#kiosk banking registration

Explore tagged Tumblr posts

Text

What exactly is kiosk banking registration?

Kiosk Banking Registration refers to the process by which an individual or entity registers with a bank to become an authorized Kiosk Banking CSP or Customer Service Point. Kiosk banking, also known as BCSPs or banking through customer service points, is a service provided by banks to extend their reach to unbanked or underbanked areas through third-party agents.

Customer service point as well as kiosk banking registration aligns with the broader goal of the banking industry to ensure access to financial services for all segments of society. When both registration processes are made simpler, it will lead to a positive reputation. It means that a simplified CSP and kiosk registration, as well as the application process, can enhance the bank's reputation as an inclusive and accessible financial institution. This can improve the bank's standing in the community and among potential customers. In general, simplifying these two processes can lead to a range of benefits that contribute to the growth and efficiency of banking services, especially in areas where access to traditional banking is limited.

Whether you apply for CSP registration or kiosk registration, you may need to come across various steps, including:

· Eligibility Check

· Application Submission

· Documentation

· Due Diligence

· Approval and Agreement

On approval of CSP and kiosk banking applications after registration, you may need to undergo comprehensive training on the operation of these outlets. However, all nationalized banks in the country will provide training to the selected candidates to help them do their tasks efficiently and effortlessly. The training will make sure that the CSP and kiosk outlet operators get the knowledge they need to perform their daily tasks according to the specifications of the banks. The training also helps the chosen candidates familiarize themselves with the nature of products, services, as well as operational procedures of the banks. It can help them commence the operations efficiently, as well.

However, when you intend to apply for CSP registration or kiosk registration, the specific requirements as well as the procedures may vary between banks and regions. Therefore, interested parties need to contact the specific bank they wish to partner with for detailed information and guidance on the registration process.

Source: https://cspbankmitrabc2021.blogspot.com/2024/06/what-exactly-is-kiosk-banking.html

0 notes

Text

How to Get Started as a Bank CSP Provider

Becoming a Bank CSP Provider or Bank Mitra is a lucrative business opportunity that can help you earn a steady income while serving your community. A Bank Mitra is a banking agent who provides basic financial services to people who do not have access to traditional banking facilities. Bank Mitras helps bridge the gap between banks and their customers in remote and rural areas. In this article, we will discuss the steps involved in becoming a Bank CSP Provider and how to register for the same. Step 1: Understand the Requirements The first step towards becoming a Bank CSP Provider is to understand the requirements set by the banks. Each bank has its own set of guidelines and criteria for selecting Bank Mitras. It is essential to research and gather information about the banks and their requirements before proceeding with the registration process. Some of the common requirements for Bank Mitra Registration include the following: • Minimum age limit of 21 years • Educational qualifications (minimum 10th standard) • Good communication skills • No criminal record Step 2: Identify the Bank Once you have understood the prerequisites, the subsequent step is to recognize the bank with which you intend to collaborate. It is crucial to select a bank that is firmly established and has a credible standing in the market. You can visit the websites of various banks and check their requirements and guidelines for Bank Mitra Registration. Step 3: Gather the Required Documents Once you have identified the bank, the next step is to gather the necessary documents required for registration. The documents required may vary from bank to bank, but some of the common documents include: • Proof of identity, which may include an Aadhaar card, PAN card, driving license, or any other valid identity card. • Address proof (electricity bill, passport, etc.) • Educational certificates • Bank account details • Passport size photographs Step 4: Submit the Application After gathering all the required documents, the next step is to submit the application for Bank Mitra Registration. The application form can be downloaded from the bank's website or obtained from their nearest branch. The application form must be filled out carefully, and all the details must be provided accurately. Step 5: Training and Certification Once your application is accepted, the bank will provide you with training and certification. The training will equip you with the necessary skills and knowledge to perform your Bank Mitra duties. The certification process may vary from bank to bank, but it generally involves assessing your skills and knowledge. Winding it up Becoming a Bank Mitra or Bank CSP Provider is an excellent opportunity to serve your community while earning a steady income. Remember to maintain a positive attitude, be persistent in your efforts, and provide excellent customer service to ensure your success as a Bank Mitra. Blog Source: https://applyforcspbank.finance.blog/2023/05/16/how-to-get-started-as-a-bank-csp-provider

0 notes

Text

Unlock the Benefits of SBI Kiosk Banking with NICT CSP Company

Streamline Your Banking Experience with NICT CSP Company's Expertise and Efficient Services

Are you tired of long lines at the bank and endless wait times for basic banking services? Look no further, as NICT CSP Company is here to make your banking experience easier and more convenient. With our expertise and efficient services, we can help you unlock the benefits of SBI Kiosk Banking. Choose NICT CSP Company for your Bank CSP Apply process today and start enjoying fast, convenient, and efficient banking services. With our expert services and support, you can rest assured that your banking experience will be streamlined and hassle-free.

SBI Kiosk Banking is a state-of-the-art banking solution that offers a range of services, including cash deposit and withdrawal, fund transfer, and more. By registering for SBI Kiosk Banking, you can enjoy fast and convenient banking services right at your fingertips. At NICT CSP Company, we understand the importance of having a reliable and efficient banking system. That's why we are here to help you with the registration process for SBI Kiosk Banking. Our team of experts will guide you through the process and ensure that your registration is completed smoothly and hassle-free.

We are committed to providing our customers with the best possible service and support. That's why we offer a wide range of services to help you get the most out of SBI Kiosk Banking. From technical support to ongoing training and maintenance, we help you all the way.

Our team of experts has comprehensive experience in the banking industry and is well-equipped to deal with any issues that may arise during the registration process. We are committed to ensuring that your registration is completed quickly and efficiently, so you can enjoy SBI Kiosk Banking immediately.

