#insurance claims nz

Explore tagged Tumblr posts

Text

How Does the Insurance Claim Process Work in NZ? A Step-by-Step Guide!

Insurance is an important part of life, as it protects you from the unexpected. Be it your car and home insurance, health insurance, or life insurance, you must understand how the insurance claim process in NZ works so that you can make sure you get the help and compensation you need when things go wrong. In New Zealand, the process may appear complex at first; however, if you familiarize yourself with it, it's a cakewalk. It's a step-by-step explanation of how insurance claims go about in New Zealand.

1. Notify Your Insurance Provider Immediately

The initial and most important step when an accident occurs is notifying your insurance company immediately. The majority of insurance policies require you to report the incident in a timely manner, within a specified period, which is predominantly 48 hours for critical cases such as loss of residence or motor vehicle accidents. Not reporting your insurer in time can result in your claim being rejected. You have to be prompt while you make an insurance claim to be processed effectively.

To report the fraud being carried out against you to your insurer, you will normally be asked to provide the following information:

Policy Number: Your policy or customer reference number helps the insurer locate your records with no hassle.

Date and Circumstances of the Incident: The complete circumstances surrounding the incident, including where and when it took place, along with the time.

Degree of Damage: An approximate measure of the extent of damage caused or loss suffered.

At times, you might be required to give extra information or complete a claim form. Be accurate and truthful while giving the details as any discrepancy will lead to trouble. If you are a member of NZ Insurances, you can easily send in your claim online or speak to an agent at once.

This first step is of vital importance in the insurance claim process NZ, and giving early notice will prevent you from missing out on the cover you are entitled to.

2. Assessment of the Claim

Your insurer will usually send out an assessor or claims adjuster to examine the case once the claim has been reported. The assessor will confirm your claim details and what exactly is the loss or damage. Small claims are a case of negligence, just a phone call or email. More serious claims, such as a house fire or car pileup, might require a visit. This is the major component of insurance claims in NZ to check everything properly.

The following can be considered while verifying:

Cause of the Incident: There are exemptions under insurance covers, and knowledge of whether the cause of the incident falls under the cover is important. An example would be damage caused by natural calamities (earthquakes) included under a special rider or compensatory cover.

Repair or Replacement Costs: The assessor is likely to use contractors or specialists to put the repair or replacement costs into estimates.

Policy Terms and Limits: The claim would also be verified against policy terms, including the levels of cover, excess points (deductibles), and exclusions.

It needs to be noted that when the insurer comes across any damage inflicted on a property due to negligence or default on the part of another party, they take time for a comprehensive investigation. They promise you a completely comprehensive checking carried out by assessors if you're a client with NZ Insurances, leaving the investigative process open in order to allow a proper amount of compensation to you.

3. Decision on the Claim

Your insurance company will then accept or decline the claim after it has been evaluated. The insurance company will notify you of the extent of the reimbursement and how to proceed in case of approval. They may also provide you with a payment timeframe or means on how to receive the compensation. This is where you get to witness the result of the process after you make an insurance claim.

In some cases, the insurance company may only pay for half of the claim if the loss is not covered by the whole policy. For example, if you have a car policy with an excess of $5000 and your car is destroyed in an accident, then the insurer will only pay for the cost after deducting the excess.

In case your claim is rejected, the insurer owes you the duty of giving reasonable cause for the rejection. The usual grounds for rejection are failure to disclose material facts, the mishap not being insured under the policy, or failure to serve the notice. In case you are not satisfied with the rejection, you can protest or appeal it, and that leads us to the second step.

4. Appeals and Disputes

If your insurance claim is rejected or the settlement amount offered is less than you had hoped for, then you can dispute the decision. The first step is to go to your insurer and speak with them about the matter. Most insurers will have internal dispute resolution or complaints procedures.

If you are dissatisfied with the result of making a visit to the insurer, you can have the case transferred to the Insurance & Financial Services Ombudsman (IFSO). It is an independent entity that operates as an intermediary between consumers and insurers to resolve conflicts. The IFSO offers a free investigation and advising solution service, although their finding is non-binding.

Before reaching out to the IFSO, make sure to gather all relevant documentation, including your policy, the claim details, any communication with the insurer, and any assessments or estimates from repairers or specialists. NZ Insurances also has a dedicated customer service team to help resolve issues if you’re unhappy with the decision. They aim to make the insurance claims NZ process as smooth as possible and ensure customer satisfaction.

5. Receiving Your Payout

After your claim has been settled, getting your payment is the next thing. Insurers in New Zealand usually have payments through direct deposit, but there are some that have other types such as cheque payments. It will take time to get your money depending on how easy the claim is and the processing time of the insurer. Easy claims can be paid within days, but difficult claims can take weeks or months.

It should be noted that the company can compensate either the fixer or the contractor for the repair or fixing in case of car or house repair. It is possible there that you wouldn't take everything home that is due to you but a check for fixing stuff.

6. Finalizing the Claim

When your cheque is sent, upon being paid, you will be asked to sign documents that will seal the claim in a binding nature. This may be by an agreement form where it is stated that you are satisfied with your compensation and you promise not to make further claims regarding the accident.

Conclusion

The insurance claim process in NZ is typically straightforward. However, it might be complicated or drawn out sometimes if you are familiar with the process and preparing for each step so that the process will not appear too daunting. From the moment you notify your insurance company to the time money comes to you, being assertive, honest, and transparent will allow you to go through the process confidently.

In the remotest possibility that you require assistance or guidance at some point, all you have to do is approach your insurer or a stand-alone intermediary such as the IFSO. NZ Insurances does everything it can to provide its policyholders with a quality experience of the insurance claim process and is happy enough to deal with any inconvenience arising in between. Awareness and initiative are enough to get what is your right when you make an insurance claim. Whether it is a first-time insurance claim or a complex problem, having your facts in order is the answer to settling your peace of mind in order.

Call NZ Insurances today and find out more about our insurance in NZ and settle your future in order.

Frequently Asked Questions

1. How soon should I notify my insurer after an incident?

You have to report your insurance company immediately, preferably within 48 hours, for serious cases like car accidents or house damage. You might lose your claim if you do not do it timely. You should be timely in action so that the insurance claim process in NZ goes smoothly.

