Don't wanna be here? Send us removal request.

Text

Good Things You Can Do With The Help of a Personal Loan

Personal loans are one of the most common loans that banks offer to people. In modern times, getting a personal loan has become extremely simple, provided you have the right documents and you are eligible for it. These days banks have a personal loan EMI calculator wherein you can get a fair idea of the EMI you will pay on a monthly basis if you take a specific amount of loan. You just have to enter your details and the EMI calculator will give you an idea of how your loan repayment will look like. There can be many reasons why an individual takes a personal loan. Here are some of the good things that you can do with the help of a personal loan:

Streamline Your Debt

Sometimes, you end up accumulating debt from various parties and have to deal with all of them. Different parties can have different loan interest rates and that can also create a lot of financial chaos for you. If you take a personal loan to pay off all parties and concentrate on paying just one EMI every month and paying interest at one interest rate, your life can get a lot simpler. With this move, you can streamline your debt and subsequently your overall finances.

Live a Dream

We all have a dream or desire that we keep delaying because of lack of funds. If you have the capacity to pay an EMI, you can take a personal loan to fulfil the dream that you have been avoiding for long. It could be that dream vacation that you always wanted to take or a dream experience that you always wanted to have – such dreams could be turned into reality by applying for personal loans.

Address The Immediate Need for Cash

You might run short of cash for something important, like a wedding in the family or some house renovation work that needs to be done urgently. Such urgent needs can be addressed with the help of a personal loan. The loan can be paid in instalments over a period of time, but there are things that need cash right now and for those things personal loan is perfect.

As mentioned earlier, there are endless reasons why an individual takes a personal loan. However, in all the scenarios there is one thing common and that is the need for urgent cash and that is served well when you get a personal loan.

0 notes

Text

Why a Travel Credit Card May be the Best for You

Travel can be an adventure but sometimes the costliest fun one could ever be entitled to. All costs could pile up, starting from booking flights and hotel rooms to where you dine or shop. However, a travel credit card can always come in handy. With rewards, benefits, and privileged offers, the right card could save you money above all, and create a better travelling experience.

Among the best in the business, AU Bank travel credit cards come with premium credit card options that really make travelling very hassle-free and rewarding. Be it about a metal credit card offering its luxury benefits, or applying for a maximum travel benefits credit card; AU Bank brings in options for almost every traveller in this bracket.

What is a Travel Credit Card?

A Travel credit card is strictly for those persons who leave home frequently. Miles and reward points are given through these credit cards, and with them, come benefits like access to airport lounges, being lodged free in some hotels, or getting discounted tickets. Credit cards for travelling are for those people who are likely to spend most of their time travelling.

Types of Travel Credit Cards

Travel credit cards are divided into two broad categories:

Co-Branded Travel Credit Cards

Co-branded with an airline or hotel chain.

Earn benefits such as extra miles on particular airlines or hotel loyalty points.

Non-Co-Branded General Travel Credit Cards

Not tied to a particular brand, which offers flexibility when redeeming points.

Redeem for any of the air travel, accommodations, or other travel services

Advantages Of Travel Credit Card

Airport Lounge Access: Earn access to free entry to the lounge in domestic as well as international airports.Ideal for regular travellers who wish to make their travel safe from hassle.

Travel Insurance & Protection: Provides protection against cancellations, loss of baggage, and medical issues. It makes one relax while traveling.Earns cashback, discount, or free stays at partner hotelsand offers a chance to save money on flight and accommodation.

If you want to apply for credit card that can enhance your travel lifestyle, follow these steps.

Check Eligibility

You should have an income and a good credit score.

Right Card

Co-branded cards or general travel credit cards.

Look out for benefits that include lounge access, travel insurance, and rewards.

Documents Submission

Apply with ID, income proof, and address.

No hustle in the online application at AU Bank.

0 notes

Text

Apply for a Personal Loan Today – Fast, Easy, and Hassle-Free!

Personal loans are great when it comes to meeting your financial requirements such as handling medical emergencies, remodelling your home, or organizing a dream vacation for the family. It also helps that since these loans are not secured you do not have to pledge any valuable asset as collateral. However, this also drives up the interest rates on the repayment of these loans and that means a high personal loan EMI (equated monthly instalment) each month you are paying the loan back, also you can also calculate EMI using personal Loan EMI Calculator. However, you can always bring down the EMIs in these loans by following a few simple tips that we will talk about over here.

Knowing your budget

This is something that you should do before you even apply personal loan online. It is important to have a proper budget in place as the first step in managing these EMIs. Analyse your monthly expenses and income to find out how much money you can allot each month to pay off these EMIs without having to compromise on your other financial commitments. Once you have decided on the EMI amount in your budget make sure to do away with all the unnecessary expenses. It is also important to remain organized and committed in these cases.

