#increase the reward of your investment portfolio significantly.

Explore tagged Tumblr posts

Text

Smart Investors Choose Crypto: Unlocking the Potential of Crypto Investment

#Introduction#Are you looking to break into the world of crypto investing? You’ve come to the right place. Investing in crypto has become increasingly po#It's not hard to understand why—the global cryptocurrency market cap recently surpassed a staggering $1 trillion#with more investors jumping onboard daily to take advantage of the potential profits crypto has to offer.#Crypto investment offers opportunities that can disrupt entire markets#and it is up to the savvy investor to find out how they can best position themselves to capture these returns. That’s where I come in; let#Benefits of Investing in Crypto#As an investor#you know that potential rewards come with potential risks. What sets cryptocurrency apart from other investments is its low barrier to entr#making it accessible for more people to begin their first foray into investing. Investing in cryptocurrency can also be a great way to dive#While the crypto market has seen its ups and downs#the consensus among financial experts is that crypto shows real#long-term promise. By investing in different coins#you can spread out your risk and#if all goes well#increase the reward of your investment portfolio significantly.#Plus#the versatility of cryptocurrencies means you can use them for more than just buying and selling stocks—cryptocurrency has a wide variety o#you open up a whole new set of possibilities and ensure your financial future is secure.#Get to Know EOSNOX Global#the Innovative Crypto Investment Platform#Investing in crypto is a smart move#and having the right platform to tackle it is even more important. EOSNOX Global is the innovative crypto investment platform you've been l#you can trade dozens of digital currencies on the spot market and access leading blockchain products.#Here’s some reasons why EOSNOX Global is a great choice for tapping into the potential of cryptos:#Secure and compliant: Our exchanges use cutting-edge encryption protocols to secure your funds. And our manual compliance processes ensure#Trading tools: We offer tools to help you make smarter decisions—such as our in-depth analytics#trading systems#risk management solutions#and much more!

1 note

·

View note

Text

Maximizing Your Income: 25 Effective Ways to Make More Money from Home - Money Earn Info

Get Over 2,500 Online Jobs. You may have already tried to make money online. Here is Some Information about Easy Job you can do from home. 👉 Offers for you

.

.

Freelancing Across Multiple Platforms: Expand your freelancing endeavors by joining multiple platforms such as Upwork, Freelancer, and Fiverr. Diversifying your presence can increase your visibility and attract a broader range of clients.

Remote Consulting Services: If you possess expertise in a particular field, consider offering consulting services. Platforms like Clarity — On Demand Business Advice connects consultants with individuals seeking advice, providing an avenue for additional income.

youtube

Create and Sell Online Courses: Capitalize on your skills and knowledge by creating online courses. Platforms like Udemy, Teachable, and Skillshare allow you to share your expertise and earn money passively.

Affiliate Marketing Mastery: Deepen your involvement in affiliate marketing by strategically promoting products and services related to your niche. Building a well-curated audience can significantly increase your affiliate earnings.

Start a Profitable Blog: Launch a blog centered around your passions or expertise. Monetize it through methods like sponsored content, affiliate marketing, and ad revenue to create a steady stream of passive income.

E-commerce Entrepreneurship: Set up an online store using platforms like Shopify or Etsy. Sell physical or digital products, tapping into the global market from the comfort of your home.

Remote Social Media Management: Leverage your social media skills to manage the online presence of businesses or individuals. Platforms like Buffer and Hootsuite can streamline your social media management tasks.

Virtual Assistance Services: Offer virtual assistance services to busy professionals or entrepreneurs. Tasks may include email management, scheduling, and data entry.

Invest in Dividend-Paying Stocks: Start building a portfolio of dividend-paying stocks. Over time, as these stocks generate regular dividends, you can create a source of passive income.

Remote Graphic Design: Expand your graphic design services on platforms like 99designs or Dribbble. Building a strong portfolio can attract high-paying clients.

Web Development Projects: If you have web development skills, take on remote projects. Websites like Toptal and Upwork connect skilled developers with clients in need of their services.

Launch a YouTube Channel: Create engaging and valuable content on a YouTube channel. Monetize through ad revenue, sponsorships, and affiliate marketing as your channel grows.

Digital Product Sales: Develop and sell digital products such as ebooks, printables, or templates. Platforms like Gumroad and Selz make it easy to sell digital goods online.

Stock Photography Licensing: If you have photography skills, license your photos to stock photography websites. Each download earns you royalties.

Remote Transcription Jobs: Explore opportunities in remote transcription on platforms like Rev or TranscribeMe. Fast and accurate typists can find quick and consistent work.

Participate in Paid Surveys: Sign up for reputable paid survey websites like Swagbucks and Survey Junkie to earn extra income by providing your opinions on various products and services.

Remote Customer Service Representative: Many companies hire remote customer service representatives. Search job boards and company websites for remote customer service opportunities.

Cashback and Rewards Apps: Use cashback apps like Rakuten and Honey when shopping online to earn cashback and rewards on your purchases.

Create a Niche Podcast: Start a podcast around a niche you are passionate about. Monetize through sponsorships, affiliate marketing, and listener donations.

Automated Webinars for Digital Products: Create automated webinars to promote and sell digital products or services. This hands-off approach can generate income while you focus on other tasks.

youtube

Rent Out Your Property on Airbnb: If you have extra space in your home, consider renting it out on Airbnb for short-term stays. This can be a lucrative source of additional income.

Remote SEO Services: If you have expertise in search engine optimization (SEO), offer your services to businesses looking to improve their online visibility.

Invest in Real Estate Crowdfunding: Diversify your investment portfolio by participating in real estate crowdfunding platforms like Fundrise or RealtyMogul.

Create a Subscription Box Service: Develop a subscription box service around a niche you are passionate about. Subscribers pay a recurring fee for curated items.

Remote Project Management: Utilize your project management skills by taking on remote project management roles. Platforms like Remote OK and Home feature remote opportunities.

Making more money from home is not just a possibility; it’s a reality with the myriad opportunities available in today’s digital age. By diversifying your income streams and leveraging your skills, you can create a robust financial foundation. Whether you choose to freelance, start an online business, or invest in passive income streams, the key is consistency and dedication. Explore the strategies outlined in this guide, identify those that align with your strengths and interests, and embark on a journey to maximize your income from the comfort of your home.

#makemoneyonline #makemoney #money #workfromhome #entrepreneur #business #affiliatemarketing #bitcoin #success #onlinebusiness #forex #digitalmarketing #motivation #investment #makemoneyfast #earnmoney #financialfreedom #passiveincome #cash #businessowner #entrepreneurship #marketing #luxury #earnmoneyonline #millionaire #makemoneyonlinefast #makemoneyfromhome #investing #cryptocurrency #onlinemarketing

#makemoneyonline#makemoney#money#workfromhome#entrepreneur#business#affiliatemarketing#bitcoin#success#onlinebusiness#forex#digitalmarketing#motivation#investment#makemoneyfast#earnmoney#financialfreedom#passiveincome#cash#businessowner#entrepreneurship#marketing#luxury#earnmoneyonline#millionaire#makemoneyonlinefast#makemoneyfromhome#investing#cryptocurrency#onlinemarketing

34 notes

·

View notes

Text

2024: the year of teeth

When I reflect back on 2024 in any capacity, I’ll always remember this was the year I got braces.

In an unexpected turn of events, though people who wear braces will probably not be too surprised to hear this, I’m wearing them well past the date I was initially quoted for removal. The experience has been harder on me than I’ve been wanting to admit. A lot of this has to do with how woefully underprepared I was for braces. If you think it happened in such a way that I got everything set on my teeth at the start of April with no real plan for how I would conduct my life afterwards, uh, you would be correct.

Here are the truths I've learned so far. I don’t like eating soft foods and pasta. I’m dealing with a substantial lowkey depression from not having salads or sandwiches in my diet. (Salads = lettuce stuck in the wires, croutons popping off the brackets. Sandwiches = foods you need to bite into which are off-limits.) I haven’t been able to travel anywhere hardly either. If a bracket pops off, I need to be able to rush back to the dentist to get it glued back on or else delay the process of how long I continue to wear braces.

