#largest metaverse companies

Explore tagged Tumblr posts

Text

In this blog, we explore the dynamic world of the metaverse and how Simulanis, a prominent metaverse company, is shaping the future of business and technology. With a comprehensive metaverse business plan, immersive metaverse business meetings, and cutting-edge metaverse software, Simulanis is paving the way for companies to thrive in the virtual world. Whether you are seeking a metaverse technology company or exploring metaverse companies to invest in, Simulanis offers innovative solutions that align with the evolving demands of the digital landscape

#metaverse company#metaverse software company near me#metaverse business plan#metaverse business meetings#private metaverse companies#companies with metaverse plans#metaverse related companies#metaverse business model#metaverse business suite#metaverse company list#metaverse listed companies in india#largest metaverse companies#metaverse marketing company#metaverse vr company#metaverse software companies#what is a metaverse company#metaverse companies to watch#biggest metaverse companies#metaverse belongs to which company#metaverse startup companies#metaverse company stock in india#metaverse companies to invest in#metaverse technology company#metaverse technology companies in india#metaverse business till date#metaverse tech companies#Simulanis

0 notes

Text

Virtualize Technologies is a leading game development company, specializing in creating immersive and engaging gaming experiences. Our expertise spans multiple genres and platforms, including mobile, PC, and console games. With cutting-edge tools and a creative team, we deliver high-quality games tailored to your vision. Whether it's 2D, 3D, or multiplayer games, Virtualize Technologies is your trusted partner in game development.

#metaverse#2d metaverse#virtual reality#game development#augmented reality#game development company#mobile game developer#best game development company#largest game development company

0 notes

Text

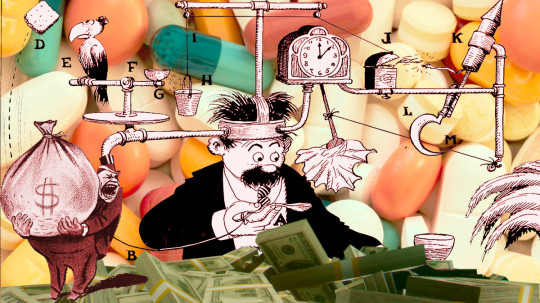

What the fuck is a PBM?

TOMORROW (Sept 24), I'll be speaking IN PERSON at the BOSTON PUBLIC LIBRARY!

Terminal-stage capitalism owes its long senescence to its many defensive mechanisms, and it's only by defeating these that we can put it out of its misery. "The Shield of Boringness" is one of the necrocapitalist's most effective defenses, so it behooves us to attack it head-on.

The Shield of Boringness is Dana Claire's extremely useful term for anything so dull that you simply can't hold any conception of it in your mind for any length of time. In the finance sector, they call this "MEGO," which stands for "My Eyes Glaze Over," a term of art for financial arrangements made so performatively complex that only the most exquisitely melted brain-geniuses can hope to unravel their spaghetti logic. The rest of us are meant to simply heft those thick, dense prospectuses in two hands, shrug, and assume, "a pile of shit this big must have a pony under it."

MEGO and its Shield of Boringness are key to all of terminal-stage capitalism's stupidest scams. Cloaking obvious swindles in a lot of complex language and Byzantine payment schemes can make them seem respectable just long enough for the scammers to relieve you of all your inconvenient cash and assets, though, eventually, you're bound to notice that something is missing.

If you spent the years leading up to the Great Financial Crisis baffled by "CDOs," "synthetic CDOs," "ARMs" and other swindler nonsense, you experienced the Shield of Boringness. If you bet your house and/or your retirement savings on these things, you experienced MEGO. If, after the bubble popped, you finally came to understand that these "exotic financial instruments" were just scams, you experienced Stein's Law ("anything that can't go forever eventually stops"). If today you no longer remember what a CDO is, you are once again experiencing the Shield of Boringness.

As bad as 2008 was, it wasn't even close to the end of terminal stage capitalism. The market has soldiered on, with complex swindles like carbon offset trading, metaverse, cryptocurrency, financialized solar installation, and (of course) AI. In addition to these new swindles, we're still playing the hits, finding new ways to make the worst scams of the 2000s even worse.

That brings me to the American health industry, and the absurdly complex, ridiculously corrupt Pharmacy Benefit Managers (PBMs), a pathology that has only metastasized since 2008.

On at least 20 separate occasions, I have taken it upon myself to figure out how the PBM swindle works, and nevertheless, every time they come up, I have to go back and figure it out again, because PBMs have the most powerful Shield of Boringness out of the whole Monster Manual of terminal-stage capitalism's trash mobs.

PBMs are back in the news because the FTC is now suing the largest of these for their role in ripping off diabetics with sky-high insulin prices. This has kicked off a fresh round of "what the fuck is a PBM, anyway?" explainers of extremely variable quality. Unsurprisingly, the best of these comes from Matt Stoller:

https://www.thebignewsletter.com/p/monopoly-round-up-lina-khan-pharma

Stoller starts by pointing out that Americans have a proud tradition of getting phucked by pharma companies. As far back as the 1950s, Tennessee Senator Estes Kefauver was holding hearings on the scams that pharma companies were using to ensure that Americans paid more for their pills than virtually anyone else in the world.

But since the 2010s, Americans have found themselves paying eye-popping, sky-high, ridiculous drug prices. Eli Lilly's Humolog insulin sold for $21 in 1999; by 2017, the price was $274 – a 1,200% increase! This isn't your grampa's price gouging!

Where do these absurd prices come from? The story starts in the 2000s, when the GW Bush administration encouraged health insurers to create "high deductible" plans, where patients were expected to pay out of pocket for receiving care, until they hit a multi-thousand-dollar threshold, and then their insurance would kick in. Along with "co-pays" and other junk fees, these deductibles were called "cost sharing," and they were sold as a way to prevent the "abuse" of the health care system.

The economists who crafted terminal-stage capitalism's intellectual rationalizations claimed the reason Americans paid so much more for health care than their socialized-medicine using cousins in the rest of the world had nothing to do with the fact that America treats health as a source of profits, while the rest of the world treats health as a human right.

No, the actual root of America's health industry's problems was the moral defects of Americans. Because insured Americans could just go see the doctor whenever they felt like it, they had no incentive to minimize their use of the system. Any time one of these unhinged hypochondriacs got a little sniffle, they could treat themselves to a doctor's visit, enjoying those waiting-room magazines and the pleasure of arranging a sick day with HR, without bearing any of the true costs:

https://pluralistic.net/2021/06/27/the-doctrine-of-moral-hazard/

"Cost sharing" was supposed to create "skin in the game" for every insured American, creating a little pain-point that stung you every time you thought about treating yourself to a luxurious doctor's visit. Now, these payments bit hardest on the poorest workers, because if you're making minimum wage, at $10 co-pay hurts a lot more than it does if you're making six figures. What's more, VPs and the C-suite were offered "gold-plated" plans with low/no deductibles or co-pays, because executives understand the value of a dollar in the way that mere working slobs can't ever hope to comprehend. They can be trusted to only use the doctor when it's truly warranted.

So now you have these high-deductible plans creeping into every workplace. Then along comes Obama and the Affordable Care Act, a compromise that maintains health care as a for-profit enterprise (still not a human right!) but seeks to create universal coverage by requiring every American to buy a plan, requiring insurers to offer plans to every American, and uses public money to subsidize the for-profit health industry to glue it together.

Predictably, the cheapest insurance offered on the Obamacare exchanges – and ultimately, by employers – had sky-high deductibles and co-pays. That way, insurers could pocket a fat public subsidy, offer an "insurance" plan that was cheap enough for even the most marginally employed people to afford, but still offer no coverage until their customers had spent thousands of dollars out-of-pocket in a given year.

