#investor programs Canada

Explore tagged Tumblr posts

Text

Canada Immigrant Investor Program

Consisting of 10 provinces and three territories, Canada extends from the Atlantic to the Pacific and northward into the Arctic Ocean, covering 9.98 million square kilometres (3.85 million square miles) in total, making it the world’s second-largest country by total area. Canada shares the world’s longest border with the United States. Though sparsely populated overall, Canada is home to bustling mega-cities and large expanses of wide-open country ranging from mountains, to prairie, to ancient hardwood forests. Canada enjoys a high quality of life, and a strong and stable economy.

0 notes

Text

Canada has excellent startup opportunities and the best resources for immigrants to start their business ventures. The business immigration program in Canada focuses on ways by which foreign nationals can set up their business and expand their strategies on a long-term basis.

#Canada Startup Program#Canada Business Visa#Business Innovation Visa#Business Entrepreneur Visa#Business Investor Visa

0 notes

Text

#canada business visa#Canada ICT program#Intra Company Transfer#Canada Investor Visa#Canada Business Visa

0 notes

Note

All these fucking immigrants are ruining this country, nobody can find a job or housing because these pieces of shit are coming here and taking the jobs and buying up all the rentals, these selfish outsiders don't care that they are destroying this country. And people won't talk about it because if you point it out, you're racist.

You are a racist. Fuck off.

453 notes

·

View notes

Text

Ideals

An American Colleague: "I gotta admit; before I came here, I thought Canada had sort of traded guns and Manifest Destiny Badassery for Star Trek's Humanist values. I, uh... I'm kinda disappointed."

Me: "Yeah, we're a lot closer to Marvel's idea of Canada than anything Gene Roddenberry would've pencilled in."

AAC: "What do you mean? What's Marvel's idea of Canada?"

Me, sipping coffee on Slack's video-call module: "The land of bilingual smiles and friendliness that actually hides deeply troubling war crimes behind a thin veneer of seemingly-universal acceptability. Think residential schools, widespread clear-cutting to attract corpo investors, the Weapon X program..."

AAC: "Wait, what?! Canada made the Weapon X program?!"

Me: (nodding) "And Deadpool and Sabertooth, in some continuities. Plus, Wolverine is pretty much the Fantasy Canadian par excellence; no funny way of saying about but he does call people bub. Ryan Reynolds should've worked with Hugh Jackman to actually develop a correct Wolverine alternate, where his primal instincts are at odds with the niceness of your average Albertan and he turns apologetic as soon as he skewers someone with his claws. Also, that particular Wolverine alternate needs to have put in a year or two in Second-Language French, and to only recall bits and bobs of the language."

AAC: "Huh. Wolvie isn't terribly Canadian, now that I think of it..."

Me: "Which is why Alpha Flight feels like a big, clumsy and well-meaning representational Band-Aid..."

#canada#marvel comics#ideals#wolverine#deadpool#sabertooth#weapon x#logan howlett#thoughts#geek post

22 notes

·

View notes

Text

Remember when Ayn Rand wrote books on why this is awesome? Like, yeah go you! You did it! You bought all the housing and you're getting rich! You must feel so proud! You beat capitalism! You only had to basically fucking with 20% of the entire populations housing.

4 notes

·

View notes

Text

Ladies please share this with any women you know starting their own business or non-profit

Business grants for women can help you grow your business for free, as opposed to small-business loans or other types of debt-based funding that you must pay back. But competition for small-business grants is fierce, and it takes considerable time and effort to win them.

If you’re up for the challenge, though, grants can be a great way to fund your new or existing business. Here are 18 places women entrepreneurs can look for small-business grants and other free financial resources.