Take advantage of the benefits of Bank CSP Apply registration! Contact NICT CSP today to schedule your appointment for registration. Our team of experts is ready to help you unlock the full potential of SBI Kiosk Banking and streamline your banking experience.

Blog Source: https://thenictcsp.wordpress.com/2023/03/17/unlock-the-benefits-of-sbi-kiosk-banking-with-nict-csp-company

#Nict CSP Registration#Digital CSP Apply#SBI CSP Apply#CSP Apply#Bank CSP Apply#Apply For CSP#CSP Application#SBI Kiosk Banking

0 notes

Text

NHL TEAMS WITH DESIGNATED DRIVER PROGRAMS 💙

taken from starryote on twitter

Anaheim Ducks (Honda Center)

Sign Up @ Guest Services in Section 214

Incentive: Entry to a raffle for a $200 gift card to the Ducks Team Store

Discount Codes for Lyft Rides on Holidays (Fourth of July, Labor Day Weekend, Halloween, Thanksgiving Eve, and New Years)

Carolina Hurricanes (PNC Arena)

Sign Up @ The Good Sport Designated Driver Station is located at Section 127, Across from the Guest Services

Incentive: Unknown

Flames (Scotiabank Saddledome) -

Sign Up @ The Budweiser Good Sport Booth

Incentive: A free coupon for a soft drink and will be entered into a draw to win a Good Sport gift package.

LA Kings (STAPLES Center)

Sign Up @ Their Website: cryptoarena.com/arena-info/res…

Incentive: Receive a coupon for one complimentary non-alcoholic beverage (redeemable at select concession stands) & entered into drawings for future games tickets w/ a grand prize of a suite seat

Edmonton Oilers (Rogers Place)

Sign Up @ Guest Services in Section 121, Section 129 or Section 230.

Incentive: Unknown

Canucks (Rogers Arena)

Sign Up @ Guest Services in Sections 104, 114, or 310

Registration is open until the end of first period every game.

Restrictions: Must be 19+ w/ valid drivers license & will be given designated wristbands.

Incentive: Coupon for free drink

Blackhawks (United Center)

Sign Up @ Gates 2 or 6 Guest Relations Booth

Restrictions: Must be 21+

Incentive: A coupon for one free regular size fountain soda

Colorado Avalanche (Pepsi Center)

Sign Up @ The Kiosk in Section 132 near the First Aid Station.

Restrictions: Must be 21+

Incentive: Unknown

Dallas Stars (American Airlines Center)

Sign Up @ Guest Relations

Incentive: Promotional Giveaway Items

Detroit Red Wings (Little Caesars Arena)

Sign Up @ The District Detroit App

Restrictions: Must be 21+

Incentive: Unique Bar Code for free Soda

Panthers (Amerant Bank Arena)

Sign Up @ Guest Relations

Incentive: Free Bottled Water or Soft Drink + Entered to Win Promotional Giveaway Items Monthly & Annually

Ottawa Senators (Canadian Tire Center)

Sign Up @ Guest Services Booth Behind Section 201 in Main Concourse

Incentive: Unknown

Lightning (Amalie Arena)

Sign Up @ Amalie Arena App

Incentive: Free Non-Alcoholic Beverage

Toronto MapleLeafs (Scotiabank Arena)

Sign Up @ Fan Services at Gate 1 or Section 301

Restriction: Must be 19+

Incentive: Free Coors Edge & Entered into a drawing to win a prize at end of the season.

NJ Devils (Prudential Center)

Sign Up @ Outside of Club Lounge East near Section 17.

Incentive: Free Drink Coupon & Entered into a raffle for a prize pack

Pittsburgh Penguins (PPG Paints Arena)

Sign Up @ The Designated Drivers Booth

Incentive: Free Drink Coupon

Washington Capitals (Capital One Arena)

Sign Up @ Responsibility Has Its Rewards booth at Section 108

Incentive: Entered for promotional give–a–ways and prizes.

Seattle Kraken (Climate Arena)

Sign Up @ Guest Services

Incentives: A free public transit ticket for safe transportation home at all publicly ticketed home games

Has a program, but no info:

- San Jose Sharks (SAP Center)

- Golden Knights (T-Mobile Arena)

- Minnesota Wild (Xcel Energy Center)

- Nashville Predators (Bridgestone Arena)

- St Louis Blues (Enterprise Center)

- Winnipeg Jets (Bell MTS Center)

- Boston Bruins (TD Garden)

- Buffalo Sabres (Keybank Center)

- Columbus Blue Jackets (Nationwide Arena)

- New York Rangers (Madison Square)

- Philadelphia Flyers (Wells Fargo Center)

Doesn’t have a dedicated program:

- Montreal Canadiens (Bell Centre)

- New York Islanders (UBS Arena)

12 notes

·

View notes

Text

Kiosk Printer Market - Top 3 Innovations and Developments

The global kiosk printer market is set to progress growth with a CAGR of 5.89% in the forecast period 2025-2032. Get more insights into our press releases.

The kiosk printing market is experiencing rapid growth driven by increasing demand for self-service solutions across retail, healthcare, banking, and transportation sectors. This technology emphasizes compact, reliable printers offering high-speed output, paper-saving features, and seamless integration capabilities to meet diverse customer needs.

Get the Latest Insights on the Kiosk Printer Market in Our Sample Report

Top 3 Innovations in Kiosk Printer Market

1. Eco-Friendly Event Check-in Solution

Sprintr unveils EcoKiosk, a sustainable registration solution for events featuring recyclable Re-Board construction. The versatile kiosk, launched at Events Uncovered 2024, offers modular designs for both freestanding and desktop configurations, helping reduce the events industry's environmental impact through its reusable and portable nature.