Choosing a suitable loan tenure

If you are serious about affordable personal loan EMIs you must be sensible in deciding the tenure of loan repayment. Know and understand that your EMIs would be decided by the loan term along with the interest and the loan amount. So, choose a loan tenure and amount to ensure that the EMIs are manageable even as the lender decides the interest rate it will charge you depending on your credit profile. If you choose a shorter period the EMIs will be higher than in a longer period but overall you will be paying lesser interest in such a loan.

There are some other worthwhile steps that you can take in this context such as using EMI calculators, paying the loan back on time, and keeping your repayment capacity in mind while applying for the loan. It is also important to have an emergency fund in these cases and make sure you do not take several loans simultaneously. One of the best decisions that you can make in these cases is to get the loan from a leading bank such as AU Bank which offers you a whole lot of options for you to choose from in this context.

0 notes

Text

Everything You Should Know About Current Accounts and How to Open One

Current account is one of the most flexible banking options among those companies, individuals, or entrepreneurs who experience regular transactions every day. Compared to others, a current account is developed taking into consideration the handling of high volumes of daily banking which is relatively more flexible and comfortable. Current account applications become easily accessible, or one can get them online with the help of innovative offers from AU Bank.

It is a type of deposit account mainly to be used in businesses. In it, any amount can be deposited and withdrawn in a smooth fashion for financial performance. Current accounts are not so that they normally do not allow any interest accrual but the account offers great facilities for managing bulky cash flows.

Main advantages of Current Accounts:

Infinite amount transaction.

Sufficient cash-in/deposit facilities.

All transfers can be done very conveniently from that account without much hassle through cheques, Demand Draft, Net banking, etc.

Overdraft facilities and doorstep banking amongst others.

Current account offerings by AU Bank also comprise a lot of facilities that ensure effective management in their customers' books, and some of them are the following:

Debit Card Benefits: Free debit cards with higher withdrawal limits and purchase protection.

Seamless Transactions: Fast and free fund transfers through QR codes, UPI, or online banking.

Doorstep Banking: Pickup and delivery of cheques and other banking services at your convenience.

How to Open a Current Account?

The application process for the current account is very easy in AU Bank.

Online

Log in to the online portal of AU Bank

Fill out the application form and submit scanned copies of all documents that are required.

The entire process takes place via video KYC.

Offline

Visit the branch of AU Bank, near your area to apply current account.

Application form containing a cheque which would be the source of initial funds to open your current account.

When submitted to a processing centre, it gets activated after approval.

One of the most trusted partners for businesses, AU Bank provides Current account solutions that cater to various needs. Whether it is a large corporation seeking to apply for current accounts or a small business seeking to open current account online, the bank's flexibility ensures that the process is hassle-free. New avenues of innovative products like zero balance accounts, digital banking, and 24/7 access help to set a new standard for business finance management with AU Bank.

0 notes

Text

From single to king-size, selecting the right mattress size is crucial for comfort. Explore a variety of sizes to find the perfect fit for your bed.

0 notes

Text

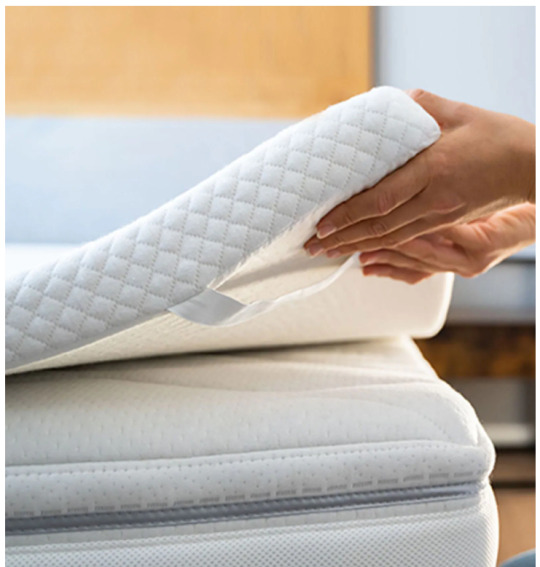

Looking for better sleep? Mattress toppers provide extra comfort and support, making your mattress feel like new. Discover the best options for a restful night.

0 notes

Text

Sofa cum beds are perfect for modern homes, offering both style and convenience. Discover space-saving designs that ensure comfort without compromising aesthetics.

0 notes

Text

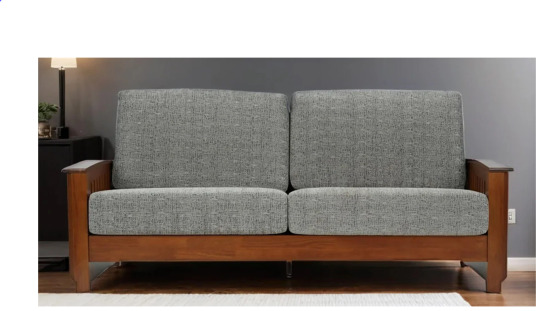

Discover the charm and durability of wooden sofas. Explore a range of designs that blend elegance with comfort, making them the perfect addition to your living space.

