#jpmcoin

Explore tagged Tumblr posts

Text

JP Morgan CEO Questions Bitcoin's Value Amidst Rising Prices: Is It Worth Anything? #Bitcoin #bitcoinprice #CEOofJPMorganChase #cryptocurrencymarket #JamieDimon #JPMCoin

0 notes

Text

In the ongoing legal battle between Ripple and the US Securities and Exchange Commission (SEC), John Deaton, a prominent lawyer supporting XRP, has recently shed light on potential conflicts of interest and regulatory capture that may have influenced the SEC’s decision to take legal action against Ripple. Ethereum is at the epicenter of these allegations. The intricate tapestry referred to as “ETH-Gate” reveals a complex network of connections. The charges are multifaceted and challenging to navigate. In a recent tweet, Deaton distilled the most critical details. How Ripple Became The Alleged Victim Beginning with an explanation of “regulatory capture,” Deaton tweets, “What is regulatory capture: regulatory capture, a form of government failure in which a regulatory agency, which is supposed to represent the needs of the greater public, advances the commercial concerns of a special interest group w/in the sector the agency is supposed to be regulating.” Deaton brings attention to a sequence of events that connects former SEC Chairman Jay Clayton, SEC official William Hinman, and venture capital firm a16z (Andreessen Horowitz). On March 26, 2018, Lowell Ness, a lawyer representing a16z, allegedly delivered a note and Safe Harbor document to Hinman. The document specifically referenced ETH. Shortly after, Hinman, while not officially retired and still a profit-sharing partner with his law firm which was part of the Enterprise Ethereum Alliance (EEA), declared ETH to be a non-security. Deaton states, “Hinman’s law firm was a member of the EEA and Hinman was not retired, but instead, was a profit sharing partner with his law firm, when he declared ETH a non-security 10 weeks later.” Furthermore, Deaton alleges a direct conflict of interest involving Clayton’s law firm representing Joseph Lubin, ETH’s co-founder, and Consensys, a major ETH holder and promoter. Highlighting another potential conflict, Deaton mentions, “Clayton’s firm also brokered the merger between Quorum and Consensys using the JPMCoin, a direct competitor to Ripple and XRP.” Further complicating matters is the involvement of Joe Grundfest. According to Deaton, Grundfest was an integral part of the said working group, and he had interactions with Ethereum founders as early as 2014-2015. Quoting Grundfest, Deaton states, “He said XRP should not be treated any differently than ETH. Grundfest pointed out that the mass exodus of Clayton, Hinman, Berger etc was suspicious. He said there was no reason to bring the suit considering XRP had traded publicly for seven years and that innocent people with no connection to Ripple would suffer the most.” However, despite the pleas, Clayton made the decision to sue Ripple on his way out of the SEC. Not long after, Clayton joined One River, which had previously placed a $1 billion bet on Bitcoin and Ethereum. Tying the narrative back to Hinman, Deaton remarks on Hinman’s lucrative re-entry into the private sector, “Hinman returned to his EEA law firm $15 Million richer after less than 3 years at the SEC and then later became partners at A16Z with the same people who helped put that list together asking for the safe harbour for ETH.” Moreover, Deaton raises questions about Hinman’s compliance with directives, claiming that “His own SEC emails prove Hinman ignored that instruction and violated 18 USC 208 three more times by meeting them.” The revelations made by Deaton are significant, hinting at questionable practices and connections within the SEC during the time of Ripple’s lawsuit filing. As of the time of this report, neither the SEC nor the involved parties have made any official statements in response to Deaton’s allegations. At press time, XRP traded at $0.5097. XRP remains below the trendline, 1-day chart | Source: XRPUSD on TradingView.com Source

0 notes

Link

Хотя новое руководство OCC по стабильным монетам (stablecoin) не влияет на JPM Coin, оно может привести к криптовалютным платежам, если будет спрос...