2. Printing Firm Modernizes with AI Quotes and Smart Kiosks

Catdi Printing introduces an AI-powered instant quoting system for its printing services alongside new self-service kiosks across Houston, Richmond, Sugar Land, and Washington, DC. This dual innovation streamlines customer experience by offering automated pricing and convenient pickup locations.

3. APS Launches Compact 3" Kiosk Printer

APS introduces the EKP 3" Kiosk Printer, a compact yet powerful printing solution for self-service applications. Designed for retail, parking, ticketing, and hospitality sectors, this high-performance printer combines advanced features with durability to meet diverse business needs.

Asia-Pacific to be the Fastest Growing Region in the Kiosk Printer Market

The Asia-Pacific kiosk printer market is seeing robust expansion, particularly in China, Japan, India, and South Korea. Growth is fueled by urbanization, digital transformation, and e-commerce adoption. The rising middle class and demand for self-service solutions across retail, hospitality, government services, and photo printing are driving widespread kiosk deployment in the region.

Key Contenders in the Kiosk Printer Market:

Advanced Kiosks, Boca Systems Inc, Custom Spa, Epson, Fujitsu, Hengstler GmbH, Shenzhen Hongzhou Smart Technology Co Ltd, Microcom Corporation, Nippon Primex Inc, Pyramid Technologies, Shenzhen Lean Kiosk Systems Co Ltd, Star Micronics, Surfbox, SZ Kmy Co Ltd, Xerox Corporation, Zebra Technologies Corporation, and Shanghai Zhuxin Intelligent Technology Co Ltd.

#KioskPrinterMarket#ConsumerGoods#ConsumerElectronics#TritonMarketResearch#MarketReport#ResearchReport

0 notes

Text

Revolutionizing Customer Experience with Addsoft Technologies’ Queue Management System

In today’s fast-paced world, managing queues effectively has become a critical aspect of enhancing customer satisfaction and streamlining operations. Whether it’s in banks, hospitals, government offices, or retail outlets, long waiting times and poorly managed queues can lead to frustration and loss of business. Addsoft Technologies’ Queue Management System (QMS) is designed to address these challenges, offering a seamless and efficient way to handle customer flow while improving service delivery.

What is a Queue Management System?

A Queue Management System is a digital solution that helps businesses organize and streamline the process of serving customers. It involves the use of hardware and software to track, prioritize, and manage customer interactions, reducing wait times and ensuring a smooth flow of operations.

Addsoft Technologies takes this concept a step further by integrating cutting-edge technologies, user-friendly interfaces, and robust analytics to deliver a superior queue management experience.

Key Features of Addsoft’s Queue Management System

Customizable Queues: Tailor the system to meet specific needs, such as token-based services, appointment scheduling, or walk-in customer management.

Real-Time Monitoring: Track queue status and customer flow in real-time, enabling staff to make informed decisions and minimize delays.

Multi-Channel Integration: Allow customers to book appointments or get queue status updates via mobile apps, SMS, or kiosks.

Data Analytics: Gain insights into customer behavior, service times, and peak hours to optimize resources and improve service efficiency.

Seamless Integration: Compatible with existing business systems such as CRM, ERP, or POS platforms, ensuring a smooth transition and better coordination.

Enhanced Customer Experience: Provide updates on waiting times, issue digital tokens, and display information on digital signage to keep customers informed and engaged.

Benefits of Implementing Addsoft’s Queue Management System

Reduced Waiting Times: Efficiently manage customer flow to minimize queues and reduce perceived waiting times.

Improved Staff Productivity: Free up staff to focus on delivering quality service instead of managing queues manually.

Enhanced Customer Satisfaction: Transparent and organized queue management leads to happier customers and better retention rates.

Scalable Solution: Designed to grow with your business, the system can handle increasing customer demands effortlessly.

Cost-Effective Operations: Streamlining processes reduces overhead costs associated with manual queue management.

Industries Benefiting from Queue Management Systems

Healthcare: Streamline patient check-ins, appointments, and consultations.

Banking: Manage customer flow for teller services, account opening, and loan processing.

Retail: Enhance the shopping experience with efficient billing and service counters.

Government Offices: Simplify processes like passport applications, licensing, and tax services.

Education: Organize student registration, counseling, and administrative services.

Why Choose Addsoft Technologies?

Addsoft Technologies is a trusted name in the field of innovative digital solutions. Our Queue Management System is built with the latest technology, ensuring reliability, scalability, and ease of use. We work closely with our clients to understand their unique requirements and deliver tailored solutions that drive results.

Managing queues efficiently is no longer a luxury but a necessity in today’s customer-centric world. Addsoft Technologies’ Queue Management System empowers businesses to enhance operational efficiency, elevate customer satisfaction, and stay ahead of the competition.

Invest in a smarter queue management solution today and transform the way you serve your customers!

#blog#news#business#article#software#productivity software#enterprise software#electronic#technologies

0 notes

Text

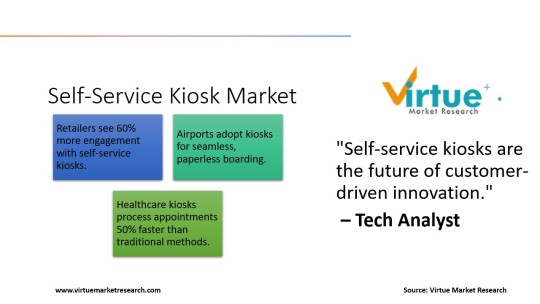

The Self-Service Kiosk Revolution: Transforming Customer Experiences Across Industries

In a fast-paced world driven by convenience, self-service kiosks are emerging as game-changers across industries. From retail stores and restaurants to banks and hospitals, these versatile machines are redefining the way businesses interact with their customers.

