#laser focused with your Forex Trading

Explore tagged Tumblr posts

Text

The Role of AI in Analyzing EURUSD Market Trends: Deep Dive into Rare Insights Ever wondered how some traders seem to have a crystal ball, effortlessly predicting EURUSD market trends? Spoiler alert: they might just be using AI. Today, we're not just dipping our toes into the role of AI in Forex, but diving deep to uncover rare, under-the-radar insights that you won't find in your average trading manual. Brace yourself—this journey is filled with a mix of game-changing techniques, hidden opportunities, and a sprinkle of humor, just to make things interesting. The Matrix Has You, Trader: How AI Spots What You Can’t Alright, let's get one thing clear: AI doesn't see the market like you do. While you're busy looking at price charts and wondering why EURUSD won't just do what you want, AI is analyzing mountains of data, from economic indicators to Twitter sentiment. Imagine trying to count every leaf in a forest while someone else already knows which tree is going to shed first. That’s AI in the Forex market. Artificial Intelligence algorithms, particularly machine learning models, can process an absurd amount of data at lightning speed. They don't get tired, they don't blink, and they don't get emotionally attached to a trade (looking at you, John). These models analyze historical data to identify complex patterns that human traders often overlook. One trader I know once called AI "the Sherlock Holmes of market analysis"—except AI doesn’t have to deal with a Watson who constantly needs explaining. Deep Neural Networks: Not Just for Self-Driving Cars Deep learning techniques like neural networks play a significant role in analyzing the EURUSD pair. These models are capable of making sense of complex, non-linear relationships within the data—something akin to untangling the headphones you left in your pocket. The hidden layers of a neural network can pinpoint correlations between seemingly unrelated market events, which translates to better trend prediction and better trade timing. For instance, a neural network might detect that a rise in European economic confidence, combined with positive sentiment from Federal Reserve reports, might trigger a significant move in the EURUSD. Sure, you could manually crunch the numbers for a month to figure this out, but wouldn’t it be better to let a glorified, super-intelligent calculator do it in 30 seconds? Unseen Opportunities with AI Sentiment Analysis Here's where we take the unconventional route: AI sentiment analysis. While most traders are laser-focused on technical indicators, AI has the audacity to ask, "What’s the mood like today?" Sentiment analysis tools leverage natural language processing (NLP) to interpret emotions in financial news, social media, and even central bank speeches. If AI detects a shift towards optimism across multiple channels, it could signal an upward move in EURUSD. The secret sauce here is that sentiment analysis provides context that technical charts simply can't. It's like listening to your favorite song—you’re not just analyzing the notes, you’re feeling the vibe. AI taps into that vibe, then quantifies it, turning emotions into numbers. Imagine knowing whether the market is feeling cheerful or anxious—it’s almost like insider knowledge, but legal. AI-Driven Trading Bots: Ninja Tactics for the EURUSD Market Let’s address the elephant in the room: trading bots. Not just any bots, but AI-driven bots that adapt to evolving market conditions like a chameleon on steroids. Most traders think of bots as "set it and forget it," but AI bots are much more sophisticated. These bots learn from each trade, adapt their strategy, and evolve with changing market dynamics—something even your favorite Forex guru can’t do on-the-fly. Take EURUSD, for example: If a bot notices that its usual strategies are less effective during specific Fed announcements, it can adjust its parameters to mitigate risk—think of it as the ultimate survival ninja, dodging every market punch in real-time. While most traders struggle to avoid whipsaw movements during such announcements, AI bots execute precise orders at optimal times, ensuring they make fewer mistakes (and fewer sad trader faces). Contrarian Insights: How AI Challenges the Herd Mentality Here's a myth worth busting: more data equals better predictions. False. AI knows that what matters is the right data. One of the most valuable insights AI provides is challenging the herd mentality. When everyone is bullish on EURUSD, AI might identify subtle contrarian signals, like an uptick in bond yields or a shift in liquidity preference, that could indicate a pending reversal. Picture this: A crowd of traders piling into a long EURUSD position because it’s “the obvious choice,” while AI quietly takes the opposite side of the trade because it’s detected an overbought condition. AI isn’t just your trading buddy—it’s that one friend who won’t follow the crowd to a terrible party. Instead, it takes you to a hidden speakeasy where the real action’s at. Unpacking the Hype: Is AI All It’s Cracked Up to Be? Alright, it's easy to put AI on a pedestal, but let’s be real: AI isn’t foolproof. Like every other system, it can make errors, especially if it's fed incomplete or poor-quality data. Garbage in, garbage out. But the difference here is that AI can also learn from its mistakes—something most of us struggle with (admit it, how many times have you ignored that risk management rule?). In terms of EURUSD, AI models are only as good as the data they’re trained on. An edge comes not just from the AI system itself, but also from the quality and depth of historical data, the integration of alternative data sources (like satellite images or weather reports), and the creativity behind building the model. The trick is combining robust data sets with out-of-the-box thinking—think, "How would Sherlock Holmes trade Forex?" The Real Magic Trick: Combining AI Insights with Human Intuition Here’s where it all comes together: AI is not a replacement for the human trader, but rather an enhancement. Traders who combine their market intuition—that gut feeling you get after watching the EURUSD charts for years—with AI-driven insights are the ones who truly achieve next-level performance. Think of AI as a loyal sidekick, like Robin to your Batman. Robin does a lot of the work, but let’s face it—Batman’s intuition saves the day. One unconventional approach is to use AI to screen out the noise, then rely on your experience to make the final decision. AI might indicate a high probability of a breakout based on historical volatility, but you, as the trader, can assess whether current market conditions really make sense for that breakout to happen. By blending emotionless data-crunching with a nuanced understanding of market psychology, traders can make decisions that are both precise and insightful. Leveraging AI for EURUSD Market Trends - AI processes vast amounts of data at lightning speed to identify market trends before they’re visible to humans. - Deep learning models, like neural networks, reveal complex patterns, helping traders predict EURUSD movements. - Sentiment analysis using AI can provide insights into the market mood—offering a contrarian edge. - AI trading bots are the ultimate survival ninjas, learning from each trade and adapting to market changes. - AI challenges herd mentality, often revealing profitable contrarian opportunities. - Combining AI insights with human intuition leads to strategic, data-driven trading—Robin and Batman working in harmony. Ready to Level Up Your Forex Game? Want more insider secrets on navigating the volatile waters of Forex trading? We've got your back: - Stay Ahead with Market Insights: Get the latest Forex news and market movers at StarseedFX Forex News Today. - Expand Your Knowledge: Learn advanced trading strategies that take your trading from average to exceptional at StarseedFX Forex Education. - Join the Community: Access exclusive analysis, alerts, and live trading insights by joining our community here. AI is powerful, but it’s even better when you’re using the right tools and strategies. Time to make the market work for you—without needing a crystal ball. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