2. What happens after I report my claim?

Once you make an insurance claim, an assessor or a claims adjuster will visit the loss or damage, and establish the coverage according to your policy. This is an important step in insurance claims in NZ.

3. What happens if my claim is denied?

If your claim is rejected, you will be given clear reasons for the same. You can have the decision appealed or referred to the Insurance & Financial Services Ombudsman (IFSO) if necessary. Being aware of your rights while following the insurance claim process in NZ.

4. How will I receive my payout?

Once your claim is settled, payment is usually by cheque or direct deposit into an account. Payment in some instances will be made directly to the service provider for repair. Your payout will be based on the level of complexity of the claim.

5. How do I close my claim?

Once you get your money, you can be asked to sign an acknowledgment that you are satisfied with the amount and you concur with the ruling on the payment of the claim. Make sure all issues of your insurance claim are resolved before closing the claim.

0 notes

Note

I’m really glad to see some mild deradicalization spreading through the left on tumblr. In many cases it’s true that a radical perspective is necessary, but in many cases, the radical position just is not materially the most helpful for the people it seeks to help and claims to represent. I like in the US and for years I desired radical revolution to completely overthrow and restructure the government. And yeah our government is horrible. The system sucks. But many of the people who would benefit most from a violent revolution wouldn’t make it through one. This has deradicalized me a ton. I don’t know what the answer is to fix the system, but I can no longer stand behind the extreme perspective. The way people are celebrating the LA fires encapsulates this perfectly

Literally this.

The violent revolution people are calling for will just make it harder for underserved groups.

What needs to happen is legislation changes, which does not work due to violence in a two party landscape which is the US.

Like here in NZ, protests work because if one of the two major parties doesn't pander to any side, then people vote for the minor parties and the major party is forced into a coalition government with two minor parties, which often will block certain policies the major party wants.

Like fuck NZ first, but they stopped the reversal of the foreign buyer ban thay national wants. The policy prevents people from overseas buying homes they don't intend to live in if they aren't a citizen. This is because a lot of people from overseas were buying houses and either leaving them empty or renting them out for far more than market rate

And conversely, national shut down the transgender bathroom bill, which would force trans folk to use the bathroom of our assigned sex at birth, which is a bill nz first wanted.

Like yes, protesting is still important in the US, but if you don't have a petition or aren't lobbying the government in tangent, nothing is going to change, especially under trump.

A violent revolution will just be shut down by military police.

And to give an example of how it would negatively affect underserved groups, well use insurance as an example since it's a hot topic.

Hospitals won't stop significantly overcharging during a violent revolution with insurance. You'll just have a bunch of people, but disproportionately disabled folk, having to pay their medical costs with no insurance.

And this is one of my main gripes with the left as a leftist myself. People are so focused on "sticking it to the man" that they'll step on their neighbors back.

Instead of building community which is what leftism is about, people are so individualistic that it starts to actively harm those they claim to be wanting to help

24 notes

·

View notes

Text

I’ve written and posted about it before, but hating and despising the United States healthcare system is my special interest and part of my belief is that so many Americans don’t see how awful it is because they’ve never experienced anything different.

in NZ we have a public healthcare system that provides free healthcare to everyone (citizens, tourists, anyone who needs it). when I broke my arm I wasn’t sure it was broken so I went to the nearest doctor, who sent me to get x-rays, who then confirmed it was broken and sent me to ER.

Each step was walk in, never asked for ID or payment because it’s irrelevant. The only paperwork I filled in was so I could get scheduled for rehabilitation PT after cast was removed.

another time I injured myself playing hockey and got a bunch of PT and acupuncture- all for free, no claims or reimbursement, just some simple paperwork that described how I injured myself.

when I was in Argentina I got really bad food poisoning and went to a private hospital (because after checking online I saw they had English-speaking doctors) who prescribed antibiotics. I don’t remember specifics but as a cash-paying patient without insurance I think I paid about USD$30 (which would be unaffordable for many locals but provides a relative example of how much healthcare costs).

NZ isn’t perfect either, and NZ also has private health insurance for people who can afford it. I had jobs in NZ where private health insurance was provided as a benefit with my job but unlike US healthcare it was an actual benefit (eg I didn’t pay any premium etc, employer paid everything) and I never had a need to use it.

the counter argument is that “you pay so much in taxes” and yes, NZ does have higher income tax rates but at the end of the day you have more money in your pocket than the United States because you pay so much more in health insurance premiums, deductibles, co-pays, prescriptions, than you do in any difference in taxes (as an example of how weird and foreign these concepts are, when I moved to the United States it took me a while to even understand what a deductible or a co-pay was).

healthcare system in the United States is absolutely 100% fucked up, it’s fucked up that it was created, it’s fucked up that’s it’s been allowed to persist for decades, it’s fucked up that there is almost zero political support for changing it.

12 notes

·

View notes

Text

Protect Your Future with AFA Insurance

Looking for the best way to secure your health? Choosing health insurance NZ with AFA Insurance is a step towards peace of mind and protection. Life can be unpredictable, but your healthcare shouldn't be. With tailored plans to suit individuals, families, and businesses, AFA Insurance ensures you're covered when it matters most. From routine check-ups to unexpected medical expenses, our comprehensive policies are designed to meet your unique needs.

Why wait for uncertainty to knock on your door? Join thousands of Kiwis who trust us to provide reliable and affordable health insurance NZ coverage. With AFA Insurance, you’ll enjoy quick claims processing, excellent customer support, and the assurance that your well-being is always a priority. Take control of your health today. Let us help you safeguard your future while giving you the freedom to focus on what matters most in life. Visit AFA Insurance now to explore our plans and find the perfect fit for your health and budget.

#critical care insurance#critical illness insurance#serious illness insurance#trauma insurance#trauma cover#partners life trauma cover#critical illness policy#trauma insurance nz#cheapest health insurance nz#family health cover

0 notes

Text

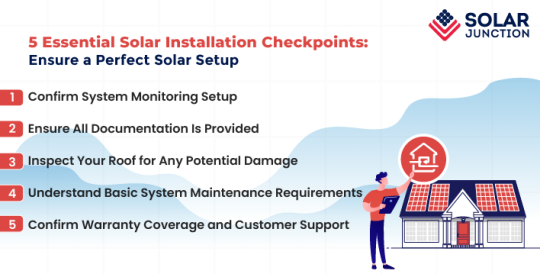

Essential Checks Before Your Solar Installers Leave: A Homeowner's Guide to a Perfect Solar Setup

Ensuring your solar system is set up correctly can make all the difference between a smooth, cost-saving experience and future situations. Before your solar installers pack up, take the time to review a few essential elements. This quick solar installation checklist can help homeowners avoid common pitfalls and guarantee optimal performance.

