#india fintech

Explore tagged Tumblr posts

Text

Top investors in space in India

Why Venture Capitalists Are Betting Big on India’s Space Sector

A Thriving Ecosystem of Space Startups: India’s space ecosystem is no longer limited to government-run entities like the Indian Space Research Organisation (ISRO). Today, a surge of innovative space startups are taking the stage, offering cutting-edge solutions in satellite technology, launch services, space data analytics, and more. Companies like Skyroot Aerospace, Agnikul Cosmos, and Pixxel lead the charge, each carving out a unique niche. These startups are pushing the boundaries of what’s possible, driving investor interest with the potential for high returns in a relatively untapped market.

Strong Government Support and Policy Reforms: One of the key reasons behind the surge in space venture capital in India is the proactive stance taken by the Indian government. Recent policy reforms have opened the doors for private players to participate in space activities, previously dominated by ISRO. Establishing IN-SPACe (Indian National Space Promotion and Authorization Center) is a significant step, providing a regulatory framework that encourages private sector involvement. Such government support has given investors in space in India the confidence to back ambitious projects, knowing there’s a clear path for private ventures.

Cost-Effective Innovation as a Competitive Edge: India’s reputation for cost-effective innovation is another major attraction for investors. Launching satellites at a fraction of the cost compared to global competitors has positioned India as a hub for affordable space technology. This competitive edge not only allows Indian space startups to thrive domestically but also makes them attractive on the international stage. Investors are keen to support companies that can deliver world-class technology with lower capital outlays, reducing investment risks while promising impressive returns.

Global Interest in Indian Talent and Expertise: India’s space sector is not just about affordability; it’s about world-class talent. The country boasts a deep pool of highly skilled engineers, scientists, and entrepreneurs with expertise in aerospace and technology. This talent pool has been instrumental in driving innovation and attracting global attention. International investors are increasingly looking to partner with Indian space startups, recognizing the country’s unique blend of technical prowess and entrepreneurial spirit.

A Growing Market for Space-Based Services: The market for space-based services, including satellite communications, Earth observation, and data analytics, is expanding rapidly. In India, this growth is driven by rising demand from industries such as agriculture, telecommunications, logistics, and defense. With space technology playing a crucial role in optimizing these sectors, investors see an opportunity to capitalize on the potential for domestic and international applications. Space-based services represent a lucrative market, attracting space venture capital in India to back startups that can cater to these needs.

Strategic Partnerships and Collaborations: Indian space startups are not working in isolation; they are forming strategic partnerships with global companies and space agencies. Collaborations with NASA, ESA (European Space Agency), and private companies have opened up new opportunities for technology sharing, funding, and market access. These partnerships have also strengthened investor confidence, as they reduce risks and validate the technology being developed by Indian companies. For investors in space in India, such collaborations signal a promising future, driving more venture capital into the sector.

A New Era of Commercial Space Exploration: The idea of commercial space exploration, once confined to science fiction, is now becoming a reality. From reusable rockets to satellite constellations, Indian space startups are exploring new frontiers that were once considered out of reach. This new era of commercial space exploration has piqued the interest of venture capitalists who see the potential for profitable exits through IPOs, acquisitions, and global partnerships. With private space missions no longer just a dream, space venture capital in India is ready to fuel the next big leap.

Encouraging Signs from Successful Fundraising Rounds: The confidence in India’s space sector is evident from the successful fundraising rounds by leading space startups. Companies like Skyroot Aerospace and Agnikul Cosmos have secured millions in funding from top-tier venture capital firms. These funding rounds not only provide the necessary resources for scaling but also act as a signal to other investors that the Indian space market is mature and ready for high-stakes investment. The momentum created by these early successes is a clear indicator of why investors in space in India are increasingly willing to place their bets.

Conclusion: A Promising Orbit for Investment India’s space sector is on an exciting trajectory. With a favorable policy environment, a surge of innovative startups, and a proven track record of cost-effective solutions, it’s no wonder that space venture capital in India is booming. As the country continues to explore new frontiers and expand its role in global space exploration, venture capitalists are set to play a pivotal role in shaping the future. For those looking to invest in the final frontier, India’s space industry presents a unique opportunity to be part of a revolution that’s only just beginning.

#305, 3rd Floor, 5 Vittal Mallya Road, Bengaluru, Karnataka, 560001, India

5 Ring Road, Lajpat Nagar 4, 3rd Floor, New Delhi-110024

#Keywords#best venture capital firm in india#venture capital firms in india#popular venture capital firms#venture capital firm#seed investors in bangalore#deep tech investors india#startup seed funding india#funding for startups in india#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#fintech funding#india alternatives investment advisors#best venture capital firms in india#business investors in kerala#venture capital company#semiconductor startups#semiconductor venture capital#investors in semiconductors#startup seed funding in India#deep tech venture capital#deeptech startups in india#semiconductor companies in india#saas angel investors#saas venture capital firms#saas venture capital#b2b venture capital#space venture capital in india

2 notes

·

View notes

Text

Apply Online for Quick Loan with Instant Approval

We often run out of finance and need quick funding to fulfill our dreams and aims. The obvious solution for the same is to choose for the loan. But in the fear of rejections or due to less knowledge we often end up taking financial aid from informal sources at higher interest rates. This puts our life in debt and creates financial stress. To avoid all these things the easier solution is to opt for the loan that can help you to overcome your financially harder time.