China’s Weekend Wobbles Will Unsettle Markets

US stock markets finished the week on a positive note following solid bank earnings and steady PPI data that leave future rate cuts by the Federal Reserve on track. The S&P 500 closed at a record high, the US Dollar Index consolidated its week's gains, closing near 103.00, and WTI eased 1.30% to $74.50 a barrel.

The bipolar world of financial markets is likely to persist this week. US markets are focusing on clues as to how the Fed will cut at its next meeting, and Asian markets are laser-focused on stimulus measures coming out of China.

US markets are closed today for Columbus Day, leaving China the only game in town as the week starts.

That tone will likely be negative after disappointing China inflation data released over the weekend. China's September YoY Inflation fell unexpectedly to 0.40%, while September PPI slumped by -2.80% YoY. Despite China's barrage of monetary stimulus measures announced, the data suggests that investor concerns over disinflationary pressures in China remain valid.

Market sentiment in Asia won't be helped by an underwhelming press conference over the week by China's Ministry of Finance. Finance Minister Lan's comments were heavy on promises, but light on specific details like the amount of fiscal firepower that China will deploy to address China's structural issues.

Despite pullbacks last week, China's short-term spec market still looks long, and the weekend data points may resume pressure on Mainland and Hong Kong stocks today.

HKG50 H1

In Asia, the week's data calendar continues to be dominated by China, which releases export data today and a data dump of GDP, Industrial Output and Retail Sales on Friday. Japan releases Machinery Orders on Wednesday, with Singapore's GDP data today spurring some volatility in the Straits Times.

