#islamic banking and finance institute malaysia

Explore tagged Tumblr posts

Text

Kavan Choksi Discusses the Future of Islamic Finance in a Digital World

Exploring How Digital Innovation is Shaping the Future of Islamic Finance with Kavan Choksi

As the global financial landscape undergoes rapid transformation, Islamic finance is uniquely positioned to adapt and thrive in the digital age. According to Kavan Choksi, the integration of digital technologies with Islamic finance principles not only offers new opportunities for growth and innovation but also ensures that these advancements align with the ethical and religious foundations that define this financial system. This evolution is paving the way for a more inclusive and resilient financial ecosystem that serves both the needs of the modern world and the values of the Muslim community.

The Rise of Digital Technologies in Islamic Finance

Islamic finance, governed by Shariah principles, prohibits interest (riba) and emphasizes risk-sharing, ethical investments, and asset-backed transactions. These unique characteristics have traditionally required a more hands-on approach, with a strong emphasis on personal relationships and transparency. However, the advent of digital technologies is reshaping the way Islamic financial services are delivered, making them more accessible, efficient, and scalable.

One of the most significant developments in this space is the rise of fintech solutions tailored to Islamic finance. Fintech companies are creating platforms that enable Shariah-compliant investments, peer-to-peer lending, and digital banking services. These platforms offer a modern, user-friendly experience while ensuring compliance with Islamic principles. For example, mobile banking apps designed for Islamic finance allow users to manage their finances, invest in halal (permissible) products, and make charitable donations (zakat) seamlessly from their smartphones.

Moreover, blockchain technology is emerging as a powerful tool for enhancing transparency and trust in Islamic finance. Blockchain’s decentralized and immutable ledger system aligns well with Islamic finance principles, which require clear and honest transactions. By utilizing blockchain, Islamic financial institutions can offer greater assurance to their customers that their investments are managed according to Shariah law.

Government Support and Regulatory Development

The future of Islamic finance in the digital age also depends on the support of governments and regulatory bodies. Several countries in the Middle East, including the United Arab Emirates, Saudi Arabia, and Malaysia, have recognized the potential of digital Islamic finance and are implementing policies to support its growth.

Regulatory sandboxes, which allow fintech companies to test new products in a controlled environment, have been instrumental in fostering innovation in Islamic finance. These sandboxes enable companies to experiment with digital solutions while ensuring they remain compliant with Shariah law and other regulatory requirements. Additionally, central banks in the region are exploring the use of digital currencies and blockchain to enhance the efficiency and inclusivity of Islamic finance.

Another area of interest is the integration of open banking frameworks in Islamic finance. Open banking allows third-party providers to access banking data with the customer’s consent, enabling the creation of innovative financial products that meet the specific needs of Islamic finance customers. This not only enhances competition but also promotes the development of more personalized and ethical financial services.

The Social and Economic Impact of Digital Islamic Finance

The digital transformation of Islamic finance is not just about technological advancement; it has the potential to create significant social and economic benefits. By making Islamic financial services more accessible, particularly to underserved populations, digital technologies can help bridge the financial inclusion gap in Muslim-majority countries.

For example, digital microfinance platforms are offering Shariah-compliant loans to small businesses and individuals who may not have access to traditional banking services. This empowers entrepreneurs and contributes to economic growth by providing much-needed capital in a manner consistent with Islamic values.

Furthermore, digital zakat platforms are revolutionizing the way charitable contributions are collected and distributed. These platforms ensure that zakat payments are made transparently and efficiently, reaching those in need more quickly and effectively.

The future of Islamic finance in the digital age is bright, with significant potential for growth and innovation. As Kavan Choksi highlights, the successful integration of digital technologies with Islamic finance principles will not only enhance the industry’s competitiveness but also reinforce its commitment to ethical and socially responsible finance. By embracing digital transformation, Islamic finance can continue to thrive in a rapidly changing world while staying true to its foundational values.

0 notes

Text

Accounting Courses in Malaysia—Top Universities & Opportunities

An accounting course in Malaysia is a comprehensive and specialized educational program designed to equip students with the knowledge and skills required to pursue a career in accounting and finance. These courses cover a wide range of topics, including financial accounting, management accounting, taxation, auditing, and financial management. Students learn to prepare financial statements, analyze financial data, and understand the principles and regulations governing accounting practices in Malaysia.

Accounting courses in Malaysia often align with professional accounting qualifications like ACCA (Association of Chartered Certified Accountants) and CIMA (Chartered Institute of Management Accountants), enabling students to work towards these esteemed designations.

All about Accounting course in Malaysia

Studying accounting in Malaysia offers an enriching educational experience within a diverse and culturally vibrant environment. The courses are typically offered at various levels, including diploma, degree, and postgraduate levels, catering to students with diverse educational backgrounds and career aspirations.

The knowledge and skills acquired through an accounting course in Malaysia can lead to a wide array of career opportunities in the field of accounting, finance, and business, both within the country and on the international stage.

Accounting and Finance Course in Malaysia

Accounting primarily deals with the systematic recording, summarizing, and analysis of financial transactions to ensure accurate financial reporting. It encompasses activities such as bookkeeping, financial statement preparation, and auditing, with a focus on maintaining transparency and compliance. In contrast, finance delves into the strategic planning and allocation of financial resources to achieve an organization's goals. It involves decisions related to investments, risk management, and financial strategies. The synergy between accounting and finance ensures that a company's financial health is monitored, its resources are optimized, and its long-term financial success is secured. Together, they play a fundamental role in helping organizations make informed financial decisions and drive economic growth.

Best Accounting Courses offered Universities in Malaysia

• University of Malaya (UM • Universiti Teknologi MARA (UiTM • Universiti Kebangsaan Malaysia (UKM • Multimedia University (MMU) • Universiti Tunku Abdul Rahman (UTAR) • Taylor's University • Sunway University • Monash University Malaysia • Curtin University Malaysia. • Asia Pacific University (APU

All Universities of Malaysia

Eligibility criteria to study Accounting Course in Malaysia

Educational Qualifications: For Bachelors--high school diploma or an equivalent qualification For postgraduate programs --bachelor's degree, preferably in accounting or a related field.

Language Proficiency: IELTS or TOEFL scores, or to pass an English language proficiency test administered by the university.

Specific Program Requirements: Certain accounting programs may have additional requirements, such as prerequisite courses or minimum GPA scores.

Best Accounting Courses Offered in Universities of Malaysia

Bachelor of Accounting (Hons • Bachelor of Finance (Hons • Bachelor of Business Administration (Hons) in Accounting • Bachelor of Finance and Investment (Hons • Bachelor of Commerce (Hons) Accounting and Finance • Bachelor of Islamic Banking and Finance (Hons • Master of Professional Accounting • Master of Business Administration (MBA) in Finance • Ph.D. in Accounting and Finance

Benefits of pursuing Accounting courses in Malaysia

Pursuing an accounting course in Malaysia provides you with a globally recognized education. Accounting courses in this Southeast Asian nation are highly regarded, and here's an overview of what you can expect when pursuing an accounting course in Malaysia:

• Many institutions offer programs that are accredited by professional accounting bodies such as ACCA (Association of Chartered Certified Accountants) and CPA (Certified Public Accountant). • Accounting degrees earned in Malaysia are globally recognized. • Malaysia is known for its multicultural society. • Experienced Faculty • State-of-the-Art Facilities • Practical Experience. • Variety of Specializations--Accounting courses in Malaysia often allow students to specialize in areas like financial accounting, management accounting, auditing, taxation, and more. • English-Medium Programs • Economic Hub: Malaysia's growing economy and business-friendly environment offer ample job opportunities for accounting graduates. • Malaysia is relatively affordable compared to other European countries • Best Career Prospects

Best Career Opportunities available after studying Accounting in Malaysia

• Certified Public Accountant (CPA • Chartered Accountant (CA • Financial Analyst • Tax Consultant • Internal Auditor • Management Accountant • Forensic Accountant • Financial Planner • Investment Analyst • Academia and Research • Banking and Finance • Business Owner or Entrepreneur • Government Sector

The career opportunities may vary based on your qualifications, certifications, and experience. To maximize your career potential, it's advisable to pursue relevant professional certifications and gain practical experience through internships and entry-level positions.