There are many financial aid companies that are making the tough task of taking loans easy by helping the borrowers in documentations and processing of the loan. With the introduction of technology many financial aid companies have inculcated and have shifted successfully to the technology to ease the process of loans. Now you can apply online for loan online and avail of the loan without much trouble. The article below is an attempt to make the readers understand about the loan providers companies. Further it will explain to you the benefits of choosing the loan providers. At the end, the article will conclude by giving you the list of top loan providers in Delhi.

What are loan Providers companies? What are the benefits of choosing Loan Providers?

Loan providers are companies or financial institutions that offer loans to individuals, businesses, or other entities in need of financial assistance. You can apply for quick loan and fulfill your dreams. These loans can be used for various purposes, such as personal expenses, buying a house or a car, funding a business venture, or consolidating debts.

Some common types of loan providers include:

Banks

Credit Unions

Online Lenders

Peer-to-Peer Lending Platforms

Microfinance Institutions

Payday Lenders

Credit Card Companies

Finance Companies

Choosing loan providers can offer several benefits, depending on your financial needs and circumstances. Here are some of the advantages of opting for loan providers:

Access to Funds: Loan providers offer you access to the funds you need when you are facing financial constraints or have specific financial goals, such as purchasing a home or funding a business.

Flexible Repayment Options: Many loan providers offer various repayment plans, allowing you to choose a schedule that aligns with your income and financial capabilities. This flexibility can make it easier to manage your debt.

Quick Processing and Approval: These companies offer easy loan applications to the borrowers. With the advent of online lending platforms, the loan application and approval process have become quicker and more streamlined. In many cases, you can receive loan approval within a short period, providing you with swift access to funds.

Build Credit History: Responsible borrowing and timely repayments can help you build a positive credit history. A good credit score can open doors to better loan options and lower interest rates in the future.

Consolidating Debt: Loan providers may offer debt consolidation loans, allowing you to combine multiple debts into a single loan with a potentially lower interest rate. This can simplify your finances and reduce overall interest costs.

Competitive Interest Rates: By shopping around and comparing different loan providers, you can find competitive interest rates that suit your budget and save you money over time.

Specialized Loan Products: Some loan providers offer specialized loan products tailored to specific needs, such as home loans, auto loans, student loans, or small business loans.

Online Accessibility: Many loan providers now offer online applications, making it convenient to apply for a loan from the comfort of your home and access customer support through digital channels.

Avoiding Depletion of Savings: Taking out a loan for planned expenses can help you preserve your savings for emergencies or unexpected financial situations.

Top Loan Providers in Delhi

Here is the list of top finance companies in Delhi with their locations. These loan companies in Delhi shall help you to get instant loan the assistance you need in financial aid matters.

My Mudra: It is a largest growing fintech having headquartered in Delhi. The company is providing financial services since decades.

Credset: It is a loan provider agency based in Karol Bagh Delhi.

Finance loan in India online

Trust: They are providing different types of loans and have been based out in Netaji Subhash Palace, Pitampura, Delhi.

KG Loan Expert Pvt. Ltd: It is a loan provider agency based in Netaji Subhash Palace in Delhi.

GRD India Financial Service: This is a financial aid provider company based out in Ashok Nagar Delhi.

Conclusion

It's essential to carefully consider the terms and conditions, interest rates, and repayment terms offered by different loan providers before committing to a loan. Borrowers should also ensure that they can comfortably meet their repayment obligations to avoid financial difficulties. My Mudra is one of the top fintech organizations which has been making loans and helping people since decades.

#Apply Online for Loans#apply for quick loan#loan instant approval#get instant loan#loan in India online#top fintech organizations

2 notes

·

View notes

Link

4 notes

·

View notes

Text

India's Digital Payments Revolution: Redefining Financial Landscapes

The story of India’s digital payments revolution is nothing short of extraordinary. In a nation of 1.4 billion people, where cash once reigned supreme, technology has rewritten the rules of commerce. Seamlessly blending innovation, government policies, and mass adoption, India has emerged as a global leader in cashless transactions. This article dives deep into the remarkable growth, the impact on entrepreneurs, the role of regional banks, and India’s vision for leading the global digital payment landscape. Expand to read more

#India digital payment growth#UPI adoption in India#digital payments for startups#regional banks role in fintech#future of cashless India#digital economy India#global payment systems#India fintech innovation#cashless transactions in India#Insights on financial inclusion in India#Insightful take on digital payments.

0 notes

Text

Why Choose the Best Colleges for MBA Finance in India?

India has emerged as a hub for management education, offering some of the finest colleges and programs for aspiring business leaders. Among the array of specializations, MBA in Finance is one of the most sought-after courses due to its scope in banking, investment, and corporate finance. For those considering this path, selecting the right college is a crucial step. In this article, we’ll explore why the best colleges for MBA finance in India stand out and how they can shape your future.

Top MBA Institutes in Hyderabad: A Prime Choice

Hyderabad, known as India’s "City of Pearls," has gained prominence as an educational hotspot, housing some of the Top MBA institutes in Hyderabad. These institutes are known for their cutting-edge infrastructure, experienced faculty, and industry-aligned curriculum.

Institutes like the Indian School of Business (ISB) and other reputed business schools in Hyderabad offer tailored courses for MBA Finance, ensuring students acquire both theoretical and practical knowledge. Additionally, their strong industry connections help students secure internships and placements with leading financial organizations.

The Role of Business Analytics in Finance

With the advent of technology, financial management now relies heavily on data-driven decision-making. Many colleges in India provide integrated courses that combine Business analytics admission in India with traditional MBA Finance programs.