Elsewhere, Australia's employment data on Thursday morning is always good for short-term volatility on the AUD/USD, as markets become increasingly desperate for the RBA to join the easing party. The European Central Bank will provide some respite from Fed-watching on Thursday as it is expected to announce its own 0.25% cut.

Geopolitical tensions in the Middle East can never be discounted, but oil's recent rally is losing momentum. Brent crude failed ahead of its 200-day moving average last week and looks set for a deeper correction after weaker China data over the weekend.

USOIL H1

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Video

youtube

laser focused with your Forex Trading

Throughout this video, you will know how to become laser-focused with your forex trading. You must have laser focus if you don't want to be a generalist instead to be a specialist. It's no secret that most of the people get into trading to be successful and earn money.

News? Newspapers? Instagram? Facebook? When pursuing a career trading the financial markets, it's crucial you learn how to control distractions. The media feeds into your attention, taking it away from what's important, which is your own life and results! Of course, knowing fundamentals and news releases is beneficial with making decisions on your trading positions. But knowing what's positive and negative when it comes to what you choose to view and consume, could be the make or break point of your Forex trading.

Check the next link to learn more about how to trade forex, PLEASE visit: 👉 https://bsappsfx.com/

Follow our video clips concerning how to trade forex and also other comparable subjects on

Instagram: https://www.instagram.com/bsappsfx

#why most traders fail#trading mistakes#forex trading for beginners#investing#trading psychology#fx trading strategy#forex education#How to become laser focused#laser focused with your Forex Trading

0 notes

Video

youtube

Scamming Forex Traders and their secret lifestyles // BSAPPSFX

Welcome to the "BSAPPSFX" YouTube channel. Throughout this video, you will know how to become laser-focused with your forex trading. You must have laser focus if you don't want to be a generalist instead to be a specialist. It's no secret that most of the people get into trading to be successful and earn money.

News? Newspapers? Instagram? Facebook? When pursuing a career trading the financial markets, it's crucial you learn how to control distractions. The media feeds into your attention, taking it away from what's important, which is your own life and results! Of course, knowing fundamentals and news releases is beneficial with making decisions on your trading positions. But knowing what's positive and negative when it comes to what you choose to view and consume, could be the make or break point of your Forex trading.

Check the next link to learn more about how to trade forex, PLEASE visit: 👉 https://bsappsfx.com/

Follow our video clips concerning how to trade forex and also other comparable subjects on

Instagram: https://www.instagram.com/bsappsfx

For More Details Please Visit us :-

Website:- https://bsappsfx.com/

Facebook:- https://web.facebook.com/Bsappsfx?_rdc=1&_rdr

Instgram:- https://www.instagram.com/bsappsfx/

Linkedin:- https://www.linkedin.com/bsappsfx

#forex trading secrets#day trading#stock market#why most traders fail#best trading strategy#How to become laser focused#laser focused with your Forex Trading

0 notes

Text

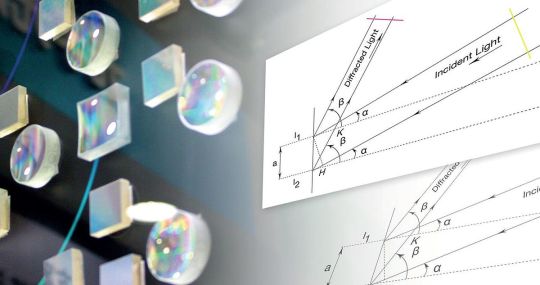

Plane Diffraction Grating

Videos For Plane Diffraction Grating

Diffraction Grating Explanation With Theory

Grating Element Of Plane Diffraction Grating

Diffraction Gratings - University Of Virginia

Plane Diffraction Grating Theory

Diffraction Grating

Diffraction Grating History Create parallel groves which enforce a phase lag with each adjacent reflection. Grooves can be transparent/opaque rulings on a transmissive material, formed by opaque lines on a mirror, or consist of tilted facets. Phase lags with integral multiples of a given wavelength interfere constructively. A diffraction grating is a periodically structure of subsequent most evenly spaced grating lines. Those grooves or opaque lines diffract the incident light depending on its periocity and microstructure. Plane ruled diffraction gratings are blazed for maximum efficiency in the first order Littrow configuration at specific wavelengths. Ruled reflection gratings are especially well suited for spectroscopic systems requiring high resolution. High efficiency at design wavelength and blaze angle.

