#industrial refrigeration systems market

Explore tagged Tumblr posts

Text

Industrial Refrigeration Systems Market Size, Share & Trends Report, 2030

Industrial Refrigeration Systems Market Growth & Trends

The global industrial refrigeration systems market size is anticipated to reach USD 27.66 billion by 2030, registering a CAGR of 4.4% from 2023 to 2030, according to a new report published by Grand View Research, Inc. The demand for industrial refrigeration is increasing due to the fast-moving consumer goods and retail food which needs efficient storage for perishable edible items. Governments are taking initiatives to support and strengthen the cold chain infrastructure and shifting towards eco-friendly refrigeration systems.

Global warming and climate change have alarmed nations to take the necessary step to curb the crisis. As a result, industrial refrigeration system manufacturing companies have expressed concerns regarding the potential of global warming and ozone depletion of their refrigerants. As a result, companies are focusing on technologies to offer improved cost-effectiveness, lesser toxic refrigerants, lower energy consumption, and less toxic materials.

For instance, DanFoss, a prominent manufacturer of industrial refrigeration systems, introduced Cool selector 2 to help them design and optimize their air conditioning and refrigeration systems. System designers, engineers, and consultants can use the software to make optimum use of energy and HVACR systems. The benefits of using CO2 refrigeration systems are recognized worldwide as CO2 has a GWP (Global Warming Potential) of 1. The new update allows you to calculate components from the standpoint of an application for transcritical high-pressure side systems.

With the advancements in technology, industrial refrigeration systems have shown enhancement in their processes. Innovations have led to the manufacturing of smart and intelligent devices that monitor, set temperature, and notify the person as and when needed. The incorporation of Artificial Intelligence (AI) in the systems became a breakthrough in the market by enhancing productivity and lowering the operational cost for the organizations.

The industry growth in Asia Pacific is anticipated to observe the fastest growth during the forecast period. This expansion is attributed to the rapid growth prospects of cold-chain storage infrastructure in the countries such as Japan, India, and China. For instance, India is the second-largest fruit and vegetable producer, worldwide. The cold storage and handling the refrigeration of this huge vegetable and fruit produce is a challenging job thus fueling the market growth.

Request a free sample copy or view the report summary: https://www.grandviewresearch.com/industry-analysis/industrial-refrigeration-systems-market

Industrial Refrigeration Systems Market Report Highlights

The compressor segment is the largest growing component in the refrigeration system as they are used in commercial as well as industrial refrigeration, heat pumps, and air conditioning applications

Food and beverage applications accounted for the largest market share due to the growing disposable income and the rising population. It has augmented the demand for frozen and processed food products

The 500-1000kW capacity segment led the industrial refrigeration systems market as they helped extend the shelf life and reduce product wastage

Asia Pacific is the highest-growing region in the market due to the maximum number of fruits and vegetable producers and also a requirement for cold-chain storage

Industrial Refrigeration Systems Market Segmentation

Grand View Research has segmented the global industrial refrigeration systems market market based on component, capacity, refrigerant, application, and region

Industrial Refrigeration Systems Component Outlook (Revenue, USD Million, 2018 - 2030)

Compressors

Rotary Screw Compressor

Centrifugal Compressor

Reciprocating Compressors

Diaphragm Compressors

Others

Condensers

Evaporators

Controls

Others

Industrial Refrigeration Systems Capacity Outlook (Revenue, USD Million, 2018 - 2030)

Less than 100kW

100-500kW

500-1000kW

1000-5000kW

More than 5000kW

Industrial Refrigeration Systems Refrigerant Outlook (Revenue, USD Million, 2018 - 2030)

Ammonia

Carbon Dioxide

Hydrofluorocarbon

Hydrochlorofluorocarbons

Others

Industrial Refrigeration Systems Application Outlook (Revenue, USD Million, 2018 - 2030)

Refrigerated Warehouse

Food & Beverage

Chemical Petrochemical & Pharmaceuticals

Refrigerated Transportation

Industrial Refrigeration Systems Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

S.

Canada

Europe

Germany

K.

France

Italy

Spain

Asia Pacific

Japan

China

India

South Korea

Australia

Latin America

Brazil

Mexico

Middle East and Africa

Saudi Arabia

South Africa

List of the Key Players in the Industrial Refrigeration Systems Market

Johnson Controls

Emerson Electric Co

Dan Foss

DAIKIN Industries Ltd.

GEA Group Aktiengesellschaft

MAYEKAWA MFG Co. Ltd.

BITZER

EVAPCO Inc.

Guntner GmbH & Co. KG

LU-VE S.P.A

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/industrial-refrigeration-systems-market

#Industrial Refrigeration Systems#Industrial Refrigeration Systems Market#Industrial Refrigeration Systems Market Size#Industrial Refrigeration Systems Market Share

0 notes

Text

The global industrial refrigeration systems market was USD 25.07 Billion in 2022 and is expected to reach USD 43.82 Billion in 2032, and register a rapid revenue CAGR of 6.4% during the forecast period.

1 note

·

View note

Text

Industrial Refrigeration Systems Market Segmented On The Basis Of Component, Capacity, Application, Region And Forecast 2030: Grand View Research Inc.

San Francisco, 29 Sep 2023: The Report Industrial Refrigeration Systems Market Size, Share & Trends Analysis Report By Component (Compressors, Condensers, Evaporators, Controls, Others), By Capacity, By Application, By Region, And Segment Forecasts, 2023 – 2030 The global industrial refrigeration systems market size is anticipated to reach USD 27.66 billion by 2030, registering a CAGR of 4.4%…

View On WordPress

#Industrial Refrigeration Systems Industry#Industrial Refrigeration Systems Market#Industrial Refrigeration Systems Market 2023#Industrial Refrigeration Systems Market 2030#Industrial Refrigeration Systems Market Revenue#Industrial Refrigeration Systems Market Share#Industrial Refrigeration Systems Market Size

0 notes

Text

Industrial Refrigeration Systems Market Likely To Reach Beyond $27.66 Billion By 2030

The global industrial refrigeration systems market size is anticipated to reach USD 27.66 billion by 2030, registering a CAGR of 4.4% from 2023 to 2030, according to a new report published by Grand View Research, Inc. The demand for industrial refrigeration is increasing due to the fast-moving consumer goods and retail food which needs efficient storage for perishable edible items. Governments are taking initiatives to support and strengthen the cold chain infrastructure and shifting towards eco-friendly refrigeration systems.

Global warming and climate change have alarmed nations to take the necessary step to curb the crisis. As a result, industrial refrigeration system manufacturing companies have expressed concerns regarding the potential of global warming and ozone depletion of their refrigerants. As a result, companies are focusing on technologies to offer improved cost-effectiveness, lesser toxic refrigerants, lower energy consumption, and less toxic materials.

For instance, DanFoss, a prominent manufacturer of industrial refrigeration systems, introduced Cool selector 2 to help them design and optimize their air conditioning and refrigeration systems. System designers, engineers, and consultants can use the software to make optimum use of energy and HVACR systems. The benefits of using CO2 refrigeration systems are recognized worldwide as CO2 has a GWP (Global Warming Potential) of 1. The new update allows you to calculate components from the standpoint of an application for transcritical high-pressure side systems.

With the advancements in technology, industrial refrigeration systems have shown enhancement in their processes. Innovations have led to the manufacturing of smart and intelligent devices that monitor, set temperature, and notify the person as and when needed. The incorporation of Artificial Intelligence (AI) in the systems became a breakthrough in the market by enhancing productivity and lowering the operational cost for the organizations.