Business analytics enables finance professionals to interpret large datasets, analyze trends, and make informed investment decisions. This skill is essential for students who wish to thrive in today's competitive job market. By opting for programs that include business analytics, students can diversify their skill sets and expand their career opportunities.

Emerging Trends: PGDM in Fintech

India's fintech sector is growing at an exponential rate, making it an exciting area for students pursuing finance education. Several PGDM fintech colleges in India offer specialized programs that combine financial principles with modern technology such as blockchain, cryptocurrency, and digital payments.

By enrolling in these programs, students can gain expertise in areas like financial technology, innovation, and regulatory compliance, which are critical for modern financial ecosystems. These courses also provide hands-on experience through real-world projects and internships with leading fintech companies.

Key Benefits of Studying MBA Finance in India

Global Recognition: The top MBA institutes in Hyderabad and across India are globally recognized, providing students with a competitive edge in international markets.

Strong Alumni Network: The best colleges boast an extensive alumni network, helping students with mentorship, guidance, and career placements.

Practical Exposure: Programs often include internships, case studies, and live projects to ensure students are industry-ready.

Diverse Career Options: Graduates from MBA Finance programs can explore roles such as financial analysts, investment bankers, portfolio managers, and more.

Conclusion

Choosing the best colleges for MBA Finance in India is a step toward a promising and fulfilling career. Institutions in Hyderabad and other parts of India are well-equipped to meet the demands of modern finance through specialized programs like business analytics admission in India and PGDM fintech colleges in India. These courses not only offer technical and managerial skills but also ensure global career opportunities.

If you're aiming for a dynamic and rewarding career in finance, now is the time to explore the options and secure your admission to one of India’s premier MBA institutes.

#Top MBA institutes in Hyderabad#Business analytics admission in India#PGDM fintech colleges in India

0 notes

Text

Key Trends in Portfolio Management Services in India 2025

Over the past ten years, portfolio management services in india has experienced significant expansion. There has been a significant shift in the way these services are provided and utilized by high net worth individuals and individual investors looking for complex investment solutions that complement their financial objectives.

Understanding the Modern Portfolio Management Ecosystem

Portfolio management services in India have moved far away from the buy and hold concept. Today, portfolio managers rely on advanced analytics together with deep market knowledge to produce customized investment propositions. It is the shift in the wealth management service offering based on the customization and the risk-adjusted returns.

Data-Driven Decision Making Reshapes the Industry

Technology innovation, particularly in the form of data analytics, is now included in the usage of investment portfolio management. Portfolio managers currently utilize artificial intelligence in analyzing the market patterns that may indicate possible investment opportunities or optimize asset allocation. It is a technologically advanced way of managing risks and possibly better returns for the investor.

Growing Momentum in ESG Integration

ESG factors have become the core element of portfolio management services in India. Growth in demand by investors in sustainable investments drives service providers in wealth management to fall in line with ESG metrics contained within the investment framework. The trend and an orientation to performance through this direction toward responsible investment are meant to be illustrated.

Democratization of Investment Expertise

Portfolio management services have become extremely accessible in India. The area of ultra-high-net-worth individuals, which has been a preserve for long, is now more inclusive. Investment portfolio management companies are lowering the minimum investment thresholds and are reaching out through digital platforms to serve a much wider client base.

Alternative Investments Take Center Stage

Alternative assets are becoming more and more popular among portfolio managers. These days, private equity, REITs, and structured products are all essential components of diverse portfolios. Such an evolution in investment portfolio management protects one against market volatility and also perhaps boosts returns.

Personalization Through Technology

Tailored portfolio products serve as a revolution in the package of overall portfolio management services rendered in India. Sophisticated approaches toward managing risks occur here. Sophisticated stress tests and scenario analyses enhance portfolio management service to be readier in various probable conditions brought by the marketplace. In other words, moves to make headways result in a kind of preserving wealth amid turmoil that concurrently supports the notion of continuous growth.

Financial Education End

India's leading portfolio management services have also realized the necessity of educating their investors. These include clients with continuous workshops, deep market insight, and transparent performance reporting. Better investing judgments are made by the investor with the aid of such knowledge.

The Way Forward

The future seems optimistic in portfolio management services through constant innovation in investment strategy and service delivery. As markets become more complex and interdependent, professional portfolio management will represent the ultimate source to help in achieving long-term finance success.

Transformational Impact on Wealth Creation

A suitable portfolio management service is one of the most significant factors in long-term wealth generation. Technological innovation combined with personalized strategy and professional know-how offers a powerful tool in the hands of investors to realize their financial objectives.

With the ever-changing investment landscape, the expertise of experienced portfolio managers is a must for coping with market intricacies and opportunities for growth. Such an environment pushes investors adopting sophisticated investment strategies for professional portfolio management, yet it goes in accordance with financial goals and risk tolerance. Ongoing evolution continues to reshuffle the very way Indians approach their wealth creation and preservation.

#portfolio trends#PMS India 2025#investment tips#asset allocation#ESG investing#fintech PMS#market insights#mutual funds#equity growth#passive income#wealth growth#PMS benefits#smart investing#risk analysis#fund strategies#PMS trends#digital tools#AI in PMS#tax efficiency#custom plans

0 notes

Text

How Fintech is Transforming Traditional Banking in India

The financial services landscape in India has undergone a revolutionary change with the advent of fintech. Over the last decade, fintech has emerged as a game-changer, challenging the status quo of traditional banking.

From streamlining transactions to offering personalized financial solutions, the impact of fintech on traditional banking in India has been profound.