Why the Solar Installation Checkup Matters?

A solar installation checklist helps ensure that your system is installed correctly and that all aspects of the installation process meet quality standards. Not only does the solar checkup guarantee that you receive everything you paid for, but it also sets the stage for efficient, trouble-free operation.

Skipping these steps could lead to problems like ineffective monitoring, documentation issues, or even minor roof damage.

Confirm System Monitoring Setup

Why It's Important: Monitoring is like the dashboard of your car—it provides a real-time view of how much energy your system is generating and how efficiently it's running. Often included in the system price, a functional monitoring system is crucial to understanding your energy savings.

What to Watch Out For: After a busy installation day, some installers might overlook this final step or face issues connecting the system to Wi-Fi. They might leave you to resolve the connection issues, resulting in delayed or incomplete monitoring.

How to Check: Make sure the monitoring system is fully functional before they leave. If they claim they'll resolve issues later, be firm—it's part of the installation and should work from day one.

If they've completed the installation after dark, set a reminder to contact them the next day to ensure monitoring is fully operational once the sun is out.

2. Ensure All Documentation Is Provided

Why It Matters: Documentation might seem like a minor detail, but it's actually essential. According to Australian standards (AS/NZS 5033:2021 and AS/NZS 4777.1:2016), installers are required to provide comprehensive documentation with every installation. This paperwork is crucial for understanding your system, and claiming warranties, and can even be necessary for insurance claims.

Common Issues: Some installers may forget or neglect to provide the full set of documents. However, this is not optional; it's a requirement and a critical part of the solar panel installation inspection process.

What to Request: Ask for all necessary documentation upfront. This includes user manuals, warranty papers, compliance certificates, and any other relevant paperwork.

Some companies now offer digital documentation via QR codes located on the switchboard or meter panel, which provides easy access to a complete documentation package.

3. Inspect Your Roof for Any Potential Damage

Why It's Crucial: Solar installations involve a lot of activity on your roof, which can sometimes lead to minor damage. Small chips, cracked tiles, or ridge point shifts might seem insignificant initially but can lead to leaks or other issues down the line.

What Often Gets Missed: Minor damage may not be immediately visible, and some installers might patch up cracked tiles with silicon instead of informing the homeowner about the issue.

Steps to Take: Before installation begins, take a few pictures of your roof. After installation, carefully inspect the roof or ask the installers to review the condition with you. Documenting the before and after can be helpful in case any issues arise.

Additionally, don't hesitate to ask about any repairs or modifications they made during the installation.

Learn More About Essential Checks Before Your Solar Installers Leave: A Homeowner's Guide to a Perfect Solar Setup Click Here

0 notes

Text

Shattered Ground: The 2010 Canterbury Earthquake

On the early morning of September 4, 2010, the South Island of New Zealand was jolted awake by a powerful 7.1 magnitude earthquake, now known as the Canterbury or Darfield earthquake. Striking at 4:35 am local time, it was one of the most significant seismic events in New Zealand's recent history. With a maximum intensity of X (Extreme) on the Mercalli scale, the quake unleashed a wave of destruction that reverberated through the region.

Initial Impact and Damage

The earthquake’s epicenter was located near Darfield, about 40 kilometers west of Christchurch, New Zealand's second-largest city. At a depth of just 10 km, the quake caused extensive damage and left residents grappling with power outages. Remarkably, while there were serious injuries—two from falling debris and flying glass—there were only two fatalities. The timing of the quake, early in the morning, and the relatively modern construction of many buildings helped limit the death toll.

The quake was followed by several powerful aftershocks, including a 5.8 magnitude foreshock just seconds before the main event. The tremors were felt across the South Island and even reached parts of the North Island. Despite the shaking, no tsunami was triggered, as the epicenter was situated inland.

Response and Recovery

In the aftermath, New Zealand's National Crisis Management Centre was activated, and a state of emergency was declared for Christchurch and surrounding areas. The New Zealand Army was deployed to assist with recovery efforts, and initial curfews were set for affected areas. The cost of insurance claims ranged between NZ$2.75 and $3.5 billion, with the total damage estimated to reach up to $40 billion, marking it as one of the most expensive natural disasters in recent history.

The Geology Behind the Quake

The 2010 quake was a result of strike-slip faulting within the Pacific plate’s crust, near the Southern Alps’ eastern foothills. The earthquake’s complex nature involved multiple faults and was linked to regional seismic activity. The peak ground acceleration (PGA) recorded was 1.26 g, an extremely high value for such a fault rupture.

Aftershocks and Ongoing Impact

The aftershocks were relentless, with over 11,000 recorded by August 2012. Significant aftershocks included a 6.3 magnitude quake in February 2011, which devastated Christchurch, causing 185 deaths and massive damage. Other notable aftershocks occurred throughout the year, continuing to affect the region and complicate recovery efforts.

Financial and Structural Aftermath

The financial impact of the earthquake was staggering, with estimates of total costs reaching up to NZ$4 billion. Insurance and reinsurance companies faced substantial claims, with the Earthquake Commission (EQC) covering domestic residences and private insurers handling additional costs. This earthquake was the fifth most costly insurance event globally since 1953.

The 2010 Canterbury earthquake remains a significant event in New Zealand's history, showcasing the region's vulnerability to seismic activity and the resilience of its people. The recovery from this disaster highlighted the importance of preparedness and the need for ongoing efforts to mitigate future risks.

0 notes

Text

Protect Your Business: The Importance of Public Liability Insurance

Running a business is an exhilarating journey, filled with opportunities and challenges. As you navigate this path, protecting your venture from unforeseen risks becomes paramount. One critical aspect of safeguarding your business is securing Public Liability Insurance.

This essential coverage of Best Public Liability Insurance NZ not only shields you from potential financial burdens but also enhances your reputation and trustworthiness among clients and partners.