0 notes

Text

https://www.pepperfry.com/category/mattresses-by-size.html?utm_source=offpage&utm_medium=referral&utm_campaign=2025_offpage

Whether you need a compact single or a spacious king-size mattress, we’ve got the right fit for you. Explore the best options to enhance your sleep quality.

0 notes

Text

https://www.pepperfry.com/category/mattress-toppers.html?utm_source=offpage&utm_medium=referral&utm_campaign=2025_offpage

A good mattress topper enhances support and extends mattress life. Explore options designed to give you the perfect balance of softness and firmness.

0 notes

Text

https://www.pepperfry.com/discover/sofa-cum-bed-design.html?utm_source=offpage&utm_medium=referral&utm_campaign=2025_offpage

Make the most of your living space with a sofa cum bed. Whether for daily use or guests, these designs offer flexibility and functionality.

0 notes

Text

https://www.pepperfry.com/discover/wooden-sofas.html?utm_source=offpage&utm_medium=referral&utm_campaign=2025_offpage

Wooden sofas provide both aesthetic beauty and structural strength. Explore a collection that offers the perfect mix of comfort, functionality, and style.

0 notes

Text

How Mattress Size Influences Sleep Movement and Comfort

People who tend to move a lot in their sleep need a properly mattress size to avoid sleep disturbances. A small mattress can limit movement, leading to discomfort, while a larger one provides ample space for unrestricted movement.

For couples, a king or queen-size mattress allows each person to move without disturbing the other. Solo sleepers who prefer extra room can opt for a double or queen-size mattress to enhance comfort.

Selecting the right mattress size based on sleeping habits ensures a restful sleep experience, reducing frequent awakenings caused by movement restrictions.

0 notes

Text

The Role of Mattress Toppers in Guest Room Comfort

A guest bed might not always be the most comfortable, especially if it hasn’t been updated in a while. Adding a mattress topper is an easy and cost-effective way to improve the sleeping experience for visitors.

For guest rooms that don’t see daily use, a medium-firm mattress topper made from memory foam or gel-infused foam provides universal comfort suitable for most sleepers. Additionally, hypoallergenic materials ensure that guests with sensitivities can sleep peacefully without allergens like dust mites or mold buildup.

Since guest beds may be used by people with different sleep preferences, a balanced topper that provides both support and cushioning is ideal. A breathable design also helps regulate temperature, ensuring comfort for visitors in all seasons.

With a quality mattress topper, a guest room can provide the same level of comfort as a hotel bed, leaving guests well-rested and appreciative of their stay.

0 notes

Text

Multi-Layer Mattress Technology in Sofa Cum Bed Designs

One of the most important aspects of a sofa cum bed is the quality of the mattress used. Many modern sofa cum bed designs incorporate multi-layer mattress technology to provide superior comfort and durability. These designs ensure that users enjoy a good night’s sleep without experiencing discomfort from uneven surfaces.

A high-quality sofa cum bed mattress typically consists of multiple layers:

Base Layer: Provides firm support to maintain durability and prevent sagging.

Comfort Layer: Often made of memory foam or latex, this layer adapts to the body’s contours for personalized comfort.

Top Layer: A breathable, soft fabric that enhances airflow and prevents overheating during sleep.

Multi-layer technology helps distribute body weight evenly, reducing pressure points and improving spinal alignment. This is particularly beneficial for individuals with back pain or those who require additional support while sleeping.

Whether used occasionally for guests or as a primary sleeping solution, a sofa cum bed with an advanced mattress ensures both longevity and comfort, making it a valuable investment for any home.

0 notes

Text

The Influence of Wooden Sofas on Traditional and Modern Interiors

Wooden sofas hold a special place in both traditional and contemporary interior designs. Their ability to adapt to different styles makes them a popular choice for homeowners looking to balance old-world charm with modern sensibilities. Whether your home follows a classic aesthetic with vintage décor or leans towards a minimalist modern look, a wooden sofa seamlessly integrates into the setting.

For traditional interiors, wooden sofas with rich carvings, ornate armrests, and deep wooden finishes add an element of grandeur. These designs often pair well with antique furniture, Persian rugs, and warm-toned upholstery, creating a regal and inviting atmosphere.

On the other hand, contemporary spaces benefit from sleek, straight-lined wooden sofas with lighter finishes. These minimalist designs add warmth and texture to modern interiors while maintaining a clean, uncluttered look. The versatility of wooden sofas allows them to complement a variety of color palettes, from neutral tones to vibrant hues, making them a staple in interior design.

0 notes

Text

Find the Perfect Mattress Size for Your Needs

From Twin to King-size mattresses, discover the ideal fit for your space and comfort preferences. Our collection offers a variety of options to cater to every sleeper’s needs.

0 notes