#k-1 net rental real estate income

Explore tagged Tumblr posts

Text

0 notes

Text

Beginners guide to Financial Planning

Introduction

It is the process of managing your own and your household personal finances, or it is the most valuable point you will have to understand about the data that advice how a single manage his/her personal finance. It Include Financial planning which one person makes over time. That means you establish goals and benchmarks and track your progress. With that said, now let's pretty much get into the basics of how to kick-start your financial journey.

1. What is Financial Planning?

The purpose of financial planning is to assess your financial status, identify the goals you would like to achieve, and come up with a way in which these goals can be possible. This includes budgeting, saving, investing, and managing debt/loans to maintain financial security and well-being as well as planning for life events.

2. Setting Financial Goals

Set clear, achievable goals:

Short-term (rough guideline: build a 3-6 month emergency fund or pay off > 7% interest debt

– Medium Term: Save for a down payment or large expenditure

Long-term — for retirement or your child's education.

3. Understanding Your Finances

Understand your finances by:

Net worth (Assets – Liabilities)- Tracking income and expenses

- Evaluating debt.

4. Creating a Budget

A budget is how you spend your income on expenses, saving, and investments.

- List income sources.

So, the things you got to do are: — Expense characterization (fixed and variable)

- Set spending limits.

- Regularly review and adjust.

5. Building an Emergency Fund

Have three to six months living expenses set aside in a liquid account for medical problems or loss of job.

6. Managing Debt

Reduce debt by:

Focusing on high interest debt

- Consolidating debt.

- Creating a repayment plan.

7. Investing for the Future

Invest to grow wealth:

Stocks- high returns, risk also higher.

– Bonds: Consistent income, lower risk.

Diversified portfolio — mutual funds

Real estate: rental income and appreciation

8. Retirement Planning

Redefining goal retirement savings with retire Expense

401(k) — Employer-sponsored plans

– IRA (Individual Retirement Accounts)

Pension plans:

Steady income after retirement.

9. Insurance and Risk Management

Protect assets with:

— Health/Life/Disability/Property Insurance

10. Reviewing Your Financial Plan

Be sure to revise and fine-tune your plan over time to reflect the goals you are working towards.

Conclusion

Financial planning gives you clear control over your financial future. Establish goals, financial plan, manage debt and invest in interest of stability and wealth creation. Persevere and be able to adapt.

#economy#investing#entrepreneur#investment#startup#insurance#retirement#retireearly#finance#personal finance#debt#debt recovery#debt relief#debt consolidation#income

4 notes

·

View notes

Video

youtube

Achieve Financial Freedom Using the Proven 50-30-20 Budgeting Method

Managing personal finances and assets effectively is crucial for professional men and women aiming to build wealth, secure financial stability, and achieve long-term financial goals. Below is a detailed guide on personal money and asset management. 1. Budgeting and Expense Management Key Principles: 50/30/20 Rule: 50% for essentials (rent/mortgage, utilities, food, insurance) 30% for discretionary spending (entertainment, travel, shopping) 20% for savings and investments Zero-Based Budgeting: Every dollar is allocated a purpose before the month starts. Envelope System/Digital Budgeting: Use cash or budgeting apps (YNAB, Mint, Personal Capital) to track expenses. Best Practices: ✅ Track income and expenses monthly. ✅ Automate bill payments to avoid late fees. ✅ Minimize debt by paying off high-interest loans first (avalanche method). 2. Income Management & Career Growth Increasing Income Streams: Salary Negotiation: Research market rates and negotiate pay raises. Enhance skills to stay competitive. Side Hustles & Passive Income: Freelancing, consulting, investing, rental properties, dividend stocks, and royalties. Entrepreneurship: Starting a business or monetizing professional expertise. 3. Debt Management & Credit Score Optimization Managing Debt: Good Debt: Mortgage, student loans, business loans (if manageable). Bad Debt: High-interest credit cards, payday loans, auto loans with bad terms. Debt Repayment Strategies: Avalanche Method: Pay off the highest interest debt first. Snowball Method: Pay off the smallest debt first to gain momentum. Optimizing Credit Score: Pay bills on time. Keep credit utilization below 30%. Avoid unnecessary hard inquiries. Maintain a mix of credit accounts. 4. Saving & Emergency Fund Planning Short-Term Savings: Have 3-6 months of living expenses in a high-yield savings account. Separate emergency funds from regular savings. Retirement Accounts: Maximize 401(k) (especially if employer matches contributions). Contribute to Roth IRA/Traditional IRA for tax advantages. Consider HSA (Health Savings Account) for medical savings. 5. Investment Strategies for Wealth Building Investment Vehicles: Stocks & ETFs: Growth potential with some risk. Bonds & Fixed Income: Stability, lower risk. Real Estate: Rental income and property appreciation. Alternative Investments: Private equity, venture capital, commodities, cryptocurrency (for experienced investors). Key Investment Principles: ✅ Diversify assets to mitigate risks. ✅ Invest based on risk tolerance and time horizon. ✅ Use tax-efficient strategies (Roth IRA, tax-loss harvesting). ✅ Avoid emotional trading; focus on long-term growth. 6. Insurance & Risk Management Health Insurance: Essential for covering medical expenses. Disability Insurance: Protects income in case of illness/injury. Life Insurance: Term life for financial dependents; whole life for estate planning. Auto/Home Insurance: Protect assets and liability risks. Umbrella Insurance: Additional liability protection beyond home/auto coverage. 7. Tax Planning & Optimization Maximize deductions & credits (charitable donations, home office expenses). Utilize tax-advantaged accounts (401k, HSA, IRA). Tax-efficient investing (index funds, municipal bonds, tax-loss harvesting). Work with a tax professional for complex situations (business owners, high-net-worth individuals). 8. Estate Planning & Wealth Transfer Create a Will & Trust: Ensure assets go to intended beneficiaries. Power of Attorney: Designate someone to handle finances if incapacitated. Beneficiary Designations: Keep them updated on retirement accounts & insurance. Minimize Estate Taxes: Use gifting strategies, irrevocable trusts, and charitable donations. Final Tips for Financial Success ✅ Start early—compounding works best over time. ✅ Live below your means and prioritize financial independence. ✅ Educate yourself continuously on financial strategies. ✅ Seek professional advice (financial advisors, tax planners, estate lawyers).

0 notes

Text

How to Save More Money for Retirement Outside of Pension and 457(b) Plans

Planning for a secure retirement requires a multifaceted approach, especially when looking beyond traditional pension plans and 457(b) accounts. As a financial advisor with over 28 years of experience, I've guided many individuals in Florida toward achieving their retirement goals through diversified strategies. In this guide, we'll explore various methods to enhance your retirement savings, providing practical examples to illustrate each approach.

1. Maximize Contributions to Tax-Advantaged Accounts

Options to Consider:

Traditional IRAs: Tax-deferred growth with taxes paid upon withdrawal.

Roth IRAs: Tax-free growth since contributions are made after-tax.

Contribution Limits (2025):

Under 50: $6,500 annually

50 and older: $7,500 annually

Example:

Sarah, a 45-year-old Florida teacher, contributes $6,500 yearly to a Roth IRA.

With a 6% annual return over 20 years, her account could grow to $238,000, tax-free.

2. Utilize a Health Savings Account (HSA)

Key Benefits:

Triple Tax Advantage:

Contributions are tax-deductible.

Growth is tax-free.

Withdrawals for qualified medical expenses are tax-free.

Example:

John, 50, contributes the family maximum of $8,300 annually.

After 15 years at a 5% annual return, his HSA could grow to $165,000, which can cover medical costs in retirement.

3. Invest in Taxable Brokerage Accounts

Why Choose Brokerage Accounts?

Unlimited Contributions: No caps like retirement accounts.

Diverse Investment Options: Includes stocks, bonds, mutual funds, and ETFs.

Example:

Emily invests $10,000 yearly in a diversified portfolio.

Over 20 years, assuming a 7% annual return, her account could reach $424,000.