Private small-business grants for women

Some private corporations and organizations offer business grants for women. Here are six to consider:

1. Amber Grant

Every month, WomensNet awards a $10,000 Amber Grant to a woman-owned business in a specific, rotating category. The categories for 2023 are as follows:

January: Skilled trades

February: Health & fitness

March: Food & beverage

April: Sustainability

May: Mental & emotional support

June: Business support service

July: Animal services

August: Hair care & skincare

September: Education & child care

October: Creative arts

November: Technology

December: Fashion & interior designers

On top of that, the organization awards a second $10,000 monthly grant to a woman-owned business and a quarterly $10,000 grant to one startup and one nonprofit.

At the end of each year, two of the 12 general grant winners and one of the industry-specific grant winners are awarded an additional $25,000.

The application is relatively simple: Explain your business, describe what you’d do with the grant money and pay a $15 application fee. The foundation’s advisory board chooses the winners, looking for women with passion and a good story. Businesses operating in the U.S. and Canada are eligible.

Because there’s no time in business requirement, companies seeking startup business grants for women may want to prioritize the Amber Grant.

2. IFundWomen Universal Grant Application Database

IFundWomen is a grant marketplace that specializes in funding and coaching for women-owned businesses. You can submit one application and when IFundWomen adds a grant from an enterprise partner, it will match the partner’s grant criteria to applications within the database.

If your business is a match, you’ll receive a notification and invitation to apply. Previous grant partners have included companies like Visa, Neutrogena and American Express.

3. SoGal Black Founder Startup Grant

The SoGal Foundation ��� along with company sponsors like Bluemercury, Twilio and others — offer startup grants to businesses owned by Black women or Black nonbinary entrepreneurs. Grants are available in amounts of either $5,000 or $10,000.

Awardees also receive fundraising advice, with a focus on investor financing, and lifetime access to the SoGal Foundation team. Applications are accepted on a rolling basis, so you can apply on the SoGal website at any time.

4. Fearless Strivers Grant Contest

The Fearless Fund, in collaboration with Mastercard, offers $20,000 grants to businesses owned by Black women through the Fearless Strivers Grant Contest. The winners also receive digital tools to help them get and sustain their businesses online and one-on-one mentorship with a Mastercard small-business mentor.

The Fearless Fund runs a national grant program, as well as city-specific grant contests in Atlanta; Birmingham, Alabama; Dayton, Ohio; Los Angeles; New Orleans; New York City; and St. Louis. To qualify for this small-business grant, you must have a U.S.-based business, 50 or fewer employees and have made $3 million or less in annual revenue in the past year.

» MORE: Best business grants for Black women entrepreneurs

5. Cartier Women's Initiative Awards

Every year, Cartier awards three grants to women-owned businesses in nine different regions around the world. The Cartier Women’s Initiative Awards program is designed to support early-stage businesses that are focused on a range of social, economic and environmental development issues.

The first-place business is awarded a $100,000 grant, second place receives $60,000 and third place gets $30,000. Winners also receive executive coaching and the opportunity to participate in a variety of training workshops.

6. Comcast RISE

Comcast awards $10,000 grants to businesses owned by women and people of color several times per year. Each Comcast RISE Investment Fund application cycle is open to entrepreneurs in specific target cities. You can also apply for “marketing services and tech makeovers,” which don’t include cash prizes but can still help your business grow.

7. High Five Grant for Moms

The Mama Ladder organization — along with co-hosts Proof, Belly Bandit and Caden Concepts — offer an annual small-business grant specifically for moms. This grant, called the High Five Grant, is designed to support women caregivers with child(ren) of all ages, including first-time expecting moms, stepmoms and foster moms.

Entrepreneurs can submit an application online and share the story behind their business on social media. Finalists will be chosen by a panel of judges and then a public vote will determine the top three winners. The top business will receive a $25,000 grant, the runner up will receive a $10,000 grant and the third place finalist will receive $5,000.

Additional private business grant options

Although these options aren’t specifically for women, they’re good small-business grants to consider for any entrepreneur.

8. FedEx Small Business Grant

FedEx awards up to $30,000 apiece to 10 small businesses annually. One veteran-owned business from among those 10 winners can receive an additional $20,000 from USAA Small Business Insurance. Winners also receive money to use toward FedEx Office print and business services.