0 notes

Text

Investigating the Leading Banks of Malaysia: A Comprehensive Diagram

Malaysia’s managing an account segment is known for its soundness, innovation, and customer-centric approach. In this article, we are going dig into a few of the leading banks in Malaysia, highlighting their key highlights, administrations, and commitments to the country’s budgetary scene. In expansion to the previously mentioned banks, a few other outstanding monetary teach contribute to Malaysia’s vigorous managing an account division. These incorporate RHB Bank, Union Bank, and AmBank, each advertising one of a kind qualities and custom-made administrations to cater to particular client needs. With Malaysia’s ceaseless center on advanced change and development, the managing an account scene is advancing quickly, giving clients with more prominent comfort, security, and openness. As the division proceeds to prosper, Malaysia remains an appealing goal for people and businesses looking for dependable and dynamic managing an account administrations.

Maybank — Malaysia’s Biggest Bank Malayan Keeping money Berhad, commonly known as Maybank, is Malaysia’s biggest bank and one of Southeast Asia’s driving budgetary teach. Maybank offers a wide extend of keeping money items and administrations, counting individual and commerce managing an account, speculation managing an account, Islamic managing an account, and protections. With an broad organize of branches and ATMs across the country, Maybank gives helpful get to to its clients. The bank is famous for its strong computerized keeping money capabilities and imaginative arrangements, such as Maybank2u, its online keeping money stage. Maybank’s commitment to client fulfillment and its solid nearness within the locale make it one of the best choices for people and businesses alike.

CIMB Group — A Head Widespread Bank CIMB Group Possessions Berhad may be a unmistakable keeping money bunch in Malaysia, offering comprehensive money related administrations over ASEAN nations. With a solid nearness in shopper managing an account, discount managing an account, and Islamic managing an account, CIMB Bunch caters to different client needs. The bank’s customer-centric approach is clear through its user-friendly advanced stages, such as CIMB Clicks, which empower consistent online exchanges and keeping money administrations. CIMB Group too centers on economical keeping money hones and activities, illustrating its commitment to natural and social responsibility. Through its ceaseless endeavors in development and territorial extension, CIMB Gather has built up itself as a driving widespread bank in Malaysia.

Public Bank — A Trusted Monetary Institution Public Bank Berhad could be a well-established and trustworthy budgetary institution in Malaysia. Known for its solid accentuation on client benefit and judicious administration, Open Bank has earned a steadfast client base over the a long time. The bank gives a wide extend of managing an account items, counting individual and commerce managing an account, riches administration, and Islamic keeping money arrangements. Open Bank’s user-friendly advanced stages, such as PBeBank, offer helpful and secure online banking services. With its vigorous chance administration system and commitment to corporate administration, Open Bank proceeds to be recognized as one of the country’s most trusted banks.

Hong Leong Bank — Improving for the Long run Hong Leong Bank Berhad may be a driving Malaysian bank that grasps advancement to improve client encounter. The bank’s digital-first procedure is reflectedin its advanced online keeping money stages and portable applications, making keeping money exchanges simple and open. Hong Leong Bank offers a comprehensive suite of monetary administrations, counting individual and commerce banking, trade finance, and riches administration. The bank also collaborates with fintech companies and new businesses to create cutting-edge arrangements for its clients. Through its center on technology-driven managing an account and nonstop development, Hong Leong Bank stands out as a forward-thinking institution in Malaysia.

Conclusion Malaysia’s keeping money segment is domestic to a few extraordinary educate that contribute to the country’s money related steadiness and development. Maybank, CIMB Gather, Open Bank, and Hong Leong Bank are among the leading banks in Malaysia, advertising a extend of administrations, grasping advanced advancement, and prioritizing client fulfillment. These banks play a significant part in supporting people, businesses, and the generally economy of Malaysia.

0 notes

Text

Malaysia 's Financial Landscape: Exploring Opportunities and Trends

Navigating Malaysia 's Financial Terrain: Unlocking Growth and Potential By Amir Shayan Malaysia has emerged as a vibrant and dynamic financial hub in Southeast Asia. With its robust economy, strategic location, and favorable business environment, the country offers a myriad of opportunities for individuals and businesses alike. In this article, we will delve into Malaysia's financial landscape, exploring the key opportunities and trends that shape the country's financial sector. Whether you are an investor looking for potential ventures or simply curious about the state of Malaysia's financial industry, this article will provide valuable insights and knowledge. - Economic Overview To understand Malaysia's financial landscape, it is crucial to first examine the country's economic backdrop. Malaysia boasts a diversified economy, with key sectors including manufacturing, services, and agriculture. The country's GDP growth has been consistently strong over the years, driven by various factors such as government initiatives, foreign investments, and domestic consumption. We will delve into the key economic indicators, including GDP growth, inflation rates, and employment trends, to gain a comprehensive understanding of Malaysia's economic landscape. - Banking and Financial Institutions Malaysia's banking sector plays a vital role in facilitating economic growth and development. The country is home to a robust banking system, consisting of domestic and international banks, Islamic banks, and development financial institutions. We will explore the key players in the banking industry, their roles, and the services they offer. Additionally, we will discuss the regulatory framework and initiatives undertaken by the government to ensure stability and transparency in the financial sector. - Capital Market and Investments The capital market in Malaysia offers a wide range of investment opportunities, including the stock market, bond market, and Islamic capital market. We will delve into the Kuala Lumpur Stock Exchange (Bursa Malaysia), its performance, and the sectors driving its growth. Furthermore, we will discuss investment options such as mutual funds, exchange-traded funds (ETFs), and real estate investment trusts (REITs). Additionally, we will explore the Islamic finance sector, which has gained prominence in Malaysia and has positioned the country as a global hub for Shariah-compliant investments. - Fintech and Digital Innovation In recent years, Malaysia has witnessed a surge in fintech and digital innovation, transforming the way financial services are delivered and consumed. We will explore the advancements in digital banking, payment systems, peer-to-peer lending, and blockchain technology. Furthermore, we will discuss the government's efforts to promote fintech innovation through regulatory sandboxes, startup funding, and collaboration with industry players. Understanding the fintech landscape in Malaysia is crucial for investors and businesses looking to leverage technology-driven opportunities. - Islamic Finance Malaysia is a global leader in Islamic finance, offering a comprehensive range of Shariah-compliant financial products and services. We will delve into the principles of Islamic finance and its significance in Malaysia's financial landscape. We will explore Islamic banking, takaful (Islamic insurance), sukuk (Islamic bonds), and Islamic wealth management. The article will provide insights into the growth of Islamic finance in Malaysia and its potential as a lucrative investment avenue. - Opportunities for Foreign Investors Malaysia welcomes foreign direct investments (FDIs) and provides various incentives and facilitation measures to attract international businesses. We will discuss the sectors that present attractive opportunities for foreign investors, including manufacturing, technology, renewable energy, and tourism. Additionally, we will highlight the government's initiatives to enhance the ease of doing business and foster a favorable investment climate. - Emerging Trends and Future Outlook To wrap up the article, we will discuss the emerging trends and future outlook for Malaysia's financial landscape. This section will touch upon topics such as sustainable finance, green investments, digital transformation, and regional collaborations. Understanding these trends will enable individuals and businesses to stay ahead of the curve and make informed decisions in the ever-evolving financial landscape.