That's the background: GWB created high-deductible plans, Obama supercharged them. Keep that in your mind as we go through the MEGO procedures of the PBM sector.

Your insurer has a list of drugs they'll cover, called the "formulary." The formulary also specifies how much the insurance company is willing to pay your pharmacist for these drugs. Creating the formulary and paying pharmacies for dispensing drugs is a lot of tedious work, and insurance outsources this to third parties, called – wait for it – Pharmacy Benefits Managers.

The prices in the formulary the PBM prepares for your insurance company are called the "list prices." These are meant to represent the "sticker price" of the drug, what a pharmacist would charge you if you wandered in off the street with no insurance, but somehow in possession of a valid prescription.

But, as Stoller writes, these "list prices" aren't actually ever charged to anyone. The list price is like the "full price" on the pricetags at a discount furniture place where everything is always "on sale" at 50% off – and whose semi-disposable sofas and balsa-wood dining room chairs are never actually sold at full price.

One theoretical advantage of a PBM is that it can get lower prices because it bargains for all the people in a given insurer's plan. If you're the pharma giant Sanofi and you want your Lantus insulin to be available to any of the people who must use OptumRX's formulary, you have to convince OptumRX to include you in that formulary.

OptumRX – like all PBMs – demands "rebates" from pharma companies if they want to be included in the formulary. On its face, this is similar to the practices of, say, NICE – the UK agency that bargains for medicine on behalf of the NHS, which also bargains with pharma companies for access to everyone in the UK and gets very good deals as a result.

But OptumRX doesn't bargain for a lower list price. They bargain for a bigger rebate. That means that the "price" is still very high, but OptumRX ends up paying a tiny fraction of it, thanks to that rebate. In the OptumRX formulary, Lantus insulin lists for $403. But Sanofi, who make Lantus, rebate $339 of that to OptumRX, leaving just $64 for Lantus.

Here's where the scam hits. Your insurer charges you a deductible based on the list price – $404 – not on the $64 that OptumRX actually pays for your insulin. If you're in a high-deductible plan and you haven't met your cap yet, you're going to pay $404 for your insulin, even though the actual price for it is $64.

Now, you'd think that your insurer would put a stop to this. They chose the PBM, the PBM is ripping off their customers, so it's their job to smack the PBM around and make it cut this shit out. So why would the insurers tolerate this nonsense?

Here's why: the PBMs are divisions of the big health insurance companies. Unitedhealth owns OptumRx; Aetna owns Caremark, and Cigna owns Expressscripts. So it's not the PBM that's ripping you off, it's your own insurance company. They're not just making you pay for drugs that you're supposedly covered for – they're pocketing the deductible you pay for those drugs.

Now, there's one more entity with power over the PBM that you'd hope would step in on your behalf: your boss. After all, your employer is the entity that actually chooses the insurer and negotiates with them on your behalf. Your boss is in the driver's seat; you're just along for the ride.

It would be pretty funny if the answer to this was that the health insurance company bought your employer, too, and so your boss, the PBM and the insurer were all the same guy, busily swapping hats, paying for a call center full of tormented drones who each have three phones on their desks: one labeled "insurer"; the second, "PBM" and the final one "HR."

But no, the insurers haven't bought out the company you work for (yet). Rather, they've bought off your boss – they're sharing kickbacks with your employer for all the deductibles and co-pays you're being suckered into paying. There's so much money (your money) sloshing around in the PBM scamoverse that anytime someone might get in the way of you being ripped off, they just get cut in for a share of the loot.

That is how the PBM scam works: they're fronts for health insurers who exploit the existence of high-deductible plans in order to get huge kickbacks from pharma makers, and massive fees from you. They split the loot with your boss, whose payout goes up when you get screwed harder.

But wait, there's more! After all, Big Pharma isn't some kind of easily pushed-around weakling. They're big. Why don't they push back against these massive rebates? Because they can afford to pay bribes and smaller companies making cheaper drugs can't. Whether it's a little biotech upstart with a cheaper molecule, or a generics maker who's producing drugs at a fraction of the list price, they just don't have the giant cash reserves it takes to buy their way into the PBMs' formularies. Doubtless, the Big Pharma companies would prefer to pay smaller kickbacks, but from Big Pharma's perspective, the optimum amount of bribes extracted by a PBM isn't zero – far from it. For Big Pharma, the optimal number is one cent higher than "the maximum amount of bribes that a smaller company can afford."

The purpose of a system is what it does. The PBM system makes sure that Americans only have access to the most expensive drugs, and that they pay the highest possible prices for them, and this enriches both insurance companies and employers, while protecting the Big Pharma cartel from upstarts.

Which is why the FTC is suing the PBMs for price-fixing. As Stoller points out, they're using their powers under Section 5 of the FTC Act here, which allows them to shut down "unfair methods of competition":

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

The case will be adjudicated by an administrative law judge, in a process that's much faster than a federal court case. Once the FTC proves that the PBM scam is illegal when applied to insulin, they'll have a much easier time attacking the scam when it comes to every other drug (the insulin scam has just about run its course, with federally mandated $35 insulin coming online, just as a generation of post-insulin diabetes treatments hit the market).

Obviously the PBMs aren't taking this lying down. Cigna/Expressscripts has actually sued the FTC for libel over the market study it conducted, in which the agency described in pitiless, factual detail how Cigna was ripping us all off. The case is being fought by a low-level Reagan-era monster named Rick Rule, whom Stoller characterizes as a guy who "hangs around in bars and picks up lonely multi-national corporations" (!!).

The libel claim is a nonstarter, but it's still wild. It's like one of those movies where they want to show you how bad the cockroaches are, so there's a bit where the exterminator shows up and the roaches form a chorus line and do a kind of Busby Berkeley number:

https://www.46brooklyn.com/news/2024-09-20-the-carlton-report

So here we are: the FTC has set out to euthanize some rentiers, ridding the world of a layer of useless economic middlemen whose sole reason for existing is to make pharmaceuticals as expensive as possible, by colluding with the pharma cartel, the insurance cartel and your boss. This conspiracy exists in plain sight, hidden by the Shield of Boringness. If I've done my job, you now understand how this MEGO scam works – and if you forget all that ten minutes later (as is likely, given the nature of MEGO), that's OK: just remember that this thing is a giant fucking scam, and if you ever need to refresh yourself on the details, you can always re-read this post.

The paperback edition of The Lost Cause, my nationally bestselling, hopeful solarpunk novel is out this month!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/09/23/shield-of-boringness/#some-men-rob-you-with-a-fountain-pen

Image: Flying Logos (modified) https://commons.wikimedia.org/wiki/File:Over_$1,000,000_dollars_in_USD_$100_bill_stacks.png

CC BY-SA 4.0 https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#matthew stoller#pbms#pharmacy benefit managers#cigna#ftc#antitrust#intermediaries#bribery#corruption#pharma#monopolies#shield of boringness#Caremark#Express Scripts#OptumRx#insulin#gbw#george w bush#co-pays#obamacare#aca#rick rules#guillotine watch#euthanize rentiers#mego

445 notes

·

View notes

Text

Top, screen capture from La bête (The Beast), directed by Bertrand Bonello, 2023. Via. Bottom, photograph by Doug Bierend (no title and no date found). Via.

--

Roblox is an online platform that allows users to create games and play those designed by others. A self-described “ultimate virtual universe,” it is hard to pinpoint exactly what Roblox is: Is it a game? Is it social media? Is it a place to create content or consume media? Is it a place to shop or sell? Is it a metaverse? Or simply a platform? How do we even understand what Roblox is? And does it matter?

Roblox is a multiplayer game world where users create their own singular avatar and move through immersive experiences built by other users. On Roblox, users can move through approximately 40 million different experiences to play, shop, converse and consume media. (...)