The industry growth in Asia Pacific is anticipated to observe the fastest growth during the forecast period. This expansion is attributed to the rapid growth prospects of cold-chain storage infrastructure in the countries such as Japan, India, and China. For instance, India is the second-largest fruit and vegetable producer, worldwide. The cold storage and handling the refrigeration of this huge vegetable and fruit produce is a challenging job thus fueling the market growth.

Request a free sample copy or view the report summary: Industrial Refrigeration Systems Market Report

Industrial Refrigeration Systems Market Report Highlights

The compressor segment is the largest growing component in the refrigeration system as they are used in commercial as well as industrial refrigeration, heat pumps, and air conditioning applications

Food and beverage applications accounted for the largest market share due to the growing disposable income and the rising population. It has augmented the demand for frozen and processed food products

The 500-1000kW capacity segment led the industrial refrigeration systems market as they helped extend the shelf life and reduce product wastage

Asia Pacific is the highest-growing region in the market due to the maximum number of fruits and vegetable producers and also a requirement for cold-chain storage

Industrial Refrigeration Systems Market Segmentation

Grand View Research has segmented the global industrial refrigeration systems market based on the component, capacity, application, and region.

Industrial Refrigeration Systems Component Outlook (Revenue, USD Million, 2018 - 2030)

Compressors

Rotary Screw Compressor

Centrifugal Compressor

Reciprocating Compressors

Diaphragm Compressors

Others

Condensers

Evaporators

Controls

Others

Industrial Refrigeration Systems Capacity Outlook (Revenue, USD Million, 2018 - 2030)

Less than 100kW

100-500kW

500-1000kW

1000-5000kW

More than 5000kW

Industrial Refrigeration Systems Application Outlook (Revenue, USD Million, 2018 - 2030)

Refrigerated Warehouse

Food & Beverage

Chemical Petrochemical & Pharmaceuticals

Refrigerated Transportation

Industrial Refrigeration Systems Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

Germany

U.K.

France

Asia Pacific

Japan

China

India

Latin America

Brazil

Mexico

Middle East and Africa

List of the Key Players in the Industrial Refrigeration Systems Market

Johnson Controls

Emerson Electric Co

Dan Foss

DAIKIN Industries Ltd.

GEA Group Aktiengesellschaft

MAYEKAWA MFG Co. Ltd.

BITZER

EVAPCO Inc.

Guntner GmbH & Co. KG

LU-VE S.P.A

0 notes

Text

What Are Most-Significant Applications of Industrial Refrigeration Systems?

The ongoing COVID-19 pandemic has put the spotlight on the global healthcare ecosystem, as many of the myths about how advanced the medical infrastructure around the world is were busted. With the case and death counts rising, the industry was caught gasping for breath (metaphorically), while the patients were literally gasping for breath (COVID is a lung infection). During this time, the number of research studies being conducted in the pharmaceutical and healthcare sectors on virology skyrocketed, as a vaccine was to be the leader of the charge against the pandemic.

Therefore, the number of clinical trials being conducted for viral vaccines rose massively, as did the worldwide trade of vaccines, aided by several such products getting regulatory approvals. With the healthcare and pharmaceutical sectors expected to not drop their guard for many years to come, the industrial refrigeration systems market size, as calculated by P&S Intelligence, is predicted to increase to $41.1 billion in 2030 from $26.8 billion in 2019, at a 5.0% CAGR between 2020 and 2030.

This is because an efficient, unbroken cold chain is essential for drug development and trade. Refrigerators are not only used to store and transport the final pharmaceutical products but also for the storage and transportation of the raw materials. Pharmaceuticals, biosimilars, excipients, active ingredients, tissues, and blood products are extremely sensitive to heat; therefore, effective cooling is necessary to protect them from damage and make them viable for use over a long time.

Another sector where refrigeration is important for the same reason is food and beverage. Most agricultural products spoil in the heat, which is why keeping them in cool conditions is paramount. Several of the processed food packages carry the directions “store in a cool and dry place”. In food processing factories, the ingredients, intermediate goods, and final products must be refrigerated to increase their shelf life. Thus, with the rising disposable income allowing people in developing countries to purchase processed food, the demand for industrial-grade refrigerators among food and beverage companies is surging.

Other industries where refrigeration is vital are oil and gas, construction, and manufacturing. Since, the food and beverage sector has been the largest user of such systems, their sales have been the highest in Asia-Pacific (APAC). Home to the largest number of people in the world, APAC has the most-productive food and beverage industry. India is already home to the fifth-largest processed food industry, which continues to garner extensive government support. “…the food processing sector in India has received around US$ 7.54 billion worth of Foreign Direct Investment (FDI) during the period April 2000-March 2017.”, says the India Brand Equity Foundation (IBEF).

Moreover, recently, the Indian government announced plans to establish 40 mega food parks, which are essentially integrated manufacturing districts for the food and beverage sector. With this, the industrial refrigeration systems market is poised for strong growth, with such equipment being important in this industry. Moreover, Invest India expects the country’s food processing sector to value more than $500 billion by 2025, which reflects a consistently growing demand for processing equipment.

Hence, with the pharmaceutical and food and beverage production growing, the procurement of industrial-grade refrigerators will escalate too.

#Industrial Refrigeration Systems Market Share#Industrial Refrigeration Systems Market Size#Industrial Refrigeration Systems Market Growth#Industrial Refrigeration Systems Market Applications#Industrial Refrigeration Systems Market Trends

1 note

·

View note

Text

Industrial Refrigeration System Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2028

Global Industrial Refrigeration System Market was valued at USD 20.21 Billion in 2021 and is expected to reach USD 26.96 Billion by the year 2028, at a CAGR of 4.2%.

Refrigeration is utilized to remove excess heat from a substance. The modern industrial processes in the various end-use sectors such as food and chemicals are managed by accurate process conditions and temperature is an important parameter in any process. The industrial refrigeration system has a prominent role in maintaining the stability of the overall industrial process and directly influence the quality of the end product. Additionally, refrigeration act as a major role in industry and society. As freezing inhibits microbiological growth, decreasing chemical reactions and delaying physical transformations, it is possible to preserve food, maintaining its quality without wasting, during long storage periods. This capacity is essential for the increasingly demanding modern society. Furthermore, energy can neither be created nor be destroyed and it is transformable from one form to another. Heat is a form of energy that travels owing to the difference in temperature. It transfers from the warmer to the cooler object. There are different refrigerants which are chemicals that are precipitated into the liquid form. They extend into vapor and extract the heat from the surrounding area.

The global Industrial Refrigeration System market research investigates the market in-depth and offers a comprehensive analysis of the major growth determinants, Industrial Refrigeration System market share, current trends, key players, and their future predictions. In addition, market demand and supply, each geographical region's growth rate, and market potential are all included in the Industrial Refrigeration System Market study. Raw materials, marketing channels, client surveys, industry trends and proposals, CAGR status, product scope, Industrial Refrigeration System market trends, major leading countries/regions, market risk, and market driving force are all included in the market research. The market prediction was based on a thorough market investigation completed by several industry experts.

To learn more about this report, request a free sample copy:

https://introspectivemarketresearch.com/request/15902

Key Industry Players in the Industrial Refrigeration System Market:

· Star Refrigeration (Scotland)

· Daikin Industries Ltd. (Japan)

· Emerson Electric Co. (US)

· Danfoss A/S (Denmark)

· GEA Group Aktiengesellschaft (Germany)

· Danfoss (Denmark)

· Mayekawa (Japan)

· Daikin (Japan)

· Ingersoll Rand (Ireland)

· EVAPCO

· Inc. (the US)

· Johnson Controls (Ireland)

· LU-VE Group (Italy)

· MTA S.p.A. (Italy)

· Frascold (Italy)

· HITEMA INTERNATIONAL (Italy)

· Güntner GmbH & Co. KG (Germany)

· KOBELCO (Japan)

· Innovative Refrigeration Systems (US)

· Parker Hannifin (US)

· Lennox International (US)

· Clauger (France)

· Rivacold (Italy)

· Dorin S.p.A. (Italy)

· Industrial Frigo (Lombardy)

· BITZER Kuhlmaschinenbau GmbH (Germany)

· Carnot Refrigeration (Canada)

· SRM Italy (Italy)

· Mayekawa Mfg. Co. Ltd. (Japan)

· Baltimore Aircoil Company (US) and others major key players.