The application requires an explanation of your business, how you’d use the money, photos of your business and — this part is optional — a short video explaining your business. To be eligible, you must operate a for-profit business with fewer than 99 employees and at least six months of operating history.

9. National Association for the Self-Employed Growth Grant

Every quarter, the NASE awards up to $4,000 to up to four small businesses via its growth grants. These funds can be used for a variety of business needs, including marketing, advertising and hiring employees.

To apply for this grant, you must be a NASE member in good standing for at least three months. Annual members can apply at any time.

10. Halstead Grant

The Halstead Grant is an annual award for entrepreneurs looking to break into the silver jewelry industry. The winner receives a $7,500 startup grant, as well as $1,000 in jewelry merchandise. Five finalists and semi-finalists also receive $250 or $500 and help with promoting their businesses.

Both men and women-owned businesses are eligible for this small-business grant. To apply, you must answer 15 business-related questions and submit a design portfolio. Applications are due August 1 each year.

11. Fast Break for Small Businesses

These $10,000 grants — funded by LegalZoom, the NBA, WNBA and NBA G League and managed by the Accion Opportunity Fund — are available twice a year. Winners also receive LegalZoom services worth up to $500. You can sign up on LegalZoom’s website to be notified when applications open.

Federal small-business grants for women

Some federal government grants for small-business owners are designated for specific purposes, such as research and development projects, or for businesses in rural areas. Government grants typically can’t be used for startup costs or day-to-day expenses.

12. Grants.gov

Grants.gov is a database of federally sponsored grants, including grants for small businesses. Although these grants are not exclusive to women-owned businesses, this database is a great place to start if you’re looking for free financing.

To apply, you must obtain a Unique Entity ID for your business (a 12-character alphanumeric identification number), register to do business with the U.S. government through its System for Award Management website and create an account at Grants.gov.

To view grants specifically for small businesses, filter the results on the left side of the page under “eligibility.”

13. Small Business Innovation Research and Small Business Technology Transfer programs

The SBA facilitates these two competitive programs, which provide grants to small businesses that contribute to federal research and development. Eleven federal agencies — including the departments of Agriculture, Defense, and Health and Human Services — post business grant opportunities on their websites. You can search current grant opportunities on the SBIR website.

To qualify, you must operate a for-profit business with no more than 500 employees and meet other eligibility requirements.

14. Program for Investors in Microentrepreneurs (PRIME)

Although the SBA coordinates some grant programs, the agency doesn’t typically offer grant funding directly to small businesses. With the PRIME program, however, the SBA provides federal grants to microenterprise development organizations so that they can offer training, technical assistance and coaching to disadvantaged small-business owners.

These grants are available to nonprofit, private, state, local or tribal-run organizations, including those that focus on working with women-owned small businesses. The Wisconsin Women’s Business Initiative Corporation, for example, was awarded a $200,000 grant in 2022.

» MORE: Business grants are ‘just not that easy.’ Here are some tips to help

State and local small-business grants for women

Because federal small-business grants are limited in number and often very competitive, you may have better luck seeking out grants for women at the state and municipal levels. You’ll have to do your own research to pinpoint specific grant programs in your area, but here are some places to help you get started:

15. Women’s Business Centers

The SBA sponsors more than 100 Women’s Business Centers nationwide, designed to help women entrepreneurs with business development and access to capital. Some, such as the California Capital Financial Development Corp., lend money directly while others help you find small-business grants and loans that you may qualify for.

16. Economic Development Administration

Every state and many cities have economic development resources focused on promoting strong local economies. For example, New York has several economic development districts, such as the Lake Champlain - Lake George Regional Planning Board, which helps local businesses access state and federal funding.

17. Small Business Development Centers

There are hundreds of SBA-sponsored Small Business Development Centers around the country, typically housed at colleges and universities. SBDCs offer free, one-on-one business consulting, such as help with developing a business plan, researching markets and finding financing — including grants, business loans and crowdfunding.

