables the FinTech companies and challenger banks to have a huge scope of growth in the future.

0 notes

Text

#mutual fund api#how to launch mutual funds#api for mutual funds#launching mutual fund api#deposit api#quick way to become fintech

0 notes

Text

Introducing PEAKDEFI Protocol

PEAKDEFI

is a decentralized, performance-based asset management fund, created to connect investors and asset managers for capital growth.

“The vision of PEAKDEFI is to enable everybody on the planet to grow their wealth, no matter what position they are in at the moment.We want to provide a decentralized investment gateway that is easy to use and accessible for millions of people to shape their future. That’s the mission at PEAKDEFI.”

What is the PEAKDEFI Fund?The Idea of a mutual fund is basically pooling your money with the money of other investors and investing it in a portfolio of different assets. The PEAKDEFI fund is a decentralized fund, programmed as a smart contract on the Ethereum blockchain, managed by different Managers in a decentralized, permissionless and smart way to get the best outcome for everybody involved. Investors can invest in the contract and buy a share of the PEAKDEFI fund, whereas managers can participate in on-chain trading with the fund’s capital.

Great Opportunity for Investors and Asset ManagersPEAKDEFI was created to disrupt the whole investment environment. While current solutions have a lot of flaws, especially for small investors and asset managers, PEAKDEFI paves a completely new way by creating one global fund for everybody, transparent to anybody, governed by all together, to reach the PEAK of the Markets.

Security Audit of the PEAKDEFI Smart ContractSecurity has the highest priority at PEAKDEFI. Our system was reviewed and audited by Quantstamp, one of the best smart contract security companies, to ensure the security of the PEAKDEFI fund and the staking process. You can verify this information by visiting

Quantstamps certificate

database and search for “PEAKDEFI”. Or you can just

click here

to see the full audit report.

Benefits for InvestorsInvesting in the PEAKDEFI fund is as easy as counting 1,2,3. Our PEAKDEFI platform is programmed on a Smart Contract, which means that each investor can simply connect to the platform with his own ETH wallet and invest with Ethereum or 70+ other ERC20 tokens.

You are in control of your capitalAll user deposits are locked in smart contracts without any third party having direct access to those funds. PEAKDEFI is non-custodial and permissionless and is never taking control of any assets. It can be used directly from a wallet (i.e. MetaMask / WalletConnect) that only you control.

Autonomous Optimization to achieve the best resultsYou don’t have to worry about choosing THE right manager, who will manage your capital.The Distribution of the managed PEAKDEFI fund adjusts automatically between the best asset managers through smart contracts to achieve optimal results. You just have to invest in the PEAKDEFI fund and you are ready to make profits.

Short Trading Cycles to guarantee a flexible Capital ManagementIn today’s world, flexibility is one of the most valuable treasures. To guarantee the managers as well as the investors more flexibility there is a fixed management period of just 57 days, followed by a 3 day transition phase, where investors can sell their PEAKDEFI Shares again. We refer to this whole period as 60 day cycles, where managers can make proper trading decisions while investors can access their funds

In addition, investors have the opportunity to generate additional income through referrals and staking.

When profits are generated, they are divided as follows:If the fund was profitable in a cycle the profits will be shared automatically between investors, fund managers and affiliates in the following way:

65% of the Profits will be distributed to the investors15% of the Profits will be distributed to the fund managers20% of the Profits will be distributed to the affiliates

Opportunity for fund managersInstead of managing an own fund the idea at PEAKDEFI is to manage one global fund with many other managers together in a decentralized and permissionless way. This is a completely new and disruptive way for asset managing that also implies different managing approaches compared to traditional hedge funds and raises a couple of questions:How can managers manage the capital of investors in a decentralized environment?How does the distribution of the assets under management (AUM) work?How does the handling of good and bad managers work?How can inactive managers be treated, who block capital to grow?

Decentralized environmentLike investors, the managers connect their Ethereum-wallet with the platform to interact with the smart contract. Managers can open and close trades, even margin trades, all in a decentralized way. To provide all these solutions the PEAKDEFI platform interacts automatically with different decentralized protocols like 1inch, Kybernetwork, Uniswap and Compound Finance.