I also made the decision not to date this year. Some of this is for vanity reasons (a metal mouth literally needs to sit out dating when the competition is all blinding white veneers - do NOT put me in, coach). Mostly though, it’s because of the general upkeep. At the start of wearing braces, I had a lot of ortho wax in my mouth. Braces, stray pieces of wax, and elastic bands?! I may be in my late thirties, but every day I inch closer to some delayed adolescent in band camp awkward phase I never lived through. Pass the clarinet so I can cover it in saliva, please.

The worst thing I heard — which I think was supposed to make me feel better, but it didn’t! — was one of the dental assistants at my dentist's office who told me she wore braces for six years. Six years. You think to yourself that could not possibly ever be me, but realize that it could if you justified the actions and the work invested for the reward. I would think that if you had braces on for three years, it would be a matter of your brain going “we’re 50% there, halfway point, just need to keep going!” Or perhaps that’s just how my brain rationalizes how to reach a goal.

Some nine months in, my teeth have straightened up significantly. I have time lapse photos on my phone and the difference is incredible. And I no longer get migraines. I’ve battled migraines for the better part of my adult life. This speaks so much to the correlation between dental health and physical health. My hope is once these braces are off, it means the hypothetical investment portfolio that is “me” will increase substantially. I have a personal theory that because I lack perfect, blinding white, straight teeth, the algorithms on dating apps and websites are downvoting my appearance. When my teeth look pretty, when my smile looks pretty, when I have the status symbol that is a retainer by the bathroom sink, I’ll feel confident again. My stock will go back up.

In addition to prioritizing my teeth, I’ve worked really, really hard in all my various writing roles this year. I have been crushing my quarterly goals and the Summer of Savings tentpole this summer, AKA almost four months of nonstop unbelievably hard work that paid off. I was recognized with an award at work, will attend a retreat next year (possibly with my braces still on at this rate…), and I was a guest on a podcast talking about writing in the shopping vertical. My freelance has been just as important to me. After years of being asked about it, we finally did a series on NBA mascots. I had a blast doing it! I want to cover another sports league in 2025.

Next year marks 10 years of PopIcon. Most, if not 100% of all current writers, journalists, and freelancers, know it is not the norm to have a decade-long column. I still remember the night I wrote my first article. I was living in West LA in an apartment that was less an apartment and more like a converted office building turned makeshift “apartment.” Five girl roommates all sharing one bathroom. Three bedrooms. Nobody had a bed. Everyone had a mattress on the floor and somehow, I managed to get my own bedroom. I lived off of Trader Joe’s wraps. I would go next door to the Coffee Bean and use their bathroom when ours was occupied (and it usually was!). I remember getting the email with the all-clear that we could begin, sitting down on my mattress on the floor, and typing. You've come a long way, baby. 10 years of a life spent in the company of brand mascots.

In 2024, I read a lot of books. More than 25! A return to form after a disturbing number of years passed where I wasn’t reading books at all. I spent time with my family and through the ups and downs of my father’s health, having the necessary conversations about where the cremation receipts are kept and where to retrieve the urns. I got my hair cut quite short (shoulder length), mourned its loss, and all of a sudden it grew back super fast. It’s almost halfway down my back again. I had several eye exams, got new glasses, and switched to a new brand of contact lenses. I got to see Hans Zimmer live when he announced a second show date in LA and went to the Family Guy 25th Anniversary where I laughed and listened as the cast read one of the scripts for an upcoming episode airing in 2025.

When I was preparing for my final 1:1 this month with my manager, she asked me to share a personal goal I have for next year. I thought for awhile on what to write and really hold myself accountable to. At the start of 2024, I had mentioned my goal for the year was to undergo a lot of dental work. I made good by that promise and the work is still ongoing so I used that as my jumping off point.

Then I thought about all of the other goals and milestones I hope to achieve in my life. Every last one looks like a fuzzy question mark to me. Still! Nothing is more clear today than it was five, 10 years ago. Sometimes the longer I think about these things, the more I spiral out and start to feel like I have no personality. Or that I do have a personality but it’s so thoroughly buried under a facade of nonstop work to define me that I don’t even know what or who that girl is!

Mostly, I think about all the steps involved that act as a means to the end of achieving my bigger personal goals. Creating a personal goal is one thing. How you get to the finish line is another.

It’s like wearing braces, which changed the way I treat my teeth. If I want to be successful with my dental goals, I need to put in the work. As much as I do not like soft foods, I ate and continue eating them to be mindful of my brackets and wires. But not all personal goals are designed like dental work where there’s a literal biweekly plan to follow to ensure success. Different goals are trickier because you can’t fully know the outcome like you can with teeth.

In the end, I determined an attainable goal to share. What I really want next year is to take a proper personal vacation.

Several vacations, once my braces are off. And I don’t want these to be the same-old “go back to your parents’ house and return to your 16 year old personality in your childhood bedroom” trips either. Those are visits.

I’ve had a lot of days over the last few months where I’ve missed the good old days of traipsing about in a new-to-me city. When I travel, I don’t have the thought of “I could really move here, huh?” that most people do. It’s a getaway and a regional one at that, with its own customs and weather and sandwich shops. Instead, I like to focus on connecting with the sidewalk underneath my feet, the stars above my head, and my physical body, moving through this landscape.

In 2025, I’d also like to try…

An intro class at Pure Barre.

Going on a weekend getaway where I ride on the Amtrak to my destination.

Starting a Substack but also...

... Not necessarily busying myself with more random writing if it keeps pushing my real goals further and further out.

Dating with intention.

Buying a Halloween costume. (For clarity, because my birthday is so close to Halloween I’ve spent years financially prioritizing one over the other.)

Whatever martini or alcoholic drink is trending next year.

Seeing a show at a new-to-me venue.

There's a container full of grapes in my fridge right now, waiting for the midnight hour to arrive. See you real soon, 2025.

2 notes

·

View notes

Text

How to Withdraw Liquidity From a Pool: A Step-by-Step Guide for Beginners and Enthusiasts

Let’s talk about withdrawing liquidity from a pool. At first glance, this might sound like some obscure, technical operation best left to the experts, but trust me, it’s not. If you’ve ever transferred money between your savings and checking accounts, or even cashed out a joint investment, you’ve already grasped the essence of what it means to withdraw liquidity.

Now, let me guide you through this process in a way that feels personal, relatable, and empowering. Whether you're new to the world of DeFi or just need some clarity, this guide is for you.

The Basics: What Is Liquidity Withdrawal

Think of a liquidity pool as a communal fund where participants like you and me deposit assets to facilitate trading on decentralized platforms. You’re essentially lending your assets to the pool, and in return, you earn a share of the fees generated from trades that happen in the pool.

Now, when you decide it’s time to retrieve your share—your initial deposit plus any accrued earnings—you “withdraw liquidity.” It’s that simple. It’s like owning a vending machine with others, collecting a cut of the profits, and deciding when to cash out your share.

The Step-by-Step Process

Step 1: Locate Your Liquidity Pool

Start by navigating to the "Pools" section of the platform you’re using. Once there, switch to the "My Pools" tab. This section is your personal ledger, listing all the pools you’ve contributed to.

Imagine logging into your online portfolio and seeing all the stocks or mutual funds you own. Each pool is like an individual investment account, showing you exactly where your assets are working for you.

Step 2: Select the Desired Pool

From the list, select the pool you want to withdraw from. Scroll to the bottom of the pool’s page, and you’ll find a button labeled Withdraw. This is your starting point for taking back your funds.

Think of this as walking into a bank and telling the teller which specific account you’d like to withdraw from. Simple, right?

Step 3: Decide How Much to Withdraw

Clicking Withdraw opens a window where you’ll specify how much liquidity you want to withdraw. If you’re ready to take it all, select the MAX option.

This step is like deciding how much cash to withdraw from an ATM. You might want to take only what you need and leave the rest to grow, or you might be ready to take it all out—it’s entirely up to your financial strategy and goals.