Hitachi Diffraction Gratings Analyze a Variety of Radiations Ranging from X-rays to Infrared.

Learn2Trade is a UK-based platform specializing in educational content on trading. MYC Forex & Commodities Signals (@MYC Signals) When it comes to producing forex signals, MYC. Download Signal for Android, iOS, Linux, macOS, and Windows. Signal telegram. Telegram Forex Signals Trading is your home of profitable success rate Telegram forex signals, our members have consistently enjoyed our daily Telegram forex signals. As a way to give an opportunity for non-subscribers to benefit from our signals, we have a free Telegram Forex Signals Channel.

Hitachi diffraction gratings are adopted in a wide range of scientific and industrial fields, e.g. large spectrograph for photobiological research and Spectrophotometers for extreme ultraviolet explorer.

Videos For Plane Diffraction Grating

*

These gratings are available in North America and Europe.

Features

The diffraction gratings capable of analyzing a variety of radiations ranging from soft X-rays to far infrared are now expanding their application areas as optical elements indispensable for spectroscopy. The diffraction gratings developed by Hitachi have been used in various application areas, and are now highly evaluated as the world's foremost optical elements. For example, a total of 36 diffraction gratings having a size of 15 × 15 cm and arranged in a mosaic pattern, are adopted in the large spectrograph used in the Okazaki National Research Institutes, National Institute for Basic Biology. The spectrograph has successfully realized the world's largest artificial rainbow whose intensity is 20 times the sunlight energy right above the equator. Furthermore, the Hitachi plane diffraction gratings consisting of varied space grooves have also been adopted in the Spectrophotometers of the extreme ultraviolet explorer scheduled to be launched by NASA of the U.S.A. Hitachi has developed the reflection plane gratings and concave gratings to meet such most-advanced technological fields as exemplified above. These gratings are available in a wide variety of models to meet your diversified needs.

Large spectrograph at the Institute for Basic Biology

Diffraction Grating Explanation With Theory

Control computer

Power supply room

Condensing mirror

30 kW xenon lamp

Deflection mirror

Optical fiber room

Operation room

Illumination room

Diffraction grating

“Flying into the Rainbow' by Naoya Sakagami (In the arrival lobby of New Haneda Airport)

A tool to customize your desktop goose. Contribute to lim10dev/desktop-goose-customizer development by creating an account on GitHub. Desktop goose free. A modding launcher for the Desktop Goose by the ResourceHub project desktop-goose resourcehub resourcelauncher resourcehub-launcher desktop-goose-modding C# GPL-3.0 9.

Grating Element Of Plane Diffraction Grating

An art object representing a rainbow under the dome, which was created using the Hitachi diffraction grating parts.

*

These gratings are available in North America and Europe.

Plane Diffraction Gratings

A wide variety of high performance, mechanically-ruled diffraction gratings.

The ruling engine equipped with a highly sensitive laser interferometer is able to rule grating grooves with ultrahigh accuracy, and realizes high resolution spectroscopic instruments.

Burnishing process, by using a diamond tool, serves to form triangularly shaped echelette grooves whose surfaces are extremely smooth yielding minimum stray light.

The grooves, having an exact blaze angle, can be formed by selecting an appropriate diamond tool and measuring the groove profiles with a scanning electron microscope. These processes allow the grating to provide a highly efficient diffraction efficiency in the designed wavelength region.

Grating grooves having 2 or more different blaze anoles can be combined on a single diffraction grating. This structure allows for broader wavelength coverage.

A variety of diffraction gratings with variable spaced grooves and shapes are manufactured.

Concave Diffraction Grating

From X-rays to Infrared! Gratings can now be designed to meet specific requirements.

