#in hindsight these are p much just mental health tips but they really come in handy when you dont see ppl face to face

Explore tagged Tumblr posts

Text

My roommate’s already going a little stir crazy, so in case anyone else might find them helpful, here are some tips for staying at home/quarantine from someone with garbagebrain who’s spent a p significant time in unmonitored, unstructured situations:

Stretch often. Seems like a tip that everyone probably heard, but I don’t mean do yoga every morning (tho that’s good if you can manage it!). You aren’t in public, you don’t have to adhere to social mannerism as much--roll on the floor. Flop around. Lay down with your legs straight on the wall. Movement is important, and if you have trouble with regular exercise, at least give into any temptation to ragdoll yourself around your room, as that’ll still help

Get as much sunlight as possible. Another common one, but as someone who, after a decade of trying, still doesn’t feel healthy or good or productive if I have to regularly wake up before 9, I don’t mean it in a “don’t be a nightdwelling cave creature” way. Get a vitamin D supplement and try to let in as much light as you can, when you can. I found that eating the first meal of the day near a window helps

Find reasons to talk to people. Video games are great for this--friends are easier to keep in contact with if you have a common activity to rally behind. Might be a good time to start a new Stardew Valley farm. If that’s not your style, maybe try to video call people more often--maybe while doing something boring, like cooking or chores. If that’s not your thing, or if you don’t feel like you have people to talk to, try engaging in a community--something like Twitch can be great, if you can find a positive streamer, because that sort of interaction may still give you a sense of social closeness and togetherness

Keep your space clear. This one’s a hard one, but also sometimes the biggest difference between feeling like shit and feeling okay in your space. I say clear instead of “organized” or “clean” because those things mean different things to different people--the key is that you want to feel control and ownership. Sometimes it helps to start by getting rid of knick-knacky things that don’t really mean anything to you--a lot of people get trapped in the mindset of “I own it, so it’s mine, so it’s important, so I have to keep it,” but sometimes that just clogs up your ability to see what is meaningful to you. Marie Kondo that shit. Here’s a few questions to ask yourself: If this item got misplaced, would I realize? Would I miss it? Would I even notice it was gone? If not, would there be something that reminded me of it later that would prompt me to look for it? If you find that you only have it because you have it, and it doesn’t really hold any value beyond the fact that you have it, then maybe it would be best to donate it. The less stuff you have in your space, the easier it is to keep it open and clean, and the easier it is for that space to feel like something you control, and something that’s yours. If you have to spend a lot of time in that space, that can make a huge, huge difference on your mental state. I had a period of time where I had a day each week on which I cleaned, at least just a little bit, because I was not doing well in the brainspace and it was one of my not-falling-apart procedures. It made a big difference, even if all I did was sweep the floor. You’re going to be in that space a lot--try to curate it into something that feels good to be in

Plan a project. You can start it, too, but I say "plan” because it doesn’t have to go anywhere--the key is not to be productive, but to be Excited! It’s only got to mean something to you, and it doesn’t have to go anywhere. It could be an artwork, a story, or even just some plot--my friends and I spent a lot of time in high school making plans for dream houses with spires and secret rooms and apocalypse defenses, and it was nothing but fun. Be indulgent, and do it 100% for yourself, and fuck publish-culture that makes you feel if it’s not getting likes on social media, it’s not worth doing.

Drink water. Eat a vegetable

#in hindsight these are p much just mental health tips but they really come in handy when you dont see ppl face to face#like theyre important normally but they become p dang important when youre stuck in your room all day#long post#mental health

52 notes

·

View notes

Photo

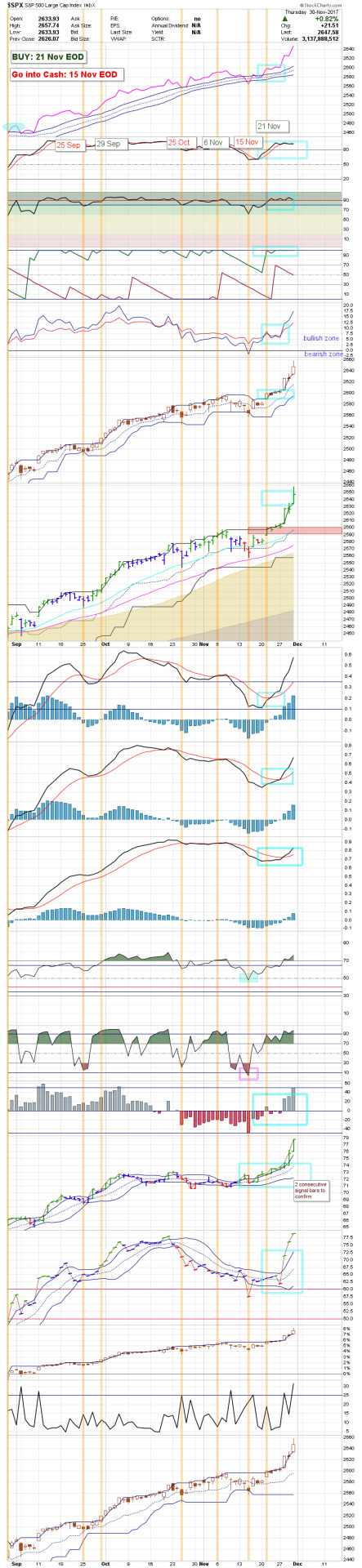

S&P 500: 30 Nov 2017 (End of Day, EOD)

The Trend is: UP (Strength @ 100%)

Daily Price Action: The daily price action is bullish.

Remarks

Since the trend is UP; you should not short sell the S&P 500 index.

Since the Daily Price Action is bullish, it does not make sense to be in CASH.

So the only logical position at this point in time is to be LONG.

S&P 500 e-minis position based on data @ 21 Nov 2017 EOD: LONG

Current Stock holding: TSN, HD.

—————————————-

Experiment #3

Strength of buy signal on the S&P 500: 8 out of 9 (Another experiment. Charts not included.)