Valued at $12.1 billion in 2024, the self-service kiosk market is projected to soar to $17.89 billion by 2030, growing at an impressive CAGR of 6.73%. But what’s fueling this remarkable growth? Let’s dive in.

Download Sample: click

Why Self-Service Kiosks Are Taking Over

Convenience: Customers prefer the speed and efficiency of kiosks over traditional service models.

Cost Efficiency: Businesses benefit from reduced operational costs—quick-service restaurants alone reported a 30% cost reduction after kiosk adoption.

Accuracy: Restaurants using kiosks have seen a 75% improvement in order accuracy.

Tech-Savvy Consumers: Post-pandemic, more consumers demand touchless, personalized, and secure interactions.

The Numbers Speak for Themselves

68% of customers in retail prefer kiosks over traditional checkout lines.

The hospitality sector saw a 21% growth in kiosk usage for check-ins and check-outs.

Over 1.2 billion transactions were processed by kiosks globally in 2023.

52% of businesses noted improved customer retention thanks to kiosk integration.

Inquite to Buy : Click

Trends That Are Shaping the Future

The self-service kiosk market is constantly evolving to meet modern demands:

AI and Personalization: Kiosks are now offering tailored recommendations based on customer preferences.

Touchless Technology: Voice-activated interfaces are becoming the new norm.

Biometric Security: Features like facial recognition ensure safer transactions.

Sustainability: Eco-friendly kiosk designs are catering to environmentally conscious consumers.

AR/VR Integration: Imagine immersive experiences for retail or entertainment kiosks—it's happening!

Challenges on the Horizon

While self-service kiosks are transforming industries, they’re not without challenges:

High Initial Costs: Installation and integration can be expensive for smaller businesses.

Maintenance: Outdoor kiosks require robust systems to withstand environmental factors.

Cybersecurity Risks: Handling sensitive customer data demands strong security protocols.

Inclusivity: Older generations may struggle with complex interfaces, requiring user-friendly designs.

Industries Leading the Kiosk Revolution

Retail: Enhancing customer checkout and in-store navigation.

Hospitality: Streamlining check-ins, room selections, and concierge services.

Healthcare: Managing registrations and patient information securely.

Banking: Offering account management and financial transactions.

As consumer expectations continue to rise, self-service kiosks offer a solution that blends convenience, efficiency, and innovation. They are more than just machines—they are the future of customer engagement.

How do you feel about using kiosks in your daily life? Love them or leave them? Let me know!

#SelfServiceKiosks #CustomerExperience #TechInnovation #RetailTech #HospitalityIndustry #ConvenienceMatters #FutureOfBusiness #Automation #CustomerSatisfaction #TechTrends #AIInBusiness #RetailSolutions #BankingTech #HealthcareInnovation #Sustainability #TouchlessTechnology #DigitalTransformation #MarketGrowth

0 notes

Text

Kiosks with Camera Enhancement: Filling the Void Between Automation and User Engagement

The nexus between technology and user experience is more important than ever in the fast-paced world of today. Camera for kiosk enhanced kiosks are one of the many innovations that are starting to disrupt the game by combining automation and user involvement. These sophisticated camera-equipped kiosks provide a previously unheard-of degree of efficiency, convenience, and customization. Let's explore the secondary advantages of camera for kiosk technology and how it is transforming a number of sectors.

Camera-Enhanced Kiosks' Ascent

Many new opportunities have arisen as a result of the incorporation of cameras into kiosks. Kiosks have always functioned as simple transactional or informational tools, but the integration of cameras has made them into dynamic, interactive systems. These camera-enhanced kiosks are now able to collect data to continuously improve the customer experience, do facial recognition, and offer real-time assistance.

Strengthened protection and verification

More security is one of the main advantages of adding a camera for kiosk By using facial recognition technology to identify users, sensitive information or services can only be accessed by authorized individuals. This is especially helpful for banking, where safe transactions are crucial. Kiosks that employ cameras for identity verification can lower fraud and boost user trust.

Secondary Terms:

Kiosk Facial Recognition Technology

Security Camera Kiosk

Customized User Interface

Kiosks with cameras integrated inside them are able to interpret users' body language and facial emotions to provide a more customized experience. These kiosks, for example, can make product recommendations in retail environments based on the customer's age, gender, or even emotional condition. By offering customized suggestions, this degree of customization increases consumer happiness and increases revenue.

Secondary Terms:

Interactive Points of Sale

Personalized Experience with Kiosk

Healthcare Process Streamlining

Cameras for kiosk systems are progressing significantly in the healthcare industry. By instantly recognizing patients and accessing their medical details, these kiosks help speed up the check-in procedure. They can also keep an eye on patients' vital signs and identify irregularities, giving medical experts useful information. In addition to saving time, this automation enhances patient monitoring and medical record accuracy.

Secondary Terms:

Cameras for healthcare kiosks

Patient Registration Desk

Increasing Hospitality and Customer Service Quality

Camera for kiosk are also benefiting the hospitality sector. These kiosks improve customer service by streamlining processes, such as ordering food from restaurants and checking guests into hotels. While facial recognition technology helps speed up check-in procedures, cameras can help recognize and greet returning guests and customize their stay. Furthermore, these kiosks don't require extra workers because they can run nonstop, offering round-the-clock service.