Roblox was released in 2006 by co-founders David Baszucki and Erik Cassel, and its popularity dramatically increased during the COVID-19 pandemic. In 2023, it generated revenue of US$2.7 billion and is currently valued at about US$25 to $30 billion. This makes it one of the world’s largest virtual economies; the platform’s GDP is as large as that of some countries.

Similar to YouTube, Roblox doesn’t create content — instead, it hosts what the company refers to as “immersive experiences.”

Roblox is a new category of communication and entertainment, at the nexus of internet technologies and game engines, with social media and entertainment brands. Roblox describes itself as a “medium of shared experiences.”

It differs from legacy media such as television with shows and commercials, or even Web 2.0 games like Neopets or Webkinz where players engage with prebuilt game worlds. Instead, Roblox is part of a new iteration of the internet, one that is built on game engines, blockchain technologies and token-based economies.

Natalie Coulter, from The growing influence of virtual gaming platforms like Roblox on how we interact online, July 1, 2024.

3 notes

·

View notes

Text

In 2022, I attended my first SXSW, and I couldn’t escape the suffocating atmosphere of crypto evangelism. A convention that touts itself as the nexus of art and technology, it seemed fertile ground for the seemingly growing NFT community. This year? I could barely find a mention of crypto. And the few who did bring it up seemed embarrassed to do so.

That strategy of non-acknowledgment might just be the future of crypto.

For the uninitiated, SXSW is an event that takes over nearly the whole city of Austin. There’s the main convention center, panels at different hotels, and concerts at the biggest stadiums. But almost every bar, club, and venue also has some tie-in party or concert. And those that don’t host official SXSW events hold unofficial ones to at least catch some of the hype.

All of that is to say, if you want to set up shop during SXSW, you can probably find a place to do so. This is what made it so bizarre that I was able to go most of the week with scarcely a hint of words like crypto, blockchain, or NFT.

In 2022, crypto blew the doors off the entire city. An outdoor venue with giant domes housed bombastic raves celebrating some little-known bunny NFTs called Flufs. (Incidentally, I attended the event last year, and the 3D images of crudely rendered rotting rabbits still occasionally haunt me.)

Blockchain Creative Labs—a division of Fox Entertainment—was a key sponsor of SXSW 2022. In 2023, BCL was nowhere to be found. Last year, there were dozens of panels advocating crypto’s benefits. This year, the word “crypto” only appears a dozen times in the SXSW event schedule. (Both “AI” and “metaverse” clocked at least 30 mentions.) Four of those were showings of a documentary about (among other things) “WallStreetBets and crypto fanatics,” and one was a panel with prominent crypto skeptic Molly White.

The minimal crypto presence at SXSW isn’t terribly surprising. Despite claims to the contrary, NFTs don’t actually work the way a lot of their advocates say they do. Many artists have rejected NFTs entirely and find them to be an external headache, rather than a useful business tool.

It’s not the first time tech has promised to revolutionize an industry only to fundamentally misunderstand the field it’s entering. (Just ask Stadia how easy it is to build a gaming platform.) But what’s notable is that crypto didn’t abandon SXSW entirely.

Instead, it simply came in disguise.

On the expo floor, I saw a few companies that were still proud to admit they used crypto tech to insert a financial layer into an otherwise existing product. I saw a blockchain-based camera and a crypto streaming platform—both with names I’d never heard of—in tiny booths. The largest booth that prominently announced its crypto affiliation was Polkadot, a startup that “unites and secures a growing ecosystem of specialized blockchains called parachains.”

For every one of these companies, however, I saw just as many (if not more) that employed crypto while trying very hard to avoid mentioning that fact. Two companies claimed to be building the future of social media. Dig deep enough into their websites and they both offered users crypto-based incentives, but neither chose to feature crypto or blockchain tech as a selling point.

One of them, Ascend, had flyers all over the city. These made lofty—arguably impossible—promises, such as “no misinformation” (who defines what counts as misinformation?). Some of these promises were fundamentally contradictory, such as “no toxicity” and “no hate speech” but also “no centralized censorship.” It’s unclear how the company expects to reconcile many of these competing priorities, but according to its site the solution somehow involves earning “Ascend credits,” which are only described as crypto in a chart.

Another company, Arkive, launched a DAO in 2022 aimed at creating a community of members that would use NFTs and the blockchain to form a museum curated by the internet, rather than a central organization. The group met at SXSW 2023 and even put on a panel about the decentralization of art, but they downplayed the DAO and the crypto angle. Even Arkive’s own coverage of its SXSW 2023 presence barely mentions crypto.

In some cases, it’s unclear whether companies have abandoned their crypto plans or would simply prefer not to highlight them. Even expo booths for companies that are widely known for their work in crypto seemed hesitant to use any of the keywords closely associated with it. A display for The Sandbox—sharing a small booth with some other developers in the space—proudly touted the “metaverse” game and occasionally mentioned being a “Web3” platform. But the fact that much of the game is built around NFTs on the blockchain was somewhat obscured.

It’s a dynamic I started to internally refer to as crypto-obfuscation. It’s not that any of these companies would refuse to acknowledge crypto, per se. When asked, many were all too happy to discuss their vision of a blockchain-based future. But they seemed to operate as though calling attention to it unprovoked was, at best, a little uncouth. At worst? An active deterrent.

Crypto has often been compared to the early internet, where the tech is exciting but not ready for normies yet. Still, no matter how cringey the internet was in its youth, there was never a time when companies avoided saying they were building a product on “the web” or “online.”

I’ll openly admit that I was deeply skeptical of crypto, even in 2022. There was already enough evidence of scams, rugpulls, disinformation, and fraud to make anyone wary of the blockchain for the next decade at least. But I felt compelled to keep my opinions a little quiet. At one crypto-themed party that year, a friend shouted quite loudly, “NFTs SUCK!!” And while I aspire to her energy, I also lightly shushed her for fear someone would take offense.

This year, I felt like my skepticism had become the norm, or at least mainstream enough to express openly. Out of nearly everyone I spoke to, the few with any opinions about crypto seemed eager to share their doubts. Most simply hadn’t thought about the technology. And besides, generative AI was much more interesting to discuss.

I doubt any of this means crypto is dead or dying. The tech has been around in some form or another for over a decade, and public interest in it comes in waves. However, its subdued presence at SXSW suggests its advocates had learned a powerful lesson from the previous year: The best way to evangelize crypto outside the tech bubble is to hope you can convince people to pay no attention to the blockchain behind the curtain.

2 notes

·

View notes

Text

Well, what did you expect? I really hate that this is making me defend Meta, but: Meta wants their software to run on the largest group of machines they can possibly target, and they don’t want to tell people “just go out and buy a new machine” because their target market is ultimately businesses, and a majority of businesses buy the cheapest machines they can get away with and use them until they literally stop working. Metaverse does have a minimum hardware requirement, but it includes CPUs from over a decade and a half ago (2008), because businesses are still using those machines. At this point, a game company would be telling you “go get a new machine” instead of trying to rig up support. That means Meta literally can’t do anything complex, because it would make the software unusable on machines they claim they support. They’re trying to write software which will run on machines which are only somewhat better than the Wii and the PS3, and I’m not even sure about that. (Their minimum CPU requirement is better than the Wii, but on the other hand game consoles tend to have specialized hardware for 3D graphics which is not guaranteed to be present on PCs. It’s possible that a Wii version of Metaverse would be more functional than Metaverse running on minimal PC hardware.)

Furries who are doing this stuff, on the other hand, are willing to drop money on new hardware. Of course they can do more stuff and get better results. If you’re willing to buy a race car every few years and modify it, you will win more races than somebody who is using their company car purchased from the lowest bidder 14 years ago.