Some SBDCs offer training on certification programs like the SBA 8(a) Business Development Program and Minority and Women Business Enterprise Certifications. These programs can help businesses level the playing field when competing in the public and private sector.

18. Minority Business Development Agency Centers

The MBDA operates a network of business centers across the country that are designed to help minority business owners access capital, secure contracts and develop financial strategies. Your local MBDA business center can work with you to identify the right financing options for your business, including federal, state and private small-business grants.

The MBDA also runs the Enterprising Women of Color Initiative, or EWOC, to support minority women in their business endeavors. The EWOC provides access to resources, events and other opportunities for women minority-owned businesses.

» MORE: Find small-business grants for minorities

Alternatives to small-business grants

Finding and applying for business grants can be difficult, as well as time-consuming. If you don’t qualify for certain grants — or simply want to explore other ways to fund your women-owned business — here are some avenues to explore:

Best small-business loans for women: Compare SBA loans, online term loans, lines of credit, microloans and learn about other available resources for your business.

Crowdfunding for business: Tap into the power of the internet to raise money for your business and promote your company’s product or service.

Small-business credit cards: Compare dozens of cards and find the best choice for financing your everyday business purchases — and earn rewards in the process.

SBA microloans: Work with a nonprofit financial institution to apply for these government-backed loans, which can be a good choice for new or very small businesses.

33 notes

·

View notes

Text

Financial sources

To launch 'Little Ladoo' at the farmer’s market with sufficient initial funding, I have outlined a diverse set of financial sources:

Personal Savings: I will utilize my savings to provide an initial start-up investment, including ingredient procurement, packaging materials, and initial marketing efforts.

Family and Friends: I will ask for financial support from family members who share my enthusiasm for this business opportunity. This contribution will primarily be used to acquire essential kitchen equipment and establish a strong presence at the farmer’s market.

Government Grant: I will apply for a government grant tailored to small businesses in the food sector. This grant program offers funding specifically for equipment purchases and initial operational costs, which will significantly support our ability to expand and meet customer demand.

Home Equity Line of Credit (HELOC): Leveraging the equity in my home, I will apply for a HELOC to secure additional capital for scaling operations and navigating potential unforeseen expenses during the early stages of 'Little Ladoo.' This financing option provides flexibility and ensures I have adequate resources to sustain growth."

Government Sources to Consider: In my research find some sources that can help me to grow my business in the future.

City of Toronto Small Business Grants:

The City of Toronto offers various grant programs to support small businesses and entrepreneurs across different sectors.

For specific programs like the Starter Company Plus program, which provides training, mentorship, and grant funding of up to $5,000.

Ontario Government Grants:

Ontario provincial government provides grants and funding programs aimed at supporting small businesses, including programs like the Ontario Small Business Support Grant,

Federal Government Grants:

The Government of Canada offers various grant programs through agencies like the Canada Business Network (CBN) and Innovation, Science, and Economic Development Canada (ISED).

Non-Profit Organizations and Associations:

Toronto Region Board of Trade: TRBOT offers support and resources to small businesses, including information on funding opportunities and grants available in the Toronto region.

Startup Incubators and Accelerators:

Organizations like Ryerson Futures, DMZ, and Next Canada provide not only funding but also mentorship, networking opportunities, and access to investors for startups in Toronto.