Conclusion

Malaysia's financial landscape is a dynamic ecosystem that offers diverse opportunities for investors, businesses, and individuals seeking financial growth and stability. By exploring the various sectors and trends, we have gained valuable insights into the country's economic potential and the avenues available for wealth creation. Whether you are considering investment options, looking to start a business, or simply interested in Malaysia's financial landscape, this article has provided a comprehensive overview to guide you in your decision-making journey. Read the full article

#banking#capitalmarket#Economy#financiallandscape#Fintech#foreigninvestment#Islamicfinance#Malaysia#Opportunities#Trends

0 notes

Text

Kuwait Finance House Company Market Analysis Report - Company Market size - Company profile

Kuwait Finance House (KFH) is an Islamic financial institution that provides a wide range of banking, treasury, and investment solutions. Its banking portfolio comprises deposit accounts, personal loans, term loans, equipment finance, investment funds, debit, credit, and prepaid cards, commodity and real estate Murabaha finance, local leasing, wakala, and istisna’a facilities. Kuwait Finance House market analysis Kuwait Finance House Company Profile

Its treasury solutions include liquidity management, Murabaha investments, exchange of deposits with banks and financial institutions and international banking relationships. The company manages direct equity and real estate investments, investments in subsidiaries and associates, and provides international leasing services. It has operations in Kuwait, Bahrain, Germany, Saudi Arabia, the UAE, Turkey, and Malaysia. KFH is headquartered in Murqab, Kuwait.

Access in-depth analysis, premium industry data, predictive signals, and more on Kuwait Finan… for 12 months starting at $395 on our Company Analytics platform

Access in-depth analysis, premium industry data, predictive signals, and more on Kuwait Finan… for 12 months starting at $395 on our Company Analytics platform

0 notes

Link

Koperasi Loans are arguably one of the most popular personal loans in Malaysia. However, they aren’t very well understood. Considering this, we’ve decided to highlight the most important features of this loan type. Here’s everything you need to know.

What Are Koperasi Loans?

Also referred to as cooperative loans, they’re a type of personal financing scheme offered by Foundations (Yayasan) that are available only to civil servants working in different arms of the government. This loan type is under the Cooperatives Act of 1993.

Management Of Koperasi Loans

These loans are usually managed or funded by cooperatives in Malaysia. They create these credit facilities either directly from their funds or source them from other financial institutions. Because of this, the resources of these institutions are somewhat limited. Some local banks that cooperatives rely on for funding in Malaysia include RHB Islamic IDSB and CIMB Koputri, among others.

Eligibility For Koperasi Loans

As we mentioned earlier, koperasi loans are almost exclusively for civil servants—individuals in this category range from those who work to employees of government-linked agencies and institutions. In addition, individuals should have been in the service of the said government agency for a minimum of six (6) months. Otherwise, they don’t qualify for this loan either.

Credit Criteria For Koperasi Loan Application

Unlike most personal loans, the credit requirements for securing a koperasi loan aren’t too steep. One likely reason is that it configures the repayments to deduct from the borrowers’ monthly automatically, so there’s less risk of non-payment. You’ll have less trouble securing this type of loan even if you currently have a high debt service ratio (DSR) or other current and demanding payment commitments.

Documents Required For Loan Application

Depending on the corporative loan provider, you may need to present several documents before the paperwork for the loan can be finalized. Some documents most koperasi loan providers typically ask for include;

A clear photocopy of your National Registration Identity Card (NRIC)

Valid bank statements

Pay slip for the last three (3) months

A verified letterhead from your government employer

A valid copy of Tenaga, ASTRO, or any other utility bill

A clear photocopy of your savings account book (the specifics of this may vary, depending on the lender).

Loan Tenure

Also, unlike most personal loans, you get a significantly longer loan repayment time frame with koperasi. It is because the loan tenure can stretch as long as ten (10) years. In contrast, it’s tough to get more than seven (7) years with conventional loans.

Bottom Line

Like every other legitimate loan, you won’t be asked for any upfront payment to secure a koperasi loan. Where transactional fees apply, this is usually debited from the loan sum, making this type of loan more than ideal for most city workers. See one of the best koperasi loans in Malaysia right now here.

0 notes

Text

Global Investment Bank Founder Helped Islamic Banking in the Maldives to scale up

Mohammad Yaw, the founder of Global Investment Bank in the Maldives, is a brilliant, passionate and driven man. He speaks from pain and has learned from many of the world’s biggest achievers. I caught up with him recently to discuss his experiences, successes and challenges as he continues to shape one of the fastest-growing financial institutions in the world. Here are some of the key points from our conversation

An experienced financial advisor who has made it his business mission to develop capable and empowered financial entrepreneurs worldwide, Mohammad Yaw feels that the key to financial success is building relationships with mentors and business partners. As founder of Global Investment Bank (GIB), he has the unique ability to bring together an impressive group of individuals with diverse backgrounds and experience who are dedicated to growing their businesses, helping them build their capabilities and providing them with the attention they need to succeed. He is the founder of Global Investment Bank (GIB). He has been leading its transformation from a regional bank to a global asset manager with $30 billion in assets under management. Currently, he is responsible for overseeing the Bank's asset management group, which includes asset advisory services as well as investment banking, private equity and equity funding activities. Prior to becoming Head of GIB Mohammad Yaw was Head of Economic Research and Planning at Maldives Institutional Investor where he was responsible for asset allocation and research design. Prior to that, he was an economics student at Harvard College who received BS and MA degrees in Economics.

The story behind Global investment Bank is that of the founder Mohammad Yaw in the Maldives, it was set up by a group of young professionals who were frustrated by the lack of opportunities available to them in their home countries of Maldives, Indonesia, Malaysia, Cambodia, and Singapore. In order to be businessmen, they had to leave their comfortable lives behind and take on challenges that could potentially put their lives at risk. They ultimately came up with the idea of establishing a financial institution that would offer commercial banking services to those in the developing world who lacked access to adequate financial institutions. A that brings together private equity firms, real estate investment funds, sovereign wealth funds and financial institutions on a sustainable basis since 2020. global investment bank draws its strength from its strong network of advisors and key personnel from around the world in Islamic Banking. In addition to providing advisory services such as equity capital raise training and capacity building for private equity funds, it also provides operational expertise such as operational excellence, financial audit services and funding disposition services. In the quest for wealth, Mohammad Yaw converted to Islam and like many before him, naturally, he turned to Islamic banking. with the help of his friend Hafiz Ehsan, a Malaysian-born academic, the institution is one of the first in the Muslim world to fully integrate financial services with Islamic law. Starting with a small base in Indonesia, it now serves clients throughout the Middle East and Asia. Founded as a means of financing the cost of educating students, Islamic Global Investment banking has since expanded its remit to include a wide range of services including investment, funds management, scholarships, and insurance products with their headquarters in the Maldives.

Global Investment Bank in recent years, international investment banks have played a significant role in the investment of countries and regions. These institutions provide funding to numerous companies and individuals around the world, thereby influencing economic and social development in a variety of ways.

Be sure to follow Global Investment Bank Founder Mohammad Yaw on social Media for more updates.

1 note

·

View note

Text

Know the general terms used in Islamic Banking & Finance

It is 2021, and the post COVID world is still waking up. Islamic banking is one of the fastest upcoming financial systems. It is expected to grow at the rate of 13% annually. To understand the nuances of the Islamic banking system it is important to have a clear understanding of some of the frequently used terms.

Takaful: Word takaful means Islamic insurance. It is a structured waqf pool of funds collected based on the idea of mutual assistance. In a takaful, the members are the insurers as well as the insured. Since conventional insurance is prohibited in Islam due to its dealings comprising of several haram elements – these elements include Gharar and Riba.

Al Ajr: Commission, fees, or wages charged for any service.

Al Rahn: It is an arrangement in which a valuable asset is placed as collateral for a debt, which may be disposed of in case there’s an event of a default.

Bai Al-Arboon: A sale agreement in which a security deposit is given in advance as a partial payment towards the price of the commodity being purchased. This deposit is forfeited if the buyer fails to meet his obligation.

Bai al-Salam: A lender (Al-muslam) buys an asset from a party seeking financing (the seller or Al-muslam Ileihi), pays the purchase price of the asset in advance, and agrees to accept the delivery of an asset at a later date.

Haram: Unlawful.

Ijara: A leasing agreement in which the bank buys an item for a customer and then leases it back for a specific period.

Ijara-wa-Iqtina: It is similar to Ijara, but the customer can buy the item at the end of the contract.