Experiment #4

Strength of buy signal on the S&P 500: 5 out of 6. (This uses a different set of criteria from Experiment #3 above.) Yet another experiment. Charts not included.

Experiment #5 - S&P 500 Intra-day charts:

This experiment was started on hindsight on 1st Oct. Charts not included.

S&P 500 Intra-day (10 Minute) Chart #1:

Long Tem MA’s: Bullish (EOD 16 Nov)

S&P 500 Intra-day (60 minute) Chart #2:

Short Term MA’s: Bullish (EOD 17 Nov)

Long Tem MA’s: Bullish (EOD 6 Sep)

Experiment #7 (New)

Charts not included.

Daily S&P 500 D-5 Indicator: Trending Bullish

Weekly S&P 500 D-5 Indicator: Trending Bullish

Monthly S&P 500 D-5 Indicator: Trending Bullish

Experiment #8 (New)

XLB - Bullish signal

XLE - Bullish signal

XLF - Bullish signal

XLI - Bullish signal

XLK - Bearish signal <------------

XLP - Bullish signal

XLU - Bullish signal

XLV - Bullish signal

XLY - Bullish signal

SPY - Bullish signal

RSP - Bullish signal

$XVG - Bullish signal

EQAL - Bullish signal

EQWS - Bullish signal

$VIX - Bearish signal <-------------

——————————————

The indicators used in my chart are quite sensitive. Meaning there is no point in preempting or front running potential changes in signals. It’s better to just wait for the signals to change and weigh up the weight of evidence.

This blog is a Work-in-progress. While every effort is made to maintain accuracy and consistency, you should expect unannounced edits, changes in format style and content. This blog will evolve as my thinking evolves in response to an ever changing stock market.

“My Thoughts About Technical Analysis” was posted on 4 June 2017, 19 July 2017

——————————————-

“ Technical Analysis is a windsock, not a crystal ball. “ - Carl Swenlin. (Editorial comment: We are using technical analysis to measure what the trend is doing today. We are not using it to predict what the trend will do tomorrow.)

“Good investment advice is repetitive and boring. There is nothing exciting about it.” – D. Muthukrishnan

“Everybody wants to win, of course. But not everybody wants to bet, and therein lies a difference of the greatest magnitude.” - Max Gunther

“To make any kind of gain in life, ... you must place some of your material and/or emotional capital at risk. That is the law of the universe. Except by blind chance, it cannot be circumvented. There are no appeals. It is the law. - Max Gunther

“Worry is not a sickness but a sign of health. If you are not worried, you are not risking enough.” - Max Gunther

“I’ve learned many things from [George Soros] but perhaps the most significant is that it’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong. Soros has taught me that when you have tremendous conviction on a trade, you have to go for the jugular. As far as Soros is concerned, when you’re right on something, you can’t own enough. It takes courage to ride a profit with huge leverage.” - Stanley Druckenmiller

“And then all that is required is a willingness to bet heavily when the odds are extremely favorable, using resources available as a result of prudence and patience in the past. It’s not given to human beings to have such talent that they can just know everything about everything all the time. But it is given to human beings who work hard at it—who look and sift the world for a mispriced bet—that they can occasionally find one. And the wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don’t. It’s just that simple.” - Charlie Munger

“The second piece, analytically, is bet size, which is once you have an edge, how much do you bet in your portfolio? That’s a second key component which is often overlooked.” - Michael Mauboussin

[[[ “There’s no such thing as overbought in an uptrend.” Technical analysis’ primary goal is to find stocks that are trending and then take advantage of that trend. Assuming you don’t short things (please don’t), then the only way to make money as an investor is to buy low and sell high - i.e., ride an uptrend.

Given that finding and riding uptrends is our primary mission, once you are riding an uptrend, why would you ever get off of it before it reverses? This is where the concept of “overbought” can work against you.

“Oscillators oscillate.” This brilliant insight reminds me that many technical indicators go up and down frequently - even if the stock is continuing to move higher. They can’t help it. They were designed to work that way. (In reality, they are meant to be used when a stock is moving sideways, not when it is in an uptrend.) ]]] - Chip Anderson

“In a bull market, buy fast and sell slow.” - Anonymous

“In a bull market, negative divergences (eg. momentum or breadth) tend to resolve themselves to the upside. This is called the bull market bias.” - Anonymous with hat tip to Carl Swenlin

“In a bull market, you buy the technically oversold condition. In a bear market, you short sell the over bought condition.” - Anonymous

“Daniel-san, trust quality of what you know, not quantity.” - Mr Miyagi, Karate Kid. ( It’s not how much you know. It’s how well you have mastered what you already know.)

“It’s not what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” - Mark Twain

“Complexity is your enemy. Anybody can make things complicated. It’s hard to keep things simple.” - Richard Branson

“Simplicity has a way of improving performance through enabling us to better understand what we are doing.” - Charlie Munger

“Simple is not always best. But best is always simple.” - Anonymous

“Build systems, not goals. When you set a goal, you can fail to reach it. But with a system you always win.” Real success comes from following a system – not a random assortment of good ideas. - Ramit Sethi

“The main thing is to keep the main thing, the main thing.” - Anonymous

“Your focus determines your reality.” - Qui-Gon Jinn, Star Wars Episode 1 (Editor: So what do you want to go big on?)

“Focus—and true productivity—is not what we’re doing but what we’re not doing.” - Caroline Beaton

“You cannot overestimate the unimportance of practically everything.” — John Maxwell

“Instead of widening your options, narrow your priorities.” - Caroline Beaton (Editor: So what do you want to go big on?)