All these billionaires who invested in the metaverce and Neuralink must be questioning their life choices looking at what what furries are doing in VR chat.

43K notes

·

View notes

Text

Top 5 Companies Owned By Meta (Updated 2025)

Meta, the powerhouse behind the world’s largest social platforms, has revolutionized the way we connect, communicate, and live online. With over 3.35 billion people using at least one of its core products in Q4 of 2024, it’s clear that our world can’t run without Meta!

Meta has become the cornerstone of global social interaction. But its impact doesn’t stop there – it has given birth to a whole new universe: the metaverse, where virtual and reality blend seamlessly.

Click Here: Read More

#topcompaniesownedbymeta#Meta#Technology#SocialMedia#WhatsApp#Instagram#MetaQuest#VR#Metaverse#DigitalMarketing#TechNews#BusinessGrowth#AI#FutureOfTech#SocialNetworking#Innovation

0 notes

Text

India’s growing role in shaping the future of global ER&D : Deloitte India's Report

Key Findings

A total of 428 out of the 2,000 largest companies driving research and development (R&D) are based in Europe, highlighting the region’s crucial role in fostering innovation and technological advancement.

Germany represents nearly 36 percent of the research and development (R&D) spending in Europe, with the automotive and parts sector at the forefront of these investments in European R&D.

Focusing on the domestic market through localization has been successful. At the same time, Engineering Research and Development (ER&D) centers in India are using a dual approach with the "India for the world" strategy. This shows India's growing role as a reliable ER&D provider and an innovation hub for global companies.

India is home to 91 unicorns and supports over 31,000 technology start-ups. This growing community of entrepreneurs is important for boosting research and development. It helps position India as a leader in innovation and growth.

Introduction

The geopolitical and economic environment is shifting and so is the demand for engineering research & development (ER&D). This has enabled India to become a strategic player in engineering and related research globally. According to a joint study by Deloitte and NASSCOM, ‘Spotlight on Germany's Evolving ER&D Operating Model Strategy: Tapping into India Advantage,’ India is getting more influential with how ER&D projects are developed globally.

India's engineering research and development environment is changing immensely, mostly due to the rapidly expanding number of employees at ER&D-focused Global Capability Centers (GCCs). In the past, India mostly supported the functions, but today it is a key force driving innovation and digital transformation for companies in a variety of industries. Leading global corporations' R&D strategies are increasingly ingrained in their operations rather than only being an add-on source for reasonably priced technical services.

This evolution reflects a strategic shift where Indian firms are harnessing advanced technologies, such as artificial intelligence, machine learning, and data analytics, to create cutting-edge solutions that meet complex global demands. India is widely acknowledged as a global innovation powerhouse capable of creating considerable value by combining local insights with an international perspective. Therefore, such innovations not only enable India to participate in the ER&D industry but also solidify its standing as a leading partner in directing the development of global industrial processes and technology.

Germany’s Growing Collaboration with India

In FY23, Europe made up 24% of global R&D spending, with Germany accounting for 36% of that total. The study highlights how German companies are using India's well-developed engineering and research and development (ER&D) system to boost product innovation, resilience, and speed to market, particularly in the automotive and industrial engineering sectors. In order to address global concerns and promote innovation, this alliance brings together India's workforce with digital skills and Germany's engineering experience.

India’s ER&D Ecosystem and Global Leadership

India has developed a robust ER&D ecosystem, solidifying its position as a global leader in the field. The country hosts over 1,700 Global Capability Centers (GCCs), with more than 1,680 offering ER&D services. A significant portion of the world’s top 50 engineering service providers are headquartered in India. The country is also advancing technologies such as generative AI, spatial computing, and the industrial metaverse.

About ‘Spotlight on Germany's evolving ER&D operating model strategy: Tapping into India advantage’

The report offers a thorough analysis of the evolving Engineering Research and Development landscape in Germany and its implications for Europe. It highlights Germany as a pivotal market, serving as a barometer for broader regional trends. The report examines key themes, including investment priorities, sectoral trends and the adoption of emerging technologies, such as digitalisation, autonomous systems and sustainability-driven innovations.

This comprehensive study summarizes insights from 30 primary interviews with senior ER&D stakeholders, including global ER&D leaders, GCC executives, and External Service Providers (ESPs). It also includes secondary research analysing over 2,500 companies globally, which represent ~80 percent of global R&D expenditure. The research includes data from sources such as the Industrial Research and Innovation dataset and detailed financial analyses from FY23.

0 notes

Text

[ad_1] Immerso, an Eros Innovation company- home to Eros Media and Eros Now, and a global leader in AI innovation and intellectual property (IP), has joined forces with Everdome, pioneers in creating interactive metaverse experiences, to revolutionize digital entertainment. Immerso and Everdome Partner to Drive Innovation in the Metaverse Through AI-Powered Experiences The partnership combines Immerso’s exceptional IP portfolio, featuring an extensive library of over 12,000 film titles, with Everdome’s immersive technology. Together, they aim to transform how audiences engage with entertainment in the digital era. Backed by Eros Innovation, Immerso brings unparalleled resources to the table. Eros Media World boasts a 30% market share in the Indian film industry, selling 2.7 billion tickets annually and reaching a global audience in the billions. This partnership unlocks the potential to become the world’s largest film market for metaverse engagement. Jeremy Lopez, CEO of Everdome, commented, “This partnership propels Everdome’s vision to merge the metaverse with AI tools and intellectual property, setting the stage for the creation of interactive, metaverse-native IP experiences for brands on a global scale. With nearly 50 years of Bollywood history under their belt and a strong commitment to the metaverse and immersive computing, Immerso is the perfect partner as Everdome steps into its next chapter.” Swaneet Singh, CEO of Immerso added, "We firmly believe in the transformative potential of virtual experiences and Web3 in reshaping the way users connect. By combining immersive experiences with AI-powered hybrid content and user-generated creation, we’re opening up new possibilities - and we are thrilled to be at the forefront of this innovation alongside Everdome.’’ Immerso is uniquely positioned to lead large-scale innovation in AI, entertainment, and the metaverse. As one of the first AI Intellectual Property (AIIP) companies, Immerso owns over a trillion AI tokens and has trained models across all LLM platforms. This foundation, coupled with initiatives such as establishing India’s first AI Park and a billion-dollar investment in a Malaysian AI park and film studio, showcases Immerso's commitment to pushing the boundaries of digital experiences. Everdome, recognized for its expertise in creating immersive and accessible digital experiences, is dedicated to bringing real use cases and larger audiences to the metaverse. With a proven track record of collaborations with global brands like the Alpine Web3, and Binance Fan Token Everdome is well-versed in bringing established IPs to life in new and engaging ways. With an initial focus on integrating Indian cinema's vast library of films, stars, directors, and influencers into immersive virtual worlds, together, Immerso and Everdome will offer audiences entirely new ways to connect with entertainment. This collaboration marks a significant step toward a future where AI, IP, and immersive technology converge to transform how the world interacts with storytelling and creativity. It sets a new standard for connectivity and engagement in the metaverse and establishes a framework for a thriving creator economy. Immerso and Everdome will offer audiences entirely new ways to connect with entertainment. The future of the metaverse is driven by collaboration, and this partnership unlocks the potential to become one of the world’s largest film markets for metaverse engagement, revolutionizing how users view, engage with, and interact with traditional media in an immersive digital world. #ImagineTheMetaverseDifferently About Immerso AIIP Limited Immerso AIIP Limited is a global leader in the media and entertainment industry. With a rich history dating back to 1977, the company has consistently pushed the boundaries of innovation and creativity. Immerso AIIP owns a vast library of over 12,000 film titles, commanding a 30% market share over the past two decades.