Coma-type aberration-corrected concave grating for high resolution Seya-amioka monochromator: This grating eliminates the coma-type aberration of the Seya-Namioka monochromator, which has been most widely used in monochromators with concave gratings that provide high resolution. Hitachi is manufacturing a wide variety of aberration-corrected gratings for Seya-Namioka monochromator which cover a wavelength range from the vacuum ultra-violet to the near infrared region.

Diffraction gratings for compact, high efficiency monochromator: These gratings are designed for normal incidence mounting. They reduce aberrations and at the same time increase the efficiency of light intensity. A as a result, a high quality of image focusing of the concave grating is available.

Diffraction gratings for flat field spectrograph: Variable space grooves enable flat-field image focusing of concave grating spectrograph. The spectrograph permits simultaneous measurement of multi-wavelength spectra when combined with a linear array detector. Gratings are designed optimally for the grazing-incidence optical system (for soft X-ray) and the normal incidence optical system (for VIS-UV ray), respectively.

Diffraction gratings for multi wavelength optical communication: A compact and efficient aberration corrected concave grating is manufactured for transmitting multiple wavelength light beams through an optical fiber and acts to separate the beams at the receiving terminal.

Diffraction gratings for soft X-rays: Highly dispersive concave gratings for grazing-incidence mounting are available especially used for synchrotron radiation and extreme ultra-violet applications. These gratings are very effective for the application of soft x-rays whose reflectance is extremely low on a metal surface.

UV-Vis/NIR Basic Course

The basics of spectrophotometer, from 'What can an ultraviolet and visible spectrophotometer Do?' to 'Structure of a spectrophotometer.'

Science & Medical Systems

Diffraction Gratings - University Of Virginia

Analytical Systems

Spectrophotometers (UV-Vis/NIR, FL)

Related Links

© Hitachi High-Tech Corporation. 2001, 2021. All rights reserved.

Plane Diffraction Grating Theory

0 notes

Video

youtube

Welcome to the "BSAPPSFX" YouTube channel. Throughout this video, you will know how to become laser-focused with your forex trading. You must have laser focus if you don't want to be a generalist instead to be a specialist. It's no secret that most of the people get into trading to be successful and earn money.

News? Newspapers? Instagram? Facebook? When pursuing a career trading the financial markets, it's crucial you learn how to control distractions. The media feeds into your attention, taking it away from what's important, which is your own life and results! Of course, knowing fundamentals and news releases is beneficial with making decisions on your trading positions. But knowing what's positive and negative when it comes to what you choose to view and consume, could be the make or break point of your Forex trading.

Check the next link to learn more about how to trade forex, PLEASE visit: https://bsappsfx.com/

Follow our video clips concerning how to trade forex and also other comparable subjects on

Instagram: https://www.instagram.com/bsappsfx

#day trading#stock market#why most traders fail#how to trade forex#trading mistakes#forex trading for beginners#best trading strategy#forex trading live

0 notes

Text

The Most Important Trading Tool: A Trading Journal

A trading journal is probably the most important tool a trader needs to have in order to trade profitably. You can read any trading book and you will see that 95% of all trading books will recommend having a trading journal.

In the end, trading is like running a business. And no business will survive if the owner does not know the numbers. If you do not know your revenue, how much your costs are, what your profits are, which your best-selling product is and how much tax you owe, of course, you cannot run a successful business. I think we can all agree on that. In trading, it works just like that too.

Just ask yourself right now: Do you remember your last 10 or 20 trades? Do you remember what went wrong and what you should have done? Can you recall what you did especially well and what you need to do more of? Which mistakes do you keep repeating and when? I could go on forever, but I am sure you get the point.

Of course, no one will be able to recall all their previous trades from the top of their head. But how can you expect to become a better trader if you do not know where to improve and how to do it?

The only way to become a better trader

The failure rate among traders is above 95%. Only very few traders actually make it. Why is that?

A lack of professionalism is the main cause of the high failure rate. Without a journal and without being able to review what you have been doing, traders are doomed to repeat the same mistakes and also draw the wrong conclusions about why they are not succeeding.

System-hopping (changing trading systems all the time, hunting for the one perfect system that will just make money) is the result when traders focus on the wrong things.