“Just because something is valuable doesn’t mean that we need it.” ― Elle Luna

“Not every decision we make is actually rational. We see what we want to see filtered through our inherent biases, and then we make decisions based on those biases. These biases are called cognitive biases and we all have them.” - Christine Comaford

“There is only one side of the market and it is not the bull side or the bear side, but the right side.” - Jesse Livermore (Editor: In the stock market, both bulls and bears can trade profitably. But pigs and mules tend to get slaughtered)

“I think it was a long step forward in my trading education when I realized at last that when old Mr. Partridge kept on telling other customers, “Well, you know this is a bull market!” he really meant to tell them that the big money was not in the individual fluctuations but in the main movements that is, not in reading the tape but in sizing up the entire market and its trend.” - Jesse Livermore

“The only way you can make money in the market is with a trend. Price has to trend (move) higher or lower or you just break even. This trend can be hours or months, smooth or choppy but it’s that trend, the movement of price that makes you money. The trend, indeed, is your friend. “ Unknown

(Editorial comment: The more stable [or less volatile] the trend, the easier it is to make money.)

“Trading is all about putting the odds in our favor, and we can increase our odds with one key assumption: The trend will remain in force until proven otherwise. In other words, a trend in motion is expected to stay in motion or assume that the trend will extend, and not end. - Arthur Hill

(Editorial comment: And my own favorite bullish quote “The trend is up until it is not.”)

“Isn’t it strange how you want to enter long positions during a bull market, but you want to wait on that “pullback”? Then the market pulls back and you think the selling has just begun and you don’t want to enter too early so you wait. Everyone goes through this mental game.” - Tom Bowley

“Corrections are tricky because nobody knows how long they will last, how far they will extend and what path they will take. … the bigger trend is up … timing a correction is difficult. … I prefer timing the end of the correction rather than the beginning.“ - Arthur Hill

“Don’t buy the dip. Buy after the dip, once it begins to turn higher again. You don’t want to buy weakness indiscriminately. If you wait for the evidence that the buyers are back in control, you have a much higher probability trade with lower risk and stress.” - Brian Shannon

“One of the biggest challenges in technical analysis is to distinguish between a mere correction and the start of a bigger downtrend.” - Arthur Hill

“It is said that while bottoms are events, but tops are processes. Translated, markets bottom out when panic sets in, and therefore they can be more easily identifiable. By contrast, market tops form when a series of conditions come together, but not necessarily all at the same time” - Cam Hui

“Man plans, and God laughs” - Yiddish Proverb

“Everybody has a plan until they get hit in the face. Then, like a rat, they stop in fear and freeze.” - Mike Tyson

“In economics (and markets), things take longer to happen than you think they will, and then they happen faster than you thought they could.” - Rudiger Dornbusch

“You can’t prepare for everything, but the things you can prepare for can set you up for life.” - Ramit Sethi

“It is not the strongest of the species that survives. It is the one that is most adaptable to change.” - Charles Darwin

“Diversification is a protection against ignorance. It makes very little sense for those that know what they are doing.” - Warren Buffet

“I only focus on what is black or white and kind of sift out the gray area in my investing style.” - Stanley Druckenmiller

(Editor: Why invest in anything which you are unsure about when there are other options that you are more sure about? This is simple “opportunity cost” thinking.)

“Correlations on many assets go to one during a crisis.” - Unknown

“You can get in way more trouble with a good idea than a bad idea, because you forget that the good idea has limits.” – Ben Graham

“Not dead. Can’t quit.” - Richard Machowicz

“My goal is to build a life I don’t need a vacation from.” - Unknown

“The things that make life worth living cannot be thought in your head. It must be felt in your heart.” - Unknown

0 notes

Photo

S&P 500: 29 Nov 2017 (End of Day, EOD)

The Trend is: UP (Strength @ 100%)

Daily Price Action: The daily price action is bullish.

Remarks

Since the trend is UP; you should not short sell the S&P 500 index.

Since the Daily Price Action is bullish, it does not make sense to be in CASH.

So the only logical position at this point in time is to be LONG.

S&P 500 e-minis position based on data @ 21 Nov 2017 EOD: LONG

Current Stock holding: TSN, HD. Stopped out of MA.

—————————————-

Experiment #3

Strength of buy signal on the S&P 500: 6 out of 9 (Another experiment. Charts not included.)

Experiment #4

Strength of buy signal on the S&P 500: 6 out of 6. (This uses a different set of criteria from Experiment #3 above.) Yet another experiment. Charts not included.

Experiment #5 - Intra-day charts:

This experiment was started on hindsight on 1st Oct. Charts not included.

Intra-day (10 Minute) Chart #1:

Long Tem MA’s: Bullish (EOD 16 Nov)

Intra-day (60 minute) Chart #2:

Short Term MA’s: Bullish (EOD 17 Nov)

Long Tem MA’s: Bullish (EOD 6 Sep)

Experiment #7 (New)

Charts not included.

Daily D-5 Indicator: Trending Bullish

Weekly D-5 Indicator: Trending Bullish

Monthly D-5 Indicator: Trending Bullish

——————————————

The indicators used in my chart are quite sensitive. Meaning there is no point in preempting or front running potential changes in signals. It’s better to just wait for the signals to change and weigh up the weight of evidence.

This blog is a Work-in-progress. While every effort is made to maintain accuracy and consistency, you should expect unannounced edits, changes in format style and content. This blog will evolve as my thinking evolves in response to an ever changing stock market.

“My Thoughts About Technical Analysis” was posted on 4 June 2017, 19 July 2017

——————————————-

“ Technical Analysis is a windsock, not a crystal ball. “ - Carl Swenlin. (Editorial comment: We are using technical analysis to measure what the trend is doing today. We are not using it to predict what the trend will do tomorrow.)

“Good investment advice is repetitive and boring. There is nothing exciting about it.” – D. Muthukrishnan

“Everybody wants to win, of course. But not everybody wants to bet, and therein lies a difference of the greatest magnitude.” - Max Gunther

“Worry is not a sickness but a sign of health. If you are not worried, you are not risking enough.” - Max Gunther

[[[ “There’s no such thing as overbought in an uptrend.” Technical analysis’ primary goal is to find stocks that are trending and then take advantage of that trend. Assuming you don’t short things (please don’t), then the only way to make money as an investor is to buy low and sell high - i.e., ride an uptrend.