This extensive catalogue forms the foundation for Eros Now, the company's streaming platform with an impressive 250 million registered users. Recognizing the transformative power of artificial intelligence, Immerso is focused on pioneering the development of AI-driven content creation tools. Immerso has amassed over a trillion AI tokens, used to train sophisticated language models (SLM and LLM) that empower creators to build the next generation of immersive experiences. Immerso AIIP is committed to fostering a thriving creator economy on Web 3, leveraging its vast IP library and AI capabilities to unlock new possibilities for content creation and distribution. About Everdome Everdome builds future themed metaverse experiences to provide creators, brands, individuals and businesses with immersive, interactive spaces to collaborate on the creation and enjoyment of shared digital experiences. Launched in 2022, Everdome uses blockchain, advanced real-time 3D creation tools such as UE5, spatial computing and cryptocurrency to build, run and fuel their project, creating a platform to combine metaverse-on-demand tooling with engaging features and high quality environments. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

[ad_1] Immerso, an Eros Innovation company- home to Eros Media and Eros Now, and a global leader in AI innovation and intellectual property (IP), has joined forces with Everdome, pioneers in creating interactive metaverse experiences, to revolutionize digital entertainment. Immerso and Everdome Partner to Drive Innovation in the Metaverse Through AI-Powered Experiences The partnership combines Immerso’s exceptional IP portfolio, featuring an extensive library of over 12,000 film titles, with Everdome’s immersive technology. Together, they aim to transform how audiences engage with entertainment in the digital era. Backed by Eros Innovation, Immerso brings unparalleled resources to the table. Eros Media World boasts a 30% market share in the Indian film industry, selling 2.7 billion tickets annually and reaching a global audience in the billions. This partnership unlocks the potential to become the world’s largest film market for metaverse engagement. Jeremy Lopez, CEO of Everdome, commented, “This partnership propels Everdome’s vision to merge the metaverse with AI tools and intellectual property, setting the stage for the creation of interactive, metaverse-native IP experiences for brands on a global scale. With nearly 50 years of Bollywood history under their belt and a strong commitment to the metaverse and immersive computing, Immerso is the perfect partner as Everdome steps into its next chapter.” Swaneet Singh, CEO of Immerso added, "We firmly believe in the transformative potential of virtual experiences and Web3 in reshaping the way users connect. By combining immersive experiences with AI-powered hybrid content and user-generated creation, we’re opening up new possibilities - and we are thrilled to be at the forefront of this innovation alongside Everdome.’’ Immerso is uniquely positioned to lead large-scale innovation in AI, entertainment, and the metaverse. As one of the first AI Intellectual Property (AIIP) companies, Immerso owns over a trillion AI tokens and has trained models across all LLM platforms. This foundation, coupled with initiatives such as establishing India’s first AI Park and a billion-dollar investment in a Malaysian AI park and film studio, showcases Immerso's commitment to pushing the boundaries of digital experiences. Everdome, recognized for its expertise in creating immersive and accessible digital experiences, is dedicated to bringing real use cases and larger audiences to the metaverse. With a proven track record of collaborations with global brands like the Alpine Web3, and Binance Fan Token Everdome is well-versed in bringing established IPs to life in new and engaging ways. With an initial focus on integrating Indian cinema's vast library of films, stars, directors, and influencers into immersive virtual worlds, together, Immerso and Everdome will offer audiences entirely new ways to connect with entertainment. This collaboration marks a significant step toward a future where AI, IP, and immersive technology converge to transform how the world interacts with storytelling and creativity. It sets a new standard for connectivity and engagement in the metaverse and establishes a framework for a thriving creator economy. Immerso and Everdome will offer audiences entirely new ways to connect with entertainment. The future of the metaverse is driven by collaboration, and this partnership unlocks the potential to become one of the world’s largest film markets for metaverse engagement, revolutionizing how users view, engage with, and interact with traditional media in an immersive digital world. #ImagineTheMetaverseDifferently About Immerso AIIP Limited Immerso AIIP Limited is a global leader in the media and entertainment industry. With a rich history dating back to 1977, the company has consistently pushed the boundaries of innovation and creativity. Immerso AIIP owns a vast library of over 12,000 film titles, commanding a 30% market share over the past two decades.

This extensive catalogue forms the foundation for Eros Now, the company's streaming platform with an impressive 250 million registered users. Recognizing the transformative power of artificial intelligence, Immerso is focused on pioneering the development of AI-driven content creation tools. Immerso has amassed over a trillion AI tokens, used to train sophisticated language models (SLM and LLM) that empower creators to build the next generation of immersive experiences. Immerso AIIP is committed to fostering a thriving creator economy on Web 3, leveraging its vast IP library and AI capabilities to unlock new possibilities for content creation and distribution. About Everdome Everdome builds future themed metaverse experiences to provide creators, brands, individuals and businesses with immersive, interactive spaces to collaborate on the creation and enjoyment of shared digital experiences. Launched in 2022, Everdome uses blockchain, advanced real-time 3D creation tools such as UE5, spatial computing and cryptocurrency to build, run and fuel their project, creating a platform to combine metaverse-on-demand tooling with engaging features and high quality environments. !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '311356416665414'); fbq('track', 'PageView'); [ad_2] Source link

0 notes

Text

"Industrial Metaverse: Where Virtual Meets Reality 2025–2033 🌌🏭"

Industrial Metaverse Market represents a revolutionary convergence of immersive digital environments with industrial operations. Combining technologies like virtual reality (VR), augmented reality (AR), IoT, and AI, the market enables interactive simulations, digital twins, and remote collaborations. These advancements drive efficiency, predictive maintenance, and optimized production processes, ushering in a new era of industrial innovation.

To Request Sample Report: https://www.globalinsightservices.com/request-sample/?id=GIS31506 &utm_source=SnehaPatil&utm_medium=Article

The market is experiencing significant growth, driven by advancements in digital twin technology and virtual simulation applications. The manufacturing sector leads, utilizing immersive technologies for process optimization and predictive maintenance. The energy and utilities segment follows closely, leveraging the metaverse for remote monitoring and infrastructure management.

Regionally, North America dominates due to robust investments in digital transformation and the presence of tech pioneers. Europe ranks as the second-largest market, supported by government initiatives promoting Industry 4.0 and sustainable practices. Among countries, the United States leads with its innovation-driven economy, followed by Germany, known for its strong industrial base and technological integration.

In 2023, the market volume was estimated at 320 million units, with projections to reach 550 million units by 2033. Virtual reality holds the largest market share at 45%, followed by augmented reality (30%) and mixed reality (25%). VR’s dominance stems from its applications in immersive training and simulations. Leading companies such as Siemens AG, NVIDIA Corporation, and Microsoft Corporation continue to push boundaries, with Siemens focusing on digital twin integration and NVIDIA enhancing graphics capabilities.

Despite challenges like high costs and technological complexity, the market is expected to grow at a 15% CAGR over the next decade. Innovations in AI, IoT, and 5G connectivity present lucrative opportunities across manufacturing, logistics, and other sectors

#IndustrialMetaverse #DigitalTwins #ImmersiveTech #VRinIndustry #ARApplications #IoTInnovation #AIIntegration #ManufacturingTech #ProcessOptimization #PredictiveMaintenance #EnergyTech #LogisticsEvolution #SmartIndustries #Industry4Point0 #FutureOfIndustry

0 notes

Text

Private equity rips off its investors, too

I'm coming to DEFCON! TOMORROW (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). On SATURDAY (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

It's amazing how many of the scams that have devastated our economy and everyday people owe their success to the fact that we assume that rich people know what they're doing, so if they're doing something, it must be real.