4. Explore Real Estate Investments

Benefits of Real Estate:

Steady Income: Passive rental income.

Appreciation Potential: Real estate values often rise over time.

Example:

Mike buys a $300,000 rental property in Miami, paying 20% down.

He nets $1,200 monthly in rental income. After 15 years, the mortgage is paid off, and the property appreciates to $450,000.

5. Leverage Employer-Sponsored Plans Beyond 457(b)

Consider These Options:

401(k) and 403(b) Plans: Take advantage of employer matching.

Example:

Lisa’s employer offers a 5% 401(k) match.

She contributes $20,000 annually, and her employer adds $1,000.

Over 25 years, with a 6% annual return, her savings grow to $1.2 million.

6. Delay Social Security Benefits

Key Advantage:

Increased Benefits: Delaying Social Security until age 70 increases monthly payments by about 8% per year.

Example:

Tom’s full retirement benefit is $2,000 monthly at 67.

By waiting until 70, his monthly benefit increases to $2,480, providing an extra $5,760 annually.

7. Start a Side Hustle or Part-Time Work

Benefits:

Additional Income: Keep earning while pursuing a passion.

Extra Investment Opportunities: Use the income to grow your retirement funds.

Example:

Maria, a retired teacher, earns $10,000 annually tutoring students part-time. She invests this extra income to boost her savings.

8. Follow a Tax-Efficient Withdrawal Strategy

Plan Your Withdrawals:

Withdraw from taxable accounts first, then tax-deferred, and finally tax-free accounts to minimize taxes.

Example:

David starts withdrawals from his taxable brokerage account, allowing his Roth IRA to grow tax-free and reducing his taxable income.

9. Review and Adjust Your Plan Regularly

Stay on Track:

Annual Check-Ins: Meet with a financial advisor to review your portfolio and adapt to changes.

Example:

Karen reviews her investment portfolio every year with her advisor, making adjustments based on market conditions and her goals.

Final Thoughts

By diversifying your retirement savings strategy, you can build a secure financial future. Whether through maximizing tax-advantaged accounts, investing in real estate, or leveraging a side hustle, every step brings you closer to a comfortable retirement.

For personalized guidance, contact David Kassir at Manna Wealth Management. With over 28 years of experience, we can help you tailor a plan that aligns with your goals and financial situation.

Secure your future today!

0 notes

Text

Tax Planning with a Wealth Management Advisor: Strategies to Save

Effective tax planning is a cornerstone of sound financial management. It goes beyond merely filing returns and aims to minimize your tax liabilities while maximizing your savings. This is where a wealth management advisor can be invaluable. These professionals offer strategic guidance tailored to your financial goals, ensuring you retain more of your wealth. In this article, we’ll explore the importance of tax planning and how a wealth management advisor can help you implement effective strategies to save.

The Importance of Tax Planning

Tax planning involves analyzing your financial situation and structuring it to take advantage of tax-saving opportunities. A proactive approach ensures you comply with tax laws while strategically reducing your taxable income. Proper tax planning has numerous benefits, including:

Lowering overall tax liability

Enhancing investment returns through tax-efficient strategies

Ensuring compliance with tax regulations

Freeing up funds for other financial goals

However, navigating the complexities of tax laws and regulations can be daunting, which is why a wealth management advisor plays a crucial role.

How a Wealth Management Advisor Helps with Tax Planning

A wealth management advisor specializes in creating comprehensive financial strategies, including tax planning. Here’s how they assist:

1. Identifying Tax-Saving Opportunities

Wealth management advisors are well-versed in tax laws and can identify deductions, credits, and exemptions that apply to your financial situation. From Section 80C investments in India to charitable contributions and home loan deductions, they help you take full advantage of available options.

2. Structuring Investments for Tax Efficiency

An advisor ensures that your investments are tax-efficient by recommending instruments like:

Equity-Linked Savings Schemes (ELSS): For tax-saving under Section 80C while generating market-linked returns.

Public Provident Fund (PPF): Offering tax-free returns and exemptions on contributions.

Tax-Free Bonds: Providing tax-exempt interest income.

3. Planning for Capital Gains

Capital gains tax can significantly impact investment returns. A wealth management advisor helps you:

Time the sale of assets to fall within favorable tax periods.

Utilize indexation benefits to reduce long-term capital gains tax.

Reinvest in tax-saving options like government bonds or property under Section 54.

4. Retirement Planning with Tax Benefits

Retirement accounts like the National Pension Scheme (NPS) in India or Individual Retirement Accounts (IRAs) in the U.S. offer tax advantages. Advisors guide you on contributions, withdrawals, and strategies to optimize retirement savings while minimizing tax implications.

5. Managing Tax on Inheritance and Gifts

Inheritance and gift taxes can be significant for high-net-worth individuals. A wealth management advisor helps structure your estate to minimize tax liabilities, ensuring a smooth transfer of wealth to heirs.

6. Ensuring Compliance and Avoiding Penalties

Advisors ensure that your financial plans align with tax laws, helping you avoid penalties for non-compliance. They stay updated on changes in tax regulations and adjust your strategies accordingly.

Key Tax-Saving Strategies Recommended by Wealth Management Advisors

1. Diversifying Income Sources

By diversifying income into salary, dividends, capital gains, and rental income, advisors can help optimize tax rates and reduce liabilities.

2. Utilizing Tax-Advantaged Accounts

Advisors recommend maximizing contributions to tax-advantaged accounts like EPF, NPS, or 401(k), which offer deductions and tax-deferred growth.

3. Investing in Real Estate

Tax benefits on home loan interest and principal repayment make real estate an attractive option for tax planning. Advisors guide you on leveraging these benefits effectively.

4. Gifting and Donations

Charitable contributions not only support meaningful causes but also offer tax deductions. Advisors help structure donations to maximize tax benefits.

5. Timing Income and Expenditures

A wealth management advisor helps you defer income or accelerate expenses to align with tax-efficient years. For instance, advancing certain expenditures in a high-income year can lower taxable income.

Case Study: How Tax Planning Saved a Client Millions

Consider a high-net-worth individual with multiple income streams. By working with a wealth management advisor:

Investments were restructured to prioritize tax-efficient instruments.

Capital gains were timed strategically to fall under favorable tax periods.

Contributions to charitable trusts were maximized, reducing overall taxable income. This resulted in substantial tax savings while aligning with long-term financial goals.

Conclusion

Tax planning is a vital aspect of financial well-being, and a wealth management advisor is your trusted partner in navigating its complexities. By leveraging their expertise, you can implement strategies that not only minimize your tax liabilities but also align with your broader financial objectives.

Whether you’re looking to save for retirement, optimize investments, or plan your estate, a wealth management advisor ensures your money works harder for you. With their guidance, tax planning becomes less of a burden and more of an opportunity to grow and protect your wealth.

0 notes

Text

Earnings: Unlocking the Path to Financial Freedom

When was the last time you stopped to think about what "earnings" truly mean to you? Whether it's your paycheck, profits from a side hustle, or investment returns, earnings are more than just numbers—they’re the fuel that powers your financial dreams. Let's dive deep into the world of earnings and explore how they impact your life, how you can grow them, and how they shape your financial journey.

1. What Are Earnings?

Earnings are essentially the money you make in exchange for your time, skills, or capital. It could be wages from a job, profits from a business, or returns from investments. Think of earnings as the "scorecard" of your financial efforts—it shows how much value you bring to the table.

2. Why Earnings Matter

Why do we care so much about earnings? They give us the power to live the life we want. Whether it's paying bills, saving for a dream vacation, or investing in your future, earnings are at the heart of it all. Without them, financial independence is just a pipe dream.

3. Types of Earnings

a. Active Earnings

This is money earned from actively working—like your salary or freelance income.

b. Passive Earnings

Money you earn with minimal effort, such as royalties, rental income, or dividends.

c. Portfolio Earnings

Returns from investments like stocks, bonds, or mutual funds.

4. Earnings vs. Income: What's the Difference?

Many people use these terms interchangeably, but there’s a subtle difference. Earnings typically refer to the money you generate (e.g., salary, business profit), while income is your earnings minus expenses. If earnings are the gross amount, income is the net takeaway.