Given that finding and riding uptrends is our primary mission, once you are riding an uptrend, why would you ever get off of it before it reverses? This is where the concept of “overbought” can work against you.

“Oscillators oscillate.” This brilliant insight reminds me that many technical indicators go up and down frequently - even if the stock is continuing to move higher. They can’t help it. They were designed to work that way. (In reality, they are meant to be used when a stock is moving sideways, not when it is in an uptrend.) ]]] - Chip Anderson

“In a bull market, buy fast and sell slow.” - Anonymous

“In a bull market, negative divergences (eg. momentum or breadth) tend to resolve themselves to the upside. This is called the bull market bias.” - Annonymous with hat tip to Carl Swenlin

“In a bull market, you buy the technically oversold condition. In a bear market, you short sell the over bought condition.” - Annonymous

“Daniel-san, trust quality of what you know, not quantity.” - Mr Miyagi, Karate Kid. ( It’s not how much you know. It’s how well you have mastered what you already know.)

“It’s not what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” - Mark Twain

“Complexity is your enemy. Anybody can make things complicated. It’s hard to keep things simple.” - Richard Branson

“Simplicity has a way of improving performance through enabling us to better understand what we are doing.” - Charlie Munger

“Simple is not always best. But best is always simple.” - Anonymous

“Build systems, not goals. When you set a goal, you can fail to reach it. But with a system you always win.” Real success comes from following a system – not a random assortment of good ideas. - Ramit Sethi

“The main thing is to keep the main thing, the main thing.” - Anonymous

“Your focus determines your reality.” - Qui-Gon Jinn, Star Wars Episode 1 (Editor: So what do you want to go big on?)

“Focus—and true productivity—is not what we’re doing but what we’re not doing.” - Caroline Beaton

“You cannot overestimate the unimportance of practically everything.” — John Maxwell

“Instead of widening your options, narrow your priorities.” - Caroline Beaton (Editor: So what do you want to go big on?)

“Just because something is valuable doesn’t mean that we need it.” ― Elle Luna

“Not every decision we make is actually rational. We see what we want to see filtered through our inherent biases, and then we make decisions based on those biases. These biases are called cognitive biases and we all have them.” - Christine Comaford

“There is only one side of the market and it is not the bull side or the bear side, but the right side.” - Jesse Livermore (Editor: In the stock market, both bulls and bears can trade profitably. But pigs and mules tend to get slaughtered)

“I think it was a long step forward in my trading education when I realized at last that when old Mr. Partridge kept on telling other customers, “Well, you know this is a bull market!” he really meant to tell them that the big money was not in the individual fluctuations but in the main movements that is, not in reading the tape but in sizing up the entire market and its trend.” - Jesse Livermore

“The only way you can make money in the market is with a trend. Price has to trend (move) higher or lower or you just break even. This trend can be hours or months, smooth or choppy but it’s that trend, the movement of price that makes you money. The trend, indeed, is your friend. “ Unknown

(Editorial comment: The more stable [or less volatile] the trend, the easier it is to make money.)

“Trading is all about putting the odds in our favor, and we can increase our odds with one key assumption: The trend will remain in force until proven otherwise. In other words, a trend in motion is expected to stay in motion or assume that the trend will extend, and not end. - Arthur Hill

(Editorial comment: And my own favorite bullish quote “The trend is up until it is not.”)

“Isn’t it strange how you want to enter long positions during a bull market, but you want to wait on that “pullback”? Then the market pulls back and you think the selling has just begun and you don’t want to enter too early so you wait. Everyone goes through this mental game.” - Tom Bowley

“Corrections are tricky because nobody knows how long they will last, how far they will extend and what path they will take. … the bigger trend is up … timing a correction is difficult. … I prefer timing the end of the correction rather than the beginning.“ - Arthur Hill

“Don’t buy the dip. Buy after the dip, once it begins to turn higher again. You don’t want to buy weakness indiscriminately. If you wait for the evidence that the buyers are back in control, you have a much higher probability trade with lower risk and stress.” - Brian Shannon

“One of the biggest challenges in technical analysis is to distinguish between a mere correction and the start of a bigger downtrend.” - Arthur Hill

“It is said that while bottoms are events, but tops are processes. Translated, markets bottom out when panic sets in, and therefore they can be more easily identifiable. By contrast, market tops form when a series of conditions come together, but not necessarily all at the same time” - Cam Hui

“Man plans, and God laughs” - Yiddish Proverb

“Everybody has a plan until they get hit in the face. Then, like a rat, they stop in fear and freeze.” - Mike Tyson

“In economics (and markets), things take longer to happen than you think they will, and then they happen faster than you thought they could.” - Rudiger Dornbusch

“You can’t prepare for everything, but the things you can prepare for can set you up for life.” - Ramit Sethi

“It is not the strongest of the species that survives. It is the one that is most adaptable to change.” - Charles Darwin

“Diversification is a protection against ignorance. It makes very little sense for those that know what they are doing.” - Warren Buffet

“Correlations on many assets go to one during a crisis.” - Unknown

“You can get in way more trouble with a good idea than a bad idea, because you forget that the good idea has limits.” – Ben Graham

“Not dead. Can’t quit.” - Richard Machowicz

“My goal is to build a life I don’t need a vacation from.” - Unknown

“The things that make life worth living cannot be thought in your head. It must be felt in your heart.” - Unknown

0 notes

Photo

S&P 500: 28 Nov 2017 (End of Day, EOD)

The Trend is: UP (Strength @ 100%)

Daily Price Action: The daily price action is bullish.

Remarks

Since the trend is UP; you should not short sell the S&P 500 index.

Since the Daily Price Action is bullish, it does not make sense to be in CASH.

So the only logical position at this point in time is to be LONG.

S&P 500 e-minis position based on data @ 21 Nov 2017 EOD: LONG

Current Stock holding: TSN, MA, HD

—————————————-

Experiment #3

Strength of buy signal on the S&P 500: 7 out of 9 (Another experiment. Charts not included.)