Step 4: Confirm the Transaction

After selecting the amount, click Withdraw Liquidity and confirm the transaction using your wallet. Remember, this step requires a small amount of TON (or the platform’s native token) to cover blockchain transaction fees.

Think of these fees as gas for your car. Just as you can’t drive without fuel, you can’t complete a blockchain transaction without covering the cost of its operation. Always ensure you’ve got enough TON in your wallet to keep things running smoothly.

Things to Keep in Mind

Transaction Rewards

When you withdraw liquidity, you’re not just taking back your initial deposit—you’re also collecting the rewards generated from trading fees in the pool. It’s like reinvesting dividends from a stock portfolio. Over time, these earnings can significantly boost your total return.

Impermanent Loss

This concept might sound intimidating, but let me break it down. Impermanent loss occurs when the value of the tokens you’ve contributed to the pool changes relative to holding them individually.

Imagine you own equal amounts of gold and silver. If gold's price doubles while silver's remains stagnant, your combined portfolio value in the pool might not reflect the full increase you’d get from holding gold alone. However, this "loss" becomes less relevant if the trading fees and rewards outweigh it.

A Personal Take on Liquidity Withdrawal

When I first ventured into liquidity pools, I was cautious, like anyone dipping their toes into a new financial venture. I double-checked every step, making sure I wasn’t leaving anything behind or exposing myself to unnecessary risks.

Over time, I realized that withdrawing liquidity is less about technical steps and more about understanding the underlying principles. Each withdrawal felt like cashing out a successful investment—rewarding and motivating.

Why It Matters

Learning how to withdraw liquidity isn’t just about reclaiming your funds; it’s about understanding how decentralized finance works, making informed decisions, and taking control of your financial future.

If you’ve ever wondered whether you could navigate the complexities of DeFi, let me reassure you: you absolutely can. It’s no different from learning to manage your personal finances—just with a digital twist. And as you gain confidence, you’ll find that the possibilities in this space are virtually limitless.

So, are you ready to take the next step in your DeFi journey? If you have questions or need clarification, let’s discuss them below. After all, in the world of crypto, shared knowledge is the most valuable currency of all.

6 notes

·

View notes

Text

How to Ride the Uptrend and Maximize Profits

Capitalizing on a market uptrend can significantly increase your investment returns. Read on for practical tips to navigate market movements and optimize your profits. Start improving your investment strategy today!

How to Predict the Uptrend?

Predicting exactly when the market will experience an uptrend is challenging. Even if experts anticipate an uptrend soon, the exact timing—whether in 2024, 2025, or beyond—remains uncertain.

The real challenge lies in avoiding premature profit-taking that could cause you to miss out on gains, while also not holding investments too long and risking losses when the market turns.

So, how can we navigate these challenges and maximize our gains during an uptrend? Here are some strategies to consider:

Focus on Your Goals

Monitoring market movements is not sufficient on its own. It’s crucial to establish clear financial goals. Attempting to buy at the absolute lowest and sell at the highest points is an impractical approach since it’s impossible to precisely predict the end of an uptrend.

Instead, set clear, achievable targets that align with your financial objectives. This approach will guide you in making well-informed decisions rather than chasing market trends.

Use the Four-Year Cycle

The four-year cycle remains a dependable framework for anticipating market movements, even though minor deviations can occur. This cycle can help guide your profit-taking strategy, allowing you to gauge the mid-phase of an uptrend.

Utilizing a dollar-cost averaging (DCA) approach, particularly from late 2024 to Q3 2025, can be beneficial. DCA involves consistently investing a fixed amount, which mitigates the risk of buying at peak prices manipulated by market whales. For those preferring a safer strategy, DCA can be an effective way to spread investment risk over time.

Stick to Your Strategy

Maintaining a well-defined and disciplined strategy is crucial. This disciplined approach helps you stay focused and avoid making emotional decisions driven by market volatility.

Adhering to your plan, even amidst market fluctuations, is key to successful profit-taking. Regularly reviewing and adjusting your strategy based on your goals and market conditions can also enhance your decision-making process.

Diversify Your Investments

Diversification is a time-tested strategy to manage risk and enhance profit potential. While applying DCA to established assets like Bitcoin, consider diversifying your portfolio by holding presale tokens such as $BUSAI or participating in airdrops.

Presale tokens are often available at lower prices, offering potential high returns with reduced initial investment. Diversification spreads your risk across various assets, reducing the impact of any single asset’s performance on your overall portfolio.

BUSAI PRESALE CASE STUDY

In today’s crowded presale landscape, distinguishing between genuine opportunities and scams is crucial. For example, the meme AI project BUSAI is gaining significant attention, but don’t let the hype cloud your judgment.

Before diving in, it's vital to thoroughly examine the whitepaper, tokenomics, and the project's backers. If your research checks out, it could be worth considering.

BUSAI stands out with its impressive ecosystem and strategic tokenomics. Its innovative features, such as the interact-and-earn and staking rewards, set it apart from typical meme tokens.

Its tokenomics emphasizing substantial presale, marketing, and liquidity allocations, the project shows strong growth potential. Additionally, BUSAI’s focus on community engagement and cutting-edge technology makes it a distinctive and promising investment in the evolving crypto arena.

By following these guidelines, you can navigate the uptrend effectively and avoid common pitfalls. Stay focused, be disciplined, and make informed decisions to achieve your financial goals.

BUSAI Official Channel: Website | Twitter | Telegram

3 notes

·

View notes

Text

How to Buy a Buy-to-Let Property

Investing in property can be a lucrative venture, and one of the most popular strategies is buying buy-to-let properties. This approach not only allows you to generate rental income but also offers potential capital appreciation over time.

However, searching and purchasing a buy-to-let can seem daunting for beginners. From understanding market trends to choosing the right type of property and securing financing, there are many factors at play. Whether you're an investor looking to expand your portfolio or a newcomer eager to take your first steps into real estate, this guide will walk you through everything you need to know about purchasing a buy-to-let property.

Get ready to unlock the door to financial growth and discover how strategic investments can lead you down a successful path in the property market.

What is buy-to-let property?

Buy-to-let property refers to residential real estate purchased specifically for the purpose of renting it out. This strategy allows investors to earn a steady stream of rental income while potentially benefiting from long-term capital appreciation. Typically, buy-to-let properties are single-family homes or apartments that appeal to tenants. Investors often seek locations with high demand and good rental yields. The concept is simple: you buy a property, find tenants, and collect rent each month. However, successful buy-to-let investing requires careful planning and market research. Understanding tenant needs and local regulations is crucial in this arena. Factors such as location, property type, and pricing can significantly impact your investment's profitability. As an investor delving into this sector, it's essential to grasp what drives tenant demand in your chosen area for optimal results.

Benefits and risks of investing in buy-to-let properties

Investing in buy-to-let properties offers several benefits. For one, it provides a steady income stream through rental payments. This can help build financial stability over time. Another advantage is capital appreciation. As property values rise, your investment could significantly increase in worth, providing potential for substantial profits when sold. However, there are risks to consider as well. Market fluctuations can lead to decreased property values and rental demand. Economic downturns may also affect tenants’ ability to pay rent on time. Additionally, managing a rental property requires effort and resources. Maintenance costs and tenant issues can eat into your profits if not handled properly. Understanding these dynamics is essential before diving into the buy-to-let market. Balancing the rewards against possible pitfalls will help you make informed decisions about your investments.

UK property market and its current trends

The UK property market is currently navigating a landscape of dynamic changes. Post-pandemic shifts have influenced buyer preferences, with many seeking more space and better amenities. City centers still draw attention, but suburban areas are increasingly popular as remote work becomes the norm. This trend has led to rising demand in regions previously overlooked. Interest rates are another critical factor influencing the market. While some fear potential downturns, others see opportunities for growth—especially at property auctions where competitive bidding can yield significant discounts. Moreover, sustainability is gaining traction. Buyers are now prioritizing energy-efficient homes that promise lower utility bills and environmental benefits. Investors keen on buy-to-let properties should remain vigilant about these evolving trends to maximize their returns and minimize risk. Keeping an eye on market fluctuations can pave the way for smarter investment decisions in this vibrant sector.