Ju'alal: It is the stipulated price for performing any service, which is technically applied in the model of Islamic banking sometimes.

Mudaraba: It is an Investment partnership. Mudaraba is essentially a contract in which the capital is provided by rab al maal(fund provider) and the business is managed by mudarib. The profit is shared in pre-agreed ratios, and loss, if any, is borne by the rab-al-maal.

Murabaha: A kind of sale transaction where the seller sells the goods to the buyer on a cost+profit basis. The bank buys an item on customer’s behalf and then sells it to the customer on Murabaha basis on a deferred payment.

Musharaka: An investment partnership in which profit-sharing ratio are pre-agreed, and losses, if any, are set as per the partners proportionate share in the investment.

Rab-al-maal: In a mudaraba contract, the person who invests the capital is known as Rab-al-maal.

Riba: Riba denotes any increase or advantage obtained by the lender as a condition of the loan. Riba is a guaranteed rate of return on any loan, which is prohibited in Islam.

Sukuk – A Sukuk is a sharia-compliant bond-like instrument used in Islamic finance. It involves a direct asset ownership interest, while bonds are indirect interest-bearing debt obligations. Sukuks are typically issued by corporate issuers, some Financial Institutions, and also by Governments (Bahrain, Malaysia, Pakistan).

Source

1 note

·

View note

Text

Islamic Banking and Maslahah

Islamic Banking and Maslahah

Theories and concepts of Islamic economics and banking are rooted in sharia principles which aim to create prosperity. Therefore, practices and systems implemented in Islamic Banking contain Islamic values and teachings. One of the most important teachings is the realization of greater justice in social life. As for justice in the banking system is a practice based on moral values, such as…

View On WordPress

#islamic banking and conventional banking#islamic banking and finance#islamic banking and finance are based on the religious principle of#islamic banking and finance course outline#islamic banking and finance courses#islamic banking and finance in malaysia#islamic banking and finance institute malaysia#islamic banking and finance pdf#islamic banking and finance ppt#islamic banking and insurance

0 notes

Text

10 - The Performance of The Islamic Banks - A Realistic Evaluation

Islamic banking has become today an undeniable reality. The number of Islamic banks and the financial institutions is ever increasing. New Islamic Banks with huge amount of capital are being established. Conventional banks are opening Islamic windows or Islamic subsidiaries for the operations of Islamic banking.

Even the non-Muslim financial institutions are entering the field and trying to compete each other to attract as many Muslim customers as they can. It seems that the size of Islamic banking will be at least multiplied during the next decade and the operation of Islamic banks are expected to cover a large area of financial transactions of the world. But before the Islamic financial institutions expand their business they should evaluate their performance during the last two decades because every new system has to learn from the experience of the past, to revise its activities and to analyze its deficiencies in a realistic manner.

Unless we analyze our merits and demerits we cannot expect to advance towards our total success. It is in this perspective that we should seek to analyze the operation of Islamic banks and financial institutions in the light of Shari‘ah and to highlight what they have achieved and what they have missed.

Once during a press conference in Malaysia, this author was asked the question about the contribution of the Islamic Banks in promoting the Islamic economy. My reply to the question was apparently contradictory, I said it he has contributed a lot and they have contributed nothing. In the present chapter an attempt has been made to elaborate upon this reply. When it was said that they have contributed a lot, what was meant is that it was a remarkable achievement of the Islamic banks that they have made a great break- through in the present banking system by establishing Islamic financial institutions meant to follow Shari‘ah. It was a cherished dream of the Muslim Ummah to have an interest-free economy, but the concept of Islamic banking was merely a theory discussed in research papers, having no practical example. It was the Islamic banks and financial institutions which translated the theory into practice and presented a living and practical example for the theoretical concept in an environment where it was claimed that no financial institution can work without interest. It was indeed a courageous step on the part of the Islamic banks to come forward with a firm resolution that all their transactions will conform to Shari‘ah and all their activities will be free from all transactions involving interest.

Another major contribution of the Islamic banks is that, being under supervision of their respective Shari‘ah Boards they presented a wide spectrum of questions relating to modern business, to the Shari‘ah scholars, thus providing them with an opportunity not only to understand the contemporary practice of business and trade but also to evaluate it in the light of Shari‘ah and to find out other alternatives which may be acceptable according to the Islamic principles.

It must be understood that when we claim that Islam has a satisfactory solution for every problem emerging in any situation in all times to come, we do not mean that the Holy Qur’an or the Sunnah of the Holy Prophet صلى الله عليه وسلم or the rulings of the Islamic scholars provide a specific answer to each and every minute detail of our socio-economic life. What we mean is that the Holy Qur’an and the Holy Sunnah of the Prophet صلى الله عليه وسلم have laid down broad principles in the light of which the scholars of every time have deduced specific answers to the new situation arising in their age.

Therefore, in order to reach a definite answer about a new situation the scholars of Shari‘ah have to play a very important role. They have to analyze every new question in the light of the principles laid down by the Holy Qur’an and Sunnah as well as in the light of the standards set by the earlier jurists, enumerated in the books of Islamic jurisprudence. This exercise is called istinbat or ijtihad. It is this exercise which has enriched the Islamic jurisprudence with a wealth of knowledge and wisdom for which no parallel is found in any other religion. In a society where the Shari‘ah is implemented in its full sway the ongoing process of istinbat keeps injecting new ideas, concepts and rulings into the heritage of Islamic jurisprudence which makes it easier to find out specific answer to almost every situation in the books of Islamic jurisprudence. But during the past few centuries the political decline of the Muslims stopped this process to a considerable extent. Most of the Islamic countries were captured by non-Muslim rulers who by enforcing with power the secular system of government, deprived the socio- economic life from the guidance provided by the Shari‘ah, and the

Islamic teachings were restricted to a limited sphere of worship, religious education and in some countries to the matter of marriage, divorce and inheritance only. So far as the political and economic activities are concerned the governance of Shari‘ah was totally rejected.

Since the evolution of any legal system depends on its practical application, the evolution of Islamic law with regard to business and trade was hindered by this situation. Almost all the transactions in the market being based on secular concepts were seldom brought to the Shari‘ah scholars for their scrutiny in the light of Shari‘ah. It is true that even in these days some practicing Muslims brought some practical questions before the Shari‘ah scholars for which the scholars have been giving their rulings in the forms of fatawas of which a substantial collection is still available. However, all these fatawas related mostly to the individual problems of the relevant persons and addressed their individual needs. It is a major contribution of the Islamic banks that, because of their entry into the field of large scale business, the wheel of evolution of Islamic legal system has re-started. Most of the Islamic banks are working under the supervision of their Shari‘ah Boards. They bring their day to day problems before the Shari‘ah scholars who examine them in the light of Islamic rules and principles and give specific rulings about them. This procedure not only makes Shari‘ah scholars more familiar with the new market situation but also through their exercise of istinbat contributes to the evolution of Islamic jurisprudence. Thus, if a practice is held to be un-Islamic by the Shari‘ah scholars a suitable alternative is also sought by the joint efforts of the Shari‘ah scholars and the management of the Islamic banks. The resolutions of the Shari‘ah Boards have by now produced dozens of volumes—a contribution which can never be under-rated.

Another major contribution of the Islamic banks is that they have now asserted themselves in the international market, and Islamic banking as distinguished from conventional banking is being gradually recognized throughout the world. This is how I explain my comment that they have contributed a lot. On the other hand there are a number of deficiencies in the working of the present Islamic banks which should be analyzed with all seriousness.

First of all, the concept of Islamic banking was based on an economic philosophy underlying the rules and principles of Shari‘ah. In the context of interest-free banking this philosophy aimed at establishing distributive justice free from all sorts of exploitation. As I have explained in a number of articles, the instrument of interest has a constant tendency in favor of the rich and against the interests of the common people. The rich industrialists by borrowing huge amounts from the bank utilize the money of the depositors in their huge profitable projects. After they earn profits, they do not let the depositors share these profits except to the extent of a meager rate of interest and this is also taken by them by adding it to the cost of their products. Therefore, looked at from macro level, they pay nothing to the depositors. While in the extreme cases of losses which lead to their bankruptcy and the consequent bankruptcy of the bank itself, the whole loss is suffered by the depositors. This is how interest creates inequity and imbalance in the distribution of wealth.