Think of how many people lost everything by gambling on junk bonds, exotic mortgage derivatives, cryptocurrency and web3, because they saw that the largest financial institutions in the world were going all-in on these weird, incomprehensible bets.

Then there are the people who are convinced that online advertising is built around a mind-control ray, because tech companies claim that's what they have ("I am an evil dopamine-loop-hacking wizard and I can sell anything to anyone!"), and because huge, sober blue-chip companies hand billions to these soi dissant svengalis. Sure, online ads are a swamp of clickfraud and garbage, but would these super smart captains of industry spend so much on online advertising if it didn't work super-well?

http://pluralistic.net/HowToDestroySurveillanceCapitalism

From our worms'-eye-view here on the ground, it's easy to assume that rich people and the people who sell them stuff are all on the same side. "If you're not paying for the product, you're the product," right? If Facebook is tormenting you with surveillance advertising, it must be doing so on behalf of the surveillance advertisers, for whom Mark Zuckerberg has bottomless reservoirs of honest, forthright impulses.

The reality is simultaneously weirder, and obvious in hindsight. The reason Zuck is tormenting you is that he's a remorseless sociopath who doesn't care who he hurts. He rips off everyone he can rip off, and that includes advertisers, who have seen steady price-hikes and lower-fidelity targeting, even as ad-fraud has skyrocketed while Facebook draws down its anti-fraud spending:

https://www.404media.co/where-facebooks-ai-slop-comes-from/

This is not to say that Facebook advertisers have your best interests at heart, that they aren't engaged in active deception in order to better themselves at your expense. Rather, it's to say that there's no honor among thieves, and Zuck is an equal-opportunity predator. Moreover, both Zuck and his advertisers are credulous dolts, so the mere fact that they are pouring money into something (advertisers: FB ads; Zuck: metaverse) it doesn't follow that these are real or important or the coming thing.

For me, the Ur-example of "rich people are dumb, even when it comes to money" is the private equity sector. I've written a lot about PE, and how destructive it is to the real economy, from Toys R Us to pet grooming:

https://pluralistic.net/2024/08/05/rugged-individuals/#misleading-by-analogy

How they killed Red Lobster:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

And how they actually created the death panels that Sarah Palin warned us about (it's OK, though: these death panels are run by the efficient private sector, not government bureaucrats):

https://pluralistic.net/2023/04/26/death-panels/#what-the-heck-is-going-on-with-CMS

The devastating effect of private equity on the real economy is increasingly well understood, and a curious side-effect of this is that people assume that if PE is destroying their lives, they must be doing so on behalf of their investors, who are making bank.

But – like Zuck – PE bosses are just as happy to steal from their investors as they are to to steal from the workers and customers of the businesses they acquire on those investors' behalf. They swaddle this theft in performative complexity and specialized jargon, but when you strip all that away, you find more fraud.

All the misery that PE inflicts on workers, communities and customers are just a convincer in a Big Store con, a bid to make the scam seem credible. For a certain kind of investor, any economic activity that destroys communities and workers' livelihoods must be a good bet. This is the dynamic at work in the pitch of AI image-generator companies, who spend tens of billions on technology that there is no substantial market for:

https://pluralistic.net/2024/07/25/accountability-sinks/#work-harder-not-smarter

AI image generators represent a high-profile, extremely visible example of "a job that AI can do." Nevermind that AI illustration went from a novelty to a tired cliche in less than a year. Even if you think that AI illustrations are a perfect substitute for commercial illustrations, that still won't come anywhere near making AI companies a profit. Add up the entire wage bill for every commercial illustrator in the world, hand it to Open AI, and you're not even gonna cover the kombucha budget for Open AI's staff kitchens.

Hell, all the wages of every commercial illustrator that ever lived won't pay back even a fraction of the money the AI companies spent on image generators. The pauperization of an entire class of creative workers is just a canned demo, a way to fool investors into thinking that there is a whole universe of similarly situated workers whose wages can be diverted to AI companies. This is the logic of small-time spammers, scaled up to the scale of the entire S&P 500. Smalltime spammers looked at AI and thought, "OK, I can generate as much botshit as I want on demand for free. Science fiction magazines pay $0.10/word. So if I generate a billion words, I'll get $100 million." But that's not how any of that works: sf magazines don't buy botshit, and even if they did, the entire market for short fiction adds up to what Sam Altman spends on a single designer t-shirt. The point of destroying these beloved, useful things isn't to make a lot of money by taking their markets – it's to convince dopey, panicked rich people to give you lots of money you can steal, because they think you can do this to every market and they don't want to miss out on the opportunity of a lifetime:

https://pluralistic.net/2024/01/15/passive-income-brainworms/#four-hour-work-week

Take "divi recaps": after a private equity firm acquires a company (by borrowing money against its assets), it typically declares a "special dividend," emptying out the company's cash reserves and pocketing them. A "divi recap" is when PE then takes out another massive loan against the company's (remaining) assets and pockets that:

https://pluralistic.net/2020/09/17/divi-recaps/#graebers-ghost

All of this happens under an opaque cloud, thanks to the light-to-nonexistent disclosure rules for PE. A public company has to open its books for the SEC, its investors, and the world. PE is private – and so are its finances. It is absolutely routine for PE bosses to put their spouses, kids, and pals on the payroll and hand them millions for doing little to nothing, all at the expense of their investors:

https://www.nakedcapitalism.com/2022/02/sec-set-to-lower-massive-boom-on-private-equity-industry.html

PE bosses charge huge fees to their investors – not merely the usual 2-and-20 (2% of the funds under management and 20% of any profits) – but also a wide variety of special one-off fees that pile to the sky. They also dip into their investors' funds to issue themselves massive loans that they use to make side-bets, without telling the investors about it:

https://pluralistic.net/2022/02/10/monopoly-begets-monopoly/#gary-gensler

PE investors are chickens ripe for the plucking: take "continuation funds," which allow PE bosses to soak the rich people and pension funds who supply them with billions:

https://news.bloomberglaw.com/mergers-and-acquisitions/matt-levines-money-stuff-buyout-funds-buy-from-themselves

Remember 2-and-20? 2% of all the money you manage, every year, and 20% of all the profits. You'd think that these would be somewhat zero sum, right? If you use some of your investors' cash to buy a company, and then sell off that company for a profit, you get the 20%, but now the pot of money you're managing has gone down by the amount you used to buy the company, and so your 2% carry goes down, too.

But what if you sell your portfolio companies to yourself, using your investors' own money? When you do that, you continue to hold the company on your PE firm's books, meaning you continue to get the 2% carry, and you can pocket 20% of the sale price as a "profit":

https://pluralistic.net/2023/07/20/continuation-fraud/#buyout-groups

This is straight-up fraud, wrapped up in so much jargon that it can successfully masquerade as "financial engineering" ("financial engineering" is really just a euphemism for "fraud"). PE bosses keep coming up with new, exotic ways to steal from their investors. The latest scam is "tax receivable agreements":

https://archive.ph/RczJ9

On its face, this is a tax scam. When a company goes public, early investors generally hold stock in the original partnership or LLC; this company ends up holding a ton of shares in the new, public company. When they sell those non-public shares in the LLC, this creates a (potentially gigantic) tax credit.

A TRA hustle involves tracking down these LLC shareholders and convincing them to sign off on dumping the LLC's shares, which generates a huge tax credit for the public company. The hustler offers to split these credits with the LLC holders.

All of this is especially attractive to PE bosses, who often take a company private, do a bunch of "financial engineering" and then take it public again, leaving the PE firm as the owner of those LLC shares that can be converted to a TRA and a huge windfall – which the PE bosses pocket, because they (not their investors) are holding those credits.