Types of buy-to-let properties

When diving into the buy-to-let market, understanding the various property types is essential. Each type comes with its own set of benefits and challenges.

Residential properties - These are the most common choice for landlords. These can range from single-family homes to multi-unit buildings. They attract long-term tenants looking for stability.

Commercial buy-to-let - These are retail shops or office spaces. While these often come with longer lease terms, they typically require a larger upfront investment.

Serviced Accommodation- Another option is serviced accommodation, like holiday rentals or Airbnb properties. These can offer higher returns but demand more active management and marketing efforts.

Student Housing- Student housing presents an appealing niche in university towns. This sector often guarantees high occupancy rates due to consistent demand from students each academic year.

Factors to consider when choosing Buy-to-Let Property

1. Location

Location is paramount in the world of buy-to-let properties. It can make or break your investment's success. A well-placed property attracts tenants easily and keeps vacancy rates low. Consider proximity to essential amenities like schools, supermarkets, and public transport. Areas with good access often see higher demand from renters. Urban centers typically offer more opportunities for employment, which can be a significant draw. Also think about neighborhood trends. Up-and-coming areas may present lower initial costs but show promise for growth over time. Researching local developments or investments in infrastructure can signal future appreciation. Safety is another vital aspect; families tend to prioritize living in secure neighborhoods. Take note of crime rates as they impact desirability and rental values significantly. In essence, location isn't just about where the property sits—it's about understanding the broader community dynamics that influence tenant attraction and retention.

2. Property Type

When investing in buy-to-let properties, the type of property you choose matters significantly. Different types cater to various tenant demographics and market demands. Houses often attract families looking for long-term rentals. They usually come with gardens and multiple bedrooms, making them desirable. On the other hand, apartments are popular among young professionals or students due to their affordability and proximity to city centers. Consideration should also be given to newer developments versus older properties. New builds may require less maintenance but might not have the character that some tenants seek in historic homes. Each property type has its own set of advantages and challenges. Researching local demand can help you pinpoint which option aligns best with your investment strategy.

Ultimately, understanding these nuances will guide you toward a more informed decision on what fits your goals as a landlord.

3. Rental Yield

Rental yield is a critical metric for any buy-to-let investor. It measures the annual return on your investment property relative to its value. A higher rental yield indicates a more profitable investment. To calculate this, you divide your annual rental income by the property's purchase price and multiply by 100 to get a percentage. Understanding this figure can help gauge whether a property will generate sufficient cash flow. Location plays a significant role in determining rental yields. Urban areas with high demand often provide better returns than rural locations.

Market trends can also influence yields, as shifts in supply and demand affect how attractive certain properties become over time. Keep an eye on local developments too—new schools or transport links can boost desirability. Identifying properties with strong potential for consistent rents is essential for maximizing your profit margins efficiently.

4. Potential for Capital Appreciation

When considering a buy-to-let property, the potential for capital appreciation is crucial. This refers to the increase in the property's value over time. A well-located property can experience significant growth as demand rises. Urban areas or regions undergoing regeneration often see sharp increases in price. Research local market trends before making a purchase. Areas with planned infrastructure improvements or new amenities typically attract more buyers and renters alike. Also, consider external factors that could influence prices. Economic conditions, interest rates, and employment opportunities play a vital role in determining property values. Investing in properties with strong capital growth potential can provide future financial security. It’s not just about rental income; the long-term gains are equally important to your investment strategy.

5. Financing Options

When considering a buy-to-let property, financing options are crucial. Traditional mortgages for rental properties differ from standard home loans. Lenders often require larger deposits and may have stricter criteria. Look into buy-to-let mortgages specifically designed for investors. These typically focus on the expected rental income rather than just personal earnings. This can be beneficial if your salary is modest but potential rent is significant. Another option includes bridging loans, which provide quick funds to seize opportunities or improve cash flow during renovations. However, they usually come with higher interest rates. Consider remortgaging existing properties too; this could unlock equity that you can reinvest in new opportunities. Always assess the overall costs against potential returns before making any commitments. Each financing route has its advantages and challenges, so it's essential to explore thoroughly before deciding which fits your investment strategy best.

6. Tax implications

When investing in buy-to-let properties, understanding the tax implications is crucial. Different taxes apply to rental income and property ownership, which can significantly impact your returns. You’ll need to consider income tax on rental profits. This amount is calculated after deducting allowable expenses such as maintenance costs and mortgage interest. Familiarizing yourself with these deductions can help maximize your profit margin. Capital Gains Tax (CGT) also comes into play when you sell a property for more than you paid. Knowing how CGT works will prepare you for potential liabilities down the line. Additionally, think about Stamp Duty Land Tax (SDLT) when purchasing a buy-to-let property. The rates differ from residential purchases, so check current guidelines to avoid unexpected costs. Finally, stay updated on any changes in legislation that could affect landlords. Tax laws evolve regularly; being informed ensures you’re always prepared.

7. Legal and regulatory requirements

Understanding the legal and regulatory requirements is crucial for any buy-to-let investor. Each country, and often local councils, have specific rules governing rental properties. Familiarizing yourself with these regulations can save you from costly fines or legal disputes. You need to comply with safety standards, including gas safety checks and electrical inspections. These are not just recommended; they are mandatory in many areas. Failing to meet them could jeopardize your investment. Licensing might also be necessary depending on the property type or location. Some regions require landlords to obtain a license before renting out their properties. Ignoring this step could lead to penalties that undermine your profits. Consider tenant rights as well; understanding eviction processes and deposit protections is essential for smooth operations. Keeping up with changes in legislation will help you navigate potential pitfalls effectively while maintaining a positive relationship with tenants.

8. Risks associated with buy-to-let investing

Investing in buy-to-let properties can be lucrative, but it is not without its risks. Market fluctuations can lead to decreased property values or rental income. Understanding the local market trends before making any commitments is crucial. Vacancies are another concern. A property that remains unoccupied for an extended period can quickly erode your profits. Effective marketing and maintaining a desirable living space will help mitigate this risk. Additionally, unexpected maintenance costs may arise at any time. Regular upkeep of the property can prevent larger expenses down the line, so budgeting for repairs is wise. Tenants might also pose a challenge; issues like late payments or even damage to your property can occur. Conducting thorough background checks and maintaining good communication with tenants helps foster positive relationships while minimizing potential disputes. Lastly, legislative changes may impact buy-to-let investments as well such as the new "Renters' Rights Bill" which was introduced to parliament on the 11th September 2024. Staying informed about new regulations ensures compliance and protects your investment from sudden legal shifts. Navigating these risks requires diligence and careful planning but understanding them allows you to make informed decisions on your journey into buy-to-let investing.

Conclusion

Investing in buy-to-let properties can be a rewarding venture for those willing to navigate the complexities of the property market. Understanding what a buy-to-let property is, along with its benefits and risks, lays a solid foundation for making informed decisions. The UK property market continues to evolve, presenting various opportunities that savvy investors can capitalize on. From residential flats to commercial spaces, each type of buy-to-let offers unique advantages and challenges. Choosing the right location and understanding current trends are crucial steps in your investment journey. Financing options like auction finance can streamline your purchase process at house auctions, providing flexibility when securing capital. Engaging with legal considerations ensures compliance with ever-changing regulations while managing your property effectively keeps tenants happy and minimizes turnover. As you explore this investment path, remember that knowledge is power. With careful planning and strategic choices, buying a buy-to-let property could become not just an investment but also a valuable asset over time. The potential rewards make it worth considering if you're prepared for the responsibilities involved in being a landlord.

2 notes

·

View notes

Text

After $100,000, Bitcoin May Hit $1 Million By 2033: How Can Indian Investors Ride The Wave?