Secondary Terms:

Hotel Registration Desk

Eatery Ordering Station

Increasing Public Service Efficiency

The way citizens engage with government services is changing as a result of public service kiosks that have cameras installed. These kiosks can submit forms, authenticate users for secure access to personal records, and even offer video conversations for virtual support. This not only shortens wait times but also improves public accessibility to government services.

Secondary Terms:

Government Service Kiosks

Public Service Kiosk Camera

Data collection and analysis

Another significant advantage of cameras for kiosk systems is their ability to collect and analyze data. By observing user interactions, these kiosks can gather valuable insights into user behavior, preferences, and demographics. Businesses and service providers can use this data to improve their offerings and tailor their services to better meet user needs.

Secondary Keywords:

Kiosk Data Analytics

User Behavior Kiosk Data

Overcoming Challenges

While the benefits of camera-enhanced kiosks are clear, there are challenges to consider. Privacy concerns are paramount, as users may be wary of being recorded. It is crucial to implement robust security measures and transparent data policies to address these concerns. Additionally, ensuring the accuracy and reliability of facial recognition technology is vital to avoid errors and maintain user trust.

Secondary Keywords:

Kiosk Privacy Concerns

Facial recognition accuracy

The Future of Camera-Enhanced Kiosks

The future of camera for kiosk technology is promising, with continuous advancements in AI and machine learning. These kiosks will become even more intuitive, capable of understanding and responding to user needs in real time. We can expect to see more widespread adoption across various sectors, from retail and healthcare to hospitality and public services.

Secondary Keywords:

AI in Kiosks

Future Kiosk Technology

In summary

The world of automation and user engagement is changing with the introduction of camera for kiosk . These kiosks use cameras to deliver increased productivity, tailored experiences, and security for a variety of sectors. We may anticipate even more creative uses of cameras for kiosk systems as technology develops further, eventually bridging the gap between automation and user involvement in ways we never would have imagined.

Businesses and service providers may create better client experiences, improve operations, and maintain their competitive edge in an increasingly cutthroat market by adopting these technologies. Kiosks with cameras added are not merely a fad; they represent the direction of interactive technology and will change the way we interact with automated systems.

for more details visit below website

https://www.vadzoimaging.com/post/vital-role-kiosk-cameras-library-kiosks

0 notes

Text

Self Service Kiosk Market - Forecast (2024 - 2030)

The Self Service Kiosk Market is estimated to surpass $35.8 billion mark by 2026 growing at an estimated CAGR of more than 6.4% during the forecast period 2021 to 2026. Self-Service Kiosks are computer devices designed to help people in performing specific tasks and services on their own like paying bills, buying tickets, bank transactions and others. Self-service kiosks are extensively used in retail industry, entertainment, healthcare, transportation, government & BFSI and education among others. They enhance the user experience to make services hassle free and matters of seconds which are of paramount importance to the comfort level of consumers. Data security is a key feature of kiosks which is driving the demand of self-service kiosk market.

Self Service Kiosk Market Report Coverage

The report: “Self Service Kiosk Market– Forecast (2021-2026)”, by IndustryARC covers an in-depth analysis of the following segments of the Self Service Kiosk Market.

By Implementation: Point-of-Information, Product Promotion, Service / Transaction, Internet Commerce, Product Dispensing and Others

By Usage: Checkin-Checkout, Advertising, Navigation, Recruitment, Photos, Inventory Management, Employee Information, Reservations, Ticket Printing, Patient Service, Bill Payments, Food Ordering, Registration and Identification and Others

By End Use Industry: Hospitality, Financial Services, Retail, Medical, Transportation, Education, Government and others

By Geography - North America (U.S, Canada, Mexico), South America(Brazil, Argentina and others), Europe (Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, SK, Aus and Others), and RoW (Middle east and Africa).

Key Takeaways

The increasing convergence of emerging technologies such as artificial intelligence and the Internet of Things into electronics is increasing manufacturers' focus on advances in traditional kiosks. As a result, high production of self-service kiosks is proliferating due to increasing demand from various sectors.

Technological advancements such as Near-Field Communication (NFC) and Radio Frequency Identification (RFID) in the field of digital payment and security applications have also contributed to the expansion of applications and the use of self-service kiosks.

Increased smartphone and tablet adoption, along with mobile payment preference, has also had a positive impact on the growth of this market.

Self Service Kiosk Market Segment Analysis - By Usage

Food ordering held the largest share in the Self-Service Kiosk market in 2020 and is growing at a CAGR of 9.21% during the forecast period. Self-ordering kiosks are constantly gaining traction in the transformation of the way orders are delivered in fast-service restaurants with a high footprint. Popular fast-food restaurants such as McDonald's, KFC, and Pizza Hut have already embarked on the most ambitious transition, integrating a range of emerging technology and ground-breaking cashless payment service concepts. The COIVD-19 pandemic has further unlatched doors for self-ordering kiosks in the food ordering application. Ticketing printing self-service kiosk are commonly used in travel, theme parks and film theatres. Ticketing self-service kiosk offers the end user the ease of printing their tickets. Ticketing self-service kiosk uses modern and it combines with any configuration, whether they are put outdoors in the open or inside the premises, helps to improve customer service.

0 notes

Text

Convenient Ways to Settle Dubai Traffic Fines

Dubai, known for its stunning skyline, luxurious lifestyle, and bustling streets, is also infamous for its strict traffic regulations. It's not uncommon for residents and visitors alike to find themselves facing fines for various traffic violations. However, navigating the process of settling these fines can often be confusing and time-consuming. Fortunately, Dubai offers several convenient methods for individuals to settle their traffic fines efficiently. In this blog post, we'll explore some of these convenient options, making the process hassle-free for everyone involved.