5. How to Maximize Your Earnings

Maximizing earnings isn’t about working harder—it’s about working smarter. Here’s how:

Negotiate Your Salary: Don’t settle; always ask for what you’re worth.

Upskill Yourself: Learn in-demand skills to stay competitive.

Diversify Income Streams: Don’t rely on one source; explore side hustles or investments.

6. The Role of Education in Earnings

Education can be a game-changer for your earning potential. Studies consistently show that higher education correlates with higher earnings. But it's not just about degrees—certifications and skills-based learning can also boost your paycheck.

7. Earnings and Investments

Investments are the bridge between earning and wealth creation. When you reinvest your earnings, they start working for you. From stocks to real estate, there are countless ways to grow your money over time.

8. Earnings from Side Hustles

The gig economy has made it easier than ever to earn extra cash. Whether it’s freelancing, driving for a rideshare service, or selling handmade goods, side hustles can significantly boost your earnings. Bonus? They often turn into full-fledged businesses.

9. Passive Earnings: Earning While You Sleep

Wouldn’t it be great to make money while binge-watching your favorite series? That’s the magic of passive earnings. Popular options include:

Real Estate: Rental income is a tried-and-true method.

Dividend Stocks: Let your investments pay you back.

Content Creation: Write a book, design an online course, or start a YouTube channel.

10. Taxes and Your Earnings

Taxes are an unavoidable part of earnings, but smart planning can help reduce your tax liability. Consider strategies like:

Tax-Advantaged Accounts: Use 401(k)s or IRAs to save for retirement and reduce taxable income.

Deductions: Take advantage of tax breaks for education, healthcare, and business expenses.

11. Tracking and Managing Your Earnings

Without a system to track your earnings, it’s easy to lose sight of your financial goals. Use apps or spreadsheets to monitor your income streams and expenses. This habit is the cornerstone of financial stability.

12. Earnings Trends in the Digital Age

From influencers to e-commerce entrepreneurs, the digital age has redefined earnings. Today, you can earn money from YouTube ads, online courses, or even virtual real estate in the metaverse. The opportunities are endless!

13. The Psychology of Earnings

Earnings are not just about dollars—they’re deeply tied to our sense of worth and happiness. Studies show that while more money doesn’t always mean more happiness, financial security does play a huge role in overall well-being.

14. Common Mistakes That Shrink Your Earnings

Are you sabotaging your earning potential without realizing it? Common pitfalls include:

Not Asking for a Raise: Many people leave money on the table by avoiding this conversation.

Poor Time Management: Your time is your most valuable asset—use it wisely.

Ignoring Financial Education: Without knowledge, you’re likely to make costly mistakes.

15. Conclusion: Your Earnings Journey

Earnings are more than just numbers—they’re the building blocks of your financial story. Whether you’re at the start of your career or looking to diversify income streams, there’s always room to grow. The key is to take charge, stay informed, and keep pushing forward.

FAQs

1. What are the best ways to increase my earnings? Upskilling, diversifying income streams, and smart investments are the top strategies.

2. How can I manage taxes on my earnings? Use tax-advantaged accounts, take deductions, and consult a tax professional for personalized advice.

3. What are some common side hustles for extra earnings? Freelancing, e-commerce, content creation, and gig economy jobs are great options.

4. Are passive earnings truly "effortless"? While they require initial setup (e.g., buying a rental property or creating a course), passive earnings involve minimal ongoing effort.

5. How does education impact earnings? Higher education and certifications typically lead to higher earning potential by opening doors to better-paying opportunities.

0 notes

Text

A guide to retirement planning for freelancers

A guide to retirement planning for freelancers

Retirement planning is crucial for freelancers, as they often do not have the traditional employee benefits and safety nets that come with working for a salaried position. As a freelancer, it is essential to proactively plan for retirement to ensure a secure financial future. This document provides insights into the importance of retirement planning for freelancers and the steps they can take to build a solid foundation for their future. Why Retirement Planning Is Important for Freelancers As a freelancer, your income may be variable and unpredictable, making retirement planning more challenging. However, it is still essential to prioritize retirement planning for the following reasons: 1. Financial Security: Retirement planning ensures that you have a stable income during your retirement years, allowing you to maintain a comfortable lifestyle. 2. Estate Planning: Proper retirement planning helps you manage your assets, minimize taxes, and ensure that your wealth is distributed according to your wishes. 3. Health and Well-being: Retirement planning takes into account healthcare costs and long-term care expenses, ensuring that you have the financial means to pursue a healthy lifestyle. 4. Financial Independence: By saving for retirement, you can have the freedom to choose if and when you want to stop working, allowing you to pursue other interests and hobbies.

Photo by Julia Taubitz Steps for Retirement Planning for Freelancers Retirement planning as a freelancer requires a different set of strategies and considerations compared to employees. Consider the following steps: 1. Identify Your Retirement Goals: Determine what you want your retirement to look like and how much money you will need to fund it. 2. Calculate Your Retirement Savings: Calculate the amount you will need to save for retirement based on your age, expected retirement age, and desired lifestyle. 3. Set a Retirement Savings Target: Determine how much you can save annually and adjust your budget to accommodate this savings goal. 4. Invest Wisely: Explore different investment options, such as mutual funds, stocks, bonds, and real estate, to maximize your retirement savings. 5. Maximize Retirement Accounts: Take advantage of tax-advantaged retirement accounts, such as IRAs and 401(k)s, to compound your retirement savings. 6. Consider Diversifying Income Streams: In addition to your main freelance work, explore other passive income opportunities, such as rental properties, annuities, or royalties. 7. Plan for Healthcare Expenses: Consider health insurance options, long-term care insurance, and strategies to manage healthcare costs during retirement. 8. Stay Updated: Stay informed about changes in tax laws, social security benefits, and retirement regulations to maximize your retirement income.

Conclusion Retirement planning is crucial for freelancers, as it enables them to build a secure financial future. By proactively planning and taking the necessary steps, freelancers can ensure that they have the financial means to enjoy a comfortable and enriching retirement. It is important for freelancers to prioritize retirement planning and take the necessary steps to secure their future. Read the full article

#Aguidetoretirementplanningforfreelancers#bestdiybusinessideas#businessgrowth#businesssuccess#digitalbusiness#digitalentrepreneur#digitalgrowth#digitalmarketing#digitalmarketingtips#digitalstrategy#digitalsuccess#digitalsuccessstrategy#diybusinesscardideas#diybusinessforsale#diybusinessfromhome#diybusinessideas#diybusinessideasforstudents#diybusinessnews#diylifehack#diylifestyleblog#EmpowerYourCreativity:DIYDelightsUnleashedOnline!#entrepreneurlifestyle#entrepreneurmindset#entrepreneurmotivation#entrepreneurship#howtostartadiybusiness#odiyi#onlinediyideas#onlinedoityourselfideas#OnlineDoItYourselfIdeasBlog

0 notes

Text

Investment Finance: Key Tips for First-Time Investors

The world of investment finance can be daunting for newcomers. With an array of investment vehicles, market terminologies, and fluctuating economic conditions, taking that first step might seem overwhelming. However, armed with knowledge and a strategic approach, first-time investors can navigate this landscape effectively. Let's explore the essentials of investment finance and share some crucial tips tailored for novice investors.

1. Introduction to Investment Finance

Investment finance involves the allocation of capital to assets or ventures, expecting a future return. Whether it's stocks, bonds, real estate, or startups, investments aim to grow wealth over time, leveraging the power of compound returns.

2. Setting Clear Investment Goals

Every investment journey should begin with a clear objective. Are you saving for retirement, buying a house, or building an emergency fund? Setting specific, measurable, attainable, relevant, and time-bound (SMART) goals can provide direction and purpose.

3. Understanding Risk and Return

In finance, risk and return are two sides of the same coin. Generally, higher potential returns come with higher risks. As a first-time investor:

Assess Your Risk Tolerance: Understand your comfort level with market fluctuations. Tools and questionnaires can help gauge your risk appetite.