Bitcoin has stormed past the $100,000 mark, marking a historic milestone fuelled by a mix of political and economic developments in the US. Bitcoin Crosses $100,000: Bitcoin has stormed past the $100,000 mark, marking a historic milestone fuelled by a mix of political and economic developments in the United States. The cryptocurrency‘s recent rally comes amid growing institutional confidence and a pro-crypto policy shift under the leadership of US President-Elect Donald Trump. His appointment of Paul Atkins, a crypto advocate, as the SEC Chair and Elon Musk’s leadership in the newly formed Department of Government Efficiency are clear signals of a favourable regulatory environment for digital assets. Over the past month alone, BTC has surged by 50 per cent, with its market cap crossing the $2 trillion threshold and delivering 144 per cent year-to-date (YTD) return. Riding this wave of optimism, other tokens have also gained significant traction — SOL and XRP have hit an all-time high.

What’s Driving Bitcoin’s Meteoric Rise?

This rally isn’t just about political shifts. Bitcoin ETFs recorded a staggering $676 million inflow in a single day, highlighting robust institutional demand. Edul Patel, CEO of Mudrex, expects that Bitcoin is expected to hit $120,000 in coming weeks.

Global investment firm Bernstein in its latest report said Bitcoin could be headed for the stratosphere. It predicts Bitcoin to touch $200,000 by 2025, $500,000 by 2029, and $1 million per token by 2033.

With the US embracing pro-crypto policies other countries are also moving favourably, China has now lifted restrictions on personal crypto ownership. Brazil, and Russia are considering Bitcoin for reserves, signalling its growing global economic role.

What Experts Suggest Indian Investors

For Indian investors, this rally presents a golden opportunity. Despite regulatory uncertainty in India, the global push toward cryptocurrency legitimisation could benefit local investors. With increasing acceptance, Bitcoin is cementing itself as a hedge against inflation and a mainstream asset class.

“For investors, the spotlight now shifts to long-term planning: keeping an eye on market cycles, diversifying portfolios, and staying updated on regulatory shifts. While this breakthrough fuels optimism, it’s important to tread carefully — volatility remains part of the game," Himanshu Maradiya, Chairman and Founder, CIFDAQ.

Balaji Srihari, business head at CoinSwitch, said if the past is any indicator, the April 2024 halving could spark a rally of 300-400 per cent, aligning perfectly with this forecasted target.

“However, in this dynamic environment, investors must stay informed about market developments to make confident and well-informed decisions," Srihari added.

How to Invest in Bitcoin in India?

If you’re new to the crypto world or looking to expand your portfolio, here’s how you can get started:

Choose a Reliable Exchange

Platforms like WazirX, CoinDCX, and Binance offer secure and user-friendly interfaces for trading Bitcoin. Ensure the platform is compliant with Indian regulations and offers robust security features.

Understand the Risks

Bitcoin’s volatility is legendary. While its long-term trajectory seems promising, investors must be prepared for sharp price swings. Invest only what you can afford to lose.

Stay Informed

Keep an eye on global developments, particularly in the US, as policy changes can significantly impact crypto markets. Utilise tools like CoinMarketCap and Glassnode to monitor Bitcoin’s performance.

Diversify Your Portfolio

While Bitcoin is the most popular cryptocurrency, consider diversifying into other digital assets like Ethereum, Solana, or Cardano. Diversification can help balance risk and reward.

Consult Your Financial Advisor

Crypto is a highly volatile instrument involving high risk, it is highly necessary to consult a financial advisor before putting your money into such instruments.

Tax Implications for Indian Investors

In India, cryptocurrency gains are treated as a separate class of income. As per current regulations:

Flat 30% Tax on Gains: Any profit from the transfer of cryptocurrency, including Bitcoin, is taxed at a flat rate of 30%. This applies irrespective of the holding period (short-term or long-term).

No Deduction for Losses or Expenses: Except for the cost of acquisition, no other deductions are allowed. Losses from crypto cannot be set off against other income and cannot be carried forward to subsequent years.

1% TDS: A 1% Tax Deducted at Source (TDS) is applicable on transactions exceeding ₹50,000 (₹10,000 for non-salaried individuals) in a financial year. https://www.news18.com/business/cryptocurrency/analysts-peg-bitcoin-at-1-million-by-2033-how-can-indian-investors-ride-the-wave-9145692.html www.cifdaq.com

CIFDAQ#BITCOIN#CRYPTOINVESTING

0 notes

Text

After $100,000, Bitcoin May Hit $1 Million By 2033: How Can Indian Investors Ride The Wave?

Bitcoin has stormed past the $100,000 mark, marking a historic milestone fuelled by a mix of political and economic developments in the US. Bitcoin Crosses $100,000: Bitcoin has stormed past the $100,000 mark, marking a historic milestone fuelled by a mix of political and economic developments in the United States. The cryptocurrency‘s recent rally comes amid growing institutional confidence and a pro-crypto policy shift under the leadership of US President-Elect Donald Trump. His appointment of Paul Atkins, a crypto advocate, as the SEC Chair and Elon Musk’s leadership in the newly formed Department of Government Efficiency are clear signals of a favourable regulatory environment for digital assets. Over the past month alone, BTC has surged by 50 per cent, with its market cap crossing the $2 trillion threshold and delivering 144 per cent year-to-date (YTD) return. Riding this wave of optimism, other tokens have also gained significant traction — SOL and XRP have hit an all-time high.

What’s Driving Bitcoin’s Meteoric Rise?

This rally isn’t just about political shifts. Bitcoin ETFs recorded a staggering $676 million inflow in a single day, highlighting robust institutional demand. Edul Patel, CEO of Mudrex, expects that Bitcoin is expected to hit $120,000 in coming weeks.

Global investment firm Bernstein in its latest report said Bitcoin could be headed for the stratosphere. It predicts Bitcoin to touch $200,000 by 2025, $500,000 by 2029, and $1 million per token by 2033.

With the US embracing pro-crypto policies other countries are also moving favourably, China has now lifted restrictions on personal crypto ownership. Brazil, and Russia are considering Bitcoin for reserves, signalling its growing global economic role.

What Experts Suggest Indian Investors

For Indian investors, this rally presents a golden opportunity. Despite regulatory uncertainty in India, the global push toward cryptocurrency legitimisation could benefit local investors. With increasing acceptance, Bitcoin is cementing itself as a hedge against inflation and a mainstream asset class.

“For investors, the spotlight now shifts to long-term planning: keeping an eye on market cycles, diversifying portfolios, and staying updated on regulatory shifts. While this breakthrough fuels optimism, it’s important to tread carefully — volatility remains part of the game," Himanshu Maradiya, Chairman and Founder, CIFDAQ.

Balaji Srihari, business head at CoinSwitch, said if the past is any indicator, the April 2024 halving could spark a rally of 300-400 per cent, aligning perfectly with this forecasted target.

“However, in this dynamic environment, investors must stay informed about market developments to make confident and well-informed decisions," Srihari added.

How to Invest in Bitcoin in India?

If you’re new to the crypto world or looking to expand your portfolio, here’s how you can get started:

Choose a Reliable Exchange

Platforms like WazirX, CoinDCX, and Binance offer secure and user-friendly interfaces for trading Bitcoin. Ensure the platform is compliant with Indian regulations and offers robust security features.

Understand the Risks

Bitcoin’s volatility is legendary. While its long-term trajectory seems promising, investors must be prepared for sharp price swings. Invest only what you can afford to lose.

Stay Informed

Keep an eye on global developments, particularly in the US, as policy changes can significantly impact crypto markets. Utilise tools like CoinMarketCap and Glassnode to monitor Bitcoin’s performance.

Diversify Your Portfolio

While Bitcoin is the most popular cryptocurrency, consider diversifying into other digital assets like Ethereum, Solana, or Cardano. Diversification can help balance risk and reward.

Consult Your Financial Advisor

Crypto is a highly volatile instrument involving high risk, it is highly necessary to consult a financial advisor before putting your money into such instruments.

Tax Implications for Indian Investors

In India, cryptocurrency gains are treated as a separate class of income. As per current regulations:

Flat 30% Tax on Gains: Any profit from the transfer of cryptocurrency, including Bitcoin, is taxed at a flat rate of 30%. This applies irrespective of the holding period (short-term or long-term).