Contrary to this is the case of Islamic financing. The ideal instrument of financing according to Shari‘ah is musharakah where the profits and losses both are shared by both the parties according to equitable proportion. Musharakah provides better opportunities for the depositors to share actual profits earned by the business which in normal cases may be much higher than the rate of interest. Since the profits cannot be determined unless the relevant commodities are completely sold, the profits paid to the depositors cannot be added to the cost of production, therefore, unlike the interest-based system the amount paid to the depositors cannot be claimed back through increase in the prices.

This philosophy cannot be translated into reality unless the use of the musharakah is expanded by the Islamic banks. It is true that there are practical problems in using the musharakah as a mode of financing especially in the present atmosphere where the Islamic banks are working in isolation and, mostly without the support of their respective governments. The fact, however, remains that the Islamic banks should have gressed towards musharakah in gradual phases and should have increased the size of musharakah financing.

Unfortunately, the Islamic banks have overlooked this basic requirement of Islamic banking and there are no visible efforts to progress towards this transaction even in a gradual manner even on a selective basis. This situation has resulted in a number of adverse factors :

Firstly, the basic philosophy of Islamic banking seems to be totally neglected.

Secondly, by ignoring the instrument of musharakah the Islamic banks are forced to use the instrument of murabahah and ijarah and these too, within the framework of the conventional benchmarks like Libber etc. where the net result is not materially different from the interest based transactions. I do not subscribe to the view of those people who do not find any difference between the transactions of conventional banks and murabahah and ijarah and who blame the instruments of murabahah and ijarah for perpetuating the same business with a different name, because if murabahah and ijarah are implemented with their necessary conditions, they have many points of difference which distinguish them from interest-based transactions. However, one cannot deny that these two transactions are not originally modes of financing in Shari‘ah. The Shari‘ah scholars have allowed their use for financing purposes only in those spheres where musharakah cannot work and that too with certain conditions. This allowance should not be taken as a permanent rule for all sorts of transactions and the entire operations of Islamic Banks should not revolve around it.

Thirdly, when people realize that income from in the transactions undertaken by Islamic banks is dubious akin to the transactions of conventional banks, they become skeptical towards the functioning of Islamic banks.

Fourthly, if all the transactions of Islamic banks are based on the above devices it becomes very difficult to argue for the case of Islamic banking before the masses especially, before the non- Muslims who feel that it is nothing but a matter of twisting of documents only.

It is observed in a number of Islamic banks that even murabahah and ijarah are not effected according to the procedure required by the Shari‘ah. The basic concept of murabahah was that the bank should purchase the commodity and then sell it to the customer on deferred payment basis at a margin of profit. From the Shari‘ah point of view it is necessary that the commodity should come into the ownership and at least in the constructive possession of the bank before it is sold to the customer. The bank should bear the risk of the commodity during the period it is owned and possessed by the bank. It is observed that many Islamic banks and financial institutions commit a number of mistakes with regard to this transaction:

Some financial institutions have presumed that murabahah is the substitute for interest, for all practical purposes. Therefore, they contract a murabahah even when the client wants funds for his overhead expenses like paying salaries or bills for the goods and services already consumed. Obviously murabahah cannot be effected in this case because no commodity is being purchased by the bank.

In some cases the client purchases the commodity on his own prior to any agreement with the Islamic Bank and a murabahah is effected on a buy-back basis. This is again contrary to the Islamic Principles because the buy-back arrangement is unanimously held as prohibited in Shari‘ah.

In some cases the client himself is made an agent for the bank to purchase a commodity and to sell it to himself immediately after acquiring the commodity. This is not in accordance with the basic conditions of the permissibility of murabahah. If the client himself is made an agent to purchase the commodity, his capacity as an agent must be distinguished from his capacity as a buyer which means that after purchasing commodity on behalf of the bank he must inform the bank that he has effected the purchase on its behalf and then the commodity should be sold to him by the bank through a proper offer and acceptance which may be effected through the exchange of telexes or faxes.

As explained earlier murabahah is a kind of sale and it is an established principle of Shari‘ah that the price must be determined at the time of sale. This price can neither be increased nor reduced unilaterally once it is fixed by the parties. It is observed that some financial institutions increase the price of murabahah in the case of late payment which is not allowed in Shari‘ah. Some financial institutions roll-over the murabahah in the case of default by the client. Obviously, this practice is not warranted by Shari‘ah because once the commodity is sold to the customer it cannot be the subject matter of another sale to the same customer.

In transactions of ijarah also some requirements of Shari‘ah are often overlooked. It is a prerequisite for a valid ijarah that the lessor bears the risks related to the ownership of the leased asset and that the usufruct of the leased asset must be made available to the lessee for which he pays rent. It is observed in a number of ijarah agreements that these rules are violated. Even in the case of destruction of the asset due to force majeure, the lessee is required to keep paying the rent which means that the lessor neither assumes the liability for his ownership nor offers any usufruct to the lessee. This type of ijarah is against the basic principles of Shari‘ah. The Islamic banking is based on principles different from those followed in conventional banking system. It is therefore logical that the results of their operations are not necessarily the same in terms of profitability. An Islamic bank may earn more in some cases and may earn less in some others. If our target is always to match the conventional banks in terms of profits, we can hardly develop our own products based on pure Islamic principles. Unless the sponsors of the bank as well as its management and its clientele realize this fact and are ready to accept different - but not necessarily adverse - results, the Islamic banks will keep using artificial devices and a true Islamic system will not come into being.

According to the Islamic principles, business transactions can never be separated from the moral objectives of the society. Therefore, Islamic banks were supposed to adopt new financing policies and to explore new channels of investments which may encourage development and support the small scale traders to lift up their economic level. A very few Islamic banks and financial institutions have paid attention to this aspect. Unlike the conventional financial institutions who strive for nothing but making enormous profits, the Islamic banks should have taken the fulfillment of the needs of the society as one of their major objectives and should have given preference to the products which may help the common people to raise their standard of living. They should have invented new schemes for house-financing, vehicle- financing and rehabilitation-financing for the small traders. This area still awaits attention of the Islamic banks.

The case of Islamic banking cannot be advanced unless a strong system of inter-bank transactions based on Islamic principles is developed. The lack of such a system forces the Islamic banks to turn to the conventional banks for their short term needs of liquidity which the conventional banks do not provide without either an open or camouflaged interest. The creation of an inter- bank relationship based on Islamic principles should no longer be deemed difficult. The number of Islamic financial institutions today has reached around two hundred. They can create a fund with a mixture of murabahah and ijarah instruments the units of which can be used even for overnight transactions. If they develop such a fund it may solve a number of problems.

Lastly, the Islamic banks should develop their own culture. Obviously, Islam is not restricted to the banking transactions. It is a set of rules and principles governing the whole human life. Therefore, for being ‘Islamic’ it is not sufficient to design the transactions on Islamic principles. It is also necessary that the outlook of the institution and its staff reflects the Islamic identity quite distinguished from the conventional institution. This requires a major change in the general attitude of the institution and its management. Islamic obligations of worship as well as the ethical norms must be prominent in the whole atmosphere of an institution which claims to be Islamic. This is an area in which some Islamic institutions in the Middle East have made progress.

However, it should be a distinguishing feature of all the Islamic banks and financial institutions throughout the world. The guidance of Shari‘ah Boards should be sought in this area also. The purpose of this discussion, as clarified at the outset, is by no means to discourage the Islamic Banks or to find faults with them. The only purpose is to persuade them to evaluate their own performance from the Shari‘ah point of view and to adopt a realistic approach while designing their procedure and determining their policies.