Diversify: Spreading investments across various assets can mitigate risk.

4. Building a Solid Financial Foundation

Before venturing into investments:

Clear High-Interest Debts: The interest on some loans might exceed potential investment returns.

Establish an Emergency Fund: Having 3-6 months' worth of expenses can provide a safety net, ensuring you don't liquidate investments during emergencies.

5. Exploring Investment Avenues

There's a plethora of investment options available:

a. Stocks: Equities represent ownership in companies. They offer potential high returns but come with higher risk.

b. Bonds: Loans given to entities (like governments or corporations) that pay periodic interest.

c. Mutual Funds: Pooled investments managed by professionals, spreading risk across a portfolio of assets.

d. Real Estate: Investing in property can offer rental income and appreciation.

e. ETFs: Similar to mutual funds but traded on stock exchanges.

f. Retirement Accounts: Tax-advantaged accounts like 401(k)s or IRAs to save for retirement.

6. The Importance of Research

Stay Informed: Keeping abreast of economic news and market trends is essential.

Analyze Companies: If considering stocks, study the company's financial health, competitive position, and industry trends.

7. Cost Considerations

Commissions and Fees: Understand the charges associated with buying or selling assets.

Tax Implications: Some investments come with tax benefits, while others might incur hefty taxes on profits.

8. Avoiding Common Pitfalls

a. Emotional Investing: Avoid making decisions based on fear or greed. Stay rational and stick to your strategy.

b. Chasing Past Performance: Just because an asset performed well in the past doesn't guarantee future success.

c. Overcomplicating: Especially for beginners, it's wise to keep your investment strategy straightforward.

9. The Role of Financial Advisors

For those unsure about crafting an investment strategy, financial advisors can provide valuable guidance:

Expertise: Advisors can recommend suitable assets based on your goals and risk tolerance.

Planning: They can help design a holistic financial plan, considering various life stages and needs.

10. Continuous Learning and Adapting

The financial landscape evolves constantly:

Stay Updated: Regularly review and update your knowledge.

Review Portfolio: Periodically assess your portfolio's performance and rebalance if necessary.

11. Embracing Technology

a. Robo-Advisors: Automated platforms that offer investment advice based on algorithms.

b. Investment Apps: Mobile apps can make trading and tracking investments easier and more accessible.

12. The Long-Term Perspective

Investment is more of a marathon than a sprint. Short-term market fluctuations are inevitable:

Stay Patient: Historically, markets have trended upwards over longer periods.

Compounding Magic: Even small investments can grow significantly over time due to compound returns.

Conclusion

Starting an investment journey can be both exciting and nerve-wracking. The key lies in education, patience, and a strategic approach. While uncertainties are part of the investment world, understanding the basics and making informed decisions can pave the way for a prosperous financial future. Remember, every seasoned investor started as a beginner. With commitment and diligence, first-time investors can harness the dynamic world of investment finance to achieve their financial aspirations.

#finance news#finance guide#finance management#finance#finance stock#finance assignment help#finance & law