Automated AUM Distribution via Reputation TokenTo ensure that managers have a fair share of the AUM (Assets under Management), so-called reputation tokens are used. A fixed sum of 100 reputation token must be acquired by every manager when he or she enters the platform and they reflect a certain share of the AUM. How much AUM a Reputation Token represents changes due to various factors such as the number of active traders, the amount of investments made to the fund and other factors. If more Managers enter the fund it has to be shared between more Managers and therefore every Manager get’s a smaller piece to manage. But more traders usually mean less volatility and therefore more stability for the fund.

The Amount of Reputation Token is directly linked to the manager’s personal performance. While every Manager starts with a fixed sum of 100 Reputation Token, over time the number of reputation tokens and therefore the capital for the respective manager can increase or decrease, based on the trading decisions of the Manager. Reputation Token can only be purchased once, at the beginning. They can’t be sold nor can a Manager purchase more.

Managers have to stake their reputation tokens in order to set trades, which calculates a risk threshold level for this specific trader. The risk threshold mechanism is also monitoring how active the managers are and inactive trader will lose their reputation tokens and there shares, if they don´t trade. Fund managers, like investors, are bound to 60-day cycles and can trade for 57 days. There is a trading stop during the 3-day intermediate phase where investors can sell their funds.

Benefits for fund ManagersThere are several advantages to being a manager at our PEAKDEFI fund. One of the most attractive advantages is of course the profit sharing. Each manager receives approximately 15% of the total profit of the PEAKDEFI fund. This depends on the manager’s performance and the activity he has shown during the cycle of trading. Another advantage is that you can start immediately as an asset manager by buying reputation token and get a piece of the fund to manage without consulting different clients first. That’s the beauty of a decentralized protocol, there are no boundaries. Of course, there are mechanisms to avoid losses for the fund. Therefore bad traders lose their reputation (token) fast and will have consequently less AUMs. But on the other hand, good traders get automatically more reputation token (and therefore AUM), which means more income and no search for clients anymore.

What is PEAK Staking?Besides investing in the PEAKDEFI global fund, you can grow your capital by staking PEAK. At a very basic level, “staking” means locking your crypto assets for a certain period of time for a specific purpose. With regard to PEAK, you’ll get rewards for decreasing the current circulating supply in the market and stabilizing the PEAK price by locking your PEAK on the PEAKDEFI platform. 50% of the total PEAK supply, which converts to 1bn PEAK, is reserved for staking rewards. You can earn up to nearly 83% in PEAK Staking per Year!

The PEAK-Staking Formula depends on 3 Parameters: The Amount of PEAK to stake (Bigger Bonus), the period of time you are willing to lockup your PEAK (Longer Bonus) and the stage when you start staking (Early Factor). The amount of PEAK staked (s) can be 10–1,000,000 PEAK. The time the PEAK are staked for (d), can be 10 to 1,000 days.

Bigger Bonus p.a. B(S)The Bigger Bonus p.a. B(S) is determined by the amount of PEAK that you are willing to stake (s). You can earn up to 10% on top of the regular staking rewards.

Longer BonusThe Longer Bonus L(d) is determined by the length of time (d) that you are willing to stake. The minimum period is 10 days, the maximum 1000 days. The longer you stake the higher your APY ( Annual Percentage Yield). Due to the daily growth factor (β) on top of the daily fixed factor (α), it is always more lucrative to stake longer in one piece (e.g. 100 days in a row) than for multiple short periods (e.g. 10 x 10 days).

Early FactorThe earlier you start staking the greater your rewards are. This is due to the Early Factor (w). There is only a specific amount of available PEAK for staking ( 700 Mio.) The staking rewards are reduced by the factor (w) that depends on the amount of PEAK which has already been spent or is reserved. The less PEAK are remaining for staking, the less the APY (Annual Percentage Yield).

Rewards for inviting friendsWe have also thought about rewarding our investors who recommend our PEAKDEFI fund. So if you decide to recommend the PEAKDEFI fund, the platform will automatically pay you a small commission. There are two types of commissions, one is a percentage of the PEAKDEFI fund’s profit and the other is a commission when your partners participate in the staking program. With our small reward plan we want to give you an additional incentive to recommend our platform to others.