4 notes

·

View notes

Photo

Well holy shit, this time last year #JPMorgan was shouting about how shite BitCoin was and how crypto is unsustainable! Now they have their own crypto called #JPMCoin and it’s the first one to be backed by a big financial institution! https://bloom.bg/2Go4put https://www.instagram.com/p/Bt-_HWcHe3t/?utm_source=ig_tumblr_share&igshid=ydz9k9lsfr7w

2 notes

·

View notes

Photo

Running #Zuckbucks and #JPMcoin will benefit #bitcoin ? (Silicon Valley) https://www.instagram.com/p/Bute7P7gqUg/?utm_source=ig_tumblr_share&igshid=e3m67scx791a

1 note

·

View note

Link

#latest cryptocurrency news#crypto#cryptocurrency#digitalcurrency#jpmorgan#jpmorganchase#stablecoin#cnbc#blockchain#honeywellinternational#facebook#umarfarooq#ripple#xrp#swift#jpmcoin#jamiedimon#coindelite#coindelitenews

1 note

·

View note

Text

JPMorgan Uses JPMCoin to Execute Blockchain-Based Repo Transaction

JPMorgan Uses JPMCoin to Execute Blockchain-Based Repo Transaction

Blockchain technology just got a major endorsement from one of the major finance players. JPMorgan Executes Blockchain-Powered Repo Transaction Using JPMcoin Wall Street titan JPMorgan on Thursday announced that it had executed a blockchain-enabled repo transaction using its JPMCoin. Notably, the announcement comes shortly after JPMorgan rebranded its blockchain unit – now called Onyx. TheRead More

https://btcmanager.com/jpmorgan-jpmcoin-execute-blockchain-repo-transaction/?utm_source=Tumblr&utm_medium=socialpush&utm_campaign=SNAP

0 notes

Text

Citi Scraps Its Plan for a JPM Coin-Like Bank-Backed Cryptocurrency

In light of the splash JPMorgan made recently with its plan for a bank-backed cryptocurrency, it’s worth remembering another big institution first tested a token to connect global payments – back in 2015.

Codenamed “Citicoin,” the project out of Citigroup’s innovation lab in Dublin was never formally announced by the bank, even as a proof of concept. The idea was to streamline global payment…

View On WordPress

#Banking#Business News#Citigroup#coindesk#Forex#JPMCoin#JPMorgan Chase#News#TCRNews#thecryptoreport#Trade Finance

0 notes

Photo

#dailycryptoupdate #cryptonews #crypscrow #disney #intalks #acquire #cryptoexchange #btc #indicator #signal #gains #chilean #government #bill #cryptocurrency #jpmcoin #negative #xrp #weiss https://www.instagram.com/crypscrow/p/BwleYj2gEPu/?utm_source=ig_tumblr_share&igshid=x395ykxh51dl

#dailycryptoupdate#cryptonews#crypscrow#disney#intalks#acquire#cryptoexchange#btc#indicator#signal#gains#chilean#government#bill#cryptocurrency#jpmcoin#negative#xrp#weiss

0 notes

Text

JP Morgan CEO Questions Bitcoin's Value Amidst Rising Prices: Is It Worth Anything? #Bitcoin #bitcoinprice #CEOofJPMorganChase #cryptocurrencymarket #JamieDimon #JPMCoin