4 notes

·

View notes

Text

my idea for my lis/ud crossover has always been that the timelines add up pretty well with lis being in 2013 and ud being in 2015, as well as oregon and california being decently close in location (depending on where you're from in oregon, ig). from his main estate, or any estate, josh would likely fly to oregon.

in 2013, josh would have been around 17-18, the perfect age to be a senior at blackwell academy. in this verse, josh's dad acts as a fairly new investor in blackwell. he became interested in the academy during its shift to the senior-only program (two years), wanting his son and daughters to study the best. with josh's interest in following in his dad's footsteps, bob enrolled josh in 2011. this would be right around just before the curriculum changed to the two-year senior program, which josh was eligble to enroll in given his age and also his standing.

basically, it goes from there. he primarily lives in oregon for the school terms and typically plans to go home for breaks (mostly california, sometimes canada to the lodge for winter and summer occasions, and other various places globally tbh, sometimes cairo, sometimes milan). his sisters are supposed to follow suit.

can follow LIS’s timeline as a standalone verse or can intermingle with UD canon (LIS’s first-game timeline leads right into UD’s game timeline).

#josh tbt#i imagine he is fond of kate tbh#and had an interest maybe in rachel at some point#was invited to a lot of the rich kid stuff bc he is a rich kid#but i can imagine he liked chloe bc he's that kind of guy like they were at least decent?#maybe friendly??#i can see him having some relationship of some sort with max or none at all tbh until chloe

2 notes

·

View notes

Text

RECENT ECOMMERCE NEWS (INCLUDING ETSY), Early April 2024

Welcome to my coverage of all the important Etsy and other ecommerce news that microbusinesses need to know! It's been a few weeks since my last update, so there is a fair amount to report.

Want to get the news more often and in a more timely fashion? Please sign up to support my Patreon site, where among other features, I will soon be starting periodical live chats on important topics. (I promise there will be one the day Etsy announces a fee increase)

TOP NEWS & ARTICLES

Etsy has made changes to how processing times and estimated delivery dates work; I covered everything you need to know in this post.

Etsy seems to be sending more Messages to the spam folder, so you may miss a real message. After reading that thread, I checked, and there was one from another seller needing help from just 5 hours ago. Etsy did say engineers are looking into it.

UPS has won the USPS air cargo contract, currently held by FedEx. It kicks in at the end of September. “As of May 31, 2023, FedEx counted the USPS as the largest customer of its Express unit.”

ETSY NEWS

Etsy is rolling out a new seller pricing tool, and it is just as useless as the old version. I posted some early thoughts (with screenshots).

Some shop owners are struggling to cancel Etsy coupons, while others are not having the same problem. Support says the company is aware of the issue.

If you still can't access most of the Etsy forum after the changes on Tuesday March 26, post in this Technical Issues thread so that your account can be fixed.

Periodically, some shops suddenly stop getting deposits. If your shop has recently had a security warning, you may want to check to see if your bank account is still verified with Etsy.

Looks like Etsy has an issue with misrepresenting how many items are left for each listing on the app; I wrote about it here.

Canadians getting harassed by Etsy to sign up for TurboTax should know that the company has told a seller that it doesn’t import Etsy data into your tax return for you; that is only available for Americans. [If you can’t import your info from your various platforms, my suggestion is use a free online program to file instead; I’ve used Wealthsimple for several years with no issues filing small business taxes; the T-2125 is part of the program.]

Etsy’s activist investor seems to think that the marketplace can “…add more buyers and increase the amount of money they spend on the platform”. But “monetization opportunities” were also mentioned.

Etsy is yet again called out for allowing AI-generated porn on the site. “Several of the available listings also appear to violate existing trademarks — TheStreet identified listings that sell NSFW (not safe for work) AI-generated, suggestive images that appear to mimic Rapunzel from Disney's "Tangled," Princess Jasmine from Disney's "Aladdin" and She-Hulk from Marvel's "She-Hulk."

Etsy has been talking a lot about "image quality" lately, but doesn't really define the term anywhere. While I agree with those that say it is more than image size - Etsy would not have humans curating images to train its AI if "quality" could simply be measured by pixels - note that Google Shopping Ads describe image quality as size. “The resolution of your product images determines its quality. Google considers images with more than 1024 pixels as high-resolution images.”