No Deduction for Losses or Expenses: Except for the cost of acquisition, no other deductions are allowed. Losses from crypto cannot be set off against other income and cannot be carried forward to subsequent years.

1% TDS: A 1% Tax Deducted at Source (TDS) is applicable on transactions exceeding ₹50,000 (₹10,000 for non-salaried individuals) in a financial year. https://www.news18.com/business/cryptocurrency/analysts-peg-bitcoin-at-1-million-by-2033-how-can-indian-investors-ride-the-wave-9145692.html www.cifdaq.com

CIFDAQ#BITCOIN#CRYPTOINVESTING

0 notes

Text

After $100,000, Bitcoin May Hit $1 Million By 2033: How Can Indian Investors Ride The Wave?

Bitcoin Crosses $100,000: Bitcoin has stormed past the $100,000 mark, marking a historic milestone fuelled by a mix of political and economic developments in the United States. The cryptocurrency‘s recent rally comes amid growing institutional confidence and a pro-crypto policy shift under the leadership of US President-Elect Donald Trump. His appointment of Paul Atkins, a crypto advocate, as the SEC Chair and Elon Musk’s leadership in the newly formed Department of Government Efficiency are clear signals of a favourable regulatory environment for digital assets. Over the past month alone, BTC has surged by 50 per cent, with its market cap crossing the $2 trillion threshold and delivering 144 per cent year-to-date (YTD) return. Riding this wave of optimism, other tokens have also gained significant traction — SOL and XRP have hit an all-time high.

What’s Driving Bitcoin’s Meteoric Rise? This rally isn’t just about political shifts. Bitcoin ETFs recorded a staggering $676 million inflow in a single day, highlighting robust institutional demand. Edul Patel, CEO of Mudrex, expects that Bitcoin is expected to hit $120,000 in coming weeks.Global investment firm Bernstein in its latest report said Bitcoin could be headed for the stratosphere. It predicts Bitcoin to touch $200,000 by 2025, $500,000 by 2029, and $1 million per token by 2033.With the US embracing pro-crypto policies other countries are also moving favourably, China has now lifted restrictions on personal crypto ownership. Brazil, and Russia are considering Bitcoin for reserves, signalling its growing global economic role.

What Experts Suggest Indian Investors For Indian investors, this rally presents a golden opportunity. Despite regulatory uncertainty in India, the global push toward cryptocurrency legitimisation could benefit local investors. With increasing acceptance, Bitcoin is cementing itself as a hedge against inflation and a mainstream asset class. “For investors, the spotlight now shifts to long-term planning: keeping an eye on market cycles, diversifying portfolios, and staying updated on regulatory shifts. While this breakthrough fuels optimism, it’s important to tread carefully — volatility remains part of the game," Himanshu Maradiya, Chairman and Founder, CIFDAQ. Balaji Srihari, business head at CoinSwitch, said if the past is any indicator, the April 2024 halving could spark a rally of 300-400 per cent, aligning perfectly with this forecasted target. “However, in this dynamic environment, investors must stay informed about market developments to make confident and well-informed decisions," Srihari added.

How to Invest in Bitcoin in India? If you’re new to the crypto world or looking to expand your portfolio, here’s how you can get started:

Choose a Reliable Exchange Platforms like WazirX, CoinDCX, and Binance offer secure and user-friendly interfaces for trading Bitcoin. Ensure the platform is compliant with Indian regulations and offers robust security features.

Understand the Risks Bitcoin’s volatility is legendary. While its long-term trajectory seems promising, investors must be prepared for sharp price swings. Invest only what you can afford to lose.

Stay Informed Keep an eye on global developments, particularly in the US, as policy changes can significantly impact crypto markets. Utilise tools like CoinMarketCap and Glassnode to monitor Bitcoin’s performance.

Diversify Your Portfolio While Bitcoin is the most popular cryptocurrency, consider diversifying into other digital assets like Ethereum, Solana, or Cardano. Diversification can help balance risk and reward.

Consult Your Financial Advisor Crypto is a highly volatile instrument involving high risk, it is highly necessary to consult a financial advisor before putting your money into such instruments.

Tax Implications for Indian Investors In India, cryptocurrency gains are treated as a separate class of income. As per current regulations: Flat 30% Tax on Gains: Any profit from the transfer of cryptocurrency, including Bitcoin, is taxed at a flat rate of 30%. This applies irrespective of the holding period (short-term or long-term).No Deduction for Losses or Expenses: Except for the cost of acquisition, no other deductions are allowed. Losses from crypto cannot be set off against other income and cannot be carried forward to subsequent years.1% TDS: A 1% Tax Deducted at Source (TDS) is applicable on transactions exceeding ₹50,000 (₹10,000 for non-salaried individuals) in a financial year.Make sure to report all crypto transactions accurately in your Income Tax Return (ITR) to avoid penalties.

www.cifdaq.com

0 notes

Text

The Art of Venture Capital: Key Strategies for a Winning Portfolio

Venture capital (VC) is a specialized investment approach that funds early-stage companies with high growth potential. Unlike traditional investments, venture capital involves significant risk due to startups' unpredictable nature. However, a well-structured portfolio can mitigate risks and optimize returns.

Investors must grasp the fundamentals of venture capital, including funding rounds, equity distribution, and exit strategies. A strong foundation enables venture capitalists to identify opportunities, evaluate risks, and support startups effectively. Understanding industry trends and economic cycles further aids in making informed decisions.

Create a Balanced and Diversified Portfolio

Diversification is essential for mitigating risk in venture capital investments. By spreading investments across different sectors, geographic regions, and funding stages, investors can safeguard their portfolios against industry-specific downturns. A well-balanced portfolio increases the likelihood of achieving high returns.

Investing in a mix of early-stage startups and later-stage companies can balance risk and reward. While early-stage investments offer exponential growth potential, later-stage investments provide stability and a higher probability of successful exits. This strategic approach enhances the overall resilience of a VC portfolio.

Conduct Thorough Market and Business Analysis

Conducting in-depth due diligence is crucial before investing. This process includes analyzing a startup’s business model, financial performance, competitive positioning, and scalability. Investors should also assess market demand, customer acquisition strategies, and the startup's ability to adapt to industry shifts.

Beyond financial metrics, evaluating the startup’s leadership team is vital. Founders who demonstrate vision, adaptability, and strong execution skills significantly increase a startup’s chances of success. Assessing their track record, industry knowledge, and decision-making capabilities helps investors make well-informed choices.

Build Meaningful Relationships with Founders

Successful venture capitalists establish strong partnerships with founders to provide more than just financial support. Mentorship, strategic guidance, and industry connections can significantly influence a startup’s trajectory. By adding value beyond capital, investors foster trust and alignment with entrepreneurs.

Engaging in open communication and offering constructive feedback strengthens the investor-founder relationship. This collaborative approach increases the chances of startup success while ensuring that venture capitalists remain actively involved in the growth journey. The stronger the relationship, the more opportunities there are for long-term returns.

Expand Your Network for Better Deal Flow

Access to high-quality investment opportunities depends on the strength of an investor’s network. Venture capitalists who actively engage with startup ecosystems, accelerators, and industry events gain early access to promising companies. Collaborating with other investors and co-investing in deals further enhances portfolio potential.

Networking with experienced venture capitalists, angel investors, and industry experts provides valuable insights and partnerships. A well-connected investor is likelier to identify high-potential startups and access exclusive investment opportunities that may not be publicly available.

Focus on Long-Term Value Creation

Unlike traditional investments, venture capital requires patience. Startups take time to scale and generate returns. Investors should adopt a long-term perspective and be prepared to support their portfolio companies through different growth stages. Follow-on funding, strategic input, and operational assistance can maximize value creation.

Monitoring key performance indicators (KPIs) and regular check-ins with startup teams ensure investors stay informed about progress and potential risks. Adjusting investment strategies based on real-time data and market trends is crucial for optimizing long-term outcomes.