This blog explores the various dimensions of this transformation, highlighting the opportunities and challenges faced by both sectors.

What is Fintech?

Fintech, short for financial technology, refers to innovative technologies designed to improve and automate the delivery of financial services.

These technologies have reshaped how people interact with money, making financial processes more efficient, secure, and accessible.

Key Features of Fintech

Digital Payments: Mobile wallets and UPI transactions.

Lending Platforms: Quick loans through apps.

Robo-Advisors: Automated investment advice.

Blockchain and Cryptocurrencies: Decentralized financial solutions.

The Impact of Fintech on Traditional Banking in India

1. Enhanced Customer Experience

Fintech platforms prioritize user experience by offering intuitive interfaces, 24/7 accessibility, and faster services. Traditional banks, constrained by legacy systems, often struggle to match this agility.

2. Increased Financial Inclusion

Fintech has extended banking services to unbanked and underbanked populations, particularly in rural India. Mobile-based solutions have bridged the gap, which traditional banks found challenging due to high operational costs.

3. Competition and Collaboration

The rise of fintech has introduced healthy competition. However, many traditional banks are now partnering with fintech startups to innovate their offerings and stay relevant.

4. Cost Efficiency

Fintech eliminates intermediaries and automates processes, reducing operational costs significantly. Traditional banks are adopting these technologies to cut costs and improve efficiency.

5. Data-Driven Decision Making

Fintech leverages big data and AI to offer personalized services. Traditional banks are now investing in similar technologies to enhance customer engagement.

Challenges for Traditional Banks

1. Technological Lag

Traditional banks often operate on outdated systems, making it difficult to integrate advanced fintech solutions seamlessly.

2. Regulatory Hurdles

While fintech operates in a relatively flexible regulatory environment, traditional banks are bound by stringent compliance requirements.

3. Loss of Market Share

The growing preference for digital platforms has caused traditional banks to lose market share, especially among tech-savvy younger generations.

Opportunities for Traditional Banks

1. Collaboration with Fintech

Many traditional banks have recognized the need to collaborate with fintech startups. Partnerships with leading players allow banks to enhance their digital capabilities.

2. Adoption of Digital Banking

By embracing digital banking solutions, traditional banks can modernize their offerings and retain their customer base.

3. Upskilling Workforce

Training employees in emerging technologies like AI, blockchain, and data analytics can help traditional banks compete effectively.

Role of Investment Banking in the Fintech Revolution

Investment Banking in Mumbai: A Hub of Innovation

Mumbai, the financial capital of India, has witnessed significant activity in the fintech and investment banking sectors. Institutes offering specialized courses, such as an investment banking course in Mumbai, equip professionals with the skills required to navigate this evolving landscape.

Investment Banking Institutes in Mumbai

Leading institutes focus on blending traditional banking principles with fintech innovations. These programs are essential for professionals aiming to thrive in this hybrid environment.

Case Studies: Fintech Success Stories in India

1. Paytm

Starting as a digital wallet, Paytm has expanded into various financial services, from banking to stock trading, posing a significant challenge to traditional banks.

2. Razorpay

This payment gateway simplifies online transactions, making it a preferred choice for businesses and individuals alike.

3. Kotak Mahindra Bank

Among traditional banks, Kotak has effectively integrated fintech solutions, offering seamless digital experiences to its customers.

The Future of Banking in India

1. Hyper-Personalization

AI-driven insights will enable banks to offer tailored financial products, enhancing customer satisfaction.

2. Blockchain Adoption

Blockchain technology will revolutionize secure transactions and fraud prevention.

3. Increased Collaborations

Expect more partnerships between fintech startups and traditional banks, leading to hybrid financial ecosystems.

Stay Ahead in the Fintech Revolution

The impact of fintech on traditional banking in India is undeniable. Whether you are an IT professional, a business owner, or a budding entrepreneur, understanding this transformation is crucial.

To excel in this dynamic field, consider enrolling in an investment banking course in Mumbai. Equip yourself with the skills and knowledge to thrive in the digital age.

Sign up today and be part of the future of banking!

#Fintech#impact of fintech on traditional banking#Future of Banking in India#investment banking course in Mumbai#investment banking institute in Mumbai

1 note

·

View note

Text

0 notes

Text

plutos ONE Wins 'Fintech Startup of the Year 2024' by Outlook Business: Redefining Innovation in India's Fintech Landscape

India’s fintech industry continues to be a hotbed of innovation, and at its forefront is plutosONE, the youngest TSP (Technology Service Provider) for the Bharat Connect (BBPS). We are thrilled to share that our company has been honored with the prestigious 'Fintech Startup of the Year 2024' award by Outlook, recognizing our relentless pursuit of excellence in bill payment solutions, consumer engagement, and incentivization platforms. This milestone highlights our pivotal role in transforming the way businesses and customers interact within the financial ecosystem.

A Decade of Leadership: The Evolution of plutos ONE

Our journey, spanning over 14 years, is a testament to our vision of making financial transactions seamless and rewarding. Starting in 2010 as a merchant aggregator for leading Brands in India, we quickly expanded our expertise. Over the years, we added industry giants like ICICI, SBI, HDFC, and Mastercard to our portfolio and became synonymous with innovation.

Fast forward to 2022, plutos ONE emerged as a licensed and empaneled BBPS TSP, offering a comprehensive suite of cutting-edge fintech solutions for banks and financial networks. These include:

Conversational AI Solutions for bill payments via WhatsApp and other platforms.

Incentives and Engagement Platforms to reward customers for every transaction.