Instead of hoping to just stumble over a profitable system somehow, traders need to focus on making the system they have work. At the same time, traders need to work on themselves. And the only way to do that is through reviewing past trades, evaluating what went wrong and then learning from mistakes.

Outside of trading, we know this is true. But when it comes to trading, we forget it too easily. You won’t just become a great student, a successful businessman or a top athlete overnight. You constantly have to work on yourself.

The good news is, that such an approach will ALWAYS work. It may take more time, but it guarantees that you move in the right direction. You take out the guesswork and can finally become a better trader.

What a good trading journal does for you

So far, conventional trading journals have been very dull and also did not really provide the tools needed. Especially the self-made Excel spreadsheets sooner or later end as data graveyards and we forget about them because they do not provide actionable tips.

Here are the three most important points when it comes to having a good trading journal:

A trading journal holds you accountable and makes you more aware of your trading. Trading can be a lonely profession at times. But once you start keeping a trading journal, you will see how it functions as an invisible mentor and your accountability partner.

One size fits all’ doesn’t work when it comes to trading journals. Every trader has unique requirements, thinks slightly differently and also faces different issues. That’s why a good trading journal should be customizable.

The feedback from your trading journal needs to be actionable. Writing down your thoughts in a notebook or writing how much money you won or lost in a random Excel spreadsheet may sound like a good idea, but it leads to nowhere. A trading journal is only worth keeping if it really tells you what to change and how to change it.

Thus far, only bank traders and big prop trading firms had access to professional trading analytics software. With Edgewonk, every trader can finally use a customized and professional trading journal to work on his (or her) trading.

Why Edgewonk?

A trader should not spend his time creating spreadsheets that still don’t really provide help. In the end, you want to be a trader, right? A businessman does not write his accounting software himself, but he focuses his energy and time on his real job. You need to start thinking like a professional and work towards your goals with laser focus and clear priorities.

We aren’t developers ourselves, but we hired some to turn our trading journal needs into a user-friendly tool. We wanted, once and for all, to solve the issues with trading journals and allow other traders to stop worrying about this area of their trading.

Edgewonk discount: all Tradeciety fans can use the discount code “Tradeciety” to get $30 off on their Edgewonk purchase!

Disclosure: Tradeciety is also behind Edgewonk.com and the trading journal software. Our goal with Tradeciety and Edgewonk is to provide high-quality trading education and we are happy to announce that the Tradeciety team has created the Edgewonk trading journal.

#1 The first personalized and fully customizable trading journal

Edgewonk is fully customizable to your own trading style. You can track your own trading strategy, your individual setups and define personalized trade management and execution comments to create a fully unique journaling experience.

Edgewonk even offers more slots for fully customizable comments/tags. This way, Edgewonk becomes your own personal and professional trading mentor, always ready at hand.

Edgewonk also allows you to enter planned trades, do weekly reviews and even journal missed trades so that you can work on all areas of your trading.

#2 Emotional analytics – Psychology edge

Every trader knows that emotions play a very important role in trading and that emotions significantly influence your trading decisions. Thus far, traders used to manually write down which emotions they think affected them. Edgewonk is the only trading journal that quantifies how emotions impact your trading performance. Furthermore, the built-in Tilt-Meter provides early warning signals when you repeatedly make bad trading decisions. Now you can take out the guesswork and professionally manage your emotions and the psychological aspects of trading.

#3 Order Optimization

Edgewonk also helps you optimize your orders and the way you place your trades. For example, setting stop loss orders too far away reduces your risk-reward ratio and, therefore, the performance of your trading strategy. On the other hand, setting take profit orders too far away will result in a decreased winrate because price won’t reach your take profit orders and turn around ahead of target.

Edgewonk takes care of that and provides specific tips, based on your individual trading parameters, to optimize your orders to help you increase your trading performance.

#4 What to do once you are in a trade?

Usually, traders spend all their time focusing on entries and once in a trade, they don’t really know what to do. Edgewonk is aware of this problem and the Trade Management analytics analyze your trading behavior. Micro-management and uncertainty are big problems for traders and the transparent Edgewonk analytics take out the guesswork.