0 notes

Text

The absolute best 5 Key Benefits of Purchasing and Owning Investment Realty

So... You may ask yourself, why should you buy or invest in real estate property in the First Place? Because it's the IDEAL investment! Let's take a moment to handle the reasons why people should have investment real estate in the first place. The easiest alternative is a well-known acronym that addresses the key benefits for all those investment real estate. Put simply, Investment Real Estate is an IDEAL financial commitment. The IDEAL stands for: • I - Income • H - Depreciation • E - Expenses • The - Appreciation • L - Leverage Real estate will be IDEAL investment compared to all others. I'll explain each help in depth. The "I" in IDEAL stands for Income. (a. k. a. positive cash flow) Does it even earn money? Your investment property should be generating income from rental prices received each month. Of course, there will be months where you may feel a vacancy, but for the most part your investment could be producing an income. Be careful because many times beginning investors exaggerate their assumptions and don't take into account all potential costs. The particular investor should know going into the purchase that the property will surely cost money each month (otherwise known as negative cash flow). The scenario, although not ideal, may be OK, only in precise instances that we will discuss later. It boils to the risk tolerance and ability for the owner to fund plus pay for a negative producing asset. In the boom years regarding real estate, prices were sky high and the rents couldn't increase proportionately with many residential real estate investment properties. A large number of naïve investors purchased properties with the assumption that the understanding in prices would more than compensate for the fact that your high balance mortgage would be a significant negative impact on a funds each month. Be aware of this and do your best towards forecast a positive cash flow scenario, so that you can actually realize all the INCOME part of the IDEAL equation. Often times, it may require a more significant down payment (therefore lesser amount being mortgaged) so that your cash is acceptable each month. Ideally, you eventually pay off the actual mortgage so there is no question that cash flow will be coming in each month, and substantially so. This ought to be a vital aspect of one's retirement plan. Do this a few times and you won't really need to worry about money later on down the road, which is the main goal as well as reward for taking the risk in purchasing investment property from the start. The "D" in IDEAL Stands for Depreciation. With commitment real estate, you are able to utilize its depreciation for your own tax advantages. What is depreciation anyway? It's a non-cost accounting method to take into account the overall financial burden incurred through real estate investment. Look at this a second way, when you buy a brand new car, the minute you travel off the lot, that car has depreciated in appeal. When it comes to your investment real estate property, the IRS allows you to deduct this amount yearly against your taxes. Please note: Now i'm not a tax professional, so this is not meant to be a tutorial in taxation policy or to be construed as place a burden on advice. With that said, the depreciation of a real estate investment property depends on the overall value of the structure of the property and the period of time (recovery period based on the property type-either residential or commercial). If you have ever gotten a property tax bill, they usually break your property's assessed value into two categories: one for the importance of the land, and the other for the value of the arrangement. Both of these values added up equals your total "basis" for property taxation. When it comes to depreciation, you can deduct in opposition to your taxes on the original base value of the building only; the IRS doesn't allow you to depreciate land worth (because land is typically only APPRECIATING). Just like your new van driving off the lot, it's the structure on the property that may be getting less and less valuable every year as the nation's effective age gets older and older. And you can use this with your tax advantage. The best example of the benefit regarding this unique concept is through depreciation, you can actually turn a property who creates a positive cash flow into one that shows a damage (on paper) when dealing with taxes and the IRS. As well as by doing so, that (paper) loss is deductible against your wages for tax purposes. Therefore , it's a great benefit for those that are specifically looking for a "tax-shelter" of sorts for their properties investments. For example , and without getting too technical, suppose that you are able to depreciate $15, 000 a year from a $500, 000 residential investment property that you own. Let's say you're cash-flowing $1, 000 a month (meaning that after all prices, you are net-positive $1000 each month), so you have $12, 000 total annual income for the year from this property's rental income. Although you took in $12, 000, you can show through your accountancy with the depreciation of your investment real estate that you actually lost $3, 000 on paper, which is used against any income taxes that you may owe. Out of your standpoint of IRS, this property realized a loss in $3, 000 after the "expense" of the $15, 000 accounting allowance amount was taken into account. Not only are there no taxes expected on that rental income, you can utilize the paper decrease in $3, 000 against your other regular taxable cash from your day-job. Investment property at higher price details will have proportionally higher tax-shelter qualities. Investors use this in their benefit in being able to deduct as much against their taxable amount owed each year through the benefit of depreciation with their underlying investor. Although this is a vastly important benefit to owning funding real estate, the subject is not well understood. Because depreciation is actually a somewhat complicated tax subject, the above explanation was intended to be cursory in nature. When it comes to issues involving taxation's and depreciation, make sure you have a tax professional that can give you advice appropriately so you know where you stand. The "E" in RECOMMENDED is for Expenses - Generally, all expenses incurred with regards to the property are deductible when it comes to your investment property. The retail price for utilities, the cost for insurance, the mortgage, as well as interest and property taxes you pay. If you use home manager or if you're repairing or improving the property its own matters, all of this is deductible. Real estate investment comes with a lot of expenses, chores, and responsibilities to ensure the investment property itself performs in order to its highest capability. Because of this, contemporary tax law mostly allows that all of these related expenses are deductible towards the benefit of the investment real estate landowner. If you were to make sure you ever take a loss, or purposefully took a burning on a business investment or investment property, that decline (expense) can carry over for multiple years to protect against your income taxes. For some people, this is an aggressive and technological strategy. Yet it's another potential benefit of investment realty. The "A" in IDEAL is for Appreciation - Understanding means the growth of value of the underlying expenditure of money. It's one of the main reasons that we invest in the first place, and it's really a powerful way to grow your net worth. Many properties in the city of San Francisco are several million cash in today's market, but back in the 1960s, the same property was initially worth about the cost of the car you are currently operating (probably even less! ). Throughout the years, the area has become more popular and the demand that ensued caused the real residence prices in the city to grow exponentially compared to where they were a few decades ago. People that were lucky enough to recognize the, or who were just in the right place at the ideal time and continued to live in their home have recognized an investment return in the 1000's of percent. At this time that's what appreciation is all about. What other investment can make you will this kind of return without drastically increased risk? The best piece about investment real estate is that someone is forking over you to live in your property, paying off your mortgage, and making an income (positive cash flow) to you each month along the way through your course of ownership. The "L" in IDEAL would mean Leverage - A lot of people refer to this as "OPM" (other people's money). This is when you are using a small amount of your money to overpower a much more expensive asset. You are essentially leveraging your sign up and gaining control of an asset that you would ordinarily not be able to purchase without the loan itself. Leverage is substantially more acceptable in the real estate world and inherently much less risky than leverage in the stock world (where it is done through means of options or buying "on Margin"). Leverage is common in real estate. Otherwise, people may only buy property when they had 100% of the hard cash to do so. Over a third of all purchase transactions are all-cash transactions as our recovery continues. Still, about 2/3 of all purchases are done with some level of financing, to be sure the majority of buyers in the market enjoy the power that leverage generally offer when it comes to investment real estate. For example , if a real estate investor was basically to buy a house that costs $100, 000 with 10% down payment, they are leveraging the remaining 90% through the use of the attached mortgage. Let's say the local market improves by 20% covering the next year, and therefore the actual property is now worth $120, 000. When it comes to leverage, from the standpoint of this property, the value increased by 20%. But compared to the investor's precise down payment (the "skin in the game") of $10, 000- this increase in property value of 20% genuinely means the investor doubled their return on the investment decision actually made-also known as the "cash on cash" gain. In this case, that is 200%-because the $10, 000 is now reliable and entitled to a $20, 000 increase in all round value and the overall potential profit. Although leverage is viewed a benefit, like everything else, there can always be too much of an excellent. In 2007, when the real estate market took a turn for that worst, many investors were over-leveraged and fared any worst. They could not weather the storm of a lengthening economy. Exercising caution with every investment made will help to ensure that you can purchase, retain, pay-off debt, and grow your own wealth from the investment decisions made as opposed to being at the particular mercy and whim of the overall market fluctuations. For certain there will be future booms and busts as the past would certainly dictate as we continue to move forward. More planning and setting up while building net worth will help prevent getting bruised and battered by the side effects of whatever market we all find ourselves in. Many people think that investment real estate is barely about cash flow and appreciation, but it's so much more compared with that. As mentioned above, you can realize several benefits through each one real estate investment property you purchase. The challenge is to maximize the benefits by means of every investment. Furthermore, the IDEAL acronym is not just a reminder of the benefits of investment real estate; it's also here to deliver as a guide for every investment property you will consider selecting in the future. Any property you purchase should conform to all of the notes that represent the IDEAL acronym. The underlying property ought to have a good reason for not fitting all the guidelines. And on almost every case, if there is an investment you are considering that doesn't click all the guidelines, by most accounts you should probably Give it! Take for example a story of my own, regarding a home that I purchased early on in my real estate career. To this day, oahu is the biggest investment mistake that I've made, and it's really because I didn't follow the IDEAL guidelines that you are checking and learning about now. I was naïve and the experience was not yet fully developed. The property I paid for was a vacant lot in a gated community production. The property already had an HOA (a monthly care fee) because of the nice amenity facilities that were built for this, and in anticipation of would-be-built homes. There were big expectations for the future appreciation potential-but then the market turned for those worse as we headed into the great recession that lasted from 2007-2012. Can you see what parts of the IDEAL specifications I missed on completely? Let's start with "I". Typically the vacant lot made no income! Sometimes this can be ideal, if the deal is something that cannot be missed. But for one of the most part this deal was nothing special. In all honesty, I had considered selling the trees that are currently on the vacant lot to the local wood mill for some actual source of income, or putting up a camping spot ad on the localized Craigslist; but unfortunately the lumber isn't worth ample and there are better spots to camp! My expected values and desire for price appreciation blocked the rational as well as logical questions that needed to be asked. So , when the software came to the income aspect of the IDEAL guidelines for a investment, I paid no attention to it. And I paid out the price for my hubris. Furthermore, this investment did not realize the benefit of depreciation as you cannot depreciate land! So , we are zero for two so far, with the IDEAL guideline for you to real estate investing. All I can do is hope typically the land appreciates to a point where it can be sold sooner or later. Let's call it an expensive learning lesson. You at the same time will have these "learning lessons"; just try to have because few of them as possible and you will be better off.

1 note

·

View note

Text

passive investing in commercial real estate

#passive investing in commercial real estate#passive real estate investing#multifamily investing#apartment investing#cost segregation#apartment investment group#syndicated deal analyzer#free multifamily deal analyzer#chatgpt real estate investing#k-1 net rental real estate income#deal analyzer#k1 rental income#chatgpt commercial real estate#multifamily investment group

0 notes

Text

Vacation Home Conversion, Debt Discharge, And Partnership Issues All In One Tax Court Case

New Post has been published on https://perfectirishgifts.com/vacation-home-conversion-debt-discharge-and-partnership-issues-all-in-one-tax-court-case/

Vacation Home Conversion, Debt Discharge, And Partnership Issues All In One Tax Court Case

Big Brother style camera over the entrance to the United States Tax Court

Nothing like packing several issues into one decision. That’s what we have in the Duffy case. Since the Tax Court will not be issuing any opinions until after Christmas I decided to look at the court’s top hits for 2020. I reached out to #TaxTwitter for suggestions and the first nomination was an interesting one.

If you are still reading at this point you probably know that Title 26 US Code is the Internal Revenue Code, but that is not something that everybody knows. It is the sort of thing that tax nerds will use to distinguish themselves like saying Subchapter K when they are talking about partnerships. Using that as your twitter handle is above and beyond when it comes to being a tax nerd.

Several Issues

The Duffy case had a lot going on, which may have been why I passed over it. Mx. Code is right that it covers some issues that are likely to be prevalent in returns covering this plague year 2020 and likely 2021. The stakes were pretty high $662,458 in tax and $131,314 in penalties for the years 2009 through 2014.

Freeman Law in The Tax Court in Brief has a tight summary of the eight issues involved in the decision:

(1) ordinary loss from their sale in 2011 of residential property in Oregon;

(2) 2011 COD income due to discharge of debt that the property secured;

(3) losses reported from their rental of the Oregon property;

(4) 2013 COD income from the discharge of a home equity line

(5) losses allocated to Mr. Duffy by a business partnership;

(6) unreimbursed partnership expenses reported on Schedules E for their 2012 through 2014 tax years;

(7) self-employment tax on Mr. Duffy’s guaranteed payments received from partnership

(8) accuracy-related penalties.

There was also a problem that I had never thought about that might have required algebra to solve, but ended up getting passed over. I often remark that you learn all the math you need for tax work by the fourth grade. This could have been one of the rare exceptions.

The Residence

The residence referred to as the “Gearhart property” is the source of most of the complications. The Duffys purchased the property in 2006 for $2 million of which they paid $430,500 but were unable to pay the balance when it came due in July 2008. They borrowed $1.4 million from JP Morgan Chase JPM in 2008 identifying the property as a second residence.