PEAKDEFI Ethereum Wallet for Android and iOSIn addition to our PEAKDEFI protocol we have launched our PEAKDEFI wallet app to onboard non-advanced crypto users in an easy way. The App is a secure Ethereum wallet app that is specialized for DeFi and should be included in every crypto portfolio. You can download it for iOS and Android on app.peakdefi.com. It is free and available for everyone, even if you don’t have anything to do with PEAKDEFI. Some core features of the app are:

- It’s non-custody & decentralized, so that private keys and mnemonic phrase are generated locally and stored in the vault of the smartphone.

Create and import (by private keys) an Ethereum walletSend, receive and track ETH and ERC20 Tokensavailable in multiple languagesQR-Code scan availableAn integrated DEX (decentralized exchange) is available“WalletConnect” protocol is also implemented for connecting decentralised applications to mobile wallets with QR code scanning or deep linkingBuy Cryptocurrencies within our PEAKDEFI wallet app with FIAT through our cooperation with Moonpay

Also more DeFi protocols like Compound, Maker, Aave and many more will be implemented.As you can see, the PEAKDEFI Wallet is a great Ethereum wallet, which can be a great help for every crypto user, even independent of our platform.

If you want to get a

full introduction

and

update

about our PEAKDEFI wallet app. Please check this

intro

and

update

article on our Medium profile.

Ecosystem and TokenomicsThe PEAKDEFI protocol is part of the PEAK ecosystem, which includes the PEAKDEFI fund, the PEAKDEFI wallet app and the education and software platform MarketPeak. The PEAK token distribution is currently running mostly on the MarketPeak platform, but will now be additionally run by the PEAKDEFI platform and its staking. Overall there will be a total supply of 2,000,000,000 PEAK Token (2 billion PEAK).

Here is a better overview of our PEAK token distribution

The majority of our PEAK tokens will be distributed via PEAKDEFI staking (50%). These tokens are created “on the fly” until the amount of 1 billion has been reached. There will be two ways of staking. The first, “normal” way is to lock up PEAK to stabilize the liquidity and price and earn staking rewards. The second way, a so-called protection staking will be launched in v2 next year. We expect that it will take at least 3 to 5 years until the 1 billion PEAK are distributed through staking.

360,000,000 PEAK (18%) are reserved for members of our educational and software platform MarketPeak. So far, almost 6% have been distributed on the fly. If the distribution of 18% won’t be reached, e.g. due to stagnation of the MarketPeak Platform, the remaining reserved PEAK tokens will be burned.

200,000,000 PEAK (10%) will be distributed to the internal team and founders. These Tokens will be minted immediately with a 3 years vesting period.15% of the total supply, 300.000.000 PEAK, will be reserved for private and institutional Investors, who facilitate the development of the platform. These Tokens will be minted with a 3 years vesting period as soon as the investors get involved. So far no investors participate in the PEAKDEFI development. If no investors join, we will use the PEAK for the protection staking for the community.138,000,000 PEAK (6.9%) of PEAK will be used as yield farming rewards for liquidity providers which will go live in January 2021. More details coming soon.2.000.000 PEAK have been provided for the initial liquidity in PEAK/USDC and PEAK/ETH on Uniswap during the last month.

RoadmapWe have big plans with our PEAKDEFI platform. The launch of the platform is just the beginning of a project that will grow and develop over the years. Here is an outlook on the current roadmap.

If we have aroused your interest and you would like to have more information about our PEAKDEFI platform or our app, please feel free to read the Gitbook and Whitepaper.Or just visit our PEAKDEFI platform and become a part of our community! ;)

Join now:

https://bit.ly/joinpeakdefi

Gitbook:

https://peakdefi.gitbook.io/peakdefi/

Whitepaper:

https://peakdefi.com/assets/pdf/PEAKDEFI_Whitepaper_v0.1.pdf

Quantstamp certificate:

https://certificate.quantstamp.com/full/peakdefi

More info

https://dappradar.com/blog/peakdefi-an-easy-to-use-decentralized-investment-gateway

https://www.dapp.com/app/peakdefi

0 notes

Text

New Mode! Finxflo Launches The First Ever Hybrid (DeFi + CeFi) Liquidity...