This scam is really doing big numbers. KKR – the monsters who killed Toys R Us – just diverted $650 million in TRA loot, prompting a lawsuit from Steamfitters union pension fund, which had handed these jerks millions of its members' money to gamble with:

https://archive.ph/kqQvI

This highlights another very weird aspect of the PE scam: they are absolutely dependent on pension funds. To add insult to injury, PE funds are notorious union-busters – they use union money to buy companies and destroy their unions:

https://pluralistic.net/2023/10/05/mr-gotcha/#no-ethical-consumption-under-capitalism

People who try to understand the PE business model often give up, because it seems to make no sense, leading many to assume that they're too unsophisticated to grasp the complex financials here. For example, PE is absolutely dependent on massive loans as a way of looting its businesses, but it also often defaults on those loans. Why do banks and investors keep making huge loans to PE deadbeats? Because – like the PE fund investors – they are credulous dolts.

The reason PE seems like a scam is that it is a scam. It is a fractal scam – every part of it is a scam. You might have heard about the "carried interest" tax loophole that allows PE bosses to avoid billions in taxes on the money they steal from their investors, creditors, workers and customers. Most people assume "carried interest" has something to do with "interest" on a loan. Nope: "carried interest" is a 16th century nautical tax rule designed for mercantalist sea-captains who had an "interest" in the cargo they "carried":

https://pluralistic.net/2021/04/29/writers-must-be-paid/#carried-interest

But rich people and other "sophisticated investors" (like pension fund investment managers) are no smarter than the rest of us. They are herd animals. When they see other rich people piling into some scheme or asset class, they rush to join them, which makes the asset price go up, which makes them think they're smart (until the inevitable rug-pull). When one plute jumps off the Empire State Building, the rest of them jump, too.

Which is why there's more money flooding into PE than at any time in history, $2.62T in "dry powder," handed over to greedy, thieving PE bosses in a poker game where everyone is the sucker at the table:

https://www.institutionalinvestor.com/article/2di1vzgjcmzovkcea8f0g/portfolio/private-equitys-dry-powder-mountain-reaches-record-height

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/08/sucker-at-the-table/#clucks-definance

#pluralistic#tra#tax receivable asset#financial engineering#private equity#two sided markets#pe#looters#sucker at the table#kkr#debt#dry powder

381 notes

·

View notes

Text

Japan Metaverse Market Growth and Forecast 2024 to 2030

The Japan metaverse market size is anticipated to reach USD 56.73 billion by 2030, according to a new report by Grand View Research, Inc. The market is expected to grow at a CAGR of 48.2% from 2024 to 2030. Emerging innovations in gaming technology worldwide are expected to drive this growth. Some other factors that propel the growth of the Japan metaverse industry include the rise in virtual events and conferences, online shopping, and the need to test and inspect machinery using augmented reality (AR) and virtual reality (VR).

The COVID-19 pandemic had a positive impact on the metaverse market in Japan. The increase in virtual social platforms, such as cluster.mu and VRChat, boosted the user base of VR devices. The metaverse is finding numerous applications apart from socialization; for instance, in June 2020, during COVID-19, a hospital in Tokyo incorporated a surgery over VR live-streamed for research and educational purposes.

Numerous companies are collaborating to make Japan metaverse-ready in line with the Society 5.0 initiative. In February 2023, Fujitsu Ltd.; TBT Lab Inc.; Toppan Inc.; Sompo Japan Insurance, Inc.; esona Holdings, Inc.; Mitsubishi UFJ Financial Group, Inc.; Sumitomo Mitsui Financial Group, Inc.; Mizuho Financial Group, Inc.; and JCB Co., Ltd. signed an agreement to create an Open Metaverse Infrastructure named RYUGUKOKU through the metaverse creation framework PEGASUS WORLD KIT developed by JP GAMES Inc. This agreement is based on the concept of updating Japan through the power of games, developed by Hajime Tabata, a renowned game creator, and Web 3.0 advisor for the Japanese Government's Digital Agency. The Japan Metaverse Economic Zone is also being created through the endorsement of each company.

Virtual live events are being widely accepted in Japan. For instance, in September 2023, Dentsu Group Inc. enhanced xambr, a metaverse system to promote it at large-scale events. The system was used at TOKYO GAME SHOW VR 2023 at virtual venue. The virtual venue at TOKYO GAME SHOW VR 2022 attracted around 0.4 million visitors, with 98.5% of participants intending to revisit.

Japan Metaverse Market Report Highlights

Based on product, the software segment accounted for the largest revenue share of 42.7% in 2023 and is expected to retain its position over the forecast period. This can be attributed to the advent of artificial intelligenceand the improvements in hardware architecture.

Based on platform, the desktop segment held the dominant revenue share of 41.4% in 2023 and is also expected to grow at a significant CAGR over the forecast period. This can be attributed to the rising demand for a versatile device and the emergence of e-sports. The mobile segment is expected to grow at the fastest CAGR from 2024 to 2030, owing to the increasing research and development of smartphone components.

Based on technology, the VR & AR segment led the market with a revenue share of 34.9% owing to the increasing demand for simulation platforms for training and educational needs

Based on application, the digital marketing (advertising) segment is expected to witness a rapid CAGR of 51.2% over the forecast period, owing to the increasing user base in the metaverse

Based on end-user, the BFSI segment held the largest revenue share of 27.9% in 2023. The rise of digitization, the increase in employment, and income per capita are promoting the growth of the segment.

Bandai Namco has launched a USD 7.9 million fund to invest in upcoming gaming companies related to Web 3 and metaverse, focusing on blockchain companies, NFT adoption, and entertainment-related products and services such as AR and VR

Japan Metaverse Market Segmentation

Grand View Research has segmented the Japan metaverse market based on product, platform, technology, application, and end-user:

Japan Metaverse Product Outlook (Revenue, USD Million, 2018 - 2030)

Infrastructure

Chips & Processors

Network Capabilities

Cloud & Edge Infrastructure

Cybersecurity

Hardware

Holographic Displays

eXtended Reality (XR) Components

Haptic Sensors & Devices

Smart Glasses

Omni Treadmills

Total

AR/VR Devices

Others

Software

Asset Creation Tools

Programming Engines

Virtual Platforms

Avatar Development

Services

User Experiences

Asset Marketplaces

Financial Services

Japan Metaverse Platform Outlook (Revenue, USD Million, 2018 - 2030)

Desktop

Mobile

Headsets

Japan Metaverse Technology Outlook (Revenue, USD Million, 2018 - 2030)

Blockchain

VR & AR

Mixed Reality

Others

Japan Metaverse Application Outlook (Revenue, USD Million, 2018 - 2030)

Gaming

Online Shopping

Content Creation & Social Media

Events & Conference

Digital Marketing (Advertising)

Testing & Inspection

Others

Japan Metaverse End-user Outlook (Revenue, USD Million, 2018 - 2030)

Aerospace & Defense

Education

Healthcare

Tourism & Hospitality

BFSI

Retail

Media & Entertainment

Automotive

Others (Manufacturing)

Order a free sample PDF of the Japan Metaverse Market Intelligence Study, published by Grand View Research.