Apparently Etsy CEO Josh Silverman likes to make “unorthodox, downright risky career decisions” that often involve a ton of responsibility. [Link to podcast in article; I haven’t listened to it]

ECOMMERCE NEWS (minus social media)

General

Patreon’s live chats are now accessible on the web (instead of just the app). A creator can assign moderators, and have chats for different categories of members.

Canadians: beware that new tax rules requiring digital platform operators to report their users’ income to the Canada Revenue Agency are expected for 2025. These laws would make Canada similar to the United States and the United Kingdom, among others.

Amazon

Amazon is struggling to verify the VAT status of many UK sellers, and the fact the company holds all funds until the process is complete means many sellers are without income.

eBay

eBay is offering 3 free “express payouts” to select US sellers by email only, available until June 30th. Money is paid to seller debit cards and can take a half hour or more to receive. (The usual cost is 1.5%.)

If you use eBay For Charity, you may want to check to see if the charity is getting paid, as some apparently are not.

If you advertise on eBay, or just list inconsistently, you may be interested in the marketing trends calendar for 2024. It shows you when certain types of searches peak.

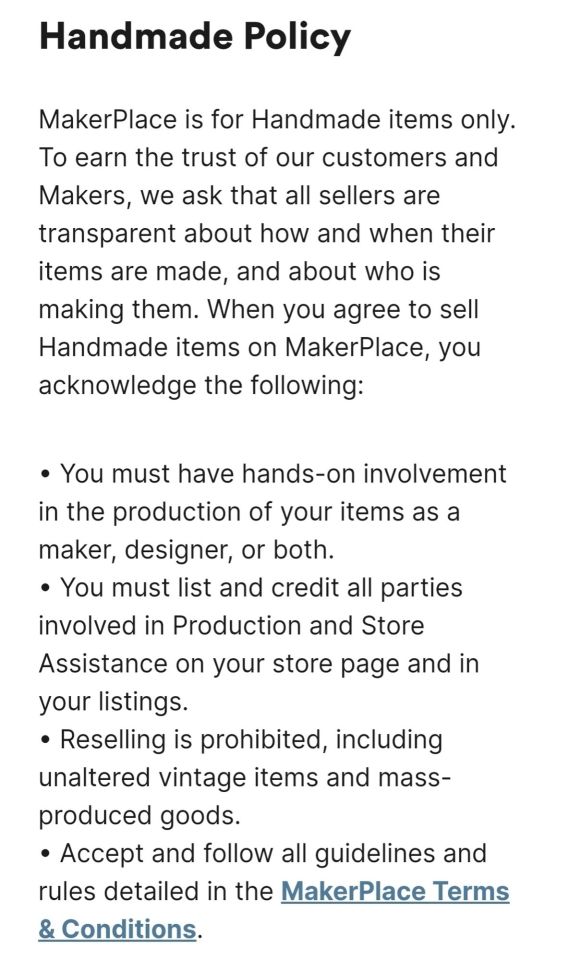

Michaels Makerplace

The landing page for Makerplace sellers doesn’t provide a lot of hard details; some of the actual policies appear once you begin to sign up. Here’s how they define handmade:

Thanks to Bluesky user Brushfeather for the info.

Shopify

Shopify is putting more effort into large businesses these days, despite its core offerings targeting small and medium-sized businesses for years. [soft paywall; Business Insider] The company “...has made a concerted effort over the last 18 months to introduce more software solutions to win over larger merchants. It has enhanced Shopify Plus, a higher-tier subscription with more features, and launched Hydrogen, a more custom framework geared toward retailers with more complex needs...Shopify introduced Commerce Components, an offering that allows merchants to integrate parts of Shopify's software into their existing tech stack. Mattel was its first retail partner for that product, and Everlane has since adopted Shop Pay as a stand-alone component.”

CEO Tobi Lutke recently received almost $200 million CAD in Shopify stock options, “one of the largest compensation packages in Canadian history.” As company founder, he now has around $8 billion worth of Shopify stock.

CIRRO Fulfillment now integrates with Shopify.