Manage Risks with a Strategic Approach

Risk management is a fundamental aspect of venture capital investing. Not all startups will succeed, and some investments will inevitably fail. However, by implementing a well-defined risk management strategy, investors can minimize losses and increase their chances of achieving positive returns.

Developing contingency plans, setting clear investment criteria, and conducting stress tests on business models help mitigate potential risks. Additionally, identifying potential exit opportunities early—whether through acquisition, IPO, or secondary sales—ensures a proactive approach to portfolio management.

Stay Adaptable and Continuously Learn

The venture capital landscape is constantly evolving. Emerging technologies, shifting consumer behaviors, and economic fluctuations influence investment opportunities. Investors who remain adaptable and continuously educate themselves about market trends position themselves for sustained success.

Staying updated on industry innovations, regulatory changes, and global market trends allows venture capitalists to refine their strategies and capitalize on emerging opportunities. Continuous learning and flexibility are key to maintaining a competitive edge in the venture capital industry.

Building a strong venture capital portfolio requires strategic investment, thorough due diligence, and active involvement in startup growth. Investors can maximize returns and create long-term value by fostering relationships with founders, leveraging networks, and maintaining a diversified portfolio. Staying informed, adaptable, and committed to continuous learning ensures success in the dynamic world of venture capital investing.

0 notes

Text

Chasing Growth: An Investor's Guide to Aggressive Growth Mutual Funds

Aggressive growth mutual funds are for those investors who aren't afraid to take on a bit more risk in pursuit of substantial returns. These funds primarily invest in stocks of companies with high growth potential, often smaller and newer businesses that operate in fast-growing sectors. While the potential for significant gains is enticing, it's crucial to understand the risks involved before diving in.

How Aggressive Growth Funds Work:

Focus on Growth: These funds prioritize companies expected to experience rapid expansion, often sacrificing stability for the potential for explosive growth.

High Equity Allocation: A significant portion of the fund's assets is invested in stocks, typically 80% or more, making them highly susceptible to market fluctuations.

Active Management: Fund managers actively select stocks, constantly searching for companies with the most promising growth prospects. This active management style aims to outperform the overall market.

Higher Risk, Higher Reward: The potential for significant gains is balanced by the inherent volatility of these funds. Market downturns can lead to substantial losses.

Who Should Consider Aggressive Growth Funds?

High-Risk Tolerance: You must be comfortable with the possibility of significant short-term losses.

Long-Term Investment Horizon: These funds are designed for investors with a long-term perspective (5-10 years or more) to allow time for market fluctuations to even out.

Growth-Oriented Goals: If your primary objective is maximizing capital appreciation, these funds might align with your investment strategy.

Understanding the Risks: You must fully grasp the potential for significant losses before investing.

Key Risks to Consider:

Market Volatility: These funds are highly sensitive to market swings, leading to significant short-term fluctuations in value.

Concentration Risk: Some funds may concentrate investments in specific sectors or a limited number of companies, increasing risk if those sectors or companies underperform.

Fund Manager Risk: The fund's success heavily relies on the fund manager's ability to consistently identify and select high-growth stocks.

Choosing the Right Aggressive Growth Fund:

Research Fund Performance: Analyze the fund's long-term track record and how it has performed during different market cycles.

Evaluate the Fund Manager: Understand their investment philosophy, experience, and track record.

Consider Fees: Lower expense ratios can significantly impact your overall returns.

Review Portfolio Composition: Examine the types of companies and sectors the fund invests in to ensure it aligns with your investment preferences.

Aggressive Growth Funds vs. Other Fund Types:

Compared to more conservative options like large-cap or balanced funds, aggressive growth funds offer higher growth potential but also carry significantly higher risk. They are not suitable for investors seeking stability, regular income, or short-term gains.

Conclusion:

Aggressive growth funds can be a powerful tool for long-term wealth accumulation, but they are not for everyone. Carefully assess your risk tolerance, investment goals, and time horizon before investing. If you're comfortable with the higher risk and have a long-term perspective, these funds could be a valuable addition to your diversified portfolio. Remember to conduct thorough research and consult with a qualified financial advisor if needed.

0 notes

Text

Buidl: Simple, Profitable Staking Protocol, and Easy Earnings with High Fixed APY

In DeFi space, it can be challenging for investors to choose a platform that aligns with their financial goals while also offering a stable and secure environment. The key factor that sets BUIDL apart is its ability to combine high rewards with long-term sustainability. Unlike many platforms that promise high returns but fall short due to unstable tokenomics, BUIDL’s carefully designed system ensures that rewards remain predictable and sustainable.

Investors are given clear expectations from the beginning, with a fixed 526.5% APY and automatic rebase rewards.

Unlike some DeFi platforms that rely on variable rates or obscure mechanisms, BUIDL offers a straightforward, transparent method of earning that ensures users understand how their rewards will accumulate.

Investors simply buy and hold $BUIDL tokens in their wallet, and the platform does the rest. The automatic staking, rebase, and compounding mechanisms ensure that users receive rewards without the need for constant monitoring or interaction.

How BUIDL Can Fit Into Your Investment Strategy

For those looking to diversify their portfolios and increase exposure to cryptocurrency, BUIDL presents a valuable opportunity. As part of a broader investment strategy, BUIDL can serve as a long-term, low-maintenance asset that steadily appreciates in value. Investors can complement their higher-risk crypto ventures with the stable, fixed rewards offered by BUIDL, creating a more balanced investment approach that includes both growth and passive income.

For those already involved in DeFi, adding BUIDL to a diversified portfolio can further strengthen one’s crypto holdings. By leveraging BUIDL’s fixed returns and automatic rewards, investors can generate income passively, allowing them to reinvest in other opportunities or simply enjoy the growth of their existing assets.

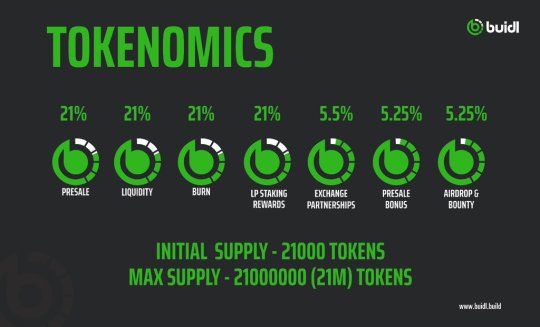

BUIDL Tokenomics: A Vision for Stability, Growth, and Sustainability

The BUIDL protocol is built on a carefully crafted economic model that prioritizes both the growth of its token value and the long-term sustainability of its ecosystem. The $BUIDL token, which serves as the backbone of the BUIDL ecosystem, operates on the Binance Smart Chain (BSC) as a BEP-20 token.

Its elastic supply and positive rebase formula enable it to reward holders while ensuring the protocol remains resilient and capable of delivering consistent returns. Let's take a closer look at how BUIDL's tokenomics create an environment that fosters growth, stability, and sustainability for all its users.

The Elastic Supply of BUIDL: A Scarcity-Focused Approach

One of the defining characteristics of the BUIDL token is its elastic supply. While many cryptocurrencies have fixed supplies, $BUIDL begins with a very small initial supply of just 21,000 tokens, significantly lower than the supply of well-known assets like Bitcoin.

This limited supply creates a sense of scarcity, which can help boost the value of $BUIDL over time. The protocol’s maximum supply is capped at 21 million tokens, a number that mirrors Bitcoin’s ultimate limit.

The decision to start with such a small initial supply ensures that the value of $BUIDL is not diluted from the outset. The low initial supply creates an environment where every token is precious, incentivizing early adoption and creating upward pressure on token value as demand for $BUIDL increases.

Transaction Fee Breakdown: Funding Key Functions to Ensure Longevity

The BUIDL ecosystem supports its automatic compounding and rebase rewards through a series of transaction fees that are carefully allocated to critical functions. These fees allow the protocol to support its APY, ensure liquidity, and provide protection against market volatility. Here’s how the fees break down:

Buy Transactions: When users buy $BUIDL tokens, a 13% transaction fee is applied. Of this, 5% is directed to the Risk-Free Value (RFV) fund, which helps to back the staking rewards provided by the positive rebase formula. Another 5% is allocated to the automatic liquidity pool (LP), which ensures there is enough liquidity for users to buy and sell tokens. 2% goes to the insured fund (BIF), which acts as a safeguard against sudden market downturns, while the remaining 1% is burned to reduce the overall supply of $BUIDL.