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2012 - 2028. For this study, Grand View Research has segmented the global industrial refrigeration systems market based on component, Refrigerant type, application, and region:

Segmentation Analysis Includes,

By Component:

· Compressor

· Condenser

· Evaporator

· Expansion Valves

· Others

By Application:

· Food & Beverage

· Petrochemicals & Pharmaceuticals

· Electricity Production

· Refrigerated Warehouse

· Refrigerated Transportation

· Others

By Refrigerant Type:

· Ammonia

· Hydrofluorocarbon (HFC)

· Carbon Dioxide

· Others

By Region:

· North America (U.S., Canada, Mexico)

· Europe (Germany, U.K., France, Italy, Russia, Spain, Rest of Europe)

· Asia-Pacific (China, India, Japan, Singapore, Australia, New Zealand, Rest of APAC)

· Middle East & Africa (Turkey, Saudi Arabia, Iran, UAE, Africa, Rest of MEA)

· South America (Brazil, Argentina, Rest of SA)

Will you have any doubt about this report? Please contact us on:

https://introspectivemarketresearch.com/inquiry/15902

Key questions answered by the report: -

· What is the expected revenue CAGR for the global industrial refrigeration market over the forecast period (2022-2028)?

· What was the industrial refrigeration market size in 2021?

· Which factors are expected to drive the adoption of industrial refrigeration?

· What are some restraints for growth of the industrial refrigeration market?

· What are Opportunities in Industrial Refrigeration Market?

Industrial refrigeration systems widely use Chlorofluorocarbon (CFC) R-12 or Hydrochlorofluorocarbon (HCFC) R-22 because of these refrigerants\' thermal stability, safety, nonflammability, minimal toxicity, and high performance. However, due to contribution in increasing ozone layer depletion and surging global warming, Original Equipment Manufacturers (OEMs) of industrial refrigeration systems are moving towards refrigerant alternatives with the same benefits of CFCs and HCFCs. These OEMs are trying to phase out refrigerants with ozone depletion potential.

Purchase This Report: -

https://introspectivemarketresearch.com/checkout/?user=1&_sid=15902

Knowing market share in the base year provides you an idea of the competition and size of the suppliers. It reflects the market's fragmentation, accumulation, dominance, and amalgamation features. The Competitive Scenario provides an outlook study of the suppliers' various industry growth plans. This section's news provides vital insights at various stages while keeping up with the industry and engaging players in the economic discussion. Merger & Acquisition, Collaboration, Partnership, Agreement, Investment & Funding, New Product Launch & Enhancement, Recognition, Rewards & Expansion are the categories that the competitive scenario represents.

Related Report: -

https://introspectivemarketresearch.com/reports/commercial-refrigeration-equipment-market/

https://introspectivemarketresearch.com/reports/industrial-ammonia-refrigeration-systems-market/

https://introspectivemarketresearch.com/reports/industrial-refrigeration-equipments-market/

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1047

Linkedin| Twitter| Facebook

Email: [email protected]

0 notes

Text

Milton Orr looked across the rolling hills in northeast Tennessee. “I remember when we had over 1,000 dairy farms in this county. Now we have less than 40,” Orr, an agriculture adviser for Greene County, Tennessee, told me with a tinge of sadness.

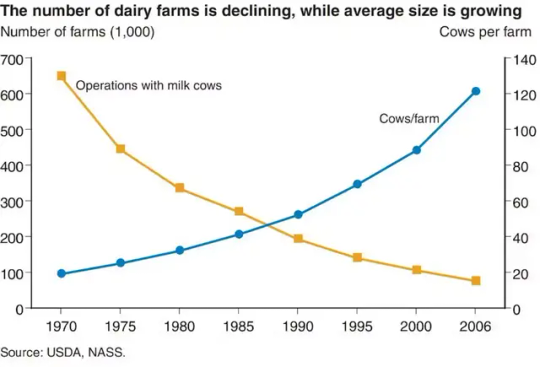

That was six years ago. Today, only 14 dairy farms remain in Greene County, and there are only 125 dairy farms in all of Tennessee. Across the country, the dairy industry is seeing the same trend: In 1970, more than 648,000 US dairy farms milked cattle. By 2022, only 24,470 dairy farms were in operation.

While the number of dairy farms has fallen, the average herd size—the number of cows per farm—has been rising. Today, more than 60 percent of all milk production occurs on farms with more than 2,500 cows.

This massive consolidation in dairy farming has an impact on rural communities. It also makes it more difficult for consumers to know where their food comes from and how it’s produced.

As a dairy specialist at the University of Tennessee, I’m constantly asked: Why are dairies going out of business? Well, like our friends’ Facebook relationship status, it’s complicated.

The Problem with Pricing

The biggest complication is how dairy farmers are paid for the products they produce.

In 1937, the Federal Milk Marketing Orders, or FMMO, were established under the Agricultural Marketing Agreement Act. The purpose of these orders was to set a monthly, uniform minimum price for milk based on its end use and to ensure that farmers were paid accurately and in a timely manner.

Farmers were paid based on how the milk they harvested was used, and that’s still how it works today.

Does it become bottled milk? That’s Class 1 price. Yogurt? Class 2 price. Cheddar cheese? Class 3 price. Butter or powdered dry milk? Class 4. Traditionally, Class 1 receives the highest price.

There are 11 FMMOs that divide up the country. The Florida, Southeast, and Appalachian FMMOs focus heavily on Class 1, or bottled, milk. The other FMMOs, such as Upper Midwest and Pacific Northwest, have more manufactured products such as cheese and butter.

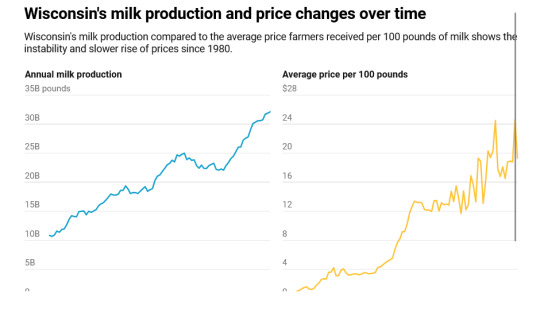

For the past several decades, farmers have generally received the minimum price. Improvements in milk quality, milk production, transportation, refrigeration, and processing all led to greater quantities of milk, greater shelf life, and greater access to products across the US. Growing supply reduced competition among processing plants and reduced overall prices.

Along with these improvements in production came increased costs of production, such as cattle feed, farm labor, veterinary care, fuel, and equipment costs.

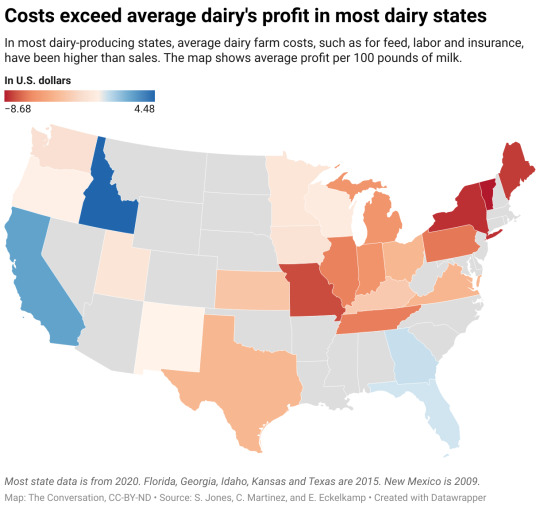

Researchers at the University of Tennessee in 2022 compared the price received for milk across regions against the primary costs of production: feed and labor. The results show why farms are struggling.