Squarespace

Squarespace is rolling out Squarespace Payments to sellers in the United States, and they expect to add more countries later this year. Fees are in line with other payment processors.

All Other Marketplaces

Mercari is following Depop and is ending seller transaction fees while adding a buyer fee. There is now a seller earnings withdrawal fee of $2, however, plus the pricing only applies to items listed after the announcement on March 27th, and sellers now have to accept returns for any reason, within 72 hours of receipt. I suppose this fee might work for buyers if many are also sellers on Mercari or elsewhere, and are buying stock. If you see a good deal you know you can flip with a good margin, you might not mind paying a buyers fee on top of the listing price. The only other way I can see being willing to pay a buyers fee is if you are so enamoured with the platform and its culture that it is worth paying more for. Or maybe I am just out of touch… The Mercari CEO basically calls out Etsy for raising seller fees too much [soft paywall; Modern Retail]: “I’m not going to mention them by name, but you have marketplaces that have a lot of makers, a lot of people that create things, and the fees around selling on those platforms have just been going up a lot very aggressively”. [my emphasis] Mercari wants fees to remain competitive while attracting better inventory. Another article on Mercari’s announcement mentions Etsy by name when discussing seller fees.

Mercari might want to consult lawyers the next time the site makes changes, though, as many sellers were furious that their existing balances were now subject to withdrawal fees without any warning, leading some to file complaints with the FTC. That led the company to announce that “On March 27, 2024, Mercari announced that it would begin charging a $2 fee(s) (“ACH Charge”) for all ACH direct deposit requests. Effective immediately through April 3, 2024 at 11:59 P.M. Pacific Daylight Time (“Waiver Period”), Mercari will waive the ACH Charge for ACH direct deposit requests made prior to the end of the Waiver Period for all eligible account holders.” Those who already incurred withdrawal charges will get refunds.

And because apparently you can never have enough Mercari news, they’ve introduced a listing importer for eBay and Depop. It uses AI.

AliExpress will now do livestream shopping events in the UK.

Payment Processing

PayPal users in the US will soon have only 30 days after delivery to file a significantly not described claim in most cases. Items not delivered by 180 days will still have the full 180 days.

Shipping

UPS is planning on closing about 200 facilities in the United States, and hopes to save money by instead using more automated hubs. Having fewer employees and consolidating locations is expected to save the company around $3 billion by the end of 2028.

FedEx is continuing to combine its Express and Ground pickups and deliveries, both to save money and to make pickups easier on customers.

2 notes

·

View notes

Text

Canada Immigrant Investor Program

Consisting of 10 provinces and three territories, Canada extends from the Atlantic to the Pacific and northward into the Arctic Ocean, covering 9.98 million square kilometres (3.85 million square miles) in total, making it the worlds second-largest country by total area. Canada shares the worlds longest border with the United States. Though sparsely populated overall, Canada is home to bustling mega-cities and large expanses of wide-open country ranging from mountains, to prairie, to ancient hardwood forests. Canada enjoys a high quality of life, and a strong and stable economy.

0 notes

Text

The Abrostudies is a pioneering visionary corporation in India’s immigration consultancy industry, dedicated to providing unmatched visa solutions to individuals, families, entrepreneurs and investors. At Abrostudies immigration services we’re committed to opening a world of opportunities and experiences to students by offering high-quality education and study abroad programs across the globe.

#immigration#study visa#tourism#tourist visa#work permit visa#trendingnow#viralpost#studyabroad#studyinuk#studyincanada#studyingermany#internationalstudents

3 notes

·

View notes

Text

The Role of Government in Supporting Start-Ups in Canada

Learn how the Canadian government supports entrepreneurs through various Start-up Visa programs, grants, and tax credits. Discover how these initiatives are helping start-ups succeed and how regulation changes foster innovation.