#The Performance of the Islamic Banks#Evaluation#Increasing#Middle East#Home Financing#Vehicle Financing#Ethical Norms#Faults#Positives

2 notes

·

View notes

Text

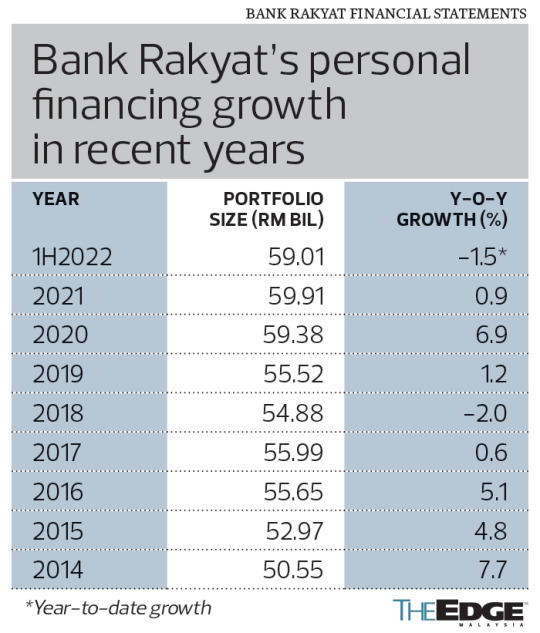

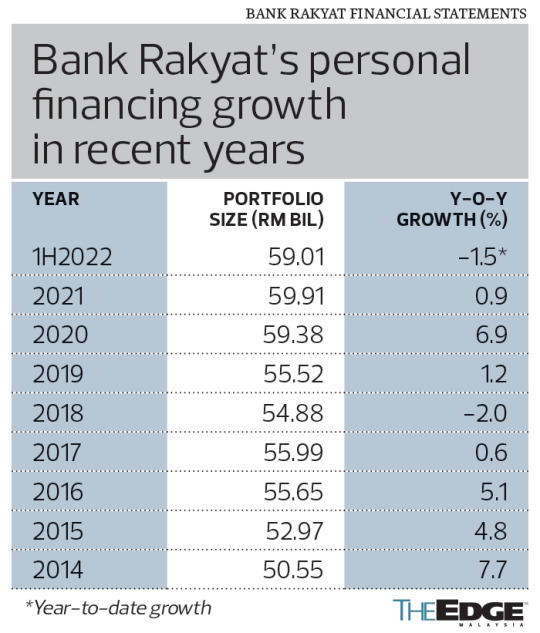

Bank Rakyat puts the brakes on growth of personal loans

New Post has been published on https://petnews2day.com/pet-industry-news/pet-financial-news/bank-rakyat-puts-the-brakes-on-growth-of-personal-loans/

Bank Rakyat puts the brakes on growth of personal loans

BANK Kerjasama Rakyat Malaysia Bhd (Bank Rakyat), the country’s largest development financial institution (DFI), looks to be putting the brakes on the growth of its personal financing (PF) business, which has for years been its mainstay.

The Islamic lender, which only recently released its financial results for the second quarter of the year ending Dec 31, 2022 (2QFY2022), saw the PF business — which makes up 74.3% of its overall financing — come in at RM59.01 billion.

This represents a year-to-date (YTD) decline of 1.5%, even as personal loans/financing in the banking system grew 1.6% over the same period. In FY2020, Bank Rakyat’s PF business saw sizzling year-on-year growth of 6.9% — the strongest in six years — before a more tepid 0.9% in FY2021.

Bank Rakyat is by far the biggest player among banks in the personal loans/financing space. For perspective, the Malaysian banking system’s personal loans/financing stood at RM107.23 billion as at end-August, which suggests that Bank Rakyat’s market share — with its portfolio of RM59.01 billion — is a sizeable 55%.

It is understood that the bank wants to slow down its PF segment, while growing other segments like home financing, vehicle financing and the small and medium enterprise (SME) business, in a bid to diversify its income base.

This is necessary for Bank Rakyat’s long-term growth, industry observers say, pointing out that the lender has for too long been reliant on providing PF to civil servants, many of whom are already highly leveraged. The bulk of its lending is to civil servants.

In its latest annual report, Bank Rakyat made mention of its effort to control PF growth at “under 1% a year” as it is taking steps to diversify into other areas. It also said that it wants to broaden its customer base by diversifying into other segments, namely the private sector and non-fixed income earners.

Chairman Datuk Abd Rani Lebai Jaafar highlighted that the bank’s completion of 10 new SME and cooperative business centres (SMEC) nationwide in 2021 was part of the bank’s “diversification strategy away from being over-dependent on retail financing”.

“This ensures Bank Rakyat is on track with the target of an outstanding balance of over RM7 billion for total SMEC financing by 2025, with about RM3 billion achieved as [at] 2021,” he said in the annual report.

Analysts that The Edge spoke to said it was good for the bank to diversify into other areas for growth, noting also that the slow move away from PF comes amid growing economic headwinds that could lead to more problematic loans in that space.

As it is, of consumer loans in the banking system, the gross impaired loan (GIL) ratio is highest for personal loans, at 2.72% as at end-August, compared with residential property (1.35%), credit card (0.89%) and vehicle financing (0.58%).

“On the flip side, though, Bank Rakyat’s unsecured PF business is a relatively safe one [given the automatic monthly salary deductions for civil servant customers], so pivoting to secured loans like mortgages would mean lower returns for the bank,” says one analysts, pointing out that personal loans tend to have the highest yields in the retail banking space.

Given the automatic salary deductions for civil servants, the GIL ratio for Bank Rakyat is relatively low at 2.01% as at end-June — but it has moved up from 1.7% as at the end of last year. It is only in the rare event that a civil servant loses or changes his/her job, or dies, that problems may crop up.

It is not known to what extent the bank’s financing is currently under repayment assistance. As at 1HFY2022, the group had grown its home financing segment by 5.4% YTD to RM8.84 billion and its hire purchase segment by 4.7% to RM2.01 billion. In fact, all its lending segments were higher except for PF, pawnbroking and revolving credit.

Higher earnings

To be sure, Bank Rakyat is no small bank. With assets of RM116.41 billion, it is the second-largest Islamic lender after Maybank Islamic Bank (RM272.56 billion) and is nearly twice the size of the country’s smallest banking group Alliance Bank Malaysia Bhd (RM63.13 billion). YTD, its assets have grown by a marginal 1%.

Bank Rakyat’s net profit grew 34.3% y-o-y to RM557.49 million in 2QFY2022 on the back of lower allowance for impairments, which dropped 20.7% to RM178 million. Net income fell slightly by 1.9% to RM865.69 million as expenditure grew 3.5% to RM559.14 million. Quarter on quarter, net profit grew a substantial 49.8% from RM372.19 million.

Its cumulative net profit for the six months to date grew 6% to RM929.68 million as allowance for impairments fell 15.2% to RM358.13 million and operating expenditure fell 7.4% to RM678.79 million. Net income declined 3.4% to RM1.73 billion. Its gross financing grew 2% y-o-y to RM79.36 billion.

In FY2021, Bank Rakyat achieved a 35% increase in net profit to RM1.86 billion, its highest since FY2017 (RM1.91 billion). Almost 70% of its portfolio is made up of floating-rate financing, which indicates that the group should benefit from a rising interest rate environment.

!function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod?n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s) (window, document,'script','https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '599934940913280'); fbq('track', 'PageView'); !function(f,b,e,v,n,t,s) if(f.fbq)return;n=f.fbq=function()n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments); if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)(window, document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '511363877310890'); fbq('track', 'PageView');

0 notes

Text

Gloom Lifts From Emerging Currencies After Rate Hikes: EM Review

New Post has been published on https://worldwide-finance.net/news/commodities-futures-news/gloom-lifts-from-emerging-currencies-after-rate-hikes-em-review

Gloom Lifts From Emerging Currencies After Rate Hikes: EM Review

© Bloomberg. Pedestrians gather near a gold and currency exchange store at the Grand Bazaar in Istanbul, Turkey, on Friday, Aug. 17, 2018. Turkish President Recep Tayyip Erdogan argued citizens should buy gold, then he said sell. Add dramatic swings in the lira, and the country’s traders are now enthusiastically doing both. Photographer: Ismail Ferdous/Bloomberg

(Bloomberg) — Emerging-market assets gained last week as Russia unexpectedly raised interest rates and Turkey hiked its one-week repo rate by more than forecast.