From 2005 to 2020, milk sales income per 100 pounds of milk produced ranged from $11.54 to $29.80, with an average price of $18.57. For that same period, the total costs to produce 100 pounds of milk ranged from $11.27 to $43.88, with an average cost of $25.80.

On average, that meant a single cow that produced 24,000 pounds of milk brought in about $4,457. Yet, it cost $6,192 to produce that milk, meaning a loss for the dairy farmer.

More efficient farms are able to reduce their costs of production by improving cow health, reproductive performance, and feed-to-milk conversion ratios. Larger farms or groups of farmers—cooperatives such as Dairy Farmers of America—may also be able to take advantage of forward contracting on grain and future milk prices. Investments in precision technologies such as robotic milking systems, rotary parlors, and wearable health and reproductive technologies can help reduce labor costs across farms.

Regardless of size, surviving in the dairy industry takes passion, dedication, and careful business management.

Some regions have had greater losses than others, which largely ties back to how farmers are paid, meaning the classes of milk, and the rising costs of production in their area. There are some insurance and hedging programs that can help farmers offset high costs of production or unexpected drops in price. If farmers take advantage of them, data shows they can functions as a safety net, but they don’t fix the underlying problem of costs exceeding income.

Passing the Torch to Future Farmers

Why do some dairy farmers still persist, despite low milk prices and high costs of production?

For many farmers, the answer is because it is a family business and a part of their heritage. Ninety-seven percent of US dairy farms are family owned and operated.

Some have grown large to survive. For many others, transitioning to the next generation is a major hurdle.

The average age of all farmers in the 2022 Census of Agriculture was 58.1. Only 9 percent were considered “young farmers,” age 34 or younger. These trends are also reflected in the dairy world. Yet, only 53 percent of all producers said they were actively engaged in estate or succession planning, meaning they had at least identified a successor.

How to Help Family Dairy Farms Thrive

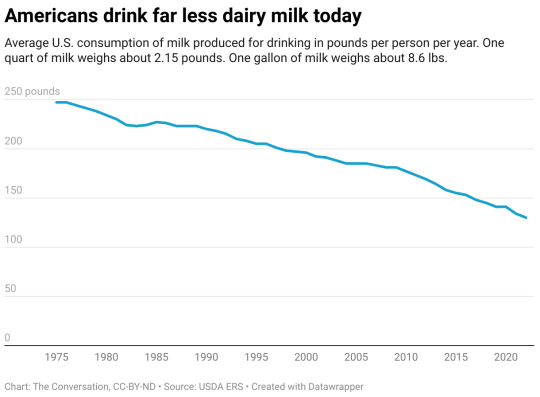

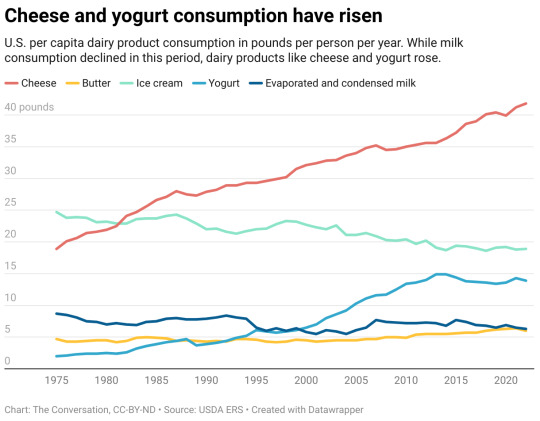

In theory, buying more dairy would drive up the market value of those products and influence the price producers receive for their milk. Society has actually done that. Dairy consumption has never been higher. But the way people consume dairy has changed.

Americans eat a lot, and I mean a lot, of cheese. We also consume a good amount of ice cream, yogurt, and butter, but not as much milk as we used to.

Does this mean the US should change the way milk is priced? Maybe.

The FMMO is currently undergoing reform, which may help stem the tide of dairy farmers exiting. The reform focuses on being more reflective of modern cows’ ability to produce greater fat and protein amounts; updating the cost support processors receive for cheese, butter, nonfat dry milk, and dried whey; and updating the way Class 1 is valued, among other changes. In theory, these changes would put milk pricing in line with the cost of production across the country.

The US Department of Agriculture is also providing support for four Dairy Business Innovation Initiatives to help dairy farmers find ways to keep their operations going for future generations through grants, research support, and technical assistance.

Another way to boost local dairies is to buy directly from a farmer. Value-added or farmstead dairy operations that make and sell milk and products such as cheese straight to customers have been growing. These operations come with financial risks for the farmer, however. Being responsible for milking, processing, and marketing your milk takes the already big job of milk production and adds two more jobs on top of it. And customers have to be financially able to pay a higher price for the product and be willing to travel to get it.

33 notes

·

View notes

Text

Unraveling the Growth Potential of the Geofoams Market: Global Outlook

The global geofoams market size is expected to reach USD 972.6 million by 2027, expanding at a CAGR of 2.7%, according to a new report by Grand View Research, Inc. Factors such as availability of geofoams at low cost coupled with its superior strength and durability are projected to fuel the market growth. Expansion of the construction industry across the globe coupled with the infrastructural developments in economies such as India, China, Brazil, Mexico, Saudi Arabia, and others is expected to propel the demand for geofoams over the forecast period. In addition, maintenance of the existing infrastructure in developed nations is likely to drive the growth of the market.

Geofoams Market Report Highlights

The expanded polystyrene geofoams segment accounted for USD 508.2 million in 2019 and is projected to expand at a CAGR of 3.1% from 2020 to 2027. The compatibility of the product has resulted in its increasing adoption for applications including roads and highway construction, building and infrastructure, and others

The road and highway construction application segment accounted for 38.07% of the total market and is projected to expand at a CAGR of 3.4% from 2020 to 2027 on account of the rising infrastructural growth across the developing economies including China, India, Brazil, UAE, Saudi Arabia, and others

Asia-Pacific accounted for USD 278.5 million in 2019 and is estimated to expand at a CAGR of 3.2% from 2020 to 2027 owing to the rising demand for road pavement, which is anticipated to further benefit the growth

China accounted for the highest market share in Asia Pacific on account of the rapidly expanding construction industry in the country

Europe market is estimated to expand at a CAGR of 2.8% owing to the rising number of construction and infrastructural activities in economies including Spain, Italy, and others

For More Details or Sample Copy please visit link @: Geofoams Market Report

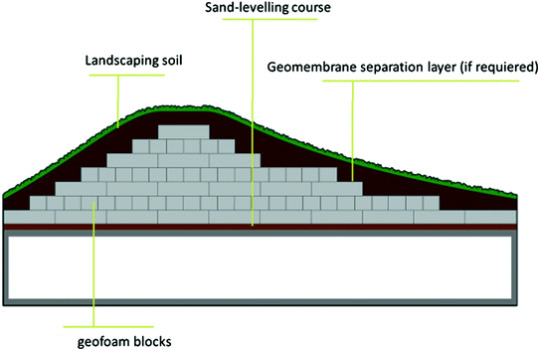

Geofoams are increasingly used in the construction industry as it helps in suppressing the noise and vibrations. In addition, it is easy to handle and does not require any special equipment for installation. The product is increasingly used in the railway track systems, below the refrigerated storage buildings, storage tanks, and others to avoid ground freezing.