What is Public Liability Insurance?

Public Liability Insurance is a type of insurance that covers the costs associated with legal claims made against your business by third parties. These claims typically arise from incidents where someone suffers injury or property damage due to your business operations. Whether you own a small café, a construction company, or a consultancy firm, this insurance is indispensable.

Why Your Business Needs Public Liability Insurance

Financial Protection: Accidents happen, and when they do, they can lead to costly legal battles. Public Liability Insurance ensures that your business is protected from the financial strain of compensation claims and legal fees. Without this coverage, a single claim could potentially cripple your finances and jeopardise your business's future.

Enhanced Credibility: Having Public Liability Insurance demonstrates professionalism and responsibility. Clients, customers, and partners are more likely to trust and engage with a business that has taken steps to protect their interests. This insurance can be a decisive factor when bidding for contracts or securing high-profile clients.

Legal Requirement: In many industries, Public Liability Insurance is not just a recommendation but a legal requirement. For instance, contractors and tradespeople often need to show proof of insurance to work on certain projects. Failing to comply can result in hefty fines and legal repercussions, putting your business at risk.

Peace of Mind: Knowing that you have a safety net in place allows you to focus on growing your business without the constant worry of potential lawsuits. Public Liability Insurance provides peace of mind, enabling you to operate with confidence and peace of mind.

Real-Life Scenarios Where Public Liability Insurance Matters

Retail Business: Imagine a customer slips on a wet floor in your store and sustains an injury. Without Public Liability Insurance, you could be liable for medical expenses and compensation, which could run into thousands of dollars.

Construction Company: A passerby is injured by falling debris at your construction site. The public liability insurance NZ would cover the legal costs and any awarded damages, protecting your business from financial ruin.

Event Planning: At an event you organised, a guest trips over electrical wiring and suffers a broken arm. Your Public Liability Insurance would cover the medical costs and any legal fees associated with the incident.

Choosing the Right Public Liability Insurance

When selecting public liability insurance, it's essential to consider the specific needs of your business. Here are a few tips:

Assess Your Risks: Identify potential hazards associated with your business operations. This assessment will help you determine the appropriate coverage level.

Compare Policies: Not all insurance policies are created equal. Compare different providers and policies to find one that offers comprehensive coverage at a competitive price.

Understand Exclusions: Be aware of what is and isn't covered by your policy. Some policies may exclude certain types of claims or incidents, so it's crucial to read the fine print.

Seek Professional Advice: Consulting with an insurance broker or professional can provide valuable insights and help you make an informed decision.

Summing Up

Public Liability Insurance is more than just a safety net; it's a strategic investment in your business's future. By protecting against the unexpected, you can focus on what you do best – running and growing your business.

Don't wait for an incident to realise the importance of this coverage. Act now, secure your public liability insurance NZ, and ensure your business is prepared for whatever comes its way.

Source - https://liability-insurance-cover.blogspot.com/2024/08/protect-your-business-importance-of.html

0 notes

Text

Disability Equipment Funding and Support Options in NZ

Navigating the world of disability equipment can be challenging, especially considering the costs involved.

For many individuals and families in New Zealand, finding financial support and funding options is crucial to obtaining the necessary equipment to improve their quality of life.

This blog will explore various funding sources and support options available for disability equipment NZ, providing valuable information to help you access the necessary resources.

Understanding Disability Equipment Needs in NZ

Disability equipment plays a pivotal role in enhancing the lives of individuals with disabilities.

The right equipment, from mobility aids like wheelchairs and scooters to essential daily living aids such as grab rails and adapted kitchen tools, can significantly improve independence and overall well-being.

However, the cost of such equipment can be prohibitive for many, making it essential to explore available funding and support options.

Government Funding and Support

Ministry of Health

The Ministry of Health in New Zealand offers several funding options for disability equipment. The Disability Support Services (DSS) programme provides financial assistance for essential equipment and services to support individuals with disabilities.

This can include mobility aids, communication devices, and home modifications. Eligibility for DSS funding typically requires a health professional's assessment and confirmation of the need for the equipment.

ACC (Accident Compensation Corporation)

The Accident Compensation Corporation (ACC) provides funding for necessary equipment and rehabilitation services for individuals whose disabilities result from accidents.

ACC’s support extends to various disability equipment, such as prosthetics, orthotics, and mobility aids, aimed at helping individuals recover and regain independence after an accident.

Work and Income New Zealand

Work and Income New Zealand (WINZ) offers financial assistance through its Disability Allowance programme.

This allowance helps cover the cost of disability-related expenses, including equipment. Individuals can apply for the Disability Allowance if they have a disability or health condition that results in extra costs.

Eligibility criteria include proving that the disability equipment is necessary for daily living and that other funding sources have been exhausted.

Non-Governmental Organisations (NGOs)

The New Zealand Red Cross

The New Zealand Red Cross supports individuals with disabilities through its various programmes.

They offer equipment loans and grants for essential disability equipment. The Red Cross can assist with mobility aids, home modifications, and other necessary items.

Their focus is on providing short-term support and emergency assistance, making it a valuable resource for immediate needs.

The Hugh Green Foundation

The Hugh Green Foundation is another key player in the support of disability equipment NZ. This charitable organisation grants individuals and families needing financial assistance for disability-related expenses.

They aim to support those who may not be able to access sufficient government funding or other sources of financial aid.

IHC Foundation

The IHC Foundation is dedicated to improving the lives of individuals with intellectual disabilities in New Zealand. They offer grants and support for disability equipment, including mobility aids and communication devices.

The foundation ensures that individuals with disabilities can access the necessary tools to enhance their independence and quality of life.

Insurance Options

Private Health Insurance

Some private health insurance plans in New Zealand may cover disability equipment costs. It is important to review your policy to understand what is included and the process for claiming.

Private health insurance can provide additional support beyond what is offered through government funding and NGOs, helping cover equipment costs and other related expenses.

Specialist Disability Insurance

Specialist disability insurance is designed to provide coverage for disability-related needs, including equipment.

This type of insurance can be particularly useful for individuals who require specific or custom equipment that may not be fully covered by other funding sources.

Consulting with an insurance advisor can help you determine the best policy for your needs.