Experiment #4

Strength of buy signal on the S&P 500: 6 out of 6. (This uses a different set of criteria from Experiment #3 above.) Yet another experiment. Charts not included.

Experiment #5 - Intra-day charts:

This experiment was started on hindsight on 1st Oct. Charts not included.

Intra-day (10 Minute) Chart #1:

Long Tem MA’s: Bullish (EOD 16 Nov)

Intra-day (60 minute) Chart #2:

Short Term MA’s: Bullish (EOD 17 Nov)

Long Tem MA’s: Bullish (EOD 6 Sep)

Experiment #7 (New)

Charts not included.

Daily D-5 Indicator: Trending Bullish

Weekly D-5 Indicator: Trending Bullish

Monthly D-5 Indicator: Trending Bullish

——————————————

The indicators used in my chart are quite sensitive. Meaning there is no point in preempting or front running potential changes in signals. It’s better to just wait for the signals to change and weigh up the weight of evidence.

This blog is a Work-in-progress. While every effort is made to maintain accuracy and consistency, you should expect unannounced edits, changes in format style and content. This blog will evolve as my thinking evolves in response to an ever changing stock market.

“My Thoughts About Technical Analysis” was posted on 4 June 2017, 19 July 2017

——————————————-

“ Technical Analysis is a windsock, not a crystal ball. “ - Carl Swenlin. (Editorial comment: We are using technical analysis to measure what the trend is doing today. We are not using it to predict what the trend will do tomorrow.)

“Good investment advice is repetitive and boring. There is nothing exciting about it.” – D. Muthukrishnan

“Everybody wants to win, of course. But not everybody wants to bet, and therein lies a difference of the greatest magnitude.” - Max Gunther

“To make any kind of gain in life, … you must place some of your material and/or emotional capital at risk. That is the law of the universe. Except by blind chance, it cannot be circumvented. There are no appeals. It is the law. - Max Gunther

“Worry is not a sickness but a sign of health. If you are not worried, you are not risking enough.” - Max Gunther

“I’ve learned many things from [George Soros] but perhaps the most significant is that it’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong. Soros has taught me that when you have tremendous conviction on a trade, you have to go for the jugular. As far as Soros is concerned, when you’re right on something, you can’t own enough. It takes courage to ride a profit with huge leverage.” - Stanley Druckenmiller

“And then all that is required is a willingness to bet heavily when the odds are extremely favorable, using resources available as a result of prudence and patience in the past. It’s not given to human beings to have such talent that they can just know everything about everything all the time. But it is given to human beings who work hard at it—who look and sift the world for a mispriced bet—that they can occasionally find one. And the wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don’t. It’s just that simple.” - Charlie Munger

“The second piece, analytically, is bet size, which is once you have an edge, how much do you bet in your portfolio? That’s a second key component which is often overlooked.” - Michael Mauboussin

[[[ “There’s no such thing as overbought in an uptrend.” Technical analysis’ primary goal is to find stocks that are trending and then take advantage of that trend. Assuming you don’t short things (please don’t), then the only way to make money as an investor is to buy low and sell high - i.e., ride an uptrend.

Given that finding and riding uptrends is our primary mission, once you are riding an uptrend, why would you ever get off of it before it reverses? This is where the concept of “overbought” can work against you.

“Oscillators oscillate.” This brilliant insight reminds me that many technical indicators go up and down frequently - even if the stock is continuing to move higher. They can’t help it. They were designed to work that way. (In reality, they are meant to be used when a stock is moving sideways, not when it is in an uptrend.) ]]] - Chip Anderson

“In a bull market, buy fast and sell slow.” - Anonymous

“In a bull market, negative divergences (eg. momentum or breadth) tend to resolve themselves to the upside. This is called the bull market bias.” - Annonymous with hat tip to Carl Swenlin

“In a bull market, you buy the technically oversold condition. In a bear market, you short sell the over bought condition.” - Annonymous

“Daniel-san, trust quality of what you know, not quantity.” - Mr Miyagi, Karate Kid. ( It’s not how much you know. It’s how well you have mastered what you already know.)

“It’s not what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” - Mark Twain

“Complexity is your enemy. Anybody can make things complicated. It’s hard to keep things simple.” - Richard Branson

“Simplicity has a way of improving performance through enabling us to better understand what we are doing.” - Charlie Munger

“Simple is not always best. But best is always simple.” - Anonymous

“Build systems, not goals. When you set a goal, you can fail to reach it. But with a system you always win.” Real success comes from following a system – not a random assortment of good ideas. - Ramit Sethi

“The main thing is to keep the main thing, the main thing.” - Anonymous

“Your focus determines your reality.” - Qui-Gon Jinn, Star Wars Episode 1 (Editor: So what do you want to go big on?)

“Focus—and true productivity—is not what we’re doing but what we’re not doing.” - Caroline Beaton

“You cannot overestimate the unimportance of practically everything.” — John Maxwell

“Instead of widening your options, narrow your priorities.” - Caroline Beaton (Editor: So what do you want to go big on?)

“Just because something is valuable doesn’t mean that we need it.” ― Elle Luna

“Not every decision we make is actually rational. We see what we want to see filtered through our inherent biases, and then we make decisions based on those biases. These biases are called cognitive biases and we all have them.” - Christine Comaford

“There is only one side of the market and it is not the bull side or the bear side, but the right side.” - Jesse Livermore (Editor: In the stock market, both bulls and bears can trade profitably. But pigs and mules tend to get slaughtered)

“I think it was a long step forward in my trading education when I realized at last that when old Mr. Partridge kept on telling other customers, “Well, you know this is a bull market!” he really meant to tell them that the big money was not in the individual fluctuations but in the main movements that is, not in reading the tape but in sizing up the entire market and its trend.” - Jesse Livermore

“The only way you can make money in the market is with a trend. Price has to trend (move) higher or lower or you just break even. This trend can be hours or months, smooth or choppy but it’s that trend, the movement of price that makes you money. The trend, indeed, is your friend. “ Unknown

(Editorial comment: The more stable [or less volatile] the trend, the easier it is to make money.)