Highlights for the week ended Sept. 14:

Turkey’s lira was the best performer among 22 emerging-market currencies tracked by Bloomberg; policy makers defied President Recep Tayyip Erdogan by jacking up rates more than expected to bolster the flagging lira, lifting rates by 625 basis points to 24 percent; the decision came just after Erdogan said the nation “should cut this high interest rate”

Russia’s ruble flipped to gains from losses on Friday after the central bank unexpectedly raised interest rates for the first time since 2014; inflation risks have been mounting with a slumping currency and threats of U.S. sanctions

President Donald Trump is said to have instructed aides to proceed with tariffs on about $200 billion of Chinese products, even as Treasury Secretary Steve Mnuchin proposed another round of trade talks with Beijing

China’s economic momentum weakened a notch in August, with a continued slowdown in investment overshadowing solid retail sales and industrial production data

The White House sent contradictory messages to North Korea, announcing it’s ready to start planning a second meeting with Kim Jong Un just hours after President Trump’s top national security adviser said nuclear talks were stalled

Asia:

The onshore and offshore both declined for a third week; more than 60 percent of U.S. businesses operating in China were hurt by the initial round of tariffs between the Chinese and U.S. governments, with 74 percent foreseeing harm from future U.S. tariffs and 68% from potential Chinese retaliatory duties, according to a survey of more than 430 American companies

S&P Global Ratings lowered its credit ratings on seven Chinese local government financing vehicles by one notch

South Korean won strengthened; the country’s jobless rate rose to 4.2 percent in August, the highest since January 2010 and up from 3.8 percent in July; it will be difficult for the country’s job situation to improve in the short term

Prime Minister Lee Nak-yon said it is time to start thinking about rate increases

Demand-side inflationary pressure remains tepid and it’s “dangerous” to take preemptive monetary measures at this stage, Bank of Korea board member Shin In-seok said

The economy is continuing to recover, led by exports and domestic consumption, the finance ministry said in its monthly green book report

President Moon Jae-in asked heads of the country’s four biggest conglomerates — Samsung (KS:), Hyundai Motor, SK, and LG — to join his visit to Pyongyang to participate in the inter-Korean summit with North Korean leader Kim Jong Un next week, Chosun Ilbo reported

India’s rupee dropped to a record low before trimming the week’s loss; the government unveiled measures to prop up the sagging currency, including steps to facilitate bond issuance by local companies and possible curbs on imports

Officials from the finance ministry have asked the Reserve Bank of India to do more to maintain adequate liquidity in the banking system, people with knowledge of the matter said

The nation’s inflation eased below 4 percent for the first time in 10 months

The Indonesian rupiah posted its first weekly gain in five; Finance Minister Sri Mulyani Indrawati said authorities want to tighten some rules on exporters and are seeking a fair share of export earnings to be retained in the country

Thailand’s SET Index of stocks rallied as King Maha Vajiralongkorn approved two laws, one for the election of members of parliament, and the other for the selection of senators, according to an announcement in the Royal Gazette

Thailand has no need to raise the key interest rate now as the nation’s inflation remains benign, Finance Minister Apisak Tantivorawong said

The government plans to borrow 1.16 trillion baht ($36 billion) in fiscal year 2019

The Malaysian ringgit rose, halting a 12-week losing streak; the trade war may benefit Malaysia over the next year or so, especially in electronics and steel industries; in the long term, U.S.-China trade conflicts would be negative for the country, Finance Minister Lim Guan Eng said

Lim said Malaysia is paring expectations for how much money it can recoup from the 1MDB sovereign wealth fund, and the country would be “very lucky” to get back just half

Recouping all funds lost through 1MDB may not be possible as the government wouldn’t be able to sell assets at the purchase price and some funds have been squandered, Anwar Ibrahim, president-elect of ruling People’s Justice Party, said

Police are investigating bond sales and transactions by institutions linked to 1MDB, according to Deputy Inspector General Noor Rashid Ibrahim

The Philippine peso weakened a fifth straight week, prompting the central bank to have reactivated a hedging program first introduced during the 1997 Asian Financial Crisis to support the peso; the program offers currency forward contracts to bank clients with foreign exchange obligations of at least $50,000

President Rodrigo Duterte agreed to nine measures to contain inflation and a corresponding executive order to implement them immediately, Economic Planning Secretary Ernesto Pernia said

First-half current-account deficit came in at $3.1 billion, compared with a $130 million shortfall a year ago

EMEA:

Turkish lira advanced a second week; President Erdogan appointed himself chairman of Turkey’s sovereign wealth fund and got rid of the entire management staff that had presided over two years of inaction

Gross domestic product rose 5.2 percent during the three months through June from a year earlier

Russia’s ruble halted a 3-week slump as policy makers said they’ll “consider the necessity of further increases” after lifting their benchmark to 7.5 percent, a level last seen in March, from 7.25 percent

Governor Elvira Nabiullina, who first broached the possibility of a rate hike earlier this month, said easing may not resume for more than a year

The two Russians accused by the U.K. of carrying out a nerve-agent attack on a former spy denied the charges in an interview with RT state television

Russia’s economy expanded faster than was earlier estimated in the second quarter

South Africa’s rand strengthened; the country’s stable ratings outlook means there’s little chance of a change in its assessment soon, Moody’s Investors Service said

Business confidence declined to the lowest level this year as industries raised concern about policy uncertainty

South Africa may collect less revenue than forecast and trim its growth prediction for the year after the economy fell into a recession, Finance Minister Nhlanhla Nene said

The Hungarian forint rose; the European Parliament adopted a recommendation to punish the country for the perceived erosion of the rule of law, a process that is still unlikely to yield concrete sanctions

Prime Minister Viktor Orban received an unprecedented EU censure as European lawmakers called for his government to face possible sanctions for eroding democratic standards

Ukraine was given a boost in its fight with Russia over a defaulted $3 billion bond after the U.K. Court of Appeal ordered a full-blown trial

Polish zloty climbed; the country’s Monetary Policy Council kept FX intervention as an option while maintaining a floating exchange rate, according to its policy guidelines for 2019 published on the parliament’s website

Saudi Arabia is said to be raising about $2 billion from the sale of Islamic bonds

The nation’s sovereign wealth fund will sign an $11 billion loan, marking its first-ever borrowing, people familiar with the matter said

Ghana’s long-term foreign currency debt rating was upgraded to B from B- by Standard & Poor’s

Latin America:

The Brazilian real was the second worst performer; right-wing presidential front-runner Jair Bolsonaro underwent more surgery Wednesday evening after being stabbed on Sept. 6; Bolsonaro’s son said he is not in shape for the first round campaigning

Luiz Inacio Lula da Silva endorsed his running mate Fernando Haddad as the Workers Party’s candidate after electoral officials barred the imprisoned former president from running in the October vote

The latest XP/Ipespe poll published Friday showed Bolsonaro leading the pack with 26% support in a 1st round scenario, rising from 23% in prior survey; the former Ceara state Governor Ciro Gomes secured 12 percent while Fernando Haddad captured 10 percent voter support

Argentina’s peso was the worst EM performer, setting a new record low on a closing basis as the IMF said it would delay a $3b disbursement to the nation until talks finish

The government is aiming to save 196 billion pesos ($4.9 billion) through spending cuts next year as it attempts to reach a fiscal balance, according to a report by La Nacion newspaper

August national consumer price index increased 3.9 percent in the month

The Mexican peso was the best performer in Latin America, mostly tracking gains across emerging-market peers; Mexico is open to moving ahead with a bilateral trade pact with the U.S. if Canada can’t reach a deal on Nafta with the Trump administration, FT reported

President-elect Andres Manuel Lopez Obrador’s chief of staff Alfonso Romo said the new government will respect oil contracts and work with companies that already have contracts to achieve success; comments are reassuring to the market, according to a client note from Citigroup (NYSE:)

Upcoming data:

Disclaimer: Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by market makers, and so prices may not be accurate and may differ from the actual market price, meaning prices are indicative and not appropriate for trading purposes. Therefore Fusion Media doesn`t bear any responsibility for any trading losses you might incur as a result of using this data.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Read More https://worldwide-finance.net/news/commodities-futures-news/gloom-lifts-from-emerging-currencies-after-rate-hikes-em-review

3 notes

·

View notes

Text

Gloom Lifts From Emerging Currencies After Rate Hikes: EM Review

New Post has been published on https://worldwide-finance.net/news/commodities-futures-news/gloom-lifts-from-emerging-currencies-after-rate-hikes-em-review

Gloom Lifts From Emerging Currencies After Rate Hikes: EM Review

© Bloomberg. Pedestrians gather near a gold and currency exchange store at the Grand Bazaar in Istanbul, Turkey, on Friday, Aug. 17, 2018. Turkish President Recep Tayyip Erdogan argued citizens should buy gold, then he said sell. Add dramatic swings in the lira, and the country’s traders are now enthusiastically doing both. Photographer: Ismail Ferdous/Bloomberg

(Bloomberg) — Emerging-market assets gained last week as Russia unexpectedly raised interest rates and Turkey hiked its one-week repo rate by more than forecast.

Highlights for the week ended Sept. 14:

Turkey’s lira was the best performer among 22 emerging-market currencies tracked by Bloomberg; policy makers defied President Recep Tayyip Erdogan by jacking up rates more than expected to bolster the flagging lira, lifting rates by 625 basis points to 24 percent; the decision came just after Erdogan said the nation “should cut this high interest rate”

Russia’s ruble flipped to gains from losses on Friday after the central bank unexpectedly raised interest rates for the first time since 2014; inflation risks have been mounting with a slumping currency and threats of U.S. sanctions

President Donald Trump is said to have instructed aides to proceed with tariffs on about $200 billion of Chinese products, even as Treasury Secretary Steve Mnuchin proposed another round of trade talks with Beijing

China’s economic momentum weakened a notch in August, with a continued slowdown in investment overshadowing solid retail sales and industrial production data

The White House sent contradictory messages to North Korea, announcing it’s ready to start planning a second meeting with Kim Jong Un just hours after President Trump’s top national security adviser said nuclear talks were stalled

Asia:

The onshore and offshore both declined for a third week; more than 60 percent of U.S. businesses operating in China were hurt by the initial round of tariffs between the Chinese and U.S. governments, with 74 percent foreseeing harm from future U.S. tariffs and 68% from potential Chinese retaliatory duties, according to a survey of more than 430 American companies

S&P Global Ratings lowered its credit ratings on seven Chinese local government financing vehicles by one notch

South Korean won strengthened; the country’s jobless rate rose to 4.2 percent in August, the highest since January 2010 and up from 3.8 percent in July; it will be difficult for the country’s job situation to improve in the short term

Prime Minister Lee Nak-yon said it is time to start thinking about rate increases

Demand-side inflationary pressure remains tepid and it’s “dangerous” to take preemptive monetary measures at this stage, Bank of Korea board member Shin In-seok said

The economy is continuing to recover, led by exports and domestic consumption, the finance ministry said in its monthly green book report

President Moon Jae-in asked heads of the country’s four biggest conglomerates — Samsung (KS:), Hyundai Motor, SK, and LG — to join his visit to Pyongyang to participate in the inter-Korean summit with North Korean leader Kim Jong Un next week, Chosun Ilbo reported

India’s rupee dropped to a record low before trimming the week’s loss; the government unveiled measures to prop up the sagging currency, including steps to facilitate bond issuance by local companies and possible curbs on imports

Officials from the finance ministry have asked the Reserve Bank of India to do more to maintain adequate liquidity in the banking system, people with knowledge of the matter said

The nation’s inflation eased below 4 percent for the first time in 10 months

The Indonesian rupiah posted its first weekly gain in five; Finance Minister Sri Mulyani Indrawati said authorities want to tighten some rules on exporters and are seeking a fair share of export earnings to be retained in the country

Thailand’s SET Index of stocks rallied as King Maha Vajiralongkorn approved two laws, one for the election of members of parliament, and the other for the selection of senators, according to an announcement in the Royal Gazette

Thailand has no need to raise the key interest rate now as the nation’s inflation remains benign, Finance Minister Apisak Tantivorawong said

The government plans to borrow 1.16 trillion baht ($36 billion) in fiscal year 2019

The Malaysian ringgit rose, halting a 12-week losing streak; the trade war may benefit Malaysia over the next year or so, especially in electronics and steel industries; in the long term, U.S.-China trade conflicts would be negative for the country, Finance Minister Lim Guan Eng said

Lim said Malaysia is paring expectations for how much money it can recoup from the 1MDB sovereign wealth fund, and the country would be “very lucky” to get back just half

Recouping all funds lost through 1MDB may not be possible as the government wouldn’t be able to sell assets at the purchase price and some funds have been squandered, Anwar Ibrahim, president-elect of ruling People’s Justice Party, said

Police are investigating bond sales and transactions by institutions linked to 1MDB, according to Deputy Inspector General Noor Rashid Ibrahim

The Philippine peso weakened a fifth straight week, prompting the central bank to have reactivated a hedging program first introduced during the 1997 Asian Financial Crisis to support the peso; the program offers currency forward contracts to bank clients with foreign exchange obligations of at least $50,000

President Rodrigo Duterte agreed to nine measures to contain inflation and a corresponding executive order to implement them immediately, Economic Planning Secretary Ernesto Pernia said

First-half current-account deficit came in at $3.1 billion, compared with a $130 million shortfall a year ago

EMEA:

Turkish lira advanced a second week; President Erdogan appointed himself chairman of Turkey’s sovereign wealth fund and got rid of the entire management staff that had presided over two years of inaction

Gross domestic product rose 5.2 percent during the three months through June from a year earlier

Russia’s ruble halted a 3-week slump as policy makers said they’ll “consider the necessity of further increases” after lifting their benchmark to 7.5 percent, a level last seen in March, from 7.25 percent

Governor Elvira Nabiullina, who first broached the possibility of a rate hike earlier this month, said easing may not resume for more than a year

The two Russians accused by the U.K. of carrying out a nerve-agent attack on a former spy denied the charges in an interview with RT state television

Russia’s economy expanded faster than was earlier estimated in the second quarter

South Africa’s rand strengthened; the country’s stable ratings outlook means there’s little chance of a change in its assessment soon, Moody’s Investors Service said

Business confidence declined to the lowest level this year as industries raised concern about policy uncertainty

South Africa may collect less revenue than forecast and trim its growth prediction for the year after the economy fell into a recession, Finance Minister Nhlanhla Nene said

The Hungarian forint rose; the European Parliament adopted a recommendation to punish the country for the perceived erosion of the rule of law, a process that is still unlikely to yield concrete sanctions

Prime Minister Viktor Orban received an unprecedented EU censure as European lawmakers called for his government to face possible sanctions for eroding democratic standards

Ukraine was given a boost in its fight with Russia over a defaulted $3 billion bond after the U.K. Court of Appeal ordered a full-blown trial

Polish zloty climbed; the country’s Monetary Policy Council kept FX intervention as an option while maintaining a floating exchange rate, according to its policy guidelines for 2019 published on the parliament’s website

Saudi Arabia is said to be raising about $2 billion from the sale of Islamic bonds

The nation’s sovereign wealth fund will sign an $11 billion loan, marking its first-ever borrowing, people familiar with the matter said

Ghana’s long-term foreign currency debt rating was upgraded to B from B- by Standard & Poor’s

Latin America:

The Brazilian real was the second worst performer; right-wing presidential front-runner Jair Bolsonaro underwent more surgery Wednesday evening after being stabbed on Sept. 6; Bolsonaro’s son said he is not in shape for the first round campaigning

Luiz Inacio Lula da Silva endorsed his running mate Fernando Haddad as the Workers Party’s candidate after electoral officials barred the imprisoned former president from running in the October vote