Biller Onboarding Services, including onboarding, settlements, and refunds.

Simplify your billing process with our Unified Presentment Management System. Consolidate bills, automate payments, and improve customer satisfaction.

Agent Institution BBPS, enabling banks to activate new agent institutions seamlessly.

India’s Largest Incentive Platform

Apart from bill payment innovations, we operate India’s largest Merchant-funded Offers Platform. With partnerships spanning over 300+ online brands, 60+ cities for dining and hotel offers, and 3,000+ wellness points, we have cemented our reputation as the ultimate rewards ecosystem for customers and businesses. Collaborating with industry leaders like Myntra, Burger King, McDonald’s, Cult.Fit, and Visa, our platform offers unmatched value for its users.

A Comprehensive Bill Payment Stack

Our BBPS solutions are tailored to empower banks and customers alike. Our bill payment stack includes:

COU TSP (Customer Operating Unit TSP): Streamlining bill acceptance from customers.

BOU TSP (Biller Operating Unit TSP): Enabling billers to issue invoices and receive payments efficiently.

Payments on WhatsApp: Delivering chatbot-led payment solutions for ultimate convenience.

AI-driven solutions for rapid activation of agent institutions.

Partnering with India’s Financial Giants

Our success stems from strong partnerships with major players in the Indian financial ecosystem. These include NPCI (RuPay, UPI, Bharat Connect), HDFC Bank, Kotak Mahindra Bank, Punjab National Bank, and Bandhan Bank. Our role in managing card activation and loyalty platforms for banks and large brands further underscores our capabilities.

Recognition as the Fintech Startup of the Year

Winning the “Fintech Startup of the Year 2024 award” is not just an acknowledgment of our innovative solutions but also a celebration of our commitment to empowering India’s digital economy. By leveraging cutting-edge technology, we have made bill payments more accessible, engaging, and rewarding for millions of users.

A Vision for the Future

As we look ahead, our team remains committed to pioneering solutions that redefine financial services in India. From upcoming innovations like UPI TPAP solutions to scaling our BBPS capabilities, we are well-poised to shape the future of fintech in India.

Conclusion

Our journey from a merchant aggregator to a leader in India’s fintech space is nothing short of remarkable. With a robust suite of BBPS solutions, the largest merchant-funded offers platform, and partnerships with leading banks, we exemplify the spirit of innovation and excellence.

We are immensely grateful to our customers and clients for their trust and continued support, which drives us to innovate and excel every day. A heartfelt thank you to Outlook for recognizing our efforts with the 'Fintech Startup of the Year' award. This acknowledgment inspires us to strive harder and achieve greater milestones and reaffirms our position as a transformative force in the industry. As India’s fintech ecosystem continues to grow, plutos ONE stands as a beacon of progress, innovation, and success.

#fintech startup#fintech company in India#fintech award#fintech startup of the year#plutos.ONE#Bharat Bill Payment System#BBPS TSP#digital payments#fintech solutions#bill payment innovation#incentives platform#Outlook awards

0 notes

Text

A wonderfully put together origin story of one of India's largest banks - HDFC.

0 notes

Text

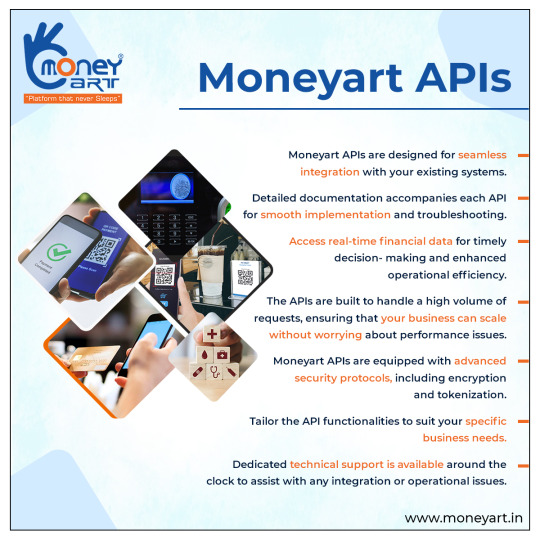

Explore Moneyart's suite of innovative financial solutions, including APIs, B2B collaborations, and white label offerings. Elevate your business with secure and efficient money transfer APIs. Join us in reshaping the financial landscape.

0 notes

Text

Top b2b venture capital in 2024

One of India’s prominent venture capital firms, dedicated to funding innovative startups and empowering entrepreneurs with strategic guidance and financial support.

Are you a budding entrepreneur or a growing business looking for the perfect partner to fuel your success? Look no further than SEAFUND, the best venture capital firm in India!

Zippee, a tech-driven logistics platform, is a standout portfolio company of Seafund, highlighting the firm’s expertise in B2B venture capital investments.

SEAFUND’s commitment to backing innovative startups like Zippee reflects its strategy of investing in early-stage B2B venture capital opportunities that drive operational excellence and growth.

By aligning with Zippee’s mission, SEAFUND strengthens its position as a leader in B2B venture capital, supporting transformative solutions for logistics and supply chain management.