Mrs. Duffy testified that they started renting the Gearhart property to friends and acquaintances in 2009. Previously it had been a vacation property. In 2009 they reported a loss of $135,959 on the Gearhart property ($9,500 rental income and $145,450 of expenses – mortgage interest, tax, and depreciation). In 2010 the loss was $65,490 with $3,200 in rental income.

In both years the losses were suspended under Code Section 469 (passive activities). Adjusted gross income was over the threshold that would have allowed $25,000 of the losses to be deducted.

In 2011 they reported the sale of the Gearhart property on Form 4797 claiming an ordinary loss of $971,988. They also reported $624,046 as income from the discharge of indebtedness from the JPMorgan Chase loan on the Gearhart property but excluded the income due to insolvency. The disposition released the passive losses which combined with the 2011 activity made a Schedule E loss of $199,875.

That gave them a net operating loss of $274,002 which they carried back to 2009 and 2010. Here is where the algebra or perhaps an iterative computation might have come into play. The reduced adjusted gross income allowed $25,000 of passive losses to be deducted in 2009 and $13,792 in 2010.

It seems like that should have reduced the 469 carryover into 2011 which would have reduced the net operating loss carryback. But then the 2010 adjusted gross income would change. Whoever prepared the carryback claim did not trouble themselves about the apparent double-dipping. And it ended up not mattering.

Recourse Versus Nonrecourse

When you borrow money secured by property whether the debt is recourse or nonrecourse can have tremendous tax significance. From an economic viewpoint, you want the debt to be nonrecourse.

The idea is that if you can’t pay, you hand the bank the keys and you are done. Sometimes though you can get that deal with recourse debt. It is called a “short sale”, which has a different meaning in real estate than it does on Wall Street.

Was it better for the Duffys for the debt to be recourse or nonrecourse? That turns on how they did with the issue of whether the Gearhart property was business property or personal-use property. That determination was the biggest issue in the case.

If the property is personal use there is no 1231 loss on its sale and no accumulation of rental losses suspended by Code Section 469. In that case, it is clearly better for the debt to have been nonrecourse since including it in proceeds just reduces a nondeductible loss.

If the Duffys won on the business use issue having the debt be recourse with a short sale, which is what they argued, is preferable if they can establish that they are insolvent.

Judge Halpern’s resolution on the business/personal issue is a little disappointing. On the 1231 loss, he notes that the basis for purposes of determining loss is the lesser of adjusted basis or fair market value at the time of conversion to business use less subsequent depreciation.

There was no evidence introduced as to what FMV at the time of conversion was, so there was no loss on the sale. As far as whether the rental losses were good, the issue was not raised in the briefs submitted by Mrs. Duffy so it was deemed that the issue had been conceded.

Judge Halpern then, in effect, cuts the Duffys a break. He does not need to address the issue of whether the Duffys were insolvent in 2011, because the debt was nonrecourse. This was actually a pretty tricky determination, It turned on how the foreclosure was handled under Oregon law.

“Because the documents which the parties stipulated regarding petitioners’ sale of the Gearhart property do not include any judicial filings by JPMorgan Chase and we find no reference to any judicial proceedings in the documents that were stipulated, we infer that the sale was part of an administrative rather than a judicial foreclosure. Therefore, Oregon’s antideficiency statute prevented JPMorgan Chase from seeking satisfaction from petitioners’ other assets of that part of its loan in excess of the proceeds it received from the sale of the Gearhart property.”

Lew Taishoff told me that the answer would be different in New York:

The kicker is the OR anti-deficiency statute, which makes the lender’s election to foreclose without trial (which we can’t do in NY; there is no administrative foreclosure here) an election to waive any recourse against the mortgagor. Our deficiency statute is different (see NYRPAPL§1371).

Planners will need to hone in on this issue as it seems likely we will be having more than our fair share of foreclosures in the coming year. It is a little troubling that whether a debt is or is not recourse may turn, in some states, on how the debt holder chooses to enforce it.

Another Debt Discharge

In 2013 Wells Fargo WFC forgave $391,532 on the home equity line on the Duffy residence in Portland. There is a pretty lengthy discussion of their solvency. Judge Halpern ends up excluding some but not all of the discharge.

Partnership Issues

Mr. Duffy started a business in 2011 – Impact Medical. The company itself is an interesting story as you can see from this article in the Portland Business Journal by Elizabeth Hayes, but we will stick with the tax issues.

IM was an LLC owned solely by Mr. Duffy, but in 2012 a friend who had loaned money converted the loan to a membership interest thereby making IM a partnership for income tax purposes.

This part of the case makes me think that the Duffys must have caught the agent from hell (AFH). AFH is not technically strong, but they are dogged. The IRS was trying to deny losses due to basis, but Judge Halpern wasn’t having it.

On brief, respondent acknowledges that Mr. Duffy made capital contributions to Impact Medical of $50,000 and $450,000. He does not explain why, even leaving aside Mr. Duffy’s share of the partnership’s liabilities, those contributions did not provide Mr. Duffy sufficient outside basis to deduct at least some of the ordinary losses the partnership allocated to him.

There were other problems. The partnership had amended its return allocating all losses away from Mr. Duffy for 2012, but the Duffys did not take that into account. On the other hand, Judge Halpern found plenty of basis to support the 2013 loss.

In 2014 there was no taxable income, so the only relevance of the basis question was for self-employment tax. Judge Halpern determined that there was plenty enough basis to offset a $25,082 guaranteed payment.

There were also deductions for “unreimbursed partnership expenses” (UPE). Whether you can deduct UPE hinges on the partnership agreement. Judge Halpern didn’t need to go there, though, since the expenses were unsubstantiated.

Reilly’s Sixteenth Law of Tax Planning – Being right without substantiation can be as bad as being wrong.

Better Lucky Than Good

The Duffys caught a break on the penalties. Assessment of the accuracy requires supervisory approval. The IRS thought they had it, but it was not good enough for the judge.

We need not decide whether petitioners’ reasonably relied on their return preparers because we conclude that respondent failed to meet the burden of production imposed on him by section 7491(c). In particular, respondent has not established compliance with the supervisory approval requirement of section 6751(b)(1). The civil penalty approval form included in the record establishes that

Ms. Crespi approved the penalties for some of the years in issue, but respondent has not established that Ms. Crespi is “the immediate supervisor of the individual” who made the determination to assess penalties.

I’m thinking of adding a new law of tax planning – Better to be lucky than good.

Overall

I don’t think this case will win the big prize. On the other hand, I think it is highly instructive in some areas that are going to be very important in the next few tax seasons. At this point, I have only one other nomination, but I am sure there will be more. Stay tuned.

Other Coverage

As noted Freeman Law has a good summary in The Tax Court in Brief.

Theresa Schliep has Tax Court Says IRS Didn’t Show Approval For $131K Penalty on Law 360.

Ed Zollars used the case to do a thorough discussion of “short sales” in Current Federal Tax Developments.

Lew Taishoff has Short Sale – Part Deux. Mr. Taishoff focused on the real estate, debt discharge and penalty leaving the partnership issues to the rest of the tax blogoshpere.

More from Taxes in Perfectirishgifts

0 notes

Text

In Search Of FIRE: Financial Samurai Retirement Portfolio Review

It hit me the other day that I’ve got to get my act together if I plan to retire a second time soon.

The first attempt at retirement lasted for just under a year until I started feeling too sheepish telling anyone I was retired at 34. Although my retirement portfolio was generating about $80,000 a year in passive income at the time, I started itching for more.

Seven years later, I’m running out of steam. I’ve already conducted multiple calls with boutique investment banks, private equity shops, and larger media companies on the potential sale of Financial Samurai after its 10-year anniversary mark in July 2019.

I’ve also tentatively convinced my wife to go back to work once our son turns two years and five months old this Fall. Spending 29 months as a stay at home parent should be long enough to feel like a parent did the best he or she could without feeling too guilty for going back to work. But we shall see when the time comes.