0 notes

Text

youtube

Top 10 Richest Companies in the World. You may not know them all. Discover the top 10 richest companies in the world and how they dominate industries with their staggering wealth and influence. https://www.youtube.com/channel/UC3o4B5eoAcewBjxvaeC5Rxg?sub_confirmation=1 The world’s economy is driven by powerful corporations that generate staggering revenues and influence markets globally. This guide explores the top 10 richest companies in the world, revealing the giants that shape industries and set benchmarks for success. At the top of the list is Apple, the first company to reach a $3 trillion market valuation. Known for its innovative technology and sleek designs, Apple’s influence extends far beyond its iconic products. Following closely is Microsoft, a leader in software and cloud computing, with its revenue surpassing $200 billion annually. Amazon ranks high as the world’s largest e-commerce platform, leveraging its logistics network and cloud services to dominate the market. Alphabet, Google’s parent company, continues to thrive with its advertising empire and investments in AI and autonomous technologies. Saudi Aramco, the world’s most profitable oil company, plays a significant role in the energy sector, earning billions in annual profits. Tesla, led by Elon Musk, has redefined the automotive industry with its electric vehicles and sustainable energy solutions. Berkshire Hathaway, helmed by Warren Buffett, remains a financial powerhouse with investments across multiple sectors. Meta, formerly Facebook, dominates the social media landscape while expanding into virtual reality and the metaverse. Closing the list are Tencent, a Chinese tech giant leading in gaming and social media, and Walmart, the world’s largest retailer, known for its vast global operations and competitive pricing. These companies are not just financial titans—they are innovators and leaders that influence technology, energy, retail, and beyond. Their wealth and reach underscore their pivotal roles in the global economy, shaping the way we live, work, and connect. TIME STAMPS: 00:00 Intro 00:38 Number 10 01:31 Number 9 02:04 Number 8 03:11 Number 7 03:53 Number 6 04:47 Number 5 05:20 Number 4 06:00 Number 3 06:53 Number 2 07:38 Number 1 📂 For The Latest Stories on luxury travel, getaways goods, the rich, companies, Top 10’s, biographies, Lavish History, news, and more 📂 https://www.youtube.com/@Lavishangle 🎉 For business enquires contact us at full4sog (@) gmail dot com 💬 Don't forget to leave your thoughts in the comments below. We love hearing from you! ���� and hit that bell to stay updated on all new videos we release. #lavishgetaways #thelavishandaffluentangle #thelavish&affluentangle #tlaa #viralyoutubevideo #video #viralyoutubevideo #youtubeviralvideos #videosviral #videos #videosyoutube #videosbeta #viralvideos #viralvideo #viral #viralreels #youtubevideos #viralyoutubevideos #RichestCompanies #GlobalWealth #Top10Companies #AppleInc #MicrosoftWealth #AmazonRiches #AlphabetGoogle #SaudiAramco #TeslaInnovation #BerkshireHathaway #MetaFacebook #TencentTech #WalmartGlobal #EconomicLeaders #CorporateGiants #BigTech #GlobalEconomy #BusinessTitans #FinancialPowerhouses #RichestCorporations via The Lavish & Affluent Angle https://www.youtube.com/channel/UC3o4B5eoAcewBjxvaeC5Rxg December 11, 2024 at 02:00AM

#lavishgetaways#luxurylifestyle#luxuryhotels#luxurytravel#luxuryliving#traveltheworld#travelgoals#Youtube

1 note

·

View note

Text

Who is the CEO of digital brands?

In today’s rapidly evolving digital landscape, the term "digital brands" refers to companies that primarily operate in the digital space. These brands leverage online platforms and digital channels to build their business, engage with customers, and drive growth. From e-commerce giants to innovative tech startups, digital brands have transformed how businesses function in the modern world.

One of the key aspects of any successful company is its leadership, and the CEO (Chief Executive Officer) plays a crucial role in guiding the company’s vision, operations, and strategy. But who are the CEOs behind the most prominent digital brands today? Let’s take a closer look at some of the top digital brands and their visionary leaders.

1. Jeff Bezos – Amazon (E-commerce Giant)

When we think of digital brands, Amazon immediately comes to mind. Founded by Jeff Bezos in 1994, Amazon started as an online bookstore but quickly evolved into the world’s largest e-commerce platform. Bezos, who served as the CEO of Amazon for nearly three decades, transformed the way people shop online and pioneered the development of cloud computing through Amazon Web Services (AWS).

Bezos stepped down as Amazon’s CEO in July 2021, but his impact on the company and the digital world remains immense. Under his leadership, Amazon revolutionized e-commerce, logistics, and digital infrastructure, making it one of the most valuable companies globally.

2. Mark Zuckerberg – Facebook (Meta Platforms)

Another digital brand that has shaped the digital marketing landscape is Facebook, now known as Meta Platforms. Founded by Mark Zuckerberg in 2004, Facebook became the world’s leading social media platform, connecting billions of people globally. Over the years, Zuckerberg has expanded Meta’s reach through acquisitions of Instagram, WhatsApp, and Oculus, solidifying Meta as a digital brand powerhouse.

As the CEO of Meta, Zuckerberg has played a pivotal role in developing and evolving the social media industry, advertising solutions, and even the concept of the Metaverse. His leadership has influenced how businesses connect with audiences through digital marketing and social media engagement.

3. Elon Musk – Tesla and SpaceX (Tech & Innovation)

Elon Musk is another visionary leader who has built successful digital brands through his ventures, including Tesla and SpaceX. Known for his ambitious goals of transforming industries and pushing the boundaries of technology, Musk has positioned both Tesla and SpaceX at the forefront of innovation in electric vehicles and space exploration, respectively.

Musk’s leadership at Tesla has not only disrupted the automobile industry but has also made digital technology and renewable energy a central part of the brand. Tesla’s digital ecosystem, which includes software updates, autonomous driving, and a digital interface, has redefined what it means to be a modern tech-driven brand.

4. Reed Hastings – Netflix (Streaming Industry)

Reed Hastings, the co-founder and former CEO of Netflix, is another key figure in the digital brand landscape. Founded in 1997 as a DVD rental service, Netflix transitioned to a streaming platform in 2007, becoming the global leader in online entertainment. Under Hastings’ leadership, Netflix grew exponentially and changed the way we consume television and movies.

Hastings helped Netflix become a global digital brand by embracing digital streaming, producing original content, and investing in innovative technologies that enhanced user experience. Netflix’s success story is a testament to the power of digital transformation in the entertainment industry.

5. Jack Dorsey – Twitter (Social Media)

Jack Dorsey is known for co-founding Twitter, the social media platform that has become a significant player in global communication, news sharing, and marketing. Launched in 2006, Twitter quickly gained popularity due to its unique microblogging format, which allowed users to share short messages known as “tweets.” Dorsey served as Twitter's CEO twice, first from 2006 to 2008 and again from 2015 to 2021.

Under his leadership, Twitter became a hub for digital conversations, breaking news, and brand engagement. Despite his departure as CEO in late 2021, Dorsey’s influence on the platform and the digital marketing space continues to be felt.

6. Brian Chesky – Airbnb (Online Travel & Hospitality)

Brian Chesky, the co-founder and CEO of Airbnb, has played a significant role in the success of one of the leading digital brands in the travel and hospitality industry. Founded in 2008, Airbnb revolutionized the way people travel by offering short-term rentals directly from property owners. Chesky’s vision of creating a community-driven platform led Airbnb to disrupt the traditional hotel industry and become a leading global travel brand.

Chesky’s leadership in creating an online marketplace for lodging has not only transformed the travel industry but also introduced new ways for brands to connect with customers through digital platforms.

Conclusion

The CEOs of these digital brands – Jeff Bezos, Mark Zuckerberg, Elon Musk, Reed Hastings, Jack Dorsey, and Brian Chesky – have all been instrumental in shaping the digital world we know today. Their visionary leadership has not only helped create some of the most successful digital brands but has also influenced how businesses approach digital transformation and customer engagement in the digital age.

As the digital world continues to evolve, the role of visionary leaders will remain critical in driving innovation, shaping the future of business, and unlocking new opportunities in the digital space.

If you're looking to take your business to the next level in the digital world, partnering with a digital marketing agency in Tamil Nadu can help you develop effective strategies to enhance your online presence and connect with your target audience. Let expert guidance lead you toward success in the ever-changing digital landscape.

0 notes