Understanding Dubai's Traffic Fines System

Before delving into the methods of settling traffic fines in Dubai, it's essential to understand how the system works. The Dubai Police, responsible for enforcing traffic laws, utilizes a sophisticated network of cameras and patrols to monitor the roads constantly. When a violation occurs, whether it's speeding, running a red light, or illegal parking, the offender receives a fine.

These fines vary depending on the severity of the violation, with penalties ranging from minor fines to license suspension or vehicle impoundment for more serious offenses. It's crucial for individuals to address these fines promptly to avoid escalation and potential legal repercussions.

Convenient Methods for Settling Traffic Fines

Now that we have a basic understanding of Dubai's traffic fines system, let's explore some convenient ways to settle these fines:

Online Payment Portal: Dubai offers a user-friendly online payment portal where individuals can easily settle their traffic fines from the comfort of their homes or offices. By visiting the Dubai Police website or the RTA (Roads and Transport Authority) website, users can access the payment portal and enter their fine details to initiate the payment process. Accepted payment methods typically include credit/debit cards and online banking, providing a convenient and secure way to settle fines without the need to visit physical locations.

Mobile Applications: In addition to the online payment portal, Dubai Police and RTA offer dedicated mobile applications that streamline the process of settling traffic fines. These apps provide a range of features, including fine inquiry, payment processing, and even notifications for upcoming fines. Users can download these apps from the App Store or Google Play Store, allowing them to manage their fines on the go with just a few taps on their smartphones.

Self-Service Kiosks: For individuals who prefer a more hands-on approach, Dubai provides self-service kiosks located at various convenient locations across the city. These kiosks allow users to check their fines, make payments, and print receipts instantly. With user-friendly interfaces and step-by-step instructions, these kiosks offer a hassle-free solution for settling traffic fines without the need for human assistance.

Authorized Banks and Exchange Centers: Another convenient option for settling traffic fines in Dubai is through authorized banks and exchange centers. Many banks and financial institutions in the city facilitate fine payments on behalf of Dubai Police and RTA. Individuals can simply visit their nearest bank branch or exchange center, provide their fine details, and make the payment through the available channels. This option is particularly useful for those who prefer face-to-face interactions and cash transactions.

Auto Renewal Services: To prevent fines from accumulating due to expired vehicle registrations or driver's licenses, Dubai offers auto renewal services through various channels. By enrolling in these services, individuals can ensure that their documents remain up to date, reducing the risk of fines for non-compliance. This proactive approach not only saves time and effort but also helps individuals stay compliant with Dubai's traffic regulations.

Conclusion

In conclusion, settling traffic fines in Dubai doesn't have to be a daunting task. With a range of convenient options available, individuals can easily manage their fines and stay compliant with the city's traffic laws. Whether it's through online portals, mobile applications, self-service kiosks, authorized banks, or auto renewal services, Dubai provides numerous avenues for resolving fines efficiently. By utilizing these convenient methods, residents and visitors can navigate Dubai's roads with peace of mind, knowing that their traffic fines are taken care of.

Blog Source - Rasmal.com

0 notes

Text

Empowering Rural India through Kiosk Banking

State Bank of India (SBI) has revolutionized the banking landscape in India by introducing Kiosk Banking, bringing services to rural and remote regions. It's a network of kiosks offering basic banking to those without traditional options. To benefit from this initiative, individuals can Apply For CSP Registration and enjoy the convenience and empowerment that SBI Kiosk Banking brings to their lives. Applying for CSP Registration The SBI CSP Apply process is straightforward and hassle-free. Here's how you can start with SBI Kiosk Banking • Find the closest SBI Kiosk Bank branch: Go to the SBI website and use the "Kiosk Locator" to locate the nearest branch. • Open a bank account: If you don't have an account with SBI, you can open a savings account at the kiosk. Fill out the account opening form and bring a valid ID and address proof. • Use banking services: After opening an account, you can access basic services like deposits, withdrawals, and transfers. Provide your account details and Aadhaar number to use these services. Benefits of SBI Kiosk Banking Choosing to Apply For CSP Registration offers several advantages that cater to the needs of rural and remote communities. Let's explore the benefits it brings: • Ease of Access: SBI makes banking reachable to people in far-off regions through kiosk banking, ensuring everyone can access banking services. • Convenient Banking: The kiosk offers convenient banking services like depositing, withdrawing, and transferring money, saving people the trouble of travelling to a distant bank. • Financial Inclusion: SBI Kiosk Banking aims to include financially marginalized individuals by offering them banking services and empowering their involvement in the official economy. • Improving Lives: This initiative enhances the lives of rural communities by allowing them to safeguard their savings, investments, and finances through access to banking services. • Safety and Security: SBI Kiosk Bank branches prioritize the safety and security of customers' money and personal information by implementing stringent security measures. Overall, SBI Kiosk Banking stands as a pioneering initiative by the State Bank of India to extend basic banking services to rural and remote areas, fueling financial inclusion and economic empowerment. Through SBI CSP Apply, individuals residing in these regions can take advantage of the services offered by SBI Kiosk Bank, securing and managing their money for a better future. By embracing technology and innovative solutions, SBI continues to bridge the gap and uplift the lives of millions in India's rural landscape. Blog Source: https://bankmitraregistration.wordpress.com/2023/07/11/empowering-rural-india-through-kiosk-banking

0 notes

Text

Why Applying for CSP Online is a Game-Changer?