Many top features

Edgewonk has a lot of cool features and every trader will find ways in which edgewonk can help to improve one’s trading. Here is just a brief list of the most popular features:

Risk Simulator

Track and evaluate emotions

Track and analyze trades you missed

Daily, weekly and monthly built-in review feature

Works for all markets worldwide

Works for all currencies

For Forex, futures, stocks, spread betting and cryptocurrency trading

Attach up to 4 screenshots per trades

Analyze your trade management and find the optimal strategy

Improve stop and target placement

and much more

Finally, there is a solution to solving the trading journal problem

If you are looking to take your trading to the next level and you are sick of not seeing any results, maybe it’s time to take things a little more seriously and start a professional trading routine.

Edgewonk discount: all Tradeciety fans can use the discount code “Tradeciety” to get $30 off on their Edgewonk purchase!

Disclosure: Tradeciety is also behind Edgewonk.com and the trading journal software. Our goal with Tradeciety and Edgewonk is to provide high-quality trading education and we are happy to announce that the Tradeciety team has created the Edgewonk trading journal.

youtube

The post The Most Important Trading Tool: A Trading Journal appeared first on Tradeciety Online Trading.

The Most Important Trading Tool: A Trading Journal published first on your-t1-blog-url

0 notes

Text

New Post has been published on Atticusblog

New Post has been published on https://atticusblog.com/beauty-instagram-accounts-to-have-on-your-radar/

Beauty Instagram Accounts to Have on Your Radar

Back whilst splendor blogging took YouTube by the storm

It has become crystal clear that you don’t ought to be an expert makeup artist or celeb facialist to present your two cents on the splendor and skin care; instead, you could just be a Sephora VIB with an iPhone.

Today, the fine (and most convenient) manner to eat beauty recommendations and hints from regular people and specialists alike is through Instagram, where you could read pretty distinctive product evaluations and tutorials proper in the captions. Plus, now that you could “keep” images at the app on your very own folders, it’s extraordinary clean to preserve tune of all of the looks and products you want to attempt.

To help you faucet into the great of the pleasant, we’ve pulled together a handful of splendor-centric Instagram debts you must surely have for your radar — a combination of skin care enthusiasts with workplace day jobs, young makeup artists presenting all of the out-of-the-container into, and even some OG YouTubers, too.

Beauty Therapy Vs Cosmetology

People regularly get these terms harassed. They each take the region in a splendor school, they both require a few shape of certification, and they both contain cosmetic work which can assist clients appearance and feel more lovely than ever before. Most individuals suppose that those are the same element, however, there are large differences that individuals ought to be aware of before selecting their profession path.

Cosmetology

Cosmetology is what the general public think about after they consider splendor faculty within the first place. They envision reducing and styling to perfection in a salon. Facials, professional manicures, and pedicures and faultless makeup looks are a few other matters that cosmetology is known for. One of the important thing approaches to help differentiate among the two is remembering that cosmetology frequently entails matters which can be extra along the lines of slicing, styling and quick floor matters which can effortlessly be reversed, consisting of facials or manicures.

Beauty Therapy

Beauty therapy is just like cosmetology in the fact that someone is going to high school to research beauty remedies. The coursework is regularly specific, however. Schools specializing in splendor remedy treatments regularly provide greater superior coursework, like laser hair removal education and different beauty remedy. In addition to this, they often offer a number of the greater famous courses which might be offered at faculties that specialize in cosmetology, which includes certified nail technician guides.

Which one to pick

When students are faced with figuring out which faculty to attend, they’re regularly faced with selecting between cosmetology and beauty therapy faculties. While beauty remedy faculties offer some of the identical things that cosmetology faculties offer, maximum cosmetology colleges do not provide publications in laser hair elimination training.

Students are endorsed to take a seat lower back and recollect their training desires. If a pupil would really like to learn more superior splendor therapy remedies, a splendor school that focuses on courses consisting of laser hair elimination training might be a great choice. Students which have a dream of working in a salon and giving their clients a haircut that they’ll fall in love with or the ideal pedicure will discover that a beauty school that specializes in more cosmetology practices rather than superior splendor remedy treatments, like laser hair elimination education, might be more up their alley.