Community Support and Fundraising

Local Community Grants

Many local communities in New Zealand offer grants and funding for disability equipment through community trusts and local councils.

These grants are often aimed at supporting individuals in their local area and can provide financial assistance for purchasing or maintaining disability equipment.

Crowdfunding and Fundraising

Crowdfunding platforms and community fundraising events can effectively raise money for disability equipment.

Fundraising events, such as charity auctions or community runs, can also generate funds for purchasing essential equipment.

Conclusion

Accessing disability equipment NZ can be challenging due to the costs involved, but numerous funding and support options are available.

Government programmes, non-governmental organisations, insurance options, and community support all play crucial roles in helping individuals obtain the necessary equipment to improve their quality of life.

By exploring these resources and understanding the various funding avenues, you can find the support you need to acquire disability equipment in NZ.

Whether you are seeking government assistance, non-profit support, or exploring private insurance and fundraising options, there are multiple pathways to obtaining the equipment that can make a significant difference in daily living.

If you or a loved one requires disability equipment, don’t hesitate to reach out to these organisations and explore the funding options available.

With the right support, you can enhance independence and enjoy a better quality of life.

#wheelchair nz#mobility scooters nz#mobility equipment & services#walkers for seniors#electric mobility scooter#disability equipment nz#walker nz

0 notes

Text

Seeing eye dogs (guide dogs in nz which is what I'll be calling them) are trained to do their business on command, particularly to avoid accidents in the handlers work/social life but it also means if the handler knows they'll be somewhere where poop duty will be tricky (solo adventures or something) they can prepare a bit in advance.

One thing to remember is most blind/low vision people will have some vision and often carefully looking coupled with the dog pooping on command means they can pick it up themselves. For my friend who had no vision (2 glass eyes, one set of which got eaten by his guide dog which is an interesting insurance claim to make!) Then his lucky kids got the task of cleaning up poop. And again, because they're trained to poop on command it's easier for that to happen at home or in a situation where someone with vision can assist

I'm glad the internet exists to answer all my weird ass niche questions but all that seems to have done is driven me deeper down the hole of weirder, nicher questions

3K notes

·

View notes

Text

TPD Insurance in NZ: How It Works and Why You Might Need It

Generally, we people like to focus on health or medical insurance to cover minor and major health problems. But we never think of curing or getting rid of permanent health issues. Here we are talking about "Total and Permanent Disability (TPD)." If you are a citizen of New Zealand then, you might be well aware of TPD. That provides financial support if you're permanently unable to work due to a disability.

In addition, with TPD insurance, you will be supported to cover all expenses and living costs which you can feel carefree and financially secure. However, if you still have some other query, then you would be able to clarify much stuff with this downward information also. So, it could be considered a good smart choice and a precious investment for the future also.

What is TPD Insurance?

You can best understand TPD insurance as a policy that helps you go through your lifetime. So, if permanent disability prevents you from working, a lump sum is received by availing of this policy. Secondly, in New Zealand, this is available as a stand-alone or as an add-on to life insurance.

In addition, if you depend on your income to make up for certain expenses, you should regard this as a good choice. Some of the expenses that fall into this category are mortgage repayments, the general cost of living, and support of long-term family dependents.

Types of TPD Insurance

There are majorly two types of TPD insurance in New Zealand you must take note of. These include:

Own Occupation TPD Insurance: First of all, if you are suffering from a permanent disability then "Own Occupation TPD Insurance" might help you. Owning it helps you in preventing you from performing the specific duties of your trained and experienced occupation.

Any Occupation TPD Insurance: The next we have is "Any Occupation TPD Insurance" which pays only when you are incapable of doing any job suitable to your training and experience. Also, it is usually less expensive than Own Occupation coverage but difficult to claim.

Remember, all policies offer different benefits, so over there you need to understand the variations. That can help you select the appropriate coverage according to your profession, lifestyle, and financial goals.

How Does TPD Insurance Work?

There are some significant factors that you need to consider in case you want to find out the working efficiency of TPD Insurance. These comprise:

It covers you and gives you a lump sum payment in case you are permanently disabled.

It helps you achieve financial security that may meet a requirement such as rehabilitation, doctors, or a change of lifestyle which is quite unavoidable.

Claim Process for TPD Insurance

For the TPD insurance claim process, medical proof of permanent disability along with reasons for the effect of the disorder on working capabilities.

Also, a qualified adviser can help streamline the claims process and help get a fair settlement.

Customizable Policies

Most NZ insurers usually allow policy customization.

Options include adding riders for extra coverage or reducing premiums by excluding non-relevant conditions.

Why TPD Insurance Might Be Essential

Here's why you should put it in your financial plan just like most New Zealanders. So, let's, without wasting time, pass over these TPD Insurance financial protection points:

Protection Against Financial Hardship

Permanent disability could hinder your ability to generate income and add further burdens to your pockets.

With total and permanent disability insurance, there are lump-sum payouts that address the essentials, including mortgage repayments, daycare, and living costs.

Covers Medical and Rehabilitation Expenses

Disabilities often have a high cost of medical care, specialized equipment, or home modifications.

TPD insurance can alleviate this burden, allowing you to maintain a stable standard of living.

Long-Term Family Security

If you have dependents, TPD insurance provides peace of mind knowing that they will be financially supported if you are unable to work.

The lump sum can ensure your family's future, offsetting educational costs and helping them adapt to new situations.

Flexibility in the Use of Funds

TPD insurance is paid as a single, lump sum payment. This way you may use the funds for immediate needs or to ensure long-term financial security if you need it.

Who Should Consider TPD Insurance?

There is no doubt that TPD Insurance will be very helpful for lots of people, but there are some target groups for whom it has been created especially for people facing permanent disability. Let's go into further details and learn more about them below:

Professionals with Specialized Skills

If a disability limits your ability to work in your specific field? Then, TPD insurance provides financial support to cover the income gap.

Primary Income Earners

As the main provider, TPD insurance ensures your family has financial support if you’re unable to work.

Homeowners with Mortgages

TPD insurance offers a lump sum to help pay off or reduce your mortgage, providing added security for your home.

Assessing Your TPD Coverage Needs

You need to know your finances, lifestyle, and savings before you make the right choice of TPD cover. Ideally, you need to have an amount that will cover your debts, future goals, and potential medical costs.

