#incometaxcalculator

Explore tagged Tumblr posts

Text

Common Mistakes To Avoid When Using The Income Tax Calculator

As soon as the financial year ends, everyone rushes to do all the math and calculate the amount they need to pay. An Income Tax calculator has emerged as a saviour amidst this chaos of calculating, filing and whatnot. While an income tax calculator is of great help, there are some mistakes that people commit while using one. In this article, we are going to discuss those common mistakes that should be avoided for a smooth process and accurate results.

1. Overlooking Income Sources

This is one of the prominent and common mistakes that people make. They forget to include all of their income sources to calculate income tax. This results in inaccurate estimation of tax, thus causing problems. Therefore, whenever you are filling in the details, make sure you have covered all the income sources, be it salary, rent etc.

2. Neglecting Deductions and Exemptions

Just like people forget to include all the income sources, they also forget to take into account the deductions and exemptions they are entitled to. You can enjoy tax exemption on various things like insurance plans, health expenses and many more. Be sure to research what tax exemptions you may be eligible for and take advantage of them.

3. Feeding Incorrect Data

To err is to human but this will cost you! Sometimes in a hurry or for some other reason, people fill in incorrect details in the Income Tax Calculator. This could be incorrect income, deductions and more. Keep in mind to enter accurate data, deductions, exemptions and everything. This is a very important thing if you want to get a real and accurate estimate of your income tax.

4. Not Being Informed And Updated

Another mistake that people commit is not staying up-to-date. Tax laws keep changing. It is possible that what was deductible and exempt last year is not eligible today. Such mistakes lead to miscalculations. Make sure you are always up-to-date on tax laws to calculate your income taxes accurately.

5. Delaying!

Most of us are guilty of this. We keep waiting and delaying filing the income tax till the last date. This causes end-moment mistakes like inaccurate entries, missed data and whatnot. Instead of delaying, start your tax planning early. This will give you sufficient time to collect all the required data and also to fill in the correct details.

Taking these mistakes into consideration will make income tax planning easier than ever for you. Once you have gathered all the details, all you need to do is go online and search for Tax Calculator 2023. Various companies like PNB MetLife offer the feasibility of calculating your income tax from the comfort of your home through their online income tax calculator. You can avail of these services to make this troublesome process easy and convenient.

0 notes

Text

The Income Tax Calculator is a tool that evaluates taxes based on a person's income. It enables the public to have quick access to basic tax calculations.

#Incometax#IncometaxCalculator#IncomeTaxSlabs#Taxpayers#FinanceCalculator#FitnessCalculator#MathCalculator#Allcalculator

1 note

·

View note

Text

#businesstaxconsultant#Incometaxaudit#Incometaxcalculation#IncomeTaxReturn#INCOMETAXRETURNFILING#taxconsultant#taxliability#caonweb#caservicesonline

0 notes

Link

1 note

·

View note

Photo

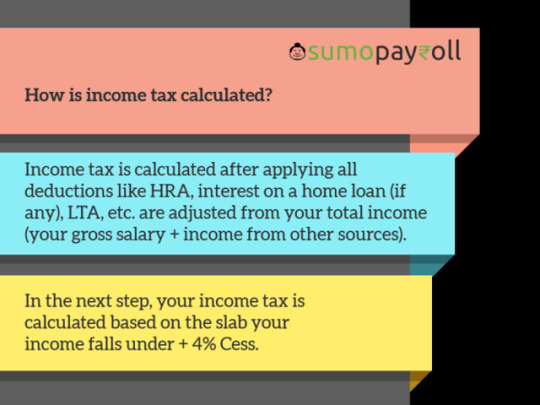

Sumopayroll's Income tax calculator is an easy to use online tool which provides you an estimation of the tax payable once you provide the necessary details. Know more! https://bit.ly/2Vw3QmX

0 notes

Video

youtube

टैक्स चोरी करने वालों की अब खैर नहीं | Income Tax Slabs | By Money Mantras

#moneymantras#incometaxcalculator#howtocalculateincometax#incometaxcalculation#CBDT#CentralBoardofDirectTaxes

0 notes

Link

Get insurance, tax calculators, loans, and more online only at Aegon Life

0 notes

Link

Calculate tax, EMI’s, get loans, and more only at Aegon Life

0 notes

Text

Annuity Calculator – Keep Risks at Bay

Managing finances and coping with the financial issues is a part of every individual’s life. We like it or not financial planning engulfs the road to retirement in the look of sunshine during the golden years of life. Annuities – the scheme of receiving series of payments, as monthly income for life or a definite period – is one of the most commonly opted retirement security of an individual. Now, calculating the monthly income of the annuitant comes across as a major requirement for the person opting for the scheme. Continue reading: https://www.entrepreneurshipsecret.com/annuity-calculator/ Read the full article

#401kcalculator#annuitydue#annuityfactor#annuitypayment#calculators#compoundinterestcalculator#definitionofannuity#financialcalculator#financialcalculatoronline#financialcalculators#fixedannuityrates#fixedincomeannuities#futurevaluecalculator#futurevalueofanannuity#futurevalueofannuity#incometaxcalculator#interestcalculator#interestratecalculator#investmentgrowthcalculator#iracalculator#ordinaryannuity#presentvaluecalculator#presentvalueofanannuitycalculator#rrspcalculator#simpleretirementcalculator#socialsecuritybenefitcalculator#socialsecuritycalculator#taxcalculator#taxshelteredannuity#timevalueofmoneycalculator

0 notes

Photo

#incometax #incometaxreturn #freetaxfiling #incometaxcalculator ##HappyGudiPadwa #Navratri #incometaxefiling

0 notes

Photo

#incometax #incometaxreturn #freetaxfiling #incometaxcalculator #HappyGudiPadwa #Navratri #incometaxefiling

https://www.facebook.com/tax2win/posts/822278951258696:0

0 notes