“Trading is all about putting the odds in our favor, and we can increase our odds with one key assumption: The trend will remain in force until proven otherwise. In other words, a trend in motion is expected to stay in motion or assume that the trend will extend, and not end. - Arthur Hill

(Editorial comment: And my own favorite bullish quote “The trend is up until it is not.”)

“Isn’t it strange how you want to enter long positions during a bull market, but you want to wait on that “pullback”? Then the market pulls back and you think the selling has just begun and you don’t want to enter too early so you wait. Everyone goes through this mental game.” - Tom Bowley

“Corrections are tricky because nobody knows how long they will last, how far they will extend and what path they will take. … the bigger trend is up … timing a correction is difficult. … I prefer timing the end of the correction rather than the beginning.“ - Arthur Hill

“Don’t buy the dip. Buy after the dip, once it begins to turn higher again. You don’t want to buy weakness indiscriminately. If you wait for the evidence that the buyers are back in control, you have a much higher probability trade with lower risk and stress.” - Brian Shannon

“One of the biggest challenges in technical analysis is to distinguish between a mere correction and the start of a bigger downtrend.” - Arthur Hill

“It is said that while bottoms are events, but tops are processes. Translated, markets bottom out when panic sets in, and therefore they can be more easily identifiable. By contrast, market tops form when a series of conditions come together, but not necessarily all at the same time” - Cam Hui

“Man plans, and God laughs” - Yiddish Proverb

“Everybody has a plan until they get hit in the face. Then, like a rat, they stop in fear and freeze.” - Mike Tyson

“In economics (and markets), things take longer to happen than you think they will, and then they happen faster than you thought they could.” - Rudiger Dornbusch

“You can’t prepare for everything, but the things you can prepare for can set you up for life.” - Ramit Sethi

“It is not the strongest of the species that survives. It is the one that is most adaptable to change.” - Charles Darwin

“Diversification is a protection against ignorance. It makes very little sense for those that know what they are doing.” - Warren Buffet

“I only focus on what is black or white and kind of sift out the gray area in my investing style.” - Stanley Druckenmiller

(Editor: Why invest in anything which you are unsure about when there are other options that you are more sure about? This is simple “opportunity cost” thinking.)

“Correlations on many assets go to one during a crisis.” - Unknown

“You can get in way more trouble with a good idea than a bad idea, because you forget that the good idea has limits.” – Ben Graham

“Not dead. Can’t quit.” - Richard Machowicz

“My goal is to build a life I don’t need a vacation from.” - Unknown

“The things that make life worth living cannot be thought in your head. It must be felt in your heart.” - Unknown

0 notes

Photo

S&P 500: 27 Nov 2017 (End of Day, EOD)

The Trend is: UP (Strength @ 100%)

Daily Price Action: The daily price action is bullish.

Remarks

Since the trend is UP; you should not short sell the S&P 500 index.

Since the Daily Price Action is bullish, it does not make sense to be in CASH.

So the only logical position at this point in time is to be LONG.

S&P 500 e-minis position based on data @ 21 Nov 2017 EOD: LONG

Current Stock holding: TSN (bought @ 24 Nov)

—————————————-

Experiment #3

Strength of buy signal on the S&P 500: 5 out of 9 (Another experiment. Charts not included.)

Experiment #4

Strength of buy signal on the S&P 500: 6 out of 6. (This uses a different set of criteria from Experiment #3 above.) Yet another experiment. Charts not included.

Experiment #5 - Intra-day charts:

This experiment was started on hindsight on 1st Oct. Charts not included.

Intra-day (10 Minute) Chart #1:

Long Tem MA’s: Bullish (EOD 16 Nov)

Intra-day (60 minute) Chart #2:

Short Term MA’s: Bullish (EOD 17 Nov)

Long Tem MA’s: Bullish (EOD 6 Sep)

Experiment #6

- Experiment terminated. No useful insights.

——————————————

The indicators used in my chart are quite sensitive. Meaning there is no point in preempting or front running potential changes in signals. It’s better to just wait for the signals to change and weigh up the weight of evidence.

This blog is a Work-in-progress. While every effort is made to maintain accuracy and consistency, you should expect unannounced edits, changes in format style and content. This blog will evolve as my thinking evolves in response to an ever changing stock market.

“My Thoughts About Technical Analysis” was posted on 4 June 2017, 19 July 2017

——————————————-

“ Technical Analysis is a windsock, not a crystal ball. “ - Carl Swenlin. (Editorial comment: We are using technical analysis to measure what the trend is doing today. We are not using it to predict what the trend will do tomorrow.)

“Good investment advice is repetitive and boring. There is nothing exciting about it.” – D. Muthukrishnan

“Everybody wants to win, of course. But not everybody wants to bet, and therein lies a difference of the greatest magnitude.” - Max Gunther

“Worry is not a sickness but a sign of health. If you are not worried, you are not risking enough.” - Max Gunther

[[[ “There’s no such thing as overbought in an uptrend.” Technical analysis’ primary goal is to find stocks that are trending and then take advantage of that trend. Assuming you don’t short things (please don’t), then the only way to make money as an investor is to buy low and sell high - i.e., ride an uptrend.

Given that finding and riding uptrends is our primary mission, once you are riding an uptrend, why would you ever get off of it before it reverses? This is where the concept of “overbought” can work against you.

“Oscillators oscillate.” This brilliant insight reminds me that many technical indicators go up and down frequently - even if the stock is continuing to move higher. They can’t help it. They were designed to work that way. (In reality, they are meant to be used when a stock is moving sideways, not when it is in an uptrend.) ]]] - Chip Anderson

“In a bull market, buy fast and sell slow.” - Anonymous

“In a bull market, negative divergences (eg. momentum or breadth) tend to resolve themselves to the upside. This is called the bull market bias.” - Annonymous with hat tip to Carl Swenlin

“In a bull market, you buy the technically oversold condition. In a bear market, you short sell the over bought condition.” - Annonymous

“Daniel-san, trust quality of what you know, not quantity.” - Mr Miyagi, Karate Kid. ( It’s not how much you know. It’s how well you have mastered what you already know.)