Shop around

An education is what determines a person’s future, making it one of the most crucial choices in a younger adult’s lifestyles. Because of this, college students are recommended to take their time shopping round, much like after they want to discover the perfect outfit.

Many beauty schools have websites that list their lessons, the various courses which are provided, and what the timetable will look like. If a scholar is fascinated, they could normally take an excursion of the facility, and visit the labs that they may be working in. Sometimes, a faculty may also allow an interested man or woman to take a seat in on a laser hair removal schooling elegance in an effort to determine if this is the direction that they would really like to take.

When choosing a career direction

Understanding the distinction between cosmetology and splendor remedy is critical in making the choice on which to school to attend, and which profession path they would like to take. Confusing these phrases is extremely not unusual, but it may additionally imply the difference between attending a faculty that focuses on stylish work and attending a faculty that specializes in more advanced splendor remedies, which includes laser hair removal schooling.

Instagram As A Shopping Platform

From being a media-sharing app for selfies and something visually attractive, Instagram is branching out into the eCommerce field.

It will quickly roll out a purchasing feature which online retailers and shoppers will discover very handy.

The social massive is quite a whole lot aware that mobile commerce goes to overhaul PCs in years’ time or maybe earlier, therefore it desires to be one of its cornerstones.

What’s pleasant approximately Instagram’s new feature is that it is able to serve as a merchandising channel for your products, or even more so for your online keep.

As for your ability clients, they may be able to see and explore your merchandise while not having to leave Instagram for some other website online.

How to sell on Instagram

The normal Instagrammers amongst you may locate Instagram’s buying characteristic extremely good easy to apply.

Now, if you’re not partial to this visible media sharing app, however looking into it as a capability revenue source, you simply want to put together exquisite pix which highlight your merchandise.

To get started out, add an image which functions up to five merchandise which you’re selling.

When a person clicks on the faucet to view products link at the bottom left of the image, a tag will appear on every of the gadgets, showing the product’s name and fee.

Once they click on on a tag, they will be taken throughout to a page that suggests the entire description, special capabilities and add-ons-if there is any of a product.

While the patron is there, they’ll opt to click on the Shop Now link inside the product information, so that you can redirect them to the product to your website in which they can buy it.

Know who buys from you

Choosing Foreign Currency Accounts For Global Payment Systems

Once your company meets the sporting ability in a domestic marketplace

You may begin planning on seeking out possibilities in an overseas region. There are numerous blessings and opportunities you may get from the worldwide exchange – ones which are in any other case unavailable within the domestic marketplace. However, there are a lot of things that come into play which most business owners are not prepared to face.

If you’re seeking to set foot on international exchange, you may have to analyze your present day function within the domestic change and weigh the benefits and challenges you get there. Additionally, in order to take benefit of the opportunities, choosing the right option for worldwide charge structures ought to also be one of your priorities.

If you will have trades foreign places

Starting an overseas forex account is vital. This will can help you ship and acquire payments made overseas in a much less complicated fashion. Setting up a foreign currency account for your business will allow you to store cash without the want to pay the conversion fee. Additionally, other dangers which are related to overseas currencies along with fluctuations can also be avoided.

Owning a foreign forex account is not a lot extraordinary from proudly owning an everyday modern account. The account is managed the identical manner, but, one-of-a-kind banks have one of a kind standards and charges might also vary from one another. Additionally, while beginning a foreign currency account, your corporation will go through due diligence approaches.

Depending on us of you will be having enterprise deals with

Retaining the bills in that currency could make matters a lot less complicated on the way to make payments as well as prevent conversion charges. The cost of conversion can vary anywhere from one to ten percent which is quite the amount already. Moreover, there also are a few companies who purchase currency ahead of time and deposit it into their account. This is one of the steps some companies take so that you can avoid fluctuations in exchange rate. However, it can affect your employer’s cash go with the flow so it’s far important to take into account it cautiously earlier than doing it.

Lastly, opening a foreign forex account will-will let you have a cheque e book for your overseas currency transactions, funding for short-term coins waft desires, as well as simplification of world payments. However, there are also downsides to having an overseas forex account. One such is the financial institution rate that is quite excessive. When starting this account, make certain to weigh this element as well as the blessings to make sure you get the most of what you want.

0 notes