#Startup Visa Program#Business Immigration to Canada#Investor Visa Program#Canada Business Investor Visa#Canada Visa#Business Visa#Startup Visa

0 notes

Link

Are you looking for Canada Start-up Visa? Canada’s Start-Up Visa Program allows immigrants to establish businesses in Canada and apply for permanent residency

#Canada Startup visa#Canada Business Visa#Canada Investor visa#Canada Business Visa Program#Businessimmigrationvisas

0 notes

Text

Events 11.9 (after 1950)

1953 – Cambodia gains independence from France. 1960 – Robert McNamara is named president of the Ford Motor Company, becoming the first non-Ford family member to serve in that post. He resigns a month later to join the newly-elected John F. Kennedy administration. 1963 – At a coal mine in Miike, Japan, an explosion kills 458 and hospitalises 839 with carbon monoxide poisoning. 1965 – Several U.S. states and parts of Canada are hit by a series of blackouts lasting up to 13 hours in the Northeast blackout of 1965. 1965 – A Catholic Worker Movement member, Roger Allen LaPorte, protesting against the Vietnam War, sets himself on fire in front of the United Nations building. 1967 – Apollo program: NASA launches the unmanned Apollo 4 test spacecraft, atop the first Saturn V rocket, from Florida's Cape Kennedy. 1970 – Vietnam War: The Supreme Court of the United States votes 6–3 against hearing a case to allow Massachusetts to enforce its law granting residents the right to refuse military service in an undeclared war. 1979 – Cold War: Nuclear false alarm: The NORAD computers and the Alternate National Military Command Center in Fort Ritchie, Maryland detected purported massive Soviet nuclear strike. After reviewing the raw data from satellites and checking the early-warning radars, the alert is cancelled. 1985 – Garry Kasparov, 22, of the Soviet Union, becomes the youngest World Chess Champion by beating fellow Soviet Anatoly Karpov. 1989 – Cold War: Fall of the Berlin Wall: East Germany opens checkpoints in the Berlin Wall, allowing its citizens to travel to West Berlin. 1993 – Stari Most, the "old bridge" in the Bosnian city of Mostar, built in 1566, collapses after several days of bombing by Croat forces during the Croat–Bosniak War. 1994 – The chemical element darmstadtium is discovered. 1998 – A U.S. federal judge, in the largest civil settlement in American history, orders 37 U.S. brokerage houses to pay US$1.03 billion to cheated NASDAQ investors to compensate for price fixing. 1998 – Capital punishment in the United Kingdom, already abolished for murder, is completely abolished for all remaining capital offences. 1999 – TAESA Flight 725 crashes after takeoff from Uruapan International Airport in Uruapan, Michoacán, Mexico, killing all 18 people on board. 2000 – Uttarakhand officially becomes the 27th state of India, formed from thirteen districts of northwestern Uttar Pradesh. 2004 – Firefox 1.0 is released. 2005 – The Venus Express mission of the European Space Agency is launched from the Baikonur Cosmodrome in Kazakhstan. 2005 – Suicide bombers attack three hotels in Amman, Jordan, killing at least 60 people. 2012 – A train carrying liquid fuel crashes and bursts into flames in northern Myanmar, killing 27 people and injuring 80 others. 2012 – At least 27 people are killed and dozens are wounded in conflicts between inmates and guards at Welikada prison in Colombo. 2014 – A non-binding self-determination consultation is held in Catalonia, asking Catalan citizens their opinion on whether Catalonia should become a state and, if so, whether it should be an independent state. 2020 – Second Nagorno-Karabakh War: An armistice agreement is signed by Armenia, Azerbaijan and Russia.

2 notes

·

View notes

Text

1 in 5 homeowners across much of Canada are property investors, StatsCan data shows

Publishing data related to housing investors for the first time, the Canadian Housing Statistics Program has found that more than a fifth of all houses in British Columbia, New Brunswick, Nova Scotia and Ontario were owned by investors in 2020.

from CBC | New Brunswick News https://ift.tt/CiMAmsR

2 notes

·

View notes