“It’s not what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” - Mark Twain

“Complexity is your enemy. Anybody can make things complicated. It’s hard to keep things simple.” - Richard Branson

“Simplicity has a way of improving performance through enabling us to better understand what we are doing.” - Charlie Munger

“Simple is not always best. But best is always simple.” - Anonymous

“Build systems, not goals. When you set a goal, you can fail to reach it. But with a system you always win.” Real success comes from following a system – not a random assortment of good ideas. - Ramit Sethi

“The main thing is to keep the main thing, the main thing.” - Anonymous

“Your focus determines your reality.” - Qui-Gon Jinn, Star Wars Episode 1 (Editor: So what do you want to go big on?)

“Focus—and true productivity—is not what we’re doing but what we’re not doing.” - Caroline Beaton

“You cannot overestimate the unimportance of practically everything.” — John Maxwell

“Instead of widening your options, narrow your priorities.” - Caroline Beaton (Editor: So what do you want to go big on?)

“Just because something is valuable doesn’t mean that we need it.” ― Elle Luna

“Not every decision we make is actually rational. We see what we want to see filtered through our inherent biases, and then we make decisions based on those biases. These biases are called cognitive biases and we all have them.” - Christine Comaford

“There is only one side of the market and it is not the bull side or the bear side, but the right side.” - Jesse Livermore (Editor: In the stock market, both bulls and bears can trade profitably. But pigs and mules tend to get slaughtered)

“I think it was a long step forward in my trading education when I realized at last that when old Mr. Partridge kept on telling other customers, “Well, you know this is a bull market!” he really meant to tell them that the big money was not in the individual fluctuations but in the main movements that is, not in reading the tape but in sizing up the entire market and its trend.” - Jesse Livermore

“The only way you can make money in the market is with a trend. Price has to trend (move) higher or lower or you just break even. This trend can be hours or months, smooth or choppy but it’s that trend, the movement of price that makes you money. The trend, indeed, is your friend. “ Unknown

(Editorial comment: The more stable [or less volatile] the trend, the easier it is to make money.)

“Trading is all about putting the odds in our favor, and we can increase our odds with one key assumption: The trend will remain in force until proven otherwise. In other words, a trend in motion is expected to stay in motion or assume that the trend will extend, and not end. - Arthur Hill

(Editorial comment: And my own favorite bullish quote “The trend is up until it is not.”)

“Isn’t it strange how you want to enter long positions during a bull market, but you want to wait on that “pullback”? Then the market pulls back and you think the selling has just begun and you don’t want to enter too early so you wait. Everyone goes through this mental game.” - Tom Bowley

“Corrections are tricky because nobody knows how long they will last, how far they will extend and what path they will take. … the bigger trend is up … timing a correction is difficult. … I prefer timing the end of the correction rather than the beginning.“ - Arthur Hill

“Don’t buy the dip. Buy after the dip, once it begins to turn higher again. You don’t want to buy weakness indiscriminately. If you wait for the evidence that the buyers are back in control, you have a much higher probability trade with lower risk and stress.” - Brian Shannon

“One of the biggest challenges in technical analysis is to distinguish between a mere correction and the start of a bigger downtrend.” - Arthur Hill

“It is said that while bottoms are events, but tops are processes. Translated, markets bottom out when panic sets in, and therefore they can be more easily identifiable. By contrast, market tops form when a series of conditions come together, but not necessarily all at the same time” - Cam Hui

“Man plans, and God laughs” - Yiddish Proverb

“Everybody has a plan until they get hit in the face. Then, like a rat, they stop in fear and freeze.” - Mike Tyson

“In economics (and markets), things take longer to happen than you think they will, and then they happen faster than you thought they could.” - Rudiger Dornbusch

“You can’t prepare for everything, but the things you can prepare for can set you up for life.” - Ramit Sethi

“It is not the strongest of the species that survives. It is the one that is most adaptable to change.” - Charles Darwin

“Diversification is a protection against ignorance. It makes very little sense for those that know what they are doing.” - Warren Buffet

“Correlations on many assets go to one during a crisis.” - Unknown

“You can get in way more trouble with a good idea than a bad idea, because you forget that the good idea has limits.” – Ben Graham

“Not dead. Can’t quit.” - Richard Machowicz

“My goal is to build a life I don’t need a vacation from.” - Unknown

“The things that make life worth living cannot be thought in your head. It must be felt in your heart.” - Unknown

0 notes

Photo

S&P 500: 24 Nov 2017 (End of Day, EOD)

The Trend is: UP (Strength @ 100%)

Daily Price Action: The daily price action is bullish.

Remarks

Since the trend is UP; you should not short sell the S&P 500 index.

Since the Daily Price Action is bullish, it does not make sense to be in CASH.

So the only logical position at this point in time is to be LONG.

S&P 500 e-minis position based on data @ 21 Nov 2017 EOD: LONG

Current Stock holding: TSN (bought @ 24 Nov)

—————————————-

Experiment #3

Strength of buy signal on the S&P 500: 5 out of 9 (Another experiment. Charts not included.)

Experiment #4

Strength of buy signal on the S&P 500: 6 out of 6. (This uses a different set of criteria from Experiment #3 above.) Yet another experiment. Charts not included.

Experiment #5 - Intra-day charts:

This experiment was started on hindsight on 1st Oct. Charts not included.

Intra-day (10 Minute) Chart #1:

Long Tem MA’s: Bullish (EOD 16 Nov)

Intra-day (60 minute) Chart #2:

Short Term MA’s: Bullish (EOD 17 Nov)

Long Tem MA’s: Bullish (EOD 6 Sep)

Experiment #6

- Experiment terminated. No useful insights.