The geofoams undergo chemical changes when it comes in contact with petroleum solvents. It turns into a glue-type substance, thereby losing its strength. This factor is projected to limit the use of geofoams in the construction industry which is projected to restrict the industry growth over the forecast period.

#Geofoam#Expanded polystyrene (EPS)#Geofoam blocks#Construction materials#Road and highway construction#Retaining walls#Geotechnical engineering#Soil stabilization#Environmental protection#Earthquake resistance#Noise and vibration control#Water management#Hydrostatic pressure#Thermal insulation#Structural stability

10 notes

·

View notes

Text

Refrigeration Was A Wonderful Invention When It Wasn’t Trying To Kill You

Over the years, Cincinnatians have discovered myriad methods to kill themselves. Breweries alone offered boiling vats, open shafts, toppling equipment and exploding barrels. At home, poisonous wallpaper, flammable nightgowns and yawning cesspools claimed many lives. As if we needed any additional hazards to jeopardize our safety, the Twentieth Century introduced yet another deadly contraption – the refrigerator.

The Cincinnati Post [22 June 1920] related one incident that nearly ended in tragedy:

“Firemen carried several tenants from upper floors of a four-story building at Eighteenth and Main streets Tuesday when ammonia fumes, escaping from an ice machine in the cellar, entered corridors and apartments. A valve in a machine that supplies refrigeration in the butcher shop of John Stegner, first floor of the building, blew off shortly before 10 a.m., causing the fumes to escape.”

The circumstances involved here were fairly typical for Cincinnati in the early 1920s and 1930s. Refrigeration was just beginning to enter the domestic market and most electric refrigerators were installed by businesses. In the early days, the noisy refrigeration machinery was usually relegated to the basement. The coolant of choice for most commercial systems was ammonia. Some of these installations were ponderous, as reported in the Post [10 March 1930]:

“Attempting to shut off ammonia pipes after a compressor head broke in the 15-ton refrigeration plant at Hamilton County Tuberculosis Sanitarium Monday at 8 a.m., Gus Leistner, 65, of 914 Findlay-st, engineer, partially was overcome by fumes.”

Later that same year, the University Club at Fourth and Broadway had to be evacuated because of ammonia leaking from its refrigeration system. The Strietmann Baking Company at Central Parkway and Plum Street suffered a massive ammonia spill in 1924. Firemen needed gas masks to enter the Hilberg Packing Company at 516 Polar Street in 1928 when ammonia seeping from the refrigerator filled the building.

Despite such catastrophes, ammonia was the most common coolant for the first thirty years of the 1900s. A Cincinnati firm, the F.W. Niebling & Son Co., of 406 Elm Street, boasted in an advertisement [20 February 1927] that the first ammonia-infused refrigeration plant installed by the company was 31 years old and still “in excellent condition.”

Still, ammonia was connected to so many mishaps that advertisers touted any system that did not involve ammonia. In 1926, the Tudor Court Apartments in Clifton installed a building-wide refrigeration system, with each of the 86 apartments equipped with a Frigidaire unit serviced by a massive compressor in the basement. The owners hastened to advertise that “no brine or ammonia” was used in that system.

Ammonia wasn’t the only chemical employed in refrigeration equipment. Responding to a reader’s inquiry, the Post [22 July 1921] inventoried a veritable witch’s cauldron of compounds used in various systems:

“What is the formula for the solution which is used in the cooling coils of an electric refrigerator? Substances are: Ammonia, carbon dioxide, ethyl chloride, methyl chloride and sulphur dioxide.”

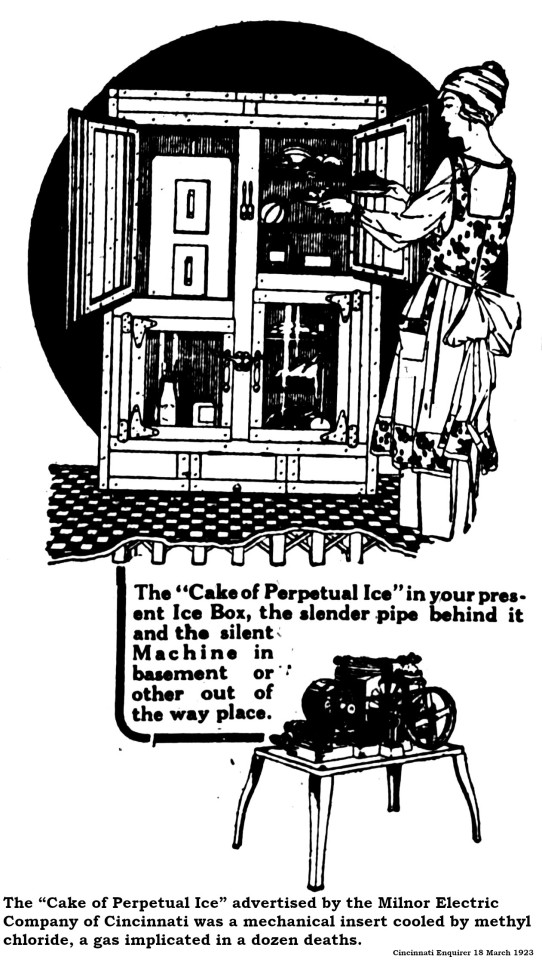

Of that formulary, ammonia’s biggest competitor was methyl chloride, a colorless, odorless, flammable gas. Methyl chloride was more efficient than ammonia and better suited to the small coolant devices required for a single house, as opposed to the big industrial machines cooled by ammonia. Units incorporating methyl chloride were so small they were retrofitted as mechanical ice blocks. Customers kept their old ice boxes, canceled ice delivery and turned on a methyl chloride unit in the same compartment where they would formerly have loaded a block of ice.

Manufacturers also claimed methyl chloride was safer than ammonia. Cincinnati’s Milnor Electric Co. highlighted this benefit in an advertisement [18 March 1923] for their Serv-el Automatic Electric Home Refrigeration products in the Cincinnati Enquirer:

“Important Notice: The gas (methyl-chloride) used in Serv-el is harmless, odorless and non-poisonous. Only Serv-el has this advantage.”

This claim was sorely tested in August 1929 when a rash of deaths blamed on methyl chloride refrigerators was reported from Chicago. The Chicago deaths created a panic among refrigeration companies who appealed to the federal government for assistance. The Cincinnati Enquirer [23 August 1929] reported that three governmental agencies – the Public Health Service, the Bureau of Standards, and the Bureau of Mines – had announced that household refrigeration systems were safe.

“Serious accidents from household refrigeration systems, the statement continued, have been small in comparison to the number in use and added that improvements might be expected that would reduce materially the small hazard that does exist.”

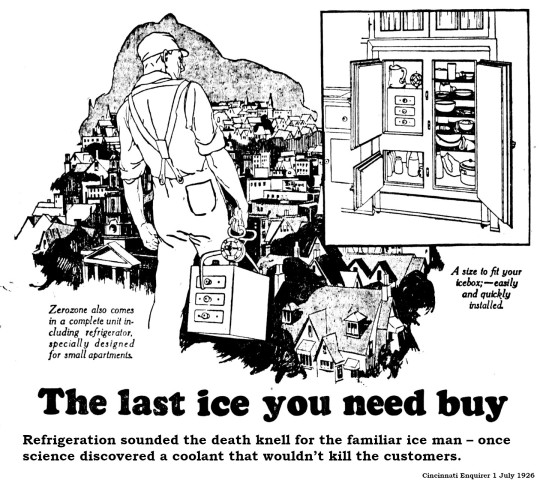

The Chicago deaths gave hope to the consumer ice industry, fighting a losing battle against the march of progress. In an Enquirer advertisement [31 July 1926], the City Ice & Fuel Co. complained that these new-fangled systems required:

“ . . . a complicated, high-cost mechanical-chemical outfit, dependent on a large and continuous supply of electricity to make it ‘run,’ and on some chemical (SULPHUR DIOXIDE OR METHYL CHLORIDE) to create cold – just as ammonia is used in the big ice plants.”