The final thing I need to do is make sure our after-tax retirement portfolios are generating enough income to cover our desired living expenses just in case Financial Samurai is sold and my wife can’t get a reasonable job in a field of interest.

I feel blessed to be able to do all the things I love since leaving full-time work in 2012 – coaching high school tennis for the past three years, writing almost daily on Financial Samurai, traveling around the world, and spending time being a stay at home dad since early 2017.

But all good things come to an end. We must frequently adjust in order to keep the good times going for longer.

How To Build A Healthy Retirement Portfolio

Before discussing my retirement portfolio’s latest income figures, I’d like to share five tips for everyone to follow to build their own healthy retirement portfolio.

1) Save until it hurts each month. Most people think that saving for retirement in their 401(k) or IRA is enough, but it is not. In order to have the optionality of retiring early or ensuring a healthy retirement at a more traditional retirement age, it’s important to max out your 401(k) while also contributing at least 20% of your after-401(k), after-tax income to an after-tax investment portfolio.

The after-tax retirement portfolio really is the key to early retirement since most people can’t access their pre-tax retirement accounts without a 10% penalty before age 59.5.

2) Focus on income producing assets. After you’ve had your fill of high octane growth stocks as a young person, it’s time to focus on income producing assets as you get closer to retirement. Dividend generating stocks, certificates of deposit, municipal bonds, government treasury bonds, corporate bonds, and real estate should all be considered in your retirement portfolio.

When I was younger, my favorite type of semi-passive income was rental property income because it was a tangible asset that provided reliable income. As I grew older, my interest in rental property waned because I no longer had the patience and time to deal with maintenance issues and tenants. Instead, my interest in REITs and real estate crowdfunding grew since the income generated is 100% passive.

3) Start as soon as possible. Building a large enough early retirement portfolio takes a tremendously long time largely due to declining interest rates since the late 1980s. Gone are the days of making a 5%+ return on a short-term CD or savings account. You need to save early and often to make compounding work most for you.

I knew I didn’t want to work 70 hours a week in finance forever. As a result, I started saving every other paycheck and 100% of my bonus starting my first year out of college in 1999. By the time 2012 rolled around, I was earning enough passive income to negotiate a severance and retire early.

4) Calculate how much retirement income you need. It’s important to have a retirement income goal. Otherwise, it’s too easy to lose motivation and focus. A good goal is to try and generate retirement income to cover all basic living expenses such as food, shelter, transportation, and clothing. Once you hit that goal, focus on covering your wants.

If your annual expense number is $50,000, divide that figure by your expected rate of return or comfortable withdrawal rate to see how much capital you will need to save. If you expect to earn a 4% rate of return, then you would need at least a $2,000,000 after-tax retirement portfolio, and closer to $2,200,000 – $2,500,000 due to taxes.

5) Make sure you are properly diversified. The first rule of financial independence is to never lose money. We saw a lost decade for tech stocks between 2000 – 2010 after the first dotcom bust. For NASDAQ investors, it took 13 years to get back to even.

You always want to be moving forward on your journey to early retirement. Please do not confuse brains with a bull market.

Financial Samurai Retirement Portfolio Review

Since retiring the first time around in 2012, I have yet to stress test my after-tax retirement portfolios because I received a severance that paid out enough money to survive for five years.

While I was living off my severance income, my wife worked until she negotiated her own severance at the end of 2014. She is three years younger than me. Having her work and provide healthcare was very comforting and allowed me to reinvest 100% of our after-tax retirement portfolio income.

Then once both of us weren’t working full-time jobs in 2015, Financial Samurai started generating a livable income as well. This positive sequence of events is why planning is so important. It’s frankly why quitting your job to retire early is a suboptimal move.

Ideally, we want to live on between $15,000 – $18,000 a month in after-tax income to live our best lives while raising one or two children in expensive San Francisco or Honolulu. Using a 28% effective tax rate, we’re talking a target $250,000 – $300,000 a year in annual gross retirement income.

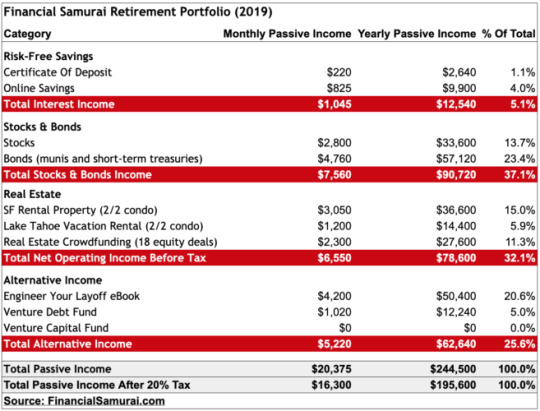

Here’s our latest source of income streams to fund our second retirement.

As you can see from the chart, we generate about $16,300 a month in after-tax retirement income if we use a 20% effective tax rate. The effective tax rate for investment income is lower than W2 wage income. This is something to think about when forecasting your own retirement income needs from investments.

$16,300 a month or $195,600 a year in after-tax retirement income should be more than enough to provide for our current family of three as our all-in housing cost is less than $6,000 a month. Once all our housing cost is covered, our costs for food, transportation, and everything else aren’t too bad.

$16,300 a month will also allow us to continue saving at least 30% a month for a rainy day (~$5,000). Because we’ve been in the habit of saving at least 50% of our after-tax income since graduating from college in 1999 and 2001, it would feel foreign to not continue saving in retirement.

The main anticipated increase in cost is preschool tuition starting this Fall at $1,800 a month. The other potential increase in cost is if we are blessed with another child. Ideally, we’d love to have two, but once you hit your late 30s or early 40s, the chances of a natural birth are only about 5%. Hence, we will consider fostering or adopting as well.

If we stay in San Francisco long term, our goal is to send our boy to public school after preschool if he can win the SF public school lottery system. If our son does not get into a reputable public school close by, then we’ll be forced to spend about $3,000 a month for elementary school and likely $5,000 a month for high school when the time comes.

These potential grade school tuition costs are the main reason why I’m striving towards $18,000 a month in after-tax retirement income, or ~$2,000 a month higher than current levels. I’ve got three years to make this goal a reality.

Below is an analysis of the major retirement income categories.

Risk-Free Savings: $1,045/month (5% of total)

I love risk-free savings, especially after the Federal Reserve hiked interest rates multiple times since the end of 2015.

To be able to earn ~2.45% risk-free after making massive gains in the stock market and real estate market since 2009 sparks joy! Gone are the days of pitiful 0.1% savings interest rates.

My target is to always have between 5% – 10% of my retirement income and net worth in risk-free investments. You just never know what might happen in the future.

Stocks & Bonds: $7,560/month (37%)

After a tremendous rebound in the stock market in 2019, I decided to asset allocate more towards 3-month treasuries in my main House Fund portfolio.

As of now, my House Fund portfolio is roughly 20%/80% stocks/bonds because my plan is to buy another property within the next 6-12 months.

The House Fund portfolio had a $400,000 swing (-13%, then +23%) and I want to ensure that I protect the principal going forward. My other main public investment portfolio is closer to 60% stocks / 40% bonds. I plan to gradually shift the weighting closer to 50%/50%.

Below is my public stock and bond portfolio performance +9.2% vs. the S&P 500 +15.9% year-to-date according to Personal Capital’s performance tracker. With the income from my existing bond holdings, I should have relatively no problem closing out a 10-11% total return for the year.

As I edge closer towards retirement, my main goal is to minimize volatility and try and achieve a 5% – 7% total return equal to 2X-3X the 10-year bond yield.

The rise in short-term interest rates has really been a boon to my bond portfolio income stream. I plan to continue actively investing in 3-month treasury bonds and saving about 80% of my monthly cash flow.

Real Estate: $6,550/month (32%)

Real estate used to dominate my retirement portfolio income (~60%) until I sold a significant SF rental house in 2017 for 30X annual gross rent.