——————————————

The indicators used in my chart are quite sensitive. Meaning there is no point in preempting or front running potential changes in signals. It’s better to just wait for the signals to change and weigh up the weight of evidence.

This blog is a Work-in-progress. While every effort is made to maintain accuracy and consistency, you should expect unannounced edits, changes in format style and content. This blog will evolve as my thinking evolves in response to an ever changing stock market.

“My Thoughts About Technical Analysis” was posted on 4 June 2017, 19 July 2017

——————————————-

“ Technical Analysis is a windsock, not a crystal ball. “ - Carl Swenlin. (Editorial comment: We are using technical analysis to measure what the trend is doing today. We are not using it to predict what the trend will do tomorrow.)

“Good investment advice is repetitive and boring. There is nothing exciting about it.” – D. Muthukrishnan

“Everybody wants to win, of course. But not everybody wants to bet, and therein lies a difference of the greatest magnitude.” - Max Gunther

“Worry is not a sickness but a sign of health. If you are not worried, you are not risking enough.” - Max Gunther

“Daniel-san, trust quality of what you know, not quantity.” - Mr Miyagi, Karate Kid. ( It’s not how much you know. It’s how well you have mastered what you already know.)

“It’s not what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” - Mark Twain

“In a bull market, buy fast and sell slow.” - Anonymous

“In a bull market, negative divergences (eg. momentum or breadth) tend to resolve themselves to the upside. This is called the bull market bias.” - Annonymous with hat tip to Carl Swenlin

“In a bull market, you buy the technically oversold condition. In a bear market, you short sell the over bought condition.” - Annonymous

“Complexity is your enemy. Anybody can make things complicated. It’s hard to keep things simple.” - Richard Branson

“Simplicity has a way of improving performance through enabling us to better understand what we are doing.” - Charlie Munger

“Simple is not always best. But best is always simple.” - Anonymous

“Build systems, not goals. When you set a goal, you can fail to reach it. But with a system you always win.” Real success comes from following a system – not a random assortment of good ideas. - Ramit Sethi

“The main thing is to keep the main thing, the main thing.” - Anonymous

“Your focus determines your reality.” - Qui-Gon Jinn, Star Wars Episode 1 (Editor: So what do you want to go big on?)

“Focus—and true productivity—is not what we’re doing but what we’re not doing.” - Caroline Beaton

“You cannot overestimate the unimportance of practically everything.” — John Maxwell

“Instead of widening your options, narrow your priorities.” - Caroline Beaton (Editor: So what do you want to go big on?)

“Just because something is valuable doesn’t mean that we need it.” ― Elle Luna

“Not every decision we make is actually rational. We see what we want to see filtered through our inherent biases, and then we make decisions based on those biases. These biases are called cognitive biases and we all have them.” - Christine Comaford

“There is only one side of the market and it is not the bull side or the bear side, but the right side.” - Jesse Livermore (Editor: In the stock market, both bulls and bears can trade profitably. But pigs and mules tend to get slaughtered)

“I think it was a long step forward in my trading education when I realized at last that when old Mr. Partridge kept on telling other customers, “Well, you know this is a bull market!” he really meant to tell them that the big money was not in the individual fluctuations but in the main movements that is, not in reading the tape but in sizing up the entire market and its trend.” - Jesse Livermore

“The only way you can make money in the market is with a trend. Price has to trend (move) higher or lower or you just break even. This trend can be hours or months, smooth or choppy but it’s that trend, the movement of price that makes you money. The trend, indeed, is your friend. “ Unknown

(Editorial comment: The more stable [or less volatile] the trend, the easier it is to make money.)

“Trading is all about putting the odds in our favor, and we can increase our odds with one key assumption: The trend will remain in force until proven otherwise. In other words, a trend in motion is expected to stay in motion or assume that the trend will extend, and not end. - Arthur Hill

(Editorial comment: And my own favorite bullish quote “The trend is up until it is not.”)

“Isn’t it strange how you want to enter long positions during a bull market, but you want to wait on that “pullback”? Then the market pulls back and you think the selling has just begun and you don’t want to enter too early so you wait. Everyone goes through this mental game.” - Tom Bowley

“Corrections are tricky because nobody knows how long they will last, how far they will extend and what path they will take. … the bigger trend is up … timing a correction is difficult. … I prefer timing the end of the correction rather than the beginning.“ - Arthur Hill

“Don’t buy the dip. Buy after the dip, once it begins to turn higher again. You don’t want to buy weakness indiscriminately. If you wait for the evidence that the buyers are back in control, you have a much higher probability trade with lower risk and stress.” - Brian Shannon

“One of the biggest challenges in technical analysis is to distinguish between a mere correction and the start of a bigger downtrend.” - Arthur Hill

“It is said that while bottoms are events, but tops are processes. Translated, markets bottom out when panic sets in, and therefore they can be more easily identifiable. By contrast, market tops form when a series of conditions come together, but not necessarily all at the same time” - Cam Hui

“Man plans, and God laughs” - Yiddish Proverb

“Everybody has a plan until they get hit in the face. Then, like a rat, they stop in fear and freeze.” - Mike Tyson

“In economics (and markets), things take longer to happen than you think they will, and then they happen faster than you thought they could.” - Rudiger Dornbusch

“You can’t prepare for everything, but the things you can prepare for can set you up for life.” - Ramit Sethi

“It is not the strongest of the species that survives. It is the one that is most adaptable to change.” - Charles Darwin

“Diversification is a protection against ignorance. It makes very little sense for those that know what they are doing.” - Warren Buffet

“Correlations on many assets go to one during a crisis.” - Unknown

“You can get in way more trouble with a good idea than a bad idea, because you forget that the good idea has limits.” – Ben Graham

“Not dead. Can’t quit.” - Richard Machowicz

“My goal is to build a life I don’t need a vacation from.” - Unknown

“The things that make life worth living cannot be thought in your head. It must be felt in your heart.” - Unknown

0 notes