#305, 3rd Floor, 5 Vittal Mallya Road, Bengaluru, Karnataka, 560001, India

5 Ring Road, Lajpat Nagar 4, 3rd Floor, New Delhi-110024

#Keywords#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#popular venture capital firms#startup seed funding india#seed investors in bangalore#deep tech investors india#venture capital firms in india#best venture capital firms in india#seed investors in delhi#semiconductor startups#semiconductor venture capital#saas venture capital#b2b venture capital#saas angel investors#saas venture capital firms#deep tech venture capital#deeptech startups in india#semiconductor companies in india#investors in semiconductors#space venture capital in india#space startups#investors in space in India#best venture capital firm in india#venture capital firm#funding for startups in india#fintech funding#india alternatives investment advisors

0 notes

Text

How to Set Up a FinTech Company in India: A Comprehensive Guide by NBFC Advisory

The financial technology (FinTech) market in India is showing remarkable growth, which is becoming one of the most exciting sectors for innovation and startups that are in debt. Therefore, the country is now turning out to be digitalized quickly and banking products are also available easily. Currently, you can open a business in this space and this has become the ever-prevailing demand in the market.

However, the procedure still encounters difficulties. Talking about regulatory gaps, risks, and the competition in the segment require regular monitoring, and hence, business owners need to invest their time on strategic planning and product development effectively. This manual gives a comprehensive report on the various stages of the establishment of a FinTech company in India.

Through NBFC Advisory, we guide FinTech startup owners not only at the ideation but also in the course of setting up to the point where the compliance and strategic guidance are hands-free during the whole setup.

Understanding India’s FinTech Ecosystem

India has become a global leader in FinTech, with innovations such as the Unified Payments Interface (UPI), Bharat Bill Payment System (BBPS), as well as the regulatory sandbox by the Reserve Bank of India (RBI) are the causes of the country’s success and it’s anticipations of great development. The country’s initiative to cause financial inclusion, along with government programs such as Digital India, has driven the populace to adopt digital financial services.

The market presents a high number of opportunities in areas like payments, lending, insurtech, and wealth management. Nonetheless, to boost this, the new arrivals must comprehend the regulatory setting and the unique difficulties that India’s FinTech ecosystem faces.

Key Steps to Setting Up a FinTech in India

1. Conducting Market Research and Feasibility Analysis

Before launching any business, it is quite important to conduct thorough market research. The FinTech sector is very competitive with several players already in the market. To be successful, you are required to identify your market target, seize customer\’s needs, and figure out which areas are not provided well. If you intend to operate in payments, digital lending, or insurance technology you must gauge the demand anticipation of these products, major problems in regulation, and the competitive setup.

A feasibility analysis is used to check if your business idea has got a chance to be real in the current market atmosphere. It enables you to adjust your finance model and give your clients practical suggestions informed by what is happening in the market. Properly thought out market entry strategies improve the company\’s chances of gaining success by creating the right fit between the products or services that they produce and the market needs.

2. Choosing the Right Business Structure

Choosing the fitting legal structure is an important thing to consider because it will affect everything from compliance to funding options. For FinTech startups in India, the following are the most popular types of business structures:

Private Limited Company: This is the model most favored by new companies since it provides a quick way of getting funds and offers protection from limited accountability.

Limited Liability Partnership (LLP): This offers a say in partnership and shields partners from personal debt, but it may be not as attractive as a private limited company for investors because of the internal control of the organisation or the hesitance of the partners to give their shares rapidly changing.

The choice of structure influences taxation, the regulation of your activities, and the ease with which you can raise capital. It is important that you elect a legal form that is congruent with your long-term plans of growth.

3. Regulatory Compliance and Licensing

One of the significantly regulated sectors in India is the country’s FinTech sector, and business entities will need to observe different laws according to the operations they want to run. The Reserve Bank of India (RBI) is the main regulator of most microfinance services including payments and lending. Based on the business model you chose, you would have to apply for one or more of the licences listed below:

NBFC License: In case your career objective is lending, you most likely will need to register as a Non-Banking Financial Company (NBFC). This course is mandatory for digital lenders and other businesses engaged in financial intermediation.

Payment Gateway Licence: If your operations happen in the payments sector, you have to comply with the Payment and Settlement Systems Act and the RBI must also approve your complete set up.

PPI Authorization: Such wallets aka Prepaid Payment Instruments (PPI) must be approved by the RBI to see if they comply with the legal requirements.

Of the various regulatory processes and formalities, the most difficult one for the Indian startups is the regulation of financial institutions. This is because the startups are very diverse and many of them are doing innovative projects. Often, when people break the designated rules, they may face penalties, fines that they have to get or sometimes even the companies may have to be terminated.

In NBFC Advisory, we specialise in guiding businesses through the complex regulatory landscape, helping them secure the necessary licences and remain compliant with all applicable laws.

4. Building a Robust Technology Infrastructure

Technology is the backbone of any FinTech business. Irrespective of the stage of development of a payment platform, an AI-based lending solution, or a blockchain-powered system, your technology infrastructure should remain secure, reliable, and scalable. Some of the main degrees are:

Scalability: In the scenario, where the number of users is growing rapidly, your system should support the increase in the traffic and data volume.

Security: Cybersecurity is a very critical issue because financial data is usually very sensitive. One major move to keep your customer data safe is by constant compliance with data laws, such as the Bill of Data Security for Personal Data in India.

Innovation: Innovation is the bedrock of the FinTech space, and using futuristic technologies such as AI, blockchain, and machine learning can drive you ahead of the competition.

When you work with the right technology partners, there is a guarantee that your platform will deliver the expected regulatory compliance and will be a fun user experience.

5. Financial Planning and Securing Funding

Fintech startup struggles with lack of funding can be regarded as one of the biggest problems. No matter if you are going for raising fund through venture capitalists, private equity investors, or government schemes, a good financial plan is a must. Investors are the ones that will require the clearing up of the financial outlook, a defined revenue model, and a roadmap that states the objectives of the business scaling.