Choosing the Right TPD Insurance Provider

Research Provider Reputation

Choose providers with good customer service and a fair claims process. Online reviews, testimonials, and industry rankings can help you understand their reliability.

Compare Policy Options

Review coverage terms, exclusions, and premiums across providers. Read the fine print to avoid surprises when making a claim.

Consult an Insurance Adviser

An experienced adviser can help clarify policy details and recommend a TPD plan that fits your needs.

Working with an Insurance Adviser

If you do not want to get yourself into trouble, either while or before processing further, then the best for you would be to work with an insurance adviser. An insurance advisor can guide you through the application and claims process. That ensures you understand your policy and helps you find the best coverage for your situation.

How to Apply for TPD Insurance in NZ

Before applying for TPD insurance you must know that it usually involves assessing your financial needs. Besides, completing an application, and having a medical evaluation. Follow the below straightforward points to grab more information about the process:

Initial Consultation

The very first thing you have to do is consult an advisor to assess your financial needs and determine the right coverage. Doing so will save you from getting into any trouble in the future.

Application and Medical Assessment

After the initial conversation, you have to move ahead by filling up the application. And don't forget to undergo any medical tests, if necessary.

Policy Finalization

Finally, to conclude the process review and finalize your policy. Thus, you can ensure whether it fully aligns with your needs or not.

Securing Your Future with NZ Insurance

For NZ Insurances, we can offer you the most comprehensive and informed guidance in acquiring the correct coverage. From picking up the right policy to providing help through claims, our advisers take care of all that. Contact us now and get insured against your financial insecurity.

0 notes

Text

Top 6 Considerations for Choosing Equine Insurance Policies

When it comes to your beloved four-legged companions, ensuring their well-being and security is paramount. One essential aspect of safeguarding your equine friend is investing in a comprehensive equine insurance policy.

With a myriad of options available, it can be overwhelming to choose the right coverage. To simplify your decision-making process, here are the top 6 considerations to keep in mind when selecting the perfect equine insurance policy:

Coverage Extent and Limits

The first step in selecting an equine insurance NZ policy is understanding the coverage it offers. Consider the specific needs of your horse, such as medical care, surgical procedures, mortality coverage, and more. Ensure that the policy limits align with the potential risks your horse may face.

Comprehensive coverage will provide you with peace of mind, knowing that your equine companion is protected in various situations.

Premium Costs and Payment Options

While searching for the ideal equine insurance policy, it is crucial to evaluate the premium costs associated. Compare different insurance providers to find a balance between affordability and coverage.

Additionally, inquire about flexible payment options that suit your financial preferences. Investing in your horse's well-being should not break the bank, so choose a policy that offers value for your money.

Reputation of the Insurance Provider

Selecting a reputable equine insurance NZ provider is essential to guarantee efficient claim processing and excellent customer service.

Research the insurance company's background, read reviews from other horse owners, and assess their track record in handling claims. A reliable provider will offer transparency in their policies and ensure timely assistance when needed.

Policy Exclusions and Limitations

Before finalising your equine insurance policy, carefully review the exclusions and limitations outlined in the agreement. Understand what specific circumstances are not covered by the policy to avoid any surprises in the event of a claim.

Clarify any ambiguities with the insurance provider to have a clear understanding of your horse's protection under the policy.

Additional Services and Benefits

Some equine insurance policies may offer additional services and benefits beyond basic coverage. Look for value-added services such as emergency veterinary care, coverage for alternative therapies, or access to specialised equine clinics.

These extra benefits can enhance the overall protection provided to your horse and contribute to their well-being.

Policy Flexibility and Customisation Options

Every horse is unique, with specific requirements and characteristics. Opt for an equine insurance policy that offers flexibility and customisation options to tailor the coverage according to your horse's individual needs.

Whether you have a young foal, a competitive jumper, or a retired companion, a personalised policy ensures that your horse receives the appropriate care and protection.

Final Thoughts

Choosing the right equine insurance NZ policy for your horse requires careful consideration and research. By prioritising coverage extent, premium costs, provider reputation, policy details, additional benefits, and customisation options, you can select a policy that offers comprehensive protection and peace of mind for you and your equine companion.

Invest in the well-being of your horse today with a tailored equine insurance policy that meets all your requirements and provides the necessary support for any unforeseen circumstances.

0 notes

Text

Understanding Mechanical Breakdown Insurance: What It Covers

If you own a vehicle, you probably already have insurance to protect you in case of accidents. But what about those unexpected mechanical failures? That's where mechanical breakdown insurance (MBI) comes in.

MBI is designed to cover the costs of repairs to your vehicle when it experiences a breakdown due to mechanical failure. In this article, let’s explore what Compare Best Mechanical Breakdown Insurance NZ covers and why it's important to consider adding it to your auto insurance policy.

What Does MBI Cover?

Mechanical insurance covers the cost of repairing or replacing covered vehicle components when they break down due to mechanical failure. While coverage can vary depending on the insurance provider and policy, typical components covered by MBI include:

Engine

MBI can cover repairs to your vehicle's engine, including components such as the cylinder block, cylinder head, and internal parts.

Transmission

Coverage may extend to the transmission and its internal components, such as the torque converter, transmission case, and gears.

Drive Axle

This includes repairs to the components that transfer power from the transmission to the wheels, such as the drive shafts, constant velocity joints, and differential assembly.

Electrical System

MBI may cover repairs to the vehicle's electrical system, including the starter motor, alternator, and wiring harnesses.

Cooling System

Coverage may extend to components of the vehicle's cooling system, such as the radiator, water pump, and thermostat.

Air Conditioning and Heating

MBI can cover repairs to the vehicle's air conditioning and heating systems, including the compressor, condenser, and heater core.

Suspension

This includes repairs to the vehicle's suspension system, including the shocks, struts, and control arms.

Brakes

MBI may cover repairs to the vehicle's braking system, including the master cylinder, brake booster, and callipers.

Fuel System

Coverage may extend to components of the vehicle's fuel system, such as the fuel pump, fuel injectors, and fuel tank.

Why Do You Need Mechanical Breakdown Insurance?

While standard auto insurance policies typically cover damages resulting from accidents, they may not cover repairs to your vehicle's mechanical components if they break down due to normal wear and tear.