Over the years, the tremendous changes that have taken place in the banking sector have been witnessed. One of the most significant changes is the introduction of CSP (Customer Service Point) facilities. CSPs have become a crucial part of the banking ecosystem, providing access to banking services to people in remote areas where traditional bank branches are not feasible. In this blog, I will share my thoughts on why choosing CSP Online Apply is a game-changer.What is CSP? For those who are not familiar with CSP, it is an initiative taken by the Government of India to provide basic banking services to people living in remote areas. CSPs are small outlets that act as mini-bank and offer services such as account opening, cash deposit, withdrawal, and fund transfer. These CSPs are typically run by entrepreneurs who partner with banks and provide banking services to people in their locality. Why Applying for CSP Online is a Game-Changer? Applying for CSP online has many advantages. Firstly, it is a time-saving process. Entrepreneurs interested in setting up CSPs can now apply online, saving them the time and effort of visiting the bank physically. Secondly, it is a convenient process. Entrepreneurs can opt for CSP Online Apply from anywhere, at any time, as long as they have an internet connection. This makes it easier for entrepreneurs who live in remote areas to apply for CSPs. Moreover, the online application process is more transparent and efficient. Entrepreneurs can track the status of their applications online and receive updates on the progress of their applications. This helps to reduce the time taken to process applications and ensures that entrepreneurs receive timely updates on the status of their applications. Perks of Applying for CSP Online Apart from the advantages mentioned above, there are several other perks of applying for CSP online. Firstly, the online application process is more secure. Entrepreneurs can submit their applications online without worrying about their personal and financial information being secure. Secondly, the online application process is more user-friendly. Entrepreneurs can easily fill in the application form and submit it online without the need for any technical knowledge. In conclusion, applying for CSP online is a game-changer. It saves time and is convenient, transparent, and secure. The expert Bank CSP Provider believes this initiative will help improve financial inclusion and provide access to basic banking services to people living in remote areas. It is recommended that all entrepreneurs who are interested in setting up CSPs apply online and take advantage of this initiative.

Blog Source: https://cspbankmitrabc.blogspot.com/2023/04/why-applying-for-csp-online-is-game.html

#Bank CSP Registration#All Bank CSP#Bank CSP#Bank CSP Provider#CSP Provider#SBI CSP Apply#SBI Kiosk Banking

0 notes

Text

Why you should apply for SBI CSP?

SBI gives a good commission per account opening. Check your eligibility and apply for SBI CSP through NICT CSP. Almost 90% of CSPs are centered under the State bank of India because SBI CSP earns a commission for most services provided.

0 notes

Text

Exploring the Landscape of Kiosk Manufacturers in India

In today's fast-paced world, self-service kiosks have become an integral part of various industries, revolutionizing the way businesses interact with their customers. From retail to healthcare, banking to hospitality, kiosks have streamlined processes, enhanced customer experiences, and contributed to operational efficiency. As the demand for these versatile solutions continues to rise, India has emerged as a hub for kiosk manufacturing, catering to both domestic and international markets.

The Rise of Self-Service Kiosks:

Self-service kiosks have transformed the way businesses engage with their customers. These interactive terminals provide users with access to a wide range of services and information without the need for human intervention. The adoption of kiosks is driven by their ability to reduce waiting times, eliminate errors, and offer round-the-clock services. This trend has led to the proliferation of kiosk manufacturers in India, each offering unique solutions tailored to different sectors.

Diverse Applications:

The versatility of self-service kiosks is evident in their applications across various industries. In retail, they facilitate self-checkout, inventory checking, and product information dissemination. Healthcare kiosks expedite patient check-ins, appointment scheduling, and prescription refills. Banking kiosks enable quick transactions, account inquiries, and even issuance of debit cards. In the hospitality sector, kiosks are used for check-ins and check-outs, as well as concierge services. Moreover, educational institutions employ kiosks for student registrations and campus information dissemination.

Key Players in the Indian Market:

Several prominent players have emerged in the Indian kiosk manufacturing landscape, each contributing to the industry's growth:

Diebold Nixdorf: A global leader in connected commerce, Diebold Nixdorf offers a wide range of self-service solutions, including ATMs, cash recyclers, and interactive kiosks. Their innovative approach to kiosk design and functionality has positioned them as a significant player in the Indian market.

Olea Kiosks: With a focus on interactive kiosk solutions, Olea Kiosks delivers custom-designed, cutting-edge kiosks for various industries. Their commitment to design aesthetics and user experience has earned them a reputation for quality and innovation.

Lucid Kiosk: Lucid Kiosk specializes in creating intuitive and user-friendly self-service solutions. They offer kiosks for retail, hospitality, healthcare, and more. Their emphasis on incorporating the latest technology trends sets them apart in the competitive market.

Phoenix Kiosk: Phoenix Kiosk is known for its comprehensive kiosk solutions that cover everything from design and manufacturing to installation and maintenance. Their diverse portfolio caters to sectors like retail, banking, and transportation.

Mootek Technologies: Mootek Technologies focuses on delivering advanced interactive kiosk systems with features like touchscreens, RFID, and QR code integration. They have successfully penetrated the Indian market by offering tailored solutions to businesses of all sizes.

The Road Ahead:

The future of touch screen kiosk manufacturing in India looks promising. As businesses across industries continue to realize the benefits of self-service kiosks, the demand for innovative and efficient solutions is expected to grow. Kiosk manufacturers are likely to focus on incorporating emerging technologies such as AI, biometrics, and advanced data analytics to enhance user experiences and provide more personalized services.

In conclusion, the landscape of kiosk manufacturing in India is thriving, driven by the increasing adoption of self-service solutions across various sectors. The versatility of kiosks and their ability to streamline processes and improve customer experiences make them indispensable tools for businesses. With companies like Diebold Nixdorf, Olea Kiosks, Lucid Kiosk, Phoenix Kiosk, and Mootek Technologies leading the way, the Indian market is poised to contribute significantly to the global kiosk industry. As technology continues to evolve, we can anticipate even more innovative and tailored kiosk solutions to meet the diverse needs of businesses and consumers alike.