It was, of course, a losing proposition. The old ice boxes were messy, moldy things that really didn’t keep food all that cold and regularly flooded the kitchen with water melted from the huge block of ice delivered by some guy who tracked muddy footprints across your carpet.

All the industry needed was a better coolant, a chemical that cooled your refrigerator but didn’t kill you. The solution came from an inventor named Thomas Midgley Jr., who lived just up the road in Dayton. In 1932, Midgley came up with something called Freon. It checked all the boxes and soon replaced all other coolants for the next 60 years or so.

Problem was, Freon, a chlorofluorocarbon, accumulated in the atmosphere and contributed to the destruction of the ozone layer that protects life on earth from the harmful rays of the sun. So, in essence, to avoid a few disastrous refrigeration accidents, we found a solution that endangered all life on the planet.

Ponder that the next time you pull a brewski from the fridge.

4 notes

·

View notes

Text

Refrigerated vans Market Growth Scope Assessment Till 2027

The refrigerated vans market refers to the market for vans that are equipped with refrigeration units to transport perishable goods at a controlled temperature. Refrigerated vans are used to transport a wide range of products, including food and beverages, pharmaceuticals, and other temperature-sensitive goods.

The primary driver of the refrigerated vans market is the growing demand for temperature-controlled logistics services. With the increasing demand for fresh and perishable products, there is a need for efficient and reliable transportation systems to ensure the products reach their destination in optimal condition.

For Download Free Sample Link Here:-https://www.marketinforeports.com/Market-Reports/Request-Sample/510785

Another factor driving the market is the increasing demand for online grocery delivery services. Online grocery shopping has become increasingly popular in recent years, and refrigerated vans are an essential component of the logistics chain for these services.

The market for refrigerated vans is highly competitive and is dominated by a few major players. Some of the key players in the market include Daimler AG, Ford Motor Company, General Motors Company, and Renault SA.

In terms of geography, North America and Europe are currently the largest markets for refrigerated vans, primarily due to the well-established logistics infrastructure in these regions. However, the market in Asia Pacific is expected to grow at a significant rate in the coming years due to the increasing demand for fresh and perishable products and the growing e-commerce industry in countries such as China and India.

Overall, this is expected to continue to grow in the coming years due to the increasing demand for temperature-controlled logistics services and the growing e-commerce industry. However, the market may face challenges due to the high cost of refrigerated vans and the need for strict regulatory compliance for the transportation of temperature-sensitive goods.

2 notes

·

View notes

Text

How Technology is Revolutionising the Indian Edible Oil and Rice Sectors

The Indian edible oil and rice sectors, two critical components of the country's food economy, are experiencing a remarkable transformation fuelled by technological advancements. As the world embraces cutting-edge technology, agriculture is not left behind. Innovations are reshaping every aspect of the supply chain, from the fields to the consumers’ tables.

As a leading oil manufacturing company in India and a rice exporter in India, Halder Venture Limited has adoptedthe latest technology, including PLCs and ERP systems to enhance efficiency, quality, and sustainability across its operations. This blog explores the technological advancements that are revolutionising the Indian edible oil and rice sectors. From modern farming techniquesto advanced processing techniques, technology playsa pivotal role in the industry.

Edible Oil Sector

Modern Farming Techniques

Precision Agriculture: The use of drones, satellite imagery, and data analytics enables farmers to optimise resource allocation, monitor crop health, and detect pests and diseases early on.

Mechanisation: Tractors and harvesters reduce labour costs and improve efficiency, leading to higher yields and lower production costs.

Improved Seed Varieties: Developing high-yielding and disease-resistant seed varieties ensures better crop performance and increased productivity.

Advanced Processing Technologies

Solvent Extraction: Modern plants utilise solvent extraction plants extract oil efficiently from oilseeds, maximising yield and minimising waste.

Refining Technologies: State-of-the-art refining processes used in oil refineries remove impurities and improve the quality of edible oils, ensuring safety and consumer satisfaction.

Packaging Innovation: Advanced packaging materials and techniques protect edible oils from spoilage and maintain their nutritional value.

Supply Chain Management

Blockchain Technology: Blockchain can track the entire journey of edible oils from the farm to the consumer, ensuring transparency, traceability, and safety.

Cold Chain Management: Cold storage facilities and refrigerated transportation maintain the quality of edible oils throughout the supply chain.

Rice Sector

High-Yielding Varieties

Genetic Modification: Genetically modified rice varieties offer higher yields, improved resistance to pests and diseases, and enhanced nutritional content, strengthening the Indian rice industry.

Hybrid Rice: Hybrid rice varieties combine the best traits of different parent lines, resulting in increased productivity and better adaptation to local conditions.

Mechanisation

Rice Transplanters: Efficient rice transplanters reduce labour costs and improve planting accuracy, leading to higher yields.

Rice Harvesting Machines: Modern harvesting machines speed up the harvesting process, minimising losses and ensuring timely processing.

Post-Harvest Technologies

Parboiling: Parboiling rice enhances its cooking quality, nutritional value, and shelf life.

Rice Milling: Advanced rice milling machines improve the quality and appearance of rice, making it more appealing to consumers.

Export Promotion

Quality Standards: Adhering to international standards (ISO,HACCP) ensures that Indian rice meets global requirements and facilitates exports.

Branding and Marketing: Effective branding and marketing initiatives promote Indian rice as a premium agro-product in international markets, bolstering the reputation of India as a leading rice exporter in India.

Conclusion

Technology is transforming the Indian edible oil and rice sectors, driving efficiency, sustainability, and quality. By adopting modern farming practices, advanced processing techniques, and effective supply chain management, these industries are poised to meet the growing domestic and international demand for food products. As technology continues to evolve, agro-product sectors are well-positioned to play a significant role in the country's economic growth and food security.

0 notes

Text

Energy Recovery Ventilator Core Market: Trends, drivers, challenges, and opportunities

As the global demand for energy-efficient and sustainable building solutions continues to rise, the Energy Recovery Ventilator (ERV) Core market is experiencing significant growth. These essential components, central to modern HVAC (heating, ventilation, and air conditioning) systems, play a vital role in maintaining air quality and optimizing energy efficiency. ERV cores facilitate the exchange of heat and moisture between the outgoing stale air and incoming fresh air, reducing the burden on heating and cooling systems. This process not only conserves energy but also ensures a more comfortable indoor environment. In this article, we explore the key trends, drivers, challenges, and opportunities in the ERV core market, offering insights for industry experts seeking to understand the future of this vital sector.

Key Drivers Fueling Market Growth

Energy Recovery Ventilator Core Market Is projected to grow from USD 1.01 billion in 2024 to USD 1.56 billion by 2030, at a CAGR of 7.4% during the forecast period. Major factors contributing to the growth of the energy recovery ventilator core market include a heightened focus on indoor air quality driven by climate change.

The ERV core market is primarily driven by the increasing need for energy efficiency and sustainability, both of which have become paramount in the building and construction industry. Governments across the globe are introducing stricter regulations on energy consumption, and buildings are under pressure to meet higher standards of energy efficiency. With the adoption of green building standards like LEED (Leadership in Energy and Environmental Design) and the ASHRAE (American Society of Heating, Refrigerating, and Air-Conditioning Engineers) guidelines, energy recovery ventilators are becoming indispensable for achieving these goals.