New Post has been published on https://www.bestcoinlist.com/crypto-trading-idea/new-mode-finxflo-launches-the-first-ever-hybrid-defi-cefi-liquidity/

New Mode! Finxflo Launches The First Ever Hybrid (DeFi + CeFi) Liquidity...

Finxflo is the first-ever global DeFi-CeFi hybrid liquidity aggregator. The platform allows users to trade, lend, borrow, stake, farm, and yield farm their coins from a single one-stop solution, combining liquidity of more than 50 individual centralized and decentralized ecosystems. Moreover, Finxflo is always identifying the best rates and prices, enabling its users to utilize them for their benefit.

Since the beginning of 2020, the majority of cryptocurrency investors became highly aware of the DeFi potential. DeFi (Decentralized Finance) is, basically, a structured and interoperable financial sector based on decentralized platforms such as Ethereum. Currently, there is almost $7 billion of value locked in various DeFi projects and a total market capitalization of over $15 billion. Thus making DeFi a catalyst for growth in the cryptocurrency market, with just 1% of crypto investors involved. The market can only grow from here.

Despite all the DeFi enthusiasm, the majority of trading still transpires on highly centralized, mutually detached trading platforms. Therefore the liquidity is dispersed across the global market, losing a part of its potential. The fees in the DeFi market tend to also be rather high.

Furthermore, an average user still struggles to understand complex smart contract functions and navigating unfriendly interfaces. This is exactly why Finxflo is bypassing these challenges and creating a more efficient trading environment. With its innovative approach, Finxflo is becoming the go-to solution for digital asset management by creating both DeFi and CeFi aggregators.

How Does Finxflo Work? Finxflo implements a unique set of smart order algorithms to always offer its users the best prices and rates. The system dubbed Hybrid Aggregation Engine combines DEX (decentralized exchanges) and CEX (centralized exchanges) liquidity, making Finxflo the ultimate single gateway to cryptocurrency trading and investing. DeFi contains broad liquidity and CeFi is more user friendly. Finxflo has combined the power of both. Crypto users can control and allocate their funds to more than 50 different DeFi and CeFi services from one single account.

Finxflo is also operational on mobile platforms via mobile app. With its One-Click mechanism, all users are able to automate all desired operations through customizable action plans. This ultimate user-friendliness is making Finxflo ideal for retail investors who need to manage their assets on the go. The platform is also highly appealing for institutions diversifying into crypto investments. This is because institutional investors are able to blend Finxflo with their existing infrastructures through API integrations. Thus retaining their workflow whilst adding this revolutionary technology to their business.

The whole Finxflo system is based on the FXF token which is generated by doing what investors do – trade and invest on the platform. Additionally, FXF will be distributed for farming and yield farming, which is the process where investors utilize their tokens to generate income.

Highly Flexible, Efficient, and Secure Just like any other asset class, scalability is paramount. Finxflo is able to scale horizontally, in accordance with server workload fluctuations. By distributing data backups among individual nodes, the system neutralizes the possible damage of individual node failure. This is especially significant in the unlikely event of a platform downtime. Should this occur, all the data remains secure and most importantly, re-usable when the platform resumes operation.

Meanwhile, all users’ funds will be protected by SGX (Software Guard Extensions) and MPC (Multi-Party Computing), integrated onto the platform by Fireblocks. These security systems, the most guarded in the industry, neutralize the possibility of a hacker’s attack. Should a highly unlikely breach occur, Finxflo’s client funds are insured by a policy of up to $150 million. Finxflo processes all the incoming records instantly. Consequently, this accelerates the execution as the system does not accumulate micro-batches before processing them.

Moreover, FXF uses the latest and best tech achievements to be able to withstand thousands of operations per second, making the system congestion close to null. Meanwhile, the platform enforces risk monitoring and fraud detection in accordance with the highest industry practices and security standards.