Sell Transactions: The transaction fee for selling $BUIDL tokens is slightly higher at 15%. Similar to buy transactions, 6% is directed to the RFV fund to sustain staking rewards, while 5% goes to the automatic LP to support liquidity. The BIF receives 3% of the transaction fee to further protect against market risks. As with buys, 1% of the sell transaction fee is burned, reducing the circulating supply and enhancing the potential scarcity of $BUIDL over time.

These fees are designed to serve multiple functions within the ecosystem, making the system self-sustaining while providing liquidity, backing the staking rewards, and protecting the value of the token from inflationary pressures.

The Rebase Mechanism in Buidl: Growing Your Holdings Automatically

BUIDL’s core feature is its automatic rebase mechanism, which allows users to earn rewards simply by holding $BUIDL tokens in their wallets. The protocol automatically distributes rewards to holders every 60 minutes, ensuring that users' holdings grow continually without any action required on their part. This feature is key to the protocol’s success in offering one of the highest fixed APYs in the crypto industry.

With every rebase, $BUIDL token holders receive 0.021% interest on their holdings, which is automatically compounded and added to their wallet balance. This frequent, fast compounding mechanism accelerates the growth of an investor’s holdings, allowing them to benefit from the snowball effect of compounding interest. Over time, this process leads to substantial gains, making BUIDL an attractive option for passive crypto investors.

Supporting Liquidity and Maintaining Stability

Liquidity is a crucial factor in maintaining a healthy and sustainable DeFi ecosystem. BUIDL addresses this by automatically directing 5% of the transaction fees to the liquidity pool. This ensures that there is always sufficient liquidity in the market to support trades, enabling users to enter and exit positions without difficulty. The automatic addition of liquidity also ensures that the value of $BUIDL remains stable, which is essential for maintaining the protocol’s promised returns.

Burning Mechanism: Reducing Inflation Over Time

BUIDL employs an automatic burn mechanism to reduce the total supply of the token over time. Each transaction, whether it is a buy or a sell, includes a small burn fee of 1%. This burn reduces the circulating supply of $BUIDL tokens, increasing scarcity and potentially driving up demand as the total number of tokens decreases.

The burn mechanism, combined with the capped total supply of 21 million tokens, creates a controlled, deflationary environment that rewards holders for their long-term commitment to the protocol.

The Path to Sustainability: Long-Term Value Creation

BUIDL’s tokenomics ensure that the protocol is built for long-term sustainability. The careful balance between rewards, liquidity, and scarcity is key to maintaining stability and ensuring that users continue to receive high returns over time. With a limited token supply, a strong liquidity system, and a robust risk management structure, BUIDL is designed to weather market fluctuations and deliver value to its holders.

In The End Post - By providing high, stable returns with minimal effort, BUIDL offers a smart and sustainable investment opportunity for crypto investors looking to build wealth in the ever-evolving world of decentralized finance.

If you need update and you can learn more at:

Website : https://buidl.build

Twitter : https://x.com/buidlbsc

Telegram Group : https://t.me/buidlbsc

Telegram Channel : https://t.me/buidl_bsc

Author:

Username: Naradom Sihanuk

Profile Link URL: https://bitcointalk.org/index.php?action=profile;u=3429350

Wallet Address: 0x52564bdCA07024a11AC7e3218d0123C61c795eAE

1 note

·

View note

Text

After $100,000, Bitcoin May Hit $1 Million By 2033: How Can Indian Investors Ride The Wave? Bitcoin has stormed past the $100,000 mark, marking a historic milestone fuelled by a mix of political and economic developments in the US.

Bitcoin Crosses $100,000: Bitcoin has stormed past the $100,000 mark, marking a historic milestone fuelled by a mix of political and economic developments in the United States. The cryptocurrency‘s recent rally comes amid growing institutional confidence and a pro-crypto policy shift under the leadership of US President-Elect Donald Trump. His appointment of Paul Atkins, a crypto advocate, as the SEC Chair and Elon Musk’s leadership in the newly formed Department of Government Efficiency are clear signals of a favourable regulatory environment for digital assets.

Over the past month alone, BTC has surged by 50 per cent, with its market cap crossing the $2 trillion threshold and delivering 144 per cent year-to-date (YTD) return. Riding this wave of optimism, other tokens have also gained significant traction — SOL and XRP have hit an all-time high.

What’s Driving Bitcoin’s Meteoric Rise?

This rally isn’t just about political shifts. Bitcoin ETFs recorded a staggering $676 million inflow in a single day, highlighting robust institutional demand. Edul Patel, CEO of Mudrex, expects that Bitcoin is expected to hit $120,000 in coming weeks.

Global investment firm Bernstein in its latest report said Bitcoin could be headed for the stratosphere. It predicts Bitcoin to touch $200,000 by 2025, $500,000 by 2029, and $1 million per token by 2033.

With the US embracing pro-crypto policies other countries are also moving favourably, China has now lifted restrictions on personal crypto ownership. Brazil, and Russia are considering Bitcoin for reserves, signalling its growing global economic role.

What Experts Suggest Indian Investors

For Indian investors, this rally presents a golden opportunity. Despite regulatory uncertainty in India, the global push toward cryptocurrency legitimisation could benefit local investors. With increasing acceptance, Bitcoin is cementing itself as a hedge against inflation and a mainstream asset class.

“For investors, the spotlight now shifts to long-term planning: keeping an eye on market cycles, diversifying portfolios, and staying updated on regulatory shifts. While this breakthrough fuels optimism, it’s important to tread carefully — volatility remains part of the game," Himanshu Maradiya, Chairman and Founder, CIFDAQ.

Balaji Srihari, business head at CoinSwitch, said if the past is any indicator, the April 2024 halving could spark a rally of 300-400 per cent, aligning perfectly with this forecasted target.

“However, in this dynamic environment, investors must stay informed about market developments to make confident and well-informed decisions," Srihari added.

How to Invest in Bitcoin in India?

If you’re new to the crypto world or looking to expand your portfolio, here’s how you can get started:

1. Choose a Reliable Exchange

Platforms like WazirX, CoinDCX, and Binance offer secure and user-friendly interfaces for trading Bitcoin. Ensure the platform is compliant with Indian regulations and offers robust security features.

2. Understand the Risks

Bitcoin’s volatility is legendary. While its long-term trajectory seems promising, investors must be prepared for sharp price swings. Invest only what you can afford to lose.

3. Stay Informed

Keep an eye on global developments, particularly in the US, as policy changes can significantly impact crypto markets. Utilise tools like CoinMarketCap and Glassnode to monitor Bitcoin’s performance.

4. Diversify Your Portfolio

While Bitcoin is the most popular cryptocurrency, consider diversifying into other digital assets like Ethereum, Solana, or Cardano. Diversification can help balance risk and reward.

5. Consult Your Financial Advisor

Crypto is a highly volatile instrument involving high risk, it is highly necessary to consult a financial advisor before putting your money into such instruments.

Tax Implications for Indian Investors

In India, cryptocurrency gains are treated as a separate class of income. As per current regulations:

Flat 30% Tax on Gains: Any profit from the transfer of cryptocurrency, including Bitcoin, is taxed at a flat rate of 30%. This applies irrespective of the holding period (short-term or long-term).

No Deduction for Losses or Expenses: Except for the cost of acquisition, no other deductions are allowed. Losses from crypto cannot be set off against other income and cannot be carried forward to subsequent years.

1% TDS: A 1% Tax Deducted at Source (TDS) is applicable on transactions exceeding ₹50,000 (₹10,000 for non-salaried individuals) in a financial year.

www.cifdaq.com

0 notes

Text

How Property Management Near Me Can Simplify Your Life as a Landlord