As new construction projects prioritize low energy consumption and environmental responsibility, there is growing demand for ERVs. Buildings today are constructed with highly efficient insulation and sealed windows, which, while excellent for maintaining energy control, require effective ventilation solutions. Without proper ventilation, indoor air quality can deteriorate, creating health concerns for occupants. ERVs address this need by providing fresh air while recovering energy from the air being exhausted. This process not only reduces the need for additional heating and cooling but also ensures that the air quality inside is fresh and healthy.

Moreover, as awareness of environmental impact grows, businesses and consumers are increasingly seeking products that reduce carbon footprints. ERVs offer a straightforward solution by minimizing energy wastage in buildings and cutting down the reliance on HVAC systems for temperature regulation. This energy efficiency is appealing to both commercial and residential property owners, resulting in wider adoption.

Technological Advancements Shaping the Market

The ERV core market is not just growing in size—it is evolving in sophistication. Manufacturers are continually refining the materials used in ERV cores to enhance energy transfer efficiency. Materials like enthalpy wheels, heat exchange plates, and polymer membranes are being developed to maximize energy recovery while minimizing the size and cost of the units. These innovations are making ERVs more efficient, compact, and cost-effective, opening the market to a broader range of applications.

One of the most significant advancements in ERV technology is the integration of smart systems. The introduction of Internet of Things (IoT) connectivity has revolutionized the way ERVs operate. Building managers can now remotely monitor and adjust ventilation settings in real-time. This capability enables dynamic energy management, where ventilation rates are automatically adjusted based on factors like occupancy and indoor air quality. Additionally, predictive maintenance powered by artificial intelligence (AI) is helping businesses identify potential issues before they become costly problems, ensuring that systems remain in peak condition for longer.

These technological improvements not only enhance the performance of ERVs but also position them as more accessible and valuable for building owners and facility managers. The ability to optimize energy consumption through intelligent systems aligns perfectly with the growing demand for smart, sustainable building solutions.

Overcoming Market Challenges

While the ERV core market is poised for growth, there are several challenges that need to be addressed. The primary obstacle remains the high initial cost of installation. Despite the long-term energy savings, the upfront investment for an ERV system can be substantial, especially for small and medium-sized enterprises (SMEs) or residential projects with tight budgets. While governments offer incentives and rebates to encourage energy-efficient building practices, the initial financial commitment can still be a barrier to adoption for many.

Another challenge is the complexity of retrofitting existing buildings with ERV systems. Many older buildings were not designed with modern energy recovery solutions in mind, making it difficult to integrate ERVs into the existing HVAC infrastructure. This process can be costly and technically demanding, requiring a tailored approach for each building. However, with the growth of the market and the development of more modular, adaptable systems, this challenge is slowly being overcome.

Finally, the need for skilled technicians and engineers who understand the intricacies of installing and maintaining ERV systems cannot be overlooked. As the demand for these systems grows, so too does the need for professionals who are trained in their installation and maintenance. Addressing this skills gap will be critical to ensuring that ERVs are installed correctly and continue to perform efficiently over time.

Future Outlook and Opportunities for Growth

The future of the ERV core market looks incredibly promising. As the construction industry continues to embrace green building practices, the demand for energy-efficient ventilation solutions will only increase. The ongoing emphasis on reducing carbon emissions and improving air quality will drive continued innovation in ERV technologies, with manufacturers focusing on improving efficiency, reducing environmental impact, and offering greater ease of installation.

Smart technologies will likely be a key focus for the next phase of market development. The ability to integrate ERVs with broader building management systems for real-time energy optimization offers significant opportunities for manufacturers to enhance product offerings. Businesses that adopt IoT-enabled, energy-efficient ERV systems will likely see increased demand from both residential and commercial property owners seeking to reduce their energy consumption while maintaining indoor air quality.

Geographically, emerging markets present a significant opportunity for growth. As urbanization accelerates in regions like Asia, Africa, and the Middle East, the demand for energy-efficient building technologies will rise. ERV adoption in these regions could be a major growth driver as these economies prioritize sustainability and energy efficiency in their infrastructure development.

Download PDF Brochure :

The Energy Recovery Ventilator Core market is in the midst of a transformation, driven by a convergence of regulatory pressures, environmental awareness, and technological advancements. As more buildings are constructed with energy efficiency in mind, the demand for ERV systems will continue to grow. While challenges such as high installation costs and retrofitting hurdles remain, the long-term benefits in terms of energy savings, improved air quality, and sustainability make ERVs a vital component of modern HVAC systems. For industry experts investing in energy recovery ventilators offers a promising path to creating more efficient, sustainable, and comfortable buildings for the future.

#Energy Recovery Ventilator#energy efficiency#HVAC systems#sustainable building solutions#smart building technologies#energy recovery#green building.

0 notes

Text

Metro Redx: Your Reliable Inverter Battery Exporter to Nigeria

In a country like Nigeria, where power outages are a frequent challenge, having a reliable energy backup solution is essential. Metro Redx stands out as a Reliable Inverter Battery Exporter to Nigeria, providing high-quality, durable, and efficient batteries designed to meet diverse energy needs. Whether for residential, commercial, or industrial applications, our inverter batteries deliver uninterrupted power with exceptional performance.

Why Choose Metro Redx as Your Inverter Battery Exporter?

Metro Redx has established itself as a trusted name in the energy storage sector, offering batteries that combine advanced technology with unmatched reliability. Here’s why Nigerian customers prefer our products:

1. High-Quality Products

Our inverter batteries are engineered to deliver optimal performance, even in demanding environments. Built with top-grade materials, they are designed to withstand frequent use and extreme weather conditions, making them ideal for Nigeria’s climate.

2. Durability and Longevity

Metro Redx batteries are known for their durability and long service life. They are manufactured with robust designs and innovative technology, ensuring reliable power backup for years without frequent replacements.

3. Energy Efficiency

Energy efficiency is at the core of our inverter battery solutions. Our batteries are designed to store and discharge energy effectively, reducing energy waste and optimizing power usage. This helps households and businesses save on electricity costs while enjoying uninterrupted power.

4. Customizable Solutions

We understand that every customer has unique energy needs. That’s why we offer a wide range of inverter batteries in various capacities, allowing Nigerian customers to choose solutions that best suit their specific requirements.

Applications of Metro Redx Inverter Batteries

Our inverter batteries cater to a variety of applications, ensuring reliable power across different sectors in Nigeria:

1. Residential Power Backup

Frequent power cuts can disrupt daily life at home. Metro Redx inverter batteries provide consistent power backup for essential household appliances like lights, fans, refrigerators, and entertainment systems, ensuring comfort and convenience.

2. Commercial Applications

Businesses in Nigeria rely on uninterrupted power to maintain operations and productivity. Our batteries are the perfect solution for powering offices, shops, and other commercial establishments during outages.

3. Industrial Use

For industries that require heavy-duty energy backup, our high-capacity inverter batteries offer dependable performance. They ensure smooth operations for factories, warehouses, and manufacturing units, even during prolonged power cuts.

4. Renewable Energy Systems

Metro Redx batteries are compatible with solar energy systems, making them an excellent choice for Nigerian customers looking to adopt renewable energy solutions. They efficiently store solar energy for use during nighttime or cloudy days.

Our Commitment to Customer Satisfaction

At Metro Redx, customer satisfaction is our top priority. We are committed to providing Nigerian customers with superior products and exceptional service. Our team ensures:

Timely Delivery: Reliable and prompt export services to meet customer timelines.