0 notes

Text

Citibank not Really into Cryptocurrencies

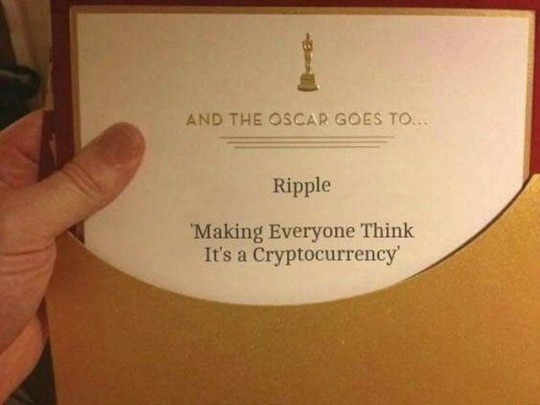

Citibank is one of the world's 20 largest banks in terms of asset value but it is reluctant to jump on the blockchain train. The entity once had a plan to launch its own cryptocurrency asset but it turns out it has since changed its stance. What's even weirder, is that instead of following the latest technology trends like many of its competitors, Citibank is betting on the same old SWIFT that drives everyone crazy. In times when big players such as JP Morgan are launching their own digital assets in hope of transforming the financial system, Citibank is more into developing and improving the already existing solutions. The global head of innovations for treasury and trade solutions at Citibank, Gulru Atak was quoted saying: “Based on our learnings from that experiment we actually decided to make meaningful improvements in the existing rails. We are considering the fintechs as well or the regulators around the world as well, including SWIFT.” Nevertheless, Citibank has been flirting with cryptocurrencies for quite a while now. In fact, rumor has it, the bank has been sniffing around digital assets since 2015. This led many to speculate that the entity was soon to launch its in-house token dubbed Citicoin. Well, it turns out that was never going to happen despite Citibank's head of innovation, Ken Moore, claims the bank is researching distributed ledger technologies. Despite the previously shown interest, Citibank is obviously on a hunt for short-term gains, as it appears unwilling to invest more time and funds into blockchain technology. The SWIFT payment system offers safety and while many institutions prefer to stay on the safe side, many others are tired of its tremendous tax rates and tens of others downsides. Over 10,000 financial entities use SWIFT, which means that transforming SWIFT would be much harder than jumping on the blockchain bandwagon at this very moment. Notably, Citibank is not entirely giving up on blockchain technologies as it is hoping one day they will indeed become the standard. It is just not into launching its own token. For better or worse JP Morgan did launch JPM Coin, which is so centralized that many experts refuse to deem it a cryptocurrency at all. Read the full article

0 notes

Photo

#share2steem #bitcoin over 4000 in the #wallstreetjournal HUGE deal for this to be in a newspaper back in 2017 when it first happened... no one was saying 4000 dollars was ANY sort of psychological milestone back in 2017 and when it happened the price soared past 5k 6k 7k didnt stop till it hit 8k and kept going to 19k before coming back down to 3.5k and now 4k . Since 2017 #banks want to or already have been buying bitcoin, so the next bull run is upon us, but I'm PRETTY SURE the banks want to make their own shit and will end up buying in at the last minute when btc is fucking 30k let's be real JPMorgan are not masterminds just because jaime daimon had corrupt mafia connections during 2009 doesnt make him a genius... fucking boot lickers in 2009 calling him.a genius when jaime daimon is a loser who hasnt innovated in his field, he just had the GOVERNMNET hand him some assets in 2009, and he doesnt experience a life any nicer than the average middle class American. His JPM coin is NOT a blockchain, maybe it has crypto and maybe it's a currency but not even, it's just jpm store credit that's it, and #jpmcoin by #jpmorgan @JPMorgan is a joke and everyone who is an expert in the NEW field of crypto knows this.... #blockchain #cryptocurrency #money #finance #wsj @wallstreetjournal https://www.instagram.com/p/BvKGcAsAUif/?utm_source=ig_tumblr_share&igshid=r6oqztn99v06

#share2steem#bitcoin#wallstreetjournal#banks#jpmcoin#jpmorgan#blockchain#cryptocurrency#money#finance#wsj

0 notes

Photo

#Repost @investmentsm (@get_repost) • • • Era habitual leer opiniones negativas de parte de la reconocida institución financiera refiriéndose a los criptoactivos, especialmente hacia el bitcoin, pero hace unas semanas eso cambió y nos tomó a todos por sorpresa cuando desde JP Morgan Chase, anunciaron el nacimiento de la JPM Coin, criptomoneda que muchos califican como un clon privado. . Fueron muchas las veces en que vimos a Jamie Dimon, CEO de JPMorgan, burlarse del bitcoin, criminalizarla e incluso llamarla fraude, cosa que entendemos porque los criptoactivos representan una amenaza para los modelos de negocios que la industria bancaria internacional ha mantenido durante décadas. . Sin embargo, podemos estar seguros que el anuncio de JPMorgan es un claro indicio que la adopción de los criptoactivos va a seguir avanzando, más alla de las cotizaciones de las criptomonedas o tokens en los mercados. Independientemente les guste o no a los bancos la naturaleza disruptiva y de empoderamiento que este conjunto de tecnologías les brinda a los usuarios, seguirá evolucionando. . ¿Qué crees que ocurrió para que en JPMorgan dieran este giro de 180 grados? . #JPMorganChase #JPMCoin #SMI #BTC #Criptomonedas #Bitcoin #Finanzas #Tecnología (en El Silencio, Distrito Federal, Venezuela) https://www.instagram.com/aaronolmos1/p/BufOtlqnPke/?utm_source=ig_tumblr_share&igshid=13mwup6h1mzhl

0 notes

Photo

#ABRA CEO: #JPMCOIN - a possible example of nonsense (J.P.Morgan) https://www.instagram.com/p/BuZAslqHZo5/?utm_source=ig_tumblr_share&igshid=1u0uwk28gkl03

0 notes

Link

JPMorgan Chase CEO, Jamie Dimon publicly announces his move into the cryptocurrency market. What is the reason behind this investment?

0 notes