I ended up reinvesting $600,000 of the proceeds in mostly dividend-paying stocks, $600,000 of the proceeds in mostly municipal bonds, and then $550,000 of the proceeds in real estate crowdfunding ($810,000 total) in order to not lose too much real estate exposure.

I did get a surprise $45,598.04 distribution on 4/16/2019 from the RS DME fund where I have a total of $800,000 invested. The fund has 17 investments, across 12 states, and 6 property types. My Class A Austin Multifamily property was sold for a 24.6% return over two years.

So far the fund is returning a 10% cash-on-cash return net of fees. I’m hoping the end IRR is much higher after the equity investments are sold within the next 2-3 years.

For retirement portfolio calculation purposes, although I received $45,598.04 in distribution, I’m only inputting the profits as passive income to stay conservative. Perhaps there will be another significant distribution later in the year.

Once about half my RS DME fund distributions are returned, I will look to reinvest about $300,000 in a couple Fundrise eREITs and around $100,000 in individual RealtyMogul sponsored commercial real estate investments. I already have a decent sized position in OHI and O, two publicly traded REITs.

So far I like the simplicity of investing in a real estate fund versus spending time trying to pick the best deals. But if I’m going to retire again, I’ll have more free time to do due diligence.

My goal is to always have at least 30% of my net worth exposed to real estate as it is my favorite asset class to build long term wealth.

I haven’t raised the rent on my SF 2/2 condo in almost three years. At $4,200 a month, the property is now under market value by $300 – $400 a month. But I plan to just keep the rent below market rate because they’ve been good tenants. I’ll wait until one or both decides to move out before raising the rent.

Our Lake Tahoe property is coming back to life! We’ve had a fantastic winter in 2018/2019, which has resulted in a roughly doubling of net rental income over last year.

As the storms have subsided, we plan to finally take our boy up to the mountains. Spending time with my own family has been a dream of mine since I first bought the property in 2007.

Alternative Income: $5,220/month

Online books sales for How To Engineer Your Layoff has steadily increased each year since the first edition was published in 2012. I wrote a new foreword for 2019 and updated some data.

My wife has spent the past four months updating the book for a 3rd edition launch in 2H2019. The 3rd edition will have even more case studies and strategies to guide people to better negotiate a severance. We will likely raise the book’s price by 15% as well.

The amount of positive feedback we continually get from readers who’ve successfully negotiated their severance has been tremendous. If you plan to retire early, it behooves you to try and negotiate a severance. You have nothing to lose.

To generate $50,400 a year in almost passive online income from a book would require amassing a $1,008,000 portfolio generating 5%. Not needing to have capital is why I’m so bullish on building online real estate as well. There is almost no risk except for putting your education and creativity to use.

There’s not too much to report on my venture debt fund investments. I’m still waiting to get paid in full for my first venture debt fund from five years ago. The second venture debt fund just did a 25% capital call for a total of 92% of the capital committed.

Finally, I invested in my first venture capital fund. I did so because I believe in the main general partner who has a good investing track record. This is a 10-year fund by Kleiner, Perkins, Caufield, & Byers, where I don’t expect to see any income until perhaps year five.

Enough To FIRE

Based on this deep-dive analysis, my wife and I should have enough to live a comfortable retirement lifestyle in San Francisco or Honolulu.

Keeping lifestyle inflation at bay while steadily growing our investment income has been key to building our retirement portfolio. For example, we have the ability to buy a house 3X the cost of our existing house which we purchased in 2014 but have chosen not to do so, despite the addition to our family.

What I find most interesting is that even though it’s clear that mathematically I shouldn’t have a problem retiring, I still have trepidation about selling Financial Samurai and retiring from my second career.

Change is always hard, especially after you’ve spent a decade doing one thing. Giving up a steady income stream is also scary when you’ve been through the 2000 dotcom bubble and the 2009 financial crisis and now have a family to support.

Eventually, we’ll need to start spending our retirement portfolio income. But as of now, we plan to continue reinvesting 100% of the investment proceeds and saving 80% of our active income until a retirement decision is made.

Related: Ranking The Best Passive Income Investments For Retirement

Readers, any of you planning to retire within the next 12 months? If so, what type of deep dive retirement portfolio analysis have you done to ensure that financially everything will be OK once you retire? Do you see any holes in our retirement portfolio we need to work on shoring up? Featured art by Colleen Kong-Savage.

The post In Search Of FIRE: Financial Samurai Retirement Portfolio Review appeared first on Financial Samurai.

from https://www.financialsamurai.com/in-search-of-fire-financial-samurai-retirement-portfolio-review/

0 notes

Text

What’s the Qualified Business Income Deduction and Can You Claim It?

The Tax Cuts and Jobs Act passed in December of 2017. It drastically cut the corporate tax rate, but it also introduced the Qualified Business Income (QBI) deduction.

The QBI deduction offers a way to lower the effective tax rate on the profits of owners of pass-through entities — trade or business where the income “passes through” to the owner’s individual tax return. These include the sole proprietorship (including independent contractors), partnerships, limited liability companies, and S corporations. Some trusts and estates may also be eligible to take the deduction. Income earned through a C corporation or services provided as an employee are not eligible, however.

The qualified business income (QBI) deduction can prove to be a significant tax reduction for those business owners who qualify. But because it remains a deduction and not a tax rate reduction, its effectiveness depends on an owner’s tax bracket. It represents a temporary measure in the tax law, which sunsets after 2025 unless Congress acts. It can also prove very, very complicated.

Here is a summary of what the deduction entails:

The QBI deduction is a personal write-off for owners of domestic pass-through businesses where owners pay business taxes on their personal tax return.

The deduction can be up to 20% of QBI minus the net capital gains.

Business owners can take the deduction in addition to the ordinarily allowable business expense deductions.

Deductions for higher-income individuals may be limited or ineligible.

This deduction is in place for tax years 2018 through 2025.

Here are answers to some commonly asked questions about the QBI deduction that may help you understand whether you qualify and, if so, how to gain the most benefit possible.

What is a Qualified Business Income Deduction?

A qualified business income(QBI) deduction allows domestic small business owners and self-employed individuals to deduct up to 20% of their QBI plus 20% of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income on their taxes, or 20% of a taxpayer’s taxable income minus net capital gains.

Qualified REIT dividends include most of the real estate investment trust dividends that people earn. Also, to qualify, you must hold the real estate investment trust for longer than 45 days. The payment must be for you, and it cannot be a capital gains dividend or regular qualified dividend. Qualified income from a PTP includes your share of income, gains, deductions, and losses from a PTP.

To qualify for the deduction, the 2019 taxable income must be under $321,400 for couples who are married filing jointly, $160,725 for married filing separately, or $160,700 for all other taxpayers. In 2020, those figures increase to $326,000 for couples married filing jointly and $163,300 for everyone else.

Anything higher and the IRS invokes a series of complicated rules that place limits on whether the trade or business income qualifies for a full or partial deduction. Deduction limitations include such factors as the trade or business type, taxable income, and the amount of W-2 wages paid by the company.

Some refer to the qualified business income (QBI) deduction as the Section 199A deduction. It does not really fit the description of a business deduction, however, even though it’s based on income. And it doesn’t reduce gross income like other business-related deductions. Take, for example, the self-employed health insurance deduction and one-half of self-employment tax. It doesn’t impact self-employment tax at all.

What the QBI deduction does offer is a personal tax deduction based on trade or income. You claim it on your individual income tax return (1040) as the owner whether you use the standard deduction or itemize personal deductions.

You get to take the deduction if you qualify for it. However claiming the deduction doesn’t require any purchase or outlay of cash, as with other types of deductions.

What is Qualified Business Income?

According to the IRS, qualified business income represents the net amount of qualified income, gain, deduction, and loss from any qualified trade or business. (Simply put, that means your share of the business’s net profit.) The trade or business must also be located in the U.S.

The IRS only counts items included in taxable income, such as:

Payments to an S corporation owner

Investments gains or losses

Interest income on outstanding receivables.

Certain items are excluded from QBI deductions when figuring qualified income, including:

Capital gains and losses