Elements of a financial plan that have to be included are:

Initial Capital Requirements: You should calculate an amount which will cover the start-up expenses like tech development, jurisdiction compliance, and marketing.

Revenue Model: First of all, tell how your business will get money. Will transaction fees be the only source of income or are there other monetization strategies in place?

Break-Even Analysis: Compute the duration it will take your business to reach breakeven, and put forward a plan to ensure proper cash flow management during the period.

A financial plan of high quality will not only help the effort to find the sources of finance but also provide a precise and clear way to manage your resources.

Navigating Regulatory Compliance

– RBI Guidelines and Licensing Requirements

There are some really tough guidelines and rules set up by RBI FinTech businesses that are based in India. The smart investment decision is made only when such companies are to be compliant with the new regulations—all these realities ought to be highly respected. Make all possible efforts to always stay on top of new regulatory affairs since the law is changing fast.

Also, in the case of the loans and credit business, a National Bank License is the way to go. This permit has many regulatory duties, such as, for instance, the observance of liquidity norms established by the RBI, clearance of capital adequacy ratios and the guarantee of transparency in the operations of the company.

–Data Protection and Security Regulations

When it becomes evident that data breaches are happening very often, the data that your users are supposed to be kept secure is the first priority of your company. India’s Draft Personal Data Protection Bill is going to become the law of the land very soon and it will introduce new compliance rules and procedures to all businesses whose data handling includes sensitive financial data. Adherence to the provisions of these laws not only protects you from legal actions but also wins the trust of users.

Know More: https://nbfcadvisory.com/how-to-set-up-a-fintech-company-in-india-a-comprehensive-guide-by-nbfc-advisory/

0 notes

Text

Why Fintech Companies in India are Revolutionizing the Financial Device Industry

India's financial landscape is undergoing a major transformation, and at the heart of this change are fintech companies. These firms are disrupting the traditional ways of handling money and payment processes, and one of the most influential areas is the manufacturing of financial devices. Point-of-Sale (POS) machines, biometric systems, and other such devices are now integral to daily transactions. But what makes Fintech company in India stand out is their innovation, adaptability, and the role they play in empowering millions across the country.

Growing Demand for Financial Devices in India

India has been rapidly adopting digital payment solutions, driven by both government initiatives and consumer demand. According to recent research, the digital payments industry in India is expected to grow at a CAGR of 20.2%, reaching over USD 500 billion by 2025. The surge in demand for POS machines, particularly in tier-2 and tier-3 cities, shows how fintech companies are crucial in bridging the gap between traditional banking systems and modern, cashless transactions.

One of the key players contributing to this revolution is Evolute’s subsidiary, Fintech, which specializes in manufacturing finance-related electronic devices. These devices, especially POS and biometric machines, are vital in transforming the way businesses operate and accept payments.

With over 1.2 billion Aadhaar-linked biometric cards in circulation, biometric authentication has become a major part of India’s financial ecosystem. Fintech companies like Evolute’s Fintech are capitalizing on this by producing advanced biometric machines that are used for secure authentication in various sectors, including banking and retail. These machines are streamlining verification processes, making financial transactions more secure and accessible.

The Push from Digital India

The Indian government’s Digital India initiative has been a major catalyst for the fintech sector. The push for a cashless economy post-demonetization and the growth in Unified Payments Interface (UPI) transactions have increased the demand for financial devices. In September 2023, UPI transactions crossed 10 billion in volume, marking a sharp rise from the previous year. This spike indicates the growing need for reliable POS machines and other digital transaction facilitators.

Fintech companies are responding by developing devices that integrate seamlessly with UPI, mobile wallets, and other digital platforms. Fintech, under the Evolute umbrella, has positioned itself as a leader by offering devices that support multiple forms of payment. Whether it’s a traditional credit card swipe or a UPI-based payment, the company’s devices cater to every need.

The company Cleantech, also a subsidiary of Evolute, plays a supporting role in this growth by focusing on energy-efficient batteries for EVs and other applications, ensuring a sustainable future for fintech device operations. Similarly, Glomore, another Evolute subsidiary, contributes by manufacturing industrial batteries, helping sustain operations that require uninterrupted power, including those dependent on financial devices.

POS and Biometric Machines: Powering Businesses Across India

India’s small and medium enterprises (SMEs) have been among the biggest beneficiaries of fintech innovation. The availability of affordable POS machines has enabled even small merchants in rural areas to accept digital payments. According to a 2024 study by the National Payments Corporation of India (NPCI), the penetration of POS machines in rural areas grew by 32% over the last year, compared to just 18% in urban regions. This increase shows that fintech companies are reaching deeper into the country’s financial infrastructure.

Biometric machines are another game-changer in India’s fintech ecosystem. With Aadhaar-based verification becoming the norm for most financial services, these devices ensure faster and more secure transactions. For example, rural banking agents rely heavily on biometric authentication devices to verify identities and facilitate payments, a trend driven largely by fintech companies.

This shift has increased the need for innovation in biometric machines, something that Fintech has capitalized on by producing devices that are both portable and reliable. These machines are already being used in remote areas for government-backed schemes such as Direct Benefit Transfers (DBT), ensuring that subsidies reach the intended beneficiaries with minimal fraud.

Why Fintech Companies Are Thriving

One of the reasons fintech companies in India, particularly those involved in the manufacturing of financial devices, are thriving is their ability to adapt to the country’s diverse and challenging market conditions. From the bustling streets of Mumbai to the remote villages in Bihar, fintech devices are simplifying financial transactions.