Comprehensive Support: Assistance in selecting the right battery solutions and providing after-sales service.

Affordable Pricing: High-quality inverter batteries at competitive prices.

Why Metro Redx is the Trusted Choice in Nigeria

Proven Expertise: Years of experience in exporting inverter batteries to global markets.

Advanced Technology: State-of-the-art manufacturing processes for superior product quality.

Eco-Friendly Solutions: Batteries designed with sustainability in mind, reducing environmental impact.

Conclusion

Metro Redx is proud to be a Reliable Inverter Battery Exporter to Nigeria, delivering power solutions that exceed expectations. With our durable, efficient, and high-performance batteries, we empower Nigerian homes, businesses, and industries to overcome energy challenges with ease.

Choose Metro Redx for inverter batteries that bring consistent power, reliability, and peace of mind. Together, let’s build a brighter and more energy-secure future for Nigeria.

Original Source: https://metroredxbatteries.blogspot.com/2024/11/metro-redx-your-reliable-inverter.html

0 notes

Text

Smart Home Market Size, Status, Analysis and Forecast 2030

The global smart home market size is expected to reach USD 537.01 billion by 2030, registering a CAGR of 27.07% from 2023 to 2030, according to a new study by Grand View Research, Inc. The smart home is driven by computing devices and information technology that link smart home instruments and gadgets to provide convenience, entertainment, and enhanced comfort to residents in a sustainable way. The market growth is attributed to the rising penetration of the Internet of Things (IoT) and Internet connectivity in homes. Moreover, the trend of modern technologies, such as Artificial Intelligence (AI), being integrated with smart homes has enabled more advanced and digitally smart devices for better living.

In addition, the growing penetration of smartphones is driving the market as smart home devices can be controlled through a smartphone, thereby enabling ease of access and usage. Furthermore, the trend of automation in daily mundane tasks is expected to support market growth significantly. The rising need for home security has prompted the use of AI-powered smart home devices. Facial recognition and threat analysis are among the features included in these gadgets that are expected to drive the demand for smart home solutions. Asia Pacific is expected to emerge as the fastest-growing region over the forecast period.

This is mainly owing to the improved standards of living and increased consumer disposable income levels in the region. The rapid penetration of the internet, smartphones, and other digitally advanced equipment in the region is also expected to drive market growth. Furthermore, the increased demand for smart speakers, such as Siri and Alexa, significantly impacts the region’s growth. In addition, the trend of luxurious lifestyles in developing nations in the region, due to increased disposable income and personal choice among consumers for smart devices, is propelling the market growth.

Gather more insights about the market drivers, restrains and growth of the Global Smart Home Market

Smart Home Market Report Highlights

Based on products, the security & access controls segment recorded the highest revenue share in 2022 due to the increased demand for advanced security solutions and the necessity to restrict access to rooms or safes with valuable items and goods

The wireless protocols segment is expected to grow at the highest CAGR over the forecast period as wireless technology is continuously undergoing extreme developments in terms of connectivity and latency

The new construction application segment is expected to register the fastest CAGR over the forecast period as product installations are easier in new constructions with prior knowledge of wall placements and wire/power outlets

The Asia Pacific region is anticipated to grow at the highest CAGR during the forecast period due to the increasing internet and IoT devices penetration

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

People Counting System Market: The global people counting system market size was estimated at USD 1.26 billion in 2024 and is anticipated to grow at a CAGR of 13.7% from 2025 to 2030.

Call Center AI Market: The global call center AI market size was valued at USD 2.00 billion in 2024 and is projected to grow at a CAGR of 23.8% from 2025 to 2030.

Smart Home Market Segmentation

Grand View Research has segmented the global smart home market on the basis of products, protocols, application, and region:

Smart Home Products Outlook (Revenue, USD Million, 2018 - 2030)

Security & Access Controls

Security Cameras

Video Door Phones

Smart Locks

Remote Monitoring Software & Services

Others

Lighting Control

Smart Lights

Relays & Switches

Occupancy Sensors

Dimmers

Other Products

Entertainment Devices

Smart Displays/TV

Streaming Devices

Sound Bars & Speakers

HVAC

Smart Thermostats

Sensors

Smart Vents

Others

Smart Kitchen Appliances

Refrigerators

Dish Washers

Cooktops

Microwave/Ovens

Home Appliances

Smart Washing Machines

Smart Water Heaters

Smart Vacuum Cleaners

Smart Furniture

Home Healthcare

Other Devices

Smart Home Protocols Outlook (Revenue, USD Million, 2018 - 2030)

Wireless Protocols

ZigBee

Wi-Fi

Bluetooth

Z Wave

Others

Wired Protocols

Hybrid

Smart Home Application Outlook (Revenue, USD Million, 2018 - 2030)

New Construction

Retrofit

Smart Home Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

Order a free sample PDF of the Smart Home Market Intelligence Study, published by Grand View Research.

0 notes

Text

Rigid Polyurethane Foam Manufacturer and exporter-Alaska Puf

Alaska PUF stands as a trusted name in the industry, recognized as a premier Rigid Polyurethane Foam Manufacturer and exporter. With state-of-the-art facilities and a commitment to innovation, we produce a comprehensive range of rigid polyurethane foam (PUF) and polyisocyanurate (PIR) materials tailored for high-performance thermal insulation applications.

Our Rigid Polyurethane Foam products are crafted to deliver exceptional thermal efficiency, durability, and versatility, making them ideal for industries like construction, refrigeration, cold storage, and HVAC systems. With a strong presence in domestic and international markets, Alaska PUF is a leading provider of Rigid Polyurethane Foam in India, ensuring superior quality and performance in every application.

At Alaska PUF, we leverage advanced manufacturing technologies to produce rigid polyurethane foam solutions that meet global standards. Our product range includes insulation panels, pipe sections, blocks, and customised solutions, designed to address specific industry requirements. As a reputable Rigid Polyurethane Foam Manufacturer, we prioritise quality and sustainability, offering products that enhance energy efficiency and reduce environmental impact.

Why Choose Alaska PUF?

Advanced Manufacturing: Hi-tech facilities producing premium-quality Rigid Polyurethane Foam.

Expertise: Years of experience as a leading Rigid Polyurethane Foam Manufacturer in India.

Global Reach: Renowned exporter of rigid polyurethane foam products to international markets.

Diverse Product Range: Comprehensive solutions for thermal insulation across industries.

Customization: Tailored products to meet unique client needs.

Whether you need reliable insulation materials for industrial, commercial, or residential applications, Alaska PUF is your trusted partner. Experience excellence in Rigid Polyurethane Foam solutions with Alaska PUF – where quality meets innovation. Contact us today to explore our extensive range of products!

For More Information:

8141433999,8200100912

102 Avantika Flats, 35 Chaitanya Society, Sardar Patel Stadium Rd,, Navrangpura, Ahmedabad, Gujarat 380009

0 notes

Text

Find the best Fin Coils in Mumbai

The market leader for high-end Fin coils in Mumbai is still Marathe Fin Tubes. Marathe Fin Tubes is a well-known brand in Mumbai's industrial market for manufacturing and supplying premium fin coils. High-performance fin coils are produced by Marathe Fin Tubes, with a focus on heat transfer effectiveness. Numerous industries, including power plants, HVAC systems, refrigeration, and chemical processing facilities, use these coils extensively. Their fin coils are manufactured using state-of-the-art methods to ensure outstanding durability and heat transfer. Fin coils from Marathe are made to withstand harsh conditions and demanding applications. They are available in a range of materials, such as copper, stainless steel, and aluminum. These coils are essential because they are made to have the highest possible thermal conductivity.

0 notes