This is where mechanical breakdown insurance NZ comes in handy. Here are a few reasons why you should consider adding MBI to your auto insurance policy:

Protect Your Investment: A vehicle is a significant investment, and unexpected mechanical repairs can be costly. MBI provides an extra layer of protection, ensuring that you won't have to pay out of pocket for expensive repairs.

Peace of Mind: With MBI, you can drive with confidence knowing that you're protected against unexpected mechanical failures. Whether you're driving across town or across the country, you can rest assured that you're covered.

Save Money: The cost of MBI is often much lower than the cost of paying for repairs out of pocket. By adding MBI to your auto insurance policy, you can save money in the long run.

Convenience: Dealing with a mechanical breakdown can be a hassle, especially if you're far from home. With MBI, you can take your vehicle to any licensed repair facility, making the claims process quick and easy.

How Much Does Mechanical Breakdown Insurance Cost?

The cost of mechanical insurance can vary depending on factors such as the make and model of your vehicle, your driving history, and the level of coverage you choose. However, MBI is typically very affordable, with premiums ranging from $50 to $200 per year.

In Conclusion

Mechanical insurance provides an extra layer of protection against unexpected mechanical failures. By covering the cost of repairs to your vehicle's mechanical components, MBI can save you money and provide peace of mind. If you're looking for added protection for your vehicle, consider adding mechanical breakdown insurance NZ to your auto insurance policy.

Source - https://autolifecarinsurancenz.blogspot.com/2024/05/understanding-mechanical-breakdown.html

#mbi insurance nz#best mechanical breakdown insurance nz#mechanical insurance nz#car mechanical insurance nz

0 notes

Text

Exploring the Hidden Services Offered by NZ Car Towing Companies

When you think of a tow truck manukau company, the first image that likely comes to mind is a tow truck hauling a broken-down vehicle to the nearest repair shop. While towing is their primary service, these companies often offer a plethora of other services that you might not be aware of. In this article, we'll explore these lesser-known services offered by car towing companies. Buckle up, because there's more to towing than meets the eye!

1. Emergency Roadside Assistance: Your Guardian Angel on the Road

Car Jump-Starts: Dead battery? Towing companies can bring your vehicle back to life with a jump-start.

Flat Tire Changes: No need to struggle with changing a flat tire. Towing companies can handle it swiftly.

Fuel Delivery: Running on empty? A towing company Auckland will deliver fuel to get you back on the road.

Lockout Services: Locked your keys in the car? Towing companies can help you get back inside.

2. Long-Distance Towing: Taking You the Extra Mile

Cross-Country Towing: Planning a long-distance move? Towing companies can help you.

Interstate Towing: If you're stranded far from home, they can tow your car across state lines.

RV Towing: Got an RV or camper? Towing companies can tow even larger vehicles.

3. Motorcycle Towing: Two-Wheel Rescues

Motorcycle Transport: Towing companies have specialized equipment for safe motorcycle transportation.

Towing for All Terrain Vehicles (ATVs): Off-roading gone wrong? A towing company Auckland will get you covered.

4. Winching Services: Rescuing from Tough Spots

Stuck in Mud or Snow: Towing companies have powerful winches to pull you out of sticky situations.

Recovery from Ditches: If your car ends up in a ditch, they can recover it safely.

5. Flatbed Towing: The Extra Layer of Protection

Vehicle Protection: Flatbed towing is ideal for luxury cars, classics, or fragile vehicles.

Reduced Wear and Tear: It's gentler on your car, reducing the risk of damage during transport.

6. Salvage and Auction Services: Turning Wrecks into Cash

Salvage Yard Transportation: They can transport your salvage vehicle to a scrapyard.

Auction Transport: Need to move a vehicle to an auction house? A towing auckland firm has the expertise.

7. Insurance Assistance: Navigating the Paperwork

Accident Reports: They can help you complete accident reports for insurance claims.

Claims Handling: Towing companies often assist in filing insurance claims after accidents.

8. Junk Car Removal: Turning Trash into Treasure

Free Removal: Towing companies may offer free removal of junk cars cluttering your property.

Environmental Responsibility: They ensure proper disposal and recycling of old vehicles.

Conclusion:

Next time you find yourself in a roadside predicament, remember that car towing companies offer far more than just towing services. From jump-starts and flat tire changes to long-distance transportation and junk car removal, they are your go-to solution for a wide range of automotive needs. So, when you see a tow truck, think beyond the tow, because there's a world of assistance waiting to be uncovered. For quotes on car breakdown services for 24 hours, contact us now.

0 notes

Text

I don’t have any references to back it up, but I think private healthcare must also be incredibly wasteful in terms of overhead.

In NZ when I needed various vaccinations before coming to the United States I went to my local doctors office, was checked in my receptionist, and then saw the doctor (two people).

In NYC I recently got a vaccine and I was checked in by receptionist, brought to a waiting area by a nurse, saw another nurse for my vitals and health screener, saw another nurse for my actual vaccine. Behind the scenes I’m sure that the practice has a billing and coding person who enters info for insurance, and then someone on insurance side who approves claim etc. at least 6 people involved in that visit (maybe more).

Private health insurance in the United States is also a relatively new development (less than 100 years) after the U.S. joined WW2 there were wage freezes, and it was determined that fringe benefits like private health insurance were not part of the wage freeze so companies started offering it to be more attractive for hiring employees.

In 1954 Truman proposed universal healthcare for all Americans and initially it had very popular public support. The American Medical Association freaked out (it would lower healthcare costs and therefore their profit) and and hired the first political advertising firm which used the red scare of the Cold War which successfully spun it as a threat to American democracy.

it’s worth noting that it was congress that blocked even voting on this bill for universal healthcare, and during Truman’s two terms he had six years where there was a democratic majority in both the house and the senate.

btw, this is what electoral maps looked like for Truman in 1944 and 1948 (Roosevelt died in 1945)

absolutely bananas to me that with such popular support for his policies congress could be influenced (manipulated) to trash public healthcare.

The thing that gets me so worked up about universal healthcare is how people say that it will be so expensive for the tax payer.

This is long rant warning so I added a break lol.

The TLDR is that even in a low tax state like Florida, someone making 50k a year will have an effective rate of of 32% (for taxes, healthcare, costs for an undergraduate degree).