India's population of over 1.4 billion includes a vast number of unbanked individuals. According to a 2024 report by the Reserve Bank of India (RBI), about 20% of India’s population still remains unbanked. However, fintech companies are closing this gap. Through devices like portable POS and biometric machines, even those in the most underserved areas can participate in the financial system.

Another contributing factor is the accessibility of affordable technology. A report by the Indian Council for Research on International Economic Relations (ICRIER) found that fintech device costs have reduced by over 40% in the past five years, making these machines affordable for small businesses. Companies like Fintech have been at the forefront of producing cost-effective, high-quality financial devices, helping small merchants embrace digital payments with minimal investment.

The Future of Financial Devices in India

The trajectory of fintech companies in India is upward. As mobile and internet penetration continue to rise in rural areas, the demand for POS and biometric machines is expected to increase. Research predicts that the number of POS machines in India will grow by 25% year-on-year until 2026, driven by the expanding digital payments market and increased focus on financial inclusion.

Furthermore, fintech companies are likely to introduce more advanced features in their devices, such as contactless payment options, integration with cryptocurrency wallets, and improved security measures. These innovations will not only cater to the growing urban demand but will also continue to extend the reach of digital transactions in rural areas.

For companies like Evolute’s Fintech, the future holds immense potential. With continued support from its sister companies Cleantech and Glomore, which ensure energy efficiency and industrial reliability, the company's financial devices will play a key role in shaping India’s financial future.

Conclusion

India’s fintech companies are revolutionizing the financial device industry, addressing a growing need for secure, accessible, and affordable financial solutions. Companies like Fintech, part of Evolute, are at the forefront of this change, creating devices that empower small businesses, enhance financial inclusion, and contribute to the country’s digital economy. As more people adopt digital payments and the government pushes for financial inclusion, fintech companies will remain pivotal in modernizing India’s financial ecosystem.

0 notes

Text

Apply for AeronPay Prepaid Card

In today's digital age, convenience and security are paramount for consumers when it comes to managing payments. Prepaid cards excel at providing both ease of use and strong security, making them a highly attractive option. With prepaid cards becoming increasingly popular, it's important to understand their functionality, benefits, and overall utility in today's financial landscape.

The AeronPay prepaid card is a Rupay card, and has a partnership with Pine Labs. It is a type of payment card that has a certain amount of preloaded money on it, allowing you to make purchases, withdraw cash, pay bills, and do other things. Prepaid cards work just like debit cards, but instead of a linked bank account, you use the preloaded balance on the card. AeronPay offers both types of prepaid cards to its users: physical and virtual, depending on the issuer's choice. Prepaid cards are one of the most reliable methods of digital payments.

Perks of AeronPay Prepaid Cards

Budgeting and control

With AeronPay prepaid cards, users have full control over their spending. Customers can easily set spending limits, monitor their expenses, and easily reload their prepaid cards as needed. The AeronPay prepaid card will be a popular choice for college students and other young adults trying to establish strong financial habits.

Wide acceptance and flexibility

The AeronPay Prepaid Card offers exceptional flexibility and wide acceptance, making it a valuable tool for managing finances. It is accepted at many locations and stores, both online and offline. It also empowers customer with versatile financial management options and can be used for various purposes such as travel, shopping, gifting, bill payments, and subscriptions without any hassle.

ATM Access

AeronPay offers convenient access to ATMs for prepaid card balances, allowing users to withdraw cash whenever they need it. This access to ATMs ensures that cardholders can manage their finances effectively and access their funds with ease. This accessibility feature for ATMs enhances their utility, providing users with peace of mind and convenience.

Risk Control

AeronPay prepaid cards offer a high level of security as they are not linked to a bank account. In case of loss or theft, the card can be easily blocked and can maintain peace of mind while preserving their funds securely.

How Do You Get Your Own AeronPay Prepaid Card?

Follow the below-mentioned steps to get your own AeronPay Prepaid Card:

Ø To get started, open Chrome and go to 'business.aeronpay.app' and complete the “Sign Up” process, then “Login” with OTP Verification.

Next, click on the “Prepaid Card” section on the dashboard.

Ø It will display the KYC page, where you have to complete your “Minimum and Full KYC” with the required details.

Ø After successfully completing the KYC process, click on “Card Issue” to issue your prepaid card.

Ø Here you will get your AeronPay “Virtual Prepaid Card," which can be used anywhere online.

Ø To issue a physical prepaid card Click on “Physical Card," enter the required details, and submit.

After completing the mentioned process, you will receive details about the delivery of your physical prepaid card via text message. Once you get your physical prepaid card, you can easily swipe it anywhere, like shopping, bill payments, and everyday transactions.

Conclusion

The AeronPay Prepaid Card comes across as a comprehensive payment solution that meets the needs of modern consumers. Ideal for those who prioritize convenience, flexibility, and security in their financial transactions, it offers a seamless online and offline experience. Users can also earn reward points and cashback by using the AeronPay Prepaid Card. With the AeronPay Prepaid Card, you can enjoy the convenience and flexibility of payments while keeping your finances secure.

#financial#digital payments#fintech#aeronpay#top fintech companies in india#prepaid card#top fintech in jodhpur

0 notes

Text

Cryptocurrency

Challenges Faced by P2P Cryptocurrency Exchanges in India

Looking for legal guidance on the p2p cryptocurrency exchange India? Then, Finlaw consultancy will provide you with expert advice on the regulatory landscape and operational strategies for p2p cryptocurrency exchanges in India.

1 note

·

View note