When talking about legal security, it is important to emphasize that Finxflo was successfully granted an exemption by the Monetary Authority of Singapore (MAS) under the grandfathering provisions of the act, effectively permitting Finxflo to continue its operations whilst regulatory approvals are obtained.

Finxflo’s Team of Highly-Skilled Professionals Co-founded by James Gillingham, Thomas Plaskocinski, and Liam Patrick Jones, Finxflo is led by experts with the likes of Royal Bank of Scotland, Société Générale, Simex, and UBS in their jobs portfolios. Furthermore, Mark Hammond, Stefano Virgilli, and Dr. Anthony O���Sullivan provide invaluable support for the team from their past work experience with giants like CitiBank, Merrill Lynch, any Lloyds Bank.

Looking at the whole package, Finxflo offers a revolutionary and highly disrupting ecosystem that is bridging the gap between a number of various, previously detached DeFi and CeFi products and services. Its DeFi and CeFi aggregator, along with a mobile-friendly platform solution represents a groundbreaking improvement in what used to be a newbie-unfriendly crypto environment. The full-scale operation is to be released in phases across the remainder of 2020 and the beginning of 2021, with the global market expansion as the ultimate goal.

If you want to know more about the project, refer to the links below: OFFICIAL WEBSITE ICO DeFi EMAIL

0 notes

Text

Annotated edition for latest Week in Ethereum News

So last week I mentioned the annotated editions and then...didn’t do one. Just got too busy. So we’ll see how this one goes.

One thing to note: Edcon and EthParis both got cancelled.

Original Week in Ethereum News issue.

Eth1

Geth v1.9.11. DNS peer discovery, EIP2464 implementation, faster Geth console

Latest core devs call. Notes. Lots of next fork planning. EVM subroutines likely happening pending Solidity benchmarks, ProgPoW back on the agenda, lots of eip1962 precompile talk

Draft spec for block witnesses

Stateless Eth1 update

draft EIP to add BLS12-381 precompiles to the EVM

Implementing account abstraction via new PAYGAS opcode

Rich transaction compile draft EIP. allow transactions from EOAs to bytcode directly

Literally nobody:

A few people on core devs call: ProgPoW!

I don’t really get it. The reason ProgPoW keeps being so controversial is that core devs don’t publicize it much, and then they suddenly announce that it’s going in a hard fork. Add to that the fact that every time miners advocate for ProgPoW, they show themselves to be outside of the Ethereum community, and you can understand why it produces such strong reactions.

Add to this the fact that one ProgPoW proponent (though oddly he sometimes says he isn’t) has told me explicitly that he doesn’t think the community can evaluate ProgPoW so he doesn’t even try to convince the larger ecosystem.

I go back to what I wrote a few weeks ago:

at some point there is going to be (another) fight over ProgPoW. It’s an odd beast where both sides are convinced that they have already won - meaning that anger and disgruntled ragequits are almost guaranteed.

It only gets worse when you just announce forks and don’t try to set a process and make sure people are heard.

I have more thoughts on governance, but that’s it for now.

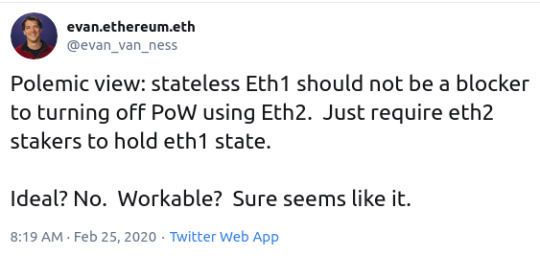

Meanwhile, lots of very interesting work going on for stateless Eth1, which is currently necessary to turn off proof of work (though I don’t think it should be)

Eth2

Latest what’s new in Eth2

Update on fuzzing the beacon chain clients. Finding bugs, expanding capabilities

A short history and a way forward for phase 2

Automated detection of dynamic state access

Casey Detrio’s simple protocol for cross-shard transfers

Quick demo on getting an eth2 EE up and running using Quilt’s SEE tool

Lots of phase2 stuff this week. An overview is that we’re still not particularly close to phase2 as there are plenty of research and design decisions to be made even before all the nitty gritty of engineering tradeoffs.