0 notes

Text

How to Become an AeronPay Merchant

AeronPay provides you with a wide range of digital payment services including online recharge & bill payments, UPI services in India, and many more. AeronPay is a leading payment solutions provider to e-commerce merchants.

AeronPay Enables merchants for an entire suite of contactless payment options including UPI balance, credit and debit cards, AEPS, EMIs, and bank offers, and sends a digital bill to avoid contact.

Accepting Payment has never been so easy. AeronPay is a unified fintech platform that helps retailers provide customers with a truly Omni channel and delightful shopping experience.

AeronPay retail payment solutions enable retail institutions to accept payment methods like credit cards, debit cards, and wallets via mobile apps, web checkout, QR codes, NFC, kiosks, POS, etc. AeronPay also offers invoicing capabilities, chargeback, and refund mechanisms with inbuilt reconciliation and settlement modules to help retail institutions work smoothly.

Coupled with a loyalty management solution and payment insights, AeronPay also empowers the business to have the proper connection with the customer. It helps retail institutions launch campaigns, give rewards and incentives to loyal customers, and interact with them via mobile notifications to ensure repeat business.

Before becoming a merchant on AeronPay, a seller must complete the AeronPay Merchant registration process on AeronPay's website. Becoming an AeronPay Merchant is free and registration takes only a few minutes.

Step 1: Go to AeronPay's Website.

Step 2: Provide the details required for the account.

Step 3: Complete the email verification process.

Step 4: Complete the mobile number verification process.

Step 5: Update business information and address.

Step 6: Provide KYC Documents (More on this below)

Step 7: For verification, AeronPay will take maximum 3-5 working days.

Step 8: Once your all documents are approved your account will be activated within 1 working day

0 notes

Text

Queue Management Systems: Streamlining Customer Flow for Better Experiences

Long queues can be a major source of frustration for customers and a missed opportunity for businesses. Whether in retail stores, healthcare facilities, or government offices, poorly managed queues lead to dissatisfaction and lost productivity. That’s where a Queue Management System (QMS) comes in—a technology-driven solution designed to optimize the customer journey, reduce wait times, and improve operational efficiency.

Let’s explore how queue management systems are transforming customer service and why they’re becoming essential for modern businesses.

What is a Queue Management System?

A Queue Management System is a software-based solution that organizes and manages queues in a systematic way. It often includes:

Ticketing kiosks or apps: Customers take a ticket or register digitally for their place in line.

Digital displays: Inform customers of their queue status and guide them to service points.

Notifications: Alerts sent via SMS, app, or email when it’s a customer’s turn.

Analytics tools: Help businesses track and analyze service efficiency.

Benefits of a Queue Management System

1. Reduced Wait Times

A QMS ensures customers are served efficiently by distributing workload evenly among staff. Automated ticketing and prioritization reduce idle time and long lines.

2. Enhanced Customer Experience

With clear communication about wait times and queue status, customers feel more in control and less frustrated. Features like SMS notifications allow them to wait comfortably elsewhere instead of standing in line.

3. Increased Productivity

Employees can focus on providing quality service instead of managing chaotic queues. The system ensures a steady flow of customers, reducing downtime and maximizing efficiency.

4. Improved Service Accuracy

By categorizing customers based on needs or urgency (e.g., VIP customers, specific services), a QMS ensures customers are directed to the right representative, minimizing errors and confusion.

5. Actionable Insights

Queue management systems collect data on customer flow, wait times, and service durations. Businesses can use these insights to identify bottlenecks, allocate resources effectively, and improve overall operations.

Industries That Benefit from Queue Management Systems

1. Healthcare

Hospitals, clinics, and pharmacies use QMS to manage patient appointments, walk-ins, and emergency cases. It reduces crowding and ensures patients are served based on priority.

2. Retail

In stores and malls, a QMS helps manage checkout lines, customer service desks, and even click-and-collect services, enhancing the shopping experience.

3. Banking and Finance

Banks use queue management systems to handle high foot traffic, directing customers to available tellers or self-service kiosks.

4. Government Offices

From DMV offices to municipal centers, QMS ensures smoother handling of appointments and walk-in requests, improving citizen satisfaction.

5. Hospitality and Entertainment

Hotels, restaurants, and event venues use QMS to manage reservations, ticketing, and crowd control, creating a seamless experience for guests.

Key Features of Modern Queue Management Systems

Self-Service Kiosks: Allow customers to register their place in line or book appointments.

Multichannel Integration: Support for in-person, app-based, or web-based queue registration.

Real-Time Updates: Digital displays and notifications keep customers informed about their position.

Customizable Workflows: Tailored to suit different business needs, from appointment scheduling to walk-in queues.

Data Analytics Dashboard: Provides reports on service efficiency, customer trends, and staff performance.

AI and Machine Learning: Predict peak times and optimize staff allocation.

Emerging Trends in Queue Management Systems

Virtual Queues: Allow customers to join a queue remotely via apps or websites, reducing physical crowding.

IoT Integration: Smart sensors monitor real-time foot traffic to adjust queue processes dynamically.

Touchless Solutions: QR codes and mobile apps enable contactless queue registration—a vital feature post-pandemic.

Personalized Service: Systems analyze customer history to provide tailored services, enhancing loyalty.

Why Your Business Needs a Queue Management System

In an era where customer experience can make or break a business, a QMS is a vital tool for:

Keeping customers happy and engaged.

Ensuring operational efficiency and staff productivity.

Gaining a competitive edge in industries where customer flow matters.

#blog#article#news#business#technologies#software#electronic#productivity software#enterprise software#technology

0 notes