Someone making 50k a year in a 'high tax' country like New Zealand has an effective rate of 21% (for taxes, healthcare, costs for an undergraduate degree).

For an American and a Kiwi with the same salary of $50k, if they have the same disposable income, the Kiwi will be able to save an extra $75,000 over 10 years that they can use for a downpayment on a home to further build wealth.

Low tax states just have the costs shuffled to other places, you end up paying a LOT more for the same services.

Here's a comparison of someone who makes $50,000 a year in New Zealand and Florida (I chose Florida as an extreme example because they have 0% state tax rate) and each person makes $15,000 worth of purchases that are taxable.

New Zealand

$7,658 in combined income taxes and levies

$2,250 in taxes on $15k of purchases (15% sales tax)

Total of $9,908 - an effective total rate of 19.8% paid to taxes and purchases and healthcare

Florida

$7,945 in combined taxes (federal taxes, social security, medicaid etc)

$1,050 in taxes on $15k of purchases (7% sales tax)

$1,700 average annual health insurance premium for Florida

$2,060 average annual health insurance deductible for Florida

Total of $12,755 - an effective total rate of 25.5% paid to taxes and purchases and healthcare

Even in a low tax state, you're already have less take-home income than someone with the same salary in New Zealand.

But

... in New Zealand with your taxes you're also getting public education. It's not completely free, but costs are fixed, and you get one year of your undergraduate free, so for example a Bachelor of Arts would cost a total of $13,548 (USD $8,347)

If you can't pay that upfront, you can get a 0% loan from the government, which you don't need to start paying off until you earn at least $23k per year. For someone making $50k that would be an extra 6.5% deducted from your income ($270/month) until the loan is paid off (which would be 2 years and 8 months).

In Florida the average student loan debt is 25k and if you're making the same payments as someone in NZ ($270/month) then you'll be paying that off for 11 years. [Note: I believe that some private loan interest rates go as high as 15%].

Bachelor of Arts in NZ $13,548, paid off over ~2.7 years.

Bachelor of Arts in Florida $35,539, paid off over ~11 years.

So lets look at effective payments over 11 years (for simplicity salary stays at 50k).

New Zealand works out to be 21% effective rate over 11 years (including taxes, healthcare, and undergraduate degree).

Florida works out to be 32% effective rate over 11 years (including taxes, healthcare, and an undergraduate degree) - you're paying 52% more!

That means someone with the same income will effectively be able to save an additional $5,000 per year over 11 years, if they invest that extra amount and get a 5% return, the New Zealander will have savings of about $75k which they can use for downpayment for a home etc.

In conclusion, even though it may seem like you're getting a good deal in a low tax state like Florida, you end up paying soooo much more in healthcare and education costs compared to a country where taxes are a little higher, but you get public healthcare and education.

Why is the U.S. so expensive? Well once place to look is defense, intelligence, and police. In the United States this costs on average $3,700 per person. New Zealand spends $1,600 per person (USD ~1,000).

62 notes

·

View notes

Text

A Comprehensive Guide to Public Liability Insurance

Public liability insurance is an essential consideration for any business operating in New Zealand.

Whether you're a small business owner, a freelancer, or a large corporation, having the right insurance coverage can protect you from financial losses in unexpected events.

In this comprehensive guide, we'll dive into what Public Liability Insurance NZ is, why it's important, what it covers, how much it costs, and where to find the best coverage for your needs.

Understanding Public Liability Insurance

What is Public Liability Insurance?

Public liability insurance NZ is a type of business insurance that covers claims against your business for injury or property damage to third parties.

These third parties can include customers, clients, suppliers, or members of the public who may be affected by your business activities.

Why is it Important?

Public liability insurance NZ is important because it protects your business from the financial consequences of accidents or incidents on your premises or as a result of your business activities.

Without adequate insurance, you could be liable for significant compensation costs, legal fees, and other expenses, potentially bankrupting your business.

What Does Public Liability Insurance Cover?

Injuries to Third Parties

One of the primary coverages provided by public liability insurance NZ is protection against claims for bodily injury to third parties.

Suppose someone is injured on your business premises or due to business activities. In that case, your insurance policy will cover the costs associated with their medical treatment and any compensation they may be entitled to.

Property Damage

Public liability insurance NZ also covers claims for damage to third-party property. Whether it's accidental damage to a client's property during a service or damage caused by your business operations, your insurance policy will cover the costs of repairing or replacing the damaged property.

Legal Costs

Legal costs can quickly add up in case of a liability claim against your business. Public liability insurance NZ includes coverage for legal fees, court costs, and settlement expenses, providing the financial support you need to defend your business in court.

Advertising Liability

Public liability insurance NZ may also include coverage for advertising liability, protecting your business from claims related to defamation, slander, or copyright infringement arising from your advertising activities.

How Much Does Public Liability Insurance Cost?

The cost of public liability insurance in New Zealand can vary depending on various factors, including the size and nature of your business, the level of coverage you require, your claims history, and your industry.

As a general rule, the higher the risk of liability claims for your business, the higher your insurance premiums will likely be. However, the peace of mind and financial protection that public liability insurance provides far outweigh the costs.

Where to Find the Best Public Liability Insurance Coverage

When finding the best public liability insurance in New Zealand coverage for your business, it's essential to shop around and compare quotes from different insurance providers.

Look for insurers specialising in business insurance and with a strong reputation for customer service and claims handling.

Additionally, consider the level of coverage and any additional features or benefits offered by each policy to ensure you get the best value for your money.

Conclusion

Public liability insurance is a crucial form of protection for businesses in New Zealand. It provides coverage for claims related to injury, property damage, legal costs, and advertising liability.

By understanding what public liability insurance NZ covers, why it's important, how much it costs, and where to find the best coverage, you can protect your business against unexpected events and potential financial losses.

Source - https://liability-insurance-cover.blogspot.com/2024/06/the-ultimate-guide-to-public-liability.html

0 notes

Photo

Insurance Advisor In Auckland | Life Insurance Advisory Firm

Claim your insurance hassle-free. Consult our financial and insurance advisors in Auckland NZ for assistance.

#Insurance#Financial advisory firm auckland#business insurance in Auckland#income protection insurance Auckland#eurekafinancial

1 note

·

View note